0001543151false--12-312023Q3P12M0.0123701P8Y26700015431512023-01-012023-09-3000015431512023-11-02xbrli:shares00015431512022-12-31iso4217:USD00015431512023-09-30iso4217:USDxbrli:shares00015431512022-07-012022-09-3000015431512023-07-012023-09-3000015431512022-01-012022-09-300001543151us-gaap:NoncontrollingInterestMember2021-12-310001543151us-gaap:CommonStockMember2021-12-310001543151us-gaap:AdditionalPaidInCapitalMember2021-12-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001543151us-gaap:RetainedEarningsMember2021-12-310001543151uber:NonredeemableNoncontrollingInterestMember2021-12-3100015431512021-12-310001543151us-gaap:CommonStockMember2022-01-012022-03-310001543151us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100015431512022-01-012022-03-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001543151us-gaap:NoncontrollingInterestMember2022-01-012022-03-310001543151us-gaap:RetainedEarningsMember2022-01-012022-03-310001543151uber:NonredeemableNoncontrollingInterestMember2022-01-012022-03-310001543151us-gaap:NoncontrollingInterestMember2022-03-310001543151us-gaap:CommonStockMember2022-03-310001543151us-gaap:AdditionalPaidInCapitalMember2022-03-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001543151us-gaap:RetainedEarningsMember2022-03-310001543151uber:NonredeemableNoncontrollingInterestMember2022-03-3100015431512022-03-310001543151us-gaap:CommonStockMember2022-04-012022-06-300001543151us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-3000015431512022-04-012022-06-300001543151us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001543151us-gaap:RetainedEarningsMember2022-04-012022-06-300001543151uber:NonredeemableNoncontrollingInterestMember2022-04-012022-06-300001543151us-gaap:NoncontrollingInterestMember2022-06-300001543151us-gaap:CommonStockMember2022-06-300001543151us-gaap:AdditionalPaidInCapitalMember2022-06-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001543151us-gaap:RetainedEarningsMember2022-06-300001543151uber:NonredeemableNoncontrollingInterestMember2022-06-3000015431512022-06-300001543151us-gaap:CommonStockMember2022-07-012022-09-300001543151us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001543151us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001543151uber:NonredeemableNoncontrollingInterestMember2022-07-012022-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001543151us-gaap:RetainedEarningsMember2022-07-012022-09-300001543151us-gaap:NoncontrollingInterestMember2022-09-300001543151us-gaap:CommonStockMember2022-09-300001543151us-gaap:AdditionalPaidInCapitalMember2022-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001543151us-gaap:RetainedEarningsMember2022-09-300001543151uber:NonredeemableNoncontrollingInterestMember2022-09-3000015431512022-09-300001543151us-gaap:NoncontrollingInterestMember2022-12-310001543151us-gaap:CommonStockMember2022-12-310001543151us-gaap:AdditionalPaidInCapitalMember2022-12-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001543151us-gaap:RetainedEarningsMember2022-12-310001543151uber:NonredeemableNoncontrollingInterestMember2022-12-310001543151us-gaap:CommonStockMember2023-01-012023-03-310001543151us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100015431512023-01-012023-03-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001543151us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001543151us-gaap:RetainedEarningsMember2023-01-012023-03-310001543151uber:NonredeemableNoncontrollingInterestMember2023-01-012023-03-310001543151us-gaap:NoncontrollingInterestMember2023-03-310001543151us-gaap:CommonStockMember2023-03-310001543151us-gaap:AdditionalPaidInCapitalMember2023-03-310001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001543151us-gaap:RetainedEarningsMember2023-03-310001543151uber:NonredeemableNoncontrollingInterestMember2023-03-3100015431512023-03-310001543151us-gaap:CommonStockMember2023-04-012023-06-300001543151us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000015431512023-04-012023-06-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001543151us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001543151us-gaap:RetainedEarningsMember2023-04-012023-06-300001543151uber:NonredeemableNoncontrollingInterestMember2023-04-012023-06-300001543151us-gaap:NoncontrollingInterestMember2023-06-300001543151us-gaap:CommonStockMember2023-06-300001543151us-gaap:AdditionalPaidInCapitalMember2023-06-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001543151us-gaap:RetainedEarningsMember2023-06-300001543151uber:NonredeemableNoncontrollingInterestMember2023-06-3000015431512023-06-300001543151us-gaap:CommonStockMember2023-07-012023-09-300001543151us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001543151us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001543151us-gaap:RetainedEarningsMember2023-07-012023-09-300001543151uber:NonredeemableNoncontrollingInterestMember2023-07-012023-09-300001543151us-gaap:NoncontrollingInterestMember2023-09-300001543151us-gaap:CommonStockMember2023-09-300001543151us-gaap:AdditionalPaidInCapitalMember2023-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001543151us-gaap:RetainedEarningsMember2023-09-300001543151uber:NonredeemableNoncontrollingInterestMember2023-09-300001543151uber:CareemSuperAppMember2023-04-300001543151uber:UberMember2023-04-30xbrli:pure0001543151uber:MobilityMember2022-07-012022-09-300001543151uber:MobilityMember2023-07-012023-09-300001543151uber:MobilityMember2022-01-012022-09-300001543151uber:MobilityMember2023-01-012023-09-300001543151uber:DeliveryMember2022-07-012022-09-300001543151uber:DeliveryMember2023-07-012023-09-300001543151uber:DeliveryMember2022-01-012022-09-300001543151uber:DeliveryMember2023-01-012023-09-300001543151uber:FreightMember2022-07-012022-09-300001543151uber:FreightMember2023-07-012023-09-300001543151uber:FreightMember2022-01-012022-09-300001543151uber:FreightMember2023-01-012023-09-300001543151uber:UnitedStatesAndCanadaMember2022-07-012022-09-300001543151uber:UnitedStatesAndCanadaMember2023-07-012023-09-300001543151uber:UnitedStatesAndCanadaMember2022-01-012022-09-300001543151uber:UnitedStatesAndCanadaMember2023-01-012023-09-300001543151srt:LatinAmericaMember2022-07-012022-09-300001543151srt:LatinAmericaMember2023-07-012023-09-300001543151srt:LatinAmericaMember2022-01-012022-09-300001543151srt:LatinAmericaMember2023-01-012023-09-300001543151us-gaap:EMEAMember2022-07-012022-09-300001543151us-gaap:EMEAMember2023-07-012023-09-300001543151us-gaap:EMEAMember2022-01-012022-09-300001543151us-gaap:EMEAMember2023-01-012023-09-300001543151srt:AsiaPacificMember2022-07-012022-09-300001543151srt:AsiaPacificMember2023-07-012023-09-300001543151srt:AsiaPacificMember2022-01-012022-09-300001543151srt:AsiaPacificMember2023-01-012023-09-3000015431512023-10-012023-09-3000015431512024-10-012023-09-300001543151us-gaap:USTreasuryAndGovernmentMember2022-12-310001543151us-gaap:USTreasuryAndGovernmentMember2023-09-300001543151us-gaap:CommercialPaperMember2022-12-310001543151us-gaap:CommercialPaperMember2023-09-300001543151us-gaap:CorporateBondSecuritiesMember2022-12-310001543151us-gaap:CorporateBondSecuritiesMember2023-09-300001543151us-gaap:CertificatesOfDepositMember2022-12-310001543151us-gaap:CertificatesOfDepositMember2023-09-300001543151uber:DidiEquitySecuritiesMember2022-12-310001543151uber:DidiEquitySecuritiesMember2023-09-300001543151uber:OtherEquitySecuritiesMember2022-12-310001543151uber:OtherEquitySecuritiesMember2023-09-300001543151uber:GrabEquitySecuritiesMember2022-12-310001543151uber:GrabEquitySecuritiesMember2023-09-300001543151uber:AuroraEquitySecuritiesMember2022-12-310001543151uber:AuroraEquitySecuritiesMember2023-09-300001543151us-gaap:RelatedPartyMember2022-12-310001543151