UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For

the quarterly period ended

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from ____________ to ____________

Commission

File Number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (IRS Employer | |

| incorporation or organization) | Identification No.) |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or, an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company,” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As of May 14, 2024, there were outstanding shares of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE: None.

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Quarterly Report contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical fact contained in this Quarterly Report are forward-looking statements, including without limitation, statements regarding current expectations, as of the date of this Quarterly Report, our future results of operations and financial position, our ability to effectively process our minerals and achieve commercial grade at scale; risks and hazards inherent in the mining business (including risks inherent in exploring, developing, constructing and operating mining projects, environmental hazards, industrial accidents, weather or geologically related conditions); uncertainty about our ability to obtain required capital to execute our business plan; our ability to hire and retain required personnel; changes in the market prices of lithium and lithium products and demand for such products; the uncertainties inherent in exploratory, developmental and production activities, including risks relating to permitting, zoning and regulatory delays related to our projects; uncertainties inherent in the estimation of lithium resources. These statements involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance, or achievements to differ materially from any future results, performance or achievement expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential”, or “continue” or the negative of these terms or other similar expressions Factors that could cause future results to materially differ from the recent results or those projected in forward-looking statements include, but are not limited to: unprofitable efforts resulting not only from the failure to discover mineral deposits, but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production; market fluctuations; government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection; competition; the loss of services of key personnel; unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of infrastructure as well as general economic conditions.

The forward-looking statements in this Quarterly Report are based largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Quarterly Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described under the sections in this Quarterly Report titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other of our filings made with the SEC.

You should read this Quarterly Report and the documents that we reference in this Quarterly Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

| 3 |

PART I - FINANCIAL INFORMATION

Item 1 FINANCIAL STATEMENTS

ATLAS LITHIUM CORPORATION

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

March 31, 2024 and December 31, 2023

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable | ||||||||

| Inventories | ||||||||

| Taxes recoverable | ||||||||

| Prepaid and other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Right of use assets - operating leases, net | ||||||||

| Investments | ||||||||

| Total assets | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Derivative liabilities | ||||||||

| Convertible Debt | ||||||||

| Operating lease liabilities | ||||||||

| Total current liabilities | ||||||||

| Convertible Debt | ||||||||

| Operating lease liabilities | ||||||||

| Deferred consideration from royalties sold | ||||||||

| Other noncurrent liabilities | ||||||||

| Total liabilities | ||||||||

| Stockholders’ Equity: | ||||||||

| Series A preferred stock, $ par value. shares authorized; share issued and outstanding as of March 31, 2024 and December 31, 2023 | ||||||||

| Series D preferred stock, $par value. shares authorized; issued and outstanding as of March 31, 2024 and December 31, 2023 | ||||||||

| Common stock, $par value. shares authorized as of March 31, 2024 and December 31, 2023, and and shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total Atlas Lithium Co. stockholders’ equity | ||||||||

| Non-controlling interest | ||||||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-1 |

ATLAS LITHIUM CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

For the Three Months Ended March 31, 2024 and 2023

| Three months ending March 31 | ||||||||

| 2024 | 2023 | |||||||

| Revenue | ||||||||

| Cost of revenue | ||||||||

| Gross loss | ||||||||

| Operating expenses | ||||||||

| General and administrative expenses | ||||||||

| Stock-based compensation | ||||||||

| Exploration | ||||||||

| Other operating expenses | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other expense (income) | ||||||||

| Other expense (income) | ( | ) | ||||||

| Fair value adjustments, net | ( | ) | ||||||

| Finance costs (revenue) | ||||||||

| Total other expense | ( | ) | ||||||

| Loss before provision for income taxes | ( | ) | ( | ) | ||||

| Provision for income taxes | ||||||||

| Net loss | ( | ) | ( | ) | ||||

| Loss attributable to non-controlling interest | ( | ) | ( | ) | ||||

| Net loss attributable to Atlas Lithium Corporation stockholders | $ | ( | ) | $ | ( | ) | ||

| Basic and diluted loss per share | ||||||||

| Net loss per share attributable to Atlas Lithium Corporation common stockholders | $ | ) | $ | ) | ||||

| Weighted-average number of common shares outstanding: | ||||||||

| Basic and diluted | ||||||||

| Comprehensive loss: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Foreign currency translation adjustment | ||||||||

| Comprehensive loss | ( | ) | ( | ) | ||||

| Comprehensive loss attributable to noncontrolling interests | ( | ) | ( | ) | ||||

| Comprehensive loss attributable to Atlas Lithium Corporation stockholders | $ | ( | ) | $ | ( | ) | ||

The accompanying notes are an integral part of the consolidated financial statements.

| F-2 |

ATLAS LITHIUM CORPORATION

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

For the Three Months Ended March 31, 2024 and 2023

| Series

A Preferred Stock | Series

D Preferred Stock | Common Stock | Additional Paid-in | Accumulated Other Comprehensive | Accumulated | Noncontrolling | Total Stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Value | Shares | Value | Shares | Value | Capital | Loss | Deficit | Interests | Equity | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | | |||||||||||||||||||||||||||||||

| Issuance of common stock in connection with sales made under private offerings | - | - | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock in connection with purchase of mining rights | - | - | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock in exchange for consulting, professional and other services | - | - | ||||||||||||||||||||||||||||||||||||||||||

| Exercise of warrants | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Stock based compensation | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Change in foreign currency translation | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Sale of Jupiter Gold common stock in connection with equity offerings | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||||

| Series

A Preferred Stock | Series

D Preferred Stock | Common Stock | Additional Paid-in | Accumulated Other Comprehensive | Accumulated | Noncontrolling | Total Stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Value | Shares | Value | Shares | Value | Capital | Loss | Deficit | Interests | Equity | ||||||||||||||||||||||||||||||||||

| Balance, December 31, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | | |||||||||||||||||||||||||||||||

| Issuance of common stock in exchange for consulting, professional and other services | - | - | ||||||||||||||||||||||||||||||||||||||||||

| Stock based compensation | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Change in foreign currency translation | - | - | - | |||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | $ | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | $ | ||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-3 |

ATLAS LITHIUM CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

For the Three Months Ended March 31, 2024 and 2023

| Three months ending March 31 | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities of continuing operations: | ||||||||

| Net loss | $ | ( | ) | ( | ) | |||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Stock based compensation and services | ||||||||

| Depreciation and amortization | ||||||||

| Interest expense | ||||||||

| Fair value adjustments | ( | ) | ||||||

| Intangible assets purchases payables | ||||||||

| Other non cash expenses | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ||||||

| Inventories | ( | ) | ||||||

| Taxes recoverable | ( | ) | ||||||

| Deposits and advances | ( | ) | ( | ) | ||||

| Accounts payable and accrued expenses | ( | ) | ||||||

| Other noncurrent liabilities | ( | ) | ( | ) | ||||

| Net cash provided (used) by operating activities | ( | ) | ( | ) | ||||

| Cash flows from investing activities: | ||||||||

| Acquisition of capital assets | ( | ) | ( | ) | ||||

| Increase in intangible assets | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Net proceeds from sale of common stock | ||||||||

| Proceeds from sale of subsidiary common stock to noncontrolling interests | ||||||||

| Net cash provided by financing activities | ||||||||

| Effect of exchange rates on cash and cash equivalents | ||||||||

| Net increase (decrease) in cash and cash equivalents | ( | ) | ||||||

| Cash and cash equivalents at beginning of period | ||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

The accompanying notes are an integral part of the consolidated financial statements.

| F-4 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION, BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Description of Business

Atlas Lithium Corporation (together with its subsidiaries “Atlas Lithium.” the “Company”, “the Registrant”, “we”, “us”, or “our”) was incorporated under the laws of the State of Nevada, on December 15, 2011. The Company changed its management and business on December 18, 2012, to focus on mineral exploration in Brazil.

