| | | | | | | | | | | |

REPORT TO SHAREHOLDERS | | |

Year ended December 31, 2023 | |

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

| | | |

| | | |

Table of Contents | | | |

| | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated February 22, 2024, and is supplementary to, and should be read in conjunction with, Pembina's audited consolidated financial statements as at and for the year ended December 31, 2023 ("Consolidated Financial Statements"). The Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, using the accounting policies described in Note 3 of the Consolidated Financial Statements. All dollar amounts contained in this MD&A are expressed in Canadian dollars unless otherwise noted. For further details on Pembina and Pembina's significant assets, including definitions for capitalized terms used herein and not otherwise defined, refer to Pembina's annual information form ("AIF") for the year ended December 31, 2023. Additional information about Pembina filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (filed with the U.S. Securities and Exchange Commission under Form 40-F) and management information circulars, can be found online at www.sedarplus.ca, www.sec.gov and through Pembina's website at www.pembina.com.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the Abbreviations section of this MD&A.

Non-GAAP and Other Financial Measures

Pembina has disclosed certain financial measures and ratios within this MD&A that management believes provide meaningful information in assessing Pembina's underlying performance, but which are not specified, defined or determined in accordance with the Canadian generally accepted accounting principles ("GAAP") and which are not disclosed in Pembina's Consolidated Financial Statements. Such non-GAAP financial measures and non-GAAP ratios do not have any standardized meaning prescribed by IFRS and may not be comparable to similar financial measures or ratios disclosed by other issuers. Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A for additional information regarding these non-GAAP measures and non-GAAP ratios.

Risk Factors and Forward-Looking Information

Management has identified the primary risk factors that could have a material impact on the financial results and operations of Pembina. Such risk factors are described in the "Risk Factors" section of this MD&A and are also included in Pembina's AIF. The Company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Forward-Looking Statements & Information" section of this MD&A. This MD&A contains forward-looking statements based on Pembina's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company's future plans and expectations and may not be appropriate for other purposes.

Pembina Pipeline Corporation 2023 Annual Report 1

1. ABOUT PEMBINA

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for 70 years. Pembina owns an integrated network of hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through our integrated value chain, we seek to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Pembina's Purpose and Strategy

We deliver extraordinary energy solutions so the world can thrive.

Pembina will build on its strengths by continuing to invest in and grow the core businesses that provide critical transportation and midstream services to help ensure reliable and secure energy supply. Pembina will capitalize on exciting opportunities to leverage its assets and expertise into new service offerings that proactively respond to the transition to a lower-carbon economy. In continuing to meet global energy demand and its customers' needs, while ensuring Pembina's long-term success and resilience, the Company has established four strategic priorities:

1.To be resilient, we will sustain, decarbonize, and enhance our businesses. This priority is focused on strengthening and growing our existing franchise and demonstrating environmental leadership.

2.To thrive, we will invest in the energy transition to improve the basins in which we operate. We will expand our portfolio to include new businesses associated with lower-carbon commodities.

3.To meet global demand, we will transform and export our products. We will continue our focus on supporting the transformation of Western Canadian Sedimentary Basin commodities into higher margin products and enabling more coastal egress.

4.To set ourselves apart, we will create a differentiated experience for our stakeholders. We remain committed to delivering excellence for our four key stakeholder groups meaning that:

a.Employees say we are the 'employer of choice' and value our safe, respectful, collaborative, and inclusive work culture.

b.Communities welcome us and recognize the net positive impact of our social and environmental commitment.

c.Customers choose us first for reliable and value-added services.

d.Investors receive sustainable industry-leading total returns.

2 Pembina Pipeline Corporation 2023 Annual Report

Alliance/Aux Sable Acquisition

On December 13, 2023, Pembina announced that it had entered into an agreement with Enbridge Inc. ("Enbridge") to acquire all of Enbridge's interests in the Alliance, Aux Sable and NRGreen joint ventures for an aggregate purchase price of approximately $3.1 billion (subject to certain adjustments), including approximately $327 million of assumed debt, representing Enbridge's proportionate share of the indebtedness of Alliance (the "Alliance/Aux Sable Acquisition"). Upon closing of the Alliance/Aux Sable Acquisition, Pembina will hold 100 percent of the equity interests in Alliance, Aux Sable's Canadian operations and NRGreen and approximately 85 percent of Aux Sable's U.S. operations.

In connection with the Alliance/Aux Sable Acquisition, on December 19, 2023, Pembina closed a bought deal offering in Canada and the United States of subscription receipts (the "Subscription Receipt Offering"), pursuant to which Pembina issued and sold 29.9 million subscription receipts (including 3.9 million subscription receipts issued pursuant to the exercise in full by the underwriters for the Subscription Receipt Offering of the over-allotment option granted to them by Pembina) at a price of $42.85 per subscription receipt for total gross proceeds of approximately $1.3 billion.

The purchase price and the expenses related to the Alliance/Aux Sable Acquisition will be funded through a combination of: (i) the net proceeds of the Subscription Receipt Offering; (ii) a portion of the net proceeds of the offering of $1.8 billion aggregate principal amount of senior unsecured medium-term notes, which closed on January 12, 2024; and (iii) amounts drawn under Pembina's existing credit facilities and cash on hand. Refer to the "Share Capital" and "Liquidity & Capital Resources - Financing Activity" sections of this MD&A for additional information.

The Alliance/Aux Sable Acquisition is expected to close in the first half of 2024, subject to the satisfaction or waiver of customary closing conditions, including the receipt of required regulatory approvals.

Pembina Pipeline Corporation 2023 Annual Report 3

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

| Revenue | 2,466 | | 2,699 | | (233) | | |

Net revenue(1) | 1,117 | | 1,043 | | 74 | | |

| | | | |

Gross profit | 850 | | 681 | | 169 | | |

Adjusted EBITDA(1) | 1,033 | | 925 | | 108 | | |

| | | | |

Earnings | 698 | | 243 | | 455 | | |

Earnings per common share – basic and diluted (dollars) | 1.21 | | 0.39 | | 0.82 | | |

| | | | |

| Cash flow from operating activities | 880 | | 947 | | (67) | | |

Cash flow from operating activities per common share – basic (dollars) | 1.60 | | 1.72 | | (0.12) | | |

Adjusted cash flow from operating activities(1) | 747 | | 690 | | 57 | | |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 1.36 | | 1.25 | | 0.11 | | |

| Capital expenditures | 177 | | 143 | | 34 | | |

Total volumes (mboe/d)(2) | 3,453 | | 3,392 | | 61 | | |

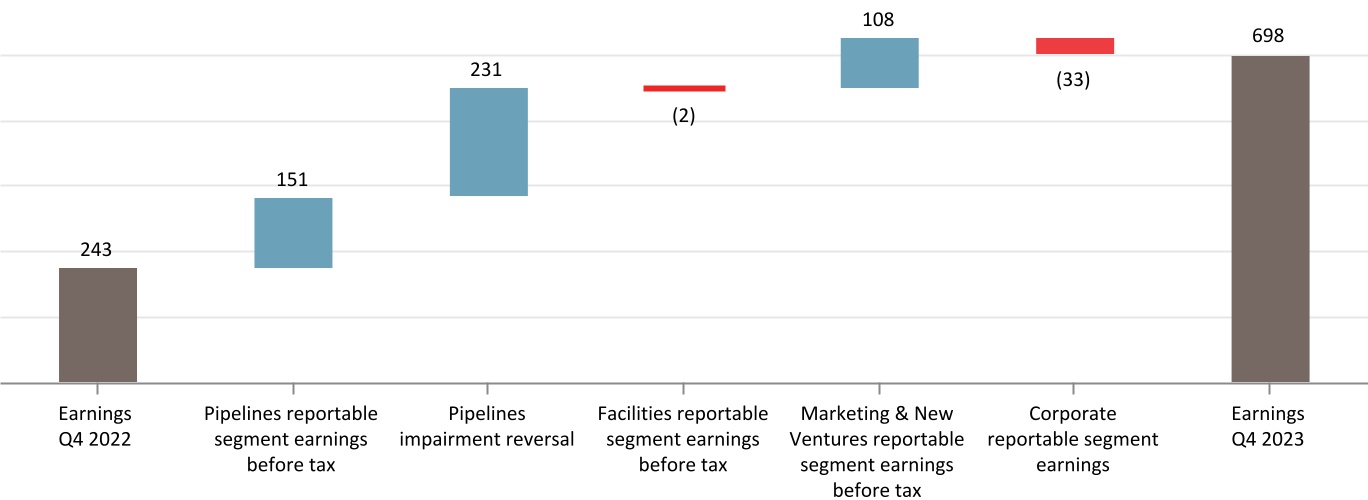

Change in Earnings ($ millions)(3)

Results Overview

Earnings in the fourth quarter of 2023 reflect continued growth in the Pipelines and Marketing & New Ventures Divisions, while the Facilities Division saw higher revenues from its terminalling assets. During the quarter, the Pipelines Division also recognized an impairment reversal related to the reactivation of the Nipisi Pipeline. Additionally, earnings were impacted by the following factors:

•Pipelines: higher net revenues, partially offset by lower Share of Profit from Alliance. This is coupled with lower other expenses as a result of the Ruby settlement provision that was incurred in the fourth quarter of 2022.

•Facilities: lower project write-off costs, offset by higher depreciation during the quarter compared to the fourth quarter of 2022.

•Marketing & New Ventures: gains on commodity-related derivatives for the quarter compared to losses in the fourth quarter of 2022, higher Share of Profit from Aux Sable, and higher margins on NGL sales, which were offset by lower margins on natural gas sales.

•Corporate: higher income tax expense due to higher earnings compared to the same period in 2022.

4 Pembina Pipeline Corporation 2023 Annual Report

| | | | | | |

Changes in Results for the Three Months Ended December 31 |

| Revenue | | $233 million decrease, resulting from lower revenue in Marketing & New Ventures primarily due to a decrease in prices across the crude oil complex and lower NGL prices, and lower recoverable operating expenses in the Pipelines and Facilities Divisions. These results were partially offset by higher revenue in Pipelines due to higher volumes and increased tolls largely due to contractual inflation adjustments on certain of Pembina's Pipelines assets, combined with higher recoverable project costs, higher terminalling revenue in Facilities, and higher marketed NGL volumes. |

| Cost of goods sold | | $307 million decrease, primarily due to lower crude oil and NGL market prices, partially offset by higher marketed NGL volumes in Marketing & New Ventures. |

| Operating expenses | | $23 million decrease, due to lower recoverable power costs on certain of Pembina's Pipelines and Facilities assets. |

| | |

| Impairment reversal | | $231 million recognized in December 2023 related to the reactivation and incremental firm contracts on the Nipisi Pipeline. |

| | |

| Cash flow from operating activities | | $67 million decrease, primarily driven by the change in non-cash working capital, higher taxes paid, and a decrease in payments collected through contract liabilities, partially offset by an increase in earnings adjusted for items not involving cash. |

Adjusted cash flow from operating activities(1) | | $57 million increase, largely due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital and taxes paid, partially offset by higher current income tax expense. |

Adjusted EBITDA(1) | | $108 million increase, primarily due to higher net revenue on certain of Pembina's Pipelines and Facilities assets, as well as higher adjusted EBITDA from PGI and Aux Sable. These results were partially offset by realized losses on commodity-related derivatives during the fourth quarter of 2023 compared to gains in the fourth quarter of 2022, lower adjusted EBITDA from Alliance, and higher general and administrative expenses. |

Total volumes (mboe/d)(2) | | 61 mboe/d increase, largely driven by higher volumes on certain of Pembina's Pipelines assets resulting from new contracts and the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, combined with increased producer activity at certain PGI assets, partially offset by lower volumes at the Redwater Complex. |

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(2) Total revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section of this MD&A for further information.

(3) Pipelines reportable segment earnings before tax excludes impairment reversal.

Pembina Pipeline Corporation 2023 Annual Report 5

Consolidated Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

| Revenue | 9,125 | | 11,611 | | (2,486) | | |

Net revenue(1) | 3,994 | | 4,247 | | (253) | | |

| | | | |

Gross profit | 2,840 | | 3,123 | | (283) | | |

Adjusted EBITDA(1) | 3,824 | | 3,746 | | 78 | | |

| | | | |

Earnings | 1,776 | | 2,971 | | (1,195) | | |

Earnings per common share – basic (dollars) | 3.00 | | 5.14 | | (2.14) | | |

Earnings per common share – diluted (dollars) | 2.99 | | 5.12 | | (2.13) | | |

| Cash flow from operating activities | 2,635 | | 2,929 | | (294) | | |

Cash flow from operating activities per common share – basic (dollars) | 4.79 | | 5.30 | | (0.51) | | |

Adjusted cash flow from operating activities(1) | 2,646 | | 2,661 | | (15) | | |

Adjusted cash flow from operating activities per common share – basic (dollars)(1) | 4.81 | | 4.82 | | (0.01) | | |

| Capital expenditures | 606 | | 605 | | 1 | | |

Total volumes (mboe/d)(2) | 3,306 | | 3,383 | | (77) | | |

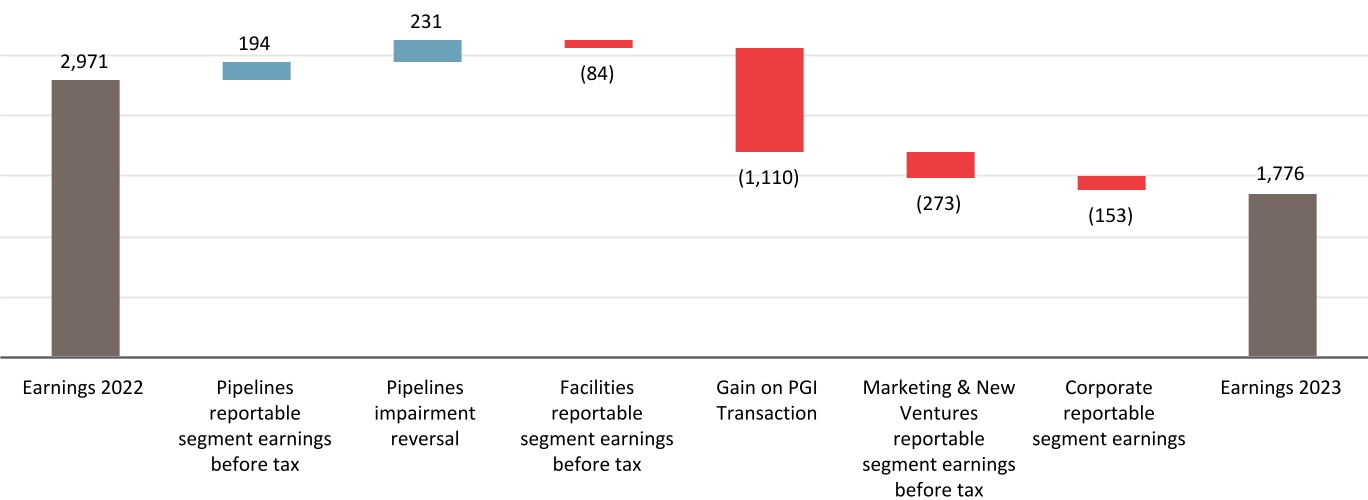

Change in Earnings ($ millions)(3)(4)

Results Overview

Earnings for 2023 reflect resilient performance in the Pipelines Division, despite the impact of the Northern Pipeline system outage, Wildfires, and third-party outages during the period. The Pipelines Division also recognized an impairment reversal in the fourth quarter of 2023, related to the reactivation of the Nipisi Pipeline. The Facilities Division was impacted by the net operating result of the PGI Transaction, while the previous year benefited from a gain on the PGI Transaction. The Marketing & New Ventures Division saw lower margins on crude oil, NGL, and natural gas sales due to a lower pricing environment for the year compared to 2022. Additionally, earnings were impacted by the following factors:

•Pipelines: higher net revenues, partially offset by lower Share of Profit from Alliance, higher operating expenses, and higher depreciation. This is coupled with lower other and general & administrative expenses as a result of the Ruby settlement provision and associated legal fees incurred in the fourth quarter of 2022.

•Facilities: the impact of the PGI Transaction, partially offset by a gain resulting from a contract renewal of an asset now recognized as a finance lease.

•Marketing & New Ventures: lower contribution from Aux Sable, partially offset by lower losses on commodity-related derivatives for the year compared to 2022, and gains recognized on foreign exchange derivatives compared to losses in 2022.

•Corporate: higher income tax expense due to the reduction in tax expense recorded in 2022 as a result of the PGI Transaction, and lower general and administrative expenses, net of shared service revenue.

6 Pembina Pipeline Corporation 2023 Annual Report

| | | | | | |

Changes in Results for the 12 Months Ended December 31 |

| Revenue | | $2.5 billion decrease, resulting from lower revenue in Marketing & New Ventures primarily due to the decrease in prices across the crude oil complex and lower NGL prices, combined with lower revenue in Facilities largely due to revenue from the field-based gas processing assets contributed to PGI now being reflected in share of profit from equity accounted investees ("Share of Profit") (2022 included $295 million in revenue related to the assets contributed to PGI) and lower recoverable power costs. Additionally, the unplanned outage on the Northern Pipeline system in the first quarter of 2023 ("Northern Pipeline system outage"), resulted in a negative impact on consolidated revenue of $54 million. Also, during the second quarter of 2023, volumes on certain assets in Pipelines were temporarily curtailed due to the wildfires in Alberta and British Columbia ("Wildfires"), resulting in a negative impact to consolidated revenue of $23 million. These results were partially offset by higher revenue in Pipelines due to higher volumes and increased tolls largely due to contractual inflation adjustments, as well as higher recoverable project costs. |

| Cost of goods sold | | $2.2 billion decrease, primarily due to lower crude oil and NGL market prices. |

| Operating expenses | | $44 million decrease, primarily due to lower Facilities operating expenses as a result of the PGI Transaction (2022 included $71 million in operating expenses related to the assets contributed to PGI) and lower recoverable power costs at certain of Pembina's Pipelines assets, combined with lower recoverable geotechnical costs related to the Western Pipeline, partially offset by $17 million in costs associated with the Northern Pipeline system outage, as well as higher integrity spending primarily on the Northern Pipeline system and the Cochin Pipeline, and higher repairs and maintenance costs. |

| Impairment reversal | | $231 million recognized in December 2023 related to the reactivation and incremental firm contracts on the Nipisi Pipeline. |

| Cash flow from operating activities | | $294 million decrease, primarily driven by the change in non-cash working capital, a decrease in earnings adjusted for items not involving cash, combined with a decrease in payments collected through contract liabilities and higher share-based compensation payments, partially offset by higher distributions from equity accounted investees and lower taxes paid. |

Adjusted cash flow from operating activities(1) | | $15 million decrease, primarily due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital, taxes paid, and share-based compensation payments, combined with higher current tax expense, partially offset by lower accrued share-based payment expense. |

Adjusted EBITDA(1) | | $78 million increase, primarily due to higher net revenue on certain of Pembina's Pipelines assets, and higher adjusted EBITDA from PGI which more than offset the lower adjusted EBITDA from Aux Sable, Alliance, and Ruby. Additionally, there were realized gains on commodity-related derivatives during the period compared to losses recognized during 2022, and a $16 million gain resulting from a contract renewal of an asset now recognized as a finance lease. These results were partially offset by lower net revenue from the Facilities and Marketing & New Ventures Divisions, the impact in Pipelines and Facilities resulting from the Northern Pipeline system outage ($71 million) and the Wildfires ($24 million), as well as higher general and administrative expenses. |

Total volumes (mboe/d)(2) | | 77 mboe/d decrease, largely driven by the disposition of Pembina's interest in certain Facilities assets at Empress in the fourth quarter of 2022, impacts of the Northern Pipeline system outage and the Wildfires which resulted in lower volumes of 46 mboe/d and 14 mboe/d, respectively, combined with lower volumes from Ruby and planned outages in certain Facilities assets in the third quarter of 2023, partially offset by the volumes at certain PGI assets and higher volumes on certain assets in Pipelines due to new contracts, and the reactivation of the Nipisi Pipeline in the fourth quarter of 2023. |

(1) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(2) Total revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section of this MD&A for further information.

(3) Pipelines reportable segment earnings before tax excludes impairment reversal.

(4) Facilities reportable segment earnings before tax excludes the gain recognized in connection with the PGI Transaction.

Pembina Pipeline Corporation 2023 Annual Report 7

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, storage and rail services in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. Through Pembina's wholly-owned and joint venture assets, the Pipelines Division manages pipeline transportation capacity of 2.9 mmboe/d(1), above ground storage capacity of approximately 10 mmbbls(1) and rail terminalling capacity of approximately 105 mboe/d(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crude oil, condensate and natural gas liquids from western Alberta and northeast British Columbia to the Edmonton, Alberta area for further processing or transportation on downstream pipelines. The oil sands and heavy oil assets transport heavy and synthetic crude oil produced within Alberta to the Edmonton, Alberta area and offer associated storage, terminalling and rail services. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages to Pembina's Facilities Division assets across North America, enabling integrated customer service offerings. Together, these assets supply products from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, and Illinois, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Through its wholly-owned assets and its interest in PGI, Pembina's natural gas gathering and processing facilities are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and are integrated with the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately 5.4 bcf/d(2) for its customers. Condensate and NGL extracted at virtually all Canadian-based facilities have access to transportation on Pembina's pipelines. In addition, all NGL transported along the Alliance Pipeline are extracted through the Pembina operated Channahon Facility at the terminus. The Facilities Division includes approximately 354 mbpd(2) of NGL fractionation capacity, 21 mmbbls(1) of cavern storage capacity and associated pipeline and rail terminalling facilities and a liquefied propane export facility on Canada's West Coast. These facilities are fully integrated with the Company's other divisions, providing customers with the ability to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine import/export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division leverages Pembina's integrated value chain and existing network of pipelines, facilities, and energy infrastructure assets to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina pursues the creation of new markets, and further enhances existing markets, to support both the Company's and its customers' business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure. The division also focuses on developing new business platforms and undertaking initiatives that seek to reduce the greenhouse gas ("GHG") emissions of Pembina's and its customers' operations.

Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities including buying and selling products (natural gas, ethane, propane, butane, condensate, crude oil, electricity, and carbon credits), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale. Through this infrastructure capacity, including Pembina's Prince Rupert Terminal, as well as utilizing the Company's expansive rail fleet and logistics capabilities, Pembina's marketing business adds incremental value to the commodities by accessing high value markets across North America and globally.

The Marketing & New Ventures Division is also responsible for the development of new large-scale, or value chain extending projects, including those that provide enhanced access to global markets and support a transition to a lower-carbon economy. Currently, Pembina is pursuing opportunities associated with liquefied natural gas ("LNG"), low-carbon commodities, and large-scale GHG emissions reductions.

(1)Net capacity.

(2)Net capacity; includes Aux Sable capacity; the financial and operational results for Aux Sable are included in the Marketing & New Ventures Division.

8 Pembina Pipeline Corporation 2023 Annual Report

Financial and Operational Overview by Division

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 |

| 2023 | 2022 |

($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | | | | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | | | | Adjusted EBITDA(2) |

| Pipelines | 2,652 | | 677 | | | | | 617 | | 2,593 | | 295 | | | | | 548 | |

| Facilities | 801 | | 143 | | | | | 324 | | 799 | | 145 | | | | | 288 | |

Marketing & New Ventures | — | | 204 | | | | | 173 | | — | | 96 | | | | | 171 | |

| Corporate | — | | (209) | | | | | (81) | | — | | (206) | | | | | (82) | |

| Total | 3,453 | | 815 | | | | | 1,033 | | 3,392 | | 330 | | | | | 925 | |

| | | | | | | | | | | | |

| 12 Months Ended December 31 |

| 2023 | 2022 |

($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | | | | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings (Loss) Before Tax | | | | Adjusted EBITDA(2) |

| Pipelines | 2,538 | | 1,840 | | | | | 2,234 | | 2,524 | | 1,415 | | | | | 2,127 | |

| Facilities | 768 | | 610 | | | | | 1,213 | | 859 | | 1,804 | | | | | 1,137 | |

Marketing & New Ventures | — | | 435 | | | | | 597 | | — | | 708 | | | | | 721 | |

| Corporate | — | | (696) | | | | | (220) | | — | | (708) | | | | | (239) | |

| Total | 3,306 | | 2,189 | | | | | 3,824 | | 3,383 | | 3,219 | | | | | 3,746 | |

(1) Total revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity. Marketed NGL volumes are excluded from volumes to avoid double counting. Refer to the "Marketing & New Ventures" section of this MD&A for further information.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Equity Accounted Investees Overview by Division

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 |

| | | | |

| 2023 | 2022 |

| ($ millions, except where noted) | Share of profit | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) | Share of profit (loss) | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Pipelines(1) | 31 | | 76 | | 19 | | 79 | | 142 | | 44 | | 85 | | 4 | | 96 | | 147 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Facilities(2) | 48 | | 183 | | — | | 116 | | 356 | | 49 | | 156 | | 32 | | 110 | | 336 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Marketing & New Ventures(3) | 15 | | 21 | | 183 | | 32 | | 35 | | (14) | | (14) | | 10 | | 29 | | 35 | |

| Total | 94 | | 280 | | 202 | | 227 | | 533 | | 79 | | 227 | | 46 | | 235 | | 518 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12 Months Ended December 31 |

| | | | |

| 2023 | 2022 |

| ($ millions, except where noted) | Share of profit (loss) | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) | Share of profit | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Pipelines(1) | 109 | | 281 | | 20 | | 279 | | 140 | | 171 | | 343 | | 4 | | 343 | | 158 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Facilities(2) | 233 | | 671 | | 33 | | 463 | | 351 | | 108 | | 379 | | 62 | | 196 | | 183 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Marketing & New Ventures(3) | (26) | | 58 | | 218 | | 77 | | 34 | | 82 | | 107 | | 29 | | 134 | | 36 | |

| Total | 316 | | 1,010 | | 271 | | 819 | | 524 | | 361 | | 829 | | 95 | | 673 | | 377 | |

(1) Pipelines includes Alliance, Ruby (Pembina ceased to have an interest in the Ruby Pipeline on January 13, 2023), and Grand Valley.

(2) Facilities includes PGI, Veresen Midstream (which was contributed to PGI as part of the PGI Transaction on August 15, 2022), and Fort Corp.

(3) Marketing and New Ventures includes Aux Sable, CKPC (which was dissolved on December 31, 2023), Cedar LNG, and ACG.

(4) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(5) Distributions exclude returns of capital. In 2023, Pembina received an incremental $61 million from PGI as a return of capital (2022: nil).

(6) Total revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation 2023 Annual Report 9

Pipelines

Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

| | | | |

| | | | |

| | | | |

Pipelines revenue(1) | 737 | | 686 | | 51 | | |

Cost of goods sold(1) | 11 | | — | | 11 | | |

Net revenue(1)(2) | 726 | | 686 | | 40 | | |

Operating expenses(1) | 171 | | 205 | | (34) | | |

| Depreciation and amortization included in operations | 110 | | 104 | | 6 | | |

| Share of profit from equity accounted investees | 31 | | 44 | | (13) | | |

| Gross profit | 476 | | 421 | | 55 | | |

| Reportable segment earnings before tax | 677 | | 295 | | 382 | | |

| | | | |

Adjusted EBITDA(2) | 617 | | 548 | | 69 | | |

Volumes (mboe/d)(3) | 2,652 | | 2,593 | | 59 | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

| | |

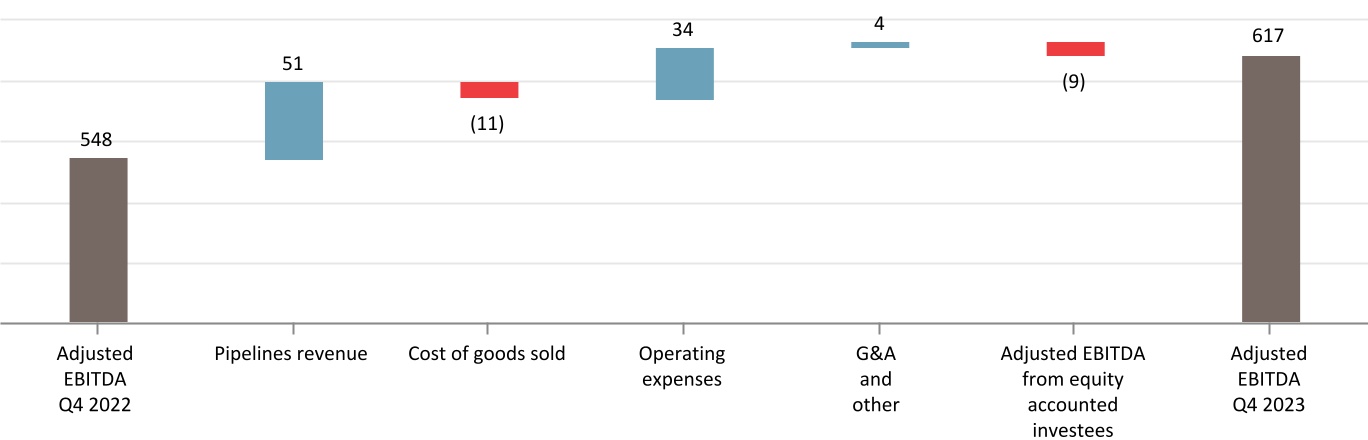

Net revenue(1)(2) | | Increase largely due to higher volumes on the Peace Pipeline system and on the Drayton Valley Pipeline, net loss allowance, higher tolls primarily on the Cochin Pipeline and the Peace Pipeline system largely related to contractual inflation adjustments, and higher recoverable project costs primarily on the Peace Pipeline system, combined with the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, partially offset by lower recoverable power costs. |

| | |

Operating expenses(1) | | Decrease largely due to lower recoverable power costs, as a result of the lower power pool price during the period. |

| | |

| Share of profit from equity accounted investees | | Decrease primarily due to lower revenues from Alliance as a result of lower interruptible tolls and volumes. |

| Reportable segment earnings before tax | | Increase largely due to the reversal of impairment related to the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, the Ruby settlement provision incurred in the fourth quarter of 2022, higher revenue, discussed above, partially offset by lower Share of Profit from Alliance, discussed above. |

Adjusted EBITDA(2) | | Increase largely due to higher revenue, discussed above, partially offset by lower revenue from Alliance due to the lower interruptible tolls and volumes. Included in adjusted EBITDA is $74 million (2022: $83 million) related to Alliance. |

Volumes (mboe/d)(3) | | Increase primarily due to the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, higher contracted volumes on the Peace Pipeline system, as well as higher volumes on the Drayton Valley Pipeline. Volumes include 142 mboe/d (2022: 147 mboe/d) related to Alliance. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

10 Pembina Pipeline Corporation 2023 Annual Report

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

| | | | |

| | | | |

| | | | |

Pipelines revenue(1) | 2,707 | | 2,508 | | 199 | | |

Cost of goods sold(1) | 17 | | — | | 17 | | |

Net revenue(1)(2) | 2,690 | | 2,508 | | 182 | | |

Operating expenses(1) | 695 | | 677 | | 18 | | |

| Depreciation and amortization included in operations | 414 | | 396 | | 18 | | |

| Share of profit from equity accounted investees | 109 | | 171 | | (62) | | |

| Gross profit | 1,690 | | 1,606 | | 84 | | |

| Reportable segment earnings before tax | 1,840 | | 1,415 | | 425 | | |

| | | | |

Adjusted EBITDA(2) | 2,234 | | 2,127 | | 107 | | |

Volumes (mboe/d)(3) | 2,538 | | 2,524 | | 14 | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

| | |

Net revenue(1)(2) | | Increase largely due to higher contracted volumes and tolls on the Peace Pipeline system, net loss allowance, as well as higher tolls and the higher U.S. dollar exchange rate on the Cochin Pipeline, higher recoverable project costs on various systems, and higher volumes on the Vantage Pipeline due to third party outages in 2022, combined with the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, partially offset by lower revenue due to the Northern Pipeline system outage and the Wildfires, a deferred recognition of flow-through charges for capital integrity work on the Peace Pipeline system during the second quarter of 2023 that resulted in a revenue timing difference, as well as lower recoverable power costs. |

| | |

Operating expenses(1) | | Increase largely due to costs associated with the Northern Pipeline system outage, higher integrity spending primarily on the Northern Pipeline system and the Cochin Pipeline, and higher repairs and maintenance costs, partially offset by lower recoverable geotechnical costs primarily related to the Western Pipeline and lower recoverable power costs, as a result of the lower power pool prices in the fourth quarter of 2023. |

Depreciation and amortization included in operations | | Increase primarily due to asset upgrades and associated retirements during 2023 and assets placed into service in the second half of 2022. |

Share of profit from equity accounted investees | | Decrease primarily due to lower revenues from Alliance as 2022 included the sale of linepack inventory, as well as lower revenues as a result of lower interruptible tolls and volumes and seasonal contracts being replaced by firm contracts at lower regulated rates. |

| Reportable segment earnings before tax | | Increase largely due to the reversal of impairment related to the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, the Ruby settlement provision and associated legal fees incurred in 2022, and higher revenue, discussed above, partially offset by lower Share of Profit from Alliance, higher operating expenses, and higher depreciation, discussed above. |

Adjusted EBITDA(2) | | Increase due to higher revenue, discussed above, partially offset by lower revenue from Alliance and no adjusted EBITDA from Ruby since the first quarter of 2022. Refer to the "Selected Equity Accounted Investee Information" section for further details on Ruby. Included in adjusted EBITDA is $277 million (2022: $323 million) related to Alliance and nil (2022: $15 million) related to Ruby. |

Volumes (mboe/d)(3) | | Increase primarily due to higher contracted volumes on the Peace Pipeline system, the reactivation of the Nipisi Pipeline in the fourth quarter of 2023, and higher volumes on the Vantage Pipeline due to third-party outages in 2022, partially offset by lower volumes related to the Northern Pipeline system outage, the impacts of the Wildfires, and lower volumes from Ruby. Volumes include 140 mboe/d (2022: 144 mboe/d) related to Alliance and nil (2022: 14 mboe/d) related to Ruby. |

Pembina Pipeline Corporation 2023 Annual Report 11

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| | |

| 2023 | 2022 | 2023 | 2022 |

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) |

Pipelines(3) | | | | | | | | | | | | |

| Conventional | 1,054 | | 311 | | 370 | | 1,024 | | 266 | | 314 | | 968 | | 1,085 | | 1,296 | | 959 | | 1,026 | | 1,208 | |

| Transmission | 590 | | 117 | | 189 | | 593 | | 4 | | 177 | | 586 | | 421 | | 702 | | 589 | | 278 | | 679 | |

| Oil Sands & Heavy Oil | 1,008 | | 251 | | 60 | | 976 | | 26 | | 58 | | 984 | | 341 | | 243 | | 976 | | 121 | | 250 | |

| General & administrative | — | | (2) | | (2) | | — | | (1) | | (1) | | — | | (7) | | (7) | | — | | (10) | | (10) | |

| Total | 2,652 | | 677 | | 617 | | 2,593 | | 295 | | 548 | | 2,538 | | 1,840 | | 2,234 | | 2,524 | | 1,415 | | 2,127 | |

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines Division. Refer to Pembina's AIF for the year ended December 31, 2023.

12 Pembina Pipeline Corporation 2023 Annual Report

Projects & New Developments(1)

Pipelines continues to focus on the execution of various system expansions. The projects in the following table were recently placed into service.

| | | | | |

| Significant Projects | In-service Date |

| Phase IX Peace Pipeline Expansion | December 2022 |

The following outlines the projects and new developments within Pipelines:

| | | | | | | | |

| Phase VIII Peace Pipeline Expansion | | |

Original Capital Budget: $530 million | In-service Date: Second quarter of 2024 | Status: On time, trending under budget |

Revised Cost Estimate: $430 million |

This expansion will enable segregated pipeline service for ethane-plus and propane-plus NGL mix from Gordondale, Alberta, which is centrally located within the Montney trend, into the Edmonton area for market delivery. The project includes new 10-inch and 16-inch pipelines, totaling approximately 150 km, in the Gordondale to La Glace corridor of Alberta, as well as new mid-point pump stations and terminal upgrades located throughout the Peace Pipeline system. Phase VIII will add approximately 235 mbpd of incremental capacity between Gordondale, Alberta and La Glace, Alberta, as well as approximately 65 mbpd of capacity between La Glace, Alberta and the Namao hub near Edmonton, Alberta. The estimated project cost has been revised lower to $430 million, compared to the original budget of $530 million. The revised cost reflects highly effective project management and execution, favourable weather conditions and productive contractor relationships. The project is trending on time, with three pump stations completed. The construction is expected to be completed in the first quarter of 2024, with pipeline and facility commissioning and start-up expected in the second quarter of 2024. |

|

| | | | | | | | |

| NEBC MPS Expansion | | |

Capital Budget: $90 million | In-service Date: Fourth quarter of 2024 | Status: On time, on budget |

The NEBC MPS Expansion includes a new mid-point pump station, terminal upgrades, and additional storage, which will support approximately 40,000 bpd of incremental capacity on the NEBC Pipeline system. This capacity will fulfill customer demand in light of growing production volumes from NEBC and previously announced long-term midstream service agreements with three premier NEBC Montney producers. |

|

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2023 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

Pembina Pipeline Corporation 2023 Annual Report 13

Facilities

Financial Overview for the Three Months Ended December 31

Results of Operations | | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

| | | | |

| | | | |

Facilities revenue(1) | 248 | | 237 | | 11 | | |

Cost of goods sold(1) | — | | — | | — | | |

Net revenue(1)(2) | 248 | | 237 | | 11 | | |

Operating expenses(1) | 95 | | 104 | | (9) | | |

Depreciation and amortization included in operations | 46 | | 34 | | 12 | | |

| | | | |

| Unrealized gain on commodity-related derivative financial instruments | — | | (2) | | 2 | | |

Share of profit from equity accounted investees | 48 | | 49 | | (1) | | |

| Gross profit | 155 | | 150 | | 5 | | |

| Reportable segment earnings before tax | 143 | | 145 | | (2) | | |

| | | | |

Adjusted EBITDA(2) | 324 | | 288 | | 36 | | |

Volumes (mboe/d)(3) | 801 | | 799 | | 2 | | |

| | | | | | |

| Changes in Results | | |

| | |

| | |

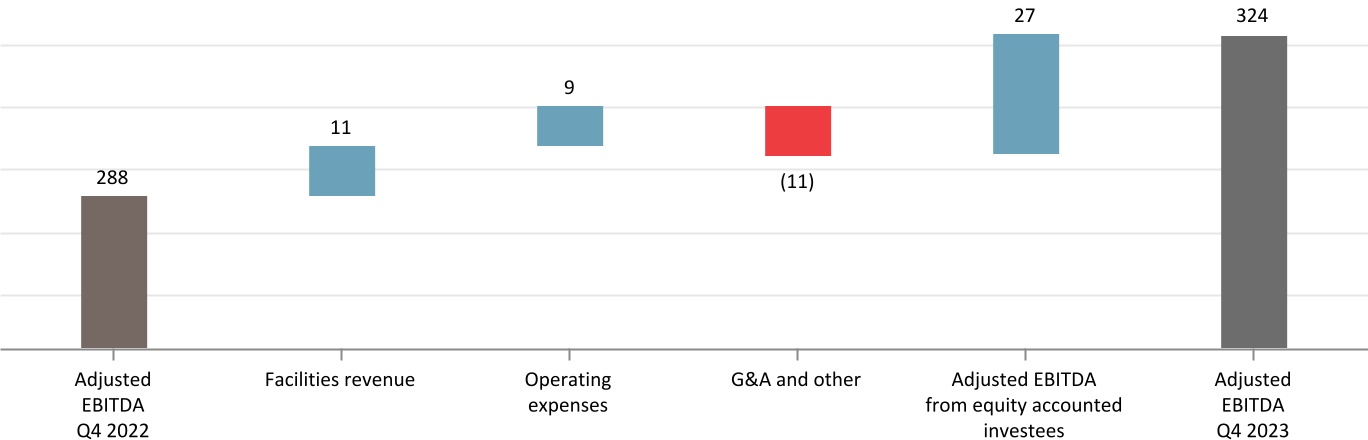

Net revenue(1)(2) | | Increase largely due to higher terminalling revenue at the Redwater Complex and at Vancouver Wharves, partially offset by lower recoverable power costs at the Redwater Complex and at Empress, discussed below. |

Operating expenses(1) | | Decrease largely due to lower recoverable power costs at the Redwater Complex and at Empress as a result of the commissioning of the Empress Cogeneration Facility in November 2022 and the lower power pool price during the quarter. |

| Depreciation and amortization included in operations | | Increase primarily due to asset upgrades and associated retirements in the fourth quarter of 2023. |

| | |

| | |

Share of profit from equity accounted investees | | Consistent with prior period. Lower operating expenses, acquisition costs, and income tax expense, were largely offset by higher net finance costs due to unrealized losses on non-commodity related derivative financial instruments recognized in the fourth quarter of 2023 compared to gains in the fourth quarter of 2022, and higher depreciation due to changes in asset life estimates and more asset retirements in the fourth quarter of 2023 compared to the fourth quarter of 2022. |

| Reportable segment earnings before tax | | Consistent with the prior period. Increased revenue and lower other expenses due to lower project write-offs recognized in the quarter, were largely offset by higher depreciation, discussed above. |

Adjusted EBITDA(2) | | Increase due to the higher adjusted EBITDA from PGI, mainly from the former Energy Transfer Canada plants, at the Hythe Gas Plant and on the Dawson Assets due to increased volumes, combined with higher revenue, discussed above. Included in adjusted EBITDA is $179 million (2022: $153 million) related to PGI. |

| | |

Volumes (mboe/d)(3) | | Consistent with prior period. Increase largely due to higher volumes from PGI, primarily at the Hythe Gas Plant and on the Dawson Assets due to increased producer activity, largely offset by lower volumes at the Redwater Complex. Volumes include 356 mboe/d (2022: 336 mboe/d) related to PGI. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity.

14 Pembina Pipeline Corporation 2023 Annual Report

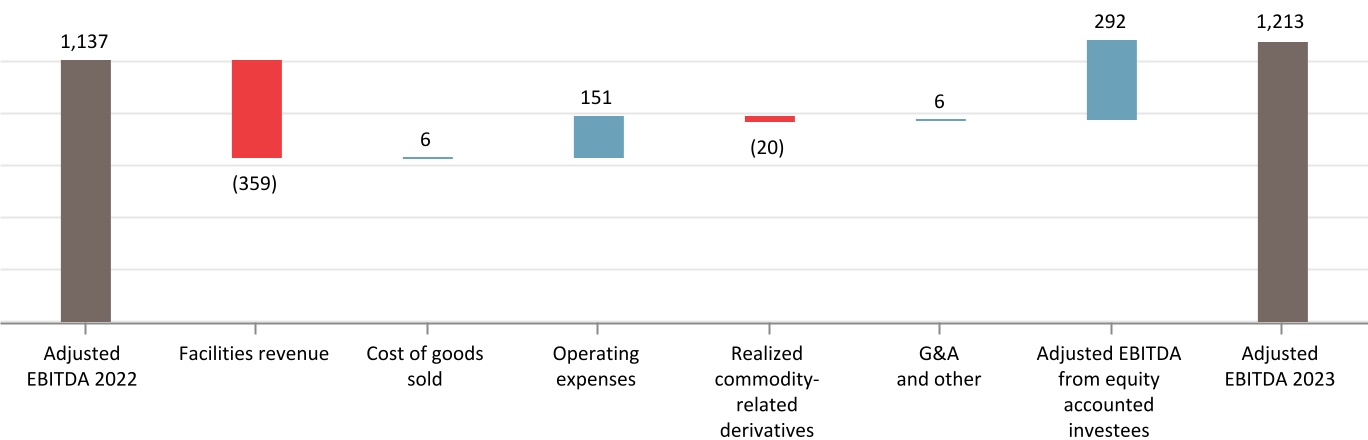

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

($ millions, except where noted) | 2023 | 2022 | Change | |

| | | | |

| | | | |

Facilities revenue(1) | 909 | | 1,268 | | (359) | | |

Cost of goods sold(1) | — | | 6 | | (6) | | |

Net revenue(1)(2) | 909 | | 1,262 | | (353) | | |

Operating expenses(1) | 360 | | 511 | | (151) | | |

Depreciation and amortization included in operations | 159 | | 196 | | (37) | | |

Realized gain on commodity-related derivative financial instruments | — | | (20) | | 20 | | |

| Unrealized gain on commodity-related derivative financial instruments | — | | (50) | | 50 | | |

Share of profit from equity accounted investees | 233 | | 108 | | 125 | | |

| Gross profit | 623 | | 733 | | (110) | | |

| Reportable segment earnings before tax | 610 | | 1,804 | | (1,194) | | |

| | | | |

Adjusted EBITDA(2) | 1,213 | | 1,137 | | 76 | | |

Volumes (mboe/d)(3) | 768 | | 859 | | (91) | | |

| | | | | | |

| Changes in Results | | |

| | |

| | |

Net revenue(1)(2) | | Decrease largely due to the change in ownership of the majority of Pembina's wholly-owned field-based gas processing assets as part of the PGI Transaction. The revenue from these assets is included in Share of Profit (2022 included $295 million in revenue related to the assets contributed to PGI). This is combined with lower recoverable costs as a result of the commissioning of the Empress Cogeneration Facility and the lower power pool price during the period, along with the disposition of Pembina's interest in the E1 and E6 assets at Empress in the fourth quarter of 2022, and lower supply volumes at the Redwater Complex and at Younger primarily due to the Northern Pipeline system outage. |

Operating expenses(1) | | Decrease largely due to the PGI Transaction which resulted in operating expenses for the formerly wholly-owned field-based gas processing assets now being accounted for in Share of Profit (2022 included $71 million in operating expenses related to the assets contributed to PGI), as well as lower recoverable power costs resulting from the commissioning of the Empress Cogeneration Facility and the lower power pool price during the fourth quarter of 2023, and the disposition of Pembina's interest in the E1 and E6 assets. |

| Depreciation and amortization included in operations | | Decrease primarily due to the field-based gas processing assets contributed as part of the PGI Transaction now being accounted for under equity accounting by Pembina for its investment in PGI, partially offset by more asset upgrades and retirements in 2023 compared to 2022. |

| Realized and unrealized gain on commodity-related derivatives | | The commodity-related derivatives were transferred as part of the field-based gas processing assets contributed to PGI on August 15, 2022. |

| | |

Share of profit from equity accounted investees | | Increase primarily due to a full year of earnings from PGI, including a strong contribution from the former Energy Transfer Canada plants, the Hythe Gas Plant, and the Dawson Assets, partially offset by higher depreciation expense, net finance costs, income tax expense, and general and administrative expenses compared to Share of Profit in the first seven and a half months of 2022 when Pembina owned a 45 percent interest in Veresen Midstream. |

| Reportable segment earnings before tax | | Decrease primarily due to the $1.1 billion gain recognized on the PGI Transaction during the third quarter of 2022, coupled with lower contributions resulting from the change in ownership of the majority of Pembina's wholly-owned field-based gas processing assets and commodity-related derivatives as part of the PGI Transaction, and lower supply volumes at the Redwater Complex and at Younger, partially offset by the higher Share of Profit from PGI, lower depreciation, a $16 million gain recognized in the third quarter of 2023 resulting from a contract renewal of an asset now recognized as a finance lease, and lower project write-offs recognized in the period. |

Adjusted EBITDA(2) | | Increase primarily due to the higher contributions from PGI, mainly from the former Energy Transfer Canada plants, the Hythe Gas Plant, and the Dawson Assets and a gain on the recognition of a finance lease, discussed above, partially offset by lower supply volumes at the Redwater Complex and at Younger. Included in adjusted EBITDA is $657 million (2022: $230 million) related to PGI and nil (2022: $135 million) related to Veresen Midstream. |

Volumes (mboe/d)(3) | | Decrease primarily due to the disposition of Pembina's interest in the E1 and E6 assets at Empress in exchange for a processing agreement that provides Pembina with the right to first priority for gas processing at all Plains Midstream-operated assets at Empress, as well as lower volumes at the Redwater Complex and at Younger resulting from the Northern Pipeline system outage and planned outages in the third quarter of 2023, partially offset by the volumes from PGI, primarily at the former Energy Transfer Canada plants and on the Dawson Assets. Volumes include 351 mboe/d (2022: 126 mboe/d) related to PGI and nil (2022: 57 mboe/d) related to Veresen Midstream. |

Pembina Pipeline Corporation 2023 Annual Report 15

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity.

16 Pembina Pipeline Corporation 2023 Annual Report

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| 2023 | 2022 | 2023 | 2022 |

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) |

Facilities(3) | | | | | | | | | | | | |

| Gas Services | 602 | | 57 | | 203 | | 588 | | 82 | | 182 | | 584 | | 285 | | 755 | | 653 | | 1,506 | | 706 | |

| NGL Services | 199 | | 87 | | 122 | | 211 | | 65 | | 108 | | 185 | | 327 | | 460 | | 206 | | 305 | | 438 | |

| General & administrative | — | | (1) | | (1) | | — | | (2) | | (2) | | — | | (2) | | (2) | | — | | (7) | | (7) | |

| Total | 801 | | 143 | | 324 | | 799 | | 145 | | 288 | | 768 | | 610 | | 1,213 | | 859 | | 1,804 | | 1,137 | |

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes do not include Empress processing capacity.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's Gas Services and NGL Services assets within the Facilities operating segment. For a description of Pembina's gas and NGL assets, refer to Pembina's AIF for the year ended December 31, 2023.

Projects & New Developments(1)

Facilities continues to build-out its natural gas and NGL processing and fractionation assets to service customer demand. The projects in the following table were recently placed into service.

| | | | | | | | |

| Significant Projects | In-service Date | | | |

| | | | |

| Empress Cogeneration Facility | November 2022 | | | |

The following outlines the projects and new developments within Facilities:

| | | | | | | | |

| RFS IV | | |

Capital Budget: $460 million | In-service Date(2): First half of 2026 | Status: On time, on budget |

RFS IV is a 55,000 bpd propane-plus fractionator at the existing Redwater fractionation and storage complex (the "Redwater Complex"). The project includes additional rail loading capacity and will leverage the design, engineering, and operating best practices of its existing facilities. With the addition of RFS IV, the fractionation capacity at the Redwater Complex will total 256,000 bpd. Site clearing activities have been completed, engineering and procurement activities continue, and site construction is expected to begin in the second quarter of 2024. |

| | | | | | | | |

| Wapiti Expansion | | |

Capital Budget: $140 million (net to Pembina) | In-service Date(2): First half of 2026 | Status: Recently sanctioned |

PGI is developing an expansion that will increase natural gas processing capacity at the Wapiti Plant by 115 mmcf/d (gross to PGI). The expansion opportunity is driven by strong customer demand supported by growing Montney production and will be full underpinned by long-term, take-or-pay contacts. The project includes a new sales gas pipeline and other related infrastructure. |

| | | | | | | | |

| K3 Cogeneration Facility | | |

Capital Budget: $70 million (net to Pembina) | In-service Date(2): First half of 2026 | Status: Recently sanctioned |

PGI is developing a 28 MW cogeneration facility at its K3 Plant, which is expected to reduce overall operating costs by providing power and heat to the gas processing facility, while reducing customers' exposure to power prices. The K3 Cogeneration Facility is expected to fully supply the K3 Plant's power requirements, with excess power sold to the grid at market rates. Further, this project is expected to contribute to a reduction in annual emissions compliance costs at the K3 Plant through the utilization of the cogeneration waste heat and the low-emission power generated. |

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2023 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

(2) Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section of this MD&A.

Pembina Pipeline Corporation 2023 Annual Report 17

Marketing & New Ventures

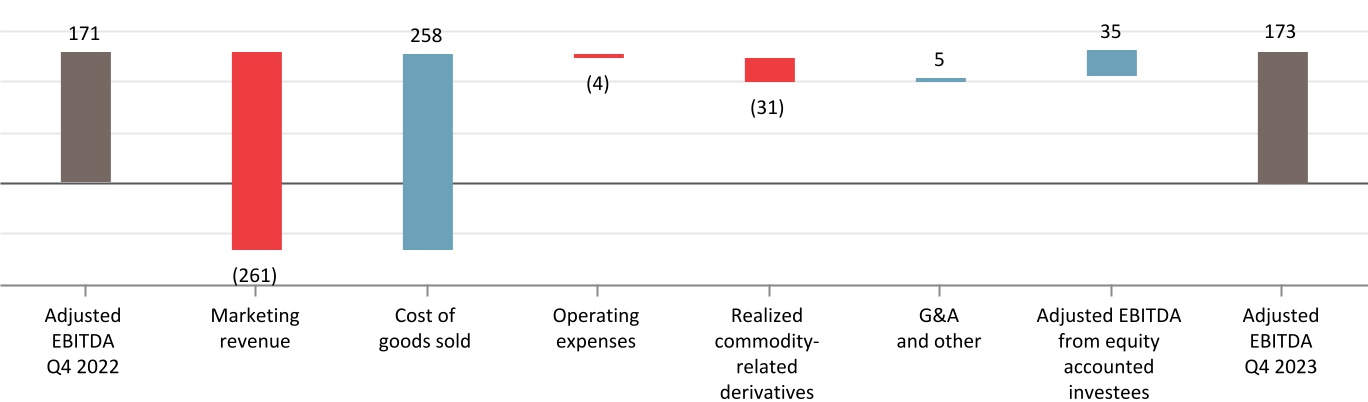

Financial Overview for the Three Months Ended December 31

Results of Operations | | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

Marketing revenue(1) | 1,660 | | 1,921 | | (261) | | |

Cost of goods sold(1) | 1,476 | | 1,734 | | (258) | | |

Net revenue(1)(2) | 184 | | 187 | | (3) | | |

Operating expenses(1) | 4 | | — | | 4 | | |

| Depreciation and amortization included in operations | 12 | | 10 | | 2 | | |

| Realized loss (gain) on commodity-related derivative financial instruments | 21 | | (10) | | 31 | | |

| Unrealized (gain) loss on commodity-related derivative financial instruments | (46) | | 61 | | (107) | | |

| Share of profit (loss) from equity accounted investees | 15 | | (14) | | 29 | | |

| Gross profit | 208 | | 112 | | 96 | | |

| Reportable segment earnings before tax | 204 | | 96 | | 108 | | |

| | | | |

Adjusted EBITDA(2) | 173 | | 171 | | 2 | | |

| | | | |

Volumes (mboe/d)(3) | 217 | | 193 | | 24 | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

Net revenue(1)(2) | | Consistent with prior period. Lower natural gas marketing margins due to the decrease in Chicago natural gas prices, as well as lower crude oil margins resulting from the lower prices across the crude oil complex, were largely offset by higher NGL margins, primarily due to lower input natural gas prices and higher marketed NGL volumes, discussed below. |

| Realized loss (gain) on commodity-related derivatives | | The realized loss is primarily due to losses on natural gas-based derivatives and crude oil-based derivatives, partially offset by realized gains related to renewable power purchase agreements and NGL-based derivatives. |

| Unrealized (gain) loss on commodity-related derivatives | | The unrealized gain on commodity-related derivatives is primarily due to the decrease in the forward prices for crude, as well as contracts that matured and were realized in the period. |

| | |

| | |

| Share of profit (loss) from equity accounted investees | | Increase due to higher Share of Profit from Aux Sable largely resulting from no impact of commodity-related derivatives recognized in the fourth quarter of 2023 compared to losses in the fourth quarter of 2022, partially offset by lower revenues due to lower NGL prices. |

| Reportable segment earnings before tax | | Increase largely due to gains on commodity-related derivatives compared to losses in the fourth quarter of 2022, a higher Share of Profit from Aux Sable, and lower net finance costs due to decreased foreign exchange losses in the period compared to the fourth quarter of 2022, combined with a change in the insurance contract provision related to financial assurances for Cedar LNG during the fourth quarter of 2023. |

Adjusted EBITDA(2) | | Consistent with prior period. Higher contributions from Aux Sable, discussed above, were largely offset by realized losses on commodity-related derivatives compared to gains in the fourth quarter of 2022. Included in adjusted EBITDA is $22 million (2022: $12 million loss) related to Aux Sable. |

| | |

Volumes (mboe/d)(3) | | Increased marketed NGL volumes were primarily driven by higher propane, ethane, and butane sales. Revenue volumes include 35 mboe/d (2022: 35 mboe/d) related to Aux Sable. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Marketed NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

18 Pembina Pipeline Corporation 2023 Annual Report

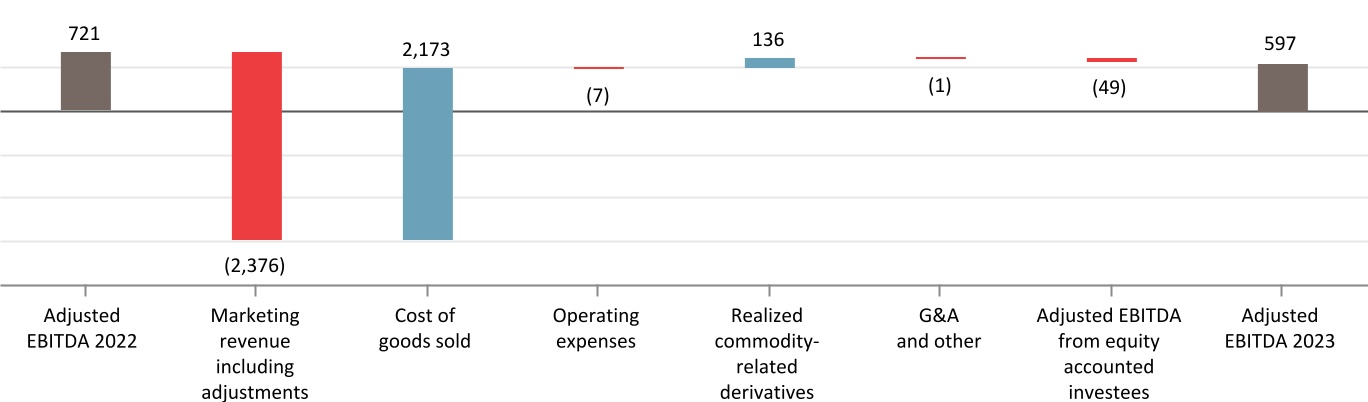

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2023 | 2022 | Change | |

Marketing revenue(1) | 6,087 | | 8,471 | | (2,384) | | |

Cost of goods sold(1) | 5,509 | | 7,682 | | (2,173) | | |

Net revenue(1)(2) | 578 | | 789 | | (211) | | |

Operating expenses(1) | 7 | | — | | 7 | | |

| Depreciation and amortization included in operations | 46 | | 44 | | 2 | | |

| Realized (gain) loss on commodity-related derivative financial instruments | (11) | | 125 | | (136) | | |

| Unrealized loss (gain) on commodity-related derivative financial instruments | 32 | | (83) | | 115 | | |

| Share of (loss) profit from equity accounted investees | (26) | | 82 | | (108) | | |

| Gross profit | 478 | | 785 | | (307) | | |

| Reportable segment earnings before tax | 435 | | 708 | | (273) | | |

| | | | |

Adjusted EBITDA(2) | 597 | | 721 | | (124) | | |

| | | | |

Volumes (mboe/d)(3) | 185 | | 190 | | (5) | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

Net revenue(1)(2) | | Decrease largely due to lower margins on crude oil resulting from the lower prices across the crude oil complex, coupled with lower NGL margins resulting from lower propane and butane prices, and lower natural gas marketing margins due to the decrease in Chicago natural gas prices. |

| | |

| Realized (gain) loss on commodity-related derivatives | | The realized gain is primarily due to gains on NGL-based derivative instruments and renewable power purchase agreements, partially offset by realized losses related to natural gas marketing and crude oil-based derivatives. |

| Unrealized loss (gain) on commodity-related derivative financial instruments | | The unrealized loss on commodity-related derivatives is primarily due to contracts that matured and were realized in the period, as well as the change in the forward prices for natural gas and power, partially offset by gains resulting from the decrease in the forward price for crude. |

| Share of (loss) profit from equity accounted investees | | Decrease largely attributable to lower Share of Profit from Aux Sable resulting from lower revenues due to lower NGL prices, combined with a settlement provision recognized during the third quarter of 2023, partially offset by no impact of commodity-related derivatives recognized in the period compared to losses in 2022. |

| | |

| | |

| Reportable segment earnings before tax | | Decrease largely due to lower net revenue and lower Share of Profit from Aux Sable, discussed above, partially offset by lower losses on commodity-related derivatives in 2023 compared to 2022, and lower net finance costs due to gains recognized on foreign exchange derivatives compared to losses in 2022. |

Adjusted EBITDA(2) | | Decrease largely due to lower net revenue and lower contributions from Aux Sable, which resulted from lower revenues and no impact of realized commodity-related derivatives compared to losses in 2022. These are partially offset by realized gains on commodity-related derivatives in 2023 compared to losses in 2022. Included in adjusted EBITDA is $68 million (2022: $116 million) related to Aux Sable. |

| | |

Volumes (mboe/d)(3) | | Consistent with the prior period. Revenue volumes include 34 mboe/d (2022: 36 mboe/d) related to Aux Sable. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Marketed NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation 2023 Annual Report 19

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| 2023 | 2022 | 2023 | 2022 |

| ($ millions, except where noted) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) | Volumes(1) | Reportable Segment Earnings Before Tax | Adjusted EBITDA(2) |

Marketing & New Ventures(3) | | | | | | | | | | | | |

| Marketing | 217 | | 206 | | 174 | | 193 | | 98 | | 177 | | 185 | | 465 | | 625 | | 190 | | 729 | | 746 | |

New Ventures(4) | — | | (2) | | (1) | | — | | (2) | | (6) | | — | | (30) | | (28) | | — | | (21) | | (25) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | 217 | | 204 | | 173 | | 193 | | 96 | | 171 | | 185 | | 435 | | 597 | | 190 | | 708 | | 721 | |

(1) Marketed NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's marketing activities and new ventures projects within the Marketing & New Ventures operating segment. For further details on Pembina's marketing activities and projects, refer to Pembina's AIF for the year ended December 31, 2023.

(4) All New Ventures projects have not yet commenced operations and therefore have no volumes.

Projects & New Developments(1)

The New Ventures group is responsible for the development of new large-scale, or value chain extending projects, including those that provide enhanced access to global markets and support a transition to a lower-carbon economy. Currently, Pembina is pursuing opportunities associated with LNG, low-carbon commodities, and large-scale GHG emissions reductions.

Pembina has formed a partnership with the Haisla Nation to develop the proposed Cedar LNG project, a three million tonne per annum floating LNG facility strategically positioned to leverage Canada's abundant natural gas supply and British Columbia's growing LNG infrastructure to produce industry-leading low-carbon, cost-competitive Canadian LNG for overseas markets. Cedar LNG will provide a valuable outlet for WCSB natural gas to access global markets and is expected to achieve higher prices for Canadian producers, contribute to lower overall emissions, and enhance global energy security. Given that Cedar LNG will be a floating facility, manufactured in the controlled conditions of a shipyard, it is expected that the project will have lower construction and execution risk. Further, powered by BC Hydro, Cedar LNG is expected to be one of the lowest emissions LNG facilities in the world.

Cedar LNG has substantially completed several key project deliverables, including obtaining material regulatory approvals; advancing inter-project agreements with Coastal GasLink and LNG Canada; signing a heads of agreement with Samsung Heavy Industries Co., Ltd. and Black & Veatch Corporation; and executing a lump sum engineering, procurement, and construction agreement to provide Cedar LNG with the necessary services to construct the project. In order to achieve this momentum, as at December 31, 2023, Pembina had invested approximately $200 million in Cedar LNG.

Though numerous milestones have been achieved, the Cedar LNG project still faces a number of schedule driven interconnected elements that require resolution prior to making a final investment decision ("FID"), including binding commercial offtake, obtaining certain third-party consents, and project financing. On this basis, a FID is now expected in the middle of 2024.

Pembina and TC Energy Corporation ("TC Energy") have formed a partnership to develop the Alberta Carbon Grid ("ACG"), a carbon transportation and sequestration platform that is intended to enable Alberta-based industries to effectively manage their GHG emissions, contribute positively to Alberta's lower-carbon economy, and create sustainable long-term value for Pembina and TC Energy stakeholders. ACG is developing the Industrial Heartland project, which will have the potential to transport and store up to ten million tonnes of carbon dioxide annually. ACG completed the appraisal well drilling, logging and testing in December 2023. Preliminary data was consistent with ACG's storage capacity expectations and further work is underway to confirm the initial results. Throughout 2024, ACG will continue to progress commercial conversations, refine the project scope, and advance project engineering, including facility design and work on the pipeline routing.

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2023 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

20 Pembina Pipeline Corporation 2023 Annual Report

Corporate

Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions) | 2023 | 2022 | Change | |

| | | | |

| | | | |

| Revenue | 12 | — | | 12 | | |

General and administrative(1) | 103 | 93 | 10 | | |

Other expense(1) | 6 | | 2 | | 4 | | |

Net finance costs(1) | 111 | 109 | 2 | | |

Reportable segment loss before tax(1) | (209) | | (206) | | (3) | | |

| | | | |

| | | | |

| Income tax expense | 117 | | 87 | | 30 | | |

| | | | |

| | | | |

Adjusted EBITDA(2) | (81) | | (82) | | 1 | | |

| | | | | | |

| Change in Results | | |

| Revenue | | Relates primarily to fixed fee income related to shared service agreements with joint ventures following the PGI Transaction. $9 million of shared service fee fixed income was netted against general and administrative in the fourth quarter of 2022. |

| General and administrative | | Increase due to fixed fee income related to shared service agreements with joint ventures previously netted against general and administrative in 2022, discussed above, coupled with higher short-term incentive costs. |

| | |

| | |

| | |

| | |

| | |

| Reportable segment loss before tax | | Consistent with prior period. |

| Income tax expense | | Higher primarily due to higher earnings compared to the same period in 2022, partially offset by the recognition of previously unrecognized deferred tax assets. |

Adjusted EBITDA(2) | | Consistent with the prior period. |

(1) Includes inter-segment eliminations.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions) | 2023 | 2022 | Change | |

| | | | |

| | | | |

| Revenue | 47 | — | | 47 | | |

General and administrative(1) | 314 | 285 | 29 | | |

Other expense(1) | 6 | | 4 | | 2 | | |

Net finance costs(1) | 425 | 418 | 7 | | |

Reportable segment loss before tax(1) | (696) | | (708) | | 12 | | |

| | | | |

| | | | |

| Income tax expense | 413 | | 248 | | 165 | | |

| | | | |

| | | | |

| | | | |

| | | | |

Adjusted EBITDA(2) | (220) | | (239) | | 19 | | |

| | | | |

| | | | |

| | | | | | |

| Change in Results | | |

| Revenue | | Relates primarily to fixed fee income related to shared service agreements with joint ventures following the PGI Transaction. $24 million of shared service fee fixed income was netted against general and administrative in 2022. |

| General and administrative | | Increase largely due to fixed fee income related to shared service agreements with joint ventures previously netted against general and administrative in 2022, discussed above, combined with higher salaries and wages, short-term incentive costs, and information technology-related maintenance costs, partially offset by lower long-term incentive costs driven by the change in Pembina's share price in 2023 compared to the change in share price in 2022, as well as Pembina's performance relative to peers. |

| | |

| | |

| | |

| | |

| | |

| Reportable segment loss before tax | | Lower loss primarily due to shared service revenue and lower long-term incentive costs, partially offset by higher salaries and wages, short-term incentive costs, and information technology-related maintenance costs. |

| Income tax expense | | Higher due to the reduction in tax expense recorded in 2022 as a result of the PGI Transaction. |

| | |

| | |

| | |

| | |

Adjusted EBITDA(2) | | Increase largely due to the same items impacting reportable segment loss before tax, discussed above. |

(1) Includes inter-segment eliminations.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Pembina Pipeline Corporation 2023 Annual Report 21

4. LIQUIDITY & CAPITAL RESOURCES

Available Sources of Liquidity

| | | | | | | | |

| | |

As at December 31 ($ millions) | 2023 | 2022 |

Working capital(1) | (588) | | (696) | |

Variable rate debt | | |

Senior unsecured credit facilities(2) | 778 | | 771 | |

| Interest rate swapped debt | (31) | | (338) | |

| | |

Total variable rate loans and borrowings outstanding (weighted average interest rate of 6.3% (2022: 5.9%)) | 747 | | 433 | |

Fixed rate debt | | |

| Senior unsecured medium-term notes | 9,100 | | 9,200 | |

| Interest rate swapped debt | 31 | | 338 | |

| | |

Total fixed rate loans and borrowings outstanding (weighted average interest rate of 4.0% (2022: 3.9%)) | 9,131 | | 9,538 | |

| Total loans and borrowings outstanding | 9,878 | | 9,971 | |

| Cash and unutilized debt facilities | 2,240 | | 2,181 | |

Subordinated hybrid notes (weighted average interest rate of 4.8% (2022: 4.8%)) | 600 | | 600 | |

| | |

(1) Current assets of $2.6 billion (December 31, 2022: $1.4 billion) less current liabilities of $3.2 billion (December 31, 2022: $2.1 billion). As at December 31, 2023, working capital included $650 million (December 31, 2022: $600 million) associated with the current portion of long-term debt.

(2) Includes U.S. $250 million variable rate debt outstanding at December 31, 2023 (2022: U.S. $250 million), with the full notional amount hedged using an interest rate swap at 1.47 percent.

Pembina currently anticipates that its cash flow from operating activities, the majority of which is derived from fee-based contracts, will be more than sufficient to meet its operating obligations, to fund its dividend and to fund its capital expenditures in the short term and long term, in addition to the funding commitment of the Alliance/Aux Sable Acquisition. Pembina expects to source funds required for debt maturities from cash, its credit facilities and by accessing the capital markets, as required. Based on its successful access to financing in the capital markets over the past several years, Pembina expects to continue to have access to additional funds as required. Refer to "Risk Factors – General Risk Factors – Additional Financing and Capital Resources" in this MD&A and Note 23 to the Consolidated Financial Statements for more information. Management continues to monitor Pembina's liquidity and remains satisfied that the leverage employed in Pembina's capital structure is sufficient and appropriate given the characteristics and operations of the underlying asset base.

Management may adjust Pembina's capital structure as a result of changes in economic conditions or the risk characteristics of the underlying assets. To maintain or modify Pembina's capital structure in the future, Pembina may renegotiate debt terms, repay existing debt, seek new borrowings, issue additional equity or hybrid securities and/or repurchase or redeem additional common or preferred shares.