|

UNITED STATES | |||

|

SECURITIES AND EXCHANGE COMMISSION | |||

|

Washington, D.C. 20549 | |||

|

| |||

|

SCHEDULE 14A INFORMATION | |||

|

| |||

|

Proxy Statement Pursuant to Section 14(a) of | |||

|

| |||

|

Filed by the Registrant x | |||

|

| |||

|

Filed by a Party other than the Registrant o | |||

|

| |||

|

Check the appropriate box: | |||

|

o |

Preliminary Proxy Statement | ||

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

|

x |

Definitive Proxy Statement | ||

|

o |

Definitive Additional Materials | ||

|

o |

Soliciting Material under §240.14a-12 | ||

|

| |||

|

Georgetown Bancorp, Inc. | |||

|

(Name of Registrant as Specified In Its Charter) | |||

|

| |||

|

| |||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

|

| |||

|

Payment of Filing Fee (Check the appropriate box): | |||

|

x |

No fee required. | ||

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

|

|

(1) |

Title of each class of securities to which transaction applies: | |

|

|

|

| |

|

|

(2) |

Aggregate number of securities to which transaction applies: | |

|

|

|

| |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

|

|

| |

|

|

(4) |

Proposed maximum aggregate value of transaction: | |

|

|

|

| |

|

|

(5) |

Total fee paid: | |

|

|

|

| |

|

o |

Fee paid previously with preliminary materials. | ||

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

|

|

(1) |

Amount Previously Paid: | |

|

|

|

| |

|

|

(2) |

Form, Schedule or Registration Statement No.: | |

|

|

|

| |

|

|

(3) |

Filing Party: | |

|

|

|

| |

|

|

(4) |

Date Filed: | |

|

|

|

| |

March 19, 2013

Dear Stockholder:

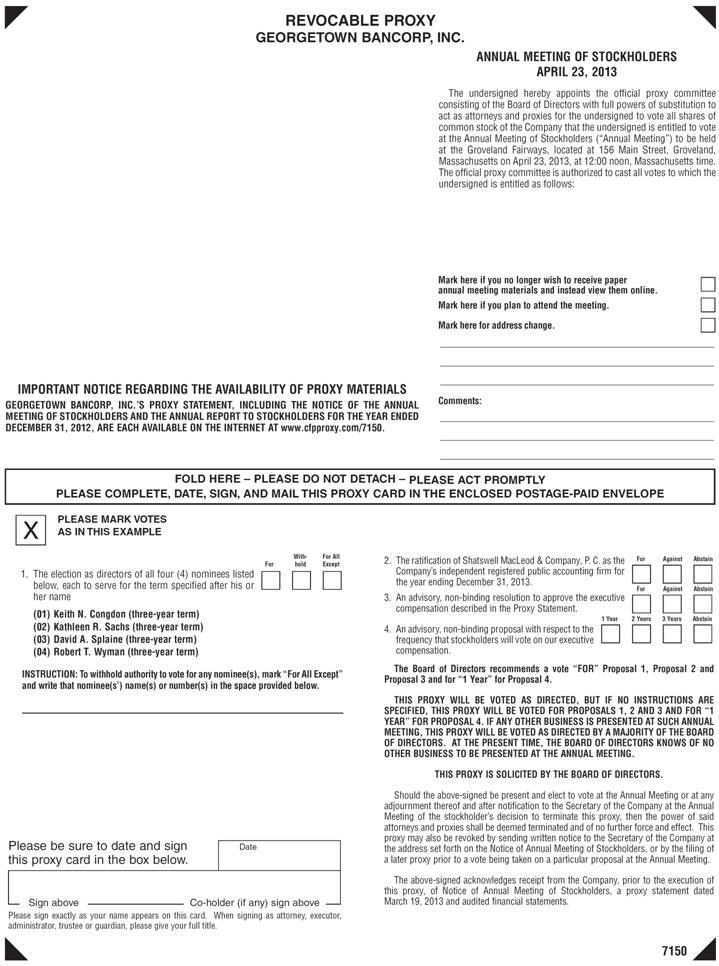

We cordially invite you to attend the Annual Meeting of Stockholders of Georgetown Bancorp, Inc. (the “Company.”) The Company is the holding company of Georgetown Bank, and our common stock is traded on the NASDAQ Capital Market under the symbol “GTWN.” The Annual Meeting will be held at the Groveland Fairways, located at 156 Main Street, Groveland, Massachusetts, at 12:00 noon, Massachusetts time, on Tuesday, April 23, 2013.

The enclosed Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted. During the Annual Meeting we will also report on the operations of the Company. Directors and officers of the Company, as well as representatives of our independent registered public accounting firm, Shatswell, MacLeod & Company, P.C., will be present to respond to any questions that stockholders may have. Also enclosed for your review is our Annual Report to Stockholders, which contains detailed information concerning the activities and operating performance of the Company.

The Annual Meeting is being held so that stockholders may consider the election of directors, the ratification of the appointment of Shatswell, MacLeod & Company, P.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2013, an advisory, non-binding resolution to approve the executive compensation described in the Proxy Statement and an advisory, non-binding proposal with respect to the frequency that stockholders will vote on our executive compensation. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote “FOR” each matter to be considered and that stockholders mark the “1 YEAR” option with respect to the advisory proposal on the frequency of the stockholders’ vote on executive compensation.

On behalf of the Board of Directors, we urge you to sign, date and return the enclosed proxy card as soon as possible, even if you currently plan to attend the Annual Meeting. This will not prevent you from voting in person, but will assure that your vote is counted if you are unable to attend the meeting. Your vote is important, regardless of the number of shares that you own.

Sincerely,

Robert E. Balletto

President and Chief Executive Officer

Georgetown Bancorp, Inc.

2 East Main Street

Georgetown, Massachusetts 01833

(978) 352-8600

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On April 23, 2013

Notice is hereby given that the Annual Meeting of Stockholders of Georgetown Bancorp, Inc. (the “Company”) will be held at the Groveland Fairways, located at 156 Main Street, Groveland, Massachusetts, on Tuesday, April 23, 2013 at 12:00 noon, Massachusetts time.

A Proxy Card and a Proxy Statement for the Annual Meeting are enclosed.

The Annual Meeting is for the purpose of considering and acting upon:

1. The election of four directors to the Board of Directors;

2. The ratification of the appointment of Shatswell, MacLeod & Company, P.C. as the independent registered public accounting firm for the Company for the year ending December 31, 2013;

3. An advisory, non-binding resolution to approve the executive compensation described in the Proxy Statement;

4. An advisory, non-binding proposal with respect to the frequency that stockholders will vote on our executive compensation; and

such other matters as may properly come before the Annual Meeting, or any adjournments thereof. The Board of Directors is not aware of any other business to come before the Annual Meeting.

Any action may be taken on the foregoing proposals at the Annual Meeting on the date specified above, or on any date or dates to which the Annual Meeting may be adjourned. Stockholders of record at the close of business on March 7, 2013, are the stockholders entitled to vote at the Annual Meeting, and at any adjournments thereof.

