UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from _______ to _________

Commission File Number 000-54701

YEW BIO-PHARM GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 26-1579105 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

9460 Telstar Avenue, Suite 6

El Monte, California 91731

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (626) 401-9588

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Name of each exchange on which registered | |

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of March 30, 2016 was approximately $1,894,834.

As of March 30, 2016, there were 51,875,000 shares, $0.001 par value per share, of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

YEW BIO-PHARM GROUP, INC.

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

| Page | ||

| PART I | ||

| ITEM 1. | BUSINESS | 1 |

| ITEM 1A. | RISK FACTORS | 15 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS | 26 |

| ITEM 2. | PROPERTIES | 26 |

| ITEM 3. | LEGAL PROCEEDINGS | 28 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 28 |

| PART II | ||

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 29 |

| ITEM 6. | SELECTED FINANCIAL DATA | 30 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 30 |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 43 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 43 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 43 |

| ITEM 9A. | CONTROLS AND PROCEDURES | 43 |

| ITEM 9B. | OTHER INFORMATION | 44 |

| PART III | ||

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 45 |

| ITEM 11. | EXECUTIVE COMPENSATION | 47 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 49 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 50 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES | 51 |

| PART IV | ||

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | 52 |

| SIGNATURES | 55 | |

| POWER OF ATTORNEY | 55 | |

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact are “forward-looking statements”, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Except for our ongoing obligation to disclose material information as required by the federal securities laws, we do not intend, and undertake no obligation, to update any forward-looking statement.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. Some of the key factors impacting these risks and uncertainties include, but are not limited to:

| ● | risks related to our ability to collect amounts owed to us by some of our largest customers; | |

| ● | our ability to continue to purchase yew cuttings from our various suppliers at relatively stable prices; | |

| ● | our dependence on a small number of customers for our yew raw materials, including a related party; | |

| ● | our dependence on a small number of customers for our yew trees for reforestation; | |

| ● | our ability to market successfully yew raw materials used in the manufacture of traditional Chinese medicine, or TCM; | |

| ● | industry-wide market factors and regulatory and other developments affecting our operations; | |

| ● | our ability to sustain revenues should the Chinese economy slow from its current rate of growth; | |

| ● | continued preferential tax treatment for the sale of yew trees and potted yew trees; | |

| ● | uncertainties about involvement of the Chinese government in business in the PRC generally; | |

| ● | any change in the rate of exchange of the Chinese Renminbi, or RMB, to the U.S. dollar, which could affect currency translations of our results of operations, which are earned in RMB but reported in dollars; | |

| ● | industry-wide market factors and regulatory and other developments affecting our operations; | |

| ● | any impairment of any of our assets; | |

| ● | a slowdown in the Chinese economy; and | |

| ● | risks related to changes in accounting interpretations. |

For a detailed description of these and other factors that could cause actual results to differ materially from those expressed in any forward-looking statement, please see the section entitled “Risk Factors”, beginning on page 15 below.

PART I

The discussion of our business is as of the date of filing this report, unless otherwise indicated.

| ITEM 1 | BUSINESS |

Introduction

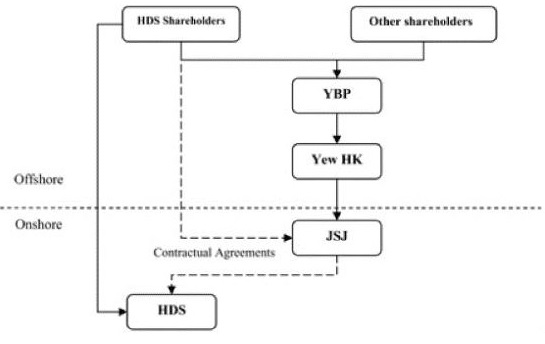

Unless otherwise noted, references in this registration statement to the “Company,” “we,” “our” or “us” means Yew Bio-Pharm Group, Inc. (individually, “YBP”), a Nevada corporation; its wholly-owned subsidiaries, Yew Bio-Pharm Holdings Limited (individually, “Yew HK”), a corporation organized under the laws of Hong Kong, and Heilongjiang Jinshangjing Bio-Technology Development Co., Limited (individually, “JSJ”), a corporation organized in the People’s Republic of China, (“China” or the “PRC”); and a deemed variable interest entity, or VIE, Harbin Yew Science and Technology Development Co., Ltd. (individually, “HDS”), a corporation organized in the PRC, and Harbin Yew Food Co. LTD (individually, “HYF”), the subsidiary of HDS, a corporation organized in the PRC.

We are a major grower and seller of yew trees and manufacturer of products made from yew trees in China. We also sell raw material, including the branches and leaves of yew trees, used in the manufacture of TCM. The yew raw material contains taxol, and TCM containing yew raw material has been approved in the PRC for use as a secondary treatment of certain cancers, meaning it must be administered in combination with other pharmaceutical drugs. The yew industry is regulated in the PRC because the yew tree is considered an endangered species. In the first quarter of 2015, we started to sell wood ear mushroom.

We believe that our business is built upon five unique components:

| ● | We have entered into several land use agreements with various parties, which provide the potential for us to grow a large number of yew trees on large areas of land over the next few decades, although we cannot currently estimate the number of trees we will grow or the total amount of land we will put into production over such period. | |

| ● | We employ proprietary, patented accelerated growth technology, the Asexual Reproduction Method, to bring yew trees to commercialization decades faster than growing yew trees naturally. | |

| ● | Because of our more productive and faster rate of yew cultivation, we have a sufficient supply of raw material to allow us to use the branches and leaves, rather than the bark, of yew trees, to sell to customers for the purpose of making TCM. The yew industry is highly regulated in the PRC because the yew tree is considered an endangered species. By harvesting only branches and leaves of yew trees we respond to both environmental sensitivities and regulations, because cutting the bark of the yew trees will damage the trees and stop it from growing new branches. | |

| ● | We have permits from the Heilongjiang provincial government to sell our yew trees and manufacture handicrafts using yew timber. We believe that we are one of only a handful of companies in the PRC with permissions to manufacture handicrafts using yew timber. | |

| ● | The TCM raw materials and yew tree segments of our business are tax-free in the PRC. |

Using patented accelerated growth technology developed by our founder and President, Zhiguo Wang, based on principles of asexual propagation and cloning, we can bring yew trees to maturity and commercialize them in as little as two-to-three years, compared to more than 50 years needed for naturally grown yew trees. Additionally, we have permits from the Heilongjiang provincial government to sell our yew trees and products made from yew trees. We believe that we are one of only a few companies in the PRC with such permission.

We operate in five business segments: TCM raw materials, yew trees, handicrafts, wood ear mushroom and others. We sell TCM raw materials in the form of yew tree branches and leaves to our customers, primarily an affiliate, to manufacture TCM containing taxol. We began the TCM raw materials segment in 2010.

In December 2009, another company owned directly and indirectly primarily by Mr. Wang, Heilongjiang Yew Pharmaceutical Co., Ltd., or Yew Pharmaceutical, received approval from the Heilongjiang Food and Drug Agency, or HFDA, to sell Zi Shan , a TCM to be sold under both prescription and over-the-counter drug categories. Zi Shan contains taxol, and the TCM is approved in the PRC as a secondary treatment of cancer, meaning it must be administered in combination with other pharmaceutical drugs. In February 2010, we began selling to Yew Pharmaceutical branches and leaves of yew trees, which is more environmentally responsible than using the bark of yew trees, to extract taxol.

