UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material pursuant to § 240.14a-12

|

RLJ Entertainment, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

RLJ ENTERTAINMENT, INC.

8515 Georgia Avenue, Suite 650

Silver Spring, Maryland 20910

Dear Fellow Stockholders:

You are cordially invited to attend a Special Meeting of Stockholders of RLJ Entertainment, Inc. (or the Company) on Friday, December 4, 2015 at 9:30 a.m. local time at the offices of RLJ Entertainment, Inc. located at 8515 Georgia Avenue, Suite 650, Silver Spring, Maryland 20910.

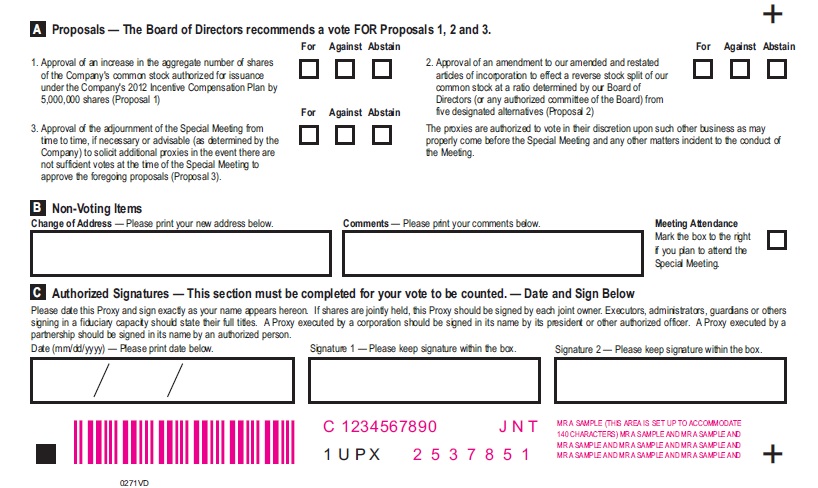

Our Board of Directors recommends that stockholders vote FOR the following three proposals that will be considered and voted on during the Special Meeting:

| 1. | To approve an increase in the aggregate number of shares of the Company's common stock authorized for issuance under the Company's 2012 Incentive Compensation Plan by 5,000,000 shares (Proposal 1); |

| 2. | To approve an amendment to our amended and restated articles of incorporation to effect a reverse stock split of our common stock at a ratio determined by our Board of Directors (or any authorized committee of the Board) from five designated alternatives (Proposal 2); and |

| 3. | To approve the adjournment of the Special Meeting from time to time, if necessary or advisable (as determined by the Company) to solicit additional proxies in the event there are not sufficient votes at the time of the Special Meeting to approve either of the foregoing proposals (Proposal 3). |

Please read the accompanying proxy statement carefully for information about the matters you are being asked to consider and vote upon. Your vote is important. Whether or not you attend the Special Meeting in person, the Board urges you to promptly vote your proxy as soon as possible by mail using the enclosed postage-paid reply envelope. If you decide to attend the meeting and vote in person, you will, of course, have that opportunity.

Thank you for your continued support.

| Sincerely, | ||

|

|

|

|

Robert L. Johnson

|

Miguel Penella

|

|

|

Chairman of the Board

|

Chief Executive Officer

|

RLJ ENTERTAINMENT, INC.

8515 Georgia Avenue, Suite 650

Silver Spring, Maryland 20910

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On December 4, 2015

To our Stockholders:

On behalf of the Board of Directors, you are cordially invited to attend a Special Meeting of Stockholders, which will be held at the offices of RLJ Entertainment, Inc. located at 8515 Georgia Avenue, Suite 650, Silver Spring, Maryland 20910 at 9:30 a.m. local time on Friday, December 4, 2015, for the following purposes:

| 1. | To approve an increase in the aggregate number of shares of the Company's common stock authorized for issuance under the Company's 2012 Incentive Compensation Plan by 5,000,000 shares (Proposal 1); |

| 2. | To approve an amendment to our amended and restated articles of incorporation to effect a reverse stock split of our common stock at a ratio determined by our Board of Directors (or any authorized committee of the Board) from five designated alternatives (Proposal 2); |

| 3. | To approve the adjournment of the Special Meeting from time to time, if necessary or advisable (as determined by the Company) to solicit additional proxies in the event there are not sufficient votes at the time of the Special Meeting to approve either of the foregoing proposals (Proposal 3); and |

| 4. | To discuss and resolve any other matters that properly come before the meeting. |

These items of business are more fully described in the proxy statement accompanying this Notice. Please carefully read the accompanying proxy statement.

The Board of Directors recommends stockholders vote “FOR” Proposals 1, 2 and 3, as set forth in the accompanying proxy statement.

Stockholders of record of our common stock at the close of business on October 21, 2015 will be entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

We have enclosed a proxy statement, a form of proxy and a postage-paid reply envelope.

Your vote is important, and we appreciate your cooperation in considering and acting on the matters presented.

|

By order of the Board of Directors,

|

||

|

||

|

Miguel Penella

|

||

|

Chief Executive Officer

|

October 26, 2015

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on December 4, 2015

The Company’s proxy statement is available on the Investors webpages at www.rljentertainment.com or http://phx.corporate-ir.net/phoenix.zhtml?c=109706&p=irol-reports.

IMPORTANT

Whether or not you expect to attend the Special Meeting in person, we urge you to vote your proxy at your earliest convenience by mail using the enclosed postage-paid reply envelope. This will help ensure the presence of a quorum at the Special Meeting and will save us the expense of additional solicitation. Sending in your proxy will not prevent you from voting your shares in person at the Special Meeting if you desire to do so. Your proxy is revocable at your option in the manner described in the accompanying proxy statement.

|

Item

|

Page

|

|

3

|

|

|

6

|

|

|

8

|

|

|

10

|

|

|

15

|

|

|

17

|

|

|

20

|

|

|

20

|

|

|

22

|

|

|

23

|

|

|

25

|

|

|

25

|

|

|

26

|

|

|

26

|

|

|

26

|

RLJ ENTERTAINMENT, INC.

8515 Georgia Avenue, Suite 650

Silver Spring, Maryland 20910

(301) 608-2115

Proxy Statement

For the 2015 Special Meeting of Stockholders

To Be Held On Friday, December 4, 2015

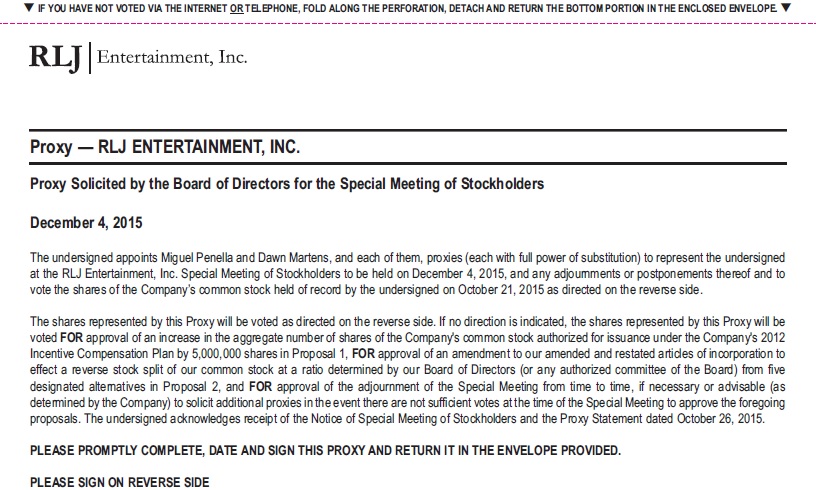

Our Board of Directors (or our Board) is soliciting proxies to be voted at a Special Meeting of Stockholders on Friday, December 4, 2015 at 9:30 a.m., local time, and at any adjournments or postponements thereof, for the purposes set forth in the attached Notice of Special Meeting of Stockholders.

