|

Investment Company Act file number

|

811-22680

|

|

Ultimus Managers Trust

|

|

(Exact name of registrant as specified in charter)

|

|

225 Pictoria Drive, Suite 450 Cincinnati, Ohio

|

45246

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

|

|

(Name and address of agent for service)

|

|

Registrant's telephone number, including area code:

|

(513) 587-3400

|

|

Date of fiscal year end:

|

February 28, 2017

|

|

|

Date of reporting period:

|

February 28, 2017

|

| Item 1. |

Reports to Stockholders.

|

HVIA EQUITY FUND

INSTITUTIONAL CLASS (HVEIX)

Managed by

Hudson Valley Investment Advisors, Inc.

ANNUAL REPORT

February 28, 2017

|

HVIA EQUITY FUND |

February 28, 2017 |

The HVIA Equity Fund (HVEIX) (the “Fund”) launched on October 3rd 2016. The Fund’s focus is on using a G.A.R.P. investment framework to determine suitable investments. This acronym is “Growth at a Reasonable Price” which focuses on investing in equities that are at a discount to their expected growth rate. In my experience of using this investment philosophy I’ve come to realize that the process does not fit neatly into months, quarters or years but is expected to outperform over the longer term.

Investment Environment

The election of President Donald Trump has moved investors to reevaluate the market. The last several years have seen equity investments with consistent revenue/earnings and bond like dynamics (sectors such as REIT’s, Utilities and Consumer Staples) outperforming. Due to the Trump election win, these sectors have underperformed since the start of the year as markets discounted an improvement in economic conditions. The Trump agenda has pointed to an expectation of a reduction of regulations, tax reform and infrastructure investment. The market has been discounting a more pro-business agenda which is expected to be a change in fiscal policy, investments into U.S. infrastructure and the greater willingness of businesses to expand. The outcome is for increased earnings and for more cyclical industry groups to report higher than consensus results.

The early efforts by the Trump administration have focused on adding jobs by pushing through pipeline approvals, pushing companies to return jobs to the U.S. from overseas and changing domestic taxes that may make it more expensive to operate outside of the United States (U.S.). This framework of focusing on an America first agenda has at least made businesses look to retain and grow jobs in the U.S. This last point does not take into account the potential ancillary ramifications as trade, manufacturing and logistics are all intertwined and the end result may be less helpful to the U.S. than intended.

We believe that the economic position of the U.S. is pointing to an improvement in growth, a reflationary economy, higher commodity prices and ultimately EPS growth. Over the past few weeks we have seen a pickup in economic vitality. Suboptimal growth over the past few years is now enjoying acceleration and we believe it will improve the economic strength of the U.S. and will have the ancillary effect of supporting worldwide growth in the quarters to come.

The Fund’s Adviser, Hudson Valley Investment Advisors, Inc. (the “Adviser”) focuses on changes to S&P 500 revenues and earnings as they are, in our opinion, the main driver of stocks over the longer term. The equity markets have digested a flat earnings stream for the S&P 500 from 2014 through 2016 and are now discounting improving EPS growth of mid-single digits. Equity markets have seen appreciation over the past few years as market multiples expanded. We believe that multiple expansion will be limited moving forward as multiples are now at the higher end of their historical range. The Adviser is anticipating higher earnings growth in 2017 which could spur additional market appreciation.

1

Current Market and Economic Conditions

At February 28th, 2017, the equity market has seen a year over year improvement in both revenues and earnings for the S&P 500. This is the first time since the end of fiscal year 2014 and the first quarter of 2015 that earnings have seen improvement two quarters in a row. In addition, the number of negative earnings revisions has been limited versus historical patterns and margins have maintained strong historical levels.

Other factors are the yield curve maintaining a positive slope which points to a continued expectation of economic improvement by fixed income investors while commodity prices have pointed to an environment of economic strength. PMI’s, employment and consumer confidence are also pointing to continued strength in the economy.

Our stock selections are focused on improvement in economic vitality. In spite of the higher level of P/E ratios, many of our overweight sectors, such as Financials, are trading at lower P/E ratios than that of the overall market. Individual names have benefited from leverage that is seen from their business lines and changes in the overall economy.

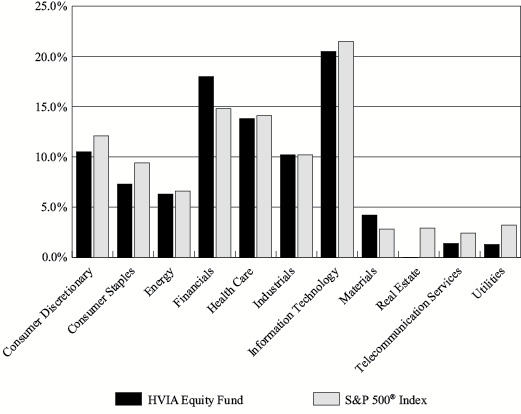

Investment Philosophy and Performance

Since inception through February 28, 2017, HVEIX is up 14.06% versus 10.34% for the S&P 500. The Fund outperformed its benchmark due to our overweight in the Financials and Information Technology sectors while underweighting the Consumer Staples, Real Estate and Utilities sectors. In addition, stock selection in select Industrial and Financial names helped provide outperformance during the quarter. We are positioned for a continued improvement in corporate revenues and expansion of margins as we move into the back half of 2017. We are investing with an eye for the longer term, which means over 18 months. Our focus is on stocks that are showing improving asset utilization, margin improvement and the efficient use of capital. This can be summed up in an improving return on equity, but are trading at a discount to their historical growth or that of the industry group.

The following three positions had the largest impact on the Fund’s performance since inception through February 28th, 2017:

|

a) |

CSX Corporation - CSX (+59.3%) |

|

b) |

Bank of America Corporation - BAC (+53.4%) |

|

c) |

Goldman Sachs Group - GS (+48.5%) |

Since the inception on October 3, 2016, the Fund benefited from improving dynamics in the financial services industry and the better than expected earnings from more cyclically oriented groups. What these stocks have in common is that they are leveraged to economic growth. CSX is benefitting from a rebound in chemical and intermodal transportation but also is the beneficiary of increasing coal shipments which grew to 20% of total revenues. CSX has a long runway to get back to its historical high in coal shipments 10 years ago of 40% of total revenues. Both BAC and GS helped the Fund as the focus of an improving economy was seen from higher levels of trading revenues and the better than expected lending environment. The continued expectation of a higher lending spread and pick up in markets growth should not surprise investors as interest rates normalize.