EACH STOCKHOLDER, WHETHER HE OR SHE PLANS TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD WITHOUT DELAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. ANY PROXY GIVEN BY THE STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED. A PROXY MAY BE REVOKED BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE. ANY STOCKHOLDER PRESENT AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE PERSONALLY ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR OWN NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM YOUR RECORD HOLDER IN ORDER TO VOTE PERSONALLY AT THE ANNUAL MEETING.

|

|

By Order of the Board of Directors |

|

|

|

|

|

/s/ Joseph W. Kennedy |

|

|

|

|

|

Joseph W. Kennedy |

|

|

Corporate Secretary |

March 19, 2013

|

|

|

A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES. |

PROXY STATEMENT

Georgetown Bancorp, Inc.

2 East Main Street

Georgetown, Massachusetts 01833

(978) 352-8600

ANNUAL MEETING OF STOCKHOLDERS

April 23, 2013

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of Georgetown Bancorp, Inc. (the “Company”) to be used at the Annual Meeting of Stockholders of the Company (the “Annual Meeting”), which will be held at the Groveland Fairways, located at 156 Main Street, Groveland, Massachusetts, on April 23, 2013, at 12:00 noon, Massachusetts time, and all adjournments of the Annual Meeting. The accompanying Notice of Annual Meeting of Stockholders, the Proxy Card and this Proxy Statement are first being mailed to stockholders on or about March 19, 2013.

REVOCATION OF PROXIES

Stockholders who execute proxies in the form solicited hereby retain the right to revoke them in the manner described below. Unless so revoked, the shares represented by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies solicited on behalf of the Board of Directors of the Company will be voted in accordance with the directions given thereon. Where no instructions are indicated, validly executed proxies will be voted “FOR” the proposals set forth in this Proxy Statement and for the “1 Year” option with respect to the frequency of voting on executive compensation. If any other matters are properly brought before the Annual Meeting, the persons named in the accompanying proxy will vote the shares represented by such proxies on such matters in such manner as shall be determined by a majority of the Board of Directors.

A proxy may be revoked at any time prior to its exercise by sending written notice of revocation to the Secretary of the Company at the address shown above, by delivering to the Company a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. However, if you are a stockholder whose shares are not registered in your own name, you will need appropriate documentation from your record holder to vote personally at the Annual Meeting. The presence at the Annual Meeting of any stockholder who had returned a proxy shall not revoke such proxy unless the stockholder delivers his or her ballot in person at the Annual Meeting or delivers a written revocation to the Secretary of the Company prior to the voting of such proxy.

VOTING PROCEDURES AND METHODS OF COUNTING VOTES

Holders of record of the Company’s common stock, par value $0.01 per share, as of the close of business on March 7, 2013 (the “Record Date”) are entitled to one vote for each share then held. As of the Record Date, the Company had 1,949,447 shares of common stock issued and outstanding. The presence in person or by proxy of a majority of the total number of shares of common stock outstanding and entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining that a quorum is present. In the event there are not sufficient votes for a quorum, or to approve or ratify any matter being presented at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors, the Proxy Card being provided by the Board of Directors enables a stockholder to vote FOR the election of the four nominees proposed by the Board of Directors, to WITHHOLD AUTHORITY to vote for the nominees being proposed or to vote FOR ALL EXCEPT one or more of the nominees being proposed. Directors are elected by a plurality of votes cast, without regard to either broker non-votes or proxies as to which authority to vote for the nominees being proposed is withheld.

As to the ratification of Shatswell, MacLeod & Company, P.C. as the Company’s independent registered public accounting firm, by checking the appropriate box, a stockholder may: (i) vote FOR the ratification; (ii) vote AGAINST the ratification; or (iii) ABSTAIN from voting on the ratification. The ratification of this matter shall be determined by a majority of the votes cast, without regard to broker non-votes or proxies marked ABSTAIN.

As to the advisory, non-binding resolution to approve our executive compensation as described in this Proxy Statement, a stockholder may: (i) vote FOR the resolution; (ii) vote AGAINST the resolution; or (iii) ABSTAIN from voting on the resolution. The affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to broker non-votes or proxies marked ABSTAIN box, is required for the approval of this non-binding resolution. While this vote is required by law, it will neither be binding on the Company or the Board of Directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on the Company or the Board of Directors.

As to the advisory, non-binding proposal with respect to the frequency that stockholders will vote on our executive compensation, a stockholder may select that stockholders: (i) consider the proposal every 1 YEAR; (ii) consider the proposal every 2 YEARS; (iii) consider the proposal every 3 YEARS; or (iv) ABSTAIN from voting on the proposal. Generally, approval of any matter presented to stockholders requires the affirmative vote of a majority of the votes cast. However, because this vote is advisory and non-binding, if none of the frequency options receive a majority of the votes cast, the option receiving the greatest number of votes will be considered the frequency recommended by the Company’s stockholders. Even though this vote will neither be binding on the Company or the Board of Directors, nor will it create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on the Company or the Board of Directors, the Board of Directors will take into account the outcome of this vote in making a determination on the frequency that advisory votes on executive compensation will be included in our proxy statements.

If you participate in the Georgetown Bank Employee Stock Ownership Plan (the “ESOP”), you will receive vote authorization form for the plan that reflects all shares you may direct the trustee to vote on your behalf under the plan. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but each ESOP participant may direct the trustee how to vote the shares of common stock allocated to his or her account. The ESOP trustee, subject to the exercise of its fiduciary responsibilities, will vote all unallocated shares of Georgetown Bancorp, Inc. common stock held by the ESOP, all allocated shares for which a participant has marked the voting form to “ABSTAIN” and all allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions. The deadline for returning your ESOP voting instructions is Thursday, April 11, 2013.

The Company’s Articles of Incorporation provide that, subject to certain exceptions, record owners of the Company’s common stock that is beneficially owned by a person who beneficially owns in excess of 10% of the Company’s outstanding shares are not entitled to any vote in respect of the shares held in excess of the 10% limit.

Proxies solicited hereby will be returned to the Company and will be tabulated by an Inspector of Election designated by the Board of Directors of the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Persons and groups who beneficially own in excess of 5% of the common stock are required to file certain reports with the Securities and Exchange Commission (the “SEC”) regarding such ownership. The following table sets forth, as of the Record Date, the shares of common stock beneficially owned by each person who was the beneficial owner of more than 5% of the Company’s outstanding shares of common stock, and all directors and executive officers of the Company as a group.

