|

OMB APPROVAL | |

|

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck, Esq.

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | October 31 | |

| Date of reporting period: | October 31, 2019 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-866-822-9555 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-866-822-9555. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

STRALEM EQUITY FUND

LETTER TO SHAREHOLDERS

December 2019

Dear Shareholder,

Each year following the close of Stralem Equity Fund’s (the “Fund”) fiscal year on October 31, the Fund reports to you on its results and Stralem & Company Incorporated’s (Stralem) current investment outlook.

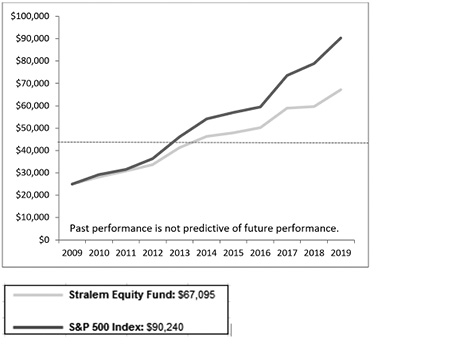

Performance

For the fiscal year ended October 31, 2019, the Fund (STEFX) provided a return of +12.56% before taxes and after fees and expenses but trailed the benchmark S&P 500 Index (the “Benchmark”) which returned +14.33% (which of course has no fees, taxes or expenses) as shown in the table below.

AVERAGE ANNUAL TOTAL RETURNS

BEFORE TAXES AND AFTER FEES AND EXPENSES

|

Periods Ended 10/31/19 |

|||

1 YR |

5 YRS |

10 YRS |

Since |

|

Stralem Equity Fund |

12.56% |

7.67% |

10.38% |

5.94% |

S&P 500 Index |

14.33% |

10.78% |

13.70% |

5.82% |

* |

Inception: January 18, 2000. |

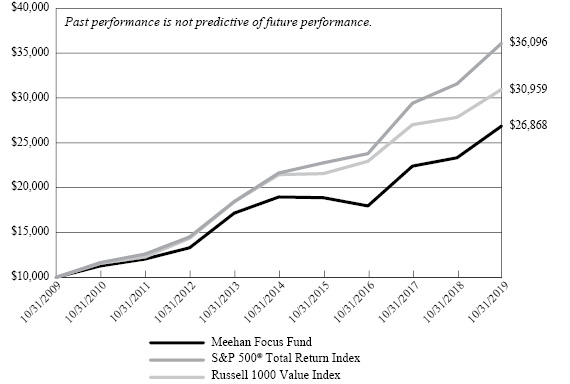

Comparison of the Change in Value of a $25,000 Investment in

Stralem Equity Fund- vs. S&P 500 Index

1

PERFORMANCE NOTES: Stralem Equity Fund is advised by Stralem & Company Incorporated (“Stralem”), an independent, SEC registered investment adviser established in 1966. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month end or to receive a prospectus, please call (866) 822-9555 toll free or visit the Fund’s website at www.stralemequityfund.com. Performance results for the Fund are stated after investment advisory fees and expenses (net) but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund can suffer losses as well as gains. Performance results are calculated on a total return basis, which includes all income from dividends and interest and realized and unrealized gains or losses. Assuming dividends are reinvested, the growth in dollars of an investment in a period can be computed using these rates of return. The S&P 500 Index is widely used as a barometer of U.S. stock market performance. The S&P 500 Index is the Standard & Poor’s Composite Index of 500 Stocks, a widely recognized, unmanaged index of common stock prices. It is shown with dividends included and reflects no deduction for fees, expenses or taxes. |

In the first calendar quarter of 2019, the S&P 500 was +13.6%, representing a near full reversal of the notably weak fourth quarter of 2018 when the index was -13.5%, and the month of December 2018 (-9.0%) which was the worst December since 1931. However, as historically bad as the fourth quarter was, the rebound in early 2019 was almost equally historic, as it represented the best first quarter return in over 20 years with the month of January return (+8.0%) the best in 30 years! This significant market volatility comes as the S&P 500 Index has now returned an extraordinary +460% in the 10+ years since the market bottom in March 2009 (+17.6% annualized) and as of the end of the Fund’s fiscal year sits at an all-time high, +23.2% in calendar year 2019.

The market continues to be fueled by slow and steady economic growth made possible by record-low interest rates, loose monetary policy, muted inflation, strong and consistent job growth, and a fiscal stimulus (reduced corporate taxes) that drives corporate margins well above average and supports continued earnings growth.

While the bull market re-accelerated in 2019 after a hard sell off to end 2018, volatility also returned indicating investors were anxious about the macro environment and not fully comfortable with simply being long and strong. The story of 2019 centered around the contentious negotiations between the U.S. and China surrounding trade policy and tariffs and the ripple effect this battle inflicted on the world’s two largest economies as well as peripheral economies in Europe and Asia. While punitive tariffs were ultimately implemented on both sides, the result was a global growth slowdown which eventually devolved into a manufacturing recession in the U.S., sub-2.0% GDP in Q3, and China GDP (+6%) at the lowest growth rate since 1992!

The weakening growth in the U.S. coupled with concerns about further slowing in Europe struggling to resolve Brexit, forced the Federal Reserve to respond by reversing course and not only lowering interest rates three times in 2019, but also re-instituting its bond buying program (Quantitative Easing) in an effort to

2

hold down longer rates. The lower rates helped buoy the resilient U.S. consumer, prevented GDP from falling even lower and acted as a sustained catalyst for the equity markets – there seemed to be no one willing to fight the Fed.

Similarly, the EU was forced to deal with economic growth bordering on recessionary, so the European Central Bank also continued to lower rates – often to yields below zero – to stimulate the economy. Currently $17 trillion of global sovereign debt carries a negative interest rate yield!

As the year progressed and global manufacturing continued to contract, the ongoing uncertainty about the resolution of a trade deal and the negative effect of implemented tariffs beginning to take hold, visibility into future economic growth became increasingly questionable. Investors sought the safety of defensive equities and bonds. This rotation into bonds at the same time the Fed was easing caused the yield curve to invert – where shorter term rates are higher than longer term rates – historically an early and strong signal of an impending recession. Just the mention of the “R word” spooked investors and led to additional angst and uncertainty.

Against this backdrop, globally exposed companies found the environment especially challenging as emerging market demand was unpredictable and supply chains exposed to tariffs were disrupted. Typically, large international firms prefer government regulatory certainty and visibility in order to manage their business demands efficiently and effectively. This was hardly the case in 2019 and while corporate margins remained solid, they were decidedly below the peak of 2018, and S&P 500 earnings growth expectations for 2019 fell below 2%, while Q3 earnings were negative on a year-over-year basis! Certainly not the fundamental backdrop for all-time highs in the S&P 500.

