united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22669

AmericaFirst Quantitative Funds

(Exact name of registrant as specified in charter)

17605 Wright Street, Omaha, Nebraska 68130

(Address of principal executive offices) (Zip code)

James Ash, Gemini Fund Services, LLC.

80 Arkay Drive, Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 6/30

Date of reporting period: 6/30/16

Item 1. Reports to Stockholders.

ANNUAL REPORT

AmericaFirst Defensive Growth Fund

AmericaFirst Income Trends Fund

AmericaFirst Tactical Alpha Fund (Formerly AmericaFirst Absolute Return Fund)

AmericaFirst Quantitative Strategies Fund

AmericaFirst Seasonal Trends Fund

June 30, 2016

AmericaFirst Quantitative Funds

c/o Gemini Fund Services, LLC

17605 Wright Street, Suite 2

Omaha, NE 68130

AmericaFirst Capital Management, LLC is located at 8150 Sierra College Blvd (Suite 290), Roseville, CA.The Funds’ distributor is Northern Lights Distributors, LLC. AmericaFirst Capital Management, LLC is an owner of Matrix Capital Group, Inc. AmericaFirst is not affiliated with Burlington Capital Group, LLC (formerly America First Companies) or any of its subsidiaries.

Dear Shareholder:

AmericaFirst Capital Management is pleased to announce the Fiscal Year 2016 annual report and performance for the AmericaFirst family of mutual funds.

Market Summary

The fiscal year ending 6/30/2016 was negative for most equity and commodity indices.

While domestic magna-cap stocks (as represented by the S&P 100) gained 4.62%, broader stock indices such as the Value Line Composite Index lost 8.34%. Small cap stocks (S&P 600) lost 6.73%, Europe (MSCI Europe NTR) lost 11.22%, Asia (MSCI AC Asia Pacific GTR) lost 9.35%, and Latin America (MSCI EM Latin America) lost 7.38%. In other words, stock investors were likely negative the last 12 months unless they owned very large domestic stocks.

Bonds continued to provide positive returns. Domestic Corporate Bonds (as represented by the Barclays Credit Bond Index) gained 7.55%, High Yield Bonds (Barclays US Corp High Yield Index) gained 1.62%, and Foreign Bonds (Barclays Global Aggregate Bond) gained 11.54%.

Commodities (as represented by the S&P GSCI Index) lost 26.08% led by Agricultural and Energy Futures. Bucking the trend was Gold (London PM), which earned 12.79%.

Fund Performance (load waived) as of 6/30/2016[1]

| Fund Name | Symbol |

Return 1 Yr. |

Return 3 Yr. |

Return 5 Yr. |

Return Incep | Since Reformulation |

| AmericaFirst Defensive Growth A | DGQAX | -5.12 | 5.74 | 8.17 | 7.97 | |

| AmericaFirst Income Trends A | AFPAX | -11.80 | -3.51 | -1.25 | 0.29 | |

| AmericaFirst Tactical Alpha A | ABRFX | 1.37 | 8.51 | 3.31 | 3.85 | |

| AmericaFirst Quantitative Strgy A | AFIAX | -8.64 | 1.00 | 3.42 | -0.41 | 10.84 7 |

| AmericaFirst Seasonal Trends A | STQAX | 0.42 | - | - | 0.63 |

America First’s philosophy is centered on the belief that investment markets are never fully efficient. These market inefficiencies are derived from informational and emotional sources. We believe market inefficiencies can be exploited via the use of rigidly tested rules-based strategies.

[1] The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. Review the Funds’ prospectus for more information regarding the Funds’ fees and expenses, including other share classes. For performance information current to the most recent month-end, call toll free (866) 960-1355.

| 1 |

Rules-based strategies are based on an objective set of fundamental and/or technical criteria. In most cases, there is no discretion as to what to buy and sell. Exceptions may exist in extraordinary circumstances (e.g. delisting, corporate merger, illiquidity, etc.).

AmericaFirst Defensive Growth Fund

(A Shares: DGQAX, U Shares: DGQUX, I Shares: DGQIX)

Objective: The AmericaFirst Defensive Growth Fund seeks long-term capital appreciation while attempting to reduce exposure to general equity market risk.

Description: The Defensive Growth Fund provides a unique approach to equity investing by combining a portfolio of defensive, non-cyclical stocks with a portfolio of short positions designed to provide capital appreciation when equities are down.

Narrative: The AmericaFirst Defensive Growth Fund has nearly quadrupled the cumulative returns of its peer benchmark (the Lipper Long/Short Equity Index) since inception.

Despite strong performance from its Utilities and Consumer Staples positions, the Defensive Growth Fund lost 5.12% for the fiscal year ending June 30, 2016. This compares to its benchmark category return of -2.63%. The Fund was negatively impacted by its Healthcare positions as well as its short positions in Mining stocks (April, 2016). In addition, the Fund’s exposure to small-caps negatively impacted its performance. The Russell Global Total Return Index lost 3.33% for the fiscal year-end.

Defensive stocks continue to look attractive in light of today’s volatile economic environment. Regardless of the economy, we need essentials such as soap, pharmaceuticals, food, and utilities to carry on our daily lives. The constant demand for these goods and services often result in more stable earnings growth – which may result in better stock performance with less economic risk.

Returns (load waived):

| Fund Name | Symbol |

Return 1 Yr. |

Return 3 Yr. |

Return 5 Yr. |

Return Incep |

| AmericaFirst Defensive Growth A | DGQAX | -5.12 | 5.74 | 8.17 | 7.97 |

| AmericaFirst Defensive Growth I | DGQIX | -4.12 | 6.89 | 9.15 | 8.91 |

| AmericaFirst Defensive Growth U | DGQUX | -5.59 | 5.23 | 7.62 | 7.40 |

| Lipper Long/Short Equity Index | - | -2.63 | 2.07 | 2.59 | 2.28 |

| Class A versus Benchmark Index | -2.49 | 3.67 | 5.58 | 5.69 |

The adviser has contractually agreed to waive management fees and reimburse expenses through 2/4/2017, to the extent that total annual Fund operating expenses exceed 2.45% (A shares, excluding short sale dividend expense). Operating expenses include management fees, distribution fees and administrative, legal, registration and other expenses. If fee waivers and reimbursements had not been included performance would have been lower. There are additional costs associated with the use of short sales. Short-sale dividends generally reduce the market value of the securities by the amount of the dividend declared; thus increasing the Fund’s unrealized gain or reducing the Fund’s unrealized loss on the securities sold short.

AmericaFirst Income Trends Fund

(A Shares: AFPAX, U Shares: AFPUX, I Shares: AFPIX)

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 2 |

Objective: The Fund seeks to maximize income, while maintaining prospects for capital appreciation, by investing in a diversified portfolio of stocks and bonds.

Description: The Fund selects from an expansive universe of income-generating sectors and asset classes to provide a unique and diversified portfolio.

Narrative: Despite strong performance from its Utilities and Real Estate Investment Trust (REIT) positions, the Income Trends Fund suffered an 11.80% loss due to poor performance from its Energy/MLP, Financial Services and Basic Materials stocks and bonds. Global and small-cap exposure also contributed to the Fund’s fiscal year loss. Though no suitable benchmark index exists for the Fund, it is worth noting the Barclays Intermediate Government Bond Index gained 3.89% during the last twelve months ending 6/30/2016.

It is the Portfolio Manager’s strong opinion the Income Trends Fund represents an outstanding opportunity as the primary contributors to its 12-month decline have reversed their downward trend to provide strong returns the last quarter (Q2, 2016). In addition, the Fund pays a very attractive monthly distribution rate while investors wait for the Fund to rally.

Returns (load waived):

| Fund Name | Symbol |

Return 1 Yr. |

Return 3 Yr. |

Return 5 Yr. |

Return Incep |

| AmericaFirst Income Trends A | AFPAX | -11.80 | -3.51 | -1.25 | 0.29 |

| AmericaFirst Income Trends I | AFPIX | -10.91 | -2.68 | -0.55 | 0.96 |

| AmericaFirst Income Trends U | AFPUX | -12.14 | -3.95 | -1.71 | -0.20 |

| Morningstar Tactical Allocation Index | - | -2.30 | 2.32 | 2.46 | 4.77 |

| Class A versus Benchmark Index | -9.51 | -5.87 | -3.94 | -4.66 |

The adviser has contractually agreed to waive management fees and reimburse expenses through 2/4/2017, to the extent that total annual Fund operating expenses exceed 2.20% (A shares, excluding short sale dividend expense). Operating expenses include management fees, distribution fees and administrative, legal, registration and other expenses. If fee waivers and reimbursements had not been included performance would have been lower. There are additional costs associated with the use of short sales. Short-sale dividends generally reduce the market value of the securities by the amount of the dividend declared; thus increasing the Fund’s unrealized gain or reducing the Fund’s unrealized loss on the securities sold short.

AmericaFirst Tactical Alpha Fund

(A Shares: ABRFX, U Shares: ABRUX, I Shares: ABRWX)

Objective: The AmericaFirst Tactical Alpha Fund seeks capital appreciation through long/short positions in global equity, credit, commodity and interest rate markets.

Description: The Tactical Alpha Fund selects from a starting universe of over thirty indices by utilizing a data-driven “all asset” approach that combines top-down technical analysis with bottom-up fundamental analysis.

Narrative: Since its inception, the AmericaFirst Tactical Alpha Fund has more-than-doubled its benchmark category returns.

The “goes anywhere, at any time” Fund earned 1.37% for the fiscal year ended 6/30/2016 while its benchmark category (the Lipper Absolute Return Fund Index) lost 1.72%.

