aaxx8k.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 12, 2013

Cellular Concrete Technologies, Inc.

(Exact Name of Registrant as Specified in its Charter)

(Formally known as Accelerated Acquisitions XX, Inc.)

| |

|

|

|

|

|

Delaware

|

|

000-54612

|

|

45-4511068

|

|

|

|

|

|

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File

No.)

|

|

(I.R.S. Employer

Identification No.)

|

|

100 Pacifica Drive, Suite 130, Irvine, CA

|

|

92618

|

|

|

|

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (972) 388-1973

1840 Gateway Drive, Suite 200, Foster City, CA 94404

(Former name or former address, if changed since last report)

(Address of Principal Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

TABLE OF CONTENTS

|

Item 1.01 Entry into a Material Definitive Agreement

|

|

3 |

| |

|

|

| tem 2.01 Completion of Acquisition or Disposition of Assets. |

|

3 |

| |

|

|

|

Item 5.06 Change in Shell Company Status

|

|

4 |

| |

|

|

|

Item 9.01 Financial Statements and Exhibits

|

|

29 |

| |

|

|

|

SIGNATURES

|

|

30 |

| |

|

|

|

EXHIBIT INDEX

|

|

31 |

Item 1.01 Entry into a Material Definitive Agreement.

On July 11, 2013, Cellular Concrete Technologies, Inc. “the Company” entered into a Licensing Agreement (“Licensing Agreement”) with Cellular Concrete Technologies, LLC (“Licensor”) pursuant to which the Company was granted an, exclusive license for intellectual property as described in Patent No. US 5,900,191, Patent No. US 6,046,255; US Patent Application No. 13/560,882; US Trademark Stable Air(R); Canadian Trademark Stable Air(tm); US Trademark CCT; US Trademark CCT Add Air (R) that includes STABLE AIR® and STABLE AIR AERATOR® developed by Licensor, principally comprising of a unique intellectual property for the production of different types of cellular concrete: Structural lightweight concrete, non-structural lightweight concrete, as well as infill, backfill and flowable fill (the “Technology”). The license includes the use and licensing of the technology to produce a variety of customized lightweight concrete products for the global housing, oil, flowable fill and ready mix concrete industries.

Except for the rights granted under the License Agreement, Licensor retains all rights, title and interest to the Technology and any improvements thereto, although the License includes the Company’s right to utilize such improvements.

The term of the License commences on the date of the Licensing Agreement and continues for thirty (30) years, provided that the Licensee is not in breach or default of any of the terms or conditions contained in this Agreement. In addition to other requirements, the continuation of the License is conditioned on the Company generating net revenues in the normal course of operations or the funding by the Company of specified amounts for qualifying research, development and commercialization expenses related to the Technology. In addition, the Company is required to fund certain specified expenses related to the commercialization of the Technology as specified in the License Agreement. The license is terminated upon the occurrence of events of default specified in the License Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On March 8, 2011, the Company entered into the Licensing Agreement with Licensor pursuant to which the Company was granted an exclusive, non-transferrable worldwide license for certain intellectual property, principally comprising technology, patents, intellectual property, know-how, trade secret information regarding STABLE AIR® and STABLE AIR AERATOR® concrete technologies.

The Company acquired the Technology from Cellular Concrete Technologies, LLC, a company controlled by Paul Falco an officer and director of the Company. Cellular Concrete Technologies, LLC, owns 22.350,000 shares of the Company’s outstanding common stock, representing an 88.2% ownership interest in the Company. Cellular Concrete Technologies, LLC purchased its shares in the Company on September 21, 2012. There were no other agreements between the Company and Cellular Concrete Technologies, LLC prior to the Share Purchase Agreement entered into on September 21, 2012.

Mr. Timothy Neher, the Company’s Chief Executive Officer prior to September 21, 2012, controls Accelerated Venture Partners, LLC (“AVP”), an entity which has agreed to provide financial advisory services to the Company. AVP owns 3,000,000 shares of the Company’s outstanding common stock, representing an 11.8% ownership interest in the Company (collectively, Cellular Concrete Technologies, LLC and AVP own 100% of the Company as there are no other stockholders). Up to 1,500,000 of AVP’s shares can be repurchased by the Company for $0.0001 per share under certain circumstances. AVP is entitled to receive specified cash compensation if the Company achieves certain financial milestones as outlined in the “Our Business” section below. Aside from the Cellular Concrete Technologies, LLC, Paul Falco, AVP and Mr. Neher, no other parties have an interest related to the Share Purchase Agreement or the Licensing Transaction.

Under the terms of the Licensing Agreement, the Company has agreed to pay the Licensor three percent (2%) of any royalties received if the Company grants any third parties royalty-bearing licenses to the Technology. In addition, the Company has agreed to pay Licensor a royalty of one quarter of three percent (3%) of all gross revenue resulting from use of the Technology by the Company. In order to retain its rights, the Company must receive revenues or net of expenses incurred in the normal course of operations, or has funded, a minimum of US $1,400,000 for "qualifying research, development and commercialization expenses" in accordance with the following schedule: (a) a minimum of US $200,000 during the period commencing from the date of execution of the Agreement by all parties ("July 11, 2013 the Execution Date") and ending on the first anniversary of the Execution Date; or (b) a minimum of US $400,000 during the period commencing upon the Execution Date and ending on the second anniversary of the Execution Date; or (c) a minimum of US $800,000 during the period commencing upon the Execution Date and ending on the third anniversary of the Execution Date. There are additional customary commercialization requirements in the Licensing Agreement, and this description is qualified by the terms of the Licensing Agreement.

Item 5.06 Change in Shell Company Status.

Prior to the Company’s entry into a unique business of providing services to produce a variety of customized lightweight concrete products for the global housing, oil, flowable fill and ready mix concrete industries through the execution of the License Agreement, the Company was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of entering into this agreement and undertaking efforts to begin manufacturing and product distribution operations, we ceased to be a shell company.

OTHER PERTINENT INFORMATION

Unless specifically set forth to the contrary, when used herein, the terms “Accelerated Acquisitions XX, Inc.”, “Cellular Concrete Technologies, Inc.”, “CCT”, “we”, “our”, “Company” and similar terms refer to Accelerated Acquisitions XX, Inc., or Cellular Concrete Technologies, Inc., a Delaware corporation.