Basis of Presentation and Principles of Consolidation

The

consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States

of America (“U.S. GAAP”) and are expressed in United States dollars. For the period ended March 31, 2024, the

consolidated financial statements include the accounts of the Company; its

All material intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingencies at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results may differ from those estimates.

Recent Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new pronouncements that have been issued that might have a material impact on its financial position or results of operations.

| F-5 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS

Property and Equipment

The following table sets forth the components of the Company’s property and equipment at March 31, 2024 and December 31, 2023:

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||

| Accumulated | Net Book | Accumulated | Net Book | |||||||||||||||||||||

| Cost | Depreciation | Value | Cost | Depreciation | Value | |||||||||||||||||||

| Capital assets subject to depreciation: | ||||||||||||||||||||||||

| Land | ||||||||||||||||||||||||

| Prepaid Assets (CIP) | ||||||||||||||||||||||||

| Total fixed assets | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

Intangible Assets

Intangible

assets consist of mining rights which are not amortized as the mining rights are perpetual. The carrying value of these mineral rights

as of March 31, 2024 and at December 31, 2023 was $

The

Company previously reported it was acquiring five mineral rights totaling

| ● | Payment

of $ | |

| ● | Issuance

of $ |

As of March 31, 2024, there are no outstanding commitments related to this transaction.

Accounts Payable and Accrued Liabilities

| March 31, 2024 | December 31, 2023 | |||||||

| Accounts payable and other accruals | $ | $ | ||||||

| Mineral rights payable | ||||||||

| Total | $ | $ | ||||||

| F-6 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS (CONTINUED)

Leases

Finance Leases

For the reporting period ended March 31, 2024, no financial leases meeting the criteria outlined in ASC 842 have been identified.

Operating Leases

Right of use (“ROU”) assets and lease liabilities are recognized at the lease commencement date based on the present value of the future lease payments over the lease term. When the rate implicit to the lease cannot be readily determined, we utilize our incremental borrowing rate in determining the present value of the future lease payments. The ROU asset includes any lease payments made and lease incentives received prior to the commencement date. Operating lease ROU assets also include any cumulative prepaid or accrued rent when the lease payments are uneven throughout the lease term. The ROU assets and lease liabilities may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. The ROU and lease liabilities are primarily related to commercial offices with third parties.

The

lease agreements have terms between

| Lease liabilities at December 31, 2023 | $ | |||

| Additions | $ | |||

| Interest expense | $ | |||

| Lease payments | $ | ( | ) | |

| Foreign exchange | ||||

| Lease liabilities at March 31, 2024 | $ | |||

| Current portion | $ | |||

| Non-current portion | $ |

The maturity of the lease liabilities (contractual undiscounted cash flows) is presented in the table below:

| Less than one year | $ | |||

| Year 2 | $ | |||

| Year 3 | $ | |||

| Year 4 | $ | |||

| Total contractual undiscounted cash flows | $ |

| F-7 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS (CONTINUED)

Convertible Debt

| March 31, 2024 | December 31, 2023 | |||||||

| Due to Nanyang Investment Management Pte Ltd | ||||||||

| Due to Jaeger Investments Pty Ltd | ||||||||

| Due to Modha Reena Bhasker | ||||||||

| Due to Clipper Group Limited | ||||||||

| Total convertible debt | $ | $ | ||||||

| Current portion | $ | $ | ||||||

| Non-current portion | $ | $ | ||||||

On

November 7, 2023, the Company entered into a convertible note purchase agreement (the “November 7, 2023 Convertible Note Agreement”)

with Mr. Martin Rowley (“Mr. Rowley”) and other investors to raise up to $

| - | Maturity

date: |

| - | Principal repayment terms: due on maturity; |

| - | Interest

rate: |

| - | Interest payment terms: due semiannually in arrears until maturity, unless converted or redeemed earlier and payable at the election of the holder in cash, in shares of common stock, or in any combination thereof; |

| - | Conversion right: the holder retains a right to convert all or any portion of the note into shares of the Company’s Common Stock at the Conversion Price up until the maturity date; and |

| - | Conversion

Price: US$ |

| - | Redemption

right: the Company shall vest a right to redeem the convertible notes if and when |

In

the three months ended March 31, 2024, the Company recorded $

Derivative Liabilities

| March 31, 2024 | December 31, 2023 | |||||||

| Derivative liability – conversion feature on the convertible debt | ||||||||

| Derivative liability – other stock incentives | ||||||||

| Total derivative liabilities | $ | $ | ||||||

| F-8 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS (CONTINUED)

a) Derivative liability – embedded conversion feature on convertible debt

On November 7, 2023, the Company issued convertible promissory notes to Mr. Rowley and other investors. In accordance with FASB ASC 815, the conversion feature of the convertible debt was determined to be an embedded derivative. As such, it was bifurcated from the host debt liability and was recognized as a derivative liability in the consolidated statement of financial position. The derivative liability is measured at fair value through profit or loss.

At

December 31, 2023, the fair value of the embedded conversion feature was determined to be $

| Value cap | Value floor | |||||||

| December 31, 2023 | December 31, 2023 | |||||||

| Measurement date | ||||||||

| Number of options | ||||||||

| Stock price at fair value measurement date | $ | $ | ||||||

| Exercise price | $ | $ | ||||||

| Expected volatility | % | % | ||||||

| Risk-free interest rate | % | % | ||||||

| Dividend yield | % | % | ||||||

| Expected term (years) | ||||||||

At

March 31, 2024, the fair value of the embedded conversion feature was determined to be $

| Value cap | Value floor | |||||||

| March 31, 2024 | March 31, 2024 | |||||||

| Measurement date | ||||||||

| Number of options | ||||||||

| Stock price at fair value measurement date | $ | $ | ||||||

| Exercise price | $ | $ | ||||||

| Expected volatility | % | % | ||||||

| Risk-free interest rate | % | % | ||||||

| Dividend yield | % | % | ||||||

| Expected term (years) | ||||||||

In the Black-Scholes collar option pricing models, the expected volatilities were based on historical volatilities of the securities of the Company and its trading peers, and the risk-free interest rates were determined based on the prevailing rates at the grant date for U.S. Treasury Bonds with a term equal to the expected term of the instrument being valued.

In

the three months ended March 31, 2024, the Company recognized a $

| F-9 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 2 – COMPOSITION OF CERTAIN FINANCIAL STATEMENT ITEMS (CONTINUED)

b) Derivative liability – other stock incentives

As of March 31, 2024, the Company there were stock-based incentives outstanding held by one of the Company’s executive officers that provide for the issuance of up to a remaining maximum of % of the Company’s Common Stock outstanding, in five equal tranches of % of the Company’s Common Stock outstanding, with an expiry date of December 31, 2026 and market vesting conditions as follows:

| - | Tranche 3: when the Company achieves a $ million market capitalization |

| - | Tranche 4: when the Company achieves a $ million market capitalization |

| - | Tranche 5: when the Company achieves a $ million market capitalization |

| - | Tranche 6: when the Company achieves a $ million market capitalization |

| - | Tranche 7: when the Company achieves a $ billion market capitalization |

In accordance with FASB ASC 815, these RSU awards were classified as a liability, measured at fair value through profit or loss, and compensation expense is recognized over the expected term.

