Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 10-Q

_________________________________________

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2018

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 000-55598

__________________________________________

RREEF Property Trust, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

|

| |

Maryland | 45-4478978 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| |

345 Park Avenue, 26th Floor, New York, NY 10154 | (212) 454-6260 |

(Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o (Do not check if smaller reporting company) | Smaller reporting company | x |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of August 9, 2018, the registrant had 3,790,010 shares of Class A common stock, $.01 par value, outstanding, 5,094,476 shares of Class I common stock, $.01 par value, outstanding, 502,312 shares of Class T common stock, $.01 par value, outstanding, and no shares of Class D common stock, $.01 par value, or Class N common stock, $.01 par value, outstanding.

RREEF PROPERTY TRUST, INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended June 30, 2018

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

RREEF PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS |

| | | | | | | |

| June 30, 2018 (unaudited) | | December 31, 2017 |

ASSETS |

| |

|

Investment in real estate assets: |

| |

|

Land | $ | 37,238,612 |

| | $ | 37,238,612 |

|

Buildings and improvements, less accumulated depreciation of $13,599,178 and $11,476,041, respectively | 90,052,290 |

| | 92,160,948 |

|

Furniture, fixtures and equipment, less accumulated depreciation of $251,245 and $211,727, respectively | 229,948 |

| | 239,225 |

|

Acquired intangible lease assets, less accumulated amortization of $17,349,901 and $15,510,271, respectively | 19,445,433 |

| | 21,285,063 |

|

Total investment in real estate assets, net | 146,966,283 |

| | 150,923,848 |

|

Investment in marketable securities | 14,130,288 |

| | 10,046,177 |

|

Total investment in real estate assets and marketable securities, net | 161,096,571 |

| | 160,970,025 |

|

Cash and cash equivalents | 2,176,134 |

| | 2,441,853 |

|

Receivables, net of allowance for doubtful accounts of $18,696 and $9,586, respectively | 2,566,287 |

| | 2,615,939 |

|

Deferred leasing costs, net of amortization of $280,375 and $201,108, respectively | 2,097,861 |

| | 1,833,527 |

|

Prepaid and other assets | 2,129,899 |

| | 1,454,988 |

|

Total assets | $ | 170,066,752 |

| | $ | 169,316,332 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

| |

|

Line of credit, net | $ | 58,062,796 |

| | $ | 63,022,061 |

|

Mortgage loans payable, net | 27,272,093 |

| | 27,254,431 |

|

Accounts payable and accrued expenses | 1,186,698 |

| | 768,049 |

|

Due to affiliates | 3,768,736 |

| | 4,375,191 |

|

Note to affiliate, net of unamortized discount of $1,437,536 and $1,509,753, respectively | 7,512,464 |

|

| 7,440,247 |

|

Acquired below market lease intangibles, less accumulated amortization of $3,212,332 and $3,016,239, respectively | 5,471,423 |

| | 5,667,516 |

|

Distributions payable | 277,419 |

| | 258,542 |

|

Other liabilities | 1,183,417 |

| | 1,190,779 |

|

Total liabilities | 104,735,046 |

| | 109,976,816 |

|

Stockholders' Equity: |

| |

|

Preferred stock, $0.01 par value; 50,000,000 shares authorized; none issued | — |

| | — |

|

Class A common stock, $0.01 par value; 200,000,000 shares authorized; 3,731,903 and 3,666,927 issued and outstanding, respectively | 37,319 |

| | 36,670 |

|

Class I common stock, $0.01 par value; 200,000,000 shares authorized; 4,958,940 and 4,352,050 issued and outstanding, respectively | 49,590 |

| | 43,521 |

|

Class T common stock, $0.01 par value; 250,000,000 shares authorized; 232,464 and 71,316 issued and outstanding, respectively | 2,325 |

| | 713 |

|

Class D common stock, $0.01 par value; 50,000,000 shares authorized; none issued | — |

| | — |

|

Class N common stock, $0.01 par value; 300,000,000 shares authorized; none issued | — |

| | — |

|

Additional paid-in capital | 96,712,060 |

| | 86,813,276 |

|

Deficit | (31,469,588 | ) | | (28,290,303 | ) |

Accumulated other comprehensive income | — |

| | 735,639 |

|

Total stockholders' equity | 65,331,706 |

| | 59,339,516 |

|

Total liabilities and stockholders' equity | $ | 170,066,752 |

| | $ | 169,316,332 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Revenues |

| | | | | | |

Rental and other property income | $ | 3,842,279 |

| | $ | 3,784,351 |

| | $ | 7,667,276 |

| | $ | 7,581,484 |

|

Tenant reimbursement income | 540,585 |

| | 530,623 |

| | 1,219,108 |

| | 1,067,823 |

|

Investment income on marketable securities | 119,925 |

| | 76,980 |

| | 208,777 |

| | 120,856 |

|

Total revenues | 4,502,789 |

| | 4,391,954 |

| | 9,095,161 |

| | 8,770,163 |

|

Expenses |

| | | | | |

|

General and administrative expenses | 495,784 |

| | 481,617 |

| | 1,006,789 |

| | 864,746 |

|

Property operating expenses | 1,337,600 |

| | 1,296,348 |

| | 2,750,093 |

| | 2,647,479 |

|

Advisory fees | 389,761 |

| | 257,054 |

| | 669,216 |

| | 504,402 |

|

Depreciation | 1,073,786 |

| | 1,087,167 |

| | 2,162,655 |

| | 2,168,488 |

|

Amortization | 906,158 |

| | 932,102 |

| | 1,812,962 |

| | 1,860,349 |

|

Total operating expenses | 4,203,089 |

| | 4,054,288 |

| | 8,401,715 |

| | 8,045,464 |

|

Net realized (loss) gain upon sale of marketable securities | (155,052 | ) | | (6,906 | ) | | (408,532 | ) | | 47,796 |

|

Net unrealized gain on investment in marketable securities | 981,763 |

| | — |

| | 481,245 |

| | — |

|

Operating income | 1,126,411 |

| | 330,760 |

| | 766,159 |

| | 772,495 |

|

Interest expense | (884,364 | ) | | (886,455 | ) | | (1,787,914 | ) | | (1,711,934 | ) |

Net income (loss) | $ | 242,047 |

| | $ | (555,695 | ) | | $ | (1,021,755 | ) | | $ | (939,439 | ) |

|

| | | |

| | |

Basic and diluted net income (loss) per share of Class A common stock | $ | 0.03 |

| | $ | (0.07 | ) | | $ | (0.12 | ) | | $ | (0.12 | ) |

Basic and diluted net income (loss) per share of Class I common stock | $ | 0.03 |

| | $ | (0.07 | ) | | $ | (0.12 | ) | | $ | (0.12 | ) |

Basic and diluted net income (loss) per share of Class T common stock | $ | 0.03 |

| | $ | — |

| | $ | (0.12 | ) | | $ | (0.12 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Net income (loss) | $ | 242,047 |

| | $ | (555,695 | ) | | $ | (1,021,755 | ) | | $ | (939,439 | ) |

Other comprehensive income (loss) for the three and six months ended June 30, 2017: |

| |

| |

| |

|

Reclassification of previous unrealized loss (gain) on marketable securities into net realized loss | — |

| | 6,906 |

| | — |

| | (47,796 | ) |

Unrealized gain on marketable securities for the three and six months ended June 30, 2017 | — |

| | 83,545 |

| | — |

| | 62,314 |

|

Total other comprehensive gain for the three and six months ended June 30, 2017 | — |

| | 90,451 |

| | — |

| | 14,518 |

|

Comprehensive income (loss) | $ | 242,047 |

| | $ | (465,244 | ) | | $ | (1,021,755 | ) | | $ | (924,921 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Class A Common Stock | | Class I Common Stock | | Class T Common Stock | | Class D Common Stock | | Class N Common Stock | | Additional Paid-in Capital | | Deficit | | Accumulated Other Comprehensive Income | | Total

