|

OMB APPROVAL

|

|

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6

|

|

Investment Company Act file number

|

811-22680

|

|

Ultimus Managers Trust

|

|

(Exact name of registrant as specified in charter)

|

|

225 Pictoria Drive, Suite 450 Cincinnati, Ohio

|

45246

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246_

|

|

(Name and address of agent for service)

|

|

Registrant's telephone number, including area code:

|

(513) 587-3400

|

|

Date of fiscal year end:

|

August 31

|

|

|

Date of reporting period:

|

August 31, 2017

|

| Item 1. |

Reports to Stockholders.

|

|

ALAMBIC FUNDS

LETTER TO SHAREHOLDERS |

September 22, 2017

|

|

Albert Richards

|

Brian Thompson

|

Rob Slaymaker

|

|

CEO

|

CRO

|

Partner

|

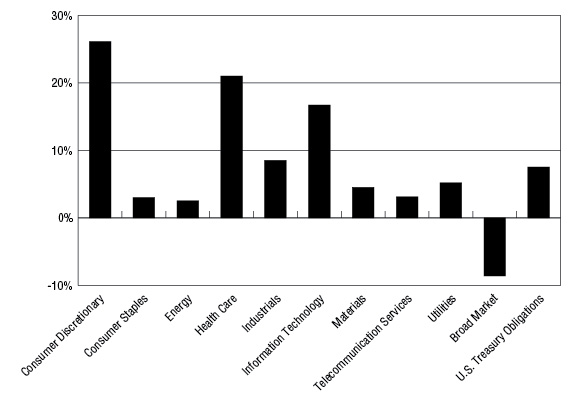

PERFORMANCE INFORMATION

August 31, 2017 (Unaudited)

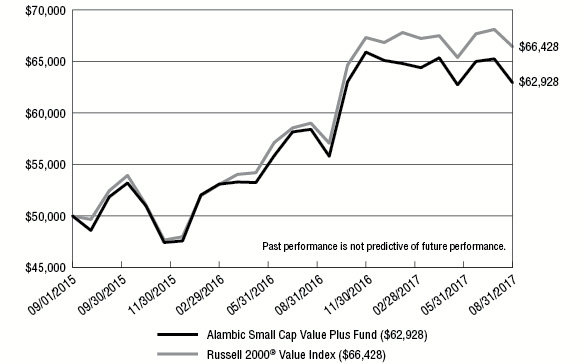

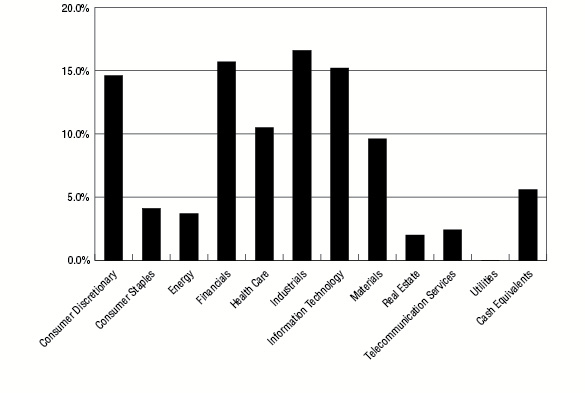

in Alambic Small Cap Value Plus Fund versus the

Russell 2000® Value Index.

|

Average Annual Total Returns

(for the periods ended August 31, 2017) |

|||

|

1 Year

|

Since

Inception(a) |

||

|

Alambic Small Cap Value Plus Fund(b)

|

8.20%

|

12.19%

|

|

|

Russell 2000® Value Index

|

13.47%

|

15.26%

|

|

|

(a)

|

Commencement of operations for Alambic Small Cap Value Plus Fund was September 1, 2015.

|

|

(b)

|

The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

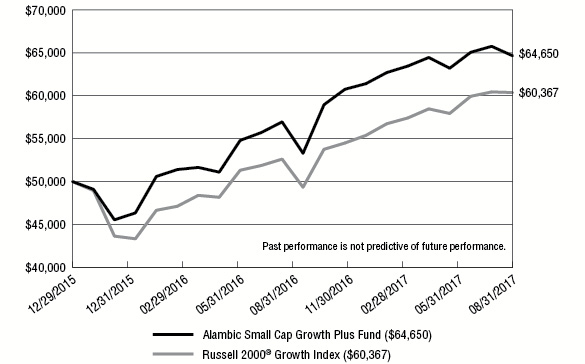

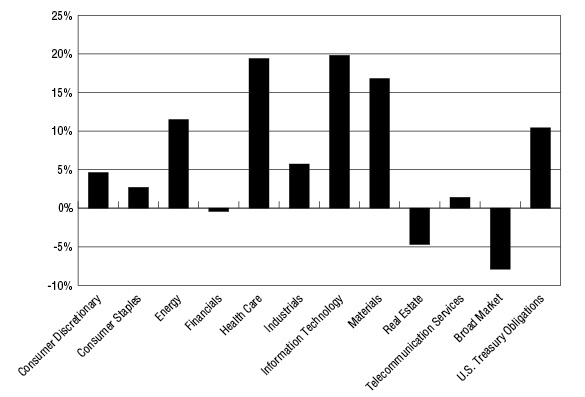

PERFORMANCE INFORMATION

August 31, 2017 (Unaudited)

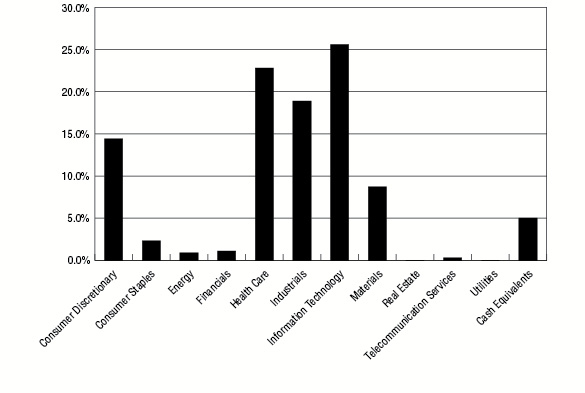

in Alambic Small Cap Growth Plus Fund versus the

Russell 2000® Growth Index.

|

Average Annual Total Returns

(for the periods ended August 31, 2017) |

|||

|

1 Year

|

Since

Inception(a) |

||

|

Alambic Small Cap Growth Plus Fund(b)

|

16.07%

|

16.59%

|

|

|

Russell 2000® Growth Index

|

16.39%

|

11.91%

|

|

|

(a)

|

Commencement of operations for Alambic Small Cap Growth Plus Fund was December 29, 2015.

|

|

(b)

|

The total returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

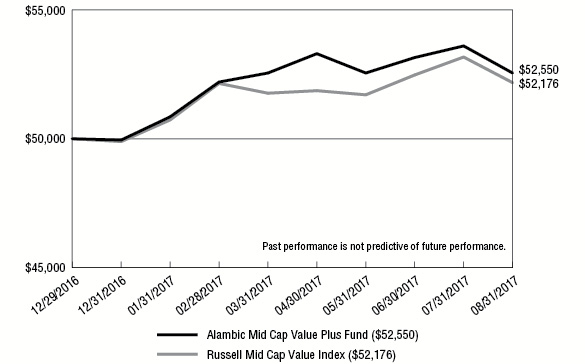

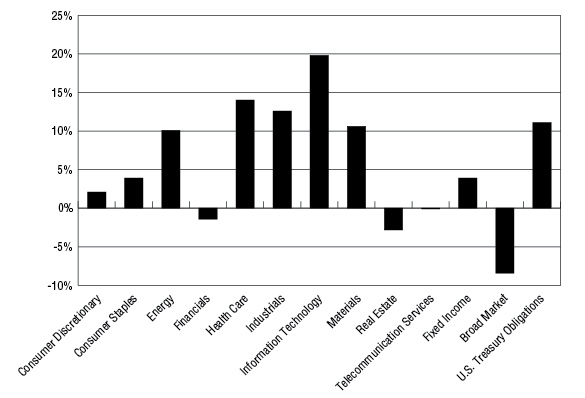

PERFORMANCE INFORMATION

August 31, 2017 (Unaudited)