We also derive a significant amount of our revenue from the sale of yew seedlings and trees to state-owned enterprises and private businesses for reforestation in Heilongjiang Province and Jilin Province, in the northeastern China, as well as the sale of potted yew trees to retail customers. We also generate revenue from the sale of handicrafts, including furniture, made from yew timber. We started to sell wood ear mushroom on the fourth quarter of 2014. Additionally, we started to sell yew candles in the third quarter of 2015, and pine needle extracts in the fourth quarter of 2015. Most of our revenue is derived from the Chinese domestic market for the year ended December 31, 2015.

| 1 |

For the year ended December 31, 2015, revenues from the sale of TCM raw materials represented approximately 55.69% of consolidated revenue (including 47.73% of consolidated revenues from a related party); sale of yew trees represented approximately 3.84% of consolidated revenue; sale of handicrafts represented approximately 0.53% of consolidated revenue; sale of wood ear mushroom represented approximately 8.95% of consolidated revenue; and the sale of the others, which include yew candles and pine needle extracts, represented approximately 30.99% of consolidated revenue. For the year ended December 31, 2014, revenues from the sale of TCM raw materials represented approximately 52.33% of consolidated revenue (including 22.88% of consolidated revenues from a related party); sale of yew trees represented approximately 41.53% of consolidated revenue; and the sale of handicrafts represented approximately 2.24% of consolidated revenue; and the sale of wood ear mushroom represented approximately 3.90% of consolidated revenue.

Under Article 27 of the Law of the PRC on Enterprises Income Tax and Article 15 of the provisional regulations of the PRC on Value Added Tax, we do not pay any tax, including income tax and value-added tax, or VAT, in our TCM raw materials and yew tree segments. Our current VAT exemption certificate is valid from July 1, 2005 through December 31, 2016 and our current income tax exemption certificate is valid from January 1, 2008 through December 31, 2058. We pay taxes on handicrafts made from yew timber, wood ear mushroom, yew candle and pine needle extracts.

Zhiguo Wang, the founder of the Company and our President, does not devote all of his time to the Company’s business. We estimate that Mr. Wang devotes approximately 71% of his time, or approximately 120 hours per month, to the Company’s business. He devotes about 12% of his time, or approximately 20 hours per month, to the business of Yew Pharmaceutical and the balance of his time, or approximately 28 hours per month, to the business of other companies in which he is involved. These allocations are approximate only and are subject to change depending upon the particular projects and changing needs of the individual businesses in which he is involved.

The executive offices of HDS, our operating entity, are located in Harbin City, the capital of Heilongjiang Province in the PRC. Our four nurseries used to cultivate yew trees, and our production facilities to manufacture products made from yew trees, are located in and around Harbin. We also have a facility in Harbin where we exhibit and warehouse potted yew trees, handicrafts and furniture.

YBP was incorporated in Nevada on November 5, 2007. YBP’s current executive office is located at 9460 Telstar Avenue Suite 6, El Monte, CA 91731, and our telephone number is (626) 401-9588. Our website is www.yewbiopharm.com. No part of our website is incorporated into this registration statement or any other report we file with the Securities and Exchange Commission, or the SEC, from time to time.

Industry Overview

Since 1996, we have grown Japanese yew trees (also referred to in China as Northeast yew trees), taxus cuspidata , on mountain hillsides near Harbin and cultivate them in four nurseries we operate near Harbin. We have successfully cultivated more than eight million yew nursery seedlings in four nurseries. These nurseries occupy approximately 19,759 Mu (approximately 2,957 acres) of forested land. We currently have the capacity to grow up to two million yew nursery seedlings annually. We also have contractual rights to use an additional 1,000,000 Mu (approximately 166,667 acre) site in Wuchang, which land we currently do not utilize, for future expansion of our yew tree growing operations.

Northeast yew trees grow well in the climate of Northeast China. Using our patented Asexual Reproduction Method, developed by our founder and President, Zhiguo Wang, based on principles of asexual propagation and cloning, we can bring yew trees to maturity and commercialize them in as little as two-to-three years, compared to more than 50 years of maturity period for naturally grown yew trees. We believe that utilizing the Asexual Reproduction Method addresses an imbalance between supply and demand for yew trees, both for reforestation and use in the production of cancer-fighting TCM.

The Northeast yew is a small- to medium-sized evergreen tree, typically growing from between 35 and 65 feet tall, with a trunk up to 6-1/2 feet in diameter. The bark is thin and scaly brown. The leaves are lanceolate, flat and dark green, typically between 1/2 and 1-1/2 inches long and about 0.1 inches broad, arranged in a spiral pattern on the stem. The Northeast yew tree is relatively slow growing compared to other species of yew trees, but can be very long-lived. It is estimated that a Northeast yew tree can live up to 2,000 years. The growing cycle of a Northeast yew tree is extremely long and regeneration is difficult.

Yew trees are scarce and, traditionally, it takes a long time to bring them to commercialization. It can take more than 50 years for a yew tree to mature naturally for pharmaceutical use. Our Asexual Reproduction Method shortens this period significantly. We begin with cuttings from natural yew trees, which we transplant at our nurseries. By using our Asexual Reproduction Method, the success rate of maturation is enhanced and in approximately two-to-three years the yew tree is able to be used for commercialization. We use some trees in their entirety and parts of other yew trees that we need and take the rest of the tree itself back to the forest to finish full growth to maturity in 10-15 years, creating a new generation of mature yew trees.

| 2 |

Because the Northeast yew trees are categorized as an endangered species and are protected in the PRC as a Level 2 preserved tree, the operation of the yew industry in the PRC is strictly regulated by the PRC Forest Law and its Implementing Regulations, Rules on Permit for Felling of Forest Trees, Regulations on Wild Plants Protection and other PRC laws and regulations. The available sources for yew trees for commercialization are scarce and costs of production are relatively high.

In accordance with the Notification about Key Points of Forestry Policies from National Forestry Bureau Registered (2007) No.173, or the Notification, issued on August 10, 2007 jointly by the National Forestry Bureau, the National Development and Reform Commission, the Finance Ministry, the Commerce Department, the State Administration of Taxation, the China Banking Regulatory Commission, and China Security Regulatory Commission, the Chinese government encourages the development of technologies promoting the cultivation of rare trees and plant-based pharmaceuticals; encourages the cultivation of fast growing timber species, especially rare and large diameter timber; and accelerates the reorganization and integration of existing wood-based panels, furniture, wood products manufacturing enterprises. The Notification also provides that the forestry industry shall enjoy state preferential taxation policies. According to the provisions of the relevant tax laws and regulations on enterprises engaged in agriculture and forestry projects, the enterprise income tax can be reduced or eliminated.

The Ministry of Science and Technology of the PRC implemented the Spark Program, or the Spark Program, in 1986. The major task of the Spark Program is to rejuvenate the rural economy by relying on science and technology and popularizing advanced and applicable scientific and technological findings in the rural areas. To encourage the Spark Program, the Chinese government set up the National Spark Prize in 1987, including Spark Science and Technology Prize, Spark Talent Training Prize, Spark Management Prize, Spark Outstanding Youth Prize and Spark Demonstrating Enterprise Prize. In 2001 the project of cultivation of yew trees has been recognized by the Ministry of Science and Technology of PRC as the Spark Program.

