UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the Fiscal Year Ended December 31, 2015 |

OR

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from To

Commission File Number 001-35675

RLJ ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

45-4950432 |

|

(State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification Number) |

8515 Georgia Avenue, Suite 650, Silver Spring, Maryland, 20910

(Address of principal executive offices, including zip code)

(301) 608-2115

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class: |

|

Name of Each Exchange on Which Registered: |

|

|

|

Common Stock, par value $0.001 |

|

NASDAQ Capital Market |

|

Securities registered pursuant to Section 12(g) of the Act:

Warrants to purchase Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO x

Indicate by check mark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. YES o NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

o |

|

|

Accelerated filer |

o |

|

Non-accelerated filer |

o |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO x

The aggregate market value of the voting stock held by non-affiliates computed on June 30, 2015, based on the sales price of $0.39 per share: Common Stock - $2,919,755. All directors and executive officers have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant; however, this determination does not constitute an admission of affiliate status for any of these shareholders.

The number of shares outstanding of the registrant’s common stock as of March 31, 2016: 14,132,820

DOCUMENTS INCORPORATED BY REFERENCE

The registrant has incorporated by reference into Part III of this Annual Report on Form 10-K portions of its proxy statement for its 2015 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A.

Form 10-K Annual Report

For The Year Ended December 31, 2015

TABLE OF CONTENTS

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

ITEM 1. |

|

|

4 |

|

|

|

ITEM 1A. |

|

|

16 |

|

|

|

ITEM 1B. |

|

|

24 |

|

|

|

ITEM 2. |

|

|

24 |

|

|

|

ITEM 3. |

|

|

24 |

|

|

|

ITEM 4. |

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

ITEM 5. |

|

|

25 |

|

|

|

ITEM 6. |

|

|

26 |

|

|

|

ITEM 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

26 |

|

|

ITEM 7A. |

|

|

42 |

|

|

|

ITEM 8. |

|

|

43 |

|

|

|

ITEM 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

81 |

|

|

ITEM 9A. |

|

|

81 |

|

|

|

ITEM 9B. |

|

|

82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

83 |

|

|

|

|

|

|

|

|

|

|

ITEM 10. |

|

|

83 |

|

|

|

ITEM 11. |

|

|

83 |

|

|

|

ITEM 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

83 |

|

|

ITEM 13. |

|

Certain Relationships and Related Transactions and Director Independence |

|

83 |

|

|

ITEM 14. |

|

|

83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

84 |

|

|

|

|

|

|

|

|

|

|

ITEM 15. |

|

|

84 |

|

|

|

|

|

|

|

|

|

|

|

|

86 |

||

|

|

|

|

|

|

|

|

Certifications |

|

|

|

|

|

This Annual Report on Form 10-K for the year ended December 31, 2015 (or Annual Report) includes forward-looking statements that involve risks and uncertainties within the meaning of the Private Securities Litigation Reform Act of 1995. Other than statements of historical fact, all statements made in this Annual Report are forward-looking, including, but not limited to, statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future results and condition. In some cases, forward-looking statements may be identified by words such as “will,” “should,” “could,” “may,” “might,” “expect,” “plan,” “possible,” “potential,” “predict,” “anticipate,” “believe,” “estimate,” “continue,” “future,” “intend,” “project” or similar words.

Forward-looking statements involve risks and uncertainties that are inherently difficult to predict, which could cause actual outcomes and results to differ materially from our expectations, forecasts and assumptions. Factors that might cause such differences include, but are not limited to:

|

|

· |

Our financial performance, including our ability to achieve improved results from operations, including improved earnings before income tax, depreciation, amortization, adjusted for cash investment in content, interest expense, loss on extinguishment of debt, goodwill impairments, severance costs, costs to modify debt, change in fair value of stock, warrants and other derivatives, stock-based compensation and basis-difference amortization in equity earnings of affiliate (or Adjusted EBITDA); |

|

|

· |

The effects of limited cash liquidity on operational performance; |

|

|

· |

Our obligations under the credit agreement, including our principal repayment obligations; |

|

|

· |

Our ability to satisfy financial ratios; |

|

|

· |

Our ability to generate sufficient cash flows from operating activities; |

|

|

· |

Our ability to raise additional capital to reduce debt, improve liquidity and fund capital requirements; |

|

|

· |

Our ability to fund planned capital expenditures and development efforts; |

|

|

· |

Our inability to gauge and predict the commercial success of our programming; |

|

|

· |

Our ability to maintain relationships with customers, employees and suppliers, including our ability to enter into revised payment plans, when necessary, with our vendors that are acceptable to all parties; |

|

|

· |

Delays in the release of new titles or other content; |

|

|

· |

The effects of disruptions in our supply chain; |

|

|

· |

The loss of key personnel; |

|

|

· |

Our public securities’ limited liquidity and trading; or |

|

|

· |

Our ability to meet the NASDAQ Capital Market continuing listing standards and maintain our listing. |

You should carefully consider and evaluate all of the information in this Annual Report, including the risk factors listed above and elsewhere, including “Item 1A. Risk Factors” below. If any of these risks occur, our business, results of operations and financial condition could be harmed, the price of our common stock could decline and you may lose all or part of your investment, and future events and circumstances could differ significantly from those anticipated in the forward-looking statements contained in this Annual Report. Unless otherwise required by law, we undertake no obligation to release publicly any updates or revisions to any such forward-looking statements that may reflect events or circumstances occurring after the date of this Annual Report.

3

Overview

RLJ Entertainment, Inc. (or RLJE) is a global entertainment content distribution company with a direct presence in North America, the United Kingdom (or U.K.) and Australia with strategic sublicense and distribution relationships covering Europe, Asia and Latin America. RLJE was incorporated in Nevada in April 2012. On October 3, 2012, we completed the business combination of RLJE, Image Entertainment, Inc. (or Image) and Acorn Media Group, Inc. (or Acorn Media or Acorn), which is referred to herein as the “Business Combination.” The use of “we,” “our” or “us” within this Annual Report is referring to RLJE and its subsidiaries.

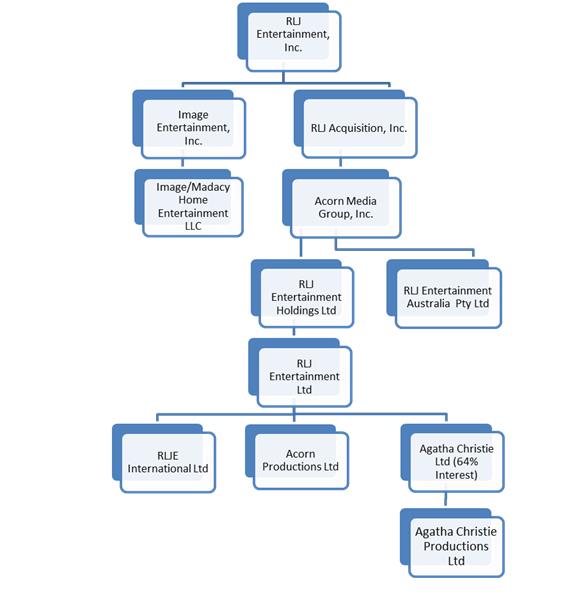

A summary of our significant corporate entities and structure is as follows:

4

We acquire content rights in various categories, with particular focus on British mysteries and dramas, urban-themed programming and full-length motion pictures. We acquire this content in two ways:

|

|

· |

Through long-term exclusive licensing agreements where we secure multiple rights to third-party programs. Generally, the rights we secure include broadcast, theatrical, digital (transactional and streaming), and physical (DVD and Blu-ray), and; |

|

|

· |

Through development, production and ownership of original drama television programming through our wholly-owned U.K. subsidiary, RLJ Entertainment Limited (or RLJE Ltd.) and our 64%-owned subsidiary, Agatha Christie Limited (or ACL). |

We control an extensive program library in genres such as British mysteries and dramas, urban/African-American, action/thriller and horror, fitness/lifestyle and long-form documentaries.

