UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment No.1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: | COMMISSION FILE NUMBER: | |

December 31, 2018 | 000-54627 | |

ATLAS FINANCIAL HOLDINGS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

CAYMAN ISLANDS | 27-5466079 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

953 AMERICAN LANE, 3RD FLOOR | 60173 | |

Schaumburg, IL | (Zip Code) | |

(Address of principal executive offices) | ||

Registrant’s telephone number, including area code: (847) 472-6700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common, $0.003 par value per share | AFH | Nasdaq Capital Market | ||

6.625% Senior Unsecured Notes due 2022 | AFHBL | OTC Markets - Pink Sheets | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No þ

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer þ

Non-Accelerated Filer ¨ Smaller Reporting Company þ

Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

There were 11,942,812 shares of the Registrant’s common stock outstanding as of March 8, 2019, all of which are ordinary voting common shares. There are no outstanding restricted voting common shares. As of the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the Registrant’s common equity held by non-affiliates of the Registrant was approximately $90.7 million (based upon the closing sale price of the Registrant’s common shares on June 30, 2018).

For purposes of the foregoing calculation only, which is required by Form 10-K, the Registrant has included in the shares owned by affiliates those shares owned by directors and officers of the Registrant, and such inclusion shall not be construed as an admission that any such person is an affiliate for any purpose.

Explanatory Note for this Amendment No. 1:

This Amendment No. 1 to Form 10-K is being filed solely for the purpose of correcting the date of the Report of Independent Registered Public Accounting Firm of BDO USA, LLP on page 67 and updating certain exhibits. Except for these corrections, there have been no changes in any of the financial or other information contained in the report. For convenience, the entire Annual Report on Form 10-K, as amended, is being re-filed.

Explanatory Note:

This Annual Report on Form 10-K for Atlas Financial Holdings, Inc. (the “Company”) relates to the fiscal year ended December 31, 2018. As previously disclosed, the Company has been unable to previously file this annual report due to delays in the year end audit process. Unless otherwise noted, disclosures in this annual report, including disclosures regarding the Company’s financial and operating condition, are as of December 31, 2018. An overview of certain developments that occurred since December 31, 2018 is included in ‘Item 1, 2019 Developments’ and “Risk Factors - Risks Related to 2019 Developments.” We expect to file our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as soon as practicable.

Atlas Financial Holdings, Inc.

Index to Annual Report on Form 10-K

December 31, 2018

2019 Developments | |||

Part I

Item 1. Business

Overview

Atlas Financial Holdings, Inc. (“Atlas” or “We” or “the Company”) is a financial services holding company whose subsidiaries specialize in the underwriting of commercial automobile insurance policies, focusing on the “light” commercial automobile sector. This sector includes taxi cabs, non-emergency para-transit, limousine, livery and business auto. With roots dating back to 1925 selling insurance for taxi cabs, we are one of the oldest insurers of taxi and livery businesses in the United States (“U.S.”). This heritage serves as the foundation of our hyper-focused specialty insurance business that embraces continuous improvement, analytics and technology. The expanding segment of commercially licensed drivers operating through transportation network companies (“TNCs”) are included in the livery product. Our goal is to be the preferred specialty insurance business in any geographic area where our value proposition delivers benefit to all stakeholders.

We were originally formed as JJR VI, a Canadian capital pool company, on December 21, 2009 under the laws of Ontario, Canada. On December 31, 2010, we completed a reverse merger wherein American Service Insurance Company, Inc. (“American Service”) and American Country Insurance Company (“American Country”), in exchange for the consideration set out below, were transferred to us by Kingsway America Inc. (“KAI”), a wholly owned subsidiary of Kingsway Financial Services Inc. (“KFSI”). Prior to the transaction, American Service and American Country were wholly owned subsidiaries of KAI. American Country commenced operations in 1979. In 1983, American Service began as a non-standard personal and commercial auto insurer writing business in the Chicago, Illinois area.

On December 31, 2010, following the reverse merger transaction described immediately hereafter, we filed a Certificate of Registration by Way of Continuation in the Cayman Islands to re-domesticate as a Cayman Islands company. In addition, on December 30, 2010 we filed a Certificate of Incorporation on Change of Name to change our name to Atlas Financial Holdings, Inc. Our current organization is a result of a reverse merger transaction involving the following companies:

(a) | JJR VI, sponsored by JJR Capital, a Toronto based merchant bank; |

(b) | American Insurance Acquisition Inc. (“American Acquisition”), a corporation formed under the laws of Delaware as a wholly owned subsidiary of KAI; and |

(c) | Atlas Acquisition Corp., a Delaware corporation wholly-owned by JJR VI and formed for the purpose of merging with and into American Acquisition. |

In connection with the reverse merger transaction, KAI transferred 100% of the capital stock of each of American Service and American Country to American Acquisition in exchange for C$35.1 million of common shares and $18.0 million of preferred shares of American Acquisition and promissory notes worth C$7.7 million, aggregating C$60.8 million. In addition, American Acquisition raised C$8.0 million through a private placement offering of subscription receipts to qualified investors in both the U.S. and Canada at a price of C$6.00 per subscription receipt.

KAI received 4,601,621 restricted voting common shares of our company, then valued at $27.8 million, along with 18,000,000 non-voting preferred shares of our company, then valued at $18.0 million, and C$8.0 million cash for total consideration of C$60.8 million in exchange for 100% of the outstanding shares of American Acquisition and full payment of certain promissory notes. Investors in the American Acquisition private placement offering of subscription receipts received 1,327,834 of our ordinary voting common shares, plus warrants to purchase one ordinary voting common share of our company for each subscription receipt at C$6.00 at any time until December 31, 2013. Every 10 common shares of JJR VI held by the shareholders of JJR VI immediately prior to the reverse merger were, upon consummation of the merger, consolidated into one ordinary voting common share of JJR VI. Upon re-domestication in the Cayman Islands, these consolidated shares were then exchanged on a one-for-one basis for our ordinary voting common shares.

In connection with the acquisition of American Service and American Country, we streamlined the operations of the insurance subsidiaries to focus on the “light” commercial automobile lines of business. During 2011 and 2012, we disposed of non-core assets and placed into run-off certain non-core lines of business previously written by the insurance subsidiaries. Since disposing of these non-core assets and lines of business, our strategic focus has been the underwriting of specialty commercial insurance for users of “light” vehicles in the U.S.

On December 7, 2012, a shareholder meeting was held where a one-for-three reverse stock split was unanimously approved. When the reverse stock split took effect on January 29, 2013, it decreased the authorized and outstanding ordinary voting common shares and restricted voting common shares at a ratio of one-for-three. The primary objective of the reverse stock split was to increase the per share price of Atlas’ ordinary voting common shares to meet certain listing requirements of the NASDAQ Stock Market.

1

Unless otherwise noted, all historical share and per share values in this Annual Report on Form 10-K reflect the one-for-three reverse stock split.

On January 2, 2013, we acquired Camelot Services, Inc. (“Camelot Services”), a privately owned insurance holding company, and its sole subsidiary, Gateway Insurance Company (“Gateway”), from an unaffiliated third party. This transaction was contractually deemed effective as of January 1, 2013. Gateway provides specialized commercial insurance products, including commercial automobile insurance to niche markets such as taxi, black car and sedan service owners and operators. Gateway also wrote contractor’s workers’ compensation insurance, which we ceased writing as part of the transaction. An indemnity reinsurance agreement was entered into pursuant to which 100% of Gateway’s workers’ compensation business was ceded to a third party captive reinsurer funded by the seller as part of the transaction.