As af March 31, 2024, Tranche 3, Tranche 4, Tranche 5, Tranche 6 and Tranche 7 remain outstanding and unvested, and the total fair value of these restricted stock awards outstanding was $, as measured using a Monte Carlo Simulation with the following ranges of assumptions: the Company’s stock price on the March 31, 2024 measurement date, expected dividend yield of %, expected volatility between % and %, risk-free interest rate between a range of % to %, and an expected term between 3 months and 12 months. The expected volatilities were based on historical volatilities of the securities of the Company and its trading peers, and the risk-free interest rates were determined based on the prevailing rates at the grant date for U.S. Treasury Bonds with a term equal to the expected term of the award being valued.

NOTE 3 – DEFERRED CONSIDERATION FROM ROYALTIES SOLD

On

May 2, 2023, the Company and Atlas Litio Brasil Ltda. (the “Company Subsidiary”), entered into a Royalty Purchase Agreement

(the “Purchase Agreement”) with Lithium Royalty Corp., a Canadian company listed on the Toronto Stock Exchange (“LRC”).

The transaction contemplated under the Purchase Agreement closed simultaneously on May 2, 2023, whereby the Company Subsidiary sold to

LRC in consideration for $

On

the same day, the Company Subsidiary and LRC entered into a Gross Revenue Royalty Agreement (the “Royalty Agreement”) pursuant

to which the Company Subsidiary granted LRC the Royalty and undertook to calculate and make royalty payments on a quarterly basis commencing

from the first receipt of the sales proceeds with respect to the products from the Property. The Royalty Agreement contains other customary

terms, including but not limited to, the scope of the gross revenue, the Company Subsidiary’s right to determine operations, and

LRC’s information and audit rights. Under the Royalty Agreement, the Company Subsidiary also granted LRC an option to purchase

additional royalty interests with respect to certain additional Brazilian mineral rights and properties on the same terms and conditions

as the Royalty, at a total purchase price of $

NOTE 4 – OTHER NONCURRENT LIABILITIES

Other

noncurrent liabilities are comprised solely of social contributions and other employee-related costs at our operating subsidiaries located

in Brazil. The balance of these employee related costs as of March 31, 2024, and December 31, 2023, amounted to $

| F-10 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY

Authorized Stock and Amendments

On

July 18, 2022, the board of directors of the Company (the “Board of Directors” or “Board”) approved a reverse stock split of the Company’s issued and outstanding shares of common stock at a ratio of

On

December 20, 2022, the Company made the appropriate filings with the Secretary of State of the State

of Nevada (“SOS”) that were intended to effect the Originally Intended Reverse Stock Split (the “Original Articles Amendment”).

In April 2023, the Board of Directors determined that due to an error, the Original Articles Amendment was a nullity and that it would be in the best interest of the Company to take corrective action to remedy the inaccuracy and to

file the documents that would have been necessary to effectuate a

On

April 21, 2023, the Board authorized and approved the necessary documents and filings with the SOS to decrease the number of the Company’s

issued and outstanding shares of common stock and correspondingly decrease the number of authorized shares of common stock, each at a

ratio of

| F-11 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY

Further, the Board of Directors determined that it was advisable and in the best interests of the Company to amend and restate the Company’s articles of incorporation to decrease the number of shares of authorized common stock to two hundred million () and to amend certain other provisions in the Company’s articles (the “Amended and Restated Articles”). The Board of Directors and the Majority Stockholder determined to decrease the number of shares of authorized common stock to reduce the number of shares available for issuance given the negative perception the dilutive effect of having such a large number of shares available for issuance may have on any potential future efforts to attract additional financing. On April 21, 2023, the Board and the Majority Stockholder approved the Amended and Restated Articles. On May 25, 2023, the Company made the appropriate filings with the SOS to effect the changes as described above.

On May 25, 2023, the Company also filed with the SOS a Certificate of Withdrawal of Designation of the Series B Convertible Preferred Stock and a Certificate of Withdrawal of Designation of the Series C Convertible Preferred which were effective as of May 25, 2023.

As of December 31, 2023 and March 31, 2024, the Company had authorized shares of common stock, with a par value of $ per share.

Series A Preferred Stock

On

December 18, 2012, the Company filed with the SOS a Certificate of Designations, Preferences and Rights of Series

A Convertible Preferred Stock (“Series A Stock”) to designate one share of a new series of preferred stock. The Certificate

of Designations, Preferences and Rights of Series A Convertible Preferred Stock provides that for so long as Series A Stock is issued

and outstanding, the holders of Series A Stock shall vote together as a single class with the holders of the Company’s common stock,

with the holders of

Series D Preferred Stock

On

September 16, 2021, the Company filed with the SOS a Certificate of Designations, Preferences and Rights of Series

D Convertible Preferred Stock (“Series D Stock”) to designate shares of a new series of preferred stock. The Certificate

of Designations, Preferences and Rights of Series D Convertible Preferred Stock (the “Series D COD”) provides that for so

long as Series D Stock is issued and outstanding, the holders of Series D Stock shall have no voting power until such time as the Series

D Stock is converted into shares of common stock. Pursuant to the Series D COD one share of Series D Stock is convertible into

shares of common stock and may be converted at any time at the election of the holder.

| F-12 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Three Months Ended March 31, 2023 Transactions

On January 9, 2023, the Company entered into an underwriting agreement (with EF Hutton, division of Benchmark Investments, LLC, as representative of the underwriters named therein (the “Representative”), pursuant to which the Company agreed to sell an aggregate of shares of the Company’s common stock, par value $ (“Common Stock”), to the Representative, at a public offering price of $ per share in a firm commitment public offering (the “Offering”). The Company also granted the Representative a 45-day option to purchase up to additional shares of the Company’s Common Stock upon the same terms and conditions for the purpose of covering any over-allotments in connection with the Offering (the “Over-Allotment Option”). On January 11, 2023, the Representative delivered its notice to exercise the Over-Allotment Option in full.

The shares of Common Stock were offered by the Company pursuant to a registration statement on Form S-1, as amended (File No. 333-262399), which was declared effective on January 9, 2023. The Offering closed on January 12, 2023 (the “Closing”).