FORM 10 DISCLOSURE

Item 2.01(f) of Form 8-K states that if the registrant was a shell company, like our company, the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to our ability to develop our operations, our ability to satisfy our obligations, our ability to consummate the acquisition of additional assets, our ability to generate revenues and pay our operating expenses, our ability to raise capital as necessary, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Risk Factors" and the risk factors described in our other filings with the Securities and Exchange Commission. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

From inception February 6, 2012, Cellular Concrete Technologies, Inc., (Formally known as Accelerated Acquisitions XX, Inc.) was organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation. Our principal business objectives were to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company has not restricted our potential candidate target companies to any specific business, industry or geographical location and, thus, may acquire any type of business.

On February 6, 2012, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

On September 21, 2012, Cellular Concrete Technologies, LLC (“Purchaser”) agreed to acquire 23,350,000 shares of the Company’s common stock par value $0.0001 for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 3,500,000 of their 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, Cellular Concrete Technologies, LLC, owned 94% of the Company’s 24,850,000, issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 6% of the total issued and outstanding shares. Simultaneously with the share purchase, Paul Falco was appointed to the Company’s Board of Directors. Such action represents a change of control of the Company.

Prior to the purchase of the shares, the Purchasers were not affiliated with the Company. However, the Purchasers will be deemed affiliates of the Company after the share purchase as a result of their stock ownership interest in the Company. The purchase of the shares by the Purchasers was completed pursuant to written Subscription Agreements with the Company. The purchase was not subject to any other terms and conditions other than the sale of the shares in exchange for the cash payment. The Company filed a Certificate of Amendment to its Certificate of Incorporation with the Secretary of State of Delaware in order to change its name to “Cellular Concrete Technologies, Inc.” on January 11, 2013 and the name was formally amended on February 22, 2013.

On September 24, 2012, the Company entered into a Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy J. Neher. The agreement requires AVP to provide the Company with certain advisory services that include reviewing the Company’s business plan, identifying and introducing prospective financial and business partners, and providing general business advice regarding the Company’s operations and business strategy in consideration of (a) an option granted by the Company to AVP to purchase 1,500,000 shares of the Company’s common stock at a price of $0.0001 per share (the “AVP Option”) (which was immediately exercised by the holder) subject to a repurchase option granted to the Company to repurchase the shares at a price of $0.0001 per share in the event the Company fails to complete funding as detailed in the agreement subject to the following milestones:

|

|

·

|

Milestone 1 – Company’s right of repurchase will lapse with respect to 60% of the shares upon securing

|

$2.5 million in available cash from funding;

|

|

·

|

Milestone 2 – Company’s right of repurchase will lapse with respect to 40% of the Shares upon securing

|

$5 million in available cash (inclusive of any amounts attributable to Milestone 1);

and (b) cash compensation at a rate of $12,500 per month. The payment of such compensation is subject to Company’s achievement of certain designated milestones, specifically, cash compensation of $150,000 is due consultant upon the achievement of Milestone 1, and $300,000 upon the achievement of Milestone 2. Upon achieving each Milestone, the cash compensation is to be paid to consultant in the amount then due at the rate of $12,500 per month. The total cash compensation to be received by the consultant is not to exceed $300,000 unless the Company receives an amount of funding in excess of the amount specified in Milestone 2. If the Company receives equity or debt financing that is an amount less than Milestone 1, in between any of the above Milestones or greater than the above Milestones, the cash compensation earned by the Consultant under this Agreement will be prorated according to the above Milestones. The Company also has the option to make a lump sum payment to AVP in lieu of all amounts payable thereunder.

On July 11, 2013, Cellular Concrete Technologies, Inc. “the Company” entered into a Licensing Agreement (“Licensing Agreement”) with Cellular Concrete Technologies, LLC (“Licensor”) pursuant to which the Company was granted an, exclusive license for intellectual property as described in Patent No. US 5,900,191, Patent No. US 6,046,255; US Patent Application No. 13/560,882; US Trademark Stable Air(R); Canadian Trademark Stable Air(tm); US Trademark CCT; US Trademark CCT Add Air (R) that includes STABLE AIR® and STABLE AIR AERATOR® developed by Licensor, principally comprising of a unique intellectual property for the production of different types of cellular concrete: Structural lightweight concrete, non-structural lightweight concrete, as well as infill, backfill and flowable fill (the “Technology”). The license includes the use and licensing of the technology to produce a variety of customized lightweight concrete products for the global housing, oil, flowable fill and ready mix concrete industries.

Cellular Concrete Technologies, Inc. is an emerging growth company that has licensed technology to entry into a unique business of designing, manufacturing and marketing customized light-weight concrete products, light concrete aggregate panels and a “kit system” of a pre-fabricated houses or structures on a standard format or custom made basis according to customer blue prints.

TECHNOLOGY

The Company licensed a proprietary technologies, known as STABLE AIR® and STABLE AIR AERATOR® technologies, to establish a business that specializes in pre-manufactured houses, structures, as well as commercial and industrial structures. These opportunities are intended be offered through strategic joint ventures and licensing for manufacturing and or marketing agreements. The Company intends to focus first in Central and South America, followed by the USA and subsequently other countries.

OVERVIEW

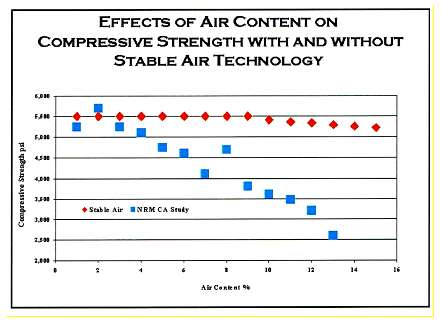

The Company licensed a unique intellectual property (the Technology) for the production of a variety of light-weight concrete products. Stable Air technology is a method that will enable concrete producers to manufacture air entrained structural lightweight concrete. In a recent study by the National Ready Mixed Concrete Association (NRMCA) conducted at the Alfred H. Smith Laboratory in College Park, Maryland, compressive strength was measured in non-air entrained concrete, and compared to identical concrete mixes containing various amounts of air entrained admixtures. Linear results were recorded with a reduction in compressive strength of approximately 275 psi for every one percent of additional air content. Illustrated in the graph below, Stable Air technology maintains compressive strength where traditional air entrained concrete cannot.