The notice, this proxy statement and the form of proxy enclosed are first being sent to stockholders on or about October 30, 2015. As used in this proxy statement, the terms “RLJE,” “Company,” “we,” “us” and “our” refer to RLJ Entertainment, Inc.

Why am I receiving these materials?

Our Board is providing these proxy materials to you in connection with a Special Meeting of Stockholders of the Company, to be held on December 4, 2015. As a stockholder of record of our common stock on October 21, 2015, you are invited to attend the Special Meeting and are entitled to and requested to vote on the proposals described in this proxy statement.

Who is soliciting my vote pursuant to this proxy statement?

Our Board is soliciting your vote at the Special Meeting. In addition, certain of our officers and employees may solicit, or be deemed to be soliciting, your vote.

Who is entitled to vote?

Only stockholders of record of our common stock at the close of business on October 21, 2015 are entitled to vote at the Special Meeting. If your shares of common stock are registered in your name on the records of the Company maintained by the Company's transfer agent, Computershare, these proxy materials are being sent to you directly. If your shares are held in “street name,” meaning that they are registered in the name of a broker, nominee, fiduciary or other custodian, then generally only that broker, nominee, fiduciary or other custodian may execute a proxy and vote your shares. If you hold shares in “street name,” these proxy materials are being sent to you by the broker, nominee, fiduciary or other custodian through which you hold your shares.

How many shares are eligible to be voted?

As of the record date of October 21, 2015, we had 12,877,064 shares of common stock outstanding. Each outstanding share of our common stock entitles its holder to one vote on each matter to be voted on at the Special Meeting.

What am I voting on?

You are voting on the following matters:

To approve an increase in the aggregate number of shares of the Company's common stock authorized for issuance under the Company's 2012 Incentive Compensation Plan by 5,000,000 shares (Proposal 1);

To vote on an amendment to our amended and restated articles of incorporation to effect a reverse stock split of our common stock at a ratio determined by our Board of Directors (or any authorized committee of the Board) from five designated alternatives (Proposal 2);

To approve the adjournment of the Special Meeting from time to time, if necessary or advisable (as determined by the Company) to solicit additional proxies in the event there are not sufficient votes at the time of the Special Meeting to approve either of the foregoing proposals (Proposal 3); and

Any other matters that properly come before the meeting.

The Board of Directors does not currently know of any other matters that may be brought before the meeting for a vote. However, if any other matters are properly presented for action, it is the intention of the persons named on the proxy card to vote on them according to their best judgment.

How does our Board recommend that I vote?

For the reasons set forth in more detail later in this proxy statement, our Board recommends that you vote:

“FOR” approval of an increase in the aggregate number of shares of the Company's common stock authorized for issuance under the Company's 2012 Incentive Compensation Plan by 5,000,000 shares (Proposal 1);

“FOR” approval of an amendment to our amended and restated articles of incorporation to effect a reverse stock split of our common stock at a ratio determined by our Board of Directors (or any authorized committee of the Board) from five designated alternatives (Proposal 2); and

“FOR” approval of the adjournment of the Special Meeting from time to time, if necessary or advisable (as determined by the Company) to solicit additional proxies in the event there are not sufficient votes at the time of the Special Meeting to approve either of the foregoing proposals (Proposal 3).

How may I cast my vote?

Stockholder of Record. If you are the stockholder of record, you may vote by one of the following methods:

in person at the Special Meeting;

by mail;

by using the Internet; or

by telephone.

Whichever method you use, the proxies identified on the proxy card will vote the shares of which you are the stockholder of record in accordance with your instructions. If you sign, date and return your proxy card without giving specific voting instructions, the proxies will vote your shares for Proposals 1, 2 and 3. The proxies will vote in their discretion with respect to any other matter properly presented for a vote at the Special Meeting or any adjournment or postponement thereof.

Beneficial Owners of Shares Held in "Street Name." If you are a beneficial owner of shares held in "street name" and do not provide the broker, nominee, fiduciary or other custodian through which you hold your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. We believe that proposals 2 and 3 set forth in this proxy statement will be considered to be routine matters but proposal 1 will not. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote." When we tabulate the votes for any particular matter, broker non-votes will be counted for purposes of determining whether a quorum is present. Your broker or nominee will usually provide you with the appropriate instruction form at the time you receive this proxy statement. We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions in the voting instruction form.

What do I need to bring with me if I attend the Special Meeting?

If you plan on attending the Special Meeting, please remember to bring with you photo identification, such as a driver's license. In addition, if you hold shares in "street name" you should bring an account statement or other acceptable evidence of ownership of common stock as of the close of business on October 21, 2015, the record date for voting. Finally, if you hold shares in "street name," in order to vote at the Special Meeting, you will also need a valid “legal proxy” issued in your name, which you can obtain by contacting your account representative at the broker, nominee, fiduciary or other custodian through which you hold your shares.

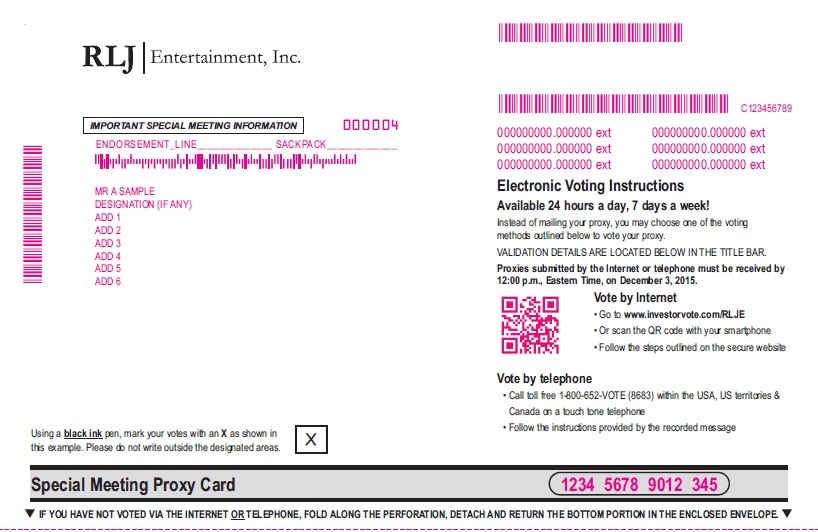

How may I cast my vote by mail?

To vote by mail, you may complete the enclosed proxy card and then sign, date and return it in the postage-paid reply envelope provided. Submitting a proxy now will not limit your right to vote at the Special Meeting if you decide to attend in person.

If your shares are held in "street name," meaning that they are registered in the name of a broker, nominee, fiduciary or other custodian, then generally only that broker, nominee, fiduciary or other custodian may execute a proxy and vote your shares. Your broker, nominee, fiduciary or other custodian should provide you with a voting instruction form for your use to provide them with instructions as to how to vote your shares at the Special Meeting. If your shares are held of record in "street name" by a broker, nominee, fiduciary or other custodian and you wish to vote in person at the Special Meeting, you must obtain from the record holder a "legal proxy" issued in your name.

Stockholders that receive more than one proxy card or voting instruction form have shares registered in different forms or in more than one account. Stockholders that receive more than one proxy card are requested to please sign, date and return all proxy cards and provide instructions for all voting instruction forms received to ensure that all of their shares are voted.