|

|

|

Amount of Shares |

|

|

| ||

|

|

|

Owned and Nature |

|

Percent of Shares |

| ||

|

|

Name and Address of |

|

|

of Beneficial |

|

of Common Stock |

|

|

|

Beneficial Owners |

|

|

Ownership (1) |

|

Outstanding (1) |

|

|

|

|

|

|

|

| ||

|

All Directors and Executive Officers |

|

|

|

|

| ||

|

as a group (15 persons) |

|

212,674 |

|

10.8% |

| ||

|

2 East Main Street |

|

|

|

|

| ||

|

Georgetown, Massachusetts 01833 |

|

|

|

|

| ||

|

|

|

|

|

|

| ||

|

Georgetown Bank Employee Stock Ownership Plan |

|

150,745 |

|

7.7% |

| ||

|

2 East Main Street |

|

|

|

|

| ||

|

Georgetown, Massachusetts 01833 |

|

|

|

|

| ||

|

Stilwell Value Partners V, L.P. (2) |

|

140,000 |

|

7.2% |

|

|

Stilwell Partners, L.P. |

|

|

|

|

|

|

Stilwell Value LLC |

|

|

|

|

|

|

Joseph Stilwell |

|

|

|

|

|

|

111 Broadway, 12th Floor |

|

|

|

|

|

|

New York, New York 10006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sandler O’Neill Asset Management LLC (3) |

|

121,400 |

|

6.2% |

|

|

Terry Maltese |

|

|

|

|

|

|

150 East 52nd Street, 30th Floor |

|

|

|

|

|

|

New York, New York 10022 |

|

|

|

|

|

|

(1) |

For purposes of this table, a person is deemed to be the beneficial owner of shares of common stock if he or she has shared voting or investment power with respect to such security, or has a right to acquire beneficial ownership at any time within 60 days from the Record Date. As used herein, “voting power” is the power to vote or direct the voting of shares, and “investment power” is the power to dispose of or direct the disposition of shares. The table includes all shares held directly as well as by spouses and minor children, in trust and other indirect ownership, over which shares the named individuals effectively exercise sole or shared voting and investment power. |

|

(2) |

As disclosed in a Schedule 13D, as filed with the SEC on July 23, 2012. |

|

(3) |

As disclosed in Amendment No. 1 to Schedule 13G, as filed with the SEC on February 14, 2013. |

PROPOSAL 1—ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of 13 members. The Company’s bylaws provide that approximately one-third of the directors are to be elected annually. Directors of the Company are generally elected to serve for a three-year period and until their respective successors have been elected. Effective as of the date of the Annual Meeting, the term of director Richard F. Spencer will expire, and our Board will be reduced to 12 members. The Nominating/Governance Committee of the Board of Directors has nominated as directors, Keith N. Congdon, Kathleen R. Sachs, David A. Splaine and Robert T. Wyman, each to serve for a three-year term and until their respective successors have been elected and shall qualify. Each of the four nominees is currently a member of the Board of Directors.

The table below sets forth certain information regarding the composition of the Company’s Board of Directors and regarding the Company’s executive officers who are not a director, including the terms of office of members of the Board of Directors. It is intended that the proxies solicited on behalf of the Board of Directors (other than proxies in which the vote is withheld as to one or more nominees) will be voted at the Annual Meeting for the election of the nominees identified below. If a nominee is unable to serve, the shares represented by all such proxies will be voted for the election of such substitute as the Board of Directors may determine. At this time, the Board of Directors knows of no reason why any of the nominees would be unable to serve if elected. Except as indicated herein, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES LISTED IN THIS PROXY STATEMENT.

|

Name (1) |

|

Age(2) |

|

Positions Held |

|

Director |

|

Current |

|

Shares of |

|

Percent of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOMINEES | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Keith N. Congdon |

|

51 |

|

Director |

|

2007 |

|

2013 |

|

14,371 (6) |

|

* |

|

Kathleen R. Sachs |

|

61 |

|

Director |

|

2007 |

|

2013 |

|

4,418 (7) |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David A. Splaine |

|

53 |

|

Director |

|

2007 |

|

2013 |

|

35,881 (8) |

|

1.84 |

|

Robert T. Wyman |

|

48 |

|

Director |

|

2007 |

|

2013 |

|

4,292 (9) |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTORS CONTINUING IN OFFICE | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert E. Balletto |

|

56 |

|

Director, President and Chief Executive Officer |

|

2004 |

|

2014 |

|

55,963 (10) |

|

2.86 |

|

Stephen L. Flynn |

|

57 |

|

Director |

|

2001 |

|

2014 |

|

5,326 (11) |

|

* |

|

Thomas L. Hamelin |

|

56 |

|

Director |

|

2000 |

|

2014 |

|

10,355 (12) |

|

* |

|

J. Richard Murphy |

|

68 |

|

Director |

|

2008 |

|

2014 |

|

9,401 (13) |

|

* |

|

Anthony S. Conte, Jr. |

|

47 |

|

Director |

|

2000 |

|

2015 |

|

16,019 (14) |

|

* |

|

Marybeth McInnis |

|

50 |

|

Director |

|

2007 |

|

2015 |

|

9,578 (15) |

|

* |

|

Mary L. Williams |

|

60 |

|

Director |

|

2005 |

|

2015 |

|

6,008 (16) |

|

* |

|

John H. Yeaton |

|

42 |

|

Director |

|

2007 |

|

2015 |

|

2,727 (17) |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXECUTIVE OFFICERS WHO ARE NOT A DIRECTOR | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph W. Kennedy |

|

53 |

|

Senior Vice President and Chief Financial Officer and Treasurer |

|

N/A |

|

N/A |

|

27,038 (18) |

|

1.39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip J. Bryan |

|

48 |

|

Senior Vice President and Chief Lending Officer of Georgetown Bank |

|

N/A |

|

N/A |

|

8,343 (19) |

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (15 persons) |

|

|

|

|

|

|

|

|

|

212,674 (20) |

|

10.81 |

|

* |

Less than one percent. |

|

(1) |

The mailing address for each person listed is 2 East Main Street, Georgetown, Massachusetts 01833. |

|

(2) |

Information as of December 31, 2012. |

|

(3) |

With regard to Mr. Balletto, Mr. Conte, Jr., Mr. Flynn and Mr. Hamelin reflects initial appointment to the Board of Trustees of the mutual predecessor to Georgetown Bank. |

|

(4) |

See definition of “beneficial ownership” in the table “Security Ownership of Certain Beneficial Owners.” |

|

(5) |

Based on 1,949,447 shares of common stock outstanding on March 7, 2013. |

|

(6) |

Includes 842 exercisable stock options, 705 shares of restricted stock over which Mr. Congdon has voting power and 8,971 shares owned through an individual retirement account. |

|

(7) |

Includes 842 exercisable stock options and 705 shares of restricted stock over which Ms. Sachs has voting power and 900 shares owned through an individual retirement account. |

|

(8) |

Includes 842 exercisable stock options, 705 shares of restricted stock over which Mr. Splaine has voting power, 3,440 shares owned by his children, 5,000 owned by his spouse in a trust and 23,989 shares owned through an individual retirement account. |

|

(9) |

Includes 842 exercisable stock options and 705 shares of restricted stock over which Mr. Wyman has voting power. |

|

(10) |

Includes 4,032 exercisable stock options, 9,258 shares of restricted stock over which Mr. Balletto has voting power, 894 shares owned by Mr. Balletto’s spouse, 27,860 shares owned through Georgetown Bank’s 401(k) plan and 7,878 shares held by the Georgetown s Bank Employee Stock Ownership Plan. |

|

(11) |

Includes 842 exercisable stock options and 705 shares of restricted stock over which Mr. Flynn has voting power and 1,998 shares owned through an individual retirement account. |