We have entered into several land use agreements with various parties, which provide the potential for us to grow a large number of yew trees on approximately 1,017,713.5 mu (approximately 169,619 acres) over the next few decades, although we cannot currently estimate the total number of trees we will grow or the total amount of land we will put into production over such period. Among these land use agreements, on March 21, 2004, we entered into a Joint-Stock Construct Rare Plant Northeast Yew Contract, or the Joint Venture Agreement, with the Heilongjiang Province Wuchang City Forestry Bureau, or the Wuchang Forestry Bureau, pursuant to which the Wuchang Forestry Bureau has given us access to 1,000,000 mu (approximately 166,667 acres) of forest land located in Wuchang City to develop yew tree forests and produce yew seedlings. Pursuant to the Joint Venture Agreement, we have permission to plant yew trees on this land from 2004 through 2034. Under the Joint Venture Agreement, any profits from the planting of yew trees and other agriculture shall be distributed 80% to the Company and 20% to the Wuchang Forestry Bureau. We have not yet cultivated this land or generated any revenue under the Joint Venture Agreement. Because of the profit-sharing feature of this agreement, we presently intend to focus on cultivating yew trees on other land subject to existing and possibly future land use agreements as our priority for at least the next few years.

Our business is sustainable and environmentally responsible. We accelerate the growth of yew trees utilizing our Asexual Reproduction Method, more than replenishing the number of yew trees we cultivate and put into production. We harvest yew trees twice a year. We do not use the bark of yew trees in production, which would kill the yew tree; instead, we use the branches and leaves of the yew tree.

Traditional Chinese Medicine

There is a long-established, scientifically recognized relationship between the Pacific yew, taxus brevifolia , and similar species of yew (including the Northeast yew), and certain cancer drugs, most notably paclitaxel, also known as taxol. Paclitaxel is a broad-spectrum mitotic inhibitor used in cancer chemotherapy. It was discovered in a U.S. National Cancer Institute program at the Research Triangle Institute in 1967 when Monroe E. Wall and Mansukh C. Wani isolated it from the bark of the Pacific yew tree and named it taxol. Taxol is found in the root, stem, leaf, seed and bark of the taxus family of trees, including the Pacific and Northeast yews. It was developed commercially by Bristol-Myers Squibb under the brand name Taxol®. The PRC State Food and Drug Administration, or the SFDA, approved a new drug certification for taxol in 1995.

The improvement on the extraction and isolation technology of the biological properties of taxol made it a breakthrough in the treatment of cancer in the 1990s, providing a non-intrusive alternative to the more radical techniques of radiotherapy and surgery. Taxol is used to treat patients with lung, ovarian, breast, head and neck cancer, and advanced forms of Kaposi’s sarcoma.

Taxol, derived from certain species of yew tree including the Northeast yew tree, is a taxane drug and mitotic inhibitor that is used to treat cancer. All cells grow by a process called mitosis (cell division). Taxol targets rapidly growing cancer cells, sticks to them while they are trying to divide and prevents them from completing the division process. Since the cancer cells cannot divide into new cells, they cannot grow and the cancer cannot metastasize. Taxol may suppress tumor growth through regulating microtubule stabilization, inducing apoptosis and adjusting immunologic mechanism. Taxol can promote the polymerization of microtubule and inhibit their degradation, through which taxol can block cell division in the G2/M stage and induce apoptosis of tumor cells.

| 3 |

Taxol is a clear, colorless fluid that is given intravenously as a chemotherapy injection or as an infusion pumped from a dose bag. Taxol can be administered as high-dose chemotherapy, once every two or three weeks, or in low doses on a weekly basis. In the treatment of certain soft tissue cancers, such as breast cancer, taxol is given for early stage and metastatic breast cancer after combination anthracycline and cytoxan therapy and is also given as neoadjuvant treatment to shrink a tumor before surgery. Taxol can also be used together with a drug called Cisplatin to treat advanced ovarian cancer and non-small cell lung cancer, or NSCLC. The U.S. Food and Drug Administration has approved taxol as the primary and secondary treatment for NSCLC. There are other generally accepted protocols for the use of taxol as a cancer drug alone or in combination with other drugs depending upon the diagnosis, staging and type of cancer, as well as a patient’s medical history, tolerances and allergies, among other relevant factors.

The Chinese Herbal Medicine Standard (manual) of Heilogjiang Province (2011 version), edited by the HFDA, states that the Northeast yew has a secondary effect on treating cancer, meaning that while it has an impact on treating cancer, yew tree extract by itself (as distinguished from processed taxol) cannot be used as a stand-alone treatment of cancer. While the TCM raw material we sell contains taxol naturally, the companies to whom we sell such raw materials do not extract taxol from our TCM raw materials to produce pharmaceutical taxol.

Certain species of yew trees are the only natural source of taxol. Initially, taxol was extracted from the bark of the yew tree, but harvesting the bark usually kills the tree. Moreover, taxol is extracted from the bark of yew trees in extremely small amounts, often requiring the destruction of several yew trees to extract enough taxol to treat a single patient. Accordingly, taxol extracted from the yew is both very expensive and environmentally harmful. Because of environmental concerns about the adverse impact on forests in the Pacific Northwest in the United States, by the 1990s taxol ceased being derived from the bark of the Pacific yew. Alternative ways to develop taxol from renewable resources is ongoing. These include taxol-producing fungi from the yew tree and using other parts of the yew tree that may contain taxol.

We believe using yew trees that have been grown using our Asexual Reproduction Method significantly shortens the maturity cycle of naturally-grown yew trees and allows earlier commercialization of yew trees as a source of taxol. We further believes that using the branches and leaves of yew trees in large quantities, as we do, provides the key to solving the need for additional sources of taxol while not further endangering the PRC’s natural supply of yew trees, which themselves were over-forested in previous decades since the discovery of taxol.

The founder and President of our company, Zhiguo Wang, with the support of the Ministry of Forest and Science, and the Technology Department of Heilongjiang Province, successfully completed a project from 1984 to 1995 for asexual reproduction of the Northeast yew, and developed the first artificial cloned yew forest in the world. Tests conducted by the Ministry of Education’s Key Laboratory of Forest Plant Ecology in Northeast Forestry University have shown that the growing cycle of a cloned yew is significantly shorter than that of a natural yew and the concentration is taxol is higher. In 1995, this project received the Second Scientific and Technological Progress Award of Heilongjiang Province.

In December 2009, Yew Pharmaceutical received authorization from HFDA approving the sale of a yew-based TCM as a secondary treatment of cancer and certain other disorders, including uric disorders, certain liver diseases and menstrual discomfort. This TCM, sold under the brand name Zi Shan , has been approved to be sold under both prescription and over-the-counter drug categories. We also believe that Zi Shan may provide general beneficial effects on overall health. According to the Quintessence of Materia Medica, published in August 2006 by the Chinese Academy of Medical Sciences - Institute of Medicinal Plants, the Northeast yew plays a role as a diuretic, detumescence and in restoring menstrual flow. The approval from HFDA allows Yew Pharmaceutical to sell Zi Shan throughout the PRC.

In November 2010, Yew Pharmaceutical applied to the SFDA to approve an upgrade of Zi Shan from provincial to national standard, which we believe will enhance its general market acceptance and therefore could create additional demand for the raw materials we sell to Yew Pharmaceutical. As of the date of this report, the application is pending.

We entered into a Cooperation and Development Agreement dated January 9, 2010, or the Development Agreement, with Yew Pharmaceutical, a related party, for the development, production and sale of yew-based TCM. Under the Development Agreement, we sell yew branches and leaves to Yew Pharmaceutical. Yew Pharmaceutical manufactures TCM at its own facilities in Harbin in accordance with the requirements of HFDA. Yew Pharmaceutical is also responsible for producing the finished product in accordance with good manufacturing practice, or GMP, requirements (in this regard, it received a GMP certificate in November 2009), and filing all applications with and obtaining all approvals from the HFDA.