We monetize our library content through carefully managed distribution windows across multiple platforms including broadcast/cable channels, digital distribution formats (which are subscription video on demand (or SVOD), ad-supported video on demand (or AVOD), download-to-own and download-to-rent), and DVD and Blu-ray retail and online e-commerce.

We market our products through a multi-channel strategy encompassing:

|

|

· |

The licensing of original program offerings through our wholly-owned subsidiary, RLJE Ltd. and our 64%-owned subsidiary, ACL (our Intellectual Property Licensing or IP Licensing segment); |

|

|

· |

Wholesale through digital, mobile, broadcast, cable partners, e-commerce and brick and mortar (our Wholesale segment); and |

|

|

· |

Direct-to-consumer activities in the United States (or U.S.) and United Kingdom (or U.K.) including traditional and e-commerce offerings and our proprietary subscription-based digital platforms (our Direct-to-Consumer segment). |

RLJE Ltd. manages and develops our intellectual property rights on British drama and mysteries. Our owned content includes 28 Foyle’s War made-for-TV films; multiple instructional Acacia titles; and through our 64% ownership interest of ACL, the Agatha Christie library. ACL is home to some of the world’s greatest literary works of mystery fiction, including Murder on the Orient Express, Death on the Nile and And Then There Were None and includes publishing and TV/film rights to iconic sleuths such as Hercule Poirot and Miss Marple. The Agatha Christie library contains a variety of short story collections, more than 80 novels, 19 plays and a film library of over 100 made-for-television films. In the third quarter of 2014, ACL published its first book, The Monogram Murders, since the death of Agatha Christie. Our television productions are typically financed by the pre-sale of certain distribution rights, typically being international TV distribution rights, as well as tax credits. The pre-sale of these rights, alongside the realization of tax incentives, allows RLJE Ltd. to reduce production risks.

Our wholesale partners are broadcasters, digital outlets and major retailers in the U.S., Canada, U.K. and Australia, including, among others, Amazon, Netflix, Walmart, Target, Costco, Barnes & Noble, iTunes, BET, Showtime, PBS, DirecTV and Hulu. We have a catalog of owned and long-term licensed content that is segmented into brands such as Acorn (British drama/mystery, including content produced by ACL), RLJE Films (independent feature films, action/thriller horror), Urban Movie Channel (or UMC) (urban), Acacia (fitness), and Athena (documentaries).

Our Direct-to-Consumer segment includes the continued roll-out of our proprietary subscription-based digital channels, such as our British mystery and drama network, Acorn TV and UMC, a channel focused on quality urban content showcasing feature films, documentaries, original series, stand-up comedy and other exclusive content for African-American and urban audiences. As of December 31, 2015, Acorn TV had over 195,000 paying subscribers, compared to 118,000 as of the end of December 2014. We expect the subscriber base to continue to grow in 2016 for all of our subscription-based digital channels as we add more exclusive content to the channels.

Acorn TV was launched in July 2011 and features British mysteries and dramas with exclusive streaming of certain series such as Agatha Christie’s Poirot, Foyle’s War, Doc Martin, Murdoch Mysteries and Midsomer Murders. Acorn TV can be accessed through AppleTV, iDevices, Roku, Amazon Prime, Samsung SmartTVs and Blu-ray players and on fixed and mobile web at www.acorn.tv.

5

During 2015, we built brand awareness and increased programming for UMC, our proprietary urban digital network targeting a broad range of urban/African-American households in the U.S. The channel provides a broad range of titles to an audience that is underserved in viewing African-American and urban content. The channel leverages our current urban content library along with investments in new content in the form of licensing acquisitions which premiere on UMC such as: The Sin Seer, Blackbird, Playin’ for Love, Hiding in Plain Sight, Find A Way, Chasing Ghosts, My Name is David and The Things We Do for Love. UMC offers a 14-day free trial to attract new subscribers and can be accessed through Roku, Amazon Prime, FireTV and on fixed and mobile web at www.UrbanMovieChannel.com.

During 2015, we refocused our health and lifestyle offering by re-launching Acacia TV with newly produced original content and a fitness questionnaire to offer personalized recommendations for customers based on their health and fitness goals. This new digital channel is available on computers, tablets and smartphones and the internet at www.acacia.tv, and on Roku. In addition we entered into an agreement with Lukup, an Indian ISP, to offer Acacia TV as part of their OTT service on their proprietary set top box.

In Q4 2015, our three SVOD channels were featured in Amazon Prime’s add-on streaming video service launch. This strategic expansion into 3rd party distribution of our proprietary SVOD services offers us a significant increase in addressable audience and brand awareness.

Strategic Direction of the Company

RLJE’s management believes that the continued convergence of television and the internet will deepen competition for the attention of viewers and increase the value of content, in particular for scripted television, independent feature films and niche programming. RLJE intends to create long-term value for its shareholders by investing in its program library and building proprietary SVOD channels for its target audiences:

|

|

· |

Program library: RLJE intends to focus its content investments primarily in the development of IP rights for television dramas and the licensing of exclusive rights for scripted television, independent feature films, urban content and documentaries. |

|

|

· |

Proprietary SVOD channels: RLJE will continue to invest in the development of proprietary SVOD channels such as Acorn TV and UMC in order to develop a direct and ongoing relationship with viewers with specific interests. We plan to explore additional third-party distribution opportunities with digital delivery partners such as Amazon, but also with traditional Multichannel Video Programming Distributors (or MVPDs) who see the value in placing niche SVOD channels alongside traditional free-to-air and cable channels. |

|

|

· |

Other long-term growth strategies include: |

|

|

· |

The increased exploitation of our film and television library outside the U.S. with a particular emphasis on key markets such as Europe and Asia. |

|

|

· |

The acquisition of content libraries that either fits or complements our genre-based focus. |

|

|

· |

The evaluation and pursuit of opportunities to own broader digital distribution platforms, including cable/satellite networks or VOD providers, where we can directly distribute our content and expand our brands. |

Investments in Content

Our business model relies on developing and acquiring content that satisfies the desire of niche audiences for higher quality entertainment within specific genres. We then monetize content agnostically across all platforms through carefully orchestrated windows of distribution. When developing content, we develop new treatments from the intellectual property (or IP) we own. We also acquire finished programs through long-term exclusive contracts. We invest in content offerings that we believe will meet or exceed management’s 20% return-on-investment (or ROI) threshold. Our definition of ROI is the return on investment over the life of the investment (generally 7 - 10 years), and it is calculated by dividing estimated content earnings by its initial investment. Content earnings are calculated by estimating the future earnings, which is after subtracting costs (including overhead) necessary to maintain the investment, and discounting the earnings using a risk-appropriate rate.

