UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: (811-22708)

Brown Advisory Funds

(Exact name of Registrant as specified in charter)

901 South Bond Street Suite 400

Baltimore, MD 21231

(Address of principal executive offices) (Zip code)

David M. Churchill

President

Brown Advisory Funds

901 South Bond Street Suite 400

Baltimore, MD 21231

(Name and address of agent for service)

(410) 537-5400

Registrant's telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2015

Item 1. Reports to Stockholders.

ANNUAL REPORT

June 30, 2015

Brown Advisory Growth Equity Fund

Brown Advisory Value Equity Fund

Brown Advisory Flexible Equity Fund

Brown Advisory Equity Income Fund

Brown Advisory Sustainable Growth Fund

Brown Advisory Small-Cap Growth Fund

Brown Advisory Small-Cap Fundamental Value Fund

Brown Advisory Opportunity Fund

Brown Advisory Multi-Strategy Fund

Brown Advisory Intermediate Income Fund

Brown Advisory Total Return Fund

Brown Advisory Strategic Bond Fund

Brown Advisory Maryland Bond Fund

Brown Advisory Tax Exempt Bond Fund

Brown Advisory Mortgage Securities Fund

Brown Advisory – WMC Strategic European Equity Fund

Brown Advisory – WMC Japan Alpha Opportunities Fund

Brown Advisory – Somerset Emerging Markets Fund

Brown Advisory Emerging Markets Small-Cap Fund

The views in the report contained herein were those of the Funds’ investment adviser, Brown Advisory LLC, or, for the sub-advised funds, of the respective sub-adviser, as of June 30, 2015 and may not reflect their views on the date this report is first published or anytime thereafter. This report may contain discussions about certain investments both held and not held in the portfolio as of June 30, 2015. All current and future holdings are subject to risk and are subject to change. While these views are intended to assist shareholders in understanding their investment in each Fund, they do not constitute investment advice, are not a guarantee of future performance and are not intended as an offer or solicitation with respect to the purchase or sale of any security. Performance figures include the reinvestment of dividend and capital gain distributions.

The Global Industry Classification Standard (GICS®) was developed by and is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Administrator, U.S. Bancorp Fund Services, LLC.

TOPIX Index Values and TOPIX Marks are subject to the proprietary rights owned by the Tokyo Stock Exchange, Inc.

TABLE OF CONTENTS

|

Brown Advisory Growth Equity Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

1

|

|

Performance Chart and Analysis

|

3

|

|

Schedule of Investments, June 30, 2015

|

4

|

|

Brown Advisory Value Equity Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

5

|

|

Performance Chart and Analysis

|

7

|

|

Schedule of Investments, June 30, 2015

|

8

|

|

Brown Advisory Flexible Equity Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

9

|

|

Performance Chart and Analysis

|

11

|

|

Schedule of Investments, June 30, 2015

|

12

|

|

Brown Advisory Equity Income Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

13

|

|

Performance Chart and Analysis

|

15

|

|

Schedule of Investments, June 30, 2015

|

16

|

|

Brown Advisory Sustainable Growth Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

17

|

|

Performance Chart and Analysis

|

19

|

|

Schedule of Investments, June 30, 2015

|

20

|

|

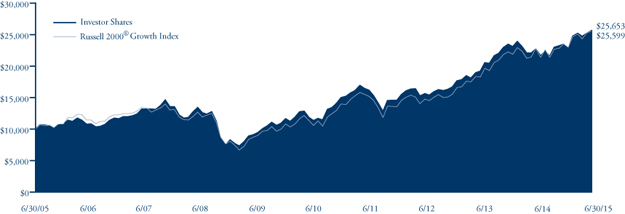

Brown Advisory Small-Cap Growth Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

21

|

|

Performance Chart and Analysis

|

23

|

|

Schedule of Investments, June 30, 2015

|

24

|

|

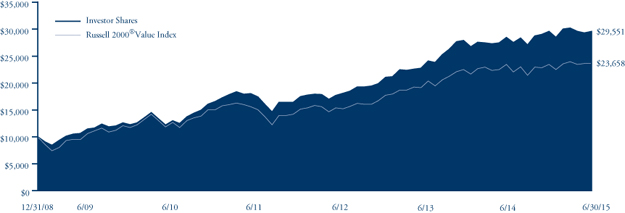

Brown Advisory Small-Cap Fundamental Value Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

26

|

|

Performance Chart and Analysis

|

28

|

|

Schedule of Investments, June 30, 2015

|

29

|

|

Brown Advisory Opportunity Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

30

|

|

Performance Chart and Analysis

|

32

|

|

Schedule of Investments, June 30, 2015

|

33

|

|

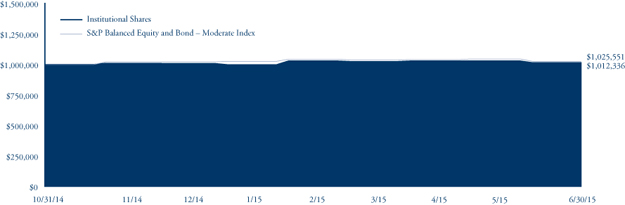

Brown Advisory Multi-Strategy Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

35

|

|

Performance Chart and Analysis

|

36

|

|

Schedule of Investments, June 30, 2015

|

37

|

|

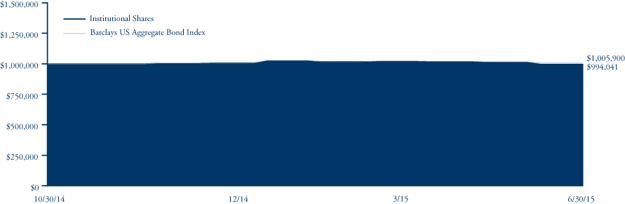

Brown Advisory Intermediate Income Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

38

|

|

Performance Chart and Analysis

|

39

|

|

Schedule of Investments, June 30, 2015

|

40

|

|

Brown Advisory Total Return Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

43

|

|

Performance Chart and Analysis

|

44

|

|

Schedule of Investments, June 30, 2015

|

45

|

|

Brown Advisory Strategic Bond Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

48

|

|

Performance Chart and Analysis

|

50

|

|

Schedule of Investments, June 30, 2015

|

51

|

|

Brown Advisory Maryland Bond Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

54

|

|

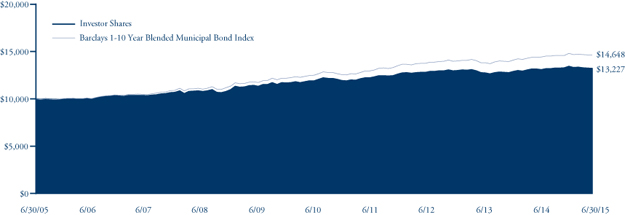

Performance Chart and Analysis

|

55

|

|

Schedule of Investments, June 30, 2015

|

56

|

|

Brown Advisory Tax Exempt Bond Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

60

|

|

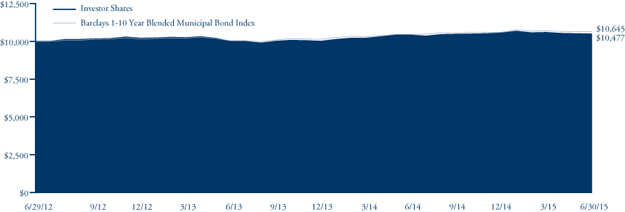

Performance Chart and Analysis

|

61

|

|

Schedule of Investments, June 30, 2015

|

62

|

|

Brown Advisory Mortgage Securities Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