Yew Pharmaceutical is the primary purchaser of the raw materials we sell in our TCM raw materials business. Pursuant to the Development Agreement, Yew Pharmaceutical pays us RMB1,000,000 per ton of raw material, whereas the current market price for such raw material is approximately RMB 1,100,000 per ton. The term of the Development Agreement is ten years, terminating on January 9, 2020. We began selling raw material in the form of branches and leaves of yew trees to Yew Pharmaceutical commencing in February 2010.

| 4 |

Yew Pharmaceutical is owned 95% by Heilongjiang Hongdoushan Ecology Forest Co., Ltd, a Chinese company, or HEFS, which itself is owned 63% by our founder, President and one of our directors, Zhiguo Wang, and 34% by his wife, Guifang Qi, who is also one of our directors. The remaining 5% is owned directly by Madame Qi. See Item 13, “Certain Relationships and Related Transactions, and Director Independence”.

Yew Pharmaceutical is the exclusive manufacturer of Zi Shan in the PRC. Zi Shan is sold in sachets in HFDA-approved dosages of two grams per sachet. It is consumed as a tea twice a day for therapeutic purposes or once a day for general health benefits. Approximately 30% of Zi Shan sales to date are in Heilongjiang Province and approximately 70% of such sales are from other provinces.

Starting in June 2010, other pharmaceutical companies started purchasing yew raw materials from us to manufacture and sell TCM similar to Zi Shan in other provinces.

Yew Trees

We have developed a detailed process of yew tree breeding. We start growing yew trees from seedlings that we purchase from various third parties, including certain affiliates. These seedlings come from naturally-grown mature yew trees. Because yew trees are protected, yew seedlings are scarce. Prices have been rising for yew seedlings by approximately 20% per year in recent years and we expect that to continue for at least the next few years. Our largest supplier of yew seedlings is a company that is directly and indirectly owned primarily by Mr. Wang and Madame Qi. See “Suppliers” below and Item 13, “Certain Relationships and Related Transactions, and Director Independence”.

We cultivate the yew seedlings at our nurseries for at least three to four years. Most of the land we lease from various parties for the growth of yew trees is location in and around Harbin. We have entered into several land use agreements with various parties, which provide the potential for us to grow a large number of yew trees on large areas of land over the next few decades, although we cannot currently estimate the number of trees we will grow or the total amount of land we will put into production over such period. Among these land use agreements, pursuant to the Joint Venture Agreement, we have been granted permission to grow yew trees on up to 1,000,000 mu (approximately 166,667 acres) and to share profits 80% to the Company and 20% to the Wuchang Forestry Bureau. In addition, we have been provided two areas to use as nurseries for the cultivation of yew seedlings in the aggregate amount of 1,400 mu (approximately 233 acres). See Item 2, “Properties”.

When the yew trees are mature enough for transplanting, we prepare survey and design specifications for an afforestation plan. Once this has been prepared and approved, we clean and divide the reproducing area, clearing brushwood and weeds, and mark off breeding areas of between five and eight meters in width and less than one meter in length. We typically plant stock in the spring, when the defrosted soil is a depth of at least 15 centimeters.

The cut materials are then dried for a period of 18-20 hours at a temperature of between 55°C and 60°C, with the temperature monitored every three hours. After the drying process, the moisture content of the plant material should not exceed 8.0%. We then use a crusher to grind the plant material into a powder. The powder is mixed before being put into sealed plastic bags. The sealed plastic bags are put into outer shipping material and the package undergoes a final inspection before being ready for shipment.

By using our patented Asexual Reproduction Method, developed by our founder and President, Zhiguo Wang, we are able to accelerate the commercial viability of a yew tree, so that it is able to be used for commercialization starting in approximately three years, compared to more than 50 years for naturally grown yew trees. For example, the branches and leaves from an accelerated growth yew tree can be used in the production of TCM in three to five years, and a cutting from an accelerated growth yew tree will develop into a small yew tree that can be sold as a potted tree starting in approximately three years. We are authorized sell cuttings of cloned yew trees without a government permit.

We sell yew trees primarily to state-owned enterprises and private businesses for reforestation in Heilongjiang Province and Jilin Province, in Northeast China. Historically, we have sold the majority of our yew trees to a small number of larger customers. However, even though we have a number of long-term customers, we do not enter into long-term agreements for the sale of our yew trees. Because our profit margin is smaller for larger customers due to volume price discounts, we are making efforts to increase sales to smaller customers. Our business relating to the sale of yew trees is seasonal. March to May, November and December are our strongest months.

After a period of three-to-seven years under cultivation, we also transplant some yew trees into decorative ceramic pots and sell these to retail customers for display in homes and offices. The Chinese people believe that in addition to its aesthetic qualities, yew trees help cleanse the air and reduce pollution. Accordingly, yew trees are purchased by individuals for personal use in their home or office and are often given as gifts. Yew trees can be found at landmarks around the world, including the White House and Lincoln Memorial.

| 5 |

We purchase high quality ceramic pots from third parties into which the yew trees are transplanted. We believe that there is a readily available supply of high-quality ceramic pots at relatively low and stable prices.

Because of the limited supply of yew trees and restrictions on the commercial use of yew trees, combined with the high quality of the ceramic pots we purchase from third-party sources, primarily in South China, used for the transplanted trees, the potted yew trees that we sell are highly prized and we charge premium retail prices by Chinese standards. Retail prices of potted yew trees vary based on the age, shape and other desirable qualities of the tree, and range from approximately RMB 280 to approximately RMB 3,080.

In connection with our entering into a land use agreement in July 2012, or the Fuye Field Agreement, we acquired more than 80,000 trees - which are not yew trees - located on that property. These trees consist of approximately 20,000 larix, 56,700 spruce and 3,700 poplar trees. Larix trees are used primarily in landscaping and we currently anticipate that we will begin selling larix trees to customers during 2013. Spruce and poplar trees are used primarily as building materials and we currently anticipate that we will begin selling these trees to customers in later periods, when these trees reach maturity in several years.

Handicrafts

Yew wood is of medium strength, making it possible to fashion products from the yew tree without undue effort or expense requiring special equipment. To create our current inventory of award-winning handicrafts, including furniture, historically we employed between 15 and 20 artisans from throughout the PRC, principally from Fujian Province and Jiangxi Province in southern China, annually from summer through late fall, to manufacture handicrafts made from yew timber at our production facility near Harbin. Since we currently have an adequate inventory of handicrafts, we now manufacture additional handicrafts only when orders are placed.

We begin the process of manufacturing handicrafts by selecting yew timber with greater variation in molding, which is indicative of a more attractive grain to the wood. The selected timber is then placed in a drying chamber and steam is injected to accelerate water evaporation until moisture content is only 3%. Depending upon the size and thickness of the timber, this process can take as long as one week.

The process of designing the item to be created begins with rough basing, based on geometrical form to summarize the overall artistic idea. During the entire process of carving the timber it is important to minimize knife scarring. Our crafted pieces typically go through a dying process; this not only can address certain small imperfections in the wood but is also done to aesthetically enhance the finished piece. After waiting at least twelve hours following dyeing, the carved item is then polished with sandpapers of different roughness and finally finishing cloths.

All of our products are hand-made, using yew tree timber of different maturities. Much of the furniture that we produce is reproductions of popular Ming and Qing Dynasty styles. We have acquired an inventory of yew timber from various parties over a number of years and have an adequate supply on hand for approximately five more years’ worth of production. Because of the scarcity of yew timber needed to produce handicrafts, it is very expensive to acquire new inventory of yew timber and supplies are extremely limited, if available at all. Accordingly, we plan to reduce and eventually eliminate our handicraft segment over the next several years.

Pursuant to the Department of Forestry of Heilongjiang Province (2003) Document No.188, issued by Department of Forestry of Heilongjiang Province on October 25, 2003, we have been granted rights to develop comprehensively and use Northeast yew resources. We believe that we are one of only a few companies in the PRC to have received approval for the manufacture of items made from yew timber.