In order to bring the technology from the R & D stage to a marketable product, official laboratory tests were conducted to confirm product results and further develop the technology. Formal studies have been performed in accordance with the American Society of Testing Materials (ASTM) guidelines by Wiss, Janney, Elstner Associated, Inc. (WJE), a national independent research and testing company in Chicago experienced in construction technology.

By comparing the results of the WJE study to empirical industry data that exists on cellular concrete, Stable Air® proved that it can produce reliable, dependable, consistent, and cost-effective structural and non-structural lightweight cellular concrete that will have several applications in the construction industry. ASTM tests have been performed to record sufficient evidence to generate a formal Specification and Usage Parameter Manual consistent with ASTM guidelines. Stable Air’s® cellular concrete technology, when compared with no-additive standard dense weight concrete and other cellular concrete, produces superior results in ASTM testing as outlined in the table set forth below:

Subsequent to the aforementioned laboratory tests, Stable Air organized industry-funded product testing and back-data research to develop specific applications. These hands-on applications by operational experts, ranging from ready mix companies and precast fabricators to architects, engineers and contractors, have provided additional qualitative data to the Company. Hand-on experience and product review by key concrete producers, combined with quantifiable scientific results, has brought Stable Air to the final stages of preparation and organization prior to commercializing its technology.

PRODUCTS

The Company’s primary licensed products have characteristics are intended to make them superior to both structural and non-structural concrete, whether the concrete mix relies on conventional, cellular or lightweight aggregate mix designs. Stable Air® is structural lightweight cellular concrete for use in load-bearing applications where 2,500 pounds per square inch or greater is required. Stable Air® Fill is lightweight cellular concrete for use in flowable fill, non-structural and low-structural applications where strengths under 2,500 pounds per square inch is sufficient. Stable Air® has produced favorable results in ASTM tests for industry requirements with ongoing tests taking place, and Stable Air® Fill/Stable Flow™ already meets or exceeds the requirements of Chapter 7 and the Uniform Building Code.

Stable Air technology consists of a few key integrated components which together create structural and non-structural lightweight cellular concrete with extremely favorable features. Through the combination of Stable Air® Surfactant and air inside the special mixing chamber of the Aerator machine, the Stable Air ™ Bubble is produced, containing bubbles different from the bubble in conventional lightweight cellular concrete. The Stable Air® Bubble is subsequently added to conventional concrete ingredients, creating the desired lightweight cellular concrete.

AERATOR

The Aerator is a foam producing machine that creates an extremely strong, consistent, reliable and dependable micro-bubble that when entrained into traditional concrete can reduce the pre cubic foot weight by up to 20 percent (120 pounds per cubic foot) while achieving structural strength over 3000 pounds per square inch in 24 hours, and exceeding 3500 pounds per square inch in 28 days. Other cementious mixes can be entrained to produce Controllable Low Density Materials (CLDM) up to 90 percent air that maintains design volume through cure. The Aerator is an electromechanical machine with few moving parts. The machine is designed to be easy to install and operate machine with low maintenance and repair requirements, it is intended for concrete operating personnel to easily work the Aerator with minimal training, eliminating the need for higher-paid, skilled labor. Through its four primary machine models, Stable Air® offers a system that is intended to be easy to install and require minimal modification to existing batch platforms.

With the exception of the “foaming lens”, the core proprietary mechanical technology which is intended to be manufactured in-house, the Aerator is intended to be produced under a manufacturing contract by qualified fabricators in accordance with strict specification of Stable Air. The Company’s management has focused on three guiding principles regarding the design and development of the machines:

1. The production of quality foam with accurate quantity control on a consistent and reliable basis.

2. Durable, compact and easy to use.

3. Compatible with industry specifications and standards.

Stable Air® Surfactant

Stable Air® Surfactant is a specially-designed, proprietary surfactant that when processed by the “foaming lens” of the Aerator is designed to form the unique Stable Air® Bubble. The surfactant is distributed in plastic containers and drums with Stable Air® Surfactant private label packaging under strict control by Stable Air.

Stable Air Bubble

The Stable Air® Bubble is a very tiny bubble, approximately four to eight times smaller than conventional cellular concrete bubbles, created by introducing the Stable Air® Surfactant through the Aerator. The Stable Air® Bubble, which is markedly different than the bubble of conventional lightweight cellular concrete, is added to conventional concrete ingredients (cement, sand, aggregate and water) at the time of initial mixing. Applying Stable Air’s standardized mixing and handling protocol, the Stable Air® Bubble is a very resilient, unique bubble which does not break, allowing for an unparalleled usage parameter for concrete products. Representing a major technical world’s first mechanical super plasticizer, it al-lows water/cement ratios to be maximized without the addition of chemicals.

DESIGN & MIXING PROTOCOL COMPUTER PROGRAM

Despite the fact that the Stable Air® Bubble is extremely resistant against pressure, there are mixing and handling conditions that should be considered to optimize the result of Stable Air® technology. For ex-ample, excess free–fall and vibration can eventually deteriorate the Stable Air® bubble and ultimately reduce the volume and increase the density and weight of the finished concrete product. Another factor that may require special attention when designing and mixing concrete ingredients includes extremes in batch temperatures. A simple, but detailed, step-by-step handling protocol will be provided to licensed users in a format of a Standard Mixing and Handling Protocol and Specification and Usage Parameter Manual reflecting ASTM guidelines.

Despite the unique proprietary inherent in both the Aerator™ and the Stable Air® surfactant, as well as the Standardized Mixing and Handling Protocol, the results generated by the Stable Air® Bubble in finished concrete products is what the Company plans to deliver to the industry.