Stockholders'

Equity |

| Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | | | |

Balance, December 31, 2017 | — |

| $ | — |

| | 3,666,927 |

| $ | 36,670 |

| | 4,352,050 |

| $ | 43,521 |

| | 71,316 |

| $ | 713 |

| | — |

| $ | — |

| | — |

| $ | — |

| | $ | 86,813,276 |

| | $ | (28,290,303 | ) | | $ | 735,639 |

| | $ | 59,339,516 |

|

Cumulative effect adjustment for change in accounting principle (see Note 2) | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| | 735,639 |

| | (735,639 | ) | | — |

|

Balance, January 1, 2018, as adjusted | — |

| — |

| | 3,666,927 |

| 36,670 |

| | 4,352,050 |

| 43,521 |

| | 71,316 |

| 713 |

| | — |

| — |

| | — |

| — |

| | 86,813,276 |

| | (27,554,664 | ) | | — |

| | 59,339,516 |

|

Issuance of common stock | — |

| — |

| | 158,539 |

| 1,585 |

| | 679,490 |

| 6,795 |

| | 159,494 |

| 1,595 |

| | — |

| — |

| | — |

| — |

| | 14,015,051 |

| | — |

| | — |

| | 14,025,026 |

|

Issuance of common stock through the distribution reinvestment plan | — |

| — |

| | 45,615 |

| 456 |

| | 44,999 |

| 450 |

| | 1,654 |

| 17 |

| | — |

| — |

| | — |

| — |

| | 1,280,344 |

| | — |

| | — |

| | 1,281,267 |

|

Redemption of common stock | — |

| — |

| | (139,178 | ) | (1,392 | ) | | (117,599 | ) | (1,176 | ) | | — |

| — |

| | — |

| — |

| | — |

| — |

| | (3,547,900 | ) | | — |

| | — |

| | (3,550,468 | ) |

Distributions to investors | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| | (2,893,169 | ) | | — |

| | (2,893,169 | ) |

Other offering costs | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | (1,848,711 | ) | | — |

| | — |

| | (1,848,711 | ) |

Net loss | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| — |

| | — |

| | (1,021,755 | ) | | — |

| | (1,021,755 | ) |

Balance, June 30, 2018 | — |

| $ | — |

| | 3,731,903 |

| $ | 37,319 |

| | 4,958,940 |

| $ | 49,590 |

| | 232,464 |

| $ | 2,325 |

| | — |

| $ | — |

| | — |

| $ | — |

| | $ | 96,712,060 |

| | $ | (31,469,588 | ) | | $ | — |

| | $ | 65,331,706 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

| 2018 | | 2017 |

Cash flows from operating activities: | | | |

Net loss | $ | (1,021,755 | ) | | $ | (939,439 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: |

| |

|

Depreciation | 2,162,655 |

| | 2,168,488 |

|

Net realized gain (loss) upon sale of marketable securities | 408,532 |

| | (47,796 | ) |

Net unrealized gain on marketable securities | (481,245 | ) | | — |

|

Amortization of intangible lease assets and liabilities | 1,722,804 |

| | 1,783,987 |

|

Amortization of deferred financing costs | 151,376 |

| | 238,100 |

|

Allowance for doubtful accounts | 9,110 |

| | (820 | ) |

Straight line rent | 310,531 |

| | (383,072 | ) |

Amortization of discount on note to affiliate | 72,217 |

| | 70,833 |

|

Changes in assets and liabilities: |

| |

|

Receivables | 107,959 |

| | 138,507 |

|

Deferred leasing costs | (342,600 | ) | | — |

|

Prepaid and other assets | (143,676 | ) | | (55,324 | ) |

Accounts payable and accrued expenses | 107,761 |

| | (953,444 | ) |

Other liabilities | (174,733 | ) | | 327,876 |

|

Due to affiliates | (539,582 | ) | | (253,739 | ) |

Net cash provided by operating activities | 2,349,354 |

| | 2,094,157 |

|

Cash flows from investing activities: |

| |

|

Improvements to real estate assets | (39,203 | ) | | (86,756 | ) |

Deposit for acquisition of investment in real estate | (500,000 | ) | | — |

|

Investment in marketable securities | (14,762,335 | ) | | (8,016,522 | ) |

Proceeds from sale of marketable securities | 10,782,894 |

| | 7,935,862 |

|

Net cash used in investing activities | (4,518,644 | ) | | (167,416 | ) |

Cash flows from financing activities: |

| |

|

Repayments of line of credit | (4,600,000 | ) | | (1,750,000 | ) |

Proceeds from issuance of common stock | 13,917,744 |

| | 7,071,574 |

|

Payment of financing costs | (492,980 | ) | | — |

|

Payment of offering costs | (1,777,700 | ) | | (1,542,912 | ) |

Distributions to investors | (2,874,292 | ) | | (2,514,534 | ) |

Redemption of common stock | (3,550,468 | ) | | (2,106,088 | ) |

Common stock issued through the distribution reinvestment plan | 1,281,267 |

| | 1,060,152 |

|

Net cash provided by financing activities | 1,903,571 |

| | 218,192 |

|

Net increase in cash and cash equivalents | (265,719 | ) | | 2,144,933 |

|

Cash and cash equivalents, beginning of period | 2,441,853 |

| | 1,493,256 |

|

Cash and cash equivalents, end of period | $ | 2,176,134 |

| | $ | 3,638,189 |

|

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

(Unaudited)

|

| | | | | | | |

| Six Months Ended June 30, |

Supplemental Disclosures of Non-Cash Investing and Financing Activities: | 2018 | | 2017 |

Distributions declared and unpaid | $ | 277,419 |

|

| $ | 244,793 |

|

Net unrealized gain on marketable securities, six months ended June 30, 2017 | — |

|

| 14,518 |

|

Purchases of marketable securities not yet paid | 406,897 |

|

| 113,249 |

|

Proceeds from sale of marketable securities not yet received | 345,683 |

|

| 61,785 |

|

Proceeds from issuance of common stock not yet received | 327,534 |

|

| — |

|

Accrued offering costs not yet paid | 1,205,945 |

| | 632,397 |

|

| | | |

Supplemental Cash Flow Disclosures: |

| |

|

Interest paid | $ | 1,525,248 |

|

| $ | 1,351,287 |

|

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2018

(Unaudited)

NOTE 1 — ORGANIZATION

RREEF Property Trust, Inc. (the “Company”) was formed on February 7, 2012 as a Maryland corporation and has elected to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. Substantially all of the Company's business is conducted through RREEF Property Operating Partnership, LP, the Company's operating partnership (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership. RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company, is the limited partner of the Operating Partnership. As the Company completes the settlement for purchase orders for shares of its common stock in its continuous public offering, it will continue to transfer substantially all of the proceeds to the Operating Partnership.

The Company was organized to invest primarily in a diversified portfolio consisting primarily of high quality, income-producing commercial real estate located in the United States, including, without limitation, office, industrial, retail and apartment properties (“Real Estate Properties”). Although the Company intends to invest primarily in Real Estate Properties, it also intends to acquire common and preferred stock of REITs and other real estate companies (“Real Estate Equity Securities”) and debt investments backed principally by real estate (“Real Estate Loans” and, together with Real Estate Equity Securities, “Real Estate-Related Assets”).