Because of the limited supply of yew timber and restrictions on the commercial use of yew trees, combined with the high quality of artisans we employ, the handicrafts and furniture we manufacture are highly prized and we charge premium retail prices to our customers. Examples of retail prices for some of our products are as follows:

| ● | a pair of yew chopsticks sells for approximately RMB198; | |

| ● | a fountain pen sells for approximately RMB2,480; | |

| ● | sculptures can sell for tens of thousands of RMB; and | |

| ● | large pieces of furniture can sell for more than RMB100,000. |

| 6 |

Wood Ear Mushroom

Wood ear mushroom grows in the deep forests throughout Asia, Europe and the United States. Though highly valued for its nutritional benefits in Asian regions, this crunchy, dark brown colored, and ear shape little super food is rarely sought after by its western counterparts. Wood ear mushroom contains high levels of polysaccharides, dietary fiber, protein, vitamins, and 20 times more iron than spinach, making it the new undisputed king vegetable. In addition, with rising concerns of heart health related diseases, researches have shown that antioxidants and anti-inflammatory agents contained in wood ear mushroom can be an excellent alternative to traditional supplements.

The Company started to sell wood ear mushroom product in the fourth quarter of 2014, and generated $2,648,180 in revenues in 2015 from this newly created business segment.

Others

The others segment includes the sales of yew candles and pine needle extracts. We started to sell yew candle products in the third quarter of 2015, and pine needle extracts in the fourth quarter of 2015. The others segment generated $9,164,478 in revenues in 2015.

Suppliers

We obtain yew seedlings from several sources. Prior to January 1, 2011, our largest supplier was Zishan Technology Co., Ltd., or ZTC, a related party. We believe that we pay market rate for the seedlings and cuttings we purchase from our suppliers. Mr. Wang and Madame Qi own approximately 39.4% and 30.7%, respectively, of ZTC. See Item 13, “Certain Relationships and Related Transactions, and Director Independence”. We do not plan on making significant purchases from ZTC in the future.

None of the agreements we have with our suppliers are long-term contracts, meaning they can be canceled at any time. We believe that the supply of yew seedlings is readily available and if we lost one of our suppliers, we could readily find a replacement.

Sales and Marketing

We sell most of our products in the Chinese domestic market. The sale of yew trees for reforestation in Heilongjiang Province and Jilin Province is to both state-owned enterprises and private businesses.

We sold our products to a relatively small number of customers. For the year ended December 31, 2015, the following customers accounted for 10% or more of our consolidated revenue:

| ● | Yew Pharmaceutical accounted for approximately 57% of our consolidated revenue | |

| ● | Dafurong Biotechnology (HK) Ltd., accounted for approximately 36% of our consolidated revenue |

For the year ended December 31, 2014, the following customers accounted for 10% or more of our consolidated revenue:

| ● | Yew Pharmaceutical accounted for approximately 27% of our consolidated revenue | |

| ● | Shenzhen Dongfang Shangcheng Trading Co., Ltd., accounted for approximately 16% of our consolidated revenue |

Yew Pharmaceutical is the manufacturer of Zi Shan and other pharmaceutical products, and is owned, directly and indirectly, primarily by Zhiguo Wang and Guifang Qi.

The sale of furniture and handicrafts from our cultivated yew trees, as well as the sale of potted yew trees for display in homes and offices, is to the Chinese domestic market. We exhibit and warehouse potted yew trees, handicrafts and furniture at a facility located in Harbin.

Retail prices for potted yew trees are high by Chinese standards, but have remained stable. We provide the potted yew trees that we sell, from our nurseries. The supply of ceramic pots that we purchase from third-parties suppliers that we use to transplant cultivated yew trees is good and prices are stable.

The sale of handicrafts is not seasonal. In December 2012, we closed our store in Harbin. Until December 2014, our headquarter warehouse in Harbin maintained inventory of a range of handicrafts and furniture, for sale and can also take orders for products custom-made to the specifications of our customers. We currently use this facility to exhibit and warehouse our products. Prices and delivery time for custom pieces vary depending upon the item and time of year, since our artisans work primarily during the warmer months from April to September.

| 7 |

Zi Shan is marketed and sold exclusively through Yew Pharmaceutical, under the Development Agreement. Yew Pharmaceutical is also our major purchaser of yew raw material used in the production of TCM. Yew Pharmaceutical is owned directly and indirectly primarily by Mr. Wang and Madame Qi.

Other TCM that is produced by manufacturers who buy yew raw material from us is marketed and sold by them to third party users, including hospitals.

We started to sell wood ear mushroom since the fourth quarter of 2014, and the major customer is our related party Heilongjiang Yew Pharmaceutical Co., Ltd. Yew Pharmaceutical purchased the wood ear mushroom and extracted for further processed. We also started to sell yew candles and pine needle extracts in the third and fourth quarters in 2015.

Intellectual Property

We believe that we are able to cultivate and grow yew trees successfully and faster by using our patented Asexual Reproduction Method, based on principles of asexual propagation and cloning, developed by our founder and President, Zhiguo Wang. Our patented Asexual Reproduction Method functions through cell replication with identical genes, sometimes referred to as cloning, of Northeast Yew with only a single parent present.

Mr. Wang first studied yew cloning techniques in 1982, for the purpose of addressing the long reproduction time, low reproduction rates and weak survival rates for yew trees in general. With the support of the Ministry of Forest and Science, and the Technology Department of Heilongjiang Province, Mr. Wang successfully completed a project from 1984 to 1995 for asexual cultivation and cloning technology of the yew, and developed the first artificial cloned yew forest in the world. Tests conducted by the Ministry of Education’s Key Laboratory of Forest Plant Ecology in Northeast Forestry University have shown that the growing cycle of a cultivated yew is significantly shorter than that of a natural yew and the concentration is taxol is higher.

We have been issued two patents related to our advanced growth technology:

| ● | “Yew Tree Plant Extracts, Methods for Extracting the Plant Extracts and Application”, or the Yew Extract Method, was granted by the State Intellectual Property Office, or SIPO, to HDS on August 16, 2011. This patent had previously been held by Heilongjiang Yew Pharmaceutical Co., Ltd. This patent is valid for 20 years, from June 23, 2004 through June 22, 2024. | |

| ● | “Northeast Yew Asexual Reproduction Method”, or the Asexual Reproduction Method, was granted by SIPO to HDS on September 21, 2011. This patent is valid for 20 years, from September 30, 2010 through September 29, 2030. |

We believe that our patented Asexual Reproduction Method has three unique advantages:

| ● | The Asexual Reproduction Method addresses the low rooting rate problem and accelerates the seedling rate and the maturity period for Northeast yew. It increases the rooting rate to over 80% and the seedling rate to over 85% for Northeast yew. It can bring the Northeast yew to maturity and ready for commercialization for medical use in as little as two-to-three years, compared to more than 50 years for naturally growing yew trees. | |

| ● | Large colonies can form to out-compete other organisms for nutrients. The active ingredients in the offspring were relatively stable with little difference. | |

| ● | There is high chance of survival of the offspring with little variation. |

| 8 |

Our patented Yew Extract Method is an extraction process to extract anti-cancer active ingredients from yew branches and leaves for use in anti-cancer drugs. It utilizes Northeast yew branches and leaves as new medicinal parts to obtain anti-cancer ingredients. The Yew Extract Method has high yield rate and low costs. According to the Shanghai Institute of Pharmaceutical Industry, the anti-cancer effect of the ingredients obtained through Yew Extract Method is no less than that of taxol. Clinical research studies show the ingredients obtained through the Yew Extract Method has also low side effects. The Yew Extract Method increases the sustainability and enhances the utilization rates for yew trees in medical use from 1/5000 (in obtaining taxol) to 1/200. The Yew Extract Method has not yet been used for commercial purposes. We are currently studying the possibility of commercializing the Yew Extract Method for medical uses.

