| OMB APPROVAL |

|

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-22680 |

| Ultimus Managers Trust |

| (Exact name of registrant as specified in charter) |

| 225 Pictoria Drive, Suite 450 Cincinnati, Ohio | 45246 |

| (Address of principal executive offices) | (Zip code) |

Matthew J. Beck

| Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (513) 587-3400 |

| Date of fiscal year end: | February 28 | |

| Date of reporting period: | February 28, 2019 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HVIA EQUITY FUND

INSTITUTIONAL CLASS (HVEIX)

Managed by

Hudson Valley Investment Advisors, Inc.

ANNUAL REPORT

February 28, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-888-209-8710 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-888-209-8710. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

HVIA EQUITY FUND |

April, 2019 |

The HVIA Equity Fund (“HVEIX” or the “Fund”) launched on October 3th 2016. The Fund’s focus is on using a G.A.R.P. investment framework to determine suitable investments. This acronym is “Growth at a Reasonable Price” which focuses on investing in equities that are at a discount to their expected growth rate. In my experience of using this investment philosophy I’ve come to realize that the process does not fit neatly into months, quarters or years but is expected to outperform over the longer term.

Investment Environment

U.S. markets have ended 8 years of positive returns (2009 – 2017), and this streak ended in a tie (1991 – 1999) for the longest positive streak in history. Equity markets sat at an all-time high, up 11% for the year at the start of September only to finish down -4.4% by the end of 2018. Many reasons were provided for the drop in stocks; China/U.S. trade relations, potential interest rate increases and political tensions. This resulted in the largest stock market decline in a fourth quarter in over 70 years. Our belief is that the economy and equity markets run in parallel in most instances but can uncouple for certain periods. This was in fact what happened at the end of December but the market rebounded from these oversold levels and pushed stocks back to recover most of the decline seen in the final months of 2018.

The U.S. economy benefitted from tax cuts, strong consumer demand and business investment that allowed the U.S. to provide buoyancy throughout the economy. Sales growth, margin expansion and earnings growth all presented solid results throughout the year and into early 2019. Inflationary pressures subsided which allowed the Federal Reserve to back away from continuing to raise interest rates.

Political tensions surrounding the China/ U.S. trade dispute were front and center but dissipated as the two countries held talks to bring a resolution that would allow for more normalized trade into the future. This process will be ongoing as we most likely get a trade deal. The most contentious issues may take more time to conclude due to the importance of technology transfer between the two countries and its implications as we move into the next generation of implementation.

The Trump administration continued to reduce regulations domestically and push against past international arrangements with partners overseas. Trade, military and other agreements are all under review which has caused nervousness with overseas partners and added risk to the markets. Trade disputes have slowed economic growth in Europe, Japan and China. This has also impacted growth within the developing world. The U.S. tax overhaul bill, which was approved at year end 2017, helped to support the economy. We are expecting that the economy will continue to benefit with the reduced taxes helping provide growth over future years.

We continue to believe that the economic position of the U.S. is pointing to a somewhat slower but steady level of growth after a strong 2018. The normalization of growth should limit inflationary pressures, allow for capital expenditures to help lift productivity and position the U.S. for continued economic growth into the future. Based on the economic backdrop, we believe we’ll continue to show solid growth and will have a positive bias for equities.

1

HVIA focuses on changes to S&P 500 revenues and earnings as they are, in our opinion, the main driver of stocks over the longer term. The equity markets are expecting to have strong growth in revenues but a slower growth in earnings due to the contraction of margins. Again, the current environment may have the economy outpacing the growth of stock prices. HVIA is continuing to anticipate earnings growth in 2019 which is likely stronger in the back half of 2019. A last thought is that we believe that we are still in the midst of an economic expansion with corporate profits staying buoyant which is the current environment.

Current Market and Economic Conditions

At February 28th, 2019, the current economy is solid. Bond market spreads between high yield and U.S. Treasuries provide insight into the level of perceived risk and remained at low levels. The tempered level of risk can also be inferred by economic indicators which are pointing to solid insight from both consumer and business statistics. Earnings estimates are expected to slow from extremely strong 2018 results but will be positive on a year over year basis while valuations appear fair. The outlook is for stronger revenue growth into 2019 while earnings are expected to be solid but at a slower growth rate relative to revenues.

President Trump has provided unexpected risks due to reworking trade agreements and political relationships. His adversarial tone on many fronts has increased uncertainty and has hurt stock prices in the short term. We believe that earnings are the ultimate arbiter of stock prices. Over time we believe that the higher earnings we expect should propel prices higher. In addition, we anticipate the growth of overseas markets capital to rebound once agreements with China and Europe are in place. This will help solidify company’s willingness to expand investment which may have been delayed over the past few quarters.

We look to the yield curve maintaining a positive slope which points to a continued expectation of economic improvement by fixed income markets. Commodity prices have been in a trading range but should see improvement in the back half of the year. Economic strength should continue as PMI’s, employment and confidence measures are all indicating solid levels of future growth.

Our stock selection is focused on continued economic vitality. We aren’t expecting multiple expansion but continued growth of earnings that should help improve prices. We continue to overweight areas such as Communication Services, Healthcare and Consumer Discretionary as growth in select areas continues to perform. Many individual names have benefited from operating leverage and the support of a strong overall economy.

Investment Philosophy and Performance

Over the first quarter through February 28, 2019, HVEIX is up 12.83% versus 11.48%for the S&P 500 total return. We are investing with an eye for the longer term, which means over 18 months. Our focus is on stocks that are showing improving asset utilization, margin expansion and the efficient use of capital. This can be summed up in an improving Return on Equity, (which is a measure of how well a company uses investments to generate earnings), but are trading at a discount to their historical growth or that of the industry group.

2

For the year ended February 28th, 2019, HVEIX is up 4.34% versus 4.68% for the S&P 500 total return. The following three positions had the largest positive impact on the Fund’s performance during the period:

|

a) |

Eli Lilly & Co. LLY (+67.75%) |

|

b) |

AutoZone Inc. AZO (+41.26%) |

|

c) |

AES Corp. AES (+64.53%) |

Since inception the Fund invested in stocks that are trading at a discount to their growth rate. We have been benefitting from investments made over 12 months ago. We believe that economic growth will continue and should benefit the overall portfolio. The company that had the best return over the period was Eli Lilly & Co. due to growth in its diabetes drug Trulicity which continue to outpace revenue expectations. We expect that the company is well positioned with other drugs and will increase its revenues over the coming year. AutoZone, Inc. rebounded after a number of quarters that it was impacted by slowing sales which reaccelerated in the back half of calendar 2018. The rebound was due in part to greater productivity as the company has switched to daily deliveries and a relatively tough winter that helps the auto parts market. Lastly was AES Corp. The company monetized assets in Latin America which is allowing for the pay down of debt and improve company cash flow.