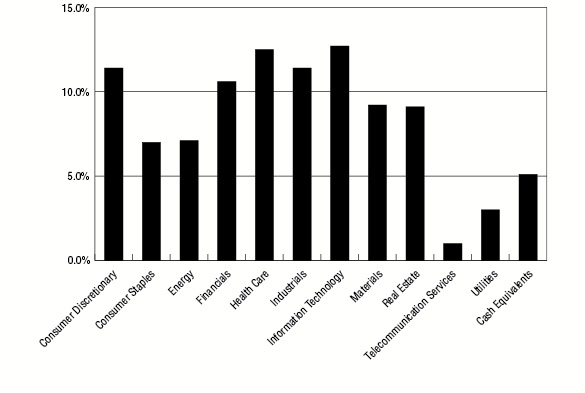

in Alambic Mid Cap Value Plus Fund versus the

Russell Mid Cap Value Index.

|

Total Returns

(for the period ended August 31, 2017) |

||

|

Since

Inception(a) |

||

|

Alambic Mid Cap Value Plus Fund(b)

|

5.10%

|

|

|

Russell Mid Cap Value Index

|

4.35%

|

|

|

(a)

|

Commencement of operations for Alambic Mid Cap Value Plus Fund was December 29, 2016.

|

|

(b)

|

The total return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

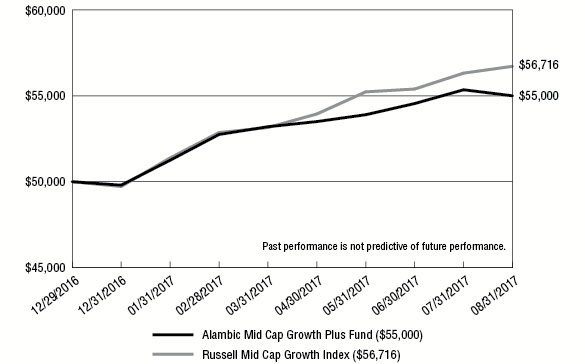

PERFORMANCE INFORMATION

August 31, 2017 (Unaudited)

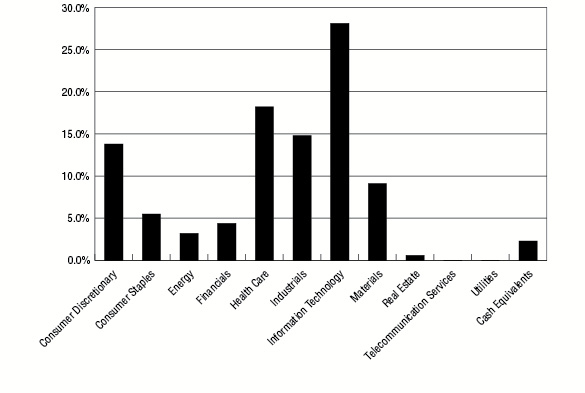

in Alambic Mid Cap Growth Plus Fund versus the

Russell Mid Cap Growth Index.

|

Total Returns

(for the period ended August 31, 2017) |

||

|

Since

Inception(a) |

||

|

Alambic Mid Cap Growth Plus Fund(b)

|

10.00%

|

|

|

Russell Mid Cap Growth Index

|

13.43%

|

|

|

(a)

|

Commencement of operations for Alambic Mid Cap Growth Plus Fund was December 29, 2016.

|

|

(b)

|

The total return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares.

|

PORTFOLIO INFORMATION

August 31, 2017 (Unaudited)

|

Security Description

|

% of Net Assets

|

|

Ennis, Inc.

|

1.7%

|

|

National Presto Industries, Inc.

|

1.6%

|

|

AngioDynamics, Inc.

|

1.4%

|

|

Greif, Inc. - Class A

|

1.3%

|

|

Potbelly Corporation

|

1.3%

|

|

YRC Worldwide, Inc.

|

1.3%

|

|

UFP Technologies, Inc.

|

1.3%

|

|

Armstrong Flooring, Inc.

|

1.2%

|

|

Stepan Company

|

1.2%

|

|

United States Lime & Minerals, Inc.

|

1.2%

|

PORTFOLIO INFORMATION

August 31, 2017 (Unaudited)

|

Security Description

|

% of Net Assets

|

|

Scientific Games Corporation - Class A

|

2.1%

|

|

Greif Inc. - Class A

|

1.6%

|

|

Quality Systems, Inc.

|

1.6%

|

|

MSG Networks, Inc. - Class A

|

1.6%

|

|

Nutrisystem, Inc.

|

1.5%

|

|

Magellan Health, Inc.

|

1.3%

|

|

Kimball International, Inc. - Class B

|

1.3%

|

|

Trinseo S.A.

|

1.3%

|

|

MasTec, Inc.

|

1.2%

|

|

Cirrus Logic, Inc.

|

1.2%

|

PORTFOLIO INFORMATION

August 31, 2017 (Unaudited)

|

Security Description

|

% of Net Assets

|

|

News Corporation - Class A

|

2.6%

|

|

Avnet, Inc.

|

2.1%

|

|

Vail Resorts, Inc.

|

2.1%

|

|

Oshkosh Corporation

|

2.0%

|

|

Owens-Illinois, Inc.

|

2.0%

|

|

Allison Transmission Holdings, Inc.

|

1.9%

|

|

H&R Block, Inc.

|

1.9%

|

|

Scotts Miracle-Gro Company (The)

|

1.8%

|

|

Huntsman Corporation

|

1.7%

|

|

Tyson Foods, Inc. - Class A

|

1.7%

|

PORTFOLIO INFORMATION

August 31, 2017 (Unaudited)

|

Security Description

|

% of Net Assets

|

|

News Corporation - Class A

|

2.5%

|

|

Vail Resorts, Inc.

|

2.4%

|

|

Allison Transmission Holdings, Inc.

|

2.4%

|

|

Hill-Rom Holdings, Inc.

|

2.1%

|

|

Vertex Pharmaceuticals, Inc.

|

1.9%

|

|

Sonoco Products Company

|

1.9%

|

|

H&R Block, Inc.

|

1.8%

|

|

Owens-Illinois, Inc.

|

1.8%

|

|

Scotts Miracle-Gro Company (The)

|

1.8%

|

|

Symantec Corporation

|

1.7%

|

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS August 31, 2017 |

||||||||

|

COMMON STOCKS — 94.3%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 14.5%

|

||||||||

|

Auto Components — 0.9%

|

||||||||

|

Shiloh Industries, Inc. (a)

|

300

|

$

|

2,628

|

|||||

|

Stoneridge, Inc. (a)

|

781

|

12,933

|

||||||

|

Tower International, Inc.

|

400

|

8,980

|

||||||

|

24,541

|

||||||||

|

Diversified Consumer Services — 1.0%

|

||||||||

|

American Public Education, Inc. (a)

|

500

|

9,225

|

||||||

|

Bridgepoint Education, Inc. (a)

|

2,100

|

18,543

|

||||||

|

27,768

|

||||||||

|

Hotels, Restaurants & Leisure — 5.2%

|

||||||||

|

BBX Capital Corporation

|

500

|

3,635

|

||||||

|

Bloomin' Brands, Inc.

|

1,000

|

17,010

|

||||||

|

Bob Evans Farms, Inc.

|

200

|

13,756

|

||||||

|

Century Casinos, Inc. (a)

|

1,000

|

6,850

|

||||||

|

Golden Entertainment, Inc. (a)

|

400

|

9,088

|

||||||

|

Monarch Casino & Resort, Inc. (a)

|

600

|

21,342

|

||||||

|

Potbelly Corporation (a)

|

3,000

|

36,000

|

||||||

|

RCI Hospitality Holdings, Inc.

|

100

|

2,330

|

||||||

|

Scientific Games Corporation - Class A (a)

|

641

|

22,563

|

||||||

|

Speedway Motorsports, Inc.

|

500

|

10,405

|

||||||

|

142,979

|

||||||||

|

Household Durables — 2.7%

|

||||||||

|

Bassett Furniture Industries, Inc.

|

600

|

21,510

|

||||||

|

Flexsteel Industries, Inc.

|

500

|

22,750

|

||||||

|

Green Brick Partners, Inc. (a)

|

700

|

6,615

|

||||||

|

Hooker Furniture Corporation

|

200

|

8,050

|

||||||

|

LGI Homes, Inc. (a)

|

350

|

14,889

|

||||||

|

Libbey, Inc.

|

200

|

1,634

|

||||||

|

75,448

|

||||||||

|

Leisure Products — 0.1%

|

||||||||

|

Johnson Outdoors, Inc. - Class A

|

50

|

3,190

|

||||||

|

Media — 1.3%

|

||||||||

|

MSG Networks, Inc. - Class A (a)

|

500

|

10,725

|

||||||

|

New Media Investment Group, Inc.

|

800

|

11,032

|

||||||

|

tronc, Inc. (a)

|

939

|

13,625

|

||||||

|

35,382

|

||||||||

|

Specialty Retail — 1.4%

|

||||||||

|

Aaron's, Inc.

|

700

|

30,989

|

||||||

|

Haverty Furniture Companies, Inc.

|

300

|

7,035

|

||||||

|

38,024

|

||||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 14.6% (Continued)

|

||||||||

|

Textiles, Apparel & Luxury Goods — 1.9%

|

||||||||

|

Crocs, Inc. (a)

|

3,100

|

$

|

27,683

|

|||||

|

Fossil Group, Inc. (a)

|

300

|

2,487

|

||||||

|

Perry Ellis International, Inc. (a)

|

1,000

|

21,830

|

||||||

|

52,000

|

||||||||

|

Consumer Staples — 4.1%

|

||||||||

|

Beverages — 0.2%

|

||||||||

|

Boston Beer Company, Inc. (The) - Class A (a)

|

40

|

5,960

|

||||||

|

Food & Staples Retailing — 1.8%

|

||||||||

|

SpartanNash Company

|

200

|

4,928

|

||||||

|

Supervalu, Inc. (a)

|

1,170

|

23,398

|

||||||

|

Village Super Market, Inc. - Class A

|

900

|

20,817

|

||||||

|

49,143

|

||||||||

|

Food Products — 1.3%

|

||||||||

|

Darling Ingredients, Inc. (a)

|

300

|

5,220

|

||||||

|

Dean Foods Company

|

800

|

8,800

|

||||||

|

Flowers Foods, Inc.

|

1,000

|

17,370

|

||||||

|

Fresh Del Monte Produce, Inc.

|

100

|

4,699

|

||||||

|

36,089

|

||||||||

|

Household Products — 0.5%

|

||||||||

|

Central Garden & Pet Company - Class A (a)

|

200

|

6,818

|

||||||

|

HRG Group, Inc. (a)

|

400

|

6,316

|

||||||

|

13,134

|

||||||||

|

Tobacco — 0.3%

|

||||||||

|

Universal Corporation

|

148

|

8,466

|

||||||

|

Energy — 3.7%

|

||||||||

|

Energy Equipment & Services — 0.5%

|

||||||||

|

Exterran Corporation (a)

|

200

|

5,548

|

||||||

|

RPC, Inc.

|

300

|

5,823

|

||||||

|

Superior Energy Services, Inc. (a)

|

400

|

3,296

|

||||||

|

14,667

|

||||||||

|

Oil, Gas & Consumable Fuels — 3.2%

|

||||||||

|

Bonanza Creek Energy, Inc. (a)

|

200

|

5,198

|

||||||

|

Chesapeake Energy Corporation (a)

|

1,834

|

6,676

|

||||||

|

CONSOL Energy, Inc. (a)

|

200

|

2,910

|

||||||

|

Eclipse Resources Corporation (a)

|

2,731

|

6,363

|

||||||

|

Energy XXI Gulf Coast, Inc. (a)

|

700

|

7,315

|

||||||

|

Midstates Petroleum Company, Inc. (a)

|

529

|

7,665

|

||||||

|

Overseas Shipholding Group, Inc. - Class A (a)

|

9,883

|

22,335

|

||||||

|

Peabody Energy Corporation (a)

|

400

|

11,600

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Energy — 3.7% (Continued)

|

||||||||

|

Oil, Gas & Consumable Fuels — 3.2% (Continued)

|

||||||||

|

Renewable Energy Group, Inc. (a)

|

146

|

$

|

1,767

|

|||||

|

Ultra Petroleum Corporation (a)

|

1,300

|

10,127

|

||||||

|

W&T Offshore, Inc. (a)

|

2,804

|

5,356

|

||||||

|

87,312

|

||||||||

|

Financials — 15.7%

|

||||||||

|

Banks — 13.6%

|

||||||||

|

Associated Banc-Corp

|

200

|

4,380

|

||||||

|

BancorpSouth, Inc.

|

300

|

8,715

|

||||||

|

BankUnited, Inc.

|

100

|

3,328

|

||||||

|

Banner Corporation

|

50

|

2,756

|

||||||

|

Cadence Bancorporation (a)

|

100

|

2,084

|

||||||

|

Cathay General Bancorp

|

300

|

10,581

|

||||||

|

Chemical Financial Corporation

|

600

|

27,246

|

||||||

|

Columbia Banking System, Inc.

|

300

|

11,151

|

||||||

|

Community Bank System, Inc.

|

50

|

2,573

|

||||||

|

CVB Financial Corporation

|

400

|

8,280

|

||||||

|

First BanCorporation (a)

|

300

|

1,704

|

||||||

|

First Citizens BancShares, Inc. - Class A

|

10

|

3,405

|

||||||

|

First Financial Bancorporation

|

200

|

4,790

|

||||||

|

First Horizon National Corporation

|

600

|

10,326

|

||||||

|

F.N.B. Corporation

|

500

|

6,345

|

||||||

|

Fulton Financial Corporation

|

400

|

6,980

|

||||||

|

Glacier Bancorp, Inc.

|

200

|

6,642

|

||||||

|

Green Bancorp, Inc. (a)

|

500

|

10,025

|

||||||

|

Hancock Holding Company

|

500

|

21,975

|

||||||

|

Hilltop Holdings, Inc.

|

1,000

|

23,670

|

||||||

|

Hope Bancorp, Inc.

|

1,000

|

16,140

|

||||||

|

Huntington Bancshares, Inc.

|

404

|

5,086

|

||||||

|

IBERIABANK Corporation

|

210

|

16,086

|

||||||

|

Independent Bank Group, Inc.

|

100

|

5,565

|

||||||

|

International Bancshares Corporation

|

250

|

8,987

|

||||||

|

Investors Bancorp, Inc.

|

1,100

|

14,399

|

||||||

|

KeyCorp

|

200

|

3,442

|

||||||

|

LegacyTexas Financial Group, Inc.

|

50

|

1,799

|

||||||

|

MB Financial, Inc.

|

400

|

15,908

|

||||||

|

National Commerce Corporation (a)

|

50

|

1,988

|

||||||

|

Old National Bancorp

|

400

|

6,540

|

||||||

|

Pacific Premier Bancorp, Inc. (a)

|

150

|

5,310

|

||||||

|

Popular, Inc.

|

100

|

3,991

|

||||||

|

Renasant Corporation

|

50

|

1,992

|

||||||

|

ServisFirst Bancshares, Inc.

|

100

|

3,411

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Financials — 15.7% (Continued)

|

||||||||

|

Banks — 13.6% (Continued)

|

||||||||

|

Sterling Bancorp

|

500

|

$

|

11,225

|

|||||

|

TCF Financial Corporation

|

200

|

3,106

|

||||||

|

Texas Capital Bancshares, Inc. (a)

|

230

|

17,078

|

||||||

|

Tompkins Financial Corporation

|

20

|

1,518

|

||||||

|

UMB Financial Corporation

|

230

|

15,438

|

||||||

|

Umpqua Holdings Corporation

|

400

|

7,000

|

||||||

|

United Bankshares, Inc.

|

100

|

3,355

|

||||||

|

United Community Banks, Inc.

|

100

|

2,611

|

||||||

|

Valley National Bancorp

|

700

|

7,833

|

||||||

|

Webster Financial Corporation

|

50

|

2,334

|

||||||

|

Wintrust Financial Corporation

|

200

|

14,562

|

||||||

|

373,660

|

||||||||

|

Capital Markets — 0.5%

|

||||||||

|

Interactive Brokers Group, Inc. - Class A

|

100

|

4,193

|

||||||

|

Legg Mason, Inc.

|

100

|

3,819

|

||||||

|

Stifel Financial Corporation

|

100

|

4,775

|

||||||

|

12,787

|

||||||||

|

Insurance — 1.3%

|

||||||||

|

American Equity Investment Life Holding Company

|

400

|

11,104

|

||||||

|

AmTrust Financial Services, Inc.

|

300

|

3,720

|

||||||

|

CNO Financial Group, Inc.

|

700

|

15,645

|

||||||

|

Primerica, Inc.

|

80

|

6,124

|

||||||

|

36,593

|

||||||||

|

Thrifts & Mortgage Finance — 0.3%

|

||||||||

|

Radian Group, Inc.

|

500

|

8,750

|

||||||

|

Health Care — 10.5%

|

||||||||

|

Biotechnology — 1.9%

|

||||||||

|

Acorda Therapeutics, Inc. (a)

|

1,200

|

24,960

|

||||||

|

AMAG Pharmaceuticals, Inc. (a)

|

400

|

6,680

|

||||||

|

Exelixis, Inc. (a)

|

100

|

2,924

|

||||||

|

Myriad Genetics, Inc. (a)

|

400

|

12,196

|

||||||

|

Versartis, Inc. (a)

|

300

|

5,700

|

||||||

|

52,460

|

||||||||

|

Health Care Equipment & Supplies — 3.6%

|

||||||||

|

Accuray, Inc. (a)

|

3,960

|

16,434

|

||||||

|

AngioDynamics, Inc. (a)

|

2,300

|

39,169

|

||||||

|

CONMED Corporation

|

300

|

14,880

|

||||||

|

Halyard Health, Inc. (a)

|

50

|

2,265

|

||||||

|

Invacare Corporation

|

900

|

12,150

|

||||||

|

Lantheus Holdings, Inc. (a)

|

800

|

14,000

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care — 10.5% (Continued)

|

||||||||

|

Health Care Equipment & Supplies — 3.6% (Continued)

|

||||||||

|

Meridian Bioscience, Inc.

|

100

|

$

|

1,390

|

|||||

|

100,288

|

||||||||

|

Health Care Providers & Services — 1.7%

|

||||||||

|

American Renal Associates Holdings, Inc. (a)

|

1,200

|

17,196

|

||||||

|

Kindred Healthcare, Inc.

|

2,200

|

17,820

|

||||||

|

Magellan Health, Inc. (a)

|

80

|

6,472

|

||||||

|

Tivity Health, Inc. (a)

|

100

|

3,920

|

||||||

|

45,408

|

||||||||

|

Health Care Technology — 1.2%

|

||||||||

|

Allscripts Healthcare Solutions, Inc. (a)

|

1,400

|

18,396

|

||||||

|

HealthStream, Inc. (a)

|

100

|

2,349

|

||||||

|

Quality Systems, Inc. (a)

|

700

|

11,025

|

||||||

|

31,770

|

||||||||

|

Life Sciences Tools & Services — 2.1%

|

||||||||

|

Luminex Corporation

|

1,500

|

28,995

|

||||||

|

Medpace Holdings, Inc. (a)

|

900

|

29,376

|

||||||

|

58,371

|

||||||||

|

Industrials — 16.6%

|

||||||||

|

Aerospace & Defense — 4.6%

|

||||||||

|

Astronics Corporation (a)

|

100

|

2,629

|

||||||

|

Moog, Inc. - Class A (a)

|

390

|

29,936

|

||||||

|

National Presto Industries, Inc.

|

440

|

43,824

|

||||||

|

Triumph Group, Inc.

|

700

|

18,410

|

||||||

|

Vectrus, Inc. (a)

|

1,100

|

31,438

|

||||||

|

126,237

|

||||||||

|

Air Freight & Logistics — 0.1%

|

||||||||

|

Park-Ohio Holdings Corporation

|

100

|

3,985

|

||||||

|

Building Products — 1.5%

|

||||||||

|

Armstrong Flooring, Inc. (a)

|

2,300

|

34,316

|

||||||

|

Ply Gem Holdings, Inc. (a)

|

356

|

5,536

|

||||||

|

39,852

|

||||||||

|

Commercial Services & Supplies — 2.4%

|

||||||||

|

ARC Document Solutions, Inc. (a)

|

3,380

|

11,932

|

||||||

|

Ennis, Inc.

|

2,400

|

45,840

|

||||||

|

Kimball International, Inc. - Class B

|

200

|

3,392

|

||||||

|

Quad/Graphics, Inc. - Class A

|

300

|

5,718

|

||||||

|

66,882

|

||||||||

|

Construction & Engineering — 1.3%

|

||||||||

|

Aegion Corporation (a)

|

300

|

6,501

|

||||||

|

Goldfield Corporation (The) (a)

|

412

|

1,833

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Industrials — 16.6% (Continued)

|

||||||||

|

Construction & Engineering — 1.3% (Continued)

|

||||||||

|

MasTec, Inc. (a)

|

100

|

$

|

4,080

|

|||||

|

Sterling Construction Company, Inc. (a)

|

1,300

|

15,314

|

||||||

|

Tutor Perini Corporation (a)

|

300

|

7,845

|

||||||

|

35,573

|

||||||||

|

Electrical Equipment — 0.5%

|

||||||||

|

Atkore International Group, Inc. (a)

|

888

|

14,794

|

||||||

|

Industrial Conglomerates — 0.9%

|

||||||||

|

Raven Industries, Inc.

|

900

|

25,200

|

||||||

|

Machinery — 3.5%

|

||||||||

|

Allison Transmission Holdings, Inc.

|

300

|

10,419

|

||||||

|

Astec Industries, Inc.

|

50

|

2,484

|

||||||

|

Columbus McKinnon Corporation

|

200

|

6,606

|

||||||

|

Commercial Vehicle Group, Inc. (a)

|

4,700

|

27,918

|

||||||

|

Gencor Industries, Inc. (a)

|

450

|

6,930

|

||||||

|

Global Brass and Copper Holdings, Inc.

|

500

|

14,925

|

||||||

|

Harsco Corporation (a)

|

800

|

13,680

|

||||||

|

L.B. Foster Company - Class A

|

100

|

1,910

|

||||||

|

Meritor, Inc. (a)

|

300

|

5,958

|

||||||

|

Wabash National Corporation

|

300

|

6,306

|

||||||

|

97,136

|

||||||||

|

Professional Services — 0.5%

|

||||||||

|

TrueBlue, Inc. (a)

|

600

|

12,270

|

||||||

|

Road & Rail — 1.3%

|

||||||||

|

YRC Worldwide, Inc. (a)

|

2,602

|

34,841

|

||||||

|

Information Technology — 15.2%

|

||||||||

|

Communications Equipment — 1.6%

|

||||||||

|

Bel Fuse, Inc. - Class B

|

1,000

|

25,500

|

||||||

|

Digi International, Inc. (a)

|

2,000

|

18,400

|

||||||

|

43,900

|

||||||||

|

Electronic Equipment, Instruments & Components — 1.5%

|

||||||||

|

Control4 Corporation (a)

|

200

|

4,952

|

||||||

|

Daktronics, Inc.

|

1,782

|

17,161

|

||||||

|

Insight Enterprises, Inc. (a)

|

250

|

10,020

|

||||||

|

OSI Systems, Inc. (a)

|

20

|

1,661

|

||||||

|

Systemax, Inc.

|

300

|

7,332

|

||||||

|

41,126

|

||||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Information Technology — 15.2% (Continued)

|

||||||||

|

Internet Software & Services — 2.1%

|

||||||||

|

Blucora, Inc. (a)

|

700

|

$

|

15,960

|

|||||

|

Cars.com, Inc. (a)

|

300

|

7,758

|

||||||

|

Endurance International Group Holdings, Inc. (a)

|

200

|

1,540

|

||||||

|

Limelight Networks, Inc. (a)

|

1,893

|

6,796

|

||||||

|

Meet Group, Inc. (The) (a)

|

600

|

2,352

|

||||||

|

XO Group, Inc. (a)

|

1,200

|

22,344

|

||||||

|

56,750

|

||||||||

|

IT Services — 3.6%

|

||||||||

|

Convergys Corporation

|

1,100

|

25,850

|

||||||

|

Everi Holdings, Inc. (a)

|

3,500

|

26,985

|

||||||

|

MAXIMUS, Inc.

|

150

|

9,117

|

||||||

|

Syntel, Inc.

|

1,000

|

18,060

|

||||||

|

Unisys Corporation (a)

|

2,458

|

19,049

|

||||||

|

99,061

|

||||||||

|

Semiconductors & Semiconductor Equipment — 2.1%

|

||||||||

|

Alpha & Omega Semiconductor Ltd. (a)

|

200

|

3,176

|

||||||

|

Amkor Technology, Inc. (a)

|

1,100

|

9,658

|

||||||

|

Cohu, Inc.

|

800

|

15,008

|

||||||

|

IXYS Corporation (a)

|

600

|

13,800

|

||||||

|

Rudolph Technologies, Inc. (a)

|

600

|

13,320

|

||||||

|

SMART Global Holdings, Inc. (a)

|

100

|

1,987

|

||||||

|

56,949

|

||||||||

|

Software — 4.3%

|

||||||||

|

American Software, Inc. - Class A

|

2,490

|

27,415

|

||||||

|

Manhattan Associates, Inc. (a)

|

700

|

29,435

|

||||||

|

Progress Software Corporation

|

800

|

26,864

|

||||||

|

QAD, Inc. - Class A

|

223

|

7,515

|

||||||

|

Silver Spring Networks, Inc. (a)

|

200

|

2,532

|

||||||

|

TiVo Solutions, Inc.

|

1,400

|

25,620

|

||||||

|

119,381

|

||||||||

|

Technology Hardware, Storage & Peripherals — 0.0% (b)

|

||||||||

|

Avid Technology, Inc. (a)

|

100

|

441

|

||||||

|

Materials — 9.6%

|

||||||||

|

Chemicals — 4.2%

|

||||||||

|

Core Molding Technologies, Inc.

|

192

|

3,949

|

||||||

|

Huntsman Corporation

|

100

|

2,657

|

||||||

|

Koppers Holdings, Inc. (a)

|

100

|

3,920

|

||||||

|

Kronos Worldwide, Inc.

|

300

|

6,279

|

||||||

|

OMNOVA Solutions, Inc. (a)

|

3,284

|

28,571

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Materials — 9.6% (Continued)

|

||||||||

|

Chemicals — 4.2% (Continued)

|

||||||||

|

PolyOne Corporation

|

400

|

$

|

14,456

|

|||||

|

Rayonier Advanced Materials, Inc.

|

237

|

3,252

|

||||||

|

Stepan Company

|

440

|

34,038

|

||||||

|

Tredegar Corporation

|

1,090

|

17,767

|

||||||

|

Valhi, Inc.

|

600

|

1,308

|

||||||

|

116,197

|

||||||||

|

Construction Materials — 1.2%

|

||||||||

|

United States Lime & Minerals, Inc.

|

420

|

33,579

|

||||||

|

Containers & Packaging — 2.9%

|

||||||||

|

Greif, Inc. - Class A

|

600

|

36,270

|

||||||

|

Owens-Illinois, Inc. (a)

|

300

|

7,392

|

||||||

|

UFP Technologies, Inc. (a)

|

1,300

|

34,580

|

||||||

|

78,242

|

||||||||

|

Metals & Mining — 1.3%

|

||||||||

|

AK Steel Holding Corporation (a)

|

3,900

|

21,840

|

||||||

|

Olympic Steel, Inc.

|

100

|

1,825

|

||||||

|

TimkenSteel Corporation (a)

|

300

|

4,449

|

||||||

|

Warrior Met Coal, Inc.

|

300

|

8,187

|

||||||

|

36,301

|

||||||||

|

Real Estate — 2.0%

|

||||||||

|

Equity Real Estate Investment Trusts (REITs) — 2.0%

|

||||||||

|

Corporate Office Properties Trust

|

100

|

3,336

|

||||||

|

Cousins Properties, Inc.

|

1,300

|

12,155

|

||||||

|

FelCor Lodging Trust, Inc.

|

800

|

5,840

|

||||||

|

GEO Group, Inc. (The)

|

300

|

8,292

|

||||||

|

Mack-Cali Realty Corporation

|

100

|

2,289

|

||||||

|

STAG Industrial, Inc.

|

200

|

5,598

|

||||||

|

STORE Capital Corporation

|

100

|

2,538

|

||||||

|

Sunstone Hotel Investors, Inc.

|

400

|

6,320

|

||||||

|

Uniti Group, Inc.

|

200

|

3,852

|

||||||

|

Weingarten Realty Investors

|

100

|

3,204

|

||||||

|

53,424

|

||||||||

|

Telecommunication Services — 2.4%

|

||||||||

|

Diversified Telecommunication Services — 0.8%

|

||||||||

|

Windstream Holdings, Inc.

|

10,300

|

21,321

|

||||||

|

Wireless Telecommunication Services — 1.6%

|

||||||||

|

Telephone and Data Systems, Inc.

|

900

|

26,379

|

||||||

|

ALAMBIC SMALL CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.3% (Continued)

|

Shares

|

Value

|

||||||

|

Telecommunication Services — 2.4% (Continued)

|

||||||||

|

Wireless Telecommunication Services — 1.6% (Continued)

|

||||||||

|

United States Cellular Corporation (a)

|

450

|

$

|

17,406

|

|||||

|

43,785

|

||||||||

|

Total Common Stocks (Cost $2,355,240)

|

$

|

2,591,417

|

||||||

|

RIGHTS — 0.0%

|

Shares

|

Value

|

||||||

|

Media General, Inc. - CVR (a)(c) (Cost $0)

|

100

|

$

|

0

|

|||||

|

Total Investments at Value — 94.5% (Cost $2,355,240)

|

$

|

2,591,417

|

||||||

|

Other Assets in Excess of Liabilities — 5.7%

|

155,286

|

|||||||

|

Net Assets — 100.0%

|

$

|

2,746,703

|

||||||

|

CVR - Contingent Value Right.

|

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

Percentage rounds to less than 0.1%.

|

|

(c)

|

Illiquid security. Security value has been determined in good faith pursuant to procedures adopted by the Board of Trustees. The total value of such securities is $0 at August 31, 2017, representing 0.0% of net assets (Note 2).

|

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS August 31, 2017 |

||||||||

|

COMMON STOCKS — 95.1%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 14.4%

|

||||||||

|

Auto Components — 1.0%

|

||||||||

|

American Axle & Manufacturing Holdings, Inc. (a)

|

1,350

|

$

|

19,723

|

|||||

|

Stoneridge, Inc. (a)

|

400

|

6,624

|

||||||

|

26,347

|

||||||||

|

Diversified Consumer Services — 1.0%

|

||||||||

|

American Public Education, Inc. (a)

|

500

|

9,225

|

||||||

|

Bridgepoint Education, Inc. (a)

|

600

|

5,298

|

||||||

|

K12, Inc. (a)

|

700

|

12,544

|

||||||

|

27,067

|

||||||||

|

Hotels, Restaurants & Leisure — 4.6%

|

||||||||

|

BBX Capital Corporation

|

500

|

3,635

|

||||||

|

Bloomin' Brands, Inc.

|

900

|

15,309

|

||||||

|

Century Casinos, Inc. (a)

|

600

|

4,110

|

||||||

|

Eldorado Resorts, Inc. (a)

|

757

|

17,411

|

||||||

|

Nathan's Famous, Inc. (a)

|

58

|

3,396

|

||||||

|

Potbelly Corporation (a)

|

1,241

|

14,892

|

||||||

|

RCI Hospitality Holdings, Inc.

|

100

|

2,330

|

||||||

|

Scientific Games Corporation - Class A (a)

|

1,550

|

54,560

|

||||||

|

Vail Resorts, Inc.

|

20

|

4,559

|

||||||

|

120,202

|

||||||||

|

Household Durables — 1.8%

|

||||||||

|

Bassett Furniture Industries, Inc.

|

500

|

17,925

|

||||||

|

Flexsteel Industries, Inc.

|

50

|

2,275

|

||||||

|

Green Brick Partners, Inc. (a)

|

1,104

|

10,433

|

||||||

|

Hooker Furniture Corporation

|

200

|

8,050

|

||||||

|

LGI Homes, Inc. (a)

|

200

|

8,508

|

||||||

|

47,191

|

||||||||

|

Internet & Direct Marketing Retail — 1.5%

|

||||||||

|

Groupon, Inc. (a)

|

600

|

2,664

|

||||||

|

Nutrisystem, Inc.

|

700

|

38,010

|

||||||

|

40,674

|

||||||||

|

Media — 2.5%

|

||||||||

|

MSG Networks, Inc. - Class A (a)

|

1,900

|

40,755

|

||||||

|

New Media Investment Group, Inc.

|

600

|

8,274

|

||||||

|

Sinclair Broadcast Group, Inc. - Class A

|

150

|

4,537

|

||||||

|

TEGNA, Inc.

|

300

|

3,786

|

||||||

|

tronc, Inc. (a)

|

480

|

6,965

|

||||||

|

64,317

|

||||||||

|

Multi-Line Retail — 0.8%

|

||||||||

|

Big Lots, Inc.

|

450

|

21,420

|

||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 14.4% (Continued)

|

||||||||

|

Specialty Retail — 0.6%

|

||||||||

|

Haverty Furniture Companies, Inc.

|

500

|

$

|

11,725

|

|||||

|

Select Comfort Corporation (a)

|

100

|

2,953

|

||||||

|

14,678

|

||||||||

|

Textiles, Apparel & Luxury Goods — 0.6%

|

||||||||

|

Crocs, Inc. (a)

|

1,700

|

15,181

|

||||||

|

Consumer Staples — 2.3%

|

||||||||

|

Beverages — 0.2%

|

||||||||

|

Cott Corporation

|

300

|

4,554

|

||||||

|

Food & Staples Retailing — 0.8%

|

||||||||

|

SUPERVALU, Inc. (a)

|

1,056

|

21,103

|

||||||

|

Food Products — 1.2%

|

||||||||

|

Darling Ingredients, Inc. (a)

|

200

|

3,480

|

||||||

|

Dean Foods Company

|

1,000

|

11,000

|

||||||

|

Flowers Foods, Inc.

|

800

|

13,896

|

||||||

|

Omega Protein Corporation

|

200

|

3,160

|

||||||

|

31,536

|

||||||||

|

Household Products — 0.1%

|

||||||||

|

Energizer Holdings, Inc.

|

50

|

2,207

|

||||||

|

Energy — 0.9%

|

||||||||

|

Energy Equipment & Services — 0.1%

|

||||||||

|

RigNet, Inc. (a)

|

100

|

1,600

|

||||||

|

Oil, Gas & Consumable Fuels — 0.8%

|

||||||||

|

Anadarko Petroleum Corporation

|

50

|

2,047

|

||||||

|

Chesapeake Energy Corporation (a)

|

2,100

|

7,644

|

||||||

|

Eclipse Resources Corporation (a)

|

3,100

|

7,223

|

||||||

|

Energy XXI Gulf Coast Inc (a)

|

100

|

1,045

|

||||||

|

W&T Offshore, Inc. (a)

|

2,100

|

4,011

|

||||||

|

21,970

|

||||||||

|

Financials — 1.1%

|

||||||||

|

Banks — 0.4%

|

||||||||

|

Bank of the Ozarks, Inc.

|

250

|

10,740

|

||||||

|

Capital Markets — 0.3%

|

||||||||

|

Evercore Partners, Inc. - Class A

|

90

|

6,791

|

||||||

|

Insurance — 0.4%

|

||||||||

|

Primerica, Inc.

|

140

|

10,717

|

||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care — 22.8%

|

||||||||

|

Biotechnology — 8.7%

|

||||||||

|

AbbVie, Inc.

|

270

|

$

|

20,331

|

|||||

|

Acorda Therapeutics, Inc. (a)

|

200

|

4,160

|

||||||

|

AMAG Pharmaceuticals, Inc. (a)

|

300

|

5,010

|

||||||

|

Biogen, Inc. (a)

|

20

|

6,331

|

||||||

|

BioSpecifics Technologies Corporation (a)

|

50

|

2,357

|

||||||

|

Celgene Corporation (a)

|

80

|

11,114

|

||||||

|

Clovis Oncology, Inc. (a)

|

40

|

3,043

|

||||||

|

Cytokinetics, Inc. (a)

|

200

|

2,970

|

||||||

|

CytomX Therapeutics, Inc. (a)

|

100

|

1,728

|

||||||

|

Exact Sciences Corporation (a)

|

250

|

10,473

|

||||||

|

Exelixis, Inc. (a)

|

600

|

17,544

|

||||||

|

FibroGen, Inc. (a)

|

200

|

9,640

|

||||||

|

Genomic Health, Inc. (a)

|

400

|

12,680

|

||||||

|

Halozyme Therapeutics, Inc. (a)

|

1,400

|

18,214

|

||||||

|

ImmunoGen, Inc. (a)

|

500

|

4,180

|

||||||

|

Ironwood Pharmaceuticals, Inc. (a)

|

1,800

|

28,710

|

||||||

|

MiMedx Group, Inc. (a)

|

200

|

3,254

|

||||||

|

Myriad Genetics, Inc. (a)

|

900

|

27,441

|

||||||

|

Puma Biotechnology, Inc. (a)

|

20

|

1,850

|

||||||

|

Seattle Genetics, Inc. (a)

|

60

|

3,152

|

||||||

|

Versartis, Inc. (a)

|

300

|

5,700

|

||||||

|

Vertex Pharmaceuticals, Inc. (a)

|

180

|

28,897

|

||||||

|

228,779

|

||||||||

|

Health Care Equipment & Supplies — 4.2%

|

||||||||

|

Accuray, Inc. (a)

|

624

|

2,590

|

||||||

|

AngioDynamics, Inc. (a)

|

800

|

13,624

|

||||||

|

Hill-Rom Holdings, Inc.

|

260

|

20,010

|

||||||

|

Lantheus Holdings, Inc. (a)

|

1,423

|

24,902

|

||||||

|

Meridian Bioscience, Inc.

|

200

|

2,780

|

||||||

|

Natus Medical, Inc. (a)

|

400

|

13,440

|

||||||

|

Quidel Corporation (a)

|

900

|

31,446

|

||||||

|

108,792

|

||||||||

|

Health Care Providers & Services — 2.2%

|

||||||||

|

Aceto Corporation

|

100

|

1,061

|

||||||

|

Amedisys, Inc. (a)

|

250

|

13,060

|

||||||

|

American Renal Associates Holdings, Inc. (a)

|

100

|

1,433

|

||||||

|

Civitas Solutions, Inc. (a)

|

100

|

1,910

|

||||||

|

HMS Holdings Corporation (a)

|

200

|

3,544

|

||||||

|

Magellan Health, Inc. (a)

|

410

|

33,169

|

||||||

|

RadNet, Inc. (a)

|

400

|

4,100

|

||||||

|

58,277

|

||||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Health Care — 22.8% (Continued)

|

||||||||

|

Health Care Technology — 2.1%

|

||||||||

|

HealthStream, Inc. (a)

|

600

|

$

|

14,094

|

|||||

|

Quality Systems, Inc. (a)

|

2,600

|

40,950

|

||||||

|

55,044

|

||||||||

|

Life Sciences Tools & Services — 3.4%

|

||||||||

|

Bruker Corporation

|

900

|

26,181

|

||||||

|

Charles River Laboratories International, Inc. (a)

|

80

|

8,704

|

||||||

|

Luminex Corporation

|

1,100

|

21,263

|

||||||

|

Medpace Holdings, Inc. (a)

|

582

|

18,996

|

||||||

|

PAREXEL International Corporation (a)

|

150

|

13,184

|

||||||

|

88,328

|

||||||||

|

Pharmaceuticals — 2.2%

|

||||||||

|

Akorn, Inc. (a)

|

300

|

9,870

|

||||||

|

Corcept Therapeutics, Inc. (a)

|

100

|

1,667

|

||||||

|

Depomed, Inc. (a)

|

100

|

608

|

||||||

|

Innoviva, Inc. (a)

|

200

|

2,808

|

||||||

|

MyoKardia, Inc. (a)

|

100

|

4,335

|

||||||

|

Nektar Therapeutics (a)

|

100

|

2,103

|

||||||

|

Phibro Animal Health Corporation - Class A

|

200

|

7,100

|

||||||

|

Prestige Brands Holdings, Inc. (a)

|

600

|

30,426

|

||||||

|

58,917

|

||||||||

|

Industrials — 18.9%

|

||||||||

|

Aerospace & Defense — 2.8%

|

||||||||

|

AeroVironment, Inc. (a)

|

300

|

14,706

|

||||||

|

Astronics Corporation (a)

|

200

|

5,258

|

||||||

|

Moog, Inc. - Class A (a)

|

170

|

13,049

|

||||||

|

National Presto Industries, Inc.

|

140

|

13,944

|

||||||

|

Triumph Group, Inc.

|

200

|

5,260

|

||||||

|

Vectrus, Inc. (a)

|

700

|

20,006

|

||||||

|

72,223

|

||||||||

|

Air Freight & Logistics — 0.2%

|

||||||||

|

Park-Ohio Holdings Corporation

|

100

|

3,985

|

||||||

|

Airlines — 0.5%

|

||||||||

|

Hawaiian Holdings, Inc. (a)

|

300

|

12,855

|

||||||

|

Building Products — 1.7%

|

||||||||

|

Armstrong Flooring, Inc. (a)

|

200

|

2,984

|

||||||

|

Builders FirstSource, Inc. (a)

|

300

|

4,884

|

||||||

|

Continental Building Products, Inc. (a)

|

1,200

|

29,220

|

||||||

|

Universal Forest Products, Inc.

|

100

|

8,721

|

||||||

|

45,809

|

||||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Industrials — 18.9% (Continued)

|

||||||||

|

Commercial Services & Supplies — 5.0%

|

||||||||

|

ARC Document Solutions, Inc. (a)

|

2,000

|

$

|

7,060

|

|||||

|

Deluxe Corporation

|

340

|

23,579

|

||||||

|

Ennis, Inc.

|

1,000

|

19,100

|

||||||

|

Hudson Technologies, Inc. (a)

|

1,500

|

13,350

|

||||||

|

Kimball International, Inc. - Class B

|

1,951

|

33,089

|

||||||

|

LSC Communications, Inc.

|

400

|

6,444

|

||||||

|

Quad/Graphics, Inc. - Class A

|

300

|

5,718

|

||||||

|

R.R. Donnelley & Sons Company

|

1,100

|

10,153

|

||||||

|

SP Plus Corporation (a)

|

350

|

12,915

|

||||||

|

131,408

|

||||||||

|

Construction & Engineering — 1.8%

|

||||||||

|

Aegion Corporation (a)

|

200

|

4,334

|

||||||

|

Dycom Industries, Inc. (a)

|

100

|

8,068

|

||||||

|

MasTec, Inc. (a)

|

800

|

32,640

|

||||||

|

Sterling Construction Company, Inc. (a)

|

100

|

1,178

|

||||||

|

46,220

|

||||||||

|

Electrical Equipment — 1.1%

|

||||||||

|

Atkore International Group, Inc. (a)

|

600

|

9,996

|

||||||

|

Belden, Inc.

|

40

|

3,083

|

||||||

|

Encore Wire Corporation

|

50

|

2,145

|

||||||

|

General Cable Corporation

|

830

|

14,068

|

||||||

|

29,292

|

||||||||

|

Industrial Conglomerates — 0.7%

|

||||||||

|

Raven Industries, Inc.

|

680

|

19,040

|

||||||

|

Machinery — 3.3%

|

||||||||

|

Allison Transmission Holdings, Inc.

|

550

|

19,101

|

||||||

|

Altra Industrial Motion Corporation

|

50

|

2,303

|

||||||

|

Astec Industries, Inc.

|

100

|

4,968

|

||||||

|

Commercial Vehicle Group, Inc. (a)

|

3,352

|

19,911

|

||||||

|

Gencor Industries, Inc. (a)

|

250

|

3,850

|

||||||

|

Global Brass & Copper Holdings, Inc.

|

500

|

14,925

|

||||||

|

Harsco Corporation (a)

|

400

|

6,840

|

||||||

|

Hillenbrand, Inc.

|

200

|

7,150

|

||||||

|

Hurco Companies, Inc.

|

200

|

7,030

|

||||||

|

86,078

|

||||||||

|

Professional Services — 0.2%

|

||||||||

|

On Assignment, Inc. (a)

|

100

|

4,770

|

||||||

|

Road & Rail — 1.2%

|

||||||||

|

YRC Worldwide, Inc. (a)

|

2,301

|

30,811

|

||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Industrials — 18.9% (Continued)

|

||||||||

|

Trading Companies & Distributors — 0.4%

|

||||||||

|

H&E Equipment Services, Inc.

|

500

|

$

|

11,770

|

|||||

|

Information Technology — 25.6%

|

||||||||

|

Communications Equipment — 0.6%

|

||||||||

|

Digi International, Inc. (a)

|

500

|

4,600

|

||||||

|

Extreme Networks, Inc. (a)

|

800

|

9,144

|

||||||

|

InterDigital, Inc.

|

20

|

1,427

|

||||||

|

15,171

|

||||||||

|

Electronic Equipment, Instruments & Components — 1.8%

|

||||||||

|

Daktronics, Inc.

|

500

|

4,815

|

||||||

|

Itron, Inc. (a)

|

250

|

18,150

|

||||||

|

KEMET Corporation (a)

|

300

|

7,173

|

||||||

|

Methode Electronics, Inc.

|

350

|

14,315

|

||||||

|

Systemax, Inc.

|

100

|

2,444

|

||||||

|

46,897

|

||||||||

|

Internet Software & Services — 5.2%

|

||||||||

|

Angie's List, Inc. (a)

|

1,000

|

12,160

|

||||||

|

Blucora, Inc. (a)

|

100

|

2,280

|

||||||

|

Carbonite, Inc. (a)

|

200

|

4,000

|

||||||

|

Care.com, Inc. (a)

|

1,400

|

20,958

|

||||||

|

Cars.com, Inc. (a)

|

200

|

5,172

|

||||||

|

Endurance International Group Holdings, Inc. (a)

|

3,000

|

23,100

|

||||||

|

NIC, Inc.

|

400

|

6,540

|

||||||

|

Quotient Technology, Inc. (a)

|

700

|

10,500

|

||||||

|

Web.com Group, Inc. (a)

|

600

|

15,180

|

||||||

|

XO Group, Inc. (a)

|

1,420

|

26,440

|

||||||

|

Zix Corporation (a)

|

1,800

|

9,558

|

||||||

|

135,888

|

||||||||

|

IT Services — 5.3%

|

||||||||

|

CSG Systems International, Inc.

|

200

|

7,742

|

||||||

|

Everi Holdings, Inc. (a)

|

3,700

|

28,527

|

||||||

|

EVERTEC, Inc.

|

600

|

11,040

|

||||||

|

MAXIMUS, Inc.

|

450

|

27,351

|

||||||

|

Syntel, Inc.

|

1,200

|

21,672

|

||||||

|

TeleTech Holdings, Inc.

|

350

|

13,895

|

||||||

|

Unisys Corporation (a)

|

3,600

|

27,900

|

||||||

|

VeriFone Systems, Inc. (a)

|

100

|

1,977

|

||||||

|

140,104

|

||||||||

|

Semiconductors & Semiconductor Equipment — 5.5%

|

||||||||

|

Alpha & Omega Semiconductor Ltd. (a)

|

283

|

4,494

|

||||||

|

Amkor Technology, Inc. (a)

|

1,100

|

9,658

|

||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Information Technology — 25.6% (Continued)

|

||||||||

|

Semiconductors & Semiconductor Equipment — 5.5% (Continued)

|

||||||||

|

AXT, Inc. (a)

|

415

|

$

|

3,237

|

|||||

|

Cirrus Logic, Inc. (a)

|

550

|

31,889

|

||||||

|

Cohu, Inc.

|

1,000

|

18,760

|

||||||

|

Entegris, Inc. (a)

|

100

|

2,545

|

||||||

|

IXYS Corporation (a)

|

900

|

20,700

|

||||||

|

Microsemi Corporation (a)

|

200

|

10,076

|

||||||

|

Nanometrics, Inc. (a)

|

100

|

2,579

|

||||||

|

Photronics, Inc. (a)

|

2,038

|

16,100

|

||||||

|

SMART Modular Technologies (WWH), Inc. (a)

|

200

|

3,974

|

||||||

|

Synaptics, Inc. (a)

|

500

|

20,785

|

||||||

|

144,797

|

||||||||

|

Software — 6.6%

|

||||||||

|

ACI Worldwide, Inc. (a)

|

1,200

|

27,312

|

||||||

|

American Software, Inc. - Class A

|

1,500

|

16,515

|

||||||

|

Aspen Technology, Inc. (a)

|

500

|

31,625

|

||||||

|

Barracuda Networks, Inc. (a)

|

100

|

2,421

|

||||||

|

Blackbaud, Inc.

|

50

|

4,220

|

||||||

|

Manhattan Associates, Inc. (a)

|

550

|

23,128

|

||||||

|

MicroStrategy, Inc. - Class A (a)

|

120

|

15,480

|

||||||

|

Progress Software Corporation

|

600

|

20,148

|

||||||

|

Silver Spring Networks, Inc. (a)

|

600

|

7,596

|

||||||

|

TiVo Corporation

|

400

|

7,320

|

||||||

|

VASCO Data Security International, Inc. (a)

|

1,300

|

16,315

|

||||||

|

172,080

|

||||||||

|

Technology Hardware, Storage & Peripherals — 0.6%

|

||||||||

|

Avid Technology, Inc. (a)

|

1,600

|

7,056

|

||||||

|

NCR Corporation (a)

|

250

|

9,133

|

||||||

|

16,189

|

||||||||

|

Materials — 8.7%

|

||||||||

|

Chemicals — 5.3%

|

||||||||

|

Chemours Company (The)

|

300

|

14,721

|

||||||

|

Core Molding Technologies, Inc.

