UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

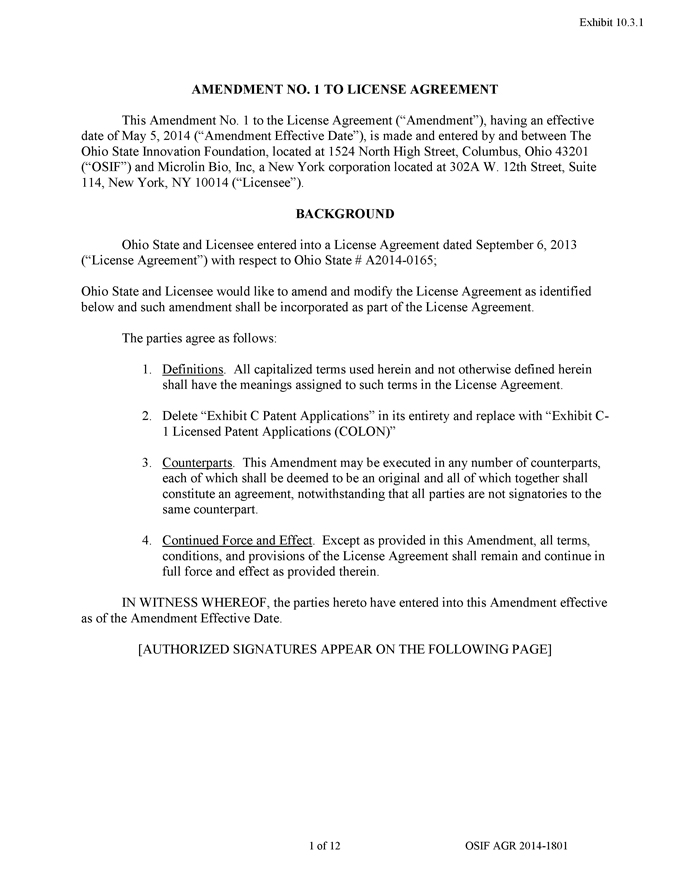

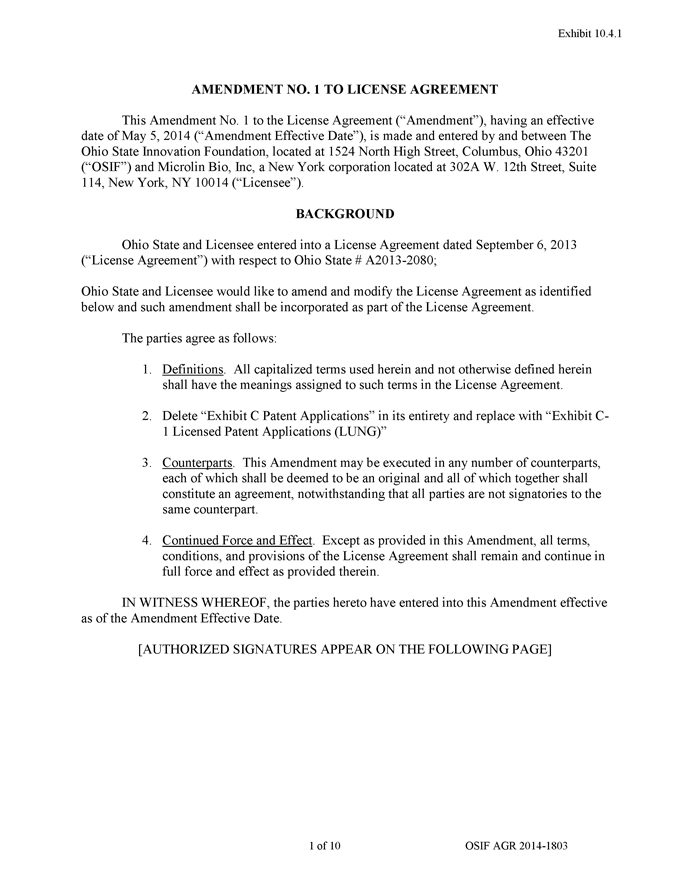

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 17, 2015

Microlin Bio, Inc.

(Exact name of small business issuer as specified in its charter)

| Delaware | 45-4507811 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

|

135 East 57th Street, 24th Floor, New York, NY 10022 |

| (Address of principal executive offices) |

|

(646) 406-6243 |

| (Issuer’s telephone number) |

|

American Boarding Company, 358 Frankfort Street, Daly City, CA 94104 (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| 2 |

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry Into a Material Definitive Agreement

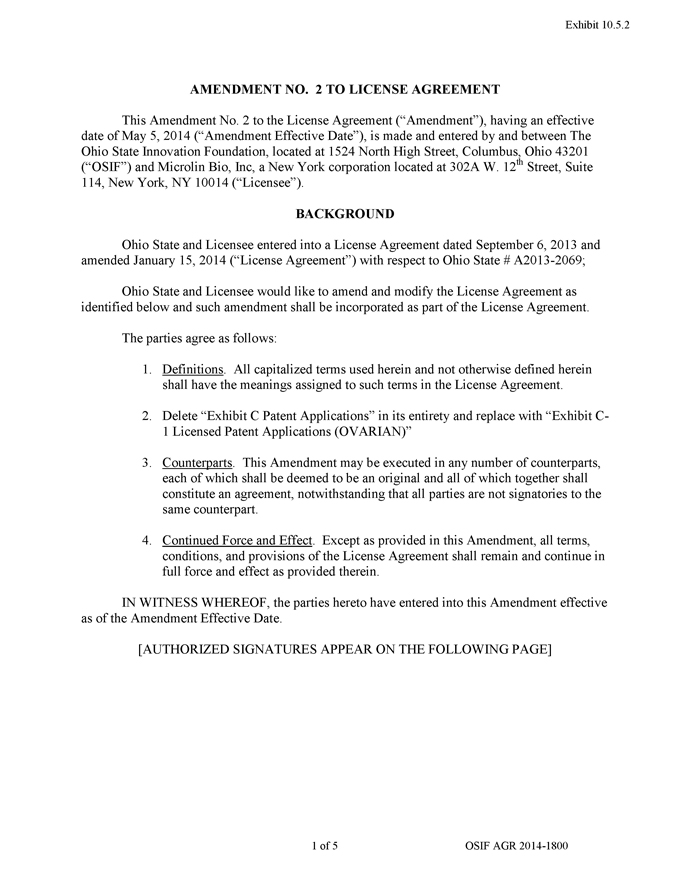

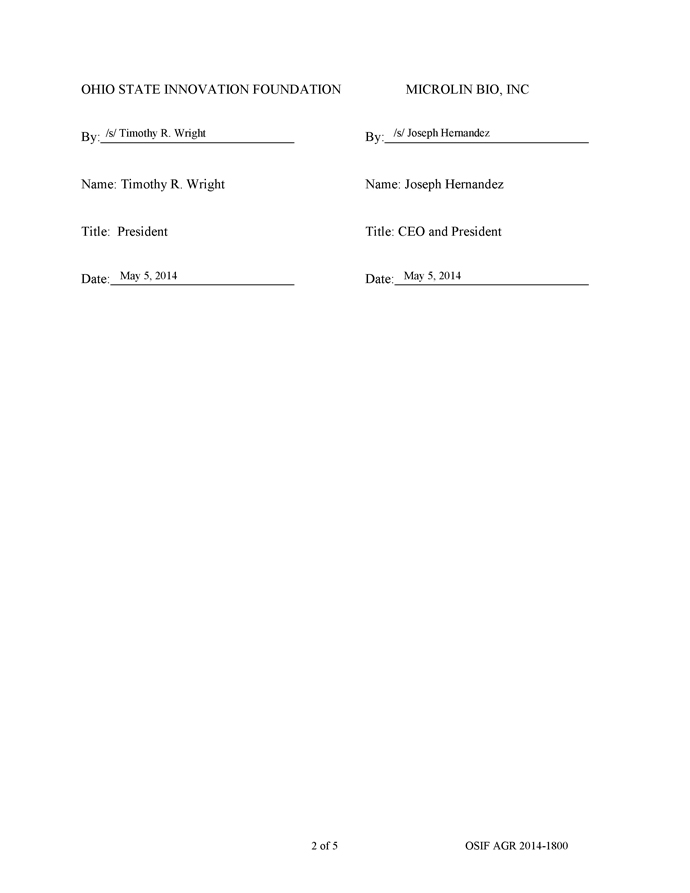

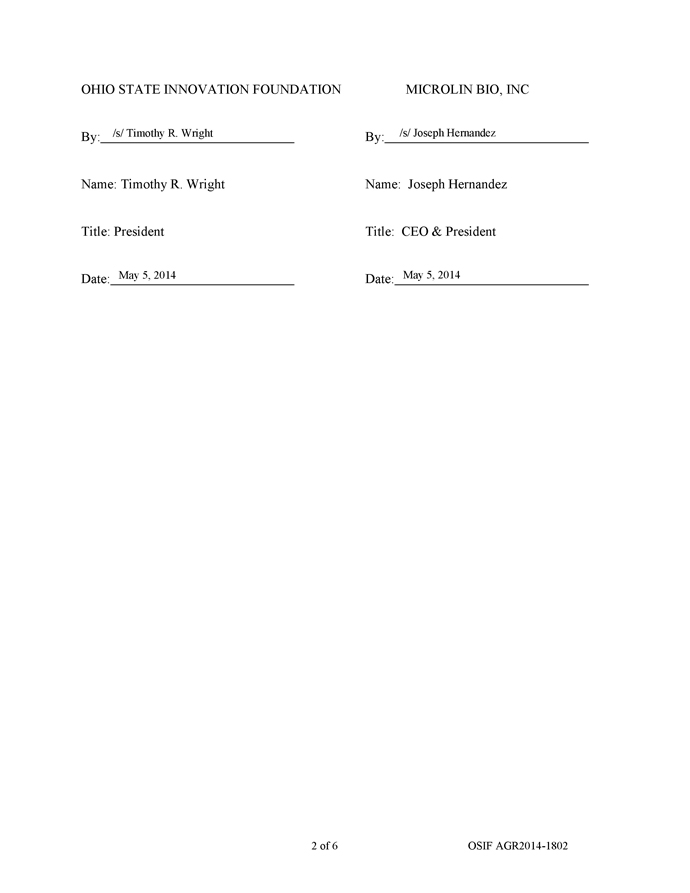

On December 17, 2015, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Microlin Bio, Inc., a private Delaware corporation (“Microlin”), and our subsidiary formed for the purposes of the transaction, Microlin Merger Sub, Inc. (the “Merger Sub”). Pursuant to the Merger Agreement, Microlin merged with and into the Merger Sub, which resulted in Microlin becoming our wholly-owned subsidiary (the “Acquisition”). Immediately following the Acquisition, the Merger Sub was merged with and into our Corporation. In connection with this subsequent subsidiary merger, we changed our corporate name to “Microlin Bio, Inc.”