65

|

|

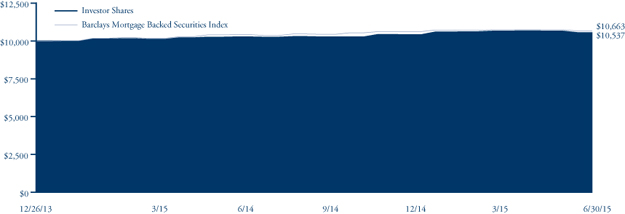

Performance Chart and Analysis

|

66

|

|

Schedule of Investments, June 30, 2015

|

67

|

|

Brown Advisory – WMC Strategic European Equity Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

72

|

|

Performance Chart and Analysis

|

74

|

|

Schedule of Investments, June 30, 2015

|

75

|

|

Brown Advisory – WMC Japan Alpha Opportunities Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

77

|

|

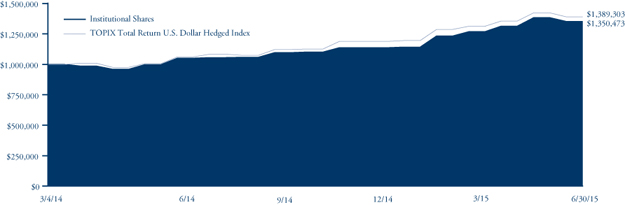

Performance Chart and Analysis

|

79

|

|

Schedule of Investments, June 30, 2015

|

80

|

|

Brown Advisory – Somerset Emerging Markets Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

83

|

|

Performance Chart and Analysis

|

85

|

|

Schedule of Investments, June 30, 2015

|

86

|

|

Brown Advisory Emerging Markets Small-Cap Fund

|

|

|

A Message to our Shareholders, June 30, 2015

|

88

|

|

Performance Chart and Analysis

|

90

|

|

Schedule of Investments, June 30, 2015

|

91

|

|

Statements of Assets and Liabilities

|

94

|

|

Statements of Operations

|

99

|

|

Statements of Changes in Net Assets

|

104

|

|

Financial Highlights

|

114

|

|

Notes to Financial Statements

|

158

|

|

Report of Independent Registered Public Accounting Firm

|

180

|

|

Additional Information

|

181

|

GLOSSARY OF TERMS

Alpha refers to the abnormal rate of return on a security or portfolio in excess of what would be predicted by an equilibrium model like the capital asset pricing model (CAPM).

Barclays 1-10 Year Blended Municipal Bond Index is a market index of high quality, domestic fixed income securities with maturities of less than 10 years.

Barclays Intermediate US Aggregate Bond Index represents domestic taxable investment-grade bonds with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities with average maturities and durations in the intermediate range. This index represents a sector of the Barclays US Aggregate Bond Index.

Barclays Mortgage Backed Securities Index is a market value-weighted index which covers the mortgage-backed securities component of the Barclays US Aggregate Bond Index. The index is composed of agency mortgage-backed passthrough securities of the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), and the Federal Home Loan Mortgage Corporation (Freddie Mac) with a minimum $150 million par amount outstanding and a weighted-average maturity of at least 1 year. The index includes reinvestment of income.

Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS, ABS and CMBS.

Basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument. The basis point is commonly used for calculating changes in interest rates, equity indexes and the yield of a fixed-income security. 1% is equal to 100 basis points.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Book value is the net asset value of a company, calculated by total assets minus intangible assets (patents, goodwill) and liabilities.

Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income.

Correlation is a statistical measurement of how two securities move in relation to each other.

Dividend Yield is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock.

Downside Capture is a statistical measure of a fund’s performance in down markets. For example, a fund with downside capture of 90% would only have declined 90% as much as the related index during the same down market period.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices.

Earnings growth is a measure of growth in a company’s net income over a specific period, often one year. The term can apply to actual data from previous periods or estimated data for future periods.

Earnings per share (EPS) is calculated by taking the total earnings divided by the number of shares outstanding.

Earnings Yield is the earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield shows the percentage of each dollar invested in the stock that was earned by the company.

EBITDA is the Earnings Before Interest, Taxes, Depreciation and Amortization. An approximate measure of a company’s operating cash flow based on data from the company’s income statement.

Enterprise Value (EV) is a measure of a company’s value, often used as an alternative to straightforward market capitalization. Enterprise Value is calculated as market capitalization plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

Forward price to earnings ratio uses forecasted earnings, rather than current earnings, to calculate the price to earnings ratio.

Free Cash Flow is the operating cash flows (net income plus amortization and depreciation) minus capital expenditures and dividends. Free cash flow is the amount of cash that a company has left over after it has paid all of its expenses, including investments.

Gross Domestic Product (GDP) is the monetary value of all the goods and services produced by an economy over a specified period. It includes consumption, government purchases, investments, and exports minus imports.

MSCI All Country World Index ex-U.S. is a market capitalization weighted index designed to provide a broad measure of stock performance throughout the world, with the exception of U.S.-based companies.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

GLOSSARY OF TERMS

MSCI Emerging Markets Small-Cap Index is a free float-adjusted market capitalization index that is designed to measure small cap equity market performance in the global emerging markets.

MSCI Europe Index is an index that captures large and mid cap representation across 15 developed market countries in Europe.

Price to Book Value Ratio is ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Price to earnings ratio (P/E) is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share.

Return of Capital (ROC) is a return from an investment that is not considered income. The return of capital is when some or all of the money an investor has in an investment is paid back to him or her, thus decreasing the value of the investment.

Return on Capital Employed (ROCE) is a financial ratio that measures a company’s profitability and the efficiency with which its capital is employed. Return on Capital Employed (ROCE) is calculated as: ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed.

Return on Equity (ROE) is the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

Return on Invested Capital (ROIC) is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. ROIC is typically calculated by taking a company’s net income, subtracting dividends the company paid out and dividing that amount by the company’s total capital.

Russell 1000® Growth Index measures the performance of the large-cap growth segment of the of the U.S. equity universe. It includes those Russell 1000® companies with higher price to book value ratios and higher forecasted growth values.

Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price to book value ratios and lower expected growth values.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price to book value ratios and higher forecasted growth values.

Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price to book value ratios and lower forecasted growth values.

Russell 3000® Index measures the performance of the 3,000 largest U.S. companies representing approximately 98% of the investable U.S. equity market.

S&P Balanced Equity and Bond – Moderate Index is the moderate profile of the S&P Balanced Equity and Bond Series which combines investable S&P indices for core equity and fixed income to provide a regulary rebalanced multi-asset measure for conservative, moderate and growth risk-reward profiles.

S&P 500 Index (“S&P 500”) is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks.

Tier 1 Capital Ratio is a comparison between a banking firm’s core equity capital and total risk-weighted assets. A firm’s core equity capital is known as its Tier 1 capital and is the measure of a bank’s financial strength based on the sum of its equity capital and disclosed reserves, and sometimes non-redeemable, non-cumulative preferred stock. A firm’s risk-weighted assets include all assets that the firm holds that are systematically weighted for credit risk. Central banks typically develop the weighting scale for different asset classes, such as cash and coins, which have zero risk, versus a letter or credit, which carries more risk.

TOPIX Total Return U.S. Dollar Hedged Index is a market capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange, hedged to eliminate the impact of the change in value between the US Dollar and Japanese Yen.

