MAP 3

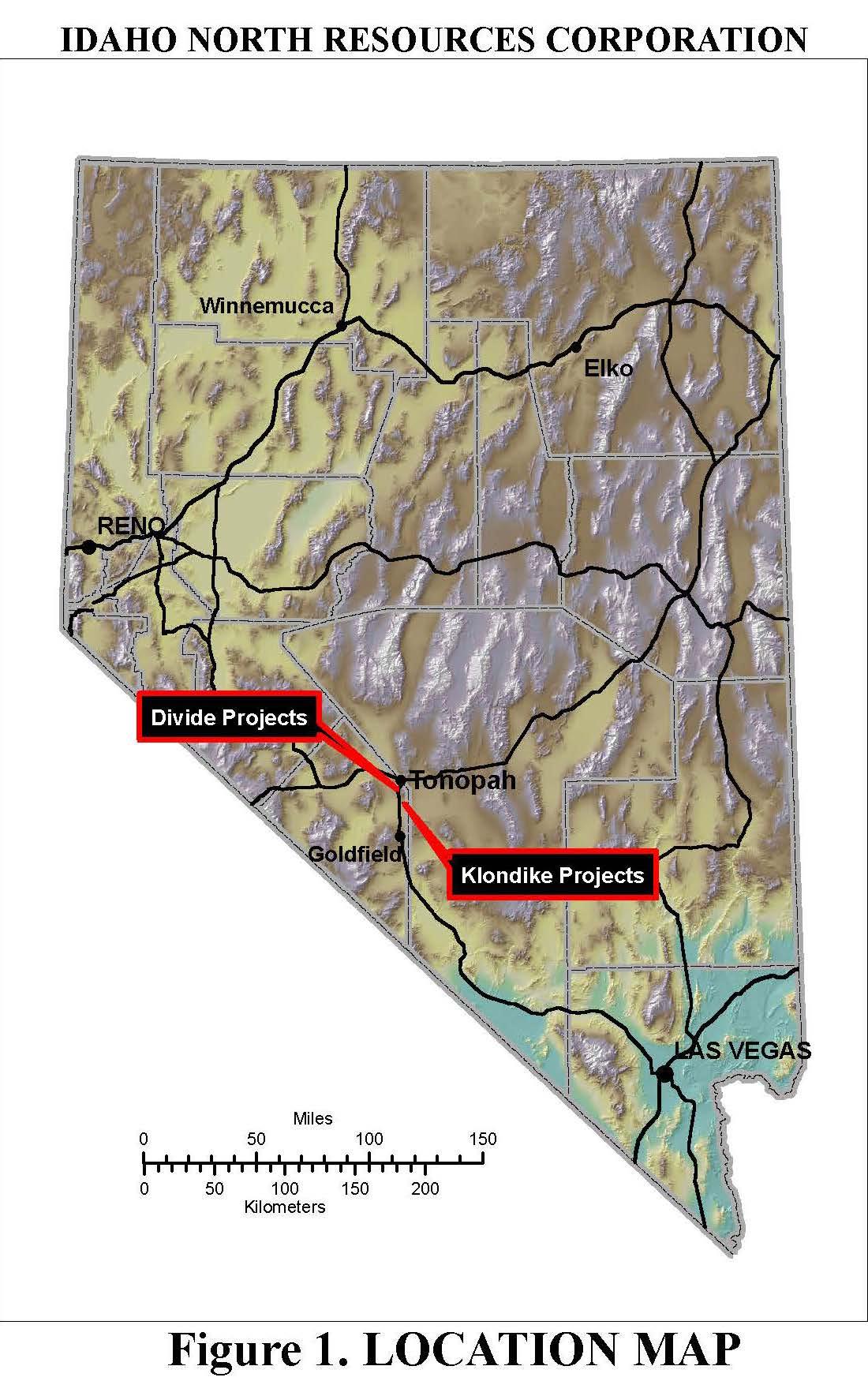

We lease the following properties from Mountain Gold Claims, LLC and Black Rock Exploration, LLC pursuant to written lease agreements.

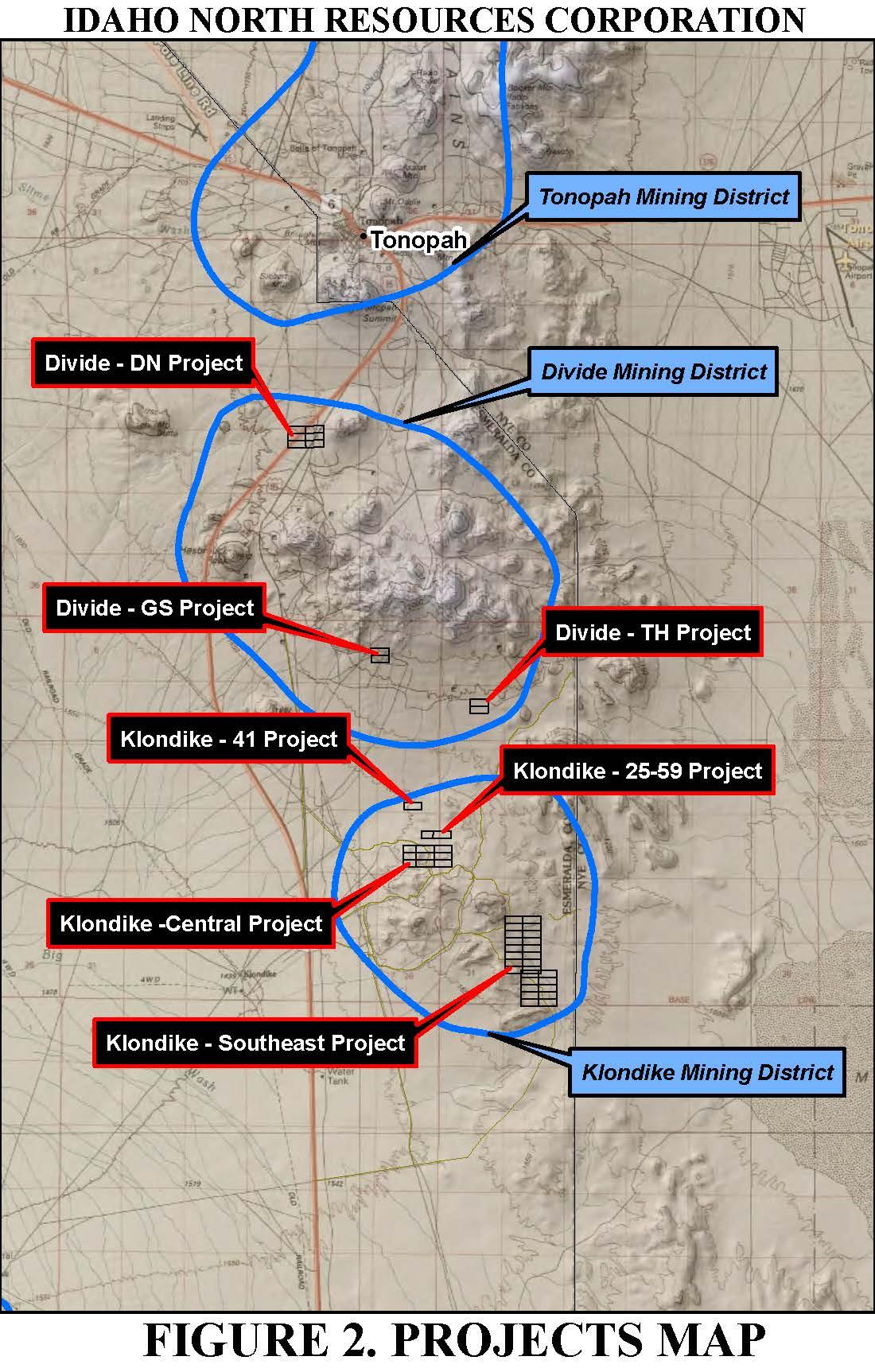

DIVIDE TH PROPERTY

The Divide TH Property is comprised of two located unpatented lode mining claims of approximately 40 acres located in the Divide Mining District, situated in Esmeralda County Nevada. The Divide TH Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC each own 50% ownership of the total 100% ownership as the registered owners of the Divide TH Project.

Location and Access

The Divide TH Property comprises of approximately 40 acres and TH 1 and TH 2 lode mining claims were located on September 1, 2011and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on November 17, 2011 as Instrument Document Number 185004 and 185005, Book 310 & Pages 298 and 299 in the official records and were filed with the Bureau of Land Management in Reno, Nevada State Office on November 28, 2011 as Instrument NMC Number 1058060 and 1058061.

