|

OMB APPROVAL

|

|

OMB Number: 3235-0570

Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22680

Ultimus Managers Trust

(Exact name of registrant as specified in charter)

|

225 Pictoria Drive, Suite 450 Cincinnati, Ohio

|

45246

|

|

(Address of principal executive offices)

|

(Zip code)

|

Frank L. Newbauer, Esq.

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: May 31, 2014

Date of reporting period: May 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

APEXcm SMALL/MID CAP GROWTH FUND

(APSGX)

Annual Report

May 31, 2014

|

APEXcm SMALL/MID CAP GROWTH FUND

LETTER TO SHAREHOLDERS |

May 31, 2014

|

Dear Fellow APEXcm Fund Shareholder,

We thank you for your ongoing support! We are pleased to report that APEXcm Small/Mid Cap Growth Fund (the “Fund”) continues to grow, and has performed well relative to its investment objective. During the year ended May 31, 2014, your Fund’s performance was +20.26% (net of expenses), outperforming the Fund’s benchmark, the Russell 2500TM Growth Index, which rose 18.51%.

APEX PHILOSOPHY

We believe that the best way to provide value-added returns is to identify companies that exhibit certain favorable fundamental advantages and benefit from secular growth trends, which allows us to structure the portfolio in high-conviction areas of longer-term sustainable growth. Embedded in our portfolio construction is the recognition of companies at different stages of their growth cycle, which we designate as “stable” and “emerging” growth stocks. We believe that having the spectrum of growth companies that are truly innovative and growing rapidly, combined with established growth businesses, can provide relative stability while allowing the opportunity to drive outperformance versus our benchmark and peers over time. Also, we believe the SMID (small/mid cap) style provides the opportunity to invest in higher growth companies and capture a longer period of growth as these companies mature.

INVESTMENT ENVIRONMENT

During this one-year period, the slow and steady slog of corporations and households continuing to deleverage, along with central banks around the world embarking on massive rounds of accommodation, has provided a choppy, challenging, but ultimately rewarding market environment. During the year, in spite of the U.S. Federal Reserve embarking on a tapering of its historic $85 billion per month bond buying liquidity infusion program, investors remained optimistic as the wealth effect created by increasing financial assets and the housing recovery fueled optimism and consumption. As tepid growth continues and we slowly grind towards a self-sustaining economy, prospects in the U.S. are relatively bright as household and corporate balance sheets, along with employment, have improved significantly. As we moved into 2014, an unusually bad winter, coupled with renewed geopolitical risks and higher volatility in high growth sectors, once again provided reason to pause, rewind and then move forward.

DISCUSSION OF KEY POSITIONING AND HOLDINGS VERSUS THE BENCHMARK

| • | Solid stock selection in the Consumer Discretionary, Energy, Financials, Health Care, Industrials and Materials sectors added approximately 7% in value, with only a slight negative offset in Information Technology of approximately -1%. |

1

| • | Overall attribution from sector effect was negative (approximately 1.5%), due mostly to our more cyclical portfolio positioning with the overweight in Consumer Discretionary and Information Technology providing a negative impact, as well as the underweight positioning in Health Care, Industrials and Consumer Staples. |

| • | Key secular growth areas of payments and processing, genomics and specialty pharmaceuticals, the drive towards energy independence, and pent-up demand in housing, autos and aerospace provided compelling investment opportunities. |

| • | Additionally, the timing of significant cash inflows into the Fund as the market continued its relentless advance negatively impacted performance. |

Information Technology: We remain overweight in Information Technology, with a preference to businesses that are in areas where cap-ex is showing improvement and possess high quality balance sheet and cash flow characteristics. The overweight slightly hurt performance and stock selection was also slightly negative. One of the leaders for the year was NXPI (+90.63%), a leader in High-Performance Mixed Signal chips that are well positioned in the high growth areas of automotives, mobile payments (with their Near Field Communication chips), and the payments and processing theme (with smart card processing chips). Payments and processing company Alliance Data Systems continued to perform well (+63.86%) as their unique approach to helping businesses capture marketing data and assimilate into growing their loyalty programs persisted in adding value along with FleetCor Technologies, a provider of fuel cards and fleet and lodging payment programs (+45.17%). Due to their success (and thus encountering market cap restrictions), both NXPI and Alliance Data were sold towards the end of the reporting period. E-commerce continues to perform well with IAC/InterActiveCorp increasing +38.32%, but the theme was negatively impacted by MercadoLibre (-25.37%), as this Latin American on-line marketplace was challenged by declining currencies in Argentina and Brazil. Also, Neustar (-42.52%) and International Game Technology (-28.12%) performed poorly.

Consumer Discretionary: We remain overweight in Consumer Discretionary, as there are several elements of the economy with significant pent-up demand. In spite of some recent slower weather-related housing data, we believe there is more improvement to come, especially in the corresponding multiplier of durables which was reflected in the stellar performance of unique housing goods company Williams-Sonoma (+26.65%). Also, the auto recovery was amplified in the performance of Autoliv (+38.12%). During the period, Signet Jewelers (+63.54%) deployed some of its industry-leading cash flow to acquire Zale’s, providing a boost to the stock. These areas of resurgence led to Consumer Discretionary stock selection adding approximately 1.75% to performance for the year.

Health Care: We maintained our underweight position in Health Care during the period, as several successful holdings were eliminated or trimmed. During the period, we sold Illumina and Incyte and eliminated Onyx, which was acquired by Amgen, with each of these holdings adding a significant amount to the sector outperformance of approximately 1.60%. The selection of Jazz Pharmaceuticals,

2

with its narcolepsy drug-Xyrem, and Salix Pharmaceuticals, with its strong franchise in treating intestinal disorders, provided additional value. During the reporting period, however, several stocks such as Momenta Pharmaceuticals and Isis Pharmaceuticals were down in excess of 20%. Small Cap biotech is an area which we have been strategically adding to as opportunity is provided but have noted areas where heightened expectations and valuations have prompted a more prudent approach.

Financials: We remain slightly overweight in Financials. In our view, the steep yield curve, better credit standards, declining delinquencies, and higher capital ratios support this attractively valued sector. Stock selection was slightly positive for the year (+.71%), as strong performance in Evercore Partners (+41.39%) was offset by a decline in Wisdom Tree Investments (-35%), as capital flows slowed into their highly successful international offerings.

Energy: We moved to a slight overweight in Energy, as the long-term theme of energy independence was heightened during the year with the emergence of more geopolitical risks. Stock selection added approximately 1.17% for the period, with companies executing well in the hydraulic fracturing areas of Eagle Ford & Marcellus (Carrizo Oil and Gas +65%) and Bakken (Whiting Petroleum +55.96%) along with flexible drill specialist Helmerich & Payne (+82.92%).

Industrials: Although still slightly underweight in Industrials, we continue to selectively add to the Fund’s allocation as many companies exhibiting pent-up demand (especially in aerospace and construction) show good long-term secular growth prospects. United Rentals was our largest positive contributor (+77.78%) for the year, as the company continues to capitalize on the corporate desire to rent capital assets in the high demand areas of construction and energy. Towers Watson, a beneficiary of the roll out of the Affordable Care Act, was up +40.82% during this time period. Both of these companies were key providers to this sector’s approximately 1.85% excess performance.