Turnover refers to a fund buying or selling securities. (The fund “turns over” its portfolio.) A fund pays transaction costs, such as commissions, when it buys and sells securities. Additionally, a higher turnover rate may result in higher taxes when the fund shares are held in a taxable account.

Yield Curve is a line that plots the yields of securities having equal credit quality but different maturity dates.

Yield Spread is the difference between yields on differing securities, calculated by deducting the yield of one security from another.

The broad based market indexes referenced in the following management commentaries are considered representative of their indicated market, the indexes are unmanaged and do not reflect the deduction of fees, such as, investment management and fund accounting fees, or taxes associated with a mutual fund. Investors cannot invest directly in an index.

Brown Advisory Growth Equity Fund

A Message to Our Shareholders

June 30, 2015

Dear Shareholder:

During the year ended June 30, 2015, the Brown Advisory Growth Equity Fund Investor Shares (the “Fund”) increased 9.54% in value. During the same period, the Russell 1000® Growth Index (the “Index”), the Fund’s benchmark, increased 10.56%.

Despite heightened volatility due to the market’s infatuation with geopolitical matters, the Fund managed to deliver a positive return for the reporting period. While absolute performance was satisfactory, the Fund return trailed the Index return by 1.02%. This is not necessarily surprising given the current market environment where fundamental growth characteristics have taken a backseat to other factors such as dividend yield. In this low interest rate environment the marginal investor is generally more concerned with generating income from their equity portfolio than long term earnings growth.

After struggling for the first two quarters of the fiscal year, our technology holdings turned the corner and the sector was the biggest positive contributor to returns for the full period. Several of our technology positions reported decent fundamental results, but their stock prices were slow to react due to the incessant preoccupation with yield amongst technology investors. One of our best performing stocks was a recent addition to the portfolio NXP Semiconductors (“NXP”). NXP is a technology leader in several fast-growing segments of the semiconductor industry. Their technology is a critical component in smartphones for applications such as Apple Pay. NXP also announced they will acquire Freescale Semiconductor, a key supplier to the automotive industry. The deal was well received by the marketplace, in recognition of the complementary nature of the two companies’ business lines and the large potential for synergies. QUALCOMM was a drag on performance as the company wrestled with regulatory issues in China. While these issues were ultimately resolved, we eliminated QUALCOMM in order to fund the purchase of NXP as we view their potential growth opportunities to be more attractive.

Amazon.com and TripAdvisor, are two recent additions to the consumer sector that made sizable positive contributions to performance. Both of these stocks were trading at attractive valuations due to misperceptions about their long term potential. However, not all of our consumer stocks performed as well. Discovery Communications was a disappointment, and our investment thesis for it began to deteriorate late last year. It has become apparent that the cable TV landscape, in the U.S. and increasingly abroad, is changing rapidly, due in part to streaming online video offerings such as Netflix. It was fortunate timing that Amazon.com, a company that we have followed for a number of years, traded down to a level that presented, in our opinion, an exceptional level of upside potential relative to downside risk, and we built a position using the proceeds from the sale of Discovery Communications shares.

Energy was the biggest drag on performance, and we did make several changes to the complexion of our energy exposure during the year. We eliminated our position in Core Laboratories, a stock that we had held for almost three-and-a-half years. We built our broad energy sector investment parameters around a range of potential oil prices, bound by demand destruction at the high end and reduced production at the other extreme. The Organization of the Petroleum Exporting Countries decision in November to protect market share rather than defend price has kept global oil markets oversupplied in recent months, allowing for a prolonged period of low oil prices below the range described above. This will probably push down earnings this year for our energy-related holdings, as producing companies reduce investment. We view Core Laboratories’ business model and valuation, compared with our other energy holdings, to be more susceptible should oil prices remain lower for longer. With so much uncertainty in the oil market, handicapping spot price movements went from extremely difficult to virtually impossible. However, we continue to monitor the energy sector landscape for potential opportunities and potential pitfalls going forward.

It is our belief that, in the long-run, the quality of business models determines our potential success as investors. It has always been this way, and while we should never simply extrapolate the past into the future, the market’s regard for best-in-breed, sustainable growth companies rarely dwindle. That is why business models remain our most important focus as investors. One can potentially recover from many mistakes as an investor: paying too much for a stock, poor timing of a trade, even mediocre management teams. A terminal mistake in our view is buying businesses that cannot contend with impending competition or disruptive technology. Such mistakes can render an investment worthless. That is why we say that our most important technique with respect to attempting to protect and grow our investors’ capital is owning leading businesses. We acknowledge that from time to time, the marginal investor will focus on other things: the strength of the dollar and how it affects translational accounting, the current

www.brownadvisoryfunds.com

1

Brown Advisory Growth Equity Fund

A Message to Our Shareholders

June 30, 2015

interest rate environment, one’s desire to seek out yield, and the immediate gratification of owning a stock that’s going up. Those and other issues will catch the fancy of many investors. But for long-term investors such considerations fade away when compared with the overarching importance of sound businesses. Given the issues that we have faced over the last two years, we try mightily to remind ourselves of this truth.

Sincerely,

Kenneth M. Stuzin, CFA

Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller and medium capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The value of the Fund’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Earnings growth is not a measure of the Fund’s future performance.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisoryfunds.com

2

Brown Advisory Growth Equity Fund

Performance Chart and Analysis

June 30, 2015

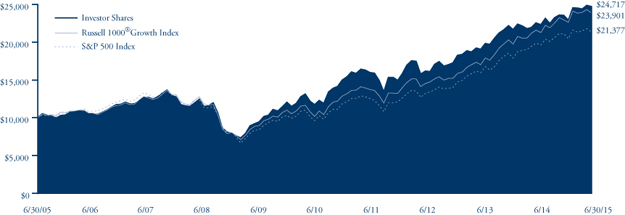

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against broad-based securities market indices. The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000® companies with higher price to book and higher forecasted growth values. The S&P 500 Index is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The indexes are unmanaged and do not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

|

Average Annual Total Return

|

One

|

Five

|

Ten

|

||

|

as of 6/30/15

|

Year

|

Year

|

Year

|

||

|

Institutional Shares1

|

9.73%

|

16.24%

|

9.63%

|

||

|

Investor Shares

|

9.54%

|

16.08%

|

9.47%

|

||

|

Advisor Shares2

|

9.28%

|

15.76%

|

9.09%

|

||

|

Russell 1000® Growth Index

|

10.56%

|

18.59%

|

9.10%

|

||

|

S&P 500 Index

|

7.42%

|

17.34%

|

7.89%

|

|

Institutional Shares

|

Investor Shares

|

Advisor Shares

|

||

|

Gross Expense Ratio3

|

0.74%

|

0.89%

|

1.14%

|

|

|

Net Expense Ratio3

|

0.74%

|

0.89%

|

1.14%

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisoryfunds.com/performance.html. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects periods during which fee waivers were in effect. In the absence of such waivers, total return would have been reduced. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower.

|

1

|

Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares.

|

|

2

|

Performance information for Advisor Shares, prior to commencement of operations on May 18, 2006, is based on the performance of Investor Shares, and adjusted for the higher expenses applicable to Advisor Shares.

|

|

3

|

Per the Fund’s prospectus dated October 31, 2014.

|

www.brownadvisoryfunds.com

3

Brown Advisory Growth Equity Fund

Schedule of Investments

June 30, 2015

|

Shares

|

Security Description

|

Value $

|

|||||

|

Common Stocks — 97.5%

|

|||||||

|

Consumer Discretionary — 11.8%

|

|||||||

| 245,135 |

Amazon.com, Inc.*

|

106,410,652 | |||||

| 1,983,531 |

Starbucks Corp.