On January 3, 2013, the Securities and Exchange Commission ("SEC") declared effective the Company's registration statement on Form S-11 (File No. 333-180356), filed under the Securities Act of 1933, as amended (the "Initial Registration Statement"). On May 30, 2013, RREEF America L.L.C., a Delaware limited liability company (“RREEF America”), the Company's sponsor and advisor, purchased $10,000,000 of the Company's Class I common stock, $0.01 par value per share ("Class I Shares"), and the Company’s board of directors authorized the release of the escrowed funds to the Company, thereby allowing the Company to commence operations.

On January 15, 2016, the Company filed articles supplementary to its articles of incorporation to add a newly-designated Class D common stock, $0.01 par value per share ("Class D Shares"). On January 20, 2016, the Company commenced a private offering of up to a maximum of $350,000,000 in Class D Shares (the "Private Offering," and together with the Follow-On Public Offering (defined below), the "Offerings").

On July 12, 2016, the SEC declared effective the Company's registration statement on Form S-11 (File No. 333-208751), filed under the Securities Act of 1933, as amended (the "Registration Statement"). Pursuant to the Registration Statement, the Company is offering for sale up to $2,100,000,000 of shares of its Class A common stock, $0.01 par value per share ("Class A Shares"), Class I Shares, and Class T common stock, $0.01 par value per share ("Class T Shares"), in its primary offering and up to $200,000,000 of Class A Shares, Class I Shares, Class N common stock, $0.01 par value per share ("Class N Shares") and Class T Shares pursuant to its distribution reinvestment plan, to be sold on a "best efforts" basis for the Company's follow-on public offering (the "Follow-On Public Offering"). The Company's initial public offering terminated upon the commencement of the Follow-On Public Offering.

Shares of the Company’s common stock are sold at the Company’s net asset value (“NAV”) per share, plus, for Class A, T and D Shares only, applicable selling commissions. Each class of shares may have a different NAV per share because of certain class-specific fees. NAV per share is calculated by dividing the NAV at the end of each business day for each class by the number of shares outstanding for that class on such day.

The Company's NAV per share for its Class A, Class I and Class T Shares is posted to the Company's website at www.rreefpropertytrust.com after the stock market close each business day. Additionally, the Company's NAV per share for its Class A, Class I and Class T Shares is published daily via NASDAQ's Mutual Fund Quotation System under the symbols ZRPTAX, ZRPTIX and ZRPTTX for its Class A Shares, Class I Shares and Class T Shares, respectively.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), the authoritative reference for U.S. generally accepted accounting principles (“GAAP”). There have been no significant changes to the Company's significant accounting policies during the six months ended June 30, 2018 except for the adoption of Accounting Standards Updates ("ASU") noted below in Note 2. The interim financial data as of June 30, 2018 and for the three and six months ended June 30, 2018 and 2017 is unaudited. In our opinion, the interim data includes all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results for the interim periods.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Real Estate Investments and Lease Intangibles

In January 2017, FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business, the intent of which is to assist entities with evaluating whether transactions should be accounted for as acquisitions (and dispositions) of assets or businesses. Under the previous implementation guidance, real estate was broadly interpreted to be a business, which required, among other things, that acquisition related costs be expensed at the time of acquisition. The amendments in ASU 2017-01 provide a screen to determine when a set of identifiable assets is not a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. Generally, a real estate asset and its related leases will be considered a single identifiable asset and therefore will not meet the definition of a business. If the real estate and related leases in an acquisition are determined to be an asset and not a business, then the acquisition related costs would be capitalized onto the consolidated balance sheet. The Company adopted ASU 2017-01 on its effective date of January 1, 2018, which did not have an impact on the Company's consolidated financial statements. Acquisitions of real estate investments after January 1, 2018 will be evaluated based on ASU 2017-01 and may result in the capitalization of acquisition related costs for those acquisitions deemed to be asset acquisitions.

Investments in Marketable Securities

Effective January 1, 2018, the Company adopted ASU 2016-01, Financial Statements - Overall (Subtopic 825-10) - Recognition and Measurement of Financial Assets and Financial Liabilities, which improves certain aspects of the recognition, measurement, presentation and disclosure of financial instruments. ASU 2016-01 revised the accounting related to the classification and measurement of investments in equity securities and the presentation of certain fair value changes for financial liabilities measured at fair value. Since the Company's inception and prior to adoption of ASU 2016-01, it has accounted for its investments in equity securities as available for sale securities, with unrealized changes in fair value recognized in other comprehensive income or loss. Beginning January 1, 2018, the net unrealized change in the fair value of the Company's investments in marketable securities is recorded in earnings as part of operating income or loss.

The Company adopted ASU 2016-01 using a modified retrospective approach that resulted in recording, on January 1, 2018, a cumulative effect adjustment of $735,639 of net unrealized gain on its investments in marketable securities as of December 31, 2017 into deficit in the accompanying consolidated financial statements.

The Company has reclassified the $6,906 of net realized loss and $47,796 of net realized gain upon sale of marketable securities on the accompanying consolidated statement of operations for the three and six months ended

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

June 30, 2017, respectively, to include it in operating income or loss for comparative purposes. This reclassification has not changed the Company's net loss for the three and six months ended June 30, 2017.

Organization and Offering Costs

Organizational expenses and other expenses which do not qualify as offering costs are expensed as incurred. Offering costs are those costs incurred by the Company, RREEF America and its affiliates on behalf of the Company which relate directly to the Company’s activities of raising capital in the Offerings, preparing for the Offerings, the qualification and registration of the Offerings and the marketing and distribution of the Company’s shares. This includes, but is not limited to, accounting and legal fees, including the legal fees of the dealer manager for the public offerings, costs for registration statement amendments and prospectus supplements, printing, mailing and distribution costs, filing fees, amounts to reimburse RREEF America as the Company’s advisor or its affiliates for the salaries of employees and other costs in connection with preparing supplemental sales literature, amounts to reimburse the dealer manager for amounts that it may pay to reimburse the bona fide due diligence expenses of any participating broker-dealers supported by detailed and itemized invoices, telecommunication costs, fees of the transfer agent, registrars, trustees, depositories and experts, the cost of educational conferences held by the Company (including the travel, meal and lodging costs of registered representatives of any participating broker-dealers) and attendance fees and cost reimbursement for employees of affiliates to attend retail seminars conducted by broker-dealers. Offering costs will be paid from the proceeds of the Offerings. These costs will be treated as a reduction of the total proceeds. Total organization and offering costs incurred by the Company with respect to a particular Offering will not exceed 15% of the gross proceeds from such particular Offering. In addition, the Company will not reimburse RREEF America or the dealer manager for any underwriting compensation (a subset of organization and offering costs) which would cause the Company’s total underwriting compensation to exceed 10% of the gross proceeds from the primary portion of a particular offering.