In addition, pursuant to the terms and conditions of the Merger Agreement:

| • | The holders of all of the capital stock of Microlin issued and outstanding immediately prior to the closing of the Acquisition exchanged their shares on a pro-rata basis for 19,000,000 newly-issued shares of our common stock. |

| • | Following the closing of the Acquisition, four of our shareholders canceled and returned a total of 8,635,000 shares of common stock. |

| • | As a result, immediately following the Acquisition, there were 20,000,000 shares of our common stock issued and outstanding. |

| • | Our officers and directors immediately prior to the Acquisition, Reza Noorkayhani and Joseph Marshall, resigned from the board and from all offices. |

| • | Joseph Hernandez, who was the sole director of Microlin prior to the Acquisition, was appointed as our new sole director, effective ten (10) days after mailing to shareholders of our Schedule 14f-1 regarding the change in our board, which was filed with the Commission and mailed to shareholders of record on December 16, 2015. |

| • | Our board also appointed the following new officers and directors, each of who had served in the same capacity as an officer of Microlin prior to the acquisition: |

- Joseph Hernandez, Executive Chairman, Chief Executive Officer, and Chief Financial Officer

- Bruce Galton, Chief Operating Officer

| • | Concurrently with the Acquisition, the holders of certain of our issued and outstanding promissory notes in the total amount of $87,844 agreed to amend the notes to remove the conversion features contained therein. In addition, we have committed to pay all of our pre-Acquisition liabilities, up to a total maximum amount of $90,000, within 120 days of the Acquisition. Our former CEO, Reza Noorkayhani, has agreed to indemnify us for any pre-Acquisition liabilities in excess of $90,000. |

As of the date of the Merger Agreement and currently, there are no material relationships between us or any of our affiliates and Microlin, other than with regard to the Merger Agreement.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the Merger Agreement, which is filed as Exhibit 2.1 hereto and incorporated herein by reference.

| 3 |

Section 2 – Financial Information

Item 2.01. Completion of Acquisition or Disposition of Assets

Information about the Company and the principal terms of the Acquisition are set forth below.

The Acquisition. On December 17, 2015, in accordance with the Merger Agreement, Microlin merged with and into the Merger Sub, which resulted in Microlin becoming our wholly-owned subsidiary. Immediately following the Acquisition, the Merger Sub was merged with and into our corporation. In exchange for all of the issued and outstanding shares of Microlin, the shareholders of Microlin received a total of 19,000,000 shares of our common stock.

There were 9,635,000 shares of our common stock outstanding before giving effect to the stock issuances in the Acquisition and the cancellation of 8,635,000 shares by four of our shareholders. Following these events, there were 20,000,000 shares outstanding, including:

Shares Held by:

19,000,000 former Microlin shareholders

1,000,000 existing shareholders

20,000,000

The issuance of shares of our common stock to the former holders of Microlin’s capital stock and convertible debentures in connection with the Acquisition was not registered under the Securities Act of 1933, as amended (the “Securities Act”), but was performed in reliance upon the exemption from registration provided by Section 4(2) of the Securities Act and/or Regulation D promulgated under that section, which exempts transactions by an issuer not involving any public offering.

Prior to the Acquisition, there were no material relationships between us and Microlin, or any of their respective affiliates, directors or officers, or any associates of their respective officers or directors.

General Changes Resulting from the Acquisition. Following the Acquisition, we intend to carry on the business of Microlin as our sole line of business. We have relocated our principal executive offices to 135 East 57th Street, 24th Floor, New York, NY 10022. Our telephone number is now (646) 406-6243.

Changes to the Board of Directors. Reza Noorkayhani and Joseph Marshall resigned from the board and from all offices. Joseph Hernandez, who was the sole director of Microlin prior to the Acquisition, was appointed as our new sole director, effective ten (10) days after mailing to shareholders of our Schedule 14f-1 regarding the change in our board, which was filed with the Commission and mailed to shareholders of record on December 16, 2015.

All directors hold office for one-year terms until the election and qualification of their successors. Officers are elected by the board of directors and serve at the discretion of the board.

| 4 |

Accounting Treatment; Change of Control. The Acquisition is being accounted for as a “reverse acquisition,” as the stockholders of Microlin possess majority voting control of the company immediately following the Acquisition and now control our board of directors. Microlin is deemed to be the accounting acquirer in the reverse acquisition. Consequently, the assets and liabilities and the historical operations of Microlin prior to the Merger will be reflected in the financial statements and will be recorded at the historical cost basis of Microlin. Our consolidated financial statements after completion of the Acquisition will include the assets and liabilities of both companies, the historical operations of Microlin, and our operations from the closing date of the Acquisition. Following the Acquisition our fiscal year-end has been changed from December 31 to September 30. As a result of the issuance of the shares of our common stock pursuant to the Acquisition, a change in control of the Company occurred on December 17, 2015. Except as described herein, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our board of directors and, to our knowledge, no other arrangements exist that might result in a future change of control of the Company. We will continue to be a “small business issuer,” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), following the Acquisition.

We were incorporated as American Boarding Company in the State of Delaware on January 27, 2013. American Boarding Company was originally a real estate based company with a principle business objective of acquisition, design, development, lease, and management services of student housing communities located within close proximity of colleges and universities in the United States.

On December 17, 2015, we entered into the Merger Agreement with Microlin, whereby we acquired all of the issued and outstanding common stock of Microlin through a subsidiary. Following the Acquisition, we merged the subsidiary with and into our corporation, and changed our name to “Microlin Bio, Inc.” as part of that process. As a consequence of the Acquisition, we will no longer pursue our former business plan.

As a result of entering into the Merger Agreement, we are now a biotechnology company focused on microRNA based therapeutics for Oncology.

| 5 |

Cautionary Note Regarding Forward-Looking Statements

The words ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘project,’’ ‘‘should,’’ ‘‘target,’’ ‘‘will,’’ ‘‘would’’ or the negative of those terms, and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, but are not limited to, statements about:

- the initiation, cost, timing, progress and results of our preclinical research and development activities;

- our compliance with the terms of our in-license agreements, including our exclusive in-license agreements with OSIF;

- our ability to generate revenue;

- Our ability to obtain additional financing;

- our ability to continue as a going concern;

- our ability to obtain or maintain the rights to microRNA intellectual property and to successfully enforce our intellectual property rights;

- the safety, efficacy and market acceptance of microRNA technology and our other product candidates;

- regulatory approval of our product candidates and future product candidates we may develop, and the labeling under any approval we may obtain;

- our ability to obtain orphan drug designation for LumiralinTM and OmiralinTM, two of our product candidates;

- future regulation by the FDA;

- our ability to bring our product candidates to clinical trial;

- regulatory developments;

- the development, success or failure of competing drugs that are or become available;

- the potential markets for our product candidates and our ability to serve and compete in those markets;

- our ability to build and maintain strategic partnerships;

- our compliance with environmental, health and safety laws and regulations such as federal and state healthcare fraud and abuse laws and regulations;

- our ability to successfully defend any product liability claims;

- the performance of our third party partners, including third party manufacturers and suppliers;

- our ability to obtain reimbursement coverage by third party payors for our product candidates;

- our ability to obtain sufficient product liability insurance coverage;

- our ability to obtain formulary approval;

| 6 |

- the production of our product candidates within a viable cost structure;

- our ability to recruit and maintain key scientific, management personnel, board members or employees;

- successful development of our sales and marketing capabilities;

- our ability to successfully defend against any lawsuits or claims against us in the ordinary course of business;

- the occurrence of system failures, natural or man-made disasters or terrorist attacks disrupting our ability to operate;

- our ability to establish and maintain effective disclosure controls and procedures; and

- the accuracy of our estimates regarding expenses, future revenues, capital requirements and need for additional financing.

These forward-looking statements are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from plans, intentions and expectations disclosed in the forward-looking statements that we make. We have based these forward-looking statements largely on our current expectations and projections about future events, and trends that we believe may affect our business, financial condition and operating results. We operate in a very competitive and rapidly changing environment and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. We have included important factors in the cautionary statements included in this Current Report, particularly in the ‘‘Risks Factors’’ section, that could cause actual future results or events to differ materially from the forward- looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

The forward-looking statements in this Current Report represent our views as of the date of this Current Report. We anticipate that subsequent events and developments will cause our views to change. However, although we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward- looking statements as representing our views as of any date subsequent to the date of this Current Report. You should read this report and the documents that we reference in this report and have filed as exhibits completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this Current Report by these cautionary statements.

Overview

We are a development stage emerging therapeutic company focusing on microRNA and its role in oncology. MicroRNAs are naturally-occurring RNA molecules (composed of 19 to 25 nucleotides) that do not encode proteins but instead regulate gene expression and play a critical role in regulating networks of biological pathways. MicroRNAs were discovered fairly recently, and scientific research has shown that the improper balance of microRNAs is linked to many diseases, including cancer. MicroRNAs represent targets for a new class of therapeutics, which we believe may be more effective in the treatment of cancer, and diseases in general, with the potential for mitigated side effects in comparison with conventional small molecule drugs. We are working to develop and market, antimiR therapies, and miR replacement therapies. Our ultimate goal is to change the field of cancer treatment, minimize unnecessary healthcare costs and improve patients’ quality of life. We are focused on four types of cancer: lung, ovarian, colorectal and prostate.