In fact, Stable Air® allows production of a special class of lightweight cellular concrete that is entirely new, so unusual, that the two primary concrete styles have been given proprietary names.

|

Stable Air’s® Proprietary Concrete Products

|

|

· Stable Air® Structural lightweight concrete made with Stable Air® foam

|

|

· Stable Flow™ Non-structural lightweight concrete made with Stable Air® foam

|

Stable Air® and Stable Air® Fill are intended to be superior concrete products to both conventional concrete and what is known in the construction industry as lightweight aggregate concrete and lightweight cellular concrete. Conventional concrete, weighing approximately 150 pounds per cubic foot, is expensive to produce, transport and handle. Nevertheless, the combination of heavy ingredients and density of material are often necessary to maintain compressive strength requirements. Compared to conventional concrete, Stable Air® and Stable Flow™ are designed to offer the following specific advantages:

|

|

·

|

Air content and weight can be predictably and accurately specified and controlled.

|

|

|

·

|

Architects and engineers can design lighter structures that are costly which have a direct effect on cost reduction of other building components.

|

|

|

·

|

Fire resistance is greatly improved; hence code requirements can be met or exceeded with less thickness further reducing cost and mass.

|

|

|

·

|

Makes seismic code compliance less costly

|

|

|

·

|

Cuts costs related to freight and handling of all concrete products with major impact in precast concrete, concrete pipe and concrete block.

|

|

|

·

|

Reduced water permeability greatly reduces damage from freezing and thawing.

|

|

|

·

|

Thermal conductivity and sound absorption is improved.

|

|

|

·

|

Workability, flowability and pump ability is greatly improved.

|

|

|

·

|

Millions of tiny Stable Air® Bubbles migrate throughout the concrete mix acting like roller bearings, or a super plasticizer, turning exceedingly low-slump concrete into flowable concrete.

|

|

|

·

|

Stable Air® Bubbles migrate into all the gradation voids and spaces in the concrete mix improving the graduation of aggregate, particularly deficiencies in sand.

|

(Stable Air® (Flowable) Fill and Stable Flow™ are used interchangeably throughout this document).

COMPARATIVE STRENGTH ANALYSIS

The principal problem with cellular concrete, as the industry knows, is the significant loss of strength and the unpredictable loss of air content because bubbles tend to break in the processes of mixing, transporting, placing and finishing. Stable Air technology has greatly reduced this limitation. In addition to the advantages Stable Air® and Stable Air® Fill offer over conventional concrete, Stable Air’s technology is far superior to today’s cellular products as a result of these three primary factors:

|

|

·

|

Ability to pre-design and achieve specific compressive strength targets.

|

|

|

·

|

Capacity to produce structural lightweight concrete, consistently and accurately.

|

|

|

·

|

Competence to maintain total volume during curing.

|

Reducing the weight in concrete below that of conventional concrete; results in a tremendous opportunity for cost savings particularly during handling and transportation. Consequently, concrete manufacturers today use lightweight aggregates and fillers in place of conventional aggregates, despite a substantial increase in cost, in order to reduce weight and maintain some of the relative compressive strength not achievable through traditional cellular concrete. However, lightweight aggregate materials are not available in many geographical markets and often produce concrete lower in compressive strength than conventional concrete. As a result, Stable Air can successfully outperform aggregate concrete.

Stable Air® and Stable Air® Fill are designed to have characteristics that make them superior to both structural and non-structural concrete, whether the competitive concrete mix relies on conventional, cellular or lightweight aggregate mix designs. Stable Air® is structural lightweight cellular concrete for use in load-bearing applications where 3000 pounds per square inch or greater is required. Stable Air® Fill is lightweight cellular concrete for use in flowable fill, non-structural and low-structural applications where strengths under 2500 pounds per square inch is sufficient. Both concrete types are designed to be produced by entraining traditional concrete with the Stable Air® Bubble, a strong, durable, reliable, dependable, cost-effective micro-bubble. Stable Air® has produced favorable results in ASTM tests for industry requirements with ongoing tests taking place, and Stable Air® Fill already meets or exceeds the requirements of Chapter 7 of the Uniform Building Code. As the chart evidences, Stable Air’s technology combines the attractive of traditional cellular and lightweight aggregate products with the compressive strength of conventional concrete.

SERVICES & SUPPORT

Stable Air’s technology is intended to be simple to install and easy to use by today’s concrete producers that very little maintenance and support is required. Manufacturing Stable Air® structural concrete and Stable Air® Fill is designed to follow the same procedures and utilizes the same techniques used in the industry. In order to achieve maximum benefits from the technology and ensure a complete quality experience, the company intends to offer on-site technical support as well as a telephone help center to its licensed concrete manufacturers. Stable Air service technicians will custom install, test and fine tune the system for each customer site and educate user personnel on Stable Air technology and the most favorable operating procedures. The formal Specification and Usage Parameter Manual, consistent with established guidelines and the standardized mixing and handling protocol will be provided to assure product quality.

BUSINESS MODEL

The Company will explore various strategic and financing alternatives. Rather than offer this technology to chemical suppliers who in turn, will market a product to the concrete industry, the company has decided to offer this industry developed technology directly to concrete industry participants.

Under a normal equipment sales agreement, the Aerator will be sold to qualified concrete manufacturers, enabling them to make Stable Air’s lightweight cellular concrete products. A maintenance and service agreement will also be offered to Stable Air customers, once the warranty period has expired.

The Aerator sales agreement requires that only Stable Air® Surfactant be used to produce Stable Air® structural concrete and Stable Air® Fill. In order to provide continuous support to its customers, Stable Air foresees regular batch testing by concrete producers with results being collected and analyzed by Stable Air. The table below outlines general terms and preliminary pricing policies.

PRODUCT MARKETS

The Company will initially focus on four main prospective markets: (1) global housing, (2) oil drilling and (3) flowable fill markets (4) U.S. and global Ready Mix market.

1. GLOBAL HOUSING

The world population continues to grow, by approximately 150 million new persons each year, and many developing nations have a critical need to house as many of their residents as possible in lower cost, easy to construct housing structures without adding stress to their limited energy and other infrastructure. Thus, these new homes must be highly insulative, energy-efficient environmentally/eco-friendly and disaster resistant. The licensed technology and products meet these criteria.