|

106,347,014 | |||||

| 874,240 |

TripAdvisor, Inc.*

|

76,181,274 | |||||

| 288,938,940 | |||||||

|

Consumer Staples — 11.6%

|

|||||||

| 536,318 |

Costco Wholesale Corp.

|

72,435,109 | |||||

| 989,524 |

Estee Lauder Companies, Inc.

|

85,752,150 | |||||

| 835,528 |

Mead Johnson Nutrition Co.

|

75,381,336 | |||||

| 1,245,313 |

Whole Foods Market, Inc.

|

49,115,145 | |||||

| 282,683,740 | |||||||

|

Energy — 4.5%

|

|||||||

| 1,226,818 |

FMC Technologies, Inc.*

|

50,900,679 | |||||

| 685,702 |

Schlumberger NV

|

59,100,655 | |||||

| 110,001,334 | |||||||

|

Financials — 4.3%

|

|||||||

| 3,222,518 |

Charles Schwab Corp.

|

105,215,213 | |||||

|

Health Care — 17.1%

|

|||||||

| 203,876 |

Alexion Pharmaceuticals, Inc.*

|

36,854,665 | |||||

| 1,047,784 |

Bristol-Myers Squibb Co.

|

69,719,547 | |||||

| 791,619 |

DaVita HealthCare Partners, Inc.*

|

62,909,962 | |||||

| 1,182,065 |

Express Scripts Holding Co.*

|

105,132,861 | |||||

| 517,636 |

Gilead Sciences, Inc.

|

60,604,823 | |||||

| 172,126 |

Intuitive Surgical, Inc.*

|

83,395,047 | |||||

| 418,616,905 | |||||||

|

Industrials — 11.5%

|

|||||||

| 980,892 |

Colfax Corp.*

|

45,268,166 | |||||

| 1,008,578 |

Danaher Corp.

|

86,324,191 | |||||

| 1,478,201 |

Fastenal Co.

|

62,350,518 | |||||

| 652,958 |

Stericycle, Inc.*

|

87,437,606 | |||||

| 281,380,481 | |||||||

|

Information Technology — 33.6%

|

|||||||

| 1,386,454 |

Amphenol Corp.

|

80,372,738 | |||||

| 514,937 |

ANSYS, Inc.*

|

46,982,852 | |||||

| 689,924 |

Apple, Inc.

|

86,533,718 | |||||

| 1,146,038 |

Cognizant Technology Solutions Corp.*

|

70,011,461 | |||||

| 1,054,371 |

Facebook, Inc.*

|

90,428,129 | |||||

| 2,511,482 |

Genpact, Ltd.*

|

53,569,911 | |||||

| 70,692 |

Google, Inc. — Class A*

|

38,176,508 | |||||

| 71,732 |

Google, Inc. — Class C*

|

37,337,223 | |||||

| 1,196,796 |

National Instruments Corp.

|

35,257,610 | |||||

| 354,820 |

NetSuite, Inc.*

|

32,554,735 | |||||

| 722,475 |

NXP Semiconductors NV*

|

70,947,045 | |||||

| 1,139,474 |

salesforce.com, Inc.*

|

79,341,575 | |||||

| 1,513,676 |

Visa, Inc.

|

101,643,343 | |||||

| 823,156,848 | |||||||

|

Materials — 3.1%

|

|||||||

| 672,652 |

Ecolab, Inc.

|

76,056,761 | |||||

|

Total Common Stocks (Cost $1,663,739,114)

|

2,386,050,222 | ||||||

|

Short-Term Investments — 2.6%

|

|||||||

|

Money Market Funds — 2.6%

|

|||||||

| 63,003,604 |

DWS Cash Account Trust — Government

|

||||||

|

& Agency Securities Portfolio —

|

|||||||

|

Institutional Shares, 0.04%#

|

63,003,604 | ||||||

|

Total Short-Term Investments (Cost $63,003,604)

|

63,003,604 | ||||||

|

Total Investments — 100.1% (Cost $1,726,742,718)

|

2,449,053,826 | ||||||

|

Liabilities in Excess of Other Assets — (0.1)%

|

(2,044,110 | ) | |||||

|

NET ASSETS — 100.0%

|

$ | 2,447,009,716 | |||||

PORTFOLIO HOLDINGS

% of Net Assets

|

Information Technology

|

33.6%

|

|

Health Care

|

17.1%

|

|

Consumer Discretionary

|

11.8%

|

|

Consumer Staples

|

11.6%

|

|

Industrials

|

11.5%

|

|

Energy

|

4.5%

|

|

Financials

|

4.3%

|

|

Materials

|

3.1%

|

|

Money Market Funds

|

2.6%

|

|

Other Assets and Liabilities

|

(0.1)%

|

|

100.0%

|

|

*

|

Non-Income Producing

|

|

#

|

Annualized seven-day yield as of June 30, 2015.

|

The accompanying notes are an integral part of these financial statements.

www.brownadvisoryfunds.com

4

Brown Advisory Value Equity Fund

A Message to Our Shareholders

June 30, 2015

Dear Shareholder:

During the year ended June 30, 2015, the Brown Advisory Value Equity Fund Investor Shares (the “Fund”) declined -2.35% while, the Russell 1000® Value Index, the Fund’s benchmark, increased 4.13%.

Most of our underperformance was concentrated in the energy sector. A combination of collapsing oil prices, an advancing U.S. dollar and slowing growth among economies outside the U.S. put notable pressure on the Fund. Stock-specific weakness in our commodity-related holdings hurt our relative performance in the industrials and materials sectors.

The fundamental energy industry picture appeared relatively benign in late 2014, but the severe downturn following the Organization of the Petroleum Exporting Countries decision in November to maintain production far exceeded many people’s expectations. At the time, we were disproportionately impacted by our overweight mix of oil services and production companies. They lagged the integrated oil majors and refiners, as oil prices declined more than 40% during the fourth quarter of 2014. Given the greater uncertainty in energy markets, we have since right-sized and rebalanced our energy holdings. We believe that this portfolio decision has mitigated some of the downside risk but still affords us an opportunity to capture potential upside returns if and when the market recovers.

While the end of 2014 was by all accounts a challenging one for the strategy, the Fund has enjoyed better absolute and relative returns through the first six months of 2015. Strong stock selection in the technology and financial sectors along with a market rotation away from utilities were the biggest contributors to performance, though not enough to offset the macro pressures weighing on global cyclical stocks.

Within technology, a main driver was the surfacing of value driven by corporate action and investor activism. Activist involvement in Informatica led to its eventual sale to private equity investors. eBay, a stock we believed was inexpensive relative to the sum of its business parts, announced plans to spin off PayPal. CommScope announced that it was acquiring TE Connectivity businesses in a highly accretive deal that is expected to generate significant costs savings and expand its product offerings. These value-unlocking events remind us that while we are aware of the “top-down” economic influences that can weigh on our holdings, our portfolio is built from the “bottom up,” one stock at a time. We favor companies whose underlying worth is not appreciated in the market.