Shares represented by a properly executed proxy will be voted at the Special Meeting and, when instructions have been given by the stockholder, will be voted in accordance with those instructions. Properly executed proxies that do not contain voting instructions with regard to a proposal will be voted "FOR" any such proposal.

How may I cast my vote over the Internet or by telephone?

If you are a stockholder of record, in addition to voting in person or by completing and mailing the proxy card, you may vote by using the Internet or by telephone. If you wish to vote via the Internet, access the website set forth on your proxy card and follow the instructions given. You will need your proxy card in hand when you access the website. Or, you can vote via telephone by calling the telephone number set forth on your proxy card. You will need your proxy card in hand when you call that number. You may vote via the Internet or telephone up until 11:59 p.m. Eastern Time the day before the Special Meeting.

If you hold your shares in "street name," the broker, nominee, fiduciary or other custodian through which you hold your shares will instruct you as to how your shares may be voted by proxy.

How may I revoke or change my vote?

If you are the record owner of your shares, you may revoke your proxy at any time before it is voted at the Special Meeting by:

submitting to our Secretary a new proxy card, dated later than the prior proxy card;

delivering written notice to our Secretary at 8515 Georgia Avenue, Suite 650, Silver Spring, Maryland 20910 stating that you are revoking your proxy; or

attending the Special Meeting and voting your shares in person.

Please note that attendance at the Special Meeting will not, by itself, constitute revocation of your proxy.

If you hold your shares in "street name," the broker, nominee, fiduciary or other custodian through which you hold your shares will instruct you as to how you may revoke or change your vote.

What are the voting requirements?

Quorum Requirement. Nevada law and our bylaws require that a quorum exist for the transaction of business at a stockholder meeting. A quorum for the actions to be taken at the Special Meeting will consist of a majority of the voting power of the outstanding shares of stock that are entitled to vote at the Special Meeting. Therefore, at the Special Meeting, the presence, in person or by proxy, of the holders of shares of common stock representing at least 6,438,533 votes will be required to establish a quorum. Proxies marked as abstaining, and any proxies returned by brokers as "broker non-votes" on behalf of shares held in "street name" because beneficial owners' discretion has been withheld as to one or more matters on the agenda for the Special Meeting, will be treated as present and entitled to vote and will count towards the establishment of a quorum.

Required Votes. Each outstanding share of our common stock is entitled to one vote on each proposal at the Special Meeting. Approval of the proposals requires the following affirmative vote:

Approval required for proposal 1: the proposal requires the affirmative vote of a majority of the outstanding shares of our common stock present, in person or by proxy, at the Special Meeting. Abstentions will have the same effect as a vote against this proposal. Non-votes will not be counted.

Approval required for proposal 2: the proposal requires the affirmative vote of a majority of the voting power outstanding. Abstentions and non-votes will have the same effect as a vote against this proposal.

Approval required for proposal 3: the proposal requires the affirmative vote of majority of the outstanding shares of our common stock present in person or by proxy. Abstentions will have the same effect as a vote against this proposal. Non-votes will not be counted.

What happens if the Special Meeting is adjourned?

If the Special Meeting is adjourned to another time or place, notice is not required to be provided to the stockholders of the adjourned meeting if the time, place and means of any remote communications by which stockholders and proxy holders may be deemed to be present in person and vote at such adjourned meeting are announced at the meeting at which the adjournment is taken and no new record date is fixed for the adjourned meeting after the adjournment. If we adjourn the Special Meeting to a later date, we will conduct the same business at the later meeting and, unless we set a new record date, only the stockholders who were eligible to vote at the original meeting will be permitted to vote at the adjourned meeting. Unless we set a new record date for an adjourned meeting and you are no longer a stockholder on the new record date, your proxy will still be effective and may be voted at the adjourned meeting. In that case, you will still be able to change or revoke your proxy until it is voted.

Who is paying for the costs of this proxy solicitation?

The Company will bear the cost of this solicitation of proxies. In addition to mailing these proxy materials, our directors, officers and employees may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile, or electronic communication. We will reimburse banks and brokers for their reasonable out-of-pocket expenses related to forwarding proxy materials to beneficial owners of stock or otherwise in connection with this solicitation.

Who are the proxies?

The Board of Directors of the Company has appointed Miguel Penella and Dawn Martens to serve as proxies at the Special Meeting. When you fill out your proxy card and return it, or if you vote electronically, you will be giving the proxies your instruction on how to vote your shares at the Special Meeting.

Who will count the votes?

Computershare, our transfer agent, will receive and tabulate the proxy cards, ballots and voting instruction forms for us.

Whom should I call if I have questions regarding the Special Meeting?

If you have questions regarding the Special Meeting, please contact Dawn Martens (Corporate Secretary) at (301) 608-2115.

This proxy statement contains forward-looking statements that involve risks and uncertainties within the meaning of the Private Securities Litigation Reform Act of 1995. Other than statements of historical fact, all statements made in this proxy statement are forward-looking, including, but not limited to, statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future results and condition. In some cases, forward-looking statements may be identified by words such as “will,” “should,” “could,” “may,” “might,” “expect,” “plan,” “possible,” “potential,” “predict,” “anticipate,” “believe,” “estimate,” “continue,” “future,” “intend,” “project” or similar words.

Unless otherwise required by law, we undertake no obligation to release publicly any updates or revisions to any such forward-looking statements that may reflect events or circumstances occurring after the date of this proxy statement. There are a number of factors, many of which are beyond our control, that could cause actual conditions, events or results to differ significantly from those described in the forward-looking statements. For a discussion of such factors, please see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Our Board has approved an amendment to the RLJ Entertainment, Inc. 2012 Incentive Compensation Plan (the “2012 Plan”). This amendment increases the number of shares available under the 2012 Plan by 5,000,000 shares from 1,244,153 to up to 6,244,153 shares.

As of September 30, 2015, a total of 1,244,153 shares of common stock were authorized for issuance and 808,621 shares of common stock were available for new grants pursuant to the 2012 Plan. Of these available shares, approximately 400,000 shares are expected to be granted to the independent members of the Board in connection with the annual compensation plan. If our stockholders approve the proposed amendment to the 2012 Plan, a total of 6,244,153 shares of common stock will have been reserved for issuance and 5,808,621 shares of common stock would be available for new grants pursuant to the 2012 Plan. The amendment to the 2012 Plan will become effective on December 4, 2015, if approved by our stockholders. Stockholder approval is required by the Nasdaq Capital Market listing standards and Section 423(b) of the Internal Revenue Code (the “Code”). The Board is asking our stockholder to approve the amendment to the 2012 Plan to assist us in attracting and retaining qualified employees, consultants and non-employee directors and motivating them to assist us in achieving our goals of increasing profitability and stockholder value, while also qualifying such shares for special tax treatment under section 421 and 423 of the Code.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE AMENDMENT TO THE RLJ ENTERTAINMENT, INC. 2012 INCENTIVE COMPENSATION PLAN WITH RESPECT TO THE ADDITION OF 5,000,000 SHARES.

Vote Required.

Approval of the proposed amendment to the 2012 Plan requires the affirmative vote of a majority of the votes cast by holders of common stock on the proposal at the Special Meeting.

Summary of the 2012 Plan.

Overview. The 2012 Plan was approved by the stockholders on September 20, 2012. The purpose of the 2012 Plan is to attract and retain qualified employees, consultants and non-employee directors and to motivate them to achieve long-term goals, to provide incentive compensation opportunities that are competitive with those of similar companies and to further align participants' interests with those of our other stockholders.