In

connection with the Closing, the Company issued to the Representative, and/or its permitted designees, as a portion of the underwriting

compensation payable to the Representative, warrants to purchase an aggregate of

On

January 30, 2023, the Company entered into a Securities Purchase Agreement with two investors, pursuant to which the Company agreed to

issue and sell to the investors in a Regulation S private placement an aggregate of restricted shares of the Company’s Common Stock for a purchase price of $per share, for total gross proceeds of $

On

February 1, 2023, the Company acquired one mineral right totaling

Additionally,

during the three months ended March 31, 2023, the Company sold an aggregate of shares of Common Stock to Triton Funds, LP (“Triton”)

for total gross proceeds of $

Three Months Ended March 31, 2024 Transactions

During the three months ended March 31, 2024, the Company issued shares of Common Stock in settlement of restricted stock units that vested in the period.

| F-13 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Common Stock Options

During the three months ended March 31, 2024 and 2023, the Company granted options to purchase common stock to officers, consultants and non-management directors. The options were valued using the Black-Scholes option pricing model with the following ranges of assumptions:

| March 31, 2024 | March 31, 2023 | |||||||

| Expected volatility | % – | % | % – | % | ||||

| Risk-free interest rate | % – | % | % – | % | ||||

| Stock price on date of grant | $ –$ | $ – $ | ||||||

| Dividend yield | % | % | ||||||

| Illiquidity discount | % | % | ||||||

| Expected term | to years | to years | ||||||

Changes in common stock options for the three months ended March 31, 2024 and 2023 were as follows:

| Number of Options Outstanding and Vested | Weighted Average Exercise Price | Remaining Contractual Life (Years) | Aggregated Intrinsic Value | |||||||||||||

| Outstanding and vested, January 1, 2024 | $ | $ | ||||||||||||||

| Issued (1) | ||||||||||||||||

| Outstanding and vested, March 31, 2024 | $ | $ | ||||||||||||||

| Number of Options Outstanding and Vested | Weighted Average Exercise Price | Remaining Contractual Life (Years) | Aggregated Intrinsic Value | |||||||||||||

| Outstanding and vested, January 1, 2023 | $ | $ | ||||||||||||||

| Issued (2) | ||||||||||||||||

| Outstanding and vested, March 31, 2023 | $ | $ | ||||||||||||||

| 1) | |

| 2) |

During three months ended March 31, 2024, the Company recorded $ in stock-based compensation expense from common stock options in the consolidated statements of operations and comprehensive loss ($, during the three months ended March 31, 2023).

| F-14 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Series D Preferred Stock Options

As at and for the three months ended March 31, 2024, the Company had no Series D preferred stock options outstanding and no shares of Series D Stock outstanding. During the three months ended March 31, 2023, the Company granted options to purchase series D stock to directors of the Company. All Series D preferred stock options granted vested immediately at the grant date and were exercisable for a period of ten years from the date of issuance. The options were valued using the Black-Scholes option pricing model with the following ranges of assumptions:

| March 31, 2023 | ||||

| Expected volatility | % – | % | ||

| Risk-free interest rate | % - | % | ||

| Stock price on date of grant | $ - $ | |||

| Dividend yield | % | |||

| Illiquidity discount | % | |||

| Expected term | years | |||

Changes in Series D preferred stock options for the three months ended March 31, 2023 were as follows:

| Number of Options Outstanding and Vested | Weighted Average Exercise Price(a) | Remaining Contractual Life (Years) | Aggregated Intrinsic Value | |||||||||||||

| Outstanding and vested, January 1, 2023 | $ | $ | ||||||||||||||

| Issued (1) | ||||||||||||||||

| Outstanding and vested, March 31, 2023 | $ | $ | ||||||||||||||

| (a) |

| 1) |

During the three months ended March 31, 2024, the Company recorded $ in stock-based compensation expense from Series D preferred stock options in the consolidated statements of operations and comprehensive loss ($, during the three months ended March 31, 2023).

| F-15 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Common Stock Purchase Warrants

Stock purchase warrants are accounted for as equity in accordance with ASC 480, Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock, Distinguishing Liabilities from Equity.

During the three months ended March 31, 2024, the Company did not issue any common stock purchase warrants. During the three months ended March 31, 2023, the Company issued common stock purchase warrants to investors, finders and brokers in connection with the Company’s equity financings. All warrants vest within 180 days from issuance and are exercisable for a period of one to five years from the date of issuance. The common stock purchase warrants were valued using the Black-Scholes option pricing model with the following ranges of assumptions:

| March 31, 2023 | ||||

| Expected volatility | % | |||

| Risk-free interest rate | % | |||

| Stock price on date of grant | $ | |||

| Dividend yield | % | |||

| Expected term | years | |||

Changes in common stock purchase warrants for the three months ended March 31, 2024 and March 31, 2023 were as follows:

| Number of Warrants Outstanding and Vested | Weighted Average Exercise Price | Weighted Average Contractual Life (Years) | Aggregated Intrinsic Value | |||||||||||||

| Outstanding and vested, January 1, 2024 | $ | - | $ | |||||||||||||

| Outstanding and vested, March 31, 2024 | $ | $ | ||||||||||||||

| Number of Warrants Outstanding and Vested | Weighted Average Exercise Price | Weighted Average Contractual Life (Years) | Aggregated Intrinsic Value | |||||||||||||

| Outstanding and vested, January 1, 2023 | $ | - | $ | |||||||||||||

| Warrants issued (1) | ||||||||||||||||

| Outstanding and vested, March 31, 2023 | $ | $ | ||||||||||||||

| 1) |

During

the three months ended March 31, 2024, the Company recorded $ in share issuance costs in the consolidated statement of changes in

equity as a result of the Company’s common stock purchase warrants issued ($

| F-16 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Restricted Stock Units (“RSUs”)

Restricted stock units (“RSUs”) are granted by the Company to its officers, consultants and directors of the Company as a form of stock-based compensation. The RSUs are granted with varying immediate-vesting, time-vesting, performance-vesting, and market-vesting conditions as tailored to each recipient. Each RSU represents the right to receive one share of the Company’s Common Stock immediately upon vesting.

| Number of RSUs Outstanding | ||||

| Outstanding at January 1, 2024 | ||||

| Granted (1) | ||||

| Vested (2) | ( | ) | ||

| Expired (3) | ( | ) | ||

| Outstanding at March 31, 2024 | ||||

| Number of RSUs Outstanding | ||||

| Outstanding at January 1, 2023 | ||||

| Granted (4) | ||||

| Vested (5) | ( | ) | ||

| Outstanding at March 31, 2023 | ||||

| 1) | |

| 2) | |

| 3) | |

| 4) | |

| 5) |

During

the three months ended March 31, 2024, the Company recorded $

in stock-based compensation expense from the

Company’s RSU activity in the period ($during the three months ended March 31, 2023).

As of March 31, 2024, there were

| F-17 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 5 – STOCKHOLDERS’ EQUITY (CONTINUED)

Other stock incentives measured at fair value through profit or loss

As

of March 31, 2024, the Company had certain other stock incentives outstanding pursuant to an officer’s employment agreement, as

further disclosed in the ‘Derivative liabilities’ section above. These were designated as liability-classified awards and

are measured at fair value through profit or loss. During the three months ended March 31, 2024, the Company recorded $ in stock-based

compensation expense from the Company’s other stock incentive activity in the period ($, during the three months ended March

31, 2023). As of March 31, 2024, the Company had

NOTE 6 – COMMITMENTS AND CONTINGENCIES

Rental Commitment

The following table summarizes certain of Atlas’s contractual obligations at March 31, 2024 (in thousands):

| Total | Less than 1 Year | 1-3 Years | 3-5 Years | More than 5 Years | ||||||||||||||||

| Lithium processing plant construction (1) | $ | $ | $ | $ | $ | |||||||||||||||

| Land acquisition (2) | ||||||||||||||||||||

| Total | ||||||||||||||||||||

| (1) | |

| (2) |

Please see commitments related to Leases in Note 2.

NOTE 7 – RELATED PARTY TRANSACTIONS

Related party transactions are recorded at the exchange amount transacted as agreed between the Company and the related party. All the related party transactions have been reviewed and approved by the board of directors.