We believe that many of our financial services stocks are well positioned for rising interest rates, and our interest-sensitive names—including Charles Schwab, Northern Trust and Synovus Financial—performed well during the reporting period. Rising rate expectations also drove investors away from high-yielding sectors such as utilities. Utilities were the third worst-performing sector in the benchmark, down in absolute returns, and our absence of exposure to the sector also contributed favorably. We expect that investors should continue to rotate out of defensive utilities into more cyclically sensitive sectors should the U.S. economic outlook further improve.

During the period, the Fund added 22 investments while eliminating 11 holdings. The portfolio activity was spread widely across sectors. As mentioned earlier, a meaningful portion of our activity was related to repositioning our energy exposure while commodity prices remained weak and commodity-exposed companies work through a bottoming process. Specifically, we swapped out of Canadian Natural Resources, Schlumberger and Freeport-McMoRan in favor of Plains GP Holdings, Oceaneering and Suncor Energy. Within financials, we maintain a large absolute exposure to the sector but have diversified away from some of our regional banks into asset managers T. Rowe Price and Ameriprise and into attractively priced real-estate companies W.P. Carey and Forest City Enterprises. Within consumer names—particularly staples—we have found long-term investment opportunities in Unilever and Philip Morris, quality businesses that were oversold on concerns of slowing emerging markets and the strengthening dollar. AbbVie and General Electric are similarly inexpensive, high-quality relative value opportunities that have the potential to generate steady returns over our holding period. Copa Holdings, Viacom, Micron and Yahoo! are portfolio additions that represent depressed value situations that are out of favor and in our view offer prospects of turning around their businesses from current low-expectation levels.

www.brownadvisoryfunds.com

5

Brown Advisory Value Equity Fund

A Message to Our Shareholders

June 30, 2015

Our robust portfolio activity reflects a commitment to searching for value in all market environments and our willingness to invest for the long term, even though macro themes garner much of the market’s attention. At moments during the reporting period, our approach fell short of our standards for performance. However, our portfolio nevertheless has traded at a valuation discount to its benchmark, and we strongly believe that our focus on attractively priced global leaders with steady growth or improving prospects has the potential to create long-term shareholder value. We believe that we are being adequately compensated for near-term risks and that our patience and valuation discipline could be rewarded over time.

Sincerely,

Rick M. Bernstein, CFA

Portfolio Manager

Doron S. Eisenberg, CFA

Portfolio Manager

Michael L. Foss, CFA

Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in medium capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The value of the Fund’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. These risks are greater for investments in emerging markets. Diversification does not guarantee a profit or protect from loss in a declining market.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary on Terms.

www.brownadvisoryfunds.com

6

Brown Advisory Value Equity Fund

Performance Chart and Analysis

June 30, 2015

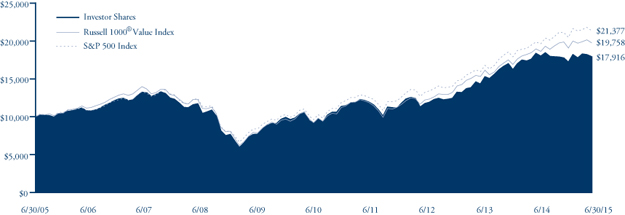

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against broad-based securities market indices. The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® companies with lower price to book ratios and lower expected growth values. The S&P 500 Index is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The indexes are unmanaged and do not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

|

Average Annual Total Return

|

One

|

Five

|

Ten

|

||

|

as of 6/30/15

|

Year

|

Year

|

Year

|

||

|

Institutional Shares1

|

-2.20%

|

14.70%

|

6.16%

|

||

|

Investor Shares

|

-2.35%

|

14.54%

|

6.00%

|

||

|

Advisor Shares2

|

-2.61%

|

14.23%

|

5.61%

|

||

|

Russell 1000® Value Index

|

4.13%

|

16.50%

|

7.05%

|

||

|

S&P 500 Index

|

7.42%

|

17.34%

|

7.89%

|

|

Institutional Shares

|

Investor Shares

|

Advisor Shares

|

||

|

Gross Expense Ratio3

|

0.77%

|

0.92%

|

1.17%

|

|

|

Net Expense Ratio3

|

0.77%

|

0.92%

|

1.17%

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisoryfunds.com/performance.html. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects periods during which fee waivers were in effect. In the absence of such waivers, total return would have been reduced. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower.

|

1

|

Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares.

|

|

2

|

Performance information for Advisor Shares, prior to commencement of operations on April 25, 2006, is based on the performance of Investor Shares, and adjusted for the higher expenses applicable to Advisor Shares.

|

|

3

|

Per the Fund’s prospectus dated October 31, 2014.

|

www.brownadvisoryfunds.com

7

Brown Advisory Value Equity Fund

Schedule of Investments

June 30, 2015

|

Shares

|

Security Description

|

Value $

|

|||||

|

Common Stocks — 96.4%

|

|||||||

|

Consumer Discretionary — 12.0%

|

|||||||

| 86,607 |

Best Buy, Inc.

|

2,824,254 | |||||

| 111,199 |

Coach, Inc.

|

3,848,598 | |||||

| 79,634 |

Discovery Communications, Inc.*

|

2,648,627 | |||||

| 87,645 |

GameStop Corp.

|

3,765,229 | |||||

| 105,366 |

Garmin, Ltd.

|

4,628,728 | |||||

| 37,302 |

Viacom, Inc.

|

2,411,201 | |||||

| 20,126,637 | |||||||

|

Consumer Staples — 4.4%

|

|||||||

| 37,368 |

Philip Morris International, Inc.

|

2,995,792 | |||||

| 103,071 |

Unilever NV ADR

|

4,312,491 | |||||

| 7,308,283 | |||||||

|

Energy — 11.5%

|

|||||||

| 103,689 |

ENSCO PLC

|

2,309,154 | |||||

| 67,173 |

National Oilwell Varco, Inc.

|

3,243,112 | |||||

| 48,193 |

Occidental Petroleum Corp.

|

3,747,970 | |||||

| 76,949 |

Oceaneering International, Inc.

|

3,585,054 | |||||

| 121,225 |

Plains GP Holdings L.P.

|

3,132,454 | |||||

| 118,378 |

Suncor Energy, Inc.

|

3,257,763 | |||||

| 19,275,507 | |||||||

|

Financials — 22.3%

|

|||||||

| 27,049 |

Ameriprise Financial, Inc.

|

3,379,232 | |||||

| 145,630 |

Charles Schwab Corp.

|

4,754,820 | |||||

| 75,095 |

Forest City Enterprises, Inc.*

|

1,659,599 | |||||

| 96,030 |

JPMorgan Chase & Co.

|

6,506,993 | |||||

| 61,027 |

Northern Trust Corp.

|

4,666,124 | |||||

| 509,867 |

Regions Financial Corp.

|

5,282,222 | |||||

| 118,215 |

SunTrust Banks, Inc.

|

5,085,609 | |||||

| 141,589 |

Synovus Financial Corp.

|

4,363,773 | |||||

| 21,863 |

T. Rowe Price Group, Inc.

|

1,699,411 | |||||

| 37,397,783 | |||||||

|

Health Care — 17.4%

|

|||||||

| 78,603 |

AbbVie, Inc.

|

5,281,336 | |||||

| 38,378 |

Baxter International, Inc.

|

2,683,773 | |||||

| 145,465 |

Hologic, Inc.*

|

5,536,398 | |||||

| 41,468 |

Merck & Co., Inc.

