UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ | ||||

| Check the appropriate box: | |||||

| ☐ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☒ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | ||||

Freshworks Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

Title of each class of securities to which transaction applies:

_____________________________________________________________________________________________

Aggregate number of securities to which transaction applies:

_____________________________________________________________________________________________

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_____________________________________________________________________________________________

Proposed maximum aggregate value of transaction:

_____________________________________________________________________________________________

Total fee paid:

_____________________________________________________________________________________________

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Amount Previously Paid:

_____________________________________________________________________________________________

Form, Schedule or Registration Statement No.:

_____________________________________________________________________________________________

Filing Party:

_____________________________________________________________________________________________

Date Filed:

_____________________________________________________________________________________________

FRESHWORKS INC.

2950 S. Delaware Street, Suite 201

San Mateo, CA 94403

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Thursday, June 2, 2022

Dear Stockholder:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (including any adjournments, continuations, or postponements thereof, the “Annual Meeting”) of Freshworks Inc., a Delaware corporation. The Annual Meeting will be held virtually, via a live, audio-only webcast at www.virtualshareholdermeeting.com/FRSH2022 on Thursday, June 2, 2022 at 9:00 a.m. Pacific Time. You will not be able to attend the meeting in person. The meeting will be held for the following purposes:

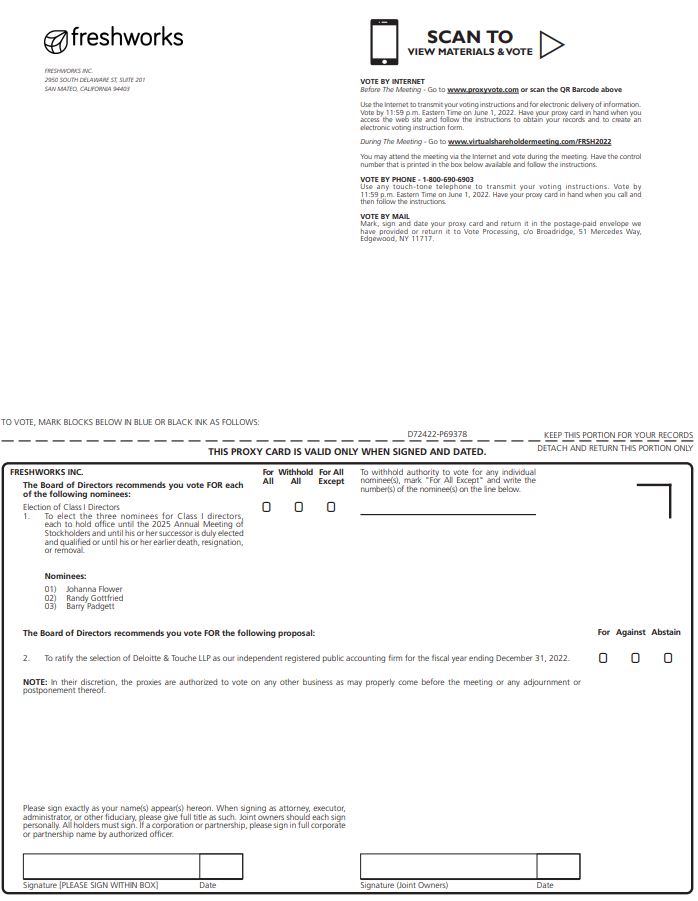

1.To elect three Class I directors, Johanna Flower, Randy Gottfried, and Barry Padgett, each to hold office until the 2025 Annual Meeting of Stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, or removal;

2.To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and

3.To conduct any other business properly brought before the meeting.

These items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders.

This year's Annual Meeting will be held virtually through a live, audio-only webcast. You will be able to attend the Annual Meeting, submit questions and vote during the live, audio-only webcast by visiting www.virtualshareholdermeeting.com/FRSH2022 and entering the 16-digit control number included in your Notice of Internet Availability, or in the instructions that you received via email. Please refer to the additional logistical details and recommendations in the accompanying proxy statement. You may log-in beginning at 8:45 a.m. Pacific Time on Thursday, June 2, 2022.

We have elected to provide internet access to our proxy materials, which include the proxy statement for our Annual Meeting (“Proxy Statement”) accompanying this Notice, in lieu of mailing printed copies. Providing our Annual Meeting materials via the internet reduces the costs associated with our Annual Meeting and lowers our environmental impact, all without negatively affecting our stockholders’ ability to timely access Annual Meeting materials.

On or about April 15, 2022 we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (“Annual Report”). The Notice provides instructions on how to vote online or by telephone and how to receive a paper copy of proxy materials by mail. The Proxy Statement and our Annual Report can be accessed directly at the internet address www.proxyvote.com using the control number located in the Notice or in the instructions that accompanied your proxy materials.

The record date for the Annual Meeting is April 4, 2022. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors

/s/ Rathna Girish Mathrubootham

Rathna Girish Mathrubootham

Chief Executive Officer and Chairman

San Mateo, California

April 11, 2022

Your vote is important. Whether or not you plan to attend the Annual Meeting, please ensure that your shares are voted during the Annual Meeting by signing and returning the proxy card mailed to you or by using our internet or telephonic voting system. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held on your behalf by a broker, bank, or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that nominee.

TABLE OF CONTENTS

PROXY STATEMENT FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 2, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Our board of directors is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (including any adjournments, continuations, or postponements thereof, the “Annual Meeting”) of Freshworks Inc., for the purposes set forth in this proxy statement for our Annual Meeting (“Proxy Statement”). The Annual Meeting will be held virtually via a live, audio-only webcast on the internet on Thursday, June 2, 2022 at 9:00 a.m., Pacific Time. The Notice of Internet Availability of Proxy Materials (“Notice”) containing instructions on how to access this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (“Annual Report”) is first being mailed on or about April 15, 2022 to all stockholders entitled to vote at the Annual Meeting. If you held shares of our Class A or Class B common stock at the close of business on April 4, 2022, you are invited to virtually attend the Annual Meeting at www.virtualshareholdermeeting.com/FRSH2022 and vote on the proposals described in this Proxy Statement.

In this Proxy Statement, we refer to Freshworks Inc. as “Freshworks,” “we,” “us,” or “our” and the board of directors of Freshworks as “our board of directors.” The Annual Report accompanies this Proxy Statement. You also may obtain a paper copy of the Annual Report without charge by following the instructions in the Notice.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this Proxy Statement and references to our website address in this Proxy Statement are inactive textual references only.

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice because our board of directors is soliciting your proxy to vote at the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 15, 2022 to all stockholders of record entitled to vote at Annual Meeting.

How do I attend the Annual Meeting?

In light of public health concerns regarding the COVID-19 pandemic, to protect the health and safety of our stockholders and employees and facilitate stockholder participation in the Annual Meeting, this year, the Annual Meeting will be held through a live, audio-only webcast at www.virtualshareholdermeeting.com/FRSH2022. You will not be able to attend the Annual Meeting in person. If you attend the Annual Meeting online, you will be able to vote and submit questions, at www.virtualshareholdermeeting.com/FRSH2022.

You are entitled to attend the Annual Meeting if you were a stockholder as of the close of business on April 4, 2022, the record date. To be admitted to the Annual Meeting, you will need to visit www.virtualshareholdermeeting.com/FRSH2022 and enter the 16-digit control number located in the Notice or in the instructions that accompanied your proxy materials. If you are a beneficial stockholder, you should contact the bank, broker or other institution where you hold your account well in advance of the meeting if you have questions about obtaining your control number.

1

Whether or not you participate in the Annual Meeting, it is important that you vote your shares.

We encourage you to access the Annual Meeting before it begins. Online check-in will start approximately 15 minutes before the meeting on Thursday, June 2, 2022.

What if I cannot find my Control Number?

Please note that if you do not have your control number and you are a registered stockholder, you will be able to login as a guest. To view the meeting webcast visit www.virtualshareholdermeeting.com/FRSH2022 and register as a guest. If you login as a guest, you will not be able to vote your shares or ask questions during the meeting.

If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other holder of record), you will need to contact that bank, broker or other holder of record to obtain your control number prior to the Annual Meeting.

Will a list of record stockholders as of the record date be available?

A list of our record stockholders as of the close of business on the record date will be made available to stockholders during the meeting at www.virtualshareholdermeeting.com/FRSH2022. In addition, for the 10 days prior to the Annual Meeting, the list will be available for examination by any stockholder of record for a legally valid purpose at our corporate headquarters during regular business hours. To access the list of record stockholders beginning May 23, 2022 and until the meeting, stockholders should email AM2022@freshworks.com.

Where can we get technical assistance?

If you have difficulty accessing the meeting, please call the technical support number that will be posted at www.virtualshareholdermeeting.com/FRSH2022.

For the Annual Meeting, how do we ask questions of management and the board of directors?

We plan to have a Q&A session at the Annual Meeting and will include as many stockholder questions as the allotted time permits. Stockholders may submit questions that are relevant to our business in advance of the Annual Meeting as well as live during the Annual Meeting. If you are a stockholder, you may submit a question in advance of the meeting at www.proxyvote.com after logging in with your control number. Questions may be submitted during the Annual Meeting through www.virtualshareholdermeeting.com/FRSH2022. Only questions that are relevant to an agenda item to be voted on by stockholders at the Annual Meeting will be answered.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 4, 2022 will be entitled to vote at the Annual Meeting. On the record date, there were 98,265,080 shares of Class A common stock outstanding and entitled to vote and 185,306,224 shares of Class B common stock outstanding and entitled to vote.

Our Class A common stock and Class B common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited. Each share of Class A common stock is entitled to one vote on each proposal, and each share of Class B Common Stock is entitled to 10 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this Proxy Statement as our common stock. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Stockholder of Record: Shares Registered in Your Name

If on April 4, 2022 your shares were registered directly in your name with Freshworks’ transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to vote by proxy over the telephone, vote by proxy through the internet, vote online at the meeting, or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 4, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual

2

Meeting. You may vote prior to the meeting by logging in with the control number on your voting instruction form at www.proxyvote.com. You may access the meeting and vote by logging in with your control number at www.virtualshareholdermeeting.com/FRSH2022. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

There are two matters scheduled for a vote:

•The election of the three nominees for Class I directors, Johanna Flower, Randy Gottfried, and Barry Padgett, each to serve until our 2025 Annual Meeting of Stockholders and until his or her successors are duly elected and qualified, subject to his or her earlier death, resignation or removal (“Proposal 1”); and

•Ratification of selection by the audit committee of our board of directors of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022 (“Proposal 2”).

What are the voting recommendations of our board of directors?

Our board of directors recommends that you vote “For” the director nominees named in Proposal 1, and “For” the ratification of the selection of Deloitte & Touche LLP as our independent public accounting firm for its fiscal year ending December 31, 2022 as described in Proposal 2.

What if another matter is properly brought before the meeting?

Our board of directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to our board of directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote (i) online at the Annual Meeting or (ii) in advance of the Annual Meeting through the telephone, internet, or by using a proxy card that you may request. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote at the meeting even if you have already voted by proxy.

•To vote during the Annual Meeting, follow the instructions at www.virtualshareholdermeeting.com/FRSH2022 starting at 9:00 a.m. Pacific Time on June 2, 2022. You will need to enter the 16-digit control number found on your Notice, proxy card, or instructions that accompanies your proxy materials.

•To vote prior to the Annual Meeting (until 11:59 p.m. Eastern time on June 1, 2022), you may vote through the telephone, internet, or by using a proxy card that you may request or that we may elect to deliver at a later time, as described below.

•To vote over the telephone, call 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number found on your Notice, proxy card, or instructions that accompanies your proxy materials. Your telephone vote must be received by 11:59 p.m. Eastern time on June 1, 2022 to be counted.

•To vote through the internet, go to www.proxyvote.com and follow the instructions to submit your vote on an electronic proxy card. You will be asked to provide the company number and control number found on your Notice, proxy card, or instructions that accompanies your proxy materials. Your internet vote must be received by 11:59 p.m. Eastern time on June 1, 2022 to be counted.

3

•To vote using a printed proxy card, simply complete, sign and date the proxy card that you may request and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from Freshworks. To vote prior to the meeting, simply follow the voting instructions in the Notice to ensure that your vote is counted. You may access and vote at the meeting by logging in with your control number on your voting instruction form at www.virtualshareholdermeeting.com/FRSH2022. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

| Internet proxy voting will be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. | ||

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Class A common stock you own as of April 4, 2022 and you have 10 votes for each share of Class B common stock you own as of April 4, 2022.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote through the telephone, internet, or by using a proxy card, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in in accordance with the recommendations of our board of directors: (i) “For” the election of all three nominees for director; and (ii) “For” the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner and do not instruct your brokerage firm, bank, or other nominee how to vote your shares, your shares will be considered “uninstructed” and the question of whether your nominee will still be able to vote your shares depends on whether, pursuant to stock exchange rules, the particular proposal is deemed to be a “routine” matter. Brokerage firms, banks, and other nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as elections of directors (even if not contested), mergers, stockholder proposals, executive compensation, and certain corporate governance proposals, even if management supported.

Accordingly, your brokerage firm, bank, or other nominee may vote your shares on Proposal 2. Your brokerage firm, bank, or other nominee may not, however, vote your shares on Proposal 1 without your instructions, which would result in a “broker non-vote” and your shares would not be counted as having been voted on Proposal 1. Please instruct your brokerage firm, bank, or other nominee to ensure that your vote will be counted.

If you a beneficial owner of shares held in street name, and you do not plan to attend the meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

4

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to Freshworks’ Corporate Secretary at 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403.

•You may attend the Annual Meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote in advance of the Annual Meeting by telephone or through the internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing and received by December 16, 2022, at 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403, Attention: Corporate Secretary.

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal (including a director nomination) before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in the notice with respect to such annual meeting delivered to stockholders, (ii) brought specifically by or at the direction of our board of directors, or a duly authorized committee of our board of directors, or (iii) properly brought before the meeting in accordance with our amended and restated bylaws by a stockholder of record entitled to vote at the meeting. To be properly brought, stockholders must give timely advance written notice thereof to 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403, Attention: Corporate Secretary. In order to be considered timely, notice of the proposal must be submitted in writing no earlier than the close of business on February 2, 2023, but no later than the close of business on March 4, 2023 to 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403, Attention: Corporate Secretary.

In the event our 2023 annual meeting of stockholders is not held between May 3, 2023 and July 2, 2023, the notice must be received (A) not earlier than the close of business on the 120th day prior to the 2023 annual meeting of stockholders, and (B) not later than the close of business on the later of the 90th day prior to the 2023 annual meeting of stockholders or, if later than the 90th day prior to the 2023 annual meeting of stockholders, the 10th day

5

following the day on which public announcement of the date of the 2023 annual meeting is first made. Any such notice to the Corporate Secretary must include the information required by our amended and restated bylaws.

You are advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals, including director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for Proposal 2 and will have the same effect as “Against” votes. Broker non-votes on Proposal 1 will have no effect and will not be counted towards the vote total. Proposal 2 is considered a “routine” matter, accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank, or other agent that holds your shares, your broker, bank, or other agent has discretionary authority to vote your shares on Proposal 2.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in street name does not give voting instructions to the broker, bank or other securities intermediary holding as to how to vote on matters deemed to be “non-routine”, the broker, bank or other such agent cannot vote the shares. These un-voted shares are counted as “broker non-votes.”

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

How many votes are needed to approve each proposal?

For the election of directors, the three nominees receiving the most “For” votes from the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors will be elected. Only votes “For” will affect the outcome.

To be approved, Proposal 2, ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022, must receive “For” votes from the holders of a majority of the voting power of the shares present virtually or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, it will have the same effect as an “Against” vote.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote are present at the meeting virtually or represented by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of the voting power of the shares present at the meeting or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

6

INFORMATION REGARDING OUR BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The following table sets forth certain information as of March 31, 2022 concerning the Class I nominees for election at the Annual Meeting and our other directors who will continue in office after the Annual Meeting:

| Name | Class | Age | Position | Director Since | Current Term Expires | ||||||||||||

| Director Nominees | |||||||||||||||||

| Johanna Flower | I | 47 | Director | 2020 | 2022 | ||||||||||||

| Randy Gottfried | I | 56 | Director | 2019 | 2022 | ||||||||||||

| Barry Padgett | I | 51 | Director | 2020 | 2022 | ||||||||||||

| Continuing Directors | |||||||||||||||||

| Roxanne S. Austin | II | 61 | Lead Independent Director | 2021 | 2023 | ||||||||||||

| Sameer Gandhi | II | 56 | Director | 2019 | 2023 | ||||||||||||

| Rathna Girish Mathrubootham | III | 47 | Chief Executive Officer and Chairman | 2010 | 2024 | ||||||||||||

| Zachary Nelson | III | 60 | Director | 2021 | 2024 | ||||||||||||

| Jennifer Taylor | III | 49 | Director | 2021 | 2024 | ||||||||||||

Set forth below is biographical information for the Class I director nominees and each person whose term of office as a director will continue after the Annual Meeting. This includes information regarding each director’s experience, qualifications, attributes, or skills that led our board of directors to recommend them for board service.

Nominees for Election at the Annual Meeting

The following is a brief biography of each nominee and each director whose term will continue after the Annual Meeting.

Johanna Flower. Ms. Flower has served on our board of directors since February 2020. Since February 2022, she has served as Chief Marketing Officer of CrowdStrike Holdings, Inc., a cybersecurity technology company, a role she previously held from November 2014 to August 2020. Since July 2021, Ms. Flower has served on the board of directors of ForgeRock, Inc., a digital identity technology company. Ms. Flower also serves on the board of directors of privately-held companies Theta Lake, Inc., Expel, Inc., and Yellowbrick Data, Inc. Ms. Flower holds a B.A. in Business Administration from Brighton University, United Kingdom.

We believe Ms. Flower is qualified to serve as a member of our board of directors because of her significant management and leadership experience in the technology industry.

Randy Gottfried. Mr. Gottfried has served on our board of directors since October 2019. From January 2015 to April 2017, Mr. Gottfried served as Chief Financial Officer of AppDynamics, Inc., an application performance management and IT operations analytics company. Since January 2019, Mr. Gottfried has served on the board of directors of Sumo Logic, Inc., a cloud-based machine data analytics company. Since August 2021, Mr. Gottfried has served on the board of directors of Attentive Mobile, Inc., a marketing technology company. Mr. Gottfried holds a B.B.A in Accounting from the University of Michigan and an M.B.A. in Strategy and Marketing from Northwestern University, Kellogg School of Management.

We believe Mr. Gottfried is qualified to serve as a member of our board of directors because of his experience serving on the board of directors of public companies and his knowledge of the industry.

Barry Padgett. Mr. Padgett has served on our board of directors since February 2020. Since February 2022, he has served as Chief Executive Officer for Amperity, Inc., an enterprise customer data platform. From May 2020 to February 2022, he served as the Chief Operating Officer of Amperity and from April 2019 to April 2020, Mr. Padgett served as Chief Revenue Officer for Stripe, Inc., a financial services and software-as-a-service company. From January 2016 to March 2019, Mr. Padgett served as President of SAP, a software and information technology

7

services company. Since February 2022, Mr. Padgett has served on the board of directors of Amperity and he also is a member of the board of directors of privately-held Duetto Research Inc. Mr. Padgett holds a B.S. in Applied Mathematics from Union College, an M.B.A. from the University of New South Wales and an M.S. in Software Engineering from the University of Oxford.

We believe Mr. Padgett is qualified to serve as a member of our board of directors because of his significant leadership experience in the industry.

Directors Continuing in Office Until the 2023 Annual Meeting

Roxanne S. Austin. Ms. Austin has served as a member of our board of directors since May 2021. Since December 2004 she has served as the President and Chief Executive Officer of Austin Investment Advisors, a private investment and consulting firm. Since 2016, she has chaired the U.S. Mid-Market Investment Advisors Committee of EQT Partners, an investment organization. Previously, Ms. Austin has held a series of executive positions, including President and CEO of Move Networks, Inc. from 2008 to 2010, President and CEO of DIRECTV, Inc. from 2000 to 2004 and Executive Vice President and Chief Financial Officer of Hughes Electronics Corporation from 1997 to 2000. She is also a former partner of Deloitte & Touche LLP. Ms. Austin served on the board of directors of Target Corporation from 2002 to 2020 and on the board of directors of Abbott Laboratories Inc. from 2000 to April 2022. Ms. Austin currently serves on the boards of directors of several public companies including Verizon Communications, Inc., CrowdStrike Holdings, Inc., and AbbVie, Inc. Ms. Austin holds a B.B.A. in Accounting and Business Administration from the University of Texas at San Antonio.

We believe Ms. Austin is qualified to serve as a member of our board because of her extensive business and operational expertise and experience serving on the boards of directors of public companies.

Sameer Gandhi. Mr. Gandhi has served on our board of directors since December 2019. Since June 2008, Mr. Gandhi has served as a partner of Accel, a venture capital firm, where he focuses on consumer, software and services companies. Mr. Gandhi currently serves on the board of directors of CrowdStrike, and also serves on the boards of directors of several privately-held companies. Mr. Gandhi holds a B.S. in Electrical Engineering and an M.S. in Electrical Engineering and Computer Science from the Massachusetts Institute of Technology and an M.B.A. from the Stanford Graduate School of Business.

We believe Mr. Gandhi is qualified to serve as a member of our board of directors because of his extensive investment and business expertise in the technology industry.

Directors Continuing in Office Until the 2024 Annual Meeting

Rathna Girish Mathrubootham. Mr. Mathrubootham is a co-founder of our company and has served as our Chief Executive Officer since October 2010, as a member of our board of directors since August 2010 and as Chairman since May 2021. Mr. Mathrubootham holds a B.E. in Electrical and Electronics from Shanmugha Arts, Science, Technology and Research Academy, and an M.B.A. from the University of Madras.

We believe that Mr. Mathrubootham is qualified to serve as a member of our board of directors because of the perspective and experience he brings as our Chief Executive Officer and a co-founder and because of his extensive experience with technology companies.

Zachary Nelson. Mr. Nelson has served on our board of directors since August 2021. From July 2002 to June 2017, Mr. Nelson served as Chief Executive Officer at NetSuite Inc., a business management software company that was acquired by Oracle Corporation, a computer technology company, in November 2016. Since June 2018, Mr. Nelson has served on the board of directors of PagerDuty Inc., an incident management platform company. Mr. Nelson also currently serves on the board of directors of privately-held Snyk Limited. Mr. Nelson holds a B.S. in Biological Sciences and an M.A. in Anthropology from Stanford University.

We believe that Mr. Nelson is qualified to serve as a member of our board of directors because of his extensive experience working in the technology sector and senior leadership experience at technology companies.

Jennifer Taylor. Ms. Taylor has served on our board of directors since September 2021. Since June 2017, Ms. Taylor has served as Chief Product Officer and Senior Vice President of Products at Cloudflare, Inc., a website security company. From August 2015 to June 2017, she served as Senior Vice President of Product Management for Data.com and Search at Salesforce.com, Inc., a cloud-based software company. Ms. Taylor holds a B.A. in Public Policy from Brown University and an M.B.A. from Harvard Business School.

8

We believe Ms. Taylor is qualified to serve as a member of our board of directors because of her product development expertise and strong experience in the technology industry.

Board Diversity

The Board Diversity Matrix, below, provides the diversity statistics for our board of directors.

| Board Diversity Matrix (As of April 11, 2022) | ||||||||||||||

Total Number of Directors | 8 | |||||||||||||

| Female | Male | Non- Binary | Did Not Disclose Gender | |||||||||||

Part I: Gender Identity | ||||||||||||||

Directors | 3 | 5 | — | — | ||||||||||

Part II: Demographic Background | ||||||||||||||

African American or Black | — | — | — | — | ||||||||||

Alaskan Native or Native American | — | — | — | — | ||||||||||

Asian | — | 2 | — | — | ||||||||||

Hispanic or Latinx | — | — | — | — | ||||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | ||||||||||

White | 3 | 3 | — | — | ||||||||||

Two or More Races or Ethnicities | — | — | — | — | ||||||||||

LGBTQ+ | 1 | |||||||||||||

Did Not Disclose Demographic Background | — | |||||||||||||

Independence of our Board of Directors

Our Class A common stock is listed on the Nasdaq Global Select Market (“Nasdaq”). Under the listing standards of the Nasdaq, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our board of directors consults with the Company’s counsel to ensure that their determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations and based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that each of Ms. Austin, Ms. Flower, Mr. Gandhi, Mr. Gottfried, Mr. Nelson, Mr. Padgett, and Ms. Taylor do not have relationships that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under Nasdaq listing standards. In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining their independence, including the beneficial ownership of our shares held by each non-employee director and the transactions described in the section titled “Transactions with Related Persons and Indemnification.” Based on this review, our board of directors affirmatively determined that all of the directors nominated for election at the Annual Meeting are independent under the standards set forth in the Company’s Corporate Governance Guidelines and applicable Nasdaq rules.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Nasdaq listing standards. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the Nasdaq listing standards.

9

Board Leadership Structure

Our board of directors is currently chaired by the Chief Executive Officer of the Company, Mr. Mathrubootham. Our board of directors has appointed Ms. Austin as lead independent director.

We believe that combining the positions of Chief Executive Officer and Chairman helps to ensure that our board of directors and management act with a common purpose. In our view, separating the positions of Chief Executive Officer and Chairman has the potential to give rise to divided leadership, which could interfere with good decision-making or weaken our ability to develop and implement strategy. Instead, we believe that combining the positions of Chief Executive Officer and Chairman provides a single, clear chain of command to execute the Company’s strategic initiatives and business plans. In addition, we believe that a combined Chief Executive Officer/Chairman is better positioned to act as a bridge between management and the board of directors, facilitating the regular flow of information. We also believe that it is advantageous to have a Chairman with an extensive history with and knowledge of the Company (as is the case with the Company’s Chief Executive Officer). Our board of directors expects to review this structure periodically to ensure that it continues to be the appropriate board leadership structure for our company.

The board of directors appointed Ms. Austin as the lead independent director to help reinforce the independence of the board of directors as a whole. The position of lead independent director has been structured to serve as an effective balance to a combined Chief Executive Officer/Chairman: the lead independent director is empowered to, among other duties and responsibilities, approve agendas and meeting schedules for regular board meetings, preside over board meetings in the absence of the Chair, preside over and establish the agendas for meetings of the independent directors, act as liaison between the Chair and the independent directors, approve information sent to the board of directors, preside over any portions of board meetings at which the evaluation or compensation of the Chief Executive Officer is presented or discussed and, as appropriate upon request, act as a liaison to stockholders. In addition, it is the responsibility of the lead independent director to coordinate between the board of directors and management regarding the determination and implementation of responses to any problematic risk management issues. As a result, we believe that the lead independent director can help ensure the effective independent functioning of the board of directors in its oversight responsibilities. In addition, we believe the lead independent director is better positioned to build a consensus among directors and to serve as a conduit between the other independent directors and the Chairman, for example, by facilitating the inclusion on meeting agendas of matters of concern to the independent directors. In light of the Chief Executive Officer’s extensive history with and knowledge of the Company, and because the board’s lead independent director is empowered to play a significant role in the board’s leadership and in reinforcing the independence of the board of directors, we believe that it is advantageous for the Company to combine the positions of Chief Executive Officer and Chairman.

Role of the Board in Risk Oversight

Our board of directors oversees our risk management processes, which are designed to support the achievement of organizational objectives, improve long-term organizational performance, and enhance stockholder value while mitigating and managing identified risks. A fundamental part of our approach to risk management is not only understanding the most significant risks we face as a company and the necessary steps to manage those risks, but also deciding what level of risk is appropriate for our company. Our board of directors plays an integral role in guiding management’s risk tolerance and determining an appropriate level of risk.

While our full board of directors has overall responsibility for evaluating key business risks, its committees monitor and report to our board of directors on certain risks. Our audit committee monitors our major financial, reporting, and cybersecurity risks, and the steps our management has taken to identify and control these exposures, including by reviewing and setting guidelines, internal controls, and policies that govern the process by which risk assessment and management is undertaken. Our audit committee also monitors compliance with legal and regulatory requirements, and directly supervises our internal audit function. Our compensation committee assesses and monitors whether any of our compensation policies and programs have the potential to encourage excessive risk-taking, and also plans for leadership succession. Our nominating and governance committee oversees risks associated with director independence and the composition and organization of our board of directors, monitors the effectiveness of our corporate governance guidelines, and provides general oversight of our other corporate governance policies and practices.

In connection with its reviews of the operations of our business, our full board of directors addresses holistically the primary risks associated with our business, as well as the key risk areas monitored by its committees, including cybersecurity risks. Our board of directors appreciates the evolving nature of our business and industry and is actively involved in monitoring new threats and risks as they emerge. In particular, our board of directors is committed to the prevention, timely detection, and mitigation of the effects of cybersecurity threats or incidents. Further, our board of directors has been closely monitoring the rapidly changing COVID-19 pandemic, its potential effects on our business, and related risk mitigation strategies.

10

At periodic meetings of our board of directors and its committees, management reports to and seeks guidance from our board and its committees with respect to the most significant risks that could affect our business, such as legal risks, cybersecurity and privacy risks, and financial, tax, and audit-related risks. In addition, among other matters, management provides our audit committee periodic reports on our compliance programs and investment policy and practices.

Meetings of the Board of Directors

The board of directors met 16 times and acted by unanimous written consent two times during the last fiscal year. Each board member attended 75% or more of the aggregate number of meetings of the board of directors and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member. Members of the board of directors are expected to prepare for, attend, and participate in all meetings. We encourage our directors to attend our annual meetings of stockholders.

Information Regarding Committees of the Board of Directors

Our board of directors has an audit committee, a compensation committee and a nominating and corporate governance committee. The following table provides membership for each of these board committees:

| Name | Audit | Compensation | Nominating and Corporate Governance | ||||||||

| Roxanne S. Austin | X | X* | |||||||||

| Johanna Flower | X | ||||||||||

| Sameer Gandhi | X* | X | |||||||||

| Randy Gottfried | X* | X | |||||||||

| Zachary Nelson | X | ||||||||||

| Barry Padgett | X | X | |||||||||

| Jennifer Taylor | |||||||||||

* Committee chair

Below is a description of the audit committee, compensation committee and nominating and corporate governance committee of the board of directors. Our committees operate under written charters that satisfy the applicable Nasdaq listing standards. Each committee charter is available to stockholders on the Investor Relations section of our website at ir.freshworks.com/corporate-governance/governance-overview.

Audit Committee

Our audit committee consists of Ms. Austin, Mr. Gottfried, and Mr. Nelson. Our board of directors has determined that each member of the audit committee satisfies the independence requirements under Nasdaq listing standards and Rule 10A-3(b)(1) of the Exchange Act. The chair of our audit committee is Mr. Gottfried. Our board of directors has determined that Mr. Gottfried is an “audit committee financial expert” within the meaning of SEC regulations. Each member of our audit committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, our board of directors has examined each audit committee member’s scope of experience and the nature of his employment.

The primary purpose of the audit committee is to discharge the responsibilities of our board of directors with respect to our corporate accounting and financial reporting processes, systems of internal control and financial statement audits, and to oversee our independent registered public accounting firm. Specific responsibilities of our audit committee include, among other things:

•helping our board of directors oversee our corporate accounting and financial reporting processes;

•managing the selection, engagement, qualifications, independence and performance of a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results;

11

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•reviewing related person transactions;

•obtaining and reviewing a report by the independent registered public accounting firm at least annually that describes our internal quality control procedures, any material issues with such procedures and any steps taken to deal with such issues when required by applicable law; and

•approving or, as permitted, pre-approving, all audit and all permissible non-audit services to be performed by the independent registered public accounting firm.

Our audit committee operates under a written charter that satisfies the applicable Nasdaq listing standards. During the fiscal year ended December 31, 2021, our audit committee held seven meetings.

Compensation Committee

Our compensation committee consists of Mr. Gandhi, Mr. Gottfried, and Mr. Padgett. The chair of our compensation committee is Mr. Gandhi. Our board of directors has determined that each member of the compensation committee is independent under Nasdaq listing standards, and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

The primary purpose of our compensation committee is to discharge the responsibilities of our board of directors in overseeing our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. Specific responsibilities of our compensation committee include, among other things:

•reviewing and recommending to our board of directors the compensation of our chief executive officer and other executive officers;

•reviewing and recommending to our board of directors the compensation of our directors;

•administering our equity incentive plans and other benefit programs;

•reviewing, adopting, amending and terminating incentive compensation and equity plans, severance agreements, profit sharing plans, bonus plans, change-of-control protections and any other compensatory arrangements for our executive officers and other senior management; and

•reviewing and establishing general policies relating to compensation and benefits of our employees, including our overall compensation philosophy.

Our compensation committee operates under a written charter that satisfies the applicable Nasdaq listing standards. During the fiscal year ended December 31, 2021, our compensation committee held three meetings and acted by unanimous written consent seven times.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee are currently or have been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Ms. Austin, Ms. Flower, Mr. Gandhi, and Mr. Padgett. The chair of our nominating and corporate governance committee is Ms. Austin. Our board of directors has determined that each member of the nominating and corporate governance committee is independent under Nasdaq listing standards.

Specific responsibilities of our nominating and corporate governance committee include, among other things:

•identifying and evaluating candidates, including the nomination of incumbent directors for reelection and nominees recommended by stockholders, to serve on our board of directors;

•considering and making recommendations to our board of directors regarding the composition and chairmanship of the committees of our board of directors;

•evaluating the independence of the directors and director nominees and the members of each committee of our board of directors against the independence requirements of Nasdaq, the applicable rules and regulations of the SEC, and other applicable laws;

•developing and making recommendations to our board of directors regarding corporate governance guidelines and related matters; and

•overseeing periodic evaluations of the board of directors’ performance, including committees of the board of directors.

12

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable Nasdaq listing standards. During the fiscal year ended December 31, 2021, our nominating and corporate governance committee held one meeting and acted by unanimous written consent three times.

Nomination to the Board of Directors

Candidates for nomination to our board of directors are selected by our board of directors based on the recommendation of the nominating and corporate governance committee in accordance with the committee’s charter, our stockholder director nominations policy, our amended and restated certificate of incorporation and amended and restated bylaws, our corporate governance guidelines, and the requirements of applicable law. In recommending candidates for nomination, the nominating and corporate governance committee considers candidates recommended by directors, officers, and employees, as well as candidates that are properly submitted by stockholders in accordance with our policies and amended and restated bylaws, using the same criteria to evaluate all such candidates.

Our nominating and corporate governance committee will consider recommendations for candidates to our board of directors from stockholders holding at least 1% of our fully diluted capitalization continuously for at least 12 months prior to the date of the submission of the recommendation, so long as such recommendations comply with our amended and restated certificate of incorporation and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC. Any such stockholder that wishes to recommend a candidate for election to the board of directors must deliver written notice to our Corporate Secretary at 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403. The notice must include, among other things, the candidate's name, business and residence address, biographical data, and the class and number of Freshworks shares held. Additional information regarding the process and required information to properly and timely submit stockholder nominations for candidates for membership on our board of directors is set forth in our amended and restated bylaws and corporate governance guidelines.

Evaluations of candidates generally involve a review of background materials, internal discussions, and interviews with selected candidates as appropriate and, in addition, the nominating and corporate governance committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Our nominating and corporate governance committee and our board of directors use a variety of qualifications for identifying and evaluating director nominees. In considering and evaluating candidates, our nominating and corporate governance committee and our board of directors consider, among other relevant factors, character, integrity, judgment, diversity, independence, area of expertise, experience, length of services, potential conflicts of interest, other commitments, the ability to exercise sound business judgment, skills that are complementary to those of the existing board of directors, the ability to support managements and make signification contributions to Company’s success, and an understanding of the fiduciary responsibilities that are required and the commitment of time and energy necessary to diligently carry out those responsibilities. In evaluating director candidates, our nominating and corporate governance committee and our board of directors will also consider the current size and composition of our board of directors, our company's operating requirements, and the long-term interests of our stockholders.

Our board of directors believes that the board of directors should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee considers the benefits of diverse viewpoints. Our nominating and corporate governance committee also operates in compliance with applicable laws and regulations, such as recently enacted legislation in California which requires exchange-listed companies headquartered in California with boards with six or more members to have a minimum of three women directors by December 31, 2021.

Stockholder Engagement and Communications with the Board of Directors

Stockholders or interested parties who wish to communicate with our board of directors or with an individual director may do so by mail to our board of directors or the individual director, care of our Corporate Secretary at 2950 S. Delaware Street, Suite 201, San Mateo, CA 94403. In accordance with our corporate governance guidelines, our Corporate Secretary or legal department, in consultation with appropriate directors as necessary, will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations, and patently offensive or otherwise inappropriate material) and, if appropriate, will route such communications to the appropriate director(s) or, if none is specified, to the chairperson of the board of directors or the lead independent director.

13

Code of Ethics

We have adopted a code of business conduct and ethics that applies to, among others, our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. Our code of business conduct and ethics is available under the Corporate Governance section of our website at ir.freshworks.com/corporate-governance/governance-overview. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq listing standards concerning any amendments to, or waivers from, any provision of the code.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to ensure that our board of directors has the necessary practices in place to review and evaluate Freshworks’ business operations and make decisions that are independent of our management. The corporate governance guidelines set forth the practices our board of directors follows with respect to board composition and selection, board meetings and involvement of senior management, executive officer performance evaluation and succession planning, board compensation, director education, and conflicts of interest. The corporate governance guidelines, as well as the charters for each committee of our board of directors, are posted on our website at ir.freshworks.com/corporate-governance/governance-overview.

Prohibition on Hedging, Short Sales, and Pledging

Our board of directors has adopted an insider trading policy that applies to all of our officers, directors, employees and other related individuals (such as consultants and independent contractors). This policy prohibits hedging transactions with respect to all transactions involving our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, and collars. In addition, our insider trading policy prohibits trading in derivative securities related to our common stock, which include publicly traded call and put options, engaging in short selling of our common stock, purchasing our common stock on margin or holding it in a margin account, and pledging our shares as collateral for a loan.

14

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets forth certain information with respect to the compensation earned by or paid to our directors for the fiscal year ended December 31, 2021, other than Rathna Girish Mathrubootham, our Chief Executive Officer and Chairman, who is also a member of our board of directors but did not receive any additional compensation for service as a director. The compensation paid to Mr. Mathrubootham is set forth in “Executive Compensation.”

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Total ($) | ||||||||

| Roxanne S. Austin | — | 9,505,552(4) | 9,505,552 | ||||||||

| Johanna Flower | — | 1,986,176 (5) | 1,986,176 | ||||||||

| Sameer Gandhi | — | 13,366(6) | 13,366 | ||||||||

| Randy Gottfried | 15,500 | — | 15,500 | ||||||||

| Zachary Nelson | — | 12,239,948(7) | 12,239,948 | ||||||||

| Barry Padgett | — | 1,988,041(8) | 1,988,041 | ||||||||

| Jennifer Taylor | — | 15,100,398(9) | 15,100,398 | ||||||||

Mohit Bhatnagar(3) | — | — | — | ||||||||

Eugene Frantz(3) | — | — | — | ||||||||

________________

(1) The amounts disclosed represent the aggregate grant date fair value of the restricted stock units granted to our non-employee directors during 2021 under our 2021 Equity Incentive Plan (the “2021 Plan”) and 2011 Stock Plan, as amended (the “2011 Plan”), computed in accordance with Financial Accounting Standard Board (“FASB”) Accounting Standards Codification (“ASC”) 718. The assumptions used in calculating the grant date fair value of the restricted stock units are set forth in the notes to our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021. These amounts do not reflect the actual economic value that will be realized by the directors upon the vesting of the restricted stock units, or the sale of any common stock acquired under such restricted stock units.

(2) As of December 31, 2021, the number of shares subject to outstanding restricted stock unit awards held by each non-employee director was as follows: Ms. Austin — 469,790 shares; Ms. Flower — 281,250 shares; Mr. Gottfried – 112,500; Mr. Nelson — 421,870 shares; Mr. Padgett — 271,880 shares; and Ms. Taylor — 421,870 shares. For purposes of this footnote, the number of restricted stock unit awards excludes shares that had met the time-based service and liquidity event vesting conditions yet remained subject to the expiration of the final lock-up period, which occurred on February 14, 2022.

(3) Mr. Bhatnagar and Mr. Frantz resigned from our board of directors as of August 2021.

(4) Pursuant to Ms. Austin’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Ms. Austin 656 shares of our Class A common stock, which were fully vested as of the date of grant. In addition, in May 2021 in connection with her appointment to the board of directors, our board of directors granted Ms. Austin a restricted stock unit award for 550,000 shares of our Class B common stock, with a vesting commencement date of May 8, 2021. 1/48th of the shares subject to the restricted stock unit will vest in equal monthly installments over 48 months following the vesting commencement date, subject to Ms. Austin's continued service with us as of each such date. The board of directors determined that the size of Ms. Austin's pre-IPO grant was appropriate based on, among other things, market information, analysis, and other advice regarding non-executive director compensation provided by Compensia and Ms. Austin's role as our Lead Independent Director.