We do not currently own any trade names, trademarks or service marks the loss of which would be materially adverse to our business.

Research and Development

We entered into a Technology Development Service Agreement dated January 1, 2010, or the Technology Agreement, with Shanghai Kairun Bio-Pharmaceutical Co., Ltd., or Kairun. Under the Technology Agreement, Kairun provides us with testing and technologies regarding utilization of yew trees to extract taxol and develop higher concentration of taxol in the yew trees we grow and cultivate. For these services, we have agreed to pay Kairun a one-time fee in the amount of RMB 200,000 after the technologies developed by Kairun are tested and approved by us. We retain all intellectual property rights in connection with the technologies developed by Kairun. Kairun may not provide similar services to any other party without our prior written consent.

The initial term of the Technology Agreement was two years. Kairun informed us that it is taking longer than originally expected to develop the technologies and conduct the tests under the Technology Agreement.

Accordingly, in February 2012, we entered into a supplemental agreement with Kairun, extending the term of the Technology Agreement indefinitely until project results specified in the original Technology Agreement are achieved. Kairun is owned directly and indirectly primarily by Mr. Wang and Madame Qi. See Item 13, “Certain Relationships and Related Transactions, and Director Independence”.

We incurred $13,554 and $53,542 of research and development expenses in 2015 and 2014, respectively.

Competition

We believe that we face little competition within the PRC for the growth and cultivation of yew trees because of the amount of space needed for proper cultivation of yew trees, the long period to maturity of the yew tree, the difficulties of propagation, the scarcity of yews and the regulation of the yew industry in the PRC. Because of the need for governmental approval to grow, cultivate and commercialize yew trees, we believe that there are high barriers to entry to our industry.

Most of our competitors are smaller companies that do not have cloning technology and therefore have to engage in substantially longer growing cycles to commercialize yew trees. Our main competitors in the growth of yew trees and cultivation of yew cuttings include Zhejiang Changshan Mandiya Yew Science and Technology Limited Company, located in Zhejiang, China; and Luo Yang Madia Yew Science and Technology Development Limited Company, or Luo Yang, located in Henan, China. For example, Luo Yang has only approximately 300 mu (approximately 50 acres) of yew seedlings under cultivation.

There is significant competition for the sale of furniture, handicrafts and potted trees in the PRC. This is a highly fragmented industry in the PRC with innumerable competitors and little, if any, concentration of market share locally, regionally or nationally. Many of our competitors are probably larger than we are and can devote more resources than we can to the manufacture, distribution and sale of furniture, handicrafts and potted trees. Additionally, many of our competitors sell furniture and handicrafts, not made of yew trees, at prices considerably lower than the premium prices at which we sell our products. However, we believe that there is relatively little competition within the Chinese domestic market for our premium-priced yew products, primarily because of the scarcity of yew trees and the regulation of the yew industry in the PRC. We believe that we are the only business in the PRC that has been given permission to produce furniture and handicrafts from yew timber.

While we do not manufacture TCM or any taxol-based product ourselves, we could be seen as indirectly competing with companies that do manufacture taxol-based medicine. We face potential competition from many providers of TCM for many ailments. With respect to TCM specifically for use as a secondary treatment for cancer, we may be seen to compete with companies such as Fujian Leephick Pharmaceutical Limited Company, or Fujian Leephick, located in Wuping, China, and Qi Ao Chinese Medicine Tablet Co., Ltd., or Qi Ao, located in Anguo City, Hebei Province, China. Fujian Leephick is a fairly new company that we believe is only in an early stage of its research and development. Qi Ao can be differentiated from our company in that Qi Ao does not cultivate yew trees and requires third party supply of raw materials to produce TCM, whereas we produce the raw materials and sell them to our affiliate under the Development Agreement for the production of TCM, thereby providing a reliable supply of raw materials combined with the financial assurance of being paid up-front rather than being paid depending upon the timing and amount of sales to purchasers of the TCM.

| 9 |

Ningbo Green-Health Pharmaceutical Company Co., Ltd. is a leading manufacturer of food and drugs with substantially greater financial and other resources than ours. However, taxol-based medicine is only one of Ningbo’s products and they do not produce any other yew-based products other than taxol-based medicine.

Plant and Equipment

The machinery and other equipment that we use in making our products are manufactured, for the most part, in the PRC. We conduct our own maintenance of our machinery and equipment. Replacement parts are relatively easy to obtain without delays as and when required, and are not subject to significant price fluctuations.

Government Regulations

Certain parts of our business are regulated under national, provincial and local laws in the PRC. The following information summarizes certain major regulations that apply to us.

Regulations at the national, provincial and local levels in the PRC are subject to change. To date, compliance with governmental regulations has not had a material impact on our earnings or competitive position, but, because of the evolving nature of such regulations, we are unable to predict the impact such regulation may have in the foreseeable future.

The growing and cultivation of yew trees and manufacturing products from yew trees, is regulated by Forest Law and its Implementing Regulations, Rules on Permit for Felling of Forest Trees, Regulations on Wild Plants Protection and other PRC laws and regulations. HDS received approval issued by the Department of Forestry of Heilongjiang Province (Document No. 188) on October 25, 2003, allowing it to sell yew trees and manufacture handicrafts using yew timber. There is no cost to the Company to maintain this approval. This approval has no expiration date.

As a foreign-invested enterprise, JSJ is subject to the Foreign-Invested Enterprise Law (1986), as amended, and the Regulations of Implementation of the Foreign Investment Enterprise Law (1990), as amended, both of which provide for incorporation, corporate governance, operation, business and other aspects of a foreign-invested enterprise.

PRC resident shareholders of the Company are required to complete foreign exchange registration with the State Administration on Foreign Exchange, or SAFE. In October 2005, SAFE issued the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-raising and Return Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies, or SAFE Circular 75, which became effective as of November 1, 2005, and was further supplemented by two implementation notices issued by the SAFE on November 24, 2005, May 29, 2007 and July1, 2011, respectively. SAFE Circular 75 states that PRC residents, whether natural or legal persons, must register with the relevant local SAFE branch prior to establishing or taking control of an offshore entity established for the purpose of overseas equity financing involving onshore assets or equity interests held by them.

In 2006, six PRC regulatory agencies jointly adopted Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule. The M&A Rule requires that, if an overseas company established or controlled by PRC domestic companies or citizens intends to acquire equity interests or assets of any other PRC domestic company affiliated with the PRC domestic companies or citizens, such acquisition must be submitted to the Ministry of Commerce, or MOFCOM, rather than local regulators, for approval. In addition, this regulation requires that an overseas company controlled directly or indirectly by PRC companies or citizens and holding equity interests of PRC domestic companies needs to obtain the approval of the China Securities Regulatory Commission, or the CSRC, prior to listing its securities on an overseas stock exchange. On September 21, 2006, the CSRC published a notice on its official website specifying the documents and materials required to be submitted by overseas special purpose companies seeking CSRC’s approval of their overseas listings.

Environmental Issues

Our operations are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating facilities have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that the operations are in compliance with the relevant PRC environmental laws and regulations.