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 3 |

The Fund benefited by its diversified positions in Precious Metals, Utilities, and Bonds (domestic and global). Working against the Fund were international, energy and small cap positions.

We continue to believe the Tactical Alpha Fund represents an excellent selection for long-term investors that seek a total return vehicle that invests beyond just stocks and bonds.

Returns (load-waived):

| Fund Name | Symbol |

Return 1 Yr. |

Return 3 Yr. |

Return 5 Yr. |

Return Incep |

| AmericaFirst Tactical Alpha A | ABRFX | 1.37 | 8.51 | 3.31 | 3.85 |

| AmericaFirst Tactical Alpha I | ABRWX | 2.83 | 9.62 | 4.14 | 6.61 |

| AmericaFirst Tactical Alpha U | ABRUX | 0.79 | 7.98 | 2.78 | 3.31 |

| Lipper Absolute Return Funds Index | - | -1.72 | 0.81 | 1.21 | 1.59 |

| Class A versus Benchmark Index | 3.09 | 7.70 | 2.10 | 2.26 |

The adviser has contractually agreed to waive management fees and reimburse expenses through 2/4/17, to the extent that total annual Fund operating expenses exceed 2.45% (A shares, excluding short sale dividend expense). Operating expenses include management fees, distribution fees and administrative, legal, registration and other expenses. If fee waivers and reimbursements had not been included performance would have been lower. There are additional costs associated with the use of short sales. Short-sale dividends generally reduce the market value of the securities by the amount of the dividend declared; thus increasing the Fund’s unrealized gain or reducing the Fund’s unrealized loss on the securities sold short.

AmericaFirst Quantitative Strategies Fund

(A Shares: AFIAX, C Shares: AFISX, I Shares AFIIX)

Objective: The Fund seeks to provide capital appreciation with a focus on producing positive returns regardless of the directions of financial markets.

Description: The AmericaFirst Quantitative Strategies Fund is a compilation of AmericaFirst strategies that are lowly correlated to each other.

Narrative: The Quantitative Strategies Fund changed its name and investment objective on November 3rd, 2008. Since this change, the Fund has substantially outperformed its category benchmark (the Morningstar Tactical Allocation Index).

The Fund underperformed its benchmark for the fiscal year ending 6/30/2016 as it lost 8.64% (versus a 2.30% loss for the benchmark). The Fund was hurt by its positions in Energy, Small-Cap, and international stocks. High yield bonds also contributed to the Fund’s negative returns. The Fund rebalanced its portfolio in January, 2016 and has earned positive returns the first half of 2016 seemingly reversing the negative trend of 2015. Over the same period of time, the Russell Global Total Return Index lost 3.33%.

We are very excited about the Fund’s allocation in 2016. The Fund is allocated amongst several low-correlated strategies ranging from long/short commodities and bonds to defensive and share buyback equity strategies.

Returns (load waived):

| Fund Name | Symbol | Return 1 Yr. | Return 3 Yr. |

Return 5 Yr. |

Return Incep | Since Reformulation |

| AmericaFirst Quantitative Strgy A | AFIAX | -8.64 | 1.00 | 3.42 | -0.41 | 10.84 |

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 4 |

| AmericaFirst Quantitative Strgy C | AFISX | -9.43 | 0.26 | 2.66 | -1.15 | 10.20 |

| AmericaFirst Quantitative Strgy I | AFIIX | -8.68 | - | - | -7.39 | - |

| Morningstar Tactical Allocation Index | - | -2.30 | 2.32 | 2.46 | 5.18 | 5.94 |

| Class A versus Benchmark Index | -6.34 | -1.32 | 0.96 | -5.60 | 4.90 |

The adviser has contractually agreed to waive management fees and reimburse expenses through 2/4/2017, to the extent that total annual Fund operating expenses exceed 1.50% (A shares, excluding short sale dividend expense). Operating expenses include management fees, distribution fees and administrative, legal, registration and other expenses. If fee waivers and reimbursements had not been included performance would have been lower. There are additional costs associated with the use of short sales. Short-sale dividends generally reduce the market value of the securities by the amount of the dividend declared; thus increasing the Fund’s unrealized gain or reducing the Fund’s unrealized loss on the securities sold short.

AmericaFirst Seasonal Trends Fund

(A Shares: STQAX, U Shares: STQUX, I Shares: STQIX)

Objective: The Fund seeks to achieve capital appreciation with a focus on producing positive returns regardless of the direction of the financial markets.

Description: The Fund employs a “Seasonal” strategy to allocate assets between equity and fixed income securities. This strategy is based on the Advisor’s study of seasonal price patterns in asset classes over various time periods. The Advisor anticipates rebalancing Fund holdings to reduce equity exposure in May and increasing it in November.

Narrative: AmericaFirst’s version of “Sell in May & Walk Away” yielded positive returns the fiscal year ending 6/30/2016.

The Seasonal Trends Fund earned a positive 0.42% the last 12 months thanks largely to a cyclical bull run in February, March and April of 2016. The Fund’s category benchmark (the Morningstar Tactical Allocation Index) lost 2.30% the last 12 months. Over the same period of time, the Russell Global Total Return Index lost 3.33%.

Over 200 years of global stock market data supports the “Sell in May & Walk Away” adage. Through its own research, AmericaFirst has observed substantial outperformance of stocks during the November through April versus the May through October timeframe.

While we do not expect this to be the case every year (as no strategy is 100%), we anticipate this trend to remain the predominance of the time for the disciplined buy-and-hold investor of this Fund.

Returns (load waived):

| Fund Name | Symbol |

Return 1 Yr. |

Return 3 Yr. |

Return 5 Yr. |

Return Incept. |

| AmericaFirst Seasonal Trends A | STQAX | 0.42 | - | - | 0.63 |

| AmericaFirst Seasonal Trends I | STQIX | 0.93 | - | - | 1.13 |

| AmericaFirst Seasonal Trends U | STQUX | -0.11 | - | - | 0.13 |

| Morningstar Tactical Allocation Index | - | -2.30 | - | - | 0.52 |

| Class A versus Benchmark Index | 2.72 | - | - | 0.11 |

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 5 |

The adviser has contractually agreed to waive management fees and reimburse expenses through 2/4/2017, to the extent that total annual Fund operating expenses exceed 2.45% (A shares, excluding short sale dividend expense). Operating expenses include management fees, distribution fees and administrative, legal, registration and other expenses. If fee waivers and reimbursements had not been included performance would have been lower. There are additional costs associated with the use of short sales. Short-sale dividends generally reduce the market value of the securities by the amount of the dividend declared; thus increasing the Fund’s unrealized gain or reducing the Fund’s unrealized loss on the securities sold short.

Summary:

As an industry, we have dangerously adopted a “what’s working now?” philosophy by keeping short-term winners and scrapping short-term underperformers. Ultimately, the danger to such an approach is that we end up with a portfolio of investments that all move the same – and even though the investments may be positive currently, the odds are strong they will move in lockstep when the Markets turn south. I’ve often reminded Investors the losers of today often become the winners of tomorrow as they start to rally to their historical mean.

Investors (and their Advisors) can easily fall into a trap of comparing investments to the S&P 500 without learning what is moving the index. As I mentioned earlier, the largest of the large cap stocks were the primary contributors to positive returns this year. Investors that held a diversified portfolio of stocks (in other words, not just huge companies) likely felt some pain these last 12 months. Yes, there are years in which diversification can result in lower returns – nothing is 100%.

It is important to remember small and medium cap companies have historically outperformed large companies…and stocks have historically outperformed bonds. There is danger in owning only what has worked recently - think about those that bought technology stocks at the end of 1999 just because of short-term performance (the Nasdaq 100 lost over 73% the next three years).

It is my very strong position our worst performers the last 12 months will be among our top performers the next 12 months. We have already begun to see the losers of last year rally the last couple quarters.

Thank you again for placing your trust in AmericaFirst. Please know we have a vested interest in your success.

Sincerely,

Rick Gonsalves

President, Portfolio Manager and CEO

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 6 |

Definitions:

| 1. | Beta is a measure of a security's volatility relative to the market. Up Beta measures the relative volatility in positive markets while Down Beta measures the relative volatility in down markets. |

| 2. | Correlation is a statistical measure of how investments move in relation to each other. Up Correlation measures the relationship of the Fund to stocks in positive markets while Down Correlation measures the relationship of the Fund to stocks in down markets. |

| 3. | Up-capture compares an investment’s performance against its benchmark during periods when the benchmark’s performance is positive, while Down-capture compares the investment’s performance against the benchmark during periods when the benchmark’s performance is negative. A value of 100% for either ratio implies that the investment fully captures, or matches, the benchmark return during the period evaluated. A value of greater than 100% indicates that the investment captured more upside or downside than the benchmark. |

| 4. | Standard Deviation shows how much variation or "dispersion" exists from the average (mean, or expected value). A low standard deviation indicates that the data points tend to be very close to the mean (or less volatile); whereas high standard deviation indicates that the data points are spread out over a large range of values (more volatile). |

| 5. | S&P 500 Index - The S&P 500® has been widely regarded as the best single gauge of the large cap U.S. equities market since the index was first published in 1957. The index has over US$ 5.58 trillion benchmarked, with index assets comprising approximately US$ 1.31 trillion of this total. The index includes 500 leading companies in leading industries of the U.S. economy, capturing 75% coverage of U.S. equities. |

| 6. | Dow Jones US Moderately Conservative Portfolio Index: This index is a weighted average of other stock, bond, and cash indexes. It is reconstructed monthly and represents 40% of the risk of the U.S. equities market. The equities position (which is close to 40% of the portfolio) is constructed by equally weighting six Dow Jones U.S. Style Indexes (Large Growth, Large Value, Mid Growth, Mid Value, Small Growth and Small Value). The bond and cash position (which is close to 60% of the portfolio) is composed of various Barclays U.S. fixed income indexes. |

| 7. | Lipper Absolute Return: Absolute Return portfolios seek to achieve an absolute return in the reference currency within a certain value at risk quintile relative to that reference currency group. |

| 8. | Lipper Long Short Equity: Long Short portfolios employ strategies combining long holdings of equities with short sales of equity, equity options, or equity index options. The funds may be either net long or net short, depending on the portfolio manager’s view of the market. |

| 9. | Lipper Flexible Income – Funds that emphasize income generation by investing at least 85% of their assets in debt issues and preferred and convertible securities. Common stocks and warrants cannot exceed 15%. |

| 10. | Lipper Alternative Multi-Strategy-- Funds that, by prospectus language, seek total returns through the management of several different hedge-like strategies. These funds are typically quantitatively driven to measure the existing relationship between instruments and in some cases to identify positions in which the risk-adjusted spread between these instruments represents an opportunity for the investment manager. |

| 11. | The Barclays Aggregate Bond Index, which used to be called the "Lehman Aggregate Bond Index," is a broad base index, maintained by Barclays Capital, which took over the index business of the now defunct Lehman Brothers, and is often used to represent investment grade bonds being traded in United States. Index funds and exchange-traded funds are available that track this bond index. |

4570-NLD-7/29/2016

AmericaFirst Capital Management

Roseville, CA

866-960-1355

www.AmericaFirstFunds.com

| 7 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

June 30, 2016

COMPARISON OF A $10,000 INVESTMENT IN THE AMERICAFIRST DEFENSIVE GROWTH FUND CLASS A SHARES AND THE S&P 500 TOTAL RETURN INDEX (Unaudited)

Average Annual Total Return

| One Year | Three Year | Five Year | Commencement of Operations | |||

| through June 30, 2016 (1) | ||||||

| Class A | Without sales load | (5.12)% | 5.74% | 8.17% | 7.97% | |

| With sales load | (9.86)% | 3.95% | 7.06% | 6.89% | ||

| Class U | Without sales load | (5.59)% | 5.23% | 7.62% | 7.40% | |

| With sales load | (7.96)% | 4.35% | 7.07% | 6.86% | ||

| Class I | (4.12)% | 6.89% | 9.15% | 8.91% | ||

| S&P 500 Total Return Index | 3.99% | 11.66% | 12.10% | 11.94% | ||

| (1) | AmericaFirst Defensive Growth Fund Class A, Class U and Class I shares commenced operations on May 23, 2011. Redemption fees are a 1% of amount redeemed, if sold within 90 days. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-217-8363.

The above graph depicts the performance of the AmericaFirst Defensive Growth Fund Class A shares versus the S&P 500 Total Return Index. The S&P 500 Total Return Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the AmericaFirst Defensive Growth Fund, which will not invest in certain securities comprising this index.

| 8 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

June 30, 2016

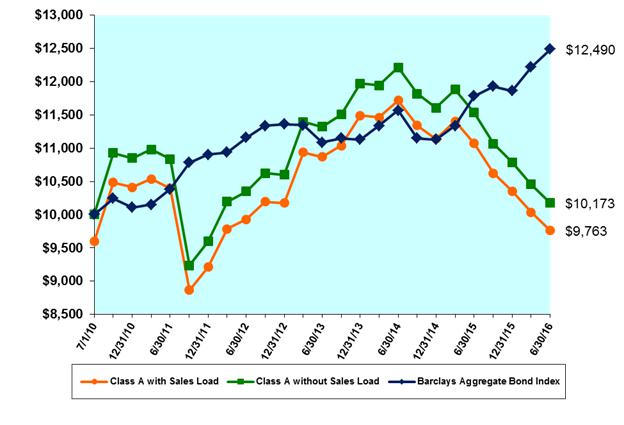

COMPARISON OF A $10,000 INVESTMENT IN THE AMERICAFIRST INCOME TRENDS FUND CLASS A SHARES AND THE BARCLAYS AGGREGATE BOND INDEX (Unaudited)

Average Annual Total Return

| One Year | Three Year | Five Year | Commencement of Operations | |||

| through June 30, 2016 (1) | ||||||

| Class A | Without sales load | (11.80)% | (3.51)% | (1.25)% | 0.29% | |

| With sales load | (15.34)% | (4.80)% | (2.08)% | (0.40)% | ||

| Class U | Without sales load | (12.14)% | (3.95)% | (1.71)% | (0.20)% | |

| With sales load | (13.94)% | (4.60)% | (2.13)% | (0.53)% | ||

| Class I | (10.91)% | (2.68)% | (0.55)% | 0.96% | ||

| Barclays Aggregate Bond Index | 6.00% | 4.06% | 3.76% | 3.78% | ||

| (1) | AmericaFirst Income Trends Fund Class A, Class U and Class I shares commenced operations on July 1, 2010. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-217-8363.

The above graph depicts the performance of the AmericaFirst Income Trends Fund Class A shares versus the Barclays Aggregate Bond Index. The Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). Investors cannot invest directly in an index or benchmark.

As with any fund, save an index fund, that commonly compares its performance to the Barclays Aggregate Bond Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the AmericaFirst Income Trends Fund, which will not invest in certain securities comprising this index.

| 9 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

June 30, 2016

COMPARISON OF A $10,000 INVESTMENT IN THE AMERICAFIRST TACTICAL ALPHA FUND* CLASS A SHARES AND THE S&P 500 TOTAL RETURN INDEX (Unaudited)

Average Annual Total Return

| 1 Year | 3 Year |

5 Year |

Commencement of Operations | |||

| through June 30, 2016 (1) | ||||||

| Class A | Without sales load | 1.37% | 8.51% | 3.31% | 3.85% | |

| With sales load | (3.73)% | 6.67% | 2.25% | 3.01% | ||

| Class U | Without sales load | 0.79% | 7.98% | 2.78% | 3.31% | |

| With sales load | (1.71)% | 7.09% | 2.27% | 2.90% | ||

| Class I (2) | 2.83% | 9.62% | 4.14% | 6.61% | ||

| S&P 500 Total Return Index | 3.99% | 11.66% | 12.10% | 13.02% | ||

| (1) | AmericaFirst Tactical Alpha Fund Class A and Class U shares commenced operations on February 26, 2010. Benchmark since inception return assumes inception date of February 26, 2010. |

| (2) | AmericaFirst Tactical Alpha Fund Class I commenced operations on July 12, 2010. |

* Formerly known as AmericaFirst Absolute Return Fund.

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-217-8363.

The above graph depicts the performance of the AmericaFirst Tactical Alpha Fund Class A shares versus the S&P 500 Total Return Index. The S&P 500 Total Return Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the AmericaFirst Tactical Alpha Fund, which will not invest in certain securities comprising this index.

| 10 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

June 30, 2016

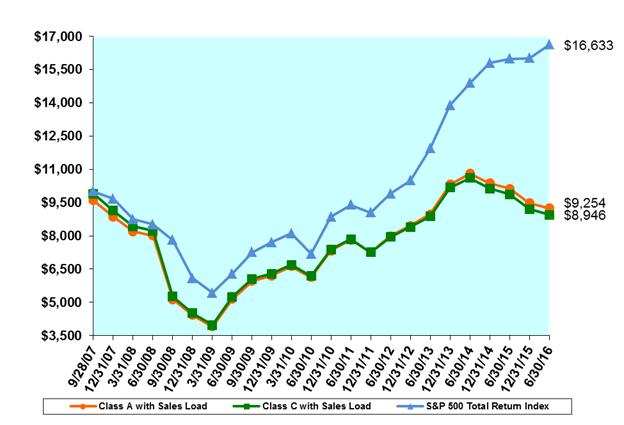

COMPARISON OF A $10,000 INVESTMENT IN THE AMERICAFIRST QUANTITATIVE STRATEGIES FUND AND THE S&P 500 TOTAL RETURN INDEX (Unaudited)

Average Annual Total Return

|

Commencement of Operations | ||||||

| One Year | Three Year | Five Year | through June 30, 2016 | |||

| Class A (1) | Without sales load | (8.64)% | 1.00% | 3.42% | (0.41)% | |

| With sales load | (12.31)% | (0.35)% | 2.58% | (0.88)% | ||

| Class C (1) | Without sales load | (9.43)% | 0.26% | 2.66% | (1.15)% | |

| With sales load | (10.33)% | (0.06)% | 2.41% | (1.26)% | ||

| Class I (2) | (8.68)% | N/A | N/A | (7.39)% | ||

| S&P 500 Total Return Index | 3.99% | 11.66% | 12.10% | 5.98% | ||

| (1) | AmericaFirst Quantitative Strategies Fund Class A and Class C shares commenced operations on September 28, 2007. Benchmark since inception return assumes inception date of September 28, 2007. |

| (2) | AmericaFirst Quantitative Strategies Fund Class I shares commenced operations on December 31, 2014. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-217-8363.

The above graph depicts the performance of the AmericaFirst Quantitative Strategies Fund Class A and C Shares versus the S&P 500 Total Return Index. The S&P 500 Total Return Index by Standard and Poor’s Corp. is a capitalization-weighted index comprising 500 issues listed on various exchanges, representing the performance of the stock market generally. Please note that indices do not take into account any fees and expenses of investing in the individual securities that they track and individuals cannot invest directly in any index.

As with any fund, save an index fund, that commonly compares its performance to the S&P 500 Total Return Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the AmericaFirst Quantitative Strategies Fund, which will not invest in certain securities comprising this index.

| 11 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

June 30, 2016

COMPARISON OF A $10,000 INVESTMENT IN THE AMERICAFIRST SEASONAL TRENDS FUND CLASS A SHARES AND THE DOW JONES U.S. MODERATELY CONSERVATIVE PORTFOLIO INDEX (Unaudited)

Average Annual Total Return

|

Commencement of Operations | ||||

| 1 Year | through June 30, 2016 (1) | |||

| Class A | Without sales load | 0.42% | 0.63% | |

| With sales load | (4.61)% | (1.31)% | ||

| Class U | Without sales load | (0.11)% | 0.13% | |

| With sales load | (2.64)% | (0.83)% | ||

| Class I (2) | 0.93% | 1.13% | ||

|

Dow Jones U.S. Moderately Conservative Portfolio Index

|

3.97% | 5.52% | ||

| (1) | AmericaFirst Seasonal Trends Fund Class A, Class U, and Class I shares commenced operations on October 31, 2013. Benchmark since inception return assumes inception date of October 31, 2013. |

The performance information quoted in this annual report assumes the reinvestment of all dividend and capital gain distributions, if any, and represents past performance, which is not a guarantee of future results. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The investment return and principal value of an investment will fluctuate and, therefore, an investor’s shares, when redeemed, may be worth more or less than their original cost. Updated performance data current to the most recent month-end can be obtained by calling 1-877-217-8363.

The above graph depicts the performance of the AmericaFirst Seasonal Trends Fund Class A shares versus the Dow Jones U.S. Moderately Conservative Portfolio Index. The Dow Jones U.S. Moderately Conservative Portfolio Index This index is a weighted average of other stock, bond, and cash indexes. It is reconstructed monthly and represents 40% of the risk of the U.S. equities market. The equities position (which is close to 40% of the portfolio) is constructed by equally weighting six Dow Jones U.S. Style Indexes (Large Growth, Large Value, Mid Growth, Mid Value, Small Growth and Small Value). The bond and cash position (which is close to 60% of the portfolio) is composed of various Barclays U.S. fixed income indexes.

As with any fund, save an index fund, that commonly compares its performance to the Dow Jones U.S. Moderately Conservative Portfolio Index, such a comparison may be said to be inappropriate because of the dissimilarity between the Fund’s investments and the securities comprising the index; so too with the AmericaFirst Seasonal Trends Fund, which will not invest in certain securities comprising this index.

| 12 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

EXPENSE EXAMPLE

Information About Your Fund’s Expenses (Unaudited)

|

Total Fund operating expense ratios as stated in the Fund’s prospectus dated June 6, 2016 were as follows:

| |

| AmericaFirst Defensive Growth Fund Class A, gross of fee waivers or expense reimbursements | 2.94% |

| AmericaFirst Defensive Growth Fund Class A, after waiver and reimbursement | 2.94% |

| AmericaFirst Defensive Growth Fund Class U, gross of fee waivers or expense reimbursements | 3.68% |

| AmericaFirst Defensive Growth Fund Class U, after waiver and reimbursement | 3.64% |

| AmericaFirst Defensive Growth Fund Class I, gross of fee waivers or expense reimbursements | 2.68% |

| AmericaFirst Defensive Growth Fund Class I, after waiver and reimbursement | 2.63% |

| AmericaFirst Income Trends Fund Class A, gross of fee waivers or expense reimbursements | 2.42% |

| AmericaFirst Income Trends Fund Class A, after waiver and reimbursement | 2.42% |

| AmericaFirst Income Trends Fund Class U, gross of fee waivers or expense reimbursements | 3.17% |

| AmericaFirst Income Trends Fund Class U, after waiver and reimbursement | 2.95% |

| AmericaFirst Income Trends Fund Class I, gross of fee waivers or expense reimbursements | 2.17% |

| AmericaFirst Income Trends Fund Class I, after waiver and reimbursement | 1.65% |

|

AmericaFirst Tactical Alpha Fund Class A, gross of fee waivers or expense reimbursements AmericaFirst Tactical Alpha Fund Class A, after fee waiver and reimbursements AmericaFirst Tactical Alpha Fund Class U, gross of fee waivers or expense reimbursements AmericaFirst Tactical Alpha Fund Class U, after fee waiver and reimbursements AmericaFirst Tactical Alpha Fund Class I, gross of fee waivers or expense reimbursements AmericaFirst Tactical Alpha Fund Class I, after fee waiver and reimbursements

|

3.38% 2.89% 4.13% 3.39% 3.10% 2.18%

|

| AmericaFirst Quantitative Strategies Fund Class A, gross of fee waivers or expense reimbursements | 1.92% |

| AmericaFirst Quantitative Strategies Fund Class A, after waiver and reimbursement | 1.77% |

| AmericaFirst Quantitative Strategies Fund Class C, gross of fee waivers or expense reimbursements | 2.67% |

| AmericaFirst Quantitative Strategies Fund Class C, after waiver and reimbursement | 2.52% |

|

AmericaFirst Quantitative Strategies Fund Class I, gross of fee waivers or expense reimbursements AmericaFirst Quantitative Strategies Fund Class I, after fee waiver and reimbursements

AmericaFirst Seasonal Trends Fund Class A, gross of fee waivers or expense reimbursements AmericaFirst Seasonal Trends Fund Class A, after fee waiver and reimbursements AmericaFirst Seasonal Trends Fund Class U, gross of fee waivers or expense reimbursements AmericaFirst Seasonal Trends Fund Class U, after fee waiver and reimbursements AmericaFirst Seasonal Trends Fund Class I, gross of fee waivers or expense reimbursements AmericaFirst Seasonal Trends Fund Class I, after fee waiver and reimbursements

|

1.63% 1.63%

2.51% 2.47% 3.25% 2.97% 2.24% 1.97% |

| The Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain the AmericaFirst Defensive Growth Fund’s total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds, and extraordinary expenses) at 2.45% for Class A shares, 2.95% for Class U shares, and 1.94% for Class I shares of the AmericaFirst Defensive Growth Fund’s average daily net assets through February 4, 2017. Total Gross Operating Expenses during the year ended June 30, 2016 were 3.11% for Class A, 3.63% for Class U, and 2.62% for Class I of the AmericaFirst Defensive Growth Fund. The Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain the AmericaFirst Income Trends Fund’s total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds, and extraordinary expenses) at 2.20% for Class A shares, 2.70% for Class U shares, and 1.40% for Class I shares of the AmericaFirst Income Trends Fund’s average daily net assets through February 4, 2017. Total Gross Operating Expenses during the year ended June 30, 2016 were 3.27% for Class A, 3.73% for Class U, and 2.68% for Class I of the AmericaFirst Income Trends Fund. The Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain the Tactical Alpha Fund’s total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds, and extraordinary expenses) at 2.45% for Class A shares, 2.95% for Class U shares, and 1.74% for Class I shares of the AmericaFirst Tactical Alpha Fund’s average daily net assets through February 4, 2017. Total Gross Operating Expenses during the year ended June 30, 2016 were 4.68% for Class A, 5.20% for Class U, and 4.21% for Class I of the AmericaFirst Tactical Alpha Fund. The Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain the Quantitative Strategies Fund’s total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds, and extraordinary expenses) at 1.50% for Class A shares, 2.25% for Class C shares, and 1.95% for Class I shares of the AmericaFirst Quantitative Strategies Fund’s average daily net assets through February 4, 2017. Total Gross Operating Expenses during the year ended June 30, 2016 were 2.29% for Class A, 3.05% for Class C, and 2.23% for Class I of the AmericaFirst Quantitative Strategies Fund. The Manager has contractually agreed to waive fees and/or reimburse expenses but only to the extent necessary to maintain the Seasonal Trends Fund’s total annual operating expenses (excluding brokerage costs; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; costs of investing in underlying funds, and extraordinary expenses) at 2.45% for Class A shares, 2.95% for Class U shares, and 1.95% for Class I shares of the AmericaFirst Seasonal Trends Fund’s average daily net assets through February 4, 2017. Total Gross Operating Expenses during the year ended June 30, 2016 were 3.57% for Class A, 4.10% for Class U, and 3.01% for Class I of the AmericaFirst Seasonal Trends Fund. Class I shares for all Funds except AmericaFirst Seasonal Trends do not exclude borrowing costs from the expense limitations noted. Please see the Information About Your Fund’s Expenses, the Financial Highlights and Notes to Financial Statements (Note 3) sections of this report for gross and net expense related disclosure during the year ended June 30, 2016. | |

| 13 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

EXPENSE EXAMPLE

Information About Your Fund’s Expenses (Unaudited)(Continued)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, and redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. The example below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example below is based on an investment of $1,000 invested at the beginning of the period (1/1/16) and held for the entire period through 6/30/16.

Actual Expenses

The first section of each table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period/year.

Hypothetical Example for Comparison Purposes

The second section of each table provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. For more information on transactional costs, please refer to the Fund’s prospectus.

Expenses and Value of a $1,000 Investment for the six month period from January 1, 2016 through June 30, 2016

|

Actual Fund Return (in parentheses) |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Defensive Growth Fund Class A (-1.57%) | $ 1,000.00 | $ 984.30 | $ 16.63 |

| AmericaFirst Defensive Growth Fund Class U (-1.79%) | 1,000.00 | 982.10 | 18.69 |

| AmericaFirst Defensive Growth Fund Class I (-1.00%) | 1,000.00 | 990.00 | 11.78 |

|

Hypothetical 5% Fund Return |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Defensive Growth Fund Class A | $ 1,000.00 | $ 1,008.10 | $ 16.83 |

| AmericaFirst Defensive Growth Fund Class U | 1,000.00 | 1,006.00 | 18.92 |

| AmericaFirst Defensive Growth Fund Class I | 1,000.00 | 1,013.02 | 11.92 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 3.37%, 3.79% and 2.38% for the AmericaFirst Defensive Growth Fund Class A, Class U and Class I shares, respectively; multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| 14 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

EXPENSE EXAMPLE

Information About Your Fund’s Expenses (Unaudited)(Continued)

Expenses and Value of a $1,000 Investment for the six month period from January 1, 2016 through June 30, 2016

|

Actual Fund Return (in parentheses) |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Income Trends Fund Class A (-5.71%) | $ 1,000.00 | $ 942.90 | $ 13.73 |

| AmericaFirst Income Trends Fund Class U (-5.83%) | 1,000.00 | 941.70 | 14.47 |

| AmericaFirst Income Trends Fund Class I (-5.17%) | 1,000.00 | 948.30 | 7.39 |

|

Hypothetical 5% Fund Return |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Income Trends Fund Class A | $ 1,000.00 | $ 1,010.73 | $ 14.21 |

| AmericaFirst Income Trends Fund Class U | 1,000.00 | 1,010.96 | 14.98 |

| AmericaFirst Income Trends Fund Class I | 1,000.00 | 1,017.28 | 7.65 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 2.84%, 3.00% and 1.52% for the AmericaFirst Income Trends Fund Class A, Class U and Class I shares, respectively; multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

Expenses and Value of a $1,000 Investment for the six month period from January 1, 2016 through June 30, 2016

|

Actual Fund Return (in parentheses) |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Tactical Alpha Fund Class A (4.31%) | $ 1,000.00 | $1,043.10 | $ 14.07 |

| AmericaFirst Tactical Alpha Fund Class U (3.97%) | 1,000.00 | 1,039.70 | 15.65 |

| AmericaFirst Tactical Alpha Fund Class I (5.37%) | 1,000.00 | 1,053.70 | 11.07 |

|

Hypothetical 5% Fund Return |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Tactical Alpha Fund Class A | $ 1,000.00 | $ 1,011.09 | $ 13.85 |

| AmericaFirst Tactical Alpha Fund Class U | 1,000.00 | 1,009.52 | 15.42 |

| AmericaFirst Tactical Alpha Fund Class I | 1,000.00 | 1,014.08 | 10.86 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 2.77%, 3.09% and 2.17% for the AmericaFirst Tactical Alpha Fund Class A, Class U and Class I shares, respectively; multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

| 15 |

| AMERICAFIRST QUANTITATIVE FUNDS | ANNUAL REPORT |

EXPENSE EXAMPLE

Information About Your Fund’s Expenses (Unaudited) (Continued)

Expenses and Value of a $1,000 Investment for the six month period from January 1, 2016 through June 30, 2016

|

Actual Fund Return (in parentheses) |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Quantitative Strategies Fund Class A (-2.44%) | $ 1,000.00 | $ 975.60 | $ 9.86 |

| AmericaFirst Quantitative Strategies Fund Class C (-2.82%) | 1,000.00 | 971.80 | 12.94 |

| AmericaFirst Quantitative Strategies Fund Class I (-2.39%) | 1,000.00 | 976.10 | 13.50 |

|

Hypothetical 5% Fund Return |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Quantitative Strategies Fund Class A | $ 1,000.00 | $ 1,014.88 | $ 10.06 |

| AmericaFirst Quantitative Strategies Fund Class C | 1,000.00 | 1,011.74 | 13.20 |

| AmericaFirst Quantitative Strategies Fund Class I | 1,000.00 | 1,011.20 | 13.74 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 2.01%, 2.64%, and 2.75% for the AmericaFirst Quantitative Strategies Fund Class A, Class C, and Class I shares, respectively; multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

Expenses and Value of a $1,000 Investment for the six month period from January 1, 2016 through June 30, 2016

|

Actual Fund Return (in parentheses) |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Seasonal Trends Fund Class A (9.09%) | $ 1,000.00 | $ 1,090.90 | $ 12.25 |

| AmericaFirst Seasonal Trends Fund Class U (8.83%) | 1,000.00 | 1,088.30 | 14.84 |

| AmericaFirst Seasonal Trends Fund Class I (9.43%) | 1,000.00 | 1,094.30 | 7.12 |

|

Hypothetical 5% Fund Return |

Beginning Account Value 1/1/16 |

Ending Account Value 6/30/16 |

Expenses Paid During Period*

|

| AmericaFirst Seasonal Trends Fund Class A | $ 1,000.00 | $ 1,013.14 | $ 11.80 |

| AmericaFirst Seasonal Trends Fund Class U | 1,000.00 | 1,010.65 | 14.29 |

| AmericaFirst Seasonal Trends Fund Class I | 1,000.00 | 1,018.07 | 6.86 |

| * | Expenses are equal to the Fund’s annualized expense ratios of 2.36%, 2.86% and 1.37% for the AmericaFirst Seasonal Trends Fund Class A, Class U and Class I shares, respectively; multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period. |

For more information on Fund expenses, please refer to the Fund’s prospectus, which can be obtained from your investment representative or by calling 1-877-217-8363. Please read it carefully before you invest or send money.

| 16 |

| AmericaFirst Defensive Growth Fund | ||||

| SCHEDULE OF INVESTMENTS | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| COMMON STOCK - 98.0 % | ||||

| BEVERAGES - 11.4% | ||||

| 9,669 | Boston Beer Co., Inc. * (a) | $ 1,653,689 | ||

| 10,646 | Coca-Cola Bottling Co. (a) | 1,569,966 | ||

| 43,863 | Coca-Cola Co. (a) | 1,988,310 | ||

| 38,322 | Coca-Cola Enterprises, Inc. (a) | 1,367,712 | ||

| 20,421 | Dr Pepper Snapple Group, Inc. (a) | 1,973,281 | ||

| 18,939 | PepsiCo, Inc. (a) | 2,006,398 | ||

| 10,559,356 | ||||

| BIOTECHNOLOGY - 6.3 % | ||||

| 6,345 | Biogen, Inc. * (a) | 1,534,348 | ||

| 19,141 | Gilead Sciences, Inc. (a) | 1,596,742 | ||

| 45,216 | Myriad Genetics, Inc. * (a) | 1,383,610 | ||

| 12,762 | United Therapeutics Corp. * (a) | 1,351,751 | ||

| 5,866,451 | ||||

| COMMERCIAL SERVICES - 1.6 % | ||||

| 39,835 | INC Research Holdings, Inc. * (a) | 1,518,909 | ||

| COSMETICS/PERSONAL CARE - 2.1 % | ||||

| 21,359 | Estee Lauder Cos., Inc. (a) | 1,944,096 | ||

| ELECTRIC - 7.7 % | ||||

| 36,384 | Black Hills Corp. (a) | 2,293,647 | ||

| 228,400 | Calpine Corp. * (a) | 3,368,900 | ||

| 43,610 | OGE Energy Corp. (a) | 1,428,228 | ||

| 7,090,775 | ||||

| ELECTRONICS - 2.2 % | ||||

| 45,558 | Agilent Technologies, Inc. (a) | 2,020,953 | ||

| ENGINEERING & CONSTRUCTION - 0.4 % | ||||

| 3,194 | SBA Communications Corp. * (a) | 344,760 | ||

| FOOD - 15.9 % | ||||

| 40,328 | Cal-Maine Foods, Inc. (a) | 1,787,337 | ||

| 35,109 | Campbell Soup Co. (a) | 2,335,802 | ||

| 90,847 | Flowers Foods, Inc. (a) | 1,703,381 | ||

| 32,583 | General Mills, Inc. (a) | 2,323,820 | ||

| 21,168 | Hershey Co. (a) | 2,402,356 | ||

| 15,310 | JM Smucker Co. (a) | 2,333,397 | ||

| 57,361 | Whole Foods Market, Inc. (a) | 1,836,699 | ||

| 14,722,792 | ||||

| GAS - 6.6 % | ||||

| 24,261 | AGL Resources, Inc. (a) | 1,600,498 | ||

| 12,458 | Sempra Energy (a) | 1,420,461 | ||

| 68,356 | UGI Corp. (a) | 3,093,109 | ||

| 6,114,068 | ||||

The accompanying notes are an integral part of these financial statements.

| 17 |

| AmericaFirst Defensive Growth Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| HEALTHCARE-SERVICES - 18.0 % | ||||

| 13,621 | Anthem, Inc. (a) | $ 1,788,982 | ||

| 45,185 | Centene Corp. * (a) | 3,224,853 | ||

| 27,494 | HCA Holdings, Inc. * (a) | 2,117,313 | ||

| 24,881 | ICON PLC * (a) | 1,741,919 | ||

| 26,225 | LifePoint Health, Inc. * (a) | 1,714,328 | ||

| 26,704 | MEDNAX, Inc. * (a) | 1,934,171 | ||

| 31,818 | Molina Healthcare, Inc. * (a) | 1,587,718 | ||

| 23,617 | WellCare Health Plans, Inc. * (a) | 2,533,632 | ||

| 16,642,916 | ||||

| PHARMACEUTICALS - 16.3 % | ||||

| 18,998 | AmerisourceBergen Corp. (a) | 1,506,921 | ||

| 21,568 | Cardinal Health, Inc. (a) | 1,682,520 | ||

| 22,517 | Express Scripts Holding Co. * (a) | 1,706,789 | ||

| 34,995 | Herbalife Ltd. * (a) | 2,048,257 | ||

| 23,966 | Mead Johnson Nutrition Co. (a) | 2,174,915 | ||

| 56,947 | Natural Health Trends Corp. (a) | 1,605,336 | ||

| 58,948 | Pfizer, Inc. (a) | 2,075,559 | ||

| 34,192 | VCA, Inc. * (a) | 2,311,721 | ||

| 15,112,018 | ||||

| RETAIL - 2.5 % | ||||

| 50,401 | Nu Skin Enterprises, Inc. (a) | 2,328,022 | ||

| TELECOMMUNICATIONS - 7.0 % | ||||

| 111,907 | CenturyLink, Inc. (a) | 3,246,422 | ||

| 21,304 | Level 3 Communications, Inc. * (a) | 1,096,943 | ||

| 39,119 | Verizon Communications, Inc. (a) | 2,184,405 | ||

| 6,527,770 | ||||

| TOTAL COMMON STOCK (Cost - $87,539,834) | 90,792,886 | |||

| SHORT-TERM INVESTMENT - 1.2 % | ||||

| MONEY MARKET FUND - 1.2 % | ||||

| 1,154,184 | Dreyfus Cash Management, Institutional Shares - 0.30% ** | |||

| TOTAL SHORT-TERM INVESTMENT (Cost - $1,154,184) | 1,154,184 | |||

| TOTAL INVESTMENTS IN SECURITIES HELD LONG - 99.2 % (Cost - $88,694,018) (b) | $ 91,947,070 | |||

| TOTAL INVESTMENTS IN SECURITIES SOLD SHORT - (24.4) % (Proceeds - $18,499,110) (b) | (22,577,235) | |||

| OTHER ASSETS LESS LIABILITIES - 25.2 % | 23,301,932 | |||

| NET ASSETS - 100.0 % | $ 92,671,767 | |||

The accompanying notes are an integral part of these financial statements.

| 18 |

| AmericaFirst Defensive Growth Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| INVESTMENTS IN SECURITIES SOLD SHORT* - (24.4) % | ||||

| COMMON STOCK - (24.4) % | ||||

| INTERNET - (1.7) % | ||||

| (476,023) | Groupon, Inc. | $ (1,547,075) | ||

| IRON/STEEL - (2.0) % | ||||

| (112,408) | United States Steel Corp. | (1,895,199) | ||

| LODGING - (1.9) % | ||||

| (19,669) | Wynn Resorts Ltd. | (1,782,798) | ||

| MINING - (17.2) % | ||||

| (188,178) | Freeport McMoran, Inc. | (2,096,303) | ||

| (116,052) | Goldcorp, Inc. | (2,220,074) | ||

| (36,106) | Royal Gold, Inc. | (2,600,354) | ||

| (113,322) | Silver Wheaton Corp. | (2,666,467) | ||

| (239,683) | Teck Resources Ltd. | (3,156,625) | ||

| (600,557) | Yamaha Gold, Inc. | (3,122,896) | ||

| (15,862,719) | ||||

| RETAIL - (1.6) % | ||||

| (72,268) | Kate Spade & Co. * | (1,489,444) | ||

| TOTAL INVESTMENTS IN SECURITIES SOLD SHORT (Proceeds $18,499,110) | $ (22,577,235) | |||

| PLC - Public Limited Company | ||||

| * Non-income producing security. | ||||

| ** The rate shown represents the rate at June 30, 2016 and is subject to change daily. | ||||

| (a) All or a portion of the security is segregated as collateral for securities sold short at June 30, 2016. | ||||

| (b) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes, including short sales, is $70,326,612 and differs from market value by net unrealized appreciation (depreciation) of securities as follows: | ||||

| Unrealized appreciation: | $ 8,671,842 | |||

| Unrealized depreciation: | (9,628,619) | |||

| Net unrealized depreciation: | $ (956,777) | |||

The accompanying notes are an integral part of these financial statements.

| 19 |

| AmericaFirst Defensive Growth Fund | ||||

| June 30, 2016 | ||||

| The Fund’s holdings were divided among the following economic sectors (Unaudited): | ||||

| Value | Percentage | |||

| HEALTHCARE-SERVICES | $ 16,642,916 | 24.0% | ||

| PHARMACEUTICALS | 15,112,018 | 21.8% | ||

| FOOD | 14,722,792 | 21.2% | ||

| BEVERAGES | 10,559,356 | 15.2% | ||

| ELECTRIC | 7,090,775 | 10.2% | ||

| TELECOMMUNICATIONS | 6,527,770 | 9.4% | ||

| GAS | 6,114,068 | 8.8% | ||

| BIOTECHNOLOGY | 5,866,451 | 8.5% | ||

| ELECTRONICS | 2,020,953 | 2.9% | ||

| COSMETICS/PERSONAL CARE | 1,944,096 | 2.8% | ||

| COMMERICAL SERVICES | 1,518,909 | 2.2% | ||

| MONEY MARKET FUND | 1,154,184 | 1.7% | ||

| RETAIL, NET | 838,578 | 1.2% | ||

| ENGINEERING & CONSTRUCTION | 344,760 | 0.5% | ||

| INTERNET | (1,547,075) | -2.2% | ||

| LODGING | (1,782,798) | -2.6% | ||

| IRON/STEEL | (1,895,199) | -2.7% | ||

| MINING | (15,862,719) | -22.9% | ||

| Total Portfolio Holdings | $ 69,369,835 | 100.0% | ||

| The percentages in the above table are based on market value of the Fund's portfolio holdings as of June 30, 2016 and are subject to change. | ||||

The accompanying notes are an integral part of these financial statements.

| 20 |

| AmericaFirst Income Trends Fund | ||||

| SCHEDULE OF INVESTMENTS | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| COMMON STOCK - 72.9 % | ||||

| ADVERTISING - 0.5 % | ||||

| 1,017 | Omnicom Group | $ 82,875 | ||

| AEROSPACE/DEFENSE 1.8 % | ||||

| 765 | Boeing Co. | 99351 | ||

| 414 | Lockheed Martin Corp | 102742 | ||

| 855 | United Tech Corp. | 87,680 | ||

| 289,773 | ||||

| AGRICULTURE - 2.4 % | ||||

| 1,961 | Altria Group, Inc. | 135,230 | ||

| 1,504 | Philip Morris International, Inc. | 152,987 | ||

| 2,014 | Reynolds American Inc. | 108,615 | ||

| 396,832 | ||||

| BANKS - 6.1 % | ||||

| 1,278 | Bank of Hawaii Corp. | 87,926 | ||

| 2,284 | Bank of Montreal | 144,783 | ||

| 1,317 | JP Morgan Chase | 81,838 | ||

| 2,347 | Royal Bank of Canada | 138,684 | ||

| 1,741 | Wells Fargo and Co. | 82,402 | ||

| 35,000 | UBS Group * | 453,600 | ||

| 989,233 | ||||

| BEVERAGES -1.2 % | ||||

| 2,191 | Coca Cola Co. | 99,318 | ||

| 891 | Pepsi Co. | 94,393 | ||

| 193,711 | ||||

| CHEMICALS - 4.1 % | ||||

| 3,406 | CF Industries Holdings, Inc. | 82,085 | ||

| 2,247 | Dow Chemical Co. | 111,698 | ||

| 1,418 | LyondellBasell Industries NV | 105,527 | ||

| 17,307 | Potash Corp of Saskatchewan, Inc. | 281,066 | ||

| 815 | Praxair, Inc. | 91,598 | ||

| 671,974 | ||||

| COMMERCIAL SERVICES - 0.6 % | ||||

| 5,691 | Western Union Co. | 109,153 | ||

| COMPUTERS - 2.9 % | ||||

| 789 | International Business Machines Corp. | 119,754 | ||

| 9,761 | Seagate Technology PLC | 237,778 | ||

| 2,277 | Western Digital Corp. | 107,611 | ||

| 465,143 | ||||

| COSMETICS/PERSONAL CARE - 0.7 % | ||||

| 1,322 | Procter & Gamble Co. | 111,934 | ||

| DISTRIBUTION/WHOLESALE - 0.5 % | ||||

| 1,893 | Fastenal Co. | 84,030 | ||

| DIVERSIFIED FINANCIAL SERVICES - 3.4 % | ||||

| 2,882 | Eaton Vance Corp | 101,850 | ||

| 3,498 | Federated Investors, Inc. | 100,672 | ||

| 8,660 | NorthStar Asset Management Group, Inc. | 88,418 | ||

| 1,207 | T Rowe Price Group, Inc. | 88,075 | ||

| 9,753 | Waddell & Reed Financial, Inc. | 167,947 | ||

| 546,962 | ||||

The accompanying notes are an integral part of these financial statements.

| 21 |

| AmericaFirst Income Trends Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| ELECTRIC - 2.7 % | ||||

| 2,895 | Public Service Enterprise Group, Inc. | $ 134,936 | ||

| 2,445 | Emerson Electric Co. | 127,531 | ||

| 4,154 | Garmin Ltd | 176,213 | ||

| 438,680 | ||||

| FOOD - 3.1 % | ||||

| 4,604 | Cal-Maine Foods, Inc. | 204,049 | ||

| 4,585 | Flowers Foods, Inc. | 85,969 | ||

| 1,557 | General Mills, Inc. | 111,045 | ||

| 900 | Hershey Co. | 102,141 | ||

| 503,204 | ||||

| HOME FURNISHINGS - 0.6 % | ||||

| 1,945 | Leggett & Platt, Inc. | 99,409 | ||

| HOUSEWARES - 1.0 % | ||||

| 2,789 | Tupperware Brands Corp. | 156,965 | ||

| INSURANCE - 5.0 % | ||||

| 1,272 | Aflac, Inc. | 91,788 | ||

| 2,340 | First American Financial Corp. | 94,115 | ||

| 2,197 | MetLife, Inc. | 87,507 | ||

| 6,641 | Old Republic International Corp. | 128,105 | ||

| 2,431 | Principal Financial Group, Inc. | 99,938 | ||

| 1,397 | Prudential Financial, Inc. | 99,662 | ||

| 3,346 | Sun Life Financial, Inc. | 109,849 | ||

| 5,291 | Symantec Corp. | 108,677 | ||

| 819,641 | ||||

| LODGING - 1.1 % | ||||

| 4,151 | Las Vegas Sands Corp. | 180,527 | ||

| MACHINERY-DIVERSIFIED - 1.4 % | ||||

| 1,234 | Cummins, Inc. | 138,751 | ||

| 781 | Rockwell Automation, Inc. | 89,674 | ||

| 228,425 | ||||

| MANUFACTURING - 1.1 % | ||||

| 518 | 3M Co. | 90,712 | ||

| 1,323 | Dover Corp. | 91,710 | ||

| 182,422 | ||||

| MINING - 0.7 % | ||||

| 1,450 | Compass Minerals International, Inc. | 107,576 | ||

| OFFICE EQUIPMENT - 0.7 % | ||||

| 6,258 | Pitney Bowes, Inc. | 111,392 | ||

The accompanying notes are an integral part of these financial statements.

| 22 |

| AmericaFirst Income Trends Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| OIL & GAS - 3.9 % | ||||

| 4,004 | HollyFrontier Corp. | $ 95,175 | ||

| 2,814 | Oceaneering International, Inc. | 84,026 | ||

| 1,099 | Phillips 66 | 87,195 | ||

| 1658 | Valero Energy Corp. | 84,558 | ||

| 13,944 | Western Refining, Inc. | 287,668 | ||

| 638,622 | ||||

| PACKAGING & CONTAINERS - 0.7 % | ||||

| 1,640 | Packaing Corp. of America | 109,765 | ||

| PHARMACEUTICALS - 2.8 % | ||||

| 1,965 | AbbVie, Inc. | 121,653 | ||

| 836 | Johnson & Johnson | 101,407 | ||

| 1,988 | Merck & Co., Inc. | 114,529 | ||

| 3,428 | Pfizer, Inc. | 120,700 | ||

| 458,289 | ||||

| PIPELINES - 2.9 % | ||||

| 1,625 | EQT Midstream Partners LP | 130,488 | ||

| 5,131 | MPLX LP | 172,556 | ||

| 2,118 | Magellan Midstream Partners LP | 160,968 | ||

| 464,012 | ||||

| REITS - 0.6 % | ||||

| 1,391 | Taubman Centers, Inc. | 103,212 | ||

| RETAIL - 12.1 % | ||||

| 6,626 | American Eagle Outfitters, Inc. | 105,552 | ||

| 3,038 | Best Buy Co. | 92,963 | ||

| 1,912 | Brinker International, Inc. | 87,053 | ||

| 3,435 | Coach, Inc. | 139,942 | ||

| 746 | Cracker Barrel Old Country Store, Inc. | 127,917 | ||

| 5,064 | DSW, Inc. | 107,256 | ||

| 5,625 | Game Stop Corp. | 149,513 | ||

| 6,546 | Gap, Inc. | 138,906 | ||

| 954 | Genuine Parts Co. | 96,593 | ||

| 1,304 | MSC Insutrial Direct Co. | 92,010 | ||

| 3,971 | Macy's, Inc. | 133,465 | ||

| 791 | McDonalds Corp. | 95,189 | ||

| 2,511 | Nordstrom, Inc. | 95,544 | ||

| 2,985 | NuSkin Enterprises, Inc. | 137,877 | ||

| 2,512 | Outerwall, Inc. | 105,504 | ||

| 31,963 | Pier 1 Imports, Inc. | 164,290 | ||

| 1,447 | WalMart Stores, Inc. | 105,660 | ||

| 1,975,234 | ||||

| SEMICONDUCTORS - 3.5 % | ||||

| 1,570 | Analog Devices, Inc. | 88,925 | ||

| 2,833 | Intel Corp. | 92,922 | ||

| 1,891 | Linear Tech Corp. | 87,988 | ||

| 2,251 | Qualcomm Corp. | 120,586 | ||

| 1,438 | Texas Instruments, Inc. | 90,091 | ||

| 1,764 | Xilinx, Inc. | 81,373 | ||

| 561,885 | ||||

The accompanying notes are an integral part of these financial statements.

| 23 |

| AmericaFirst Income Trends Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| SOFTWARE - 1.4 % | ||||

| 3,461 | CA, Inc. | $ 113,625 | ||

| 1,868 | Paychex, Inc. | 111,146 | ||

| 224,771 | ||||

| TELECOMMUNICATIONS - 0.6 % | ||||

| 3,405 | Cisco Systems, Inc. | 97,689 | ||

| TOYS - 0.5 % | ||||

| 1,012 | Hasbro, Inc. | 84,998 | ||

| TRANSPORTATION - 2.3 % | ||||

| 1,194 | CH Robinson Worldwide, Inc. | 88,655 | ||

| 3,431 | CSX Corp. | 89,480 | ||

| 1,077 | Union Pacific Corp. | 93,968 | ||

| 948 | UPS, Inc. | 102,119 | ||

| 374,222 | ||||

| TOTAL COMMON STOCK (Cost - $11,916,035) | 11,862,560 | |||

| Principal | ||||

| BONDS & NOTES - 26.9 % | ||||

| COMMERCIAL SERVICES - 2.4 % | ||||

| $ 400,000 | Rent-A-Center, Inc., 6.625%, 11/15/20 (a) | 383,000 | ||

| DIVERSIFIED FINANCIAL SERVICES - 1.9 % | ||||

| 315,000 | Navient Corp., 5.50%, 1/15/19 (a) | 316,780 | ||

| ELECTRIC - 6.2 % | ||||

| 330,000 | Calpine Corp., 5.75%, 1/15/25 (a) | 322,162 | ||

| 400,000 | GenOn Energy, Inc., 9.875%, 10/15/20 | 286,000 | ||

| 400,000 | NRG Energy, Inc., 6.625%, 3/15/23 | 396,000 | ||

| 1,004,162 | ||||

| ENTERTAINMENT - 1.8 % | ||||

| 300,000 | AMC Entertainment, Inc., 5.75%, 6/15/25 (a) | 300,000 | ||

| HEALTHCARE-SERVICES - 1.9 % | ||||

| 300,000 | Tenet Healthcare Corp., 8.125%, 4/1/22 | 308,940 | ||

| HOLDING COMPANIES-DIVERSIFIED - 1.9 % | ||||

| 300,000 | Leucadia National Corp., 5.50%, 10/18/23 (a) | 305,782 | ||

| LODGING - 2.0 % | ||||

| 300,000 | MGM Resorts International, 6.625%, 12/15/21 (a) | 327,750 | ||

The accompanying notes are an integral part of these financial statements.

| 24 |

| AmericaFirst Income Trends Fund | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Principal | Value | |||

| OIL & GAS - 2.9 % | ||||

| $ 660,000 | Chesapeake Energy Corp., 6.625%, 8/15/20 (a) | $ 466,950 | ||

| RETAIL - 1.9 % | ||||

| 300,000 | QVC, Inc, 4.375%, 3/15/23 (a) | 302,293 | ||

| TELECOMMUNICATIONS - 4.0 % | ||||

| 370,000 | Sprint Corp., 7.25%, 9/15/21 (a) | 317,275 | ||

| 340,000 | Windstream Services LLC, 7.75%, 10/15/20 (a) | 334,900 | ||

| 652,175 | ||||

| TOTAL BONDS & NOTES (Cost - $3,948,812) | 4,367,832 | |||

| Shares | SHORT-TERM INVESTMENT - 0.4 % | |||

| MONEY MARKET FUND - 0.4 % | ||||

| 66,276 | Dreyfus Cash Management, Institutional Shares - 0.30% ** | 66,276 | ||

| TOTAL SHORT-TERM INVESTMENT ( Cost - $66,276) | ||||

| TOTAL INVESTMENTS IN SECURITIES HELD LONG - 100.2 % (Cost - $15,931,123) (b) | $ 16,296,668 | |||

| TOTAL INVESTMENTS IN SECURITIES SOLD SHORT - (10.3) % (Proceeds - $1,469,280) (b) | (1,680,630) | |||

| OTHER ASSETS LESS LIABILITIES - 10.1 % | 1,650,582 | |||

| NET ASSETS - 100.0 % | $ 16,266,620 | |||

| INVESTMENTS IN SECURITIES SOLD SHORT* - (10.3) % | ||||

| COMMON STOCK - (1.6) % | ||||

| TRANSPORTATION - (1.6) | ||||

| (17,000) | Golar LNG Ltd | (263,500) | ||

| TOTAL COMMON STOCK SOLD SHORT (Proceeds $283,038) | ||||

| REAL ESTATE INVESTMENT TRUSTS - (8.7) % | ||||

| (16,000) | American Capital Agency Corp. | (317,120) | ||

| (21,000) | Hatteras Financial Corp. | (344,400) | ||

| (26,000) | New Residential Investment Corp. | (359,840) | ||

| (19,000) | Senior Housing Properties Trust | (395,770) | ||

| TOTAL REAL ESTATE INVESTMENT TRUSTS SOLD SHORT (Proceeds $1,186,242) | (1,417,130) | |||

| TOTAL INVESTMENTS IN SECURITIES SOLD SHORT (Proceeds $1,469,280) | $ (1,680,630) | |||

| LLC - Limited Liability Company. | ||||

| LP - Limited Partnership. | ||||

| * Non-income producing security. | ||||

| ** The rate shown represents the rate at June 30, 2016 and is subject to change daily. | ||||

| (a) All or a portion of the security is segregated as collateral for securities sold short at June 30, 2016. | ||||

| (b) Represents cost for financial reporting purposes. Aggregate cost for federal tax purposes, including short sales, is $14,460,018 and differs from market value by net unrealized appreciation (depreciation) of securities as follows: | ||||

| Unrealized appreciation: | $ 740,780 | |||

| Unrealized depreciation: | (584,760) | |||

| Net unrealized appreciation: | $ 156,020 | |||

The accompanying notes are an integral part of these financial statements.

| 25 |

| AmericaFirst Income Trends Fund | ||||

| June 30, 2016 | ||||

| The Fund’s holdings were divided among the following economic sectors (Unaudited): | ||||

| Value | Percentage | |||

| RETAIL, NET | $ 2,277,527 | 15.6% | ||

| ELECTRIC, NET | 1,442,842 | 9.9% | ||

| OIL & GAS, NET | 1,105,572 | 7.6% | ||

| BANKS | 989,233 | 6.8% | ||

| DIVERSIFIED FINANCIAL SERVICES, NET | 863,742 | 5.9% | ||

| INSURANCE | 819,641 | 5.6% | ||

| TELECOMMUNICATIONS, NET | 749,864 | 5.1% | ||

| CHEMICALS | 671,974 | 4.6% | ||

| SEMICONDUCTORS | 561,885 | 3.8% | ||

| LODGING, NET | 508,277 | 3.5% | ||

| FOOD | 503,204 | 3.4% | ||

| PHARMACEUTICALS | 458,289 | 3.1% | ||

| COMMERCIAL SERVICES, NET | 492,153 | 3.4% | ||

| COMPUTERS | 465,143 | 3.2% | ||

| PIPELINES | 464,012 | 3.2% | ||

| AGRICULTURE | 396,832 | 2.7% | ||

| HEALTHCARE-SERVICES | 308,940 | 2.1% | ||

| HOLDING COMPANIES-DIVERSIFIED | 305,782 | 2.1% | ||

| ENTERTAINMENT | 300,000 | 2.1% | ||

| AEROSPACE/DEFENSE | 289,773 | 2.0% | ||

| MACHINERY-DIVERSIFIED | 228,425 | 1.6% | ||

| SOFTWARE | 224,771 | 1.5% | ||

| BEVERAGES | 193,711 | 1.3% | ||

| MANUFACTURING | 182,422 | 1.3% | ||

| HOUSEWARES | 156,965 | 1.1% | ||

| COSMETICS/PERSONAL CARE | 111,934 | 0.8% | ||

| OFFICE EQUIPMENT | 111,392 | 0.8% | ||

| TRANSPORTATION, NET | 110,722 | 0.8% | ||

| PACKAGING & CONTAINERS | 109,765 | 0.8% | ||

| MINING | 107,576 | 0.7% | ||

| HOME FURNISHINGS | 99,409 | 0.7% | ||

| TOYS | 84,998 | 0.6% | ||

| DISTRIBUTION/WHOLESALE | 84,030 | 0.6% | ||

| ADVERTISING | 82,875 | 0.6% | ||

| MONEY MARKET FUND | 66,276 | 0.5% | ||

| REAL ESTATE INVESTMENT TRUST, NET | (1,313,918) | -9.0% | ||

| Total Portfolio Holdings | $ 14,616,038 | 100.0% | ||

| The percentages in the above table are based on market value of the Fund's portfolio holdings as of June 30, 2016 and are subject to change. | ||||

The accompanying notes are an integral part of these financial statements.

| 26 |

| AmericaFirst Tactical Alpha Fund (Formerly AmericaFirst Absolute Return Fund) | ||||

| SCHEDULE OF INVESTMENTS | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| COMMON STOCK - 71.9 % | ||||

| BEVERAGES - 6.1% | ||||

| 14,204 | Cia Cervercias Unidas SA - ADR (a) | $ 331,521 | ||

| 3,796 | Coca Cola - ADR (a) | 314,916 | ||

| 646,437 | ||||

| CHEMICALS - 9.1 % | ||||

| 2,204 | Air Product and Chemicals, Inc. (a) | 313,056 | ||

| 2,832 | PPG Industries, Inc. (a) | 294,952 | ||

| 16,451 | Ultrapar Participacoes SA - ADR (a) | 362,087 | ||

| 970,095 | ||||

| DIVERSIFIED FINANCIAL SERVICES - 7.0 % | ||||

| 4,194 | American Express Co. (a) | 254,827 | ||

| 4,986 | Discover Financial Services (a) | 267,200 | ||

| 6,414 | Nelnet, Inc. (a) | 222,887 | ||

| 744,914 | ||||

| ELECTRIC - 2.4 % | ||||

| 9,994 | Korea Electric Power Corp. - ADR (a) | 259,144 | ||

| ELECTRONICS - 2.2 % | ||||

| 21,826 | GoPro Inc. (a)* | 235,939 | ||

| ENGINEERING & CONSTRUCTION - 8.4 % | ||||

| 12,121 | Aegion Corp. (a)* | 236,481 | ||

| 3,622 | Grupo Aeroportuario - ADR (a) | 371,726 | ||

| 12,654 | MasTec, Inc. (a)* | 282,437 | ||

| 890,644 | ||||

| HOME FURNISHINGS -2.6 % | ||||

| 13,067 | Select Comfort Corp. (a)* | 279,372 | ||

| INSURANCE - 5.3 % | ||||

| 1,286 | Everest Re Group Ltd (a) | 234,914 | ||

| 5,784 | Primerica, Inc. (a) | 331,076 | ||

| 565,990 | ||||

| INTERNET - 2.0 % | ||||

| 65,366 | Groupon, Inc. (a)* | 212,440 | ||

| METAL FABRICATION - 2.2 % | ||||

| 7,610 | Timken Co. (a) | 233,323 | ||

| MANUFACTURING - 1.8 % | ||||

| 4,374 | EnPro Industries, Inc. (a) | 194,162 | ||

| OIL & GAS - 5.2 % | ||||

| 3,921 | China Petroleum and Chemicals - ADR (a) | 282,312 | ||

| 3,910 | PetroChina Co. Ltd. - ADR (a) | 265,567 | ||

| 547,879 | ||||

| PACKAGING & CONTAINERS - 6.4 % | ||||

| 4,473 | Ball Corp. (a) | 323,353 | ||

| 5,274 | Packaging Corp of America (a) | 352,989 | ||

| 676,342 | ||||

The accompanying notes are an integral part of these financial statements.

| 27 |

| AmericaFirst Tactical Alpha Fund (Formerly AmericaFirst Absolute Return Fund) | ||||

| SCHEDULE OF INVESTMENTS (Continued) | ||||

| June 30, 2016 | ||||

| Shares | Value | |||

| RETAIL - 4.7 % | ||||

| 3,080 | Childrens Place, Inc. (a) | $ 246,954 | ||

| 12,263 | Finish Line, Inc. (a) | 247,590 | ||

| 494,544 | ||||

| TELECOMMUNICATIONS - 4.0 % | ||||

| 4,877 | China Telecom Corp. Ltd. - ADR (a) | 219,416 | ||

| 19,650 | China Unicom Hong Kong Ltd. - ADR (a) | 204,557 | ||

| 423,973 | ||||

| TRANSPORTATION - 2.5 % | ||||

| 6,218 | Atlas Air Worldwide Holdings (a)* | 257,550 | ||

| TOTAL COMMON STOCK (Cost - $7,499,281) | 7,632,748 | |||

| EXCHANGE-TRADED FUNDS - 13.0 % | ||||

| 50,643 | iShares Silver Trust (a)* | 904,990 | ||

| 16,096 | PowerShares Emerging Markets Sovereign Debt Portfolio | 476,120 | ||

| 10 | United States Natural Gas Fund LP (a)* | 86 | ||

| TOTAL EXCHANGE-TRADED FUNDS (Cost - $1,161,451) | 1,381,196 | |||

| REAL ESTATE INVESTMENT TRUSTS - 13.8% | ||||

| 5,496 | American Campus Communities, Inc. (a) | 290,573 | ||

| 6,207 | DuPont Fabros Technology, Inc. (a) | 295,081 | ||

| 5,540 | National Retail Properties, Inc. (a) | 286,529 | ||

| 13,964 | Physicians Realty Trust (a) | 293,383 | ||

| 10,017 | STORE Capital Corp. (a) | 295,001 | ||

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost - $1,280,609) | 1,460,567 | |||

| SHORT-TERM INVESTMENT - 1.7% | ||||

| MONEY MARKET FUND - 1.7% | ||||