2

The following positions had the greatest negative impact on the Fund’s performance since inception through February 28, 2017:

|

a) |

Conoco Phillips COP (-5.8%) |

|

b) |

Williams Companies WMB (-4.8%) |

|

c) |

AutoZone AZO (-3.5%) |

The two energy names COP and WMB, were impacted by the lower oil prices seen in the short term after a rebound during the prior quarter. The third equity position, AZO, was hurt by the perceived impact from Amazon’s (“AMZN”) announcement that it would be entering the auto parts market. We believe that energy prices will see growth from the improvement in worldwide growth off a low base which should be a tailwind to the energy complex. In our opinion, the AMZN announcement should not impact the stock over the long term as AMZN already sells parts online. Most consumers need a part immediately and are unwilling to wait several days for delivery. We believe the wait to have a car fixed does not make AMZN a viable competitor and might not be as impactful to the brick and mortar businesses.

Sincerely,

Gustave J. Scacco

Portfolio Manager

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-209-8710.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.hviafunds.com or call 1-888-209-8710 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of February 28, 2017, please see the Schedule of Investments section of the annual report. The opinions of the Fund’s Adviser with respect to those securities may change at any time.

3

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

4

HVIA EQUITY FUND

PERFORMANCE INFORMATION

February 28, 2017 (Unaudited)

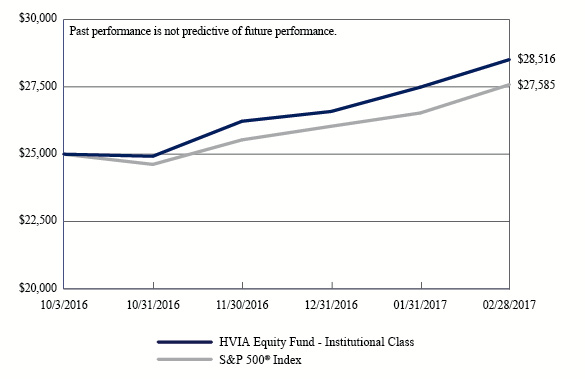

Comparison of the Change in Value of a $25,000 Investment in

HVIA Equity Fund - Institutional Class versus the S&P 500® Index

|

Total Returns |

|

|

Since |

|

|

HVIA Equity Fund - Institutional Class(a) |

14.06% |

|

S&P 500® Index |

10.34% |

|

(a) |

The Fund’s total return does not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

(b) |

The Fund commenced operations on October 3, 2016. |

5

HVIA EQUITY FUND

PORTFOLIO INFORMATION

February 28, 2017 (Unaudited)

Sector Diversification (% of Net Assets)

Top 10 Equity Holdings

|

Security Description |

% of |

|

CSX Corporation |

3.3% |

|

JPMorgan Chase & Company |

3.0% |

|

Bank of America Corporation |

2.9% |

|

Broadcom Ltd. |

2.8% |

|

Apple, Inc. |

2.7% |

|

Adobe Systems, Inc. |

2.7% |

|

Facebook, Inc. - Class A |

2.6% |

|

Morgan Stanley |

2.5% |

|

Alphabet, Inc. - Class C |

2.4% |

|

FedEx Corporation |

2.4% |

6

|

HVIA EQUITY FUND |

||||||||

|

COMMON STOCKS — 93.5% |

Shares |

Value |

||||||

|

Consumer Discretionary — 10.5% |

||||||||

|

Hotels, Restaurants & Leisure — 2.0% |

||||||||

|

Royal Caribbean Cruises Ltd. |

2,335 |

$ |

224,393 |

|||||

|

Household Durables — 1.0% |

||||||||

|

Lennar Corporation - Class A |

2,400 |

117,096 |

||||||

|

Media — 1.3% |

||||||||

|

Walt Disney Company (The) |

1,400 |

154,126 |

||||||

|

Multi-line Retail — 1.0% |

||||||||

|

Dollar General Corporation |

1,525 |

111,355 |

||||||

|

Specialty Retail — 4.1% |

||||||||

|

AutoZone, Inc. (a) |

195 |

143,627 |

||||||

|

CarMax, Inc. (a) |

3,175 |

204,915 |

||||||

|

Home Depot, Inc. (The) |

850 |

123,174 |

||||||

|

471,716 |

||||||||

|

Textiles, Apparel & Luxury Goods — 1.1% |

||||||||

|

NIKE, Inc. - Class B |

2,100 |

120,036 |

||||||

|

Consumer Staples — 7.3% |

||||||||

|

Beverages — 3.3% |

||||||||

|

Molson Coors Brewing Company - Class B |

1,950 |

195,760 |

||||||

|

PepsiCo, Inc. |

1,650 |

182,127 |

||||||

|

377,887 |

||||||||

|

Food Products — 3.0% |

||||||||

|

J.M. Smucker Company (The) |

1,000 |

141,730 |

||||||

|

Kraft Heinz Company (The) |

2,200 |

201,322 |

||||||

|

343,052 |

||||||||

|

Personal Products — 1.0% |

||||||||

|

Estée Lauder Companies, Inc. (The) - Class A |

1,300 |

107,705 |

||||||

|

Energy — 6.3% |

||||||||

|

Oil, Gas & Consumable Fuels — 6.3% |

||||||||

|

ConocoPhillips |

3,700 |

176,009 |

||||||

|

Enbridge, Inc. |

4,207 |

176,046 |

||||||

|

Exxon Mobil Corporation |

2,300 |

187,036 |

||||||

|

Williams Companies, Inc. (The) |

6,300 |

178,542 |

||||||

|

717,633 |

||||||||

7

|

HVIA EQUITY FUND |

||||||||

|

COMMON STOCKS — 93.5% (Continued) |

Shares |

Value |

||||||

|

Financials — 18.0% |

||||||||

|

Banks — 9.4% |

||||||||

|

Bank of America Corporation |

13,400 |

$ |

330,712 |

|||||

|

JPMorgan Chase & Company |

3,800 |

344,356 |

||||||

|

SunTrust Banks, Inc. |

3,850 |

229,037 |

||||||

|

Wells Fargo & Company |

2,750 |

159,170 |

||||||

|

1,063,275 |

||||||||

|

Capital Markets — 6.3% |

||||||||

|

Bank of New York Mellon Corporation (The) |

4,000 |

188,560 |

||||||

|

Goldman Sachs Group, Inc. (The) |

1,000 |

248,060 |

||||||

|

Morgan Stanley |

6,200 |

283,154 |

||||||

|

719,774 |

||||||||

|

Insurance — 2.3% |

||||||||

|

Marsh & McLennan Companies, Inc. |

3,600 |

264,528 |

||||||

|

Health Care — 13.8% |

||||||||

|

Biotechnology — 2.3% |

||||||||

|

Celgene Corporation (a) |

2,100 |

259,371 |

||||||

|

Health Care Equipment & Supplies — 3.1% |

||||||||

|

Danaher Corporation |

2,400 |

205,320 |

||||||

|

Medtronic plc |

1,800 |

145,638 |

||||||

|

350,958 |

||||||||

|

Health Care Providers & Services — 2.0% |

||||||||

|

UnitedHealth Group, Inc. |

1,350 |

223,263 |

||||||

|

Life Sciences Tools & Services — 3.2% |

||||||||

|

PerkinElmer, Inc. |

3,350 |

181,771 |

||||||

|

Thermo Fisher Scientific, Inc. |

1,200 |

189,216 |

||||||

|

370,987 |

||||||||

|

Pharmaceuticals — 3.2% |

||||||||

|

Eli Lilly & Company |

2,300 |

190,463 |

||||||

|

Pfizer, Inc. |

5,000 |

170,600 |

||||||

|

361,063 |

||||||||

|

Industrials — 10.2% |

||||||||

|

Air Freight & Logistics — 2.4% |

||||||||

|

FedEx Corporation |

1,400 |

270,172 |

||||||

|

Building Products — 1.0% |

||||||||

|

Masco Corporation |

3,450 |

116,541 |

||||||

8

|

HVIA EQUITY FUND |

||||||||

|

COMMON STOCKS — 93.5% (Continued) |

Shares |

Value |

||||||

|

Industrials — 10.2% (Continued) |

||||||||

|

Machinery — 3.5% |

||||||||

|

Lincoln Electric Holdings, Inc. |

2,500 |

$ |

210,525 |

|||||

|

Oshkosh Corporation |

2,750 |

186,697 |

||||||

|

397,222 |

||||||||

|

Road & Rail — 3.3% |

||||||||

|

CSX Corporation |

7,750 |

376,340 |

||||||

|

Information Technology — 20.5% |

||||||||

|

Communications Equipment — 1.9% |

||||||||

|

Harris Corporation |

2,025 |

222,548 |

||||||

|

Internet Software & Services — 6.5% |

||||||||

|

Alphabet, Inc. - Class C (a) |

335 |

275,775 |

||||||

|

eBay, Inc. (a) |

4,750 |

161,025 |

||||||

|

Facebook, Inc. - Class A (a) |

2,200 |

298,188 |

||||||

|

734,988 |

||||||||

|

Semiconductors & Semiconductor Equipment — 2.8% |

||||||||

|

Broadcom Ltd. |

1,520 |

320,614 |

||||||

|

Software — 6.6% |

||||||||

|

Adobe Systems, Inc. (a) |

2,600 |

307,684 |

||||||

|

Microsoft Corporation |

3,050 |

195,139 |

||||||

|

Red Hat, Inc. (a) |

2,975 |

246,360 |

||||||

|

749,183 |

||||||||

|

Technology Hardware, Storage & Peripherals — 2.7% |

||||||||

|

Apple, Inc. |

2,250 |

308,228 |

||||||

|

Materials — 4.2% |

||||||||

|

Chemicals — 4.2% |

||||||||

|

Dow Chemical Company (The) |

2,850 |

177,441 |

||||||

|

LyondellBasell Industries N.V. - Class A |

1,875 |

171,075 |

||||||

|

Sherwin-Williams Company (The) |

425 |

131,129 |

||||||

|

479,645 |

||||||||

|

Telecommunication Services — 1.4% |

||||||||

|

Diversified Telecommunication Services — 1.4% |

||||||||

|

Verizon Communications, Inc. |

3,200 |

158,816 |

||||||

9

|

HVIA EQUITY FUND |

||||||||

|

COMMON STOCKS — 93.5% (Continued) |

Shares |

Value |

||||||

|

Utilities — 1.3% |

||||||||

|

Electric Utilities 0.9% |

||||||||

|

Duke Energy Corporation |

1,200 |

$ |

99,060 |

|||||

|

Independent Power and Renewable Electricity Producers — 0.4% |

||||||||

|

AES Corporation |

4,000 |

46,080 |

||||||

|

Total Investments at Value — 93.5% (Cost $9,307,498) |

$ |

10,637,655 |

||||||

|

Other Assets in Excess of Liabilities — 6.5% |

742,886 |

|||||||

|

Net Assets — 100.0% |

$ |

11,380,541 |

||||||

|

(a) |

Non-income producing security. |

|

See accompanying notes to financial statements. |

|

10

|

HVIA EQUITY FUND |

||||

|

ASSETS |

||||

|

Investments in securities: |

||||

|

At acquisition cost |

$ |

9,307,498 |

||

|

At value (Note 2) |

$ |

10,637,655 |

||

|

Cash |

729,717 |

|||

|

Receivable for capital shares sold |

550 |

|||

|

Receivable from Adviser (Note 4) |

2,712 |

|||

|

Dividends receivable |

15,840 |

|||

|

Other assets |

7,140 |

|||

|

TOTAL ASSETS |

11,393,614 |

|||

|

LIABILITIES |

||||

|

Payable to administrator (Note 4) |

5,580 |

|||

|

Other accrued expenses |

7,493 |

|||

|

TOTAL LIABILITIES |

13,073 |

|||

|

NET ASSETS |

$ |

11,380,541 |

||

|

NET ASSETS CONSIST OF: |

||||

|

Paid-in capital |

$ |

10,030,341 |

||

|

Undistributed net investment income |

7,199 |

|||

|

Accumulated net realized gains from security transactions |

12,844 |

|||

|

Net unrealized appreciation on investments |

1,330,157 |

|||

|

NET ASSETS |

$ |

11,380,541 |

||

|

PRICING OF INSTITUTIONAL SHARES (Note 1) |

||||

|

Net assets applicable to Institutional Shares |

$ |

11,380,541 |

||

|

Shares of Institutional Shares outstanding (unlimited number of shares authorized, no par value) |

999,124 |

|||

|

Net asset value, offering price and redemption price per share (Note 2) |

$ |

11.39 |

||

|

See accompanying notes to financial statements. |

11

|

HVIA EQUITY FUND |

||||

|

INVESTMENT INCOME |

||||

|

Dividend income |

$ |

60,866 |

||

|

EXPENSES |

||||

|

Investment advisory fees (Note 4) |

29,050 |

|||

|

Professional fees |

10,649 |

|||

|

Fund accounting fees (Note 4) |

10,262 |

|||

|

Administration fees (Note 4) |

9,871 |

|||

|

Transfer agent fees (Note 4) |

7,403 |

|||

|

Trustees’ fees (Note 4) |

6,375 |

|||

|

Compliance fees (Note 4) |

4,935 |

|||

|

Registration and filing fees |

4,635 |

|||

|

Custody and bank service fees |

2,906 |

|||

|

Postage and supplies |

2,640 |

|||

|

Printing of shareholder reports |

810 |

|||

|

Other expenses |

3,163 |

|||

|

TOTAL EXPENSES |

92,699 |

|||

|

Less fee reductions and expense reimbursements by the Adviser (Note 4) |

(53,835 |

) |

||

|

NET EXPENSES |

38,864 |

|||

|

NET INVESTMENT INCOME |

22,002 |

|||

|

REALIZED AND UNREALIZED GAINS ON INVESTMENTS |

||||

|

Net realized gains from security transactions |

12,844 |

|||

|

Net change in unrealized appreciation (depreciation) on investments |

1,330,157 |

|||

|

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS |

1,343,001 |

|||

|

NET INCREASE IN NET ASSETS FROM OPERATIONS |

$ |

1,365,003 |

||

|

(a) |

Represents the period from the commecement of operations (October 3, 2016) through February 28, 2017. |

|

See accompanying notes to financial statements. |

|

12

|

HVIA EQUITY FUND |

||||

|

|

Period Ended February 28, |

|||

|

FROM OPERATIONS |

||||

|

Net investment income |

$ |

22,002 |

||

|

Net realized gains from security transactions |

12,844 |

|||

|

Net change in unrealized appreciation (depreciation) on investments |

1,330,157 |

|||

|

Net increase in net assets from operations |

1,365,003 |

|||

|

DISTRIBUTIONS TO SHAREHOLDERS |

||||

|

From net investment income, Institutional Shares |

(14,803 |

) |

||

|

CAPITAL SHARE TRANSACTIONS |

||||

|

Institutional Shares |

||||

|

Proceeds from shares sold |

10,308,817 |

|||

|

Net asset value of shares issued in reinvestment of distributions to shareholders |

1 |

|||

|

Payments for shares redeemed |

(278,477 |

) |

||

|

Net increase in Institutional Shares net assets from capital share transactions |

10,030,341 |

|||

|

TOTAL INCREASE IN NET ASSETS |

11,380,541 |

|||

|

NET ASSETS |

||||

|

Beginning of period |

— |

|||

|

End of period |

$ |

11,380,541 |

||

|

UNDISTRIBUTED NET INVESTMENT INCOME |

$ |

7,199 |

||

|

CAPITAL SHARE ACTIVITY |

||||

|

Institutional Shares |

||||

|

Shares sold |

1,026,182 |

|||

|

Shares reinvested |

0 |

* |

||

|

Shares redeemed |

(27,058 |

) |

||

|

Net increase in shares outstanding |

999,124 |

|||

|

Shares outstanding at beginning of period |

— |

|||

|

Shares outstanding at end of period |

999,124 |

|||

|

(a) |

Represents the period from the commencement of operations (October 3, 2016) through February 28, 2017. |

|

* |

Shares round to less than 1. |

|

See accompanying notes to financial statements. |

|

13

|

HVIA EQUITY FUND |

||||

|

Per Share Data for a Share Outstanding Throughout the Period |

||||

|

|

Period Ended February 28, |

|||

|

Net asset value at beginning of period |

$ |

10.00 |

||

|

Income from investment operations: |

||||

|

Net investment income |

0.02 |

|||

|

Net realized and unrealized gains on investments |

1.39 |

|||

|

Total from investment operations |

1.41 |

|||

|

Less distributions: |

||||

|

From net investment income |

(0.02 |

) |

||

|

Net asset value at end of period |

$ |

11.39 |

||

|

Total return (b) |

14.06 |

%(c) |

||

|

Net assets at end of period (000’s) |

$ |

11,381 |

||

|

Ratios/supplementary data: |

||||

|

Ratio of total expenses to average net assets |

2.36 |

%(d) |

||

|

Ratio of net expenses to average net assets (e) |

0.99 |

%(d) |

||

|

Ratio of net investment income to average net assets (e) |

0.56 |

%(d) |

||

|

Portfolio turnover rate |

2 |

%(c) |

||

|

(a) |

Represents the period from the commencement of operations (October 3, 2016) through February 28, 2017. |

|

(b) |

Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and reimbursed expenses. |

|

(c) |

Not annualized. |

|

(d) |

Annualized. |

|

(e) |

Ratio was determined after advisory fee reductions and expense reimbursements (Note 4). |

|

See accompanying notes to financial statements. |

|

14

HVIA EQUITY FUND

NOTES TO FINANCIAL STATEMENTS

February 28, 2017

1. Organization

HVIA Equity Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. The Fund commenced operations on October 3, 2016.

The investment objective of the Fund is to seek growth at a reasonable price.

The Fund currently offers one class of shares: Institutional Class shares (sold without any sales loads or distribution fees and subject to a $25,000 initial investment requirement). As of February 28, 2017, the Investor Class shares (to be sold without any sales load, but subject to a distribution fee of up to 0.25% of the class’ average daily net assets and subject to a $2,500 initial investment requirement) are not currently offered. When both classes are offered, each share class will represent an ownership interest in the same investment portfolio.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). As an investment company, as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Update 2013-08, the Fund follows accounting and reporting guidance under FASB Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

In October 2016, the Securities and Exchange Commission (the “SEC”) released its final rule on Investment Company Reporting Modernization (the “Rule”). The Rule, which introduces two new regulatory reporting forms for investment companies – Form N-PORT and Form N-CEN, also contains amendments to Regulation S-X which impact financial statement presentation, particularly the presentation of derivative investments. Although it is still evaluating the impact of the Rule, management believes that many of the Regulation S-X amendments are consistent with the Fund’s current financial statement presentation and expects that the Fund will be able to comply with the Rule’s Regulation S-X amendments by the August 1, 2017 compliance date.

Securities valuation – The Fund values its portfolio securities at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. The Fund values its common stocks on the basis of the security’s last sale price on the security’s primary exchange, if available, otherwise at the exchange’s most recently quoted mean price. NASDAQ-listed securities are valued at the NASDAQ Official Closing Price. The Fund values securities traded in the over-the-counter market at the last sale price, if available, otherwise at the most recently quoted mean price. When using a quoted price and when the market is considered active, the security will be classified as Level 1 within the fair value

15

|

HVIA EQUITY FUND |

hierarchy. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value pursuant to procedures established by and under the direction of the Board of Trustees (the “Board”) of the Trust. Under these procedures, the securities will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Unavailable or unreliable market quotes may be due to the following factors: a substantial bid-ask spread; infrequent sales resulting in stale prices; insufficient trading volume; small trade sizes; a temporary lapse in any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading. As a result, the prices of securities used to calculate the Fund’s net asset value (“NAV”) may differ from quoted or published prices for the same securities.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

|

● |

Level 1 – quoted prices in active markets for identical securities |

|

● |

Level 2 – other significant observable inputs |

|

● |

Level 3 – significant unobservable inputs |

The inputs or methods used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of February 28, 2017:

|

|

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||

|

Common Stocks |

$ |

10,637,655 |

$ |

— |

$ |

— |

$ |

10,637,655 |

||||||||

Refer to the Fund’s Schedule of Investments for a listing of common stocks by industry type. As of February 28, 2017, the Fund did not have any transfers between Levels. In addition, the Fund did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of February 28, 2017. It is the Fund’s policy to recognize transfers between Levels at the end of the reporting period.

16

|

HVIA EQUITY FUND |

Cash account – The Fund’s cash is held in a bank account with balances which may exceed the amount covered by federal deposit insurance. As of February 28, 2017, the cash balance reflected on the Statement of Assets and Liabilities represents the amount held in a deposit sweep account.

Share valuation – The NAV per share of each class of the Fund is calculated daily by dividing the total value of its assets attributable to that class, less liabilities attributable to that class, by the number of shares outstanding of that class. The offering price and redemption price per share of each class of the Fund is equal to the NAV per share of such class.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Security transactions – Security transactions are accounted for on the trade date. Realized gains and losses on securities sold are determined on a specific identification basis.

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – The Fund will distribute to shareholders any net investment income dividends and net realized capital gains distributions at least once each year. The amount of such dividends and distributions are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid by the Fund to shareholders during the period ended February 28, 2017 was ordinary income.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions which affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts from prior years.

17

|

HVIA EQUITY FUND |

The following information is computed on a tax basis for each item as of February 28, 2017:

|

Tax cost of portfolio investments |

$ |

9,307,498 |

||

|

Gross unrealized appreciation |

$ |

1,380,141 |

||

|

Gross unrealized depreciation |

(49,984 |

) |

||

|

Net unrealized appreciation |

1,330,157 |

|||

|

Undistributed ordinary income |

20,043 |

|||

|

Accumulated earnings |

$ |

1,350,200 |

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” of being sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for the period ended February 28, 2017 and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Fund identifies its major tax jurisdiction as U.S. Federal.

3. Investment Transactions

During the period ended February 28, 2017, cost of purchases and proceeds from sales of investment securities, other than short-term investments were $9,491,648 and $195,464, respectively.

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Hudson Valley Investment Advisors, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an investment advisory fee, computed and accrued daily and paid monthly, at the annual rate of 0.74% of its average daily net assets.

Pursuant to an Expense Limitation Agreement (“ELA”), the Adviser has contractually agreed, until July 1, 2019, to reduce investment advisory fees and reimburse other expenses to the extent necessary to limit total annual operating expenses (excluding brokerage costs, taxes, interest, acquired fund fees and expenses, costs to organize the Fund, extraordinary expenses such as litigation and merger or reorganization costs and other expenses not incurred in the ordinary course of the Fund’s business, and amounts, if any, payable pursuant to a plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940, as amended (the “1940 Act”)) to an amount not exceeding 0.99% of average daily net assets of Institutional Class shares. Accordingly, the Adviser did not collect any of its investment advisory fees and in addition, reimbursed other operating expenses totaling $24,785 during the period ended February 28, 2017.

18

|

HVIA EQUITY FUND |

Under the terms of the ELA, investment advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided the repayments do not cause total annual operating expenses to exceed the (i) the expense limitation then in effect, if any, and (ii) the expense limitation in effect at the time the expenses to be repaid were incurred. As of February 28, 2017, the Adviser may seek repayment of investment advisory fee reductions and expense reimbursements in the amount of $53,835 no later than February 29, 2020.

The Adviser paid all expenses incurred related to the organization, offering and initial registration of the Fund. Such expenses are not subject to repayment by the Fund to the Adviser.

Until April 25, 2017, an officer of the Fund was also an officer of the Adviser.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting, compliance and transfer agency services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services. In addition, the Fund pays out-of-pocket expenses including, but not limited to, postage, supplies, and costs of pricing the Fund’s portfolio securities.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as the principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also officers of Ultimus and the Distributor.

TRUSTEE COMPENSATION

Each Trustee who is not an “interested person” of the Trust (“Independent Trustee”) receives a $1,000 annual retainer from the Fund, paid quarterly, except for the Board Chairperson who receives a $1,200 annual retainer from the Fund, paid quarterly. Each Independent Trustee also receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement for travel and other meeting-related expenses.

PRINCIPAL HOLDER OF FUND SHARES

As of February 28, 2017, the following shareholder owned of record 5% or more of the outstanding shares of the Fund:

|

NAME OF RECORD OWNER |

% Ownership |

|

Pershing, LLC (for the benefit of its customers) |

100% |

19

|

HVIA EQUITY FUND |

A beneficial owner of 25% or more of the Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholder’s meeting.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted the following: On April 25, 2017, David R. Carson was elected Principal Executive Officer of the Fund, replacing Gustave J. Scacco.

20

|

HVIA EQUITY FUND |

To the Shareholders of HVIA Equity Fund and Board of Trustees of Ultimus Managers Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of HVIA Equity Fund (the “Fund”), a series of Ultimus Managers Trust, as of February 28, 2017, and the related statements of operations and changes in net assets, and the financial highlights for the period October 3, 2016 (commencement of operations) through February 28, 2017. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of February 28, 2017, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of HVIA Equity Fund as of February 28, 2017, the results of its operations, the changes in its net assets, and the financial highlights for the period indicated above, in conformity with accounting principles generally accepted in the United States of America.

COHEN & COMPANY, LTD.

Cleveland, Ohio

April 27, 2017

21

|

HVIA EQUITY FUND |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (October 3, 2016) and held until the end of the period (February 28, 2017).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.” The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

22

|

HVIA EQUITY FUND |

|

Institutional Class |

Beginning Account Value September 1, |

Ending February 28, 2017 |

Net Expense Ratio (b) |

Expenses |

|

Based on Actual Fund Return |

$ 1,000.00 |

$ 1,140.60 |

0.99% |

$ 4.33 |

|

Based on Hypothetical 5% Return (before expenses) |

$ 1,000.00 |

$ 1,019.89 |

0.99% |

$ 4.96 |

|

(a) |

Beginning Account Value is as of October 3, 2016 (date of commencement of operations) for the Actual Fund Return. |

|

(b) |

Annualized, based on the Fund’s expenses for the period since inception. |

|

(c) |

Expenses are equal to the Fund’s annualized net expense ratio multiplied by the average account value over the period, multiplied by 149/365 (to reflect the period since inception) and 181/365 (to reflect the one-half year period), for the Actual Fund Return and Hypothetical 5% Return, respectively. |

23

|

HVIA EQUITY FUND |

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-209-8710, or on the SEC website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the period ending June 30, 2017 will be available without charge upon request no later than August 31, 2017 by calling toll-free 1-888-209-8710, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-888-209-8710. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

24

|

HVIA EQUITY FUND |

The Board has overall responsibility for management of the Trust’s affairs. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement, or removal. The Trustees, in turn, elect the officers of the Fund to actively supervise its day-to-day operations. The officers have been elected for an annual term. Unless otherwise noted, each Trustee’s and officer’s address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

|

Name and |

Length of Time Served |

Position(s) |

Principal Occupation(s) |

Number of Funds in Trust Overseen by Trustee |

Directorships of Public Companies Held by Trustee During Past 5 Years |

|

Interested Trustees: |

|||||

|

Robert G. Dorsey* Year of Birth: 1957 |

Since |

Trustee (February 2012 to present) President (June 2012 to October 2013) |

President and Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present) |

26 |

None |

|

Independent Trustees: |

|||||

|

Janine L. Cohen Year of Birth: 1952 |

Since January |

Trustee |

Retired since 2013; Chief Financial Officer from 2004 to 2013 and Chief Compliance Officer from 2008 to 2013 at AER Advisors, Inc. |

26 |

None |

|

David M. Deptula Year of Birth: 1958 |

Since |

Trustee |

Vice President of Legal and Special Projects at Dayton Freight Lines, Inc. since 2016; Vice President of Tax Treasury at The Standard Register Inc. (formerly the Standard Register Company) from 2011 to 2016 |

26 |

None |

|

John J. Discepoli Year of Birth: 1963 |

Since |

Chairman Trustee |

Owner of Discepoli Financial Planning, LLC (personal financial planning company) since 2004 |

26 |

None |

|

* |

Mr. Dorsey is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent and distributor. |

25

|

HVIA EQUITY FUND |

|

Name and |

Length of Time Served |

Position(s) |

Principal Occupation(s) During Past 5 Years |

|

Executive Officers: |

|||

|

David R. Carson Year of Birth: 1958 |

Since |

Principal President (October 2013 to present) Vice President (April 2013 to October 2013) |

Vice President and Director of Client Strategies of Ultimus Fund Solutions, LLC (2013 to present); President, Unified Series Trust (2016 to present); Chief Compliance Officer, FSI LBAR Fund (2013 to 2016), The Huntington Funds (2005 to 2013), Huntington Strategy Shares (2012 to 2013), and Huntington Asset Advisors (2013); Vice President, Huntington National Bank (2001 to 2013) |

|

Jennifer L. Leamer Year of Birth: 1976 |

Since |

Treasurer Assistant Treasurer (April 2014 to October 2014) |

Vice President, Mutual Fund Controller of Ultimus Fund Solutions, LLC (2014 to present); Business Analyst of Ultimus Fund Solutions, LLC (2007 to 2014) |

|

Bo J. Howell Year of Birth: 1981 |

Since |

Secretary Assistant Secretary (October 2014 to April 2015) |

President, Valued Advisers Trust (2017 to present); Secretary, Unified Series Trust (2016 to present); Vice President, Director of Fund Administration for Ultimus Fund Solutions, LLC (2014 to present); Counsel – Securities and Mutual Funds for Western & Southern Financial Group (2012 to 2014) |

|

Charles C. Black Year of Birth: 1979 |

Since |

Chief Compliance Officer (January 2016 to present) Assistant Chief Compliance Officer (April 2015 to January 2016) |

Chief Compliance Officer of The Caldwell & Orkin Funds, Inc. (2016 to present); Senior Compliance Officer of Ultimus Fund Solutions, LLC (2015 to present); Senior Compliance Manager at Touchstone Mutual Funds (2013 to 2015); Senior Compliance Manager at Fund Evaluation Group (2011 to 2013) |

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-888-209-8710.

26

|

HVIA EQUITY FUND |

The Board, including the Independent Trustees voting separately, has reviewed and approved the Fund’s Investment Advisory Agreement (the “Agreement”) with the Adviser for an initial two-year term. Approval took place at an in-person meeting held on July 25-26, 2016, at which all of the Trustees were present.

In the course of their deliberations, the Board was advised by legal counsel. The Board received and reviewed a substantial amount of information provided by the Adviser in response to requests of the Board and counsel.

In considering the Agreement and reaching their conclusions with respect thereto, the Board reviewed and analyzed various factors that they determined were relevant, including the factors described below.

The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the responsibilities the Adviser would have under the Agreement. The Board also considered the Adviser’s proposed services to the Fund including, without limitation: the Adviser’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objective and limitations; the proposed initial marketing and distribution efforts; and the Adviser’s compliance procedures and practices. After reviewing the foregoing and further information provided to the Board (e.g., information regarding the Adviser’s business), the Board concluded that the quality, extent, and nature of the services to be provided by the Adviser to the Fund were satisfactory and adequate.

The investment management capabilities and experience of the Adviser. The Board considered the investment management experience of the Adviser and thoroughly discussed with the Adviser the investment objective and strategies for the Fund. The Board also reviewed the Adviser’s experience in managing similar types of strategies, and its plans for implementing such strategies. After consideration of these and other factors, the Board determined that the Adviser has the requisite experience to serve as investment adviser for the Fund.

The costs of the services to be provided and profits to be realized by the Adviser and its affiliates from the relationship with the Fund. The Board considered the Adviser’s personnel and methods of operation; the education and experience of its personnel; its compliance program, policies, and procedures; its financial condition and the level of financial commitment to the Fund; the projected asset levels of the Fund; and the overall expenses of the Fund, including the advisory fee. The Board reviewed the ELA and noted the benefit to the Fund from the Adviser’s contractual obligation to reduce its advisory fee or reimburse other operating expenses through July 1, 2019. The Board discussed the Adviser’s financial condition and its ability to satisfy its financial commitments to the Fund. The Board also considered potential benefits for the Adviser in managing the Fund, including promotion of

27

|

HVIA EQUITY FUND |

the Adviser’s name. The Board noted that the Fund’s advisory fee of 0.74% was above the average and the median for the Fund’s custom peer group. The Board further noted that the proposed expense ratio of 0.99% is above the average and median for the Fund’s custom peer group but was not the highest in the group. Upon further consideration and discussion of the foregoing, the Board concluded that the proposed advisory fee and total expense limit for the Fund is within the range of what would have been negotiated at arms-length in light of all the surrounding circumstances.

The extent to which the Fund and its investors would benefit from economies of scale. In this regard, the Board considered the Agreement and the ELA. The Board determined that the shareholders of the Fund would benefit from the ELA until the Fund’s assets grew to a level where its expenses otherwise fall below the expense limit. Following further consideration of the Fund’s projected asset levels, expectations for growth, and level of fees, the Board determined that the Fund’s fee arrangements with the Adviser would provide benefits for the next two years, and the Board could review the arrangements going forward as necessary. After further discussion, the Board concluded the Fund’s arrangements with the Adviser were fair and reasonable in relationship to the nature and quality of services to be provided by the Adviser and would benefit the Fund and its shareholders.

Brokerage and portfolio transactions. The Board considered the Adviser’s policies and procedures as it relates to seeking best execution for the Fund. The Board also considered the anticipated portfolio turnover rate for the Fund; the method and basis for selecting and evaluating the broker-dealers used to complete the Fund’s portfolio transactions; any anticipated allocation of portfolio business to persons affiliated with the Adviser; and the extent to which the Fund’s trades may be allocated to soft-dollar arrangements. After further review and discussion, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory.

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the Adviser’s process for allocating trades among its different clients, including the Adviser’s other clients with similar types of investment objectives and strategies as the Fund. The Board also considered the substance and administration of the Adviser’s Code of Ethics. Following further consideration and discussion, the Board determined that the Adviser’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory.

Conclusion

After full consideration of the above factors as well as other factors, and in reliance on the information provided by the Adviser and Trust management, the Board unanimously concluded that approval of the Agreement was in the best interests of the Fund and its shareholders.

28

This page intentionally left blank.

LADDER SELECT BOND FUND

INSTITUTIONAL CLASS (LSBIX)

Managed by

Ladder Capital Asset Management LLC

ANNUAL REPORT

February 28, 2017

|

LADDER SELECT BOND FUND |

March 17, 2017 |

Dear Ladder Select Bond Fund Shareholders,

From inception on October 18, 2016 to February 28, 2017, the Ladder Select Bond Fund (the “Fund”) returned +0.85%. For the same period, the Fund’s benchmark, the Bloomberg Barclays Intermediate Government/Credit Bond Index, returned -1.15%. The Fund outperformed its benchmark by 2.00%.

The Fund seeks to capitalize on the sector-specific knowledge of commercial real estate (“CRE”) and commercial mortgage-backed securities (“CMBS”) of its adviser, Ladder Capital Asset Management (“LCAM”), to select investments that satisfy the Fund’s investment objective of seeking a combination of current income and capital preservation.

Consistent with LCAM’s philosophy of seeking outperformance through deep sector expertise, the strong performance of the Fund versus its benchmark during the period was driven by three of its larger holdings.

|

■ |

JPMCC 2016-WPT D – This investment is secured by a highly diverse office portfolio of 108 properties with 417 tenant leases. A significant proportion of those tenants are rated investment grade. The floating rate investment grade security owned by the Fund is rated BBB by S&P and has a coupon of one-month dollar LIBOR (“LIBOR”) +3.75%. |

|

■ |

WFCM 2013-LC12 A3FL – The Fund’s investment in this conduit last cash flow floating rate security allowed the Fund to be exposed to the AAA CMBS basis without the exposure to Treasury rates or the potential cost of interest rate hedges. The position was bought and sold during the period. |

|

■ |

COMM 2014-BBG A – The Fund invested in a single pass-through security secured by the Bloomberg world headquarters located at East 59th Street and Lexington Avenue in Manhattan. Rated AAA, this floating rate security was bought at a discount to par value given its coupon of LIBOR+0.90%. The Fund has been able to realize a mark to market price increase with the tightening of spreads during the period. |

Underperformance during the period in a number of Fund positions was a result of the rise in U.S. Treasury yields as further discussed below. The following three fixed rate Fund positions: HILT 2016-SFP A, HILT 2016-SFP B and GSMS 2005-ROCK X1 were the most significant underperformers during the period.

To minimize exposure to interest rate moves, the Fund diversified its investments in shorter-duration and floating-rate CMBS investments, ending the period with a portfolio comprised of 48.9% floating-rate securities indexed to LIBOR, 36.5% fixed rate securities, and 14.6% cash. To further mitigate the portfolio’s exposure to interest rate movements, the Fund expects to employ hedging strategies using derivatives. At the end of the period, the Fund’s portfolio included a short position in 5-year interest rate swap future contracts.

1

Market Environment:

Since the Fund’s inception, improved consumer sentiment, expectations of a potential tax code overhaul, modification and/or repeal of numerous government regulations and the relative strength of domestic economic data have propelled U.S. stock market indices to all-time highs. The U.S. Treasury curve has been range bound, with the 2-year to 10-year Treasury curve steepening slightly. From the Fund’s inception through February 28, 2017, the 2-year Treasury yield increased 46 basis points, the 5-year Treasury yield increased 70 basis points, and the 10-year Treasury yield increased 65 basis points. Three to four rate hikes by the Federal Reserve are expected during 2017 with the first rate increase of 25 basis points announced at the recent March Federal Open Market Committee meeting.

Spreads on CMBS during the period tightened as investors searched for yield, with last cash flow 2016 AAAs tighter by 16 basis points and 2016 BBB- bonds tighter by 135 basis points. The market’s expectations for higher interest rates in the future also created an aggressive investor bid for floating rate and shorter duration investments. Spreads on 2013 last cash flow AAA bonds, which LCAM looks at as an example of intermediate-duration performance, tightened by 22 basis points over the period.

LCAM generally views current CMBS underwriting standards as supportive of capital preservation. According to Wells Fargo’s monthly CMBS Research Briefing – January 6, 2017, loan-to-value ratios at origination for CRE loans underlying conduit transactions since 2010 have ranged from 59.2% to 65.8%, with 2016 originations at 61.0% loan-to-value. Debt service coverage ratios for the same transactions have ranged from 1.61x to 1.89x, with the 2016 vintage posting the highest post-crisis debt service coverage ratio of 1.89x. These relatively conservative credit metrics are supported by an active CRE acquisition market, which provides support for the overall level of CRE valuations.

Outlook:

LCAM continues to monitor market volatility and financial market expectations of the new U.S. Presidential administration. We anticipate some increase in U.S. economic growth in the medium term as a result of positive consumer sentiment, potential for lower personal and corporate taxes, government spending increases directed at infrastructure and defense, and deregulation. However, these potential policy changes could lead to larger U.S. budget deficits, higher inflation rates, rising interest rates and increased market volatility.

In this environment, CRE values may benefit via an increase in sector and individual property cash flows, but higher interest rates could put pressure on CRE cap rates. Increased CRE cap rates could have a negative effect on the fundamentals, as higher cap rates could make it more difficult to refinance existing debt. New loans may require more leverage or new capital in the form of mezzanine debt, preferred equity, or entirely new equity via an outright sale either by the existing owner or the CMBS servicer.

Consistent with its capital preservation objective, the Fund will continue its strategy of investing in CRE debt exhibiting strong fundamental credit metrics while focusing on relative value within each respective transaction’s capital structure. The Fund will also continue to be cautious with respect to credit exposure given the potential for increased refinance risk in a higher interest rate environment.

2

On behalf of everyone at Ladder Capital Asset Management, we would like to thank you for investing with us. We look forward to the Fund’s continued success.

Sincerely,

|

|

|

|

Brian Harris |

Craig Sedmak |

|

Principal Executive Officer and Portfolio Manager |

Portfolio Manager |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month-end are available by calling 1-888-859-5867.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit the Fund’s website at www.ladderfunds.com or call 1-888-859-5867 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. For a complete list of securities held by the Fund as of February 28, 2017, please see the Schedule of Investments section of the annual report. The opinions of the Fund’s adviser with respect to those securities may change at any time.

Statements in the Letter to Shareholders that reflect projections or expectations for future financial or economic performance of the Fund and the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed, or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to factors noted with such forward-looking statements, include, without limitation, general economic conditions, such as inflation, recession, and interest rates. Past performance is not a guarantee of future results.

3

LADDER SELECT BOND FUND

PERFORMANCE INFORMATION

February 28, 2017 (Unaudited)

Comparison of the Change in Value of a $100,000 Investment in

Ladder Select Bond Fund - Institutional Class versus the

Bloomberg Barclays Intermediate Government/Credit Bond Index

|

Total Returns |

|

|

Since |

|

|

Ladder Select Bond Fund - Institutional Class (a) |

0.85% |

|

Bloomberg Barclays Intermediate Government/Credit Bond Index |

(1.15%) |

|

(a) |

The Fund's total return does not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

|

(b) |

The Fund commenced operations on October 18, 2016. |

4

LADDER SELECT BOND FUND

PORTFOLIO INFORMATION

February 28, 2017 (Unaudited)

Portfolio Allocation (% of Net Assets)

Top 10 Long-Term Holdings

|

Security Description |

% of |

|

Commercial Mortgage Trust, Series 2014-BBG, Class A, 144A, 1.5700%(a), due 03/15/2029 |

21.5% |

|

JPMorgan Chase Commercial Mortgage Securities Trust, Series 2016-WPT, Class D, 144A, 4.5200%(a), due 10/15/2033 |

14.4% |

|

Hilton USA Trust, Series 2016-SFP, Class A, 144A, 2.8284%, due 11/05/2035 |

4.8% |

|

Commercial Mortgage Trust, Series 2012-LC4, Class AM, 4.0630%, due 12/10/2044 |

4.7% |

|

Hilton USA Trust, Series 2016-SFP, Class B, 144A, 3.3228%, due 11/05/2035 |

4.5% |

|

Progressive Residential Trust, Series 2016-SFR1, Class A, 144A, 2.2722%(a), due 09/17/2033 |

4.4% |

|

Wells Fargo Commercial Mortgage Trust, Series 2012-LC5, Class B, 4.1420%, due 10/15/2045 |

4.3% |

|

Commercial Mortgage Trust, Series 2013-WWP, Class B, 144A, 3.7255%, due 03/10/2031 |

4.3% |

|

Morgan Stanley Capital I Trust, Series 2017-PRME, Class B, 144A, 2.1200%(a), due 02/15/2034 |

4.1% |

|

Commercial Mortgage Trust, Series 2014-TWC, Class B, 144A, 2.3761%(a), due 02/13/2032 |

3.6% |

|

(a) |

Variable rate security. The rate shown is the effective interest rate as of February 28, 2017. |

5

|

LADDER SELECT BOND FUND |

||||||||||||||

|

MORTGAGE-BACKED SECURITIES — 85.1% |

Coupon |

Maturity |

Par Value |

Value |

||||||||||

|

Commercial — 85.1% |

||||||||||||||

|

Citigroup Commercial Mortgage Trust, |

||||||||||||||

|

Series 2016-SMPL, Class A, 144A |

2.2280 |

% |

09/10/2031 |

$ |

51,000 |

$ |

50,096 |

|||||||

|

Cobalt CMBS Commercial Trust, |

||||||||||||||

|

Series 2007-C2, Class A1A |

5.4770 |

% |

04/15/2047 |

33,308 |

33,372 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2014-BBG, Class A, 144A |

1.5700 |

%(a) |

03/15/2029 |

2,655,000 |

2,659,166 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2013-WWP, Class A2, 144A |

3.4244 |

% |

03/10/2031 |

62,500 |

64,706 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2013-WWP, Class B, 144A |

3.7255 |

% |

03/10/2031 |

509,000 |

526,349 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2014-TWC, Class B, 144A |

2.3761 |

%(a) |

02/13/2032 |

450,000 |

450,703 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2012-LC4, Class AM |

4.0630 |

% |

12/10/2044 |

550,000 |

582,023 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2013-LC6, Class AM |

3.2820 |

% |

01/10/2046 |

107,000 |

108,412 |

|||||||||

|

Commercial Mortgage Trust, |

||||||||||||||

|

Series 2013-LC13, Class AM, 144A |

4.5570 |

% |

08/10/2046 |

206,000 |

222,299 |

|||||||||

|

Goldman Sachs Mortgage Securities Trust, IO, |

||||||||||||||

|

Series 2005-ROCK, Class X1, 144A |

0.2072 |

%(a) |

05/03/2032 |

14,016,000 |

272,499 |

|||||||||

|

Hilton USA Trust, |

||||||||||||||

|

Series 2016-SFP, Class A, 144A |

2.8284 |

% |

11/05/2035 |

600,000 |

592,569 |

|||||||||

|

Hilton USA Trust, |

||||||||||||||

|

Series 2016-SFP, Class B, 144A |

3.3228 |

% |

11/05/2035 |

565,000 |

562,430 |

|||||||||

|

JPMorgan Chase Commercial Mortgage Securities Trust, |

||||||||||||||

|

Series 2016-WPT, Class D, 144A |

4.5200 |

%(a) |

10/15/2033 |

1,750,000 |

1,778,416 |

|||||||||

|

LSTAR Commercial Mortgage Trust, |

||||||||||||||

|

Series 2014-2, Class B, 144A |

4.2050 |

% |

01/20/2041 |

150,000 |

150,023 |

|||||||||

|

Morgan Stanley Capital Group Trust, |

||||||||||||||

|

Series 2016-SNR, Class A, 144A |

3.3480 |

% |

11/15/2034 |

375,000 |

374,350 |

|||||||||

|

Morgan Stanley Capital I Trust, |

||||||||||||||

|

Series 2017-PRME, Class B, 144A |

2.1200 |

%(a) |

02/15/2034 |

500,000 |

502,365 |

|||||||||

|

Progressive Residential Trust, |

||||||||||||||

|

Series 2016-SFR1, Class A, 144A |

2.2722 |

%(a) |

09/17/2033 |

534,466 |

540,780 |

|||||||||

|

Resource Capital Corporation Ltd., |

||||||||||||||

|

Series 2015-CRE4, Class A, 144A (b) |

2.1722 |

%(a) |

08/17/2032 |

126,442 |

125,812 |

|||||||||

6

|

LADDER SELECT BOND FUND |

||||||||||||||

|

MORTGAGE-BACKED SECURITIES — 85.1% (Continued) |

Coupon |

Maturity |

Par Value |

Value |

||||||||||

|

Commercial — 85.1% (Continued) |

||||||||||||||

|

Wells Fargo Commercial Mortgage Trust, |

||||||||||||||

|

Series 2013-120B, Class D, 144A |

2.7096 |

%(a) |

03/18/2028 |

$ |

39,000 |

$ |

38,291 |

|||||||

|

Wells Fargo Commercial Mortgage Trust, |

||||||||||||||

|

Series 2012-LC5, Class B |

4.1420 |

% |

10/15/2045 |

506,000 |

526,799 |

|||||||||

|

WTC Depositor, LLC Trust, |

||||||||||||||

|

Series 2012-7WTC, Class A, 144A |

4.0824 |

% |

03/13/2031 |

47,112 |

47,715 |

|||||||||