The Divide TH Project is located within Sections 7 and 8, Township 1 North, Range 43 East in the Divide Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Divide TH Project is approximately 9.5 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 3.5 miles southeast along old US Hwy 9, then 3.3 miles east on unimproved dirt roads to the Divide TH Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Divide TH Project is in good standing to September 1, 2012. A yearly maintenance fee of $280 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Divide Project, several historical prospects, adits and shafts have explored the project area. There is no recorded production from the ground covered by the Divide TH Project. In 2003, MK Gold conducted limited reconnaissance geological mapping and geochemical sampling. In 2006, AuEx, Inc. conducted limited reconnaissance geological mapping and geochemical sampling. In 2011 and 2012, Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC conducted limited reconnaissance exploration and geological mapping.

Physiography, Climate, Vegetation and Water

The Divide TH Project is situated in the southeastern portion of the Divide Mining District and is approximately nine and one-half miles southeast of the town of Tonopah, Nevada. Topography on the Project is very gentle with an average elevation range of 5,680 feet to 5,760 feet.

The Divide TH Project area is of a typically high desert climate with relatively moderate temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah.

Regional Geology

The Divide TH Project is situated in the southwestern portion of the San Antonio Mountains within the northwest-trending Walker Lane structural domain of the Basin and Range physiographic province. The right-lateral, strike-slip faulting associated with the Walker Lane zone created a large, east-west trending drag fold in the area of Tonopah and Divide mining districts. Most mineralization in the Divide Mining District occurs on west-northwest slays from this regional structural activities. The Divide Mining District is situated on a major Tertiary felsic to intermediate volcanic eruptive center intruded by several late stage rhyolitic and latitic intrusive-extrusive bodies. Miocene pre-mineral volcanic rocks in the Divide Mining District consist of the Fraction Tuff (rhyolitic), Siebert Formation tuffaceous and lacustrine siltstone and tuff, Oddie Rhyolite intrusives and lower part of the Divide Andesite. Post-mineral volcanic rocks include the Brougher Rhyolite and upper Divide Andesite.

In the southeast portion of the Divide Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates are the dominate rocks and locally may have intruded by rhyolitic dikes, sills and plug.

Divide TH Project Geology

The Divide TH Project comprises of Tertiary volcanic rocks consisting of intermediate to felsic flows and tuffs of the Fraction Tuff host rocks and locally has been intruded by rhyolitic bodies. The Fraction Tuff Formation has been strongly fractured and developed northeast-southwest and northwest-southeast-west faults and joints. In the central portion of the Project area, a north-south trending hydrothermal breccia zone intrudes the Fraction Tuff and a flow banded rhyolite dome intrusive.

Divide TH Project Mineralization

At the Divide TH Project, alteration is very extensive consisting of epithermal zones of argillization-sericitization, local silicification and quartz-adularia-pyrite veinlets along faults and fracture planes. Pyrite is disseminated and occurs along and within veinlets and is general oxidized. At the Divide TH Project, a regional, north-south structural zone may control the emplacement of gold and silver mineralization exposed in old mine workings and outcrops. Mineralization is hosted in the Fraction Tuff and may be associated with a rhyolite dome intrusive and hosted within east-west faults and a north-south trending hydrothermal breccia zone.

DIVIDE DN PROPERTY

The Divide DN Property is comprised of six located unpatented lode mining claims of approximately 120 acres located in the Divide Mining District, situated in Esmeralda County Nevada. The Divide DN Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC each own 50% ownership of the total 100% ownership as the registered owners of the Divide DN Project.

Location and Access

The Divide DN Project comprises of approximately 120 acres and DN 1 thru DN 6 lode mining claims were located on September 1, 2011and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on November 17, 2011 as Instrument Document Number 184997 thru 185002, Book 310 & Pages 292 thru 297 in the official records and were filed with the Bureau of Land Management in Reno, Nevada State Office on November 28, 2011 as Instrument NMC Number 1058054 thru 1058059.

The Divide DN Project is located within Sections 14, 15, 22 and 23, Township 2 North, Range 42 East the Divide Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Divide DN Project Property is approximately 3.0 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 0.3 miles southeast along old US Hwy 9 to the Divide DN Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Divide DN Project is in good standing to September 1, 2011. A yearly maintenance fee of $840 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Project, several historical prospects have explored the project area. There is no recorded production from the ground covered by the Divide DN Project. In 2011, Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC conducted limited reconnaissance exploration, geological mapping and rock chip geochemical sampling.

Physiography, Climate, Vegetation and Water

The Divide DN Project is situated in the northern portion of the Divide Mining District and is approximately three miles south of the town of Tonopah, Nevada. Topography on the Project is very gentle with an average elevation range of 5,800 feet to 5,960 feet.

The Divide DN Project area is of a typically high desert climate with relatively moderate temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah.

Regional Geology

The Divide DN Project is situated in the southwestern portion of the San Antonio Mountains within the northwest-trending Walker Lane structural domain of the Basin and Range physiographic province. The right-lateral, strike-slip faulting associated with the Walker Lane zone created a large, east-west trending drag fold in the area of Tonopah and Divide mining districts. Most mineralization in the Divide Mining District occurs on west-northwest slays from this regional structural activities. The Divide Mining District is situated on a major Tertiary felsic to intermediate volcanic eruptive center intruded by several late stage rhyolitic and latitic intrusive-extrusive bodies. Miocene pre-mineral volcanic rocks in the Divide Mining District consist of the Fraction Tuff (rhyolitic), Siebert Formation tuffaceous and lacustrine siltstone and tuff, Oddie Rhyolite intrusives and lower part of the Divide Andesite. Post-mineral volcanic rocks include the Brougher Rhyolite and upper Divide Andesite.

In the northern portion of the Divide Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates are the dominated host rocks and locally may have been intruded by rhyolitic dikes, sills and plugs.

Divide DN Project Geology

The Divide DN Project is comprised of Tertiary volcanic rocks consisting of intermediate to felsic flows and tuffs of the Fraction Tuff host rocks and has been locally intruded by rhyolitic bodies. The Fraction Tuff Formation has been strongly fractured and developed northeast-southwest and east-west joints.

Divide DN Project Mineralization

At the Divide DN Project, alteration is very extensive consisting of epithermal zones of argillization-sericitization, local silicification and quartz-adularia-pyrite veinlets along faults and fracture planes. Pyrite is disseminated and occurs along and within veinlets and is general oxidized and locally hosts visible, mineralized material. At the DN claims, northeast striking structures host quartz-pyrite alteration and sampling of old workings and outcrops returned mineralized material.

DIVIDE GS PROPERTY

The Divide GS Property is comprised of two located unpatented lode mining claims of approximately 40 acres located in the Divide Mining District, situated in Esmeralda County, Nevada. The Divide GS Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC each own 50% ownership of the total 100% ownership as the registered owners of the Divide GS Project.

Location and Access

The Divide GS Project comprises of approximately 40 acres and GS 1 and GS 3 lode mining claims were located on September 1, 2011and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on November 17, 2011 as Instrument Document Number 185007 and 185008, Book 310 & Pages 300 and 301 in the official records and were filed with the Bureau of Land Management in Reno, Nevada, State Office on November 28, 2011 as Instrument NMC Number 1058062 and 1058063.

The Divide GS Project is located within Sections 1 and 2, Township 1 North, Range 42 East in the Divide Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Divide GS Project Property is approximately 7.5 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 3.5 miles southeast along old US Hwy 9, then 1.3 miles east on unimproved dirt roads to the Divide GS Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Divide GS Project is in good standing to September 1, 2012. A yearly maintenance fee of $280 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Property, a several historical prospects have explored the project area. There is no recorded production from the ground covered by the Divide GS Project. In 1991, Kennecott Exploration conducted limited reconnaissance geological mapping and geochemical sampling. In 2003, MK Gold conducted limited reconnaissance geological mapping and geochemical sampling. In 2006, AuEx, Inc. conducted limited reconnaissance geological mapping and geochemical sampling. In 2011 and 2012, Mountain Gold Claims, LLC Series 5 and Black Rock Exploration, LLC conducted limited reconnaissance exploration and geological mapping.

Physiography, Climate, Vegetation and Water

The Divide GS Project is situated in the southeastern portion of the Divide Mining District and is approximately seven and one-half miles southeast of the town of Tonopah, Nevada. Topography on the Project is very gentle with an average elevation range of 5,840 feet to 5,960 feet.

The Divide GS Project area is of a typically high desert climate with relatively moderate temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah.

Regional Geology

The Divide GS Project is situated in the southwestern portion of the San Antonio Mountains within the northwest-trending Walker Lane structural domain of the Basin and Range physiographic province. The right-lateral, strike-slip faulting associated with the Walker Lane zone created a large, east-west trending drag fold in the area of Tonopah and Divide mining districts. Most mineralization in the Divide Mining District occurs on west-northwest slays from this regional structural activities. The Divide Mining District is situated on a major Tertiary felsic to intermediate volcanic eruptive center intruded by several late stage rhyolitic and latitic intrusive-extrusive bodies. Miocene pre-mineral volcanic rocks in the Divide Mining District consist of the Fraction Tuff (rhyolitic), Siebert Formation tuffaceous and lacustrine siltstone and tuff, Oddie Rhyolite intrusives and lower part of the Divide Andesite. Post-mineral volcanic rocks include the Brougher Rhyolite and upper Divide Andesite.

In the southeast portion of the Divide Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates are the dominate rocks and locally may have intruded by rhyolitic dikes, sills and plugs.

Divide GS Project Geology

The Divide GS Project is comprised of Tertiary volcanic rocks consisting of intermediate to felsic flows and tuffs of the Fraction Tuff host rocks and locally has been intruded by rhyolitic bodies.

The Fraction Tuff Formation has been strongly fractured and developed northeast-southwest and northwest-southeast-west faults and joints.

Divide GS Project Mineralization

At the Divide GS Project, alteration is very extensive consisting of epithermal zones of argillization-sericitization, local silicification and quartz-adularia-pyrite veinlets along faults and fracture planes. Pyrite is disseminated and occurs along and within veinlets and is general oxidized and locally hosts visible, mineralized material. At the GS claims, northwest structures host quartz-pyrite alteration and sampling of old workings and outcrops returned mineralized material.

KLONDIKE 25-59 PROPERTY

The Klondike 25-59 Property is comprised of two located unpatented lode mining claims of approximately 33 acres located in the Klondike Mining District, situated in Esmeralda County, Nevada. The Klondike 25-59 Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 8 is the registered owner of the Klondike 25-59 Project.

Location and Access

The Klondike 25-59 Project comprises of approximately 33 acres and KN 25 lode mining claim was located on November 22, 2006 and was filed in the Esmeralda County recorder’s office in Goldfield, Nevada on February 13, 2007 as Instrument Document Number 166406, Book 249 & Page 360 in the official records and was filed with the Bureau of Land Management in Reno, Nevada, State Office on February 14, 2007 as Instrument NMC Number 946383.

KN 59 lode mining claim was located on January 19, 2007 and was filed in the Esmeralda County recorder’s office in Goldfield, Nevada on April 16, 2007 as Instrument Document Number 167077, Book 251 & Page 391 in the official records and was filed with the Bureau of Land Management in Reno, Nevada, State Office on April 17, 2007 as Instrument NMC Number 949623.

The Klondike 25-59 Project is located within Section 24, Township 1 North, Range 42 East and Section 19, Township 1 North, Range 43 East in the Klondike Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Klondike 25-59 Property is approximately 12.2 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 7 miles southeast along old US Hwy 95, then southeast 2.5 miles along an improved and dirt road to the Klondike 25-59 Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Klondike 25-59 Project is in good standing to September 1, 2012. A yearly maintenance fee of $280.00 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the property, a few historical prospects have explored the project area. There is no recorded production from the ground covered by the Klondike 25-59 Project. In 2006, Mountain Gold Exploration, Inc. conducted limited renaissance exploration and geological mapping. Between 2008 and 2009, exploration and geological mapping was conducted by AuEx, Inc.

Physiography, Climate, Vegetation and Water

The Klondike 25-59 Project is situated midway between the towns of Tonopah and Goldfield, Nevada and approximately 12 miles south-southeast of Tonopah in the northern portion of the Klondike Hill.

Topography on the Project is gentle to moderate with an average elevation range of 5,440 feet to 5,560 feet.

The Klondike 25-59 Project area is of a typically desert climate with relatively high temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah or Goldfield.

Regional Geology

The Klondike 25-59 Project is situated in the Klondike Hills within the northwest-trending Walker Lane structural domain province and where Walker Lane related structures intersects a possible, recently recognized caldera margin. The Klondike Hills are part of a large syncline with an axis trending northeast and plunging to the northeast. Anticlinal folding and imbricated thrusting along the southern limb have created a complex structural setting and locally control precious metal mineralization. The majority of the rocks in the Klondike Mining District consist of early Cambrian Mule Springs Limestone,

Cambrian Emigrant Formation consisting of argillite and limestone, Paleozoic Ordovician Palmetto Formation consisting of limestone, carbonaceous argillite, siltstone and chert. The Cambrian and Paleozoic sediments have been intruded by Mesozoic granites and Tertiary rhyolite dikes and sills. In the northern portion of the Klondike Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates locally intruded by rhyolitic dikes, sill and plugs occur.

Klondike 25-59 Project Geology

The Klondike 25-59 Project comprised of Tertiary volcanic rocks consisting of intermediate to felsic flows tuffs, lahars and agglomerates and may have been locally intruded by rhyolitic bodies.

Klondike 25-59 Project Mineralization

At the Klondike 25-59 Project, alteration includes local quartz-calcite veining-stockwork, argillization and disseminated pyritization. Mineralized material in the Klondike 25-59 Project area is hosted along scattered north-south striking calcite-quartz stockwork veinlets which intrude Tertiary volcanic tuffs and agglomerates.

KLONDIKE 41 PROPERTY

The Klondike 41 Property is comprised of one located unpatented lode mining claim of approximately 20 acres located in the Klondike Mining District, situated in Esmeralda County, Nevada. Mountain Gold Claims, LLC Series 8 is the registered owner of the Klondike 41 Project.

Location and Access

The Klondike 41 Project comprises of approximately 20 acres and KN 41 lode mining claim was located on November 22, 2006 and was filed in the Esmeralda County recorder’s office in Goldfield, Nevada on February 13, 2007 as Instrument Document Number 166423, Book 249 & Page 376 in the official records and were filed with the Bureau of Land Management in Reno, Nevada, State Office on February 14, 2007 as Instrument NMC Number 946399.

The Klondike 41 Project is located within Section 13, Township 1 North, Range 42 East in the Klondike Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Klondike 41 Property is approximately 12.0 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 7 miles southeast along old US Hwy 95, then southeast 2.3miles along a dirt road to the Klondike 41 Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Klondike 41 Project is in good standing to September 1, 2012. A yearly maintenance fee of $140.00 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Project, a few historical prospects have explored the project area. There is no recorded production from the ground covered by the Klondike 41 Project. In 2006, Mountain Gold Exploration, Inc. conducted limited reconnaissance exploration and geological mapping. Between 2008 and 2009, Exploration and geological mapping was conducted by AuEx, Inc.

Physiography, Climate, Vegetation and Water

The Klondike 41 Project is situated midway between the towns of Tonopah and Goldfield, Nevada approximately 12 miles south-southeast of Tonopah in the northern portion of the Klondike Hill.

Topography on the Project is gentle to moderate with an average elevation range of 5,400 feet to 5,480 feet.

The Klondike 41 Project area is of a typically desert climate with relatively high temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah or Goldfields.

Regional Geology

The Klondike 41 Property is situated in the Klondike Hills within the northwest-trending Walker Lane structural domain province and where Walker Lane related structures intersects a possible, recently recognized caldera margin. The Klondike Hills are part of a large syncline with an axis trending northeast and plunging to the northeast. Anticlinal folding and imbricated thrusting along the southern limb have created a complex structural setting and locally control precious metal mineralization. The majority of the rocks in the Klondike Mining District consist of early Cambrian Mule Springs Limestone, Cambrian Emigrant Formation consisting of argillite and limestone and the Paleozoic Ordovician Palmetto Formation consisting of limestone, carbonaceous argillite, siltstone and chert. The Cambrian and Paleozoic sediments have been intruded by Mesozoic granites and Tertiary rhyolite dikes and sills. In the northern portion of the Klondike Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates locally intruded by rhyolitic dikes, sill and plugs occur.

Klondike 41 Project Geology

The Klondike 41 Project comprises of Tertiary volcanic rocks consisting of intermediate to felsic flows tuffs, lahars and agglomerates and may have been locally intruded by rhyolitic bodies.

Klondike 41 Project Mineralization

At the Klondike 41 Project, alteration includes local quartz-calcite veining-stockwork, argillization and disseminated pyritization. Mineralization in the Klondike 41 Project area includes anomalous mineralized material hosted along scattered north-south striking calcite-quartz stockwork veinlets which intrude Tertiary volcanic tuffs and agglomerates.

KLONDIKE CENTRAL PROPERTY

The Klondike Central Property is comprised of nine located unpatented lode mining claims of approximately 160 acres located in the Klondike Mining District, situated in Esmeralda County, Nevada. The Klondike Central Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 8 is the registered owner of the Klondike Central Project.

The Klondike Central Property comprises of approximately 160 acres and KN 1 thru KN 6 lode mining claims were located on August 29, 2006 and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on November 22, 2006 as Instrument Document Number 165874 thru 165879, Book 247 & Pages 209 thru 214 in the official records and were filed with the Bureau of Land Management in Reno, Nevada, State Office on November 17, 2006 as Instrument NMC Number 938562 thru 938567.

KN 14 thru KN 16 lode mining claims were located on October 17, 2006 and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on November 22, 2006 as Instrument Document Number 165881 thru 165883, Book 247 & Pages 215 thru 217 in the official records and were filed with the Bureau of Land Management in Reno, Nevada, State Office on November 28, 2006 as Instrument NMC Number 940167 thru 9440169.

The Klondike Central Property is located within Section 24, Township 1 North, Range 42 East, and Sections 19, Township 1 North, Range 43 East in the Klondike Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Klondike Central Property is approximately 12.2 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles south from Tonopah on US Hwy 95, then 7 miles southeast along old US Hwy 95, then southeast 2.5 miles along an improved gravel road to the Klondike Central Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Klondike Central Project is in good standing to September 1, 2012. A yearly maintenance fee of $1,260.00 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Property, several prospects, adits and mine shafts have explored the project area. Although, there is no recorded production from the ground covered by the Klondike Central Project, disturbed ground near the main mine workings may suggest limited open pit and underground operations in the 1900’s. In 2006, Mountain Gold Exploration, Inc. conducted limited reconnaissance geological mapping and geochemical sampling. Between 2008 and 2009, geological mapping, geochemical soil and rock chip sampling, geophysical magnetic survey, along with limited reverse circulation drilling was conducted by AuEx, Inc. In 2011-2012, Mountain Gold Claims, LLC conducted limited geological mapping and geochemical sampling for Idaho North Resources Corporation.

Physiography, Climate, Vegetation and Water

The Klondike Central Project is situated midway between the towns of Tonopah and Goldfield, Nevada approximately 12 miles south-southeast of Tonopah in the northern portion of the Klondike Hill.

Topography on the Project is gentle to moderate with an average elevation range of 5,440 feet to 5,640 feet.

The Klondike Central Project area is of a typically desert climate with relatively high temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah or Goldfields.

Regional Geology

The Klondike Central Property is situated in the Klondike Hills within the northwest-trending Walker Lane structural domain province and where Walker Lane related structures intersects a possible, recently recognized caldera margin. The Klondike Hills are part of a large syncline with an axis trending northeast and plunging to the northeast. Anticlinal folding and imbricated thrusting along the southern limb have created a complex structural setting and locally control precious metal mineralization. The majority of the rocks in the Klondike Mining District consist of early Cambrian Mule Springs Limestone, Cambrian Emigrant Formation consisting of argillite and limestone, Paleozoic Ordovician Palmetto Formation consisting of limestone, carbonaceous argillite, siltstone and chert. The Cambrian and Paleozoic sediments have been intruded by Mesozoic granites and Tertiary rhyolite dikes and sills. In the northern portion of the Klondike Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates locally intruded by rhyolitic dikes, sill and plugs occur.

Klondike Central Project Geology

The northern portion of the Klondike Central Project comprise of Tertiary volcanic rocks consisting of intermediate to felsic flows tuffs, lahars and agglomerates and have been locally intruded by rhyolitic dikes, sills and flow domes. In the southern portion of the Klondike Central Project, older Cambrian-Paleozoic limestone, argillite, carbonaceous argillite, siltstone and shale sedimentary rocks dominate to area and are locally intruded by Tertiary rhyolitic dikes and sills. In the central portion of the Klondike Central Project, a northwest-southeast trending fault zone separates the Tertiary volcanic rocks from the older Cambrian-Paleozoic sedimentary rocks.

Klondike Central Project Mineralization

At the Klondike Central Property, alteration is wide spread covering the majority of the project area. Alteration includes silicification, quartz-calcite veining, stockwork, argillization, pyritization and iron-manganese-jarosite oxidation alteration. Mineralized material in the Klondike Central Project is hosted along the northwest-southeast structural zone and localized along bedding plane, structural zones in the Cambrian-Paleozoic sedimentary rocks.

KLONDIKE SOUTHEAST PROPERTY

The Klondike Southeast Project is comprised of twenty six located unpatented lode mining claims of approximately 520 acres located in the Klondike Mining District, situated in Esmeralda County Nevada. The Klondike Southeast Project covers formal exploratory workings on an indicated mineral showing. Mountain Gold Claims, LLC Series 8 is the registered owner of the Klondike Southeast Project.

Location and Access

The Klondike Southeast Project comprises of approximately 520 acres and KN 100 thru KN 109 and KN 147 thru KN 162 lode mining claim were located on November 16, 2011and were filed in the Esmeralda County recorder’s office in Goldfield, Nevada on February 6, 2012 as Instrument Document Number 186186 thru 186211, Book 312, Pages 306-331in the official records and were filed with the Bureau of Land Management in Reno, Nevada State Office on February 9, 2012 as Instrument NMC Number 1066359 thru 1066384.

The Klondike Southeast Property is located within Section 29 and 32, Township 1 North, Range 43 East and Section 5, Township 1 South, Range 43 East in the Klondike Mining District of Esmeralda County, Nevada.

Access from Tonopah, Nevada to the Klondike Southeast Property is approximately 14.2 miles to the southeast. From the Town of Tonopah, Nevada, access via 2.7 miles from Tonopah on US Hwy 95, then 7 miles southeast along old US Hwy 95, then southeast 4.5 miles along an improved and dirt road to the Klondike Southeast Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Klondike Southeast Project is in good standing to September 1, 2012. A yearly maintenance fee of $3,640 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Project, several historical prospects have explored the project area. There is no recorded production from the ground covered by the Klondike Southeast Project. Between 2008 and 2009, exploration and geological mapping and sampling was conducted by AuEx, Inc.

Physiography, Climate, Vegetation and Water

The Klondike Southeast Project is situated midway between the towns of Tonopah and Goldfield, Nevada approximately 14 miles southeast of Tonopah in the northern portion of the Klondike Hill.

Topography on the Project is gentle to moderate with an average elevation range of 5,440 feet to 5,640 feet.

The Klondike Southeast Project area is of a typically desert climate with relatively high temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells or from the towns of Tonopah or Goldfields.

Regional Geology

The Klondike Southeast Project is situated in the Klondike Hills within the northwest-trending Walker Lane structural domain province and where Walker Lane related structures intersects a possible, recently recognized caldera margin. The Klondike Hills are part of a large syncline with an axis trending northeast and plunging to the northeast. Anticlinal folding and imbricated thrusting along the southern limb have created a complex structural setting and locally control precious mineralization. The majority of the rocks in the Klondike Mining District consist of early Cambrian Mule Springs Limestone, Cambrian Emigrant Formation consisting of argillite and limestone, Paleozoic Ordovician Palmetto Formation consisting of limestone, carbonaceous argillite, siltstone and chert. The Cambrian and Paleozoic sediments have been intruded by Mesozoic granites and Tertiary rhyolite dikes and sills. In the northern portion of the Klondike Mining District, Tertiary volcanic rocks of intermediate to felsic composition consisting of flows, tuffs, lahars and agglomerates locally intruded by rhyolitic dikes, sill and plugs occur.

Klondike Southeast Project Geology

The Klondike Southeast Project comprises of Tertiary volcanic rocks consisting of intermediate to felsic flows tuffs, lahars and agglomerates and may have been locally intruded by rhyolitic bodies and older. Adjacent to the Tertiary volcanic rocks to the west and south, older Cambrian-Paleozoic limestone, and carbonaceous argillite-siltstone sedimentary rocks occur and may be locally intruded by Tertiary rhyolitic dikes and sills.

Klondike Southeast Mineralization

At the Klondike Southeast Project, alteration of the volcanic tuffs and agglomerate rocks appears high-level consisting of argillization and local quartz-calcite veining-stockwork and disseminated pyritization. The surrounding older Cambrian-Paleozoic rocks to the west and south are pervasively silicified and cut by quartz stockwork and the alteration appears similar to Carlin-type systems. Mineralization in the Klondike Southeast Project area includes anomalous mineralized material in both host rock units.

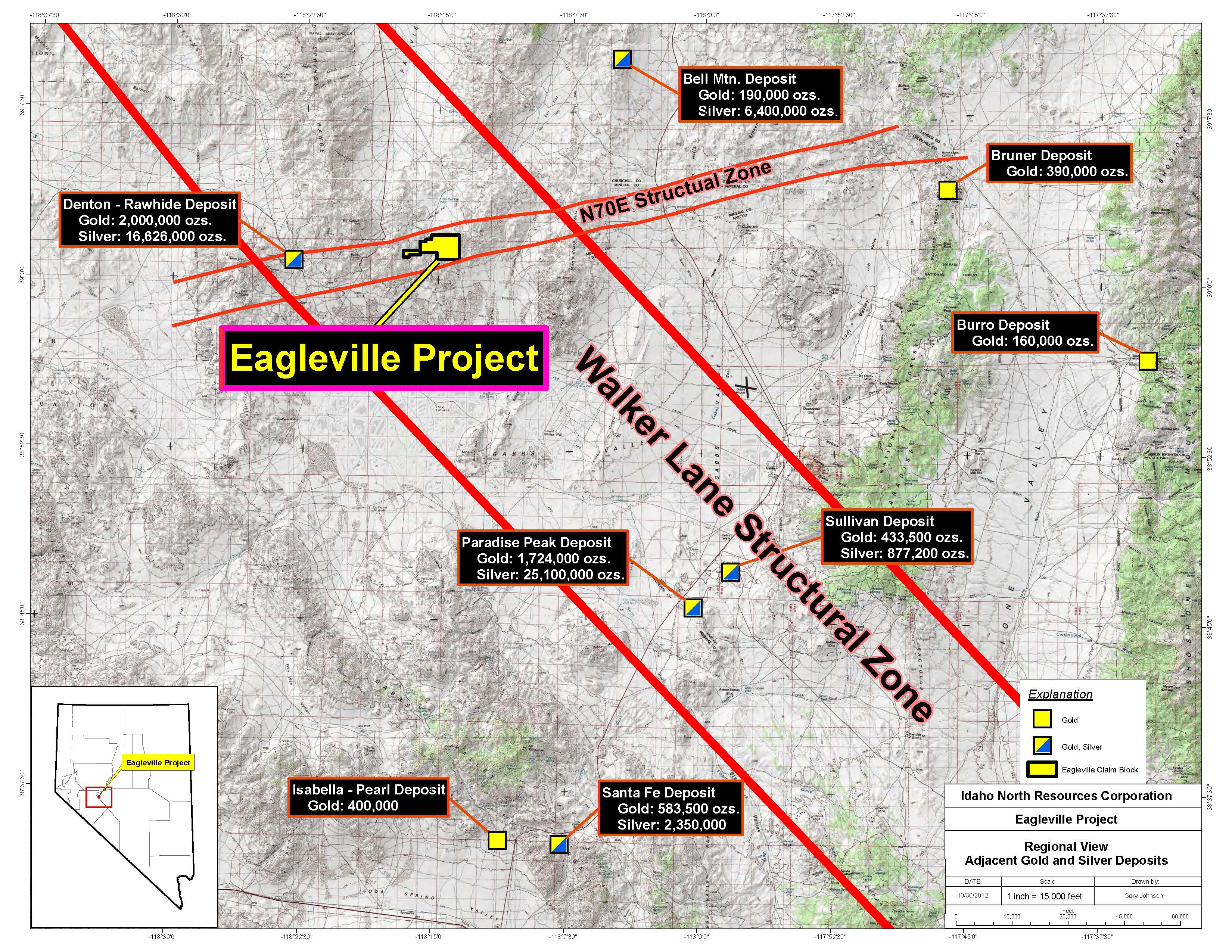

EAGLEVILLE PROPERTY

The Eagleville Property is comprised of fifty eight (58) located unpatented lode mining claims of approximately 1,160 acres located in the Eagleville Mining District, situated in Mineral County Nevada. Mountain Gold Exploration, Inc. owns 34% ownership and Lane Griffin and Associates owns 66% ownership and collectively both parties own a total 100% ownership as the registered owners of the Eagleville Project. The Eagleville Property is leased to us pursuant to a written Exploration and Mining Lease and Option to Purchase Agreement dated July27, 2012.

Location and Access

The Eagleville Property is comprised of approximately 1,160 acres and 58 lode mining claims which were located and filed in the Mineral County recorder’s office in Hawthorne, Nevada.

The Eagleville Project is located within Sections 33, 34, 35, Township 14 North, Range 33 East and Sections 2, 3, 4 and 5 Township 13 North, Range 33 East in the Eagleville Mining District of Mineral County, Nevada.

Access from Fallon Nevada, Nevada to the Eagleville Project is approximately 50 miles to the southeast. From the Town of Fallon, Nevada, access via 30 miles southeast from Fallon on US Hwy 50, then 17 miles south along Nevada State Route 839, then 3 miles east on unimproved dirt roads to the Eagleville Project.

In addition to the state regulations, federal regulations require a yearly maintenance fee to keep the claim in good standing. In accordance with federal regulations, the Eagleville Project is in good standing to September 1, 2013. A yearly maintenance fee of $8,120 is required to be paid to the Bureau of Land Management prior to the expiration date to keep the claim in good standing for an additional year.

History

At the Eagleville Project, several historical prospects, adits and shafts have explored the project area. Between 1884 and 1894, there was approximately $20,000 (1,000 ounces of gold) undocumented recorded production from the ground covered by the Eagleville Project. In 1982, Duval conducted underground mapping and sampling. In 1983, Phelps Dodge conducted surface mapping.

Physiography, Climate, Vegetation and Water

The Eagleville Project is situated in the central portion of the Eagleville Mining District and is approximately 50 miles southeast of the town of Fallon, Nevada. Topography on the Project is moderate relief gentle with an average elevation range of 5,600 feet to 6,260 feet.

The Eagleville Project area is of a typically high desert climate with relatively moderate temperatures and low precipitation. Vegetation consists mainly of sparse sage brush. Sources of water would be available from valley wells and springs or from the Rawhide gold and silver deposit.

Regional Geology

The Eagleville Project is located in the southern flank of the Sand Springs Range and situated in the transitional structural zone along the northeastern bounding structure of the Walker Lane Structural Belt which separates the Great Basin and the Walker Lane physiographic provinces.

Eagleville Project Geology

At Eagleville, Triassic age complex of bi-modal intrusives dikes, sills and plugs have intruded meta-volcanic and sedimentary rocks of the Excelsior Formation, which in turn were intruded by Cretaceous granites. Locally, post-mineral Tertiary rocks cover and conceal portions of the mineralized system.

Eagleville Project Mineralization

At the Eagleville Project, the earliest mineralization appears to be a series of north 80 east striking, silver-lead-barite veins that extend at least 3000 feet. These earlier north 80 east trending silver-lead-barite vein structural zones is steeply dipping and well exposed for over 3000 feet to the southwest and an isolated exposure in a drainage canyon suggests the veins may extend over 8,000 feet. High grade, narrow, free-gold mineralization is hosted along a series of northwest striking, en echelon quartz-pyrite vein and numerous working have explored and mined these veins. The gold is found primarily in the free state as sub millimeter grains with minor sulfides and iron oxides. The quartz veins were mined at an average width of 3 feet from the surface down to over 400 feet down dip by stoping on 50 foot levels.

BLM serial numbers or identification numbers in regarding the Eagleville property .

|

Name of claims or sites

|

BLM Serial Number

|

| |

|

|

Molly

|

683538

|

|

Mitchel

|

683539

|

|

Sleeper

|

840466

|

|

Dragon Stone

|

840467

|

|

Eagle Gold 1

|

813143

|

|

Eagle Gold 2

|

813144

|

|

Eagle 12

|

800373

|

|

Eagle 14

|

800374

|

|

Eagle 33

|

800375

|

|

Eagle 35

|

800376

|

|

Eagle 8 to Eagle 11

|

846896 to 846899

|

|

Eagle 13

|

846900

|

|

Eagle 15 to Eagle 18

|

846901 to 846904

|

|

Eagle 27 to Eagle 32

|

846913 to 846918

|

|

Eagle 37

|

846919

|

|

Eagle 39 to Eagle 42

|

846920 to 846924

|

|

Eagle 44

|

846925

|

|

Eagle 46

|

846927

|

|

Eagle 51

|

846932

|

|

Eagle 52 to Eagle 70

|

846951 to 846969

|

|

Eagle 91 to Eagle 94

|

846946 to 846949

|

|

Eagle 102

|

846950

|

|

Eagle 103

|

846971

|

Property Agreements

We lease the foregoing properties pursuant to the following lease agreements:

|

|

1.

|

Mountain Gold Claims LLC for the Klondike 25-29 Property, Klondike 41 Property, Klondike Central Property and Klondike Southeast Property.

|

|

|

2.

|

Mountain Gold Claims LLC and Black Rock Exploration LLC for the Divide TH Property, Divide DN Property and Divide GS Property.

|

Our interest in the properties is limited to our leasehold interest. Our leases, however, grant us a right to purchase the underlying minerals upon completion of certain conditions described below .

On October 24, 2011, we entered into an Exploration and Mining Lease and Option to Purchase Agreement (the “Agreement”) with Mountain Gold Claims, LLC. Series 8, a Nevada Limited Liability Company (“MGC”) wherein we leased the Klondike North Property from MGC under the terms of the claims MGC holds on the property. The term of the lease is 50 years. Under the terms of the Agreement we are obligated to make yearly lease payments to MGC of $10,000 or 250,000 restricted shares of common stock the first year, $20,000 the second year; $30,000 the third year; $40,000 the fourth year; $50,000 the fifth year; and, $100,000 the eleventh year and thereafter. Further, we are obligate to issue 500,000 restricted shares of common stock to Mountain Gold Holdings LLC, Series S. In addition we are obligated to pay MGC a net smelter royalty of 3% from the sale or production of minerals from the property. We are also obligated to expend at least $5,000 during the first year of the Agreement; $25,000 the second year; $50,000 the third year; $75,000 the fourth year; and, $100,000 the fifth year and thereafter. In addition to the foregoing, we are obligated to perform work assessments on the property required by federal and state laws. In consideration of the foregoing, we have the right to remove all minerals from the property. We also have the right to acquire 1% of the smelter royalty for $1,000,000 and an additional 1% for $3,000,000. We also have the right to purchase the claims underlying the Agreement from MGC in consideration of $400,000. During the term of the lease, we are obligated to pay all fees related thereto and indemnify MGC from any losses incurred by MGC. The Agreement contains additional obligations to be performed by us during the term of the Agreement.

On February 21, 2012, we entered into an Exploration and Mining Lease and Option to Purchase Agreement (the “Agreement”) with Mountain Gold Claims, LLC. Series 5, a Nevada Limited Liability Company and Black Rock Exploration LLC, a Nevada Limited Liability Company (collectively the “Owner”) wherein we leased the Divide Property from the Owner under the terms of the claims Owner holds on the property. The term of the lease is 50 years. Under the terms of the Agreement we are obligated to deliver 100,000 restricted shares of common stock on the execution of the Agreement and make yearly lease payments to the Owner of $10,000 or 100,000 restricted shares of common stock the first year; $20,000 the second year; $30,000 the third year; $40,000 the fourth year; $50,000 the fifth year; and, $100,000 the eleventh year and thereafter. Further, we are obligate to issue 100,000 restricted shares of common stock to the Owner. In addition we are obligated to pay the Owner a net smelter royalty of 3% from the sale or production of minerals from the property. We are also obligated to expend at least $5,000 during the first year of the Agreement; $25,000 the second year; $50,000 the third year; $75,000 the fourth year; and, $100,000 the fifth year and thereafter. In addition to the foregoing, we are obligated to perform work assessments on the property required by federal and state laws. In consideration of the foregoing, we have the right to remove all minerals from the property. We also have the right to acquire 1% of the smelter royalty for $1,000,000 and an additional 1% for $3,000,000. We also have the right to purchase the claims underlying the Agreement from Owner in consideration of $400,000. During the term of the lease, we are obligated to pay all fees related thereto and indemnify Owner from any losses incurred by Owner. The Agreement contains additional obligations to be performed by us during the term of the Agreement.

On July 27, 2012, we entered into an Exploration and Mining Lease and Option to Purchase Agreement (the “Agreement”) with Mountain Gold Exploration, Inc. and Lane A. Griffin and Associates (collectively the “Owner”) wherein we leased the Eaglesville Property from the Owner. The term of the lease is 50 years. Under the terms of the Agreement we are obligated to deliver a total of 600,000 restricted shares of common stock over the next two years and make Advance Royalty Payments of $6,000 upon the execution of the Agreement; $15,000 prior to July 27, 2013; $20,000 prior to July 27, 2014; $30,000 prior to July 27, 2015; $40,000 prior to July 27, 2016; $50,000 prior to July 27, 2017; and $100,000 prior to July 27, 2018 and each year thereafter during the term of the Agreement. In addition we are obligated to pay the Owner a net smelter royalty of 3% from the sale or production of minerals from the property and pay a production royalty equal to 1% of the net smelter returns. The 3% net smelter royalty from the sale or production of minerals from the 58 unpatented lode mining claims only. A 1% net smelter royalty from the sale or production of minerals shall be paid to the lessor from all other mining claims that exist within the Area of Interest outside of the 58 unpatented lode mining claims. Area of Interest is defined as the area within Sections 32, 33, 34 and 35, Township 14 North, Range 33 East; and Sections 2, 3, 4, 5, 8, 9, 10 and 11Township 13 North, Range 33 East . We are also obligated to expend at least $5,000 during the first year of the Agreement; $10,000 the second year; $25,000 the third year; $50,000 the fourth year; and, $100,000 the fifth year and each year thereafter. In addition to the foregoing, we are obligated to perform work assessments on the property required by federal and state laws. In consideration of the foregoing, we have the right to remove all minerals from the property. We also have the right to acquire 1% of the smelter royalty for $1,000,000 and an additional 1% for $3,000,000. We also have the right to purchase the claims underlying the Agreement from Owner in consideration of $400,000. During the term of the lease, we are obligated to pay all fees related thereto and indemnify Owner from any losses incurred by Owner. The Agreement contains additional obligations to be performed by us during the term of the Agreement.

Supplies

Supplies and manpower are readily available for exploration of the claim.

Other

Other than our interest in the claims, we own no other property.

Our Proposed Exploration Program

We plan on conducting geological mapping and additional rock chip and soil sampling, underground rock chip sampling, and if necessary performing hand trenching work to expose bedrock. The object of this work will be to determine if there is an economically recoverable gold-silver resource on the properties. All sample locations will be marked and mapped. The initial phase of work will provide enough information to allow the company to decide whether or not to proceed to the next phase of exploration and warrant follow up drilling.

It will take us two to three weeks to conduct the geological mapping and rock chip sampling, as well as hand trenching, if necessary. It will take approximately another two to three weeks to obtain results from the lab. We will plot all sample locations on enlarged topographic maps and provide GPS with these locations. Thereafter we will begin reverse circulation or core drilling.

Funds will be used for GIS/drafting and data compilation work, land-claim research compilation, claim surveying, staking and recording, grid surveying and installation, sample collecting, hand trenching, geological mapping, supplies, shipping, lab costs, meals, lodging, truck fuel and mileage expenses and labor.

We must conduct exploration to determine what amount of minerals, if any, exist on the properties we lease and if any minerals which are found can be economically extracted and profitably processed. Our interest in the properties is limited to our leasehold interest. Our leases, however, grant us a right to purchase the underlying minerals upon completion of certain conditions .

The properties are undeveloped raw land. Exploration and surveying has not been initiated until we raise additional money. That is because we do not have money to complete exploration.