us-gaap:RelatedPartyMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001543151us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CallOptionMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CallOptionMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151us-gaap:CallOptionMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001543151uber:ZomatoMember2022-09-300001543151uber:ZomatoMember2022-07-012022-09-300001543151us-gaap:EquitySecuritiesMember2022-12-310001543151us-gaap:NotesReceivableMember2022-12-310001543151us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310001543151us-gaap:EquitySecuritiesMember2023-01-012023-09-300001543151us-gaap:NotesReceivableMember2023-01-012023-09-300001543151us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-01-012023-09-300001543151us-gaap:EquitySecuritiesMember2023-09-300001543151us-gaap:NotesReceivableMember2023-09-300001543151us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2023-09-300001543151uber:DidiEquitySecuritiesMember2022-07-012022-09-300001543151uber:DidiEquitySecuritiesMember2022-01-012022-09-300001543151uber:DidiEquitySecuritiesMember2023-07-012023-09-300001543151uber:DidiEquitySecuritiesMember2023-01-012023-09-300001543151uber:MLUB.V.Member2022-12-310001543151uber:MLUB.V.Member2023-09-300001543151uber:MissionBay3And4Member2022-12-310001543151uber:MissionBay3And4Member2023-09-300001543151uber:OtherEquityMethodInvestmentsMember2022-12-310001543151uber:OtherEquityMethodInvestmentsMember2023-09-300001543151uber:MLUB.V.Member2023-04-210001543151uber:MLUB.V.Member2023-04-212023-04-210001543151uber:MLUB.V.Memberus-gaap:CallOptionMember2021-08-300001543151uber:MLUB.V.Memberus-gaap:CallOptionMember2022-09-300001543151uber:MLUB.V.Memberus-gaap:CallOptionMember2022-01-012022-09-300001543151uber:MLUB.V.Memberus-gaap:CallOptionMemberus-gaap:MeasurementInputExpectedTermMember2022-09-300001543151uber:MLUB.V.Memberus-gaap:CallOptionMemberus-gaap:MeasurementInputOptionVolatilityMember2022-09-300001543151uber:MobilityMember2022-12-310001543151uber:DeliveryMember2022-12-310001543151uber:FreightMember2022-12-310001543151uber:MobilityMember2023-01-012023-09-300001543151uber:DeliveryMember2023-01-012023-09-300001543151uber:FreightMember2023-01-012023-09-300001543151uber:MobilityMember2023-09-300001543151uber:DeliveryMember2023-09-300001543151uber:FreightMember2023-09-300001543151us-gaap:CustomerRelationshipsMember2022-12-310001543151us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001543151us-gaap:TrademarksAndTradeNamesMember2022-12-310001543151us-gaap:CustomerRelationshipsMember2023-09-300001543151us-gaap:TechnologyBasedIntangibleAssetsMember2023-09-300001543151us-gaap:TrademarksAndTradeNamesMember2023-09-300001543151uber:A2025RefinancedTermLoanMemberus-gaap:SecuredDebtMember2022-12-310001543151uber:A2025RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-09-300001543151uber:A2027RefinancedTermLoanMemberus-gaap:SecuredDebtMember2022-12-310001543151uber:A2027RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-09-300001543151uber:A2030RefinancedTermLoanMemberus-gaap:SecuredDebtMember2022-12-310001543151uber:A2030RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-09-300001543151uber:A2025SeniorNoteMemberus-gaap:SeniorNotesMember2022-12-310001543151uber:A2025SeniorNoteMemberus-gaap:SeniorNotesMember2023-09-300001543151us-gaap:SeniorNotesMemberuber:SeniorNote2026Member2022-12-310001543151us-gaap:SeniorNotesMemberuber:SeniorNote2026Member2023-09-300001543151uber:SeniorNote2027Memberus-gaap:SeniorNotesMember2022-12-310001543151uber:SeniorNote2027Memberus-gaap:SeniorNotesMember2023-09-300001543151uber:SeniorNote2028Memberus-gaap:SeniorNotesMember2022-12-310001543151uber:SeniorNote2028Memberus-gaap:SeniorNotesMember2023-09-300001543151us-gaap:SeniorNotesMemberuber:SeniorNotes2029Member2022-12-310001543151us-gaap:SeniorNotesMemberuber:SeniorNotes2029Member2023-09-300001543151us-gaap:ConvertibleDebtMemberuber:A2025ConvertibleNoteMember2022-12-310001543151us-gaap:ConvertibleDebtMemberuber:A2025ConvertibleNoteMember2023-09-300001543151uber:A2030RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-03-030001543151uber:A2025RefinancedTermLoanMemberus-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Member2023-03-030001543151uber:A2027RefinancedTermLoanMemberus-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Member2023-03-030001543151uber:A2027RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-03-140001543151uber:RefinancedTermLoansMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2023-03-012023-03-310001543151srt:MinimumMemberuber:RefinancedTermLoansMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:SecuredDebtMember2023-03-012023-03-310001543151uber:A2030RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-01-012023-09-300001543151uber:A2025And2027RefinancedTermLoanMemberus-gaap:SecuredDebtMember2023-01-012023-09-300001543151uber:A2030RefinancedTermLoanMemberus-gaap:SecuredDebtMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151uber:ImmaterialErrorsMembersrt:RestatementAdjustmentMember2023-01-012023-03-310001543151us-gaap:ConvertibleDebtMemberuber:A2025ConvertibleNoteMember2020-12-310001543151us-gaap:ConvertibleDebtMemberuber:DebtConversionTermsOneMemberuber:A2025ConvertibleNoteMember2020-12-012020-12-31uber:day0001543151us-gaap:ConvertibleDebtMemberuber:DebtConversionTermsTwoMemberuber:A2025ConvertibleNoteMember2020-12-012020-12-310001543151us-gaap:ConvertibleDebtMemberuber:A2025ConvertibleNoteMember2020-12-012020-12-310001543151us-gaap:ConvertibleDebtMemberuber:A2025ConvertibleNoteMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151uber:A2025SeniorNoteMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151uber:SeniorNote2026Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151uber:SeniorNote2027Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151uber:SeniorNote2028Memberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151us-gaap:SeniorNotesMemberuber:SeniorNotes2029Memberus-gaap:FairValueInputsLevel2Member2023-09-300001543151us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001543151us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-04-030001543151us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-04-040001543151us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300001543151us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-07-280001543151us-gaap:RevolvingCreditFacilityMemberuber:FreightHoldingMemberuber:FreightHoldingMember2023-02-012023-02-280001543151us-gaap:RevolvingCreditFacilityMemberuber:FreightHoldingMember2023-09-300001543151us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2022-12-310001543151us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2023-09-30utr:Rate0001543151us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001543151us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-09-300001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001543151us-gaap:AccumulatedTranslationAdjustmentMember2022-09-300001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-09-300001543151us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001543151us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-09-300001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-09-300001543151us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001543151us-gaap:AccumulatedTranslationAdjustmentMember2023-09-300001543151us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-09-300001543151uber:AuroraEquitySecuritiesMember2022-07-012022-09-300001543151uber:AuroraEquitySecuritiesMember2022-01-012022-09-300001543151uber:GrabEquitySecuritiesMember2022-01-012022-09-300001543151uber:ZomatoMember2022-01-012022-09-300001543151us-gaap:OtherInvestmentsMember2022-01-012022-09-300001543151uber:AuroraEquitySecuritiesMember2023-07-012023-09-300001543151uber:JobyEquitySecuritiesMember2023-07-012023-09-300001543151uber:GrabEquitySecuritiesMember2023-07-012023-09-300001543151uber:AuroraEquitySecuritiesMember2023-01-012023-09-300001543151uber:GrabEquitySecuritiesMember2023-01-012023-09-300001543151uber:JobyEquitySecuritiesMember2023-01-012023-09-30uber:equityCompensationPlan0001543151us-gaap:StockAppreciationRightsSARSMember2022-12-310001543151us-gaap:EmployeeStockOptionMember2022-12-3100015431512022-01-012022-12-310001543151us-gaap:StockAppreciationRightsSARSMember2023-01-012023-09-300001543151us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001543151us-gaap:StockAppreciationRightsSARSMember2023-09-300001543151us-gaap:EmployeeStockOptionMember2023-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2022-12-310001543151us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2023-09-300001543151uber:OperationsAndSupportMember2022-07-012022-09-300001543151uber:OperationsAndSupportMember2023-07-012023-09-300001543151uber:OperationsAndSupportMember2022-01-012022-09-300001543151uber:OperationsAndSupportMember2023-01-012023-09-300001543151us-gaap:SellingAndMarketingExpenseMember2022-07-012022-09-300001543151us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-300001543151us-gaap:SellingAndMarketingExpenseMember2022-01-012022-09-300001543151us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001543151us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-300001543151us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001543151us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-300001543151us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001543151us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001543151us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001543151us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001543151us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001543151uber:RestrictedStockAwardsRestrictedStockUnitsAndStockAppreciationRightsMember2023-09-300001543151uber:RestrictedStockAwardsRestrictedStockUnitsAndStockAppreciationRightsMember2023-01-012023-09-300001543151us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001543151us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001543151us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001543151us-gaap:RestrictedStockMember2022-07-012022-09-300001543151us-gaap:RestrictedStockMember2023-07-012023-09-300001543151us-gaap:RestrictedStockMember2022-01-012022-09-300001543151us-gaap:RestrictedStockMember2023-01-012023-09-300001543151us-gaap:EmployeeStockMember2022-07-012022-09-300001543151us-gaap:EmployeeStockMember2023-07-012023-09-300001543151us-gaap:EmployeeStockMember2022-01-012022-09-300001543151us-gaap:EmployeeStockMember2023-01-012023-09-300001543151uber:A2025ConvertibleNoteMember2022-07-012022-09-300001543151uber:A2025ConvertibleNoteMember2023-07-012023-09-300001543151uber:A2025ConvertibleNoteMember2022-01-012022-09-300001543151uber:A2025ConvertibleNoteMember2023-01-012023-09-300001543151uber:TheCareemNotesMember2022-07-012022-09-300001543151uber:TheCareemNotesMember2023-07-012023-09-300001543151uber:TheCareemNotesMember2022-01-012022-09-300001543151uber:TheCareemNotesMember2023-01-012023-09-300001543151us-gaap:RedeemableConvertiblePreferredStockMember2022-07-012022-09-300001543151us-gaap:RedeemableConvertiblePreferredStockMember2023-07-012023-09-300001543151us-gaap:RedeemableConvertiblePreferredStockMember2022-01-012022-09-300001543151us-gaap:RedeemableConvertiblePreferredStockMember2023-01-012023-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001543151us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001543151us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001543151us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001543151us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001543151us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001543151us-gaap:CommonStockSubjectToMandatoryRedemptionMember2022-07-012022-09-300001543151us-gaap:CommonStockSubjectToMandatoryRedemptionMember2023-07-012023-09-300001543151us-gaap:CommonStockSubjectToMandatoryRedemptionMember2022-01-012022-09-300001543151us-gaap:CommonStockSubjectToMandatoryRedemptionMember2023-01-012023-09-300001543151us-gaap:EmployeeStockMember2022-07-012022-09-300001543151us-gaap:EmployeeStockMember2023-07-012023-09-300001543151us-gaap:EmployeeStockMember2022-01-012022-09-300001543151us-gaap:EmployeeStockMember2023-01-012023-09-300001543151uber:WarrantsToPurchaseCommonStockMember2022-07-012022-09-300001543151uber:WarrantsToPurchaseCommonStockMember2023-07-012023-09-300001543151uber:WarrantsToPurchaseCommonStockMember2022-01-012022-09-300001543151uber:WarrantsToPurchaseCommonStockMember2023-01-012023-09-300001543151us-gaap:ConvertibleNotesPayableMember2022-07-012022-09-300001543151us-gaap:ConvertibleNotesPayableMember2023-07-012023-09-300001543151us-gaap:ConvertibleNotesPayableMember2022-01-012022-09-300001543151us-gaap:ConvertibleNotesPayableMember2023-01-012023-09-30uber:segment0001543151us-gaap:OperatingSegmentsMemberuber:MobilityMember2022-07-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:MobilityMember2023-07-012023-09-300001543151us-gaap:OperatingSegmentsMemberuber:MobilityMember2022-01-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:MobilityMember2023-01-012023-09-300001543151us-gaap:OperatingSegmentsMemberuber:DeliveryMember2022-07-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:DeliveryMember2023-07-012023-09-300001543151us-gaap:OperatingSegmentsMemberuber:DeliveryMember2022-01-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:DeliveryMember2023-01-012023-09-300001543151us-gaap:OperatingSegmentsMemberuber:FreightMember2022-07-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:FreightMember2023-07-012023-09-300001543151us-gaap:OperatingSegmentsMemberuber:FreightMember2022-01-012022-09-300001543151us-gaap:OperatingSegmentsMemberuber:FreightMember2023-01-012023-09-300001543151us-gaap:OperatingSegmentsMember2022-07-012022-09-300001543151us-gaap:OperatingSegmentsMember2023-07-012023-09-300001543151us-gaap:OperatingSegmentsMember2022-01-012022-09-300001543151us-gaap:OperatingSegmentsMember2023-01-012023-09-300001543151us-gaap:MaterialReconcilingItemsMember2022-07-012022-09-300001543151us-gaap:MaterialReconcilingItemsMember2023-07-012023-09-300001543151us-gaap:MaterialReconcilingItemsMember2022-01-012022-09-300001543151us-gaap:MaterialReconcilingItemsMember2023-01-012023-09-3000015431512023-06-012023-06-30iso4217:GBP00015431512023-09-012023-09-300001543151us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001543151us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-09-300001543151us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001543151us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-09-300001543151uber:MooveMember2021-02-122021-02-1200015431512021-02-1200015431512021-02-122021-02-120001543151uber:MooveMember2023-09-300001543151uber:FreightHoldingMember2022-12-310001543151uber:FreightHoldingMember2023-09-300001543151uber:FreightHoldingMemberuber:A2020FreightSeriesAInvestorMemberus-gaap:PrivatePlacementMember2020-10-012020-10-310001543151us-gaap:PrivatePlacementMemberuber:UberFreightHoldingCorporationMember2020-10-012020-10-310001543151uber:FreightHoldingMemberuber:A2020FreightSeriesAInvestorMemberus-gaap:PrivatePlacementMember2022-08-012022-08-310001543151uber:NelsonChaiMember2023-01-012023-09-300001543151uber:NelsonChaiMember2023-07-012023-09-300001543151uber:NelsonChaiMember2023-09-300001543151uber:TonyWestMember2023-07-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