RLJE invests approximately $40 million to $45 million annually in content. These investments are added to our balance sheet as program rights and are expensed through the statement of operations as either amortization of advances or as overage royalty payments. During 2015, management worked extensively on the reallocation of our content investments pursuing content with higher financial returns and strong strategic value. Management terminated content genres and content agreements that were either not profitable, not meeting our financial goals, or areas where we could not acquire comprehensive long-term distribution rights or control over the content. Additionally, Management completed the re-alignment of the Company’s investment across key genres, mainly British mystery and dramas, urban, action-thriller and horror and documentaries.

6

Our investments in content provide us with significant cash flows and generate working capital, which are continuously re-deployed to acquire or produce new content and fund strategic initiatives. Some of the key program releases in 2015, which generated a significant amount of revenues for us, and planned releases for 2016 are as follows:

|

British Mystery and Drama ·Foyle's War, Set 8 (Series 9) ·Foyle’s War, The Complete Saga ·Partners In Crime ·Doc Martin, Series 7 ·Doc Martin, Six Surly Seasons + Movies ·A Place to Call Home, Seasons 1 & 2 ·Anzac Girls ·Detectorists ·Vera, Set 5 ·Miss Fisher’s Murder Mysteries, Series 3 ·Murdoch Mysteries, Season 8 ·Murdoch Mysteries, The Movies ·Midsomer Murders, Set 25, ·Midsomer Murders, Series 16 & 17 ·The Code, Series 1 ·Brokenwood Mysteries, Series 1 ·New Tricks, Season 11 ·George Gently, Series 7 ·Restless

|

|

||||

|

|

Urban ·Blackbird ·Daddy’s Home ·Mysterious Ways ·Where the Children Play

|

||||

|

Feature Films ·The Cobbler ·The Rewrite ·Bone Tomahawk ·Pay the Ghost ·Catching Faith ·The Journey Home

|

|

||||

7

|

·Some Kind of Hate ·A Christmas Horror Story ·Condemned ·The Invoking 2 ·June ·Zombieworld ·Burying the Ex ·Return to Sender ·Infected ·Dark Was the Night ·Frankenstein vs. The Mummy ·Digging Up the Marrow ·Wolfcop ·The Houses October Built ·The Town That Dreaded Sundown

|

|

||||

|

|

DocumentarY ·The Story of Women and Art ·Understanding Art: Baroque & Rococo ·World War One: The People’s Story ·The Story of Women and Power ·The Art of the Heist

|

||||

|

2016 Planned Releases ·Criminal Activities ·Kickboxer ·And Then There Were None ·Murdoch Mysteries, Season 9 ·The Fall, Series 2 ·Humans ·Soundbreaking ·The Last Panthers ·Vera, Series 6 ·19-2, Season 1 ·Agatha Raisin, Series 1 ·Suspects, Set 1 ·Nina ·Adulterers ·#LuckyNumber ·Bound: Africans vs. African Americans

|

|

||||

8

The last 12 months were primarily dedicated to the acquisition and development of content and the growth of the subscriber base and addressable audience for our proprietary digital channels. Our growth strategy for the next 12 to 18 months is focused on improving operating results and increasing EBITDA primarily through the expansion of our proprietary SVOD channels Acorn TV and UMC and the continued optimization of our distribution activities.

|

|

· |

Acquisition of long-term and exclusive broad exploitation rights for finished programs across key genres that meet financial criteria of at least 20% targeted ROI including allocation of all direct and indirect costs through net income before taxes; |

|

|

· |

Production and purchase of new intellectual property rights, particularly for British scripted dramas and mysteries, and urban/African-American content; |

|

|

· |

Expansion of content offerings on Acorn TV and UMC. In particular, through new investments in exclusive content, promotion and improved information technology (or IT) infrastructure. Our proprietary digital platforms also create opportunities for RLJE to improve gross margin as the cost to deliver can be considerably lower; |

|

|

· |

Expansion of international distribution footprint. Expand licensing and direct exploitation efforts in territories such as Europe and Asia. |

Our business model minimizes production and box-office risks by acquiring finished products with long-term rights over multiple platforms. Our business goals are to grow our digital streaming channels through the development, acquisition and distribution of exclusive rights of program franchises and feature film content. In addition, our business is complemented, particularly in the British mystery and drama genre, by the development of our own IP, whereby we leverage the operations of RLJE Ltd. and our relationships in the U.K. including our 64% ownership of ACL. We strive to maximize the value of our program library by pursuing the development and acquisition of content with long-term value and by actively managing all windows of exploitation. Also, our brands and long-running franchises promote customer loyalty and lower our overall investment risk.

9

We focus on high-quality British mystery and drama television, action and thriller independent feature films and diverse urban content, and documentary lines. Titles are segmented into genre-based, franchise and content program lines and are exploited through our various brands. Our brands are as follows:

|

|

|

Known for specializing in the best of British television, Acorn Media Group (or Acorn) monetizes high-quality dramas and mysteries to the broadcast/cable and home video windows within the North American, U.K. and Australian markets. We further leverage the Acorn brand in our direct-to-consumer outlets in the U.S. and U.K. for our home-video releases and other complementary merchandise. With a mission to provide exceptional entertainment, imaginative gifts and uncommon quality, we market to consumers via print catalogs, online e-commerce, and our subscription-based digital channel, Acorn TV. Acorn TV, offers viewers over 1,000 hours of high-quality British television programming, streaming 24/7 without commercials and on demand. New content is added on a weekly basis. Paid subscribers have access to all of the available programming, but Acorn TV offers several options to “try before you buy” through Apple TV and iDevices, Roku, Samsung SmartTVs and fixed and mobile web. Some of the series currently airing on Acorn TV are Jack Irish, 19-2, Janet King, Vera: Set 6, Midwinter of the Spirit, Suspects, Detectorists and A Place to Call Home. As of December 31, 2015, Acorn TV surpassed 195,000 paid subscribers. The Acorn catalog (www.acornonline.com) focuses on British television, specialty programming and other distinctive merchandise. Our Acorn brand generates revenues that are reported in the IP Licensing (Agatha Christie revenues), Wholesale (DVD and digital download sales) and Direct-to-Consumer segments (catalog sales and digital channels revenues).

|

RLJE Ltd. provides us access to new content as a permanent presence in the U.K. television programming community, and manages and develops our intellectual property rights. Our owned content includes the Agatha Christie branded library, through our 64% ownership interest in Agatha Christie Limited (or ACL) acquired in February 2012. The bestselling novelist of all time, Agatha Christie has sold more than 2 billion books, and her work contains a variety of short story collections, more than 80 novels, 19 plays and a film library of over 100 TV productions. Acorn is known for mystery and drama franchises and has been releasing TV movie adaptations featuring Agatha Christie’s two most famous characters, Hercule Poirot and Miss Marple, for over a decade; both series ranking among our all-time bestselling lines. Through ACL, we manage the vast majority of Agatha Christie publishing and television/film assets worldwide and across all mediums and actively develop new content and productions. In addition to film and television projects, in the third quarter of 2014, ACL published its first book, The Monogram Murders, since the death of Agatha Christie. The Agatha Christie family retains a 36% holding, and James Prichard, Agatha Christie’s great-grandson, remains Chairman of ACL.

