| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-227446-11 | ||

|

|

MSC 2020-HR8

Free Writing Prospectus

Structural and Collateral Term Sheet

$690,955,373

(Approximate Total Mortgage Pool Balance)

$593,357,000

(Approximate Offered Certificates)

Morgan Stanley Capital I Inc.

as Depositor

Morgan Stanley Mortgage Capital Holdings LLC

Argentic Real Estate Finance LLC

Starwood Mortgage Capital LLC

Barclays Capital Real Estate Inc.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2020-HR8

July 20, 2020

MORGAN STANLEY Co-Lead Bookrunning Manager |

BARCLAYS Co-Lead Bookrunning Manager | |

Mischler Financial Group, Inc. Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the SEC (File No. 333-227446) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the depositor or any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free 1-866-718-1649 or by email to prospectus@ms.com.

This is not a research report and was not prepared by any Underwriter’s research department. It was prepared by the Underwriters’ sales, trading, banking or other non-research personnel. Please see additional important information and qualifications at the end of this Term Sheet.

| MSC 2020-HR8 |

Neither this Term Sheet nor anything contained herein shall form the basis for any contract or commitment whatsoever. The information contained herein is preliminary as of the date hereof. This Term Sheet is subject to change, completion or amendment from time to time. The information contained herein supersedes information in any other communication relating to the securities described herein; provided, that the information contained herein will be superseded by similar information delivered to you as part of the Preliminary Prospectus. The information contained herein should be reviewed only in conjunction with the entire Preliminary Prospectus. All of the information contained herein is subject to the same limitations and qualifications contained in the Preliminary Prospectus. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described in the Preliminary Prospectus. The information contained herein will be more fully described in the Preliminary Prospectus. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Preliminary Prospectus in its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, the email communication to which this Term Sheet may have been attached are not applicable to this Term Sheet and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this Term Sheet having been sent via Bloomberg or another email system.

IMPORTANT NOTICE REGARDING THE CONDITIONS FOR THIS OFFERING OF ASSET-BACKED SECURITIES

THE ASSET-BACKED SECURITIES REFERRED TO IN THIS TERM SHEET ARE BEING OFFERED WHEN, AS AND IF ISSUED. IN PARTICULAR, YOU ARE ADVISED THAT THE ASSET-BACKED SECURITIES, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING, AMONG OTHER THINGS, THE POSSIBILITY THAT ONE OR MORE CLASSES OF SECURITIES MAY BE SPLIT, COMBINED OR ELIMINATED), AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS. AS A RESULT, YOU MAY COMMIT TO PURCHASE SECURITIES THAT HAVE CHARACTERISTICS THAT MAY CHANGE, AND YOU ARE ADVISED THAT ALL OR A PORTION OF THE SECURITIES MAY NOT BE ISSUED THAT HAVE THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. OUR OBLIGATION TO SELL SECURITIES TO YOU IS CONDITIONED ON THE SECURITIES AND THE UNDERLYING TRANSACTION HAVING THE CHARACTERISTICS DESCRIBED IN THIS TERM SHEET. IF WE DETERMINE THAT THE FOREGOING CONDITION IS NOT SATISFIED IN ANY MATERIAL RESPECT, WE WILL NOTIFY YOU, AND NEITHER THE ISSUING ENTITY NOR ANY UNDERWRITER WILL HAVE ANY OBLIGATION TO YOU TO DELIVER ALL OR ANY PORTION OF THE SECURITIES WHICH YOU HAVE COMMITTED TO PURCHASE, AND THERE WILL BE NO LIABILITY BETWEEN US AS A CONSEQUENCE OF THE NON-DELIVERY.

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-2

| MSC 2020-HR8 | Structural Overview |

Offered Certificates

| Class | Expected

Ratings (Fitch/DBRS Morningstar/Moody’s)(1) |

Approximate Initial Certificate Balance Amount(2) |

Approximate

Initial Credit Support(3) |

Pass-Through Rate Description |

Expected

Weighted Average Life (Years)(4) |

Expected

Principal Window (Months)(4) |

Certificate

Principal UW NOI Debt Yield(5) |

Certificate Principal to Value Ratio(6) |

| Class A-1 | AAAsf/AAA(sf)/Aaa(sf) | $11,100,000 | 30.000% | (7) | 3.03 | 1 – 60 | 15.1% | 41.2% |

| Class A-SB | AAAsf/AAA(sf)/Aaa(sf) | $16,500,000 | 30.000% | (7) | 7.26 | 60 – 113 | 15.1% | 41.2% |

| Class A-3(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 15.1% | 41.2% |

| Class A-4(8) | AAAsf/AAA(sf)/Aaa(sf) | (8)(9) | 30.000% | (7)(8) | (9) | (9) | 15.1% | 41.2% |

| Class X-A | AAAsf/AAA(sf)/Aaa(sf) | $483,668,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| Class X-B | A-sf/AA(low)(sf)/NR | $109,689,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| Class A-S(8) | AAAsf/AAA(sf)/Aa2(sf) | $36,275,000(8) | 24.750% | (7)(8) | 9.96 | 120 – 120 | 14.1% | 44.3% |

| Class B | AA-sf/AAA(sf)/NR | $36,276,000 | 19.500% | (7) | 10.04 | 120 – 121 | 13.2% | 47.4% |

| Class C | A-sf/A(high)(sf)/NR | $37,138,000(13) | 14.125%(13) | (7) | 10.04 | 121 – 121 | 12.3% | 50.6% |

Privately Offered Certificates(12)

| Class | Expected

Ratings (Fitch/DBRS Morningstar/Moody’s)(1) |

Approximate

Initial Certificate Balance or Notional Amount(2) |

Approximate

Initial Credit Support(3) |

Pass-Through Rate Description |

Expected

Weighted Average Life (Years)(4) |

Expected

Principal Window (Months)(4) |

Certificate

Principal UW NOI Debt Yield(5) |

Certificate Principal to Value Ratio(6) |

| Class X-D | BBB+sf/AA(low)(sf)/NR | $6,910,000 (10)(13) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| Class D | BBB+sf/A(high)(sf)/NR | $6,910,000(13) | 13.125%(13) | (7) | 10.04 | 121 – 121 | 12.2% | 51.2% |

| Class E-RR | BBB+sf/A(low)(sf)/NR | $7,773,000(13) | 12.000%(13) | (7) | 10.04 | 121 – 121 | 12.0% | 51.8% |

| Class F-RR | BBBsf/A(low)(sf)/NR | $9,501,000(13) | 10.625%(13) | (7) | 10.04 | 121 – 121 | 11.9% | 52.6% |

| Class G-RR | BBB-sf/BBB(sf)/NR | $18,137,000 | 8.000% | (7) | 10.04 | 121 – 121 | 11.5% | 54.2% |

| Class H-RR | BB+sf/BB(high)(sf)/NR | $10,365,000 | 6.500% | (7) | 10.04 | 121 – 121 | 11.3% | 55.1% |

| Class J-RR | BB-sf/BB(sf)/NR | $9,500,000 | 5.125% | (7) | 10.04 | 121 – 121 | 11.2% | 55.9% |