The Company’s related parties include:

| Martin Rowley | ||

| Jaeger Investments Pty Ltd (“Jaeger”) | ||

| RTEK International DMCC (“RTEK”) | ||

| Shenzhen Chengxin Lithium Group Co., Ltd | ||

| Sichuan Yahua Industrial Group Co., Ltd |

Technical Services Agreement: In July 2023, the Company entered into a technical service agreement with RTEK pursuant to which RTEK provides mining engineering, planning and business development services.

| F-18 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – RELATED PARTY TRANSACTIONS (CONTINUED)

Convertible

Note Purchase Agreement: In November 2023, the Company entered into a Convertible Note Purchase Agreement with Martin Rowley

relating to the issuance to Martin Rowley along with other experienced lithium investors of convertible promissory notes with an

aggregate total principal amount of $

Offtake

and Sales Agreements: In December 2023 the Company entered into Offtake and Sales Agreements with each of Sichuan Yahua Industrial

Group Co., Ltd. and Sheng Wei Zhi Yuan International Limited, a subsidiary of Shenzhen Chengxin Lithium Group Co., Ltd., pursuant to

which the Company agreed, for a period of five (

The related parties outstanding amounts and expenses as of March 31, 2024 and December 31, 2023 are shown below:

| March 31, 2024 | December 31, 2023 | |||||||||||||||

| Accounts Payable / Debt | Expenses / Payments | Accounts Payable / Debt | Expenses / Payments | |||||||||||||

| RTEK International | $ | $ | $ | $ | ||||||||||||

| Jaeger Investments Pty Ltd. | $ | $ | $ | $ | ||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

In the course of preparing consolidated financial statements, we eliminate the effects of various transactions conducted between Atlas and its subsidiaries and among the subsidiaries.

Jupiter Gold Corporation

During the three months ended March 31, 2024, Jupiter Gold granted options to purchase an aggregate of shares of its common stock to Marc Fogassa, the Chairman and CEO of the Company, at prices ranging between $ to $ per share. The options were valued at $ and recorded to stock-based compensation. The options were valued using the Black-Scholes option pricing model with the following average assumptions: Jupiter Gold stock price on the date of the grant ($ to $), an illiquidity discount of %, expected dividend yield of %, historical volatility calculated between % and %, risk-free interest rate between a range of % to %, and an expected term between and years. As of March 31, 2024, an aggregate Jupiter Gold common stock options were outstanding with a weighted average life of years at a weighted average exercise price of $ and an aggregated intrinsic value of $.

| F-19 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 7 – RELATED PARTY TRANSACTIONS (CONTINUED)

During

the three months ended March 31, 2023, Jupiter Gold granted options to purchase an aggregate of shares of its common stock to

Marc Fogassa at prices ranging between $ to $ per share. The options were valued at $ and recorded to stock-based compensation.

The options were valued using the Black-Scholes option pricing model with the following average assumptions: Jupiter Gold stock

price on the date of the grant ($ to $), an illiquidity discount of %, expected dividend yield of %, historical volatility

calculated at %, risk-free interest rate between a range of % to %, and an expected term between and years. During the

three months ended March 31, 2023, Marc Fogassa exercised a total options at a $ weighted average exercise price. These exercises

were paid for with

Apollo Resource Corporation

During the three months ended March 31, 2024, Apollo Resources granted options to purchase an aggregate of shares of its common stock to Marc Fogassa at a price of $ per share. The options were valued at $ and recorded to stock-based compensation. The options were valued using the Black-Scholes option pricing model with the following average assumptions: Apollo Resource stock price on the date of the grant ($), an illiquidity discount of %, expected dividend yield of %, historical volatility calculated between % and %, risk-free interest rate between a range of % to %, and an expected term of years. As of March 31, 2024, an aggregate Apollo Resources common stock options were outstanding with a weighted average life of years at a weighted average exercise price of $ and an aggregated intrinsic value of $.

During the three months ended March 31, 2023, Apollo Resources granted options to purchase an aggregate of shares of its common stock to Marc Fogassa at a price of $ per share. The options were valued at $ and recorded to stock-based compensation. The options were valued using the Black-Scholes option pricing model with the following average assumptions: Apollo Resource stock price on the date of the grant ($), an illiquidity discount of %, expected dividend yield of %, historical volatility calculated at %, risk-free interest rate between a range of % to %, and an expected term of years. As of March 31, 2023, an aggregate Apollo Resources common stock options were outstanding with a weighted average life of years at a weighted average exercise price of $ and an aggregated intrinsic value of $.

NOTE 8 – RISKS AND UNCERTAINTIES

Currency Risk

The Company operates primarily in Brazil which exposes it to currency risks. The Company’s business activities may generate intercompany receivables or payables that are in a currency other than the functional currency of the company. Changes in exchange rates from the time the activity occurs to the time payments are made may result in the Company receiving either more or less in local currency than the local currency equivalent at the time of the original activity.

The Company’s consolidated financial statements are denominated in U.S. dollars. Accordingly, changes in exchange rates between the applicable foreign currency and the U.S. dollar affect the translation of each foreign subsidiary’s financial results into U.S. dollars for purposes of reporting in the consolidated financial statements. The Company’s foreign subsidiaries translate their financial results from the local currency into U.S. dollars in the following manner: (a) income statement accounts are translated at average exchange rates for the period; (b) balance sheet asset and liability accounts are translated at end of period exchange rates; and (c) equity accounts are translated at historical exchange rates. Translation in this manner affects the shareholders’ equity account referred to as the foreign currency translation adjustment account. This account exists only in the foreign subsidiaries’ U.S. dollar balance sheets and is necessary to keep the foreign subsidiaries’ balance sheets in agreement.

| F-20 |

ATLAS LITHIUM CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 9 – SUBSEQUENT EVENTS

Registered Offering

On March 28, 2024, the Company entered into a Securities Purchase Agreement (the “Purchase Agreement”), with an accredited investor (the “Investor”), pursuant to which the Company agreed to sell and issue an aggregate of shares of its Common Stock in a registered direct offering (the “Registered Offering”) at a purchase price of $per share. The Purchase Agreement contains customary representations and warranties, covenants and indemnification rights and obligations of the Company and the Investor. The closing occurred on April 4, 2024.

The

gross proceeds from the Registered Offering were $

Offtake Agreement

In

connection with the closing of the Registered Offering, our subsidiary Atlas Lítio Brasil Ltda. (hereinafter “Atlas Brazil”)

and the Investor entered into an Offtake and Sales Agreement, pursuant to which Atlas Brazil agreed to sell and deliver to

the Investor, and the Investor agreed to purchase and take delivery of,

| F-21 |

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited consolidated financial statements and the notes to those financial statements included in Item 1 of this Quarterly Report on Form 10-Q (this “Quarterly Report”) and our consolidated financial statements and notes thereto and related Management’s Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the year ended December 31, 2023

This Quarterly Report includes forward-looking statements that are subject to risks, uncertainties and other factors described in the section entitled “Risk Factors” in Item 1.A. of Part II of this Report that could cause actual results could differ materially from those anticipated in these forward-looking statements. Additionally, our historical results are not necessarily indicative of the results that may be expected for any period in the future.

Overview

Atlas Lithium Corporation (“Atlas Lithium”, the “Company”, “we”, “us”, or “our” refer to Atlas Lithium Corporation and its consolidated subsidiaries) is a mineral exploration and development company with lithium projects and multiple lithium exploration properties. In addition, we own exploration properties in other battery minerals, including nickel, copper, rare earths, graphite, and titanium. Our current focus is the development from exploration to active mining of our hard-rock lithium project located in the state of Minas Gerais in Brazil at a well-known pegmatitic district in Brazil, which has been denominated by the government of Minas Gerais as “Lithium Valley.” We intend to mine and then process our lithium-containing ore to produce lithium concentrate (also known as spodumene concentrate), a key ingredient for the battery supply chain.