|

2,360,773 | |||||

| 37,919 |

Novartis AG ADR

|

3,728,954 | |||||

| 84,420 |

Sanofi S.A. ADR

|

4,181,323 | |||||

| 91,600 |

Teva Pharmaceutical Industries, Ltd. ADR

|

5,413,560 | |||||

| 29,186,117 | |||||||

|

Industrials — 6.6%

|

|||||||

| 22,154 |

Copa Holdings S.A.

|

1,829,699 | |||||

| 90,692 |

General Electric Co.

|

2,409,686 | |||||

| 106,908 |

Joy Global, Inc.

|

3,870,070 | |||||

| 47,904 |

PACCAR, Inc.

|

3,056,754 | |||||

| 11,166,209 | |||||||

|

Information Technology — 20.3%

|

|||||||

| 40,378 |

Apple, Inc.

|

5,064,411 | |||||

| 39,817 |

Check Point Software Technologies, Ltd.*

|

3,167,442 | |||||

| 176,474 |

Cisco Systems, Inc.

|

4,845,976 | |||||

| 109,053 |

CommScope Holdings Co, Inc.*

|

3,327,207 | |||||

| 46,171 |

eBay, Inc.*

|

2,781,341 | |||||

| 43,531 |

Microchip Technology, Inc.

|

2,064,458 | |||||

| 43,620 |

Micron Technology, Inc.*

|

821,801 | |||||

| 61,809 |

Microsoft Corp.

|

2,728,867 | |||||

| 61,139 |

NetApp, Inc.

|

1,929,547 | |||||

| 82,528 |

QUALCOMM, Inc.

|

5,168,729 | |||||

| 57,683 |

Yahoo, Inc.*

|

2,266,365 | |||||

| 34,166,144 | |||||||

|

Materials — 1.9%

|

|||||||

| 105,134 |

Potash Corp. of Saskatchewan, Inc.

|

3,256,000 | |||||

|

Total Common Stocks (Cost $134,639,527)

|

161,882,680 | ||||||

|

Real Estate Investment Trusts — 0.8%

|

|||||||

| 23,420 |

W.P. Carey, Inc.

|

1,380,375 | |||||

|

Total Real Estate Investment Trusts (Cost $1,329,451)

|

1,380,375 | ||||||

|

Short-Term Investments — 3.3%

|

|||||||

|

Money Market Funds — 3.3%

|

|||||||

| 5,505,105 |

DWS Cash Account Trust — Government

|

||||||

|

& Agency Securities Portfolio —

|

|||||||

|

Institutional Shares, 0.04%#

|

5,505,105 | ||||||

|

Total Short-Term Investments (Cost $5,505,105)

|

5,505,105 | ||||||

|

Total Investments — 100.5% (Cost $141,474,083)

|

168,768,160 | ||||||

|

Liabilities in Excess of Other Assets — (0.5)%

|

(762,664 | ) | |||||

|

NET ASSETS — 100.0%

|

$ | 168,005,496 | |||||

PORTFOLIO HOLDINGS

% of Net Assets

|

Financials

|

22.3%

|

|

Information Technology

|

20.3%

|

|

Health Care

|

17.4%

|

|

Consumer Discretionary

|

12.0%

|

|

Energy

|

11.5%

|

|

Industrials

|

6.6%

|

|

Consumer Staples

|

4.4%

|

|

Money Market Funds

|

3.3%

|

|

Materials

|

1.9%

|

|

Real Estate Investment Trusts

|

0.8%

|

|

Other Assets and Liabilities

|

(0.5)%

|

|

100.0%

|

ADR — American Depositary Receipt

|

*

|

Non-Income Producing

|

|

#

|

Annualized seven-day yield as of June 30, 2015.

|

The accompanying notes are an integral part of these financial statements.

www.brownadvisoryfunds.com

8

Brown Advisory Flexible Equity Fund

A Message to Our Shareholders

June 30, 2015

Dear Shareholder:

During the year ended June 30, 2015, the Brown Advisory Flexible Equity Fund Investor Shares (the “Fund”) increased 7.92% in value. The S&P 500 Index, the Fund’s benchmark, increased 7.42% during the same period.

We repeat our message from our Semi-Annual Report that investors may anticipate lower returns on equities in the next three- and five-year periods compared with past performance. Stock valuations, economic activity and investor sentiment are higher today compared with the past, so investors may temper their expectations. Our thinking is summed up by a quote from John Templeton, the late investor and philanthropist: “Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” A review of stock market history—whether the broad stock market, notable sectors or individual companies—reveals a consistent pattern in which investor emotion tugs equity prices up or down. To use Templeton’s phrasing, our best characterization of the current U.S. equity market is that it is maturing on optimism.

That is not to say we are bearish. The U.S. economy’s long-term record of innovation, development and adaptation supports an optimistic outlook. The cycles in investor emotions referenced in the Templeton quote occur around a rising long-term trend of economic progress. Also, the broad valuation of stocks, though higher than we prefer for the rate of future returns, is not excessive in our view, particularly in an environment of unusually low interest rates.

The biggest contributors to the Fund’s results during the year ended June 30, 2015 were Anthem Inc., a managed care company; Visa, Inc., a global payments processor; Edwards Lifesciences, a manufacturer of devices to treat cardiovascular disease; Walt Disney, a diversified leisure and entertainment business; and Express Scripts, a pharmacy benefits manager. These top contributors benefited from good business results and rising valuations.

The most significant detractors to the Fund’s performance were Copa Holdings, a Latin American airline; National Oilwell Varco, a manufacturer of equipment for oil and gas drilling; Occidental Petroleum, an integrated energy company; QUALCOMM, a wireless communications company; and American Express, a global provider of financial services. Copa’s shares declined due to disappointing earnings stemming from pricing pressures in its market resulting from economic pressures in its Central and South American markets. National Oilwell Varco and Occidental Petroleum shares fell with the decline in the price of oil. Both QUALCOMM and American Express declined when each lost a significant customer, but those are temporary setbacks in our view.

Interestingly, there is a common trait held by both our best and worst contributors listed above. This trait is share repurchases. We view share repurchases as an effective capital discipline for businesses generating more cash from their business than they can immediately and profitably redeploy in their business. Obviously, buying your own stock may not immediately result in a higher share price, but when financed internally and performed with good judgment on price to value, it may be beneficial for continuing shareholders. We are less a fan of repurchases done just to offset stock and option grants for employee incentives.

We added one new holding since our December 31, 2014, Semi-Annual Report to shareholders. Oceaneering International (“OII”) provides services for off-shore oil exploration and production, especially remotely operated vehicle services for installing, inspecting and maintaining equipment deep under water. Lower oil prices obviously challenge most oil-related businesses, but to the extent that lower prices are temporary, the share price declines present an opportunity. OII is a leader in its field, with a strong balance sheet and historically good returns on its invested capital. We believe that it will prosper over time as oil markets normalize.

We eliminated two small energy-related holdings, California Resources Corp. and NOW Inc. in part to fund our purchase of OII. Both were 2014 spin-offs from other portfolio companies. We eliminated our investment in Time Warner Cable (“TWC”) at a nice gain because of concerns about prospective regulation of the cable industry and completion of its deal to be acquired by Comcast. Once Comcast cancelled its deal for TWC, we were not surprised that Charter Communications made a subsequent bid, but we were surprised by how much higher it was. Thus, we sold too soon judging from the subsequent events.

While we are always looking for better ideas, we like the business prospects of our current holdings and, importantly, what we are paying for these companies when compared with the broader market.

We researched quite a few companies in the past few months. This is an ongoing process, but the March-to-June period is the high point for the number of annual reports and proxies that arrive from companies. Always notable among these is the Berkshire Hathaway annual report and its letter from CEO Warren Buffett. This year marks the 50th year since Buffett took control of Berkshire, and the latest report reflects on the past, present and future of this enterprise, which is among the largest holdings in the Fund. His letter is available at www.berkshirehathaway.com. Our notes from the recent annual shareholders meeting at Berkshire are available at www.brownadvisory.com.

www.brownadvisoryfunds.com

9

Brown Advisory Flexible Equity Fund

A Message to Our Shareholders

June 30, 2015

The Flexible Equity strategy looks broadly for what we believe are bargains among long-term attractive businesses with shareholder-oriented managers. Bargains can arise because of short-term investor perceptions and temporary business difficulties that are likely to improve. Attractively priced companies can also appear because they are undiscovered opportunities or are making unrecognized changes for the better.

Sincerely,

R. Hutchings Vernon, CFA

Portfolio Manager

Michael L. Foss, CFA

Portfolio Manager

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible. The Flexible Equity Fund may invest in securities of foreign issuers. Investments in such securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. These risks are greater for investments in emerging markets. The value of the Fund’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Investments in smaller companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer term debt securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisoryfunds.com

10

Brown Advisory Flexible Equity Fund

Performance Chart and Analysis

June 30, 2015

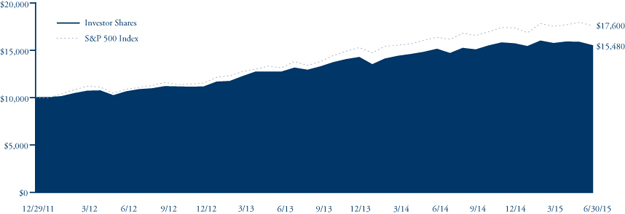

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT

The following chart reflects the change in value of a hypothetical $10,000 investment, including reinvested dividends and distributions, in the Fund as measured against the broad-based securities market index. The S&P 500 (“Index”) is a market-value weighted index representing the performance of 500 widely held, publicly traded large capitalization stocks. The Index is unmanaged and does not reflect the deduction of fees, such as investment management fees. Investors cannot invest directly in an index.

|

Since

|

|||||

|

Average Annual Total Return

|

One

|

Five

|

Inception

|

||

|

as of 6/30/15

|

Year

|

Year

|

(11/30/06)

|

||

|

Institutional Shares1

|

8.09%

|

17.34%

|

6.19%

|

||

|

Investor Shares

|

7.92%

|

17.15%

|

6.03%

|

||

|

Advisor Shares2

|

7.68%

|

16.93%

|

5.75%

|

||

|

S&P 500 Index

|

7.42%

|

17.34%

|

6.88%

|

|

Institutional Shares

|

Investor Shares

|

Advisor Shares

|

||

|

Gross Expense Ratio3

|

0.81%

|

0.96%

|

1.21%

|

|

|

Net Expense Ratio3

|

0.81%

|

0.96%

|

1.21%

|

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit our website at brownadvisoryfunds.com/performance.html. The performance table and graph above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects periods during which fee waivers were in effect. In the absence of such waivers, total return would have been reduced. Performance data does not reflect the imposition of the redemption fee of 1.00% on shares redeemed within 14 days, and if it did, performance would have been lower.

|

1

|

Performance information for the Institutional Shares, prior to commencement of operations on October 19, 2012, is based on the performance of Investor Shares, and adjusted for the lower expenses applicable to Institutional Shares.

|

|

2

|

Performance information for Advisor Shares, prior to commencement of operations on January 24, 2007, is based on the performance of Investor Shares, and adjusted for the higher expenses applicable to Advisor Shares.

|

|

3

|

Per the Fund’s prospectus dated October 31, 2014.

|

www.brownadvisoryfunds.com

11

Brown Advisory Flexible Equity Fund

Schedule of Investments

June 30, 2015

|

Shares

|

Security Description

|

Value $

|

|||||

|

Common Stocks — 93.9%

|

|||||||

|

Consumer Discretionary — 15.5%

|

|||||||

| 199,269 |

Best Buy, Inc.

|

6,498,162 | |||||

| 97,914 |

CarMax, Inc.*

|

6,482,886 | |||||

| 113,494 |

Lowe’s Companies, Inc.

|

7,600,693 | |||||

| 7,258 |

Priceline Group, Inc.*

|

8,356,644 | |||||

| 78,060 |

TJX Companies, Inc.

|

5,165,230 | |||||

| 86,541 |

Walt Disney Co.

|

9,877,790 | |||||

| 43,981,405 | |||||||

|

Consumer Staples — 1.3%

|

|||||||

| 38,500 |

PepsiCo, Inc.

|

3,593,590 | |||||

|

Energy — 7.6%

|

|||||||

| 231,513 |

Kinder Morgan, Inc.

|

8,887,784 | |||||

| 75,875 |

National Oilwell Varco, Inc.

|

3,663,245 | |||||

| 80,008 |

Occidental Petroleum Corp.

|

6,222,222 | |||||

| 58,318 |

Oceaneering International, Inc.

|

2,717,036 | |||||

| 21,490,287 | |||||||

|

Financials — 19.5%

|

|||||||

| 49,782 |

American Express Co.

|

3,869,057 | |||||

| 146,584 |

Bank of America Corp.

|

2,494,860 | |||||

| 96,004 |

Berkshire Hathaway, Inc.*

|

13,067,104 | |||||

| 247,843 |

Charles Schwab Corp.

|

8,092,074 | |||||

| 80,626 |

Franklin Resources, Inc.

|

3,953,093 | |||||

| 101,007 |

JPMorgan Chase & Co.

|

6,844,234 | |||||

| 333,345 |

Regions Financial Corp.

|

3,453,454 | |||||

| 22,755 |

T. Rowe Price Group, Inc.

|

1,768,746 | |||||

| 214,479 |

Wells Fargo Co.

|

12,062,299 | |||||

| 55,604,921 | |||||||

|

Health Care — 12.7%

|

|||||||

| 56,029 |

Anthem, Inc.

|

9,196,600 | |||||

| 42,077 |

Edwards Lifesciences Corp.*

|

5,993,027 | |||||

| 128,163 |

Express Scripts Holding Co.*

|

11,398,818 | |||||

| 46,441 |

Merck & Co., Inc.

|

2,643,886 | |||||

| 117,400 |

Teva Pharmaceutical Industries, Ltd. ADR

|

6,938,340 | |||||

| 36,170,671 | |||||||

|

Industrials — 10.5%

|

|||||||

| 153,786 |

Canadian National Railway Co.

|

8,881,141 | |||||

| 15,450 |

Canadian Pacific Railway, Ltd.

|

2,475,554 | |||||

| 57,797 |

Copa Holdings S.A.

|

4,773,454 | |||||

| 87,362 |

Owens Corning

|

3,603,683 | |||||

| 57,700 |

United Rentals, Inc*

|

5,055,674 | |||||

| 46,730 |

United Technologies Corp.

|

5,183,759 | |||||

| 29,973,265 | |||||||

|

Information Technology — 25.5%

|

|||||||

| 65,402 |

Accenture PLC

|

6,329,606 | |||||

| 62,786 |

Apple, Inc.