| Class K-RR | B-sf/B(high)(sf)/NR | $7,774,000 | 4.000% | (7) | 10.04 | 121 – 121 | 11.0% | 56.5% |

| Class L-RR | NR/B(low)(sf)/NR | $11,228,000 | 2.375% | (7) | 10.04 | 121 – 121 | 10.9% | 57.5% |

| Class M-RR | NR/NR/NR | $16,410,372 | 0.000% | (7) | 10.04 | 121 – 121 | 10.6% | 58.9% |

| (1) | Ratings shown are those of Fitch Ratings, Inc. (“Fitch”), DBRS, Inc. (“DBRS Morningstar”) and Moody’s Investors Service, Inc. (“Moody’s”). Certain nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the certificates. There can be no assurance as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated on or about the date hereof (the “Preliminary Prospectus”). Capitalized terms used but not defined herein have the meanings assigned to such terms in the Preliminary Prospectus. |

| (2) | Approximate, subject to a permitted variance of plus or minus 5% or, in the case of the Class A-3, Class A-4, Class X-D, Class C, Class D, Class E-RR and Class F-RR certificates, such greater percentages as are contemplated by footnotes (9) and (13) below. In addition, the notional amounts of the Class X-A, Class X-B and Class X-D certificates may vary depending upon the final pricing of the classes of principal balance certificates (as defined in footnote (8) below) or trust components whose certificate or principal balances comprise such notional amounts, and, if as a result of such pricing the pass-through rate of any class of the Class X-A, Class X-B or Class X-D certificates, as applicable, would be equal to zero at all times, such class of certificates will not be issued on the closing date of this securitization. |

| (3) | The initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-SB, Class A-3 and Class A-4 certificates, are presented in the aggregate, taking into account the initial principal balances of the Class A-3 and Class A-4 trust components. The approximate initial credit support percentage set forth for the Class A-S certificates represents the approximate credit support for the underlying Class A-S trust component. |

| (4) | The Expected Weighted Average Life and Expected Principal Window during which distributions of principal would be received as set forth in the foregoing table with respect to each class of principal balance certificates are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans. |

| (5) | Certificate Principal UW NOI Debt Yield for any class of principal balance certificates is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage pool, multiplied by (b) a fraction, the numerator of which is the total initial certificate balance of all the principal balance certificates, and the denominator of which is the sum of the initial certificate balance of the subject class of principal balance certificates (or, with respect to the Class A-3, Class A-4 or Class A-S certificates, the initial principal balance of the trust component with the same alphanumeric designation) and the total initial certificate balance of all other classes of principal balance certificates, if any, that are senior to such class. The Certificate Principal UW NOI Debt Yields of the Class A-1, Class A-SB, Class A-3 and Class A-4 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (6) | Certificate Principal to Value Ratio for any class of principal balance certificates is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio of the mortgage pool, multiplied by (b) a fraction, the numerator of which is the sum of the initial certificate balance of the subject class of principal balance certificates (or, with respect to the Class A-3, Class A-4 or Class A-S certificates, the initial principal balance of the trust component with the same |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-3

| MSC 2020-HR8 | Structural Overview |

| alphanumeric designation) and the total initial certificate balance of all other classes of principal balance certificates, if any, that are senior to such class, and the denominator of which is the total initial certificate balance of all the principal balance certificates. The Certificate Principal to Value Ratios of the Class A-1, Class A-SB, Class A-3 and Class A-4 certificates are calculated in the aggregate for those classes as if they were a single class. |

| (7) | The pass-through rate for each class of the Class A-1, Class A-SB, Class A-3, Class A-4, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates will be one of the following: (i) a fixed rate per annum; (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date; (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date; or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the net mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class A-3-1, Class A-3-2, Class A-3-X1, Class A-3-X2, Class A-4-1, Class A-4-2, Class A-4-X1, Class A-4-X2, Class A-S-1, Class A-S-2, Class A-S-X1 and Class A-S-X2 certificates are also offered certificates. Such classes of certificates, together with the Class A-3, Class A-4 and Class A-S certificates, constitute the “Exchangeable Certificates”. Each class of Exchangeable Certificates evidences interests in one or more “trust components”. The Class A-1, Class A-SB, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates, together with the Exchangeable Certificates with certificate balances, are referred to as the “principal balance certificates”. The maximum certificate balances of the Class A-3, Class A-4 and Class A-S certificates (subject to the constraint on the aggregate initial principal balance of the Class A-3 and Class A-4 trust components discussed under footnote (9)) will be issued on the closing date, and the certificate balance or notional amount of each other class of Exchangeable Certificates will be equal to zero on the closing date. The relative priorities, certificate balances or notional amounts and pass-through rates of the Exchangeable Certificates are described more fully below under “Exchangeable Certificates.” Each class of the Class A-3-1, Class A-3-2, Class A-3-X1, Class A-3-X2, Class A-4-1, Class A-4-2, Class A-4-X1 and Class A-4-X2 certificates is expected to be rated “AAAsf,” “AAA(sf)” and “Aaa(sf)” by Fitch, DBRS Morningstar and Moody’s, respectively. Each class of the Class A-S-1, Class A-S-2, Class A-S-X1 and Class A-S-X2 certificates is expected to be rated “AAAsf,” “AAA(sf)” and “Aa2(sf)” by Fitch, DBRS Morningstar and Moody’s, respectively. |

| (9) | The exact initial principal balances or notional amounts of the Class A-3, Class A-3-X1, Class A-3-X2, Class A-4, Class A-4-X1 and Class A-4-X2 trust components (and consequently, the exact initial certificate balances or notional amounts of the Exchangeable Certificates with an “A-3” or “A-4” designation) are unknown and will be determined based on the final pricing of the certificates. However, the initial principal balances, weighted average lives and principal windows of the Class A-3 and Class A-4 trust components are expected to be within the applicable ranges reflected in the following chart. The aggregate initial principal balance of the Class A-3 and Class A-4 trust components is expected to be approximately $456,068,000, subject to a variance of plus or minus 5%. The Class A-3-X1 and Class A-3-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-3 trust component. The Class A-4-X1 and Class A-4-X2 trust components will have initial notional amounts equal to the initial principal balance of the Class A-4 trust component. |