|

|

|

RLJ Entertainment (or RLJE) is a leading film and television licensee focusing on action, thriller and horror independent feature films. RLJE licenses exclusive long-term exploitation rights across all distribution channels, with terms ranging generally from 5 to 25 years. RLJE content is currently distributed primarily in the U.S. and Canada through broadcast/cable, physical and digital platforms. In 2014, we began to exploit RLJE content in the U.K. and Australia. Our RLJE titles that generated the highest amount of revenues in 2015 were Pay the Ghost, Bone Tomahawk and The Cobbler. All of the revenues generated by the RLJE brand are included in our Wholesale segment. |

10

|

|

|

UMC, or Urban Movie Channel, was created by Robert L. Johnson, Chairman of RLJ Entertainment and founder of Black Entertainment Television (BET). UMC is a premium subscription-based service which features quality urban content showcasing feature films, documentaries, original series, stand-up comedy and other exclusive content for African American and urban audiences. New titles added weekly include live stand-up specials like Martin Lawrence Presents: 1st Amendment Stand Up and Comedy Underground Series, and performances featuring Academy Award® winner Jamie Foxx and comedic rock star Kevin Hart; dramas including Blackbird starring Academy Award® winning actress and comedian Mo'Nique, Isaiah Washington, and directed by Patrik-Ian Polk, and Playin’ For Love, starring and directed by Robert Townsend; documentaries including Bill Duke’s Dark Girls and I Ain’t Scared of You: A Tribute to Bernie Mac; action/thrillers including The Colony starring Laurence Fishburne; and stage play productions including What My Husband Doesn’t Know by David E. Talbert. Subscribers can access UMC from multiple devices (tablet, phone and laptop), on Roku, Amazon Prime and Amazon FireTV to watch movies from today’s most recognizable talent available on demand and commercial-free.

|

Other Brands

Acacia is a healthy-living brand that encompasses original programming on DVD, a direct-to-consumer catalog and a recently launched digital channel called Acacia TV. Acacia provides distinctive, nature-oriented products to enhance customers’ enjoyment of their surroundings and to improve their appearance and well-being. We cater to customers seeking quality products that focus on physical and spiritual well-being, fitness and natural decor.

Athena is a branded line of home-video products providing a rich and enjoyable learning experience to intellectually curious consumers. These in-depth, entertaining, long-form documentaries facilitate the pursuit of lifelong learning on a diverse range of subjects. Programs include 8- to 20-page booklets with title-specific content, DVD extras and exclusive web content to enhance the learning experience and provide viewers with valuable supplementary information. Our Athena products are available through the Acorn direct-to-consumer catalog.

The Madacy library includes classic television and historical footage, as well as numerous special-interest projects. Some of the widely distributed titles include The Three Stooges, The John Wayne Collection, The Lone Ranger Collection, Bonanza and The Beverly Hillbillies, as well as documentaries about World War I and II, the Civil War, the Vietnam War, NASA, dream cars, trains and various travel collections.

Trademarks

We currently use several registered trademarks including: RLJ Entertainment, Acorn, Acorn Media, Acorn TV and UMC - Urban Music Channel. We also currently use registered trademarks through our 64%-owned subsidiary ACL including: Agatha Christie, Miss Marple and Poirot.

The above-referenced trademarks, among others, are registered with the U.S. Patent and Trademark Office and various international trademark authorities. In general, trademarks remain valid and enforceable as long as the marks are used in connection with the related products and services and the required registration renewals are filed. We believe our trademarks have value in the marketing of our products. It is our policy to protect and defend our trademark rights.

Segments

Management views the operations of the Company based on three distinct reporting segments: (1) Intellectual Property Licensing (or IP Licensing); (2) Wholesale; and (3) Direct-to-Consumer. Operations and net assets that are not associated with any of these operating segments are reported as “Corporate” when disclosing and discussing segment information. The IP Licensing segment includes intellectual property rights that we own, produce and then exploit worldwide in various formats including DVD, Blu-ray, digital, broadcast (including cable and satellite), VOD, streaming video, downloading and sublicensing. Our Wholesale and Direct-to-Consumer segments consist of the acquisition, content enhancement and worldwide exploitation of exclusive content in the same markets as our owned content. The Wholesale segment exploits the content to third parties such as Walmart, Best Buy, Target, Amazon and Costco while the Direct-to-Consumer segment distributes directly to the consumer through different exploitation channels. The Direct-to-Consumer segment distributes film and television content through our proprietary, subscription-based, digitally streaming channels (Acorn TV and UMC), our e-commerce websites and mail-order catalogs. The segment also sells complementary merchandise through our mail-order catalogs: Acorn and Acacia.

11

Net revenues by reporting segment for the periods presented are as follows:

|

|

|

Years Ended December 31, |

|

|||||

|

(In thousands) |

|

2015 |

|

|

2014 |

|

||

|

IP Licensing |

|

$ |

3,107 |

|

|

$ |

8,752 |

|

|

Wholesale |

|

|

86,241 |

|

|

|

91,379 |

|

|

Direct-to-Consumer |

|

|

35,569 |

|

|

|

37,558 |

|

|

Total revenues |

|

$ |

124,917 |

|

|

$ |

137,689 |

|

Assets for each reporting segment and Corporate as of December 31, 2015 and 2014 are as follows:

|

|

|

December 31, |

|

|||||

|

(In thousands) |

|

2015 |

|

|

2014 |

|

||

|

IP Licensing |

|

$ |

22,707 |

|

|

$ |

30,197 |

|

|

Wholesale |

|

|

112,066 |

|

|

|

140,935 |

|

|

Direct-to-Consumer |

|

|

10,514 |

|

|

|

12,049 |

|

|

Corporate |

|

|

6,173 |

|

|

|

8,873 |

|

|

|

|

$ |

151,460 |

|

|

$ |

192,054 |

|

IP Licensing

A summary of the IP Licensing segment’s revenues and expenses is as follows:

|

|

|

Years Ended December 31, |

|

|||||

|

(In thousands) |

|

2015 |

|

|

2014 |

|

||

|

Revenue |

|

$ |

3,107 |

|

|

$ |

8,752 |

|

|

Operating costs and expenses |

|

|

(2,276 |

) |

|

|

(6,662 |

) |

|

Depreciation and amortization |

|

|

(143 |

) |

|

|

(115 |

) |

|

Share in ACL earnings |

|

|

2,217 |

|

|

|

2,580 |

|

|

IP Licensing segment contribution |

|

$ |

2,905 |

|

|

$ |

4,555 |

|

Our IP Licensing segment includes owned intellectual property that is either acquired or created by us and is licensed for exploitation worldwide. The operating activities primarily consist of our 100% interest in Foyle’s War Series 8 and Series 9, as well as certain distribution rights pertaining to content acquired from ACL. Our IP Licensing segment does not include revenues generated or costs incurred from the exploitation of Foyle’s War Series by our Wholesale segment. Also included is our 64% interest in ACL. ACL is accounted for using the equity method of accounting given the voting control of the Board of Directors by the minority shareholder. Gross margin percentages generated from content that is owned is generally higher than margins realized from content that is not owned.

As part of our growth strategy, we plan to continue to produce and own more intellectual property with an emphasis in British mysteries and dramas and urban programming.

