DocumentExhibit 99.1

CRESCENT POINT ENERGY CORP.

ANNUAL INFORMATION FORM

For the Year Ended December 31, 2022

Dated March 1, 2023

| | | | | |

Section | Page |

| |

| SPECIAL NOTES TO READER | |

| GLOSSARY | |

| SELECTED ABBREVIATIONS | |

| CURRENCY OF INFORMATION | |

| OUR ORGANIZATIONAL STRUCTURE | |

| GENERAL DEVELOPMENT OF THE BUSINESS OF THE CORPORATION | |

| DESCRIPTION OF OUR BUSINESS | |

| STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION | |

| ADDITIONAL INFORMATION RESPECTING CRESCENT POINT | |

| INDUSTRY CONDITIONS | |

| RISK FACTORS | |

| DIVIDENDS AND SHARE REPURCHASES | |

| MARKET FOR SECURITIES | |

| CONFLICTS OF INTEREST | |

| LEGAL PROCEEDINGS | |

| AUDIT COMMITTEE | |

| TRANSFER AGENT AND REGISTRARS | |

| AUDITOR | |

| MATERIAL CONTRACTS | |

| INTERESTS OF EXPERTS | |

| ADDITIONAL INFORMATION | |

APPENDIX A - AUDIT COMMITTEE TERMS OF REFERENCE

APPENDIX B - RESERVES COMMITTEE TERMS OF REFERENCE

APPENDIX C - REPORTS ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR OR AUDITOR

APPENDIX D - REPORT OF MANAGEMENT AND DIRECTORS ON RESERVES DATA AND OTHER INFORMATION

SPECIAL NOTES TO READER

Any "financial outlook" or "future oriented financial information" in this annual information form, as defined by applicable securities legislation, has been approved by management of Crescent Point (as defined herein). Such financial outlook or future oriented financial information is provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes.

This AIF (as defined herein) and other reports and filings made with the securities regulatory authorities include certain statements that constitute "forward-looking statements" within the meaning of section 27A of the Securities Act of 1933, section 21E of the Securities Exchange Act of 1934 and the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" for the purposes of Canadian securities regulation (collectively, "forward-looking statements"). All forward-looking statements are based on our beliefs and assumptions based on information available at the time the assumption was made. Crescent Point has tried to identify such forward-looking statements by use of such words as "could", "should", "can", "anticipate", "expect", "believe", "will", "may", "intend", "projected", "sustain", "continues", "strategy", "potential", "projects", "grow", "take advantage", "estimate", "well-positioned" and similar expressions, but these words are not the exclusive means of identifying such statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Crescent Point believes the expectations reflected in those forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements should not be unduly relied upon. These statements speak only as of the date of this AIF or, if applicable, as of the date specified in this AIF.

In particular, this AIF contains forward-looking statements pertaining, among other things, to the following:

•corporate strategy and anticipated financial and operational performance;

•forecast prices and the expected impact of commodity price fluctuations on cash available to pay dividends and return capital to shareholders;

•return of capital framework that targets the return of up to 50% of the Corporation's discretionary excess cash flow;

•hedging strategy, including expected outcomes, and the approach to managing physical delivery contracts;

•risk mitigation strategy and the expected outcomes;

•the potential impact of competition and our working relationships with industry partners and joint operators on Crescent Point's business;

•business prospects;

•the performance characteristics of Crescent Point's oil and natural gas properties, including but not limited to oil and natural gas production levels;

•anticipated future cash flows and oil and natural gas production levels;

•projected returns and exploration potential of our assets;

•the potential of Crescent Point's plays;

•future development plans, including focus areas;

•forecast costs and expenses associated with Crescent Point's business, including capital expenditure programs and how they will be funded;

•leverage objectives;

•corporate and asset acquisitions and dispositions;

•drilling programs;

•expected location inventory development timing;

•expected production breakdown by area on a Proved and Proved plus Probable production basis;

•the quantity of oil and natural gas reserves;

•projections of commodity prices and costs;

•future enhanced oil recovery and waterflood programs;

•the possible impacts of curtailment on Crescent Point;

•the impacts of the Redwater decision and other legal decisions;

•expected decommissioning, abandonment, remediation and reclamation costs;

•Crescent Point's tax horizon;

•the impact of the Canada-United States-Mexico Agreement;

•expected trends in environmental regulation, including the anticipated impact the trends may have on operations and compliance costs;

•the impact, and projected long-term impacts, of the pricing of carbon and greenhouse gases;

•payment of dividends, including special dividends, and the repurchase of Common Shares (as defined herein) by Crescent Point, including pursuant to its normal course issuer bid;

•supply and demand for oil and natural gas;

•the actions of OPEC+;

•expectations of legal and regulatory changes and implementations and change in governmental and regulatory bodies;

•expectations regarding the ability to raise capital and to continually add to reserves through acquisitions and development;

•treatment under governmental regulatory regimes, including royalty regimes applicable to natural resources;

•stock option grants;

•the impacts of the war in Ukraine;

•the impacts of COVID-19; and

•risks related to the regulatory, social and market efforts to address climate change.

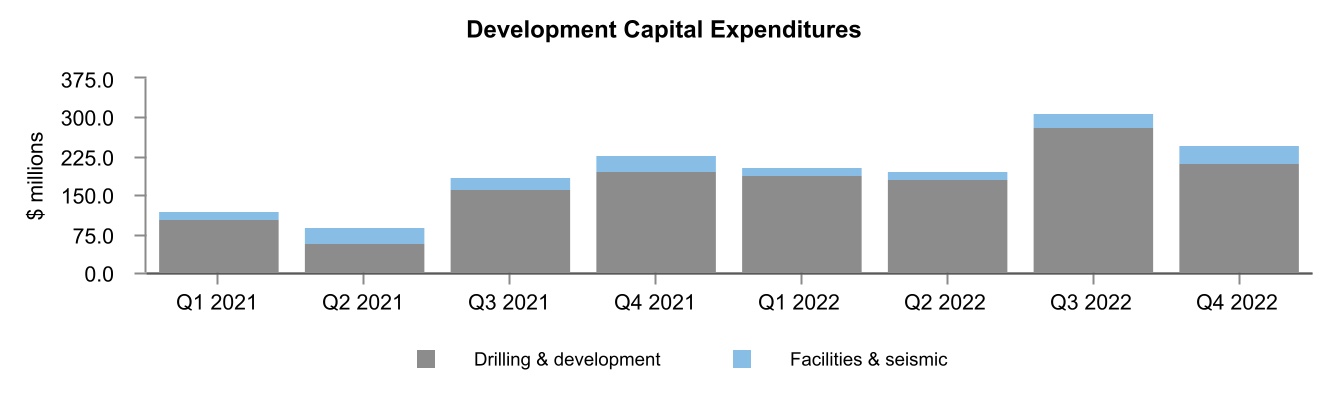

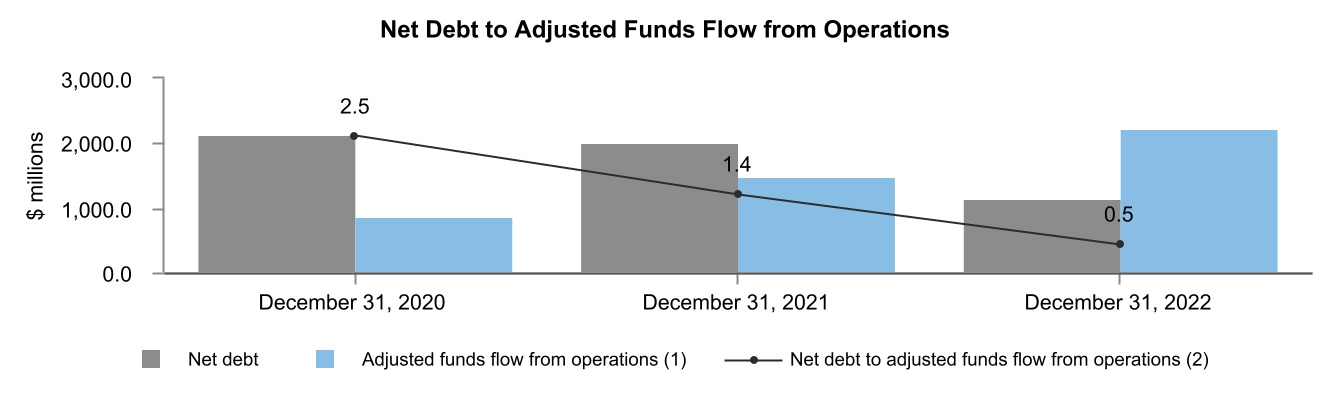

By their nature, such forward-looking statements are subject to a number of risks, uncertainties and assumptions, which could cause actual results or other expectations to differ materially from those anticipated, expressed or implied by such statements, including those material risks discussed in our Management's Discussion and Analysis for the year ended December 31, 2022, under the headings "Risk Factors" and "Forward-Looking Information" and as disclosed in this AIF. The material assumptions and factors in making forward-looking statements are disclosed in the Management's Discussion and Analysis for the year ended December 31, 2022, under the headings "Overview", "Development Capital Expenditures", "Commodity Derivatives", "Liquidity and Capital Resources", "Critical Accounting Estimates", "Risk Factors", "Changes in Accounting Policies" and "Guidance".

This information contains certain forward-looking estimates that involve substantial known and unknown risks and uncertainties, certain of which are beyond Crescent Point's control. Such risks and uncertainties include, but are not limited to: financial risk of marketing reserves at an acceptable price given market conditions; volatility in market prices for oil and natural gas; delays in business operations, pipeline restrictions and blowouts; the impacts of the war in Ukraine; the actions of OPEC+; the risk of carrying out operations with minimal environmental impact; industry conditions, including changes in laws and regulations, the adoption of new environmental laws and regulations, and changes in how environmental laws and regulations are interpreted and enforced; uncertainties associated with estimating oil and natural gas reserves; economic risk of finding and producing reserves at a reasonable cost; uncertainties associated with partner plans and approvals; operational matters related to non-operated properties; increased competition for, among other things, capital, acquisitions of reserves and undeveloped lands; competition for and availability of qualified personnel or management; incorrect assessments of the value of acquisitions and exploration and development programs and of dispositions and monetization; unexpected geological, technical, drilling, construction and processing problems; availability of insurance; the impacts of COVID-19; fluctuations in foreign exchange and interest rates; stock market volatility; failure to realize the anticipated benefits of acquisitions and dispositions; general economic, market and business conditions; inflation; uncertainties associated with regulatory approvals; uncertainty of government policy changes; uncertainties associated with credit facilities and counterparty credit risk; tax laws and changes thereto, crown royalty rates and incentive programs relating to the oil and gas industry; and other factors, many of which are outside the control of Crescent Point, including those listed under "Risk Factors" in this AIF. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as each of these are interdependent and Crescent Point's future course of action depends on management's assessment of all information available at the relevant time.