Despite this uncertain environment and potentially negative fundamental catalysts, the equity markets marched higher and the S&P 500 produced another record high at the end of October. At the same time, demand for the safety of Treasury bonds skyrocketed, and the 10-year Treasury bond yield fell to its second lowest level on record, 1.42%, at the end of September. Fixed income and equities are historically counter cyclical so for both markets to achieve record highs at essentially the same time is an anomaly that is puzzling and drives additional investor concern and caution.

While we may sound like a broken record, today just about every market pundit will agree that this market environment is not normal, nor is it likely to be sustainable indefinitely. Exactly when, why, and to what magnitude is difficult to predict, but it is not hard to predict that more volatility is likely on the way.

There have been only five market declines greater than 10% over the entire market rally since March 2009. The Fund’s portfolio structure protected capital in each instance although each proved to merely be a speed bump on the way to a new record high.

3

In summary, despite our concerns about the overall market environment, we are confident in the portfolio’s positioning as well as in the companies we own. We continue to adhere to our time-tested process and discipline and believe “participation with protection” is the best way to build long-term wealth.

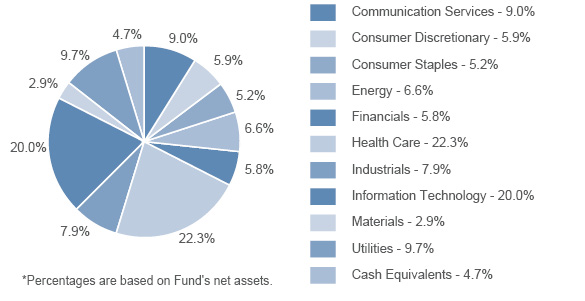

Portfolio Structure and Positioning

As of October 31, 2019, the overall allocation stood at 65% Up Market/ 35% Down Market.

Since the financial crisis Stralem has remained positioned with a slight conservative edge, allocating 35% of the portfolio to capital-preserving Down Market stocks and 65% of the portfolio emphasizing high-quality, larger-market-cap, globally exposed, stable and innovative growth-participating Up Market companies. Although this structure has predictably caused us to trail the S&P 500, we intentionally maintain it out of concern for the multitude of risks we see and are unwilling to ignore.

Investment Outlook

While the Fund’s fiscal year began slowly based on concerns about a trade war with China, it finished strongly, with hope that a phase one trade deal will be signed by the end of the year, tariffs will be reversed, and global growth will re-accelerate.

However, with the S&P 500 at an all-time high and +23.2% on a calendar year-to-date basis it is increasingly difficult to envision where the next catalyst will come from. The trade deal is not yet resolved despite endless rhetoric to the contrary and, even if an agreement can be reached, the damage to corporate confidence, supply chains, and international demand may not easily or quickly be repaired.

Global GDP continues to slow while the loosening of monetary policy may not be achieving its desired effect. In the U.S. the consumer remains strongly behind record low unemployment and accelerating wage growth, but confidence is waning, and as the consumer goes, so too goes the U.S. economy.

As we enter an election year, with a President under an impeachment inquiry and political gridlock at its highest level, it is much easier to imagine a growth slowdown in 2020 than a growth re-acceleration. And as 2020 unfolds and we get closer and closer to the election, it is hard not to expect increased volatility as campaign promises and policy prescriptions are translated into equity market winners and losers.

While many companies have done an admirable job navigating the current environment, others have not had such luck. This bifurcation in performance is a market characteristic that provides active managers like Stralem hope that fundamentals will be the driver of equity returns and not merely lower interest rates, reduced taxes or increased buybacks.

At Stralem, our mantra has long been “Participation with Protection.” At present, the protection element does not seem to be relevant; however, given views on both the macro economy and what we are seeing at the company level, we firmly

4

believe it is more important than ever. However, we also recognize that market timing, and trying to speculate what could be the catalyst to derail the market’s 10-year bull-run, are endeavors fraught with peril. As a result, while maintaining a “Down-Market” protection component in the Large Cap Equity Strategy, we also continuously try to identify and invest in the most exciting secular growth opportunities that will provide participation in strong markets.

Performance Attribution

The Fund’s slight relative underperformance for the fiscal year ended Oct 31, 2019 was driven primarily by the Up-Market sector (-0.88%) and by the cash component in the Down-Market sector (-0.78%).

While all the categories of the Up-Market sector delivered positive returns, the relative underperformance was driven by the Dominant Companies category which despite some strong performers was only +10.1% for the year, slightly lagging the benchmark. The Fund certainly had its share of Dominant Company winners, most notably D.R. Horton (+47.5%), Danaher (+39.1%) and Visa (+30.3%), however, poor performance from Fedex (-29.8%), Carnival (-18.9%), and DowDupont (-16.5%) dragged on Fund performance.

FedEx is directly in the crosshairs of the tariff dispute with China as the company relies heavily on global trade. As exports from China into Europe and the U.S. slow, FedEx is forced to adjust its routes and capacity, which impacts revenue and cost. Fortunately, the continued growth in e-commerce benefits FedEx freight business in the U.S. which has been the bright spot, but the International Priority is a high-margin business for FedEx and a slowdown in global trade can have a significant impact on earnings. We believe that the eventual resolution of the trade dispute will serve as a catalyst and we continue to believe in the long-term outlook for the company.

Carnival was negatively impacted by global growth concerns as markets in Europe and Asia have slowed dramatically. In addition, the Trump administration restricted access to Cuba for all travelers, including cruise ships, which disrupted a new and popular destination. While some of these issues are likely temporary, and overall cruise industry fundamentals remain solid, we chose to exit this position at the end of the fiscal year, uncertain about how long a fundamental turn-around might take (more details below in “Purchases & Sales”).

Another Fund holding, DowDupont, the world’s largest diversified chemical conglomerate that was a previous merger of Dow Chemical and Dupont, spent the year splitting up into three distinct companies: Dow, Dupont and Corteva. This process was confusing to investors and led to volatility in the parent DowDupont (-16.5%) before and after the spin-outs became effective. The Fund ultimately sold the Corteva and Dupont, but retained Dow Inc.because it retains a globally dominant position, strong balance sheet and the best management team of the three companies.

Both the New Industries and the New Product categories produced relative outperformance driven by stock selection. While several holdings performed very well, Broadcom (+36.0%) and Celgene (+19.1%) were the stand-out contributors for the year.