Included in offering costs are (1) distribution fees paid on a trailing basis at the rate of (a) 0.50% per annum on the NAV of the outstanding Class A Shares, and (b) 1.00% per annum for approximately three years on the NAV of the outstanding Class T Shares, and (2) dealer manager fees paid on a trailing basis at the rate of 0.55% per annum on the NAV of the outstanding Class A and Class I Shares (collectively, the "Trailing Fees"). The Trailing Fees are computed daily based on the respective NAV of each share class as of the beginning of each day and paid monthly. However, at each reporting date, the Company accrues an estimate for the amount of Trailing Fees that ultimately may be paid on the outstanding shares. Such estimate reflects the Company's assumptions for certain variables, including future redemptions, share price appreciation and the total gross proceeds raised or to be raised during each Offering. In addition, the estimated accrual for future Trailing Fees as of a given reporting date may be reduced by the aforementioned limits on total organization and offering costs and total underwriting compensation. Changes in this estimate will be recorded prospectively as an adjustment to additional paid-in capital. As of June 30, 2018 and December 31, 2017, the Company has accrued $2,646,301 and $2,238,576, respectively, in Trailing Fees to be payable in the future, which was included in due to affiliates on the consolidated balance sheets.

Revenue Recognition

In May 2014, the FASB issued ASU 2014-09, Revenue From Contracts With Customers. ASU 2014-09 requires entities to recognize revenue in their financial statements in a manner that depicts the transfer of the promised goods or services to its customers in an amount that reflects the consideration to which the entity is entitled at the time of transfer of those goods or services. As a result, the amount and timing of revenue recognition may be affected. However, certain types of contracts are excluded from the provisions of ASU 2014-09, including leases. Other types of real estate related contracts, such as for dispositions or development of real estate, will be impacted by ASU 2014-09. In addition, ASU 2014-09 requires additional disclosures regarding revenue recognition. The Company adopted ASU 2014-09, as amended, on its effective of January 1, 2018, using the cumulative effect adjustment method in the period of adoption. The adoption of ASU 2014-09 did not have a material impact on the Company's consolidated financial statements.

Net Earnings or Loss Per Share

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

Net earnings or loss per share is calculated using the two-class method. The two-class method is utilized when an entity (1) has different classes of common stock that participate differently in net earnings or loss, or (2) has issued participating securities, which are securities that participate in distributions separately from the entity’s common stock. Pursuant to the advisory agreement between the Company and its advisor (see Note 8), the advisor may earn a performance component of the advisory fee which is calculated separately for each class of common stock which therefore may result in a different allocation of net earnings or loss to each class of common stock. Since the Company’s inception, the Company has not issued any participating securities.

Concentration of Credit Risk

As of June 30, 2018 and December 31, 2017, the Company had cash on deposit at multiple financial institutions which were in excess of federally insured levels. The Company limits significant cash holdings to accounts held by financial institutions with a high credit standing. Therefore, the Company believes it is not exposed to any significant credit risk on its cash deposits.

Recent Accounting Pronouncements

In February 2016, FASB issued ASU 2016-02, Leases (Topic 842), which sets out the principles for the recognition, measurement, presentation and disclosure of leases for both lessees and lessors. ASU 2016-02 requires lessors to identify the lease and non-lease components contained within each lease. Common area maintenance reimbursements within a real estate lease under ASU 2016-02 are considered a non-lease component and as such, would have to be evaluated under the revenue recognition guidance of ASU 2014-09. However, in July 2018, FASB issued ASU 2018-11, Leases (Topic 842) - Targeted Improvements. Under ASU 2018-11, a lessor may elect a practical expedient to not separate lease and non-lease components of a lease and instead account for them as a single component if two criteria are met: (1) the timing and pattern of transfer of the non-lease component(s) and associated lease component are the same, and (2) the lease component, if accounted for separately, would be classified as an operating lease. Furthermore, the combined component will be accounted for under the new revenue recognition guidance of ASU 2014-09 if the non-lease components are the predominant component of the combined component. Otherwise, the combined component will be accounted for under the lease guidance of ASU 2016-02.

ASU 2016-02 requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight line basis over the term of the lease. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than 12 months regardless of their classification. Leases with a term of 12 months or less will be accounted for similar to existing guidance for operating leases today. As of June 30, 2018, the Company is not a lessee under any lease contracts. As of June 30, 2018, all of the Company's leases are classified as operating leases, and it is expected that such leases will continue to be classified as operating leases under ASU 2016-02. The Company intends to adopt ASU 2016-02 when it is effective on January 1, 2019. The Company is still evaluating the impact of ASU 2016-02 and subsequent amendments on its consolidated financial statements but currently does not expect adoption of ASU 2016-02 to have a material impact.

NOTE 3 — FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, FASB ASC 820, Fair Value Measurement and Disclosures, establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity's own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included in Level 1 that are

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are the unobservable inputs for the asset or liability, which are typically based on an entity's own assumption, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on input from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The Company's investments in marketable securities are valued using Level 1 inputs as the securities are publicly traded on major stock exchanges.

FASB ASC 825-10-65-1 requires the Company to disclose fair value information for all financial instruments for which it is practicable to estimate fair value, whether or not recognized in the consolidated balance sheets. Fair value of lines of credit and mortgage loans payable is determined using Level 2 inputs and a discounted cash flow approach with an interest rate and other assumptions that approximate current market conditions. The carrying amount of the Company's line of credit, exclusive of deferred financing costs, approximated its fair value of $58,500,000 and $63,100,000 at June 30, 2018 and December 31, 2017, respectively. The Company estimated the fair value of the Company's mortgage loans payable at $26,224,630 and $26,610,378 as of June 30, 2018 and December 31, 2017, respectively.

The fair value of the Company's note to affiliate is determined using Level 3 inputs and a discounted cash flow approach with an interest rate and other assumptions that estimate current market conditions. The Company has estimated the fair value of its note to affiliate at approximately $2,500,000 and $2,400,000 as of June 30, 2018 and December 31, 2017, respectively.

The Company's financial instruments, other than those referred to above, are generally short-term in nature and contain minimal credit risk. These instruments consist of cash and cash equivalents, accounts and other receivables and accounts payable. The carrying amounts of these assets and liabilities in the consolidated balance sheets approximate their fair value.

NOTE 4 — REAL ESTATE INVESTMENTS

The Company acquired no real estate property during the six months ended June 30, 2018 and 2017.

On July 17, 2018, the Company acquired three industrial properties located in Miami, Florida ("Miami Industrial") for a purchase price of $20,700,000 (excluding closing costs). The acquisition was funded with proceeds from the Offering and by borrowing $19,900,000 under the Company's line of credit. Miami Industrial consists of three warehouse distribution buildings totaling 289,919 square feet fully leased to three tenants, with one tenant per building.

All leases at Miami Industrial have been classified as operating leases. Under ASU 2017-01, the transaction was determined to be an asset acquisition, resulting in the Company's capitalization of $141,819 of acquisition related costs. The Company's allocation of the purchase price (including acquisition related costs) of Miami Industrial, which is not included in the accompanying financial statements as the acquisition was subsequent to June 30, 2018, is as follows:

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

|

| | | |

| Miami Industrial |

Land | $ | 9,420,343 |

|

Building and improvements | 8,124,985 |

|

Acquired in-place leases | 3,751,504 |

|

Acquired below-market leases | (455,013 | ) |

Total purchase price | $ | 20,841,819 |

|

The Company’s estimated revenues and net loss, on a pro forma basis (as if the acquisition of Miami Industrial was completed on January 1, 2017), for the three and six months ended June 30, 2018 are as follows:

|

| | | | | | |

| Three Months Ended June 30, 2018 | Six Months Ended June 30, 2018 |

Revenues | $ | 4,955,716 |

| $ | 10,002,660 |

|

Net income (loss) | $ | 98,555 |

| $ | (1,354,519 | ) |

Basic and diluted net income (loss) per share of Class A common stock | $ | 0.01 |

| $ | (0.15 | ) |

Basic and diluted net income (loss) per share of Class I common stock | $ | 0.01 |

| $ | (0.15 | ) |

Basic and diluted net income (loss) per share of Class T common stock | $ | 0.01 |

| $ | (0.15 | ) |

The pro forma information is presented for informational purposes only and may not be indicative of what actual results of operations would have been had the transactions occurred at the beginning of period presented, nor does it purport to represent the results of future operations.