FORM 10-Q

____________________________________________

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____ to _____

Commission File Number: 001-38902

____________________________________________

UBER TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

____________________________________________________________________________

| | | | | |

| Delaware | 45-2647441 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1515 3rd Street

San Francisco, California 94158

(Address of principal executive offices, including zip code)

(415) 612-8582

(Registrant’s telephone number, including area code)

____________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share | | UBER | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant's common stock outstanding as of November 2, 2023 was 2,057,858,230.

UBER TECHNOLOGIES, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | Pages |

| | |

| | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | | |

| Item 6. | | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q, including statements regarding our future results of operations or financial condition, business strategy and plans, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “hope,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

•our ability to successfully defend litigation and government proceedings brought against us, including with respect to our relationship with drivers and couriers, and the potential impact on our business operations and financial performance if we are not successful;

•our ability to successfully compete in highly competitive markets;

•our expectations regarding financial performance, including but not limited to revenue, achieving or maintaining profitability, ability to generate positive Adjusted EBITDA or Free Cash Flow, expenses, and other results of operations;

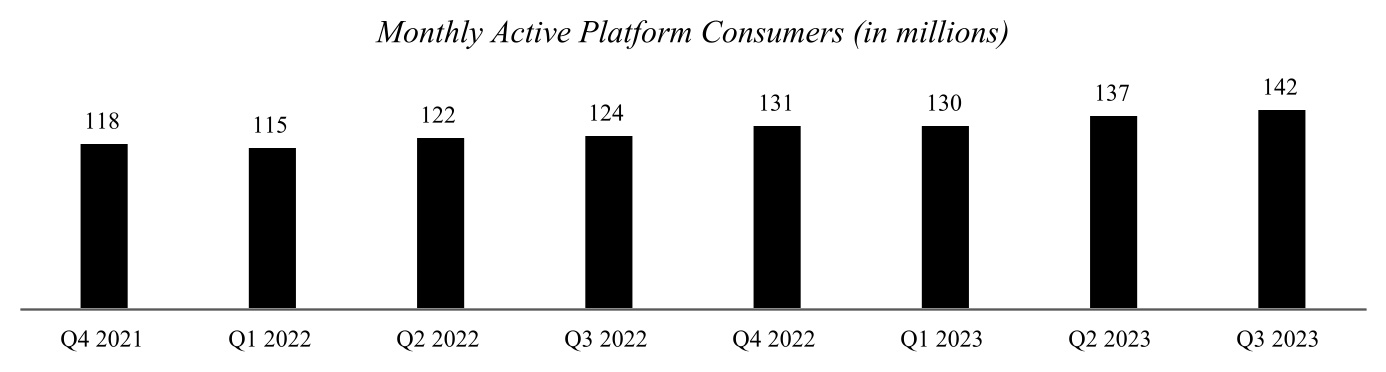

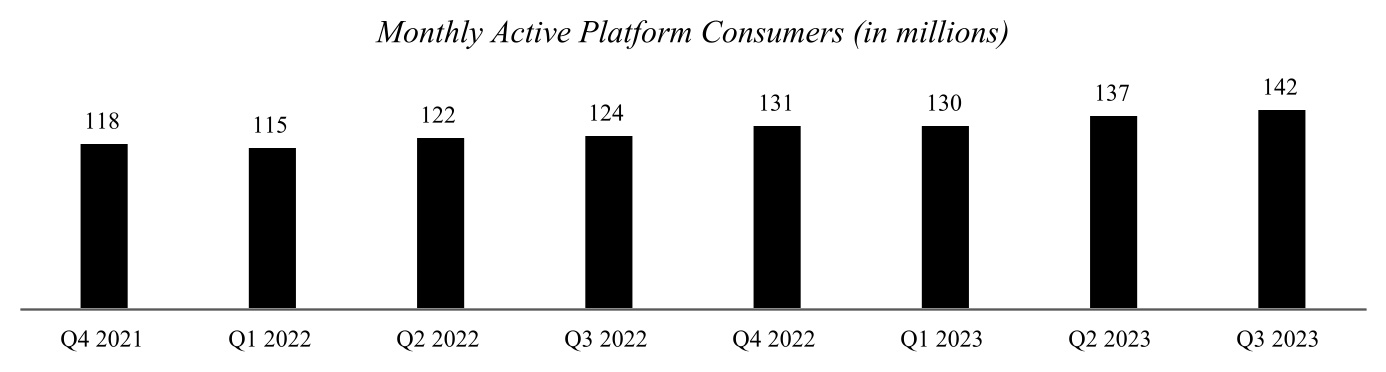

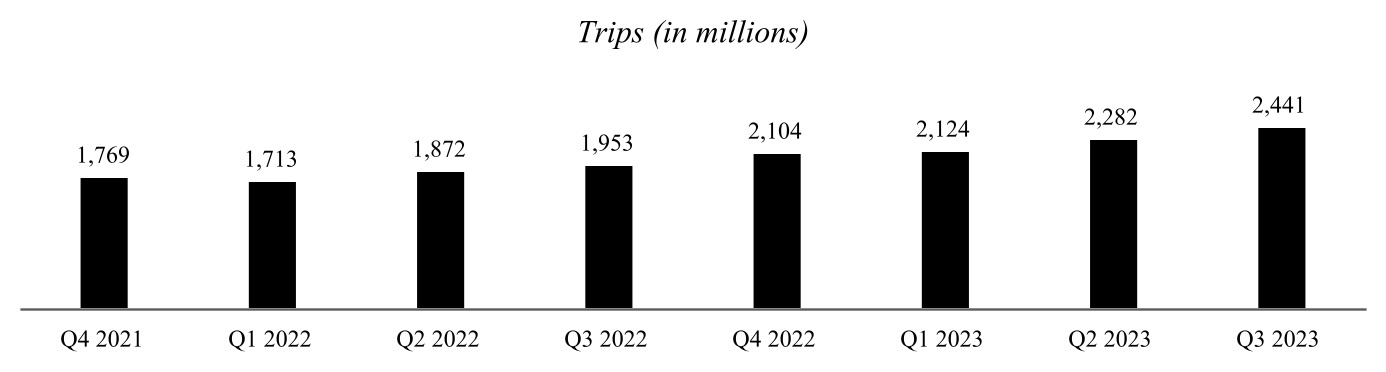

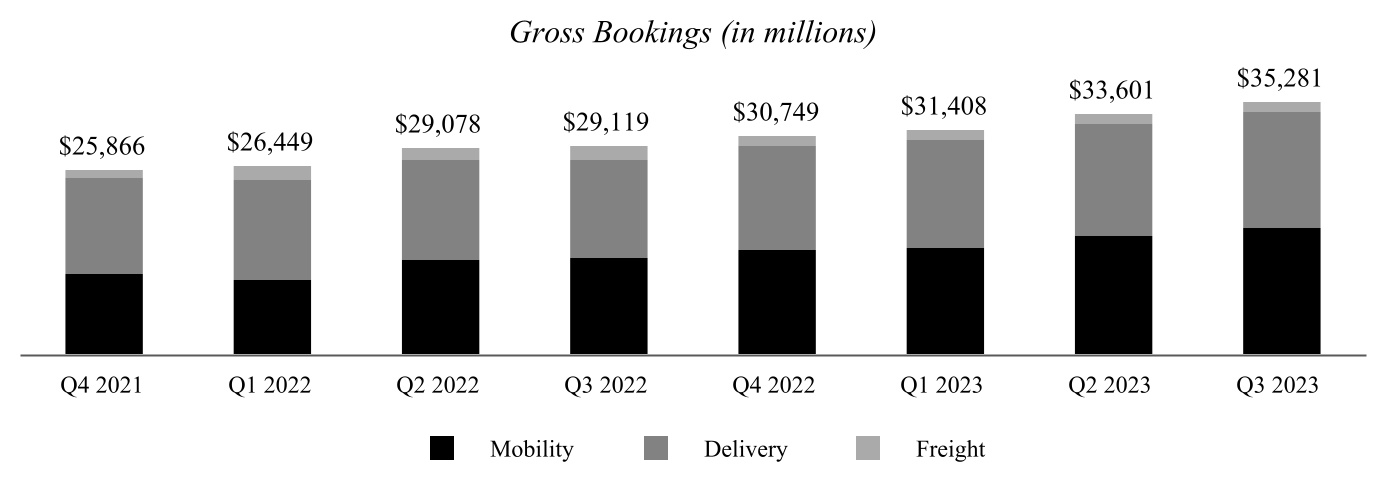

•our expectations regarding future operating performance, including but not limited to our expectations regarding future Monthly Active Platform Consumers (“MAPCs”), Trips, Gross Bookings, and Revenue Margin;

•our expectations regarding our competitors’ use of incentives and promotions, our competitors’ ability to raise capital, and the effects of such incentives and promotions on our growth and results of operations;

•our anticipated investments in new products and offerings, and the effect of these investments on our results of operations;

•our anticipated capital expenditures and our estimates regarding our capital requirements;

•our ability to close and integrate acquisitions into our operations;

•anticipated technology trends and developments and our ability to address those trends and developments with our products and offerings;

•the size of our addressable markets, market share, category positions, and market trends, including our ability to grow our business in the countries we have identified as expansion markets;

•the safety, affordability, and convenience of our platform and our offerings;

•our ability to identify, recruit, and retain skilled personnel, including key members of senior management;

•our ability to effectively manage our growth and maintain and improve our corporate culture;

•our expected growth in the number of platform users, and our ability to promote our brand and attract and retain platform users;

•our ability to maintain, protect, and enhance our intellectual property rights;

•our ability to introduce new products and offerings and enhance existing products and offerings;

•our ability to successfully enter into new geographies, expand our presence in countries in which we are limited by regulatory restrictions, and manage our international expansion;

•our ability to successfully renew licenses to operate our business in certain jurisdictions;

•our ability to successfully respond to global economic conditions, including rising inflation and interest rates;

•the availability of capital to grow our business;

•volatility in the business or stock price of our minority-owned companies;

•our ability to meet the requirements of our existing debt and draw on our line of credit;

•our ability to prevent disturbances to our information technology systems;

•our ability to comply with existing, modified, or new laws and regulations applying to our business;

•the impact of contagious disease or outbreaks of viruses, disease or pandemics on our business, results of operations, financial position and cash flows; and

•our ability to implement, maintain, and improve our internal control over financial reporting.

Actual events or results may differ from those expressed in forward-looking statements. As such, you should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Quarterly Report on Form 10-Q primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results, prospects, strategy, and financial needs. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, assumptions, and other factors described in the section titled “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q. Moreover, we operate in a highly competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Quarterly Report on Form 10-Q. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Quarterly Report on Form 10-Q. While we believe that such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Quarterly Report on Form 10-Q speak only as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information, actual results, revised expectations, or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions, except share amounts which are reflected in thousands, and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | |

| | As of December 31, 2022 | | As of September 30, 2023 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 4,208 | | | $ | 4,448 | |

| Short-term investments | | 103 | | | 725 | |

| Restricted cash and cash equivalents | | 680 | | | 833 | |

Accounts receivable, net of allowance of $80 and $84, respectively | | 2,779 | | | 3,000 | |

| Prepaid expenses and other current assets | | 1,479 | | | 1,673 | |

| Total current assets | | 9,249 | | | 10,679 | |

| Restricted cash and cash equivalents | | 1,789 | | | 1,584 | |

| Restricted investments | | 1,614 | | | 3,944 | |

| Investments | | 4,401 | | | 5,091 | |

| Equity method investments | | 870 | | | 50 | |

| Property and equipment, net | | 2,082 | | | 2,100 | |

| Operating lease right-of-use assets | | 1,449 | | | 1,259 | |

| Intangible assets, net | | 1,874 | | | 1,511 | |

| Goodwill | | 8,263 | | | 8,140 | |

| Other assets | | 518 | | | 1,591 | |

| Total assets | | $ | 32,109 | | | $ | 35,949 | |

| Liabilities, redeemable non-controlling interests and equity | | | | |

| Accounts payable | | $ | 728 | | | $ | 799 | |

| Short-term insurance reserves | | 1,692 | | | 1,823 | |

| Operating lease liabilities, current | | 201 | | | 174 | |

| Accrued and other current liabilities | | 6,232 | | | 6,609 | |

| Total current liabilities | | 8,853 | | | 9,405 | |

| Long-term insurance reserves | | 3,028 | | | 4,337 | |

| Long-term debt, net of current portion | | 9,265 | | | 9,252 | |

| Operating lease liabilities, non-current | | 1,673 | | | 1,565 | |

| Other long-term liabilities | | 786 | | | 871 | |

| Total liabilities | | 23,605 | | | 25,430 | |

| Commitments and contingencies (Note 12) | | | | |

| Redeemable non-controlling interests | | 430 | | | 394 | |

| Equity | | | | |

Common stock, $0.00001 par value, 5,000,000 shares authorized for both periods, 2,005,486 and 2,053,437 shares issued and outstanding, respectively | | — | | | — | |

| Additional paid-in capital | | 40,550 | | | 42,147 | |

| Accumulated other comprehensive loss | | (443) | | | (480) | |

| Accumulated deficit | | (32,767) | | | (32,309) | |

| Total Uber Technologies, Inc. stockholders' equity | | 7,340 | | | 9,358 | |

| Non-redeemable non-controlling interests | | 734 | | | 767 | |

| Total equity | | 8,074 | | | 10,125 | |

| Total liabilities, redeemable non-controlling interests and equity | | $ | 32,109 | | | $ | 35,949 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share amounts which are reflected in thousands, and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2023 | | 2022 | | 2023 |

| Revenue | | $ | 8,343 | | | $ | 9,292 | | | $ | 23,270 | | | $ | 27,345 | |

| Costs and expenses | | | | | | | | |

| Cost of revenue, exclusive of depreciation and amortization shown separately below | | 5,173 | | | 5,626 | | | 14,352 | | | 16,400 | |

| Operations and support | | 617 | | | 683 | | | 1,808 | | | 1,987 | |

| Sales and marketing | | 1,153 | | | 941 | | | 3,634 | | | 3,421 | |

| Research and development | | 760 | | | 797 | | | 2,051 | | | 2,380 | |

| General and administrative | | 908 | | | 646 | | | 2,391 | | | 2,079 | |

| Depreciation and amortization | | 227 | | | 205 | | | 724 | | | 620 | |

| Total costs and expenses | | 8,838 | | | 8,898 | | | 24,960 | | | 26,887 | |

| Income (loss) from operations | | (495) | | | 394 | | | (1,690) | | | 458 | |

| Interest expense | | (146) | | | (166) | | | (414) | | | (478) | |

| Other income (expense), net | | (535) | | | (52) | | | (7,796) | | | 513 | |

| Income (loss) before income taxes and income from equity method investments | | (1,176) | | | 176 | | | (9,900) | | | 493 | |

| Provision for (benefit from) income taxes | | 58 | | | (40) | | | (97) | | | 80 | |

| Income from equity method investments | | 30 | | | 3 | | | 65 | | | 43 | |

| Net income (loss) including non-controlling interests | | (1,204) | | | 219 | | | (9,738) | | | 456 | |

| Less: net income (loss) attributable to non-controlling interests, net of tax | | 2 | | | (2) | | | (2) | | | (2) | |

| Net income (loss) attributable to Uber Technologies, Inc. | | $ | (1,206) | | | $ | 221 | | | $ | (9,736) | | | $ | 458 | |

| Net income (loss) per share attributable to Uber Technologies, Inc. common stockholders: | | | | | | | | |

| Basic | | $ | (0.61) | | | $ | 0.11 | | | $ | (4.96) | | | $ | 0.23 | |

| Diluted | | $ | (0.61) | | | $ | 0.10 | | | $ | (4.97) | | | $ | 0.20 | |

| Weighted-average shares used to compute net income (loss) per share attributable to common stockholders: | | | | | | | | |

| Basic | | 1,979,299 | | | 2,044,688 | | | 1,964,483 | | | 2,027,148 | |

| Diluted | | 1,979,299 | | | 2,108,479 | | | 1,968,228 | | | 2,080,686 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2023 | | 2022 | | 2023 |

| Net income (loss) including non-controlling interests | | $ | (1,204) | | | $ | 219 | | | $ | (9,738) | | | $ | 456 | |

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Change in foreign currency translation adjustment | | 295 | | | (37) | | | 114 | | | (35) | |

| Change in unrealized gain (loss) on investments in available-for-sale debt securities | | — | | | — | | | — | | | (2) | |

| Other comprehensive income (loss), net of tax | | 295 | | | (37) | | | 114 | | | (37) | |

| Comprehensive income (loss) including non-controlling interests | | (909) | | | 182 | | | (9,624) | | | 419 | |

| Less: comprehensive income (loss) attributable to non-controlling interests | | 2 | | | (2) | | | (2) | | | (2) | |

| Comprehensive income (loss) attributable to Uber Technologies, Inc. | | $ | (911) | | | $ | 184 | | | $ | (9,622) | | | $ | 421 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF REDEEMABLE NON-CONTROLLING INTERESTS AND EQUITY

(In millions, except share amounts which are reflected in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redeemable Non-Controlling Interests | | | Common Stock | | Additional Paid-In Capital | | | | | | | | | Accumulated Other Comprehensive Income (Loss) | | Accumulated Deficit | | Non-Redeemable Non-Controlling Interests | | Total Equity |

| | | | Shares | | Amount | | | | | | | | |

| Balance as of December 31, 2021 | | $ | 204 | | | | 1,949,316 | | | $ | — | | | $ | 38,608 | | | | | | | | | | $ | (524) | | | $ | (23,626) | | | $ | 687 | | | $ | 15,145 | |

| Exercise of stock options | | — | | | | 1,093 | | | — | | | 6 | | | | | | | | | | — | | | — | | | — | | | 6 | |

| Stock-based compensation | | — | | | | — | | | — | | | 369 | | | | | | | | | | — | | | — | | | — | | | 369 | |

| Issuance of common stock for settlement of RSUs | | — | | | | 9,569 | | | — | | | — | | | | | | | | | | — | | | — | | | — | | | — | |

| Shares withheld related to net share settlement | | — | | | | (316) | | | — | | | (11) | | | | | | | | | | — | | | — | | | — | | | (11) | |

| Issuance of common stock for settlement of contingent consideration liability | | — | | | | 132 | | | — | | | 5 | | | | | | | | | | — | | | — | | | — | | | 5 | |

| Foreign currency translation adjustment | | — | | | | — | | | — | | | — | | | | | | | | | | 19 | | | — | | | — | | | 19 | |

| Net income (loss) | | 1 | | | | — | | | — | | | — | | | | | | | | | | — | | | (5,930) | | | 10 | | | (5,920) | |

| Balance as of March 31, 2022 | | 205 | | | | 1,959,794 | | | — | | | 38,977 | | | | | | | | | | (505) | | | (29,556) | | | 697 | | | 9,613 | |

| Exercise of stock options | | — | | | | 1,376 | | | — | | | 5 | | | | | | | | | | — | | | — | | | — | | | 5 | |

| Stock-based compensation | | — | | | | — | | | — | | | 484 | | | | | | | | | | — | | | — | | | — | | | 484 | |

| Issuance of common stock for settlement of RSUs | | — | | | | 12,146 | | | — | | | — | | | | | | | | | | — | | | — | | | — | | | — | |

| Issuance of common stock under the Employee Stock Purchase Plan | | — | | | | 2,988 | | | — | | | 59 | | | | | | | | | | — | | | — | | | — | | | 59 | |

| Shares withheld related to net share settlement | | — | | | | (79) | | | — | | | (2) | | | | | | | | | | — | | | — | | | — | | | (2) | |

| Foreign currency translation adjustment | | (3) | | | | — | | | — | | | — | | | | | | | | | | (200) | | | — | | | — | | | (200) | |

| Recognition of non-controlling interest upon capital investment | | 18 | | | | — | | | — | | | — | | | | | | | | | | — | | | — | | | — | | | — | |

| Net income (loss) | | (26) | | | | — | | | — | | | — | | | | | | | | | | — | | | (2,601) | | | 11 | | | (2,590) | |

| Balance as of June 30, 2022 | | 194 | | | | 1,976,225 | | | — | | | 39,523 | | | | | | | | | | (705) | | | (32,157) | | | 708 | | | 7,369 | |

| Exercise of stock options | | — | | | | 894 | | | — | | | 5 | | | | | | | | | | — | | | — | | | — | | | 5 | |

| Stock-based compensation | | — | | | | — | | | — | | | 494 | | | | | | | | | | — | | | — | | | — | | | 494 | |

| Issuance of common stock for settlement of RSUs | | — | | | | 13,355 | | | — | | | — | | | | | | | | | | — | | | — | | | — | | | — | |

| Issuance of Freight subsidiary preferred stock | | 250 | | | | — | | | — | | | — | | | | | | | | | | — | | | — | | | — | | | — | |

| Recognition of non-controlling interest upon issuance of subsidiary stock | | — | | | | — | | | — | | | — | | | | | | | | | | — | | | — | | | 5 | | | 5 | |

| Shares withheld related to net share settlement | | — | | | | (78) | | | — | | | (2) | | | | | | | | | | — | | | — | | | — | | | (2) | |

| Foreign currency translation adjustment | | (6) | | | | — | | | — | | | — | | | | | | | | | | 295 | | | — | | | — | | | 295 | |

| Net income (loss) | | (8) | | | | — | | | — | | | — | | | | | | | | | | — | | | (1,206) | | | 10 | | | (1,196) | |

| Balance as of September 30, 2022 | | $ | 430 | | | | 1,990,396 | | | $ | — | | | $ | 40,020 | | | | | | | | | | $ | (410) | | | $ | (33,363) | | | $ | 723 | | | $ | 6,970 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF REDEEMABLE NON-CONTROLLING INTERESTS AND EQUITY

(In millions, except share amounts which are reflected in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Redeemable Non-Controlling Interests | | | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated Deficit | | Non-Redeemable Non-Controlling Interests | | Total Equity | | | | | | | |

| | | | Shares | | Amount | | | | | | | | | | | | |

| Balance as of December 31, 2022 | | $ | 430 | | | | 2,005,486 | | | $ | — | | | $ | 40,550 | | | $ | (443) | | | $ | (32,767) | | | $ | 734 | | | $ | 8,074 | | | | | | | | |

| Exercise of stock options | | — | | | | 1,208 | | | — | | | 5 | | | — | | | — | | | — | | | 5 | | | | | | | | |

| Stock-based compensation | | — | | | | — | | | — | | | 482 | | | — | | | — | | | — | | | 482 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Issuance of common stock for settlement of RSUs | | — | | | | 12,708 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | | |

| Shares withheld related to net share settlement | | — | | | | (208) | | | — | | | (7) | | | — | | | — | | | — | | | (7) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | | — | | | — | | | — | | | (155) | | | — | | | — | | | (155) | | | | | | | | |

| Net income (loss) | | (11) | | | | — | | | — | | | — | | | — | | | (157) | | | 11 | | | (146) | | | | | | | | |

| Balance as of March 31, 2023 | | 419 | | | | 2,019,194 | | | — | | | 41,030 | | | (598) | | | (32,924) | | | 745 | | | 8,253 | | | | | | | | |

| Exercise of stock options | | — | | | | 1,859 | | | — | | | 10 | | | — | | | — | | | — | | | 10 | | | | | | | | |

| Stock-based compensation | | — | | | | — | | | — | | | 515 | | | — | | | — | | | — | | | 515 | | | | | | | | |

| Issuance of common stock for settlement of RSUs | | — | | | | 14,096 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | | |

| Issuance of common stock under the Employee Stock Purchase Plan | | — | | | | 4,078 | | | — | | | 85 | | | — | | | — | | | — | | | 85 | | | | | | | | |

| Shares withheld related to net share settlement | | — | | | | (76) | | | — | | | (3) | | | — | | | — | | | — | | | (3) | | | | | | | | |

| Repurchase of restricted common stock awards | | — | | | | (259) | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | | |

| Unrealized gain (loss) on investments in available-for-sale debt securities, net of tax | | — | | | | — | | | — | | | — | | | (2) | | | — | | | — | | | (2) | | | | | | | | |

| Foreign currency translation adjustment | | — | | | | — | | | — | | | — | | | 157 | | | — | | | — | | | 157 | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | (11) | | | | — | | | — | | | — | | | — | | | 394 | | | 11 | | | 405 | | | | | | | | |

| Balance as of June 30, 2023 | | 408 | | | | 2,038,892 | | | — | | | 41,637 | | | (443) | | | (32,530) | | | 756 | | | 9,420 | | | | | | | | |

| Exercise of stock options | | — | | | | 1,185 | | | — | | | 9 | | | — | | | — | | | — | | | 9 | | | | | | | | |

| Stock-based compensation | | — | | | | — | | | — | | | 504 | | | — | | | — | | | — | | | 504 | | | | | | | | |

| Issuance of common stock for settlement of RSUs | | — | | | | 13,433 | | | — | | | — | | | — | | | — | | | — | | | — | | | | | | | | |

| Shares withheld related to net share settlement | | — | | | | (73) | | | — | | | (3) | | | — | | | — | | | — | | | (3) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | (1) | | | | — | | | — | | | — | | | (37) | | | — | | | — | | | (37) | | | | | | | | |

| Net income (loss) | | (13) | | | | — | | | — | | | — | | | — | | | 221 | | | 11 | | | 232 | | | | | | | | |

| Balance as of September 30, 2023 | | $ | 394 | | | | 2,053,437 | | | $ | — | | | $ | 42,147 | | | $ | (480) | | | $ | (32,309) | | | $ | 767 | | | $ | 10,125 | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2022 | | 2023 |

| Cash flows from operating activities | | | | |

| Net income (loss) including non-controlling interests | | $ | (9,738) | | | $ | 456 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 724 | | | 620 | |

| Bad debt expense | | 76 | | | 63 | |

| Stock-based compensation | | 1,311 | | | 1,466 | |

| Gain on business divestitures | | (14) | | | — | |

| Deferred income taxes | | (251) | | | 32 | |

| Income from equity method investments, net | | (65) | | | (43) | |

| Unrealized (gain) loss on debt and equity securities, net | | 7,797 | | | (610) | |

| Loss from sale of investment | | — | | | 74 | |

| Impairments of goodwill, long-lived assets and other assets | | 15 | | | 77 | |

| Impairment of equity method investment | | 182 | | | — | |

| Revaluation of MLU B.V. call option | | (180) | | | — | |

| Unrealized foreign currency transactions | | 25 | | | 156 | |

| Other | | 5 | | | (25) | |

| Change in assets and liabilities, net of impact of business acquisitions and disposals: | | | | |

| Accounts receivable | | (219) | | | (363) | |

| Prepaid expenses and other assets | | (57) | | | (1,181) | |

| Operating lease right-of-use assets | | 142 | | | 141 | |

| Accounts payable | | (80) | | | 86 | |

| Accrued insurance reserves | | 485 | | | 1,439 | |

| Accrued expenses and other liabilities | | 897 | | | 511 | |

| Operating lease liabilities | | (169) | | | (137) | |

| Net cash provided by operating activities | | 886 | | | 2,762 | |

| Cash flows from investing activities | | | | |

| Purchases of property and equipment | | (193) | | | (168) | |

| Purchases of non-marketable equity securities | | (14) | | | (42) | |

| Purchases of marketable securities | | — | | | (5,930) | |

| | | | |

| Proceeds from maturities and sales of marketable securities | | 376 | | | 2,993 | |

| Proceeds from sale of equity method investment | | — | | | 721 | |

| Proceeds from business divestiture | | 26 | | | — | |

| Acquisition of businesses, net of cash acquired | | (59) | | | — | |

| Other investing activities | | (4) | | | 19 | |

| Net cash provided by (used in) investing activities | | 132 | | | (2,407) | |

| Cash flows from financing activities | | | | |

| Issuance of term loans and notes, net of issuance costs | | — | | | 1,121 | |

| Principal repayment on term loan and notes | | — | | | (1,150) | |

| Principal repayments on Careem Notes | | — | | | (25) | |

| Principal payments on finance leases | | (147) | | | (118) | |

| Proceeds from the issuance of common stock under the Employee Stock Purchase Plan | | 59 | | | 85 | |

| Proceeds from issuance and sale of subsidiary stock units | | 255 | | | — | |

| | | | | | | | | | | | | | |

| Other financing activities | | (63) | | | (54) | |

| Net cash provided by (used in) financing activities | | 104 | | | (141) | |

| Effect of exchange rate changes on cash and cash equivalents, and restricted cash and cash equivalents | | (293) | | | (26) | |

| Net increase in cash and cash equivalents, and restricted cash and cash equivalents | | 829 | | | 188 | |

| Cash and cash equivalents, and restricted cash and cash equivalents | | | | |

| Beginning of period | | 7,805 | | | 6,677 | |

| End of period | | $ | 8,634 | | | $ | 6,865 | |

| | | | |

| Reconciliation of cash and cash equivalents, and restricted cash and cash equivalents to the condensed consolidated balance sheets | | | | |

| Cash and cash equivalents | | $ | 4,865 | | | $ | 4,448 | |

| Restricted cash and cash equivalents-current | | 593 | | | 833 | |

| Restricted cash and cash equivalents-non-current | | 3,176 | | | 1,584 | |

| Total cash and cash equivalents, and restricted cash and cash equivalents | | $ | 8,634 | | | $ | 6,865 | |

| | | | |

| Supplemental disclosures of cash flow information | | | | |

| Cash paid for: | | | | |

| Interest, net of amount capitalized | | $ | 390 | | | $ | 469 | |

| Income taxes, net of refunds | | 149 | | | 170 | |

| Non-cash investing and financing activities: | | | | |

| Finance lease obligations | | 176 | | | 203 | |

| Right-of-use assets obtained in exchange for lease obligations | | 228 | | | 47 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UBER TECHNOLOGIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 – Description of Business and Summary of Significant Accounting Policies

Description of Business

Uber Technologies, Inc. (“Uber,” “we,” “our,” or “us”) was incorporated in Delaware in July 2010, and is headquartered in San Francisco, California. Uber is a technology platform that uses a massive network, leading technology, operational excellence and product expertise to power movement from point A to point B. Uber develops and operates proprietary technology applications supporting a variety of offerings on its platform (“platform(s)” or “Platform(s)”). Uber connects consumers (“Rider(s)”) with independent providers of ride services (“Mobility Driver(s)”) for ridesharing services, and connects Riders and other consumers (“Eaters”) with restaurants, grocers and other stores (collectively, “Merchants”) with delivery service providers (“Couriers”) for meal preparation, grocery and other delivery services. Riders and Eaters are collectively referred to as “end-user(s)” or “consumer(s).” Mobility Drivers and Couriers are collectively referred to as “Driver(s).” Uber also connects consumers with public transportation networks. Uber uses this same network, technology, operational excellence and product expertise to connect shippers (“Shipper(s)”) with carriers (“Carrier(s)”) in the freight industry. Uber is also developing technologies designed to provide new solutions to solve everyday problems.

Our technology is used around the world, principally in the United States (“U.S.”) and Canada, Latin America, Europe, the Middle East, Africa, and Asia (excluding China and Southeast Asia).

Careem non-ridesharing business

In April 2023, we entered into a series of agreements with Emirates Telecommunication Group Company (“e&”) whereby e& will contribute $400 million into the Careem Inc. (“Careem”) non-ridesharing business in exchange for a majority equity interest. At the closing date of the transaction, we will retain an approximately 42% ownership interest in the Careem non-ridesharing business. We will continue to fully own the ridesharing business of Careem. The transaction is subject to regulatory approval and other customary closing conditions, and is expected to close in the fourth quarter of 2023.

As of September 30, 2023, the assets and liabilities of the Careem non-ridesharing business have been accounted for as held for sale. The impact on our condensed consolidated balance sheet was not material.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. The condensed consolidated balance sheet as of December 31, 2022 included herein was derived from the audited consolidated financial statements as of that date. Certain information and note disclosures normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. As such, the information included in this Quarterly Report on Form 10-Q should be read in conjunction with the audited consolidated financial statements and the related notes thereto as of and for the year ended December 31, 2022, included in our Annual Report on Form 10-K. The results for the interim periods are not necessarily indicative of results for the full year.

In the opinion of management, these financial statements include all adjustments, which are of a normal recurring nature, necessary for a fair statement of the financial position, results of operations, comprehensive loss, cash flows and the change in equity for the periods presented.

There have been no changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on February 21, 2023 that have had a material impact on our condensed consolidated financial statements and related notes.

Basis of Consolidation

Our condensed consolidated financial statements include the accounts of Uber Technologies, Inc. and entities consolidated under the variable interest and voting models. All intercompany balances and transactions have been eliminated. Refer to Note 13 – Variable Interest Entities for further information.

Use of Estimates

The preparation of our unaudited condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions, which affect the reported amounts in the financial statements and accompanying notes. Estimates are based on historical experience, where applicable, and other assumptions which management believes are reasonable under the circumstances. On an ongoing basis, management evaluates estimates, including, but not limited to: fair values of investments and other financial instruments (including the measurement of credit or impairment losses); useful lives of amortizable long-lived assets; fair value of acquired intangible assets and related impairment assessments; impairment of goodwill; stock-based compensation;

income taxes and non-income tax reserves; certain deferred tax assets and tax liabilities; insurance reserves; and other contingent liabilities. These estimates are inherently subject to judgment and actual results could differ from those estimates.

Recently Adopted Accounting Pronouncements

In October 2021, the FASB issued ASU 2021-08, “Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers,” which requires entities to apply Topic 606 to recognize and measure contract assets and contract liabilities in a business combination as if it had originated the contracts. The standard is effective for public companies for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022. We adopted the ASU on January 1, 2023 and will apply the guidance prospectively for future acquisitions.

In September 2022, the FASB issued ASU 2022-04, “Liabilities—Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations,” which requires entities that use supplier finance programs in connection with the purchase of goods and services to disclose sufficient information about the program. The amendments do not affect the recognition, measurement or financial statement presentation of obligations covered by supplier finance programs. The standard is effective for public companies for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2022, except for the amendment on roll-forward information, which is effective for fiscal years beginning after December 15, 2023. We adopted the ASU on January 1, 2023.

Recently Issued Accounting Pronouncements Not Yet Adopted

In June 2022, the FASB issued ASU 2022-03, “Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions,” which clarifies that contractual sale restrictions are not considered in measuring fair value of equity securities and requires additional disclosures for equity securities subject to contractual sale restrictions. The standard is effective for public companies for fiscal years beginning after December 15, 2023. Early adoption is permitted. This accounting standard update is not expected to have a material impact on our consolidated financial statements as the amendments align with our existing policy.

Note 2 – Revenue

The following tables present our revenues disaggregated by offering and geographical region. Revenue by geographical region is based on where the transaction occurred. This level of disaggregation takes into consideration how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2023 | | 2022 | | 2023 |

Mobility revenue (1) | | $ | 3,822 | | | $ | 5,071 | | | $ | 9,893 | | | $ | 14,295 | |

Delivery revenue (1) | | 2,770 | | | 2,935 | | | 7,970 | | | 9,085 | |

| Freight revenue | | 1,751 | | | 1,286 | | | 5,407 | | | 3,965 | |

| Total revenue | | $ | 8,343 | | | $ | 9,292 | | | $ | 23,270 | | | $ | 27,345 | |

(1) We offer subscription memberships to end-users including Uber One, Uber Pass, Rides Pass, and Eats Pass (“Subscription”). We recognize Subscription fees ratably over the life of the pass. We allocate Subscription fees earned to Mobility and Delivery revenue on a proportional basis, based on usage for each offering during the respective period.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2023 | | 2022 | | 2023 |

| United States and Canada ("US&CAN") | | $ | 5,000 | | | $ | 4,940 | | | $ | 14,498 | | | $ | 15,201 | |

| Latin America ("LatAm") | | 518 | | | 642 | | | 1,431 | | | 1,834 | |

| Europe, Middle East and Africa ("EMEA") | | 1,878 | | | 2,560 | | | 4,851 | | | 7,066 | |

| Asia Pacific ("APAC") | | 947 | | | 1,150 | | | 2,490 | | | 3,244 | |

| Total revenue | | $ | 8,343 | | | $ | 9,292 | | | $ | 23,270 | | | $ | 27,345 | |

Revenue

Mobility Revenue

We derive revenue primarily from fees paid by Mobility Drivers for the use of our platform(s) and related service to facilitate and complete Mobility services and, in certain markets, revenue from fees paid by end-users for connection services obtained via the platform. Mobility revenue also includes immaterial revenue streams such as our financial partnerships products.

Additionally, in certain markets where we are responsible for Mobility services, fees charged to end-users are also included in revenue, while payments to Drivers in exchange for Mobility services are recognized in cost of revenue, exclusive of depreciation and amortization.

Delivery Revenue

We derive revenue for Delivery from Merchants’ and Couriers’ use of the Delivery platform and related service to facilitate and complete Delivery transactions.

During the second quarter of 2023, we implemented a business model change resulting in end-users becoming our customers. In these markets, end-users, in addition to Merchants and Couriers, are our customers.

Additionally, in certain markets where we are responsible for Delivery services, Delivery fees charged to end-users are also included in revenue, while payments to Couriers in exchange for delivery services are recognized in cost of revenue, exclusive of depreciation and amortization.

Delivery also includes advertising revenue from sponsored listing fees paid by Merchants and brands in exchange for advertising services.

Freight Revenue

Freight revenue consists of revenue from freight transportation services provided to Shippers.

Contract Balances and Remaining Performance Obligation

Contract liabilities represent consideration collected prior to satisfying our performance obligations. As of September 30, 2023, we had $128 million of contract liabilities included in accrued and other current liabilities as well as other long-term liabilities on the condensed consolidated balance sheet. Revenue recognized from these contracts during the three and nine months ended September 30, 2022 and 2023 was not material.

Our remaining performance obligation for contracts with an original expected length of greater than one year is expected to be recognized as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| | Less Than or

Equal To 12 Months | | Greater Than

12 Months | | Total |

As of September 30, 2023 | | $ | 23 | | | $ | 105 | | | $ | 128 | |

Note 3 – Investments and Fair Value Measurement

Investments

Our investments on the condensed consolidated balance sheets consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | As of |

| | December 31, 2022 | | September 30, 2023 |

| Classified as short-term investments: | | | | |

Marketable debt securities (1): | | | | |

| U.S. government and agency securities | | $ | 44 | | | $ | 318 | |

| Commercial paper | | 46 | | | 351 | |

| Corporate bonds | | 13 | | | 53 | |

| Certificates of deposit | | — | | | 3 | |

| Short-term investments | | $ | 103 | | | $ | 725 | |

| | | | |

| Classified as restricted investments: | | | | |

Marketable debt securities (1): | | | | |

| U.S. government and agency securities | | $ | 1,614 | | | $ | 3,944 | |

| | | | |

| | | | |

| Restricted investments | | $ | 1,614 | | | $ | 3,944 | |

| | | | |

| Classified as investments: | | | | |

| Non-marketable equity securities: | | | | |

| Didi | | $ | 1,802 | | | $ | 1,831 | |

Other (2) | | 312 | | | 322 | |

| Marketable equity securities: | | | | |

| Grab | | 1,726 | | | 1,897 | |

| Aurora | | 364 | | | 766 | |

| Other | | 87 | | | 165 | |

Note receivable from a related party (2) | | 110 | | | 110 | |

| Investments | | $ | 4,401 | | | $ | 5,091 | |

(1) Excluding marketable debt securities classified as cash equivalents and restricted cash equivalents.

(2) These balances include certain investments recorded at fair value with changes in fair value recorded in earnings due to the election of the fair value option of accounting for financial instruments.

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The following table presents our financial assets and liabilities measured at fair value on a recurring basis based on the three-tier fair value hierarchy (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2022 | | As of September 30, 2023 |

| | Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| Financial Assets | | | | | | | | | | | | | | | | |

| Money market funds | | $ | 1,005 | | | $ | — | | | $ | — | | | $ | 1,005 | | | $ | 1,351 | | | $ | — | | | $ | — | | | $ | 1,351 | |

| U.S. government and agency securities | | — | | | 1,975 | | | — | | | 1,975 | | | — | | | 4,363 | | | — | | | 4,363 | |

| Commercial paper | | — | | | 76 | | | — | | | 76 | | | — | | | 385 | | | — | | | 385 | |

| Corporate bonds | | — | | | 15 | | | — | | | 15 | | | — | | | 53 | | | — | | | 53 | |

| Certificates of deposit | | — | | | — | | | — | | | — | | | — | | | 3 | | | — | | | 3 | |

| Non-marketable equity securities | | — | | | — | | | 3 | | | 3 | | | — | | | — | | | 3 | | | 3 | |

| Marketable equity securities | | 2,177 | | | — | | | — | | | 2,177 | | | 2,829 | | | — | | | — | | | 2,829 | |

| Note receivable from a related party | | — | | | — | | | 110 | | | 110 | | | — | | | — | | | 110 | | | 110 | |

| Total financial assets | | $ | 3,182 | | | $ | 2,066 | | | $ | 113 | | | $ | 5,361 | | | $ | 4,180 | | | $ | 4,804 | | | $ | 113 | | | $ | 9,097 | |

| Financial Liabilities | | | | | | | | | | | | | | | | |

MLU B.V. Call Option (1) | | $ | — | | | $ | — | | | $ | 2 | | | $ | 2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Total financial liabilities | | $ | — | | | $ | — | | | $ | 2 | | | $ | 2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

(1) Refer to Note 4 – Equity Method Investments for further information.

As of December 31, 2022 and September 30, 2023, the amortized cost of our debt securities measured at fair value on a recurring basis approximates fair value. We did not record any material unrealized gains or losses, or credit losses as of December 31, 2022 and September 30, 2023. The weighted-average remaining maturity of our debt securities was less than one year as of September 30, 2023.

During the nine months ended September 30, 2023, we did not make any transfers into or out of Level 3 of the fair value hierarchy.

Zomato

During the third quarter of 2022, we completed the sale of $418 million of our entire stake in Zomato Media Private Limited (“Zomato”) ordinary shares for net proceeds of $376 million and recognized an immaterial loss from this transaction in other income (expense), net in our condensed consolidated statements of operations.

Fair Value Hierarchy