Types of Awards. Awards under the 2012 Plan may take the form of Options, Stock Appreciation Rights, Restricted Stock Awards, Restricted Stock Unit Awards, Bonus Stock and Awards in Lieu of Obligations, Dividend Equivalents, Performance Awards, and Other Stock-Based Awards (as those terms are defined in the Incentive Plan). No person may be granted (i) Options or Stock Appreciation Rights with respect to more than 750,000 shares or (ii) Restricted Stock, Restricted Stock Units, Performance Shares, and/or Other Stock Based Awards with respect to more than 750,000 shares. In addition, no person may be granted awards worth more than $1,000,000 of grant date fair value with respect to any 12-month Performance Period (as that term is defined in the 2012 Plan) under the 2012 Plan, or $2,000,000 with respect to any Performance Period that is more than 12 months. The maximum term allowed for an option is 10 years and a stock award shall either vest or be forfeited not more than 10 years from the date of grant.

Eligibility. The persons eligible to receive awards under the 2012 Plan include all of our employees, the employees of our subsidiaries, our non-employee directors and any of our consultants, independent contractors or advisors that the Compensation Committee identifies as having a direct and significant effect on our performance. As of September 30, 2015, approximately 120 employees and 5 non-employee members of the Board were eligible to participate in the 2012 Plan.

Share reserve/limitations. As of September 30, 2015, a total of 1,244,153 shares of common stock were authorized for issuance and 808,621 shares of common stock were available for new grants pursuant to the 2012 Plan. If the shares of stock that are subject to an award are not issued or cease to be issuable because the award is terminated, forfeited or cancelled, those shares will then become available for additional awards. The number of shares authorized and available for issuance under the 2012 Plan is subject to adjustment in the sole discretion of the Compensation Committee in the event of a stock split, stock dividend, recapitalization, spin-off or similar action.

Administration. The 2012 Plan is administered by the Compensation Committee of our Board. Each member of the Compensation Committee qualifies as an "outside director," as defined for purposes of Section 162(m) of the Code, and qualify as a "non-employee director," as defined for purposes of Securities Exchange Act Rule 16b-3. The Compensation Committee has complete and absolute authority to make any and all decisions regarding the administration of the 2012 Plan.

Terms of Awards. Subject to certain restrictions and limitations that are set forth in the 2012 Plan, the Compensation Committee has authority to set the terms, conditions and provisions of each award, including the size of the award, the exercise or base price, the vesting and exercisability schedule (including provisions regarding acceleration of vesting and exercisability) and termination, cancellation and forfeiture provisions. On September 30, 2015, the closing price for our shares on the Nasdaq Capital Market was $0.50 per share.

Change in Control. The Compensation Committee has the express authority to include in any award terms that provide for the acceleration of vesting and lapse of restrictions, as applicable, upon or following a change in control.

Amendments and Termination. The Board or the Compensation Committee, without the consent or approval of any plan participant, may amend, suspend or terminate the 2012 Plan or any award granted under the 2012 Plan, so long as that action does not materially impair any award then outstanding. Without the approval of the stockholders, however, neither the Board nor the Compensation Committee may amend the 2012 Plan to increase the number of shares available for issuance or to modify any of the limitations described in the 2012 Plan in such a manner as to materially reduce the limitation. The Board can terminate the 2012 Plan at any time. No awards will be granted under the 2012 Plan after the tenth anniversary of its effective date.

Federal Income Tax Consequences. The 2012 Plan is not qualified under the provisions of section 401(a) of the Code and is not subject to any of the provisions of the Employee Retirement Income Security Act of 1974. The following is a brief description of the material U.S. federal income tax consequences associated with awards under the 2012 Plan. It is based on existing U.S. laws and regulations, and there can be no assurance that those laws and regulations will not change in the future. Tax consequences in other countries may vary.

Stock Options. There will be no federal income tax consequences to either us or the participant upon the grant of a stock option. If the option is a non-qualified stock option, the participant will realize ordinary income at exercise equal to the excess of the fair market value of the stock acquired over the exercise price and we will receive a corresponding deduction. Any gain or loss realized upon a subsequent disposition of the stock will generally constitute capital gain. If the option is an incentive stock option, the participant will not realize taxable income on exercise, but the excess of the fair market value of the stock acquired over the exercise price may give rise to "alternative minimum tax." When the stock is subsequently sold, the participant will recognize income equal to the difference between the sales price and the exercise price of the option. If that sale occurs after the expiration of two years from the date of the grant and one year from the date of exercise, the income will constitute long-term capital gain. If the sale occurs prior to that time, the participant will recognize ordinary income to the extent of the lesser of the gain realized upon the sale or the difference between the fair market value of the acquired stock at the time of exercise and the exercise price; any additional gain will constitute capital gain. We will be entitled to a deduction in an amount equal to the ordinary income that the participant recognizes.

Restricted Stock and Restricted Stock Units. Generally, shares of restricted stock and restricted stock units are not taxable to a participant at the time of grant, but instead are included in ordinary income (at their then fair market value) when the restrictions lapse. A participant may elect to recognize income at the time of grant, in which case the fair market value of the stock at the time of grant is included in ordinary income and there is no further income recognition when the restrictions lapse. We are entitled to a tax deduction in an amount equal to the ordinary income recognized by the participant.

Other Awards. In the case of other awards, the participant will generally recognize ordinary income in an amount equal to any cash received and the fair market value of any shares received on the date of payment or the date of delivery of the underlying shares, and we will generally be entitled to a corresponding tax deduction.

Deductibility of Executive Compensation. We anticipate that any compensation deemed paid by us in connection with disqualifying dispositions of incentive stock option shares or the exercise of non-statutory stock options with exercise prices equal to or greater than the fair market value of the underlying shares on the grant date will qualify as performance-based compensation for purposes of Section 162(m) of the Code and will not have to be taken into account for purposes of the $1.0 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers. Accordingly, all compensation deemed paid with respect to those options should remain deductible without limitation under Section 162(m). However, any compensation deemed paid by us in connection with shares issued under restricted stock units will be subject to the $1.0 million limitation on deductibility per covered individual, except to the extent the vesting of those shares is based solely on one or more of the performance milestones specified above in the summary of the terms.

New Plan Benefits. The Compensation Committee plans to utilize the additional shares in order to implement two new programs designed by the Compensation Committee: a one-time retention bonus grant to senior management (the “Retention Plan”) and a four-year broad-based employee stock bonus plan beginning in 2016 (the “Employee Stock Plan”).

The Retention Plan awards are expected to be granted on the date of stockholder approval of the amendment of the 2012 Plan and to vest 50% on April 1, 2016 and 50% on October 1, 2016. The Retention Plan awards are expected to be awarded to the Chief Executive Officer, Miguel Penella, to a newly hired Chief Financial Officer and to eleven other officers and senior employees. The award to Mr. Penella is expected to be a number of shares which, when combined with the number of shares he currently holds, constitutes one percent of our stock, assuming the conversion of the outstanding convertible preferred stock (approximately 289,000 shares). The value of this award will depend upon the fair market value of the common stock on the date of the grant, but based upon the closing price per share on October 23, 2015 of $0.73, it is estimated to be approximately $200,000. The award to the new Chief Financial Officer and to each of the other officers and employees is intended to be a number of shares with a value of up to 20% of the amount of their respective annual salaries (an estimated aggregate maximum value of approximately $640,000).

The Employee Stock Plan awards that will be granted to eligible participants under the 2012 Plan are subject to the discretion of the Compensation Committee and future financial results under the long-term incentive programs and therefore are not determinable at this time. The restricted stock awards are expected to be granted annually in March, not to exceed 1.5 million shares annually and to vest in three equal, annual installments on the grant day anniversary.

Registration with SEC. We intend to file a registration statement with the SEC pursuant to the Securities Act of 1933, as amended, covering the offering of the additional shares under the 2012 Plan.

PROPOSAL 2: APPROVAL AND ADOPTION OF AMENDMENT TO AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT, AT THE DISCRETION OF OUR BOARD OF DIRECTORS, A REVERSE STOCK SPLIT OF OUR COMMON STOCK

The Board has proposed the approval and adoption of a series of five alternative amendments of the Amended and Restated Articles of Incorporation to effect a Reverse Stock Split (as defined below) of our common stock at any time prior to December 31, 2016.

The Board has adopted resolutions (1) approving and declaring advisable a series of five alternative amendments of our Amended and Restated Articles of Incorporation to effect, at the discretion of the Board (or any authorized committee of the Board), a reverse stock split at one of five reverse stock split ratios, 1-for-2, 1-for-3, 1-for-4, 1-for-5 or 1-for-6 (each of which is referred to in this Proxy Statement as a “Reverse Stock Split” and are collectively referred to as the “Reverse Stock Split Amendments”), (2) directing that the Reverse Stock Split Amendments be submitted to the holders of our common stock for their approval and adoptions and (3) recommending that the holders of our common stock approve and adopt the Reverse Stock Split Amendments.

The actual number of outstanding shares of our common stock after giving effect to the Reverse Stock Split, if and when effected, will depend on the Reverse Stock Split ratio that is ultimately determined by the Board (or any authorized committee of the Board). The table below shows the Reverse Stock Split ratio and the approximate number of authorized shares of common stock to be outstanding for each of the five alternative amendments, identified as Amendments A-E:

|

Amendment

|

Reverse Stock Split Ratio

|

Outstanding Shares

|

|

|

A

|

1-for-2

|

6,438,532

|

|

|

B

|

1-for-3

|

4,292,355

|

|

|

C

|

1-for-4

|

3,219,266

|

|

|

D

|

1-for-5

|

2,575,413

|

|

|

E

|

1-for-6

|

2,146,177

|

Upon receiving stockholder approval of the Reverse Stock Split Amendments, the Board (or any authorized committee of the Board) will have the authority, but not the obligation, in its sole discretion, at any time prior to December 31, 2016, to elect without further action on the part of the stockholders, as it determines to be in the best interests of the Company and its stockholders, whether to effect a Reverse Stock Split and, if so, to determine the Reverse Stock Split ratio from among the approved proposed ratios above and to effect the Reverse Stock Split Amendment by filing an amendment to our Amended and Restated Articles of Incorporation in the form of the Amendment attached as Annex A to this Proxy Statement. For convenience of our stockholders, each of the five amendments has been set forth in a single Annex, indicating in brackets the Reverse Stock Split ratio for each of the alternate Amendments A-E. Only the Reverse Stock Split Amendment providing for the Reverse Stock Split ratio determined by the Board (or any authorized committee of the Board) will be filed with the Secretary of State of the State of Nevada and become effective. The Board (or any authorized committee of the Board) shall abandon all other Reverse Stock Split Amendments.

Upon the effectiveness of the Reverse Stock Split, a corresponding reduction in the number of issued and outstanding shares of our common stock will occur as set forth in the table above and as further described below under “Effect of the Reverse Stock Split on Holders of Outstanding Common Stock.” The decrease in issued and outstanding shares as a result of the Reverse Stock Split will not affect any stockholder’s proportionate voting power or other rights (other than as a result of the rounding of fractional shares as described under “Fractional Shares”). If the Board (or any authorized committee of the Board) abandons the Reverse Stock Split, there will be no reduction in the number of issued and outstanding shares of our common stock.

The Board believes that stockholder approval of these five selected Reverse Stock Split ratios (as opposed to approval of a single reverse stock split ratio) provides maximum flexibility to achieve the purposes of a reverse stock split and, therefore, is in the best interests of the Company and its stockholders. In determining a ratio following the receipt of stockholder approval, the Board (or any authorized committee of the Board) may consider, among other things, factors such as:

| · | the historical trading price and trading volume of our common stock; |

| · | the number of shares of our common stock outstanding; |

| · | the then-prevailing trading price and trading volume of our common stock and the anticipated impact of the Reverse Stock Split on the trading market for our common stock; |

| · | the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; |

| · | the continued listing requirements of the Nasdaq Capital Market (“NasdaqCM”); and |

| · | prevailing general market and economic conditions. |

The Board reserves the right to elect to abandon any or all of the Reverse Stock Split Amendments, notwithstanding stockholder approval thereof, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders.

Depending on the ratio for the Reverse Stock Split determined by the Board (or any authorized committee of the Board), 2, 3, 4, 5 or 6 shares of existing common stock, as determined by the Board (or any authorized committee of the Board), will be combined into one share of common stock. The number of shares of common stock issued and outstanding will therefore be reduced, by an amount based upon the determined Reverse Stock Split ratio. If the Reverse Stock Split Amendments are approved by our stockholders and the Board (or any authorized committee of the Board) elects to effect the Reverse Stock Split at any time prior to December 31, 2016, a Certificate of Amendment of the Amended and Restated Articles of Incorporation (each a “Reverse Stock Split Amendment”) that sets forth the applicable Reverse Stock Split Amendment and provides for the Reverse Stock Split ratio determined by the Board (or any authorized committee of the Board) in its discretion will be filed with the Secretary of State of the State of Nevada with immediate effect (the “Effective Time”). At the Effective Time, all other Reverse Stock Split Amendments will be automatically abandoned.

The Board (or any authorized committee of the Board) will determine the exact timing of the filing of the Reverse Stock Split Amendment based on its evaluation as to when the filing would be the most advantageous to the Company and its stockholders. If a Reverse Stock Split Amendment Certificate has not been filed with the Secretary of State of the State of Nevada prior to December 31, 2016, then the Reverse Stock Split and all of the Reverse Stock Split Amendments will be automatically abandoned.

To avoid the existence of fractional shares of our common stock, stockholders of record who would otherwise hold fractional shares as a result of the Reverse Stock Split will be entitled to receive whole shares as described under “Fractional Shares.”

The Board (or any authorized committee of the Board) reserves the right to abandon the Reverse Stock Split without further action by our stockholders at any time before the effectiveness of any Reverse Stock Split Amendment even if the Reverse Stock Split Amendments have been approved by our stockholders. By voting in favor of the approval of the Reverse Stock Split Amendments, you are expressly also authorizing the Board (or any authorized committee of the Board) to determine not to proceed with, and abandon, the Reverse Stock Split if it should so decide.

Purpose of the Reverse Stock Split Amendments

Our common stock is listed on the NasdaqCM. In order for our common stock to continue trading on the NasdaqCM, the Company must comply with various listing standards, including that the Company maintain a minimum average closing price of at least $1.00 per share of common stock during a consecutive 30 trading-day period. Failure to comply with this listing requirement may lead to delisting from the NasdaqCM, which could have material, adverse effects on our business, financial condition and common stock. The Board submits the Reverse Stock Split Amendments to stockholders for approval with the primary intent of increasing the price of our common stock to ensure ongoing compliance with this listing requirement.

Many brokerage houses and institutional investors have internal policies and practices that prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that the Reverse Stock Split will make our common stock a more attractive and cost-effective investment for many investors, which may enhance the liquidity of our common stock for our holders.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split Amendments, as applicable, is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our common stock . As a result, even if a Reverse Stock Split Amendment is effected, it may not result in the intended benefits described above, including compliance with the NasdaqCM listing requirements, the market price of our common stock may not increase following the Reverse Stock Split or even if it does, the market price of our common stock may decrease in the future. Additionally, the market price per share of our common stock after the Reverse Stock Split may not increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

Finally, we believe that a Reverse Stock Split will provide the Company and its stockholders with other benefits. Currently, the fees we pay to list our shares on the NasdaqCM are based on the number of shares we have outstanding. Also, the fees we pay for custody and clearing services, the fees we pay to the SEC to register securities for issuance and the costs of our proxy solicitations are frequently based on or related to the number of shares being held, cleared or registered, as applicable. Reducing the number of shares that are outstanding and that will be issued in the future may reduce the amount of fees and tax that we pay to these organizations and agencies, as well as other organizations and agencies that levy charges based on the number of shares rather than the value of the shares.

Effect of the Reverse Stock Split on Holders of Outstanding Common Stock

If approved and effected, the Reverse Stock Split will take effect simultaneously and in the same ratio for all outstanding shares of our common stock. The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in us, except to the extent that the Reverse Stock Split would result in any holder of our common stock receiving a whole share in lieu of a fractional share. As described below under “Fractional Shares”, holders of common stock otherwise entitled to fractional shares as a result of the Reverse Stock Split will receive whole shares in lieu of the fractional shares. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The principal effects of the Reverse Stock Split will be that:

|

·

|

depending on the ratio for the Reverse Stock Split determined by our Board (or any authorized committee of the Board), each 2, 3, 4, 5 or 6 shares of common stock owned by a stockholder will be combined into one share of common stock; |

|

·

|

based upon the Reverse Stock Split ratio determined by our Board (or any authorized committee of the Board), the aggregate number of equity-based awards that remain available to be granted under our equity incentive plans and other benefit plans will be reduced proportionately to reflect such Reverse Stock Split ratio determined; |

|

·

|

based upon the Reverse Stock Split ratio determined by our Board (or any authorized committee of the Board), proportionate adjustments will be made to the per-share exercise price and the number of shares issuable upon the exercise of our convertible preferred stock and outstanding stock options and warrants, as well as to the number of shares that would be owned upon vesting of restricted stock awards and restricted stock units, which will result in approximately the same aggregate price that would have been required to be paid upon exercise of such options and warrants, as well as the same number of shares that would have been owned upon vesting of such restricted stock awards or units, immediately preceding the Reverse Stock Split; and |

|

·

|

the aggregate number of shares issuable pursuant to outstanding convertible preferred stock and outstanding stock options, warrants, stock appreciation rights, restricted stock awards, restricted stock units or other equity-based awards made under our equity incentive plans will be reduced proportionately based upon the Reverse Stock Split ratio determined by our Board (or any authorized committee of the Board). |

After the Effective Time, our common stock will have new Committee on Uniform Securities Identification Procedures (“CUSIP”) numbers, which numbers are used to identify our equity securities, and stock certificates with the old CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the procedures described below.

The Reverse Stock Split is not intended to be a first step in a series of steps leading to a “going private transaction” pursuant to Rule 13e-3 under the Securities Exchange Act of 1934, as amended. Implementing the Reverse Stock Split would not reasonably likely result in or would not have a purpose to, produce a going private effect.

Beneficial Holders of Common Stock. Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders in “street name” (i.e., through a bank, broker, custodian or other nominee), in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our common stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split and adjusting for fractional shares. If a stockholder holds shares of our common stock with a bank, broker, custodian or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank, broker, custodian or other nominee.

Registered “Book-Entry” Holders of Common Stock. Certain of our registered holders of common stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the common stock. They are provided with a statement reflecting the number of shares registered in their accounts.

Holders of Certificated Shares of Common Stock. Stockholders of record at the Effective Time holding shares of our common stock in certificated form (the “Old Certificates”) will be sent a transmittal letter by the transfer agent after the Effective Time and, following a determination by the Board (or any authorized committee of the Board) that shall apply to all holders of the Old Certificates, these holders will receive in exchange for their Old Certificates either (i) registered shares in book-entry form or (ii) new certificates (the “New Certificates”), in each case representing the appropriate number of whole shares of our common stock following the Reverse Stock Split.

The letter of transmittal will contain the necessary materials and instructions on how a stockholder should surrender his, her or its Old Certificates representing shares of our common stock to the transfer agent. No registered shares in book-entry form or New Certificates will be delivered to a stockholder until the stockholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. Stockholders will then receive either a statement reflecting the shares in book-entry form registered in their accounts or New Certificates representing the number of whole shares of common stock for which their shares of our common stock were combined as a result of the Reverse Stock Split.

Until surrendered, outstanding Old Certificates will represent the number of whole shares of our common stock following the Reverse Stock Split to which the shares formerly represented by the Old Certificate were combined into as a result of the Reverse Stock Split. Stockholders must exchange their Old Certificates in order to effect transfers or deliveries of shares on the NasdaqCM.

Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged, based upon the determination by the Board (or any authorized committee of the Board), for registered shares in book-entry form or New Certificates. If an Old Certificate bears a restrictive legend, the registered shares in book-entry form or New Certificate will bear the same restrictive legend.

Stockholders should not destroy any stock certificate(s) and should not submit any stock certificate(s) until requested to do so.

Fractional Shares

We will not issue fractional shares in connection with the Reverse Stock Split Amendments. Therefore, we will not issue certificates representing fractional shares. Registered stockholders who would otherwise hold fractional shares because the number of shares of common stock they hold before the Reverse Stock Split is not evenly divisible by the split ratio ultimately determined by the Board (or any authorized committee of the Board) will be entitled to receive whole shares in lieu of such fractional shares.

Authorized Shares

If and when the Reverse Stock Split is effected, the number of authorized shares of our common stock will not be reduced in proportion to the Reverse Stock Split ratio.

Accounting Matters

The proposed amendments to the Amended and Restated Articles of Incorporation will not affect the par value of our common stock per share, which will remain at $0.001. As a result, as of the Effective Time, the stated capital attributable to common stock on our balance sheet will be reduced proportionately to the Reverse Stock Split ratio, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following summary describes certain U.S. federal income tax consequences of the Reverse Stock Split to holders of our common stock. This summary does not address all of the U.S. federal income tax consequences that may be relevant to any particular holder of our common stock, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, partnerships (or other entities classified as partnerships for U.S. federal income tax purposes) and investors therein, “U.S. holders” (as defined below) whose functional currency is not the U.S. dollar, U.S. expatriates, persons subject to the alternative minimum tax, persons who acquired our common stock through the exercise of employee stock options or otherwise as compensation, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction for U.S. federal income tax purposes, or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). This summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date hereof. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split. This summary does not address the Medicare tax on net investment income or the effects of any state, local or foreign tax laws.

Each holder of our common stock should consult its own tax advisor regarding the U.S. federal, state, local, and foreign income and other tax consequences of the Reverse Stock Split.

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

U.S. Holders. The discussion in this section is addressed to “U.S. holders.” A “U.S. holder” is a beneficial owner of our common stock that is a citizen or individual resident of the United States, a corporation (or other entity classified as a corporation for U.S. federal income tax purposes) organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis in respect of our common stock. The Reverse Stock Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, no gain or loss will be recognized upon the Reverse Stock Split. Accordingly, the aggregate tax basis in the common stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis in the common stock surrendered, and the holding period for the common stock received should include the holding period for the common stock surrendered.

Non-U.S. Holders. The discussion in this section is addressed to “non-U.S. holders.” A non-U.S. holder is a beneficial owner of our common stock that is neither a U.S. holder nor a partnership (or other entity classified as a partnership for U.S. federal income tax purposes). Generally, non-U.S. holders will not recognize any gain or loss upon the Reverse Stock Split.

No Appraisal Rights

Under Nevada law, holders of our common stock will not be entitled to dissenter’s rights or appraisal rights with respect to the Reverse Stock Split Amendments.

If Proposal 2 is Not Approved

If Proposal 2 is not approved, we may be unable to maintain the listing of our common stock on the NasdaqCM, which could adversely affect the liquidity and marketability of our common stock.

Vote Required

The affirmative vote of the holders of a majority of the outstanding shares of common stock is required to approve and adopt the Reverse Stock Split Amendments.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL AND ADOPTION OF THE REVERSE STOCK SPLIT AMENDMENTS.

Our stockholders are being asked to consider and vote upon an adjournment of the Special Meeting from time to time, if necessary or advisable (as determined by the Company), to solicit additional proxies in the event there are not sufficient votes at the time of the Special Meeting to approve an increase in the aggregate number of shares of our common stock authorized for issuance under the 2012 Plan by 5,000,000 shares in Proposal 1 or to approve an amendment to our amended and restated articles of incorporation to effect a reverse stock split of our common stock at a ratio determined by our Board of Directors (or any authorized committee of the Board) from five designated alternatives in Proposal 2.

Vote Required.

Approval of the adjournment of the Special Meeting requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock present in person or represented by proxy, whether or not a quorum is present.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING.

The following table sets forth certain information as of September 30, 2015, with respect to the beneficial ownership of shares of our common stock owned by (i) each person, who, to our knowledge based on Schedules 13D or 13G or other reports filed with the SEC, is the beneficial owner of more than 5% of our outstanding common stock, (ii) each person who is a director, (iii) each Named Executive Officer, and (iv) all of our directors and executive officers as a group.

|

Name of Beneficial Owner

|

Shares of Common Stock

Beneficially Owned(1)

|

Percent of

Common

Stock(2)

|

||||||

|

RLJ SPAC Acquisition, LLC(3)

|

25,983,158

|

71.79

|

%

|

|||||

|

Robert L. Johnson (3)

|

25,983,158

|

71.79

|

%

|

|||||

|

JH Evergreen Management, LLC (4)

|

11,891,652

|

52.31

|

%

|

|||||

|

Wolverine Asset Management, LLC (5)

|

1,398,996

|

9.99

|

%

|

|||||

|

John Ziegelman (5)

|

1,398,996

|

9.99

|

%

|

|||||

|

Sudbury Capital Fund, LP (6)

|

3,271,435

|

20.63

|

%

|

|||||

|

Dayton Judd (7)

|

3,286,571

|

20.72

|

%

|

|||||

|

Wexford Spectrum Investors (8)

|

2,773,523

|

19.54

|

%

|

|||||

|

Peter Edwards (9)

|

1,979,337

|

14.00

|

%

|

|||||

|

Morris Goldfarb (10)

|

1,588,765

|

11.13

|

%

|

|||||

|

Drawbridge Special Opportunities Fund LP (11)

|

1,000,000

|

7.21

|

%

|

|||||

|

Miguel Penella (12)

|

183,518

|

1.42

|

%

|

|||||

|

Andrew S. Wilson (13)

|

33,768

|

*

|

||||||

|

Tyrone Brown

|

29,289

|

*

|

||||||

|

Andor (Andy) M. Laszlo

|

31,289

|

*

|

||||||

|

Scott Royster

|

19,944

|

*

|

||||||

| All directors and executive officers as a group (8 persons) |

30,966,533

|

76.26

|

% | |||||

*Less than 1%

Notes to Beneficial Ownership Table:

| (1) | Beneficial ownership is determined in accordance with SEC rules. For the number of shares beneficially owned by those listed above, we rely on information confirmed by each beneficial owner. Except as indicated by footnote below, each person named reportedly has sole voting and investment powers with respect to the common stock beneficially owned by that person, subject to applicable community property and similar laws. Except as indicated by footnote below, each owner’s mailing address is c/o RLJ Entertainment, Inc., 8515 Georgia Avenue, Suite 650, Silver Spring, Maryland 20910. |

| (2) | On September 30, 2015, there were 12,877,064 shares of common stock outstanding. Common stock not outstanding but which underlies preferred stock and warrants exercisable as of, or within, 60 days after September 30, 2015, is deemed to be outstanding for the purpose of computing the percentage of the common stock beneficially owned by each named person or entity (and the directors and executive officers as a group), but is not deemed to be outstanding for any other purpose. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on the record date. |

| (3) | The RLJ Companies, LLC is the sole manager and is the sole voting member of RLJ SPAC Acquisition, LLC. Robert L. Johnson is the sole manager and the sole voting member of The RLJ Companies, LLC (collectively RLJ). Mr. Johnson disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. Includes 2,666,491 shares of common stock, warrants exercisable at $12 per share to purchase 3,816,667 shares of common stock, warrants exercisable at $1.50 per share to purchase 4,500,000 shares of common stock and 15,000 shares of Series B-2 Convertible Preferred Stock with a conversion price of $1 per share into 15,000,000 shares of common stock. The mailing address for RLJ is 3 Bethesda Metro Center, Suite 1000, Bethesda, Maryland 20814. |

| (4) | Information presented regarding JH Evergreen Management, LLC (or JH Evergreen Management) is based solely on the Form 4/A filed on May 26, 2015, Schedule 13G/A filed on February 13, 2015 and Schedule 13G initially filed on October 15, 2012. The reporting persons include (i) JH Evergreen Management, a Delaware limited liability company; (ii) JH Partners Evergreen Fund, L.P., a Delaware limited partnership (or JH Evergreen); (iii) JH Investment Partners III, LP, A Delaware limited partnership (or JHIP III); (iv) JH Investment Partners GP Fund III, LLC, a Delaware limited liability company (or JHIP GP III); (v) Forrestal, LLC, a Delaware limited liability company (or Forrestal); and (vi) John C. Hansen. Includes 2,034,276 shares of common stock, warrants exercisable at $12 per share to purchase 134,114 shares of common stock, warrants exercisable at $1.50 per share to purchase 2,243,830 shares of common stock and 7,479.432 shares of Series B-1 Convertible Preferred Stock with a conversion price of $1 per share into 7,479,432 shares of common stock. The mailing address of JH Evergreen Management and the other affiliated filers is 451 Jackson Street, San Francisco, California 94111-1615. Mr. Hansen disclaimed beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

| (5) | Information presented regarding Wolverine Asset Management, LLC is based in part on the Schedule 13-D filed on June 1, 2015. The securities reported herein were purchased for the account of Wolverine Flagship Fund Trading Limited, a private investment fund managed by Wolverine Asset Management, LLC. The reporting persons include (i) Wolverine Asset Management, LLC, an Illinois limited liability company, (ii) Wolverine Holdings, L.P., an Illinois limited partnership, (iii) Wolverine Trading Partners, Inc., an Illinois corporation, (iv) Christopher L. Gust, and (v) Robert R. Bellick. The amount set forth as the beneficial ownership takes into account the Ownership Limitation (as defined below). Without such Ownership Limitation, Wolverine’s beneficial ownership would be 5,220,370, which includes warrants exercisable at $12 per share to purchase 20,370 shares of common stock, warrants exercisable at $1.50 per share to purchase 1,200,000 shares of common stock and 4,000 shares of Series A-1 Convertible Preferred Stock with a conversion price of $1 per share into 4,000,000 shares of common stock. The reporting persons are prohibited from converting any Series A-1 Convertible Preferred Stock or exercising certain warrants if as a result the reporting persons would beneficially own more than 9.99% of the outstanding common stock (the “Ownership Limitation”). The mailing address for Wolverine and the other affiliated filers is 175 West Jackson Blvd., Suites 200 and 340 Chicago, Illinois 60604. |