The following positions had the greatest negative impact on the Fund through February 28, 2019:

|

a) |

eBay Inc. EBAY (-32.55%) |

|

b) |

Goldman Sachs Group Inc. GS (-29.22%) |

|

c) |

Goodyear Tire & Rubber Co. GT (-28.04%) |

The markets took down eBay Inc. as it provided a poor outlook over the past year. The company has also been hurt by Amazon which went after its marketplace product, increased perceived risks and lowered the company’s multiple investors were willing to pay. Goldman Sachs Group, Inc. also was negatively impacted as overall trading revenue was not as strong as in past cycles and the company did not have as big an improvement from other areas to offset the trading slowdown. Lastly, Goodyear Tire and Rubber Co. had the double whammy of an increase in costs across the industry which produced an oversupply of tires that needed to be discounted. This lowered the average overall price that the company received on its tires. The cost of tires has increased due to technology that has been added over the past few years. Although we believe the company is well positioned within the industry, the secular industry headwinds will overshadow the particular company benefits.

Sincerely,

Gustave J. Scacco

Portfolio Manager

3

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-209-8710.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please call 1-888-209-8710 and a copy will be sent to you free of charge or visit the Fund’s website at www.hviafunds.com. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of February 28, 2019, please see the Schedule of Investments section of the annual report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

4

HVIA EQUITY FUND

PERFORMANCE INFORMATION

February 28, 2019 (Unaudited)

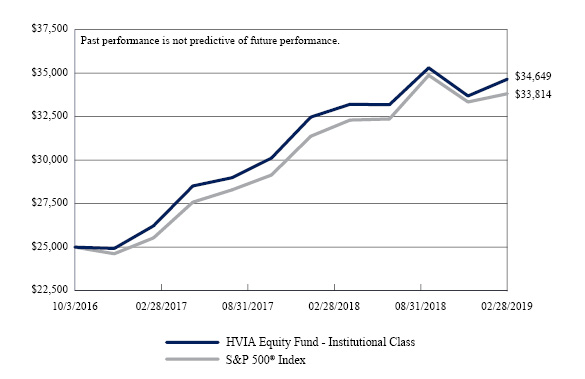

Comparison of the Change in Value of a $25,000 Investment in

HVIA Equity Fund - Institutional Class versus the S&P 500® Index

Average Annual Total Returns |

|||

1 Year |

Since |

||

HVIA Equity Fund - Institutional Class(a) |

4.34% |

14.53% |

|

S&P 500® Index |

4.68% |

13.38% |

|

(a) |

The Fund's total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

The Fund commenced operations on October 3, 2016. |

5

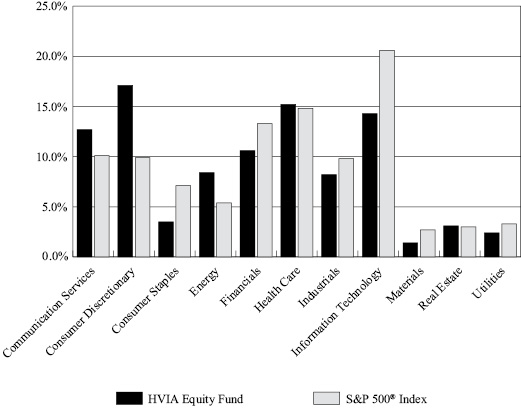

HVIA EQUITY FUND

PORTFOLIO INFORMATION

February 28, 2019 (Unaudited)