Statements relating to "reserves" and "resources" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in the quantities predicted or estimated and that the reserves can be profitably produced in the future. Actual reserve values may be greater than or less than the estimates provided herein.

There are numerous uncertainties inherent in estimating quantities of crude oil, natural gas and natural gas liquids reserves and the future cash flows attributed to such reserves. The reserve and associated cash flow information set forth herein are estimates only. In general, estimates of economically recoverable crude oil, natural gas and natural gas liquids reserves and the future net cash flows therefrom are based upon a number of variable factors and assumptions, such as historical production from the properties, production rates, ultimate reserve recovery, timing and amount of capital expenditures, marketability of oil and natural gas, royalty rates, the assumed effects of regulation by governmental agencies and future operating costs, all of which may vary materially. For these reasons, estimates of the economically recoverable crude oil, natural gas liquids and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues associated with reserves prepared by different engineers, or by the same engineers at different times, may vary. Crescent Point's actual production, revenues, taxes and development and operating expenditures with respect to its reserves will vary from estimates thereof and such variations could be material. In addition, the discounted and undiscounted net present value of future net revenues attributable to reserves do not represent fair market value; and the estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation. Crescent Point's actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking estimates and if such actual results, performance or achievements transpire or occur, or if any of them do so, there can be no certainty as to what benefits, if any, Crescent Point will derive therefrom.

Barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

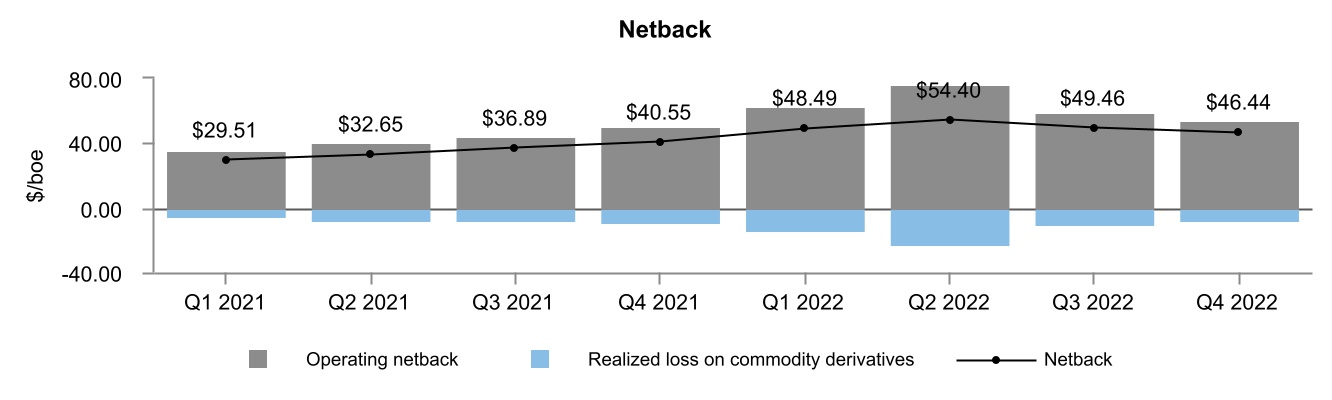

Netback received is calculated on a per boe basis as oil and gas sales, less royalties, operating and transportation expenses. Netback received excludes realized commodity derivative gains and losses. Netback received is used by management to measure operating results on a per boe basis to better analyze performance against prior periods on a comparable basis. Netback received is equivalent to "operating netback" referenced in the MD&A. The calculation of netback received is shown in the Production History section of this AIF.

The aggregate of the exploration and development costs incurred in the most recent financial year and the change during the year in estimated future development costs generally will not reflect total finding and development costs related to reserves additions for the year.

Additional information on these and other factors that could affect Crescent Point's operations or financial results are included in Crescent Point's reports on file with Canadian and U.S. securities regulatory authorities (including our Annual Report on Form 40-F and Management's Discussion and Analysis). Readers are cautioned not to place undue reliance on the forward-looking information, which is given as of the date it is expressed in this AIF or otherwise. We do not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required pursuant to applicable law. All subsequent forward-looking statements, whether written or oral, attributable to Crescent Point or persons acting on the Corporation's behalf are expressly qualified in their entirety by these cautionary statements.

Currency Presentation

All references to "dollars" and "$" are to the currency of Canada, unless otherwise indicated. The daily rate of exchange on December 31, 2022, as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars was Cdn.$1.00 equals U.S.$0.7383 and for the conversion of United States dollars into Canadian dollars was U.S.$1.00 equals Cdn.$1.3544. The following table sets forth, for 2022 and 2021, the high, low and average of the daily exchange rates for that year, each for one U.S. dollar expressed in Canadian dollars as reported by the Bank of Canada.

| | | | | | | | |

| Year ended December 31, 2022 (Cdn$/Usd) | Year ended December 31, 2021 (Cdn$/Usd) |

High | 0.8031 | 0.8306 |

Low | 0.7217 | 0.7727 |

Average | 0.7692 | 0.7980 |

Presentation of our Reserve and Resource Information

Current SEC reporting requirements permit oil and gas companies to disclose Probable reserves (as defined herein), in addition to the required disclosure of Proved reserves. Under current SEC requirements, net quantities of reserves are required to be disclosed, which requires disclosure on an after-royalties basis and does not include reserves relating to the interests of others. For a description of these and additional differences between Canadian and U.S. standards of reporting reserves, see "Risk Factors — Canadian and United States practices differ in reporting reserves and production and our estimates may not be comparable to those of companies in the United States".

New York Stock Exchange

As a Canadian corporation listed on the NYSE (as defined herein), we are not required to comply with most of the NYSE's corporate governance standards and, instead, may comply with Canadian corporate governance practices. We are, however, required to disclose the significant differences between our corporate governance practices and the requirements applicable to U.S. domestic companies listed on the NYSE. Except as summarized on our website at www.crescentpointenergy.com, we are in compliance with the NYSE corporate governance standards.

GLOSSARY

In this AIF, the capitalized terms set forth below have the following meanings:

"ABCA" means the Business Corporations Act, R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder.

"AER" means the Alberta Energy Regulator.

"Alberta EPA" means the Alberta Ministry of Environment and Protected Areas.

"AIF" means this annual information form of the Corporation dated March 1, 2023 for the year ended December 31, 2022.

"Board" or "Board of Directors" means the board of directors of the Corporation.

"Common Shares" means common shares in the capital of the Corporation.

"Conversion Arrangement" means the plan of arrangement under Section 193 of the ABCA, completed on July 2, 2009 pursuant to which the Trust effectively converted from an income trust to a corporate structure.

"CPEUS" means Crescent Point Energy U.S. Corp.

"CPHL" means Crescent Point Holdings Ltd.

"CPUSH" means Crescent Point U.S. Holdings Corp.

"Crescent Point" or the "Corporation" means Crescent Point Energy Corp., formerly Wild River Resources Ltd., a corporation amalgamated under the ABCA and, where applicable, includes its subsidiaries and affiliates.

"DRIP" means the Premium DividendTM and Dividend Reinvestment Plan of the Corporation.

"DSU Plan" means the Deferred Share Unit Plan of the Corporation.

"ESVP" means the Employee Share Value Plan of the Corporation.

"FAST Act" means the Fixing America’s Surface Transportation Act.

"Greenhouse Gases" or "GHGs" means any or all of, including but not limited to, carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulphur hexafluoride (SF6).

"IFRS" means International Financial Reporting Standards as adopted by the Canadian Accounting Standards Board for periods beginning on and after January 1, 2011.

"McDaniel" means McDaniel & Associates Consultants Ltd.

"MD&A" means the management's discussion and analysis of financial condition and results of operations of the Corporation for the year ended December 31, 2022.

"NCIB" means normal course issuer bid.

"NI 51-101" means "National Instrument 51-101 – Standards for Disclosure for Oil and Gas Activities".

"NYSE" means the New York Stock Exchange.

"OPEC+" means the Organization of the Petroleum Exporting Countries and cooperating oil-exporting nations.

"Partnership" means Crescent Point Resources Partnership, a general partnership formed under the laws of the Province of Alberta, having CPHL and the Corporation as partners.

"PSU Plan" means the Performance Share Unit Plan of the Corporation.

"Restricted Share Bonus Plan" means the Restricted Share Bonus Plan of the Corporation.

"SDP" means the Share Dividend Plan of the Corporation.

"SEC" means the U.S. Securities and Exchange Commission.

"Shareholders" means the holders from time to time of Common Shares.

"Stock Option Plan" means the Stock Option Plan of the Corporation.

"Tax Act" means the Income Tax Act (Canada), R.S.C. 1985, c. 1 (5th Supp.), and the regulations promulgated thereunder, each as amended from time to time.

"Trust" means Crescent Point Energy Trust, an unincorporated open ended investment trust governed by the laws of the Province of Alberta that was dissolved pursuant to the Conversion Arrangement.

"Trust Units" means the trust units of the Trust.

"TSX" means the Toronto Stock Exchange.

"U.S." means the United States of America.

"Unitholders" means holders of Trust Units.

For additional definitions used in this AIF, please see "Statement of Reserves Data and Other Oil and Gas Information - Notes and Definitions".