| 7 |

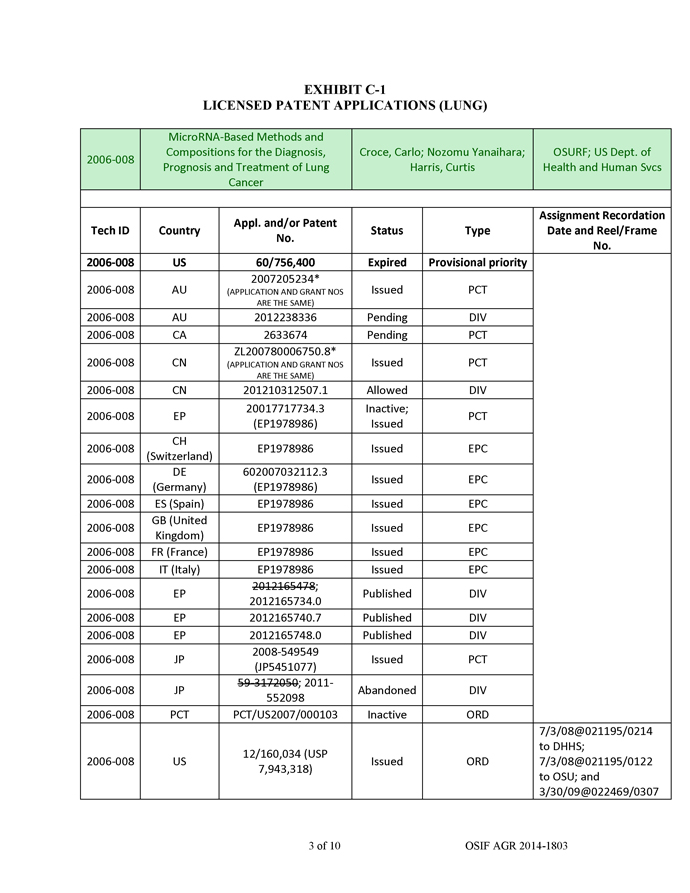

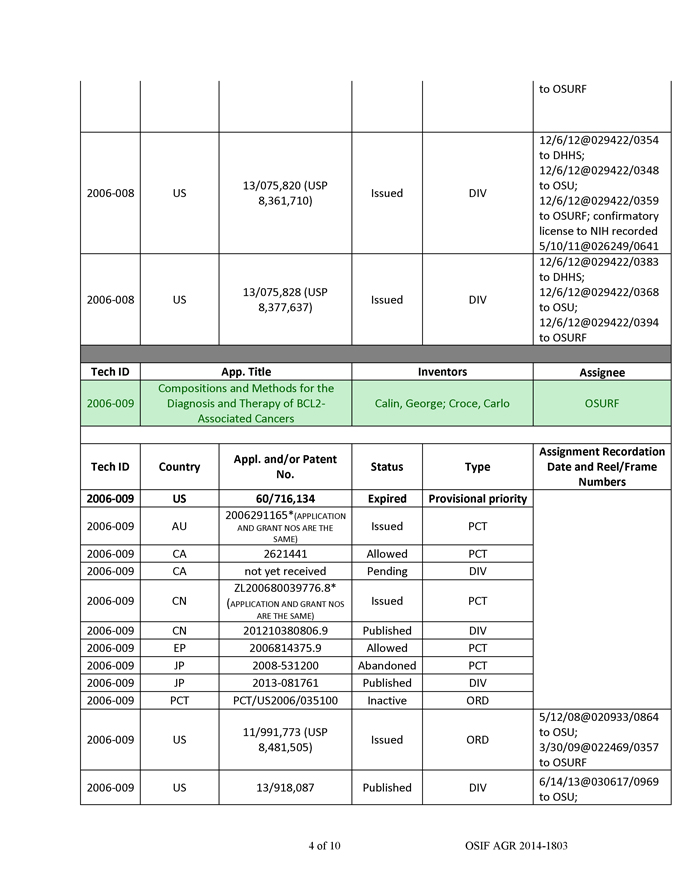

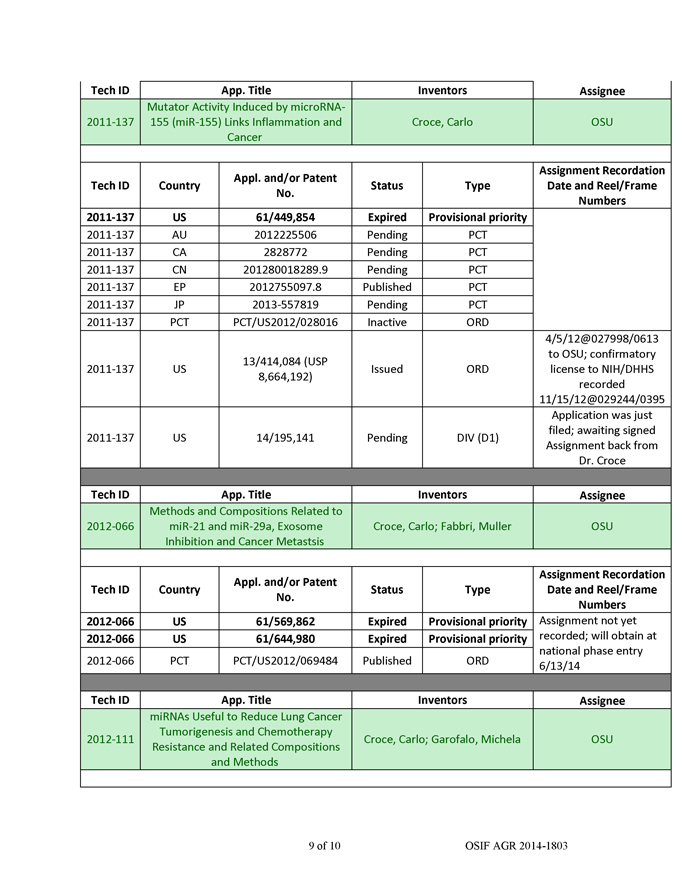

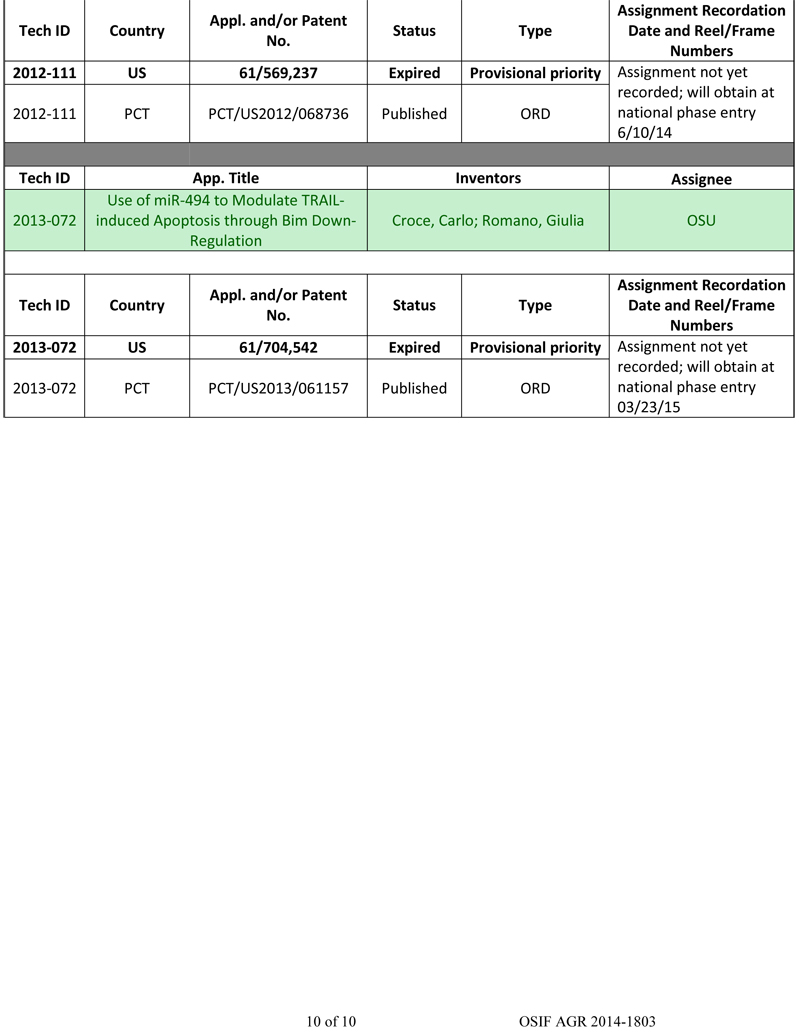

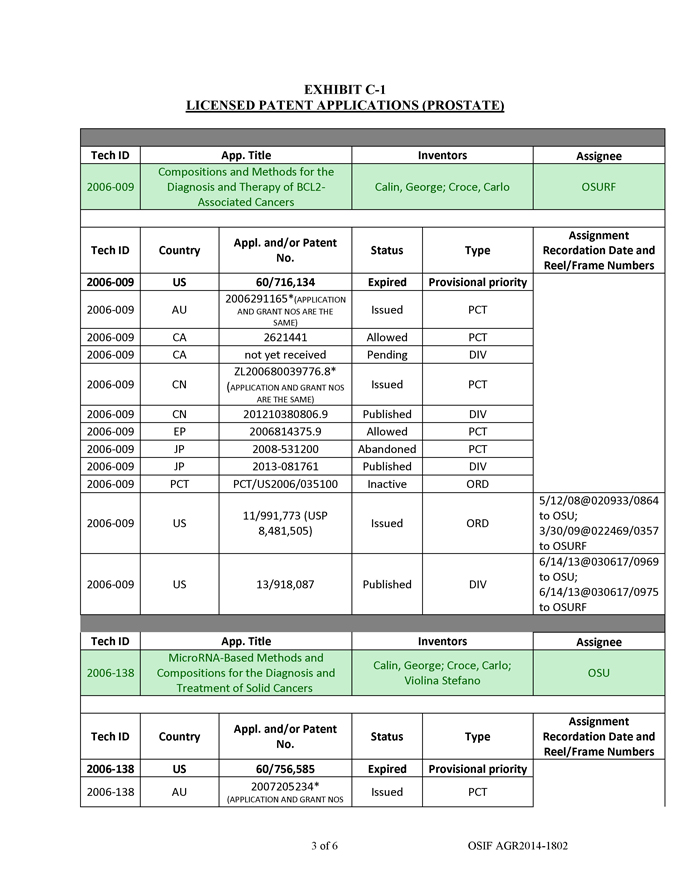

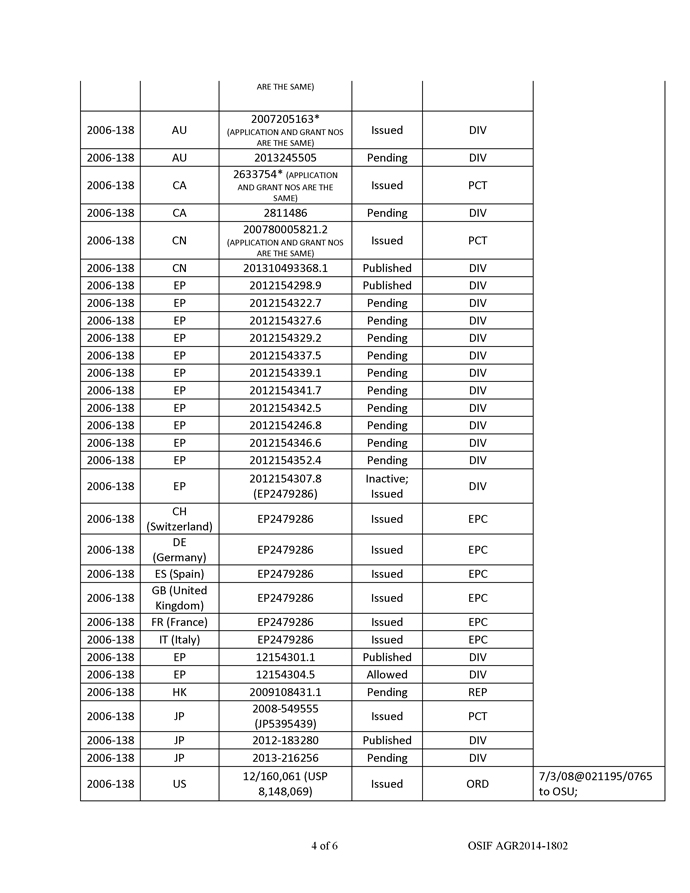

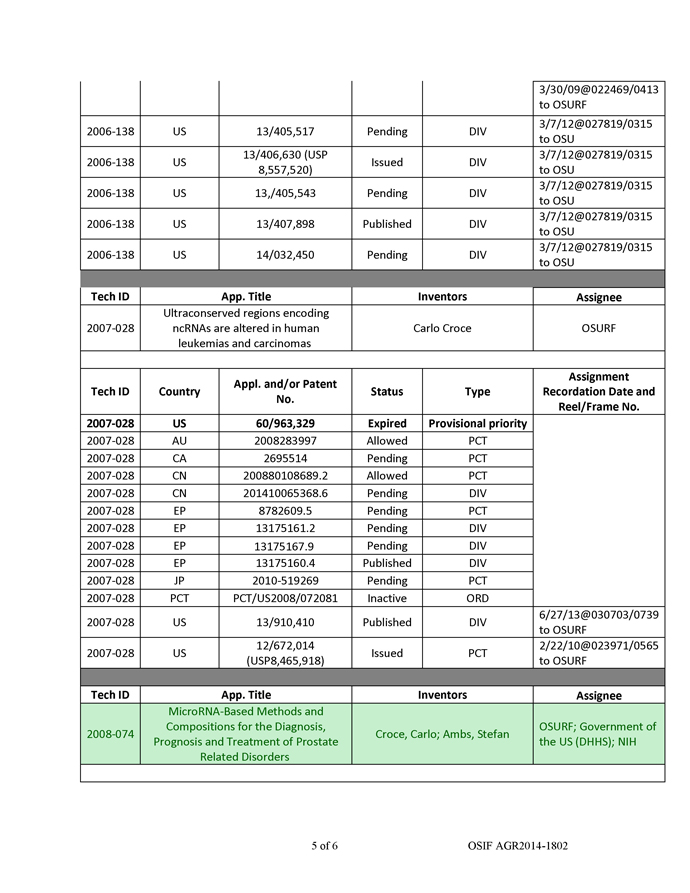

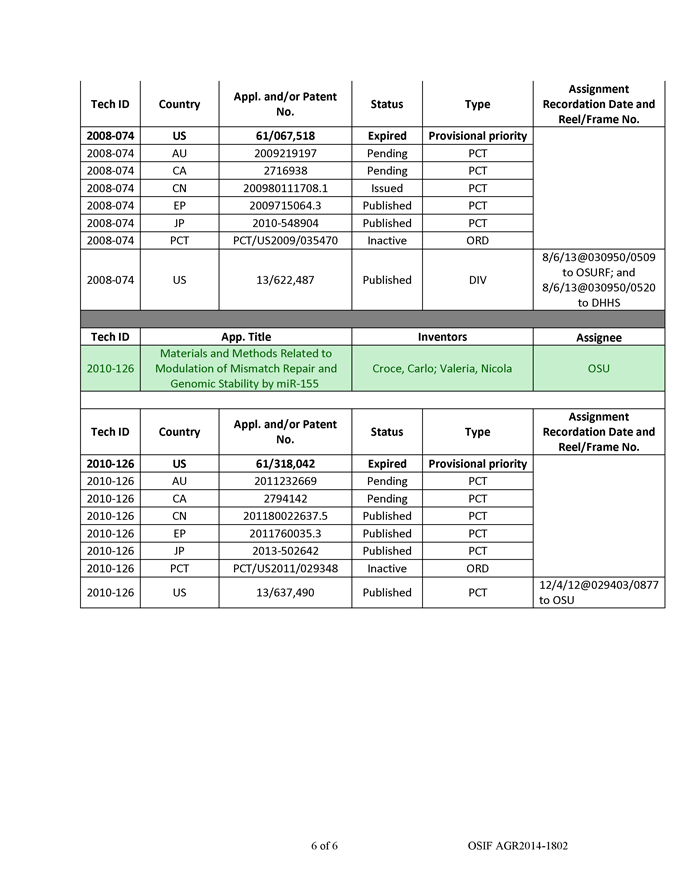

We have in-licensed a broad intellectual property portfolio of granted and pending patents and patent applications. In September 2013, we signed five exclusive licensing agreements with OSIF for approximately 138 pending patent applications and 132 granted patents covering numerous microRNAs. In addition, we licensed a novel delivery technology, which we call QTsomeTM. We have assembled a scientific advisory board with deep expertise in microRNA biology and broad business experience in biotechnology and drug development. We have also initiated the preclinical development of our lead therapeutic product candidate, LumiralinTM, including in vitro and in vivo animal studies. We believe that there is a significant clinical need for the type of therapeutics we are seeking to develop for lung, ovarian, colorectal and prostate cancers. We believe that these elements will allow us to successfully compete against existing companies who focus on microRNA therapeutics, even though our competitors are more established and have greater resources at their disposal.

Our Strategy

Our strategy thus far has been to build a company that has a limited infrastructure with flexibility to react to a wide variety of potential outcomes of our validation, clinical and preclinical work. Since we are an early stage company, being able to change direction easily, quickly and at minimal cost allows us flexibility which will be critical to the success of our company. We will need to react to critical events that will determine the course of our company, including the success and timing of our fundraising efforts, the results of our preclinical work, and the various stages of our clinical trials. Based on the outcomes of these events, we may need to alter our development plan and advance certain clinical programs over others based on resource constraint or clinical viability.

We intend for our clinical therapeutics programs to focus on areas of oncology where the current standard of care offers limited hope for patients suffering from cancer. Our product candidates are intended to employ a novel mechanism that could, alone or in combination, potentially help to eradicate or slow the progression of cancer.

A key component to our strategy is engaging seasoned executives to manage our outsourcing strategy. Another key component is our relationship with OSU. We believe OSU has been in the forefront of the discovery of microRNAs and their role in cancer. We intend to partner with OSU on several fronts, including on the preclinical work, the development of the delivery technology and on the clinical trials development. Further, one of our scientific advisors is a current professors at OSU. We view this relationship as a key component to our strategy.

Our strategy is to outsource as many elements of the development and manufacturing process as possible, which is a trend in the biotechnology industry. We believe this outsourcing strategy will allow us to avoid capital expenditures, keep fixed costs to a minimum and maximize the flexibility of our programs as we gather data and determine to which programs we should devote our resources. Outsourcing our developmental functions eliminates the need to establish a sizeable research and development facility, which is time consuming and capital intensive. We intend to work with consultants, CROs and CMOs to perform the critical work for our development and manufacturing processes. Under this model, we can leverage the expertise of established consultants, the capabilities of partner academic institutions and the experience of CROs and CMOs, resulting in an overall efficient process for drug development. To execute this strategy, we intend to work mostly as a virtual company, with members of our management team working remotely to execute our strategic plan, carry out operational management tasks and coordinate activities at the sites of our consultants, CROs and CMOs.

As part of this strategy, we currently do not own any facilities and plan instead to enter into as many consulting agreements, as opposed to employment agreements, as possible. We also plan to engage regulatory consultants to help us work through the various stringent regulations required by the relevant regulatory authorities, in particular the FDA, to acquire regulatory approval and comply with any post-approval regulatory requirements.

| 8 |

An Overview of microRNA

The Biology of microRNA

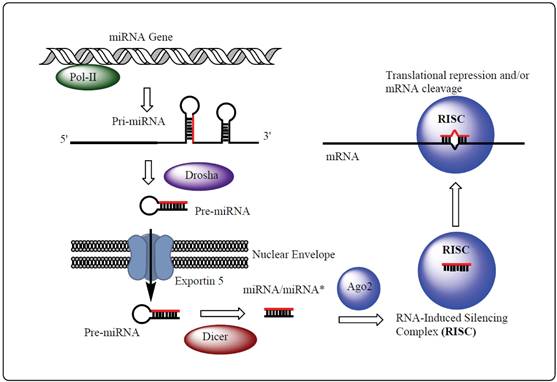

In a cell, DNA transcribed into messenger RNA (mRNA) as well as non-coding RNA. mRNA is ‘‘translated’’ into proteins, which performs various cellular functions. In contrast, microRNAs (miRNAs or miRs) are non-coding RNAs (ncRNAs) that regulate the expression of genes. First, miRNA genes are transcribed to long primary transcripts that are long precursors (‘‘pri-miRNA’’) and then processed in the nucleus by an enzyme called Drosha into another precursor (‘‘pre-miRNA’’). The pre-miRNA is then transported into the cytoplasm by exportin-5, where it is further cut into 19 to 25 nt double-stranded miRNA: miRNA* duplexes. Next, miRNA: miRNA duplexes are incorporated into RNA-Induced Silencing Complexes (RISC), followed by unwinding of the duplex and retention of the mature miRNA strand in the RISC, while the complementary miRNA* strand is degraded. The mature miRNA serves as a guide molecule for RISC by directing it to partially complementary sites located predominantly in the 3’ untranslated regions (UTRs) of target mRNAs, resulting in translational repression and/or mRNA degradation of the target mRNAs (Figure 1). Over 2,000 potential microRNAs have been identified thus far, more than one-third of all human genes are predicted to be regulated by microRNAs, and each miRNA can regulate hundreds of mRNA and ncRNA targets. Since a single miRNA can regulate an entire network of genes, miRNAs operate as master regulators of the genome.

Figure 1. Mechanism of gene regulation by miRNA

Small-interfering-RNA (siRNA) and miRNAs are similar in that both utilize the RISC to reduce target gene expression. However, there are some important differences between them. siRNAs are mostly exogenous molecules custom-designed to target a specific gene. In contrast, miRNAs are naturally expressed by cells and are regulatory molecules with multiple mRNA gene targets. The multiple mRNA targets of each microRNA have been selected by evolution and thus often play important roles in cellular pathways and networks of pathways that control specific functions. Studies have shown that changes in miRNA level in tissues and blood may be linked to various diseases, including cancer.

| 9 |

The discovery of miRNAs has opened up new opportunities in the discovery of new biomarkers and new drugs. Because levels of miRNAs are altered in many diseases, they can act as biomarkers for these diseases for their diagnosis and prognosis, for prediction of response to therapy, and for post-treatment monitoring. In addition, pathological changes caused by miRNA dysregulation can potentially be reversed by miR-based therapy. There are multiple approaches for miR-based therapy. One is miR-replacement therapy (MRT), in which an exogenous ‘‘miRNA mimic’’ for a miRNA that has a reduced level of expression is introduced. Another approach is antimiR therapy (AMT) in which an inhibitor for a miRNA that is overexpressed is introduced. These miRNA-modulating agents are synthetic oligonucleotides with sequences that are identical or complementary to the targeted miRNAs.

Designing of MRT or AMT therapeutic candidates is relatively straight forward because the sequences of the target miRNAs are already known. Because miRNA mimics and antimiRs are sequence specific, compared to the conventional small molecule chemotherapy, fewer adverse sides effects are expected for miRNA-based therapies along with much greater probability of hitting their targets. Many targets that were previously deemed undruggable can now be targeted using AMT or MRT. Finally, blood-based miRNA biomarker tests and miR-based therapeutics can be used in combination because patients most likely to benefit from therapy can be identified based on their miR expression profile and can then be treated with the corresponding miR-based therapy.

The Role of microRNA in Cancer

The role of miRNAs in cancer development was first reported in 2002 by Dr. Carlo Croce, who is a member of the National Academy of Sciences, Professor and Chairman of the Department of Molecular Virology, Immunology and Medical Genetics at the OSU College of Medicine. miRNAs expression patterns are altered in all types of cancer, with each cancer type displaying a distinctive signature miR expression pattern. miR expression profiling, therefore, potentially enables differentiation of the type of the tumor and its tissue of origin. It has been shown that changes in miRNAs can promote tumor development by increasing the expression of oncogenes that promote tumor growth and by decreasing the expression of tumor-suppressor genes. MiRNAs have been linked to tumor development, invasion, metastasis, new blood vessel generation, and tumor resistance to chemotherapy and radiotherapy. Each miR can affect multiple tumor types whereas multiple miRs may be changed in each tumor type. For example, miR-21 is increased in glioma, breast, lung, prostate, colon, stomach, esophageal, and cervical cancers, as well as diffuse large B-cell lymphoma. Meanwhile, inhibition of miR-21 has been shown to inhibit tumor growth by increasing the expression of certain tumor suppressors.

Our microRNA Product Platform

Scientists have shown in animal models that AMT inhibiting oncogenic miRs that are increased in a tumor, such as a miR-21 and members of miR-17-92 cluster, can inhibit tumor growth, tumor cell invasion, new blood vessel development (angiogenesis), and/or reverse resistance to chemotherapy and radiotherapy treatments. AntimiRs are ‘‘mirror images’’ of their miR targets and act by forming a stable complex with them, thereby inhibiting their biological function. Conversely, MRT replacing tumor suppressor miRNAs that are decreased in a tumor, such as miR-484 and miR-34a, with synthetic miR mimics can similarly achieve therapeutic benefits. Therefore, AMR and MRT and their combinations constitute miR-based therapies, a novel modality for the treatment of cancer.