Under the terms of the stock purchase agreement, the purchase price equaled the adjusted book value of Camelot Services as of December 31, 2012, subject to certain pre and post-closing adjustments, including, among others, the future development of Gateway’s actual claims reserves for certain lines of business and the utilization of certain deferred tax assets over time. The total purchase price for all of Camelot Services’ outstanding shares was $14.3 million, consisting of a combination of cash and Atlas preferred shares. Consideration consisted of a $6.0 million dividend paid by Gateway immediately prior to the closing, $2.0 million of Atlas preferred shares (consisting of a total of 2,000,000 preferred shares) and $6.3 million in cash. Pursuant to the terms of the stock purchase agreement, the Company issued an additional 940,500 preferred shares due to the favorable development of Gateway’s actual claims reserves for certain lines of business during the first quarter of 2015. During the first quarter of 2016, the Company canceled 401,940 preferred shares pursuant to the Gateway stock purchase agreement due to the unfavorable development of Gateway’s actual claims reserves for certain lines of business. During the third quarter of 2016, the Company and the former owner of Camelot Services agreed to settle the additional consideration related to future claims development and utilization of certain tax assets. Atlas redeemed all 2,538,560 of the remaining preferred shares issued to the former owner of Gateway.

On February 11, 2013, an aggregate of 4,125,000 Atlas ordinary voting common shares were offered in Atlas’ initial public offering in the U.S. 1,500,000 ordinary voting common shares were offered by Atlas and 2,625,000 ordinary voting common shares were sold by KAI at a price of $5.85 per share. Atlas also granted the underwriters an option to purchase up to an aggregate of 618,750 additional shares at the public offering price of $5.85 per share to cover over-allotments, if any. On March 11, 2013, the underwriters exercised this option and purchased an additional 451,500 shares. After underwriting and other expenses, total proceeds of $9.8 million were realized on the issuance of the shares. Since that time, Atlas’ shares have traded on the NASDAQ under the symbol “AFH.” The principal purposes of the initial offering in the U.S. were to create a public market in the U.S. for Atlas’ ordinary voting common shares and thereby enable future access to the public equity markets in the U.S. by Atlas and its shareholders, and to obtain additional capital.

On June 5, 2013, Atlas delisted from the Toronto Stock Exchange.

On August 1, 2013, Atlas used the net proceeds from the U.S. initial public offering to partially fund the repurchase of 18,000,000 of its outstanding preferred shares owned by KAI for $16.2 million. These preferred shares had accrued dividends on a cumulative basis at a rate of $0.045 per share per year (4.5%) and were convertible into 2,286,000 common shares at the option of the holder after December 31, 2015. These shares were redeemed in their entirety for $0.90 for every dollar of outstanding face value plus accrued interest.

On May 13, 2014, an aggregate of 2,000,000 Atlas ordinary voting common shares were offered in a subsequent public offering in the U.S. at a price of $12.50 per share. Atlas also granted the underwriters an option to purchase up to an aggregate of 300,000 additional shares at the public offering price of $12.50 per share to cover over-allotments, if any. On May 27, 2014, the underwriters exercised this option and purchased an additional 161,000 shares. After underwriting and other expenses, total proceeds of $25.0 million were realized on the issuance of the shares. A portion of the net proceeds from the offering was used to support the acquisition of Anchor Holdings Group, Inc. and its affiliated entities as described further below.

During the fourth quarter of 2014, Camelot Services was merged into American Acquisition.

On March 11, 2015, we acquired Anchor Holdings Group, Inc. (“Anchor Holdings”), a privately owned insurance holding company, and its wholly owned subsidiary, Global Liberty Insurance Company of New York (“Global Liberty”), along with its affiliated entities, Anchor Group Management Inc. (“AGMI”), Plainview Premium Finance Company, Inc. (“Plainview Delaware”) and Plainview Delaware’s wholly owned subsidiary, Plainview Premium Finance Company of California, Inc. (“Plainview California”, and together with Anchor Holdings, Global Liberty, AGMI, and Plainview Delaware, “Anchor,”) from an unaffiliated third party for a total purchase price of $23.2 million, consisting of a combination of cash and Atlas preferred shares that was approximately 1.3 times combined U.S. GAAP book value. Consideration consisted of approximately $19.2 million in cash and $4.0 million of Atlas preferred shares (consisting of a total of 4,000,000 preferred shares at $1.00 per preferred share). Anchor provides specialized commercial insurance products, including commercial automobile insurance to niche markets such as taxi, black car and sedan service owners and operators primarily in the New York market. During the fourth quarter of 2016, the company canceled 4,000,000 preferred shares pursuant to the Anchor stock purchase agreement due to unfavorable development of Global Liberty’s pre-acquisition claims reserves. Although the re-issuance of preferred shares to the former owner of Anchor may be highly unlikely,

2

the contingent consideration terms of the Anchor stock purchase agreement will remain in effect for a period of five years from the date of acquisition.

Our core business is the underwriting of commercial automobile insurance policies, focusing on the “light” commercial automobile sector, which is carried out through American Country, American Service and Gateway (collectively, the “ASI Pool Companies”) and Global Liberty (together with the ASI Pool Companies, our “Insurance Subsidiaries”), along with our wholly owned managing general agency, AGMI. As previously announced, certain Insurance Subsidiaries have been in rehabilitation since July 8, 2019. See ‘Item 1, 2019 Developments’ for certain developments with respect to the Company and the Insurance Subsidiaries subsequent to December 31, 2018.

Competitive Strengths

Our value proposition is driven by our competitive strengths, which include the following:

Focus on niche commercial insurance business.

We target niche markets that support pricing deemed to be adequate based on historical results and subsequent estimations of future outcomes. While the commercial automobile insurance market has generally faced loss related challenges in recent years, we believe that we are able to adapt to changing market needs through our strategic commitment, the use of technology, analytics and operating scale. We endeavor to develop and deliver superior specialty insurance products and services to meet our customers' needs with a focus on innovation.

There are a limited number of competitors specializing in these lines of business. Management believes a strong value proposition is very important to attract new business and can result in desirable retention levels as policies renew on an annual basis.

Strong market presence with recognized brands and long-standing distribution relationships.

Our Insurance Subsidiaries have a long heritage as insurers of taxi, livery and para-transit businesses. All of our Insurance Subsidiaries have strong brand recognition and long-standing distribution relationships in target markets. Our understanding of the markets we serve remains current through regular interaction between AGMI and our independent retail agents. Our Insurance Subsidiaries are currently licensed in more states than those in which we have currently elected to do business, and we routinely re-evaluate all markets to assess future potential opportunities and risks. There are also a relatively limited number of agents who specialize in these lines of business. As a result, strategic relationships with independent retail agents are important to ensure efficient distribution. AGMI’s policy system enables point of sale interface with our distribution channel providing operating efficiency and customer service benefits.

Underwriting and claims handling experience.

Atlas has extensive experience with respect to underwriting and claims management in our specialty area of insurance. Our underwriting and claims infrastructure includes an extensive data repository, proprietary technologies, deep market knowledge and established market relationships. Analysis of the substantial data available through our operating companies informs our product and pricing decisions. The Company’s recent results include a re-estimation of claim related reserves primarily for older accident years. We believe our underwriting and claims handling activities will result in enhanced risk selection, high quality service to our customers and greater control over claims costs. We are committed to continuous improvement related to this underwriting and claims handling experience as a core competency, especially in light of the challenges facing the commercial automobile insurance industry in general. In recent years, we invested significantly in the use of machine learning based predictive analytics in both our underwriting and claims areas to further leverage this heritage.

Scalable operations.

Significant changes have been made in aligning our organization’s infrastructure cost base to our expected revenue and strategic direction going forward. The core functions of our Insurance Subsidiaries were integrated into a common operating platform. We believe that our business is well positioned to support proportionate market share of approximately 20% in all of the markets in which we operate. As a result of our shift to a Managing General Agency (“MGA”) focused strategy, our business model is dependent on support from unrelated insurance underwriting partners. Our business can also operate efficiently at smaller scale. Commercial automobile insurance is a cyclical business and our priority will always be to increase or decrease market share based on expected underwriting results rather than top line revenue. We plan to continue to evaluate, and where beneficial, deploy, new technologies and analytics to maximize efficiency and scalability.

3

Experienced management team.

We have a talented and experienced management team who have decades of experience in the property and casualty (“P&C”) insurance industry. Our senior management team has worked in the P&C industry for an average of more than 25 years and with the Insurance Subsidiaries, directly or indirectly, for an average of 15 years. We believe our team has the necessary experience and commitment to address current challenges and produce improved results going forward.

Strategic Focus

Vision | To always be the preferred specialty insurance business in any geographic areas where our value proposition delivers benefit to all stakeholders. |

Mission | To develop and deliver superior specialty insurance products and services to meet our customers’ needs with a focus on innovation and the effective use of technology and analytics to deliver consistent operating profit for the insurance businesses we own. |

We seek to achieve our vision and mission through the design, sophisticated underwriting and efficient delivery of specialty insurance products and services. Our understanding of the markets we serve will remain current through interaction with our retail producers. Analysis of the substantial data available through our operating companies will drive product and pricing decisions. We intend to focus on our key strengths and leverage our geographic footprint, products and services only to the extent that these activities support our vision and mission. We will target niche markets that are expected to support adequate pricing and will be best able to adapt to changing market needs ahead of our competitors due to our scale, business partnerships and strategic commitment.

Outlook

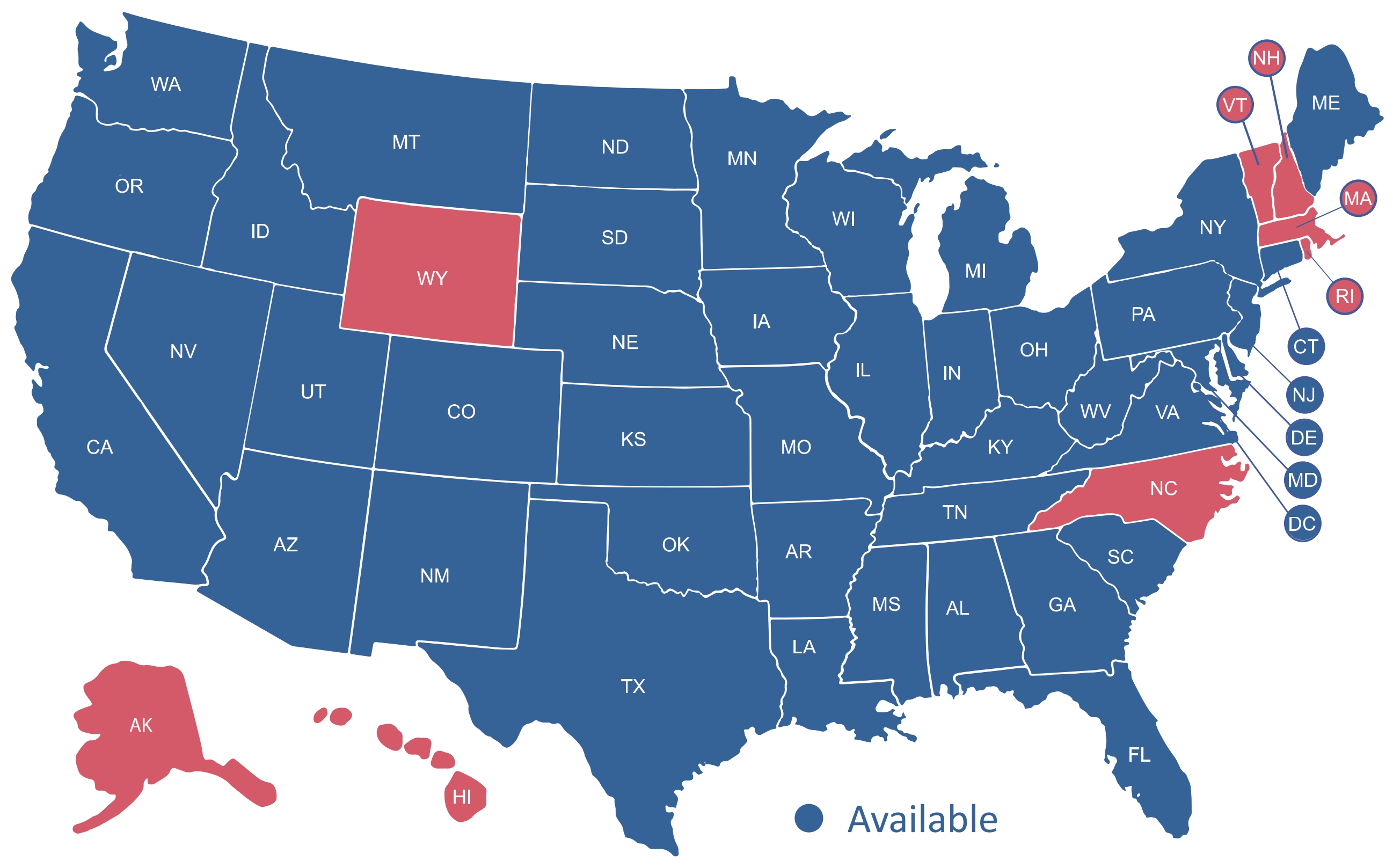

Through infrastructure re-organization, dispositions and by placing certain lines of business into run-off, our Insurance Subsidiaries have streamlined operations to focus on the lines of business we believe will leverage our core competencies and produce favorable underwriting results going forward. We have aligned the organization’s infrastructure cost base to our expected revenue stream. We integrated the core functions of our insurance businesses into a common, best practice based, operating platform. Management believes that our insurance businesses are well-positioned to support proportionate market share of approximately 20% in all of the markets in which we operate with better than industry level profitability. Based on current market conditions, coupled with underwriting and claim related initiatives implemented in recent years, we believe future underwriting results should improve. Our insurance businesses have a long heritage with respect to our core lines of business and will benefit from the efficient operating infrastructure currently in place. Through its Insurance Subsidiaries and AGMI, Atlas actively wrote business in 42 states and the District of Columbia during 2018.

We believe that the most significant opportunities going forward are: (i) continually managing our independent retail agency and customer relationships, (ii) increasing or decreasing premium volume in business segments and geographic markets based on underwriting results and anticipated future outcomes and (iii) evaluating and implementing strategic activities to optimize the value of our infrastructure and experience. Primary potential risks related to these activities include: (a) the impact of prior year reserve strengthening on our Insurance Subsidiaries, (b) not being able to achieve the expected support from reinsurance or distribution partners, and (c) insurance market conditions becoming or remaining “soft” for a sustained period of time.

We intend to identify and prioritize market expansion opportunities based on the comparative strength of our value proposition relative to competitors, the market opportunity and the legal and regulatory environment.

We intend to improve profitability by undertaking the following:

Focus on most profitable business.

In the past, we have identified and exited segments that are under-performing on our overall book of business. We are committed to continuing to make this a high priority with a focus on geographic, line of business level and competitive analysis. As the market environment evolves, our objective is to react as quickly as possible to address under performing segments and focus on more profitable ones.

Maintain legacy distribution relationships.