OUTLOOK

In spite of a dismal weather-related start to 2014, the U.S. economy seems to be improving. This trend continues to be reflected in improving leading economic indicators, expanding global Purchasing Managers’ Indices (PMIs), accelerating commercial and industrial loan growth, improving corporate earnings, and constrained budget deficits, with more political visibility and continued accommodative monetary policy. The volatility in the market reflects its self-correcting mechanism as it works off some excesses following the parabolic rise in the areas of social media, cloud computing and early-stage biotech. We believe these rotational corrections will continue versus a broad market sell-off. We believe these mini-corrections will provide opportunity in some of these high interest areas which exhibit secular growth attributes. Also, in this slow growth, low interest rate environment, we would expect an increase in mergers and acquisitions, providing continued support to smaller, faster-growth companies. While valuations are no longer cheap, we do consider the opportunities reasonable relative to growth as the economy shifts into self-sustaining trends.

3

However, following a rise this year amid placid trading, you don’t have to look too far to see reasons for a potential market cooling. Already in 2014 investors have had to digest slowing growth in China, unrest in Ukraine, the gradual policy shift regarding the incredible monetary stimulus provided by the Federal Reserve and now unsettling events in the Middle East along with a mid-term U.S. election on the horizon. We continue to monitor the impact of these uncertainties, but at this point believe there are more opportunities brewing in the secular growth areas and would look to take advantage of any persistent apprehension.

Thank you for your continued confidence in the APEXcm Small/Mid Cap Growth Fund.

Sincerely,

Nitin N. Kumbhani

President and Chief Investment Officer

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Performance data current to the most recent month end are available by calling 1-888-575-4800.

An investor should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The Fund’s prospectus contains this and other important information. To obtain a copy of the Fund’s prospectus please visit our website at www.apexcmfund.com or call 1-888-575-4800 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The APEXcm Small/Mid Cap Growth Fund is distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time and may no longer be held by the Fund. The opinions of the Adviser with respect to those securities may change at any time.

4

APEXcm SMALL/MID CAP GROWTH FUND

PERFORMANCE INFORMATION

May 31, 2014 (Unaudited)

PERFORMANCE INFORMATION

May 31, 2014 (Unaudited)

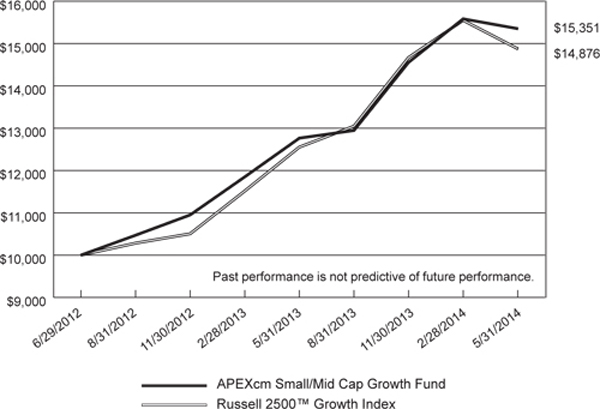

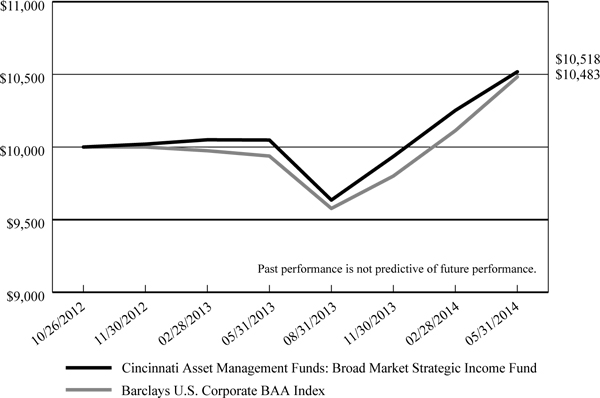

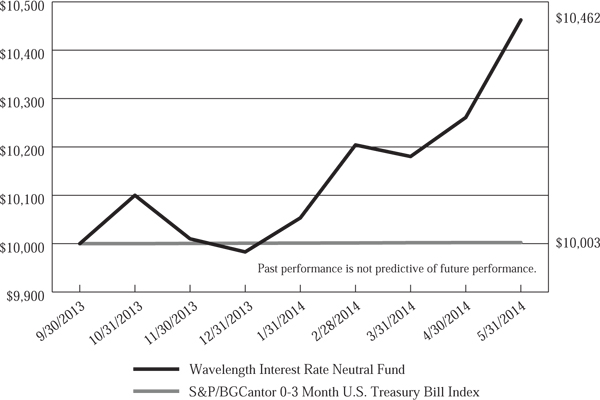

Comparison of the Change in Value of a $10,000

Investment in APEXcm Small/Mid Cap Growth Fund

versus the Russell 2500TM Growth Index

|

Average Annual Total Returns

For Periods Ended May 31, 2014 |

||

|

|

1 Year

|

Since

Inception(b) |

|

APEXcm Small/Mid Cap Growth Fund(a)

|

20.26%

|

25.00%

|

|

Russell 2500TM Growth Index

|

18.51%

|

22.97%

|

|

(a)

|

The Fund’s total return does not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

|

|

|

|

(b)

|

The Fund commenced operations on June 29, 2012.

|

5

APEXcm SMALL/MID CAP GROWTH FUND

PORTFOLIO INFORMATION

May 31, 2014 (Unaudited)

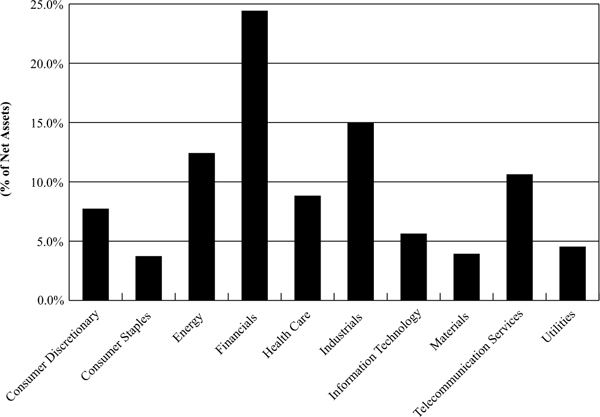

PORTFOLIO INFORMATION

May 31, 2014 (Unaudited)