|

100

|

2,057

|

||||||

|

Ferro Corporation (a)

|

100

|

1,927

|

||||||

|

LSB Industries, Inc. (a)

|

500

|

3,050

|

||||||

|

OMNOVA Solutions, Inc. (a)

|

2,801

|

24,369

|

||||||

|

PolyOne Corporation

|

500

|

18,070

|

||||||

|

Rayonier Advanced Materials, Inc.

|

1,073

|

14,721

|

||||||

|

Stepan Company

|

300

|

23,208

|

||||||

|

Tredegar Corporation

|

300

|

4,890

|

||||||

|

Trinseo S.A.

|

490

|

32,781

|

||||||

|

139,794

|

||||||||

|

ALAMBIC SMALL CAP GROWTH PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 95.1% (Continued)

|

Shares

|

Value

|

||||||

|

Materials — 8.7% (Continued)

|

||||||||

|

Construction Materials — 0.7%

|

||||||||

|

U.S. Concrete, Inc. (a)

|

200

|

$

|

16,010

|

|||||

|

United States Lime & Minerals, Inc.

|

40

|

3,198

|

||||||

|

19,208

|

||||||||

|

Containers & Packaging — 1.8%

|

||||||||

|

Greif, Inc. - Class A

|

700

|

42,315

|

||||||

|

Owens-Illinois, Inc. (a)

|

100

|

2,464

|

||||||

|

UFP Technologies, Inc. (a)

|

100

|

2,660

|

||||||

|

47,439

|

||||||||

|

Metals & Mining — 0.5%

|

||||||||

|

AK Steel Holding Corporation (a)

|

1,200

|

6,720

|

||||||

|

Warrior Met Coal, Inc.

|

200

|

5,458

|

||||||

|

12,178

|

||||||||

|

Paper & Forest Products — 0.4%

|

||||||||

|

Louisiana-Pacific Corporation (a)

|

400

|

10,192

|

||||||

|

Telecommunication Services — 0.4%

|

||||||||

|

Diversified Telecommunication Services — 0.4%

|

||||||||

|

Windstream Holdings, Inc.

|

4,300

|

8,901

|

||||||

|

Total Investments at Value — 95.1% (Cost $2,101,479)

|

$

|

2,489,531

|

||||||

|

Other Assets in Excess of Liabilities — 4.9%

|

129,299

|

|||||||

|

Net Assets — 100.0%

|

$

|

2,618,830

|

||||||

|

(a)

|

Non-income producing security.

|

|

ALAMBIC MID CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS August 31, 2017 |

||||||||

|

COMMON STOCKS — 94.9%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 11.3%

|

||||||||

|

Auto Components — 0.4%

|

||||||||

|

BorgWarner, Inc.

|

80

|

$

|

3,713

|

|||||

|

Automobiles — 1.3%

|

||||||||

|

Harley-Davidson, Inc.

|

280

|

13,163

|

||||||

|

Diversified Consumer Services — 1.9%

|

||||||||

|

H&R Block, Inc.

|

700

|

18,718

|

||||||

|

Hotels, Restaurants & Leisure — 2.2%

|

||||||||

|

Aramark

|

40

|

1,628

|

||||||

|

Vail Resorts, Inc.

|

90

|

20,515

|

||||||

|

22,143

|

||||||||

|

Household Durables — 0.8%

|

||||||||

|

CalAtlantic Group, Inc.

|

40

|

1,390

|

||||||

|

NVR, Inc. (a)

|

1

|

2,721

|

||||||

|

PulteGroup, Inc.

|

50

|

1,291

|

||||||

|

Whirlpool Corporation

|

14

|

2,402

|

||||||

|

7,804

|

||||||||

|

Internet & Direct Marketing Retail — 0.6%

|

||||||||

|

Liberty Interactive Corporation QVC Group - Series A (a)

|

280

|

6,194

|

||||||

|

Media — 3.2%

|

||||||||

|

AMC Networks, Inc. - Class A (a)

|

40

|

2,431

|

||||||

|

Discovery Communications, Inc. - Series A (a)

|

60

|

1,333

|

||||||

|

News Corporation - Class A

|

1,950

|

26,072

|

||||||

|

Viacom, Inc. - Class B

|

60

|

1,716

|

||||||

|

31,552

|

||||||||

|

Specialty Retail — 0.9%

|

||||||||

|

Staples, Inc.

|

850

|

8,683

|

||||||

|

Consumer Staples — 7.0%

|

||||||||

|

Beverages — 1.3%

|

||||||||

|

Dr Pepper Snapple Group, Inc.

|

90

|

8,195

|

||||||

|

Molson Coors Brewing Company - Class B

|

50

|

4,488

|

||||||

|

12,683

|

||||||||

|

Food Products — 5.3%

|

||||||||

|

Campbell Soup Company

|

40

|

1,848

|

||||||

|

Flowers Foods, Inc.

|

550

|

9,553

|

||||||

|

Ingredion, Inc.

|

10

|

1,238

|

||||||

|

J.M. Smucker Company (The)

|

80

|

8,381

|

||||||

|

ALAMBIC MID CAP VALUE PLUS FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 94.9% (Continued)

|

Shares

|

Value

|

||||||

|

Consumer Staples — 7.0% (Continued)

|

||||||||

|

Food Products — 5.3% (Continued)

|

||||||||

|

Kellogg Company

|

100

|

$

|

6,546

|

|||||

|

Seaboard Corporation

|

2

|

8,591

|

||||||

|

Tyson Foods, Inc. - Class A

|

260

|

16,458

|

||||||

|

52,615

|

||||||||

|

Household Products — 0.4%

|

||||||||

|

HRG Group, Inc. (a)

|

100

|

1,579

|

||||||

|

Spectrum Brands Holdings, Inc.

|

20

|

2,199

|

||||||

|

3,778

|

||||||||

|

Energy — 7.1%

|

||||||||

|

Energy Equipment & Services — 0.7%

|

||||||||

|

RPC, Inc.

|

350

|

6,793

|

||||||

|

Oil, Gas & Consumable Fuels — 6.4%

|

||||||||

|

Anadarko Petroleum Corporation

|

385

|

15,758

|

||||||

|

Apache Corporation

|

20

|

777

|

||||||

|

ConocoPhillips

|

240

|

10,478

|

||||||

|

CONSOL Energy, Inc. (a)

|

100

|

1,455

|

||||||

|

Devon Energy Corporation

|

100

|

3,140

|

||||||

|

HollyFrontier Corporation

|

300

|

9,393

|

||||||

|

Marathon Petroleum Corporation

|

140

|

7,343

|

||||||

|

Noble Energy, Inc.

|

350

|

8,320

|

||||||

|

Range Resources Corporation

|

50

|

868

|

||||||

|

Valero Energy Corporation

|

80

|

5,448

|

||||||

|

62,980

|

||||||||

|

Financials — 10.6%

|

||||||||

|

Banks — 4.1%

|

||||||||

|

Bank of the Ozarks, Inc.

|

60

|

2,577

|

||||||

|

Citizens Financial Group, Inc.

|

120

|

3,975

|

||||||

|

Comerica, Inc.

|

60

|

4,095

|

||||||

|

Cullen/Frost Bankers, Inc.

|

20

|

1,684

|

||||||

|

East West Bancorp, Inc.

|

140

|

7,752

|

||||||

|

Huntington Bancshares, Inc.

|

200

|

2,518

|

||||||

|

KeyCorp

|

300

|

5,163

|

||||||

|

M&T Bank Corporation

|

20

|

2,957

|

||||||

|

SunTrust Banks, Inc.

|

100

|

5,510

|

||||||

|

SVB Financial Group (a)

|

20

|

3,387

|

||||||

|

Western Alliance Bancorp (a)

|

20

|

965

|

||||||

|

40,583

|

||||||||

|

Capital Markets — 1.5%

|

||||||||

|

E*TRADE Financial Corporation (a)

|

20

|

820

|

||||||

|