NOTE 5 — RENTALS UNDER OPERATING LEASES

As of June 30, 2018 and 2017, the Company owned four office properties, two retail properties and one industrial property with a total of nineteen tenants, and one student housing property with 316 beds. All leases at the Company's properties have been classified as operating leases. The Company's rental and other property income from its real estate investments for the three and six months ended June 30, 2018 and 2017 is comprised of the following:

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Rental revenue | $ | 3,552,043 |

| | $ | 3,674,135 |

| | $ | 7,887,650 |

| | $ | 7,122,050 |

|

Straight-line revenue | 245,299 |

| | 72,177 |

| | (310,531 | ) | | 383,072 |

|

Above- and below-market lease amortization, net | 70,775 |

| | 63,878 |

| | 141,550 |

| | 127,756 |

|

Lease incentive amortization | (25,838 | ) | | (25,839 | ) | | (51,393 | ) | | (51,394 | ) |

Rental and other property income | $ | 3,842,279 |

| | $ | 3,784,351 |

| | $ | 7,667,276 |

| | $ | 7,581,484 |

|

Percentages of gross rental revenues by property and tenant representing more than 10% of the Company's total gross rental revenues (rental and other property income and tenant reimbursement income) for the three and six months ended June 30, 2018 and 2017 are shown below.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

|

| | | | | | |

| | Percent of actual gross rental revenues |

Property | | Three Months Ended June 30, 2018 | | Six Months Ended June 30, 2018 |

Flats at Carrs Hill, Athens, GA | | 17.2 | % | | 17.0 | % |

Loudoun Gateway, Sterling, VA | | 16.8 |

| | 17.0 |

|

Allied Drive, Dedham, MA | | 15.7 |

| | 16.6 |

|

Anaheim Hills Office Plaza, Anaheim, CA | | 13.2 |

| | 12.9 |

|

Terra Nova Plaza, Chula Vista, CA | | 12.6 |

| | 12.4 |

|

Commerce Corner, Logan Township, NJ | | 10.3 |

| | 10.4 |

|

Total | | 85.8 | % | | 86.3 | % |

| | | | |

| | Percent of actual gross rental revenues |

Tenant | | Three Months Ended June 30, 2018 | | Six Months Ended June 30, 2018 |

Orbital ATK Inc. - Loudoun Gateway | | 16.8 | % | | 17.0 | % |

New England Baptist Hospital - Allied Drive | | 13.3 |

| | 14.0 |

|

Total | | 30.1 | % | | 31.0 | % |

|

| | | | | | |

| | Percent of actual gross rental revenues |

Property | | Three Months Ended June 30, 2017 | | Six Months Ended June 30, 2017 |

Flats at Carrs Hill, Athens, GA | | 17.3 | % | | 17.3 | % |

Loudoun Gateway, Sterling, VA | | 17.0 |

| | 17.6 |

|

Allied Drive, Dedham, MA | | 16.3 |

| | 16.4 |

|

Terra Nova Plaza, Chula Vista, CA | | 12.7 |

| | 12.3 |

|

Anaheim Hills Office Plaza, Anaheim, CA | | 12.6 |

| | 12.4 |

|

Commerce Corner, Logan Township, NJ | | 10.5 |

| | 10.4 |

|

Total | | 86.4 | % | | 86.4 | % |

| | | | |

| | Percent of actual gross rental revenues |

Tenant | | Three Months Ended June 30, 2017 | | Six Months Ended June 30, 2017 |

Orbital ATK Inc. - Loudoun Gateway | | 17.0 | % | | 17.6 | % |

New England Baptist Hospital - Allied Drive | | 13.7 |

| | 13.8 |

|

Total | | 30.7 | % | | 31.4 | % |

The Company's tenants representing more than 10% of in-place annualized base rental revenues as of June 30, 2018 and 2017 were as follows:

|

| | | | | | |

| | Percent of in-place annualized base rental revenues as of |

Property | | June 30, 2018 | | June 30, 2017 |

Orbital ATK Inc. - Loudoun Gateway | | 19.9 | % | | 18.8 | % |

New England Baptist Hospital - Allied Drive | | 11.1 |

| | 10.8 |

|

Total | | 31.0 | % | | 29.6 | % |

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

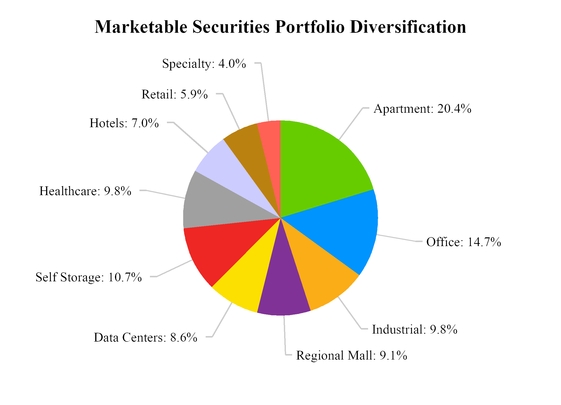

NOTE 6 — MARKETABLE SECURITIES

The following is a summary of the Company's marketable securities held as of June 30, 2018 and December 31, 2017, which consisted entirely of publicly-traded shares of common stock in REITs as of each date. All marketable securities held as of December 31, 2017 were available-for-sale securities and none were considered impaired on an other-than-temporary basis. Pursuant to ASU 2016-01 adopted by the Company (see Note 2), beginning on January 1, 2018, changes in fair value of the Company's investments in marketable securities are recorded in earnings.

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Marketable securities—cost | $ | 12,913,404 |

| | $ | 9,310,538 |

|

Unrealized gains | 1,225,587 |

| | 832,651 |

|

Unrealized losses | (8,703 | ) | | (97,012 | ) |

Net unrealized gain | 1,216,884 |

| | 735,639 |

|

Marketable securities—fair value | $ | 14,130,288 |

| | $ | 10,046,177 |

|

Upon the sale of a particular security, the realized net gain or loss is computed assuming the shares with the highest cost are sold first. During the three months ended June 30, 2018 and 2017, marketable securities sold generated proceeds of $7,055,126 and $5,072,780, respectively, resulting in gross realized gains of $131,663 and $232,736, respectively, and gross realized losses of $286,715 and $239,642, respectively. During the six months ended June 30, 2018 and 2017, marketable securities sold generated proceeds of $11,055,308 and $7,913,314, respectively, resulting in gross realized gains of $210,843 and $369,942, respectively, and gross realized losses of $619,375 and $322,146, respectively.

NOTE 7 — NOTES PAYABLE

Wells Fargo Line of Credit

On March 6, 2015, the Company, as guarantor, and the wholly-owned subsidiaries of the Operating Partnership, as co-borrowers, entered into a secured revolving line of credit arrangement (the “Wells Fargo Line of Credit”) pursuant to a credit agreement with Wells Fargo Bank, National Association, as administrative agent, and other lending institutions that may become parties to the credit agreement. The Wells Fargo Line of Credit had a three-year term set to mature on March 6, 2018 with two one-year extension options exercisable by the Company upon satisfaction of certain conditions and payment of applicable extension fees. As of December 31, 2017, the outstanding balance was $63,100,000 and the weighted average interest rate was 3.16%. As of December 31, 2017, the maximum borrowing capacity was $69,900,795, and the Company was in compliance with all covenants.