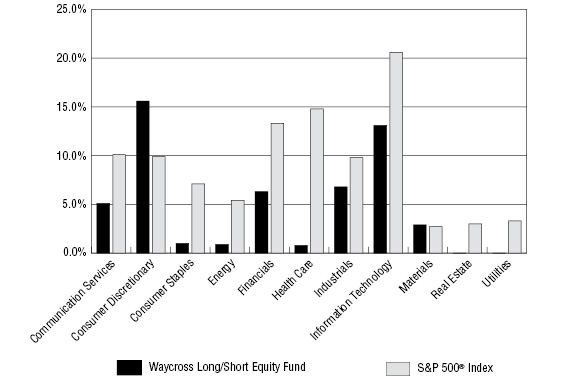

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

Security Description |

% of |

Marsh & McLennan Companies, Inc. |

3.4% |

CSX Corporation |

3.3% |

Xilinx, Inc. |

3.1% |

Danaher Corporation |

2.9% |

Walt Disney Company (The) |

2.8% |

Microsoft Corporation |

2.7% |

salesforce.com, Inc. |

2.7% |

Alphabet, Inc. - Class C |

2.7% |

Dollar General Corporation |

2.6% |

ConocoPhillips |

2.6% |

6

HVIA EQUITY FUND |

||||||||

COMMON STOCKS — 96.9% |

Shares |

Value |

||||||

Communication Services — 12.7% |

||||||||

Diversified Telecommunication Services — 2.5% |

||||||||

Verizon Communications, Inc. |

7,700 | $ | 438,284 | |||||

Entertainment — 2.8% |

||||||||

Walt Disney Company (The) |

4,500 | 507,780 | ||||||

Interactive Media & Services — 5.2% |

||||||||

Alphabet, Inc. - Class C (a) |

435 | 487,165 | ||||||

Facebook, Inc. - Class A (a) |

2,800 | 452,060 | ||||||

| 939,225 | ||||||||

Media — 2.2% |

||||||||

Comcast Corporation - Class A |

10,000 | 386,700 | ||||||

Consumer Discretionary — 17.1% |

||||||||

Hotels, Restaurants & Leisure — 4.1% |

||||||||

Royal Caribbean Cruises Ltd. |

2,835 | 335,891 | ||||||

Starbucks Corporation |

5,700 | 400,482 | ||||||

| 736,373 | ||||||||

Household Durables — 1.2% |

||||||||

Lennar Corporation - Class A |

4,400 | 211,112 | ||||||

Internet & Direct Marketing Retail — 2.3% |

||||||||

Amazon.com, Inc. (a) |

250 | 409,957 | ||||||

Multi-Line Retail — 2.6% |

||||||||

Dollar General Corporation |

4,000 | 473,840 | ||||||

Specialty Retail — 4.7% |

||||||||

AutoZone, Inc. (a) |

445 | 417,842 | ||||||

CarMax, Inc. (a) |

3,175 | 197,167 | ||||||

Home Depot, Inc. (The) |

1,275 | 236,054 | ||||||

| 851,063 | ||||||||

Textiles, Apparel & Luxury Goods — 2.2% |

||||||||

NIKE, Inc. - Class B |

4,500 | 385,785 | ||||||

Consumer Staples — 3.5% |

||||||||

Beverages — 1.2% |

||||||||

PepsiCo, Inc. |

1,850 | 213,934 | ||||||

7

HVIA EQUITY FUND |

||||||||

COMMON STOCKS — 96.9% (Continued) |

Shares |

Value |

||||||

Consumer Staples — 3.5% (Continued) |

||||||||

Food Products — 1.2% |

||||||||

Mondelēz International, Inc. - Class A |

4,400 | $ | 207,504 | |||||

Personal Products — 1.1% |

||||||||

Estée Lauder Companies, Inc. (The) - Class A |

1,300 | 204,022 | ||||||

Energy — 8.4% |

||||||||

Oil, Gas & Consumable Fuels — 8.4% |

||||||||

Cabot Oil & Gas Corporation |

12,000 | 295,440 | ||||||

ConocoPhillips |

6,900 | 468,165 | ||||||

Enbridge, Inc. |

6,306 | 233,259 | ||||||

Exxon Mobil Corporation |

2,150 | 169,914 | ||||||

Williams Companies, Inc. (The) |

12,600 | 336,294 | ||||||

| 1,503,072 | ||||||||

Financials — 10.6% |

||||||||

Banks — 6.4% |

||||||||

Bank of America Corporation |

10,000 | 290,800 | ||||||

BB&T Corporation |

4,300 | 219,171 | ||||||

JPMorgan Chase & Company |

3,350 | 349,606 | ||||||

SunTrust Banks, Inc. |

4,550 | 295,159 | ||||||

| 1,154,736 | ||||||||

Capital Markets — 0.8% |

||||||||

Morgan Stanley |

3,500 | 146,930 | ||||||

Insurance — 3.4% |

||||||||

Marsh & McLennan Companies, Inc. |

6,500 | 604,630 | ||||||

Health Care — 15.2% |

||||||||

Health Care Equipment & Supplies — 4.6% |

||||||||

Danaher Corporation |

4,150 | 527,133 | ||||||

Medtronic plc |

3,200 | 289,600 | ||||||

| 816,733 | ||||||||

Health Care Providers & Services — 2.2% |

||||||||

UnitedHealth Group, Inc. |

1,625 | 393,608 | ||||||

Life Sciences Tools & Services — 5.6% |

||||||||

Illumina, Inc. (a) |

1,225 | 383,143 | ||||||

PerkinElmer, Inc. |

3,350 | 315,436 | ||||||

Thermo Fisher Scientific, Inc. |

1,200 | 311,484 | ||||||

| 1,010,063 | ||||||||

8

HVIA EQUITY FUND |

||||||||

COMMON STOCKS — 96.9% (Continued) |

Shares |

Value |

||||||

Health Care — 15.2% (Continued) |

||||||||

Pharmaceuticals — 2.8% |

||||||||

Eli Lilly & Company |

2,300 | $ | 290,467 | |||||

Pfizer, Inc. |

5,000 | 216,750 | ||||||

| 507,217 | ||||||||

Industrials — 8.2% |

||||||||

Air Freight & Logistics — 1.8% |

||||||||

FedEx Corporation |

1,800 | 325,800 | ||||||

Machinery — 3.1% |

||||||||

Lincoln Electric Holdings, Inc. |

3,850 | 332,717 | ||||||

Oshkosh Corporation |

2,750 | 213,978 | ||||||

| 546,695 | ||||||||

Road & Rail — 3.3% |

||||||||

CSX Corporation |

8,100 | 588,627 | ||||||

Information Technology — 14.3% |

||||||||

IT Services — 2.0% |

||||||||

Visa, Inc. - Class A |

2,400 | 355,488 | ||||||

Semiconductors & Semiconductor Equipment — 3.1% |

||||||||

Xilinx, Inc. |

4,440 | 556,332 | ||||||

Software — 7.8% |

||||||||

Adobe, Inc. (a) |

1,600 | 420,000 | ||||||

Microsoft Corporation |

4,400 | 492,932 | ||||||

salesforce.com, Inc. (a) |

3,000 | 490,950 | ||||||

| 1,403,882 | ||||||||

Technology Hardware, Storage & Peripherals — 1.4% |

||||||||

Apple, Inc. |

1,470 | 254,530 | ||||||

Materials — 1.4% |

||||||||

Chemicals — 1.4% |

||||||||

Sherwin-Williams Company (The) |

595 | 257,754 | ||||||

Real Estate — 3.1% |

||||||||

Equity Real Estate Investment Trusts (REITs) — 3.1% |

||||||||

Prologis, Inc. |

2,400 | 168,144 | ||||||

Simon Property Group, Inc. |

2,100 | 380,436 | ||||||

| 548,580 | ||||||||

9

HVIA EQUITY FUND |

||||||||

COMMON STOCKS — 96.9% (Continued) |

Shares |

Value |

||||||

Utilities — 2.4% |

||||||||

Electric Utilities — 1.2% |

||||||||

Duke Energy Corporation |

2,500 | $ | 224,150 | |||||

Independent Power and Renewable Electricity Producers — 1.2% |

||||||||

AES Corporation |

12,400 | 213,652 | ||||||

Total Investments at Value — 96.9% (Cost $14,011,957) |

$ | 17,378,058 | ||||||

Other Assets in Excess of Liabilities — 3.1% |

550,596 | |||||||

Net Assets — 100.0% |

$ | 17,928,654 | ||||||

(a) |

Non-income producing security. |

See accompanying notes to financial statements. |

|

10

HVIA EQUITY FUND |

||||

ASSETS |

||||

Investments in securities: |

||||

At cost |

$ | 14,011,957 | ||

At value (Note 2) |

$ | 17,378,058 | ||

Cash (Note 2) |

528,707 | |||

Receivable from Adviser (Note 4) |

2,183 | |||

Dividends and interest receivable |

26,609 | |||

Other assets |

6,821 | |||

TOTAL ASSETS |

17,942,378 | |||

LIABILITIES |

||||

Payable to administrator (Note 4) |

7,630 | |||

Other accrued expenses |

6,094 | |||

TOTAL LIABILITIES |

13,724 | |||

NET ASSETS |

$ | 17,928,654 | ||

NET ASSETS CONSIST OF: |

||||

Paid-in capital |

$ | 14,561,447 | ||

Accumulated earnings |

3,367,207 | |||

NET ASSETS |

$ | 17,928,654 | ||

PRICING OF INSTITUTIONAL SHARES (NOTE 1) |

||||

Net assets applicable to Institutional Shares |

$ | 17,928,654 | ||

Shares of Institutional Shares outstanding (unlimited number of shares authorized, no par value) |