|

7,874,934 | |||||

| 108,592 |

eBay, Inc.*

|

6,541,582 | |||||

| 7,139 |

Google, Inc. — Class A*

|

3,855,345 | |||||

| 13,078 |

Google, Inc. — Class C*

|

6,807,230 | |||||

| 18,061 |

International Business Machines Corp.

|

2,937,802 | |||||

| 98,308 |

MasterCard, Inc.

|

9,189,832 | |||||

| 146,234 |

Microsoft Corp.

|

6,456,231 | |||||

| 107,726 |

QUALCOMM, Inc.

|

6,746,879 | |||||

| 235,044 |

Visa, Inc.

|

15,783,205 | |||||

| 72,522,646 | |||||||

|

Telecommunication Services — 1.3%

|

|||||||

| 45,185 |

Crown Castle International Corp.

|

3,628,355 | |||||

|

Total Common Stocks (Cost $214,586,835)

|

266,965,140 | ||||||

|

Warrants — 0.2%

|

|||||||

| 20,000 |

Wells Fargo Co.*

|

449,800 | |||||

|

Total Warrants (Cost $221,300)

|

449,800 | ||||||

|

Short-Term Investments — 5.5%

|

|||||||

|

Money Market Funds — 5.5%

|

|||||||

| 15,684,814 |

DWS Cash Account Trust — Government

|

||||||

|

& Agency Securities Portfolio —

|

|||||||

|

Institutional Shares, 0.04%#

|

15,684,814 | ||||||

|

Total Short-Term Investments (Cost $15,684,814)

|

15,684,814 | ||||||

|

Total Investments — 99.6% (Cost $230,492,949)

|

283,099,754 | ||||||

|

Other Assets in Excess of Liabilities — 0.4%

|

1,248,867 | ||||||

|

NET ASSETS — 100.0%

|

$ | 284,348,621 | |||||

PORTFOLIO HOLDINGS

% of Net Assets

|

Information Technology

|

25.5%

|

|

Financials

|

19.5%

|

|

Consumer Discretionary

|

15.5%

|

|

Health Care

|

12.7%

|

|

Industrials

|

10.5%

|

|

Energy

|

7.6%

|

|

Money Market Funds

|

5.5%

|

|

Consumer Staples

|

1.3%

|

|

Telecommunication Services

|

1.3%

|

|

Warrants

|

0.2%

|

|

Other Assets and Liabilities

|

0.4%

|

|

100.0%

|

ADR — American Depositary Receipt

|

*

|

Non-Income Producing

|

|

#

|

Annualized seven-day yield as of June 30, 2015.

|

The accompanying notes are an integral part of these financial statements.

www.brownadvisoryfunds.com

12

Brown Advisory Equity Income Fund

A Message to Our Shareholders

June 30, 2015

Dear Shareholder:

During the year ended June 30, 2015, the Brown Advisory Equity Income Fund Investor Shares (the “Fund”) rose 2.45%. The S&P 500 Index, the Fund’s benchmark, increased 7.42% during the same period.

Returns to U.S. large-cap equity investors in the past year look reasonable. This return, however, was not broad based. We believe two themes held several sectors back: (1) retreating oil and related commodity prices and (2) fears of rising interest rates. Oil prices peaked almost exactly one year ago, then declined approximately 50% over this past year. Most other industrial commodities have also seen meaningful price declines, including iron ore and copper. Meanwhile, high valuation combined with fears of rising interest rates led to poor performance in the utilities, Real Estate Investment Trusts (“REIT”) and telecom sectors.

Worries over rising interest rates impacted all income-oriented investments, especially during the first half of 2015. The Fund held up well against many of these alternatives. The Fund’s incremental investments have been skewed toward dividend growth, and it has avoided the most expensive bond proxies in the utility, telecom and REIT sectors. However, the Fund could not keep pace with the broader large cap indices because of its income orientation, combined with the strong performance of traditional growth stocks within the S&P 500 Index.

For the Fund’s benchmark, strong performance from the health care, consumer discretionary and information technology sectors over the past year more than made up for a significant decline in the energy sector caused by lower commodity prices. Despite meaningful weightings to the health care and consumer discretionary sectors throughout the period, the performance of the Fund’s holdings in these sectors did not keep pace. The Fund’s best-performing consumer discretionary name was mass retailer Target, which is in the midst of a sweeping operational turnaround. AbbVie was the biggest contributor among the Fund’s health care holdings due to better-than-expected earnings from its growing global pharmaceutical portfolio.

The Fund’s information technology holdings managed to keep pace with the benchmark’s performance, led by strong returns from Apple and Automated Data Processing. However, the Fund remains under-weight the benchmark in the technology sector. It has been a challenge to find enough names in the information technology sector that fit the Fund’s preference for stocks with high dividend yields and growth prospects at attractive valuations.

Two of the Fund’s worst-performing stocks during the year were Ensco and Total, both in the energy sector. Ensco was eliminated after the offshore driller’s financial results deteriorated faster and more substantially than originally anticipated amid falling energy prices. The Fund’s position in integrated oil and gas company Total was reduced.

Overall, the Fund’s preference for pipeline companies such as Plains and Kinder Morgan was a benefit during the year, driving relative outperformance in the energy sector compared to the benchmark. The Fund also benefited from its lack of exposure to the utilities sector, which also performed poorly during the period.

Portfolio turnover for the Fund was 18% over the past year, down from the annual average since inception. Opportunities have been fewer, and we like how the portfolio is currently positioned. The Fund added General Electric following the announcement by the conglomerate’s management team that it would exit most financial-related business areas and refocus on the company’s core industrial products in an effort to improve shareholder returns. Black Stone Minerals LP was also added after the mineral right owner’s recent initial public offering garnered a tepid response from investors because of near-term worries about the direction of oil and natural gas prices.

Among the Fund’s eliminations during the past year, Time Warner Cable was sold as the stock advanced ahead of a buyout proposal from rival cable operator Charter Communications. Also, one series of the Fund’s preferred stock holdings of Public Storage, an operator of self-storage facilities, was called away by the company during the period.

When we look back to the launch of the Fund nearly four years ago, we believe that many of its attributes remain as compelling today as they did then. While the absolute yield is a bit lower and valuation a bit higher than at launch, we believe the yield spread over many stock and bond indices remains high and the beta/risk remains low. We believe the growth profile has improved, and the quality of the companies we invest in remain top of mind for us.

Sincerely,

Mike Foss, CFA

Portfolio Manager

Brian Graney, CFA

Portfolio Manager

www.brownadvisoryfunds.com

13

Brown Advisory Equity Income Fund

A Message to Our Shareholders

June 30, 2015

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in smaller and medium capitalization companies generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock. The value of the Fund’s investments in REITs and Real Estate may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. The Fund may invest in ETFs, which may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the Fund can generate brokerage expenses. Investments in foreign securities entail certain risks not associated with investments in domestic securities, such as volatility of currency exchange rates, and in some cases, political and economic instability and relatively illiquid markets. Investing in Master Limited Partnerships (“MLPs”) entails risk related to fluctuations in energy prices, decreases in supply of or demand for energy commodities, unique tax consequences due to the partnership structure and various other risks. Privately Placement issued securities are restricted securities that are not publicly traded. Delay or difficulty in selling such securities may result in a loss to the Fund.

Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. For a complete list of fund holdings, please refer to the Schedule of Investments provided in this report.

Definitions for terms and indices are provided in the Glossary of Terms.

www.brownadvisoryfunds.com

14

Brown Advisory Equity Income Fund

Performance Chart and Analysis

June 30, 2015

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT