UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: | COMMISSION FILE NUMBER: | |

December 31, 2013 | 000-54627 | |

ATLAS FINANCIAL HOLDINGS, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

CAYMAN ISLANDS | 27-5466079 | |

(State or other jurisdiction of | (I.R.S. Employer | |

incorporation or organization) | Identification No.) | |

150 NW POINT BOULEVARD | 60007 | |

Elk Grove Village, IL | (Zip Code) | |

(Address of principal executive offices) | ||

Registrant’s telephone number, including area code: (847) 472-6700

Securities registered pursuant to Section 12(b) of the Act:

TITLE OF EACH CLASS: | NAME OF EACH EXCHANGE ON WHICH REGISTERED: | |||

Common, $0.003 par value per share | Nasdaq Stock Market | |||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¬ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¬ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¬

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¬

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer ¬ Accelerated Filer ¬

Non-Accelerated Filer ¬ Smaller Reporting Company þ

(do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¬ No þ

There were 9,424,734 shares of the Registrant's common stock outstanding as of March 6, 2014, of which 9,291,871 are ordinary common shares and 132,863 are restricted shares. As of the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the Registrant's common equity held by non-affiliates of the Registrant was approximately $43.0 million (based upon the closing sale price of the Registrant’s common shares on June 28, 2013).

For purposes of the foregoing calculation only, which is required by Form 10-K, the Registrant has included in the shares owned by affiliates those shares owned by directors and officers of the Registrant, and such inclusion shall not be construed as an admission that any such person is an affiliate for any purpose.

* * *

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement for its 2014 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

1

ATLAS FINANCIAL HOLDINGS, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

December 31, 2013

Acquisition of Gateway Insurance Company | |||

2

PART I

Item 1. BUSINESS

Overview

Atlas Financial Holdings, Inc. ("Atlas" or "We" or "the Company") is a financial services holding company incorporated under the laws of the Cayman Islands. Our core business is the underwriting of commercial automobile insurance policies, focusing on the “light” commercial automobile sector, which is carried out through our insurance subsidiaries, American Country Insurance Company, or American Country, American Service Insurance Company, Inc., or American Service, and Gateway Insurance Company, or Gateway, which collectively we refer to as our “insurance subsidiaries”. This insurance sector includes taxi cabs, non-emergency para-transit, limousine, livery and business auto. Our goal is to be the preferred specialty commercial transportation insurer in any geographic areas where our value proposition delivers benefit to all stakeholders.

We were originally formed as JJR VI, a Canadian capital pool company, on December 21, 2009 under the laws of Ontario, Canada. On December 31, 2010, we completed a reverse merger wherein American Service and American Country, in exchange for the consideration set out below, were transferred to us by Kingsway America Inc. ("KAI"), a wholly owned subsidiary of Kingsway Financial Services Inc. ("KFSI") a Canadian public company whose shares are traded on the Toronto and New York Stock Exchanges. Prior to the transaction, each of American Service and American Country were wholly owned subsidiaries of KAI. American Country commenced operations in 1979. With roots dating back to 1925 selling insurance for taxi cabs, American Country is one of the oldest insurers of taxi and livery businesses in the United States. In 1983, American Service began as a non-standard personal and commercial auto insurer writing business in the Chicago, Illinois area.

In connection with the acquisition of American Service and American Country, we streamlined the operations of the insurance subsidiaries to focus on the “light” commercial automobile lines of business we believe will produce favorable underwriting results. During 2011 and 2012, we disposed of non-core assets and placed into run-off certain non-core lines of business previously written by the insurance subsidiaries. Since disposing of these non-core assets and lines of business, our sole focus has been the underwriting of specialty commercial insurance for users of "light" vehicles in the United States. On January 2, 2013, Atlas acquired its third insurance subsidiary, Gateway, as detailed further on the following pages.

The address of our registered office is Cricket Square, Hutchins Drive, PO Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our operating headquarters are located at 150 Northwest Point Boulevard, Elk Grove Village, Illinois 60007, USA. We maintain a website at http://www.atlas-fin.com. Information on our website or any other website does not constitute a part of this annual report on Form 10-K.

On December 31, 2010, following the reverse merger transaction described immediately hereafter, we filed a Certificate of Registration by Way of Continuation in the Cayman Islands to re-domesticate as a Cayman Islands company. In addition, on December 30, 2010 we filed a Certificate of Incorporation on Change of Name to change our name to Atlas Financial Holdings, Inc. Our current organization is a result of a reverse merger transaction involving the following companies:

(a) | JJR VI, sponsored by JJR Capital, a Toronto based merchant bank; |

(b) | American Insurance Acquisition Inc., or American Acquisition, a corporation formed under the laws of Delaware as a wholly owned subsidiary of KAI; and |

(c) | Atlas Acquisition Corp., a Delaware corporation wholly-owned by JJR VI and formed for the purpose of merging with and into American Acquisition. |

Prior to the transaction, each of American Service and American Country were wholly owned subsidiaries of KAI. In connection with the reverse merger transaction, KAI transferred 100% of the capital stock of each of American Service and American Country to American Acquisition (another wholly owed subsidiary of KAI) in exchange for C$35.1 million of common and $18.0 million of preferred shares of American Acquisition and promissory notes worth C$7.7 million, aggregating C$60.8 million. In addition, American Acquisition raised C$8.0 million through a private placement offering of subscription receipts to qualified investors in both the United States and Canada at a price of C$6.00 per subscription receipt.

KAI received 4,601,621 restricted voting common shares of our company, which we refer to as “restricted voting shares”, then valued at $27.8 million, along with 18,000,000 non-voting preferred shares of our company, then valued at $18.0 million, and C$8.0 million cash for total consideration of C$60.8 million in exchange for 100% of the outstanding shares of American Acquisition and full payment of certain promissory notes. Investors in the American Acquisition private placement offering of subscription

3

receipts received 1,327,834 of our ordinary shares, which we refer to as “ordinary shares”, plus warrants to purchase one ordinary share of our company for each subscription receipt at C$6.00 at any time until December 31, 2013. Every 10 common shares of JJR VI held by the shareholders of JJR VI immediately prior to the reverse merger were, upon consummation of the merger, consolidated into one ordinary share of JJR VI. Upon re-domestication in the Cayman Islands, these consolidated shares were then exchanged on a one-for-one basis for our ordinary shares.

On December 7, 2012, a shareholder meeting was held where a one-for-three reverse stock split was unanimously approved. When the reverse stock split took effect on January 29, 2013, it decreased the authorized and outstanding ordinary shares and restricted voting shares at a ratio of one-for-three. The primary objective of the reverse stock split was to increase the per share price of Atlas' ordinary shares to meet certain listing requirements of the NASDAQ Capital Market. Unless otherwise noted, all historical share and per share values in this Annual Report on Form 10-K reflect the one-for-three reverse stock split.

On February 11, 2013, an aggregate of 4,125,000 Atlas ordinary shares were offered in Atlas' initial public offering in the United States. 1,500,000 ordinary shares were offered by Atlas and 2,625,000 ordinary shares were sold by KAI at a price of $5.85 per share. Atlas also granted the underwriters an option to purchase up to an aggregate of 618,750 additional shares at the public offering price of $5.85 per share to cover over-allotments, if any. On March 11, 2013, the underwriters exercised this option and purchased an additional 451,500 shares. After underwriting and other expenses, total proceeds of $9.8 million were realized on the issuance of the shares. Since that time, Atlas' shares have traded on the NASDAQ under the symbol "AFH."

On June 5, 2013, Atlas delisted from the Toronto Stock Exchange.

The principal purposes of the initial offering in the United States were to create a public market in the United States for Atlas' ordinary shares and thereby enable future access to the public equity markets in the United States by Atlas and its shareholders, and to obtain additional capital. The net proceeds from the offering were used to repurchase preferred shares, which accrued dividends on a cumulative basis at a rate of $0.045 per share per year (4.5%) and were convertible into 2,286,000 common shares at the option of the holder after December 31, 2015. As originally announced on August 1, 2013, Atlas redeemed $18 million of outstanding preferred shares for $16.2 million.

Substantially all of our new premiums written are in “light” commercial automobile lines of business. In the year ended December 31, 2013, gross premium written from commercial automobile was $88.6 million, representing a 75.2% increase relative to the year ended December 31, 2012. As a percentage of the insurance subsidiaries’ overall book of business, commercial auto gross premium written represented 95.2% of gross premium written in the year ended December 31, 2013 compared to 91.8% during the year ended December 31, 2012.

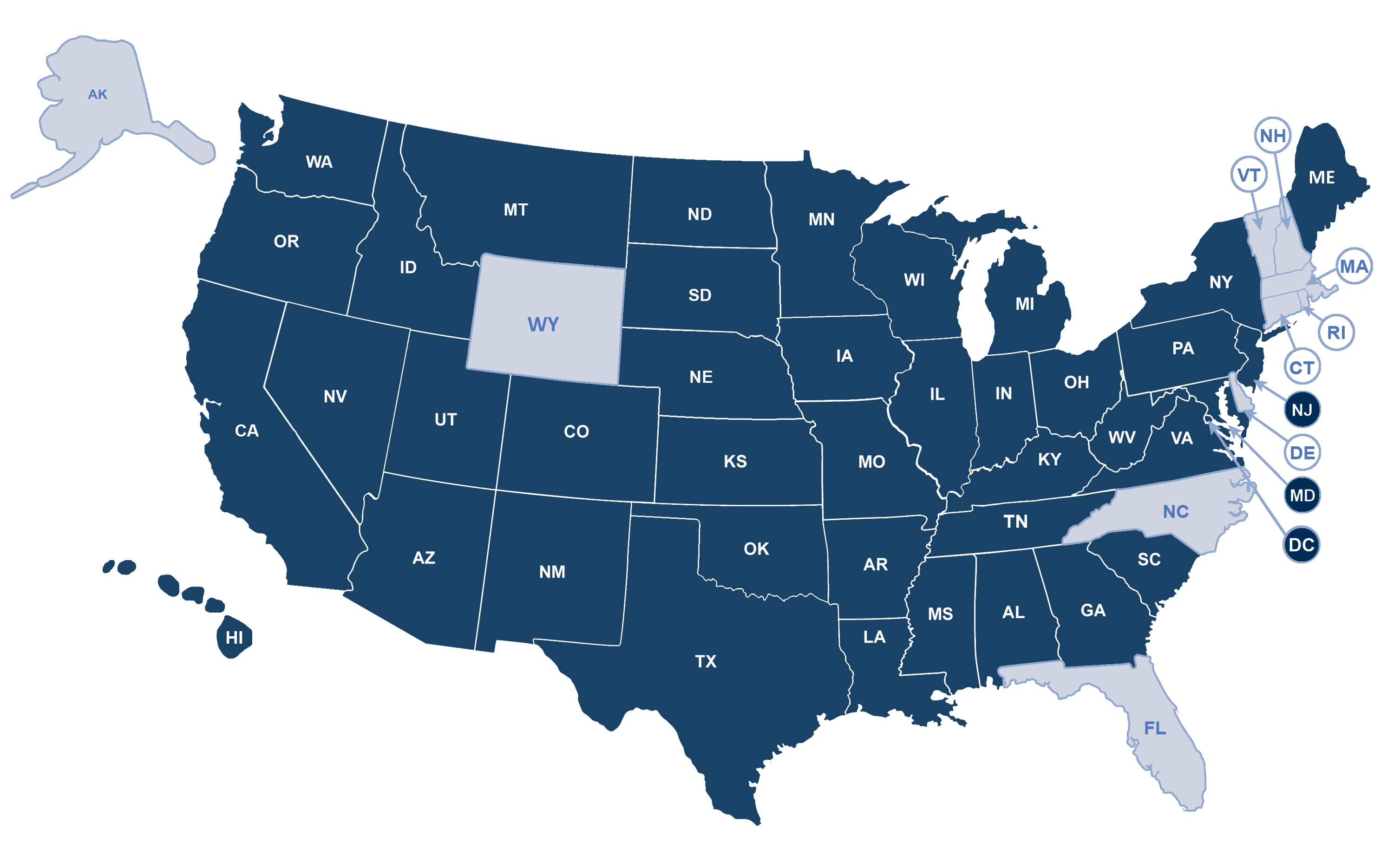

We are committed to the “light” commercial automobile and related lines of business. With the completion of the acquisition of Gateway, we increased the footprint of our current market focus to 40 states and the District of Columbia through the addition of California, Hawaii, Montana, Nebraska, North Dakota, South Dakota, Washington and West Virginia. Together, our insurance subsidiaries are licensed to write property and casualty, or P&C, insurance in 49 states plus the District of Columbia in the United States. Collectively, our insurance subsidiaries actively wrote commercial automobile insurance in more states during 2013 than in any prior year.

Market

Our core business is the underwriting of commercial automobile insurance policies, focusing on the “light” commercial automobile sector. The “light” commercial automobile policies we underwrite provide coverage for light weight commercial vehicles typically with the minimum limits prescribed by statute, municipal or other regulatory requirements. The majority of our policyholders are individual owners or small fleet operators.

The “light” commercial automobile sector is a subset of the historically profitable commercial automobile insurance industry segment. Commercial automobile insurance has outperformed the overall P&C industry in each of the past ten years based on data compiled by A.M. Best. Data published by A.M. Best estimates the total market for commercial automobile liability insurance to be approximately $24 billion. The size of the commercial automobile insurance market can be affected significantly by many factors, such as the underwriting capacity and underwriting criteria of automobile insurance carriers and general economic conditions. Historically, the commercial automobile insurance market has been characterized by periods of excess capacity and price competition followed by periods of reduced underwriting capacity and higher premium rates.

We believe that there is a positive correlation between the economy and commercial automobile insurance in general. However, operators of “light” commercial automobiles may be less likely than other business segments within the commercial automobile insurance market to take vehicles out of service as their businesses and business reputations rely heavily on availability. With

4

respect to certain business lines such as the taxi line, there are also other factors such as the cost and limited supply of medallions which may discourage a policyholder from taking vehicles out of service in the face of reduced demand for the use of the vehicle.

Acquisition of Gateway Insurance Company

On January 2, 2013 we acquired Camelot Services, Inc., or Camelot Services, a privately owned insurance holding company, and its sole subsidiary, Gateway, from Hendricks Holding Company, Inc., or Hendricks, an unaffiliated third party. This transaction was contractually deemed effective as of January 1, 2013. Gateway provides specialized commercial insurance products, including commercial automobile insurance to niche markets such as taxi, black car and sedan service owners and operators.

Gateway is a St. Louis, Missouri-based insurance company that was writing approximately $10.0 million of annual taxi and limousine net written premium in states deemed as favorable by Atlas at the time of our acquisition. Gateway is an admitted carrier in 46 states plus the District of Columbia. Atlas' acquisition of Gateway expanded our distribution channel for core commercial automobile lines to a total of 40 states and the District of Columbia, including California, Hawaii, Montana, Nebraska, North Dakota, South Dakota, Washington and West Virginia.

Under the terms of the stock purchase agreement, the purchase price equaled the adjusted book value of Camelot Services at December 31, 2012, subject to certain pre and post-closing adjustments, including, among others, claim development between the signing of the stock purchase agreement and December 31, 2012. Additional consideration, principally in the form of preferred shares, may be paid to the seller, or returned to us by the seller, depending upon, among other things, the future development of Gateway’s actual loss reserves for certain lines of business and the utilization of certain deferred tax assets over time. Gateway also wrote contractor's workers’ compensation insurance, which we ceased writing as part of the transaction. An indemnity reinsurance agreement was entered into pursuant to which 100% of Gateway’s workers’ compensation business was ceded to a third party captive reinsurer funded by the seller as part of the transaction.

The total purchase price for all of Camelot Services’ outstanding shares was $14.3 million, consisting of a combination of cash and Atlas preferred shares. Consideration consisted of a $6.0 million dividend paid by Gateway immediately prior to the closing, $2.0 million of Atlas preferred shares (consisting of a total of 2 million preferred shares) and $6.3 million in cash. We have contractual protections to offset up to $2.0 million of future adverse reserve development. We have also agreed to provide the sellers up to $2.0 million in additional consideration in the event of favorable reserve development.

Competitive Strengths

Our value proposition is driven by our competitive strengths, which include the following:

Focus on niche commercial insurance business. We target niche markets that support adequate pricing and believe we are able to adapt to changing market needs ahead of our competitors through our strategic commitment and operating scale. We develop and deliver superior specialty commercial automobile insurance products priced to meet our customers’ needs and strive to generate consistent underwriting profit for our insurance subsidiaries. We have experienced a favorable trend in loss ratios in 2013 attributable to the increased composition of commercial automobile written premium as a percentage of our insurance subsidiaries' total written premium coupled with our ability to increase pricing.

There are a limited number of competitors specializing in these lines of business. Management believes a strong value proposition is very important to attract new business and can result in desirable retention levels as policies renew on an annual basis. There are also a relatively limited number of agents who specialize in these lines of business. As a result, strategic agent relationships are important to ensure efficient distribution.

Strong market presence with recognized brands and long-standing distribution relationships. American Country, American Service and Gateway have a long heritage as insurers of taxi, livery and para-transit businesses. All of our insurance subsidiaries have strong brand recognition and long-standing distribution relationships in target markets. Through regular interaction with our retail producers, we strive to thoroughly understand each of the markets we serve in order to deliver strategically priced products to attractive markets at the right time. Our insurance subsidiaries are currently licensed in more states than those in which we have currently elected to do business and we routinely re-evaluate other markets to assess future potential opportunities.

Sophisticated underwriting and claims handling expertise. Atlas has extensive experience and expertise with respect to underwriting and claims management in our specialty area of insurance. Our well-developed underwriting and claims infrastructure includes an extensive data repository, proprietary technologies, deep market knowledge and established market relationships. Analysis of the substantial data available through our operating companies drives our product and pricing decisions. We believe our underwriting and claims handling expertise provides enhanced risk selection, high quality service to our customers and greater control over

5

claims expenses. We are committed to maintaining this underwriting and claims handling expertise as a core competency as our volume of business increases.

Scalable operations positioned for growth. Significant progress has also been made in aligning our cost base to our expected revenue going forward. The core functions of our insurance subsidiaries were integrated into a common operating platform. We believe that our insurance subsidiaries are well-positioned to begin returning to the volume of premium they wrote in the recent past with better than industry level profitability from the efficient operating infrastructure established subsequent to Atlas' acquisition of the companies.

Experienced management team. We have a talented and experienced management team who have decades of experience in the property and casualty insurance industry. Our senior management team has worked in the property and casualty industry for an average of 23 years and with the insurance subsidiaries, directly or indirectly, for an average of 12 years.

Strategic Focus

Vision

Our goal is to be the preferred specialty commercial transportation insurer in any geographic area where our value proposition delivers benefit to all stakeholders.

Mission

We develop and deliver superior specialty insurance products priced to meet our customers’ needs and generate consistent underwriting profit for our insurance subsidiaries. These products are distributed to the insured through independent retail agents utilizing our company’s operating platform.

We seek to achieve our vision and mission through the design, sophisticated pricing and efficient delivery of specialty transportation insurance products. Through constant interaction with our retail producers, we strive to thoroughly understand each of the markets we serve in order to deliver strategically priced products to attractive markets at the right time. Analysis of the substantial data available through our operating companies drives our product and pricing decisions. We focus on our key strengths and seek to expand our geographic footprint and products only to the extent these activities support our vision and mission. We target niche markets that support adequate pricing and believe we are able to adapt to changing market needs ahead of our competitors through our strategic commitment and increasing scale.

Outlook

Over the past three years, through infrastructure re-organization, dispositions and by placing certain lines of business into run-off, the insurance subsidiaries have streamlined operations to focus on the lines of business we believe will produce favorable underwriting results. Significant progress has also been made in aligning the cost base to our expected revenue stream going forward. The core functions of the insurance subsidiaries were integrated into a common, best practice based, operating platform. Management believes that our insurance subsidiaries are well-positioned to return to the volume of premium they wrote in the recent past with better than industry level profitability. Our insurance subsidiaries have a long heritage with respect to their continuing lines of business and will benefit from the efficient operating infrastructure currently in place. Through its insurance subsidiaries, Atlas actively wrote business in 40 states and the District of Columbia during 2013, representing more states than in any prior year, utilizing our well developed underwriting and claim methodology.

We believe that the most significant opportunities going forward are: (i) continued re-energizing of distribution channels with the objective of recapturing business generated prior to 2009, (ii) building business in previously untapped geographic markets to the extent that they meet our specific criteria where our insurance subsidiaries are licensed, but not recently active, and (iii) opportunistically acquiring books of business or similar insurance companies, provided market conditions support this activity. Primary potential risks related to these activities include: (i) insurance market conditions becoming or remaining “soft” for a sustained period of time, (ii) not being able to achieve the expected support from distribution partners, and (iii) the insurance subsidiaries not successfully maintaining their recently improved ratings from A.M. Best.

We seek to deploy our capital to maximize the return for our shareholders, either by investing in growing our operations or by pursuing other capital initiatives, depending upon insurance and capital market conditions. We focus on our key strengths and seek to expand our geographic footprint and products only to the extent these activities support our vision and mission. We will identify and prioritize market expansion opportunities based on the comparative strength of our value proposition relative to competitors, the market opportunity and the legal and regulatory environment.

6

We intend to continue to grow profitably by undertaking the following:

Re-establish legacy distribution relationships. We continue to build upon relationships with independent agents that have been our insurance subsidiaries’ distribution partners in the past. We seek to develop and maintain strategic distribution relationships with a relatively small number of independent agents with substantial market presence in each state in which we currently operate. We expect to continue to increase the distribution of our core products in the states where we are actively writing insurance and re-capture insurance premium historically written by the insurance subsidiaries.

Expand our market presence. We are committed to continuing to diversify by leveraging our experience, historical data and market research to expand our business in previously untapped markets to the extent incremental markets meet our criteria. Utilizing our established brands and market relationships, we have made significant inroads in new states where we had no active business in recent years. We will continue to expand into additional states or product lines where we are licensed, but not currently active, to the extent that our market expansion criteria is met in a given state.

Acquire complementary books of business and insurance companies. We plan to opportunistically pursue acquisitions of complementary books of business and insurance companies provided market conditions support this activity. We will evaluate each acquisition opportunity based on its expected economic contribution to our results and support of our market expansion initiatives. Our recent acquisition of Gateway is consistent with this aspect of our strategy.

Geographic Markets

Currently, we distribute insurance only in the United States. Through our insurance subsidiaries, we are licensed to write P&C insurance in 49 states plus the District of Columbia in the United States. The following table reflects, in percentages, the principal geographic distribution of gross premiums written for the year ended December 31, 2013. No other jurisdiction accounted for more than 5%.

Distribution of Gross Premium Written by Jurisdiction | |

New York | 22.1% |

Illinois | 12.1% |

Michigan | 9.0% |

Texas | 8.1% |

Louisiana | 5.9% |

Minnesota | 5.0% |

The diagram below outlines the states where we are focused on actively writing new insurance policies and where we believe the comparative strength of our value proposition, the market opportunity, and the legal and regulatory environment are favorable (states darkened in the below diagram). With the completion of the acquisition of Gateway, we increased the footprint of our current market focus to 40 states and the District of Columbia through the addition of California, Hawaii, Montana, Nebraska, North Dakota, South Dakota, Washington and West Virginia. The diagram below also reflects the 2013 addition of Maine to the states where we are actively writing new insurance policies.

Gateway historically issued commercial automobile insurance policies in the state of Florida. We do not plan to actively write insurance for new policyholders in Florida through our insurance subsidiaries and followed the required regulatory procedures to withdraw from that state in 2013.

7

Agency Relationships

Independent agents are recruited by us directly and through marketing efforts targeting the specialty niche upon which we focus. Interested agents are evaluated based on their experience, expertise and ethical dealing. Typically, our company enters into distribution relationships with one out of every ten agents seeking an agency contract. We are generally interested in acting as one of a relatively small number of insurance partners with whom our independent agents place business and are also careful not to oversaturate the distribution channel in any given geographic market. This helps to ensure that we are able to receive the maximum number of submissions for underwriting evaluation without unnecessary downstream pressure from agents to write business that does not fit our underwriting model. Agents receive commission as a percentage of premiums (generally 10% to 12.5%) as their primary compensation from us. Larger agents may also be eligible for profit sharing based on the growth and underwriting profitability related to their book of business with us. The quality of business presented and written by each independent agent is evaluated regularly by our underwriters and is also reviewed quarterly by senior management. Key metrics for evaluation include overall accuracy and adequacy of underwriting information, performance relative to agreed commitments, support with respect to claims presented by their customers (as applicable) and overall underwriting profitability of the agent’s book of business. While we rely on our independent agents for distribution and customer support, underwriting and claim handling responsibilities are retained by us. Many of our agents have had direct relationships with our insurance subsidiaries for a number of years. Gateway also historically distributed its taxi and limousine products through independent agents. Their distribution channel and independent agent relationships were complementary to ours at the time of acquisition and were reviewed and integrated into Atlas' overall distribution channel in 2013.

Seasonality

Our P&C insurance business is seasonal in nature. Our ability to generate written premium is also impacted by the timing of policy effective periods in the states in which we operate while our net premiums earned generally follow a relatively smooth trend from quarter to quarter. Also, our gross premiums written are impacted by certain common renewal dates in larger metropolitan markets for the light commercial risks that represent our core lines of business. For example, January 1st and March 1st are common taxi cab renewal dates in Illinois and New York, respectively. Additionally, we implemented our New York “excess taxi program” in the third quarter of 2012, which had a renewal date in the third quarter 2013. Net underwriting income is driven mainly by the timing and nature of claims, which can vary widely.

8

Competition

The insurance industry is price competitive in all markets in which the insurance subsidiaries operate. Our company strives to employ disciplined underwriting practices with the objective of rejecting under priced risks. A recent survey by A.M Best estimates the total market for commercial automobile liability insurance to be approximately $24 billion. We believe our company requires only 1% share of this market to achieve our business plan. We believe our current market share of the overall commercial auto universe in the U.S. as of December 31, 2013 is approximately 0.3%.

Our company competes on a number of factors such as distribution strength, pricing, agency relationships, policy support, claim service, and market reputation. In our core commercial automobile lines, the primary offerings are policies at the minimum prescribed limits in each state, as established by statutory, municipal and other regulations. We believe our company differentiates itself from many larger companies competing for this specialty business by exclusively focusing on these lines of insurance. We believe our exclusive focus results in the deployment of underwriting and claims professionals who are more familiar with issues common in specialty commercial automobile lines, and provides the customer better service.

Our competitors generally fall into two categories. The first is made up of large generalist insurers who often sell their products to our niche through intermediaries such as managing general agents or wholesalers. The second consists primarily of smaller local insurance companies. These smaller companies may focus primarily on one or more of our niche markets. Or, as is typical in the majority of geographic areas where we compete, they have a broader focus, often writing a significant amount of non-standard lines of business.

To compete successfully in the specialty commercial insurance industry, we rely on our ability to: identify markets that are most likely to produce an underwriting profit; operate with a disciplined underwriting approach; offer diversified products and geographic platforms; practice prudent claims management; reserve appropriately for unpaid claims; strive for cost containment through economies of scale where deemed appropriate; and, provide services and competitive commissions to our independent agents.

Regulation

We are subject to extensive regulation, particularly at the state level. The method, extent and substance of such regulation varies by state, but generally has its source in statutes and regulations which establish standards and requirements for conducting the business of insurance and that delegate regulatory authority to state insurance regulatory agencies. Insurance companies can also be subject to so-called “desk drawer rules” of state insurance regulators, which are regulatory rules or best practices that have not been codified or formally adopted through regulatory proceedings. In general, such regulation is intended for the protection of those who purchase or use insurance products issued by our insurance subsidiaries, not the holders of securities issued by us. These laws and regulations have a significant impact on our business and relate to a wide variety of matters including accounting methods, agent and company licensure, claims procedures, corporate governance, examinations, investing practices, policy forms, pricing, trade practices, reserve adequacy and underwriting standards.

In recent years, the state insurance regulatory framework has come under increased federal scrutiny. Most recently, pursuant to the Dodd-Frank Regulatory Reform Act of 2010, the Federal Insurance Office was formed for the purpose of, among other things, examining and evaluating the effectiveness of the current insurance and reinsurance regulatory framework. In addition, state legislators and insurance regulators continue to examine the appropriate nature and scope of state insurance regulation.

Many state laws require insurers to file insurance policy forms and/or insurance premium rates and underwriting rules with state insurance regulators. In some states, such rates, forms and/or rules must be approved prior to use. While these requirements vary from state to state, generally speaking, regulators review premium rates to ensure they are not excessive, inadequate or unfairly discriminatory.

As a result, the speed with which an insurer can change prices in response to competition or increased costs depends, in part, on whether the premium rate laws and regulations (i) require prior approval of the premium rates to be charged, (ii) permit the insurer to file and use the forms, rates and rules immediately, subject to further review, or (iii) permit the insurer to immediately use the forms, rates and/or rules and to subsequently file them with the regulator. When state laws and regulations significantly restrict both underwriting and pricing, it can become more difficult for an insurer to make adjustments quickly in response to changes which could affect profitability.

Insurance companies are required to report their financial condition and results of operations in accordance with statutory accounting principles prescribed or permitted by state insurance laws and regulations and the National Association of Insurance Commissioners

9

(the “NAIC”). As a result, industry data is available that enables comparisons between insurance companies, including competitors who are not subject to the requirement to prepare financial statements in conformity with U.S. GAAP. We frequently use industry publications containing statutory financial information to assess our competitive position. State insurance laws and regulations also prescribe the form and content of statutory financial statements, require the performance of periodic financial examinations of insurers, establish standards for the types and amounts of investments insurers may hold and require minimum capital and surplus levels. Additional requirements include risk-based capital (“RBC”) rules, thresholds intended to enable state insurance regulators to assess the level of risk inherent in an insurance company’s business and consider items such as asset risk, credit risk, underwriting risk and other business risks relevant to its operations. In accordance with RBC formulas, a company’s RBC requirements are calculated and compared to its total adjusted capital to determine whether regulatory intervention is warranted. At December 31, 2013, the total adjusted capital of each of our insurance subsidiaries exceeded the minimum levels required under RBC requirements.

It is difficult to predict what specific measures at the state or federal level will be adopted or what effect any such measures would have on us or our insurance subsidiaries.

Employees

As of December 31, 2013, we had 98 full-time employees, 78 of whom work at the corporate offices in Elk Grove Village, Illinois, 12 of whom work in St. Louis, 5 of whom work in New York and 3 of whom work remotely.

Item 1A. RISK FACTORS

You should read the following risk factors carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this Annual Report on Form 10-K. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known or that are not currently believed to be significant that may adversely affect our business, operating results or financial condition in the future.

The insurance subsidiaries’ provisions for unpaid claims may be inadequate, which would result in a reduction in our net income and might adversely affect our financial condition.

Our success depends upon our ability to accurately assess and price the risks covered by the insurance policies that we write. We establish reserves to cover our estimated liability for the payment of losses and expenses related to the administration of claims incurred on the insurance policies we write. Establishing an appropriate level of reserves is an inherently uncertain process. Our provisions for unpaid claims do not represent an exact calculation of actual liability, but are estimates involving actuarial and statistical projections at a given point in time of what we expect to be the cost of the ultimate settlement and administration of known and unknown claims. The process for establishing the provision for unpaid claims reflects the uncertainties and significant judgmental factors inherent in estimating future results of both known and unknown claims and as such, the process is inherently complex and imprecise. We utilize a third party actuarial firm to assist us in estimating the provision for unpaid claims. These estimates are based upon various factors, including:

• | actuarial and statistical projections of the cost of settlement and administration of claims reflecting facts and circumstances then known; |

• | historical claims information; |

• | assessments of currently available data; |

• | estimates of future trends in claims severity and frequency; |

• | judicial theories of liability; |

• | economic factors such as inflation; |

• | estimates and assumptions regarding judicial and legislative trends, and actions such as class action lawsuits and judicial interpretation of coverages or policy exclusions; and |

• | the level of insurance fraud. |

Most or all of these factors are not directly quantifiable, particularly on a prospective basis, and the effects of these and unforeseen factors could negatively impact our ability to accurately assess the risks of the policies that we write. In addition, there may be significant reporting lags between the occurrence of the insured event and the time it is actually reported to the insurer and additional lags between the time of reporting and final settlement of claims. Unfavorable development in any of these factors could cause the level of reserves to be inadequate. The following factors may have a substantial impact on future claims incurred:

10

• | the amounts of claims payments; |

• | the expenses that the insurance subsidiaries incur in resolving claims; |

• | legislative and judicial developments; and |

• | changes in economic conditions, including inflation. |

As time passes and more information about the claims becomes known, the estimates are adjusted upward or downward to reflect this additional information. Because of the elements of uncertainty encompassed in this estimation process, and the extended time it can take to settle many of the more substantial claims, several years of experience may be required before a meaningful comparison can be made between actual losses and the original provision for unpaid claims. The development of the provision for unpaid claims is shown by the difference between estimates of claims as of the initial year end and the re-estimated liability at each subsequent year end. Favorable development (reserve redundancy) means that the original claims estimates were higher than subsequently determined or re-estimated. Unfavorable development (reserve deficiency) means that the original claims estimates were lower than subsequently determined or re-estimated.

For example, in 2010, a detailed review of claim payment and reserving practices was performed, which led to significant changes in both practices, increasing ultimate loss estimates and accelerating claim payments. We recorded a total of $5.3 million in unfavorable reserve development in 2010 related to claims incurred during prior periods. Our review continued into 2011 and Atlas recorded a $1.8 million adjustment to further strengthen its reserves for claims related to policies issued while the insurance subsidiaries were under previous ownership in years preceding 2010. Although we have not recorded any further adverse development since that time, we cannot guarantee that we will not have additional unfavorable reserve developments in the future. In addition, we may in the future acquire other insurance companies. We cannot guarantee that the provisions for unpaid claims of the companies that we acquire are or will be adequate. Government regulators could require that we increase reserves if they determine that provisions for unpaid claims are understated. Increases to the provision for unpaid claims cause a reduction in our insurance subsidiaries’ surplus which could cause a downgrading of our insurance subsidiaries’ ratings. Any such downgrade could, in turn, adversely affect their ability to sell insurance policies.

In recent periods, Gateway has recorded material reserve deficiencies, and its reserves may be inadequate to pay claims, which could result in a reduction of our net income and might adversely affect our financial position.

We became responsible for the historical loss reserves established by Gateway’s management upon completion of the Gateway acquisition. While the stock purchase agreement provides for certain protections in this regard, there can be no assurances they will be sufficient to offset any further adverse development to Gateway’s historical loss reserves. Gateway recognized approximately $7.4 million in reserve strengthening in the third and fourth quarters of 2012. During the years ended 2011 and 2010, their provision for losses and loss adjustment expenses net of reinsurance recoveries increased by approximately $1.7 million and $2.4 million, respectively, as a result of changes in estimated losses incurred with respect to insured events in prior years. Any such further unfavorable development in Gateway’s reserves would reduce our net income and have an adverse effect on our financial position to the extent it exceeds the protections provided for in the stock purchase agreement related to the Gateway acquisition.

Our success depends on our ability to accurately price the risks we underwrite.

Our results of operations and financial condition depend on our ability to underwrite and set premium rates accurately for a wide variety of risks. Adequate rates are necessary to generate premiums sufficient to pay losses, loss settlement expenses and underwriting expenses and to earn a profit. To price our products accurately, we must collect and properly analyze a substantial amount of data; develop, test and apply appropriate pricing techniques; closely monitor and timely recognize changes in trends; and project both severity and frequency of losses with reasonable accuracy. Our ability to undertake these efforts successfully, and as a result price our products accurately, is subject to a number of risks and uncertainties, some of which are outside our control, including:

• | the availability of sufficient reliable data and our ability to properly analyze available data; |

• | the uncertainties that inherently characterize estimates and assumptions; |

• | underlying trends or changes affecting risk and loss costs; |

• | our selection and application of appropriate pricing techniques; and |

• | changes in applicable legal liability standards and in the civil litigation system generally. |

Consequently, we could under price risks, which would adversely affect our profit margins, or we could over price risks, which could reduce our sales volume and competitiveness. In either case, our profitability could be materially and adversely affected.

Our insurance subsidiaries rely on independent agents and other producers to bind insurance policies on and to collect premiums from our policyholders, which exposes us to risks that our producers fail to meet their obligations to us.

11

Our insurance subsidiaries market and distribute automobile insurance products through a network of independent agents and other producers in the United States. Gateway also relies on independent agents to distribute its insurance products and we did not have existing relationships with many of Gateway’s independent agents prior to our acquisition in 2013. We rely, and will continue to rely, heavily on these producers to attract new business. Independent producers generally have the ability to bind insurance policies and collect premiums on our behalf, actions over which we have a limited ability to exercise preventative control. In the event that an independent agent exceeds their authority by binding us on a risk that does not comply with our underwriting guidelines, we may be at risk for that policy until we effect a cancellation. Any improper use of such authority may result in losses that could have a material adverse effect on our business, results of operations and financial condition. In addition, in accordance with industry practice, policyholders often pay the premiums for their policies to producers for payment to us. These premiums may be considered paid when received by the producer and thereafter the customer is no longer liable to us for those amounts, whether or not we have actually received these premium payments from the producer. Consequently, we assume a degree of risk associated with our reliance on independent agents in connection with the settlement of insurance premium balances.

Our insurance subsidiaries may be unable to mitigate their risk or increase their underwriting capacity through reinsurance arrangements, which could adversely affect our business, financial condition and results of operations. If reinsurance rates rise significantly or reinsurance becomes unavailable or reinsurers are unable to pay our claims, we may be adversely affected.

In order to reduce underwriting risk and increase underwriting capacity, our insurance subsidiaries transfer portions of our insurance risk to other insurers through reinsurance contracts. We generally purchase reinsurance from third parties in order to reduce our liability on individual risks. Reinsurance does not relieve us of our primary liability to our insurance subsidiaries’ insureds. During the year ended December 31, 2013, we had ceded premium written of $12.6 million to our reinsurers. The availability, cost and structure of reinsurance protection are subject to prevailing market conditions that are outside of our control and which may affect our level of business and profitability. Our ability to provide insurance at competitive premium rates and coverage limits on a continuing basis depends in part upon the extent to which we can obtain adequate reinsurance in amounts and at rates that will not adversely affect our competitive position. There are no assurances that we will be able to maintain our current reinsurance facilities, which generally are subject to annual renewal. If we are unable to renew any of these facilities upon their expiration or to obtain other reinsurance facilities in adequate amounts and at favorable rates, we may need to modify our underwriting practices or reduce our underwriting commitments, which could adversely affect our results of operations.

Our insurance subsidiaries are subject to credit risk with respect to the obligations of reinsurers and certain of our insureds. The inability of our risk sharing partners to meet their obligations could adversely affect our profitability.

Although the reinsurers are liable to us to the extent of risk ceded to them, we remain ultimately liable to policyholders on all risks, even those reinsured. As a result, ceded reinsurance arrangements do not limit our ultimate obligations to policyholders to pay claims. We are subject to credit risks with respect to the financial strength of our reinsurers. We are also subject to the risk that their reinsurers may dispute their obligations to pay our claims. As a result, we may not recover sufficient amounts for claims that we submit to reinsurers, if at all. As of December 31, 2013, we had an aggregate of $19.1 million of reinsurance recoverables, of which $8.4 million were unsecured. In addition, our reinsurance agreements are subject to specified limits and we would not have reinsurance coverage to the extent that those limits are exceeded.

Effective immediately after the close of the Gateway transaction, we entered into a reinsurance agreement with a third party reinsurer, which covers all in-force premium and loss reserves for Gateway’s workers’ compensation program. Along with the reserves, any go-forward premium written for the workers’ compensation program will be ceded in its entirety to this third party reinsurer under the terms of this reinsurance agreement. While Gateway will remain liable to its insureds, we expect to have no net exposure to any losses related to this workers’ compensation business subsequent to the effective date of the acquisition, provided the reinsurer continues to make payments to us and otherwise complies with the terms of this reinsurance agreement, although no assurances thereof can be given.

With respect to insurance programs, the insurance subsidiaries are subject to credit risk with respect to the payment of claims and on the portion of risk exposure either ceded to captives established by their clients or deductibles retained by their clients. No assurance can be given regarding the future ability of these entities to meet their obligations. The inability of our risk sharing partners to meet their obligations could adversely affect our profitability.

The exclusions and limitations in our policies may not be enforceable.

Many of the policies we issue include exclusions or other conditions that define and limit coverage, which exclusions and conditions are designed to manage our exposure to certain types of risks and expanding theories of legal liability. In addition, many of our policies limit the period during which a policyholder may bring a claim under the policy, which period in many cases is shorter

12

than the statutory period under which these claims can be brought by our policyholders. While these exclusions and limitations help us assess and control our loss exposure, it is possible that a court or regulatory authority could nullify or void an exclusion or limitation, or legislation could be enacted modifying or barring the use of these exclusions and limitations. This could result in higher than anticipated losses and claims handling expenses by extending coverage beyond our underwriting intent or increasing the number or size of claims, which could have a material adverse effect on our operating results. In some instances, these changes may not become apparent until some time after we have issued the insurance policies that are affected by the changes. As a result, the full extent of liability under our insurance contracts may not be known for many years after a policy is issued.

The occurrence of severe catastrophic events may have a material adverse effect on our financial results and financial condition.

Although our business strategy generally precludes us from writing significant amounts of catastrophe exposed business, most property and casualty insurance contains some exposure to catastrophic loss. We have only limited exposure to natural and man-made disasters, such as hurricane, typhoon, windstorm, flood, earthquake, acts of war, acts of terrorism and political instability. While we carefully manage our aggregate exposure to catastrophes, modeling errors and the incidence and severity of catastrophes, such as hurricanes, windstorms and large-scale terrorist attacks are inherently unpredictable, and our losses from catastrophes could be substantial. In addition, it is possible we may experience an unusual frequency of smaller losses in a particular period. In either case, the consequences could be substantial volatility in our financial condition or results of operations for any fiscal quarter or year, which could have a material adverse effect on our ability to write new business. These losses could deplete our shareholders’ equity. Increases in the values and geographic concentrations of insured property and the effects of inflation have resulted in increased severity of industry losses from catastrophic events in recent years and we expect that those factors will increase the severity of catastrophe losses in the future. It is also possible that catastrophic losses could have an impact on our investment portfolio.

The risk models we use to quantify catastrophe exposures and risk accumulations may prove inadequate in predicting all outcomes from potential catastrophe events.

We rely on widely accepted and industry-recognized catastrophe risk modeling, primarily in conjunction with our reinsurance partners, to help us quantify our aggregate exposure to any one event. As with any model of physical systems, particularly those with low frequencies of occurrence and potentially high severity of outcomes, the accuracy of the model’s predictions is largely dependent on the accuracy and quality of the data provided in the underwriting process and the judgments of our employees and other industry professionals. These models do not anticipate all potential perils or events that could result in a catastrophic loss to us. Furthermore, it is often difficult for models to anticipate and incorporate events that have not been experienced during or as a result of prior catastrophes. Accordingly, it is possible for us to be subject to events or contingencies that have not been anticipated by our catastrophe risk models and which could have a material adverse effect on our reserves and results of operations.

Financial Risks

We are a holding company dependent on the results of operations of our subsidiaries and their ability to pay dividends and other distributions to us.

Atlas is a holding company with no significant operations of its own and a legal entity separate and distinct from our insurance subsidiaries. As a result, our only sources of income are dividends and other distributions from our insurance subsidiaries. We will be limited by the earnings of those subsidiaries, and the distribution or other payment of such earnings to it in the form of dividends, loans, advances or the reimbursement of expenses. The payment of dividends, the making of loans and advances or the reimbursement of expenses by our insurance subsidiaries is contingent upon the earnings of those subsidiaries and is subject to various business considerations and various statutory and regulatory restrictions imposed by the insurance laws of the domiciliary jurisdiction of such subsidiaries. In Illinois and Missouri, the states of domicile of American Service, American Country and Gateway, dividends may only be paid out of earned surplus and cannot be paid when the surplus of the company fails to meet minimum requirements or when payment of the dividend or distribution would reduce its surplus to less than the minimum amount. The state insurance regulator must be notified in advance of the payment of an extraordinary dividend and be given the opportunity to disapprove any such dividend. Our insurance subsidiaries cannot currently pay any dividends to Atlas without regulatory approval. In addition, prior to entering into any loan or certain other agreements between one or more of our insurance subsidiaries and Atlas or our other affiliates, advance notice must be provided to the state insurance regulator and the insurance regulator has the opportunity to disapprove such loan or agreement. Additionally, insurance regulators have broad powers to prevent reduction of statutory capital and surplus to inadequate levels and could refuse to permit the payment of dividends calculated under any applicable formula. As a result, we may not be able to receive dividends or other distributions from our insurance subsidiaries at times and in amounts necessary to meet our operating needs, to pay dividends to shareholders or to pay corporate expenses. The inability of our insurance subsidiaries to pay dividends or make other distributions could have a material adverse effect on our business and financial condition.

13

Our insurance subsidiaries are subject to minimum capital and surplus requirements. Failure to meet these requirements may subject us to regulatory action.

American Country and American Service are subject to minimum capital and surplus requirements imposed under the laws of Illinois and each state in which they issue policies. Any failure by one of our insurance subsidiaries to meet minimum capital and surplus requirements imposed by applicable state law may subject it to corrective action, which may include requiring adoption of a comprehensive financial plan, revocation of its license to sell insurance products or placing the subsidiary under state regulatory control. Any new minimum capital and surplus requirements adopted in the future may require us to increase the capital and surplus of our insurance company subsidiaries, which we may not be able to do. Upon the completion of the Gateway acquisition, we became subject to minimum capital and surplus requirements imposed under the laws of Missouri with regard to Gateway and the additional states where Gateway issues policies.

We are subject to assessments and other surcharges from state guaranty funds, and mandatory state insurance facilities, which may reduce our profitability.

Virtually all states require insurers licensed to do business therein to bear a portion of contingent and incurred claim handling expenses and the unfunded amount of “covered” claim and unearned premium obligations of impaired or insolvent insurance companies, either up to the policy's limit, the applicable guaranty fund covered claim obligation cap, or 100% of statutorily defined workers' compensation benefits, subject to applicable deductibles. These obligations are funded by assessments, made on a retrospective, prospective or pre-funded basis, which are levied by guaranty associations within the state, up to prescribed limits (typically 2% of “net direct written premium”), on all member insurers in the state on the basis of the proportionate share of the premiums written by member insurers in certain covered lines of business in which the impaired, insolvent or failed insurer was engaged. Accordingly, the total amount of assessments levied on us by the states in which we are licensed to write insurance may increase as we increase our premiums written. In addition, as a condition to the ability to conduct business in certain states (and within the jurisdiction of some local governments), insurance companies are subject to or required to participate in various premium or loss based insurance-related assessments, including mandatory (a/k/a “involuntary”) insurance pools, underwriting associations, workers' compensation second-injury funds, reinsurance funds and other state insurance facilities. Although we may be entitled to take premium tax credit (or offsets), recover policy surcharges or include assessments in future premium rate structures for payments we make under these facilities, the effect of these assessments and insurance-related arrangements, or changes in them, could reduce our profitability in any given period or limit our ability to grow our business.

Market fluctuations, changes in interest rates or a need to generate liquidity could have significant and negative effects on our investment portfolio. We may not be able to realize our investment objectives, which could significantly reduce our net income.

We depend on income from our securities portfolio for a substantial portion of our earnings. Investment returns are an important part of our overall profitability. A significant decline in investment yields in the securities portfolio or an impairment of securities owned could have a material adverse effect on our business, results of operations and financial condition. We currently maintain and intend to continue to maintain a securities portfolio comprised primarily of fixed income securities. As of December 31, 2013, our investment portfolio was primarily invested in fixed income securities. We cannot predict which industry sectors in which we maintain investments may suffer losses as a result of potential declines in commercial and economic activity, or how any such decline might impact the ability of companies within the affected industry sectors to pay interest or principal on their securities and cannot predict how or to what extent the value of any underlying collateral might be affected. Accordingly, adverse fluctuations in the fixed income or equity markets could adversely impact profitability, financial condition or cash flows. If we are forced to sell portfolio securities that have unrealized losses for liquidity purposes rather than holding them to maturity or recovery, we would realize investment losses on those securities when that determination was made. We could also experience a loss of principal in fixed and non-fixed income investments.

Our ability to achieve our investment objectives is affected by general economic conditions that are beyond our control. General economic conditions can adversely affect the markets for interest rate sensitive securities, including the extent and timing of investor participation in such markets, the level and volatility of interest rates and, consequently, the value of fixed maturity securities. U.S. and global markets have been experiencing volatility since mid-2007. Initiatives taken by the U.S. and foreign governments have helped to stabilize the financial markets and restore liquidity to the banking system and credit markets. In addition, markets in the United States and around the world experienced volatility in 2011 due, in part, to sovereign debt downgrades. Although economic conditions and financial markets have somewhat stabilized, if market conditions were to deteriorate, our investment portfolio could be adversely affected.

Difficult conditions in the economy generally may materially and adversely affect our business, results of operations and statement of financial position and these conditions may not improve in the near future.

14

Current market conditions and the instability in the global financial markets present additional risks and uncertainties for our business. In particular, deterioration in the public debt markets could lead to additional investment losses and an erosion of capital as a result of a reduction in the fair value of investment securities. The severe downturn in the public debt and equity markets, reflecting uncertainties associated with the mortgage crisis, worsening economic conditions, widening of credit spreads, bankruptcies and government intervention in large financial institutions, created significant unrealized losses in our securities portfolio at certain stages in 2009.

Economic uncertainty has recently been exacerbated by the increased potential for default by one or more European sovereign debt issuers, the potential partial or complete dissolution of the Eurozone and its common currency and the negative impact of such events on global financial institutions and capital markets generally. Actions or inactions of European governments may impact these actual or perceived risks. In the U.S. during 2011, one rating agency downgraded the U.S.’s long-term debt credit rating from AAA. Future actions or inactions of the United States government, including a shutdown of the federal government, could increase the actual or perceived risk that the U.S. may not ultimately pay its obligations when due and may disrupt financial markets.

Atlas’ portfolio is managed by an SEC registered investment advisor specializing in the management of insurance company portfolios. We and our investment manager consider these issues in connection with current asset allocation decisions with the object of avoiding them going forward. However, depending on market conditions going forward, we could again incur substantial realized and additional unrealized losses in future periods, which could have an adverse impact on the results of operations and financial condition. There can be no assurance that the current market conditions will improve in the near future. We could also experience a reduction in capital in the insurance subsidiaries below levels required by the regulators in the jurisdictions in which we operate. Certain trust accounts for the benefit of related companies and third parties have been established with collateral on deposit under the terms and conditions of the relevant trust agreements. The value of collateral could fall below the levels required under these agreements, putting the subsidiary or subsidiaries in breach of the agreement.

We may not have access to capital in the future.

We may need new or additional financing in the future to conduct our operations or expand our business. However, we may be unable to raise capital on favorable terms, or at all, including as a result of disruptions, uncertainty and volatility in the global credit markets, or due to any sustained weakness in the general economic conditions and/or financial markets in the United States or globally. From time to time, we may rely on access to financial markets as a source of liquidity for operations, acquisitions and general corporate purposes.

The limited public float and trading volume for our shares may have an adverse impact on the share price or make it difficult to liquidate.

Our securities are held by a relatively small number of shareholders. Future sales of substantial amounts of our shares in the public market, or the perception that these sales could occur, may adversely impact the market price of our shares and our shares could be difficult to liquidate.

Our business depends upon key employees, and if we are unable to retain the services of these key employees or to attract and retain additional qualified personnel, our business may suffer.

Our operations depend, to a great extent, upon the ability of executive management and other key employees to implement our business strategy and our ability to attract and retain additional qualified personnel in the future. The loss of the services of any of our key employees, or the inability to identify, hire and retain other highly qualified personnel in the future could adversely affect the quality and profitability of our business operations. In addition, we must forecast volume and other factors in changing business environments with reasonable accuracy and adjust our hiring and employment levels accordingly. Our failure to recognize the need for such adjustments, or our failure or inability to react appropriately on a timely basis, could lead to over-staffing (which could adversely affect our cost structure) or under-staffing (which could impair our ability to service current product lines and new lines of business). In either event, our financial results and customer relationships could be adversely affected.

Compliance Risks

We are subject to comprehensive regulation, and our results may be unfavorably impacted by these regulations.

As a holding company which owns insurance companies domiciled in the United States, we and our insurance subsidiaries are subject to comprehensive laws, regulations and rules. These laws, regulations and rules generally delegate regulatory, supervisory

15

and administrative powers to state insurance regulators. Insurance regulations are generally designed to protect policyholders rather than shareholders, and are related to matters including but not limited to:

• | rate setting; |

• | RBC ratio and solvency requirements; |

• | restrictions on the amount, type, nature, quality and quantity of securities and other investments in which insurers may invest; |

• | the maintenance of adequate reserves for unearned premiums and unpaid, and incurred but not reported, claims; |

• | restrictions on the types of terms that can be included in insurance policies; |

• | standards for accounting; |

• | marketing practices; |

• | claims settlement practices; |

• | the examination of insurance companies by regulatory authorities, including periodic financial and market conduct examinations; |

• | requirements to comply with medical privacy laws as a result of our administration of Gateway's run-off workers' compensation business; |

• | the licensing of insurers and their agents; |

• | limitations on dividends and transactions with affiliates; |

• | approval of certain reinsurance transactions; |

• | insolvency proceedings; |

• | ability to enter and exit certain insurance markets, cancel policies or non-renew policies; and |

• | data privacy. |

Such laws, regulations and rules increase our legal and financial compliance costs and make some activities more time-consuming and costly. Any failure to monitor and address any internal control issues could adversely impact operating results. In addition, the Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In connection with the audit of our insurance subsidiaries for the year ended December 31, 2010, during which our insurance subsidiaries were owned by KAI, the auditors reported to those charged with governance significant deficiencies in the internal controls of the insurance subsidiaries related to technical account reconciliations and reinsurance recoverable reconciliations and billings. A deficiency in internal control exists when the design or operation of a control does not allow management or employees, in the normal course of performing their assigned functions, to prevent or detect and correct misstatements on a timely basis. A significant deficiency is a deficiency, or combination of deficiencies, in internal control that is less severe than a material weakness, yet important enough to merit attention by those charged with governance. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity's financial statements will not be prevented, or detected and corrected on a timely basis. None of the significant deficiencies described above were reported as a material weakness. Following the reverse merger on December 31, 2010 wherein the insurance subsidiaries were transferred to us by KAI, we committed resources to addressing these identified deficiencies in internal controls and we believe they have all been addressed.

State insurance departments conduct periodic examinations of the affairs of insurance companies and require filing of annual and other reports relating to the financial condition of insurance companies, holding company issues and other matters. Our business depends on compliance with applicable laws, regulations and rules and our ability to maintain valid licenses and approvals for our operations. Regulatory authorities may deny or revoke licenses for various reasons, including violations of laws, regulations and rules. Changes in the level of regulation of the insurance industry or changes in laws, regulations and rules themselves or interpretations thereof by regulatory authorities could have a material adverse effect on our operations. Because we are subject to insurance laws, regulations and rules of many jurisdictions that are administered by different regulatory and governmental authorities, there is also a risk that one authority's interpretation of a legal or regulatory issue may conflict with another authority's interpretation of the same issue. Insurance companies are also subject to “desk drawer rules” of state insurance regulators, which are regulatory rules that have not been codified or formally adopted through regulatory proceedings. In addition, we could face individual, group and class-action lawsuits by our policyholders and others for alleged violations of certain state laws, regulations and rules. Each of these regulatory risks could have an adverse effect on our profitability.

As a result of our administration of Gateway's run-off workers' compensation business, we are required to comply with state and federal laws governing the collection, transmission, security and privacy of health information that require significant compliance costs, and any failure to comply with these laws could result in material criminal and civil penalties. These laws and rules are subject to administrative interpretation and many are derived from the privacy provisions in the Federal Gramm-Leach-Bliley Act of 2002. The Gramm-Leach-Bliley Act, which, among other things, protects consumers from the unauthorized dissemination of certain personal information, and various state laws and regulations addressing privacy issues, require us to maintain appropriate procedures for managing and protecting certain personal information of our customers and to fully disclose our privacy practices

16

to our customers. Given the complexity of these privacy regulations, the possibility that the regulations may change, and the fact that the regulations are subject to changing and potentially conflicting interpretation, our ability to maintain compliance with the privacy requirements of state and federal law is uncertain and the costs of compliance are significant.

In addition, Gateway is exiting the workers' compensation line of business across the country and we also exited the Florida market for all lines of business. Most states have adopted either statutes or regulations or have issued bulletins or informal rules that regulate the anticipated withdrawal of a product, line or sub-line of insurance business from the insurance marketplace in their state. While what constitutes a “withdrawal” or its equivalent under each state's statutory or regulatory scheme varies, Gateway will be subject to regulatory requirements in connection with its withdrawal, including, but not limited to, making notice and/or plan filings with the applicable insurance regulator in certain states and possibly requiring the prior approval of the applicable state regulator. A failure by Gateway to comply with and satisfy these regulatory requirements in connection with its planned withdrawals could lead to regulatory fines, cause a distraction for management requiring us to continue to administer Gateway's workers' compensation business for longer than anticipated and could result in Gateway continuing to write undesirable commercial automobile business in Florida, which could have an adverse impact on our reserves, results of operations and financial condition.