Trust Component |

Expected

Range of Initial |

Expected

Range |

Expected

Range of |

| Class A-3 | $145,000,000 – $200,000,000 | 9.51 – 9.54 | 113 – 116 / 113 – 116 |

| Class A-4 | $256,068,000 – $311,068,000 | 9.71 – 9.73 | 116 – 120 / 116 – 120 |

| (10) | The Class X-A, Class X-B and Class X-D certificates (collectively referred to as the “Class X certificates”) are notional amount certificates and will not be entitled to distributions of principal. The notional amount of the Class X-A certificates will be equal to the aggregate of the certificate or principal balances of the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components. The notional amount of the Class X-B certificates will be equal to the aggregate of the certificate or principal balances of the Class A-S trust component and the Class B and Class C certificates. The notional amount of the Class X-D certificates will be equal to the certificate balance of the Class D certificates. If the certificate balance of a class of principal balance certificates or principal balance of a trust component constitutes all or part of the notional amount of a class of Class X certificates, then such class of principal balance certificates or such trust component constitutes an “underlying class of principal balance certificates” or an “underlying trust component” for such class of Class X certificates. |

| (11) | The pass-through rate for the Class X-A certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1 and Class A-SB certificates and the Class A-3, Class A-3-X1, Class A-3-X2, Class A-4, Class A-4-X1 and Class A-4-X2 trust components for the related distribution date, weighted on the basis of their respective certificate or principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-B certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, Class A-S-X1 and Class A-S-X2 trust components and the Class B and Class C certificates for the related distribution date, weighted on the basis of their respective certificate or principal balances or notional amounts outstanding immediately prior to that distribution date (but excluding trust components with a notional amount in the denominator of such weighted average calculation). The pass-through rate for the Class X-D certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the net mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | Not offered pursuant to the Preliminary Prospectus or this Term Sheet. Information provided in this Term Sheet regarding the characteristics of these certificates is provided only to enhance your understanding of the offered certificates. The privately offered certificates also include the Class V and Class R certificates, which do not have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date, and which are not shown in the chart. The Class V certificates represent a beneficial ownership interest held through the grantor trust in certain excess interest in respect of mortgage loans having anticipated repayment dates, if any. The Class R certificates represent the beneficial ownership of the residual interest in each of the real estate mortgage investment conduits, as further described in the Preliminary Prospectus. Because there are no mortgage loans with anticipated repayment dates in the mortgage pool, there will be no excess interest distributable to the Class V certificates. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-4

| MSC 2020-HR8 | Structural Overview |

| (13) | The initial certificate balance of each class of the Class C, Class D, Class E-RR and Class F-RR certificates and the initial notional amount of the Class X-D certificates are subject to change based on final pricing of all certificates (other than the Class R certificates) and the final determination of the fair market value of the Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates (collectively, the “RR Certificates”), which will be retained by a “third-party purchaser” or its “majority-owned affiliate” (in each case as defined under Regulation RR) in satisfaction of the retention obligations of Morgan Stanley Mortgage Capital Holdings LLC, in its capacity as “retaining sponsor” (as defined under Regulation RR). The initial certificate balance or notional amount of, and approximate initial credit support for, each class of the Class C, Class D, Class X-D, Class E-RR and Class F-RR certificates are expected to fall within the ranges set forth below. |

Class of Certificates |

Expected

Range of Initial |

Expected

Range of Approximate Initial |

| Class C | $35,238,000 - $37,138,000 | 14.125% - 14.400% |

| Class D | $6,910,000 - $8,810,000 | 12.850% - 13.400% |

| Class X-D | $6,910,000 - $8,810,000 | N/A |

| Class E-RR | $6,910,000 - $9,673,000 | 11.850% - 12.000% |

| Class F-RR | $8,464,000 - $9,501,000 | 10.625% - 10.625% |

For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the RR Certificates and the corresponding effect on the sizing of the Class C, Class D and Class X-D Certificates, see “Credit Risk Retention” in the Preliminary Prospectus.

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-5

| MSC 2020-HR8 | Structural Overview |

Issue Characteristics

| Offered Certificates: | $593,357,000 (approximate) monthly pay, multi-class, commercial mortgage pass-through certificates, consisting of thirteen principal balance classes (Class A-1, Class A-SB, Class A-3, Class A-3-1, Class A-3-2, Class A-4, Class A-4-1, Class A-4-2, Class A-S, Class A-S-1, Class A-S-2, Class B and Class C) and eight interest-only classes (Class A-3-X1, Class A-3-X2, Class A-4-X1, Class A-4-X2, Class X-A, Class X-B, Class A-S-X1 and Class A-S-X2) |

| Co-Lead Bookrunning Managers: | Morgan Stanley & Co. LLC and Barclays Capital Inc. |

| Co-Manager: | Mischler Financial Group, Inc. |

| Mortgage Loan Sellers: | Morgan Stanley Mortgage Capital Holdings LLC, Argentic Real Estate Finance LLC, Starwood Mortgage Capital LLC and Barclays Capital Real Estate Inc. |

| Rating Agencies: | Fitch, DBRS Morningstar and Moody’s |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Certificate Administrator/ Certificate Registrar/Custodian: | Wells Fargo Bank, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Initial Directing Certificateholder: | KKR Real Estate Credit Opportunity Partners II L.P. or an affiliate thereof |

| Credit Risk Retention: | Eligible horizontal residual interest |

| Cut-off Date: | The mortgage loans will be considered part of the trust fund as of their respective cut-off dates. The cut-off date with respect to each mortgage loan is the respective due date for the monthly debt service payment that is due in July 2020 (or, in the case of any mortgage loan that has its first due date after July 2020, the date that would have been its due date in July 2020 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Pricing Date: | Week of July 20, 2020 |

| Expected Closing Date: | On or about July 31, 2020 |

| Determination Dates: | The 11th day of each month or, if the 11th day is not a business day, then the business day immediately following such 11th day. |

| Distribution Dates: | The 4th business day following each determination date. The first distribution date will be in August 2020. |

| Rated Final Distribution Date: | The distribution date in July 2053 |

| Interest Accrual Period: | Preceding calendar month |

| Payment Structure: | Sequential pay |

| Tax Treatment: | REMIC, except that the Exchangeable Certificates will evidence interests in a grantor trust |

| Optional Termination: | 1.00% clean-up call |

| Minimum Denominations: | $10,000 for each class of Offered Certificates (other than Class X-A and Class X-B certificates); $1,000,000 for the Class X-A and Class X-B certificates |

| Settlement Terms: | DTC, Euroclear and Clearstream |

| Legal/Regulatory Status: | Each class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No class of Offered Certificates is SMMEA eligible. |

| Analytics: | The certificate administrator is expected to make available all distribution date statements, CREFC® reports and supplemental notices received by it to certain modeling financial services as described in the Preliminary Prospectus. |

| Bloomberg Ticker: | MSC 2020-HR8<MTGE><GO> |

| Risk Factors: | THE OFFERED CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-6

| MSC 2020-HR8 | Structural Overview |

Structural Overview

| Accrual: | Each class of Offered Certificates will accrue interest on a 30/360 basis. |

| Amount and Order of | |

| Distributions: | On each distribution date, funds available for distribution on the certificates from the mortgage loans (which are net of specified expenses of the issuing entity, including fees payable to, and advances, costs and expenses reimbursable to, the master servicer, any primary servicer, the special servicer, the certificate administrator, the trustee, the operating advisor, the asset representations reviewer and CREFC®) other than (i) any yield maintenance charges and prepayment premiums and (ii) any excess interest distributed to the Class V certificates, will be distributed in the following amounts and order of priority:

First, to the Class A-1, Class A-SB, Class X-A, Class X-B and Class X-D certificates and the Class A-3, Class A-3-X1, Class A-3-X2, Class A-4, Class A-4-X1 and Class A-4-X2 trust components, in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those classes of certificates and trust components;

Second, to the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components as follows, to the extent of funds allocated to principal and available for distribution: either (i)(a) first, to principal on the Class A-SB certificates, until the certificate balance of the Class A-SB certificates is reduced to the planned principal balance for the related distribution date set forth in Annex E to the Preliminary Prospectus, and (b) second, to principal on the Class A-1 certificates, the Class A-3 trust component, the Class A-4 trust component and the Class A-SB certificates, in that order, in each case until the certificate or principal balance of such class of certificates or trust component has been reduced to zero, or (ii) if the certificate balance or principal balance of the Class A-S trust component and each class of the Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates has been reduced to zero as a result of the allocation of losses on the mortgage loans to those certificates or trust component, to principal on the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components, pro rata, without regard to the distribution priorities described above or the planned principal balance of the Class A-SB certificates;

Third, to the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components: (a) first, up to an amount equal to, and pro rata based on, any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by each such class or trust component, and (b) second, up to an amount equal to, and pro rata based on, interest on such unreimbursed losses previously allocated to each such class or trust component at the pass-through rate for such class or trust component from the date the related loss was allocated to such class or trust component;

Fourth, to the Class A-S, Class A-S-X1 and Class A-S-X2 trust components, as follows: (a) to each such trust component in respect of interest, up to an amount equal to, and pro rata in accordance with, the interest entitlements for those trust components; (b) to the extent of funds allocable to principal and available for distribution that remain after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in prior enumerated clauses set forth above), to principal on the Class A-S trust component until its principal balance has been reduced to zero; and (c) to reimburse the Class A-S trust component, first, for any previously unreimbursed losses on the mortgage loans that were previously allocated to such trust component, and second, for interest on such unreimbursed losses at the pass-through rate for such trust component from the date the related loss was allocated to such trust component;

Fifth, to each class of the Class B and Class C certificates, in that order, as follows: (a) to interest on such class of certificates in the amount of its interest entitlement; (b) to the extent of funds allocable to principal and available for distribution that remain after distributions in respect of principal to each class of certificates or trust component with a higher priority (as set forth in this clause or prior enumerated clauses set forth above), to principal on such class of certificates until its certificate balance has been reduced to zero; and (c) to reimburse such class of certificates, first, for any previously unreimbursed losses on the mortgage loans that were previously allocated to those certificates, and second, for interest on such unreimbursed losses at the pass-through rate for such class from the date the related loss was allocated to such class;

Sixth, to the Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates in the amounts and order of priority described in “Description of the Certificates—Distributions” in the Preliminary Prospectus; and

Seventh, to the Class R certificates, any remaining amounts.

Principal and interest payable on the Class A-3, Class A-3-X1, Class A-3-X2, Class A-4, Class A-4-X1, Class A-4-X2, Class A-S, Class A-S-X1 and Class A-S-X2 trust components will be distributed pro rata to the corresponding classes of Exchangeable Certificates representing interests therein in accordance with their Class Percentage Interests therein as described below under “Exchangeable Certificates.” |

| Interest and Principal | |

| Entitlements: | The interest entitlement of each class of Offered Certificates on each distribution date generally will be the interest accrued during the related interest accrual period on the related certificate balance or notional amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that class for such distribution date as described below. If prepayment interest shortfalls arise from voluntary prepayments on serviced mortgage loans during any collection period, the master servicer is required to make a limited compensating interest payment to offset those shortfalls. See “Description of the Certificates—Prepayment Interest Shortfalls” in the Preliminary Prospectus. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all classes of certificates (other than the Exchangeable

|

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-7

| MSC 2020-HR8 | Structural Overview |

Certificates and the Class V and Class R certificates) and trust components, pro rata, based on their respective amounts of accrued interest for the related distribution date, to reduce the interest entitlement on each such class of certificates and trust component. For any distribution date, prepayment interest shortfalls allocated to a trust component will be allocated among the related classes of Exchangeable Certificates, pro rata, in accordance with their respective Class Percentage Interests therein. If a class of certificates or trust component receives less than the entirety of its interest entitlement on any distribution date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding distribution date.

The principal distribution amount for each distribution date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and any workout-delayed reimbursement amounts that are reimbursed to the master servicer or the trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections before reimbursement from other amounts. Workout-delayed reimbursement amounts will be reimbursable from principal collections. | |

| Exchangeable Certificates: | Certificates of each class of Exchangeable Certificates may be exchanged for certificates of the corresponding classes of Exchangeable Certificates set forth next to such class in the table below, and vice versa. Following any exchange of certificates of one or more classes of Exchangeable Certificates (the applicable “Surrendered Classes”) for certificates of one or more classes of other Exchangeable Certificates (the applicable “Received Classes”), the Class Percentage Interests (as defined below) of the outstanding principal balances or notional amounts of the Corresponding Trust Components that are represented by the Surrendered Classes (and consequently their related certificate balances or notional amounts) will be decreased, and those of the Received Classes (and consequently their related certificate balances or notional amounts) will be increased. The dollar denomination of the certificates of each of the Received Classes must be equal to the dollar denomination of the certificates of each of the Surrendered Classes. No fee will be required with respect to any exchange of Exchangeable Certificates. |

| Surrendered Classes (or Received Classes) of Certificates | Received Classes (or Surrendered Classes) of Certificates | |

| Class A-3 | Class A-3-1, Class A-3-X1 | |

| Class A-3 | Class A-3-2, Class A-3-X2 | |

| Class A-4 | Class A-4-1, Class A-4-X1 | |

| Class A-4 | Class A-4-2, Class A-4-X2 | |

| Class A-S | Class A-S-1, Class A-S-X1 | |

| Class A-S | Class A-S-2, Class A-S-X2 |

On the closing date, the issuing entity will issue the following “trust components,” each with the initial principal balance (or, if such trust component has an “X” suffix, notional amount) and pass-through rate set forth next to it in the table below. Each trust component with an “X” suffix will not be entitled to distributions of principal. |

| Trust Component | Initial

Principal Balance or Notional Amount |

Pass-Through Rate | |

| Class A-3 | See footnote (9) to the first table above under “Structural Overview” | Class A-3 certificate pass-through rate minus 1.00% | |

| Class A-3-X1 | Equal to Class A-3 trust component principal balance | 0.50% | |

| Class A-3-X2 | Equal to Class A-3 trust component principal balance | 0.50% | |

| Class A-4 | See footnote (9) to the first table above under “Structural Overview” | Class A-4 certificate pass-through rate minus 1.00% | |

| Class A-4-X1 | Equal to Class A-4 trust component principal balance | 0.50% | |

| Class A-4-X2 | Equal to Class A-4 trust component principal balance | 0.50% | |

| Class A-S | $36,275,000 | Class A-S certificate pass-through rate minus 1.00% | |

| Class A-S-X1 | Equal to Class A-S trust component principal balance | 0.50% | |

| Class A-S-X2 | Equal to Class A-S trust component principal balance | 0.50% |

|

Each class of Exchangeable Certificates represents an undivided beneficial ownership interest in the trust components set forth next to it in the table below (the “Corresponding Trust Components”). Each class of Exchangeable Certificates has a pass-through rate equal to the sum of the pass-through rates of the Corresponding Trust Components and represents a percentage interest (the related “Class Percentage Interest”) in each Corresponding Trust Component, including principal and interest payable thereon (and reimbursements of losses allocable thereto), equal to (x) the certificate balance (or, if such class has an “X” suffix, notional amount) of such class of certificates, divided by (y) the principal balance of the Class A-3 trust component (if such class of Exchangeable Certificates has an “A-3” designation), the Class A-4 trust component (if such class of Exchangeable Certificates has an “A-4” designation) or the Class A-S trust component (if such class of Exchangeable Certificates has an “A-S” designation). |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-8

| MSC 2020-HR8 | Structural Overview |

| Group of Exchangeable Certificates | Class of Exchangeable Certificates | Corresponding Trust Components | |

| “Class A-3 Exchangeable Certificates” | Class A-3 | Class A-3, Class A-3-X1, Class A-3-X2 | |

| Class A-3-1 | Class A-3, Class A-3-X2 | ||

| Class A-3-2 | Class A-3 | ||

| Class A-3-X1 | Class A-3-X1 | ||

| Class A-3-X2 | Class A-3-X1, Class A-3-X2 | ||

| “Class A-4 Exchangeable Certificates” | Class A-4 | Class A-4, Class A-4-X1, Class A-4-X2 | |

| Class A-4-1 | Class A-4, Class A-4-X2 | ||

| Class A-4-2 | Class A-4 | ||

| Class A-4-X1 | Class A-4-X1 | ||

| Class A-4-X2 | Class A-4-X1, Class A-4-X2 | ||

| “Class A-S Exchangeable Certificates” | Class A-S | Class A-S, Class A-S-X1, Class A-S-X2 | |

| Class A-S-1 | Class A-S, Class A-S-X2 | ||

| Class A-S-2 | Class A-S | ||

| Class A-S-X1 | Class A-S-X1 | ||

| Class A-S-X2 | Class A-S-X1, Class A-S-X2 |

The maximum certificate balance or notional amount of each class of Class A-3 Exchangeable Certificates that could be issued in an exchange is equal to the principal balance of the Class A-3 trust component, the maximum certificate balance or notional amount of each class of Class A-4 Exchangeable Certificates that could be issued in an exchange is equal to the principal balance of the Class A-4 trust component, and the maximum certificate balance or notional amount of each class of Class A-S Exchangeable Certificates that could be issued in an exchange is equal to the principal balance of the Class A-S trust component. The maximum certificate balances of Class A-3, Class A-4 and Class A-S certificates (subject to the constraint on the aggregate initial principal balance of the Class A-3 and Class A-4 trust components discussed in footnote (9) to the first table above under “Structural Overview”) will be issued on the closing date, and the certificate balance or notional amount of each other class of Exchangeable Certificates will be equal to zero on the Closing Date.

Each class of Class A-3 Exchangeable Certificates, Class A-4 Exchangeable Certificates and Class A-S Exchangeable Certificates will have a certificate balance or notional amount equal to its Class Percentage Interest multiplied by the principal balance of the Class A-3 Trust Component, Class A-4 Trust Component or Class A-S Trust Component, respectively. Each class of Class A-3 Exchangeable Certificates, Class A-4 Exchangeable Certificates and Class A-S Exchangeable Certificates with a certificate balance will have the same approximate initial credit support percentage, Expected Weighted Average Life, Expected Principal Window, Certificate Principal UW NOI Debt Yield and Certificate Principal to Value Ratio as the Class A-3 Certificates, Class A-4 Certificates or Class A-S Certificates, respectively, shown above in the table on the first page of this Structural Overview. | |

| Special Servicer | |

| Compensation: | The principal compensation to be paid to the special servicer in respect of its special servicing activities will be the special servicing fee, the workout fee and the liquidation fee.

The special servicing fee for each distribution date is calculated at the special servicing fee rate based on the outstanding principal balance of each mortgage loan (and any related companion loan) that is serviced under the pooling and servicing agreement for this securitization (a “serviced mortgage loan” and “serviced companion loan”, respectively) and that is being specially serviced or as to which the related mortgaged property has become an REO property. The special servicing fee rate will be a rate equal to the greater of 0.25% per annum and the per annum rate that would result in a special servicing fee of $3,500 for the related month. The special servicing fee will be payable monthly, first, from liquidation proceeds, insurance and condemnation proceeds, and other collections in respect of the related specially serviced mortgage loan or REO property and, then, from general collections on all the mortgage loans and any REO properties.

The special servicer will also be entitled to (i) liquidation fees generally equal to 1.0% of liquidation proceeds and certain other collections in respect of a specially serviced mortgage loan (and any related serviced companion loan) or related REO property and of amounts received in respect of mortgage loan repurchases by the related mortgage loan sellers and (ii) workout fees generally equal to 1.0% of interest (other than post-ARD excess interest on mortgage loans with anticipated repayment dates and other than default interest) and principal payments made in respect of a rehabilitated mortgage loan (and any related serviced companion loan), in the case of each of clause (i) and (ii), subject to a cap of $1,000,000 and a floor of $25,000 with respect to any mortgage loan, whole loan or related REO property and subject to certain adjustments and exceptions as described in the Preliminary Prospectus under “Pooling and Servicing Agreement—Servicing and Other Compensation and Payment of Expenses—Special Servicing Compensation”.

With respect to any non-serviced mortgage loan, the related special servicer under the related other pooling and servicing agreement pursuant to which such mortgage loan is being serviced will be entitled to similar compensation as that described above with respect to such non-serviced mortgage loan under such other pooling and servicing agreement as further described in the Preliminary Prospectus, although any related fees may accrue at a different rate and there may be a higher (or no) cap on liquidation and workout fees. |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-9

| MSC 2020-HR8 | Structural Overview |

| Prepayment Premiums/Yield | |

| Maintenance Charges: | If any yield maintenance charge or prepayment premium is collected during any collection period with respect to any mortgage loan, then on the immediately succeeding distribution date, the certificate administrator will pay:

(a) to the holders of each class of the Class A-1, Class A-SB, Class A-3, Class A-3-1, Class A-3-2, Class A-4, Class A-4-1, Class A-4-2, Class A-S, Class A-S-1, Class A-S-2, Class B, Class C and Class D certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fees payable therefrom), (y) the related Base Interest Fraction for such class and the applicable principal prepayment, and (z) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date,

(b) to the holders of the Class A-3-X1 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-1 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-1 certificates and the applicable principal prepayment,

(c) to the holders of the Class A-3-X2 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-3-2 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-3 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-3-2 certificates and the applicable principal prepayment,

(d) to the holders of the Class A-4-X1 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-4-1 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-4 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-4-1 certificates and the applicable principal prepayment,

(e) to the holders of the Class A-4-X2 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-4-2 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-4 certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-4-2 certificates and the applicable principal prepayment,

(f) to the holders of the Class A-S-X1 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-1 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-1 certificates and the applicable principal prepayment,

(g) to the holders of the Class A-S-X2 certificates, the product of (x) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom), (y) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S-2 certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, and (z) the difference between (1) the Base Interest Fraction for the Class A-S certificates and the applicable principal prepayment and (2) the Base Interest Fraction for the Class A-S-2 certificates and the applicable principal prepayment,

(h) to the holders of the Class X-A certificates, the excess, if any, of (x) the product of (1) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom) and (2) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-1 and Class A-SB certificates, the Class A-3 Exchangeable Certificates and the Class A-4 Exchangeable Certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, over (y) the

|

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-10

| MSC 2020-HR8 | Structural Overview |

amount of such yield maintenance charge or prepayment premium distributed to the Class A-1 and Class A-SB certificates, the Class A-3 Exchangeable Certificates and the Class A-4 Exchangeable Certificates as described above,

(i) to the holders of the Class X-B certificates, the excess, if any, of (x) the product of (1) such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom) and (2) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S Exchangeable Certificates and the Class B and Class C certificates for that distribution date, and the denominator of which is the total amount of principal distributed to the Class A-1, Class A-SB, Class B, Class C and Class D certificates, the Class A-3 Exchangeable Certificates, the Class A-4 Exchangeable Certificates and the Class A-S Exchangeable Certificates for that distribution date, over (y) the amount of such yield maintenance charge or prepayment premium distributed to the Class A-S Exchangeable Certificates and the Class B and Class C certificates as described above,

and (j) to the holders of the Class X-D certificates, any remaining portion of such yield maintenance charge or prepayment premium (net of any liquidation fee payable therefrom) not distributed as described above.

Notwithstanding any of the foregoing to the contrary, if at any time the certificate balances of the principal balance certificates (other than the Control Eligible Certificates) have been reduced to zero as a result of the allocation of principal payments on the mortgage loans, the certificate administrator will pay to the holders of each remaining class of principal balance certificates then entitled to distributions of principal on the subject distribution date the product of (a) any yield maintenance charge or prepayment premium distributable on the subject distribution date (net of any liquidation fees payable therefrom) and (b) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that distribution date, and the denominator of which is the total amount of principal distributed to all principal balance certificates for that distribution date.

“Base Interest Fraction” means, with respect to any principal prepayment of any mortgage loan that provides for the payment of a yield maintenance charge or prepayment premium, and with respect to any class of principal balance certificates, a fraction (A) the numerator of which is the greater of (x) zero and (y) the difference between (i) the pass-through rate on that class, and (ii) the applicable discount rate and (B) the denominator of which is the difference between (i) the mortgage interest rate on the related mortgage loan and (ii) the applicable discount rate; provided, that: under no circumstances will the Base Interest Fraction be greater than one; if the discount rate referred to above is greater than or equal to both the mortgage interest rate on the related mortgage loan and the pass-through rate on that class, then the Base Interest Fraction will equal zero; and if the discount rate referred to above is greater than or equal to the mortgage interest rate on the related mortgage loan and is less than the pass-through rate on that class, then the Base Interest Fraction will be equal to 1.0.

Consistent with the foregoing, the Base Interest Fraction is equal to: |

| (Pass-Through Rate – Discount Rate) | |||

| (Mortgage Rate – Discount Rate) |

| Realized Losses: | On each distribution date, immediately following the distributions to be made to the certificateholders on that date, the certificate administrator is required to calculate the amount, if any, by which (i) the aggregate stated principal balance of the mortgage loans, including any successor REO loans expected to be outstanding immediately following that distribution date is less than (ii) the then aggregate certificate balance of the principal balance certificates after giving effect to distributions of principal on that distribution date (any such deficit, a “Realized Loss”), which amount will be applied to reduce the certificate balances of the Class M-RR, Class L-RR, Class K-RR, Class J-RR, Class H-RR, Class G-RR, Class F-RR, Class E-RR, Class D, Class C and Class B certificates and the Class A-S trust component, in that order, in each case until the related certificate or principal balance has been reduced to zero, and then to the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components, pro rata, based upon their respective certificate or principal balances, until their respective certificate or principal balances have been reduced to zero.

Any portion of such amount applied to the Class A-3, Class A-4 or Class A-S trust component will reduce the certificate balance or notional amount of each class of certificates in the related group of Exchangeable Certificates by an amount equal to the product of (x) its certificate balance or notional amount, divided by the principal balance of such trust component prior to the applicable reduction, and (y) the amount applied to such trust component.

|

| Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan and one or more pari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each such pari passu or generally subordinate promissory note, a “serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and (subject to the discussion in the next paragraph) the pooling and servicing agreement for this transaction: The Liz and HPE Campus. With respect to each such mortgaged property or portfolio of mortgaged properties, the related mortgage loan, together with the related serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for this transaction) as a “serviced whole loan.” Each serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. See the tables below entitled “Mortgage Loans with Pari Passu Companion Loans” and “Mortgage Loans with Subordinate Debt” and “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus, for additional information regarding each such whole loan.

With respect to each “servicing shift whole loan”, the pooling and servicing agreement for this transaction will govern servicing of such whole loan until the securitization of the related control note; however, servicing of such

|

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-11

| MSC 2020-HR8 | Structural Overview |

| whole loan will generally be directed by the holder of the related control note (which is not included in this securitization), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. After the securitization of the related lead servicing note , a servicing shift whole loan will cease to be a serviced whole loan and will be serviced pursuant to the pooling and servicing agreement for another securitization transaction (see “Non-Serviced Whole Loans” below). There will be no servicing shift mortgage loans related to the trust as of the Closing Date. | |

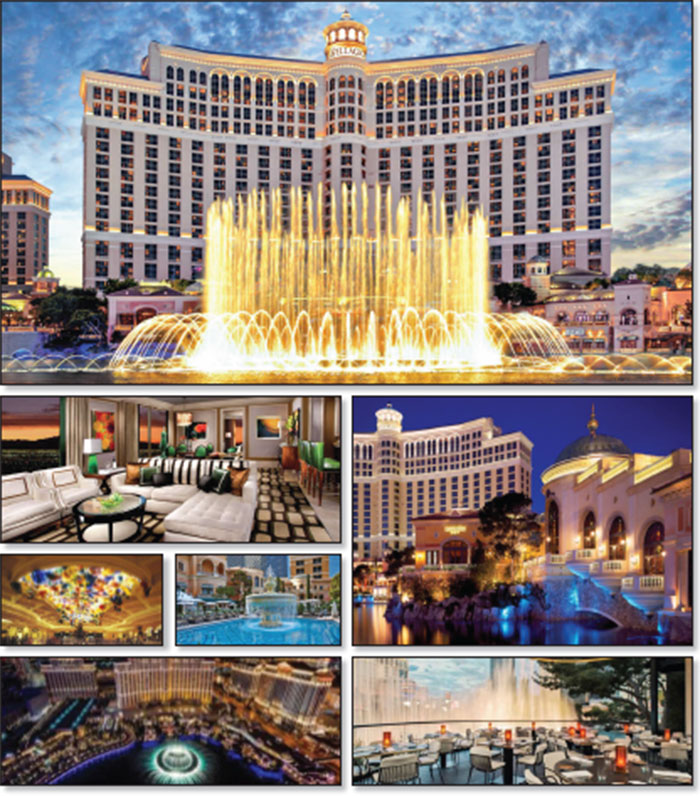

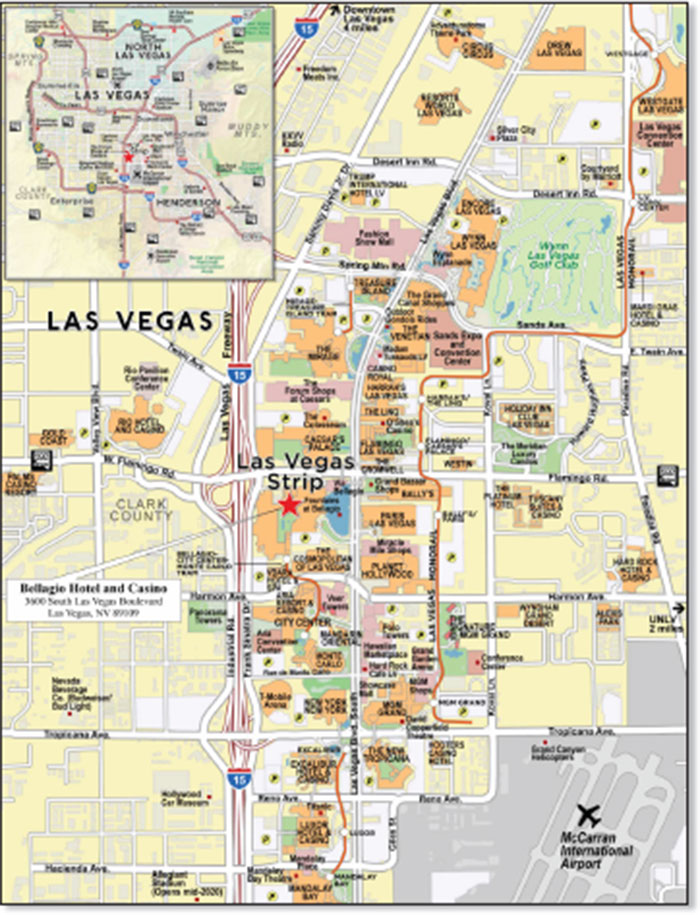

| Non-Serviced Whole Loans: | Each of the following mortgaged properties or portfolios of mortgaged properties secures a mortgage loan (each, a “non-serviced mortgage loan”), one or more pari passu promissory notes and, in some cases, one or more generally subordinate promissory notes (each such pari passu or generally subordinate promissory note, a “non-serviced companion loan”) that will be serviced pursuant to the related intercreditor agreement and the pooling and servicing agreement or trust and servicing agreement (referred to herein as a related “pooling and servicing agreement”) for another securitization transaction: 525 Market Street, Bellagio Hotel and Casino, Bushwick Multifamily Portfolio and Ralph Lauren HQ New Jersey. With respect to each such mortgaged property, the related mortgage loan, together with the related non-serviced companion loan(s), is referred to herein (for so long as it is serviced under the pooling and servicing agreement for another securitization transaction) as a “non-serviced whole loan.” Each non-serviced companion loan is not part of the mortgage pool and may be contributed to one or more future securitization transactions (if not already securitized) or may be otherwise transferred at any time, subject to compliance with the related intercreditor agreement. Servicing of each non-serviced whole loan will generally be directed by the holder of the related control note (or, if such control note is included in a securitization, the directing certificateholder thereunder (or other party designated to exercise the rights of such control note)), and such holder will have the right to replace the special servicer with respect to the related whole loan with or without cause. See the table below entitled “Mortgage Loans with Pari Passu Companion Loans” and “Mortgage Loans with Subordinate Debt” and “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus for additional information regarding each such whole loan. |

| Directing Certificateholder/ | |

| Controlling Class: | The initial Directing Certificateholder is expected to be KKR Real Estate Credit Opportunity Partners II L.P. or an affiliate thereof.

The “Directing Certificateholder” will be the Controlling Class Certificateholder (or its representative) selected by more than 50% (by certificate balance) of the Controlling Class Certificateholders; provided, that (1) absent that selection, (2) until a Directing Certificateholder is so selected or (3) upon receipt of a notice from a majority of the Controlling Class Certificateholders (by certificate balance) that a Directing Certificateholder is no longer designated, the Controlling Class Certificateholder that owns the largest aggregate certificate balance of the Controlling Class (or its representative) will be the Directing Certificateholder; provided, that (i) if such holder elects or has elected to not be the Directing Certificateholder, the holder of the next largest aggregate certificate balance of the Controlling Class will be the Directing Certificateholder, (ii) in the event no one holder owns the largest aggregate certificate balance of the Controlling Class, then there will be no Directing Certificateholder until appointed in accordance with the terms of the pooling and servicing agreement, and (iii) the certificate administrator and the other parties to the pooling and servicing agreement will be entitled to assume that the identity of the Directing Certificateholder has not changed until such parties receive written notice of a replacement of the Directing Certificateholder from a party holding the requisite interest in the Controlling Class (as confirmed by the certificate registrar) or the resignation of the then current Directing Certificateholder.

The “Controlling Class” will be, as of any time of determination, the most subordinate class of Control Eligible Certificates then outstanding that has an aggregate certificate balance (as notionally reduced by any Cumulative Appraisal Reduction Amounts (as defined below)) at least equal to 25% of the initial certificate balance thereof; provided, that if at any time the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans, then the Controlling Class will be the most subordinate class of Control Eligible Certificates that has a certificate balance greater than zero without regard to the application of any Cumulative Appraisal Reduction Amounts. The Controlling Class as of the closing date will be the Class M-RR certificates.

The “Control Eligible Certificates” will be any of the Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR, Class K-RR, Class L-RR and Class M-RR certificates. |

| Control Rights: | Prior to a Control Termination Event, the Directing Certificateholder will have certain consent and consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Control Termination Event” will occur when the most senior class of Control Eligible Certificates has a certificate balance (taking into account the application of any Cumulative Appraisal Reduction Amounts to notionally reduce the certificate balance thereof) of less than 25% of the initial certificate balance thereof; provided, that a Control Termination Event will be deemed not continuing in the event that the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Control Termination Event but prior to the occurrence of a Consultation Termination Event, the Directing Certificateholder will not have any consent rights, but the Directing Certificateholder will have certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters. A “Consultation Termination Event” will occur when there is no class of Control Eligible Certificates that has a then outstanding certificate balance at least equal to 25% of the initial certificate balance of that class, in each case, without regard to the application of any Cumulative Appraisal Reduction Amounts; provided, that a Consultation Termination Event will be deemed not continuing in the event |

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-12

| MSC 2020-HR8 | Structural Overview |

that the certificate balances of the principal balance certificates other than the Control Eligible Certificates have been reduced to zero as a result of principal payments on the mortgage loans.

After the occurrence of a Consultation Termination Event, the Directing Certificateholder will not have any consent or consultation rights, except with respect to any rights expressly set forth in the pooling and servicing agreement.

If an Operating Advisor Consultation Event has occurred and is continuing, the operating advisor will have certain non-binding consultation rights under the pooling and servicing agreement with respect to certain major decisions and other matters.

Notwithstanding any proviso to, or other contrary provision in, the definitions of “Control Termination Event,” “Consultation Termination Event” and “Operating Advisor Consultation Event,” a Control Termination Event, a Consultation Termination Event and an Operating Advisor Consultation Event will be deemed to have occurred with respect to any Excluded DCH Loan, and neither the Directing Certificateholder nor any Controlling Class Certificateholder will have any consent or consultation rights with respect to the servicing of such Excluded DCH Loan.