1,349,994 | |||

Net asset value, offering price and redemption price per share (Note 2) |

$ | 13.28 | ||

See accompanying notes to financial statements. |

11

HVIA EQUITY FUND |

||||

INVESTMENT INCOME |

||||

Dividends |

$ | 284,649 | ||

Foreign witholding taxes on dividends |

(1,820 | ) | ||

TOTAL INVESTMENT INCOME |

282,829 | |||

EXPENSES |

||||

Investment advisory fees (Note 4) |

123,615 | |||

Professional fees |

45,346 | |||

Fund accounting fees (Note 4) |

29,921 | |||

Administration fees (Note 4) |

28,250 | |||

Transfer agent fees (Note 4) |

18,000 | |||

Registration and filing fees |

13,285 | |||

Compliance fees (Note 4) |

12,000 | |||

Trustees' fees (Note 4) |

10,744 | |||

Custody and bank service fees |

9,514 | |||

Printing of shareholder reports |

5,128 | |||

Postage and supplies |

4,262 | |||

Insurance expense |

2,782 | |||

Pricing fees |

1,386 | |||

Other expenses |

7,453 | |||

TOTAL EXPENSES |

311,686 | |||

Less fee reductions and expense reimbursements by the Adviser (Note 4) |

(146,308 | ) | ||

NET EXPENSES |

165,378 | |||

NET INVESTMENT INCOME |

117,451 | |||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND FOREIGN CURRENCIES |

||||

Net realized gains (losses) from: |

||||

Investments |

383,774 | |||

Foreign currency transactions |

(1,173 | ) | ||

Net change in unrealized appreciation (depreciation) on: |

||||

Investments |

191,806 | |||

Foreign currency translations |

73 | |||

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS AND FOREIGN CURRENCIES |

574,480 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 691,931 | ||

See accompanying notes to financial statements. |

12

HVIA EQUITY FUND |

||||||||

|

Year |

Year |

||||||

FROM OPERATIONS |

||||||||

Net investment income |

$ | 117,451 | $ | 69,222 | ||||

Net realized gains (losses) from: |

||||||||

Investments |

383,774 | 57,478 | ||||||

Foreign currency transactions |

(1,173 | ) | (195 | ) | ||||

Net change in unrealized appreciation (depreciation) on: |

||||||||

Investments |

191,806 | 1,844,138 | ||||||

Foreign currency translation |

73 | (39 | ) | |||||

Net increase in net assets resulting from operations |

691,931 | 1,970,604 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) |

||||||||

Institutional Shares |

(543,722 | ) | (101,806 | ) | ||||

CAPITAL SHARE TRANSACTIONS |

||||||||

Institutional Shares |

||||||||

Proceeds from shares sold |

3,813,349 | 2,701,090 | ||||||

Net asset value of shares issued in reinvestment of distributions to shareholders |

1,550 | 54 | ||||||

Payments for shares redeemed |

(1,092,996 | ) | (891,941 | ) | ||||

Net increase in Institutional Shares net assets from capital share transactions |

2,721,903 | 1,809,203 | ||||||

TOTAL INCREASE IN NET ASSETS |

2,870,112 | 3,678,001 | ||||||

NET ASSETS |

||||||||

Beginning of year |

15,058,542 | 11,380,541 | ||||||

End of year |

$ | 17,928,654 | $ | 15,058,542 | ||||

CAPITAL SHARE ACTIVITY |

||||||||

Institutional Shares |

||||||||

Shares sold |

289,053 | 215,889 | ||||||

Shares reinvested |

132 | 4 | ||||||

Shares redeemed |

(82,962 | ) | (71,246 | ) | ||||

Net increase in shares outstanding |

206,223 | 144,647 | ||||||

Shares outstanding at beginning of year |

1,143,771 | 999,124 | ||||||

Shares outstanding at end of year |

1,349,994 | 1,143,771 | ||||||

(a) |

The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 2). For the year ended February 28, 2018, distributions to shareholders for Institutional Shares consisted of $66,697 and $35,109 of net investment income and net realized gains on investments, respectively. Undistributed net investment income as of February 28, 2018 was $9,446. |

See accompanying notes to financial statements. |

|

13

HVIA EQUITY FUND |

||||||||||||

Per Share Data for a Share Outstanding Throughout Each Period |

||||||||||||

|

Year |

Year |

Period |

|||||||||

Net asset value at beginning of year |

$ | 13.17 | $ | 11.39 | $ | 10.00 | ||||||

Income from investment operations: |

||||||||||||

Net investment income |

0.09 | 0.06 | 0.02 | |||||||||

Net realized and unrealized gains on investments and foreign currencies |

0.43 | 1.81 | 1.39 | |||||||||

Total from investment operations |

0.52 | 1.87 | 1.41 | |||||||||

Less distributions: |

||||||||||||

From net investment income |

(0.08 | ) | (0.06 | ) | (0.02 | ) | ||||||

From net realized gains |

(0.33 | ) | (0.03 | ) | — | |||||||

Total distributions |

(0.41 | ) | (0.09 | ) | (0.02 | ) | ||||||

Net asset value at end of year |

$ | 13.28 | $ | 13.17 | $ | 11.39 | ||||||

Total return (b) |

4.34 | % | 16.45 | % | 14.06 | %(c) | ||||||

Net assets at end of year (000's) |

$ | 17,929 | $ | 15,059 | $ | 11,381 | ||||||

Ratios/supplementary data: |

||||||||||||

Ratio of total expenses to average net assets |

1.86 | % | 2.11 | % | 2.36 | %(d) | ||||||

Ratio of net expenses to average net assets (e) |

0.99 | % | 0.99 | % | 0.99 | %(d) | ||||||

Ratio of net investment income to average net assets (e) |

0.70 | % | 0.53 | % | 0.56 | %(d) | ||||||

Portfolio turnover rate |

29 | % | 4 | % | 2 | %(c) | ||||||

(a) |

Represents the period from the commencement of operations (October 3, 2016) through February 28, 2017. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholders would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and reimbursed expenses. |

(c) |

Not annualized. |

(d) |

Annualized. |

(e) |

Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

|

14

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

February 28, 2019

1. Organization

HVIA Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report.

The investment objective of the Fund is to seek growth at a reasonable price.

The Fund currently offers one class of shares: Institutional Class shares (sold without any sales loads or distribution fees and subject to a $25,000 initial investment requirement). As of February 28, 2019, the Investor Class shares (to be sold without any sales load, but subject to a distribution fee of up to 0.25% of the class’ average daily net assets and subject to a $2,500 initial investment requirement) are not currently offered. When both classes are offered, each share class will represent an ownership interest in the same investment portfolio.

2. Significant Accounting Policies

In August 2018, the U.S. Securities and Exchange Commission (the “SEC”) adopted regulations that eliminated or amended disclosure requirements that were redundant or outdated in light of changes in SEC requirements, accounting principles generally accepted in the United States of America (“GAAP”), International Financial Reporting Standards or changes in technology or the business environment. These regulations were effective November 5, 2018, and the Fund is complying with them effective with these financial statements.