5

Broadcom is semiconductor manufacturer with a corporate strategy of acquiring small, but dominant and high-margin semiconductor businesses and the cross-selling the products to large device manufacturers like Apple. The company is laser focused on producing a lot of free cash flow and using it to buy more companies. In August the company announced a software acquisition, Symantec, that at first confused investors, but as the company had the chance to explain its rationale—stable, recurring revenue, strong brand and high margin business – more investors became interested.

Celgene, a large biotechnology company the Fund bought several years ago, was finally acquired by Bristol Myers at a healthy premium, and we exited the position.

The relative outperformance in the Down-Market sector was driven by the High Yield category, where strength in communications and media giant AT&T (+33.1%) and electric utility provider American Electric Power (+32.9%) were somewhat offset by weakness in shale oil and gas producer EOG Resources (-33.0%).

AEP and AT&T both executed well but benefited dramatically by the steep drop in interest rates that occurred throughout the year. At the start of the fiscal year (November 2018) the 10-year Treasury yield was over 3.2% and by the end of the fiscal year it was 1.7%. As the year progressed, and the S&P 500 made new highs, investors chose to rotate into bonds, or purchase more defensive equities – like those in our High Yield category that produce stable earnings and pay strong dividends. At the end of the fiscal year, AT&T’s dividend yield was 5.5% and AEP’s was 3.0% -- both far in excess of the Treasury yield.

EOG Resources, one of the country’s lowest-cost shale oil producers had a difficult fiscal year 2019 as the trade wars and a manufacturing recession in the U.S. drove the price of oil down approximately 20% from $67 to the low $50 range. While EOG’s extraction cost remains below $30 per barrel enabling it to profitably produce at current price levels, the sell-off in oil negatively impacted the stock. We view this as a temporary situation and expect strong and steady cash flow and returns from the company.

Purchases and Sales

During the Fund’s fiscal year ended October 31, 2019, the Fund sold two securities and bought four securities, increasing the total number of holdings to 35. Within the Dominant Companies category of the Up Market, the Fund sold Carnival (CCL) and within the Low Price to Cash Flow category of the Down Market the fund sold Bank of New York (BK).

In the Up Market, the Fund purchased KeySight Technologies (KEYS) in the New Products category and Raytheon (RTN) in the Dominant Companies category while in the Down Market the Fund bought Tyson Foods (TSN) in the Low Price to Cash Flow category and Coca Cola (KO) in the High Yield category.

A significant driver of Carnival’s investment thesis was the company’s plans to expand in Europe and Asia while launching new destinations in the Caribbean. Both of those drivers were impacted by the global economic slowdown due to the

6

trade wars that had a chilling effect on demand in some of the previously strong growth markets in Europe and Asia. And while cruising remains an affordable indulgence for many, we became concerned about a secular impact in demand, and decided to exit the position.

Bank of New York’s attractiveness as an investment was because it is largely a stable, fee-centric, custody bank with margins below its peers. The company became intriguing with the hiring of Charlie Scharf, Jamie Dimon protégé, from Visa, who convinced investors he could cut costs, drive higher margins, increase investment in technology and innovation, and take advantage of the rising rate environment. However, while interest rates rose initially, they quickly reversed, and Mr. Scharf was recruited to become CEO of Wells Fargo. With limited progress to date on Scharf’s restructuring plan and a search underway for a new CEO, we decided it was time to exit the position.

Keysight Technologies is a test and measurement company that was spun-off of Agilient Technologies (which itself was spun-off of Hewlett Packard) in 2014 and the company has a niche in the technology hardware and infrastructure market. One of the largest drivers of growth is the expected expansion of next-gen wireless cellular capabilities via 5G, which will allow increasing broadband functionality over cellular networks. With customers up and down the Communications supply chain, Keysight expects to be a big beneficiary as this new technology continues to roll out in 2019 and beyond.

Raytheon Technologies will become one of the largest Commercial Aerospace and Defense manufacturers when it completes its merger with United Technologies in 2020. In conjunction with the merger, UTX also intends to sell-off its Otis Elevator and Carrier business units and become more focused on next generation aerospace. The new company will be a dominant player in several commercial aerospace categories that will enable it to grow as the world’s airlines continue to expand along with the rising middle class’ desire to travel. The Department of Defense is very supportive of the merger and the combined company will have a strong balance sheet and steady cash flow to enable it to invest in R&D, innovate and potentially perform tuck-in acquisitions.

Tyson Foods, the nation’s largest public packaged food producer (larger than Pepsi) with an almost exclusive focus on protein-based foods (beef, pork, chicken) caters to the growing global middle class and their desire for a more complex diet. China is a significant end market and while the tariffs are having a near-term impact on demand, it is offset by the Asian Swine Flu (ASF) that forced China to kill-off a significant portion of its existing pig population. Pork is the #1 protein consumed in China and it can take several years to rebuild a pig herd which enables Tyson to be in a strong position to benefit on both a cyclical and secular basis. In addition, in developed markets, Tyson is becoming more vertically integrated and through several acquisitions can now offer more packaged and prepared foods that not only address a growing need from U.S. consumers, but these products carry a much higher margin. The combination of limited global suppliers, secular and cyclical demand and improving margins makes the company quite attractive.

7

Lastly, Coca-Cola is a well-known brand that is undergoing an internal restructuring under a new management team that has created more growth opportunities, more innovation, and more of a focus on capital allocation and profit generation – all music to our ears. Previously the company was too focused on brand Coca Cola and, when consumers sought lower sugar options, Coke lacked options. The new management team sold off many of the capital-intensive bottling operations and plowed the proceeds into acquisitions buying Costa Coffee and developing a partnership with Monster Energy drinks. This is radical innovation for Coke but the management brought process and discipline to innovation that should improve the probability of success. Already the product portfolio has been transformed and packaging changes implemented which has created a growth engine that is less focused on mere volume growth, but rather on profits. The company has started to see results and we expect the success to continue.

Conclusion

Stralem’s long-held investment discipline is based on the principle of “Participation with Protection” which is based on the understanding that when it comes to building sustainable wealth, the impact of preserving capital in falling markets far outstrips the importance of outperforming in rising ones. So, despite the challenges of outperforming the S&P 500 Index from the market low in 2009, Stralem chose not to chase performance for performance sake and remained disciplined awaiting a return to a more “normalized” historical environment. This normalized environment has taken longer to occur than we, or most Wall Street pundits, have expected, however it may finally be upon us.