|

(12) |

Includes 842 exercisable stock options, 705 shares of restricted stock over which Mr. Hamelin has voting power and 7,769 shares owned through an individual retirement account. |

|

(13) |

Includes 842 exercisable stock options and 905 shares of restricted stock over which Mr. Murphy has voting power, 1,700 shares owned through an individual retirement account and 1,500 shares owned by his spouse through an individual retirement account. |

|

(14) |

Includes 842 exercisable stock options, 705 shares of restricted stock over which Mr. Conte has voting power and 2,725 shares owned by Mr. Conte’s spouse. |

|

(15) |

Includes 842 exercisable stock options and 705 shares of restricted stock over which Ms. McInnis has voting power. |

|

(16) |

Includes 842 exercisable stock options, 805 shares of restricted stock over which Ms. Williams has voting power and 1,260 shares owned through an individual retirement account. |

|

(17) |

Includes 842 exercisable stock options and 705 shares of restricted stock over which Mr. Yeaton has voting power. |

|

(18) |

Includes 2,487 exercisable stock options, 6,220 shares of restricted stock over which Mr. Kennedy has voting power, 924 shares owned by Mr. Kennedy’s spouse through an individual retirement account, 602 shares owned through an individual retirement account, 5,685 owned through Georgetown Bank’s 401(k) plan and 5,321 shares held by the Georgetown Bank Employee Stock Ownership Plan. |

|

(19) |

Includes 709 exercisable stock options and 5,007 shares of restricted stock over which Mr. Bryan has voting power, 1,332 owned through Georgetown Bank’s 401(k) plan and 539 shares held by the Georgetown Bank Employee Stock Ownership Plan. |

|

(20) |

Includes shares held by a director whose term is expiring at the annual meeting. |

The biographies of each of the nominees, continuing board members and executive officers are set forth below. With respect to directors and nominees, the biographies also contain information regarding the person’s business experience and the experiences, qualifications, attributes or skills that caused the Nominating/Governance Committee and the Board of Directors to determine that the person should serve as a director. Each director is also a director of Georgetown Bank, and each executive officer also is an executive officer of Georgetown Bank with the exception of Mr. Bryan, who is only an executive officer of Georgetown Bank.

All of the nominees and directors continuing in office are residents of the communities served by the Company and Georgetown Bank and many of such individuals have operated, or currently operate, businesses located in such communities. As a result, each nominee and director continuing in office has significant knowledge of the businesses that operate in the Company’s market area, an understanding of the general real estate market, values and trends in such communities and an understanding of the overall demographics of such communities. Additionally, as residents of such communities, each nominee and continuing director has direct knowledge of the trends and developments occurring in such communities. As the holding company for a community banking institution, the Company believes that the local knowledge and experience of its directors assists the Company in assessing the credit and banking needs of its customers, developing products and services to better serve its customers and assessing the risks inherent in its lending operations, and provides the Company with greater business development opportunities. As local residents, our nominees and directors are also exposed to the advertising, product offerings and community development efforts of competing institutions which, in turn, assists the Company in structuring its marketing efforts and community outreach programs.

Directors

Robert E. Balletto has been employed with Georgetown Bank since 1982 and has served as Chief Executive Officer since 1988. In July 2004, Mr. Balletto was elected to the Board of Directors of Georgetown Bank and was also appointed President. Mr. Balletto has over 33 years experience in the banking industry. As Chief Executive Officer, Mr. Balletto’s experience in leading the Company and the Bank and his responsibilities for the strategic direction and management of the Company’s day-to-day operations, bring broad industry and specific institutional knowledge and experience to the Board of Directors.

Keith N. Congdon is the President and owner of Ambrosi Donahue Congdon & Co., P.C., a certified public accounting firm based in Newburyport, Massachusetts. Prior to joining Ambrosi Donahue Congdon, Mr. Congdon began his career with Coopers & Lybrand (now PricewaterhouseCoopers) as an auditor of publicly traded companies. He later joined The Stackpole Corporation in Boston, Massachusetts as a corporate officer and was actively involved in the initial public offering on the Toronto Stock Exchange of Stackpole Limited, a wholly-owned subsidiary as well as the divestiture of a number of U.S. subsidiaries. With over 28 years of extensive experience in both private industry and public accounting, Mr. Congdon currently provides tax, accounting and auditing services for closely-held businesses and their shareholders, primarily in manufacturing, technology and service industries. As a certified public accountant (CPA) and Chairman of the Board’s Audit Committee, Mr. Congdon brings to the Board of Directors his valuable experience in dealing with accounting principles, internal controls and financial reporting rules and regulations.

Anthony S. Conte, Jr. is the owner of Conte Funeral Homes, Inc., located in North Andover, Andover, Newburyport and Georgetown, Massachusetts. Mr. Conte’s 22 years of experience as owner and manager of his own company bring valuable business and leadership skills and financial acumen to the Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Stephen L. Flynn is the President and owner of Nunan Florist and Greenhouse, Inc., located in Georgetown, Massachusetts. Mr. Flynn’s 27 years of experience as owner and manager of his own company bring valuable business and leadership skills and financial acumen to the Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Thomas L. Hamelin has been a mechanical engineer for Varian Semiconductor, a subsidiary of Applied Materials, a semi-conductor equipment manufacturing firm, located in Gloucester, Massachusetts, since October 2010. Prior to that, Mr. Hamelin was a mechanical engineer for Tokyo Electron, a semi-conductor manufacturing firm, located in Beverly and Billerica, Massachusetts, since March 1998. Mr. Hamelin’s 34 years of experience in the engineering field with large manufacturing firms, combined with his leadership skills, bring a unique perspective to the Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Marybeth McInnis, Esquire owns McInnis Law Offices, a boutique law firm located in North Andover, Massachusetts, that has provided full-service estate planning services to the Merrimack Valley for more than forty-five years. The firm specializes in counseling individuals and families at all asset and income levels with estate, business, tax, charitable and long-term care planning. Ms. McInnis is actively involved with many local charitable organizations and has served on the Board of Trustees of Merrimack College since July of 2008 and the Board of Trustees of the James W. O’Brien Foundation, Inc., since June of 2000. As an experienced attorney, Ms. McInnis brings to the Board a unique and valuable perspective on legal and legal-related issues that may arise in the operations and management of the Company and the Bank.