We are building a modular plant targeted at producing 150,000 tons of lithium concentrate per annum (“tpa”) in what we describe as Phase I. We plan on adding additional modules to the plant with the intent of doubling its production capacity to 300,000 tpa in Phase II. However, there can be no assurance that we will have the necessary capital resources to develop such facility or, if developed, that we will reach the production capacity necessary to commercialize our products and with the quality needed to meet market demand.

All our mineral projects and properties are located in Brazil, a well-established mining jurisdiction. Our mineral rights include approximately:

| ● | 53,942 hectares (539 km2) for lithium in 95 mineral rights (2 in pre-mining concession stage, 85 in exploration stage, and 8 in pre-exploration stage); | |

| ● | 44,913 hectares (449 km2) for nickel in 29 mineral rights (23 in exploration stage, and 6 in pre-exploration stage); | |

| ● | 25,050 hectares (251 km2) for copper in 13 mineral rights (12 in exploration stage, and 1 in pre-exploration stage); | |

| ● | 12,144 hectares (121 km2) for rare earths in 7 mineral rights, all in exploration stage; | |

| ● | 6,927 hectares (69 km2) for titanium in 5 mineral rights, all in exploration stage; | |

| ● | 3,910 hectares (39 km2) for graphite in 2 mineral rights, all in exploration stage; | |

| ● | 1,030 hectares (10 km2) for gold mineral rights, all in exploration stage. |

In addition, we also have a few additional mineral rights in the process of being acquired and not yet titled in our name. We believe that we hold the largest portfolio of exploration properties for lithium and other battery minerals in Brazil.

| 3 |

We are primarily focused on advancing and developing our hard-rock lithium project located in the state of Minas Gerais, Brazil. Our Minas Gerais Lithium Project (“MGLP”) is our largest project and consists of 85 mineral rights spread over approximately 468 km2 and predominantly located within the Brazilian Eastern Pegmatitic Province which has been surveyed by the Brazilian Geological Survey and is known for the presence of hard rock formations known as pegmatites which contain lithium-bearing minerals such as spodumene and petalite.

We believe that we can increase our value by continuing of our exploratory work and quantification of our lithium mineralization as well as by expanding our exploration campaign to new, high-potential areas within our portfolio of mineral rights. Our initial commercial goal is to be able to enter production of lithium concentrate, a product which is highly sought after in the battery supply chain for electric vehicles.

We also have 100%-ownership of early-stage projects and properties in other minerals that are needed in the battery supply chain and high technology applications such as nickel, copper, rare earths, graphite, and titanium. We believe that the shift from fossil fuels to battery power may yield long-term opportunities for us not only in lithium but also in such other minerals.

In addition to these projects, we own 58.71% of the shares of common stock of Apollo Resources, a private company primarily focused on the development of its initial iron mine.

We also own approximately 27.42% of the shares of common stock of Jupiter Gold, a company focused on the exploration of two gold projects and a quartzite mine, the common stock of which is quoted on the OTCQB marketplace under the symbol “JUPGF.” The quartzite mine started preliminary operations in June 2023.

The results of operations from both Apollo Resources and Jupiter Gold are consolidated in our financial statements under U.S. GAAP.

Operational Update

Lithium Exploration Campaign

Our ongoing drilling campaign is delineating the lithium resources of our 100%-owned Neves Project, a cluster of four lithium mineral rights within MGLP. Our current geological team is comprised of 15 geologists, all of whom are full-time employees. To support the work of our geologists we have 13 full-time field and support technicians and machinery operators, as well as 3 trainee technicians and over 19 field assistants. Our geological team and our exploration campaign is supervised by James Abson, a Qualified Person for lithium as such term is defined in Subpart 1300 of Regulation S-K promulgated by the SEC (“Regulation S-K 1300”). Mr. Abson was appointed as our Chief Geology Officer in October 2023 and has over 29 years of diverse experience in mining and mineral exploration.

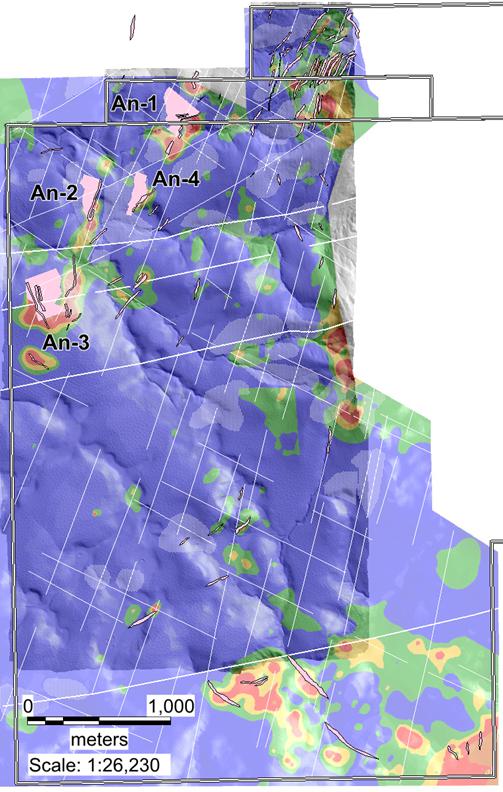

Under Mr. Abson’s leadership, our technical team adopted a systematic approach to exploration of additional potential target areas within the Neves Project. These efforts involve geological mapping, sampling of historical artisanal mining sites and exposed pegmatites to analyze potassium-rubidium ratios, as well as soil sampling using both XRF and ICP testing for both LCT pathfinders and Li. Geophysical surveys, including magnetics, are used when warranted to pinpoint additional pegmatite deposits and related structures. Deep trenching of anomalous areas is used to identify and confirm lithium-cesium-tantalum (LCT) pegmatites and estimate width, strike, dip and mineralization prior to drilling. Finally, scout drilling is aimed at testing the highest priority pegmatite targets that appear widest and most mineralized. Within Neves Project area, four confirmed pegmatite bodies with spodumene mineralization were identified (designated as Anitta 1 through 4).

| 4 |

Expanding beyond the Neves Project area, our regional exploration is now centered on the other mineral rights for lithium within the broader Minas Gerais Lithium Project (“MGLP”), a large footprint of 468 km2 of lithium mineral claims, many of which are located in Brazil’s Lithium Valley, a well-known hard-rock lithium district. A specialized exploration geology team has been assembled to initiate reconnaissance work across this wider land package. Initial efforts involve LiDAR and geological mapping with a specific focus on historical artisanal mining sites, sampling of known and previously identified pegmatites, as well as first-pass soil sampling lines and geophysics to identify anomalies. This phased approach has systematically advanced regional prospecting across our mineral rights in MGLP with a number of targets generated for further exploration by our exploration team.

We have engaged SGS Canada Inc. (“SGS”), and, in particular, their geologist Marc-Antoine Laporte, a Qualified Person for lithium under Regulation S-K 1300, to produce a mineral resource estimate report (the “Maiden Resource Report”) for our Neves Project in accordance with Regulation S-K 1300. Mr. Laporte is the author of mineral resource reports for two other companies which have hard-rock lithium projects in Lithium Valley, the general area where our Neves Project is located, and has worked on lithium properties in Lithium Valley since 2017. Mr. Laporte visited our Neves Project between May 4 and May 6, 2023.