Before minerals retrieval can begin, we must explore for and find mineralized material. After that has occurred we have to determine if it is economically feasible to remove the mineralized material. Economically feasible means that the costs associated with the removal of the mineralized material will not exceed the price at which we can sell the mineralized material. We can’t predict what that will be until we find mineralized material.

We do not claim to have any minerals or reserves whatsoever at this time on any of the claims.

We cannot provide you with a more detailed discussion of how our exploration program will work and what we expect will be our likelihood of success. That is because we have a piece of raw land and we intend to look for a gold-silver ore body. We may or may not find an ore body. We have the right to prospect, explore, test, develop, work and mine the claims. We hope we do, but it is impossible to predict the likelihood of such an event. The overwhelming likelihood is that there is no ore body on our mineral claims. In addition, the nature and direction of the exploration may change depending upon initial results.

We do not have any plan to take our company to revenue generation. That is because we have not found economic mineralization yet and it is impossible to project revenue generation from nothing.

The following is an outline of the estimated maximum costs of this first phase of exploration of the properties we lease :

|

Consulting Services

|

$

|

50,000

|

|

Survey & Surface Sampling

|

$

|

20,000

|

|

Trenching & Sampling

|

$

|

50,000

|

|

Core Drilling

|

$

|

200,000 – 300,000

|

|

Analyzing Samples

|

$

|

30,000

|

Currently we have approximately $120,000 to begin the first phase of exploration. We will have to raise additional capital to complete the first phase. We intended to obtain the capital from the exercise of our Redeemable Warrants; possible sale of additional shares of common stock; or loans. There is no assurance that we will raise the additional funds to complete the first phase of exploration.

Competitive Factors

The gold mining industry is fragmented, that is there are many, many gold prospectors and producers, small and large. We do not compete with anyone. That is because there is no competition for the exploration or removal of minerals from the claims. We will either find gold on the claims or not. If we do not, we will cease or suspend operations. We are one of the smallest exploration companies in existence. We are an infinitely small participant in the gold mining market. Readily available gold markets exist in the United States and around the world for the sale of gold. Therefore, we will be able to sell any gold that we are able to recover.

Rental Fee Requirement

We are obligated under our agreement with Mountain Gold Claims LLC and Black Rock Exploration LLC to pay the rental fee. The Federal government’s Continuing Act of 2002 extends the requirement of rental or maintenance fees in place of assessment work for filing and holding mining claims with the BLM. All claimants must pay a yearly maintenance fee of $140 per claim for all or part of the mining claim assessment year. The fee must be paid at the State Office of the Bureau of Land Management by August 31, of each year. We have paid this fee through 2012. The assessment year ends on noon of September 1 of each year. The initial maintenance fee is paid at the time the Notice of Location is filed with the BLM and covers the remainder of the assessment year in which the claim was located. There are no exemptions from the initial fee. Some claim holders may qualify for a Small Miner Exemption waiver of the maintenance fee for assessment years after the year in which the claim was located. We do not qualify for a Small Miner Exemption. The following sets forth the BLM fee schedule:

|

Fee Schedule (per claim)

|

|

Location Fee

|

$

|

30.00

|

|

Maintenance Fee

|

$

|

140.00

|

|

Service Charges

|

$

|

10.00

|

|

Transfer Fee

|

$

|

5.00

|

|

Proof of Labor

|

$

|

5.00

|

|

Notice of Intent to Hold

|

$

|

10.50

|

|

Transfer of Interest

|

$

|

10.00

|

|

Amendment

|

$

|

5.00

|

|

Petition for Deferment of Assessment Work

|

$

|

25.00

|

|

Notice of Intent to Locate on Stock Raising Homestead land

|

$

|

25.00

|

The BLM regulations provide for three types of operations on public lands: 1. Casual Use level, 2. Notice level, and 3. Plan of Operation level.

1. Casual Use means activities ordinarily resulting in no or negligible disturbance of the public lands or resources. Casual Use operations involve simple prospecting with hand tools such as picks, shovels, and metal detectors. Small-scale mining devices such as dry washers having engines with less than 10 brake-horsepower are allowed, provided they are fed using only hand tools. Casual Use level operations are not required to file an application to conduct activities or post a financial guarantee.

2. Notice level operations include only exploration activities in which five or less acres of disturbance are proposed. Presently, all Notice Level operations require a written notice and must be bonded for all activities other than reclamation.

3. Plans of Operation activities include all mining and processing (regardless of the size of the proposed disturbance), plus all other activities exceeding five acres of proposed public land disturbance.

Operators are encouraged to conduct a thorough inventory of the claims to determine the full extent of any existing disturbance and to meet with field office personnel at the site before developing an estimate. The inventory should include photographs taken “before” and “after” any mining activity.

If an operator constructs access or uses an existing access way for an operation and would object to BLM blocking, removing, or claiming that access, then the operator must post a financial guarantee that covers the reclamation of the access.

Concurrence by the BLM for occupancy is required whenever residential occupancy is proposed or when fences, gates, or signs will be used to restrict public access or when structures that could be used for shelter are placed on a claim. It is the claimant’s responsibility to prepare a complete notice or plan of operators.

Mining Claims on State Land

The Nevada law authorizing location of claims on State Lands was repealed in 1998. Acquisition of mineral rights on Nevada trust land can only be accomplished by application for a prospecting permit, mineral lease, or lease of common variety materials.

We will secure all necessary permits for exploration and, if development of a claim is warranted, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

We are in compliance with all laws and will continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect our business operations.

We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the claims.

We will secure all necessary permits for exploration and, if development is warranted on a claim, will file final plans of operation before we start any mining operations. At this point, a permit from the BLM would be required. Also, we would be required to comply with the laws of the state of Nevada and federal regulations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of a claim. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

Subcontractors

We intend to use the services of subcontractors for certain exploration work on the properties we lease when deemed necessary. Our interest in the properties is limited to our leasehold interest. Our leases, however, grant us a right to purchase the underlying minerals upon completion of certain conditions. The members of our Technical Advisory Committee will conduct the majority of the surveying, exploration, and excavating of the property. Thomas Callicrate and Roger Walther are the members of the Technical Advisory Committee. Both individuals are based in Nevada and have extensive experience in mining in the state of Nevada, specifically in the areas where we have leased properties are located. The company does not have any contract with either of them but will contract their services on a needed basis . Further, we will hire geologists and engineers as independent contractors on an as needed basis. As of today, we have not looked for or talked to any geologists or engineers who will perform work for us in the future outside of the existing members of our management team and advisory committee. Accordingly, we cannot determine at this time the precise number of people we will retain to perform the foregoing services. Mr. Fralich will handle our administrative duties.

Employees and Employment Agreements

At present, only one of our officers/directors is a full-time employee and will devote all of his time to our operations. That person is Mark Fralich, our president. One other officer, Erik Panke is a part-time employee and will devote about 10% of his time or four hours per week to our operation. Mr. Panke will perform the accounting and bookkeeping services for the corporation. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future.

Claim Interests and Mining Claims in General

Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. If the validity of a patented mining claim is challenged by the BLM or the U.S. Forest Service on the grounds that mineralization has not been demonstrated, the claimant has the burden of proving the present economic feasibility of mining minerals located thereon. Such a challenge might be raised when a patent application is submitted or when the government seeks to include the land in an area to be dedicated to another use.

Reclamation

We generally are required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and re-vegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Government Regulation

Mining operations and exploration activities are subject to various national, state, and local laws and regulations in the United States, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will obtain the licenses, permits or other authorizations currently required to conduct our exploration program. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Idaho, Nevada and the United States.

Our mineral exploration program is subject to the regulations of the Bureau of Land Management. The prospecting on the claims are provided under the existing 1872 Mining Law and all permits for exploration and testing must be obtained through the local Bureau of Land Management office of the Department of Interior. Obtaining permits for minimal disturbance as envisioned by this exploration program will require making the appropriate application and filing of the bond to cover the reclamation of the test areas. From time to time, an archeological clearance may need to be contracted to allow the testing program to proceed.

While conducting surface exploration, we will not utilize heavy equipment. Accordingly, the only BLM regulations that require our compliance will be removal of all portable equipment, cleanup and removal of all trash, and reclamation of all disturbance. If heavy equipment is to be used in the next phase of exploration, including drilling, we will have to comply with all County and BLM environmental regulations involved with either a Notice of Intent to Operate or Plan of Operations which relate to undue and unnecessary degradation of land, minimize cut and fill on roads, legal disposal of any tailings and waste should any major disturbance we generated, plugging of all drill holes in accordance with all county, state and federal regulations and reclamation of all disturbance.