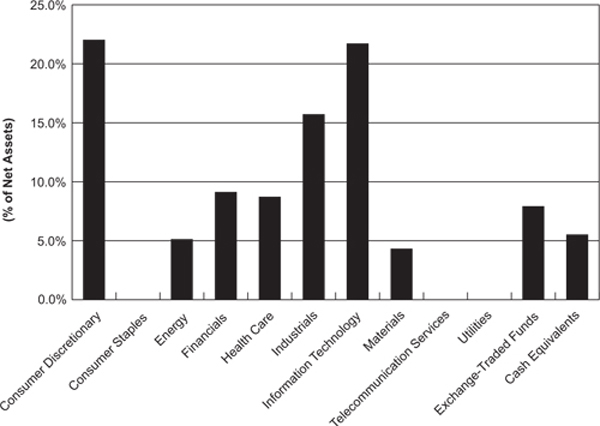

Sector Diversification

Top Ten Equity Holdings

|

Security Description

|

% of

Net Assets |

|

|

iShares Russell Mid-Cap Growth ETF

|

4.0%

|

|

|

iShares Russell 2000 Growth ETF

|

3.9%

|

|

|

United Rentals, Inc.

|

3.2%

|

|

|

Signet Jewelers Ltd.

|

3.1%

|

|

|

Expedia, Inc.

|

2.5%

|

|

|

IAC/InterActiveCorp

|

2.3%

|

|

|

Autoliv, Inc.

|

2.2%

|

|

|

Robert Half International, Inc.

|

2.2%

|

|

|

FleetCor Technologies, Inc.

|

2.2%

|

|

|

Wabtec Corp.

|

2.1%

|

6

|

APEXcm SMALL/MID CAP GROWTH FUND

SCHEDULE OF INVESTMENTS May 31, 2014 |

||||||||

|

COMMON STOCKS — 86.6%

|

Shares

|

Value

|

||||||

|

Consumer Discretionary — 22.0%

|

||||||||

|

Auto Components — 5.9%

|

||||||||

|

Autoliv, Inc.

|

18,181

|

$

|

1,927,186

|

|||||

|

Dana Holding Corp.

|

43,748

|

968,581

|

||||||

|

Gentex Corp.

|

27,671

|

800,245

|

||||||

|

Visteon Corp. *

|

16,826

|

1,533,522

|

||||||

|

|

5,229,534

|

|||||||

|

Hotels, Restaurants & Leisure — 1.4%

|

||||||||

|

Wyndham Worldwide Corp.

|

17,234

|

1,274,110

|

||||||

|

|

||||||||

|

Internet & Catalog Retail — 2.5%

|

||||||||

|

Expedia, Inc.

|

29,639

|

2,172,539

|

||||||

|

|

||||||||

|

Leisure Products — 1.9%

|

||||||||

|

Polaris Industries, Inc.

|

12,810

|

1,651,465

|

||||||

|

|

||||||||

|

Multi-line Retail — 1.0%

|

||||||||

|

Dillard's, Inc. - Class A

|

8,068

|

909,667

|

||||||

|

|

||||||||

|

Specialty Retail — 9.3%

|

||||||||

|

AutoNation, Inc. *

|

21,524

|

1,230,527

|

||||||

|

Foot Locker, Inc.

|

24,357

|

1,173,520

|

||||||

|

PetSmart, Inc.

|

21,431

|

1,231,640

|

||||||

|

Sally Beauty Holdings, Inc. *

|

15,121

|

387,400

|

||||||

|

Signet Jewelers Ltd.

|

25,888

|

2,746,458

|

||||||

|

Williams-Sonoma, Inc.

|

22,262

|

1,489,773

|

||||||

|

|

8,259,318

|

|||||||

|

Energy — 5.1%

|

||||||||

|

Energy Equipment & Services — 1.8%

|

||||||||

|

Helmerich & Payne, Inc.

|

13,994

|

1,538,640

|

||||||

|

|

||||||||

|

Oil, Gas & Consumable Fuels — 3.3%

|

||||||||

|

Carrizo Oil & Gas, Inc. *

|

25,673

|

1,475,171

|

||||||

|

Whiting Petroleum Corp. *

|

20,337

|

1,461,214

|

||||||

|

|

2,936,385

|

|||||||

|

Financials — 9.1%

|

||||||||

|

Banks — 2.8%

|

||||||||

|

Cullen/Frost Bankers, Inc.

|

14,186

|

1,061,964

|

||||||

|

First Republic Bank/CA

|

27,440

|

1,395,598

|

||||||

|

|

2,457,562

|

|||||||

7

|

APEXcm SMALL/MID CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 86.6% (Continued)

|

Shares

|

Value

|

||||||

|

Financials — 9.1% (Continued)

|

||||||||

|

Capital Markets — 2.5%

|

||||||||

|

Affiliated Managers Group, Inc. *

|

6,774

|

$

|

1,277,576

|

|||||

|

Evercore Partners, Inc. - Class A

|

16,665

|

917,242

|

||||||

|

|

2,194,818

|

|||||||

|

Diversified Financial Services — 0.5%

|

||||||||

|

Interactive Brokers Group, Inc. - Class A

|

17,120

|

394,102

|

||||||

|

|

||||||||

|

Insurance — 1.4%

|

||||||||

|

XL Group plc

|

39,230

|

1,273,406

|

||||||

|

|

||||||||

|

Real Estate Management & Development — 1.9%

|

||||||||

|

CBRE Group, Inc. - Class A *

|

57,552

|

1,717,352

|

||||||

|

|

||||||||

|

Health Care — 8.7%

|

||||||||

|

Biotechnology — 2.1%

|

||||||||

|

Keryx Biopharmaceuticals, Inc. *

|

28,396

|

374,827

|

||||||

|

Medivation, Inc. *

|

9,598

|

699,022

|

||||||

|

Momenta Pharmaceuticals, Inc. *

|

23,455

|

290,607

|

||||||

|

United Therapeutics Corp. *

|

5,204

|

498,231

|

||||||

|

|

1,862,687

|

|||||||

|

Health Care Providers & Services — 2.1%

|

||||||||

|

Universal Health Services, Inc. - Class B

|

20,476

|

1,834,035

|

||||||

|

|

||||||||

|

Life Sciences Tools & Services — 1.9%

|

||||||||

|

PAREXEL International Corp. *

|

15,717

|

792,923

|

||||||

|

WuXi PharmaTech (Cayman), Inc. - ADR *

|

28,444

|

949,176

|

||||||

|

|

1,742,099

|

|||||||

|

Pharmaceuticals — 2.6%

|

||||||||

|

Akorn, Inc. *

|

33,475

|

936,296

|

||||||

|

Jazz Pharmaceuticals plc *

|

2,780

|

394,371

|

||||||

|

Salix Pharmaceuticals Ltd. *

|

8,421

|

960,668

|

||||||

|

|

2,291,335

|

|||||||

|

Industrials — 15.7%

|

||||||||

|

Aerospace & Defense — 1.5%

|

||||||||

|

B/E Aerospace, Inc. *

|

13,947

|

1,349,372

|

||||||

|

|

||||||||

|

Electrical Equipment — 1.0%

|

||||||||

|

EnerSys, Inc.

|

12,139

|

838,077

|

||||||

8

|

APEXcm SMALL/MID CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 86.6% (Continued)

|

Shares

|

Value

|

||||||

|

Industrials — 15.7% (Continued)

|

||||||||

|

Machinery — 4.8%

|

||||||||

|

Nordson Corp.

|

15,495

|

$

|

1,263,462

|

|||||

|

Valmont Industries, Inc.

|

7,417

|

1,149,264

|

||||||

|

Wabtec Corp.

|

23,309

|

1,835,351

|

||||||

|

|

4,248,077

|

|||||||

|

Professional Services — 3.8%

|

||||||||

|

Robert Half International, Inc.

|

42,017

|

1,915,555

|

||||||

|

Towers Watson & Co. - Class A

|

13,203

|

1,485,470

|

||||||

|

|

3,401,025

|

|||||||

|

Road & Rail — 1.4%

|

||||||||

|

Old Dominion Freight Line, Inc. *

|

19,476

|

1,245,685

|

||||||

|

|

||||||||

|

Trading Companies & Distributors — 3.2%

|

||||||||

|

United Rentals, Inc. *

|

27,829

|

2,812,120

|

||||||

|

|

||||||||

|

Information Technology — 21.7%

|

||||||||

|

Communications Equipment — 3.4%

|

||||||||

|

Ciena Corp. *

|

46,621

|

904,447

|

||||||

|

F5 Networks, Inc. *

|

10,098

|

1,096,138

|

||||||

|

Finisar Corp. *

|

40,436

|

960,355

|

||||||

|

|

2,960,940

|

|||||||

|

Electronic Equipment, Instruments &

Components — 2.2% |

||||||||

|

Dolby Laboratories, Inc. - Class A *

|

22,328

|

927,505

|

||||||

|

FEI Co.

|

12,372

|

1,032,443

|

||||||

|

|

1,959,948

|

|||||||

|

Internet Software & Services — 2.3%

|

||||||||

|

IAC/InterActiveCorp

|

30,056

|

1,990,008

|

||||||

|

|

||||||||

|

IT Services — 9.0%

|

||||||||

|

FleetCor Technologies, Inc. *

|

15,103

|

1,909,170

|

||||||

|

Gartner, Inc. *

|

22,471

|

1,597,463

|

||||||

|

Global Payments, Inc.

|

18,843

|

1,291,876

|

||||||

|

Heartland Payment Systems, Inc.

|

24,859

|

1,030,406

|

||||||

|

InterXion Holding N.V. *

|

20,903

|

549,540

|

||||||

|

Total System Services, Inc.

|

53,513

|

1,619,303

|

||||||

|

|

7,997,758

|

|||||||

|

Semiconductors & Semiconductor Equipment — 0.9%

|

||||||||

|

Entegris, Inc. *

|

69,821

|

800,847

|

||||||

9

|

APEXcm SMALL/MID CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

COMMON STOCKS — 86.6% (Continued)

|

Shares

|

Value

|

||||||

|

Information Technology — 21.7% (Continued)

|

||||||||

|

Software — 3.9%

|

||||||||

|

Informatica Corp. *

|

20,292

|

$

|

742,484

|

|||||

|

Manhattan Associates, Inc. *

|

14,812

|

480,798

|

||||||

|

NetScout Systems, Inc. *

|

11,900

|

462,553

|

||||||

|

Rovi Corp. *

|

30,805

|

744,557

|

||||||

|

TIBCO Software, Inc. *

|

48,365

|

1,040,331

|

||||||

|

|

3,470,723

|

|||||||

|

Materials — 4.3%

|

||||||||

|

Chemicals — 1.0%

|

||||||||

|

Albemarle Corp.

|

12,958

|

896,564

|

||||||

|

|

||||||||

|

Containers & Packaging — 1.3%

|

||||||||

|

Silgan Holdings, Inc.

|

22,880

|

1,117,230

|

||||||

|

|

||||||||

|

Metals & Mining — 0.6%

|

||||||||

|

Constellium N.V. - Class A *

|

17,114

|

498,702

|

||||||

|

|

||||||||

|

Paper & Forest Products — 1.4%

|

||||||||

|

KapStone Paper and Packaging Corp. *

|

42,971

|

1,248,308

|

||||||

|

|

||||||||

|

Total Common Stocks (Cost $66,981,905)

|

$

|

76,574,438

|

||||||

|

EXCHANGE-TRADED FUNDS — 7.9%

|

Shares

|

Value

|

||||||

|

iShares Russell 2000 Growth ETF

|

26,842

|

$

|

3,498,855

|

|||||

|

iShares Russell Mid-Cap Growth ETF

|

40,634

|

3,528,656

|

||||||

|

Total Exchange-Traded Funds (Cost $6,852,482)

|

$

|

7,027,511

|

||||||

10

|

APEXcm SMALL/MID CAP GROWTH FUND

SCHEDULE OF INVESTMENTS (Continued) |

||||||||

|

MONEY MARKET FUNDS — 6.1%

|

Shares

|

Value

|

||||||

|

Fidelity Institutional Money Market Portfolio - Class I, 0.05% (a) (Cost $5,397,904)

|

5,397,904

|

$

|

5,397,904

|

|||||

|

|

||||||||

|

Total Investments at Value — 100.6% (Cost $79,232,291)

|

$

|

88,999,853

|

||||||

|

|

||||||||

|

Liabilities in Excess of Other Assets — (0.6%)

|

(523,153

|

)

|

||||||

|

|

||||||||

|

Net Assets — 100.0%

|

$

|

88,476,700

|

||||||

|

ADR - American Depositary Receipt.

|

|

|

|

|

|

*

|

Non-income producing security.

|

|

|

|

|

(a)

|

The rate shown is the 7-day effective yield as of May 31, 2014.

|

|

|

|

|

See accompanying notes to financial statements.

|

|

11

|

APEXcm SMALL/MID CAP GROWTH FUND

STATEMENT OF ASSETS AND LIABILITIES May 31, 2014 |

||||

|

ASSETS

|

||||

|

Investments in securities:

|

||||

|

At acquisition cost

|

$

|

79,232,291

|

||

|

At value (Note 2)

|

$

|

88,999,853

|

||

|

Dividends receivable

|

73,235

|

|||

|

Receivable for capital shares sold

|

321,030

|

|||

|

Other assets

|

14,735

|

|||

|

Total assets

|

89,408,853

|

|||

|

|

||||

|

LIABILITIES

|

||||

|

Payable for investment securities purchased

|

828,255

|

|||

|

Payable for capital shares redeemed

|

20,541

|

|||

|

Payable to Adviser (Note 4)

|

52,822

|

|||

|

Payable to administrator (Note 4)

|

12,600

|

|||

|

Other accrued expenses

|

17,935

|

|||

|

Total liabilities

|

932,153

|

|||

|

|

||||

|

NET ASSETS

|

$

|

88,476,700

|

||

|

|

||||

|

NET ASSETS CONSIST OF:

|

||||

|

Paid-in capital

|

$

|

79,271,851

|

||

|

Accumulated net investment loss

|

(105,388

|

)

|

||

|

Accumulated net realized losses from security transactions

|

(457,325

|

)

|

||

|

Net unrealized appreciation on investments

|

9,767,562

|

|||

|

NET ASSETS

|

$

|

88,476,700

|

||

|

|

||||

|

Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value)

|

5,822,222

|

|||

|

|

||||

|

Net asset value, offering price and redemption price per share (Note 2)

|

$

|

15.20

|

||

See accompanying notes to financial statements.

12

|

APEXcm SMALL/MID CAP GROWTH FUND

STATEMENT OF OPERATIONS For the Year Ended May 31, 2014 |

||||

|

INVESTMENT INCOME

|

||||

|

Dividend income

|

$

|

330,950

|

||

|

|

||||

|

EXPENSES

|

||||

|

Investment advisory fees (Note 4)

|

498,727

|

|||

|

Administration fees (Note 4)

|

51,863

|

|||

|

Custody and bank service fees

|

40,600

|

|||

|

Professional fees

|

33,058

|

|||

|

Registration and filing fees

|

32,287

|

|||

|

Fund accounting fees (Note 4)

|

31,746

|

|||

|

Transfer agent fees (Note 4)

|

18,000

|

|||

|

Compliance fees (Note 4)

|

12,000

|

|||

|

Trustees' fees and expenses (Note 4)

|

8,867

|

|||

|

Postage and supplies

|

5,351

|

|||

|

Insurance expense

|

4,030

|

|||

|

Other expenses

|

10,428

|

|||

|

Total expenses

|

746,957

|

|||

|

Less fee reductions by the Adviser (Note 4)

|

(223,293

|

)

|

||

|

Net expenses

|

523,664

|

|||

|

|

||||

|

NET INVESTMENT LOSS

|

(192,714

|

)

|

||

|

|

||||

|

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS

|

||||

|

Net realized losses from security transactions

|

(197,613

|

)

|

||

|

Net change in unrealized appreciation/depreciation on investments

|

8,704,592

|

|||

|

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS

|

8,506,979

|

|||

|

|

||||

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

8,314,265

|

||

See accompanying notes to financial statements.

13

|

APEXcm SMALL/MID CAP GROWTH FUND

STATEMENTS OF CHANGES IN NET ASSETS |

||||||||

|

|

Year

Ended May 31, 2014 |

Period

Ended May 31, 2013(a) |

||||||

|

FROM OPERATIONS

|

||||||||

|

Net investment income (loss)

|

$

|

(192,714

|

)

|

$

|

9,832

|

|||

|

Net realized losses from security transactions

|

(197,613

|

)

|

(33,444

|

)

|

||||

|

Net change in unrealized appreciation/depreciation on investments

|

8,704,592

|

1,062,970

|

||||||

|

Net increase in net assets resulting from operations

|

8,314,265

|

1,039,358

|

||||||

|

|

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

From net investment income

|

—

|

(19,469

|

)

|

|||||

|

From net realized gains on investments

|

(226,268

|

)

|

—

|

|||||

|

Decrease in net assets from distributions to shareholders

|

(226,268

|

)

|

(19,469

|

)

|

||||

|

|

||||||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Proceeds from shares sold

|

74,662,709

|

12,444,893

|

||||||

|

Net asset value of shares issued in reinvestment of distributions to shareholders

|

162,061

|

19,469

|

||||||

|

Payments for shares redeemed

|

(7,589,046

|

)

|

(431,272

|

)

|

||||

|

Net increase in net assets from capital share transactions

|

67,235,724

|

12,033,090

|

||||||

|

|

||||||||

|

TOTAL INCREASE IN NET ASSETS

|

75,323,721

|

13,052,979

|

||||||

|

|

||||||||

|

NET ASSETS

|

||||||||

|

Beginning of period

|

13,152,979

|

100,000

|

||||||

|

End of period

|

$

|

88,476,700

|

$

|

13,152,979

|

||||

|

|

||||||||

|

ACCUMULATED NET INVESTMENT LOSS

|

$

|

(105,388

|

)

|

$

|

(9,637

|

)

|

||

|

|

||||||||

|

CAPITAL SHARE ACTIVITY

|

||||||||

|

Shares sold

|

5,289,946

|

1,060,310

|

||||||

|

Shares reinvested

|

10,768

|

1,764

|

||||||

|

Shares redeemed

|

(515,199

|

)

|

(35,367

|

)

|

||||

|

Net increase in shares outstanding

|

4,785,515

|

1,026,707

|

||||||

|

Shares outstanding at beginning of period

|

1,036,707

|

10,000

|

||||||

|

Shares outstanding at end of period

|

5,822,222

|

1,036,707

|

||||||

|

(a)

|

Represents the period from the commencement of operations (June 29, 2012) through May 31, 2013.

|

See accompanying notes to financial statements.

14

|

APEXcm SMALL/MID CAP GROWTH FUND

FINANCIAL HIGHLIGHTS |

||||||||

|

Per Share Data for a Share Outstanding Throughout Each Period

|

||||||||

|

|

Year

Ended May 31, 2014 |

Period

Ended May 31, 2013(a) |

||||||

|

Net asset value at beginning of period

|

$

|

12.69

|

$

|

10.00

|

||||

|

|

||||||||

|

Income (loss) from investment operations:

|

||||||||

|

Net investment income (loss)

|

(0.03

|

)

|

0.04

|

(b)

|

||||

|

Net realized and unrealized gains on investments

|

2.60

|

2.72

|

||||||

|

Total from investment operations

|

2.57

|

2.76

|

||||||

|

|

||||||||

|

Less distributions:

|

||||||||

|

From net investment income

|

—

|

(0.07

|

)

|

|||||

|

From net realized gains on investments

|

(0.06

|

)

|

—

|

|||||

|

Total distributions

|

(0.06

|

)

|

(0.07

|

)

|

||||

|

|

||||||||

|

Net asset value at end of period

|

$

|

15.20

|

$

|

12.69

|

||||

|

|

||||||||

|

Total return (c)

|

20.26

|

%

|

27.65

|

%(d)

|

||||

|

|

||||||||

|

Net assets at end of period (000's)

|

$

|

88,477

|

$

|

13,153

|

||||

|

|

||||||||

|

Ratios/supplementary data:

|

||||||||

|

Ratio of total expenses to average net assets

|

1.49

|

%

|

4.87

|

%(e)

|

||||

|

|

||||||||

|

Ratio of net expenses to average net assets (f)

|

1.05

|

%

|

1.05

|

%(e)

|

||||

|

|

||||||||

|

Ratio of net investment income (loss) to average net assets (f)

|

(0.38

|

%)

|

0.26

|

%(e)

|

||||

|

|

||||||||

|

Portfolio turnover rate

|

47

|

%

|

18

|

%(d)

|

||||

|

(a)

|

Represents the period from the commencement of operations (June 29, 2012) through May 31, 2013.

|

|

|

|

|

(b)

|

Calculated using weighted average shares outstanding during the period.

|

|

|

|

|

(c)

|

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses.

|

|

|

|

|

(d)

|

Not annualized.

|

|

|

|

|

(e)

|

Annualized.

|

|

|

|

|

(f)

|

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4).

|

See accompanying notes to financial statements.

15

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS

May 31, 2014

NOTES TO FINANCIAL STATEMENTS

May 31, 2014

1. Organization

APEXcm Small/Mid Cap Growth Fund (the “Fund”) is a diversified series of Ultimus Managers Trust (the “Trust”), an open-end investment company established as an Ohio business trust under a Declaration of Trust dated February 28, 2012. Other series of the Trust are not incorporated in this report. The Fund commenced operations on June 29, 2012.

The investment objective of the Fund is long-term capital growth.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Securities valuation – The Fund’s portfolio securities are valued at market value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open. Securities listed on the NYSE or other exchanges are valued on the basis of their last sales prices on the exchanges on which they are primarily traded. If there are no sales on that day, the securities are valued at the closing bid price on the NYSE or other primary exchange for that day. NASDAQ listed securities are valued at the NASDAQ Official Closing Price. If there are no sales on that day, the securities are valued at the last bid price as reported by NASDAQ. Securities traded in the over-the-counter market are valued at the last sale price, if available, otherwise at the most recently quoted bid price. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities and other assets are valued at fair value as determined in good faith in accordance with procedures adopted by the Board of Trustees of the Trust and will be classified as Level 2 or 3 within the fair value hierarchy (see below), depending on the inputs used. Factors determining portfolio investments subject to fair value determination include, but are not limited to, the following: the spread between bid and asked prices is substantial; infrequency of sales; thinness of market; the size of reported trades; a temporary lapse in the provision of prices by any reliable pricing source; and actions of the securities or futures markets, such as the suspension or limitation of trading.

GAAP establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements.

16

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| • | Level 1 – quoted prices in active markets for identical securities |

| • | Level 2 – other significant observable inputs |

| • | Level 3 – significant unobservable inputs |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2014:

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

||||||||||||

|

Common Stocks

|

$

|

76,574,438

|

$

|

—

|

$

|

—

|

$

|

76,574,438

|

||||||||

|

Exchange-Traded Funds

|

7,027,511

|

—

|

—

|

7,027,511

|

||||||||||||

|

Money Market Funds

|

5,397,904

|

—

|

—

|

5,397,904

|

||||||||||||

|

Total

|

$

|

88,999,853

|

$

|

—

|

$

|

—

|

$

|

88,999,853

|

||||||||

Refer to the Fund’s Schedule of Investments for a listing of the common stocks by industry type. As of May 31, 2014, the Fund did not have any transfers in and out of any Level. In addition, the Fund did not have derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of May 31, 2014. It is the Fund’s policy to recognize transfers into and out of any Level at the end of the reporting period.

Share valuation – The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of the Fund is equal to the net asset value per share.

Investment income – Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned.

Security transactions – Security transactions are accounted for on the trade date. Gains and losses on securities sold are determined on a specific identification basis.

17

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

Common expenses – Common expenses of the Trust are allocated among the Fund and the other series of the Trust based on the relative net assets of each series or the nature of the services performed and the relative applicability to each series.

Distributions to shareholders – Distributions to shareholders arising from net investment income and net realized capital gains, if any, are distributed at least once each year. The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. Dividends and distributions to shareholders are recorded on the ex-dividend date. The tax character of distributions paid during the periods ended May 31, 2014 and May 31, 2013 was as follows:

|

Periods Ended

|

Ordinary

Income |

Long-Term

Capital Gains |

Total

Distributions |

|||||||||

|

May 31, 2014

|

$

|

212,871

|

$

|

13,397

|

$

|

226,268

|

||||||

|

May 31, 2013

|

$

|

19,469

|

$

|

—

|

$

|

19,469

|

||||||

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Federal income tax – The Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986 (the “Code”). Qualification generally will relieve the Fund of liability for federal income taxes to the extent 100% of its net investment income and net realized gains are distributed in accordance with the Code. Accordingly, no provision for income tax has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

18

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

The following information is computed on a tax basis for each item as of May 31, 2014:

|

Tax cost of portfolio investments

|

$

|

79,259,641

|

||

|

Gross unrealized appreciation

|

$

|

11,000,673

|

||

|

Gross unrealized depreciation

|

(1,260,461

|

)

|

||

|

Net unrealized appreciation

|

9,740,212

|

|||

|

Qualified late year losses

|

(535,363

|

)

|

||

|

Total accumulated earnings

|

$

|

9,204,849

|

The difference between the federal income tax cost of portfolio investments and the financial statement cost is due to certain timing differences in the recognition of capital gains or losses under income tax regulations and GAAP. These “book/tax” differences are temporary in nature and are primarily due to the tax deferral of losses on wash sales.

Qualified late year losses incurred after October 31, 2013 and within the taxable year are deemed to arise on the first day of the Fund’s next taxable year. For the year ended May 31, 2014, the Fund intends to defer $105,388 of late year ordinary losses and $429,975 of post-October capital losses to June 1, 2014 for federal income tax purposes.

For the year ended May 31, 2014, the Fund reclassified $96,963 of accumulated net investment loss against paid-in capital on its Statement of Assets and Liabilities. Such reclassification, the result of permanent differences between financial statement and income tax reporting requirements, had no effect on the Fund’s total net assets or net asset value per share.

The Fund recognizes the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed the Fund’s tax positions for all open tax periods (periods ended May 31, 2013 and May 31, 2014) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements.

3. Investment Transactions

During the year ended May 31, 2014, cost of purchases and proceeds from sales of investment securities, other than short-term investments, were $84,948,639 and $22,501,850, respectively.

19

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

The Fund’s investments are managed by Apex Capital Management, Inc. (the “Adviser”) pursuant to the terms of an Investment Advisory Agreement. Under the Investment Advisory Agreement, the Fund pays the Adviser an advisory fee, computed and accrued daily and paid monthly, at the annual rate of 1.00% of its average daily net assets.

The Adviser has contractually agreed, until October 1, 2017, to reduce its advisory fees and to reimburse the Fund’s operating expenses (excluding brokerage costs, taxes, interest, acquired fund fees and expenses, extraordinary expenses, and other expenses not incurred in the ordinary course of the Fund’s business) to the extent necessary so that the Fund’s annual ordinary operating expenses do not exceed an amount equal to 1.05% of its average daily net assets. Accordingly, the Adviser reduced its advisory fees in the amount of $223,293 during the year ended May 31, 2014.

Advisory fee reductions and expense reimbursements by the Adviser are subject to repayment by the Fund for a period of three years after such fees and expenses were incurred, provided that the repayments do not cause the Fund’s ordinary operating expenses, at the time the repayment occurs, to exceed the expense limitation of 1.05% per annum. As of May 31, 2014, the Adviser may in the future recover advisory fee reductions and expense reimbursements totaling $368,169. The Adviser may recover a portion of this amount no later than the dates as stated below:

|

May 31, 2016

|

|

May 31, 2017

|

|

$144,876

|

|

$223,293

|

Certain officers of the Fund are also officers of the Adviser.

OTHER SERVICE PROVIDERS

Ultimus Fund Solutions, LLC (“Ultimus”) provides fund administration, fund accounting, compliance and transfer agency services to the Fund. Pursuant to servicing agreements with Ultimus, the Fund pays Ultimus fees in accordance with the agreements for its services. In addition, the Fund pays out-of-pocket expenses including but not limited to postage, supplies and costs of pricing the Fund’s portfolio securities.

DISTRIBUTION AGREEMENT

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

20

APEXcm SMALL/MID CAP GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

NOTES TO FINANCIAL STATEMENTS (Continued)

Certain officers of the Trust are also officers of Ultimus and/or the Distributor.

TRUSTEE COMPENSATION

Each Trustee who is not an interested person of the Trust receives from the Fund a fee of $500 for each Board meeting attended plus reimbursement of travel and other expenses incurred in attending the meetings. Trustees affiliated with the Adviser or Ultimus are not compensated by the Trust for their services.

5. Contingencies and Commitments

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

6. Subsequent Events

The Fund is required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

21

APEXcm SMALL/MID CAP GROWTH FUND

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

To the Board of Trustees of Ultimus Managers Trust

and the Shareholders of APEXcm Small/Mid Cap Growth Fund

and the Shareholders of APEXcm Small/Mid Cap Growth Fund

We have audited the accompanying statement of assets and liabilities of the APEXcm Small/Mid Cap Growth Fund (the “Fund”), a series of shares of beneficial interest in the Ultimus Managers Trust, including the schedule of investments, as of May 31, 2014, and the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for the year then ended and for the period June 29, 2012 (commencement of operations) through May 31, 2013. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2014 by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the APEXcm Small/Mid Cap Growth Fund as of May 31, 2014, and the results of its operations for the year then ended, and the changes in its net assets and its financial highlights for the year then ended and for the period June 29, 2012 through May 31, 2013, in conformity with accounting principles generally accepted in the United States of America.

|

|

BBD, LLP

|

Philadelphia, Pennsylvania

July 24, 2014

July 24, 2014

22

APEXcm SMALL/MID CAP GROWTH FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited)

ABOUT YOUR FUND’S EXPENSES (Unaudited)

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Fund, you incur ongoing costs, including management fees and other operating expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual fund’s ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the table below are based on an investment of $1,000 made at the beginning of the most recent period (December 1, 2013) and held until the end of the period (May 31, 2014).

The table below illustrates the Fund’s ongoing costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Fund’s ongoing costs with those of other mutual funds. It assumes that the Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The Fund does not charge transaction fees, such as purchase or redemption fees, nor does it carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

23

APEXcm SMALL/MID CAP GROWTH FUND

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued)

ABOUT YOUR FUND’S EXPENSES (Unaudited) (Continued)

More information about the Fund’s expenses can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Fund’s prospectus.

|

|

Beginning

Account Value

December 1, 2013 |

Ending

Account Value

May 31, 2014 |

Expenses Paid

During Period*

|

|

Based on Actual Fund Return

|

$1,000.00

|

$1,054.70

|

$5.38

|

|

Based on Hypothetical 5% Return (before expenses)

|

$1,000.00

|

$1,019.70

|

$5.29

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.05% for the period, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

|

OTHER INFORMATION (Unaudited)

A description of the policies and procedures that the Fund uses to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-888-575-4800, or on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge upon request by calling toll-free 1-888-575-4800, or on the SEC’s website at http://www.sec.gov.

The Trust files a complete listing of portfolio holdings for the Fund with the SEC as of the end of the first and third quarters of each fiscal year on Form N-Q. These filings are available upon request by calling 1-888-575-4800. Furthermore, you may obtain a copy of the filings on the SEC’s website at http://www.sec.gov. The Trust’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

24

APEXcm SMALL/MID CAP GROWTH FUND

FEDERAL TAX INFORMATION (Unaudited)

FEDERAL TAX INFORMATION (Unaudited)

In accordance with federal tax requirements, the following provides shareholders with information concerning distributions from ordinary income and net realized gains made by the Fund during the fiscal year ended May 31, 2014. Certain dividends paid by the fund may be subject to a maximum tax rate of 23.8%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The Fund intends to designate up to a maximum amount of $131,431 as taxed at a maximum rate of 23.8%. Additionally, the Fund intends to designate up to a maximum amount of $13,397 as a long-term gain distribution.

As required by federal regulations, complete information was computed and reported in conjunction with your 2013 Form 1099-DIV.

25

APEXcm SMALL/MID CAP GROWTH FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited)

The Board of Trustees has overall responsibility for management of the Trust’s affairs. The Trustees serve during the lifetime of the Trust and until its termination, or until death, resignation, retirement, or removal. The Trustees, in turn, elect the officers of the Fund to actively supervise its day-to-day operations. The officers have been elected for an annual term. Unless otherwise noted, each Trustee’s and officer’s address is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The following are the Trustees and executive officers of the Fund:

|

Name and

Year of Birth |

Length of Time Served

|

Position(s) Held with Trust

|

Principal Occupation(s)

During Past 5 Years

|

Number of Funds in Trust Overseen by Trustee

|

Directorships of Public Companies Held by Trustee During Past 5 Years

|

|

Interested Trustees:

|

|

|

|

||

|

Robert G. Dorsey*

Year of Birth: 1957

|

Since February 2012

June 2012 to October 2013

|

Trustee

President

|

Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present)

|

7

|

n/a

|

|

Independent Trustees:

|

|||||

|

John C. Davis

Year of Birth: 1952

|

Since July

2014 Since June 2012

|

Chairman

Trustee

|

Consultant (government services) since May 2011; Retired Partner of PricewaterhouseCoopers LLP (1974-2010)

|

7

|

n/a

|

|

John J. Discepoli

Year of Birth: 1963

|

Since June 2012

|

Trustee

|

Owner of Discepoli Financial Planning, LLC (personal financial planning company) since November 2004

|

7

|

n/a

|

|

David M. Deptula

Year of Birth: 1958

|

Since June 2012

|

Trustee

|

Vice President of Tax at The Standard Register Company since November 2011; Tax Partner at Deloitte Tax LLP from 1984 to 2011

|

7

|

n/a

|

|

*

|

Mr. Dorsey is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent and distributor.

|

26

APEXcm SMALL/MID CAP GROWTH FUND

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

BOARD OF TRUSTEES AND EXECUTIVE OFFICERS

(Unaudited) (Continued)

|

Name and

Year of Birth |

Length of Time Served

|

Position(s) Held with Trust

|

Principal Occupation(s) During Past 5 Years

|

|

Executive Officers:

|

|

|

|

|

David R. Carson

Year of Birth: 1958

|

Since October 2013

April 2013 to October 2013

|

President

Vice

President |

Vice President and Director of Client Strategies of Ultimus Fund Solutions, LLC (2013 to present); Chief Compliance Officer, The Huntington Funds (2005 to 2013), The Flex-Funds (2006 to 2011), Meeder Financial (2007 to 2011), Huntington Strategy Shares (2012 to 2013), and Huntington Asset Advisors (2013); Vice President, Huntington National Bank (2001 to 2013).

|

|

Nitin N. Kumbhani

8163 Old Yankee Road, Suite E

Dayton, Ohio 45458

Year of Birth: 1948

|

Since June 2012

|

Principal Executive Officer of APEXcm Small/Mid Cap Growth Fund

|

President and Chief Investment Officer of Apex Capital Management, Inc. (1987 to present)

|

|

Michael Kalbfleisch

8163 Old Yankee Road, Suite E

Dayton, Ohio 45458

Year of Birth: 1959

|

Since June 2012

|

Vice President of APEXcm Small/Mid Cap Growth Fund

|

Vice President and Chief Compliance Officer of Apex Capital Management, Inc. (2001 to present)

|

|

Mark J. Seger

Year of Birth: 1962

|

Since

February 2014 |

Treasurer

|

Managing Director of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (1999 to present)

|

|

Frank L. Newbauer

Year of Birth: 1954

|

Since February 2012

|

Secretary

|

Assistant Vice President of Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC (2010 to present); Assistant Vice President of JPMorgan Chase Bank, N.A. (1999 to 2010)

|

|

Stephen L. Preston

Year of Birth: 1966

|

Since June 2012

|

Chief Compliance Officer

|

Assistant Vice President and Chief Compliance Officer of Ultimus Fund Distributors, LLC and Assistant Vice President of Ultimus Fund Solutions, LLC since 2011; Senior Consultant at Mainstay Capital Markets Consultants (2010 to 2011); Chief Compliance Officer at INTL Trading, Inc. (2008 to 2010).

|

Additional information about members of the Board and executive officers is available in the Fund’s Statement of Additional Information (“SAI”). To obtain a free copy of the SAI, please call 1-888-575-4800.

27

APEXcm SMALL/MID CAP GROWTH FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

The Board of Trustees (the “Board”), including the Independent Trustees voting separately, has reviewed and approved the Fund’s Investment Advisory Agreement with Apex Capital Management, Inc. (“Apex”) for an additional annual term. Approval took place at an in-person meeting held on April 21, 2014, at which all of the Trustees were present.

In the course of their deliberations, the Board was advised by legal counsel. The Board received and reviewed a substantial amount of information provided by the Apex in response to requests of the Board and counsel.

In considering the Investment Advisory Agreement and reaching their conclusions with respect thereto, the Board reviewed and analyzed various factors that they determined were relevant, including the factors described below.

The nature, extent, and quality of the services provided by Apex. In this regard, the Board reviewed the services being provided by Apex to the Fund including, without limitation, Apex’s investment advisory services since the Fund’s inception, its compliance procedures and practices, and its efforts to promote the Fund and assist in its distribution. The Board noted that the Fund’s Principal Executive Officer is an employee of Apex and serves the Trust without additional compensation from the Fund. After reviewing the foregoing information and further information concerning Apex’s business, the Board concluded that the quality, extent, and nature of the services provided by Apex were satisfactory and adequate for the Fund.

The investment performance of the Fund and Apex. In this regard, the Board compared the performance of the Fund and the performance of its benchmark index, Morningstar category and a comparable peer group index selected by Apex (the “SMID Peer Group”). The Board also considered the consistency of Apex’s management of the Fund with the Fund’s investment objectives and policies. Following discussion of the investment performance of the Fund and the Fund’s performance relative to its Morningstar category and its SMID Peer Group, Apex’s experience in managing the Fund and separate accounts, and other factors, the Board concluded that the investment performance of the Fund has been satisfactory.

The costs of the services provided and profits realized by Apex from its relationship with the Fund. In this regard, the Board considered Apex’s staffing, personnel, and methods of operating; the education and experience of Apex’s personnel; Apex’s compliance policies and procedures; the financial condition of Apex and the level of commitment to the Fund and Apex by the principals of Apex; the asset level of the Fund; the overall expenses of the Fund; and the differences in fees and services provided to Apex’s other clients that may be similar to the Fund. The Board discussed the Fund’s Expense Limitation Agreement with Apex, and considered

28

APEXcm SMALL/MID CAP GROWTH FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued)

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued)

Apex’s fee reductions and expense reimbursements with respect to the Fund. The Board further took into account Apex’s willingness to continue the Expense Limitation Agreement for the Fund until at least October 1, 2017.

The Board also considered potential benefits to Apex in managing the Fund, including promotion of Apex’s name and the potential for Apex to receive research, statistical, or other services from the Fund’s trades that may benefit Apex’s other clients. The Board compared the Fund’s advisory fee and overall expense ratio to its Morningstar category and its SMID Peer Group. The Board noted that the Fund’s advisory fee of 1.00% per annum was higher than the average advisory fee of 0.78% for its Morningstar category. The Board further noted that the overall expense ratio of 1.05% per annum (after applying the Expense Limitation Agreement) for the Fund was lower than the 1.36% average expense ratio for its Morningstar category. Following these comparisons and upon further consideration and discussion of the foregoing, the Board concluded that the advisory fee paid to Apex by the Fund is fair and reasonable.

The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with Apex, including both the advisory fee and the Expense Limitation Agreement. The Board determined that, while the advisory fee remained the same at all asset levels, the shareholders of the Fund have experienced benefits from the Expense Limitation Agreement. Following further discussion of the Fund’s asset levels, expectations for growth, and level of fees, the Board determined that the Fund’s fee arrangements with Apex continue to provide benefits through the Expense Limitation Agreement and that, at the Fund’s projected asset levels for the next year, the Fund’s arrangements with Apex are fair and reasonable.

Apex’s practices regarding brokerage and portfolio transactions. In this regard, the Board considered Apex’s policies and procedures, and performance in implementing those policies and procedures, to seek best execution for the Fund. The Board also considered the historical portfolio turnover rate for the Fund; the process by which evaluations are made of the overall reasonableness of commissions paid; the method and basis for selecting and evaluating the broker-dealers used; any anticipated allocation of portfolio business to persons affiliated with Apex; and the extent to which the Fund allocated trades to broker-dealers who provide research, statistical or other services (“soft dollars”). After further review and discussion, the Board determined that Apex’s practices regarding brokerage and portfolio transactions were satisfactory.

29

APEXcm SMALL/MID CAP GROWTH FUND

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued)

DISCLOSURE REGARDING APPROVAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited) (Continued)

Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as the experience and abilities of the advisory personnel assigned to the Fund, the basis of decisions to buy or sell securities for the Fund and/or Apex’s other accounts, Apex’s use of block trading and its process for allocating trades among its different clients, and the substance and administration of Apex’s code of ethics. Following further consideration and discussion, the Board found Apex’s standards and practices relating to the identification and mitigation of potential conflicts of interests to be satisfactory.

Conclusion

After full consideration of the above factors as well as other factors, the Board unanimously concluded that approval of the Investment Advisory Agreement was in the best interests of the Fund and its shareholders.

30

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

BARROW ALL-CAP CORE FUND