An “Excluded DCH Loan” is a mortgage loan or whole loan with respect to which the Directing Certificateholder or the holder of the majority of the Controlling Class is a Borrower Party. It is expected that there will be no Excluded DCH Loans as of the closing date with respect to this securitization.

“Borrower Party” means a borrower, a manager of a mortgaged property, an Accelerated Mezzanine Loan Lender or any Borrower Party Affiliate.

“Borrower Party Affiliate” means, with respect to a borrower, a manager of a mortgaged property or an Accelerated Mezzanine Loan Lender, (a) any other person or entity controlling or controlled by or under common control with such borrower, manager or Accelerated Mezzanine Loan Lender, as applicable, or (b) any other person or entity owning, directly or indirectly, 25% or more of the beneficial interests in such borrower, manager or Accelerated Mezzanine Loan Lender, as applicable. For the purposes of this definition, “control” when used with respect to any specified person or entity means the power to direct the management and policies of such person or entity, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Accelerated Mezzanine Loan Lender” means a mezzanine lender under a mezzanine loan that has been accelerated or as to which foreclosure or enforcement proceedings have been commenced against the equity collateral pledged to secure such mezzanine loan.

Notwithstanding any of the foregoing to the contrary, if any mortgage loan is part of a whole loan, the Directing Certificateholder’s consent and/or consultation rights with respect thereto may be limited as described in the Preliminary Prospectus. In particular, with respect to each non-serviced whole loan and any servicing shift whole loan, the Directing Certificateholder will only have certain consultation rights with respect to certain major decisions and other matters related to such whole loan, in each case only prior to a Control Termination Event (and, in the case of any such whole loan with a subordinate companion loan, only if the holder of such subordinate companion loan is no longer the controlling noteholder), and the holder of the related control note (or, if such control note has been securitized, the directing certificateholder with respect to such securitization or other designated party under the related pooling and servicing agreement) will be entitled to similar consent and/or consultation rights with respect to such whole loan. With respect to any serviced A/B whole loan, for so long as the holder of the related subordinate companion loan is the controlling note holder, the holder of such subordinate companion loan (and not the Directing Certificateholder) will be entitled to exercise such consent and consultation rights with respect to such whole loan. | |

| Appraisal Reduction Amounts and Collateral Deficiency Amounts: | An “Appraisal Reduction Amount” generally will be created in the amount, if any, by which the principal balance of a required appraisal loan (which is a mortgage loan with respect to which certain defaults, modifications or insolvency events have occurred as further described in the Preliminary Prospectus) plus other amounts overdue or advanced in connection with such mortgage loan exceeds 90% of the appraised value of the related mortgaged property plus certain escrows and reserves (including letters of credit) held with respect to the mortgage loan.

A mortgage loan will cease to be subject to an Appraisal Reduction Amount when it has been brought current for at least three consecutive months, no additional event of default is foreseeable in the reasonable judgment of the special servicer and no other circumstances exist that would cause such mortgage loan or any related companion loan to be a specially serviced mortgage loan; however, a “Collateral Deficiency Amount” may exist with respect to any mortgage loan that is modified into an AB loan structure (an “AB Modified Loan”) and remains a rehabilitated mortgage loan and, if so, will generally equal the excess of (i) the stated principal balance of such AB Modified Loan (taking into account the related junior note(s) and any pari passu notes included therein, as well as any equity interests or other obligations senior thereto), over (ii) the sum of (in the case of a whole loan, solely to the extent allocable to the subject mortgage loan) (x) the most recent appraised value for the related mortgaged property or mortgaged properties plus (y) solely to the extent not reflected or taken into account in such appraised value and to the extent on deposit with, or otherwise under the control of, the lender as of the date of such determination, any capital or additional collateral contributed by the related borrower at the time the mortgage loan became (and as part of the modification related to) such AB Modified Loan for the benefit of the related mortgaged property or mortgaged properties (provided, that in the case of a non-serviced mortgage loan, the amounts set forth in this clause (y) will be taken into account solely to the extent relevant information is received by the master servicer), plus (z) any other escrows or reserves (in addition to any amounts set forth in the immediately preceding clause (y)) held by the lender in respect of such AB Modified Loan as of the date of such determination.

|

This is not a research report and was not prepared by any Underwriter’s research department. Please see additional important information and qualifications at the end of this Term Sheet.

T-13

| MSC 2020-HR8 | Structural Overview |

As used herein, a “Cumulative Appraisal Reduction Amount” will be, as of any date of determination, the sum of (i) with respect to any mortgage loan, any Appraisal Reduction Amount then in effect, and (ii) with respect to any AB Modified Loan, any Collateral Deficiency Amount then in effect.

Any Appraisal Reduction Amount in respect of any non-serviced mortgage loan generally will be calculated in accordance with the other servicing agreement pursuant to which such mortgage loan is being serviced, which calculations are expected to be generally similar to those provided for in the pooling and servicing agreement for this transaction.

If any mortgage loan is part of a whole loan, any Appraisal Reduction Amount or Collateral Deficiency Amount will (or effectively will) be calculated in respect of such whole loan taken as a whole and allocated, to the extent provided in the related intercreditor agreement and the related pooling and servicing agreement, first, to any related subordinate companion loan(s) until the principal balance(s) thereof has been notionally reduced to zero, and second, to the related mortgage loan and any pari passu companion loan(s) on a pro rata basis by unpaid principal balance.

Appraisal Reduction Amounts in respect of, or allocable to, any mortgage loan will proportionately reduce the interest portion of debt service advances required to be made in respect of such mortgage loan. Appraisal Reduction Amounts and Collateral Deficiency Amounts will be (i) taken into account in determining the identity of the controlling class entitled to appoint the Directing Certificateholder, the existence of a Control Termination Event or an Operating Advisor Consultation Event and the allocation and/or exercise of voting rights for certain purposes (see “—Directing Certificateholder/Controlling Class” above) and (ii) allocated to the following classes of certificates and trust components, in each case to notionally reduce their certificate balances or principal balances until the certificate balance or principal balance of each such class or trust component is notionally reduced to zero: the Class M-RR, Class L-RR, Class K-RR, Class J-RR, Class H-RR, Class G-RR, Class F-RR and Class E-RR certificates, in that order, and then solely in the case of Appraisal Reduction Amounts, further to the Class D, Class C and Class B certificates and the Class A-S trust component, in that order, and then pro rata to the Class A-1 and Class A-SB certificates and the Class A-3 and Class A-4 trust components. Any Appraisal Reduction Amounts allocated to the Class A-3, Class A-4 or Class A-S trust component will be allocated to the corresponding classes of Exchangeable Certificates with certificate balances pro rata to notionally reduce their certificate balances in accordance with their Class Percentage Interests therein.

Neither (i) a Payment Accommodation with respect to any mortgage loan or serviced whole loan nor (ii) any default or delinquency that would have existed but for such Payment Accommodation will constitute an appraisal reduction event, for so long as the related borrower is complying with the terms of such Payment Accommodation.