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with GAAP. The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.”

Recent accounting pronouncement – In August 2018, FASB issued Accounting Standards Update No. 2018-13 (“ASU 2018-13”), “Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC Topic 820 (“ASC 820”), “Fair Value Measurement.” ASU 2018-13 includes new, eliminated, and modified disclosure requirements for ASC 820. In addition, ASU 2018-13 clarifies that materiality is an appropriate consideration when evaluating disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted and the Fund has adopted ASU 2018-13 with these financial statements.

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its common stocks on the basis of the security’s last sale price on the security’s primary

15

HVIA EQUITY FUND |

exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. The Fund values securities traded in the over-the-counter market at the last sale price, if available, otherwise at the most recently quoted mean price. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value hierarchy (see below). In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

|

● |

Level 1 – quoted prices in active markets for identical securities |

|

● |

Level 2 – other significant observable inputs |

|

● |

Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of February 28, 2019:

|

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

Common Stocks |

$ | 17,378,058 | $ | — | $ | — | $ | 17,378,058 | ||||||||

Refer to the Fund’s Schedule of Investments for a listing of common stocks by industry type. As of February 28, 2019, the Fund did not have any derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3).

16

HVIA EQUITY FUND |

Foreign currency translation – Securities and other assets and liabilities denominated in or expected to settle in foreign currencies, if any, are translated into U.S. dollars based on exchange rates on the following basis:

|

A. |

The fair values of investment securities and other assets and liabilities are translated as of the close of the NYSE each day. |

|

B. |

Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing as of 4:00 p.m. Eastern Time on the respective date of such transactions. |

|

C. |

The Fund does not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments. |

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions, and 3) the difference between the amounts of dividends and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Cash account – The Fund’s cash is held in a bank account with balances which may exceed the amount covered by federal deposit insurance. As of February 28, 2019, the cash balance reflected on the Statement of Assets and Liabilities represents the amount held in a deposit sweep account.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of its assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Withholding taxes on foreign dividends have been recorded in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Investment transactions – Investment transactions are accounted for on the trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series, the number of series in the Trust, or the nature of the services performed and the relative applicability to each series.

17

HVIA EQUITY FUND |

Distributions to shareholders – The Fund will distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of the Fund’s distributions during the years ended February 28, 2019 and 2018 was as follows:

Years Ended |

Ordinary |

Long-Term |

Total |

|||||||||

February 28, 2019 |

$ | 126,209 | $ | 417,513 | $ | 543,722 | ||||||

February 28, 2018 |

$ | 101,806 | $ | — | $ | 101,806 | ||||||

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

The following information is computed on a tax basis for each item as of February 28, 2019:

Tax cost of portfolio investments |

$ | 14,011,957 | ||

Gross unrealized appreciation |

$ | 3,580,656 | ||

Gross unrealized depreciation |

(214,555 | ) | ||

Net unrealized appreciation |

3,366,101 | |||

Net unrealized appreciation of assets in foreign currencies |

34 | |||

Undistributed ordinary income |

23,248 | |||

Accumulated capital and other losses |

(22,176 | ) | ||

Accumulated earnings |

$ | 3,367,207 |

18

HVIA EQUITY FUND |

Qualified late year capital losses incurred after October 31, 2018 and within the current taxable year are deemed to arise on the first day of the Fund’s next taxable year. For the year ended February 28, 2019, the Fund deferred $22,176 of late year capital losses to March 1, 2019 for federal income tax purposes.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open tax periods (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the year ended February 28, 2019, cost of purchases and proceeds from sales of investment securities, other than short-term investments, amounted to $7,489,068 and $4,553,552, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Hudson Valley Investment Advisors, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 0.74% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”), the Adviser has contractually agreed, until July 1, 2020, to reduce investment advisory fees and reimburse other expenses to the extent necessary to limit total annual operating expenses (exclusive of brokerage costs, taxes, interest, costs to organize the Fund, acquired fund fees and expenses, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business) to an amount not exceeding 0.99% of average daily net assets. Accordingly, the Adviser did not collect any of its investment advisory fees and, in addition, reimbursed other operating expenses totaling $22,693 during the year ended February 28, 2019.

19

HVIA EQUITY FUND |

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided the repayments do not cause total annual operating expenses to exceed: (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of February 28, 2019, the Adviser may seek repayment of investment advisory fee reductions and expense reimbursements in the amount of $345,679 no later than the dates listed below:

February 29, 2020 |

$ | 53,835 | ||

February 28, 2021 |

$ | 145,536 | ||

February 28, 2022 |

$ | 146,308 |

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and costs of pricing the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Effective August 1, 2018, each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,300 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,500 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses. Prior to August 1, 2018, each Independent Trustee received a $1,000 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who received a $1,200 annual retainer from the Fund, paid quarterly. Each Independent Trustee also received from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

20

HVIA EQUITY FUND |

PRINCIPAL HOLDER OF FUND SHARES

As of February 28, 2019, the following shareholder owned of record more than 25% of the outstanding shares of the Fund:

NAME OF RECORD OWNER |

% Ownership |

Pershing, LLC (for the benefit of its customers) |

99.9% |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from the performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

21

HVIA EQUITY FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Shareholders of HVIA Equity Fund and

Board of Trustees of Ultimus Managers Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of HVIA Equity Fund (the “Fund”), a series of Ultimus Managers Trust, as of February 28, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the three periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of February 28, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2016.

COHEN & COMPANY, LTD.

Cleveland, Ohio

April 25, 2019

22

HVIA EQUITY FUND |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (September 1, 2018) and held until the end of the period (February 28, 2019).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

23

HVIA EQUITY FUND |

Institutional Class |

Beginning |

Ending |

Net Expense |

Expenses |

Based on Actual Fund Return |

$ 1,000.00 |

$ 981.60 |

0.99% |

$ 4.86 |

Based on Hypothetical 5% Return (before expenses) |

$ 1,000.00 |

$ 1,019.89 |

0.99% |

$ 4.96 |

(a) |

Annualized, based on the Fund’s most recent one-half year expenses. |

(b) |

Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied 181/365 (to reflect the one-half year period). |

FEDERAL TAX INFORMATION (Unaudited)

For the fiscal year ended February 28, 2019, the Fund designated $417,523 as long-term capital gain distributions.

Qualified Dividend Income – The Fund designates 100%, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income.

Dividends Received Deduction – Corporate shareholders are generally entitled to take the dividends received deduction on the portion of a Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal year 2019 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

24

HVIA EQUITY FUND |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-209-8710, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-888-209-8710, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-888-209-8710. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov.