We plan to develop four miR-based therapeutics: LumiralinTM (antimiR-21 AMT), OmiralinTM (miR-484 MRT), ColomiralinTM (antimiR-17-5p AMT), and PromiralinTM (miR-34 mimic MRT). Since both miR-21 and miR-17-5p are elevated in many types of cancer, LumiralinTM and ColomiralinTM may be useful in treating multiple tumor types. miR-34 is also reduced in multiple tumor types, so PromiralinTM will also have therapeutic potential in multiple tumor types. miR-based therapeutics can potentially be used in combination with each other in a common delivery vehicle. Furthermore, because of their ability to decrease therapeutic resistance, miR-based therapy could potentially be combined with standard chemotherapy or radiotherapy and could potentially produce a synergistic effect.

We have in-licensed a portfolio of approximately 138 pending patent applications and 132 granted patents covering various aspects of applications of miRNAs in cancer from OSIF. The subject matter covered by these patents was developed, in whole or in part, by Dr. Carlo Croce, a pioneer and recognized leader in the field of miRNA, and by Dr. Robert Lee, a recognized expert on nanoparticle-based miRNA delivery technology. Dr. Robert Lee is a member of our scientific advisory board and a consultant to the company. The other members of our scientific advisory board also have extensive experience in miRNA biology and in oligonucleotide therapeutics design and development.

In contrast to conventional chemotherapy, miR-based therapy is biomarker-driven and its miR targets are expected to affect entire gene-regulatory networks that are believed to serve as the master switches of tumor survival. The networks usually control several different points in the course of cancer development. Therefore, miR-based therapy is likely to be more effective with fewer side effects. Rather than screening a large library of hundreds of thousands of compounds for lead identification, which is routinely done in traditional drug discovery, miR-based drug discovery is relatively straightforward because the therapeutic oligonucleotide sequence is defined by that of the miR target. The drug directly targets the dysregulated microRNA based on sequence complementarity. If successfully developed, manufactured and commercialized with all the required regulatory approvals, we believe this has the potential to alter the landscape of the oncology market.

| 10 |

Delivery Technology for miR-Based Therapeutics

A significant challenge to clinical development of miR-based therapeutics is the need for a delivery system. This is because human serum is rich in nucleases and the cell membrane is a formidable barrier to the intracellular delivery of oligonucleotides, which makes it difficult to bring the therapeutics to the target site. Other factors, such as renal and reticuloendothelial system clearance, also hinder delivery. The problem of delivery has been a major impediment in previous efforts toward clinical development of siRNA therapeutics and antisense oligonucleotides, as shown by the limited success of these classes of agents in the clinic.

The critical importance of in vivo delivery is well-recognized in the field of siRNA therapeutics as a bottleneck in their clinical development. The approval of ISIS and Genzyme’s KynamroTM as the first systemically administered antisense oligonucleotide therapy in humans for familial hypercholesterolemia in early 2013 was a watershed event in the field of oligonucleotide therapeutics. However, many antisense drugs have performed poorly in the clinic, which may be attributed to inadequacy in the delivery system. On the other hand, if an effective delivery technology is found, it would have broad applications to many types of potential oligonucleotide therapies.

There are two general strategies to addressing the delivery problem of oligonucleotides: chemical modification and nanoparticle formulation. Our delivery approach is expected to incorporate both of these strategies, based on what we believe are strong scientific rationale and strong patent positions.

This dual approach can be seen in the example of one of our therapeutic product candidates, LumiralinTM (antimiR-21). The antimiR-21 oligonucleotide is defined as the drug substance or active pharmaceutical ingredient (API) for the product. To achieve optimum activity, modifications are incorporated to increase its affinity for the miR-21 target and endonuclease stability while reducing non-specific immune system activation which may lead to side effects. While with these modifications the antimiR design is considered ‘‘optimized’’ for an unformulated free or ‘‘naked’’ agent, previous studies have shown that free antimiRs are mostly taken up by the liver and that a high dose is required for therapeutic activity, which in turn leads to potential kidney and liver toxicity.

QTsomeTM is a proprietary lipid nanoparticle-based delivery platform developed by Dr. Robert Lee, a member of our scientific advisory board, and a Professor at the OSU College of Pharmacy. QTsomesTM comprise an optimum combination of two cationic lipids, one with a quaternary amine headgroup and the other with a tertiary amine headgroup. These components can provide a stable nanoparticle and facilitate efficient delivery of the antimiR into the cytoplasm of the target cell. In addition, QTsomesTM incorporate PEG-DPPE, which cause them to stay in the blood circulation for a long time and to passively target delivery to solid tumors based on the enhanced permeability and retention (EPR) effect. This EPR effect is due to the increased blood vessel permeability of solid tumors and reduced lymphatic drainage, which lead to higher QTsomeTM uptake by the tumor.

The benefits of QTsomesTM include high efficiency, low toxicity, rational design, and, in our belief, our strong patent position. QTsomesTM utilize off-the-shelf cationic lipids and helper lipid components that are available in cGMP grade from commercial suppliers. This removes a potential barrier to clinical translation. According to Dr. Lee, production of QTsomesTM can readily be up-scaled to gram- and kilogram levels using standard and scaleable pharmaceutical manufacturing technologies such as diafiltration, sterile filtration, and lyophilization. The feasibility of large-scale production is an important advantage of the QTsomesTM formulation. Due to its higher efficacy and tumor selectivity, a lower clinical dose would be required than free antimiRs or miR mimics, and we therefore expect reduced adverse side effects.

| 11 |

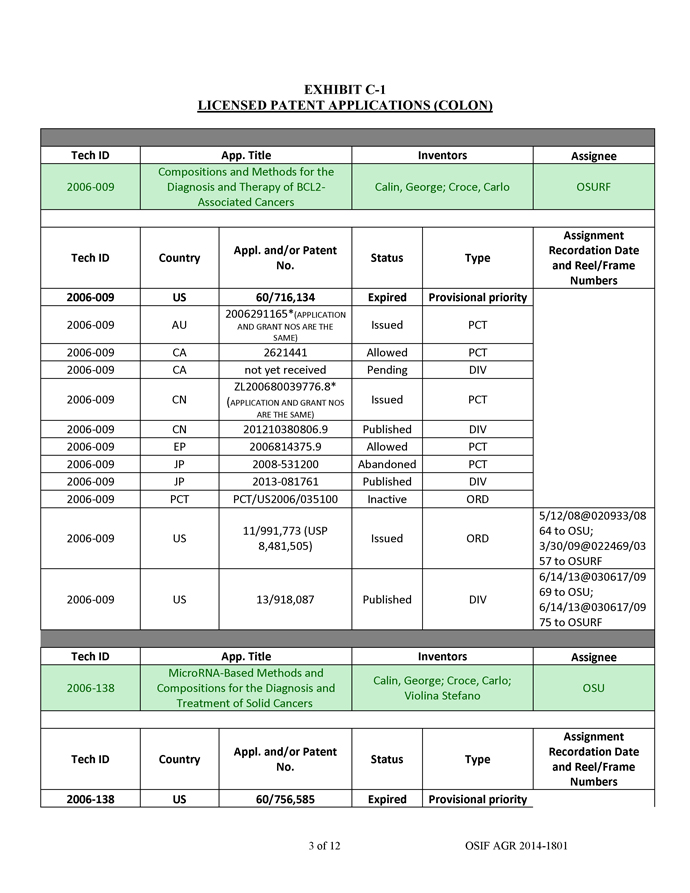

The QTsomeTM technology has been validated in Dr. Lee’s laboratory at OSU. Antimir-21 (AM-21) was shown to upregulate tumor suppressor genes RECK and PTEN in A549 lung cancer cells (Figure 2).

![[GRAPHIC MISSING]](image_002.jpg)

Figure 2. Upregulation of tumor suppressor genes in A549 lung cancer cells by AM-21

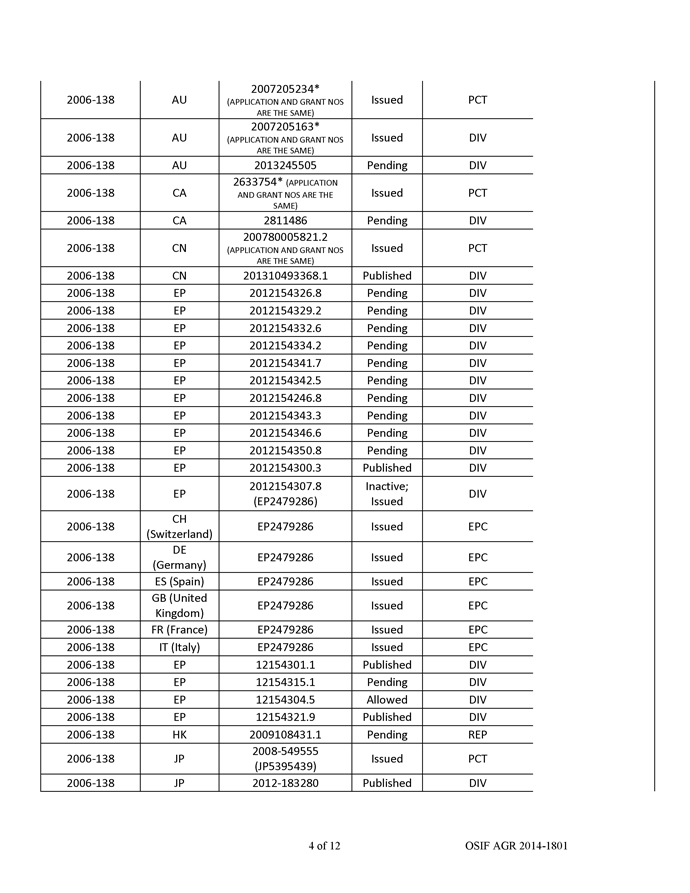

AM-21 were then loaded into QTsomesTM and evaluated in tumor cell lines and in a mouse tumor model. The QTsomesTM were small in size (~100 nm) based on dynamic light-scattering measurement and had a low surface charge. These properties are ideal for in vivo delivery. The QTsomesTM effectively inhibited miR-21’s biological functions and unregulated tumor suppressor genes RECK and PTEN in A549 cells and sensitized these cells to a chemotherapy agent paclitaxel (PTX) (Figure 3). Additionally, treatment of A549 cells with OTsomeTM/AM-21 resulted in a reduced capacity to migrate on a plastic dish (Figure 3a). This ability to reduce migration is often interpreted as a potential for the drug to be anti-metastatic. Furthermore, QTsomesTM carrying AM-21 completely inhibited the growth of A549 xenograft tumors in nude mice (Figure 3b) without causing overt toxicity to the mice as indicated by increased weight gain and no significant changes in organ weights in the treated group (data not shown).

Cell Viability (% of untreated cells)

![[GRAPHIC MISSING]](image_003.jpg)

Figure 3. QTsomeTM/AM-21 sensitized A549 cells to chemotherapy drug paclitaxel (PTX)

| 12 |

![[GRAPHIC MISSING]](image_004.jpg)

Figure 3a. QTsomeTM/AM-21 treatment of A549 lung cancer cells reduced their ability to migrate into an open space on a tissue culture dish caused by a scratch through a monolayer of cells.