J. Richard Murphy is the President and Managing Director of Grey Rock Partners, LLC located in Boston, Massachusetts. Grey Rock Partners, LLC offers Corporate Advisory Services to mid-sized privately held companies and their owners. Grey Rock’s services include mergers and acquisitions (both sell-side and buy-side representations), the placement of senior and mezzanine debt, corporate divestiture, and strategic consulting centered on maximizing shareholder value. With his extensive financial experience in mergers and acquisitions and other transactions centered on maximizing shareholder value and more than 26 years of prior banking experience, including three years as a Chief Executive Officer of a $1.4 billion, 22 branch commercial bank, Mr. Murphy provides the Board with valuable insight on these and others matters that are beneficial to the Company in evaluating potential strategic transactions, in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Kathleen R. Sachs, CFP is the founder and a principal of Sachs Financial Planning, a financial planning firm. Ms. Sachs also teaches risk management at Merrimack College. With her extensive financial experience in insurance, investments and risk management, Ms. Sachs provides the Board with valuable insight on these and others matters that are central to the operations of the Bank in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

David A. Splaine is a partner in Ellis Insurance Agency, Inc. located in York, Maine and Portsmouth, New Hampshire. He is also currently a partner in a consulting firm, specializing in providing professional sports teams financial and management assistance. From 2001 to 2006 he served as Senior Vice President of Sales for the TD Bank Garden and Boston Bruins. Prior experience includes senior lending positions at Fleet Bank (now Bank of America). He has served as a director of the Boston Celtics Limited Partnership (NYSE), and is currently a director of several private companies. Mr. Splaine’s extensive business experience in a range of industries and disciplines, combined with his leadership skills, knowledge of our market, and sensitivity to the economy, brings valuable insight and individual qualities to our Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Mary L. Williams has been employed since June 2002 at North Shore Community College providing budget management for institutional federal grants and the College’s Public Policy Institute. She also served as the Director of EdLink and coordinated development of a five-year strategic plan for the College. Prior to that and until June 2002, she was Vice President of Administration and Finance for Massachusetts College of Art. Ms. Williams’ extensive experience in higher education and management, combined with her leadership skills, knowledge of our market, and financial management experience, brings valuable insight and individual qualities to our Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Robert T. Wyman, Esquire is an attorney and partner at the law firm Wyman & Barton, LLC, of Andover and Chelmsford, Massachusetts, representing clients in the areas of civil and criminal litigation, real estate litigation and real estate conveyance. As an experienced attorney, Mr. Wyman brings to the Board a unique and valuable perspective on legal and legal-related issues that may arise in the operations and management of the Company and the Bank.

John H. Yeaton has been employed since July 2010 by Quest Diagnostics as Controller for the Cambridge, Massachusetts Business Unit. Prior to joining Quest Diagnostics Mr. Yeaton was the director of financial planning and analysis for the products division and controller for the pharmaceuticals business unit for Fresenius Medical Care North America of Waltham, Massachusetts, an $8.0 billion company that operates the nation’s largest network of dialysis clinics. In August 2011, Mr. Yeaton became a Certified Public Accountant, licensed in the State of New Hampshire. Mr. Yeaton’s extensive business experience in a range of industries and disciplines, combined with his leadership skills, knowledge of our market, and financial analysis experience, brings valuable insight and individual qualities to our Board in furtherance of the Board’s objective of maintaining a membership of experienced and dedicated individuals with diverse backgrounds, perspectives, skills, and other qualities that are beneficial to the Company.

Executive Officers of the Company or Georgetown Bank who are not a Director

Joseph W. Kennedy began employment with Georgetown Bank in 1999 as Vice President and Chief Financial Officer. Mr. Kennedy has served as Senior Vice President and Chief Financial Officer since January 2004 and Treasurer since April 2003. In October 2006, Mr. Kennedy was elected as Corporate Secretary for the Company’s federal corporation predecessor and Georgetown Bank. Prior to joining Georgetown Bank, Mr. Kennedy served as Chief Financial Officer for National Grand Bank of Marblehead, Massachusetts for four years and Ipswich Savings Bank, Ipswich Massachusetts for eight years. Both companies were stock institutions.

Philip J. Bryan began employment with Georgetown Bank in October 2010 as Senior Vice President/Retail Lending Officer. Mr. Bryan was promoted to Senior Vice President and Chief Lending Officer in April 2011. From October 2009 to October 2010 Mr. Bryan was actively managing a business venture with his wife, which is still in operations today. Prior to that, Mr. Bryan served as Senior Vice President of Retail and Lending, in charge of both the retail branch network and the lending function for Metro Credit Union, Chelsea, Massachusetts from 2005 to 2009. He also served as Senior Vice President and State Manager of Small Business Lending for TD Banknorth from 2002 to 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

The common stock of the Company is registered with the SEC pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The officers and directors of the Company and beneficial owners of greater than 10% of the Company’s common stock (“10% beneficial owners”) are required to file reports on Forms 3, 4 and 5 with the SEC disclosing beneficial ownership and changes in beneficial ownership of the common stock. SEC rules require disclosure in the Company’s Proxy Statement or Annual Report on Form 10-K of the failure of an officer, director or 10% beneficial owner of the Company’s common stock to file a Form 3, 4, or 5 on a timely basis. Based on the Company’s review of such ownership reports, the Company believes that no officer or director of the Company failed to timely file such ownership reports for the year ended December 31, 2012.

Board Independence

The Board of Directors has determined that, except for Mr. Balletto, each member of the Board of Directors is an “independent director” within the meaning of Rule 5605 of the NASDAQ corporate governance listing standards. Mr. Balletto is not considered independent because he serves as an executive officer of the Company. In determining the independence of the independent directors, the Board of Directors reviewed the following transactions, which are not required to be reported under “—Transactions With Certain Related Persons,” below:

Loans made in the normal course of business with Georgetown Bank

|

Director |

|

Total Potential/ |

| |||

|

|

|

|

| |||

|

Anthony S. Conte Jr. |

|

$ |

2,227,585 |

|

| |

|

Stephen L. Flynn |

|

1,470,382 |

|

| ||

|

Richard F. Spencer |

|

4,000 |

|

| ||

|

John H. Yeaton |

|

500,000 |

|

| ||

|

Thomas L. Hamelin |

|

150,000 |

|

| ||

|

Mary L. Williams |

|

34,294 |

|

| ||

|

Kathleen R. Sachs |

|

|

|

40,000 |

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

$ |

4,426,261 |

|

|

Sales of merchandise to Georgetown Bank

|

Director |

|

Sales for the year ended December 31, 2012 | ||

|

|

|

| ||

|

Stephen L. Flynn |

|

$ |

9,144 |

|

Board Leadership Structure and Risk Oversight

Our Board of Directors is chaired by J. Richard Murphy, who is a non-executive director. This structure ensures a greater role for the independent directors in the oversight of Georgetown Bancorp, Inc. and Georgetown Bank and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. The Chief Executive Officer is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company. The Chairman of the Board provides guidance to the Chief Executive Officer and sets the agenda for Board meetings and presides over meetings of the full Board of Directors.

The Board of Directors is actively involved in oversight of risks that could affect Georgetown Bancorp, Inc. This oversight is conducted primarily through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks. The Board of Directors satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within Georgetown Bancorp, Inc., including credit, financial, operational, liquidity, legal and regulatory risks. Risks relating to the direct operations of Georgetown Bank are further overseen by the Board of Directors of Georgetown Bank, who are the same individuals who serve on the Board of Directors of Georgetown Bancorp, Inc. The Board of Directors of Georgetown Bank also has additional committees that conduct risk oversight separate from the committees of Georgetown Bancorp, Inc. Further, the Board of Directors oversees risks through the establishment of policies and procedures that are designed to guide daily operations in a manner consistent with applicable laws, regulations and risks acceptable to the organization.

References to our Website Address

References to our website address throughout this Proxy Statement and the accompanying materials are for informational purposes only, or to fulfill specific disclosure requirements of the SEC’s rules. These references are not intended to, and do not, incorporate the contents of our website by reference into this Proxy Statement or the accompanying materials.