25

HVIA EQUITY FUND |

The Board has overall responsibility for management of the Trust’s affairs. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement, or removal. The Trustees, in turn, elect the officers of the Fund to actively supervise its day-to-day operations. The officers have been elected for an annual term. Unless otherwise noted, each Trustee’s and officer’s address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Name and |

Length |

Position(s) |

Principal Occupation(s) |

Number |

Directorships |

Interested Trustees: |

|||||

Robert G. Dorsey* Year of Birth: 1957 |

Since |

Trustee (February 2012 to present) President (June 2012 to October 2013) |

Managing Director (1999 to present), Vice Chairman (February 2019 to present), Co-CEO (April 2018 to January 2019), and President (1999 to April 2018) of Ultimus Fund Solutions, LLC and its subsidiaries (except as otherwise noted for FINRA-regulated broker dealer entities) |

17 |

None |

Independent Trustees: |

|||||

Janine L. Cohen Year of Birth: 1952 |

Since January |

Trustee |

Retired (2013) financial services executive |

17 |

None |

David M. Deptula Year of Birth: 1958 |

Since |

Trustee |

Vice President of Legal and Special Projects at Dayton Freight Lines, Inc. since 2016; Vice President of Tax Treasury at The Standard Register Inc. (formerly the Standard Register Company) from 2011 to 2016 |

17 |

None |

John J. Discepoli Year of Birth: 1963 |

Since |

Chairman Trustee |

Owner of Discepoli Financial Planning, LLC (personal financial planning company) since 2004 |

17 |

None |

* |

Mr. Dorsey is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent and distributor. |

26

HVIA EQUITY FUND |

Name and |

Length of Time Served |

Position(s) |

Principal Occupation(s) During Past 5 Years |

Executive Officers: |

|||

David R. Carson Year of Birth: 1958 |

Since |

Principal President (October 2013 to present) Vice President (April 2013 to October 2013) |

Vice President and Director of Client Strategies of Ultimus Fund Solutions, LLC (2013 to present); President, Unified Series Trust (2016 to present); Chief Compliance Officer, FSI LBAR Fund (2013 to 2016) |

Todd E. Heim Year of Birth: 1967 |

Since 2014 |

Vice President (2014 to present) |

Relationship Management Director and Vice President of Ultimus Fund Solutions, LLC (2018 to present); Client Implementation Manager and Assistant Vice President of Ultimus Fund Solutions, LLC (2014 to 2018); Naval Flight Officer of United States Navy (May 1989 to June 2017); Business Project Manager of Vantiv, Inc. (February 2013 to March 2014) |

Jennifer L. Leamer Year of Birth: 1976 |

Since |

Treasurer Assistant Treasurer (April 2014 to October 2014) |

Vice President, Mutual Fund Controller of Ultimus Fund Solutions, LLC (2014 to present); Business Analyst of Ultimus Fund Solutions, LLC (2007 to 2014) |

Daniel D. Bauer Year of Birth: 1977 |

Since 2016 |

Assistant Treasurer (April 2016 to present) |

Assistant Mutual Fund Controller (September 2015 to present) and Fund Accounting Manager (March 2012 to August 2015) of Ultimus Fund Solutions, LLC |

Matthew J. Beck Year of Birth: 1988 |

Since 2018 |

Secretary (July 2018 to present) |

Senior Attorney of Ultimus Fund Solutions, LLC (2018 to present): General Counsel of The Nottingham Company (2014 to 2018) |

Natalie S. Anderson Year of Birth: 1975 |

Since 2016 |

Assistant Secretary (April 2016 to present) |

Legal Administration Manager (July 2016 to present) and Paralegal (January 2015 to June 2016) of Ultimus Fund Solutions, LLC; Senior Paralegal of Unirush, LLC (October 2011 to January 2015) |

27

HVIA EQUITY FUND |

Name and |

Length of Time Served |

Position(s) |

Principal Occupation(s) During Past 5 Years |

Charles C. Black Year of Birth: 1979 |

Since |

Chief Compliance Officer (January 2016 to present) Assistant Chief Compliance Officer (April 2015 to January 2016) |

Senior Compliance Officer of Ultimus Fund Solutions, LLC (2015 to present); Chief Compliance Officer of The Caldwell & Orkin Funds, Inc. (2016 to present); Senior Compliance Manager at Touchstone Mutual Funds (2013 to 2015) |

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-888-209-8710.

28

This page intentionally left blank.

LADDER SELECT BOND FUND

INSTITUTIONAL CLASS (LSBIX)

Managed by

Ladder Capital Asset Management LLC

ANNUAL REPORT

February 28, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-888-859-5867 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-888-859-5867. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held with the Fund complex or at your financial intermediary.

LADDER SELECT BOND FUND |

April 2019 |

For the annual period ended February 28th, 2019, the Ladder Select Bond Fund (the “Fund”) returned 2.51%. For the same period, the Fund’s benchmark, the Bloomberg Barclays Intermediate Government/Credit Bond Index (the “Benchmark”), returned 3.22%, resulting in the Fund underperforming the Benchmark by 0.71%. For the quarter ending February 28th, 2018, the Fund returned 0.74% compared to the Benchmark return of 2.30%, underperforming by 1.56%. For the period since the Fund’s inception beginning on October 18th, 2016, the Fund returned 5.76% cumulative compared to the Benchmark cumulative return of 2.07%, outperforming by 3.69%.

The Fund seeks to capitalize on the sector-specific knowledge of commercial real estate (“CRE”) and commercial mortgage-backed securities (“CMBS”) of its adviser, Ladder Capital Asset Management (“LCAM”), to select investments that satisfy the Fund’s investment objective of seeking a combination of current income and capital preservation.

The underperformance of the Fund versus its benchmark was driven primarily by the two following positions during the period:

AREIT 2018-CRE2 B – A $597 million static CRE CLO sponsored by Silverpeak Argentic with 22 floating-rate CRE 1st mortgage loans. The class B security is rated ‘AA-‘ by Kroll Bond Rating Agency, Inc. During the period, spreads on CRE CLO debt widened as volatility and correlations to the corporate CLO market increased spreads.

LNCR 2018-CRE1 A – A $1.05 billion managed CRE CLO sponsored by LoanCore with 27 floating-rate CRE 1st mortgage loans at issuance. The Class A security is rated ‘AAA/Aaa’ by KBRA/Moody’s. During the period, spreads on CRE CLO debt widened as volatility and correlations to the corporate CLO market increased spreads.

The Fund’s exposure to short-term fixed rate investments with average lives less than two years such as COMM 2015-CR23 CMB and COMM 2015-CR23 CMD, along with floating rate positions nearing maturity such as COMM 2014-TWC B, partially offset the Fund’s overall underperformance versus its Benchmark.

The Fund focused on minimizing its exposure to potential interest rate movements by investing primarily in securities with durations inside of three years and floating rate investments indexed to 1-Month USD Libor. The Fund ended the period with a portfolio comprised of 45.7% floating rate securities, 45.8% fixed rate securities, 1% REIT equities and 7.5% cash diversified amongst its 35 debt securities and 1 equity position. To further mitigate the portfolio’s exposure to interest rate movements, the Fund employed hedging strategies using derivatives. At the end of the period, the Fund’s portfolio included short positions in 5-year interest rate swap futures contracts and 2-year Treasury futures contract.

Market Environment:

Over the Fund’s annual period, the Treasury curve exhibited significant volatility while aggressively flattening, and over the past quarter ended February 28th, 2019, Treasury yields have moved considerably lower. For these reasons it is important to consider both

1

the year-over-year move in interest rates along with the intra-year highs across the Treasury curve. During this timeframe, the 3-month Treasury bill yield was 78 basis points higher, closing at 2.43% (intra-year high of 2.44% on February 21st, 2019); the 2-year Treasury yield was 26 basis points higher, closing at 2.51% (intra-year high of 2.96% on November 8th, 2018); the 5-year Treasury yield decreased by 13 basis points, closing at 2.51% (intra-year high of 3.09% on November 8th, 2018); the 10-year Treasury yield decreased by 15 basis points, closing at 2.72% (intra-year high of 3.24% on November 8th, 2018); and the 30-year Treasury yield decreased by 4 basis points, closing at 3.08% (intra-year high of 3.45 on November 2nd, 2018).

The annual period was a tale of two different stories. During the period through November of 2018, interest rates rose on the reality and continued expectation of strong U.S. GDP growth. During the final months of 2018, as demonstrated by Treasury curve yields achieving intra-year highs in November, market expectations quickly changed on softening economic data, a December Federal Open Market Committee meeting which tightened monetary policy another 25bps irrespective of the market’s view that such action was not necessary, and a continuing trade war with China resulting in negative economic effects globally.

The CMBS investment grade credit curve steepened during the annual period, with on the run last cash flow AAAs wider by 29 basis points and on the run BBB- bonds wider by 40 basis points according to Deutsche Bank Research. In addition, negative sentiment towards credit risk and increased market volatility in Q4 2018 along with the resulting ‘flight to quality’ rally in Treasury prices caused credit spreads to widen. Intermediate and shorter duration credit spreads performed well, however, with 2013 last cash flow AAA bonds, which LCAM looks at as an example of intermediate-duration performance, being unchanged over the annual period.

New issue domestic CMBS ended 2018 at $91 billion versus year end 2017 volume of $94.1 billion. Year to date 2019 volume is $15.4 billion vs 2018 volume during the same period of $19.4 billion (sources: Wells Fargo 3.15.19; Commercial Mortgage Alert 3.22.19). Our expectations for 2019 were for an issuance decrease of 10% to 20% due to interest rates and property cash flow dynamics negating the value of refinancing and the complete lack of balloon maturities coming due as CMBS issuance during the years of 2009 and 2010 were non-existent.

Outlook:

Entering 2019, LCAM would like to note that while we seem to have witnessed a V-shaped recovery in the U.S. equity markets from January 2019 to present, interest rates still have not returned to where they were in early November 2018. The yield on the 10-year Treasury today is 2.50%, which is 74 basis point lower than its high on November 8th, 2018. We would also note that the 2-year Treasury yield is inverted against the 5-year Treasury yield and the yield curve as mentioned previously is quite flat. All of this makes us cautious looking forward to the remainder of 2019 and what lies ahead for the U.S. economy.

Consistent with its capital preservation objective, the Fund will continue its strategy of investing in CRE debt exhibiting strong fundamental credit metrics while focusing on relative value within each respective transaction’s capital structure. The Fund will also continue to be cautious in respect to credit as the later stages of the current expansion are

2

now defined by a slowing global economy, trade war with China, a possible hard Brexit, and a U.S. Federal Reserve that has quickly pivoted from an aggressive schedule of interest rate hikes expected in 2019 to indicating at the most recent FOMC meeting that they do not expect to raise rates during the 2019 calendar year.

On behalf of everyone at Ladder Capital Asset Management, we thank you for investing with us. We look forward to the Fund’s continued success.

Sincerely,

|

|

Brian Harris |

Craig Sedmak |

Principal Executive Officer and Portfolio Manager |

Portfolio Manager |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-859-5867.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.ladderfunds.com or call 1-888-859-5867 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of February 28, 2019, please see the Schedule of Investments section of the annual report. The opinions of the Adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

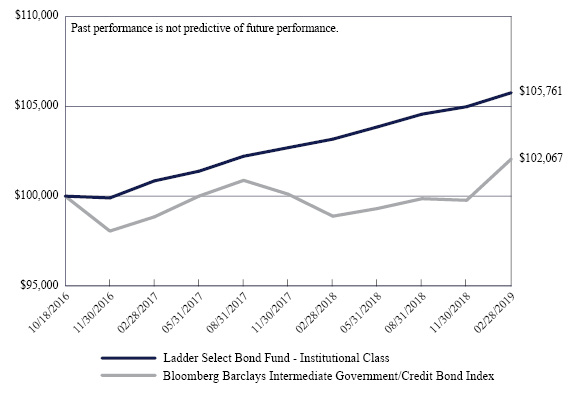

LADDER SELECT BOND FUND

PERFORMANCE INFORMATION

February 28, 2019 (Unaudited)

Comparison of the Change in Value of a $100,000 Investment in

Ladder Select Bond Fund - Institutional Class versus the

Bloomberg Barclays Intermediate Government/Credit Bond Index

Average Annual Total Returns |

|||

1 Year |

Since |

||

Ladder Select Bond Fund - Institutional Class (a) |

2.51% |

2.40% |

|

Bloomberg Barclays Intermediate Government/Credit Bond Index |

3.22% |

0.87% |

|

(a) |

The Fund’s total returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

(b) |

The Fund commenced operations on October 18, 2016. |

4

LADDER SELECT BOND FUND

PORTFOLIO INFORMATION

February 28, 2019 (Unaudited)

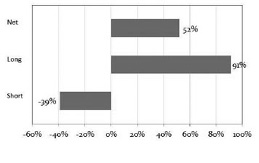

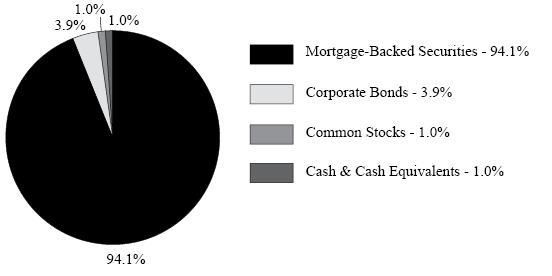

Portfolio Allocation (% of Net Assets)

Top 10 Long-Term Holdings

Security Description |

% of |

Wells Fargo Commercial Mortgage Trust, Series 2016-C34, Class A3FL, 144A, 3.548% (a), due 06/15/2049 |