![[GRAPHIC MISSING]](image_005.jpg)

Figure 3b. Inhibition of A549 xenograft tumor growth by QTsomeTM/AM-21. Mice were inoculated s.c. with A549 cells and randomized into two groups of seven after tumors reach >50 mm3 (~1 week after inoculation). The treatment group was injected intravenously with 2 mg/kg by i.v. injection 3 times in the first week and once a week thereafter.

| 13 |

QTsomeTM/AM-21 was also evaluated in KB tumor cells. As shown in Figure 4, QTsomesTM/AM-21 upregulated tumor suppressor gene PTEN over untreated control and more effectively than free AM-21. In a preliminary pilot study in vivo, intravenous delivery of an antimiR-21 formulated in QTsomesTM resulted in inhibition of miR-21 as demonstrated by upregulation of miR-21 target genes (Figure 5) and a trend toward tumor growth inhibition (data not shown). The study did not have large enough group sizes to detect the tumor growth inhibition with confidence, so larger follow up studies are underway.

![[GRAPHIC MISSING]](image_006.jpg)

Figure 4. Upregulation of tumor suppressor gene PTEN by QTsomeTM/AM-21 in KB cells.

Normalized gene expression (% of untreated tumors)

![[GRAPHIC MISSING]](image_007.jpg)

Figure 5. Upregulation of miR-21 target genes in KB cell xenograft tumors after delivery of QTsomeTM formulated antimiR-21.

| 14 |

Collectively, these results support the further development of QTsomeTM/AM-21 nanoparticles for lung cancer therapy, either alone or in combination with standard chemotherapy. We have recently identified early lead antimiR-21 compounds with a proprietary design that are more potent than the publicly available antimiR-21 compounds we used in the preclinical data here. We believe this will allow us to move forward into additional in vivo studies with proprietary compounds formulated in QTsomesTM while also performing more screens to identify additional lead compounds to enter the in vivo studies to ensure we identify the best potential clinical candidate.

Dr. Lee’s laboratory also made progress on designing enhanced versions of QTsomesTM (licensed by the company). It was found that adding the small peptide, gramicidin, into QTsomesTM was able to improve delivery in the presence of serum. These peptide-enhanced QTsomesTM were found to be very effective in delivery of both siRNA, which is similar to miR mimics, and antimiRs. In a study recently published in the Journal of Controlled Release, a targeted version of QTsomesTM loaded with antimiR-155, with enhancement by gramicidin addition, was shown to be highly active in blocking miR-155 function in liver cancer cells. In this study, a glycolipid, Lactosyl-DOPE, was also added to make these QTsomeTM nanoparticles selective for liver cancer cells, which express the asialoglycoprotein receptor. This improved both the efficiency of antimiR delivery and the selectivity for the targeted cells. The design of the antimiR incorporated chemical modifications (OMe and phosphorothioate), which improved the stability and bioactivity of the oligonucleotide. The particles synthesized were compact in size (73 nm), were slightly positively charged and had high encapsulation efficiency for the antimiR (88%). These are properties that are conducive to in vivo delivery. Treatment of the cancer cells greatly increased the expression of two tumor suppressor genes, CEBP/beta and FOXP3, by 4 and 16-fold, respectively. Importantly, these QTsomesTM were highly active when injected intravenously at a relatively low dose (1.5 mg/kg) into mice and induced similar biological effects in vivo, increasing expression of a tumor suppressor CEBP/beta and FOXP3 by 6.9 and 2.2-fold, respectively. We believe this is significant since in vivo delivery efficiency is the key towards development of a suitable delivery vehicle for clinical applications.

In summary, we have licensed a proprietary lipid nanoparticle-based miR delivery technology (QTsomeTM) for AMT and MRT from OSIF, which we believe will provide us with an advantage in addressing the problem of AMT and MRT delivery with respect to our proposed therapeutics.

Our miR-BASED THERAPEUTIC PRODUCT CANDIDATES

We intend to develop a series of miR-based AMT and MRT agents for lung, ovarian, colorectal and prostate cancers. The initial clinical development candidates are listed in the table below:

| Therapeutic Candidate | miR Target | Modality | Cancer Targets | ||||

| LumiralinTM | miR-21 | AMT | Lung | ||||

| OmiralinTM | miR-484 | MRT | Ovarian | ||||

| ColomiralinTM | miR-17-5p | AMT | Colorectal | ||||

| ProstamiralinTM | miR-34a | MRT | Prostate |

Market Opportunity

NSCLC, which includes adeno-, squamous-cell and large-cell carcinoma, is the leading cause of cancer deaths both in men and in women. Lung cancer causes more deaths than the next three most common cancers combined (colon, breast and prostate). According to the American Cancer Society, an estimated 160,340 Americans were expected to die from lung cancer in 2012, accounting for approximately 28 percent of all cancer deaths. According to a 2009 report by Global Industry Analysis, the global market for NSCLC therapeutics is set to reach $13 billion in year 2015, representing a large potential market.

Diagnosis and Current Treatment

Lung cancer is diagnosed using computed tomography (CT) X-ray-scan and tissue biopsy. Serum markers CEA and CYFRA 21-1 are often used as prognostic and predictive markers. Lung cancer treatment depends on the stage of

the disease. Early stage NSCLC is managed by surgery followed by combination chemotherapy. However, this is associated with serious side effects and limited response rates. A new molecularly targeted agent gifitinib (Iressa) has shown some early promise. However, approval of this drug was withdrawn by the FDA in 2005 due to lack of evidence that it extended life. Molecular classification of lung cancer patients is beginning to improve therapy for small subsets of patients. However, the majority of NSCLC patients (e.g., patents with mutated K-ras gene) still have no effective molecularly targeted therapy. Development of additional novel therapeutic and diagnostic strategies for NSCLC, therefore, is urgently needed to better match additional NSCLC patients to effective novel therapies. We believe that our product candidates are different from other molecularly targeted agents due to our intended targets and proprietary delivery methods.

| 15 |

LumiralinTM AMT

miR-21 may arguably be the most validated oncomiR in cancer. It is commonly elevated in many cancer types including lung, ovarian, colorectal, prostate, liver, kidney, breast and brain cancers. miR-21 targets tumor suppressor gene such as PTEN. AntimiR-21 AMT has been shown to inhibit tumor growth, migration and invasion, and to reverse chemotherapy and radiotherapy resistance of cancer cells.

miR-21 is the most frequently over-expressed miR over all cancer types and its genomic locus is amplified in some cancer types. Expression of miR-21 correlates with poor patient outcome in many cancer types, including lung cancer. miR-21 expression is known to be driven by several well characterized oncogenes including STAT3, K-ras, C-raf, and PI3K pathways. Inhibition of miR-21 with an anti-miR leads to reduced tumor formation and prolonged survival in a Ras driven model of HCC.

In one study, a mouse model was constructed in which miR-21 could be inducibly over-expressed in the hematopoietic system. When miR-21 was induced, hematopoietic organ grew to 20 times the normal size, which resulted in an acute lymphoma. After lymphomas were formed, miR-21 was shut off and the tumors completely regressed within 2 weeks. This demonstrates that these tumors were not only formed due solely to over-expression of miR-21, but the tumors were also ‘‘addicted’’ to the expression of miR-21.

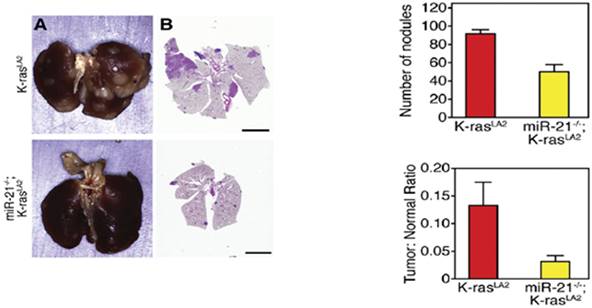

In a K-ras mouse model, miR-21 expression was found to cooperate with K-ras to form lung cancer. In this model mutant K-ras was expressed only in the lungs. Knockout of miR-21 reduced tumor formation in the model, as shown in Figure 6.

Figure 6. Knockout of miR-21 reduced tumor formation in a K-ras model (adapted from Hatley et al., 2010, Cancer Cell 18: 282-293)

We believe we have established a strong patent position on miR-21-based AMT therapy in lung cancer. Free antimiR-21 (without nanoparticles as carriers) is currently under clinical development by Regulus and Sanofi for hepatocellular carcinoma (HCC) and for kidney fibrosis. In comparison, our antimiR-21 AMT drug candidate, LumiralinTM, incorporates the proprietary delivery technology based on QTsomeTM lipid nanoparticles and we believe is likely to be more potent. LumiralinTM AMT is expected to have therapeutic activity in multiple tumor types, which we believe makes it a logical choice as a lead product for rapid clinical development. LumiralinTM AMT will be designed to be used by intravenous infusion either as a monotherapy or as a combination with standard chemotherapy in patients with recurrent disease, with extension of survival as the expected clinical endpoint. Because miR-21 is unregulated in many cancers including lung and ovarian, we will evaluate whether we can feasibly conduct human clinical trials in both lung and ovarian cancer patients and seek orphan drug status for LumiralinTM AMT.

| 16 |

Ovarian Cancer

Market Opportunity

Ovarian cancer is a leading cause of cancer death among women. The American Cancer Society estimates that approximately 22,000 new cases of ovarian cancer will be diagnosed in 2013 in the United States and approximately 14,000 of the diagnosed individuals will die. While the mortality rate of other major cancers have declined, the mortality rate for ovarian cancer changed little in the past 40 years, making it the most lethal of all gynecologic cancers. Ovarian cancer therapies are eligible for orphan drug status under the Orphan Drug Act of 1983, which provides seven years of market exclusivity. According to a 2013 report by BCC Research, the global ovarian cancer drug and diagnostic market is projected to reach $34.6 billion by 2018.

Diagnosis and Current Treatment

Ovarian cancer is diagnosed by physical exam, CT scan, ultrasound, PET scan, laparoscopy, colonoscopy, and biopsy. Serum CA-125 test is also routinely used in diagnosis and post-therapy monitoring. Early stage ovarian cancer can be effectively treated with surgery. However, most ovarian cancer patients are at an advanced stage at the time of diagnosis. The standard therapy for an ovarian cancer patient is platinum/taxane combination or Doxil therapy. Due to the frequent abdominal involvement of the disease, intraperitoneal chemotherapy can be added to intravenous chemotherapy. An antibody drug, Avastin, is sometimes added as well. There has been less success with molecularly characterizing ovarian cancer patients compared to many other cancer types and this is a factor in the poor response to current therapies. Given the poor survival rates of ovarian cancer patients and the prominent role of early diagnosis, development of new therapeutic and diagnostic strategies is urgently needed.

OmiralinTM MRT

It has been found that miR-484 expression is frequently lowered in ovarian carcinomas. This miR has been shown to regulate the mitochodrial network and programmed cell death. miR-484 MRT has been shown to inhibit tumor growth when combined with chemotherapy. We believe we have established a strong patent position on miR-484 based therapy in cancer. Our miR-484 mimic MRT drug candidate, OmiralinTM, incorporates the proprietary delivery technology based on QTsomeTM lipid nanoparticles. It is designed to be administered by intravenous infusion or intravenous/intraperitoneal combination, and can be used alone or in combination with standard chemotherapy in patients with recurrent disease, with extension of survival as the clinical endpoint.

The important role of miR-484 in cancer was discovered in Dr. Croce’s lab at OSU. miR-484 targets VEGF-B and VEGFR2 (along with many other genes) to block the angiogenic process needed by tumors.