Meetings and Committees of the Board of Directors

General. The business of the Company is conducted at regular and special meetings of the full Board of Directors and its standing committees. In addition, the “independent” members of the Board of Directors meet in

executive sessions on a monthly basis, including six meetings during the year ended December 31, 2012 and six meetings by the independent members of the Board of Directors of Georgetown Bancorp, Inc., our predecessor federal corporation. The standing committees include the Executive, Compensation, Nominating/Governance and Audit Committees. During the year ended December 31, 2012, the Board of Directors held six regular meetings and no special meetings and six regular meetings of the Board of Directors of Georgetown Bancorp, Inc., our predecessor federal corporation and four special meetings. No member of the Board of Directors or any committee thereof attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board of Directors (held during the period for which he has been a director); and (ii) the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served).

While the Company has no formal policy on director attendance at annual meetings of stockholders, all directors are encouraged to attend. All of the directors attended last year’s Annual Meeting of Stockholders with the exception of Director Stephen L. Flynn.

Executive Committee. The Executive Committee consists of directors J. Richard Murphy, (Chairman), Keith N. Congdon, Stephen L. Flynn, Marybeth McInnis, Kathleen R. Sachs, David A. Splaine and Mary L. Williams. The Executive Committee meets as needed to exercise general control and supervision in all matters pertaining to the interests of the Company, subject at all times to the direction of the Board of Directors. The Executive Committee met one time during the year ended December 31, 2012 and the Executive Committee of Georgetown Bancorp, Inc., our predecessor federal corporation, met two times during the year.

Nominating/Governance Committee. The Nominating/Governance Committee consists of directors Mary L. Williams, Chairman, Thomas L. Hamelin, Kathleen R. Sachs, Richard F. Spencer (whose term expires at the annual meeting) and Robert T. Wyman. Each member of the Nominating/Governance Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards. The Board of Directors has adopted a written charter for the Committee, which is available at the Company’s website at www.georgetownbank.com. The Committee met three times during the year ended December 31, 2012 and the Nominating/Governance Committee of Georgetown Bancorp, Inc., our predecessor federal corporation, met two times during the year.

The primary function of the Nominating/Governance Committee is to lead the search for individuals qualified to become members of the Board of Directors and to select director nominees to be presented for stockholder approval. The Nominating/Governance Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to the Company’s business and who are willing to continue in service are first considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with that of obtaining a new perspective. If any member of the Board of Directors does not wish to continue in service, or if the Committee or the Board of Directors decides not to re-nominate a member for re-election, or if the size of the Board of Directors is increased, the Committee would solicit suggestions for director candidates from all members of the Board of Directors as well as the Chief Executive Officer. In addition, the Committee is authorized by its charter to engage a third party to assist in the identification of director nominees. During the year ended December 31, 2012, the Company did not pay a fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees for director. The Nominating/Governance Committee would seek to identify a candidate who at a minimum satisfies the following criteria:

|

· |

Own beneficially at least 100 shares of capital stock of the Company initially at the time of appointment, and within a period of five years from the date of appointment, acquire a total of 4,000 shares of capital stock; unless otherwise exempted from this provision due to hardship, as determined by a majority vote of the Executive Committee; |

|

|

|

|

· |

Be well known or active in the affairs of at least one community served by Georgetown Bank; |

|

|

|

|

· |

Live or work in Georgetown Bank’s market area; |

|

|

|

|

· |

Add diversity to the Board as defined by skills, knowledge, and experience; |

|

|

|

|

· |

Have a background that causes no potential risk to the reputation of Georgetown Bank or the Company; |

|

· |

Derive no personal gain by serving on the Board, other than Board fees and benefits from stock benefit plans of Georgetown Bank or the Company; |

|

|

|

|

· |

Be of the highest integrity and above reproach; |

|

|

|

|

· |

Be able to devote the time necessary to perform the responsibilities of a Director; |

|

|

|

|

· |

Have the energy, desire and focus required to attend meetings attentively; |

|

|

|

|

· |

Have the education experience and intellect to perform and understand the duties of a Director; |

|

|

|

|

· |

Be willing to work with and interact with other Board members, acknowledging their positions and contributions; |

|

|

|

|

· |

Be open to considering and offering new ideas and proposals; and |

|

|

|

|

· |

Be an age of 75 or younger at the time of appointment/ re-election. |

Finally, the Nominating/Governance Committee will take into account whether a candidate satisfies the criteria for “independence” under the NASDAQ corporate governance listing standards, and if a nominee is sought for service on the audit committee, the financial and accounting expertise of a candidate, including whether the individual qualifies as an audit committee financial expert. When considering whether directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively, the Nominating/Governance Committee and the Board of Directors focused primarily on the information included in each of the directors’ individual biographies set forth above. The Nominating/Governance Committee and the Board of Directors do not have a diversity policy. However, as noted above, in identifying nominees for directors, however, consideration is given to the diversity of skills, knowledge, and experience among the directors so that a variety of points of view are represented in Board discussions and deliberations concerning the Company’s business.

Procedures for the Recommendation of Director Nominees by Stockholders. The Nominating/Governance Committee has adopted procedures for the submission of recommendations for director nominees by stockholders. If a determination is made that an additional candidate is needed for the Board of Directors, the Nominating/Governance Committee will consider candidates submitted by the Company’s stockholders. Stockholders can submit qualified names of candidates for director by writing to our Corporate Secretary, at 2 East Main Street, Georgetown, Massachusetts 01833. The Corporate Secretary must receive a submission not less than 90 days prior to the anniversary date of the Company’s proxy materials for the preceding year’s annual meeting. The submission must include the following information:

|

· |

the name and address of the stockholder as they appear on the Company’s books, and number of shares of the Company’s common stock that are owned beneficially by such stockholder (if the stockholder is not a holder of record, appropriate evidence of the stockholder’s ownership will be required); |

|

|

|

|

· |

the name, address and contact information for the candidate, and the number of shares of common stock of the Company that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the stockholder’s ownership will be required); |

|

|

|

|

· |

a statement of the candidate’s business and educational experience; |

|

|

|

|

· |

such other information regarding the candidate as would be required to be included in the proxy statement pursuant to SEC Rule 14A; |

|

|

|

|

· |

a statement detailing any relationship between the candidate and the Company; |

|

|

|

|

· |

a statement detailing any relationship between the candidate and any customer, supplier or competitor of the Company; |

|

· |

detailed information about any relationship or understanding between the proposing stockholder and the candidate; and |

|

|

|

|

· |

a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected. |

Submissions that are received and that meet the criteria outlined above are forwarded to the Chairman of the Nominating/Governance Committee for further review and consideration. A nomination submitted by a stockholder for presentation by the stockholder at an annual meeting of stockholders must comply with the procedural and informational requirements described in this proxy statement under the heading “Stockholder Proposals.” No submission for Board nominees was received by the Company for the Annual Meeting.

There have been no material changes to these procedures since they were previously disclosed in the proxy statement of Georgetown Bancorp, Inc., a federal corporation, for the 2012 annual meeting of stockholders.

Stockholder Communications with the Board of Directors. A stockholder of the Company who wishes to communicate with the Board of Directors or with any individual director may write to the Corporate Secretary of the Company, 2 East Main Street, Georgetown, Massachusetts 01833, Attention: Board Administration. The letter should indicate that the author is a stockholder and if shares are not held of record, should include appropriate evidence of stock ownership. Depending on the subject matter, the Corporate Secretary will:

|

· |

forward the communication to the director or directors to whom it is addressed; |

|

|

|

|

· |

attempt to handle the inquiry directly, for example where it is a request for information about the Company or a stock-related matter; or |

|

|

|

|

· |

not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate. |

At each Board of Directors meeting, management will present a summary of all communications received since the last meeting that were not forwarded and make those communications available to the directors.

The Audit Committee. The Audit Committee consists of directors Keith N. Congdon (Chairman), Marybeth McInnis, and John H. Yeaton. Each member of the Audit Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards and under SEC Rule 10A-3. The Board of Directors has determined that Director Congdon qualifies as an “audit committee financial expert” as that term is defined by the rules and regulations of the SEC. The duties and responsibilities of the Audit Committee include, among other things:

|

· |

retaining, overseeing and evaluating an independent registered public accounting firm in connection with the audit of the Company’s annual consolidated financial statements; |

|

|

|

|

· |

in consultation with the independent registered public accounting firm and the Company’s internal audit firms, reviewing the integrity of the Company’s financial reporting processes, both internal and external; |

|

|

|

|

· |

approving the scope of the audit in advance; |

|

|

|

|

· |

reviewing the financial statements and the audit report with management and the independent registered public accounting firm; |

|

|

|

|

· |

considering whether the provision of services by the independent registered public accounting firm not related to the annual audit and quarterly reviews is consistent with maintaining its independence; |

|

|

|

|

· |

reviewing earnings and financial releases and quarterly reports filed with the SEC; |

|

|

|

|

· |

consulting with the internal audit firms’ staff and reviewing management’s administration of the system of internal accounting controls; |

|

· |

approving all engagements for audit and non-audit services by the independent registered public accounting firm; and |

|

|

|

|

· |

reviewing the adequacy of the audit committee charter. |

The Audit Committee met three times during the year ended December 31, 2012 and the Audit Committee of Georgetown Bancorp, Inc., our predecessor federal corporation, met three times during the year. The Audit Committee reports to the Board of Directors on its activities and findings. The Board of Directors has adopted a written charter for the Audit Committee, which is available at the Company’s website at www.georgetownbank.com.

Audit Committee Report

The following Audit Committee Report is provided in accordance with the rules and regulations of the SEC. Pursuant to such rules and regulations, this report shall not be deemed “soliciting material,” filed with the SEC, subject to Regulation 14A or 14C of the SEC or subject to the liabilities of Section 18 of the Securities and Exchange Act of 1934, as amended.

The Audit Committee has prepared the following report for inclusion in this Proxy Statement:

As part of its ongoing activities, the Audit Committee has:

|

· |

Reviewed and discussed with management the Company’s audited consolidated financial statements for the year ended December 31, 2012; and |

|

|

|

|

· |

Discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, The Auditor’s Communication With Those Charged With Governance, as amended; and |

|

|

|

|

· |

Received the written disclosures and the letter from the independent registered public accounting firm required by PCAOB Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, and has discussed with the independent registered public accounting firm its independence; and |

|

|

|

|

· |

Pre-approved all audit, audit-related and other services to be provided by the independent registered public accounting firm. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012.

In addition, the Audit Committee approved the appointment of Shatswell, MacLeod & Company, P.C. as the Company’s independent registered public accounting firm for the year ending December 31, 2013, subject to the ratification of the appointment by the stockholders.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates this information by reference, and this report shall not otherwise be deemed “soliciting material” or filed with the SEC subject to Regulation 14A or 14C of the Securities and Exchange Commission or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended.

This report has been provided by the Audit Committee:

Keith N. Congdon, Chairman

Marybeth McInnis

John H. Yeaton

Code of Ethics

The Company has adopted a Code of Ethics that is applicable to the Company’s officers, directors and employees, including its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Ethics is available on the Company’s website at www.georgetownbank.com. Amendments to and waivers from the Code of Ethics will also be disclosed on the Company’s website.

Compensation Committee

The Compensation Committee, consisting of independent directors Kathleen R. Sachs (Chairperson), David A. Splaine and Mary L. Williams, generally determines salary and other compensation for employees, including the Named Executive Officers, as defined below. Each member of the Compensation Committee is considered “independent” as defined in the NASDAQ corporate governance listing standards. The Compensation Committee meets in executive session to determine such salaries. The Compensation Committee met four times in the year ended December 31, 2012 and the Compensation Committee of Georgetown Bancorp, Inc., our predecessor federal corporation, met five times during the year. The Board of Directors has adopted a written charter for the Compensation Committee, which is available at the Company’s website at www.georgetownbank.com.

Executive Compensation

The Board of Directors’ philosophy is to align executive compensation with the interests of its stockholders and to determine appropriate compensation levels that will enable it to meet the following objectives:

|

· |

To attract, retain and motivate an experienced, competent executive management team; |

|

|

|

|

· |

To reward the executive management team for the enhancement of shareholder value based on annual earnings performance and the market price of the Company’s stock; |

|

|

|

|

· |

To provide compensation rewards that are adequately balanced between short-term and long-term performance goals; |

|

|

|

|

· |

To encourage ownership of the Company’s common stock through stock-based compensation; and |

|

|

|

|

· |

To maintain compensation levels that are competitive with other financial institutions and particularly those in the Company’s peer group based on asset size and market area. |

The Board of Directors considers a number of factors in its decisions regarding executive compensation and benefits including, but not limited to, the level of responsibility and performance of the individual executive officer, the overall performance of the Company, and consideration of industry, community bank peers and local market conditions. Base salary levels of the Company’s and Georgetown Bank’s executive officers are set to reflect the duties and responsibilities inherent in the position and to reflect competitive conditions in the banking business in the Company’s market area. In setting base salaries, the Board of Directors also considers a number of factors relating to each executive officer, including individual performance, job responsibilities, experience level, ability and the knowledge of the position, and overall performance of the Company and the Georgetown Bank. These factors are considered subjectively, and where possible quantitatively, and are weighted partially by those aspects deemed more significant than others. Such a weighting of these evaluation factors will vary from year to year in response to the strategic plan and current market conditions. The Board of Directors also considers the recommendations of the Chief Executive Officer with respect to the compensation of the other executive officers. The Board of Directors and the Chief Executive Officer review the same information in connection with these performance evaluations and related recommendations of these executives.

The Board of Directors increased the base salary level of Mr. Kennedy and Mr. Bryan, Named Executive Officers of the Company by $4,160 and $4,850, respectively, and did not increase the base salary of Mr. Balletto, the other Named Executive Officer of the Company in the year ended December 31, 2012.

The compensation committee did not use a compensation consultant in determining director or executive officer compensation for the year ended December 31, 2012.