We believe that we are in substantial compliance with all environmental laws and regulations applicable to our business. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

| 10 |

Corporate Structure and Recapitalization

Second Restructure

In October 2010, the Company determined, in consultation with its professional advisors, that the First Restructure did not meet certain technical PRC legal requirements and that the Company would need to be further reorganized, or the Second Restructure. Accordingly, on October 28, 2010, JSJ and each of the HDS Shareholders entered into new Equity Transfer Agreement, referred to collectively as the Second Transfer Agreements, the terms of which are substantially identical to each other, pursuant to which 100% of the common stock of HDS was transferred by JSJ back to the HDS Shareholders for aggregate consideration of RMB45,000,000. Since the consideration of RMB45,000,000 due to the HDS Shareholders in the First Restructure had not yet been paid, pursuant to a Supplemental Agreement to the Second Equity Transfer Agreements dated February 16, 2011, the aggregate RMB45,000,000 amount payable by the HDS Shareholders to JSJ for the return of their HDS common stock in respect of the Second Restructure, was offset against JSJ’s liability to the HDS Shareholders in the same aggregate amount in respect of the First Transfer Agreements, which amount had not yet been paid by JSJ.

As discussed above, Mr. Jiang and HEFS had assigned to Mr. Wang their respective rights and obligations vis-a-vis JSJ resulting from the First Restructure, pursuant to the First Supplemental Agreement and the Creditors’ Agreement, since as of such time Mr. Jiang and HEFS had not yet been paid for the transfer of their interests in HDS to JSJ in the First Restructure in the amount of 3.22% and 10.62% of HDS’s equity interest, respectively. Therefore, in the Second Restructure, pursuant to the Second Transfer Agreements, JSJ transferred to Mr. Wang not only his previous shareholdings in HDS before the First Restructure (representing 62.81% of HDS’s total equity), but also an additional 13.84% of the equity in HDS as a result of Mr. Wang’s being assigned Mr. Jiang’s 3.22% equity interest in HDS and HEFS’s 10.62% equity interest in HDS.

After the foregoing transactions were completed, the HDS Shareholders then owned 100% of the shares of HDS in the following percentages:

| Mr. Wang | 76.65 | % | ||

| Madame Qi | 18.53 | % | ||

| Mr. Han | 4.82 | % |

| 11 |

On November 5, 2010, JSJ entered into a series of contractual arrangements, or the Contractual Arrangements, with HDS and/or the HDS Shareholders, as described below:

| ● | Exclusive Business Cooperation Agreement. Pursuant to the Exclusive Business Cooperation Agreement between JSJ and HDS, or the Business Cooperation Agreement, JSJ has the exclusive right to provide to HDS general business operation services, including advice and strategic planning, as well as consulting services related to technology, research and development, human resources, marketing and other services deemed necessary, or collectively referred to as the Services. Under the Business Cooperation Agreement, JSJ has exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of the Business Cooperation Agreement, including but not limited to copyrights, patents, patent applications, software and trade secrets. HDS shall pay to JSJ a monthly consulting service fee, or the Service Fee, in RMB that is equal to 100% of the monthly net income of HDS. Upon the prior written consent by JSJ, the rate of Service Fee may be adjusted pursuant to the operational needs of HDS. Within 30 days after the end of each month, HDS shall (a) deliver to JSJ the management accounts and operating statistics of HDS for such month, including the net income of HDS during such month, or the Monthly Net Income, and (b) pay 80% of such Monthly Net Income to JSJ, each such payment referred to as a Monthly Payment. Within ninety (90) days after the end of each fiscal year, HDS shall (a) deliver to JSJ financial statements of HDS for such fiscal year, which shall be audited and certified by an independent certified public accountant approved by JSJ, and (b) pay an amount to JSJ equal to the shortfall, if any, of the aggregate net income of HDS for such fiscal year, as shown in such audited financial statements, as compared to the aggregate amount of the Monthly Payments paid by HDS to JSJ in such fiscal year. HDS also granted an irrevocable and exclusive option to JSJ to purchase any and all of the assets of HDS, to the extent permitted under PRC law, at the lowest price permitted by PRC law. Unless earlier terminated in accordance with the provisions of the Business Cooperation Agreement or other agreements separately executed between JSJ and HDS, the Business Cooperation Agreement is for a term of ten years and expires on November 5, 2020; however, the term of the Business Cooperation Agreement may be extended if confirmed in writing by JSJ prior to the expiration of the term thereof. The period of the extended term shall be determined exclusively by JSJ and HDS shall accept such extended term unconditionally. Unless JSJ commits gross negligence, or a fraudulent act, against HDS, HDS shall not terminate the Business Cooperation Agreement prior to the expiration of the term, including any extended term. Notwithstanding the foregoing, JSJ shall have the right to terminate the Business Cooperation Agreement at any time upon giving 30 days’ prior written notice to HDS. |

| ● | Exclusive Option Agreement. Under an Exclusive Option Agreement among JSJ, HDS and each HDS Shareholder, individually referred to as an Option Agreement, the terms of which are substantively identical to each other, each HDS Shareholder has granted JSJ or its designee the irrevocable and exclusive right to purchase, to the extent permitted under PRC law, all or any part of the HDS Shareholder’s equity interests in HDS, or the Equity Interest Purchase Option, for RMB 10. If an appraisal is required by PRC laws at the time when and if JSJ exercises the Equity Interest Purchase Option, the parties shall negotiate in good faith and, based upon the appraisal, make a necessary adjustment to the purchase price so that it complies with any and all then applicable PRC laws. Without the consent of JSJ, the HDS Shareholders shall not sell, transfer, mortgage or dispose of their respective shares of HDS stock. Additionally, without the prior consent of JSJ, the HDS Shareholders shall not in any manner supplement, change or amend the articles of association and bylaws of HDS, increase or decrease its registered capital, change the structure of its registered capital in any other manner, or engage in any transactions that could materially affect HDS’ assets, liabilities, rights or operations, including, without limitation, the incurrence or assumption of any indebtedness except incurred in the ordinary course of business, execute any major contract over RMB 500,000, sell or purchase any assets or rights, incur of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of each Option Agreement is ten years commencing on November 5, 2020 and may be extended at the sole election of JSJ. |

| ● | Equity Interest Pledge Agreement. In order to guarantee HDS’s performance of its obligations under the Business Cooperation Agreement, each HDS Shareholder, JSJ and HDS entered into an Equity Interest Pledge Agreement, individually referred to as a Pledge Agreement, the terms of which are substantially similar to each other. Pursuant to the Pledge Agreement, each HDS Shareholder pledged all of his or her equity interest in HDS to JSJ. If HDS or the HDS Shareholders breach their respective contractual obligations and such breach is not remedied to the satisfaction of JSJ within 20 days after the giving of notice of breach, JSJ, as pledgee, will be entitled to exercise certain rights, including the right to foreclose upon and sell the pledged equity interests. During the term of the Pledge Agreement, the HDS Shareholder shall not transfer his or her equity interest in HDS or place or otherwise permit any other security interest of other encumbrance to be placed on such equity interest. Upon the full payment of the Service Fee under the Business Cooperation Agreement and upon the termination of HDS’s obligations thereunder, the Pledge Agreement shall be terminated. |

| ● | Power of Attorney. Under a Power of Attorney executed by each HDS Shareholder, individually referred to as a Power of Attorney, the terms of which are substantially similar to each other, JSJ has been granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the HDS Shareholder, to act on behalf of the HDS Shareholder as his or her exclusive agent and attorney with respect to all matters concerning the HDS Shareholder’s equity interests in HDS, including without limitation, the right to: 1) attend shareholders’ meetings of HDS; 2) exercise all the HDS Shareholder’s rights, including voting rights under PRC laws and HDS’s Articles of Association, including but not limited to the sale or transfer or pledge or disposition of the HDS Shareholder’s equity interests in HDS in whole or in part; and 3) designate and appoint on behalf of the HDS Shareholder the legal representative, executive director, supervisor, manager and other senior management of HDS. |

| 12 |

On November 29, 2010, YBP established a wholly-owned subsidiary, Yew HK, a limited liability company incorporated under the laws of Hong Kong. On January 26, 2011, YBP transferred its ownership in JSJ to Yew HK. As a result of the Second Restructure, HDS is considered a VIE, and YBP, as the sole shareholder of Yew HK and the ultimate parent company, is the controlling entity of HDS.