Low circulating levels of miR-484 in ovarian cancer patients can be used to predict patient response to chemotherapy. Meanwhile, increased expression of miR-484 sensitizes ovarian tumors to chemotherapy. Ovarian cancer can be potentially treated by ‘‘local’’ intraperitoneal delivery, in combination with chemotherapeutics.

| 17 |

Colorectal Cancer

Market Opportunity

Colorectal cancer is the third leading cause of cancer deaths in the United States among men and women. According to the American Cancer Society, it is estimated to cause 50,830 deaths in 2013. If diagnosed early, when the disease is local, 5-year survival rate is approximately 90%. However, only 40% are diagnosed at this early stage. According to a 2010 report by Global Data, the global colorectal cancer therapy market is projected to grow to $11.6 billion in 2016 with a CAGR of 9.8%.

Diagnosis and Current Treatment

Colorectal cancer is detected by colonoscopy, CT and PET scans, ultrasound, blood tests, and biopsy. Serum CEA and CA19-9 tests are also routinely used in monitoring of the disease. Early stage colon cancer can be effectively treated with surgery. However, a large portion of colon cancer patients are at an advanced stage at the time of diagnosis. The standard therapies for colorectal cancer include a combination of surgery, radiation therapy, and chemotherapy. Given the prevalence of colorectal cancer patient and the critical role of early diagnosis in the management of this disease, new therapeutic and diagnostic strategies are urgently needed.

ColomiralinTM AMT

miR-17-92 cluster consists of 6 microRNAs that are frequently elevated in lung, gastric, colon, liver, pancreatic, renal, prostate, and breast cancers. These are a family of microRNAs encoded in three genomic clusters. Because members of a microRNA ‘‘family’’ share the same seed sequence, it is possible to design a single anti-miR to inhibit multiple family members. The miR-17 family is the only family with at least two members in each cluster. The targets of the miR-17 family include important genes in cell cycle and cell surface receptor driven proliferation. The miR-17 family is well validated alone, but the compound nature of the clusters will require more work to determine the best AMT strategy. AntimiR-17-5p AMT has been shown to inhibit tumor growth. We believe we have a strong patent position on miR-17-5p based therapy in colorectal cancer. Our antimiR-17-5p AMT drug candidate, ColomiralinTM, incorporates the proprietary delivery technology based on QTsomeTM lipid nanoparticles. ColomiralinTM AMT is designed to be used by intravenous infusion as monotherapy or in combination with standard chemotherapy as a second-line therapy, with extension of survival as the clinical endpoint.

| 18 |

Prostate Cancer

Market Opportunity

Prostate cancer is very common and is the second leading cause of cancer death among men. The American Cancer Society estimates that approximately 238,590 new cases of prostate cancer will be diagnosed in the United States in 2013 and 29,720 of the diagnosed individuals will die from it. According to Decision Resources, a man has a 1 in 6 chance of diagnosis of prostate cancer in his lifetime. While the 5- year survival rate of local (Stage I, II) and regional (Stage III) disease is 100%, Stage IV prostate cancer with distant metastasis has a survival rate of only 28%. According to a report by Decision Resources, the global market for prostate cancer drug will grow from $3.6 billion in 2010 to $10.1 billion in 2020, a CAGR of

10.8%.

Diagnosis and Current Treatment

Prostate cancer is diagnosed through screening tests such as prostate-specific antigen (PSA) test and digital rectal exam, and confirmed by a biopsy. Treatment of prostate cancer includes radiation therapy, hormone therapy, orchiectomy, prostatectomy, cryoablation, high intensity focused ultrasound thermoablation, and chemotherapy. Since advanced prostate cancer is often resistant to standard chemotherapy drugs, novel therapeutic strategies are needed.

PromiralinTM MRT

miR-34a is a tumor suppressor microRNA that is significantly lowered in prostate cancer. The genomic locus of miR-34a is frequently methylated in tumors to silence expression and is also repressed by cell surface oncogenic receptor tyrosine kinases (RTKs). miR-34 potentiates the p53 tumor suppressor pathway and inhibits proliferation pathways downstream of oncogenic growth factors. The targets of miR-34a include CDK4, CDK8, Met, Myc and E2F3. Delivery of miR-34 mimics into tumor cells leads to a G1 cell cycle block. In prostate cancer, its expression is associated with less aggressive diseases. Accordingly, miR-34 MRT has been shown to inhibit tumor cell growth including in tumors with a mutated p53. miR-34 MRT, therefore, is a promising novel therapeutic modality against prostate cancer. Mirna Therapeutics, Inc. is conducting a Phase I clinical trial for MRX34 in patients with unresectable liver cancer or liver metastasis. MRX34 utilizes the SMARTICLES as the delivery vehicle, which is based on a proprietary ‘‘charge-reversing’’ lipid nanoparticle formulation. We believe we have a strong patent position on miR-34 MRT in prostate cancer. Our miR-34 mimic MRT candidate therapeutic, PromiralinTM, incorporates the proprietary delivery technology based on QTsomesTM lipid nanoparticles. PromiralinTM MRT is designed to be used by intravenous infusion as a monotherapy or in combination with standard chemotherapy in patients with metastatic disease, with extension of survival as the clinical endpoint.

| 19 |

OUR miR-BASED THERAPEUTIC PRODUCT PIPELINE

We have identified four miR-based therapeutic products (LumiralinTM AMT, OmiralinTM MRT, ColomiralinTM AMT, and PromiralinTM MRT) as our initial pipeline candidates. Lung, ovarian, colorectal, and prostate cancers have been selected as lead indications because of their established clinical need and large market potential. In addition, we believe we have strong intellectual property positions on these product candidates, which incorporate advanced delivery technology based on QTsomesTM. Each of the product candidates we have identified can target multiple tumor types given the prevalence of the corresponding miR targets in these tumors. In addition, it is possible to combine miR therapeutics to match a specific miR profile. For example, for a tumor that is high in miR-21 and low in miR-34, a therapy combination of LumiralinTM AMT and PromiralinTM MRT can be used to produce a synergistic effect. This miR combination can also be developed as a new drug product by combining the antimiR and miR-mimic into the same QTsomeTM lipid nanoparticle. This strategy can generate additional product candidates for our pipeline. Our therapeutic development strategy is to initially focus our resources on preclinical development and clinical translation of our current lead product candidate, LumiralinTM AMT, while continuing with validation of pipeline product candidates through preclinical research. We intend to seek strategic partners to develop pipeline product candidates.

OUR OUTSOURCING-BASED PRODUCT DEVELOPMENT STRATEGY

Outsourcing

An emerging trend in the biotechnology industry is to outsource developmental functions. This eliminates the need to establish a sizeable research and development facility, which is time consuming and capital intensive. By outsourcing our developmental functions, we are able to keep fixed costs to a minimum and flexibility to a maximum. Under this outsourcing model, we can leverage the established expertise of consultants and capabilities at partner academic institutions and CROs resulting in an overall efficient process for drug development. Our management will execute the strategic plan and carry out operational management and coordinate activities at sites of contractors and CROs. We are engaged in multiple discussions with CROs covering all stages of preclinical development and clinical trials. However, there is no assurance that we will enter into agreements with CROS or any other parties on acceptable terms, or at all.

Preclinical Research: Relationship with OSU

We have entered into license agreements with OSIF, an affiliate of OSU, covering approximately 138 pending patent applications and 132 granted patents covering various aspects of applications of miRNAs in cancer, as well as on miR therapeutic delivery, and as a result, we have developed a strategic relationship with OSU. The key inventor of the licensed delivery technology, Dr. Robert Lee, have extensive experience and resources to conduct preclinical research geared towards product development. Dr. Lee serves on our scientific advisory board and is a consultant to the company. Substantial complementary resources are available from the OSU Comprehensive Cancer Center, the OSU College of Medicine, the OSU College of Pharmacy, the NIH-funded Center for Clinical and Translational Sciences, the Drug Development Institute, and the NSF-funded Nanoscale Science and Engineering Center. We expect to enter into a contract with OSU and Dr. Lee pursuant to which Dr. Lee will serve as the Principal Investigator for our preclinical studies. However, we cannot provide any assurance that we will be successful in entering into such an agreement on acceptable terms, or at all.

| 20 |

Manufacturing of the Active Pharmaceutical Ingredient and the Therapeutic Product

A drug product is composed of active pharmaceutical ingredient (API) and excipients. The manufacturing of the drug product for clinical trial must be carried out under cGMP.

Sourcing of API

AntimicroRNAs and miR mimics are manufactured as custom synthetic oligonucleotides. These oligonucleotides will carry chemical modifications. For clinical development, the drug product needs to be synthesized at 100 − 1,000 gram-scale at a cGMP-compliant CMO. We are engaged in discussions and have obtained price quotes on the quantity of materials needed for preclinical development and clinical trials.

Chemical modifications will increase the potency of anti-miR compounds. Oligonucleotide therapeutic compounds have chemical modifications of the backbone or sugar of the oligonucleotide to increase potency and stability and reduce off target effects. Our QTsomeTM delivery technology, which protects the compounds in circulation, allows us more freedom around modifications. Our first library of potential anti miR-21 leads contains compounds with phosphorothioate and 2’-O-methyl modifications, both of which are in the public domain and will result in active compounds. In addition, we intend to enter into agreements with companies to license proprietary modifications that could further increase the potency of our lead compounds. We can provide no assurance, however, that we will be able to enter into such agreements on favorable terms, or at all. The resulting lead compounds that are identified in our ongoing product candidate screens will be unique chemical entities and will be proprietary to us.

Sourcing of Excipients

QTsomesTM include several key lipid ingredients. These will be acquired in cGMP-grade from excipient suppliers. Other excipients include USP grade glycine, trehalose are available from many suppliers. By design, for the QTsomesTM, all excipients are available through commercial suppliers.

| 21 |

Drug Product Manufacturing

We plan that QTsomeTM lipid nanoparticles will be manufactured at a cGMP compliant CMO. There are many CMOs to choose from, and we have engaged several CMOs in discussion. However we can provide no assurance that we will be able to enter into an agreement with a CMO on favorable terms, or at all. Each of these CMOs has established expertise on lipid-based formulations. Lipid nanoparticles are a relatively complicated formulation. Dr. Robert Lee has extensive expertise in the manufacturing of lipid nanoparticles and will advise us throughout this process. Processes and analytical methods developed in his laboratory at OSU and from the API CMO will be transferred to the CMO for making the drug product. When and if we are ready for manufacturing, the manufacturing process will be scaled up to the necessary scale for the clinical trials and performed under cGMP. Smaller non-GMP batches will be manufactured with the same product specifications prior to the clinical batch and used for IND-directed good laboratory practice (GLP) toxicology studies and stability studies. The manufacturing process includes continuous mixing, diafiltration, sterile filtration, aseptic filling, and lyophilization. The product specifications for quality control will include API content, particle size and polydispersity, zeta potential, pH, appearance and colloidal stability. In addition, stability, sterility, and pyrogen tests will be carried out. Data obtained will be incorporated into the IND in the section on Chemistry, Manufacturing, and Control (CMC).

Toxicology Testing

We expect that IND-directed toxicology testing will be carried out at a GLP-compliant toxicology CRO. There are many CROs to choose from and we have engaged a few CROs in discussion. However, we can provide no assurance that we will be able to enter into an agreement with any of these parties on acceptable terms, or at all. Materials used for the GLP toxicology study are to be provided by the CMO that produces the clinical trial material. However, a non-GMP batch manufactured to the same specifications can be used in the toxicology testing to accelerate the developmental process. The toxicology studies will include dose-escalation studies in rat and in a non-human primate and will include genotoxicity studies.