Since winning two First Place Industry Prizes at the 2012 World of Concrete Trade Show (January 2012) in Las Vegas, NV, the licensor has had many requests for new housing tracts, ranging from 5,000, 10,000 (Tanzania), 20,000 (Venezuela), 100,000+ (Guatemala and Ecuador) and up to one million new homes for the rebuilding of Iraq (in addition to many new schools). The Company intends to begin biding on these projects that are pre-cast concrete factories and other home-building systems.

By using steel, rebar or other structural supports to meet engineering standards and filling in the walls with very lightweight, insulative Stable Fill™-type materials, we intend to deliver strong, safe homes that are assembled quickly and inexpensively that use little additional energy to heat and cool.

Estimate of Annual Global New Housing Starts Needed

2. THE OIL INDUSTRY

There are elements of the integrated oil business internationally that may lends itself to consumption of the Company’s products. We highlight those that Management believes have the greatest potential for CCT:

a) Cementing Oil Wells

b) Laying down Inexpensive Roads to groups of Oil Wells

c) Developing quick, inexpensive housing and infrastructure for Oil Discovery areas

3. FLOWABLE FILL AND OTHER MARKETS

The Global Flowable Fill market is estimated to be $4-5 billion per year in total revenues, based on publicly-available corporate revenues for flowable fill contractors. The Company’s design mix is unique in that it does not use river-bottom “washed concrete” sand – a major factor in cost and environmental strain. The product uses water and cement, and adds to that about 76% (by volume) Stable Air® foam, to make a strong-bubble mix that doesn’t collapse, hence the Non-Collapsing Fully-Excavatable4 Flowable Fill.

4. THE READY MIX CONCRETE INDUSTRY

The global Ready Mix Concrete market, while huge, was seriously hurt by the sub-prime crisis both in this country, and also overseas. The five years preceding 2008 saw a tremendous amount of global ready mix concrete mergers and acquisitions – and many large firms took on too much debt in these transactions. Therefore, with significantly decreased revenues and heavy interest payments and debt loads, they have been focused on “staying alive”, managing cash flows and selling assets to pay down debt. The Company has found many ready-mix firms not yet ready to add, for example, flowable fill capabilities to their present revenues and are not yet ready to consider additional investment to enter new markets. The global Ready-Mix Concrete market is still a large and valid market.

Ready Mix

As the ready mix industry becomes accustomed to the Company’s “performance concrete”, increased importance will be placed on the use of air entrained concrete. While the benefits of air entrainment have been discussed, the industry has not yet been able to overcome the inherent compressive strength problem associated with air entrained concrete.

Precast

Consuming more than 3.8 million equivalent cubic yards of concrete during 1997, precast and pre-stressed concrete products represent a relatively small share of the total concrete market. (It should be noted that while this industry typically sells product by the linear foot or square foot, we have converted all units of measure to equivalent cubic yards.) However, due to the expanding application of lightweight pre-stressed and precast products in structural construction, higher compressive strengths are required. While the issue of compressive strength alone emphasizes the attractiveness of Stable Air technology to precast/pre-stressed producers, early results indicate that Stable Air technology could yield significant cost savings in this sector, particularly as it relates to handling and transportation of product. Stable Air can expect to capture a greater portion of the total precast/pre-stressed market than that of the ready mix market, rendering it an important segment to the company.

Concrete Block

The segment for concrete block products represents a large and potentially significant market to Stable Air as block producers may be able to realize tremendous benefits from our lightweight cellular concrete technology. During 2007, the sector produced block products representing approximately 7.2 million equivalent cubic yards of concrete mix. In contrast to precast/pre-stressed concrete, block producers typically utilize non-structural concrete mix designs. As a result of handling and transportation efficiencies derived from using lightweight concrete block, many of the nation’s block producers have already made substantial investment in aggregates. Since lightweight aggregates typically cost substantially more than that of conventional aggregates, Stable Air technology should allow block producers to manufacture lightweight concrete block at similar cost as producing standard weight concrete block.

SUMMARY

In summary, the U.S. concrete industry represents a large portion of the nation’s gross domestic product, and is comprised of a large number of relatively small producers – but with a few very large typically multi-national producers. As a commodity product, concrete is price sensitive and producers generally compete for market share on the local level. Strategic location, raw material sourcing, vertical integration and capitalization typically dictate a producer’s competitive strength within its relevant market. Stable Air’s technology are intended to provide each concrete producer with the ability to lower its production cost while providing higher quality product which ultimately will provide a competitive advantage. Internationally, the concrete industry represents a steadily growing global industry as the world’s population moves towards doubling – and the demand for low-cost, energy-efficient (thus, heavily concrete-oriented structures) housing continues unabated.

In general, the lower-end of the market – the home improvement, do-it-yourselfer (DIY) and small contractor segment represents a tremendous, untapped, new virgin territory: where the patented product with the “first-mover” advantage can take 70-80% permanent market share in this retail marketplace.

THE PROPRIETARY TECHNOLOGY

The licensor has proprietary technology for the STABLE AIR® and STABLE AIR AERATOR® that has been patented. Design documents for the proprietary foaming system, having been previously filed with the United States Patent Office, the Company now benefits from the “Method” May 4, 1999, Patent # 5,900,191 and a second Patent that was issued April 4, 2000, Patent # 6,046,255 for the “Mechanical” portion of the machine.

In addition, a US Patent Application No. 13/560,882 has been filed, as well as several Trademarks have been filed and will be filed (see Exhibit A “Licensed Assets” listed in Exhibit 10.1 “Licensing Agreement”, below).

COMPETITION

There are numerous American and international building material suppliers. We believe the factors affecting the decision of choosing building materials would be the area, the availability of the building material, the available of craftsmanship, local labor cost, import taxes, and local financing acceptance.

GOVERNMENT REGULATIONS

Portions of our business are heavily regulated by federal, state and local environmental regulations, including those promulgated under the Environmental Protection Agency. These federal, state and local environmental laws and regulations govern the discharge of hazardous materials into the air and water, as well as the handling, storage, and disposal of hazardous materials and the remediation of contaminated sites. Our businesses may involve working around and with volatile, toxic and hazardous substances and other regulated substances. We are not aware of any federal, state or local environmental laws or regulations that will materially affect our earnings or competitive position, or result in material capital expenditures; however, we cannot predict the effect on our operations of possible future environmental legislation or regulations. Further, every county or city that we will operate in will have a building code that must be followed which includes special requirements for earthquakes, hurricanes or tornados.