On February 27, 2018, the Company, as guarantor, and certain of the wholly-owned subsidiaries of the Operating Partnership, as co-borrowers, entered into an amended and restated secured revolving credit facility (the “Revised Wells Fargo Line of Credit”) with Wells Fargo Bank, National Association, as administrative agent, and other lending institutions that may become parties to the credit agreement. The Revised Wells Fargo Line of Credit has a three-year term maturing February 27, 2021. The Company has two one-year extension options following the initial term subject to satisfaction of certain conditions and payment of applicable extension fees.

The interest rate under the Revised Wells Fargo Line of Credit is based on the 1-month London Inter-bank Offered Rate ("LIBOR") with a spread of 160 to 180 basis points depending on the debt yield as defined in the agreement. In addition, the Revised Wells Fargo Line of Credit has a maximum capacity of $100,000,000 and is expandable by the Company up to a maximum capacity of $200,000,000 upon satisfaction of specified conditions. Each requested expansion must be for at least $25,000,000 and may result in the Revised Wells Fargo Line of Credit being syndicated. As of June 30, 2018, the outstanding balance was $58,500,000 and the weighted average interest rate was 3.65%.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

At any time, the borrowing capacity under the Revised Wells Fargo Line of Credit is based on the lesser of (1) an amount equal to 65% of the aggregate value of the properties in the collateral pool as determined by lender appraisals, (2) an amount that results in a minimum debt yield of 10% based on the in-place net operating income of the collateral pool as defined, or (3) the maximum capacity of the Revised Wells Fargo Line of Credit. Proceeds from the Revised Wells Fargo Line of Credit can be used to fund acquisitions, redeem shares pursuant to the Company's redemption plan and for any other corporate purpose. As of June 30, 2018, the Company's maximum borrowing capacity was $82,559,473.

The Revised Wells Fargo Line of Credit agreement contains customary representations, warranties, borrowing conditions and affirmative, negative and financial covenants, including that there must be at least five properties in the collateral pool at all times and that the collateral pool must also meet specified concentration provisions, unless waived by the lender. In addition, the Company, as guarantor, must meet tangible net worth hurdles. The Company was in compliance with all financial covenants as of June 30, 2018.

Nationwide Life Insurance Loan

On March 1, 2016, RPT Flats at Carrs Hill, LLC, a wholly-owned subsidiary of the Operating Partnership, entered into a credit agreement with Nationwide Life Insurance Company (the "Nationwide Loan"). Proceeds of $14,500,000 obtained from the Nationwide Loan were used to repay outstanding balances under the Wells Fargo Line of Credit, thereby releasing The Flats at Carrs Hill from the Wells Fargo Line of Credit. The Nationwide Loan is a secured, fully non-recourse loan with a term of ten years with no extension options. The Nationwide Loan carries a fixed interest rate of 3.63% and requires monthly interest-only payments of $43,862 during the entire term.

Hartford Life Insurance Loan

On December 1, 2016, RPT 1109 Commerce Boulevard, LLC, a wholly-owned subsidiary of the Operating Partnership, entered into a credit agreement with Hartford Life Insurance Company (the "Hartford Loan"). Proceeds of $13,000,000 obtained from the Hartford Loan were used to repay outstanding balances under the Wells Fargo Line of Credit, thereby releasing Commerce Corner from the Wells Fargo Line of Credit. The Hartford Loan is a secured, fully non-recourse loan with a term of seven years with no extension options. The Hartford Loan carries a fixed interest rate of 3.41% with interest-only payments for the first 24 months of the term, then principal and interest payments for the remainder of the term based upon a 30-year amortization schedule.

The following is a reconciliation of the carrying amount of the of the line of credit and mortgage loans payable as of June 30, 2018 and December 31, 2017:

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Line of credit | $ | 58,500,000 |

| | $ | 63,100,000 |

|

Deduct: Deferred financing costs, less accumulated amortization | (437,204 | ) | | (77,939 | ) |

Line of credit, net | $ | 58,062,796 |

| | $ | 63,022,061 |

|

| | | |

Mortgage loans payable | $ | 27,500,000 |

| | $ | 27,500,000 |

|

Deduct: Deferred financing costs, less accumulated amortization | (227,907 | ) | | (245,569 | ) |

Mortgage loans payable, net | $ | 27,272,093 |

| | $ | 27,254,431 |

|

Aggregate future principal payments of mortgage loans payable as of June 30, 2018 are as follows:

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

|

| | | | |

Year | | Amount |

Remainder of 2018 | | $ | — |

|

2019 | | 253,331 |

|

2020 | | 262,106 |

|

2021 | | 271,185 |

|

2022 | | 280,578 |

|

Thereafter | | 26,432,800 |

|

Total | | $ | 27,500,000 |

|

NOTE 8 — RELATED PARTY ARRANGEMENTS

Advisory Agreement

RREEF America is entitled to compensation and reimbursements in connection with the management of the Company's investments in accordance with an advisory agreement between RREEF America and the Company (the "Advisory Agreement"). The Advisory Agreement has a one-year term and is renewable annually upon the review and approval of the Company's board of directors, including the approval of a majority of the Company's independent directors. The Advisory Agreement has a current expiration date of January 20, 2019. There is no limit to the number of terms for which the Advisory Agreement can be renewed.

Fees

Under the Advisory Agreement, RREEF America can earn an advisory fee comprised of two components as described below.

| |

1. | The fixed component accrues daily in an amount equal to 1/365th of 1.0% of the NAV of the outstanding shares of each class of common stock for such day. The fixed component of the advisory fee is payable monthly in arrears. |

| |

2. | The performance component is calculated for each class of common stock on the basis of the total return to stockholders and is measured by the total distributions per share declared to such class plus the change in the NAV per share for such class. For any calendar year in which the total return per share allocable to a class exceeds 6% per annum (the “Hurdle Amount”), RREEF America will receive up to 10% of the aggregate total return allocable to such class with a Catch-Up (defined below) calculated as follows: first, if the total return for the applicable period exceeds the Hurdle Amount, 25% of such total return in excess of the Hurdle Amount (the “Excess Profits”) until the total return reaches 10% (commonly referred to as a “Catch-Up”); and second, to the extent there are remaining Excess Profits, 10% of such remaining Excess Profits. The performance component earned by RREEF America for each class is subject to certain other adjustments which do not apply unless the NAV per share is below $12.00 per share. The performance component is payable annually in arrears. |

The performance component is calculated daily on a year-to-date basis by reference to a proration of the per annum hurdle as of the date of calculation. Any resulting performance component as of a given date is deducted from the published NAV per share for such date. At each interim balance sheet date, the Company considers the estimated performance component that is probable to be due as of the end of the current calendar year in assessing whether the calculated performance component as of the interim balance sheet date meets the threshold for recognition in accordance with GAAP in the Company's consolidated financial statements. The ultimate amount of the performance component as of the end of the current calendar year, if any, may be more or less than the amount recognized by the Company as of any interim date and will depend on a variety of factors, including but not limited to, the performance of the Company's investments, interest rates, capital raise and redemptions. The Company considers the estimated performance component as of June 30, 2018 to be sufficiently probable to warrant

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

recognition of the calculated performance component as of June 30, 2018 in the Company's consolidated financial statements. The fixed component earned by RREEF America, and the calculated performance component recognized by the Company, for the three and six months ended June 30, 2018 and 2017, are shown below.