While we now enter the 11th year of this stock market expansion, the Federal Reserve and other global central banks are back to cutting rates and loosening monetary policy as the global economy continues to slow. In the U.S., we passed an aggressive corporate and personal tax cut plan designed to stimulate growth and increase investment at home. However, a crushing trade war with China has caused incredible uncertainty about future demand and crimped investment spending, while simultaneously increasing costs due to tariffs. Corporate America is struggling to adjust to this reality and sales, margins, and earnings have slowed as a result. Fortunately, the U.S. consumer remains healthy as unemployment is at historic lows, inflation muted, interest rates falling and wage growth starting to finally grow.

The question investors are being forced to ask themselves is how much do they expect the economy to improve from here and what is their conviction in that prediction. Judging from the rotation to bonds and safe equities in 2019, the answer seems to be obvious.

With the equity market continuing to make new highs and extending this one-way bull market into record territory, Stralem continues to be convinced that fundamental analysis, investment prudence and discipline will once again prove to be critical. We’ve experienced this several times in our 50-plus year history and know full well that it is always hardest to remain disciplined the harder it gets.

8

Market corrections – both large and small – happen, and they typically occur when least expected. At Stralem, even at the cost of sometimes trailing the Benchmark, we will remain steadfast in our discipline and patient in our approach – continuing to maintain an allocation to downside protection while seeking fundamentally advantaged, high quality companies that meet our criteria for growth and valuation. A return to fundamental investing unencumbered by very loose monetary policy should, in our view, amply reward such discipline.

Please do not hesitate to contact us with any questions.

Sincerely,

Andrea Baumann Lustig

President, Stralem & Company Incorporated

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-866-822-9555.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.stralemequityfund.com or call 1-866-822-9555 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of Stralem’s current opinions and views of the financial markets. Although Stralem believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of October 31, 2019, please see the Schedule of Investments section of the annual report. The opinions of Stralem with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

9

STRALEM EQUITY FUND

PORTFOLIO INFORMATION

October 31, 2019 (Unaudited)

As of October 31, 2018 |

As of October 31, 2019 |

||||||||||||||||

|

|

Value |

% of Total |

Value |

% of Total |

||||||||||||

UP MARKET |

NEW PRODUCTS |

$ | 12,103,796 | 12.5 | % | $ | 10,956,610 | 13.5 | % | ||||||||

NEW INDUSTRIES |

17,883,847 | 18.5 | % | 17,546,637 | 21.5 | % | |||||||||||

DOMINANT COMPANIES |

32,447,888 | 33.5 | % | 23,753,227 | 29.1 | % | |||||||||||

DOWN MARKET |

LOW PRICE TO CASH FLOW |

10,810,753 | 11.2 | % | 9,843,020 | 12.1 | % | ||||||||||

HIGH YIELD |

20,108,204 | 20.8 | % | 17,189,239 | 21.1 | % | |||||||||||

MONEY MARKET |

3,345,210 | 3.5 | % | 2,222,439 | 2.7 | % | |||||||||||

| $ | 96,699,698 | 100.0 | % | $ | 81,511,172 | 100.0 | % | ||||||||||

10

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS

October 31, 2019

COMMON STOCKS — 95.3% |

Shares |

Value |

||||||

Communication Services — 9.0% |

||||||||

Diversified Telecommunication Services — 2.8% |

||||||||

AT&T, Inc. |

59,690 | $ | 2,297,468 | |||||

Interactive Media & Services — 6.2% |

||||||||

Alphabet, Inc. - Class A (a) |

2,090 | 2,630,892 | ||||||

Facebook, Inc. - Class A (a) |

13,300 | 2,548,945 | ||||||

| 5,179,837 | ||||||||

Consumer Discretionary — 5.9% |

||||||||

Auto Components — 2.9% |

||||||||

Aptiv plc |

26,850 | 2,404,417 | ||||||

Household Durables — 3.0% |

||||||||

D.R. Horton, Inc. |

48,310 | 2,529,995 | ||||||

Consumer Staples — 5.2% |

||||||||

Beverages — 2.6% |

||||||||

Coca-Cola Company (The) |

38,990 | 2,122,226 | ||||||

Food Products — 2.6% |

||||||||

Tyson Foods, Inc. - Class A |

26,560 | 2,198,902 | ||||||

Energy — 6.6% |

||||||||

Oil, Gas & Consumable Fuels — 6.6% |

||||||||

Chevron Corporation |

19,000 | 2,206,660 | ||||||

EOG Resources, Inc. |

19,200 | 1,330,752 | ||||||

Kinder Morgan, Inc. |

96,700 | 1,932,066 | ||||||

| 5,469,478 | ||||||||

Financials — 5.8% |

||||||||

Capital Markets — 3.2% |

||||||||

Intercontinental Exchange, Inc. |

28,400 | 2,678,688 | ||||||

Insurance — 2.6% |

||||||||

Progressive Corporation (The) |

31,200 | 2,174,640 | ||||||

Health Care — 22.3% |

||||||||

Biotechnology — 4.2% |

||||||||

AbbVie, Inc. |

21,700 | 1,726,235 | ||||||

Alexion Pharmaceuticals, Inc. (a) |

16,800 | 1,770,720 | ||||||

| 3,496,955 | ||||||||

See accompanying notes to financial statements. |

11

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued)

COMMON STOCKS — 95.3% (Continued) |

Shares |

Value |

||||||

Health Care — 22.3% (Continued) |

||||||||

Health Care Equipment & Supplies — 5.4% |

||||||||

Abbott Laboratories |

25,100 | $ | 2,098,611 | |||||

Danaher Corporation |

17,200 | 2,370,504 | ||||||

| 4,469,115 | ||||||||

Health Care Providers & Services — 2.6% |

||||||||

UnitedHealth Group, Inc. |

8,750 | 2,211,125 | ||||||

Life Sciences Tools & Services — 2.1% |

||||||||

Thermo Fisher Scientific, Inc. |

5,710 | 1,724,306 | ||||||

Pharmaceuticals — 8.0% |

||||||||

Johnson & Johnson |

14,650 | 1,934,386 | ||||||

Merck & Company, Inc. |

27,180 | 2,355,419 | ||||||

Pfizer, Inc. |

61,200 | 2,348,244 | ||||||

| 6,638,049 | ||||||||

Industrials — 7.9% |

||||||||

Aerospace & Defense — 5.1% |

||||||||

Boeing Company (The) |

6,200 | 2,107,442 | ||||||

Raytheon Company |

10,100 | 2,143,321 | ||||||

| 4,250,763 | ||||||||

Air Freight & Logistics — 2.8% |

||||||||

FedEx Corporation |

15,100 | 2,305,166 | ||||||

Information Technology — 20.0% |

||||||||

Communications Equipment — 2.7% |

||||||||

Cisco Systems, Inc. |

47,700 | 2,266,227 | ||||||

Electronic Equipment, Instruments & Components — 2.1% |

||||||||

Keysight Technologies, Inc. (a) |

16,870 | 1,702,352 | ||||||

IT Services — 3.1% |

||||||||

Visa, Inc. - Class A |

14,250 | 2,548,755 | ||||||

Semiconductors & Semiconductor Equipment — 3.2% |

||||||||

Broadcom, Inc. |

9,180 | 2,688,363 | ||||||

Software — 8.9% |

||||||||

Adobe, Inc. (a) |

8,400 | 2,334,612 | ||||||

Microsoft Corporation |

17,800 | 2,551,986 | ||||||

Oracle Corporation |

46,350 | 2,525,612 | ||||||

| 7,412,210 | ||||||||

See accompanying notes to financial statements. |

12

STRALEM EQUITY FUND

SCHEDULE OF INVESTMENTS (Continued)