EMPLOYEES

We currently have 5 employees who are full-time. None of our employees are represented by a labor union and we consider our relationships with our employees to be good.

Before you invest in our securities, you should be aware that there are various risks. You should consider carefully these risk factors, together with all of the other information included in this annual report before you decide to purchase our securities. If any of the following risks and uncertainties develop into actual events, our business, financial condition or results of operations could be materially adversely affected.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to continue as a going concern and our ability to obtain future financing.

In their report dated March 31, 2013, our independent auditors stated that our financial statements for the period from inception February 6, 2012 through March 31, 2013 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern is an issue raised as a result of recurring losses from operations and cash flow deficiencies since our inception. We continue to experience net losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. If we are unable to continue as a going concern, you may lose your entire investment.

We were formed in February, 2012 and have a limited operating history and, accordingly, you will not have any basis on which to evaluate our ability to achieve our business objectives.

We are a development stage company with limited operating results to date. Since we do not have an established operating history or regular sales yet, you will have no basis upon which to evaluate our ability to achieve our business objectives.

The absence of any significant operating history for us makes forecasting our revenue and expenses difficult, and we may be unable to adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As a result of the absence of any operating history for us, it is difficult to accurately forecast our future revenue. In addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to forecast because they generally depend on our ability to promote and sell our services. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which would result in further substantial losses. We may also be unable to expand our operations in a timely manner to adequately meet demand to the extent it exceeds expectations.

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Implications of being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

|

·

|

Only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management's Discussion and Analysis of Financial Condition and Results of Operations” disclosure.

|

|

·

|

Reduced disclosure about our executive compensation arrangements.

|

|

·

|

Not having to obtain non-binding advisory votes on executive compensation or golden parachute arrangements.

|

|

·

|

Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

|

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates, or we issue more than $1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced burdens. We have not taken advantage of these reduced reporting burdens in our SEC filings and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Our limited operating history does not afford investors a sufficient history on which to base an investment decision.

We are currently in the early stages of developing our business. There can be no assurance that at this time that we will operate profitably or that we will have adequate working capital to meet our obligations as they become due.

Investors must consider the risks and difficulties frequently encountered by early stage companies, particularly in rapidly evolving markets. Such risks include the following:

| |

●

|

Competition

|

| |

●

|

ability to anticipate and adapt to a competitive market;

|

| |

● |

ability to effectively manage expanding operations; amount and timing of operating costs and capital expenditures relating to expansion of our business, operations, and infrastructure; and

|

| |

●

|

dependence upon key personnel to market and sell our services and the loss of one of our key managers may adversely affect the marketing of our services.

|

We cannot be certain that our business strategy will be successful or that we will successfully address these risks. In the event that we do not successfully address these risks, our business, prospects, financial condition, and results of operations could be materially and adversely affected and we may not have the resources to continue or expand our business operations.

We are a development stage company and are substantially dependent on a third party

The Company is a development stage Company and is currently substantially dependent upon technology licensed from Cellular Concrete Technologies, LLC. Moreover, since demand for custom building materials has not, to the Company’s knowledge, been effectively addressed by others on a global basis, Management believes, but cannot assure, that it has an opportunity and both the capability and experience to be successful in its endeavor to generate savings for purchasers of custom building materials in its target markets.

We have no profitable operating history and May Never Achieve Profitability

From inception (February 6, 2012) through March 31, 2013, the Company has an accumulated deficiency during the development stage of $10,566 notwithstanding the fact that the principals of the Company have worked without salary and the Company has operated with minimal overhead. We are an early stage company and have a limited history of operations and have not generated revenues from operations since our inception. We are faced with all of the risks associated with a company in the early stages of development. Our business is subject to numerous risks associated with a relatively new, low-capitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies, and unanticipated difficulties regarding the marketing and sale of our services. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their entire investment.

We have a need to raise additional capital

The Company will require significant additional financing in order to meet the milestones and requirements of its Business Plan and avoid discontinuation of the License. Funding would be required for staffing, marketing, public relations and the necessary research precedent to expanding the scope of its offering to include the global market. The Company intends to seek an aggregate of $5,000,000 in 2013 and 2014; however there is no guarantee that the Company will be able to raise this or any amount of additional capital and a failure to do so would have a significant adverse effect on the Company’s ability, or would cause significant delays in its ability to address the market for purchases of building materials and homes by commercial enterprises and achieve its Business Plan. Notwithstanding, the License is not subject to immediate discontinuation if the initial milestone of net revenues in excess of expenses in the normal course of operations or receive funding of at least $200,000 by July 11, 2014, at least $400,000 by July 11, 2015 and $800,000 by July 11. 2016 is not achieved. Neither the Company nor any of its advisors or consultants has significant experience in raising funds similar to the $5,000,000 estimated to be required.

The Company’s Management and its advisors lack meaningful experience in the marketing of the Licensed building material products

In view of the fact that the marketing of the Company’s licensed building material products is a new business and there are no known comparable models in the market, the Company lacks the specific experience to implement its business plan. While the Company will seek to obtain resources which will support its marketing activities, there is no assurance that this lack of experience will not negatively affect the Company’s implementation of its business plan and prospects for growth and ultimate success.

Dependence on our Management, without whose services Company business operations could cease.

At this time, our management is wholly responsible for the development and execution of our business plan. Our management is under no contractual obligation to remain employed by us, although they have no present intent to leave. If our management should choose to leave us for any reason before we have hired additional personnel our operations may fail. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation the Company could afford. Without such management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our officers and directors devote limited time to the Company’s business and are engaged in other business activities

At this time, one officers and directors devotes their full-time attention to the Company’s business. Based upon the growth of the business, we would intend to employ additional management and staff. The limited time devoted to the Company’s business could adversely affect the Company’s business operations and prospects for the future. Without full-time devoted management, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Conflicts of interest between the company and its officer and directors may impede the operational ability of the company.

