Exhibit 4.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| R | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-54598

Stellar Biotechnologies, Inc.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | N/A |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

332 E. Scott Street Port Hueneme, California |

93041 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (805) 488-2800

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of May 1, 2015, the registrant had 79,546,650 common shares issued and outstanding.

Stellar Biotechnologies, Inc.

Quarterly Report on Form 10-Q

For the Quarter Ended March 31, 2015

Table of Contents

PART I — FINANCIAL INFORMATION

| Stellar Biotechnologies, Inc. |

| Condensed Interim Consolidated Balance Sheets |

| (Unaudited) |

| (Expressed in U.S. Dollars ) |

| March 31, | September 30, | August 31, | ||||||||||

| 2015 | 2014 | 2014 | ||||||||||

| Assets: | ||||||||||||

| Current assets: | ||||||||||||

| Cash and cash equivalents | $ | 11,145,555 | $ | 13,769,953 | $ | 13,427,404 | ||||||

| Accounts receivable | 16,561 | 44,159 | 56,575 | |||||||||

| Short-term investments | - | 448,632 | 458,098 | |||||||||

| Inventory | 135,151 | 34,891 | - | |||||||||

| Prepaid expenses | 145,016 | 125,840 | 128,593 | |||||||||

| Total current assets | 11,442,283 | 14,423,475 | 14,070,670 | |||||||||

| Noncurrent assets: | ||||||||||||

| Property, plant and equipment, net | 368,432 | 388,340 | 387,392 | |||||||||

| Deposits | 15,900 | 15,900 | 15,900 | |||||||||

| Total noncurrent assets | 384,332 | 404,240 | 403,292 | |||||||||

| Total Assets | $ | 11,826,615 | $ | 14,827,715 | $ | 14,473,962 | ||||||

| Liabilities and Shareholders' Equity: | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable and accrued liabilities | $ | 413,941 | $ | 585,047 | $ | 526,626 | ||||||

| Deferred revenue | - | 86,667 | 15,000 | |||||||||

| Warrant liability, current portion | 2,489,934 | 460 | 879,040 | |||||||||

| Total current liabilities | 2,903,875 | 672,174 | 1,420,666 | |||||||||

| Long-term liabilities: | ||||||||||||

| Warrant liability, less current portion | - | 3,690,806 | 5,352,663 | |||||||||

| Total Liabilities | 2,903,875 | 4,362,980 | 6,773,329 | |||||||||

| Commitments (Note 7) | ||||||||||||

| Shareholders' equity: | ||||||||||||

| Common shares, unlimited common shares authorized, no par value, 79,546,650, 79,419,850 and 78,268,850 issued and outstanding at March 31, 2015, September 30, 2014 and August 31, 2014, respectively | 37,940,641 | 37,883,877 | 36,240,838 | |||||||||

| Accumulated share-based compensation | 5,244,026 | 5,073,144 | 5,079,985 | |||||||||

| Accumulated deficit | (34,261,927 | ) | (32,492,286 | ) | (33,620,190 | ) | ||||||

| Total shareholders' equity | 8,922,740 | 10,464,735 | 7,700,633 | |||||||||

| Total Liabilities and Shareholders' Equity | $ | 11,826,615 | $ | 14,827,715 | $ | 14,473,962 | ||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| 1 |

Stellar Biotechnologies, Inc.

Condensed Interim Consolidated Statements of Operations

(Unaudited)

(Expressed in U.S. Dollars )

| Three Months Ended | Six Months Ended | |||||||||||||||

| March 31, | March 31, | March 31, | March 31, | |||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenues: | ||||||||||||||||

| Contract services revenue | $ | 45,000 | $ | 72,000 | $ | 105,000 | $ | 87,000 | ||||||||

| Product sales | 142,627 | 42,371 | 295,288 | 58,456 | ||||||||||||

| Grant revenue | - | - | - | 27,740 | ||||||||||||

| 187,627 | 114,371 | 400,288 | 173,196 | |||||||||||||

| Expenses: | ||||||||||||||||

| Costs of contract services | 59,760 | 27,258 | 76,457 | 37,664 | ||||||||||||

| Costs of production and aquaculture | 250,236 | 147,982 | 410,640 | 294,913 | ||||||||||||

| Grant costs | - | - | - | 27,740 | ||||||||||||

| Research and development | 281,584 | 733,096 | 700,405 | 1,281,321 | ||||||||||||

| General and administration | 785,681 | 646,670 | 1,727,834 | 1,667,800 | ||||||||||||

| 1,377,261 | 1,555,006 | 2,915,336 | 3,309,438 | |||||||||||||

| Other Income (Loss) | ||||||||||||||||

| Foreign exchange gain (loss) | (307,546 | ) | (182,321 | ) | (468,658 | ) | (198,829 | ) | ||||||||

| Increase (decrease) in fair value of warrant liability | 1,061,776 | 185,607 | 1,201,332 | (3,694,588 | ) | |||||||||||

| Investment income | 18,240 | 14,895 | 31,533 | 30,815 | ||||||||||||

| 772,470 | 18,181 | 764,207 | (3,862,602 | ) | ||||||||||||

| Loss Before Income Tax | (417,164 | ) | (1,422,454 | ) | (1,750,841 | ) | (6,998,844 | ) | ||||||||

| Income tax expense | 9,000 | 11,400 | 18,800 | 12,200 | ||||||||||||

| Net Loss | $ | (426,164 | ) | $ | (1,433,854 | ) | $ | (1,769,641 | ) | $ | (7,011,044 | ) | ||||

| Loss per common share - basic | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.09 | ) | ||||

| Loss per common share - diluted | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.09 | ) | ||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic | 79,546,650 | 76,237,455 | 79,503,361 | 76,299,105 | ||||||||||||

| Diluted | 79,546,650 | 76,237,455 | 79,503,361 | 76,299,105 | ||||||||||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| 2 |

| Stellar Biotechnologies, Inc. |

| Condensed Interim Consolidated Statements of Cash Flows |

| (Unaudited) |

| (Expressed in U.S. Dollars ) |

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2015 | 2014 | |||||||

| Cash Flows Used In Operating Activities: | ||||||||

| Net loss | $ | (1,769,641 | ) | $ | (7,011,044 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 77,602 | 79,057 | ||||||

| Share-based compensation | 198,927 | 614,312 | ||||||

| Foreign exchange (gain) loss | 468,658 | 198,829 | ||||||

| Change in fair value of warrant liability | (1,201,332 | ) | 3,694,588 | |||||

| Changes in working capital items: | ||||||||

| Accounts receivable | 26,867 | 87,643 | ||||||

| Inventory | (100,260 | ) | - | |||||

| Prepaid expenses | (27,037 | ) | (29,835 | ) | ||||

| Accounts payable and accrued liabilities | (168,575 | ) | (193,727 | ) | ||||

| Deferred revenue | (86,667 | ) | - | |||||

| Net cash used in operating activities | (2,581,458 | ) | (2,560,177 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Acquisition of property, plant and equipment | (57,694 | ) | (250,666 | ) | ||||

| Proceeds on maturities of short-term investments | 424,813 | - | ||||||

| Net cash provided by (used in) investing activities | 367,119 | (250,666 | ) | |||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from exercise of warrants and options | 28,719 | 2,963,162 | ||||||

| Net cash provided by financing activities | 28,719 | 2,963,162 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (438,778 | ) | (205,712 | ) | ||||

| Net change in cash and cash equivalents | (2,624,398 | ) | (53,393 | ) | ||||

| Cash and cash equivalents - beginning of period | 13,769,953 | 15,478,038 | ||||||

| Cash and cash equivalents - end of period | $ | 11,145,555 | $ | 15,424,645 | ||||

Supplemental disclosure of non-cash transactions (Note 10)

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| 3 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

1. Nature of Operations

Stellar Biotechnologies, Inc. (“the Company”) is organized under the laws of British Columbia, Canada. The Company’s common shares are quoted on the U.S. OTCQB Marketplace Exchange under the trading symbol, SBOTF, and are listed on the TSX Venture Exchange as a Tier 2 issuer under the trading symbol, KLH.

On April 7, 2010, the Company changed its name from CAG Capital, Inc. to Stellar Biotechnologies, Inc. On April 12, 2010, the Company completed a reverse merger transaction with Stellar Biotechnologies, Inc. a California corporation, which was founded in September 1999, and remains the Company’s wholly-owned subsidiary and principal operating entity. The Company’s executive offices are located at 332 E. Scott Street, Port Hueneme, California, 93041, USA, and its registered and records office is Royal Centre, 1055 West Georgia Street, Suite 1500, Vancouver, BC, V6E 4N7, Canada.

Nature of Operations

The Company’s business is the aquaculture, research and development, manufacture and commercialization of Keyhole Limpet Hemocyanin (“KLH”). The Company markets and distributes its KLH products to biotechnology and pharmaceutical companies, academic institutions, and clinical research organizations in Europe, United States, and Asia.

Management Plans

For the six months ended March 31, 2015 and 2014, the Company reported net losses of approximately $1.8 million and $7.0 million, respectively. The most significant factor in the fluctuations in net income and losses relates to noncash changes in the fair value of warrant liability, which was a gain of $1.2 million and a loss of $3.7 million for the six months ended March 31, 2015 and 2014, respectively. As of March 31, 2015, the Company had an accumulated deficit of approximately $34.3 million and working capital of approximately $8.5 million.

In the past, operations of the Company have primarily been funded by the issuance of common shares, exercise of warrants, grant revenues, contract services revenue, and product sales. In September 2013, the Company closed a private placement with gross proceeds of $12 million. Management believes these financial resources are adequate to support the Company’s initiatives at the current level for at least 12 months. Management is also continuing the ongoing effort toward expanding the customer base for existing marketed products, and the Company may seek additional financing alternatives, including nondilutive financing through grants, collaboration and licensing arrangements, and additional equity financing.

The accompanying condensed interim consolidated financial statements have been prepared on a going concern basis, which assumes that the Company will continue in operation for the foreseeable future and be able to realize its assets and discharge its liabilities and commitments in the normal course of business.

Functional Currency

The condensed interim consolidated financial statements of the Company are presented in U.S. dollars, unless otherwise stated, which is the Company’s functional currency.

2. Basis of Presentation

The accompanying unaudited condensed interim consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q. They do not include all information and footnotes necessary for a fair presentation of financial position, results of operations and cash flows in conformity with U.S. GAAP for complete financial statements. These condensed interim consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the year ended August 31, 2014.

| 4 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

The accompanying condensed interim consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Stellar Biotechnologies, Inc. All significant intercompany balances and transactions have been eliminated in consolidation. In the opinion of management, all adjustments (consisting of normal recurring adjustments and accruals) considered necessary for a fair presentation of the results of operations for the period presented have been included in the interim period. Operating results for the six months ended March 31, 2015 are not necessarily indicative of the results that may be expected for other interim periods or the year ending September 30, 2015. The condensed interim consolidated financial data at August 31, 2014 is derived from audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended August 31, 2014, as filed on November 14, 2014 with the SEC.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates.

Change in Fiscal Year End

On June 3, 2014, the Board of Directors of the Company approved a change in the Company’s fiscal year end from August 31 to September 30 of each year. This change to the calendar quarter reporting cycle began September 1, 2014. As a result of the change, the Company had a one-month transition period from September 1, 2014 to September 30, 2014. The unaudited results for the one month ended September 30, 2014 are included in the Company’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2014, as filed on February 9, 2015 with the SEC. The unaudited balance sheet at September 30, 2014 is included in these condensed interim consolidated financial statements for comparative purposes. The audited results for the one month ended September 30, 2014 will be included in the Company’s Annual Report on Form 10-K for the fiscal year ending September 30, 2015, if not filed with the SEC prior thereto.

In addition, the results for the three months and six months ended March 31, 2015 are compared with the results of the three months and six months ended March 31, 2014, which have been recast on a calendar quarter basis due to the change in the Company’s fiscal year end from August 31 to September 30.

3. Significant Accounting Policies

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 creates a new topic in the ASC Topic 606 and establishes a new control-based revenue recognition model, changes the basis for deciding when revenue is recognized over time or at a point in time, provides new and more detailed guidance on specific topics, and expands and improves disclosures about revenue. In addition, ASU 2014-09 adds a new Subtopic to the Codification, ASC 340-40, Other Assets and Deferred Costs: Contracts with Customers, to provide guidance on costs related to obtaining a contract with a customer and costs incurred in fulfilling a contract with a customer that are not in the scope of another ASC Topic. The guidance in ASU 2014-09 is effective for public entities for annual reporting periods beginning after December 15, 2016, including interim periods therein. Early application is not permitted. In April 2015, the FASB proposed a one year deferral to the new revenue recognition guidance. Management is in the process of assessing the impact of ASU 2014-09 on the Company’s financial statements.

In August 2014, the FASB issued ASU 2014-15, Presentation of Financial Statements - Going Concern (Subtopic 205-40): Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern. ASU 2014-15 defines management's responsibility to evaluate whether there is substantial doubt about an organization's ability to continue as a going concern and to provide related footnote disclosures. The guidance in ASU 2014-15 is effective for annual reporting periods beginning after December 15, 2016, with early application permitted. Management is in the process of assessing the impact of ASU 2014-15 on the Company’s financial statements.

| 5 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

| 4. | Inventory |

The Company records inventory for custom manufacturing of products for specific customers, including manufacturing under supply agreements. Raw materials include inventory of manufacturing supplies. Work in process includes manufacturing supplies, direct and indirect labor, contracted manufacturing and testing, and allocated manufacturing overhead for custom manufacturing in process at the end of the period. There are no finished goods since once the custom manufacturing is complete, products are shipped to the customer and removed from inventory. There was no inventory for custom manufactured products at August 31, 2014. Inventory consisted of the following at March 31, 2015 and September 30, 2014:

| March 31, | September 30, | |||||||

| 2015 | 2014 | |||||||

| Raw materials | $ | - | $ | 10,480 | ||||

| Work in process | 135,151 | 24,411 | ||||||

| $ | 135,151 | $ | 34,891 | |||||

| 5. | Property, Plant and Equipment, net |

Property, plant and equipment, net consisted of the following:

| March 31, | September 30, | August 31, | ||||||||||

| 2015 | 2014 | 2014 | ||||||||||

| Aquaculture system | $ | 58,923 | $ | 58,923 | $ | 58,923 | ||||||

| Laboratory facilities | 62,033 | 62,033 | 62,033 | |||||||||

| Computer and office equipment | 77,678 | 77,697 | 77,697 | |||||||||

| Tools and equipment | 644,965 | 635,766 | 622,289 | |||||||||

| Vehicles | 10,997 | 10,997 | 10,997 | |||||||||

| Leasehold improvements | 108,990 | 61,187 | 61,187 | |||||||||

| 963,586 | 906,603 | 893,126 | ||||||||||

| Less: accumulated depreciation | (595,154 | ) | (518,263 | ) | (505,734 | ) | ||||||

| $ | 368,432 | $ | 388,340 | $ | 387,392 | |||||||

Depreciation expense amounted to $77,602 and $64,771 for the six months ended March 31, 2015 and 2014, respectively.

| 6 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

6. Intangible Assets - Licensing Rights

In December 2010, the Company entered into a research collaboration agreement with a customer. When the agreement terminated according to its terms in August 2011, the Company acquired an exclusive, worldwide sub-licensable and royalty-free license for certain technology developed in collaboration with the customer. The Company paid a $200,000 license fee for the licensing rights, which are jointly owned by the Company and the customer. The licensing rights do not have a fixed term or termination provisions. The licensing rights are amortized over the estimated useful life of seven years and are shown net of accumulated amortization and impairment losses. During the year ended August 31, 2014, the Company discontinued its use of these licensing rights and recorded impairment loss for the remaining value of licensing rights.

Amortization expense amounted to $14,286 for the six months ended March 31, 2014.

| 7. | Commitments |

Operating leases

The Company leases three buildings and facilities used in its operations under sublease agreements with the Port Hueneme Surplus Property Authority. In September 2010, the Company exercised its option to extend these sublease agreements for an additional five-year term. The Company has an option to extend the lease for a second additional five-year term.

The Company also leases facilities used for executive offices and laboratories. The Company must pay a portion of the common area maintenance. In July 2014, the Company exercised its option to extend this lease for a two-year term.

Future minimum lease payments are as follows:

| March 31, | ||||

| 2015 | ||||

| For The Year Ending September 30, | ||||

| 2015 | $ | 79,000 | ||

| 2016 | 59,000 | |||

| $ | 138,000 | |||

Rent expense on these lease agreements amounted to approximately $91,000, and $90,000 for the six months ended March 31, 2015 and 2014, respectively.

Purchase obligations

The Company has commitments totaling approximately $70,000 at March 31, 2015 for signed agreements with contract manufacturing organizations and consultants. The Company also has agreements to pay time and materials to contractors, which are estimated at approximately $85,000 at March 31, 2015. All purchase obligations are expected to be fulfilled within the next 12 months.

| 7 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

Supply agreements

The Company has three commitments under certain supply agreements with customers for fixed prices per gram on a non-exclusive basis except within that customer’s field of use. One amended and restated supply agreement replaced two prior agreements that automatically renewed each year. The new agreement is effective through March 2020 and is renewable for one-year terms upon written request of the customer. One agreement is effective through October 2019 and is renewable for one-year terms upon written request of the customer. One agreement is effective through October 2017 and is renewable for one-year terms upon written request of the customer.

Licensing fees

In July 2013, the Company acquired the exclusive, worldwide license to certain patented technology for the development of human immunotherapies against Clostridium difficile infection (“C. diff”). The license agreement required an initial, non-refundable license fee of $25,000, which was paid in fiscal August 2013, and payment of an aggregate of $200,000 in delayed license fees, which were paid in fiscal August 2014. Beginning September 2014, the terms also require a license fee of $20,000 to be paid annually, creditable against royalties due, if any. Royalties are payable for a percentage of related net sales, if any. License fees are also payable for a percentage of related non-royalty sublicensing revenue, if any. No royalties are due or have been paid to date. The Company also reimbursed patent filing costs of approximately $30,000 and $22,000 in the six months ended March 31, 2015 and 2014, respectively, and will reimburse certain future patent filing, prosecution, and maintenance costs. License fees and patent cost reimbursements paid during the six months ended March 31, 2015 and 2014, have been accounted for as research and development expense in the accompanying condensed interim consolidated statements of operations.

The license agreement expires when the last valid patent claim licensed under the license agreement expires. Prior to that time, the license agreement can be terminated by the licensor upon certain conditions. The Company will have 30 days after written notice from the licensor to cure the problem prior to termination of the license agreement. The Company can terminate the agreement with three months’ prior written notice.

Upon execution of the license agreement, the Company issued 371,200 common shares and warrants to purchase up to 278,400 of the Company’s common shares to the licensor. The warrants expired on January 23, 2015 and were not exercised.

The license agreement provides for the Company to pay up to an aggregate of $6,020,000 in milestone payments to the licensor upon achievement of various financing and development targets up to the first regulatory approval. Remaining contingent milestone payments to the licensor totaling $57,025,000 are related to achievement of sales targets. A financing milestone was met during the year ended August 31, 2014, and accordingly, the Company made a milestone payment of $100,000. No milestones were met during the six months ended March 31, 2015 and 2014, and there can be no assurance that any of the remaining milestones will be met in the future.

Retirement savings plan 401(k) contributions

The Company sponsors a 401(k) retirement savings plan that requires an annual non-elective safe harbor employer contribution of 3% of eligible employee wages. All employees over 21 years of age are eligible beginning the first payroll after 3 consecutive months of employment. Employees are 100% vested in employer contributions and in any voluntary employee contributions. Contributions to the 401(k) plan were approximately $33,000 and $27,000 for the six months ended March 31, 2015 and 2014, respectively.

Related party commitments

See Note 9.

| 8 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

8. Share Capital

The Company had the following transactions in share capital:

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2015 | 2014 | |||||||

| Number of common shares issued | 126,800 | 6,475,820 | ||||||

| Proceeds from exercise of warrants and broker units | $ | 938 | $ | 2,587,014 | ||||

| Transfer to common shares on exercise of warrants and broker units | 426 | 5,308,382 | ||||||

| Proceeds from exercise of options | 27,781 | 376,148 | ||||||

| Transfer to common shares on exercise of options | 27,619 | 341,594 | ||||||

| Share-based compensation | 198,927 | 614,312 | ||||||

Performance shares

There were 10,000,000 common shares allotted as performance shares to be issued to certain officers, directors and employees of the Company based on meeting milestones related to completion of method development for commercial-scale manufacture of KLH, compilation and regulatory submittal of all required chemistry, manufacturing and control data and completion of preclinical toxicity and immunogenicity testing of products under a performance share plan. Share-based compensation was recorded over the estimated vesting period ending in August 2012.

At March 31, 2015, there are 3,838,383 performance shares reserved for issuance.

Black-Scholes option valuation model

The Company uses the Black-Scholes option valuation model to determine the fair value of warrants, broker units and stock options. Option valuation models require the input of highly subjective assumptions including the expected price volatility. The Company has used historical volatility to estimate the volatility of the share price. Changes in the subjective input assumptions can materially affect the fair value estimates, and therefore the existing models do not necessarily provide a reliable single measure of the fair value of the Company’s warrants, broker units and stock options.

| 9 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

Warrants

A summary of the Company’s warrants activity is as follows:

| Number of Warrants | Weighted Average Exercise Price | |||||||||

| Balance - September 30, 2014 | 10,545,312 | $ | 1.01 | CDN $ | ||||||

| Exercised | (600 | ) | 0.75 | CDN $ | ||||||

| Expired | (278,700 | ) | 1.25 | CDN $ | ||||||

| Balance - March 31, 2015 | 10,266,012 | $ | 1.15 | CDN $ | ||||||

The weighted average contractual life remaining on the outstanding warrants at March 31, 2015 is 1.09 years.

The following table summarizes information about the outstanding warrants at March 31, 2015:

| Exercise Price | Number of Warrants | Expiry Date | ||||||||

| CDN$ 0.40 | 4,000,000 | October 25, 2015 | ||||||||

| CDN$ 0.40 | 278,400 | January 4, 2016 | ||||||||

| $ 1.35 | 4,701,902 | September 9, 2016 | ||||||||

| $ 1.05 | 200,000 | September 9, 2016 | Broker warrants | |||||||

| $ 1.35 | 952,377 | September 20, 2016 | ||||||||

| $ 1.05 | 133,333 | September 20, 2016 | Broker warrants | |||||||

| 10,266,012 | ||||||||||

Warrant liability

Equity offerings conducted by the Company in prior years included the issuance of warrants with exercise prices denominated in Canadian dollars. The Company’s functional currency is the U.S. dollar. As a result of having exercise prices denominated in other than the Company’s functional currency, these warrants meet the definition of derivatives and are therefore classified as derivative liabilities measured at fair value with adjustments to fair value recognized through the consolidated statements of operations. As these warrants are exercised, the fair value of the recorded warrant liability on date of exercise is included in common shares along with the proceeds from the exercise. If these warrants expire, the related decrease in warrant liability is recognized in profit or loss, as part of the change in fair value of warrant liability. There is no cash flow impact as a result of this accounting treatment.

| 10 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

The fair value of the warrants is determined using the Black-Scholes option valuation model at the end of each reporting period. Upon exercise of the warrants, the fair value of warrants included in derivative liabilities is reclassified to equity.

The fair value of warrants exercised during the six months ended March 31, 2015 and 2014 was determined using the Black-Scholes option valuation model, using the following weighted average assumptions:

| Six Months Ended | ||||||||

| March 31, 2015 | March 31, 2014 | |||||||

| Risk free interest rate | 1.12 | % | 1.07 | % | ||||

| Expected life (years) | 0.01 | 0.29 | ||||||

| Expected share price volatility | 97 | % | 106 | % | ||||

There were no warrants granted during the six months ended March 31, 2015 and 2014.

| 11 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

Broker units

The Company granted broker units as finders’ fees in conjunction with equity offerings in prior years. Broker units are fully vested when granted and allow the holders to purchase equity units. A unit consists of one common share and either one whole warrant or one half warrant to purchase common shares.

A summary of broker units activity is as follows:

| Number of Units | Weighted Average Exercise Price | |||||||||

| Balance - September 30, 2014 | 467,200 | $ | 0.25 | CDN $ | ||||||

| Exercised | (1,200 | ) | 0.50 | CDN $ | ||||||

| Balance - March 31, 2015 | 466,000 | $ | 0.25 | CDN $ | ||||||

The weighted average contractual life remaining on the outstanding broker units is 0.60 years.

The following table summarizes information about the outstanding broker units at March 31, 2015:

| Exercise Price | Number of Units | Expiry Date | ||||||

| CDN$ 0.25 | 400,000 | October 25, 2015 | ||||||

| CDN$ 0.25 | 66,000 | January 4, 2016 | ||||||

| 466,000 | ||||||||

The outstanding broker units at March 31, 2015 include one warrant.

There were no broker units granted during the six months ended March 31, 2015 and 2014.

| 12 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

Options

The Company has a 2013 fixed stock option plan (“the Plan”) administered by the Board of Directors, who have the discretion to grant up to an aggregate of 10,000,000 options. The exercise price of an option is set at the closing price of the Company’s common shares on the date of grant. Stock options granted to directors, officers, employees and consultants are subject to the following vesting schedule:

| (a) | One-third of the shares subject to the option shall vest immediately; |

| (b) | One-third of the shares subject to the option shall vest 12 months from the date of grant; and |

| (c) | One-third of the shares subject to the option shall vest 18 months from the date of grant. |

Stock options granted to investor relations consultants vest over a period of not less than 12 months with 25% of the shares subject to the option vesting on the date that is three months from the date of grant, and a further 25% vesting on each successive date that is three months from the date of the prior vesting.

Options have been granted under the Plan allowing the holders to purchase common shares of the Company as follows:

| Number of Options | Weighted Average Exercise Price | |||||||||

| Balance - September 30, 2014 | 5,885,533 | $ | 0.62 | CDN $ | ||||||

| Granted | 102,500 | 1.52 | CDN $ | |||||||

| Exercised | (125,000 | ) | 0.25 | CDN $ | ||||||

| Balance - March 31, 2015 | 5,863,033 | $ | 0.67 | CDN $ | ||||||

The weighted average contractual life remaining on the outstanding options is 3.70 years.

| 13 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

The following table summarizes information about the options under the Plan outstanding and exercisable at March 31, 2015:

| Exercise Price | Number of Options | Exercisable at March 31, 2015 | Expiry Date | |||||||||

| CDN$ 0.28 | 1,645,000 | 1,645,000 | April 9, 2017 | |||||||||

| CDN$ 0.25 | 55,000 | 55,000 | May 17, 2017 | |||||||||

| CDN$ 0.28 | 20,000 | 20,000 | June 28, 2017 | |||||||||

| CDN$ 0.28 | 70,000 | 70,000 | July 13, 2017 | |||||||||

| CDN$ 0.64 | 70,000 | 70,000 | October 25, 2017 | |||||||||

| CDN$ 1.00 | 60,000 | 60,000 | February 10, 2018 | |||||||||

| CDN$ 0.65 | 848,600 | 848,600 | August 8, 2018 | |||||||||

| CDN$ 0.50 | 5,000 | 5,000 | September 26, 2018 | |||||||||

| CDN$ 1.87 | 100,000 | 66,667 | November 7, 2018 | |||||||||

| CDN$ 0.40 | 70,000 | 70,000 | December 22, 2018 | |||||||||

| CDN$ 0.42 | 853,600 | 853,600 | April 13, 2019 | |||||||||

| CDN$ 0.29 | 90,000 | 90,000 | June 18, 2019 | |||||||||

| CDN$ 0.37 | 150,000 | 150,000 | August 9, 2019 | |||||||||

| CDN$ 0.37 | 150,000 | 150,000 | August 16, 2019 | |||||||||

| CDN$ 0.25 | 8,333 | 8,333 | October 23, 2019 | |||||||||

| CDN$ 0.25 | 215,000 | 215,000 | December 19, 2019 | |||||||||

| CDN$ 0.58 | 560,000 | 560,000 | May 14, 2020 | |||||||||

| CDN$ 0.58 | 100,000 | 100,000 | May 23, 2020 | |||||||||

| $ 1.83 | 495,000 | 330,000 | November 1, 2020 | |||||||||

| $ 1.84 | 100,000 | 66,667 | November 15, 2020 | |||||||||

| CDN$ 0.94 | 95,000 | 31,667 | June 27, 2021 | |||||||||

| CDN$ 1.52 | 102,500 | 34,167 | November 12, 2021 | |||||||||

| 5,863,033 | 5,499,701 | |||||||||||

The estimated fair value of the stock options granted during the six months ended March 31, 2015 and 2014 was determined using a Black-Scholes option valuation model with the following weighted average assumptions.

| Six Months Ended | ||||||||

| March 31, 2015 | March 31, 2014 | |||||||

| Risk free interest rate | 1.71 | % | 1.98 | % | ||||

| Expected life (years) | 7.00 | 6.71 | ||||||

| Expected share price volatility | 116 | % | 120 | % | ||||

| Expected dividend yield | 0 | % | 0 | % | ||||

The weighted average fair value of stock options awarded during the six months ended March 31, 2015 and 2014 was CDN$1.34 and CDN$1.51, respectively.

As of March 31, 2015, the Company had approximately $80,000 of unrecognized share-based compensation expense, which is expected to be recognized over a period of 1.25 years.

The intrinsic value of the options exercised during the six months ended March 31, 2015 and 2014 was CDN$1.15 and CDN$1.32, respectively. The intrinsic value of the vested options at March 31, 2015 was $0.63.

| 14 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

9. Related Party Disclosures

Royalty agreement

On August 14, 2002, through its California subsidiary, the Company entered into an agreement with a director and officer of the Company, where he would receive royalty payments in exchange for assignment of his patent rights to the Company. The royalty is 5% of gross receipts from products using this invention in excess of $500,000 annually. The Company’s current operations utilize this invention. There was no royalty expense incurred during the six months ended March 31, 2015 and 2014.

Collaboration agreement

In December 2013, the Company entered into a collaboration agreement with a privately-held Taiwan biopharmaceuticals manufacturer and a beneficial owner of over 5% of the Company’s common shares. Under the terms of the agreement, the Company will be responsible for the production and delivery of GMP grade KLH for evaluation as a carrier molecule in the collaboration partner’s potential manufacture of OBI-822 active immunotherapy. The Company is also responsible for method development, product formulation, and process qualification for certain KLH reference standards. The collaboration partner is responsible for development objectives and product specifications. The agreement provides for the collaboration partner to pay fees for certain expenses and costs associated with the collaboration. Subject to certain conditions and timing, the collaboration also provides for the parties to negotiate a commercial supply agreement for Stellar KLH™ in the future. However, there can be no assurance that any such negotiations will lead to successful execution of any further agreements related to this collaboration.

10. Supplemental Disclosure of Cash Flow and Non-Cash Transactions

Supplemental disclosure of cash flow information follows:

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2015 | 2014 | |||||||

| Cash paid during the period for taxes | $ | 18,800 | $ | 12,200 | ||||

Supplemental disclosure of non-cash financing and investing activities follows:

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2015 | 2014 | |||||||

| Transfer to common shares on exercise of warrants and broker units | $ | 426 | $ | 5,308,382 | ||||

| Transfer to common shares on exercise of options | 27,619 | 341,594 | ||||||

| Shares subscribed transferred to common shares | - | 77,736 | ||||||

11. Concentrations of Credit Risk

Credit risk is the risk of an unexpected loss if a customer or third party to a financial instrument fails to meet its contractual obligations. Financial instruments that potentially subject the Company to a concentration of credit risk consist primarily of cash, cash equivalents and accounts receivable. Management’s assessment of the Company’s credit risk for cash and cash equivalents is low as cash and cash equivalents are held in financial institutions believed to be credit worthy. The Company limits its exposure to credit loss by placing its cash with major financial institutions and invests only in short-term obligations.

| 15 |

| Stellar Biotechnologies, Inc. |

| Notes to Condensed Interim Consolidated Financial Statements (Unaudited) |

| (Expressed in U.S. Dollars) |

Approximately 82% and 77% of the Company’s product sales and contract services revenue during the six months ended March 31, 2015 and 2014, respectively, were from three customers. All of the grant revenue during the six months ended March 31, 2014 was received from the National Science Foundation.

Approximately 43% and 76% of the Company’s accounts receivable at March 31, 2015 and August 31, 2014, respectively, were from one customer and approximately 81% of the Company’s accounts receivable at September 30, 2014 was from two customers.

While the Company is exposed to credit losses due to the non-performance of its counterparties, the Company considers the risk of this remote. The Company estimates its maximum credit risk for accounts receivable at the amount recorded on the balance sheet.

| 16 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following management’s discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited condensed interim consolidated financial statements and notes thereto included in Part I, Item 1 of this Quarterly Report on Form 10-Q as of March 31, 2015 and our audited consolidated financial statements for the year ended August 31, 2014 included in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on November 14, 2014, as amended on November 21, 2014.

This Quarterly Report on Form 10-Q contains forward-looking statements. When used in this report, the words “expects,” “anticipates,” “suggests,” “believes,” “intends,” “estimates,” “plans,” “projects,” “continue,” “ongoing,” “potential,” “expect,” “predict,” “believe,” “intend,” “may,” “will,” “should,” “could,” “would” and similar expressions are intended to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks described in this report, the risks described in our Annual Report on Form 10-K for the year ended August 31, 2014 and other reports we file with the Securities and Exchange Commission. Although we believe the expectations reflected in the forward-looking statements are reasonable, they relate only to events as of the date on which the statements are made. We do not intend to update any of the forward-looking statements after the date of this report to conform these statements to actual results or to changes in our expectations, except as required by law.

The discussion and analysis of our financial condition and results of operations are based on our unaudited condensed interim consolidated financial statements as of March 31, 2015 and August 31, 2014, and for the three months and six months ended March 31, 2015 and 2014 included in Part I, Item 1 of this Quarterly Report on Form 10-Q, which we have prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported revenues and expenses during the reporting periods. On an ongoing basis, we evaluate such estimates and judgments, including those described in greater detail below. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Overview

Stellar Biotechnologies, Inc. (“Stellar,” the “Company,” “we,” “our” and “us”) is a biotechnology company engaged in the aquaculture, research and development, manufacture and commercialization of Keyhole Limpet Hemocyanin, or KLH, protein. KLH is a high molecular weight, immune-stimulating protein with an extensive history (over 40 years) of safe and effective use in immunological applications.

KLH can be used as an active pharmaceutical ingredient, or API, and combined with a disease-targeting agent to create immunotherapies targeting cancer, immune disorders, Alzheimer’s disease, and inflammatory diseases, or it can be used as a finished, injectable product in the immunodiagnostic market for measuring immune response in patients and research settings. Our mission is to become the world leader in the sustainable manufacture of KLH and use our unique, proprietary methods and intellectual property to serve the growing demand for KLH in immunotherapeutic and immunodiagnostic markets.

Change in Fiscal Year End

On June 3, 2014, the Company’s Board of Directors approved a change in the Company’s fiscal year end from August 31 to September 30 of each year, with effect from September 1, 2014. As a result, the Company had a one-month transition period from September 1, 2014 to September 30, 2014 (“Transition Period”), which was included in our Quarterly Report on Form 10-Q, for the quarter ended December 31, 2014, as filed with the Securities and Exchange Commission on February 9, 2015.

| 17 |

Significant Accounting Policies and Estimates

For a discussion of our significant accounting policies and estimates, refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014, as filed with the Securities and Exchange Commission on November 14, 2014, as amended on November 21, 2014. There are no material changes in our significant accounting policies and estimates from the disclosure provided in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014, except that we have established the following accounting policy for inventory:

Inventory

Inventory is recorded for custom manufacturing of products for specific customers, including manufacturing under supply agreements. Raw materials include inventory of manufacturing supplies. Work in process includes manufacturing supplies, direct and indirect labor, contracted manufacturing and testing, and allocated manufacturing overhead for custom manufacturing in process at the end of the period. There are no finished goods since once the custom manufacturing is complete, products are shipped to the customer and removed from inventory.

Results of Operations

Comparison of Six Months Ended March 31, 2015 and 2014

Our net loss for the six months ended March 31, 2015 was $1,769,641, or ($0.02) per basic share, as compared to a net loss of $7,011,044, or ($0.09) per basic share, for the six months ended March 31, 2014. The decrease in net loss reported in the six months ended March 31, 2015 compared to the prior period was primarily due to a significant noncash change in the fair value of warrant liability, increased sales and decreased research and development expenses.

Revenue for the six months ended March 31, 2015 totaled $400,288, as compared to revenue of $173,196 in the six months ended March 31, 2014. As expected during this early stage of our development, our revenues have high volatility as we establish a market for our products and services. Revenue for the six months ended March 31, 2015 included product sales of $295,288, as compared to $58,456 in the prior period. The increase in revenue for the six months ended March 31, 2015 was due to an increase in customers and associated greater product sales volume including sales under supply agreements and custom manufactured products. Contract services revenue was $105,000 for the six months ended March 31, 2015, as compared to $87,000 in the prior period. The increase in contract services revenue for the six months ended March 31, 2015 was due to services performed under a collaboration agreement entered into mid-December 2013. Grant revenue for the six months ended March 31, 2014 totaled $27,740 and related to the completion of work associated with our Phase II/IIB grants from the National Science Foundation (“NSF”) Small Business Innovation Research (“SBIR”) through the Technology Enhancement for Commercial Partnerships program. No grant revenue was recorded during the six months ended March 31, 2015.

Expenses for the six months ended March 31, 2015 decreased to $2,915,336, as compared to expenses of $3,309,438 incurred in the six months ended March 31, 2014. Costs of production and aquaculture for the six months ended March 31, 2015 increased to $410,640, as compared to costs of $294,913 incurred in the six months ended March 31, 2014, consistent with the increase in sales revenues. Research and development was $700,405 for the six months ended March 31, 2015, as compared to $1,281,321 for the prior period. The decrease for the six months ended March 31, 2015 was a result of the decreased use of contract research organizations due to a realignment of our focus from internal research and process development to manufacturing our Stellar KLH™ products in response to increased demand. General and administration expenses increased to $1,727,834 for the six months ended March 31, 2015, as compared to $1,667,800 in the prior period. The increase in general and administration expenses for the six months ended March 31, 2015 was caused by the net impact of increased corporate development expenses related to our transition to reporting as a U.S. domestic issuer rather than a foreign private issuer, partially offset by decreases in share-based compensation. Share-based compensation is allocated to all expense types; however, the greatest portion of the expenses is recorded as general and administration expenses. Share-based compensation was recorded as $198,927 for the six months ended March 31, 2015, which was a decrease from share-based compensation of $614,312 recorded in the six months ended March 31, 2014. The fluctuations in share-based compensation relate to the timing of the grant of stock options, changes in our share price that affect the valuation model and the vesting of options granted in prior years.

| 18 |

Other income (loss) was an overall gain of $764,207 for the six months ended March 31, 2015, as compared to a loss of $3,862,602 for the six months ended March 31, 2014. The most significant factor in the change for the six months ended March 31, 2015 as compared to the prior period resulted from the noncash change in fair value of warrant liability, which fluctuated to a gain of $1,201,332 for the six months ended March 31, 2015 from a loss of $3,694,588 in the prior period. These gains and losses occur in inverse relation to changes in our share price that affect the valuation model. The decrease in overall gain for the six months ended March 31, 2015 was offset by an increase in foreign exchange loss to $468,658 for the six months ended March 31, 2015, as compared to $198,829 for the six months ended March 31, 2014. The change was due to unfavorable exchange rates for our Canadian cash and cash equivalents. The portion of foreign exchange loss realized in cash was $7,968 for the six months ended March 31, 2015, and $21,207 for the six months ended March 31, 2014.

Comparison of Three Months Ended March 31, 2015 and 2014

Our net loss for the three months ended March 31, 2015 was $426,164, or ($0.01) per basic share, as compared to a net loss of $1,433,854, or ($0.02) per basic share, for the three months ended March 31, 2014. The decrease in net loss reported in the three months ended March 31, 2015 compared to the prior period was primarily due to a significant noncash change in the fair value of warrant liability and decreased research and development expenses.

Revenue for the three months ended March 31, 2015 totaled $187,627, as compared to revenue of $114,371 in the three months ended March 31, 2014. As expected during this early stage of our development, our revenues have high volatility as we establish a market for our products and services. Revenue for the three months ended March 31, 2015 included product sales of $142,627, as compared to $42,371 in the prior period. The increase in revenue for the three months ended March 31, 2015 was due to an increase in customers and associated greater product sales volume. Contract services revenue was $45,000 for the three months ended March 31, 2015, as compared to $72,000 in the prior period. The decrease in contract services revenue for the three months ended March 31, 2015 was due to completion of services in December 2014 related to a supply agreement. No grant revenue was recorded during the three months ended March 31, 2015 or 2014.

Expenses for the three months ended March 31, 2015 decreased to $1,377,261, as compared to expenses of $1,555,006 incurred in the three months ended March 31, 2014. Costs of production and aquaculture for the three months ended March 31, 2015 increased to $250,236, as compared to costs of $147,982 incurred in the three months ended March 31, 2014, due to additional manufacturing activities required for increased product demand. Research and development was $281,584 for the three months ended March 31, 2015, as compared to $733,096 for the prior period. The decrease for the three months ended March 31, 2015 was a result of the decreased use of contract research organizations due to a realignment of our focus from internal research and process development to manufacturing our Stellar KLH™ products in response to increased demand. General and administration expenses increased to $785,681 for the three months ended March 31, 2015, as compared to $646,670 in the prior period. The increase in general and administration expenses for the three months ended March 31, 2015 was caused by increased corporate development expenses related to our transition to reporting as a U.S. domestic issuer rather than a foreign private issuer.

Other income (loss) was an overall income of $772,470 for the three months ended March 31, 2015, as compared to an income of $18,181 for the three months ended March 31, 2014. The most significant factor in the change for the three months ended March 31, 2015 as compared to the prior period resulted from the noncash change in fair value of warrant liability, which fluctuated to a gain of $1,061,776 for the three months ended March 31, 2015 from a gain of $185,607 in the prior period. These gains and losses occur in inverse relation to changes in our share price that affect the valuation model. The increase in overall other income for the three months ended March 31, 2015 was offset by an increase in foreign exchange loss to $307,546 for the three months ended March 31, 2015, as compared to $182,321 for the three months ended March 31, 2014. The change was due to unfavorable exchange rates for our Canadian cash and cash equivalents. The portion of foreign exchange loss realized in cash was $6,125 for the three months ended March 31, 2015, and $17,050 for the three months ended March 31, 2014.

| 19 |

Capital Expenditures

Our capital expenditures, which primarily consist of scientific, manufacturing, and aquaculture equipment, for the six months ended March 31, 2015 and 2014 are as follows:

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| Assets Acquired | 2015 | 2014 | ||||||

| Property, plant and equipment | $ | 57,694 | $ | 250,666 | ||||

Liquidity and Capital Resources

Our working capital position at March 31, 2015 was $8,538,408, including cash and cash equivalents of $11,145,555 and noncash current portion of our warrant liability of $2,489,934. Management believes the current working capital is sufficient to meet our present requirements, including all contractual obligations and anticipated research and development expenditures for at least the next 12 months. We expect to finance our future expenditures and obligations through revenues from product sales, contract services income, grant revenues, and sales of our equity and debt securities. We expect to continue incurring losses for the foreseeable future and may need to raise additional capital to pursue our business plan and continue as a going concern. We may raise additional capital through the sale of our equity or debt securities in the public or private markets or through strategic collaborations. We cannot provide any assurances that we will be able to raise additional capital on commercially acceptable terms.

Six Months Ended March 31, 2015

As of March 31, 2015, our working capital position was $8,538,408, as compared to working capital of $13,751,301 as of September 30, 2014, our new fiscal year-end. Working capital is reduced by the noncash current portion of our warrant liability in the amount of $2,489,934 and $460 at March 31, 2015 and September 30, 2014, respectively.

Our cash and cash equivalents totaled $11,145,555 at March 31, 2015, as compared to cash and cash equivalents of $13,769,953 at September 30, 2014, which represented a decrease of $2,624,398 over the six month period.

During the six months ended March 31, 2015, operating activities used cash of $2,581,458. Items not affecting cash included: depreciation and amortization of $77,602; share-based compensation related to the issuance and vesting of stock options of $198,927; unrealized foreign exchange loss of $468,658; and gain in fair value of warrant liability of $1,201,332 due to the adjustment to the fair value of warrants previously issued. Changes in non-cash working capital items include a decrease in accounts receivable of $26,867; increase in inventory related to custom manufacturing orders in process of $100,260; increase in prepaid expenses of $27,037; and decrease in accounts payable and accrued liabilities of $168,575.

Investing activities provided cash of $367,119. The acquisition of property, plant and equipment used cash of $57,694. Proceeds on maturities of short-term investments provided cash of $424,813. The effect of exchange rate changes on cash and cash equivalents was a reduction of $438,778 due to a decline in Canadian dollars relative to U.S. dollars.

Financing activities provided cash of $28,719 related to proceeds from the exercise of warrants, broker units and options. As a result of such exercises, 126,800 common shares were issued during the period.

| 20 |

Six Months Ended March 31, 2014

As of March 31, 2014, our working capital position was $13,931,569, as compared to working capital of $12,663,239 as of September 30, 2013. Working capital is reduced by the noncash current portion of our warrant liability in the amount of $1,208,478 and $2,391,399 at March 31, 2014 and September 30, 2013, respectively.

Our cash and cash equivalents totaled $15,424,645 at March 31, 2014, as compared to cash and cash equivalents of $15,478,038 at September 30, 2013, which represented a decrease of $53,393.

During the six months ended March 31, 2014, operating activities used cash of $2,560,177. Items not affecting cash included: depreciation and amortization of $79,057; share-based compensation related to the issuance and vesting of stock options of $614,312; unrealized foreign exchange loss of $198,829; and loss in fair value of warrant liability of $3,694,588 due to adjustment to fair value of warrants previously issued. Changes in non-cash working capital items include a decrease in accounts receivable of $87,643 related mostly to grants; increase in prepaid expenses of $29,835; and decrease in accounts payable and accrued liabilities of $193,727.

Investing activities used cash of $250,666 for the acquisition of property, plant and equipment. The effect of exchange rate changes on cash and cash equivalents was a reduction of $205,712 due to a decline in Canadian dollars relative to U.S. dollars.

Financing activities provided cash of $2,963,162 related to proceeds from exercise of warrants, broker units and options, particularly “in-the-money” warrants and broker units that expired November 14, 2013. As a result of such exercises, 6,475,820 common shares were issued during the period.

Geographic Concentrations

The geographic markets of our potential customers are principally Europe, the United States and Asia. The geographic breakdown of revenues for: the six months ended March 31, 2015 was 33% Europe, 12% U.S, and 55% Asia and the six months ended March 31, 2014 was 33% Europe, 12% U.S. 15% Canada, and 40% Asia. The increase in revenues from Asia for the six months ended March 31, 2015 is due to contract income received under a collaboration agreement with our Taiwanese customer and sales of custom manufactured products for an Asian customer.

Research and Development

Our core business is developing and commercializing natural, sustainable KLH for use in immunotherapy and immunodiagnostic applications. Our internal research includes, among other activities, continual improvement of methods for the culture and growth of Giant Keyhole Limpet, innovations in aquaculture systems and infrastructure, biophysical and biochemical characterization of the KLH molecule, analytical processes to enhance performance of our products, KLH manufacturing process improvements, new KLH formulations, and early development of potential new KLH-based immunotherapies. However, from time to time we may engage in non-related research and development activities as opportunities arise.

Research and development costs, including materials and salaries of employees directly involved in research and development efforts, are expensed as incurred.

| 21 |

The following table includes our research and development costs for each of the six months ended March 31, 2015 and 2014:

| Six Months Ended | ||||||||

| March 31, | March 31, | |||||||

| 2015 | 2014 | |||||||

| Research and development expense | $ | 700,405 | $ | 1,281,321 | ||||

Disclosure of Contractual Obligations

We lease three buildings and facilities used in operations under sublease agreements with the Port Hueneme Surplus Property Authority. In September 2010, we exercised our option to extend these sublease agreements for an additional five-year term. We have an option to extend the lease for a second five-year term.

We also lease facilities used for executive offices and laboratories, and we must pay a portion of the common area maintenance. In July 2014, we exercised our option to extend this lease for a two-year term.

We have purchase commitments for contract research organizations and consultants.

There have been no material changes in our contractual obligations previously disclosed in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014, as filed with the Securities and Exchange Commission on November 14, 2014, as amended on November 21, 2014.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements, including unrecorded derivative instruments, that have or are reasonably likely to have a current or future material effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

We are exposed to financial market risks associated with foreign exchange rates, concentration of credit, and liquidity. In accordance with our policies, we manage our exposure to various market-based risks and where material, these risks are reviewed and monitored by our Board of Directors. For a discussion of our market risk exposure, refer to Item 7A, “Quantitative and Qualitative Disclosures About Market Risk,” in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014, as filed with the Securities and Exchange Commission on November 14, 2014, as amended on November 21, 2014. There are no material changes in market risk from the disclosure provided in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

Our management is responsible for establishing and maintaining disclosure controls and procedures to provide reasonable assurance that material information related to our Company, including our consolidated subsidiaries, is made known to senior management, including our Chief Executive Officer and Chief Financial Officer, by others within those entities on a timely basis so that appropriate decisions can be made regarding public disclosure.

We carried out an evaluation, under the supervision and with the participation of our management, including our Principal Executive Officer and our Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e)) under the Securities and Exchange Act of 1934, as amended) as of March 31, 2015. Our Chief Executive Officer and Chief Financial Officer concluded that the disclosure controls and procedures, as of March 31, 2015, were effective to give reasonable assurance that the information required to be disclosed by us in reports that we file or submit under the Exchange Act is (i) recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and (ii) accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the quarter ended March 31, 2015 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 22 |

From time to time, we may be involved in legal proceedings, claims and litigation arising in the ordinary course of business, including contract disputes, employment matters and intellectual property disputes. We are not currently a party to any material legal proceedings or claims outside the ordinary course of business. Regardless of outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

There have been no material changes in the risk factors previously disclosed in our Annual Report on Form 10-K for the fiscal year ended August 31, 2014, as filed with the Securities and Exchange Commission on November 14, 2014, as amended on November 21, 2014.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Item 3. Defaults Upon Senior Securities.

None.

Item 4. Mine Safety Disclosures.

Not applicable.

None.

The Exhibits listed in the Exhibit Index immediately preceding such Exhibits are filed with or incorporated by reference in this Quarterly Report.

| 23 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: May 11, 2015 | STELLAR BIOTECHNOLOGIES, INC. |

| /s/ Kathi Niffenegger | |

|

Kathi Niffenegger | |

| Chief Financial Officer | |

| (Principal Financial Officer) |

| 24 |

EXHIBIT INDEX

| Exhibit Number |

Description | |

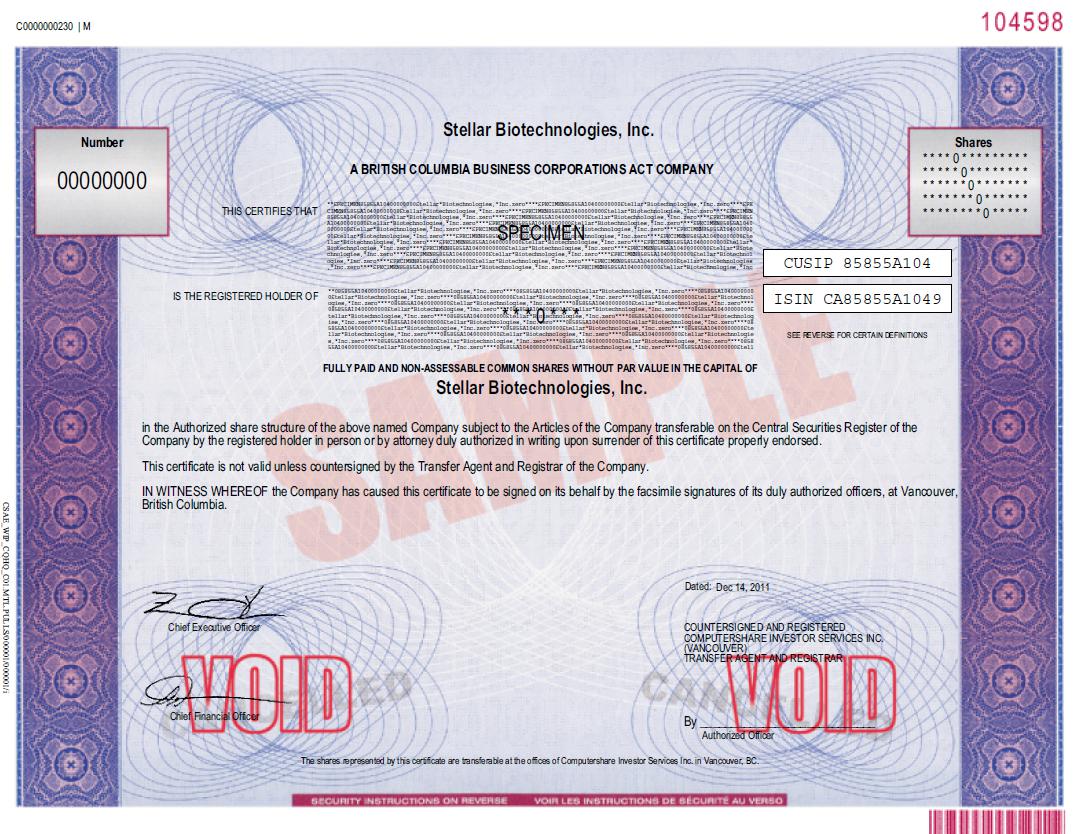

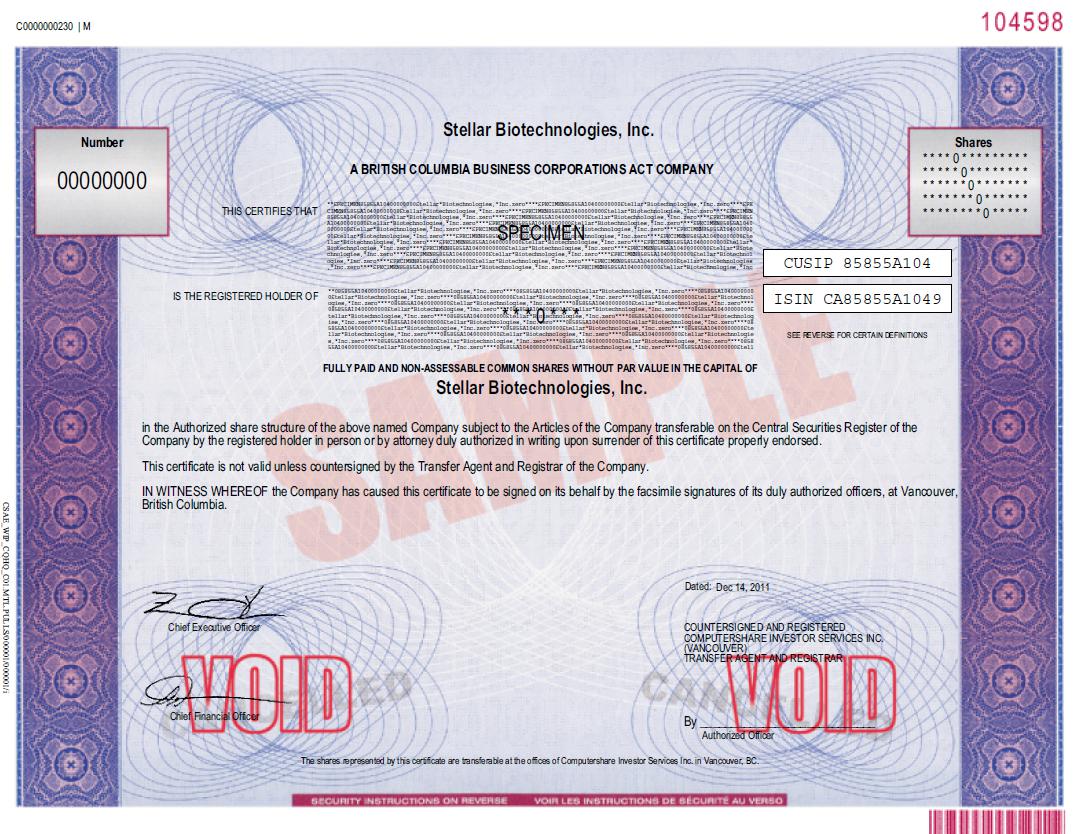

| 4.1 | Specimen Common Share Certificate | |

| 31.1 | Certification of the Principal Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 31.2 | Certification of the Principal Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. | |

| 32.1 | Certification of the Principal Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 32.2 | Certification of the Principal Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema Document | |

| 101.CAL | XBRL Taxonomy Calculation Linkbase Document | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | |

| 101.LAB | XBRL Taxonomy Label Linkbase Document | |

| 101.PRE | XBRL Taxonomy Presentation Linkbase Document |

| 25 |

Exhibit 4.1

Exhibit 31.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

(18 U.S.C. SECTION 1350)

I, Frank R. Oakes, certify that:

| 1. | I have reviewed this Quarterly Report on Form 10-Q of Stellar Biotechnologies, Inc. for the quarter ended March 31, 2015; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: May 11, 2015 | By: | /s/ Frank R. Oakes |

| Frank R. Oakes | ||

| President and Chief Executive Officer | ||

| (Principal Executive Officer) |

Exhibit 31.2

CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO

SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

(18 U.S.C. SECTION 1350)

I, Kathi Niffenegger, certify that:

| 1. | I have reviewed this Quarterly Report on Form 10-Q of Stellar Biotechnologies, Inc. for the quarter ended March 31, 2015; |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: May 11, 2015 | By: | /s/ Kathi Niffenegger |

| Kathi Niffenegger | ||

| Chief Financial Officer | ||

| (Principal Financial Officer) |

Exhibit 32.1

CERTIFICATION OF THE CHIEF EXECUTIVE OFFICER PURSUANT TO 18 U.S.C. 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report on Form 10-Q of Stellar Biotechnologies, Inc. (the “Company”) for the quarter ended March 31, 2015 (the “Report”), as filed with the Securities and Exchange Commission on the date hereof, I, Frank R. Oakes, Chief Executive Officer of the Company, certify pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| 1. | The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)); and |

| 2. | The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: May 11, 2015 | By: | /s/ Frank R. Oakes |

| Frank R. Oakes | ||

| President and Chief Executive Officer | ||

| (Principal Executive Officer) |

Exhibit 32.2

CERTIFICATION OF THE CHIEF FINANCIAL OFFICER PURSUANT TO 18 U.S.C. 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002