(5) Pursuant to Ms. Flower’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Ms. Flower 366 shares of our Class A common stock, which were fully vested as of the date of grant. In addition, in August 2021, our board of directors granted Ms. Flower a restricted stock unit award for 75,000 shares of our Class B common stock, with a vesting commencement date of September 2, 2021. 1/48th of the shares subject to the restricted stock unit will vest in equal monthly installments over 48 months following the vesting commencement date, subject to Ms. Flower’s continued service with us as of each such date. The board of directors granted such pre-IPO award to Ms. Flower to bring her equity ownership in line with that of the recently-appointed directors, Mr. Nelson and Ms. Taylor, which the board determined was appropriate based on, among other things, market information, analysis, and other advice regarding non-executive director compensation provided by Compensia.

(6) Pursuant to Mr. Gandhi’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Mr. Gandhi 509 shares of our Class A common stock, which were fully vested as of the date of grant.

15

(7) Pursuant to Mr. Nelson’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Mr. Nelson 423 shares of our Class A common stock, which were fully vested as of the date of grant. In addition, in August 2021 in connection with his appointment to the board of directors, our board of directors granted Mr. Nelson a restricted stock unit award for 450,000 shares of our Class B common stock, with a vesting commencement date of September 1, 2021. 1/48th of the shares subject to the restricted stock unit will vest in equal monthly installments over 48 months following the vesting commencement date, subject to Mr. Nelson’s continued service with us as of each such date. The board of directors determined that the size of Mr. Nelson's pre-IPO grant was appropriate based on, among other things, market information, analysis, and other advice regarding non-executive director compensation provided by Compensia.

(8) Pursuant to Mr. Padgett’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Mr. Padgett 437 shares of our Class A common stock, which were fully vested as of the date of grant. In addition, in August 2021, our board of directors granted Mr. Padgett a restricted stock unit award for 75,000 shares of our Class B common stock, with a vesting commencement date of August 28, 2021. 1/48th of the shares subject to the restricted stock unit will vest in equal monthly installments over 48 months following the vesting commencement date, subject to Mr. Padgett’s continued service with us as of each such date. The board of directors granted such pre-IPO award to Mr. Padgett to bring his equity ownership in line with that of the recently-appointed directors, Mr. Nelson and Ms. Taylor, which the board determined was appropriate based on, among other things, market information, analysis, and other advice regarding non-executive director compensation provided by Compensia.

(9) Pursuant to Ms. Taylor’s election, in lieu of the cash retainer for the quarter ended December 31, 2021 pursuant to our non-employee director compensation program, on January 1, 2022, our board of directors granted Ms. Taylor 328 shares of our Class A common stock which were fully vested as of the date of grant. In addition, in September 2021 in connection with her appointment to the board of directors, our board of directors granted Ms. Taylor a restricted stock unit award for 450,000 shares of our Class B common stock, with a vesting commencement date of September 10, 2021. 1/48th of the shares subject to the restricted stock unit will vest in equal monthly installments over 48 months following the vesting commencement date, subject to Ms. Taylor’s continued service with us as of each such date. The board of directors determined that the size of Ms. Taylor's pre-IPO grant was appropriate based on, among other things, market information, analysis, and other advice regarding non-executive director compensation provided by Compensia.

Non-Employee Director Compensation

We have adopted a non-employee director compensation program, pursuant to which each of our directors who is not an employee or consultant of our company will be eligible to receive compensation for service on our board of directors and committees of our board of directors.

Cash Compensation

Each eligible director will receive an annual cash retainer of $34,500 for serving on our board of directors, and the lead independent director of the board of directors will receive an additional annual cash retainer of $16,500 for his or her service. The chairperson of the audit committee will be entitled to an additional annual cash retainer of $20,000, the chairperson of the compensation committee will be entitled to an additional annual cash retainer of $15,000 and the chairperson of the nominating and corporate governance committee will be entitled to an additional annual cash retainer of $8,000. The members of the audit committee will be entitled to an additional annual cash retainer of $10,000, the members of the compensation committee will be entitled to an additional annual cash retainer of $7,500, and the members of the nominating and corporate governance committee will be entitled to an additional annual cash retainer of $4,000; however, in each case such cash retainer is payable only to members who are not the chairperson of such committee. All annual cash compensation amounts will be payable in equal quarterly installments in arrears, on the last day of each fiscal quarter in which the service occurred.

Each non-employee director may elect to receive fully vested shares of our Class A common stock in lieu of his or her annual cash retainer. Such shares are issued on a quarterly basis, in arrears, and the number of such shares is calculated by dividing (1) the aggregate amount of cash compensation otherwise payable to such director divided by (2) the closing sales price per share of the Class A common stock on the last day of the fiscal quarter in which the service occurred, rounded down to the nearest whole share.

Equity Compensation

Each new eligible director who joins our board of directors will be granted restricted stock units with an aggregate grant date fair value of $335,000 under our 2021 Plan. The restricted stock units will be granted on the next established grant date following the date the new eligible director joins our board of directors and will vest annually over a three-year period, subject to continued service as a director through each such vesting date.

On the next established grant date after each annual meeting of our stockholders, each eligible director who continues to serve as a director of our company following the meeting will be granted restricted stock units with an aggregate grant date fair value of $195,000 under our 2021 Plan. The shares shall vest in full on the earlier of the

16

first anniversary of the grant date or the date of the next annual stockholder meeting, subject to continued service as a director through such vesting date.

Expenses

In addition, we will reimburse eligible directors for ordinary, necessary, and reasonable out-of-pocket travel expenses to cover in-person attendance at and participation in board and committee meetings.

PROPOSAL 1 - ELECTION OF DIRECTORS

Our board of directors currently consists of eight members and is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation or removal.

Our directors are divided into the three classes as follows:

•the Class I directors are Johanna Flower, Randy Gottfried, and Barry Padgett, whose terms will expire at the upcoming Annual Meeting;

•the Class II directors are Roxanne S. Austin and Sameer Gandhi, whose terms will expire at the annual meeting of stockholders to be held in 2023; and

•the Class III directors are Rathna Girish Mathrubootham, Zachary Nelson, and Jennifer Taylor, whose terms will expire at the annual meeting of stockholders to be held in 2024.