Our officer Paul Falco is also the CEO of Cellular Concrete Technologies, LLC, who is the other parties of the Company’s Licensing Agreement. There is a conflict of interest when he needs to address disputes between the parties, decide whether a waiver or an amendment to the agreement is appropriate, or decide whether to exercise termination rights. The outcome of these decisions may not be in favor of the Company and could lead to the termination of the agreement. Additionally, if our officer and director's other business affairs requires him to devote more substantial amounts of time to such affairs, it could limit his ability to devote time to our affairs and could have a negative impact on our ability to commence operations

Mr. Timothy Neher, the Company’s Chief Executive Officer prior to September 21, 2012 and director of Company controls Accelerated Venture Partners, LLC (“AVP”), an entity which has agreed to provide financial advisory services to the Company. AVP owns 3,000,000 shares of the Company’s outstanding common stock, representing a 11.39% ownership interest in the Company. Up to 1,500,000 of AVP’s shares (5% of the Company) can be repurchased by the Company for $0.0001 per share under certain circumstances. AVP is entitled to receive specified cash compensation if the Company achieves certain financial milestones as outlined in the “Our Business” section above.

Concentrated control risks; shareholders could be unable to control or influence key corporate actions or effect changes in the Company’s board of directors or management.

Currently, the Company has two shareholders that own 100% of our outstanding shares, Cellular Concrete Technologies, LLC currently own 23,350,000 shares of our common stock, representing approximately 88,61% of the voting control of the Company. Accelerated Venture Partners LLC currently own 3,000,000 shares of our common stock, representing approximately 11.39% voting control of the Company. Our current shareholders therefore have the power to make all major decisions regarding our affairs, including decisions regarding whether or not to issue stock and for what consideration, whether or not to sell all or substantially all of our assets and for what consideration and whether or not to authorize more stock for issuance or otherwise amend our charter or bylaws.

Lack of additional working capital may cause curtailment of any expansion plans while raising of capital through sale of equity securities would dilute existing shareholders’ percentage of ownership

Our available capital resources will not be adequate to fund our working capital requirements based upon our present level of operations for the 12-month period subsequent to March 31, 2013. A shortage of capital would affect our ability to fund our working capital requirements. If we require additional capital, funds may not be available on acceptable terms, if at all. In addition, if we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could dilute existing shareholders. If funds are not available, we could be placed in the position of having to cease all operations.

We do not presently have a traditional credit facility with a financial institution. This absence may adversely affect our operations

We do not presently have a traditional credit facility with a financial institution. The absence of a traditional credit facility with a financial institution could adversely impact our operations. If adequate funds are not otherwise available, we may be required to delay, scale back or eliminate portions of our operations and product development efforts. Without such credit facilities, the Company could be forced to cease operations and investors in our common stock or other securities could lose their entire investment.

Our inability to successfully achieve a critical mass of sales could adversely affect our financial condition

No assurance can be given that we will be able to successfully achieve a critical mass of sales in order to cover our operating expenses and achieve sustainable profitability. Without such critical mass of sales, the Company could be forced to cease operations.

Our success is substantially dependent on general economic conditions and business trends, particularly in the natural products, a downturn of which could adversely affect our operations.

The success of our operations depends to a significant extent upon a number of factors relating to business spending. These factors include economic conditions, activity in the financial markets, general business conditions, personnel cost, inflation, interest rates and taxation. Our business is affected by the general condition and economic stability of our customers and their continued willingness to work with us in the future. An overall decline in the demand for building services could cause a reduction in our sales and the Company could face a situation where it never achieves a critical mass of sales and thereby be forced to cease operations.

Changes in generally accepted accounting principles could have an adverse effect on our business financial condition, cash flows, revenue and results of operations

We are subject to changes in and interpretations of financial accounting matters that govern the measurement of our performance. Based on our reading and interpretations of relevant guidance, principles or concepts issued by, among other authorities, the American Institute of Certified Public Accountants, the Financial Accounting Standards Board, and the United States Securities and Exchange Commission, our management believes that our current contract terms and business arrangements have been properly reported. However, there continue to be issued interpretations and guidance for applying the relevant standards to a wide range of contract terms and business arrangements that are prevalent in the industries in which we operate. Future interpretations or changes by the regulators of existing accounting standards or changes in our business practices could result in future changes in our revenue recognition and/or other accounting policies and practices that could have a material adverse effect on our business, financial condition, cash flows, revenue and results of operations.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with 5 full-time employees. We expect to experience a period of significant expansion in headcount, facilities, infrastructure and overhead and anticipate that further expansion will be required to address potential growth and market opportunities. Future growth will impose significant added responsibilities on members of management, including the need to identify, recruit, maintain and integrate managers. Our future financial performance and its ability to compete effectively will depend, in part, on its ability to manage any future growth effectively.

We are subject to compliance with securities law, which exposes us to potential liabilities, including potential rescission rights.

We have offered and sold our common stock to investors pursuant to certain exemptions from the registration requirements of the Securities Act of 1933, as well as those of various state securities laws. The basis for relying on such exemptions is factual; that is, the applicability of such exemptions depends upon our conduct and that of those persons contacting prospective investors and making the offering. We have not received a legal opinion to the effect that any of our prior offerings were exempt from registration under any federal or state law. Instead, we have relied upon the operative facts as the basis for such exemptions, including information provided by investors themselves.

If any prior offering did not qualify for such exemption, an investor would have the right to rescind its purchase of the securities if it so desired. It is possible that if an investor should seek rescission, such investor would succeed. A similar situation prevails under state law in those states where the securities may be offered without registration in reliance on the partial preemption from the registration or qualification provisions of such state statutes under the National Securities Markets Improvement Act of 1996. If investors were successful in seeking rescission, we would face severe financial demands that could adversely affect our business and operations. Additionally, if we did not in fact qualify for the exemptions upon which it has relied, we may become subject to significant fines and penalties imposed by the SEC and state securities agencies.

We incur costs associated with SEC reporting compliance.

The Company made the decision to become an SEC “reporting company” in order to comply with applicable laws and regulations. We incur certain costs of compliance with applicable SEC reporting rules and regulations including, but not limited to attorneys fees, accounting and auditing fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $25,000 per year. On balance, the Company determined that the incurrence of such costs and expenses was preferable to the Company being in a position where it had very limited access to additional capital funding.