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Fixed component | $ | 299,761 |

| | $ | 257,054 |

| | $ | 579,216 |

| | $ | 504,402 |

|

Performance component | 90,000 |

| | — |

| | 90,000 |

| | — |

|

| $ | 389,761 |

| | $ | 257,054 |

| | $ | 669,216 |

| | $ | 504,402 |

|

Expense Reimbursements

Under the Advisory Agreement, RREEF America is entitled to reimbursement of certain costs incurred by RREEF America or its affiliates that were not incurred under the Expense Support Agreement, as described below. Costs eligible for reimbursement, if they were not incurred under the Expense Support Agreement, include most third-party operating expenses, salaries and related costs of RREEF America's employees who perform services for the Company (but not those employees for which RREEF America earns a separate fee or those employees who are executive officers of the Company) and travel related costs for RREEF America's employees who incur such costs on behalf of the Company. Reimbursement payments to RREEF America are subject to the limitations described below under "Reimbursement Limitations."

For the three months ended June 30, 2018 and 2017, RREEF America incurred $79,877 and $72,829 of reimbursable operating expenses and offering costs, respectively, that were subject to reimbursement under the Advisory Agreement. For the six months ended June 30, 2018 and 2017, RREEF America incurred $155,637 and $137,780 of reimbursable operating expenses and offering costs, respectively, that were subject to reimbursement under the Advisory Agreement. As of June 30, 2018 and December 31, 2017, the Company had a payable to RREEF America of $99,902 and $58,874, respectively, of operating expenses and offering costs reimbursable under the Advisory Agreement.

Organization and Offering Costs

Under the Advisory Agreement, RREEF America agreed to pay all of the Company’s organization and offering costs incurred through January 3, 2013. In addition, RREEF America agreed to pay certain of the Company’s organization and offering costs from January 3, 2013 through January 3, 2014 that were incurred in connection with certain offering related activities. In total, RREEF America incurred $4,618,318 of these costs (the “Deferred O&O”) on behalf of the Company from the Company’s inception through January 3, 2014. Pursuant to the Advisory Agreement, the Company began reimbursing RREEF America monthly for the Deferred O&O on a pro rata basis over 60 months beginning in January 2014. However, if the Advisory Agreement is terminated by RREEF America, then the unpaid balance of the Deferred O&O is payable to RREEF America within 30 days. For the three months ended June 30, 2018 and 2017, the Company reimbursed RREEF America $230,157 and $230,157, respectively. For the six months ended June 30, 2018 and 2017, the Company reimbursed RREEF America $457,785 and $457,785, respectively.

The amount of Deferred O&O payable to RREEF America is shown below.

|

| | | | | | | | |

| | June 30, 2018 | | December 31, 2017 |

Total Deferred O&O | | $ | 4,618,318 |

| | $ | 4,618,318 |

|

Cumulative reimbursements made to RREEF America | | (4,147,887 | ) | | (3,690,102 | ) |

Remaining Deferred O&O reimbursable to RREEF America | | $ | 470,431 |

| | $ | 928,216 |

|

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

Expense Support Agreement

Pursuant to the terms of the expense support agreement, as most recently amended on January 20, 2016 (the "Expense Support Agreement"), RREEF America agreed to defer reimbursement of certain expenses related to the Company's operations that RREEF America has incurred that are not part of the Deferred O&O described above and, therefore, are in addition to the Deferred O&O amount (the “Expense Payments”). The Expense Payments include organization and offering costs and operating expenses as described above under the Advisory Agreement. RREEF America incurred these expenses until the date upon which the aggregate Expense Payments by RREEF America reached $9,200,000. As of December 31, 2015, the Company had incurred a total of $9,200,000 in Expense Payments in addition to the $4,618,318 of Deferred O&O noted above. The balance of $9,200,000 in Expense Payments consisted of $3,775,369 in organization and offering costs related to the Company's initial public offering, $195,450 of offering costs for the Private Offering and $5,229,181 in operating expenses. The Company has not received any Expense Payments since December 31, 2015.

In accordance with the Expense Support Agreement, the Company was to reimburse RREEF America $250,000 per quarter (the "Quarterly Reimbursement"), representing a non-interest bearing note due to RREEF America ("Note to Affiliate") which was subject to the imputation of interest. In accordance therewith, on January 1, 2016, the Company recorded a discount on the Note to Affiliate in the amount of $1,861,880 which was to be amortized to interest expense over the contractual reimbursement period using the effective interest method.

On April 25, 2016, the Company and RREEF America entered into a letter agreement that amended certain provisions of the Advisory Agreement and the Expense Support Agreement (the "Letter Agreement"). The Letter Agreement provides, in part, that the Company's obligations to reimburse RREEF America for Expense Payments under the Expense Support Agreement are suspended until the first calendar month following the month in which the Company has reached $500,000,000 in offering proceeds from the offerings (the "ESA Commencement Date"). The Company currently owes $8,950,000 to RREEF America under the Expense Support Agreement in the form of the Note to Affiliate. Beginning the month following the ESA Commencement Date, the Company will make monthly reimbursement payments to RREEF America in the amount of $416,667 for the first 12 months and $329,166 for the second 12 months, subject to monthly reimbursement payment limitations described in the Letter Agreement. The execution of the Letter Agreement represented a modification of the Note to Affiliate, and as such, the unamortized discount on the Note to Affiliate as of April 25, 2016 is instead being amortized over the estimated repayment period pursuant to the Letter Agreement. In accordance therewith, the Company is amortizing the remaining discount using an interest rate of 1.93%. For the three months ended June 30, 2018 and 2017, the Company amortized $36,137 and $35,502, respectively, of the discount on the Note to Affiliate into interest expense. For the six months ended June 30, 2018 and 2017, the Company amortized $72,217 and $70,833, respectively, of the discount on the Note to Affiliate into interest expense.

In addition, pursuant to the Letter Agreement, if RREEF America is serving as the Company's advisor at the time that the Company or the Operating Partnership undertakes a liquidation, the Company's remaining obligations to reimburse RREEF America for the unpaid Deferred O&O under the Advisory Agreement and the unreimbursed Expense Payments under the Expense Support Agreement shall be waived.

Dealer Manager Agreement

On July 1, 2016, the Company and its Operating Partnership entered into a new dealer manager agreement (the "Dealer Manager Agreement") with DWS Distributors, Inc. (formerly known as Deutsche Distributors, Inc.), an affiliate of the Company's sponsor and advisor (the "Dealer Manager"). The Dealer Manager Agreement governs the distribution by the Dealer Manager of the Company’s Class A Shares, Class I Shares, Class N Shares and Class T Shares in the Follow-On Public Offering and any subsequent registered public offering. In connection with the ongoing Trailing Fees to be paid in the future, the Company and the Dealer Manager entered into an agreement whereby the Company will pay to the Dealer Manager the Trailing Fees that are attributable to the Company's shares issued in the Company's initial public offering that remain outstanding. In addition, the Company is obligated to pay to the Dealer Manager Trailing Fees that are attributable to the Company's shares issued in the Follow-On Public

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

Offering. As of June 30, 2018 and December 31, 2017, the Company has accrued $72,286 and $67,279, respectively, in Trailing Fees currently payable to the Dealer Manager, and $2,646,301 and $2,238,576, respectively, in Trailing Fees estimated to become payable in the future to the Dealer Manager, both of which are included in due to affiliates on the consolidated balance sheets. The Company also pays the Dealer Manager upfront selling commissions and upfront dealer manager fees in connection with its Offerings, as applicable. For the three months ended June 30, 2018 and 2017, the Dealer Manager earned upfront selling commissions and upfront dealer manager fees totaling $131,195 and $18,172, respectively. For the six months ended June 30, 2018 and 2017, the Dealer Manager earned upfront selling commissions and upfront dealer manager fees totaling $164,328 and $35,234, respectively.

Under the Dealer Manager Agreement, the Company is obligated to reimburse the Dealer Manager for certain offering costs incurred by the Dealer Manager on the Company's behalf, including but not limited to broker-dealer sponsorships, attendance fees for retail seminars conducted by broker-dealers or the Dealer Manager, and travel costs for certain personnel of the Dealer Manager who are dedicated to the distribution of the Company's shares of common stock. For the three months ended June 30, 2018 and 2017, the Dealer Manager incurred $111,000 and $82,000, respectively, in such costs on behalf of the Company. For the six months ended June 30, 2018 and 2017, the Dealer Manager incurred $220,823 and $148,203, respectively, in such costs on behalf of the Company. As of June 30, 2018 and December 31, 2017, the Company had payable to the Dealer Manager $288,343 and $315,622, respectively, of such costs which was included in due to affiliates on the consolidated balance sheets.

Reimbursement Limitations

Organization and Offering Costs

The Company will not reimburse RREEF America under the Advisory Agreement or the Expense Support Agreement and will not reimburse the Dealer Manager under the Dealer Manager Agreement for any organization and offering costs which would cause the Company's total organization and offering costs with respect to a public offering to exceed 15% of the gross proceeds from such public offering. Further, the Company will not reimburse RREEF America or the Dealer Manager for any underwriting compensation (a subset of organization and offering costs) which would cause the Company's total underwriting compensation with respect to a public offering to exceed 10% of the gross proceeds from the primary portion of such public offering. The Company raised $102,831,442 in gross proceeds from its initial public offering that ended on June 30, 2016. A summary of the Company's total organization and offering costs for its initial public offering is shown below.

|

| | | | | | | | | | | | | | | |

| Deferred O&O - RREEF America | | Expense Payments - O&O Portion | | Other organization and offering costs (1) | | Total organization and offering costs |

Balance, June 30, 2018 and December 31, 2017 | $ | 4,618,318 |

| | $ | 3,775,369 |

| | $ | 7,031,029 |

| | $ | 15,424,716 |

|

(1) Includes $1,065,735 and $1,355,890 of estimated accrued Trailing Fees payable in the future as of June 30, 2018 and December 31, 2017, respectively. |

As of June 30, 2018, in the Follow-On Public Offering, the Company had raised $40,819,156 in gross proceeds and incurred total organization and offering costs of $5,019,467, including estimated accrued Trailing Fees payable in the future of $1,580,566.

Operating Expenses

Pursuant to the Company’s charter, the Company may reimburse RREEF America, at the end of each fiscal quarter, for total operating expenses incurred by RREEF America, whether under the Expense Support Agreement or otherwise. However, the Company may not reimburse RREEF America at the end of any fiscal quarter for total operating expenses (as defined in the Company’s charter) that, in the four consecutive fiscal quarters then ended, exceed the greater of 2% of average invested assets or 25% of net income determined without reduction for any additions to reserves for depreciation, bad debts or other similar non-cash reserves and excluding any gain from the

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

sale of the Company's assets for that period (the “2%/25% Guidelines”). Notwithstanding the foregoing, the Company may reimburse RREEF America for expenses in excess of the 2%/25% Guidelines if a majority of the Company’s independent directors determines that such excess expenses are justified based on unusual and non-recurring factors. For the four fiscal quarters ended June 30, 2018, total operating expenses of the Company were $3,645,349 which did not exceed the amount prescribed by the 2%/25% Guidelines.

Due to Affiliates and Note to Affiliate

In accordance with all the above, as of June 30, 2018 and December 31, 2017, the Company owed its affiliates the following amounts:

|

| | | | | | | |

| June 30, 2018 | | December 31, 2017 |

Deferred O&O | $ | 470,431 |

| | $ | 928,216 |

|

Reimbursable under the Advisory Agreement | 99,902 |

| | 58,874 |

|

Reimbursable under the Dealer Manager Agreement | 288,343 |

| | 315,622 |

|

Advisory fees | 191,472 |

| | 766,624 |

|

Accrued Trailing Fees | 2,718,588 |

| | 2,305,855 |

|

Due to affiliates | $ | 3,768,736 |

| | $ | 4,375,191 |

|

| | | |

Note to Affiliate | $ | 8,950,000 |

| | $ | 8,950,000 |

|

Unamortized discount | (1,437,536 | ) | | (1,509,753 | ) |

Note to Affiliate, net of unamortized discount | $ | 7,512,464 |

| | $ | 7,440,247 |

|

NOTE 9 — CAPITALIZATION

Under the Company's charter, as most recently amended on February 16, 2017, the Company has the authority to issue 1,000,000,000 shares of common stock and 50,000,000 shares of preferred stock. All shares of such stock have a par value of $0.01 per share. The Company's board of directors is authorized to amend its charter from time to time, without the approval of the stockholders, to increase or decrease the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue. The Company's authorized shares of common stock are allocated between classes as follows:

|

| | | |

Common Stock | | No. of Authorized Shares |

Class A Shares | | 200,000,000 |

|

Class I Shares | | 200,000,000 |

|

Class T Shares | | 250,000,000 |

|

Class D Shares | | 50,000,000 |

|

Class N Shares | | 300,000,000 |

|

| | 1,000,000,000 |

|

Class A Shares are subject to selling commissions of up to 3% of the purchase price, and annual dealer manager fees of 0.55% and distribution fees of 0.50% of NAV, both paid on a trailing basis. Class I Shares are subject to annual dealer manager fees of 0.55% of NAV paid in a trailing basis, but are not subject to any selling commissions or distribution fees. Class T Shares are subject to selling commissions of up to 3% of the purchase price, an up-front dealer manager fee of 2.50% of the purchase price, and annual distribution fees of 1.0% of NAV paid on a trailing basis for approximately three years. Class D shares sold in the Private Offering are subject to selling commissions of up to 1.0% of the purchase price, but do not incur any dealer manager or distribution fees.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

June 30, 2018

(Unaudited)

Class N Shares are not sold in the primary Follow-On Public Offering, but will be issued upon conversion of an investor's Class T Shares once (i) the investor's Class T Share account for a given offering has incurred a maximum of 8.5% of commissions, dealer manager fees and distribution fees; (ii) the total underwriting compensation from whatever source with respect to the Follow-On Public Offering exceeds 10% of the gross proceeds from the primary portion of the Follow-On Public Offering; (iii) a listing of the Class N Shares; or (iv) the Company's merger or consolidation with or into another entity or the sale or other disposition of all or substantially all of the Company's assets.

Distribution Reinvestment Plan

The Company has adopted a distribution reinvestment plan that allows stockholders to have the cash distributions attributable to the class of shares that the stockholder owns automatically invested in additional shares of the same class. Shares are offered pursuant to the Company's distribution reinvestment plan at the NAV per share applicable to that class, calculated as of the distribution date and after giving effect to all distributions. Stockholders who elect to participate in the distribution reinvestment plan, and who are subject to U.S. federal income taxation laws, will incur a tax liability on an amount equal to the fair value on the relevant distribution date of the shares of the Company's common stock purchased with reinvested distributions, even though such stockholders have elected not to receive the distributions used to purchase those shares of the Company's common stock in cash.

Redemption Plan