On March 19, 2024, our Board appointed Brian Talbot to serve as director on the Board, effective as of April 1, 2024. In addition to joining the Board, Mr. Talbot was also appointed by the Board as our Chief Operating Officer (“COO”), effective as of April 1, 2024. In his capacity as COO, Mr. Talbot will be responsible for both the Company’s development of its lithium mine and processing plant as well as all of its lithium exploration geology program. Mr. Talbot is a qualified person for lithium as such a term is defined in Item 1300 of Regulation S-K.

Mr. Talbot has an extensive track record as a technical and operational leader throughout his career with over 30 years of experience in mining operations. In particular, he has extensive experience in DMS (dense media separation) plant development and operation. Most recently, Mr. Talbot was employed by RTEK International DMCC (“RTEK”), a consulting firm that advises lithium developers and producers. From July 2022 to September 2023, Mr. Talbot was the Chief Operating Officer at Sigma Lithium Corporation (“Sigma Lithium”), a Canadian lithium producer with operations in Brazil. At Sigma Lithium, he oversaw the development of that company’s flagship Grota do Cirilo project from construction through commissioning and operations. From 2017 to 2022, Mr. Talbot held positions as General Manager and Head of Australian Operations at Galaxy Resources, now part of Arcadium Lithium PLC, one of the world’s largest fully integrated lithium companies. While at Galaxy Resources, Mr. Talbot was instrumental in increasing the production at Mt. Cattlin (a hard-rock lithium mine in Ravensthorpe, Western Australia) which resulted in record production. From 2015 to 2017, Mr. Talbot was at Bikita Minerals in Zimbabwe, which owns and operates the longest running hard-rock lithium mine in the world. Mr. Talbot holds a bachelor’s degree in chemical engineering with Honors from the University of Witwatersrand, South Africa. Please refer to Part III, Item 10, for further information on Mr. Talbot.

Neves Project

The Company’s geological team continues to explore the Neves Project area to expand its already known mineralized pegmatite tonnage. Previously discovered mineralized pegmatites in the Neves Project were initially located with the help of historic artisanal mines, outcroppings of pegmatite, or shallow sub-crop unearthed by trenching Li in soil anomalies. To date, Atlas has mapped and sampled over 84 pegmatite outcrops within the Neves permit, and ranked them based on their K/Rb ratios. The more evolved pegmatites have a higher possibility of hosting lithium minerals. In an effort to expedite the exploration of the substantial surface area of the Neves project, in late 2023, Atlas Lithium embarked on a systematic exploration campaign designed by James Abson, the Company’s Chief Geology Officer.

| 5 |

The Project Area has now been covered by:

| ● | Detailed hyperspectral satellite and drone LiDAR mapping to aid in faster pegmatite discovery; |

| ● | Geological mapping and rock sampling, including K/Rb ratio analysis, to improve target prioritization; |

| ● | Closely spaced soil sampling |

| ● | grids, with 4,599 samples taken to date, to highlight Li (>100ppm threshold) and LCT pegmatite pathfinder anomalies for drill testing; |

| ● | High-resolution drone geophysics surveys, including magnetics and radiometrics, to assist with mapping and drill targeting. |

The comprehensive data sets have generated several highly promising coincident and parallel targets (Figure 1). One notable example is a linear lithium anomaly with a strike length of 1.2km, which coincides with the Anitta 2 mineralized pegmatite. While some of these targets may represent extensions of the known mineralized Anitta trends, others could potentially indicate entirely new, untested pegmatite discoveries, particularly in the southern region of Neves.

The practical application of this new lithium soil anomaly information is exemplified at Anitta 1. Previously, an unexplained anomaly existed to the east of the drilled orebody. Guided by this anomaly, additional drilling has now uncovered the up-dip extension of Anitta 1 and a parallel orebody immediately to the east. These discoveries are expected to contribute significantly to the project’s mineralized pegmatite tonnage, demonstrating the effectiveness of the exploration approach in identifying and delineating high-quality lithium mineralization.

Figure 1: Soil sampling lithium anomaly map in relation to mapped pegmatites (pink), the mineralized Anitta pegmatites, topography, and structural geophysics data.

| 6 |

Drilled lithium-mineralized sections of pegmatites can extend up to 150m along strike beyond the termination of the surface lithium anomaly, as observed in the case of Anitta 2. In certain areas, it is probable that these pegmatites continue undetected from the surface along the same strike direction, particularly beneath higher hills where the cover and weathering profiles may be thicker. The Company’s exploration team is currently evaluating the potential use of other less mobile LCT pathfinders, such as Cs, Sn, and Ta, to identify new anomalous trends or extensions that warrant further investigation.

Furthermore, the majority of the Anitta pegmatites exhibit a close association with magnetic lows and NNE-SSW structural lineaments. This valuable information will enable the Atlas team to refine its approach to future exploration targeting activities. These activities will include more detailed follow-up work, such as infill soil grids, trenching, and drilling, to better delineate and characterize the identified targets.

Early-Revenue Strategy

On December 4, 2023, we announced implementing an early-revenue strategy. With the well-delineated initial Anitta pegmatites, positive metallurgical test work and well-advanced mining and environmental permits Atlas Lithium’s technical team opted to expedite the production timeline for its 100%-owned Neves Project. This early-revenue strategy targets initial “Phase I” production of spodumene concentrate by the fourth quarter of 2024, ramping up to “Phase II” production in mid-2025. The early-revenue Phase I plant is expected to have a maximum capacity of 150,000 tons per annum of spodumene concentrate.

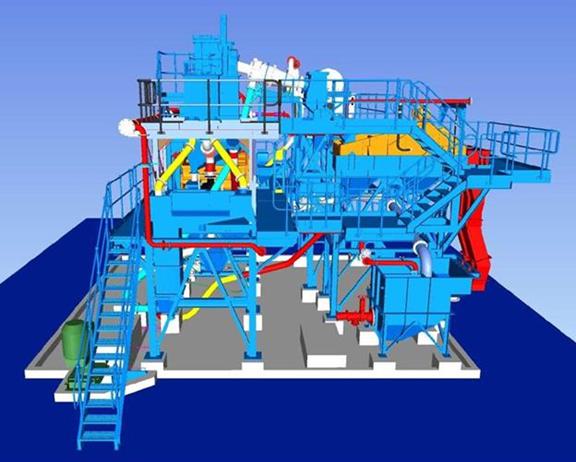

We intend to deploy compacted modular dense media separation (DMS) technology together with contracting the crushing and mining operations. The total capital expenditures, including the initial production and ramp-up is estimated at $49.5 million, which includes the modular DMS plants, tailings management module for dry stacked tailings; engineering, procurement, construction management costs; earthworks and civils; site access upgrade, mining preparation and pre-strip, commissioning and ramp-up. The fabrication of the DMS modules, tailing management module, and associated materials handling equipment is nearing completion and trial assembly is currently underway at the South African manufacturing facility as a quality assurance measure prior to shipment to Brazil.