We continue to build upon relationships with independent retail agents that have been our Insurance Subsidiaries’ distribution partners for several years. We develop and maintain strategic distribution relationships with a relatively small number of independent retail agents with substantial market presence in each state in which we currently operate. We expect to continue to increase the distribution of our core products in the states where we are actively writing insurance.

4

Expand our market presence.

We are committed to diversification by leveraging our experience, historical data and market research to expand our business into previously untapped markets to the extent incremental markets meet our criteria. A significant portion of the Company’s business in recent years relates to the expansion and evolution of TNC operators. We will continue to expand into additional states or product lines where we are licensed, but not currently active, to the extent that our market expansion criteria is met in a given state or business line. Such potential expansion is also subject to availability of capital or reinsurance support. In the alternative, we will endeavor to quickly adjust our pricing and underwriting or reduce our exposure to potentially under-performing products.

Develop and maintain new or existing strategic partnerships.

We plan to continue to leverage our relationships with reinsurers and other existing or new business partners. The combination of Insurance Subsidiaries and our wholly owned managing general agency provide flexibility in terms of both capital support as well as partnership structures and revenue streams.

Market

Our primary target market is made up of small to mid-size taxi, limousine, other livery, including TNC drivers/operators, and non-emergency para-transit operators. The “light” commercial automobile policies we underwrite provide coverage for lightweight commercial vehicles typically with the minimum limits prescribed by statute, municipal or other regulatory requirements. The majority of our policyholders are individual owners or small fleet operators. In certain jurisdictions like Illinois, Louisiana, Nevada and New York, we have also been successful working with larger operators who retain a meaningful amount of their own risk of loss through higher retentions, self-insurance or self-funded captive insurance entity arrangements. In these cases, we provide support in the areas of day-to-day policy administration and claims handling consistent with the value proposition we offer to all of our insureds, generally on a fee for service basis. We may also provide excess coverage above the levels of risk retained by the insureds where a better than average loss ratio is expected. Through these arrangements, we are able to effectively utilize the significant specialized operating infrastructure we maintain to generate revenue from business segments that may otherwise be more price sensitive.

The “light” commercial automobile sector is a subset of the broader commercial automobile insurance industry segment, which over the long term has been historically profitable. In more recent years, the commercial automobile insurance industry has seen profitability pressure. Data compiled by S&P Global also indicates that in 2018 the total market for commercial automobile liability insurance was approximately $40.4 billion. The size of the commercial automobile insurance market can be affected significantly by many factors, such as the underwriting capacity and underwriting criteria of automobile insurance carriers and general economic conditions. Historically, the commercial automobile insurance market has been characterized by periods of excess underwriting capacity and increased price competition followed by periods of reduced underwriting capacity and higher premium rates.

We believe that operators of “light” commercial automobiles may be less likely than other business segments within the commercial automobile insurance market to take vehicles out of service, as their businesses and business reputations rely heavily on availability. Our target market has changed in recent years as a result of TNC and other trends related to mobility. The significant expansion of TNC has resulted in a reduction in taxi vehicles available to insure; however, it has increased the number of livery operators. Market research also suggests that the combined addressable markets between traditional taxi, livery and TNC companies expanded during this period.

Currently, we distribute our products only in the U.S. Through our Insurance Subsidiaries, we are licensed to write P&C insurance in 49 states plus the District of Columbia. The following table reflects, in percentages, the principal geographic distribution of gross premiums written in 2018. No other jurisdiction accounted for more than 5%. AGMI is also licensed on a nationwide basis.

Distribution of Gross Premiums Written by Jurisdiction | ||

New York | 38.4 | % |

California | 16.2 | |

5

The diagram below outlines the states where we are focused on actively writing new insurance policies and where we believe the comparative strength of our value proposition, the market opportunity, and the legal and regulatory environment will provide favorable results going forward (the blue states in the below diagram).

6

Agency Relationships

Independent retail agents are recruited by us directly utilizing marketing efforts targeting the specialty niche upon which we focus. Interested agents are evaluated based on their experience, expertise and ethical dealing. Typically, our Company enters into distribution relationships with approximately one out of every ten agents seeking an agency contract. Our independent agent partners contract with AGMI through which business can be written with our Insurance Subsidiaries or strategic partners. We do not provide exclusive territories to our independent retail agents, nor do we expect to be their only insurance market. We are generally interested in acting as one of a relatively small number of insurance partners with whom our independent retail agents place business and are also careful not to oversaturate the distribution channel in any given geographic market. This helps to ensure that we are able to receive the maximum number of submissions for underwriting evaluation without unnecessary downstream pressure from agents to write business that does not fit our underwriting model.

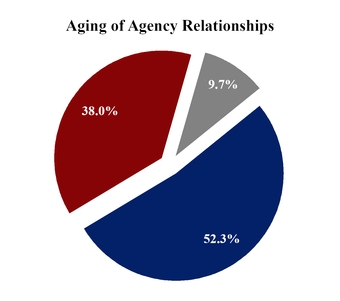

Agents receive commission as a percentage of premiums (generally 10%) as their primary compensation from us. Larger agents may also be eligible for profit sharing based on the growth and underwriting profitability related to their book of business with us. The quality of business presented and written by each independent retail agent is evaluated regularly by our underwriters and is also reviewed quarterly by senior management. Key metrics for evaluation include overall accuracy and adequacy of underwriting information, performance relative to agreed commitments, support with respect to claims presented by their customers (as applicable) and overall underwriting profitability of the agent’s book of business. The re-estimation of claims related reserves impacts the evaluation of underwriting results and profit sharing commissions. While we rely on our independent retail agents for distribution and customer support, underwriting and claims handling responsibilities are retained by us. As shown in the charts below, many of our agents have had direct relationships with our Insurance Subsidiaries for a number of years.

Seasonality

Our P&C insurance business is seasonal in nature. Our ability to generate written premium is also impacted by the timing of policy effective periods in the states in which we operate, while our net premiums earned generally follow a relatively smooth trend from quarter to quarter. Changes in the amount of quota share or other reinsurance that we may use will also impact net earned premiums period over period. Also, our gross premiums written are impacted by certain common renewal dates in larger metropolitan markets for the light commercial risks that represent our core lines of business. For example, January 1st and March 1st are common taxi cab renewal dates in Illinois and New York, respectively. Our New York “excess taxi program” has an annual renewal date in the third quarter. Net underwriting income is driven mainly by the timing and nature of claims, coupled with actuarial estimation of future claim liabilities, which can vary widely.

7

Competition

The insurance industry is competitive in all markets in which the Insurance Subsidiaries operate. Our Company strives to generate better than industry underwriting profit. While historic results have been challenging, we have implemented rate changes, analytics based underwriting and claim processes and shifted our business mix significantly. We believe these activities are important to produce more profitable business, especially in a changing environment.

Our Company competes on a number of factors, such as brand and distribution strength, pricing, agency relationships, policy support, claims service and market reputation. In our core commercial automobile lines, the primary offerings are policies at the minimum prescribed limits in each state, as established by statutory, municipal and other regulations. We believe our Company differentiates itself from many larger companies competing for this specialty business by exclusively focusing on these lines of insurance. We believe our exclusive focus results in the deployment of underwriting and claims professionals who are more familiar with issues common in specialty insurance businesses and provides our customers with better service. We leverage machine learning based predictive analytics and other technologies, such as telematics, to further differentiate ourselves from our competitors.

Our competitors generally fall into two categories. The first is made up of large generalist insurers who often sell their products to our niche through intermediaries, such as managing general agents or wholesalers. The second consists primarily of smaller local insurance companies. These smaller companies may focus primarily on one or more of our niche markets. Or, as is typical in the majority of geographic areas where we compete, they have a broader focus, often writing a significant amount of non-standard lines of business.

Regulation

We are subject to extensive regulation, particularly at the state level. The method, extent and substance of such regulation varies by state, but generally has its source in statutes and regulations that establish standards and requirements for conducting the business of insurance and that delegate regulatory authority to state insurance regulatory agencies. Insurance companies can also be subject to so-called “desk drawer rules” of state insurance regulators, which are regulatory rules or best practices that have not been codified or formally adopted through regulatory proceedings. In general, such regulation is intended for the protection of those who purchase or use insurance products issued by our Insurance Subsidiaries, not the holders of securities issued by us. These laws and regulations have a significant impact on our business and relate to a wide variety of matters including accounting methods, agent and company licensure, claims procedures, corporate governance, examinations, investing practices, policy forms, pricing, trade practices, reserve estimation and underwriting standards.

In recent years, the state insurance regulatory framework has come under increased federal scrutiny. Most recently, pursuant to the Dodd-Frank Regulatory Reform Act of 2010, the Federal Insurance Office was formed for the purpose of, among other things, examining and evaluating the effectiveness of the current insurance and reinsurance regulatory framework. In addition, state legislators and insurance regulators continue to examine the appropriate nature and scope of state insurance regulation.

Many state laws require insurers to file insurance policy forms and/or insurance premium rates and underwriting rules with state insurance regulators. In some states, such rates, forms and/or rules must be approved prior to use. While these requirements vary from state to state, generally speaking, regulators review premium rates to ensure they are not excessive, inadequate or unfairly discriminatory.

As a result, the speed with which an insurer can change prices in response to competition or increased costs depends, in part, on whether the premium rate laws and regulations (i) require prior approval of the premium rates to be charged, (ii) permit the insurer to file and use the forms, rates and rules immediately, subject to further review, or (iii) permit the insurer to immediately use the forms, rates and/or rules and to subsequently file them with the regulator. When state laws and regulations significantly restrict both underwriting and pricing, it can become more difficult for an insurer to make adjustments quickly in response to changes, which could affect profitability. Historical results and actuarial work related thereto are often required to support rate changes and may limit the magnitude of such changes in a given period.

Insurance companies are required to report their financial condition and results of operations in accordance with statutory accounting principles prescribed or permitted by state insurance laws and regulations and the National Association of Insurance Commissioners (“NAIC”). As a result, industry data is available that enables comparisons between insurance companies, including competitors who are not subject to the requirement to prepare financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). We frequently use industry publications containing statutory financial information to assess our competitive position. State insurance laws and regulations also prescribe the form and content of statutory financial statements, require the performance of periodic financial examinations of insurers, establish standards for the types and amounts of investments insurers may hold and require minimum capital and surplus levels. Additional requirements include risk-based capital (“RBC”) rules, thresholds intended to enable state insurance regulators to assess the level of risk inherent in an insurance company’s business and consider items such as asset risk, credit risk, underwriting risk and other business risks relevant to its

8

operations. The NAIC RBC formula generates the regulatory minimum amount of capital that a company is required to maintain to avoid regulatory action. There are four levels of action that a company can trigger under the formula: company action, regulatory action, authorized control and mandatory control levels. Each RBC level requires some particular action on the part of the regulator, the company, or both. For example, an insurer that breaches the Company Action Level must produce a plan to restore its RBC levels. As of December 31, 2018, the total adjusted capital of three of our Insurance Subsidiaries exceeded the minimum levels required under RBC requirements, while one subsidiary breached the Company Action Level. We are working with the appropriate regulators to address this RBC breach. We do not expect that this situation will impede our ability to execute on strategic plans.

It is difficult to predict what specific measures at the state or federal level will be adopted or what effect any such measures would have on us or our Insurance Subsidiaries. See “Risk Factors - Risks Related to 2019 Developments - Regulatory Developments” for certain developments with respect to the Insurance Subsidiaries subsequent to December 31, 2018.

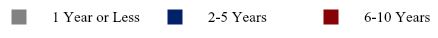

Employees

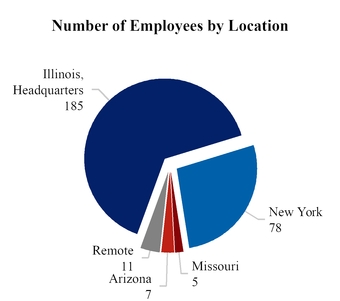

As of December 31, 2018, we had 286 full-time employees working within three main departments: Underwriting, Claims, and Corporate and Other. The Corporate and Other category includes executive, information technology, finance, facilities management and human resources. The Claims category includes in-house legal.

Available Information About Atlas

The address of our registered office is Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our operating headquarters are located at 953 American Lane, 3rd Floor, Schaumburg, Illinois 60173, USA. We maintain a website at http://www.atlas-fin.com. Information on our website or any other website does not constitute a part of this Annual Report on Form 10-K. Atlas files with the Securities and Exchange Commission (“SEC”) and makes available free of charge on its website the Annual Report on Form 10-K, Quarterly Reports on Form10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act (15 U.S.C. 78m(a) or 78o(d)) as soon as reasonably practicable after those reports are electronically filed with, or furnished to, the SEC. To access these filings, go to the Company website, using the “Investor Relations” heading. These reports are also available on the SEC’s website at http://www.sec.gov.

9

2019 Developments

As previously disclosed, since December 31, 2018, the Company was unable to timely file this Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and its Quarterly Reports on Form 10-Q for the periods ended March 31, June 30, and September 30, 2019 due to delays in the year end audit process. As a result, the Company received a number of delinquency notices from Nasdaq related to these filings as well as other matters. Nasdaq granted the Company’s request to move from the Nasdaq Global Market to the Nasdaq Capital Market and granted the Company an extension to regain compliance with its listing obligations. The Company’s ordinary shares continue to trade on the Nasdaq Capital Market, while the Company’s 6.625% Senior Unsecured Notes due 2022 moved to the OTC Pink Sheets on October 17, 2019. There can be no assurance that the Company will be able to regain compliance with Nasdaq listing requirements.

On April 29, 2019, RSM US, LLP ("RSM") was dismissed as the Corporation’s independent registered public accounting firm. At the time RSM was dismissed, the Corporation had not yet engaged a successor independent registered public accounting firm. On October 31, 2019, Baker Tilly Virchow Krause, LLP (“Baker Tilly”) was engaged as the Company’s independent registered public accounting firm to audit the Company’s financial statements commencing with the fiscal year ended December 31, 2018.

Throughout 2019, the Company has been exploring strategic alternatives, including, but not limited to, further strengthening its processes, reviewing its capital allocation and opportunities, a potential sale of the Company or certain assets, and balance sheet strengthening options with the goal of facilitating shareholder value generation. Atlas concluded that the utilization of its wholly owned MGA operation to work with strategic external insurance and reinsurance partners will enable the Company to leverage its focus, experience and infrastructure to create value for stakeholders. A definitive agreement was executed effective June 10, 2019 between Atlas and American Financial Group, Inc. (NYSE: AFG), under which Atlas will act as an underwriting manager for AFG’s National Interstate (“NATL”) subsidiary and transition new and renewal paratransit business to NATL paper for this book of business. The Company is working on additional arrangements with the objective of establishing MGA relationships in connection with the Company’s other lines of business as well. The Company agreed that should it choose to sell its MGA operations, 49% of the proceeds from any future sale of AGMI would be provided to the ASI Pool Companies to facilitate the rehabilitation process. There can be no assurance that any portion of the proceeds allocated to the ASI Pool Companies would be available for distribution to the Company.

During 2019, the Illinois Department of Insurance (the “Department”) placed all three of the ASI Pool Companies (after Gateway was redomesticated in Illinois) into rehabilitation with the Director of the Department as the statutory rehabilitator. While in rehabilitation, the operations of such insurance subsidiaries will be overseen by the statutory rehabilitator although Atlas continues to maintain its legal ownership of the stock of the ASI Pool Companies. Management’s overriding strategic plan continues to include a transition of business from these insurance companies to alternative markets within a reasonable period of time utilizing the existing platform of the MGA to work with strategic external insurance and reinsurance partners.

Effective August 15, 2019, no new business was written by the ASI Pool Companies, and only New York area new business was written by Global Liberty, which is focusing its resources on New York area business to leverage the subsidiary’s heritage in this large and specific market. The ASI Pool Companies and Global Liberty continued to write renewal business that met their underwriting standards during 2019. Non-renewals related to ASI Pool Companies’ insurance policies began towards the end of 2019.

On January 22, 2020, the Company announced a non-binding letter of intent with Buckle, a technology-driven financial services company, to purchase the stock of Atlas’ indirect subsidiary Gateway Insurance Company (“Gateway”) and its corporate charter and forty-seven (47) state insurance licenses as well as state statutory deposits, subject to regulatory and other necessary approvals, for $4.7 million plus the value of all purchased deposits, such amount to be paid to the Rehabilitator for the benefit of the rehabilitation estate of Gateway, with a tentative closing date in March of 2020. The Company anticipates that Buckle will engage the MGA and certain other subsidiaries of the Company to provide services to Buckle and that Buckle will lease space at the Company’s headquarters and its Melville, NY office.

The transaction will be subject to court approval and a bid process established by the Rehabilitator and approved by the court, and there can be no assurance that the transaction will be consummated on the terms described herein or at all.

The Company’s numerous Current Reports on Form 8-K and press releases since December 31, 2018 provide more detailed disclosures regarding the above events.

10

Item 1A. Risk Factors

You should read the following risk factors carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this Annual Report on Form 10-K. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operating results or financial condition in the future.

Risks Related to 2019 Developments

Continued delays in the filing of our periodic reports with the SEC could result in the delisting of our common stock, which would materially and adversely affect our stock price, financial condition and/or results of operations.

As a result of the need for additional time to complete our year-end audit process for the fiscal year ended December 31, 2018, we were unable to file this Annual Report on Form 10-K with the SEC on a timely basis. We also have yet to file our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019 and September 30, 2019, as we could not file such Quarterly Reports until this Annual Report on Form 10-K was filed. As a result, we remain non-compliant with Nasdaq Listing Rule 5250(c)(1) requiring the timely filing of periodic reports, which may result in the delisting of our common stock should we fail to file such reports within a time-frame acceptable to Nasdaq. In addition, the Company is not in compliance with Nasdaq Listing Rule 5450(a)(1), because the closing bid price of our common stock for the last 30 consecutive business days was below the minimum bid price of $1 per share, which may result in the delisting of our common stock should we fail to regain compliance by June 2, 2020 (the deadline set forth in the extension granted by Nasdaq). To regain compliance, the Company’s common stock must have a closing bid price of at least $1 per share for a minimum of ten consecutive business days during the compliance period, thus the Company may need to effect a reverse stock split to regain compliance. The Company is also not in compliance with Nasdaq Listing Rule 5620(a) as a result of the Company’s failure to hold an annual general meeting of shareholders during 2019.

It is the Company’s intent to hold an annual general meeting of shareholders in 2020 and to fully regain compliance with all applicable Nasdaq listing standards as soon as practicable, although there can be no assurance that it will be able to do so. Delisting would likely have a material adverse effect on us by, among other things, reducing:

• | The liquidity of our common stock; |

• | The market price of our common stock; |

• | The number of institutional and other investors that will consider investing in our common stock; |

• | The number of market makers in our common stock; |

• | The availability of information concerning the trading prices and volume of our common stock; |

• | The number of broker-dealers willing to execute trades in shares of our common stock; |

• | Our ability to access the public markets to raise debt or equity capital; |

• | Our ability to use our equity as consideration in any merger transaction; and |

• | The effectiveness of equity-based compensation plans for our employees used to attract and retain individuals important to our operations. |

Regulatory Developments

As previously disclosed, during 2019, the ASI Pool Companies were subject to an agreed order of rehabilitation with the Illinois insurance regulator following discussions of reserve levels, and the operations of the ASI Pool Companies are currently overseen by the statutory rehabilitator. In addition, no new business is being written by the ASI Pool Companies, certain of their state insurance licenses have been revoked, and other states have taken or may take action to suspend or terminate the licenses of the Insurance Companies. Therefore, the performance and financial results of the Company are more reliant on the results of AGMI. There are cost sharing and other arrangements in place between AGMI and the Insurance Subsidiaries related to support for the rehabilitation of the ASI Pool Companies, which are subject to regulatory approval and could be restricted in the future. In addition, the Company agreed that should it choose to sell its MGA operations, 49% of the proceeds from any future sale of AGMI would be provided to the ASI Pool Companies to facilitate the rehabilitation process. There can be no assurance that any portion of the proceeds allocated to the ASI Pool Companies would be available for distribution to the Company.

11

Reserve and Exposure Risks

The Insurance Subsidiaries’ provisions for unpaid claims and claims adjustment expenses may be inadequate, which would result in a reduction in our net income and might adversely affect our financial condition.

Our success depends upon our ability to accurately assess and price the risks covered by the insurance policies we write. We establish reserves to cover our estimated liability for the payment of claims and expenses related to the administration of claims incurred on the insurance policies we write. Establishing an appropriate level of reserves is an inherently uncertain process. Our provisions for unpaid claims and claims adjustment expenses do not represent an exact calculation of actual liability, but are estimates involving actuarial and statistical projections at a given point in time of what we expect to be the cost of the ultimate settlement and administration of known and unknown claims. The process for establishing the provision for unpaid claims and claims adjustment expenses reflects the uncertainties and significant judgmental factors inherent in estimating future results of both known and unknown claims, and as such, the process is inherently complex and imprecise. We utilize independent third party actuarial firms to assist us in estimating the provision for unpaid claims and claims adjustment expenses. These estimates are based upon various factors, including:

• | actuarial and statistical projections of the cost of settlement and administration of claims, reflecting facts and circumstances then known; |

• | historical claims information; |

• | assessments of currently available data; |

• | estimates of future trends in claims severity and frequency; |

• | judicial theories of liability; |

• | economic factors, such as inflation; |

• | estimates and assumptions regarding judicial and legislative trends, and actions such as class action lawsuits and judicial interpretation of coverages or policy exclusions; and |

• | the level of insurance fraud. |

Most or all of these factors are not directly quantifiable, particularly on a prospective basis, and the effects of these and unforeseen factors could negatively impact our ability to accurately assess the risks of the policies that we write. In addition, there may be significant reporting lags between the occurrence of the insured event and the time it is actually reported to the insurer and additional lags between the time of reporting and final settlement of claims. Unfavorable development in any of these factors could cause the level of reserves to be inadequate. The following factors may have a substantial impact on future claims incurred:

• | the amounts of claims payments; |

• | the expenses that the Insurance Subsidiaries incur in resolving claims; |

• | legislative and judicial developments; and |

• | changes in economic conditions, including inflation. |

As time passes and more information about the claims becomes known, the estimates are adjusted upward or downward to reflect this additional information. Because of the elements of uncertainty encompassed in this estimation process, and the extended time it can take to settle many of the more substantial claims, several years of experience may be required before a meaningful comparison can be made between actual claim costs and the original provision for unpaid claims and claims adjustment expenses. The development of the provision for unpaid claims and claims adjustment expenses is shown by the difference between estimates of claims liabilities as of the initial year end and the re-estimated liability at each subsequent year end. Favorable development (reserve redundancy) means that the original claims estimates were higher than subsequently determined or re-estimated. Unfavorable development (reserve deficiency) means that the original claims estimates were lower than subsequently determined or re-estimated.

Government regulators could require that we increase reserves if they determine that provisions for unpaid claims are understated. Increases to the provision for unpaid claims and claims adjustment expenses cause a reduction in our Insurance Subsidiaries’ surplus, which could cause a downgrading of our Insurance Subsidiaries’ ratings. Any such downgrade could, in turn, adversely affect their ability to sell insurance policies. See “Risk Factors - Risks Related to 2019 Developments - Regulatory Developments” for certain developments with respect to the Insurance Subsidiaries subsequent to December 31, 2018.

12

For the companies that we acquired or will acquire, the provisions for unpaid claims and claims adjustment expenses may be inadequate at the time of purchase, which would result in a reduction in our net income and might adversely affect our financial condition.

We cannot guarantee that the provisions for unpaid claims and claims adjustment expenses of the companies that we acquired are or will be adequate. We became or will become responsible for the historical claims reserves established by the acquired company’s management upon completion of acquisitions. While the stock purchase agreement provides for certain protections in this regard, there can be no assurances they will be sufficient to offset any adverse development to the acquired company’s historical claims reserves. Any unfavorable development in an acquired company’s claims reserves would reduce our net income and have an adverse effect on our financial position to the extent it exceeds the protections provided for in the stock purchase agreement related to each acquisition.

Our success depends on our ability to accurately price the risks we underwrite.

Our results of operations and financial condition depend on our ability to underwrite and set premium rates accurately for a wide variety of risks. Adequate rates are necessary to generate premiums sufficient to pay claims, claims adjustment expenses and underwriting expenses and to earn a profit. To price our products accurately, we must collect and properly analyze a substantial amount of data; develop, test and apply appropriate pricing techniques; closely monitor and timely recognize changes in trends; and project both severity and frequency of claims with reasonable accuracy. Our ability to undertake these efforts successfully, and as a result price our products accurately, is subject to a number of risks and uncertainties, some of which are outside our control, including:

• | the availability of sufficient reliable data and our ability to properly analyze available data; |

• | the uncertainties that inherently characterize estimates and assumptions; |

• | underlying trends or changes affecting risk and loss costs; |

• | our selection and application of appropriate pricing techniques; and |

• | changes in applicable legal liability standards and in the civil litigation system generally. |

Consequently, we could under price risks, which would adversely affect our profit margins, or we could overprice risks, which could reduce our sales volume and competitiveness. In either case, our profitability could be materially and adversely affected.

Our Insurance Subsidiaries rely on independent agents and other producers to bind insurance policies on and to collect premiums from our policyholders, which exposes us to risks that our producers fail to meet their obligations to us.

Our Insurance Subsidiaries market and distribute automobile insurance products through a network of independent agents and other producers in the U.S. The producers submit business through our wholly owned subsidiary AGMI. We rely, and will continue to rely, heavily on these producers to attract new business. Independent producers generally have the ability to bind insurance policies and collect premiums on our behalf, actions over which we have a limited ability to exercise preventative control. Although underwriting controls and audit procedures are in place with the objective of providing control over this process, such procedures may not be successful, and in the event that an independent agent exceeds their authority by binding us on a risk that does not comply with our underwriting guidelines, we may be at risk for that policy until we effect a cancellation. Any improper use of such authority may result in claims that could have a material adverse effect on our business, results of operations and financial condition. In addition, in accordance with industry practice, policyholders often pay the premiums for their policies to producers for payment to us. These premiums may be considered paid when received by the producer, and thereafter, the customer is no longer liable to us for those amounts, whether or not we have actually received these premium payments from the producer. Consequently, we assume a degree of risk associated with our reliance on independent agents in connection with the settlement of insurance premium balances.

13

Our Insurance Subsidiaries may be unable to mitigate their risk or increase their underwriting capacity through reinsurance arrangements, which could adversely affect our business, financial condition and results of operations. If reinsurance rates rise significantly or reinsurance becomes unavailable or reinsurers are unable to pay our claims, we may be adversely affected.

In order to reduce underwriting risk and increase underwriting capacity, our Insurance Subsidiaries transfer portions of our insurance risk to other insurers through reinsurance contracts. We generally purchase reinsurance from third parties in order to reduce our liability on individual risks. Reinsurance does not relieve us of our primary liability to our Insurance Subsidiaries’ insureds. During 2018, we had ceded premiums written of $86.4 million to our reinsurers. The availability, cost and structure of reinsurance protection are subject to prevailing market conditions that are outside of our control and which may affect our level of business and profitability. Our ability to provide insurance at competitive premium rates and coverage limits on a continuing basis depends in part upon the extent to which we can obtain adequate reinsurance in amounts and at rates that will not adversely affect our competitive position. There are no assurances that we will be able to maintain our current reinsurance facilities, which generally are subject to annual renewal. If we are unable to renew any of these facilities upon their expiration or to obtain other reinsurance facilities in adequate amounts and at favorable rates, we may need to modify our underwriting practices or reduce our underwriting commitments, which could adversely affect our results of operations.

Our Insurance Subsidiaries are subject to credit risk with respect to the obligations of reinsurers and certain of our insureds. The inability of our risk sharing partners to meet their obligations could adversely affect our profitability.

Although the reinsurers are liable to us to the extent of risk ceded to them, we remain ultimately liable to policyholders on all risks, even those reinsured. As a result, ceded reinsurance arrangements do not limit our ultimate obligations to policyholders to pay claims. We are subject to credit risks with respect to the financial strength of our reinsurers. We are also subject to the risk that their reinsurers may dispute their obligations to pay our claims. As a result, we may not recover sufficient amounts for claims that we submit to reinsurers, if at all. As of December 31, 2018, we had an aggregate of $81.2 million of reinsurance recoverables, of which $69.1 million were unsecured. In addition, our reinsurance agreements are subject to specified limits, and we would not have reinsurance coverage to the extent that those limits are exceeded.

With respect to insurance programs, the Insurance Subsidiaries are subject to credit risk with respect to the payment of claims and on the portion of risk exposure either ceded to captives established by their clients or deductibles retained by their clients. No assurance can be given regarding the future ability of these entities to meet their obligations. The inability of our risk sharing partners to meet their obligations could adversely affect our profitability.

The exclusions and limitations in our policies may not be enforceable.

Many of the policies we issue include exclusions or other conditions that define and limit coverage, which exclusions and conditions are designed to manage our exposure to certain types of risks and expanding theories of legal liability. In addition, many of our policies limit the period during which a policyholder may bring a claim under the policy, which period in many cases is shorter than the statutory period under which these claims can be brought by our policyholders. While these exclusions and limitations help us assess and control our claims exposure, it is possible that a court or regulatory authority could nullify or void an exclusion or limitation, or legislation could be enacted modifying or barring the use of these exclusions and limitations. This could result in higher than anticipated claims and claims adjustment expenses by extending coverage beyond our underwriting intent or increasing the number or size of claims, which could have a material adverse effect on our operating results. In some instances, these changes may not become apparent until some time after we have issued the insurance policies that are affected by the changes. As a result, the full extent of liability under our insurance contracts may not be known for many years after a policy is issued.

The occurrence of severe catastrophic events may have a material adverse effect on our financial results and financial condition.