13.1% |

Commercial Mortgage Trust, Series 2015-CR23, Class CMD, 144A, 3.684% (a), due 05/10/2048 |

7.9% |

Hudson's Bay Simon JV Trust, Series 2015-HBFL, Class AFL, 144A, 4.343% (a), due 08/05/2034 |

7.0% |

Commercial Mortgage Trust, Series 2014-TWC, Class B, 144A, 4.099% (a), due 02/13/2032 |

5.7% |

Commercial Mortgage Trust, Series 2015-CR23, Class CMB, 144A, 3.684% (a), due 05/10/2048 |

5.4% |

Wells Fargo Commercial Mortgage Trust, Series 2012-LC5, Class B, 4.142%, due 10/15/2045 |

4.6% |

JPMorgan Chase Commercial Mortgage Securities, Series 2018-WPT, Class DFL, 144A, 4.732% (a), due 07/05/2023 |

4.1% |

AREIT CRE Trust, Series 2018-CRE2, Class B, 144A, 3.884% (a), due 11/14/2035 |

3.9% |

Starwood Property Trust, Inc., 3.625%, due 02/01/2021 |

3.9% |

Latitude Management Real Estate Capital, Series 2015-CR1I, Class BR, 4.740% (a), due 02/22/2032 |

3.8% |

(a) |

Variable rate security. The rate shown is the effective interest rate as of February 28, 2019. |

5

LADDER SELECT BOND FUND |

||||||||||||||||

MORTGAGE-BACKED SECURITIES — 94.1% |

Coupon |

Maturity |

Par Value |

Value |

||||||||||||

Commercial — 94.1% |

||||||||||||||||

AREIT CRE Trust, Series 2018-CRE2, Class B, 144A (1MO LIBOR + 140) (a) |

3.884 | % | 11/14/35 | $ | 748,805 | $ | 745,727 | |||||||||

CCRESG Commercial Mortgage Trust, Series 2016-HEAT, Class A, 144A |

3.357 | % | 04/10/29 | 500,000 | 498,848 | |||||||||||

Colony American Finance Ltd., Series 2016-1, Class C, 144A |

4.638 | % | 06/15/48 | 250,000 | 249,944 | |||||||||||

Commercial Mortgage Asset Trust, IO, Series 1999-C2, Class X (a) |

2.041 | % | 11/17/32 | 264,125 | 193 | |||||||||||

Commercial Mortgage Trust, Series 2014-TWC, Class B, 144A (1MO LIBOR + 160) (a) |

4.099 | % | 02/13/32 | 1,100,000 | 1,102,747 | |||||||||||

Commercial Mortgage Trust, Series 2012-LC4, Class AM |

4.063 | % | 12/10/44 | 550,000 | 562,302 | |||||||||||

Commercial Mortgage Trust, Series 2013-LC6, Class AM |

3.282 | % | 01/10/46 | 212,000 | 211,964 | |||||||||||

Commercial Mortgage Trust, Series 2013-LC6, Class B |

3.739 | % | 01/10/46 | 50,000 | 50,243 | |||||||||||

Commercial Mortgage Trust, Series 2013-LC13, Class AM, 144A |

4.557 | % | 08/10/46 | 346,000 | 363,048 | |||||||||||

Commercial Mortgage Trust, Series 2015-CR23, |

3.684 | % | 05/10/48 | 1,040,000 | 1,045,576 | |||||||||||

Commercial Mortgage Trust, Series 2015-CR23, |

3.684 | % | 05/10/48 | 1,531,000 | 1,525,092 | |||||||||||

Goldman Sachs Mortgage Securities Trust, Series 2018-HART, Class C, 144A (1MO LIBOR + 170) (a) |

4.210 | % | 10/15/31 | 500,000 | 498,937 | |||||||||||

Goldman Sachs Mortgage Securities Trust, IO, Series 2005-ROCK, Class X1, 144A (a) |

0.207 | % | 05/03/32 | 14,016,000 | 218,308 | |||||||||||

Goldman Sachs Mortgage Securities Trust, IO, Series 2018-FBLU, Class XCP (a) |

0.166 | % | 11/15/35 | 98,481,000 | 112,623 | |||||||||||

Home Partners of America Trust, Series 2017-1, Class B, 144A (1MO LIBOR + 135) (a) |

3.858 | % | 07/17/34 | 300,000 | 299,518 | |||||||||||

Hudson's Bay Simon JV Trust, Series 2015-HBFL, Class AFL, 144A (1MO LIBOR + 158) (a) |

4.343 | % | 08/05/34 | 1,350,000 | 1,352,807 | |||||||||||

6

LADDER SELECT BOND FUND |

||||||||||||||||

MORTGAGE-BACKED SECURITIES — 94.1% (Continued) |

Coupon |

Maturity |

Par Value |

Value |

||||||||||||

Commercial — 94.1% (Continued) |

||||||||||||||||

JPMorgan Chase Commercial Mortgage Securities, Series 2018-WPT, Class DFL, 144A (a) |

4.732 | % | 07/05/23 | $ | 790,000 | $ | 788,022 | |||||||||

Ladder Capital Commercial Mortgage Securities, LLC, Series 2014-PKMD, Class MRC, 144A (a) |

2.857 | % | 11/14/27 | 22,000 | 21,887 | |||||||||||

Ladder Capital Commercial Mortgage Securities, LLC, Series 2014-909, Class D, 144A (a) |

3.898 | % | 05/01/31 | 625,000 | 624,724 | |||||||||||

Latitude Management Real Estate Capital, |

4.740 | % | 02/22/32 | 732,000 | 730,947 | |||||||||||

LoanCore Capital Credit Advisor, LLC, Series 2018-CRE1, Class A, 144A (1MO LIBOR + 113) (a) |

3.619 | % | 05/15/28 | 500,000 | 499,528 | |||||||||||

Marathon CRE Issuer Ltd., Series 2018-FL1, Class A, 144A (1MO LIBOR + 115) (a) |

3.639 | % | 06/15/28 | 500,000 | 498,908 | |||||||||||

Morgan Stanley Capital Group Trust, Series 2016-SNR, Class A, 144A (a) |

3.348 | % | 11/15/34 | 568,026 | 555,841 | |||||||||||

Morgan Stanley Capital I Trust, IO, Series 2014-CPT, Class XA, 144A (a) |

0.089 | % | 07/13/29 | 35,000,000 | 94,637 | |||||||||||

Morgan Stanley Capital I Trust, IO, Series 2004-IQ8, Class X1, 144A (a) |

0.856 | % | 06/15/40 | 3,032,529 | 34,726 | |||||||||||

MTRO Commercial Mortgage Trust, IO, Series 2019-TECI, Class XCP (a)(b) |