IND Filing with the FDA

We plan to retain a regulatory consultant to handle regulatory filings. During the development process, we expect to arrange a pre-IND meeting with the FDA to obtain input on various aspects of the product development plan. The regulatory consultant will help us organize preclinical efforts to ensure all preclinical work is completed in a timely fashion. As described above, the information relating to the Animal Pharmacology and Toxicology Studies is expected to be based on OSU studies and the GLP Toxicology Study data, which is expected to be collected by a CRO. Meanwhile, materials for the CMC section are expected to come from the CMO that manufactures the drug product. Finally, a section on Clinical Protocols and Investigator Information is expected to be generated in close collaboration with the OSU Division of Medical Oncology and the Clinical Trials Office. Clinical protocols are expected to be developed by physician scientists Dr. Miguel Villalona and Dr. John Hayes, who have extensive experience designing and leading Phase I clinical trials. If so, the clinical trial protocol will be reviewed and approved by OSU’s Institutional Review Board (IRB). In addition, we expect to draft an Investigator’s Brochure to be included in the IND application. The regulatory consultant will be expected to compile all relevant information and assemble the complete IND application and submit to the FDA and, if necessary, follow up with responses if questions are raised by the FDA.

Phase I Clinical Trials on Lumiralin in Lung Cancer and Ovarian Cancer Patients

We plan to retain the service of a CRO to conduct Phase I clinical trials at the OSU Comprehensive Cancer Center on our lead product candidate, LumiralinTM. The Phase I trial will be based on a 3x3 design of dose escalation plus an expansion cohort. This study will involve 12 − 36 patients. Patient blood samples will be analyzed for pharmacokinetics of the drug product and for biomarkers. The CRO and lead physician scientists at OSU will work closely to conduct trial planning and design, patient recruitment, data management, laboratory analysis, and reporting and oversight to ensure data integrity and adherence to good clinical practices (GCP).

| 22 |

OUR RELATIONSHIP WITH OSU

We have established relationships with multiple departments across OSU. In September 2013 we entered into five exclusive licensing agreements with OSIF, an affiliate of OSU, to exclusively in-license approximately 138 pending patent applications and 132 granted patents covering various aspects of applications of miRNAs in cancer as well as a novel delivery technology known as QTsomes. In addition, Dr. Robert Lee, the inventor of the QTsomeTM technology, serves as members of our scientific advisory board and is a consultant to the company.

We expect to engage Dr. Lee as the Principal Investigator for our preclinical studies, which will then be conducted in his lab at OSU. Throughout the manufacturing process, Dr. Lee will continue to advise and oversee the work with our third party contractor. Further, we expect to work with Dr. Lee and others at OSU in designing our clinical trials, which we expect will be carried out at the OSU Comprehensive Cancer Center. We cannot guarantee, however, that we will be able to enter into definitive agreements with these parties on acceptable terms, if at all.

We believe that our relationship with OSU will be beneficial to our company because of OSU’s deep research expertise and experience in the microRNA and oncology fields. Further, we expect that the OSU Comprehensive Cancer Center will provide us with guidance in running clinical trials as well as a large patient population pool.

OUR INTELLECTUAL PROPERTY

We have a portfolio of approximately 138 pending patent applications and 132 granted patents worldwide, which we have exclusively licensed from OSIF for use in the diagnosis, prognosis and therapy of certain types of cancer. The portfolio comprises 21 patent families having expiries between 2026 and 2035, not including any patent term adjustments or extensions, which may have been granted or which may be available, respectively. Protection of the intellectual property is being sought in major markets, including the United States, Europe, China, Japan, Australia and Canada. The portfolio embraces claims directed to composition of matter, methods of use, treatment, diagnosis, prognosis and/or stratification of patient populations and evaluation of cancer risk for ovarian, lung, colorectal and prostate cancers, including solid tumors and leukemia. Worldwide, the portfolio includes 6 granted patents directed to ovarian cancer, 37 granted patents directed to lung cancer, 92 granted patents directed to colorectal cancer and 16 granted patents directed to prostate cancer. Our product candidates are based upon the exploitation of these compositions and methods relating to the detection, measurement and/or stratification of microRNA levels or signatures in patients. Our intellectual property portfolio provides us with exclusive access to certain microRNAs and their applications in certain types of cancer as well as a proprietary delivery technology.

We believe that this intellectual property is critical to our business and we strive to strengthen and protect it. We also will rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection. Our success will depend significantly on our ability to maintain and defend our patents and other proprietary protection for commercially important technology, inventions and know-how related to our business, defend and enforce our patents, and preserve the confidentiality of our trade secrets. We also rely on know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen and maintain our proprietary position in the field of microRNA therapeutics. We intend to continue to seek opportunities to in-license relevant intellectual property as it is necessary to develop our product candidates and defend our competitive position in the marketplace.

COMPETITION

The biotechnology and pharmaceutical space is very competitive and rapidly changing, with new companies entering and working to develop new technologies and proprietary products. In addition, our field is tied to the advancement of the related fields of science, which continue to evolve and generate new insights and intellectual property.

We are aware of many competitors working in the therapeutic space for microRNA. Therapeutic competitors include miRagen Therapeutics, Inc., Mirna Therapeutics, Inc., and Regulus Therapeutics, Inc. These competitors compete with us in terms of recruiting talent, acquiring intellectual property and receiving potential funding during our development phase. Our competitors are better established, are further along in their development efforts and have greater resources at their disposal than us.

In addition, we expect that for each type of cancer for which we develop a therapeutic product candidate, we will compete against a different set of companies that market therapeutics for that given disease utilizing other approaches and technologies. For example, Mirna Therapeutics, Inc. is conducting a Phase I clinical trial for MRX34 in patients with unresectable liver cancer or liver metastasis. MRX34 utilizes the SMARTICLES as the delivery vehicle, which is based on a proprietary ‘‘charge-reversing’’ lipid nanoparticle formulation. The key competitive factors that will affect the success of any of our product candidates, if developed, manufactured and commercialized after obtaining all required regulatory approvals, are likely to be their safety, convenience, and efficacy.

| 23 |

GOVERNMENT REGULATION AND PRODUCT APPROVAL

Government authorities in both the United States, at the federal, state and local level, and other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of products such as those we are developing. The process of developing and obtaining regulatory approvals for our product candidates, as well as the subsequent compliance with applicable federal, state, local and foreign statutes and regulations, require the expenditure of substantial time and financial resources.

U.S. Therapeutic Regulations

U.S. Drug Development Process

In the United States, the FDA regulates drugs under the Federal Food, Drug and Cosmetic Act, or FDCA, and implementing regulations. Drugs are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with the appropriate federal, state, local and foreign laws and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial civil or criminal sanctions. FDA sanctions may include clinical holds, refusals to approve pending applications, withdrawal of an existing approval, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, debarment, restitution, disgorgement or civil or criminal penalties.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

- completion of nonclinical laboratory tests, animal studies and formulation studies according to good laboratory practices, or GLP;

- submission to the FDA of an IND, which must become effective before human clinical trials may begin;

- performance of adequate and well-controlled human clinical trials according to the FDA’s regulations commonly referred to as GCPs, to establish the safety and efficacy of the proposed drug for its intended use;

- submission to the FDA of a NDA for a new drug;

- satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the drug is produced to assess compliance with the FDA’s cGMP to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity;

- potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the NDA; and

- FDA review and approval of the NDA.

Before testing any compounds with potential therapeutic value in humans, the drug candidate enters the preclinical testing stage. Preclinical tests, also referred to as nonclinical studies, include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies to assess the potential safety and activity of the drug candidate. The conduct of the preclinical tests must comply with federal regulations and requirements including GLP. The sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. The FDA may also impose clinical holds on a drug candidate at any time before or during clinical trials due to safety concerns or non-compliance. Further, each clinical trial must be reviewed and approved by an independent institutional review board, or IRB, at or servicing each institution at which the clinical trial will be conducted. An IRB is charged with protecting the welfare and rights of trial participants and considers such items as whether the risks to individuals participating in the clinical trials are minimized and are reasonable in relation to anticipated benefits.

| 24 |

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

- Phase 1. The drug is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients.

- Phase 2. The drug is evaluated in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance, optimal dosage and dosing schedule.

- Phase 3. Clinical trials are undertaken to further evaluate dosage, clinical efficacy and safety in an expanded patient population at geographically dispersed clinical trial sites. These clinical trials are intended to establish the overall risk/benefit ratio of the product and provide an adequate basis for product labeling. Generally, two adequate and well-controlled Phase 3 clinical trials are required by the FDA for approval of an NDA.

Post-approval clinical trials, sometimes referred to as Phase 4 clinical trials, may be conducted after initial marketing approval. These clinical trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication. Annual progress reports detailing the results of the clinical trials must be submitted to the FDA and written IND safety reports must be promptly submitted to the FDA and the investigators for serious and unexpected adverse events or any finding from tests in laboratory animals that suggests a significant risk for human subjects. The FDA or the sponsor or its data safety monitoring board may suspend a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients.

U.S. Review and Approval Processes

The results of product development, nonclinical studies and clinical trials, along with descriptions of the manufacturing process, analytical tests conducted on the chemistry of the drug, proposed labeling and other relevant information are submitted to the FDA as part of an NDA requesting approval to market the product. The submission of an NDA is subject to the payment of substantial user fees; a waiver of such fees may be obtained under certain limited circumstances. In addition, under the Pediatric Research Equity Act, an NDA or supplement to an NDA must contain data to assess the safety and effectiveness of the drug for the claimed indications in all relevant pediatric subpopulations and to support dosing and administration for each pediatric subpopulation for which the product is safe and effective.

The FDA reviews all NDAs submitted to determine if they are substantially complete before it accepts them for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the NDA. Under the goals and policies agreed to by the FDA under the Prescription Drug User Fee Act, or PDUFA, the FDA targets 10 months in which to complete its initial review of a standard NDA and respond to the applicant, and six months for a priority NDA. The FDA often does not meet its PDUFA goal dates for standard and priority NDAs.

After the NDA submission is accepted for filing, the FDA reviews the NDA to determine, among other things, whether the proposed product is safe and effective for its intended use, and whether the product is being manufactured in accordance with cGMP to assure and preserve the product’s identity, strength, quality and purity. The FDA may refer applications for novel drug or biological products or drug or biological products which present difficult questions of safety or efficacy to an advisory committee, typically a panel that includes clinicians and other experts, for review, evaluation and a recommendation as to whether the application should be approved and under what conditions. Before approving an NDA, the FDA will inspect the facilities at which the product is manufactured.

The NDA review and approval process is frequently lengthy and complex and the FDA may refuse to approve an NDA if the applicable regulatory criteria are not satisfied or may require additional clinical data or other data and information. Even if such data and information is submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval.

If a product receives regulatory approval, the approval may be significantly limited to specific diseases and dosages or the indications for use may otherwise be limited, which could restrict the commercial value of the product. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. In addition, the FDA may require post marketing clinical trials, sometimes referred to as Phase 4 clinical trials testing, which involves clinical trials designed to further assess a drug safety and effectiveness and may require testing and surveillance programs to monitor the safety of approved products that have been commercialized.

| 25 |

U.S. Foreign Corrupt Practices Act

The U.S. Foreign Corrupt Practices Act, to which we are subject, prohibits corporations and individuals from engaging in certain activities to obtain or retain business or to influence a person working in an official capacity. It is illegal to pay, offer to pay or authorize the payment of anything of value to any foreign government official, government staff member, political party or political candidate in an attempt to obtain or retain business or to otherwise influence a person working in an official capacity.

Federal and State Fraud and Abuse Laws