Although our business strategy generally precludes us from writing significant amounts of catastrophe exposed business, most P&C insurance contains some exposure to catastrophic claims. We have only limited exposure to natural and man-made disasters, such as hurricane, typhoon, windstorm, flood, earthquake, acts of war, acts of terrorism and political instability. While we carefully manage our aggregate exposure to catastrophes, modeling errors and the incidence and severity of catastrophes, such as hurricanes, windstorms and large-scale terrorist attacks are inherently unpredictable, and our claims from catastrophes could be substantial. In addition, it is possible that we may experience an unusual frequency of smaller claims in a particular period. In either case, the consequences could have a substantially volatile effect on our financial condition or results of operations for any fiscal quarter or year, which could have a material adverse effect on our ability to write new business. These claims could deplete our shareholders’ equity. Increases in the values and geographic concentrations of insured property and the effects of inflation have resulted in increased severity of industry claims from catastrophic events in recent years, and we expect that those factors will increase the

14

severity of catastrophe claims in the future. It is also possible that catastrophic claims could have an impact on our investment portfolio.

The risk models we use to quantify catastrophe exposures and risk accumulations may prove inadequate in predicting all outcomes from potential catastrophe events.

We rely on widely accepted and industry-recognized catastrophe risk modeling, primarily in conjunction with our reinsurance partners, to help us quantify our aggregate exposure to any one event. As with any model of physical systems, particularly those with low frequencies of occurrence and potentially high severity of outcomes, the accuracy of the model’s predictions is largely dependent on the accuracy and quality of the data provided in the underwriting process and the judgments of our employees and other industry professionals. These models do not anticipate all potential perils or events that could result in a catastrophic loss to us. Furthermore, it is often difficult for models to anticipate and incorporate events that have not been experienced during or as a result of prior catastrophes. Accordingly, it is possible for us to be subject to events or contingencies that have not been anticipated by our catastrophe risk models and which could have a material adverse effect on our reserves and results of operations.

Financial Risks

We are a holding company dependent on the results of operations of our subsidiaries and their ability to pay dividends and other distributions to us.

Atlas is a holding company with no significant operations of its own and a legal entity separate and distinct from our Insurance Subsidiaries. As a result, our only sources of income are dividends and other distributions from our subsidiaries. We will be limited by the earnings of those subsidiaries, and the distribution or other payment of such earnings to them in the form of dividends, loans, advances or the reimbursement of expenses. The payment of dividends, the making of loans and advances or the reimbursement of expenses by our Insurance Subsidiaries is contingent upon the earnings of those subsidiaries and is subject to various business considerations and various statutory and regulatory restrictions imposed by the insurance laws of the domiciliary jurisdiction of such subsidiaries. In the states of domicile of our Insurance Subsidiaries, dividends may only be paid out of earned surplus and cannot be paid when the surplus of the company fails to meet minimum requirements or when payment of the dividend or distribution would reduce its surplus to less than the minimum amount. The state insurance regulator must be notified in advance of the payment of an extraordinary dividend and be given the opportunity to disapprove any such dividend. Prior to entering into any loan or certain other agreements between one or more of our Insurance Subsidiaries and Atlas or our other affiliates, advance notice must be provided to the state insurance regulator, and the insurance regulator has the opportunity to disapprove such loan or agreement. Additionally, insurance regulators have broad powers to prevent reduction of statutory capital and surplus to inadequate levels and could refuse to permit the payment of dividends calculated under any applicable formula. As a result, we may not be able to receive dividends or other distributions from our Insurance Subsidiaries at times and in amounts necessary to meet our operating needs, to pay dividends to shareholders or to pay corporate expenses. The inability of our Insurance Subsidiaries to pay dividends or make other distributions could have a material adverse effect on our business and financial condition. See “Risk Factors - Risks Related to 2019 Developments - Regulatory Developments” for certain developments with respect to the Insurance Subsidiaries subsequent to December 31, 2018.

Our Insurance Subsidiaries are subject to minimum capital and surplus requirements. Failure to meet these requirements may subject us to regulatory action.

Atlas’ Insurance Subsidiaries are subject to minimum capital and surplus requirements imposed under laws of the states in which the companies are domiciled as well as in the states where we conduct business. Any failure by one of our Insurance Subsidiaries to meet minimum capital and surplus requirements imposed by applicable state law may subject it to corrective action, which may include requiring adoption of a comprehensive financial plan, revocation of its license to sell insurance products or placing the subsidiary under state regulatory control. Any new minimum capital and surplus requirements adopted in the future may require us to increase the capital and surplus of our Insurance Subsidiaries, which we may not be able to do. See “Risk Factors - Risks Related to 2019 Developments - Regulatory Developments” for certain developments with respect to the Insurance Subsidiaries subsequent to December 31, 2018.

We are subject to assessments and other surcharges from state guaranty funds and mandatory state insurance facilities, which may reduce our profitability.

Virtually all states require insurers licensed to do business therein to bear a portion of contingent and incurred claims handling expenses and the unfunded amount of “covered” claims and unearned premium obligations of impaired or insolvent insurance companies, either up to the policy’s limit, the applicable guaranty fund covered claims obligation cap, or 100% of statutorily defined workers’ compensation benefits, subject to applicable deductibles. These obligations are funded by assessments, made on a retrospective, prospective or pre-funded basis, which are levied by guaranty associations within the state, up to prescribed limits (typically 2% of “net direct premiums written”), on all member insurers in the state on the basis of the proportionate share of the

15

premiums written by member insurers in certain covered lines of business in which the impaired, insolvent or failed insurer was engaged. Accordingly, the total amount of assessments levied on us by the states in which we are licensed to write insurance may increase as we increase our premiums written. In addition, as a condition to the ability to conduct business in certain states (and within the jurisdiction of some local governments), insurance companies are subject to or required to participate in various premium or claims based insurance-related assessments, including mandatory (a/k/a “involuntary”) insurance pools, underwriting associations, workers’ compensation second-injury funds, reinsurance funds and other state insurance facilities. Although we may be entitled to take premium tax credit (or offsets), recover policy surcharges or include assessments in future premium rate structures for payments we make under these facilities, the effect of these assessments and insurance-related arrangements, or changes in them, could reduce our profitability in any given period or limit our ability to grow our business.

Market fluctuations, changes in interest rates or a need to generate liquidity could have significant and negative effects on our investment portfolio. We may not be able to realize our investment objectives, which could significantly reduce our net income.

We depend on income from our securities portfolio for a portion of our earnings. Investment returns are an important part of our overall profitability. A significant decline in investment yields in the securities portfolio or an impairment of securities owned could have a material adverse effect on our business, results of operations and financial condition. We currently maintain and intend to continue to maintain a securities portfolio comprised primarily of investment grade fixed income securities. Despite the Company’s best efforts, we cannot predict which industry sectors or specific investments in which we maintain investments may suffer losses as a result of potential declines in commercial and economic activity. Accordingly, adverse fluctuations in the fixed income or equity markets could adversely impact profitability, financial condition or cash flows. If we are forced to sell portfolio securities that have unrealized losses for liquidity purposes rather than holding them to maturity or recovery, we would realize investment losses on those securities when that determination was made. We could also experience a loss of principal in fixed and non-fixed income investments. In addition, certain of our investments, including our investments in limited partnerships owning income producing properties, are illiquid and difficult to value.

Our ability to achieve our investment objectives is affected by general economic conditions that are beyond our control. General economic conditions can adversely affect the markets for interest rate sensitive securities, including liquidity in such markets, the level and volatility of interest rates and, consequently, the value of fixed maturity securities. Should the economy experience a recession in the future, we expect price volatility of our securities to increase.

Difficult conditions in the economy generally may materially and adversely affect our business, results of operations and statement of financial position, and these conditions may not improve in the near future.