SELECTED ABBREVIATIONS

In this AIF, the abbreviations set forth below have the following meanings:

| | | | | | | | | | | |

| Oil and Natural Gas Liquids | Natural Gas |

| bbl | barrel | Mcf | thousand cubic feet |

| bbls | barrels | Mcf/d | thousand cubic feet per day |

| bbls/d | barrels per day | Mcfe | thousand cubic feet of gas equivalent converting one barrel of oil to 6 Mcf of natural gas equivalent |

| Mbbls | thousand barrels |

| NGLs | natural gas liquids |

| | MMcf | million cubic feet |

| | MMcf/d | million cubic feet per day |

| | MMBTU | million British Thermal Units |

| | | | | |

| Other | |

| AECO | the natural gas storage facility located at Suffield, Alberta |

| boe or BOE | barrels of oil equivalent may be misleading, particularly if used in isolation. A boe conversion ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | barrel of oil equivalent per day |

| m³ | cubic metres |

| M$ | thousand dollars |

| Mboe | thousand barrels of oil equivalent |

| MMboe | million barrels of oil equivalent |

| MM$ | million dollars |

| NYMEX | New York Mercantile Exchange natural gas price |

| tCO2e/boe | tonnes of carbon dioxide equivalent per barrel of oil equivalent |

| WTI | West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for crude oil of standard grade |

CURRENCY OF INFORMATION

The information set out in this AIF is stated as at December 31, 2022, unless otherwise indicated. Capitalized terms used but not defined in the text are defined in the Glossary.

OUR ORGANIZATIONAL STRUCTURE

The Corporation

Crescent Point Energy Corp. ("Crescent Point" or the "Corporation" and, together with its direct and indirect subsidiaries and partnerships, where appropriate, "we", "our" or "us") is the successor to the Trust, following the completion of the "conversion" of the Trust from an income trust to a corporate structure under the Conversion Arrangement. Pursuant to the Conversion Arrangement, Unitholders of the Trust exchanged their Trust Units for Common Shares of the Corporation on a one-for-one basis.

The Corporation was originally incorporated pursuant to the provisions of the Company Act (British Columbia) on April 20, 1994 as 471253 British Columbia Ltd. 471253 British Columbia Ltd. changed its name to Westport Research Inc. ("Westport") on August 12, 1994. On August 1, 2006, Westport was continued into Alberta under the ABCA. On October 11, 2006, Westport changed its name to 1259126 Alberta Ltd. ("1259126"). On February 8, 2007, 1259126 amended its articles to change its name to Wild River Resources Ltd. ("Wild River"), to add a class of non-voting common shares, to change the number of authorized Common Shares from 1,000,000 to unlimited and to change the rights, privileges, restrictions and conditions attaching to such shares, to reorganize its share structure, to change the number of Wild River's issued and outstanding shares on a pro rata basis to an aggregate of 5,000,000 Common Shares, to remove the restrictions on share transfer and to amend the "other provisions" section of the articles. On June 29, 2009, Wild River amended its articles to cancel the non-voting common shares and to change the rights, privileges, restrictions and conditions of the Common Shares to remove the references to the non-voting common shares. On July 2, 2009, in connection with the Conversion Arrangement, Wild River filed Articles of Amendment to give effect to the consolidation of the Common Shares on the basis of 0.1512 of a post-consolidation Common Share for each pre-consolidation Common Share and subsequent Articles of Amendment to change its name to Crescent Point Energy Corp. On January 1, 2011, the Corporation amalgamated with Ryland Oil ULC, Darian Resources Ltd. and Shelter Bay Energy ULC.

The head and principal office of the Corporation is located at Suite 2000, 585 – 8th Avenue S.W., Calgary, Alberta, T2P 1G1 and its registered office is located at Suite 3700, 400 – 3rd Avenue S.W., Calgary, Alberta, T2P 4H2.

The Corporation is a conventional oil and gas producer with assets strategically focused in properties comprised of high quality, long life, operated, light and medium crude oil, natural gas liquids and natural gas reserves in Western Canada and the United States. We make regular cash dividends to Shareholders from our net cash flow.

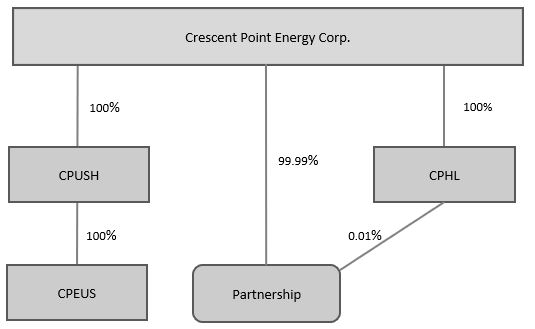

Partnership

The Partnership is a general partnership governed by the laws of the Province of Alberta. As set forth in the diagram below under "Organizational Structure of the Corporation", the partners of the Partnership are CPHL and the Corporation.

The existing business of the Corporation is carried on through the Partnership and through CPEUS. The Partnership holds all of the Corporation's Canadian operating assets and CPEUS holds all of the Corporation’s U.S. operating assets.

CPHL

CPHL is a wholly-owned subsidiary of the Corporation. CPHL is a partner of the Partnership.

CPUSH

Crescent Point U.S. Holdings Corp. is a wholly-owned direct subsidiary of the Corporation.

CPEUS

Crescent Point Energy U.S. Corp. is a wholly-owned indirect subsidiary of the Corporation. CPEUS holds the Corporation's operating assets in the United States.

Relationships

The following table provides the name, the percentage of voting securities owned by the Corporation and the jurisdiction of incorporation, continuance or formation of the Corporation's material subsidiaries as at the date hereof.

| | | | | | | | |

| Percentage of Voting Securities (Directly or Indirectly) | Jurisdiction of Incorporation/Formation |

CPHL | 100% | Alberta |

Partnership | 100% | Alberta |

CPUSH | 100% | Nevada |

CPEUS | 100% | Delaware |

Organizational Structure of the Corporation

The following diagram describes the inter-corporate relationships among the Corporation and its material direct and indirect subsidiaries described above as at December 31, 2022 and current to March 1, 2023. Reference should be made to the appropriate sections of this AIF for a complete description of the structure of the Corporation.

GENERAL DEVELOPMENT OF THE BUSINESS OF THE CORPORATION

History

The following is a description of the general development of the business of Crescent Point over the past three years.

2020

On January 20, 2020, Crescent Point sold certain associated gas infrastructure assets in Saskatchewan to Steel Reef Infrastructure Corp. ("Steel Reef") for total cash consideration of $500 million. Through the sale of these assets, Crescent Point monetized nine natural gas gathering and processing facilities and two gas sales pipelines currently in operation within Saskatchewan. These gas processing facilities and associated sales gas lines have a total throughput capacity of more than 90 MMcf/d. The assets did not include any oil-related infrastructure. Concurrently, Crescent Point entered into certain long-term take-or-pay commitments with Steel Reef in exchange for Steel Reef granting Crescent Point processing rights at the facilities.

On March 5, 2020, the Corporation announced the approval by the TSX of its notice to implement an NCIB to purchase, for cancellation, 36,884,438 Common Shares, or seven percent of the Corporation's public float, as at February 28, 2020. The 2020 NCIB commenced on March 9, 2020 and expired on March 8, 2021. No purchases were made under the NCIB.

On March 16, 2020, Crescent Point announced that (i) it had revised its 2020 capital expenditures budget to $700 to $800 million, which was expected to generate annual average production of 130,000 to 134,000 boe/d; (ii) it had revised its dividend from $0.01 per share payable every quarter to $0.0025 payable every quarter commencing in the second quarter of 2020; and (iii) all purchases under the NCIB had been deferred.

On April 20, 2020, Crescent Point announced that it had further revised its capital expenditures budget to approximately $650 to $700 million and lowered its production guidance for the year 2020 by 15%, primarily due to the voluntary shut-in of higher cost production.

On June 30, 2020, Crescent Point Holding Inc. transferred its interest in the Partnership to CPHL, a newly incorporated and wholly-owned subsidiary of Crescent Point. Crescent Point Energy Lux S.à r.l. was dissolved effective July 13, 2020.

On July 30, 2020, Myron Stadnyk was appointed to the Board. See "Additional Information Respecting Crescent Point - Directors and Officers".

On September 1, 2020, Crescent Point announced that it had reactivated shut-in volumes, which reactivation resulted in expected second half 2020 production increasing by approximately 20 percent to 119,000 to 121,000 boe/d.

2021

On February 17, 2021, the Corporation entered into an agreement with Shell Canada Energy (“Shell”), an affiliate of Royal Dutch Shell plc, to acquire Shell’s Kaybob Duvernay assets in Alberta for $900 million. The total consideration consisted of $700 million in cash and 50 million Common Shares. The acquisition closed in April 2021.

On March 5, 2021, the Corporation announced the approval by the TSX of its notice to implement a NCIB (the "2021 NCIB") to purchase, for cancellation, 26,462,509 Common Shares, or five percent of the Corporation's public float, as at February 26, 2021. The NCIB commenced on March 9, 2021 and expired on March 8, 2022. The Corporation repurchased a total of 8,602,500 Common Shares under the 2021 NCIB program.

On June 7, 2021 the Corporation completed the disposition of its remaining non-core southeast Saskatchewan conventional assets, which were previously identified as disposition candidates, for cash proceeds of $93 million. As a result of the transaction, Crescent Point also reduced its asset retirement obligations by approximately $220 million, or nearly 25 percent of its asset retirement obligations balance as at March 31, 2021.

On September 13, 2021, the Corporation announced that it was increasing its quarterly dividend from $0.0025 per share payable every quarter to $0.03 per share payable every quarter, commencing with the fourth quarter of 2021.

On December 6, 2021, the Corporation announced that it was increasing its quarterly dividend from $0.03 per share payable every quarter to $0.045 per share payable every quarter, commencing with the first quarter of 2022.

CPHI, a former partner of the Partnership, was dissolved effective December 31, 2021.

2022

On March 4, 2022, the Corporation announced the approval by the TSX of its notice to implement a NCIB (the "2022 NCIB") to purchase, for cancellation, up to 57,309,975 Common Shares, or ten percent of the Corporation's public float, as at February 28, 2022. The NCIB commenced on March 9, 2022 and is due to expire on March 8, 2023. In 2022, the Corporation purchased 25,561,600 Common Shares under the 2022 NCIB. As of February 20, 2023, the Corporation had purchased an additional 2,526,900 Common Shares under the 2022 NCIB in 2023.