The availability of a large number of authorized but unissued shares of common stock may, upon their issuance, lead to dilution of existing stockholders.

We are authorized to issue 100,000,000 shares of common stock, $0.0001 par value per share, of which, as of July 12 2013, 26,350,000 shares of common stock were issued and outstanding. We are also authorized to issue 10,000,000 shares of preferred stock, $0.0001 par value, none of which are issued and outstanding. These shares may be issued by our board of directors without further stockholder approval. The issuance of large numbers of shares, possibly at below prior investment valuations, is likely to result in substantial dilution to the interests of other stockholders. In addition, issuances of large numbers of shares may adversely affect the value of our common stock.

We may need additional capital that could dilute the ownership interest of investors.

We require substantial working capital to fund our business. If we raise additional funds through the issuance of equity, equity-related or convertible debt securities, these securities may have rights, preferences or privileges senior to those of the rights of holders of our common stock and they may experience additional dilution. We cannot predict whether additional financing will be available to us on favorable terms when required, or at all. Since our inception, we have experienced negative cash flow from operations and expect to experience significant negative cash flow from operations in the future. The issuance of additional common stock by the Company may have the effect of further diluting the proportionate equity interest and voting power of holders of our common stock.

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. While we believe that our internal controls are adequate for our current level of operations, we believe that we may need to employ accounting additional staff as our operations ramp up. We do not have a dedicated full time Chief Financial Officer, which we intend to employ within the next twelve months. Additionally, our board of directors has not designated an Audit Committee and we do not presently have any outside directors. We intend to attract outside directors once the Company commences full operations, and to designate an Audit Committee from such outside directors. There is no guarantee that such projected actions will be adequate or successful or that such improvements will be carried out on a timely basis. If, in the future, we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

We do not intend to pay cash dividends in the foreseeable future

We currently intend to retain all future earnings for use in the operation and expansion of our business. We do not intend to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

There is currently no market for our securities and there can be no assurance that any market will ever develop or that our common stock will be listed for trading.

There has not been any established trading market for our common stock and there is currently no market for our securities. Even if we are ultimately approved for trading on the OTC Bulletin Board (“OTCBB”), there can be no assurance as the prices at which our common stock will trade if a trading market develops, of which there can be no assurance. Until our common stock is fully distributed and an orderly market develops, (if ever) in our common stock, the price at which it may ultimately trade is likely to fluctuate significantly and may not reflect the actual value of the stock.

Our common stock is subject to the Penny Stock Regulations

Once it commences trading (if ever) our common stock will likely be subject to the SEC's “penny stock” rules to the extent that the price remains less than $5.00. Those rules, which require delivery of a schedule explaining the penny stock market and the associated risks before any sale, may further limit your ability to sell your shares.

The SEC has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our common stock currently has no “market price” and when and if a trading market develops, may fall within the definition of penny stock and subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser's prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer's presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the `penny stock` rules may restrict the ability of broker-dealers to sell our common stock and may affect the ability of investors to sell their common stock in the secondary market.

Our common stock is illiquid and may in the future be subject to price volatility unrelated to our operations

Our common stock has no market price and, if and when a market price is established, could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock. Sales of substantial amounts of common stock, or the perception that such sales could occur, could adversely affect the market price of our common stock (if and when a market price is established) and could impair our ability to raise capital through the sale of our equity securities.

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors' independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

We Are A New Venture With No Operating History

The Company was recently organized and only recently shifted its focus to the construction industry. Due to our limited operating history, our ability to operate successfully is materially uncertain and our operations are subject to all risks inherent in a developing business enterprise. We have no operating history upon which you may evaluate our operations and prospects. Our limited operating history makes it difficult to evaluate our likelihood of commercial viability and market acceptance of our proposed operations. Our potential success must be evaluated in light of the problems; expenses and difficulties frequently encountered by new businesses in general and particularly in the manufacturing and construction industry of masonry products.

Lack of Proven Business Model

To date, we have not generated any significant sales. There can be no assurance, however, that the implementation of such a plan, or that the implementation of the overall business plan developed by management, will result in a viable business generating revenue or that if it does result in sales, that such sales will necessarily translate into profitability. Failure to properly develop the Company’s plan of expansion will prevent the Company from generating meaningful product sales.

Tight credit standards and loan terms, curtailed lending activity, and increased interest rates among consumer and industry lenders could reduce our sales, if any. If consumer financing were to become further curtailed, sales may not develop.

The consumers and businesses who will buy homes and other products from the developers that use our technology and services in the housing, oil, flowable fill and ready mix concrete markets may use secured consumer and industry financing from third party lenders. The availability, terms and costs of consumer financing depend on the lending practices of financial institutions, governmental regulations and economic and other conditions, all of which are beyond our control.

For example, manufactured home consumer financing is at times more difficult to obtain than financing for site-built and modular homes. The poor performance of portfolios of manufactured housing consumer loans in past years has made it more difficult for consumer and industry finance companies to obtain long-term capital. Additionally, the industry has seen certain traditional real estate mortgage lenders tighten terms or discontinue financing for manufactured housing.

If consumer and industry financing for homes and other products that use our technology were to be further curtailed, we may not be able to develop sales and our operating results and cash flows would suffer.

If we are unable to establish or maintain relationships with licensees, we may not be able to develop sales and our operating results and cash flows could suffer.

We may not be able to establish relationships with licensees or maintain good relationships with licensees. Even if we do establish and maintain relationships with independent licensees, these licensees are not obligated to sell our products exclusively, and may choose to sell our competitors’ products instead. The licensees with whom we may develop relationships with can cancel these relationships on short notice. In addition, these parties may not remain financially solvent, as they are subject to the same industry, economic, demographic and seasonal trends that we face. If we do not establish and maintain relationships with solvent independent retailers in the markets we serve, sales in those markets could decline and our operating results and cash flows could suffer.

The factory-built housing industry is very competitive. If we are unable to effectively compete, our growth could be limited, our sales may not materialize and our operating results and cash flows could suffer.