COMMON STOCKS — 95.3% (Continued) |

Shares |

Value |

||||||

Materials — 2.9% |

||||||||

Chemicals — 2.9% |

||||||||

Dow, Inc. |

48,600 | $ | 2,453,814 | |||||

Utilities — 9.7% |

||||||||

Electric Utilities — 6.9% |

||||||||

American Electric Power Company, Inc. |

31,050 | 2,930,809 | ||||||

Duke Energy Corporation |

30,000 | 2,827,800 | ||||||

| 5,758,609 | ||||||||

Multi-Utilities — 2.8% |

||||||||

Dominion Energy, Inc. |

27,950 | 2,307,273 | ||||||

Total Common Stocks (Cost $55,460,255) |

$ | 79,288,733 | ||||||

MONEY MARKET FUNDS — 2.7% |

Shares |

Value |

||||||

Dreyfus Government Cash Management - Participant Shares, 1.33% (b) (Cost $2,222,439) |

2,222,439 | $ | 2,222,439 | |||||

Investments at Value — 98.0% (Cost $57,682,694) |

$ | 81,511,172 | ||||||

Other Assets in Excess of Liabilities — 2.0% |

1,677,253 | |||||||

Net Assets — 100.0% |

$ | 83,188,425 | ||||||

(a) |

Non-income producing security. |

(b) |

The rate shown is the 7-day effective yield as of October 31, 2019. |

See accompanying notes to financial statements. |

|

13

STRALEM EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2019

ASSETS |

||||

Investments in securities: |

||||

At cost |

$ | 57,682,694 | ||

At value (Note 2) |

$ | 81,511,172 | ||

Cash |

554,421 | |||

Receivable for investment securities sold |

3,230,133 | |||

Dividends receivable |

114,720 | |||

Other assets |

7,660 | |||

Total Assets |

85,418,106 | |||

LIABILITIES |

||||

Payable for investment securities purchased |

2,152,295 | |||

Payable to Investment Adviser (Note 4) |

33,944 | |||

Payable to administrator (Note 4) |

12,357 | |||

Accrued expenses |

31,085 | |||

Total Liabilities |

2,229,681 | |||

NET ASSETS |

$ | 83,188,425 | ||

NET ASSETS CONSIST OF: |

||||

Paid-in capital |

$ | 46,614,572 | ||

Accumulated earnings |

36,573,853 | |||

Net Assets |

$ | 83,188,425 | ||

Shares of beneficial interest outstanding |

9,651,332 | |||

Net asset value, offering price and redemption price per share (a) |

$ | 8.62 |

(a) |

Redemption price varies based on length of time held (Note 2). |

See accompanying notes to financial statements. |

|

14

STRALEM EQUITY FUND

STATEMENT OF OPERATIONS

For the Year Ended October 31, 2019

INVESTMENT INCOME |

||||

Dividends |

$ | 1,962,222 | ||

EXPENSES |

||||

Investment advisory fees (Note 4) |

996,023 | |||

Administration fees (Note 4) |

87,001 | |||

Fund accounting fees (Note 4) |

38,699 | |||

Audit and tax services fees |

25,000 | |||

Legal fees |

23,480 | |||

Trustees’ fees and expenses (Note 4) |

20,308 | |||

Registration and filing fees |

16,939 | |||

Transfer agent fees (Note 4) |

15,000 | |||

Compliance fees (Note 4) |

11,887 | |||

Bank service fees |

9,140 | |||

Printing |

5,685 | |||

Postage and supplies |

4,785 | |||

Insurance expense |

3,249 | |||

Other |

26,345 | |||

Total Expenses |

1,283,541 | |||

Investment advisory fee reductions (Note 4) |

(456,430 | ) | ||

Net Expenses |

827,111 | |||

NET INVESTMENT INCOME |

1,135,111 | |||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS |

||||

Net realized gains from investment transactions |

11,999,088 | |||

Net change in unrealized appreciation (depreciation) on investments |

(2,562,424 | ) | ||

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS |

9,436,664 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 10,571,775 |

See accompanying notes to financial statements. |

15

STRALEM EQUITY FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Year |

Year |

||||||

OPERATIONS |

||||||||

Net investment income |

$ | 1,135,111 | $ | 1,403,776 | ||||

Net realized gains from investment transactions |

11,999,088 | 21,339,408 | ||||||

Net change in unrealized appreciation (depreciation) on investments |

(2,562,424 | ) | (20,505,741 | ) | ||||

Net increase in net assets resulting from operations |

10,571,775 | 2,237,443 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) |

(22,588,139 | ) | (8,723,481 | ) | ||||

CAPITAL SHARE TRANSACTIONS |

||||||||

Proceeds from shares sold |

15,119,993 | 5,181,862 | ||||||

Net asset value of shares issued in reinvestment of distributions |

14,090,686 | 6,957,351 | ||||||

Proceeds from redemption fees (Note 2) |

133 | 64 | ||||||

Payments for shares redeemed |

(31,554,090 | ) | (44,946,201 | ) | ||||

Net decrease in net assets from capital share transactions |

(2,343,278 | ) | (32,806,924 | ) | ||||

TOTAL DECREASE IN NET ASSETS |

(14,359,642 | ) | (39,292,962 | ) | ||||

NET ASSETS |

||||||||

Beginning of year |

97,548,067 | 136,841,029 | ||||||

End of year |

$ | 83,188,425 | $ | 97,548,067 | ||||

CAPITAL SHARE ACTIVITY |

||||||||

Shares sold |

1,925,627 | 505,521 | ||||||

Shares reinvested |

1,770,656 | 690,899 | ||||||

Shares redeemed |

(3,814,517 | ) | (4,426,909 | ) | ||||

Net decrease in shares outstanding |

(118,234 | ) | (3,230,489 | ) | ||||

Shares outstanding, beginning of year |

9,769,566 | 13,000,055 | ||||||

Shares outstanding, end of year |

9,651,332 | 9,769,566 | ||||||

See accompanying notes to financial statements. |

16

STRALEM EQUITY FUND

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each year) |

||||||||||||||||||||

Year Ended October 31, |

||||||||||||||||||||

|

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

Net asset value, beginning of year |

$ | 9.98 | $ | 10.53 | $ | 10.52 | $ | 15.53 | $ | 17.45 | ||||||||||

Income from investment operations: |

||||||||||||||||||||

Net investment income |

0.11 | 0.13 | 0.12 | 0.22 | 0.23 | |||||||||||||||

Net realized and unrealized gains on investments |

0.90 | 0.00 | (a) | 1.49 | 0.24 | 0.34 | ||||||||||||||

Total from investment operations |

1.01 | 0.13 | 1.61 | 0.46 | 0.57 | |||||||||||||||

Less distributions: |

||||||||||||||||||||

Dividends from net investment income |

(0.11 | ) | (0.11 | ) | (0.17 | ) | (0.25 | ) | (0.25 | ) | ||||||||||

Distributions from net realized gains |

(2.26 | ) | (0.57 | ) | (1.43 | ) | (5.22 | ) | (2.24 | ) | ||||||||||

Total distributions |

(2.37 | ) | (0.68 | ) | (1.60 | ) | (5.47 | ) | (2.49 | ) | ||||||||||

Proceeds from redemption fees collected (Note 2) |

0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | 0.00 | (a) | ||||||||||

Net asset value, end of year |

$ | 8.62 | $ | 9.98 | $ | 10.53 | $ | 10.52 | $ | 15.53 | ||||||||||

Total return (b) |

12.56 | % | 1.13 | % | 17.36 | % | 4.72 | % | 3.43 | % | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Net assets, end of year (000’s) |

$ | 83,188 | $ | 97,548 | $ | 136,841 | $ | 142,965 | $ | 190,800 | ||||||||||

Ratio of total expenses to average net assets |

1.47 | % | 1.30 | % | 1.28 | % | 1.42 | % | 1.21 | % | ||||||||||

Ratio of net expenses to average net assets (c) |

0.95 | % | 0.95 | % | 0.95 | % | 0.98 | % | 0.98 | % | ||||||||||

Ratio of net investment income to average net assets (c) |

1.30 | % | 1.10 | % | 1.03 | % | 1.52 | % | 1.17 | % | ||||||||||

Portfolio turnover rate |

28 | % | 32 | % | 7 | % | 8 | % | 33 | % | ||||||||||

(a) |

Amount rounds to less than $0.01 per share. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) |

Ratio was determined after fee reductions and/or expense reimbursements by the Adviser (Note 4). |

See accompanying notes to financial statements. |

|

17

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

October 31, 2019

|

1. |

ORGANIZATION |

Stralem Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”). The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was reorganized into the Trust on October 17, 2016. It was formerly a series of Stralem Fund.

The Fund’s investment objective is to seek long-term capital appreciation.

|

2. |

SIGNIFICANT ACCOUNTING POLICIES |

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Fund’s significant accounting policies used in the preparation of its financial statements. These policies are in conformity with principles generally accepted in the United States of America (“GAAP”).

Investment valuation:

The Fund’s portfolio securities are valued as of the close of business of the regular session of trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m., Eastern time) on each day the NYSE is open. Securities which are traded on stock exchanges are valued at the closing price on the day the securities are being valued, or, if not traded on a particular day, at the closing mean price. Securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Securities traded in the over-the-counter market are valued at the last sale price, if available, otherwise, at the last quoted mean price. Investments in money market funds are valued at net asset value (“NAV”). When using a quoted price and when the market for the security is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s NAV may differ from quoted or published prices for the same securities.

18

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs

Level 3 – significant unobservable inputs

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the above fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments by security type as of October 31, 2019:

|

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Common Stocks |

$ | 79,288,733 | $ | — | $ | — | $ | 79,288,733 | ||||||||

Money Market Funds |

2,222,439 | — | — | 2,222,439 | ||||||||||||

Total |

$ | 81,511,172 | $ | — | $ | — | $ | 81,511,172 | ||||||||

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by sector and industry type. There were no Level 2 or Level 3 securities or derivative instruments held by the Fund as of or during the year ended October 31, 2019.

Share valuation and redemption fees:

The NAV per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share is equal to the NAV per share, except that shares are subject to a redemption fee of 1% if shares are redeemed within 60 days of purchase. During the years ended October 31, 2019 and 2018, proceeds from redemption fees totaled $133 and $64, respectively.

Investment transactions and income:

Investment transactions are accounted for on the trade date. Realized gains and losses on sales of investments are calculated on a specific identification basis. Dividend income is recorded on the ex-dividend date, and interest income

19

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

is recognized on the accrual basis. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Fund’s understanding of the applicable country’s rules and tax rates.

Common expenses:

Common expenses of the Trust are allocated among the Fund and other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders:

Distributions arising from net investment income and net realized capital gains are declared and paid to shareholders annually. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. The tax character of distributions paid to shareholders during the years ended October 31, 2019 and 2018 was as follows:

Years Ended |

Ordinary |

Long-Term |

Total |

|||||||||

October 31, 2019 |

$ | 1,514,867 | $ | 21,073,272 | $ | 22,588,139 | ||||||

October 31, 2018 |

$ | 1,508,018 | $ | 7,215,463 | $ | 8,723,481 | ||||||

Use of estimates:

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax:

The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of a federal excise tax applicable to regulated investment companies, the Fund must declare and pay as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

20

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

The following information is computed on a tax basis for each item as of October 31, 2019:

Cost of portfolio investments |

$ | 58,036,601 | ||

Gross unrealized appreciation |

$ | 24,911,306 | ||

Gross unrealized depreciation |

(1,436,735 | ) | ||

Net unrealized appreciation |

23,474,571 | |||

Undistributed ordinary income |

922,603 | |||

Undistributed long-term capital gains |

12,176,679 | |||

Accumulated earnings |

$ | 36,573,853 |

The difference between the federal income tax cost of portfolio investments and the financial statement cost of portfolio investments is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are due to the tax deferral of losses on wash sales.

|

3. |

INVESTMENT TRANSACTIONS |

During the year ended October 31, 2019, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $23,917,674 and $47,340,219, respectively.

|

4. |

TRANSACTIONS WITH RELATED PARTIES |

INVESTMENT ADVISORY AGREEMENT

Pursuant to an Investment Advisory Agreement with Stralem & Company Incorporated (the “Adviser”), the Fund pays the Adviser an advisory fee, payable quarterly, based on the average weekly net assets of the Fund, equal to 1.25% per annum of the first $50 million of such net assets; 1.00% per annum of the next $50 million of such net assets; and 0.75% per annum of such net assets in excess of $100 million.

The Adviser has agreed contractually, until at least March 1, 2021, to reduce its advisory fees and reimburse other expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs; taxes; interest; borrowing costs such as interest and dividend expenses on securities sold short; costs to organize the Fund; acquired fund fees and expenses; and extraordinary expenses, such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 0.95% of the Fund’s average daily net assets. During the year ended October 31, 2019, the Adviser reduced its advisory fees in the amount of $456,430.

21

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

Advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause total annual operating expenses to exceed the lesser of (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. Prior to March 1, 2021, this agreement may not be modified or terminated without the approval of the Board. This agreement will terminate automatically if the Investment Advisory Agreement is terminated. As of October 31, 2019, the amount of fee reductions and expense reimbursements available for recovery by the Adviser is $1,334,071, which must be recovered no later than the dates stated below:

October 31, 2020 |

$ | 431,852 | ||

October 31, 2021 |

445,789 | |||

October 31, 2022 |

456,430 | |||

| $ | 1,334,071 |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance, and transfer agent services for the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies and certain costs related to the pricing of the Fund’s portfolio securities.

Pursuant to a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”), the Distributor provides distribution services and serves as principal underwriter for the Fund. The Distributor is a wholly owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

22

STRALEM EQUITY FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

PRINCIPAL HOLDER OF FUND SHARES

As of October 31, 2019, the following shareholder owned of record 25% or more of the outstanding shares of the Fund:

Name of Record Owner |

% Ownership |

Pershing, LLC (for the benefit of its customers) |

79% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

|

5. |

CONTINGENCIES AND COMMITMENTS |

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had any prior claims or losses pursuant to these arrangements.

|

6. |

SUBSEQUENT EVENTS |

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events except for the following:

Effective November 5, 2019, the Fund will no longer impose a redemption fee of 1% if shares are redeemed within 60 days of purchase.

23

STRALEM EQUITY FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Stralem Equity Fund and

Board of Trustees of Ultimus Managers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Stralem Equity Fund (the “Fund”), a series of Ultimus Managers Trust, as of October 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the four years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the four years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the year ended October 31, 2015, were audited by other auditors, whose report dated December 10, 2015, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2019, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. Our audits also included evaluating the accounting principles

24

STRALEM EQUITY FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Continued)

used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2016.

COHEN & COMPANY, LTD.

Cleveland, Ohio

December 23, 2019

25

STRALEM EQUITY FUND

DISCLOSURE OF FUND EXPENSES (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses, which are deducted from the Fund’s gross income. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period (May 1, 2019) and held until the end of the period (October 31, 2019).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

|

Beginning |

Ending |

Expenses Paid |

Based on Actual Fund Return |

$ 1,000.00 |

$ 1,003.50 |

$ 4.80 |

Based on Hypothetical 5% Return |

$ 1,000.00 |

$ 1,020.42 |

$ 4.84 |

* |

Expenses are equal to the Fund’s annualized net expense ratio of 0.95% for the period, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

26

STRALEM EQUITY FUND

ADDITIONAL INFORMATION (Unaudited)

PROXY VOTING POLICIES AND PROCEDURES

A description of the Fund’s proxy voting policies and procedures is available, without charge, upon request by calling toll free (866) 822-9555, or on the U.S. Securities and Exchange Commission (the “SEC”) website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available, without charge, upon request by calling toll free (866) 822-9555, or on the SEC website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Fund’s complete schedule of portfolio holdings as of the end of the first and third quarters of each fiscal year are available on the SEC website at www.sec.gov or are available upon request, without charge, by calling toll free at (866) 822-9555.

HOUSEHOLDING

The Fund will generally send only one copy of the summary prospectus, proxy material, annual report and semi-annual report to shareholders residing at the same “household.” This reduces Fund expenses which benefits all shareholders, minimizes the volume of mail you receive and eliminates duplicates of the same information. If you need additional copies of these documents, a copy of the prospectus or do not want your mailings to be “householded,” please send us a written request or call us toll free at (866) 822-9555.

OTHER FEDERAL TAX INFORMATION (Unaudited)

For the fiscal year ended October 31, 2019, the Fund designated $21,073,272 as long-term capital gain distributions.

Qualified Dividend Income — The Fund designates 100% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction — Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distributions that qualifies under tax law. For the Fund’s fiscal year ended October 31, 2019, 100% of ordinary income dividends qualified for the corporate dividends received deduction.

27

STRALEM EQUITY FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

The Board has overall responsibility for management of the Trust’s affairs. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement, or removal. The Trustees, in turn, elect the officers of the Fund to actively supervise its day-to-day operations. The officers have been elected for an annual term. Each Trustee’s and officer’s address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The following are the Trustees and executive officers of the Funds:

Name and |

Length |

Position(s) |

Principal |

Number |

Directorships |

Interested Trustees: |

|||||

Robert G. Dorsey* Year of Birth: 1957 |

Since February 2012 |

Trustee (February 2012 to present)

President (June 2012 to October 2013) |

Vice Chairman (February 2019 to present), Managing Director (1999 to January 2019), Co-CEO (April 2018 to January 2019), and President (1999 to April 2018) of Ultimus Fund Solutions, LLC and its subsidiaries (except as otherwise noted for FINRA-regulated broker dealer entities) |

14 |

Interested Trustee of Capitol Series Trust (17 Funds) |

Independent Trustees: |

|||||

Janine L. Cohen Year of Birth: 1952 |

Since January 2016 |

Chairperson (October 2019 to present)

Trustee (January 2016 to present) |

Retired (2013) financial services executive |

14 |

None |

28

STRALEM EQUITY FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Name and |

Length |

Position(s) |

Principal |

Number |

Directorships |

Independent Trustees (Continued): |

|||||

David M. Deptula Year of Birth: 1958 |

Since June 2012 |

Trustee |

Vice President of Legal and Special Projects at Dayton Freight Lines, Inc. since 2016; Vice President of Tax Treasury at The Standard Register Inc. (formerly The Standard Register Company) from 2011 to 2016 |

14 |

None |

Robert E. Morrison Year of Birth: 1957 |

Since June 2019 |

Trustee |

Senior Vice President and National Practice Lead for Investment, Huntington National Bank/Huntington Private Bank (2014 to present); CEO, CIO, President of 5 Star Investment Management Company (2006 to 2014) |

14 |

Independent Trustee and Chairman of the Ultimus Managers Trust (2012 to 2014) |

Clifford N. Schireson Year of Birth: 1953 |

Since June 2019 |

Trustee |

Founder of Schireson Consulting, LLC (2017 to present); Director of Institutional Services for Brandes Investment Partners, LP (2004-2017) |

14 |

None |

Jacqueline A. Williams Year of Birth: 1954 |

Since June 2019 |

Trustee |

Managing Member of Custom Strategy Consulting, LLC (2017 to present); Managing Director of Global Investment Research (2005 to 2017), Cambridge Associates, LLC |

14 |

None |

* |

Mr. Dorsey is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended, because of his relationship with the Trust’s administrator, transfer agent and distributor. |

29

STRALEM EQUITY FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Name and |

Length |

Position(s) |

Principal Occupation(s) During Past 5 Years |

Executive Officers: |

|||

David R. Carson Year of Birth: 1958 |

Since 2013 |

Principal Executive Officer (April 2017 to present)

President (October 2013 to present)

Vice President (April 2013 to October 2013) |

Vice President and Director of Client Strategies of Ultimus Fund Solutions, LLC (2013 to present); President, Unified Series Trust (2016 to present); President, Centaur Mutual Funds Trust (2018 to present); Chief Compliance Officer, FSI Low Beta Absolute Return Fund (2013 to 2016) |

Todd E. Heim Year of Birth: 1967 |

Since 2014 |

Vice President (2014 to present) |

Relationship Management Director and Vice President of Ultimus Fund Solutions, LLC (2018 to present); Client Implementation Manager and AVP of Ultimus Fund Solutions, LLC (2014 to 2018); Naval Flight Officer in the United States Navy (May 1989 to June 2017) |

Jennifer L. Leamer Year of Birth: 1976 |

Since 2014 |

Treasurer (October 2014 to present)

Assistant Treasurer (April 2014 to October 2014) |

Vice President, Mutual Fund Controller of Ultimus Fund Solutions, LLC (2014 to present) |

Daniel D. Bauer Year of Birth: 1977 |

Since 2016 |

Assistant Treasurer (April 2016 to present) |

Assistant Mutual Fund Controller (September 2015 to present) and Fund Accounting Manager (March 2012 to August 2015) of Ultimus Fund Solutions, LLC |

Matthew J. Beck Year of Birth: 1988 |

Since 2018 |

Secretary (July 2018 to present) |

Senior Attorney of Ultimus Fund Solutions, LLC (2018 to present); Chief Compliance Officer of OBP Capital, LLC (2015 to 2018); Vice President and General Counsel of The Nottingham Company (2014 to 2018) |

30

STRALEM EQUITY FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

Name and |

Length |

Position(s) |

Principal Occupation(s) During Past 5 Years |

Executive Officers (Continued): |

|||

Natalie S. Anderson Year of Birth: 1975 |

Since 2016 |

Assistant Secretary (April 2016 to present) |

Legal Administration Manager (July 2016 to present) and Paralegal (January 2015 to June 2016) of Ultimus Fund Solutions, LLC; Senior Paralegal of Unirush, LLC (October 2011 to January 2015) |

Martin R. Dean Year of Birth: 1963 |

Since 2019 |

Interim Chief Compliance Officer (October 2019 to present)

Assistant Chief Compliance Officer (January 2016 to 2017) |

Vice President, Director of Fund Compliance of Ultimus Fund Solutions, LLC (2016 to present); Senior Vice President and Compliance Group Manager, Huntington Asset Services, Inc. (2013-2015) |

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-866-822-9555.

31

STRALEM EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

The Board of Trustees (the “Board”), including the Independent Trustees voting separately, has reviewed and approved the Fund’s Investment Agreement (the “Agreement”) with the Stralem & Company, Inc. (the “Adviser”) for an additional one-year term. The Board approved the Agreement at an in-person meeting held on July 22-23, 2019, at which all of the Trustees were present.

Legal counsel advised the Board during its deliberations. Additionally, the Board received and reviewed a substantial amount of information provided by the Adviser in response to requests of the Board and counsel. In deciding whether to approve the renewal of the Agreement, the Board recalled its review of the materials related to the Fund and the Adviser throughout the preceding 12 months and its numerous discussions with Trust management and the Adviser about the operations and performance of the Fund during that period. The Board further considered those materials and discussions and other numerous factors, including:

The nature, extent, and quality of the services provided by the Adviser. In this regard, the Board reviewed the services being provided by Stralem to the Stralem Fund including, without limitation, its investment advisory services since the Stralem Fund’s inception, Stralem’s compliance policies and procedures, its efforts to promote the Stralem Fund and assist in its distribution, and its compliance program. After reviewing the foregoing information and further information in the Stralem Memorandum (e.g., descriptions of its business and Form ADV), the Board concluded that the quality, extent, and nature of the services provided by Stralem were satisfactory and adequate for the Stralem Fund.

The investment performance of the Stralem Fund. In this regard, the Board compared the performance of the Stralem Fund with the performance of its benchmark index, custom peer group and related Morningstar category. The Board noted that the Stralem Fund had outperformed its custom peer group’s average and median performance for the one year period and underperformed its custom peer group’s average and median performance for the five and 10 year period and outperformed its Morningstar category’s (Large Cap Blend Category Under $250 million, True No-Load) median and average performance for the one year period, and underperformed the median and underperformed the average performance for the five and 10 year period. The Board also noted that the Stralem Fund had outperformed its benchmark index (S&P 500) since inception. The Board also considered the consistency of Stralem’s management with the Stralem Fund’s investment objective and policies. The Board indicated that Stralem had satisfactorily explained its performance results for the Stralem Fund. Following discussion of the investment performance of the Stralem Fund and its performance relative to its benchmark, custom peer group and Morningstar category, the Board concluded that the investment performance of the Stralem Fund has been satisfactory.

32

STRALEM EQUITY FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued)

The costs of the services provided and profits realized by Stralem and its affiliates from its relationship with the Stralem Fund. In this regard, the Board considered Stralem’s staffing, personnel, and methods of operations; the education and experience of its personnel; compliance program, policies, and procedures; financial condition and the level of commitment to the Stralem Fund, and, generally, Stralem’s advisory business; the asset level of the Stralem Fund; and the overall expenses of the Stralem Fund, including the advisory fee. The Board considered the Stralem ELA and considered Stralem’s current and past fee reductions and expense reimbursements for the Stralem Fund. The Board further took into account Stralem’s commitment to continue the Stralem ELA until at least March 1, 2021.