Wholesale

A summary of the Wholesale segment’s revenues and expenses is as follows:

|

|

|

Years Ended December 31, |

|

|||||

|

(In thousands) |

|

2015 |

|

|

2014 |

|

||

|

Revenue |

|

$ |

86,241 |

|

|

$ |

91,379 |

|

|

Operating costs and expenses |

|

|

(80,972 |

) |

|

|

(85,595 |

) |

|

Depreciation and amortization |

|

|

(2,213 |

) |

|

|

(1,684 |

) |

|

Goodwill impairment |

|

|

(30,260 |

) |

|

|

— |

|

|

Wholesale segment contribution |

|

$ |

(27,204 |

) |

|

$ |

4,100 |

|

The Wholesale segment consists of acquisition of content, content enhancement and worldwide exploitation of exclusive content in various formats to third parties such as Amazon, Best Buy, Costco, Target and Walmart. We market and exploit our exclusive

12

content through agreements that generally range from 5 to 25 years in duration. The revenues generated in our Wholesale segment are historically our most consistent revenue stream.

While standard DVD comprise a majority of our revenues within this segment, Blu-ray titles and related revenues continue to increase given the format’s growing acceptance. We believe that the affordability of larger screen high-definition television (or HDTV) and ease of use as an entertainment hub in consumer households will continue to accelerate the conversion from standard DVD to Blu-ray formats for all demographics. We also believe there is a significant opportunity for us to realize increased revenues from customers of Acorn branded British mystery and drama product who will be converting their standard DVD collection to Blu-ray. It is expected that future revenues generated from DVD and Blu-ray sales will decline and sale of content to consumers through digital, streaming video and downloading will increase in future years.

We engage in the exclusive licensing of the digital rights to our library of audio and video content. The demand for the types of programming found in our library continues to increase as new digital retailers enter the online marketplace. We seek to differentiate ourselves competitively by being a one-stop source for these retailers who desire a large and diverse collection of entertainment represented by our digital library. We enter into non-exclusive arrangements with retail and consumer-direct entities whose business models include the digital delivery of content. We continue to add video and audio titles to our growing library of exclusive digital rights. The near-term challenges faced by all digital retailers are to develop ways to increase consumer awareness and integrate this awareness into their buying and consumption habits. Some of our digital retailers include Amazon, Cinedigm, Google Play, Hoopla, Hulu, iTunes, Microsoft Xbox, Netflix, Overdrive, Shudder (AMC), Sony PlayStation, Vimeo, Vudu and YouTube.

We further exploit our product in the ‘traditional’ VOD channels, wherein consumers pay a fee to watch programming via their cable or satellite operators. This business model has expanded in recent years to include exclusive windows for VOD monetization prior to other channels of exploitation. For example, a high-profile release may be released on VOD prior to theatrical exploitation. In that instance, we would receive higher price points and better placement with our VOD providers. Our partners in the VOD space include AT&T, Cablevision, Comcast, DirecTV, Dish, iNDemand, Verizon and Vubiquity. We also exploit our product to cable networks in the United States. Traditionally, our Acorn product has been sold to PBS or its affiliated stations, while our feature-length product has been sold to a wide array of customers. These cable networks include BET, Foxtel, HBO, Ovation, Showtime and Starz.

Outside North America and the U.K., we sublicense distribution in the areas of home entertainment, television and digital through distribution partners such as BET International, Universal Music Group International, Universal Pictures Australia and Warner Music Australia, each of which pays us a royalty for their distribution of our products.

Direct-to-Consumer

A summary of the Direct-to Consumer segment’s revenues and expenses is as follows:

|

|

|

Years Ended December 31, |

|

|||||

|

(In thousands) |

|

2015 |

|

|

2014 |

|

||

|

Revenue |

|

$ |

35,569 |

|

|

$ |

37,558 |

|

|

Operating costs and expenses |

|

|

(41,303 |

) |

|

|

(41,413 |

) |

|

Depreciation and amortization |

|

|

(3,084 |

) |

|

|

(3,415 |

) |

|

Goodwill impairment |

|

|

— |

|

|

|

(981 |

) |

|

Direct-to-Consumer segment contribution |

|

$ |

(8,818 |

) |

|

$ |

(8,251 |

) |

The Direct-to-Consumer segment exploits the same film and television content as the Wholesale segment but exploits the content directly in the U.S. and the U.K. to consumers through various proprietary SVOD channels and in our catalogs (Acorn and Acacia) and our e-commerce websites. To date, we have three proprietary digital subscription channels, which are Acorn TV, UMC and Acacia TV. We are continually rolling-out new content on our digital channels and attracting new subscribers. As of December 31, 2015, Acorn TV had over 195,000 subscribers compared to 118,000 subscribers at December 31, 2014.

During 2015, we delivered 18.9 million catalogs and flyers of which 17.9 million were delivered in the U.S. and 950,000 were delivered in the U.K. We had approximately 3.5 million visitors in 2015 to our e-commerce websites with 4.4% of the visitors purchasing our products. The catalogs and online businesses have diverse product offerings marketed to a select audience. Through our brands, Acorn and Acacia, our product offering includes DVDs, lifestyle products for the discerning British mystery consumer, apparel, jewelry and decorative household items. Proprietary DVD revenue was negatively impacted by the 2015 release calendar as compared to the previous year, but remains as the dominant revenue driver for the Direct-To-Consumer segment.

13

Despite generating revenues in excess of $10.0 million for each of the past two years, the Acacia catalog has not secured a large enough market share to become profitable. The health and fitness sector has become increasingly competitive and digital in nature, thereby reducing opportunities for merchandise cross and up-selling. Management has therefore decided to exit the Acacia catalog and online business and focus on distributing Acacia content through RLJE’s third-party wholesale channels and its direct-to-consumer SVOD service Acacia TV.

Outsourced Services

Under a Distribution Services and License Agreement with Sony Pictures Home Entertainment (or SPHE), SPHE acts as our exclusive manufacturer in North America to meet our hard good manufacturing requirements (DVD and Blu-ray) and to provide related fulfillment and other logistics services in exchange for certain fees. Our agreement with SPHE expires in August 2019. Under our relationship with SPHE, we are responsible for the credit risk from the end customer with respect to accounts receivable and also the risk of inventory loss with respect to the inventory they manage on our behalf.

In addition to conventional manufacturing, we also utilize SPHE’s capability to manufacture-on-demand (or MOD). MOD services are provided for replication of slower moving titles, which helps avoid replicating larger minimum quantities of certain titles, and can be used for direct-to-consumer sales as needed. Under our agreement, SPHE also provides certain operational services at our direction, including credit and collections, merchandising, returns processing and certain IT functions.