On April 15, 2011, Mr. Wang, Madame Qi and Mr. Han completed an updated registration with SAFE, pursuant to the requirements under SAFE Circular 75.

As a result of the Second Restructure, as described above, the organization of the Company then looked as follows:

As of April 1, 2013, the HDS Shareholders collectively owned 22,805,512 shares, or approximately 45.61%, of YBP’s common stock, or the HDS Shareholders’ Stock. Before, during and after the Second Restructure, the HDS Shareholders served as the sole directors and principal executive officers of the Company, other than the position of CFO.

While we have not discovered any precedent under Nevada law for a transaction like the Second Restructure, it is possible that the Second Restructure should have been approved by YBP’s shareholders because it may be viewed as having involved the sale of all or substantially all of YBP’s assets in that the stock of HDS was transferred from a wholly-owned subsidiary, JSJ, to the HDS Shareholders. However, because the Company was not yet subject to the reporting obligations of the Exchange Act, YBP was unable to issue a proxy statement that complied with SEC proxy rules to its shareholders in connection with such approval. Once the Company became subject to the reporting obligations of the Exchange Act, it sought and obtained shareholder ratification of the Second Restructure and all of the transactions contemplated and effected in connection therewith at the Special Meeting on December 13, 2012. While we believe that it is unclear if the Second Restructure required shareholder approval under Nevada law, we also believe that since the Second Restructure has been ratified by our shareholders, any possible concerns about the manner by which the Second Restructure was approved under Nevada law has been alleviated, since we believe that the Nevada Corporations Law allows for shareholder ratification after-the-fact of transactions requiring shareholder approval. See Item 13, “Certain Relationships and Related Transactions, and Director Independence”.

Recapitalization

Generally, the founders of a corporation in the United States receive shares of stock in consideration of the tangible and intangible assets contributed by them to the enterprise. Since the consideration for those shares is the transfer of assets, including intellectual property, and business know-how, sometimes referred to as “sweat equity”, no cash payment for such shares occurs.

However, unfamiliar with the usual way that founders acquire equity interests in corporations in the United States, the HDS Shareholders both contributed assets to the Company and actually purchased their HDS Shareholders’ Stock between March 2008 and September 2009, for cash, in a series of four different offerings of YBP common stock during that period, at prices ranging between $0.02 and $0.10 per share, for an aggregate purchase price of $966,501.

| 13 |

As a result of the Contractual Arrangements of the Second Restructure, in which all of the profits of HDS will be paid under the terms of the Business Cooperation Agreement to JSJ, which is an indirect wholly-owned subsidiary of YBP, combined with the actual purchase by the HDS Shareholders of the HDS Shareholders’ Stock for cash, it could be viewed that Mr. Wang, Madame Qi and Mr. Han have, in effect, paid for their HDS Shareholders’ Stock twice.

Accordingly, the Company rectified this situation by obtaining shareholder approval at the Special Meeting on December 13, 2012 to issue a stock purchase option, each referred to as a Founder’s Option and collectively referred to as the Founders’ Options, to each of Mr. Wang, Madame Qi and Mr. Han in an amount equal to the number of shares of YBP common stock that each of them then currently owned. The terms of the Founders’ Options are identical to each other except for the name of the optionee and the number of shares of YBP common stock subject to each such Founder’s Option. Those terms include:

| ● | the issuance of the Founders’ Options was subject to pre-issuance approval by our shareholders, which approval was obtained at the Special Meeting; | |

| ● | each Founder’s Option was fully vested upon issuance; | |

| ● | each Founder’s Option is exercisable for a period of five years; | |

| ● | each Founder’s Option has a per share exercise price equal to the fair market value of a shares of YBP common stock on the date of grant, or $0.22 per share; and | |

| ● | each Founder’s Option has a cashless exercise feature, pursuant to which, at the optionee’s election, he or she may choose to deliver previously-owned shares of YBP common stock in payment of the exercise price or not pay the exercise price of the Founder’s Option and receive instead a reduced number of shares of YBP common stock reflecting the value of the number of shares of YBP common stock equal to the difference, if any, between the aggregate fair market value of the shares issuable upon exercise of the Founder’s Option and the exercise price of the Founder’s Option. |

The number of shares of YBP common stock subject to each Founder’s Option is as follows:

| Number of Optionee | Number of Shares Subject to Founder’s Option | |||

| Zhioguo Wang | 20,103,475 | |||

| Guifang Qi | 2,488,737 | |||

| Xingming Han | 213,300 | |||

The terms of the Founders’ Options have not been determined as a result of arm’s-length negotiations. The Board of Directors of YBP, which consists of the same persons who are the HDS Shareholders and the grantees of the Founders’ Options, obtained shareholder approval of the issuance of the Founders’ Options at the Special Meeting on December 13, 2012.

To the extent that the Founders’ Options are exercised, the number of shares of YBP common stock then held by each HDS Shareholder could as much as double, which would be highly dilutive to the other existing YBP shareholders. The following chart shows the maximum effect of this dilution assuming full exercise of each Founder’s Option for cash:

| Shareholder | Number of Shares Presently Held | Percentage of Issued Shares Presently Held | Number of Shares Held Assuming Exercise of All Founders’ Options | Percentage of Issued Shares Following Exercise of All Founders’ Options | ||||||||||||

| Zhiguo Wang | 20,103,475 | 39.04 | % | 40,206,950 | 54.11 | % | ||||||||||

| Guifang Qi | 2,439,737 | 4.74 | % | 4,928,474 | 6.63 | % | ||||||||||

| Xingming Han | 0 | 0.00 | % | 213,300 | 0.29 | % | ||||||||||

| All HDS Shareholders as a group (3 persons) | 22,543,212 | 43.74 | % | 45,348,724 | 61.03 | % | ||||||||||

| All other existing shareholders | 28,956,788 | 56.26 | % | 28,956,788 | 38.97 | % | ||||||||||

| Total | 51,500,000 | 100.00 | % | 74,305,512 | 100.00 | % | ||||||||||

See Item 13, “Certain Relationships and Related Transactions, and Director Independence”.

| 14 |

Employees

As of December 31, 2015, we had approximately 86 employees, of whom approximately 46 were full-time employees and approximately 40 were part-time employees. Our employees that work in China belong to a trade union. We believe that we maintain good labor relations with our employees. We also hire additional people for brief periods of time during peak production and processing seasons.

| ITEM 1A. | RISK FACTORS |

Risks Related to our Business

Our products may not achieve or maintain widespread market acceptance.

Success of our products is highly dependent on market acceptance. We believe that continued market acceptance of our products will depend on many factors, including:

| ● | the perceived advantages of our products over competing products and the availability and success of competing products; | |

| ● | the effectiveness of our sales and marketing efforts; | |

| ● | our product pricing and cost effectiveness; | |

| ● | the safety and efficacy of our products and the prevalence and severity of adverse side effects, if any; and | |

| ● | publicity concerning our products, product candidates or competing products. |

If our products fail to achieve or maintain market acceptance, or if new products are introduced by others that are more favorably received than our products, are more cost effective or otherwise render our products obsolete, we may experience a decline in the demand for our products. If we are unable to market and sell our products successfully, our business, financial condition, results of operation and future growth would be adversely affected.

Our future research and development projects may not be successful.