Executive Compensation

The following table sets forth for the years ended December 31, 2012 and December 31, 2011 certain information as to the total remuneration paid by the Company to Mr. Balletto, who serves as President and Chief Executive Officer, Mr. Kennedy, the Company’s Senior Vice President and Chief Financial Officer and Treasurer and Mr. Bryan, Georgetown Bank’s Senior Vice President and Chief Lending Officer (“Named Executive Officers”).

|

SUMMARY COMPENSATION TABLE | |||||||||||||||||||

|

Name and principal |

|

Year |

|

Salary |

|

Bonus |

|

Stock |

|

Option |

|

Non-equity |

|

Nonqualified |

|

All other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert E. Balletto, |

|

2012 |

|

194,000 |

|

— |

|

21,871 |

|

10,055 |

|

20,940 |

|

— |

|

65,061 |

|

311,927 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph W. Kennedy, |

|

2012 |

|

131,840 |

|

— |

|

14,216 |

|

6,536 |

|

8,697 |

|

— |

|

44,802 |

|

206,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip J. Bryan, |

|

2012 |

|

159,650 |

|

— |

|

12,029 |

|

5,530 |

|

19,892 |

|

— |

|

15,915 |

|

213,016 |

|

|

|

|

|

(1) Reflects the aggregate grant date fair value of restricted stock or option awards granted during the applicable year. The value is the amount recognized for financial statement reporting purposes in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. The assumptions used in the valuation of these awards are included in Notes 2 and 13 to our audited financial statements for the years ended December 31, 2012 and 2011 as included in our Annual Report on Form 10-K for the year ended December 31, 2012, as filed with the Securities and Exchange Commission.

(2) Consists of the following payments: | |

|

Officer |

|

Year |

|

401(k) Plan |

|

Employee Stock |

|

Term Life |

|

Executive Owned |

|

Executive |

|

Club Membership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert E. Balletto |

|

2012 |

|

11,637 |

|

8,638 |

|

9,360 |

|

31,350 |

|

1,076 |

|

3,000 |

|

|

|

|

2011 |

|

13,559 |

|

9,124 |

|

8,300 |

|

31,350 |

|

1,076 |

|

2,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph W. Kennedy |

|

2012 |

|

8,471 |

|

6,104 |

|

3,200 |

|

26,338 |

|

689 |

|

— |

|

|

|

|

2011 |

|

8,408 |

|

6,304 |

|

2,810 |

|

26,338 |

|

652 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Philip J. Bryan |

|

2012 |

|

10,009 |

|

5,906 |

|

— |

|

— |

|

— |

|

— |

|

|

|

|

2011 |

|

1,788 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Benefit Plans

401(k) Plan. Georgetown Bank maintains the Savings Bank Employee Retirement Association (SBERA) 401(k) Plan, which is a qualified, tax-exempt profit sharing plan with a salary deferral feature under Section 401(k) of the Code (the “401(k) Plan”). All employees who have attained age 21 and have completed one year of employment during which they worked at least 1,000 hours are eligible to participate. Under the 401(k) Plan, participants are permitted to make salary reduction contributions up to the lesser of 75% of compensation or $17,500 (as indexed annually). For these purposes, “compensation” includes wages reported on federal income tax form W-2, with all pre-tax contributions added, but does not include compensation in excess of the tax law limits. Georgetown Bank will make matching contributions equal to 50% of the participants’ elective deferrals up to 6% of their compensation. In addition, at the direction of the Board of Directors, Georgetown Bank may contribute an additional amount to participant accounts equal to 3% of the participant’s compensation. All employee contributions and earnings thereon are fully and immediately vested. A participant may withdraw salary reduction contributions in the event the participant suffers a financial hardship. The 401(k) Plan permits loans to participants. The 401(k) Plan permits employees to direct the investment of their own accounts into various investment options. Participants are entitled to benefit payments upon termination of employment due to normal retirement, early retirement at or after age 59½, disability or death. Benefits will be distributed in the form of lump sum or installment payments. Georgetown Bank has established an employer stock fund in the 401(k) Plan so that participants can acquire an interest in the common stock of the Company through their accounts in the 401(k) Plan.

Incentive Compensation Plan. Georgetown Bank maintains an incentive compensation plan to provide incentives and awards to employees in order to support Georgetown Bank’s organizational objectives and financial goals. Full-time and part-time employees employed for a minimum of six continuous months during the plan year are eligible to participate in the incentive compensation plan. Eligible participants who have been employed by Georgetown Bank for less than one year may receive a prorated incentive award. The award is calculated based on the achievement of Company-wide, department and individual goals, the mix and weighting of which will vary from year to year and which are approved annually by the Board of Directors. Distribution of the incentive award is generally made within thirty days of the end of the plan year. Employees whose performance level does not meet expectations may not be eligible for an incentive payout.

For the year ended December 31, 2012, Mr. Balletto’s plan provided for a target bonus of $34,920, or 18% of his current salary, with the following performance categories: (i) achievement of a return-on-assets (ROA) target; and (ii) achievement of an efficiency ratio target. For the year ended December 31, 2012, Mr. Kennedy’s plan provided for a target bonus of $14,502, or 11% of his current salary, with the following performance categories: (i) achievement of a ROA target; (ii) achievement of a net interest margin percentage target; and (iii) achievement of an efficiency ratio target. For the year ended December 31, 2012, Mr. Bryan’s plan provided for a target bonus of $17,561, or 11% of his current salary, with the following performance categories: (i) achievement of a ROA target; (ii) achievement of a mortgage banking income target; (iii) achievement of a core interest rate spread (as defined) target and (iv) achievement of a net commercial loan growth target.

Employment Agreements. Georgetown Bank has entered into employment agreements with Messrs. Balletto and Kennedy, which agreements were amended and restated in April 2012. Each of these agreements has a term of 36 months. On an annual basis, the Board of Directors of Georgetown Bank will conduct a performance review of Mr. Balletto’s performance and Mr. Balletto, as President and Chief Executive Officer, will conduct a performance review of Mr. Kennedy’s performance, which shall be further reviewed by the Board of Directors. At least six months prior to the expiration of the term of the employment agreements, the Board of Directors will review each executive’s performance for purposes of determining whether to renew the agreements for an additional term of up to three years. The Board’s decision whether or not to renew each agreement will be provided in a written notice to the applicable executive at least 60 days prior to the expiration of the term.

Under the agreements, the base salaries for Messrs. Balletto and Kennedy are $194,000 and $136,000, respectively. In addition to the base salary, each agreement provides for, among other things, participation in other benefits as provided to other full time employees of Georgetown Bank. The agreements also acknowledge that the executives and Georgetown Bank have entered into endorsement split dollar agreements with the executives with a pre-retirement death benefit of $2.0 million for Mr. Balletto and $1.0 million for Mr. Kennedy. The employment agreements require Georgetown Bank to make a tax-adjusted compensation payment towards the purchase of a life insurance policy to be owned by the executive with a death benefit of $1.0 million.

In addition, the agreements provide for reimbursement of ordinary and necessary business expenses incurred in connection with the performance of the duties under the respective agreements and subject to the approval of the Board of Directors of Georgetown Bank.