We believe the SPHE agreement provides us with several significant advantages, including:

|

|

· |

The ability to sell directly to key accounts such as Walmart, Best Buy and Costco, which eliminates other third-party distributor fees, provides incremental revenues, higher gross margins and the ability to better manage retail inventories; |

|

|

· |

Access SPHE’s point-of-sale reporting systems to better manage replenishment of store inventories on a daily basis; and |

|

|

· |

Access SPHE’s extensive scan-based trading network that features product placement in over 20,000 drug and grocery outlets. |

We also outsource certain post-production and creative services necessary to prepare a disc master for manufacturing and packaging/advertising materials for marketing of our products. Such services include:

|

|

· |

Packaging design; |

|

|

· |

DVD/Blu-ray authoring and compression; |

|

|

· |

Menu design; |

|

|

· |

Video master quality control; |

|

|

· |

Music clearance; and |

|

|

· |

For some titles, the addition of enhancements, such as: |

|

|

· |

multiple audio tracks; |

|

|

· |

commentaries; |

|

|

· |

foreign language tracks; |

|

|

· |

behind-the-scenes footage; and |

|

|

· |

interviews. |

In the U.S., Brightcove is our outsourced video delivery partner powering our proprietary SVOD channels and streaming services. Also in the U.S., Amazon Web Services is our cloud hosting partner powering our entire web portfolio and proprietary SVOD channels.

In the U.K., we have a fulfillment and logistics services arrangement with Sony DADC UK Limited, which is similar to the arrangement we have with SPHE in North America.

14

In the U.S., Trade Global is our outsourced fulfillment partner that assists with managing our Direct-to-Consumer segment’s catalog business. They provide the following services: customer service, order management and fulfillment, cash collection, credit card processing, merchandise return processing and inventory management.

Marketing and Sales

Our in-house marketing department manages promotional efforts across a wide range of off-line and online platforms. Our marketing efforts include:

|

|

· |

Point-of-sale advertising; |

|

|

· |

Print advertising in trade and consumer publications; |

|

|

· |

Television, outdoor, in-theater and radio advertising campaigns; |

|

|

· |

Internet advertising, including viral and social network marketing campaigns; |

|

|

· |

Direct-response campaigns; |

|

|

· |

Dealer incentive programs; |

|

|

· |

Trade show exhibits; |

|

|

· |

Bulletins featuring new releases and catalog promotions; and |

|

|

· |

Public relations outreach programs. |

RLJE maintains its own sales force and has a direct selling relationship with the majority of its broadcast and cable/satellite partners, and retail customers. We sell our programs to broadcasters, cable and satellite providers, traditional and specialty retailers, internet retailers, rental outlets, wholesale distributors and through alternative exploitation efforts, which includes direct-to-consumer print catalogs, proprietary e-commerce websites, direct-response campaigns, subscription service/club sales, proprietary SVOD subscription channels, home shopping television channels, other non-traditional sales channels, kiosks and sub-distributors. Examples of our key broadcast/cable/satellite partners are BET, DirecTV, Starz and public television stations. Examples of our key customers are Amazon.com, Best Buy Co., Costco, HMV, Target and Walmart,. Examples of our key distribution partners are All3Media, Alliance Entertainment, Ingram Entertainment and ITV Global Enterprises. Examples of key rental customers are Netflix and Redbox.

We also focus on special-market sales channels, to take advantage of our large and diverse catalog and to specifically target niche sales opportunities. Examples of our key customers within special markets are Midwest Tapes and Waxworks. Another special-market channel is scanned-based trading in conjunction with SPHE.

Additionally, in connection with our Distribution Services and License Agreement with SPHE, SPHE agreed to perform certain sales and inventory management functions at Best Buy, Target and Walmart. By using SPHE, we benefit from having a major studio present RLJE’s product alongside its own releases, which include well known motion pictures. SPHE is our primary vendor of record for shipments of physical product to North American retailers and wholesalers, and as the vendor of record, they are responsible for collecting these receivables and remitting these proceeds to us. In the U.K., similar services are provided by Sony DADC UK Limited.

Customer Concentration

For the year ended December 31, 2015, sales to Amazon accounted for 21.7% of our net revenues and sales to Walmart accounted 12.6% of our net revenues. We do not have any other customers which accounted for more than 10.0% of our net revenues for the year. Our top five customers accounted for approximately 54.8% of our net revenues for 2015, which includes Amazon and Walmart. At December 31, 2015, SPHE and Netflix accounted for approximately 38.4% and 22.1%, respectively, of our gross accounts receivables.

Competition

We face competition from other independent distribution companies, major motion picture studios and broadcast and internet outlets in securing exclusive content distribution rights. We also face competition from online and direct-to-consumer retailers, as well as alternative forms of leisure entertainment, including video games, the internet and other computer-related activities. The success of any of our products depends upon consumer acceptance of a given program in relation to current events as well as the other products released into the marketplace at or around the same time. Consumers can choose from a large supply of competing entertainment content from other suppliers. Many of these competitors are larger than us. Our DVD and Blu-ray products compete for a finite amount of brick-and-mortar retail and rental shelf space. Sales of digital downloading, streaming, VOD and other broadcast formats

15

are largely driven by what is visually available to the consumer, which can be supported by additional placement fees or previous sales success. Programming is available online, delivered to smartphones, tablets, laptops personal computers, or direct to the consumers’ TV set through multiple internet-ready devices and cable or satellite VOD. Digital and VOD formats are growing as an influx of new delivery devices, such as the Apple iPad and the Microsoft Xbox, gain acceptance in the marketplace. According to Pew Research based on a survey conducted in early 2015, 45% of U.S. adults own a tablet. We face increasing competition as these platforms continue to grow and programming providers enter into distribution agreements for a wider variety of formats.

Our ability to continue to successfully compete in our markets is largely dependent upon our ability to develop and secure unique and appealing content, and to anticipate and respond to various competitive factors affecting the industry, including new or changing product formats, changes in consumer preferences, regional and local economic conditions, discount pricing strategies and competitors’ promotional activities.

Industry Trends

According to The Digital Entertainment Group (or DEG), consumer home entertainment spending in calendar 2015 exceeded $18 billion, up slightly from 2014. This slight increase was driven by the 16.4% increase in total digital spending showing that consumers are continuing to build their digital film libraries.

Digital-format revenues include electronic sell-through (or EST), VOD and subscription-based streaming. EST revenues for 2015 increased by 18.1% compared to 2014. Total subscription-based programing revenues, including streaming and disc, increased by 18.3% in 2015 compared to 2014.

DEG reported that in 2015 the number of homes with Blu-ray playback devices, including set-top boxes and game consoles, was 104 million. DEG also reported that the number of households with HDTV is now more than 114 million.

According to PricewaterhouseCoopers LLP’s Global Entertainment and Media Outlook for 2015 to 2019, consumer spending for the overall physical home entertainment segment in the U.S. is projected to decline at a 9.4% compound annual rate over the 2015‑2019 period to approximately $5.3 billion in 2019. While the decline in consumer spending on physical home entertainment continues, it is substantially offset by the increase in consumer spending on electronic home video, primarily as a result of the growth of over-the-top (OTT) and SVOD services. Consumer spending in the U.S. on electronic distribution is projected to increase at a 14.6% compound annual rate over the 2015-2019 period, reaching $16.5 billion in 2019.

Employees

As of February 29, 2016, we had 88 U.S.-based employees at our Maryland, California and Minnesota locations. We had 26 employees at our U.K. and Australia locations. Our employees are primarily employed on a full-time basis.

Available Information

Under the menu “Investors—SEC Filings” on our website at www.rljentertainment.com, we provide free access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The information contained on our website is not incorporated herein by reference and should not be considered part of this Annual Report.

Risks Relating to Our Liquidity and Credit Agreement

We may not be able to generate sufficient cash to service all of our indebtedness, and we may be forced to take other actions, which may or may not be successful, to satisfy our obligations under our indebtedness. Our ability to make scheduled payments depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal and interest on our indebtedness. If our cash flows and capital resources are insufficient to fund our debt service and other obligations, we could face substantial liquidity problems and could be forced to reduce or delay capital expenditures and development efforts, sell assets or operations, seek additional capital or restructure or refinance our indebtedness. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including our senior secured Credit Agreement with certain lenders and McLarty, as Administrative Agent. Our Credit Agreement and the indenture governing our senior secured notes restrict our ability to dispose of

16

assets and use the proceeds from such dispositions. We may not be able to consummate those dispositions or to obtain the proceeds which we could realize from them, and these proceeds may not be adequate to meet any debt service obligations then due.

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

|

|

· |

Our debt holders could declare all outstanding principal and interest to be due and payable; and |

|

|

· |

We could be forced into bankruptcy or liquidation. |

Our Credit Agreement contains covenants that may limit the way we conduct business. Our Credit Agreement contains various covenants limiting our ability to:

|

|

· |

incur or guarantee additional indebtedness; |

|

|

· |

pay dividends and make other distributions; |

|

|

· |

pre-pay any subordinated indebtedness; |

|

|

· |

make investments and other restricted payments; |

|

|

· |

make capital expenditures; |

|

|

· |

enter into merger or acquisition transactions; and |

|

|

· |

sell assets. |

These covenants may have an impact on our ability to raise additional debt or equity financing, competing effectively or taking advantage of new business opportunities.

Our Credit Agreement includes covenants that require us to maintain specified financial ratios. Our ability to satisfy those financial ratios can be affected by events beyond our control, and we cannot be certain we will satisfy those ratios. As of March 31, 2015, we were not in compliance with our minimum cash balance requirement, which was waived by our lenders on April 15, 2015. As further discussed below in “Management’s Discussion and Analysis of Financial Condition and Results of Operations – New Credit Agreement,” effective with the quarter ending December 31, 2016, the financial ratios adjust to become more restrictive than the current ratios. For us to meet these more restrictive bank covenants, we will need to improve our Adjusted EBITDA and/or make an accelerated principal payment, which may be significant, on our senior debt. Although we are currently in compliance with the financial ratios, there is no assurance that our financial results during the current fiscal year will enable us to meet the adjusted ratios or that the lenders will agree to further adjust the ratios.

Our Credit Agreement provides that the failure to comply with the financial ratios or other covenants or a material adverse change in our business, assets or prospects constitutes an “event of default.” If we are unable to comply with the financial ratios, comply with other covenants as specified in the Credit Agreement, our lenders may choose to assert an event of default under our Credit Agreement. In this event, unless we are able to negotiate an amendment, forbearance or waiver, we could be required to repay all amounts then outstanding, which would have a material adverse effect on our liquidity, business, results of operations and financial condition.

We may not be able to generate the amount of cash needed to fund our future operations. Our ability either to fund planned capital expenditures and development efforts will depend on our ability to generate cash in the future. Our ability to generate cash is in part subject to general economic, financial, competitive, regulatory and other factors that are beyond our control. We cannot assure you, however, that our business will generate sufficient cash flow from operations to fund our liquidity needs.

Our liquidity depends on our cash-on-hand, operating cash flows and ability to collect cash receipts. At December 31, 2015, our cash and cash equivalents were approximately $4.5 million and, in accordance with the April 15, 2015 amendment to the Credit Agreement, we are required to maintain $1.0 million of cash at all times. We rely on our cash-on-hand, operating cash flows and ability to collect cash receipts to fund our operations and meet our financial obligations. Delays or any failure to collect our trade accounts receivable would have a negative effect on our liquidity.

We have pledged our intellectual property assets to secure our Credit Agreement, and this represents a risk to our business, results of operations and financial condition. In order to secure the financing necessary to operate our business, we pledged all of our intellectual property rights as collateral to our Credit Agreement. If we were to default on our obligations under the Credit Agreement, we could forfeit our intellectual property and, thereby, a primary source of revenue. This could have a material adverse effect on our business, results of operations and financial condition.

17

We may seek additional funding and such capital may not be available to us. We are continuing to explore various financing alternatives. If we are unable to obtain additional capital, we may be required to delay or reduce our expansion, reduce our offering of products and services, forego acquisition opportunities, delay or reduce development or enhancement of services or products or delay or reduce our response to competitive pressures in the industry. We cannot assure you that any necessary additional financing will be available on terms favorable to us, or at all. If we raise additional funds through the issuance of securities convertible into or exercisable for common stock, the percentage ownership of our stockholders could be significantly diluted, and newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. Market and industry factors may harm the market price of our common stock and may adversely impact our ability to raise additional funds. Similarly, if our common stock is delisted from the NASDAQ Capital Market, it may limit our ability to raise additional funds.

Risks Relating to Our Business

We have limited working capital and limited access to financing. Our cash requirements, at times, may exceed the level of cash generated by operations. Accordingly, we may have limited working capital.

Our ability to obtain adequate additional financing on satisfactory terms may be limited; and our Credit Agreement prevents us from incurring additional indebtedness. Our ability to raise financing through sales of equity securities depends on general market conditions, including the demand for our common stock. We may be unable to raise adequate capital through the sale of equity securities, and if we were able to sell equity, our existing stockholders could experience substantial dilution. If adequate financing is not available at all or it is unavailable on acceptable terms, we may find we are unable to fund expansion, continue offering products and services, take advantage of acquisition opportunities, develop or enhance services or products, or respond to competitive pressures in the industry.

Our business requires a substantial investment of capital. The production, acquisition and distribution of programming require a significant amount of capital. Capital available for these purposes will be reduced to the extent that we are required to use funds otherwise budgeted for capital investment to fund our operations and/or make payments on our debt obligations. Curtailed content investment over a sustained period could have a material adverse effect on future operating results and cash flows. Further, a significant amount of time may elapse between our expenditure of funds and the receipt of revenues from our television programs or motion pictures. This time lapse requires us to fund a significant portion of our capital requirements from our operating cash flow and from other financing sources. Although we intend to continue to mitigate the risks of our production exposure through pre-sales to broadcasters and distributors, tax credit programs, government and industry programs, co-financiers and other sources, we cannot assure you that we will continue to successfully implement these arrangements or that we will not be subject to substantial financial risks relating to the production, acquisition, completion and release of new television programs and motion pictures. In addition, if we increase (through internal growth or acquisition) our production slate or our production budgets, we may be required to increase overhead and/or make larger up-front payments to talent and, consequently, bear greater financial risks. Any of the foregoing could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our inability to gauge and predict the commercial success of our programming could adversely affect our business, results of operations and financial condition. Operating in the entertainment industry involves a substantial degree of risk. Each video program or feature film is an individual artistic work, and its commercial success is primarily determined by unpredictable audience reactions. The commercial success of a title also depends upon the quality and acceptance of other competing programs or titles released into the marketplace, critical reviews, the availability of alternative forms of entertainment and leisure activities, general economic conditions and other tangible and intangible external factors, all of which are subject to change and cannot be predicted. Timing is also sometimes relevant to a program’s success, especially when the program concerns a recent event or historically relevant material (e.g., an anniversary of a historical event which focuses media attention on the event and accordingly spurs interest in related content). Our success depends in part on the popularity of our content and our ability to gauge and predict it. Even if a film achieves success during its initial release, the popularity of a particular program and its ratings may diminish over time. Our inability to gauge and predict the commercial success of our programming could materially adversely affect our business, results of operations and financial condition.

We may be unable to recoup advances paid to secure exclusive distribution rights. Our most significant costs and cash expenditures relate to acquiring content for exclusive distribution. Most agreements to acquire content require upfront advances against royalties or net profits participations expected to be earned from future distribution. The amount we are willing to advance is derived from our estimate of net revenues that will be realized from our distribution of the title. Although these estimates are based on management’s knowledge of current events and actions management may undertake in the future, actual results will differ from those estimates. If sales do not meet our original estimates, we may (i) not recognize the expected gross margin or net profit, (ii) not recoup our advances or (iii) record accelerated amortization and/or fair value write-downs of advances paid. We recorded impairments related to our investments in content of $3.2 million during 2015 and $4.8 million during 2014.

18

Our inability to maintain relationships with our program suppliers and vendors may adversely affect our business. We receive a significant amount of our revenue from the distribution of content for which we already have exclusive agreements with program suppliers. However, titles which have been financed by us may not be timely delivered as agreed or may not be of the expected quality. Delays or inadequacies in delivery of titles, including rights clearances, could negatively affect the performance of any given quarter or year. In addition, results of operations and financial condition may be materially adversely affected if:

|

|

· |

We are unable to renew our existing agreements as they expire; |

|

|

· |

Our current program suppliers do not continue to support digital, DVD or other applicable format in accordance with our exclusive agreements; |

|

|

· |

Our current content suppliers do not continue to license titles to us on terms acceptable to us; or |

|

|

· |

We are unable to establish new beneficial supplier relationships to ensure acquisition of exclusive or high-profile titles in a timely and efficient manner. |

Disputes over intellectual property rights could adversely affect our business, results of operations and financial condition. Our sales and net revenues depend heavily on the exploitation of intellectual property owned by us or third parties from whom we have licensed intellectual property. Should a dispute arise over, or a defect be found in, the chain of title in any of our key franchises, this could result in either a temporary suspension of distribution or an early termination of our distribution license. This could have a material adverse impact on our business, results of operations and financial condition.

We, and third parties that manage portions of our secure data, are subject to cybersecurity risks and incidents. Our direct-to-consumer business involves the storage and transmission of customers' personal information, shopping preferences and credit card information, in addition to employee information and our financial and strategic data. The protection of our customer, employee and company data is vitally important to us. While we have implemented measures to prevent security breaches and cyber incidents, any failure of these measures and any failure of third parties that assist us in managing our secure data could materially adversely affect our business, financial condition and results of operations.

A high rate of product returns may adversely affect our business, results of operations and financial condition. As with the major studios and other independent companies in this industry, we experience a relatively high level of product returns as a percentage of our revenues. Our allowances for sales returns may not be adequate to cover potential returns in the future, particularly in the case of consolidation within the home-video retail marketplace, which when it occurs tends to result in inventory consolidation and increased returns. We have experienced a high rate of product returns over the past three years. We expect a relatively high rate of product returns to continue, which may materially adversely affect our business, results of operations and financial condition.

We depend on third-party shipping and fulfillment companies for the delivery of our products. If these companies experience operational difficulties or disruptions, our business could be adversely affected. We rely on SPHE, our distribution facilitation and manufacturing partner in North America, Sony DADC UK Limited in the U.K, and Trade Global, our fulfillment partner in the U.S., for a majority of our Direct-to-Consumer sales, to determine the best delivery method for our products. These partners rely entirely on arrangements with third-party shipping companies, principally Federal Express and UPS, for small package deliveries and less-than-truckload service carriers for larger deliveries, for the delivery of our products. The termination of arrangements between our partners and one or more of these third-party shipping companies, or the failure or inability of one or more of these third-party shipping companies to deliver products on a timely or cost-efficient basis from our partners to our customers, could disrupt our business, reduce net sales and harm our reputation. Furthermore, an increase in the amount charged by these shipping companies could negatively affect our gross margins and earnings.

Economic weakness may adversely affect our business, results of operations and financial condition. The global economic downturn had a significant negative effect on our revenues and may continue to do so. As consumers reduced spending and scaled back purchases of our products, we experienced higher product returns and lower sales, which adversely affected our revenues and results of operations in previous years. Although domestic consumer spending has improved over the last few years, weak consumer demand for our products may occur and may adversely affect our business, results of operations and financial condition.

Our high concentration of sales to and receivables from relatively few customers (and use of a third-party to manage collection of substantially all packaged goods receivables) may result in significant uncollectible accounts receivable exposure, which may adversely affect our liquidity, business, results of operations and financial condition. During 2015, sales to Amazon accounted for 21.7% of our net revenues and sales to Walmart accounted 12.6% of our net revenues. Our top five customers accounted for approximately 54.8% of our net revenues for 2015, which includes Amazon and Walmart. At December 31, 2015, SPHE and Netflix accounted for approximately 38.4% and 22.1%, respectively, of our gross accounts receivables.

19

We may be unable to maintain favorable relationships with our retailers and distribution facilitators including SPHE and Sony DADC UK Limited. Further, our retailers and distribution facilitators may be adversely affected by economic conditions. If we lose any of our top customers or distribution facilitators, or if any of these customers reduces or cancels a significant order, it could have a material adverse effect on our liquidity, business, results of operations and financial condition.

We face credit exposure from our retail customers and may experience uncollectible receivables from these customers should they face financial difficulties. If these customers fail to pay their accounts receivable, file for bankruptcy or significantly reduce their purchases of our programming, it would have a material adverse effect on our business, financial condition, results of operations and liquidity.

A high concentration of our gross accounts receivables is attributable to SPHE and Sony DADC UK Limited, as they are our vendor of record for shipments of physical product to North American and U.K. retailers and wholesalers. As part of our arrangement with our distribution facilitation partners, SPHE and Sony DADC UK Limited collect the receivables from our end customers, provide us with monthly advance payments on such receivables (less a reserve), and then true up the accounts receivables accounting quarterly. While we remain responsible for the credit risk from the end customer, if SPHE or Sony DADC UK Limited should fail to adequately collect and pay us the accounts receivable they collect on our behalf, whether due to inadequate processes and procedures, inability to pay, bankruptcy or otherwise, our financial condition, results of operations and liquidity would be materially adversely affected.

We do not control the timing of dividends paid by ACL, which could negatively impact our cash flow. Although we hold a 64% interest in ACL, we do not control the board of directors of ACL. The members of the Agatha Christie family, who hold the remaining 36% interest in ACL, have the right to appoint the same number of directors as us and, in the event of deadlock on any decision of the board, also have a second or casting vote exercised by their appointee as chairman of ACL, which allows them to exercise control of ACL’s board of directors.

Under English law, the amount, timing and form of payment of any dividends or other distributions is a matter for ACL’s board of directors to determine, and, as a result, we cannot control when these distributions are made. If ACL’s board of directors decides not to authorize distributions, our revenue and cash flow may decrease, materially adversely affecting our business, results of operations, liquidity and financial condition.