We believe there will be no adverse affect on us as a result of complying with the governmental regulations and at our current stage of operations we do not anticipate any costs related to the governmental regulations.

Environment Regulations

Our activities are subject to various federal and state laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. We intend to conduct business in a way that safeguards public health and the environment. We will conduct our operational compliance with applicable laws and regulations.

Changes to current state or federal laws and regulations, where we intend to operate could in the future require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our project.

During 2012, there were no material environmental incidents or non-compliance with any applicable environmental regulations on the properties.

Our Office

Our office is located at 2555 West Palais Drive, Coeur d’Alene, Idaho 83815. This is also our mailing address. The telephone number is (509) 928-7604. We lease the foregoing office from Timothy Major, pursuant to a written lease. The term of the lease is for 1-year beginning January 1, 2012 ending December 31, 2012 and our monthly rent is $100 per month for a 500 square foot office.

Officers and Directors

Each of our directors serves until his or her successor is elected and qualified. Each of our officers is appointed by the board of directors and serves until he resigns or is replaced. The board of directors has no nominating, auditing or compensation committees.

The names, addresses, ages and positions of our present officers and directors are set forth below:

|

Name and Address

|

Age

|

Position(s)

|

|

Mark A. Fralich

4836 S. Progress Court

Veradale, WA 99037

|

63

|

President and a member of the Board of Directors

|

|

|

|

|

|

Erik Panke

269 Diamond Hitch Dr.

Kellogg, ID 83837

|

48

|

Secretary, Treasurer, Principal Financial Officer, Principal Accounting Officer, and a member of the Board of Directors

|

|

|

|

|

|

Gregory S. Stewart

461 Paradise Lane

Pinehurst, ID 83850

|

47

|

Member of the Board of Directors

|

|

|

|

|

|

Douglas D. Dobbs

8824 South Hilby Rd.

Spokane, WA 99223

|

45

|

Member of the Board of Directors

|

Mark A. Fralich

Mark A. Fralich has been our president and a member of the board of directors since September 2011. From January 2007 to August 2008, Mr. Fralich was a consultant for Mines Management Inc., providing investor relations “Precious Metals seminars” throughout the United States and Canada to Institutional and Retail investors. Mines Management Inc., located in Spokane, Washington, is a U.S.-based exploration and development company engaged in the acquisition, exploration, and development of silver-dominant mineral projects. From August 2008 to February 2010 Mr. Fralich rendered consulting services relating to marketing and investor relations to United Mines Services, Inc., located in Pinehurst, Idaho. Mr. Fralich was involved in the development of all marketing materials as well as marketing the company to Institutional and Retail investors through a variety of mining related conferences and

showcase events. United Mines Services, Inc. was engaged in the business of providing a variety of mine related services relating to mine owners as well as development of the Crescent Silver Mine in the Silver Valley, near Kellogg, Idaho, under the new company name United Silver. From February 2010 to August 2011 Mr. Fralich provide consulting services to Consolidated Goldfields, Inc., located in Reno, Nevada. He was responsible for contacting Institutional and Retail investors with regards to diversification of their investment portfolios, website design, and marketing materials for Consolidated Goldfields, Inc. Consolidated Goldfields, Inc. is a junior gold-silver company involved in a variety of mining areas including exploration, development, and operations for both major and other junior mining companies. From August 2011 to April 2012, Mr. Fralich has been a consultant involved in investor relations for Silver Scott Mines Inc., based out of Hilton Head, S.C. Silver Scott Mines is a development stage precious metals mining company that currently operates in Mexico through a wholly owned subsidiary. Mr. Fralich has been actively involved in contacting Institutional and Retail Investors with the progress of the Silver Scott Mines operations. Mr. Fralich was elected to the board of directors as a result of his many years of experience in mining, specifically in the sector of junior exploration stage companies and his understanding of the business risks associated with junior mining companies and the mining sector as a whole .

Erik Panke

Since January 1, 2012, Erik Panke has been our secretary, treasurer, principal financial officer, principal accounting officer and since February 2012, Mr. Panke has been a member of our board of directors. Since April 2008, Mr. Panke has served as both chief financial officer and controller of United Mine Services, Inc., located in Kellogg, Idaho. United Mine Services, Inc. owns 80% of the Crescent Silver Mine and is also engaged in the business of providing a variety of mine related services to mine owners. United Mine Services is a wholly owned subsidiary of United Silver Corp., which trades on the Toronto Stock Exchange under the symbol USC. From 1986 to March 2008, Mr. Panke worked for Washington Group International, Inc., formerly Morrison Knudsen Corporation, an international engineering, construction, mining, and program management company. He started as a field accountant and progressed to Senior Manager of Business at project sites throughout the United States. He was responsible for all corporate accounting and administrative duties on engineering and construction projects, including cost and budgeting, payroll and human resources administration, client relations and financial statement preparation. Mr. Panke was elected to the board of directors as a result of his many years of experience in mining, specifically in the sector of junior exploration stage companies and his understanding of the business risks associated with junior mining companies and the mining sector as a whole .

Gregory S. Stewart

Since September 2011, Gregory A. Stewart has been a member of our board of directors. Since July 2007, Mr. Stewart has served as president, chief executive officer and a director of United Mine Services, Inc., located in Kellogg, Idaho. United Mine Services, Inc. owns 80% of the Crescent Silver Mine and is also engaged in the business of providing a variety of mine related services to mine owners. United Mine Services is a wholly owned subsidiary of United Silver Corp., which trades on the Toronto Stock Exchange under the symbol USC. Since May 2010, Mr. Stewart has been a director of United Silver Corp., and he was the CEO from May 2010 to September 2010. From 1992 to June 2007, Mr. Stewart was the sole owner of Stewart Contracting, Inc., a heavy civil and environmental remediation company located in Pinehurst Idaho. Stewart Contracting, Inc. provided excavation, road construction, steam restoration, demolition, environmental remediation, and reclamation services to public and private

clients in North Idaho’s Silver Valley. On June 30, 2007, United Mine Services acquired Stewart Contracting and retained Mr. Stewart as president and chief executive officer. Mr. Stewart was elected to the board of directors as a result of his many years of experience in mining, specifically in the sector of junior exploration stage companies and his understanding of the business risks associated with junior mining companies and the mining sector as a whole .

Douglas D. Dobbs

Since February 2012, Douglas D. Dobbs has been a member of our board of directors. Since October 2002, Mr. Dobbs has held several positions with Mines Management, Inc., located in Spokane, Washington. Currently, Mr. Dobbs is the Vice President of Corporate Finance and Development and has served in this position since March 2011. Between June 2005 and March 2011, he served as Mines Management, Inc.’s Vice President of Corporate Development, and continues to serve as Corporate Secretary . Mines Management, Inc. is a U.S.-based exploration and development company engaged in the acquisition, exploration, and development of silver-based dominant mineral projects. Mr. Dobbs was elected to the board of directors as a result of his many years of experience in mining, specifically in the sector of junior exploration stage companies and his understanding of the business risks associated with junior mining companies and the mining sector as a whole .

Involvement in Certain Legal Proceedings

During the past ten years, Messrs. Fralich, Panke, Stewart, and Dobbs have not been the subject of the following events:

|

1.

|

A petition under the Federal bankruptcy laws or any state insolvency law filed by or against, or a receiver, fiscal agent or similar officer appointed by a court for the business or property of such person, or any partnership in which he/she was a general partner at or within two years before the time of such filing, or any corporation or business association of which he/she was an executive officer at or within two years before the time of such filing;

|

|

2.

|

Convicted in a criminal proceeding or named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

3.

|

The subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him/her from, or otherwise limiting, the following activities;

|

|

|

i)

|

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; or

|

|

|

ii)

|

Engaging in any type of business practice; or

|

|

|

iii)

|

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws.

|

|

4.

|

The subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph 3.i in the preceding paragraph or to be associated with persons engaged in any such activity;

|

|

5.

|

Found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

|

|

6.

|

Found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

|

|

7.

|

The subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

|

|

|

i)

|

Any Federal or State securities or commodities law or regulation; or

|

|

|

ii)

|

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or

|

|

|

iii)

|

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

8.

|

Was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Securities Exchange Act of 1934, as amended, (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|