On May 12, 2022, the Corporation announced that it was increasing its quarterly dividend from $0.045 per share payable every quarter to $0.065 per share payable every quarter, commencing with the second quarter of 2022.

On May 19, 2022, Mindy Wight was elected to the Board. See "Additional Information Respecting Crescent Point - Directors and Officers".

On October 26, 2022, the Corporation announced a special dividend of $0.035 per share payable on November 14, 2022.

On December 9, 2022, Crescent Point entered into an agreement to acquire Kaybob Duvernay assets from Paramount Resources Ltd. for cash consideration of $375 million. The acquisition closed in January 2023.

On December 9, 2022, the Corporation announced that it was increasing its quarterly dividend from $0.065 per share payable every quarter to $0.10 per share payable every quarter, commencing with the first quarter of 2023.

2023

On January 11, 2023, Crescent Point completed the acquisition of certain Kaybob Duvernay assets in Alberta for cash consideration of $370.6 million, including closing adjustments, which is expected to be allocated substantially to property, plant and equipment and exploration and evaluation. Cash consideration was funded primarily through cash on hand and included a deposit on acquisition of $18.7 million.

DESCRIPTION OF OUR BUSINESS

General

The Corporation is an oil and gas exploration, development and production company. The Corporation is a conventional oil and gas producer with assets strategically focused in properties comprised of high quality, long life, operated, light and medium crude oil, natural gas liquids and natural gas reserves in Western Canada and the United States. The primary assets of the Corporation are currently its interest in the Partnership, shares in CPHL, shares in CPUSH and, indirectly, shares in CPEUS.

The crude oil and natural gas properties and related assets generating income for the benefit of the Corporation are located in the provinces of Saskatchewan, Alberta, British Columbia and Manitoba and in the states of North Dakota and Montana. The properties and assets consist of producing crude oil, natural gas liquids and natural gas reserves and Proved plus Probable (as defined herein) crude oil, natural gas liquids and natural gas reserves not yet on production, and land holdings.

We pay regular cash dividends to Shareholders from our net cash flow in accordance with our dividend policy. Our primary sources of cash flow are distributions from the Partnership. During the year ended December 31, 2022, total dividends declared to shareholders were $0.36 per Common Share. See "Dividends".

Strategy

Our strategy is to deliver lasting market-leading value to our stakeholders as a trusted, ethical and environmentally responsible source for energy. We will maintain a resilient, balanced and sustainable portfolio, and apply our agile, diverse, learning mindset to optimize all aspects of our business.

We strive to enhance shareholder returns by cost effectively developing a focused asset base in a responsible and sustainable manner. The Corporation employs a disciplined capital allocation framework centered around returns and balance sheet strength, in order to create value for shareholders through a combination of significant return of capital, returns-based growth and balance sheet strength.

We strategically develop our properties through detailed technical analysis including reservoir characteristics, petroleum initially in place, recovery factors and the applicability of enhanced recovery techniques. Our development strategies include, multi-stage fracture stimulation of horizontal wells, infill and step-out wells, re-completion of existing wells along with the application of secondary and enhanced oil recovery techniques, including waterflood programs.

Risk Management and Marketing

Factors outside our control impact, to varying degrees, the prices we receive for production. These include, but are not limited to:

(a) world market forces, including world supply and consumption levels and the ability of OPEC+ and others to set and maintain production levels and prices for crude oil;

(b) political conditions, including the risk of hostilities in the Middle East, South America, Eastern Europe and other regions throughout the world;

(c) availability, proximity and capacity of take-away alternatives, including oil and gas gathering systems, pipelines, processing facilities, railcars and railcar loading facilities;

(d) increases or decreases in crude oil differentials and their implications for prices received by us;

(e) the impact of changes in the exchange rate between Canadian and U.S. dollars on prices received by us for our crude oil and natural gas;

(f) North American market forces, most notably shifts in the balance between supply and demand for crude oil and natural gas and the implications for the prices of crude oil and natural gas;

(g) global and domestic economic and weather conditions and changes in demand as a result of outbreaks or other health emergencies;

(h) price and availability of alternative energy sources;

(i) the effect of energy conservation measures and government regulations;

(j) U.S. and Canada tax policy; and

(k) pandemics, such as the COVID-19 health emergency.

Fluctuations in commodity prices, differentials and foreign exchange and interest rates, among other factors, are outside of our control and yet can have a significant impact on the level of cash we have available for return of capital to our shareholders, including payment of dividends and the acquisition of Common Shares.

To mitigate a portion of these risks, we actively initiate, manage and disclose the effects of our hedging activities. Our strategy for crude oil and natural gas production is to hedge up to 65%, or as otherwise approved by the Board of Directors, of our net of royalty production up to a rolling three and a half year basis, at the discretion of management. The Corporation also uses a combination of financial derivatives and fixed-differential physical contracts to hedge price differentials. For oil differential hedging, Crescent Point's risk management program allows for hedging a forward profile of up to three and a half years, and up to 35% net of royalty production. For gas differential hedging, Crescent Point's risk management program allows for hedging a forward profile of up to three and a half years, and up to 50% net of royalty production. All hedging activities are governed by our Risk Management and Counterparty Credit Policy and are regularly reviewed by the Board of Directors.

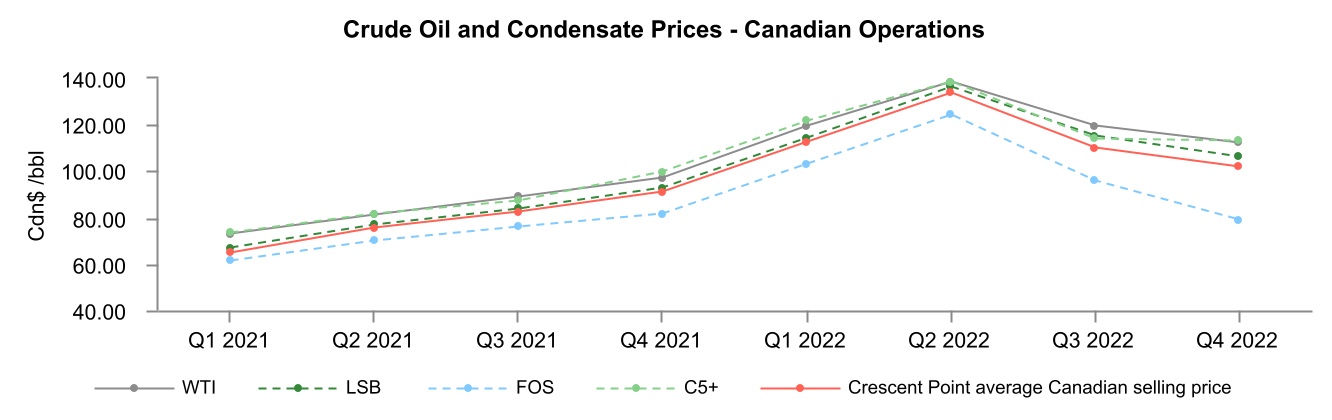

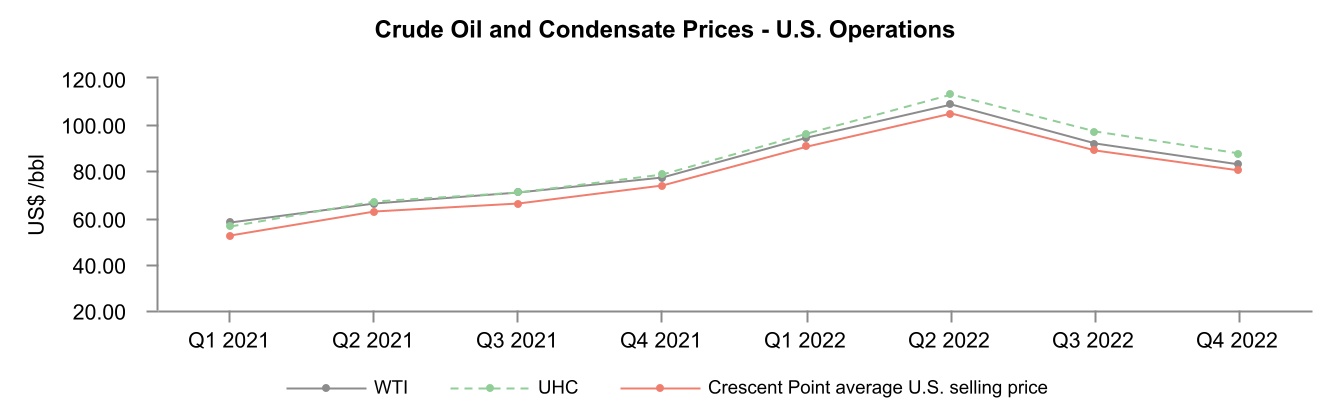

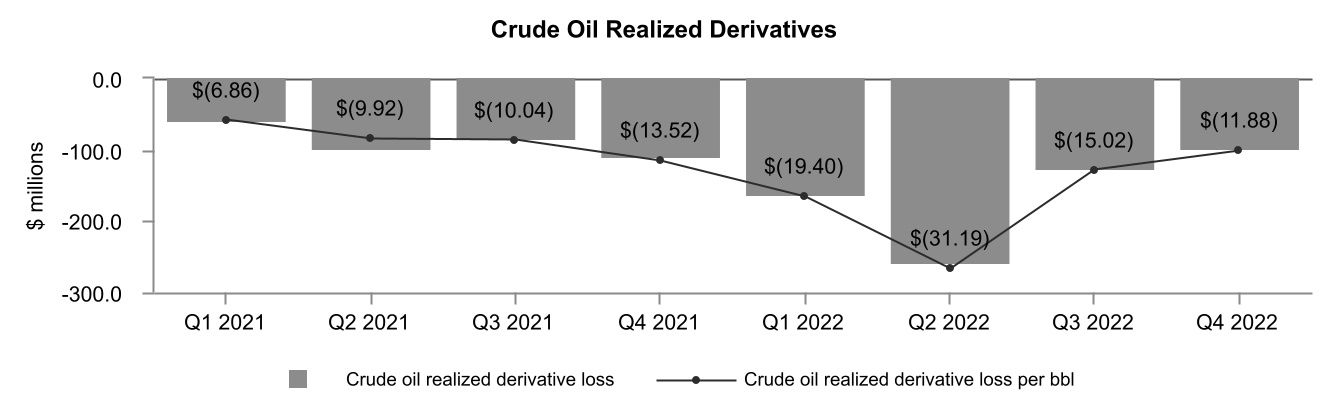

As part of our risk management program, benchmark oil prices are hedged using financial WTI-based instruments transacted in Canadian and U.S. dollars, benchmark natural gas prices are hedged using financial AECO-based instruments transacted in Canadian dollars. Total financial oil and gas hedges in 2022 amounted to approximately 43% of annual production, net of royalties, consisting of approximately 48% of annual liquids production and approximately 21% of annual natural gas production, net of royalties. The Corporation recorded a realized derivative loss on crude oil, NGL and natural gas hedge contracts of $641.8 million in 2022.

Crescent Point also enters into physical delivery and derivative WTI price differential contracts which manage the spread between US$ WTI and various stream prices on a portion of its production. The Corporation manages physical delivery contracts on a month-to-month spot and term contract basis. From January to December 2022, approximately 10,000 bbls/d of liquids production was contracted with fixed price differentials off WTI. Crescent Point also enters into derivative NYMEX price differential contracts which manage the spread between US$ NYMEX and AECO-based pricing on a portion of its natural gas production.

Refer to the annual financial statements for our commitments under all hedging agreements as at December 31, 2022.

In addition to hedging benchmark crude oil and natural gas prices with financial instruments, we also have the ability to mitigate crude oil basis risk by delivering a portion of our crude oil production into diversified refinery markets using rail transportation when it is economically beneficial to do so. Crescent Point operates two railcar loading facilities, serving its key producing areas of southeast Saskatchewan and southwest Saskatchewan. Crude oil and NGL volumes loaded at these facilities are sold at the loading facilities and our buyers are responsible for providing railcars and managing transportation logistics from that point until delivery.

We mitigate credit risk by having a well-diversified marketing portfolio for our commodity sales. Credit risk associated with the Corporation's product sales and with the Corporation's financial hedging portfolio is managed by Crescent Point's Risk Management Committee and is governed by a board-approved Risk Management and Counterparty Credit Policy that is reviewed annually by the Board of Directors. The Policy requires annual credit reviews of all trade counterparties. Credit limits are required to be set for all trade counterparties, which are based on either a fixed dollar amount which is set annually, at a minimum, or a percentage of the Corporation's portfolio calculated monthly. Crescent Point utilizes a diversified approach in both its physical sales portfolio and its financial hedging portfolio. The physical sales portfolio consists of 86 purchasers and its financial hedging portfolio consists of 10 counterparties. The Corporation's portfolio of counterparty exposures is monitored on a monthly basis.

To further mitigate credit risk associated with its physical sales portfolio, Crescent Point may obtain financial assurances such as parental guarantees, prepayments, letters of credit and third party credit insurance. Including these assurances, approximately 98% of the Corporation's oil and gas sales are with entities considered investment grade.

Revenue Sources

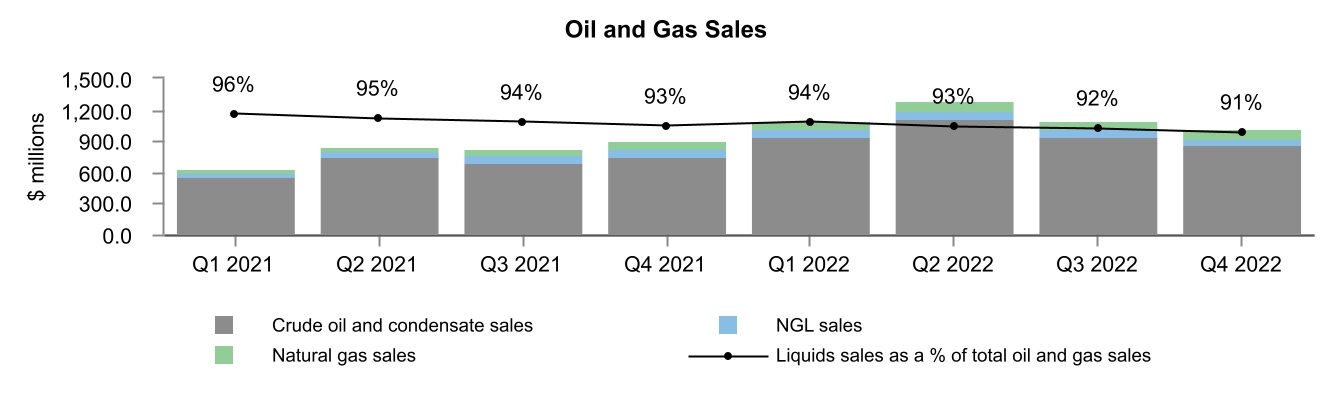

Our crude oil and natural gas volumes are sold in the United States, Saskatchewan, Alberta and British Columbia. During 2022, approximately 59% of our liquids volumes were sold in Saskatchewan, 26% in Alberta, 14% in the U.S. and less than 1% in British Columbia. Approximately 70% of our natural gas volumes were sold in Alberta, 20% in Saskatchewan, 9% in the United States and less than 1% in British Columbia.

For 2022, our commodity production mix was approximately 41% tight oil, 28% NGLs, 16% shale gas, 11% light and medium oil, 3% heavy oil and 1% conventional natural gas.

The following table summarizes our revenue sources by product before hedging and royalties:

| | | | | | | | | | | | | | | | | | | | |

| For Year Ended | Light and Medium Crude Oil | Heavy

Crude Oil | Tight Oil | NGLs | Shale Gas | Conventional Natural Gas |

| 2022 | 13.2% | 3.2% | 51.1% | 24.9% | 7.1% | 0.5% |

| 2021 | 15.4% | 3.4% | 55.8% | 19.6% | 5.3% | 0.5% |

| 2020 | 19.8% | 3.6% | 66.8% | 5.4% | 3.6% | 0.8% |

Competition

We actively compete for reserve acquisitions, exploration leases, licenses and concessions and skilled industry personnel with a substantial number of other oil and gas companies, many of which have significantly greater financial resources than we do. Our competitors include major integrated oil and natural gas companies, numerous other independent oil and natural gas entities and individual producers and operators. Similarly, we face a competitive market when we attempt to divest of non-core assets.

Certain of our customers and potential customers are themselves exploring for crude oil and natural gas, and the results of such exploration efforts could affect our ability to sell or supply crude oil or natural gas to these customers in the future. Our ability to successfully bid on and acquire additional property rights, divest property rights, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements with customers is dependent upon developing and maintaining close working relationships with our

industry partners and joint operators, our ability to select and evaluate suitable properties, and our ability to consummate transactions in a highly competitive environment.

Seasonal Factors

The production of crude oil and natural gas is dependent on access to areas where development of reserves is to be conducted. Seasonal weather variations, including freeze-up and break-up, affect access in certain circumstances.

COVID-19 Pandemic

In response to the COVID-19 pandemic, the Corporation continues to monitor the situation and make adjustments to its health and safety protocols as required.

Crude oil and natural gas prices continued to strengthen in 2022, compared to the onset of the COVID-19 pandemic in 2020, as the global recovery from the COVID-19 pandemic and vaccine roll outs facilitated increased mobility, resulting in higher demand for crude oil and crude oil products and lower inventory levels.

Personnel

As of December 31, 2022, the Corporation had 768 permanent employees: 390 employees at the head office in Calgary, 12 employees working remotely in the U.S., 346 field employees in Canada and 20 field employees in the U.S.

STATEMENT OF RESERVES DATA AND OTHER OIL AND GAS INFORMATION

Disclosure of Reserves Data

In accordance with NI 51-101, the reserves data of the Corporation set forth below (the "Reserves Data") is based upon evaluations conducted by McDaniel with an effective date of December 31, 2022 (the "Crescent Point Reserve Report"). The tables below are a combined summary of our crude oil, natural gas liquids, and natural gas reserves and the net present value of future net revenue attributable to such reserves as evaluated in the Crescent Point Reserve Report based on December 31, 2022 forecast price and cost assumptions using the average of three Independent Reserve Evaluators (McDaniel, GLJ Ltd. and Sproule Associates Ltd.). McDaniel evaluated the Corporation's total Proved plus Probable reserves and total Proved plus Probable value discounted at 10% and evaluated all of the Corporation's properties to prepare the Crescent Point Reserve Report. The tables below summarize the data contained in the Crescent Point Reserve Report.

The net present value of future net revenue attributable to our reserves is stated without provision for interest costs, and general and administrative costs, but after providing for estimated royalties, production costs, capital taxes, development costs, other income, future capital expenditures, projected carbon emission costs, and well and location abandonment costs. The reserve assessments also include costs associated with wells that have not been assessed values in the reserve reports and facilities and gathering systems associated with the ongoing production for the Corporation. It should not be assumed that the undiscounted or discounted net present value of future net revenue attributable to our reserves estimated by McDaniel represent the fair market value of those reserves. Other assumptions and qualifications relating to costs, prices for future production and other matters are summarized herein. The recovery and reserve estimates of our crude oil, NGL and natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Actual reserves may be greater than or less than the estimates provided herein.

The Corporation continuously monitors and reviews legislation concerning greenhouse gas emissions and the impact on operations. Legislation adopted in 2019 has allowed Crescent Point to reduce anticipated negative financial impacts from the production of oil and gas products through the Output-Based Performance Standard ("OBPS") program in Saskatchewan and the Technology Innovation and Emission Reduction ("TIER") program in Alberta. The carbon emission costs related to government programs are fully integrated into the operating costs and capital unit costs in the reserve evaluation.

The Crescent Point Reserve Report includes the abandonment, decommissioning, and reclamation costs for both the active and inactive locations, including all non-producing and suspended wells, facilities and pipelines. The incremental liabilities from the inactive locations on the total Proved plus Probable reserves is estimated at $208 million of value discounted at 10%. The total impact in the Crescent Point Reserve Report from the combined active and inactive liabilities on total Proved plus Probable reserves is estimated at $308 million of value discounted at 10%.

The Crescent Point Reserve Report is based on certain factual data supplied by Crescent Point as well as McDaniel's opinion of reasonable practice in the industry. The extent and character of ownership and all factual data pertaining to Crescent Point's petroleum properties and contracts were supplied by the Corporation to McDaniel, and were accepted without any further investigation. McDaniel accepted this data as presented and neither title searches nor field inspections were conducted.

Reserves Data – Forecast Prices and Costs

Summary of Oil and Gas Reserves(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Light and Medium Crude Oil | Heavy Crude Oil |

Tight Oil | Natural Gas Liquids |

Shale Gas | Conventional

Natural Gas | Total |

| Reserves Category | Company Gross (Mbbls) | Company Net (Mbbls) | Company Gross (Mbbls) | Company Net (Mbbls) | Company Gross (Mbbls) | Company Net (Mbbls) | Company Gross (Mbbls) | Company Net (Mbbls) | Company Gross (MMcf) | Company Net (MMcf) | Company Gross (MMcf) | Company Net (MMcf) | Company Gross (Mboe) | Company Net (Mboe) |

| Proved Developed Producing | | | | | | | | | | | | | | |

| Canada | 38,102 | | 33,802 | | 18,986 | | 15,886 | | 101,184 | | 94,938 | | 67,238 | | 58,433 | | 248,748 | | 228,852 | | 35,719 | | 32,243 | | 272,920 | | 246,575 | |

| United States | — | | — | | — | | — | | 17,272 | | 14,007 | | 7,272 | | 5,899 | | 23,086 | | 18,726 | | — | | — | | 28,391 | | 23,026 | |

| Total | 38,102 | | 33,802 | | 18,986 | | 15,886 | | 118,455 | | 108,945 | | 74,510 | | 64,332 | | 271,834 | | 247,578 | | 35,719 | | 32,243 | | 301,312 | | 269,601 | |

| Proved Developed Non-Producing | | | | | | | | | | | | | | |

| Canada | 337 | | 323 | | 2,323 | | 2,108 | | 342 | | 320 | | 2,148 | | 1,749 | | 12,140 | | 10,967 | | 69 | | 59 | | 7,185 | | 6,339 | |

| United States | — | | — | | — | | — | | 2,053 | | 1,663 | | 571 | | 462 | | 1,812 | | 1,468 | | — | | — | | 2,926 | | 2,370 | |

| Total | 337 | | 323 | | 2,323 | | 2,108 | | 2,395 | | 1,984 | | 2,719 | | 2,211 | | 13,953 | | 12,435 | | 69 | | 59 | | 10,111 | | 8,709 | |

| Proved Undeveloped | | | | | | | | | | | | | | |

| Canada | 10,757 | | 10,023 | | 1,731 | | 1,583 | | 36,893 | | 34,735 | | 65,878 | | 55,989 | | 225,188 | | 203,979 | | 3,491 | | 3,251 | | 153,372 | | 136,869 | |

| United States | — | | — | | — | | — | | 11,913 | | 9,649 | | 3,375 | | 2,734 | | 10,714 | | 8,678 | | — | | — | | 17,073 | | 13,829 | |

| Total | 10,757 | | 10,023 | | 1,731 | | 1,583 | | 48,806 | | 44,385 | | 69,253 | | 58,722 | | 235,901 | | 212,657 | | 3,491 | | 3,251 | | 170,446 | | 150,698 | |

| Total Proved | | | | | | | | | | | | | | |

| Canada | 49,197 | | 44,148 | | 23,039 | | 19,578 | | 138,419 | | 129,994 | | 135,264 | | 116,171 | | 486,076 | | 443,798 | | 39,279 | | 35,553 | | 433,478 | | 389,782 | |

| United States | — | | — | | — | | — | | 31,238 | | 25,319 | | 11,218 | | 9,095 | | 35,611 | | 28,872 | | — | | — | | 48,391 | | 39,226 | |

| Total | 49,197 | | 44,148 | | 23,039 | | 19,578 | | 169,657 | | 155,313 | | 146,482 | | 125,266 | | 521,688 | | 472,670 | | 39,279 | | 35,553 | | 481,868 | | 429,008 | |

| Total Probable | | | | | | | | | | | | | | |

| Canada | 36,550 | | 32,419 | | 7,230 | | 6,127 | | 75,590 | | 71,050 | | 44,562 | | 35,904 | | 149,035 | | 131,537 | | 23,599 | | 21,366 | | 192,705 | | 170,983 | |

| United States | — | | — | | — | | — | | 25,788 | | 20,896 | | 8,330 | | 6,751 | | 26,445 | | 21,433 | | — | | — | | 38,525 | | 31,219 | |

| Total | 36,550 | | 32,419 | | 7,230 | | 6,127 | | 101,378 | | 91,946 | | 52,892 | | 42,655 | | 175,480 | | 152,970 | | 23,599 | | 21,366 | | 231,230 | | 202,203 | |

| Total Proved Plus Probable | | | | | | | | | | | | | | |

| Canada | 85,747 | | 76,567 | | 30,268 | | 25,705 | | 214,009 | | 201,044 | | 179,827 | | 152,075 | | 635,111 | | 575,335 | | 62,877 | | 56,919 | | 626,182 | | 560,766 | |

| United States | — | | — | | — | | — | | 57,026 | | 46,215 | | 19,548 | | 15,846 | | 62,056 | | 50,305 | | — | | — | | 86,916 | | 70,445 | |

| Total | 85,747 | | 76,567 | | 30,268 | | 25,705 | | 271,034 | | 247,259 | | 199,374 | | 167,920 | | 697,167 | | 625,640 | | 62,877 | | 56,919 | | 713,098 | | 631,211 | |

Note:

(1) Numbers may not add due to rounding.

Net Present Value of Future Net Revenue of Oil and Gas Reserves(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Before Income Taxes Discounted at

(%/year) | | After Income Taxes Discounted at

(%/year) |

| Reserves Category | 0%

(MM$) | 5%

(MM$) | 8%

(MM$) | 10%

(MM$) | 15%

(MM$) | 20%

(MM$) | | 0%

(MM$) | 5%

(MM$) | 8%

(MM$) | 10%

(MM$) | 15%

(MM$) | 20%

(MM$) |

| Proved Developed Producing | | | | | | | | | | | | | |

| Canada | 8,536 | | 6,778 | | 6,028 | | 5,625 | | 4,850 | | 4,297 | | | 7,780 | | 6,265 | | 5,608 | | 5,252 | | 4,566 | | 4,071 | |

| United States | 871 | | 752 | | 696 | | 664 | | 598 | | 547 | | | 858 | | 743 | | 689 | | 657 | | 593 | | 543 | |

Total | 9,407 | | 7,530 | | 6,724 | | 6,288 | | 5,448 | | 4,845 | | | 8,638 | | 7,008 | | 6,296 | | 5,910 | | 5,159 | | 4,615 | |

| Proved Developed Non-Producing | | | | | | | | | | | | | |

| Canada | 277 | | 209 | | 183 | | 170 | | 146 | | 129 | | | 208 | | 156 | | 138 | | 128 | | 111 | | 99 | |

| United States | 129 | | 115 | | 109 | | 106 | | 99 | | 93 | | | 123 | | 111 | | 105 | | 102 | | 95 | | 90 | |

Total | 406 | | 324 | | 293 | | 276 | | 245 | | 222 | | | 331 | | 267 | | 243 | | 230 | | 206 | | 188 | |

| Proved Undeveloped | | | | | | | | | | | | | |

| Canada | 4,346 | | 2,958 | | 2,393 | | 2,092 | | 1,522 | | 1,130 | | | 3,283 | | 2,175 | | 1,726 | | 1,487 | | 1,037 | | 731 | |

| United States | 434 | | 341 | | 299 | | 275 | | 227 | | 189 | | | 404 | | 315 | | 275 | | 252 | | 205 | | 170 | |

Total | 4,779 | | 3,299 | | 2,692 | | 2,367 | | 1,749 | | 1,319 | | | 3,686 | | 2,490 | | 2,001 | | 1,739 | | 1,243 | | 901 | |

| Total Proved | | | | | | | | | | | | | |

| Canada | 13,159 | | 9,945 | | 8,605 | | 7,887 | | 6,518 | | 5,557 | | | 11,270 | | 8,596 | | 7,471 | | 6,867 | | 5,714 | | 4,901 | |

| United States | 1,433 | | 1,208 | | 1,104 | | 1,045 | | 923 | | 829 | | | 1,385 | | 1,169 | | 1,069 | | 1,011 | | 894 | | 803 | |

Total | 14,592 | | 11,153 | | 9,709 | | 8,932 | | 7,441 | | 6,386 | | | 12,655 | | 9,765 | | 8,540 | | 7,878 | | 6,607 | | 5,704 | |

| Total Probable | | | | | | | | | | | | | |

| Canada | 8,152 | | 4,487 | | 3,375 | | 2,854 | | 1,990 | | 1,476 | | | 6,171 | | 3,368 | | 2,516 | | 2,118 | | 1,460 | | 1,071 | |

| United States | 1,227 | | 883 | | 747 | | 675 | | 538 | | 443 | | | 987 | | 702 | | 590 | | 531 | | 421 | | 344 | |

Total | 9,380 | | 5,370 | | 4,121 | | 3,528 | | 2,528 | | 1,919 | | | 7,158 | | 4,070 | | 3,106 | | 2,649 | | 1,881 | | 1,415 | |

| Total Proved Plus Probable | | | | | | | | | | | | | |

| Canada | 21,312 | | 14,432 | | 11,980 | | 10,741 | | 8,508 | | 7,033 | | | 17,442 | | 11,964 | | 9,988 | | 8,985 | | 7,173 | | 5,973 | |

| United States | 2,660 | | 2,091 | | 1,851 | | 1,719 | | 1,461 | | 1,272 | | | 2,372 | | 1,871 | | 1,659 | | 1,543 | | 1,314 | | 1,147 | |

Total | 23,972 | | 16,523 | | 13,831 | | 12,460 | | 9,969 | | 8,305 | | | 19,813 | | 13,835 | | 11,646 | | 10,528 | | 8,488 | | 7,120 | |

Note:

(1) Numbers may not add due to rounding.

Additional Information Concerning Future Net Revenue – (Undiscounted)(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reserves Category | Revenue

(MM$) | Royalties & Burdens(2) (MM$) | Operating

Costs

(MM$) | Development

Costs

(MM$) | Abandonment and Reclamation Costs(3) (MM$) | Future Net

Revenue Before

Income Taxes

(MM$) | Income Tax

(MM$) | Future Net

Revenue After

Income Taxes

(MM$) |

| Proved | | | | | | | | |

| Canada | 33,876 | | 3,925 | | 12,205 | | 3,089 | | 1,497 | | 13,159 | | 1,889 | | 11,270 | |

| United States | 3,927 | | 1,012 | | 1,130 | | 315 | | 37 | | 1,433 | | 48 | | 1,385 | |

| Total | 37,803 | | 4,937 | | 13,336 | | 3,404 | | 1,534 | | 14,592 | | 1,937 | | 12,655 | |

| Proved Plus Probable | | | | | | | | |

| Canada | 51,653 | | 6,164 | | 18,075 | | 4,448 | | 1,655 | | 21,312 | | 3,870 | | 17,442 | |

| United States | 7,228 | | 1,867 | | 1,958 | | 696 | | 46 | | 2,660 | | 288 | | 2,372 | |

| Total | 58,881 | | 8,031 | | 20,033 | | 5,145 | | 1,701 | | 23,972 | | 4,158 | | 19,813 | |

Notes:

(1) Numbers may not add due to rounding.

(2) Saskatchewan Capital Resource Surcharge, as well as Ad Valorem, have been included under the royalties and burdens column.

(3) In accordance with the Canadian Oil and Gas Evaluation Handbook, abandonment and reclamation costs include: (i) entities with associated reserves included in the Crescent Point Reserve Report, the undiscounted abandonment and reclamation costs associated with these amounts to $843 million and $1.0 billion for Proved and Proved plus Probable, respectively; and (ii) non-reserve entities that include wells with no reserves assigned, suspended wells, pipeline, and facilities, the undiscounted abandonment and reclamation costs associated with these are estimated at $691 million.

Future Net Revenue by Production Type(1)

| | | | | | | | | | | | | | |

| Future Net Revenue Before Income Taxes(2) (Discounted at 10% per year) | Percentage | Unit Value |

| (MM$) | (%) | ($/boe) | ($/Mcfe) |

| Proved | | | | |

| CANADA | | | | |

Light and Medium Crude Oil(3) | 1,037 | | 13.1 | | 19.85 | | 3.31 | |

Heavy Crude Oil(3) | 398 | | 5.0 | | 20.19 | | 3.36 | |

Tight Oil(5) | 3,259 | | 41.3 | | 18.88 | | 3.15 | |

Shale Gas(6) | 3,144 | | 39.9 | | 22.66 | | 3.78 | |

Conventional Natural Gas(4) | 50 | | 0.6 | | 7.76 | | 1.29 | |

| Total Canada | 7,887 | | 100 | | 20.23 | | 3.37 | |

| UNITED STATES | | | | |

Light and Medium Crude Oil(3) | — | | — | | — | | — | |

Heavy Crude Oil(3) | — | | — | | — | | — | |

Tight Oil(5) | 1,045 | | 100 | | 26.63 | | 4.44 | |

Shale Gas(4)(6) | — | | — | | — | | — | |

Conventional Natural Gas(4) | — | | — | | — | | — | |

| Total United States | 1,045 | | 100 | | 26.63 | | 4.44 | |

| TOTAL | | | | |

Light and Medium Crude Oil(3) | 1,037 | | 11.6 | | 19.85 | | 3.31 | |

Heavy Crude Oil(3) | 398 | | 4.5 | | 20.19 | | 3.36 | |

Tight Oil(5) | 4,303 | | 48.2 | | 20.31 | | 3.39 | |

Shale Gas(4)(6) | 3,144 | | 35.2 | | 22.66 | | 3.78 | |

Conventional Natural Gas(4) | 50 | | 0.6 | | 7.76 | | 1.29 | |

| Total Proved | 8,932 | | 100 | | 20.82 | | 3.47 | |

Notes:

(1) Numbers may not add due to rounding.

(2) Other company revenue and costs not related to a specific production type have been allocated proportionately to production types. Unit values are based on Company Net Reserves.

(3) Including solution gas and other by-products.

(4) Including by-products, but excluding solution gas.

(5) Including solution gas (categorized as "Shale Gas") and other by-products.

(6) Shale Gas includes the majority of Natural Gas Liquids.

| | | | | | | | | | | | | | |

| Future Net Revenue

Before Income Taxes(2) (Discounted at 10% per year) | Percentage | Unit Value |

| (MM$) | (%) | ($/boe) | ($/Mcfe) |

| Proved Plus Probable | | | | |

| CANADA | | | | |

Light and Medium Crude Oil(3) | 1,710 | | 15.9 | | 18.13 | | 3.02 | |

Heavy Crude Oil(3) | 493 | | 4.6 | | 19.06 | | 3.18 | |

Tight Oil(5) | 4,752 | | 44.2 | | 18.13 | | 3.02 | |

Shale Gas(6) | 3,730 | | 34.7 | | 21.84 | | 3.64 | |

Conventional Natural Gas(4) | 57 | | 0.5 | | 7.29 | | 1.22 | |

| Total Canada | 10,741 | | 100 | | 19.15 | | 3.19 | |

| UNITED STATES | | | | |

Light and Medium Crude Oil(3) | — | | — | | — | | — | |

Heavy Crude Oil(3) | — | | — | | — | | — | |

Tight Oil(5) | 1,719 | | 100 | | 24.40 | | 4.07 | |

Shale Gas(4)(6) | — | | — | | — | | — | |

Conventional Natural Gas(4) | — | | — | | — | | — | |

| Total United States | 1,719 | | 100 | | 24.40 | | 4.07 | |

| TOTAL | | | | |

Light and Medium Crude Oil(3) | 1,710 | | 13.7 | | 18.13 | | 3.02 | |

Heavy Crude Oil(3) | 493 | | 4.0 | | 19.06 | | 3.18 | |

Tight Oil(5) | 6,471 | | 51.9 | | 19.46 | | 3.24 | |

Shale Gas(4)(6) | 3,730 | | 29.9 | | 21.84 | | 3.64 | |

Conventional Natural Gas(4) | 57 | | 0.5 | | 7.29 | | 1.22 | |

| Total Proved Plus Probable | 12,460 | | 100 | | 19.74 | | 3.29 | |

Notes:

(1) Numbers may not add due to rounding.

(2) Other company revenue and costs not related to a specific production type have been allocated proportionately to production types. Unit values are based on Company Net Reserves.

(3) Including solution gas and other by-products.

(4) Including by-products, but excluding solution gas.

(5) Including solution gas (categorized as "Shale Gas") and other by-products.

(6) Shale Gas includes the majority of Natural Gas Liquids.

Notes and Definitions

In the tables set forth above in "Disclosure of Reserves Data" and elsewhere in this AIF, the following notes and other definitions are applicable.

Reserve Categories

The determination of oil and gas reserves involves the preparation of estimates that have an inherent degree of associated uncertainty. Categories of Proved and Probable reserves have been established in accordance with NI 51-101 to reflect the level of these uncertainties and to provide an indication of the probability of recovery.

The estimation and classification of reserves requires the application of professional judgment combined with geological and engineering knowledge to assess whether or not specific reserves classification criteria have been satisfied. Knowledge of concepts including uncertainty and risk, probability and statistics, and deterministic and probabilistic estimation methods is required to properly use and apply reserves definitions.

(a) "Reserves" are estimated remaining economic quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on (a) analysis of drilling, geological, geophysical, and engineering data; (b) the use of established technology; and (c) specified economic conditions, which are generally accepted as being reasonable and shall be disclosed. Reserves are classified according to the degree of certainty associated with the estimates.

(b) "Proved" reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves.

(c) "Developed Producing" reserves are those reserves that are expected to be recovered from completion intervals open at the time of the estimate. These reserves may be currently producing or, if shut-in, they must have previously been on production, and the date of resumption of production must be known with reasonable certainty.

(d) "Developed Non-Producing" reserves are those reserves that either have not been on production, or have previously been on production, but are shut-in, and the date of resumption of production is unknown.

(e) "Undeveloped" reserves are those reserves expected to be recovered from known accumulations where a significant expenditure (e.g., when compared to the cost of drilling a well) is required to render them capable of production. They must fully meet the requirements of the reserves category (proved, probable, possible) to which they are assigned. In multi-well pools, it may be appropriate to allocate total pool reserves between the developed and undeveloped categories or to sub-divide the developed reserves for the pool between developed producing and developed non-producing. This allocation should be based on the estimator's assessment as to the reserves that will be recovered from specific wells, facilities and completion intervals in the pool and their respective development and production status.

(f) "Probable" reserves are those additional reserves that are less certain to be recovered than Proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated Proved plus Probable reserves.

Levels of Certainty for Reported Reserves

The qualitative certainty levels referred to in the definitions above are applicable to individual reserve entities (which refers to the lowest level at which reserves calculations are performed) and to reported reserves (which refers to the highest level sum of individual entity estimates for which reserves are presented). Reported reserves should target the following levels of certainty under a specific set of economic conditions:

•at least a 90% probability that the quantities actually recovered will equal or exceed the estimated Proved reserves; and

•at least a 50% probability that the quantities actually recovered will equal or exceed the sum of the estimated Proved plus Probable reserves.

A quantitative measure of the certainty levels pertaining to estimates prepared for the various reserves categories is desirable to provide a clearer understanding of the associated risks and uncertainties. However, the majority of reserves estimates will be prepared using deterministic methods that do not provide a mathematically derived quantitative measure of probability. In principle, there should be no difference between estimates prepared using probabilistic or deterministic methods.

Additional Definitions

The following terms, used in the preparation of the Crescent Point Reserve Report and this AIF, have the following meanings:

(a) "associated gas" means the gas cap overlying a crude oil accumulation in a reservoir.

(b) "crude oil" or "oil" means a mixture that consists mainly of pentanes and heavier hydrocarbons, which may contain small amounts of sulphur and other non-hydrocarbons, that exists in the liquid phase in reservoirs and remains liquid at atmospheric pressure and temperature. It does not include liquids obtained from the processing of natural gas.

(c) "development costs" means costs incurred to obtain access to reserves and to provide facilities for extracting, treating, gathering and storing the oil and gas from the reserves. More specifically, development costs, including applicable operating costs of support equipment and facilities and other costs of development activities, are costs incurred to:

(i) gain access to and prepare well locations for drilling, including surveying well locations for the purpose of determining specific development drilling sites, clearing ground, draining, road building, and relocating public roads, gas lines and power lines, to the extent necessary in developing the reserves;

(ii) drill and equip development wells, development type stratigraphic test wells and service wells, including the costs of platforms and of well equipment such as casing, tubing, pumping equipment and the wellhead assembly;

(iii) acquire, construct and install production facilities such as flow lines, separators, treaters, heaters, manifolds measuring devices and production storage, natural gas cycling and processing plants, and central utility and waste disposal system; and

(iv) provide improved recovery systems.

(d) "development well" means a well drilled inside the established limits of an oil or gas reservoir, or in close proximity to the edge of the reservoir, to the depth of a stratigraphic horizon known to be productive.

(e) "exploration costs" means costs incurred in identifying areas that may warrant examination and in examining specific areas that are considered to have prospects that may contain oil and gas reserves, including costs of drilling exploratory wells and exploratory type stratigraphic test wells. Exploration costs may be incurred both before acquiring the related property (sometimes referred to in part as "prospecting costs") and after acquiring the property. Exploration costs, which include applicable operating costs of support equipment and facilities and other costs of exploration activities, are:

(i) costs of topographical, geochemical, geological and geophysical studies, rights of access to properties to conduct those studies, and salaries and other expenses of geologists, geophysical crews and others conducting those studies (collectively sometimes referred to as "geological and geophysical costs");

(ii) costs of carrying and retaining unproved properties, such as delay rentals, taxes (other than income and capital taxes) on properties, legal costs for title defense, and the maintenance of land and lease records;

(iii) dry hole contributions and bottom hole contributions;

(iv) costs of drilling and equipping exploratory wells; and

(v) costs of drilling exploratory type stratigraphic test wells.

(f) "exploratory well" means a well that is not a development well, a service well or a development type stratigraphic test well.

(g) "field" means an area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual geological structural feature and/or stratigraphic condition. There may be two or more reservoirs in a field that are separated vertically by intervening impervious strata or laterally by local geologic barriers, or both. Reservoirs that are associated by being in overlapping or adjacent fields may be treated as a single or common operational field. The geological terms "structural feature" and "stratigraphic condition" are intended to denote localized geological features, in contrast to broader terms such as "basin", "trend", "province", "play" or "area of interest".

(h) "future prices and costs" means future prices and costs that are:

(i) generally accepted as being a reasonable outlook of the future; and

(ii) if, and only to the extent that, there are fixed or presently determinable future prices or costs to which the Corporation is legally bound by a contractual or other obligation to supply a physical product, including those for an extension period of a contract that is likely to be extended, those prices or costs rather than the prices and costs referred to in paragraph (i).

(i) "future income tax expenses" means future income tax expenses estimated (generally, year-by-year):

(i) making appropriate allocations of estimated unclaimed costs and losses carried forward for tax purposes, between oil and gas activities and other business activities;

(ii) without deducting estimated future costs that are not deductible in computing taxable income;

(iii) taking into account estimated tax credits and allowances (for example, royalty tax credits); and

(iv) applying to the future pre-tax net cash flows relating to the Corporation's oil and gas activities the appropriate year end statutory tax rates, taking into account future tax rates already legislated.

(j) "future net revenue" means the estimated net amount to be received with respect to the anticipated development and production of reserves (including synthetic oil, coal bed methane and other non-conventional reserves) estimated using future prices and costs.

(k) "gross" means:

(i) in relation to the Corporation's interest in production or reserves, its "company gross reserves", which are its working interest (operated or non-operated) share before deduction of royalties and without including any royalty interests of the Corporation;

(ii) in relation to wells, the total number of wells in which the Corporation has an interest; and

(iii) in relation to properties, the total area of properties in which the Corporation has an interest.

(l) "natural gas" means a naturally occurring mixture of hydrocarbon gases and other gases.

(m) "natural gas liquids" means those hydrocarbon components that can be recovered from natural gas as liquids including, but not limited to, ethane, propane, butanes, pentanes plus, condensate and small quantities of non-hydrocarbons.

(n) "net" means:

(i) in relation to the Corporation's interest in production or reserves, its working interest (operated or non-operated) share after deduction of royalty obligations, plus its royalty interests in production or reserves;

(ii) in relation to the Corporation's interest in wells, the number of wells obtained by aggregating the Corporation's working interest in each of its gross wells; and

(iii) in relation to the Corporation's interest in a property, the total area in which the Corporation has an interest multiplied by the working interest owned by the Corporation.

(o) "non-associated gas" means an accumulation of natural gas in a reservoir where there is no crude oil.

(p) "operating costs" or "production costs" means costs incurred to operate and maintain wells and related equipment and facilities, including applicable operating costs of support equipment and facilities as well as other costs of operating and maintaining those wells and related equipment and facilities.

(q) "production" means recovering, gathering, treating, field or plant processing (for example, processing gas to extract natural gas liquids) and field storage of oil and gas.

(r) "property" includes:

(i) fee ownership or a lease, concession, agreement, permit, license or other interest representing the right to extract oil or gas subject to such terms as may be imposed by the conveyance of that interest;

(ii) royalty interests, production payments payable in oil or gas, and other non-operated interests in properties operated by others; and

(iii) an agreement with a foreign government or authority under which the Corporation participates in the operation of properties or otherwise serves as "producer" of the underlying reserves (in contrast to being an independent purchaser, broker, dealer or importer).

A property does not include supply agreements, or contracts that represent a right to purchase, rather than extract, oil or gas.

(s) "property acquisition costs" means costs incurred to acquire a property (directly by purchase or lease, or indirectly by acquiring another corporate entity with an interest in the property), including:

(i) costs of lease bonuses and options to purchase or lease a property;

(ii) the portion of the costs applicable to hydrocarbons when land including rights to hydrocarbons is purchased in fee; and

(iii) brokers' fees, recording and registration fees, legal costs and other costs incurred in acquiring properties.

(t) "proved property" means a property or part of a property to which reserves have been specifically attributed.

(u) "reservoir" means a subsurface rock unit that contains an accumulation of petroleum.

(v) "service well" means a well drilled or completed for the purpose of supporting production in an existing field. Wells in this class are drilled for the following specific purposes: gas injection (natural gas, propane, butane or flue gas), water injection, steam injection, air injection, salt-water disposal, water supply for injection, observation, or injection for combustion.

(w) "solution gas" means natural gas dissolved in crude oil.

(x) "stratigraphic test well" means a drilling effort, geologically directed, to obtain information pertaining to a specific geologic condition. Ordinarily, such wells are drilled without the intention of being completed for hydrocarbon production. They include wells for the purpose of core tests and all types of expendable holes related to hydrocarbon exploration. Stratigraphic test wells are classified as (i) "exploratory type" if not drilled into a proved property; or (ii) "development type", if drilled into a proved property. Development type stratigraphic wells are also referred to as "evaluation wells".

(y) "support equipment and facilities" means equipment and facilities used in oil and gas activities, including seismic equipment, drilling equipment, construction and grading equipment, vehicles, repair shops, warehouses, supply points, camps, and division, district or field offices.

(z) "unproved property" means a property or part of a property to which no reserves have been specifically attributed.

(aa) "well abandonment and reclamation costs" means costs of abandoning a well (net of salvage value) and of disconnecting the well from the surface gathering system and remediating and reclaiming the site to original conditions. They do not include costs of abandoning the gathering system.

Pricing Assumptions – Forecast Prices and Costs

The average of the three independent reserve evaluator price decks (McDaniel, GLJ Ltd., and Sproule Associates Ltd.) resulted in the following pricing, exchange rate and inflation rate assumptions as of December 31, 2022 in estimating our reserves data using forecast prices and costs.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year | Crude Oil | Conventional Natural Gas | NGLs | | | |

| WTI at Cushing Oklahoma ($US/bbl) | Edmonton ($Cdn/bbl) | Henry Hub NYMEX ($US/MMBTU) | AECO/NIT Spot ($Cdn/MMBTU) | Pentane Plus Edmonton ($Cdn/bbl) | Butane Edmonton ($Cdn/bbl) | Propane Edmonton ($Cdn/bbl) | Operating Cost Inflation Rate (%/yr) | Capital Cost Inflation Rate (%/yr) | Exchange Rate ($US/$Cdn) |

| Forecast | | | | | | | | | | |

| 2023 | 80.33 | | 103.76 | | 4.74 | | 4.23 | | 106.22 | | 53.88 | | 39.80 | | 0.0% | 0.0% | 0.745 |

| 2024 | 78.50 | 97.74 | 4.50 | 4.40 | 101.35 | 52.67 | 39.14 | 2.3% | 2.3% | 0.765 |

| 2025 | 76.95 | | 95.27 | | 4.31 | | 4.21 | | 98.94 | | 51.42 | | 39.74 | | 2.0% | 2.0% | 0.768 |

| 2026 | 77.61 | 95.58 | 4.40 | 4.27 | 100.19 | 51.61 | 39.86 | 2.0% | 2.0% | 0.772 |

| 2027 | 79.16 | | 97.07 | | 4.49 | | 4.34 | | 101.74 | | 52.39 | | 40.47 | | 2.0% | 2.0% | 0.775 |

| 2028 | 80.74 | 99.01 | 4.58 | 4.43 | 103.78 | 53.44 | 41.28 | 2.0% | 2.0% | 0.775 |

| 2029 | 82.36 | | 100.99 | | 4.67 | | 4.51 | | 105.85 | | 54.51 | | 42.11 | | 2.0% | 2.0% | 0.775 |