| (6) | Information presented regarding Sudbury Capital Fund, LP (or Sudbury) is based solely on the Schedule 13-D/A filed on May 27, 2015. The reporting persons include (i) Sudbury Capital Fund, LP, a Delaware limited partnership and pooled investment vehicle (or SCF); (ii) Sudbury Holdings, LLC a Delaware limited liability company (or SH); (iii) Sudbury Capital Management, LLC a Delaware limited liability company and the investment adviser (or SCM); (iv) Sudbury Capital GP, LP, a Delaware limited partnership and the general partner of the pooled investment vehicle (or SCGP) and (v) Dayton Judd, the Managing Member of SCM and Partner and Manager of SCGP (collectively the reporting persons). Includes 290,143 shares of common stock, warrants exercisable at $12 per share to purchase 381,292 shares of common stock, warrants exercisable at $1.50 per share to purchase 600,000 shares of common stock and 2,000 shares of Series A-2 Convertible Preferred Stock with a conversion price of $1 per share into 2,000,000 shares of common stock. The mailing address for Sudbury and the other affiliated filers is 878 S. Denton Tap Road, Suite 220, Coppell, TX 75019. |

| (7) | Includes 15,136 shares of common stock and indirect ownership of Sudbury Capital Fund, LP |

| (8) | Information presented regarding Wexford Spectrum Investors LLC (or WSI) is based solely on the information provided in the Form 4 filed on January 8, 2015, Schedule 13G/A filed on January 16, 2015, Schedule 13G/A filed on February 14, 2014, Form 3 filed on February 25, 2013, Schedule 13G/A filed on February 11, 2013, and Schedule 13G initially filed on October 12, 2012. Wexford Capital LP (or Wexford Capital) may, by reason of its status as manager of WSI, be deemed to own beneficially the securities of which WSI possesses beneficial ownership. Wexford GP LLC (or Wexford GP) may, as the General Partner of Wexford Capital, be deemed to own beneficially the securities of which WSI possesses beneficial ownership. Each of Charles E. Davidson (or Davidson) and Joseph M. Jacobs (or Jacobs) may, by reason of his status as a controlling person of Wexford GP, be deemed to own beneficially the securities of which WSI possesses beneficial ownership. Each of Wexford Capital, Wexford GP, Davidson and Jacobs shares the power to vote and to dispose of the securities beneficially owned by WSI. Each of Wexford Capital, Wexford GP, Davidson and Jacobs disclaims beneficial ownership of the securities owned by WSI and this report shall not be deemed as an admission that they are the beneficial owners of such securities except, in the case of Davidson and Jacobs, to the extent of their respective interests in each member of WSI. Includes 1,452,523 shares of common stock and warrants exercisable at $12 per share to purchase 1,320,000 shares of common stock. The mailing address for WSI and the other affiliate filers is 411 West Putnam Avenue, Suite 125, Greenwich, Connecticut 06830. |

| (9) | Includes 721,812 shares of common stock, warrants exercisable at $12 per share to purchase 607,525 shares of the common stock, warrants exercisable at $1.50 per share to purchase 150,000 shares of common stock and 500 shares of Series B-2 Convertible Preferred Stock with a conversion price of $1 per share into 500,000 shares of common stock. |

| (10) | Includes 188,765 shares of common stock, warrants exercisable at $12 per share to purchase 100,000 shares of common stock, warrants exercisable at $1.50 per share to purchase 300,000 shares of common stock and 1,000 shares of Series B-2 Convertible Preferred Stock with a conversion price of $1 per share into 1,000,000 shares of common stock. |

| (11) | Information presented regarding Drawbridge Special Opportunities Fund LP is based solely on the Schedule 13G filed on October 15, 2012 filed on behalf of (i) Drawbridge Special Opportunities Fund LP, a Delaware limited partnership, directly owns warrants to acquire shares of the common stock as described herein; (ii) Drawbridge Special Opportunities GP LLC, a Delaware limited liability company, is the general partner of Drawbridge Special Opportunities Fund LP; (iii) Fortress Principal Investment Holdings IV LLC, a Delaware limited liability company, is the managing member of Drawbridge Special Opportunities GP LLC; (iv) Drawbridge Special Opportunities Advisors LLC, a Delaware limited liability company, is the investment manager of Drawbridge Special Opportunities Fund LP; (v) FIG LLC, a Delaware limited liability company, is the holder of all of the issued and outstanding interests of Drawbridge Special Opportunities Advisors LLC; (vi) Fortress Operating Entity I LP, a Delaware limited partnership, is the holder of all of the issued and outstanding interests of FIG LLC and Fortress Principal Investment Holdings IV LLC; (vii) FIG Corp., a Delaware corporation, is the general partner of Fortress Operating Entity I LP; and (viii) Fortress Investment Group LLC, a Delaware limited liability company, is the holder of all of the issued and outstanding shares of FIG Corp. Includes warrants exercisable at $12 per share to purchase 1,000,000 shares of common stock. The mailing address of Drawbridge Special Opportunities Fund LP and the other affiliated filers is c/o Fortress Investment Group LLC, 1345 Avenue of the Americas, 46th Floor, New York, New York 10105, Attention: Chief Compliance Officer. |

| (12) | Includes 149,892 shares of common stock, of which 32,189 are subject to restricted stock awards, and warrants exercisable at $12 per share to purchase 33,626 shares of common stock. |

| (13) | Includes 14,657 shares of common stock subject to restricted stock awards. |

Executive Compensation

The Company seeks to provide total compensation packages that are competitive, are tailored to the unique characteristics and needs of the Company within its industry and will adequately reward its executives for their roles in creating value for the Company’s stockholders. The Company seeks to be competitive in its executive compensation with other similarly situated companies in its industry. The compensation decisions regarding the Company’s executives are intended to be based on the Company’s need to attract individuals with the skills necessary to achieve its business plan, to reward those individuals fairly over time and to retain those individuals who continue to perform at or above the Company’s expectations. The Compensation Committee determines, or recommends to the Board for determination, the compensation paid to executive officers.

The Company intends that its executives’ compensation will consist of three primary components: salary, incentive bonus and stock-based awards issued under an incentive plan. The Company anticipates determining the appropriate level for each compensation component based in part, but not exclusively, on its view of internal equity and consistency, individual performance, the Company’s performance and other information deemed relevant and timely.

The Company recognized the need to develop a compensation strategy that would create incentives to retain executive team members and to offer an opportunity to participate in the Company’s future growth. The Company in 2013 received an analysis from Farient Advisors with respect to competitive pay practices and advice with respect to a compensation strategy. Farient developed a peer group of companies comparable to the Company from a size and business standpoint. The peer companies identified were: Gaiam, Inc., Lions Gate Entertainment Corp., LodgeNet Interactive Corporation, Navarre Corp., NTN Buzztime Inc., Perform Group plc and Entertainment One LTD (the Peer Group). Farient provided the Company data with respect to the executive salaries, short-term cash incentives and long-term equity incentives provided by the Peer Group.