On February 26, 2024, we announced that the fabrication of the DMS modules, tailing management module, and associated materials handling equipment is progressing on schedule, and first commissioning and initial production anticipated for the fourth quarter of 2024. The manufacturing orders were placed by us in December 2023. By condensing components into modules with significantly reduced footprint and weight versus recent DMS plants, Atlas Lithium plans to streamline installation and commissioning. For example, whereas fully assembled traditional DMS facilities commonly weigh 250-300 tons, the Company’s modular plant is predicted to weigh only approximately 41 tonnes. Modular DMS trial assembly on the primary 100 tons per hour (tph) module and the secondary 50 tph module. We engaged CDM Group as engineering contractor and construction coordinator and ADP Marine & Modular for plant manufacturing, with both of these firms located in South Africa. The manufacturing facility located in South Africa has recently been visited by our technical team and photographs of parts completed and in progress of our modular DMS lithium processing plant under construction can be seen in Figures 2-4 below. Figures 5-7 depict 3-D model views of our planned modular DMS lithium processing plant.

| 7 |

Figure 2: Our modular DMS lithium processing plant under construction.

| 8 |

Figure 3: View of part of our DMS lithium processing plant under construction.

| 9 |

Figure 4: View of part of our modular DMS lithium processing plant under construction.

| 10 |

Figure 5: View of 3-D model of our planned DMS lithium processing plant.

| 11 |

Figure 6: Additional view of 3-D model of our planned DMS lithium processing plant.

| 12 |

Figure 7: Additional view of 3-D Model of our planned DMS lithium processing plant.

| 13 |

Business Development Update

Mitsui & Co., Ltd.

On January 18, 2023, we announced that we had signed a non-binding, non-exclusive Memorandum of Understanding (“MOU”) with Mitsui & Co., Ltd. (“Mitsui”) with respect to Mitsui’s potential interest in acquiring the right to purchase our future lithium concentrate production. In November 2023, we ceased discussions with Mitsui regarding a potential offtake arrangement as contemplated by the MOU, but continued discussions with Mitsui regarding other possible strategic opportunities. On March 28, 2024, the Company and Mitsui entered into an agreement pursuant to which the Company agreed to sell to Mitsui 1,871,250 shares of our common stock for a purchase price of $30,000,000, representing a 10% premium to the 5-day VWAP . The closing of the sale of the shares occurred on April 4, 2024. In connection with the sale of the shares, on April 4, 2024, parties entered into an Offtake and Sales Agreement (the “Offtake”) for the future purchase of 15,000 tons of lithium concentrate from Phase 1 and 60,000 tons per year for five years from Phase 2 of Atlas Lithium’s soon to be producing Neves Project in Brazil’s Lithium Valley. The investment provided Atlas Lithium with funds to continue its development towards revenue generation

Results of Operations

The Three Months Ended March 31, 2024, Compared to the Three Months ended March 31, 2023

Net loss for the three months ended March 31, 2024, totaled $13,184,196, compared to net loss of $4,465,353 during the three months ended March 31, 2023. The increase is mainly due to:

| ● | Higher general and administrative expenses of approximately $0.9 million in the period primarily due to increased costs of consultants related to technical services, increased legal fees relating to transactions consummated during the quarter and other third-party costs; | |

| ● | An increase of approximately $5 million in stock-based compensation expense compared to the prior period, reflecting new members of the management team eligible for the stock-based compensation program; and | |

| ● | Higher exploration expenses of approximately $2 million for the period due the execution of the drilling program on our 100% owned Minas Gerais Lithium Project. |

Liquidity and Capital Resources

As of March 31, 2024, we had cash and cash equivalents of $17,529,465 and working capital of $11,280,122.

Net cash used by operating activities totaled $6,103,264 for the three months ended March 31, 2024, compared to net cash used of $3,663,428 during the three months ended March 31, 2023, representing a decrease in cash available of $2,439,836 or 67%. The increase in net cash used by operating activities was mainly due to:

| ● | Increase in expenses related to the third companies as consultants and others; | |

| ● | Increase in exploration expenses due to the increase of drilling program and exploration teams. |

| 14 |

Net cash used in investing activities totaled $6,055,535 for the three months ended March 31, 2024, compared to net cash used of $1,275,972 during the three months ended March 31, 2023, representing an increase in cash used of $4,779,563 or 375%. The increase reflects the payments made in connection with the construction of our Lithium processing plant.

Net cash provided by financing activities totaled $0 for the three months ended March 31, 2024, compared to $9,564,335 during the three months ended March 31, 2023, representing a decrease in cash provided of $9,564,335 or 100%. The decrease is mainly due to the following financing activities that occurred during the three months ended March 31, 2023:

| ● | Our underwritten public offering which closed on January 12, 2023, with aggregate gross proceeds of $4,657,500. | |

| ● | Securities Purchase Agreement with two investors, pursuant to which we agreed to issue and sell to the Investors in a Regulation S private placement an aggregate of 640,000 restricted shares of our common stock, at a purchase price of $6.25 per share, for total gross proceeds of $4,000,000. | |

| ● | The sale of an aggregate of 91,500 shares of our common stock to Triton Funds, L.P for total gross proceeds of $831,834 pursuant to a Common Stock Purchase Agreement. |

For further information on three transactions mentioned above, please refer to note 4 – stockholders´ equity.

We have historically incurred net operating losses and have not yet generated material revenues from the sale of products or services. As a result, our primary sources of liquidity have been derived through proceeds from the (i) sales of our equity and the equity of one of our subsidiaries, and (ii) issuance of convertible debt. As of March 31, 2024, we had cash and cash equivalents of $17,729,465 and working capital of $11,280,122, compared to cash and cash equivalents $29,549,927 and a working capital of $24,044,931 as of December 31, 2023. We believe our cash on hand will be sufficient to meet our working capital and capital expenditure requirements for a period of at least twelve months. However, our future short- and long-term capital requirements will depend on several factors, including but not limited to, the rate of our growth, our ability to identify areas for mineral exploration and the economic potential of such areas, the exploration and other drilling campaigns needed to verify and expand our mineral resources, the types of processing facilities we would need to install to obtain commercial-ready products, and the ability to attract talent to manage our different areas of endeavor. To the extent that our current resources are insufficient to satisfy our cash requirements, we may need to seek additional equity or debt financing. If the needed financing is not available, or if the terms of financing are less desirable than we expect, we may be forced to scale back our existing operations and growth plans, which could have an adverse impact on our business and financial prospects and could raise substantial doubt about our ability to continue as a going concern.

Currency Risk

We operate primarily in Brazil, which exposes us to currency risks. Our business activities may generate intercompany receivables or payables that are in a currency other than the functional currency of the entity. Changes in exchange rates from the time the activity occurs to the time payments are made may result in it receiving either more or less in local currency than the local currency equivalent at the time of the original activity.

Our consolidated financial statements are denominated in U.S. dollars. Accordingly, changes in exchange rates between the applicable foreign currency and the U.S. dollar affect the translation of each foreign subsidiary’s financial results into U.S. dollars for purposes of reporting in the consolidated financial statements. Our foreign subsidiaries translate their financial results from the local currency into U.S. dollars in the following manner: (a) income statement accounts are translated at average exchange rates for the period; (b) balance sheet asset and liability accounts are translated at end of period exchange rates; and (c) equity accounts are translated at historical exchange rates. Translation in this manner affects the shareholders’ equity account referred to as the foreign currency translation adjustment account. This account exists only in the foreign subsidiaries’ U.S. dollar balance sheets and is necessary to keep the foreign subsidiaries’ balance sheets in agreement.

| 15 |

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of American (“U.S. GAAP”). Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Item 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK