As filed with the Securities and Exchange Commission on August 30, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________

SPORTS FIELD HOLDINGS,

INC.

(Exact name of registrant as specified in its

charter)

_________________

|

Nevada |

|

1540 |

|

46-0939465 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(Primary Standard Industrial Classification Code Number) |

|

(I.R.S. Employer Identification Number) |

4320 Winfield Road,

Suite 200

Warrenville, Illinois 60555

(508) 366-1000

(Address,

including zip code, and telephone number including

area code, of Registrant’s principal executive

offices)

_________________

Nevada Business Center,

LLC

701 S. Carson Street, Suite 200

Carson City, Nevada 89701

(775) 887-8853

(Name, address, including zip code, and

telephone number

including area code, of agent for service)

_________________

With copies to:

|

Joseph M. Lucosky, Esq. |

|

Barry

I. Grossman, Esq. |

_________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ¨ |

|

Accelerated Filer ¨ |

|

Non-Accelerated Filer ¨ |

|

Smaller Reporting Company x |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

|

Proposed Maximum Aggregate Offering Price(1) |

|

Amount of Registration Fee(1) |

||

|

Common Stock, par value $0.00001 per share(2)(3) |

|

$ |

11,500,000 |

|

$ |

1,158.10 |

|

Warrants to Purchase Common Stock(5) |

|

|

— |

|

|

— |

|

Shares of Common Stock issuable upon exercise of the Warrants(2)(4) |

|

$ |

14,375,000 |

|

$ |

1,447.56 |

|

Representatives’ Warrant to Purchase Common Stock(5) |

|

|

— |

|

|

|

|

Shares of Common Stock issuable upon exercise of Representatives’ Warrant(2)(6) |

|

|

1,617,188 |

|

|

162.85 |

|

Total |

|

$ |

27,492,188 |

|

$ |

2,768.51 |

____________

(1) Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”).

(2) Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

(3) Includes shares of common stock which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any.

(4) There will be issued a warrant to purchase one share of common stock for every one share offered. The warrants are exercisable at a per share price of 125% of the common stock public offering price.

(5) In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant’s common stock underlying the warrants and Representative’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby.

(6) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative’s warrants is $1,617,188, which is equal to 125% of $1,293,750 (5% of $25,875,000).

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED AUGUST 30, 2016 |

______ Shares of Common Stock

Warrants to Purchase up to _____Shares of Common Stock

Sports Field Holdings, Inc.

We are offering ________ shares of our common stock, $0.00001 par value per share, and warrants to purchase ______shares of our common stock at a public offering price of $____ per share and $_____ per warrant. The warrants have an exercise price of $____ per share and expire five years from the date of issuance.

Our common stock is presently quoted on the OTCQB under the symbol “SFHI”. We have applied to have our common stock and warrants listed on The NASDAQ Capital Market under the symbols “SFHI” and “SFHIW,” respectively. No assurance can be given that our application will be approved. On _________ __, the last reported sale price for our common stock on the OTCQB was $___ per share. There is no established public trading market for the warrants. No assurance can be given that a trading market will develop for the warrants.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share |

|

Per Warrant |

|

Total |

|||

|

Public offering price |

|

$ |

|

|

$ |

|

|

$ |

|

|

Underwriting discounts and commissions(1) |

|

$ |

|

|

$ |

|

|

$ |

|

|

Proceeds to us, before expenses |

|

$ |

|

|

$ |

|

|

$ |

|

____________

(1) Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Joseph Gunnar & Co., LLC, the representative of the underwriters. See “Underwriting” for a description of compensation payable to the underwriters.

We have granted a 45-day option to the representative of the underwriters to purchase up to _____ additional shares of our common stock at a public offering price of $___ per share and/or warrants to purchase _______ shares of our common stock at a public offering price of $______ per warrant, solely to cover over-allotments, if any.

The underwriters expect to deliver our shares and warrants to purchasers in the offering on or about , 2016.

Joseph Gunnar & Co.

The date of this prospectus is , 2016.

TABLE OF CONTENTS

|

Prospectus Summary |

|

1 |

|

Risk Factors |

|

9 |

|

Use of Proceeds |

|

19 |

|

Market for Our Common Stock and Related Stockholder Matters |

|

20 |

|

Capitalization |

|

21 |

|

Dilution |

|

23 |

|

Cautionary Note Regarding Forward-Looking Statements |

|

24 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

25 |

|

Business |

|

34 |

|

Directors and Executive Officers |

|

42 |

|

Executive Compensation |

|

47 |

|

Security Ownership of Certain Beneficial Owners and Management |

|

51 |

|

Certain Relationships and Related Party Transactions |

|

52 |

|

Description of Capital Stock |

|

53 |

|

Shares Eligible for Future Sale |

|

56 |

|

Underwriting |

|

57 |

|

Legal Matters |

|

65 |

|

Experts |

|

65 |

|

Where You Can Find More Information |

|

65 |

|

Index to Consolidated Financial Statements |

|

F-1 |

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the common stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our common stock in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our common stock in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

We have registered trademarks pending with the United States Patent and Trademark Office, including FirstForm® and PrimePlay®. We also use certain trademarks, trade names, and logos that have not been registered. We claim common law rights to these unregistered trademarks, trade names and logos.

i

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our common stock and warrants, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is December 31 and our fiscal years ended December 31, 2014 and 2015 and our fiscal year ending December 31, 2016 are sometimes referred to herein as fiscal years 2014, 2015 and 2016, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” and “Sports Field” refer to Sports Field Holdings, Inc., a Nevada corporation, and our wholly owned subsidiary, FirstForm, Inc.

This prospectus assumes the over-allotment option of the underwriters has not been exercised, unless otherwise indicated.

Overview

Sports Field Holdings, Inc. (the “Company” or “Sports Field”), through its wholly owned subsidiary FirstForm, Inc. (formerly SportsField Engineering, Inc., “FirstForm”), is an innovative product development company engaged in the design, engineering and construction of athletic fields and facilities and sports complexes and the sale of customized synthetic turf products and synthetic track systems.

According to Applied Market Information (AMI), over 2,000 athletic field projects were constructed in the U.S. in 2015, creating a $1.8 billion synthetic turf market. These statistics are supported by the number of square meters of synthetic turf manufactured and installed in the U.S. in 2015, based on an average size of 80,000 square feet per project. We believe synthetic turf fields have become the field of choice for public and private schools, municipal parks, and recreation departments, non-profit and for profit sports venue businesses, residential and commercial landscaping and golf related venues. We believe this is due to the spiraling costs associated with maintaining natural grass athletic fields and the demand for increased playing time, durability of the playing surface and the ability to play on that surface in any weather conditions.

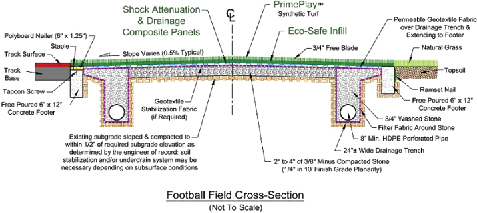

Although synthetic turf athletic fields and synthetic turf have become a viable alternative to natural grass fields over the past several years, there are a number of technical and environmental issues that have arisen through the evolution of the development of turf and the systems designed around its installation. Sports Field has focused on addressing the main technical issues that still remain with synthetic turf athletic fields and synthetic turf, including but not limited to environmental and safety concerns related to infill used in synthetic turf fields as well the reduction of surface heat, and Gmax levels (the measure of how much force the surface absorbs and in return, how much is returned to the athlete) as well drainage issues related to the base construction of turf installation).

In addition to the increased need for available playing space, collegiate athletic facilities have become an attractive recruiting tool for many institutions. The competition for athletes and recruiting has resulted in a multitude of projects to build new, or upgrade existing, facilities. These projects include indoor fields, bleachers, press boxes, lighting, concession stands as well, as locker rooms and gymnasiums. We believe that our position in the sports facilities design, construction and turf sales industry allows us to benefit from this increased demand because we are able to compete for the sale of turf as well as the design and construction on such projects, whereas our competitors can typically only compete for the turf components or the construction, but not both.. In fact, according to a current IBIS report, there are no national firms competing in these sectors that have even 5% market share.

Through our strategic operations design, we have the ability to operate throughout the U.S., providing high quality synthetic turf systems focused on player safety and performance and construct those facilities for our clients using a single partner. Due to our ability to design, estimate, engineer, general contract

1

and install our solutions, we can spend more of every owner dollar on product rather than margin and overhead, thereby delivering a premium product at market rates for our customers. Since inception we have completed a variety of projects from the design, engineering and build of entire football stadiums to the installation of a specialized turf track systems. Members of our management team have also designed, engineered and installed baseball stadiums, soccer and lacrosse fields, indoor soccer facilities, softball fields and running tracks for private sports venues, public and private high schools and public and private universities. In addition, members of our team have designed and engineered and constructed concession stands with full kitchen facilities, restroom structures, press boxes, baseball dugouts, bleacher seating, ticket booths, locker room facilities and gymnasium expansion projects.

Our Growth Strategy

Our primary goal is to be a leading provider of unique turn-key services that combine our strengths in safe and high performance synthetic turf systems, athletic facilities design, engineering and construction. The key elements of our strategy include:

Expand our sales organization and increase marketing. Our sales structure is comprised of four discrete units: direct sales representatives, distribution group partners, deal finders and sports ambassadors. We currently have six fully staffed sales territories within the U.S.: the Northeast, Southeast, Northcentral, Southcentral, Northwest and Southwest, with each territory containing its own dedicated sales professional. Our four distribution group partners represent a total of nine sales people around the U.S. We are currently contracted with eight commission only deal finders who have extensive contacts in the sports industry and are making introductions for our direct sales team members to key decision makers around the U.S. Once a project lead is established, our distribution partners and deal finders bring in the local territory representative and drive the sales to close together as a team. We intend to continue to expand our highly-trained direct sales organization to secure contracts in every major region of the United States. By securing contracts and establishing Sports Field in all major regions of the country, the Company intends to seek to leverage those client relationships and successful projects to aggressively market to all potential clients in these regions.

Broaden our relationships with strategic partners to increase sales and drive revenues. In addition to installing a new football/lacrosse field, we have recently entered into a four-year marketing agreement with IMG Academy in Bradenton, Florida (“IMG”), a world renowned school and athletic training destination. IMG’s nationally recognized sports programs attract premier athletes from all over the globe. Our official supplier agreement with IMG allows us to utilize their logo in our marketing materials, perform unlimited site visits with clients to see our products as well as allow space for our 14,000 square foot research and development installation. In addition, we are allowed to utilize IMG athletes to conduct product testing to ensure performance and safety for up to four times each year.

The campus at IMG attracts many students, athletes, university administrators and recruiters and coaches every season for training. Our showcase facility can be viewed by all of these visitors and our relationship with IMG brings national credibility to the Company. It also allows us to conduct research in an effort to consistently update our product offerings to make sure we are always doing our best to put out the safest and highest performing products in the market.

Recently, the National Council of Youth Sports (“NCYS”) has approved the Company’s products as a “Recommended Provider” of PrimePlay™ Replicated Grass™ turf systems. The NCYS membership includes over 200 member organizations that serve more than 60,000,000 registered youth participants. The NCYS leads the youth sports industry in offering its members exceptional value, and quality resources and services that are relevant, reliable, meaningful and purposeful. As NCYS’s preferred synthetic turf provider, we believe we will benefit from improved access to decision-makers within the national youth sports scene, introductions to fellow members, and unique educational opportunities regarding the Company’s advanced synthetic turf products.

We hope to continue to develop high profile strategic partnerships that will allow for greater awareness of our products and services with institutions that are focused on athlete safety and athletic performance.

2

Drive adoption and awareness of our eco-friendly turf and infill products among coaches, athletic directors, administrators, and athletes. We intend to educate coaches, athletic directors, administrators and athletes on the compelling case for our infill matrix called Organite™, an eco-safe infill alternative that contains only components that are either inert or biodegradable. Organite™ infills are free from lead, chromium and all other potential cancer causing agents that are commonly found in fields all across the U.S. Our PrimePlay™ synthetic turf products are free from the polyurethane backing, which cannot be recycled, that is commonly present in the majority of turf installations today.

Environmentally friendly, ecologically-safe, recyclable products and coating materials are available and we are using them in our current products. We believe our products perform, in all respects, as well or better than the ecologically-challenged products traditionally considered and currently used by many of our competitors. Due to our turn-key design-build process, we are able to offer our customers fields with ecologically friendly materials at a price that is competitive with the traditional products that are cheap and contain materials that are not safe. We believe that increased awareness of the benefits of our eco-friendly infill will favorably impact our sales.

Develop new technology products and services. Since inception, we have been in pursuit of developing a turf system that is comprised of synthetic fiber, turf backing, infill and shock/drainage pad that would allow us to market a product that virtually eliminates all of the current problems plaguing the industry. To date, we have studied and developed a high performing infill product that is free from any potential carcinogens and is capable of reducing field temperatures, designed a turf stitch pattern that will reduce infill migration to prevent injury, removed polyurethane from our backing to allow for recycling, tested and are provided a shock pad system that will allow for high performance while reducing impact injuries due to lower Gmax and engineered drainage design plans that allow the system to be free from standing water even in the event of major downpours. All of the improvements to the system are continuously being challenged and tested at our research and development site on campus at IMG in Bradenton, Florida.

Our next goal is to permanently staff a research and development office with development staff so that we can use everything we have learned about existing products and continue to create new products that will continue to improve performance while remaining safe for the players and the environment.

Pursue opportunities to enhance our product offerings. We may also opportunistically pursue the licensing or acquisition of complementary products and technologies to strengthen our market position or improve product margins. We believe that the licensing or acquisition of products would only strengthen our existing portfolio.

Lessen our dependency on third party manufacturers. As part of our long-term plans, we are exploring the possibility of reducing our reliance on third party manufacturers by bringing certain manufacturing, service and research and development functions in-house, which could include the acquisition of equipment and other fixed assets or the acquisition or lease of a manufacturing facility.

Operational Strengths

Highly Experienced Management and Key Personnel. We have assembled a senior management team and key personnel which includes Jeromy Olson, our CEO, Scott Allen, our Director of Architecture & Engineering, John Rombold, our Director of Project Management, and Kort Wickenheiser, our Director of Sales. This current leadership team is comprised of individuals with significant experience in sales, design, architecture, engineering and construction industry.

Diversified Project Classes. The diversity of project types that are within our capabilities is a strength that we can exploit if there is an economic slowdown on any one particular sector. Our architectural design, engineering and construction expertise along with our surfacing product sales can support the company revenue streams in two discrete ways.

Specialized Market Approach. By targeting and maintaining expertise in athletic facilities the Company is more insulated from general economic downturn than general construction companies otherwise would be. This specialization is less susceptible to customers driving normal price points lower through mass competition.

3

Infrastructure built for growth. Current staffing levels have positioned the Company with excess operational capacity capable of doubling project execution without a significant impact on overhead.

Our Risks and Challenges

An investment in our securities involves a high degree of risk including risks related to the following:

• We are not yet profitable and may never be profitable.

• We have received a going concern opinion from our auditors.

• We have a limited operating history.

• We recently completed a debt financing which is secured by the grant of a security interest in all of our assets and upon a default the lender may foreclose on all of our assets.

• The installation of synthetic turf is highly competitive industry.

• Accounting for our revenues and costs involves significant estimates.

• If we are unable to obtain raw materials in a timely manner of if the price of raw materials increases significantly, production time and product costs could increase, which may adversely affect our business.

• Failure to maintain safe work sites could result in significant losses.

• An inability to obtain bonding could have a negative impact on our operations and results.

• Design-build contracts subject us to the risk of design errors and omissions.

• Many of our contracts have penalties for late completion.

• Strikes or work stoppages could have a negative impact on our operations and results.

Failure of our subcontractors to perform as anticipated could have a negative impact on our results.

• We must anticipate and respond to rapid technological change.

• We rely upon third-party manufacturers and suppliers, which puts us at risk for third-party business interruptions.

• We may be subject to the risk of substantial environmental liability and limitations on our operations brought about by the requirements of environmental laws and regulations.

We are subject to a number of additional risks which you should be aware of before you buy our securities in this Offering. These risks are discussed more fully in the section entitled “Risk Factors” following this prospectus summary.

RECENT DEVELOPMENTS

On July 18, 2016, the Company closed a Business Loan Agreement (the “Loan Agreement”) with Genlink Capital, LLC (“Genlink”), pursuant to which Genlink made available to the Company a revolving line of credit in a principal amount not to exceed $1,000,000 (the “Revolving Loan”). Amounts under the Revolving Loan may be advanced to the Company from time to time in accordance with the provisions of the Loan Agreement.

On July 18, 2016 and pursuant to the Loan Agreement, the Company issued a promissory note to Genlink (“the Note”), up to an aggregate principal amount of $1,000,000. All unpaid principal and interest outstanding under the Note is due on or before December 20, 2017 (the “Maturity Date”). The Note bears interest at a rate of 15% per annum, and the Company shall make monthly interest payments. The Company may pay, without penalty, all or a portion or any amount owed under the Note earlier than the date by which it is due. The Note includes customary provisions regarding events of default and other terms.

4

Additionally, on July 18, 2016 and pursuant to the Loan Agreement, the Company and Genlink entered into a security agreement (the “Security Agreement”), pursuant to which the Company granted Genlink a senior security interest in substantially all of the Company’s assets as security for repayment of the Revolving Loan.

As of the date hereof, the Company has drawn down $750,000 from the Revolving Loan.

Our Corporate History

We were incorporated on February 8, 2011, as Anglesea Enterprises, Inc. Initially our activities consisted of providing marketing and web-related services to small businesses including the design and development of original websites, creative writing and graphics, virtual tours, audio/visual services, marketing analysis and search engine optimization. On June 16, 2014, Anglesea Enterprises, Inc. (“Anglesea”), Anglesea Enterprises Acquisition Corp, a wholly owned subsidiary of Anglesea (“Merger Sub”), Sports Field Holdings, Inc., a privately-held Nevada corporation headquartered in Illinois (“Sports Field Private Co”), Leslie Toups and Edward Mass Jr., as individuals (the “Majority Shareholders”), entered into an Acquisition Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Merger Sub was merged with and into Sports Field Private Co, with Sports Field Private Co surviving as a wholly-owned subsidiary of Anglesea (the “Merger”). Anglesea acquired, through a reverse triangular merger, all of the outstanding capital stock of Sports Field Private Co in exchange for issuing Sports Field Private Co’s shareholders 11,914,275 shares of Anglesea’s common stock.

Upon completion of the Merger, on June 16, 2014, Anglesea merged with Sports Field Private Co in a short-form merger transaction (the “Short Form Merger”) under Nevada law. Upon completion of the Short Form Merger, the Company became the parent company of the Sport Field Private Co’s wholly owned subsidiaries, Sports Field Contractors LLC, SportsField Engineering, Inc. and Athletic Construction Enterprises, Inc. Sports Field Contractors, LLC and Athletic Construction Enterprises, Inc. were subsequently dissolved on January 9, 2015 and September 22, 2015, respectively. SportsField Engineering, Inc. changed its name to FirstForm, Inc on April 5, 2016. In connection with the Short Form Merger, Anglesea changed its name to Sports Field Holdings, Inc. on June 16, 2014.

Where You Can Find More Information

Our website address is www.firstform.com. We do not intend for our website address to be an active link or to otherwise incorporate by reference the contents of the website into this prospectus. The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

5

THE OFFERING

|

Securities offered by us: |

|

________ shares of our common stock and warrants to purchase ______ shares of our common stock. Each warrant will have a per share exercise price of $___ per share, is exercisable immediately and will expire five years from the date of issuance. |

|

|

|

|

|

Common stock outstanding before the offering |

|

16,343,573 Shares(1) |

|

|

|

|

|

Common stock to be outstanding after the offering |

|

Shares(1) |

|

|

|

|

|

Option to purchase additional shares |

|

We have granted the underwriters a 45 day option to purchase up to additional shares of our common stock plus warrants to purchase_____ additional shares to cover allotments, if any. |

|

|

|

|

|

Use of proceeds |

|

We intend to use the net proceeds of this offering for the repayment of certain indebtedness, research and development activities; sales and marketing, and for general working capital purposes. See “Use of Proceeds.” |

|

|

|

|

|

Risk factors |

|

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 9 before deciding to invest in our securities. |

|

|

|

|

|

Trading Symbol |

|

Our common stock is currently quoted on the OTCQB under the trading symbol “SFHI”. We intend to apply to the NASDAQ Capital Market to list our common stock under the symbol “SFHI” and our warrants under the symbol “SFHIW” and expect such listing to occur concurrently with this offering.” However, there is no guarantee that our application will be granted. |

|

|

|

|

|

Lock-up |

|

We and our directors, officers and principal stockholders have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the date of this prospectus, in the case of our officers and directors, and 90 days after the date of this prospectus, in the case of our principal stockholders. See “Underwriting” section on page 57. |

NASDAQ listing requirements include, among other things, a stock price threshold. As a result, prior to effectiveness, the Company may need to take necessary steps to meet NASDAQ listing requirements, including but not limited to a reverse split of our common stock.

(1) The common stock to be outstanding before and after this offering is based on 16,343,573 shares outstanding as of August 24, 2016, and excludes the following as of such date:

• 622,500 shares issuable upon exercise of outstanding options with a weighted average exercise price of $1.02

• 667,543 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $1.03;

• 1,898,307 shares issuable upon the conversion of outstanding convertible notes; and

• shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering.

6

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following summary consolidated statements of operations data for the years ended December 31, 2015 and 2014 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the six month periods ended June 30, 2016 and 2015 and the consolidated balance sheets data as of June 30, 2016 are derived from our unaudited consolidated financial statements that are included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the six month period ended June 30, 2016 are not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2016 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

SUMMARY OPERATING DATA

|

|

|

For

the Six Months |

|

Fiscal Years Ended |

||||||||||||

|

|

|

(unaudited) |

|

(unaudited) |

|

December 31, |

||||||||||

|

|

|

2016 |

|

2015 |

|

2015 |

|

2014 |

||||||||

|

Total Revenues |

|

$ |

1,278,558 |

|

|

$ |

1,413,894 |

|

|

$ |

3,941,833 |

|

|

$ |

1,228,188 |

|

|

Cost of Sales |

|

|

1,289,080 |

|

|

|

1,471,090 |

|

|

|

4,519,997 |

|

|

|

1,716,511 |

|

|

Gross Profit (Loss) |

|

|

(10,522 |

) |

|

|

(57,196 |

) |

|

|

(578,164 |

) |

|

|

(488,323 |

) |

|

Selling, general and administrative expenses |

|

|

1,771,603 |

|

|

|

1,214,598 |

|

|

|

2,677,524 |

|

|

|

3,007,510 |

|

|

Research and Development expenses |

|

|

88,447 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation |

|

|

2,028 |

|

|

|

14,451 |

|

|

|

28,044 |

|

|

|

67,212 |

|

|

Separation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

228,414 |

|

|

Other income (expense) net |

|

|

(272,362 |

) |

|

|

(11,927 |

) |

|

|

(54,425 |

) |

|

|

(41,397 |

) |

|

Net (Loss) Income |

|

|

(2,144,962 |

) |

|

|

(1,298,172 |

) |

|

|

(3,338,157 |

) |

|

|

(3,832,856 |

) |

|

Net (Loss) Income available to common shareholders |

|

$ |

(2,144,962 |

) |

|

$ |

(1,298,172 |

) |

|

$ |

(3,338,157 |

) |

|

$ |

(3,832,856 |

) |

|

Basic & Diluted Net Income (Loss) per share: |

|

$ |

(0.14 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.24 |

) |

|

$ |

(0.29 |

) |

|

Weighted Average shares outstanding |

|

|

15,622,456 |

|

|

|

13,552,568 |

|

|

|

13,698,354 |

|

|

|

13,194,055 |

|

The following table presents consolidated balance sheets data as of June 30, 2016 on:

• an actual basis;

• an as adjusted basis, giving effect to the issuance of a promissory note in the amount of $750,000, pursuant to the Revolving Loan and $187,498 of gross proceeds from the private sale of our common stock in July 2016; and

• a pro forma, as adjusted basis, giving effect to (i) the issuance of a promissory note in the amount of $750,000 pursuant to the Revolving Loan, (ii) $187,498 of gross proceeds for the private sale of our common stock in July 2016 and (iii) the pro forma sale by us of shares of common stock and warrants in this offering at an assumed public offering price of $ per share and $_____ per warrant after deducting underwriting discounts and commissions and estimated offering expenses.

The pro forma as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

7

|

|

|

As of June 30, 2016 |

|||||||||

|

|

|

Actual |

|

As Adjusted |

|

Pro

Forma, |

|||||

|

Consolidated Balance Sheets Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

— |

|

|

$ |

840,856 |

|

|

$ |

|

|

Working Capital (deficit) |

|

|

(2,257,979 |

) |

|

|

(1,427,916 |

) |

|

|

|

|

Total assets |

|

|

477,440 |

|

|

|

1,318,296 |

|

|

|

|

|

Total liabilities |

|

|

2,735,419 |

|

|

|

3,413,151 |

|

|

|

|

|

Total stockholders’ equity (deficit) |

|

|

(2,257,979 |

) |

|

|

(2,094,855 |

) |

|

|

|

____________

(1) A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ , assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses payable by us.

8

RISK FACTORS

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this prospectus before deciding to purchase our securities. There are many risks that affect our business and results of operations, some of which are beyond our control. Our business, financial condition or operating results could be materially harmed by any of these risks. This could cause the trading price of our securities to decline, and you may lose all or part of your investment. Additional risks that we do not yet know of or that we currently think are immaterial may also affect our business and results of operations.

Risks Related To Our COMPANY

WE ARE NOT YET PROFITABLE AND MAY NEVER BE PROFITABLE.

Since inception through June 30, 2016, Sports Field has raised approximately $7,000,000 in capital. During this same period, we have recorded net accumulated losses totaling $12,414,480. As of June 30, 2016, we had a working capital deficit of $2,257,979. Our net losses for the two most recent fiscal years ended December 31, 2015 and 2014 have been $3,338,157 and $3,832,856, respectively. Our ability to achieve profitability depends upon many factors, including the ability to develop and commercialize products. There can be no assurance that we will ever achieve profitable operations.

WE HAVE RECEIVED A GOING CONCERN OPINION FROM OUR AUDITORS.

As reflected in the financial statements we have received a going concern opinion from our auditors. As of June 30, 2016, the Company has a cash overdraft of $3,518 and working capital deficit of $2,257,979. Furthermore, the Company had a net loss and net cash used in operations of $2,144,962 and $1,393,016, respectively, for the six months ended June 30, 2016 and an accumulated deficit totaling $12,414,480. Accordingly, these factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue its operations as a going concern is dependent on management’s plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements.

WE HAVE A LIMITED OPERATING HISTORY.

We have been in existence for approximately four years. Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) develop and commercialize our products; (ii) achieve market acceptance of our products; or (iii) respond to competition. Additionally, even if we do implement our business plan, we may not be successful. No assurances can be given as to exactly when, if at all, we will be able to recognize profits high enough to sustain our business. We face all the risks inherent in a new business, including the expenses, difficulties, complications, and delays frequently encountered in connection with conducting operations, including capital requirements. Given our limited operating history, we may be unable to effectively implement our business plan which could materially harm our business or cause us to cease operations.

WE MAY SUFFER LOSSES IF OUR REPUTATION IS HARMED.

Our ability to attract and retain customers and employees may be adversely affected to the extent our reputation is damaged. If we fail, or appear to fail, to deal with various issues that may give rise to reputational risk, we could harm our business prospects. These issues include, but are not limited to, appropriately dealing with potential conflicts of interest, legal and regulatory requirements, ethical issues, money-laundering, privacy, record-keeping, sales and trading practices, and the proper identification of the legal, reputational, credit, liquidity, and market risks inherent in our business. Failure to appropriately address these issues could also give rise to additional legal risk to us, which could, in turn, increase the size and number of claims and damages asserted against us or subject us to regulatory enforcement actions, fines, and penalties.

9

WE DEPEND ON OUR CHIEF EXECUTIVE OFFICER AND THE LOSS OF HIS SERVICES COULD ADVERSELY AFFECT OUR BUSINESS.

We place substantial reliance upon the efforts and abilities of Jeromy Olson, our Chief Executive Officer. Though no individual is indispensable, the loss of the services of Mr. Olson could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man life insurance on the life of Mr. Olson.

Our success depends on attracting and retaining qualified personnel and subcontractors in a competitive environment.

The success of our business is dependent on our ability to attract, develop and retain qualified personnel advisors and subcontractors. Changes in general or local economic conditions and the resulting impact on the labor market may make it difficult to attract or retain qualified individuals in the geographic areas where we perform our work. If we are unable to provide competitive compensation packages, high-quality training programs and attractive work environments or to establish and maintain successful partnerships, our ability to profitably execute our work could be adversely impacted.

Accounting for our revenues and costs involves significant estimates.

Accounting for our contract-related revenues and costs, as well as other expenses, requires management to make a variety of significant estimates and assumptions. Although we believe we have sufficient experience and processes to enable us to formulate appropriate assumptions and produce reasonably dependable estimates, these assumptions and estimates may change significantly in the future and could result in the reversal of previously recognized revenue and profit. Such changes could have a material adverse effect on our financial position and results of operations.

WE RECENTLY COMPLETED A DEBT FINANCING WHICH IS secured by the grant of a security interest in all of our assets and upon a default the lender may foreclose on all of our assets.

As further described in “Recent Developments” above, in July 2016, we entered into the Loan Agreement with Genlink, pursuant to which Genlink made available to the Company a Revolving Loan. Pursuant to the Loan Agreement, the Company issued the Genlink Note up to an aggregate principal amount of One Million Dollars ($1,000,000). Additionally, pursuant to the Loan Agreement, the Company and Genlink entered into the Security Agreement, pursuant to which the Company granted Genlink a senior security interest in substantially all of the Company’s assets as security for repayment of the Revolving Loan. In the event of the Company’s failure to make payments or to otherwise comply with the terms of the Revolving Loan under the Security Agreement or the Genlink Note, Genlink can declare a default and seek to foreclose on the Company’s assets. If the Company is unable to repay or refinance such indebtedness it may be forced to cease operations and the holders of the Company’s securities may lose their entire investment.

Our contract backlog is subject to unexpected adjustments and cancellations and could be an uncertain indicator of our future earnings.

We cannot guarantee that the revenues projected in our contract backlog will be realized or, if realized, will be profitable. Projects reflected in our contract backlog may be affected by project cancellations, scope adjustments, time extensions or other changes. Such changes may adversely affect the revenue and profit we ultimately realize on these projects.

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR SECURITIES.

Effective internal controls is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation

10

with investors may be harmed. As a result of our small size, any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital.

We currently have insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of US GAAP and SEC disclosure requirements. Additionally, there is a lack of formal process and timeline for closing the books and records at the end of each reporting period and such weaknesses restrict the Company’s ability to timely gather, analyze and report information relative to the financial statements. As a result, our management has concluded that as of December 31, 2015, we have material weaknesses in our internal control procedures and our internal control over financial reporting was ineffective.

Because of the Company’s limited resources, there are limited controls over information processing. There is inadequate segregation of duties consistent with control objectives. Our Company’s management is composed of a small number of individuals resulting in a situation where limitations on segregation of duties exist. In order to remedy this situation we would need to hire additional staff. Currently, the Company has begun to hire additional staff to facilitate greater segregation of duties. Management intends to begin documenting and formalizing controls and procedures.

RISKS RELATING TO OUR INDUSTRY

THE INSTALLATION OF SYNTHETIC TURF IS A HIGHLY COMPETITIVE INDUSTRY.

The installation of synthetic turf is a highly competitive and highly fragmented industry. Competing companies may be able to beat our bids for the more desirable projects. As a result, we may be forced to lower bids on projects to compete effectively, which would then lower the fees we can generate. We may compete for the management and installation of synthetic turf with many entities, including nationally recognized companies. Many competitors may have substantially greater financial resources than we do. In addition, certain competitors may be willing to accept lower fees for their services.

THE SUCCESS OF OUR BUSINESS IS SIGNIFICANTLY RELATED TO GENERAL ECONOMIC CONDITIONS AND, ACCORDINGLY, OUR BUSINESS COULD BE HARMED BY THE ECONOMIC SLOWDOWN AND DOWNTURN IN FINANCING OF PUBLIC WORKS CONTRACTS.

Our business is closely tied to general economic conditions. As a result, our economic performance and the ability to implement our business strategies may be affected by changes in national and local economic conditions. During an economic downturn funding for public contracts tends to decrease significantly thereby limiting the growth and opportunities available for new and established businesses in the synthetic turf industry. An economic downturn may limit the number of projects that we are able to bid on and limit the opportunities we have to penetrate the synthetic turf industry, stunting the Company’s growth prospects and having a material adverse effect on our business.

IF WE ARE UNABLE TO OBTAIN RAW MATERIALS IN A TIMELY MANNER OR IF THE PRICE OF RAW MATERIALS INCREASES SIGNIFICANTLY, PRODUCTION TIME AND PRODUCT COSTS COULD INCREASE, WHICH MAY ADVERSELY AFFECT OUR BUSINESS.

The third party manufacturers of our products depend on raw materials derived from petrochemicals such as yarn, backing and infill. If the prices of these raw materials rise significantly, we may be unable to pass on the increased cost to our customers. Our results of operations could be adversely affected if we are unable to obtain adequate supplies of raw materials in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet our specifications, resulting in potential delays or declines in output. Furthermore, problems with our raw materials may give rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty claims. Errors or defects may arise from raw materials supplied by third parties that are beyond our detection or control, which could lead to additional customer returns or product warranty claims that may adversely affect our business and results of operations.

11

Failure to maintain safe work sites could result in significant losses.

Construction and maintenance sites are potentially dangerous workplaces and often put our employees and others in close proximity with mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials. On many sites, we are responsible for safety and, accordingly, must implement safety procedures. If we fail to implement these procedures or if the procedures we implement are ineffective, we may suffer the loss of or injury to our employees, as well as expose ourselves to possible litigation. Our failure to maintain adequate safety standards could result in reduced profitability or the loss of projects or clients, and could have a material adverse impact on our financial position, results of operations, cash flows and liquidity.

An inability to obtain bonding could have a negative impact on our operations and results.

We may be required to provide surety bonds securing our performance for some of our public and private sector contracts. Our inability to obtain reasonably priced surety bonds in the future could significantly affect our ability to be awarded new contracts, which could have a material adverse effect on our financial position, results of operations, cash flows and liquidity.

Design-build contracts subject us to the risk of design errors and omissions.

Design-build is increasingly being used as a method of project delivery as it provides the owner with a single point of responsibility for both design and construction. We generally do not subcontract design responsibility as we have our own architects and engineers in-house. In the event of a design error or omission causing damages, there is risk that the subcontractor or their errors and omissions insurance would not be able to absorb the liability. In this case we may be responsible, resulting in a potentially material adverse effect on our financial position, results of operations, cash flows and liquidity.

Many of our contracts have penalties for late completion.

In some instances, including many of our fixed price contracts, we guarantee that we will complete a project by a certain date. If we subsequently fail to complete the project as scheduled we may be held responsible for costs resulting from the delay, generally in the form of contractually agreed-upon liquidated damages. To the extent these events occur, the total cost of the project could exceed our original estimate and we could experience reduced profits or a loss on that project.

Strikes or work stoppages could have a negative impact on our operations and results.

Some of our projects require union labor and although we have not experienced strikes or work stoppages in the past, such labor actions could have a significant impact on our operations and results if they occur in the future.

Failure of our subcontractors to perform as anticipated could have a negative impact on our results.

We subcontract portions of many of our contracts to specialty subcontractors, but we are ultimately responsible for the successful completion of their work. Although we seek to require bonding or other forms of guarantees, we are not always successful in obtaining those bonds or guarantees from our higher-risk subcontractors. In this case we may be responsible for the failures on the part of our subcontractors to perform as anticipated, resulting in a potentially adverse impact on our cash flows and liquidity. In addition, the total costs of a project could exceed our original estimates and we could experience reduced profits or a loss for that project, which could have an adverse impact on our financial position, results of operations, cash flows and liquidity.

WE MUST ANTICIPATE AND RESPOND TO RAPID TECHNOLOGICAL CHANGE.

The market for our products and services is characterized by technological developments and evolving industry standards. These factors will require us to continually improve the performance and features of our products and services and to introduce new products and services, particularly in response to offerings

12

from our competitors, as quickly as possible. As a result, we might be required to expend substantial funds for and commit significant resources to the conduct of continuing product development. We may not be successful in developing and marketing new products and services that respond to competitive and technological developments, customer requirements, or new design and production techniques. Any significant delays in product development or introduction could have a material adverse effect on our operations.

FAILURE TO PROTECT OUR INTELLECTUAL PROPERTY OR TECHNOLOGY OR OBTAIN RIGHTS TO USE OTHERS’ INTELLECTUAL PROPERTY OR TECHNOLOGY COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS.

We take steps to protect our intellectual property rights such as filing for patent protection where we deem appropriate. However, there is no guarantee that any technology we seek to protect will, in fact, be granted patent protection or any other form of intellectual property protection. Consequently, if we are unable to secure exclusive rights in such technology, our competitors may be free to use such technology as well. We may at times also be subject to the risks of claims and litigation alleging infringement of the intellectual property rights of others. There is no guarantee that we will be able to resolve such claims or litigations favorably, and may, as a result, be exposed to adverse decisions in such litigations which may require us to pay damages, cease using certain technologies or products, or license certain technology, which licenses may not be available to us on commercially reasonable terms or at all. Moreover, intellectual property litigation, regardless of the ultimate outcomes, is time-consuming and expensive and can result in the distraction of management personnel and expenditure of consider resources in defending against any such infringement claims.

WE RELY UPON THIRD-PARTY MANUFACTURERS AND SUPPLIERS, WHICH PUTS US AT RISK FOR THIRD-PARTY BUSINESS INTERRUPTIONS.

Success for our business depends in part on our ability to retain third party manufacturers and suppliers to provide subparts for our products and materials for the services we provide. If manufacturers and suppliers fail to perform, our ability to market products and to generate revenue would be adversely affected. Our failure to deliver products and services in a timely manner could lead to customer dissatisfaction and damage to our reputation, cause customers to cancel contracts and to stop doing business with us.

LOWER THAN EXPECTED DEMAND FOR OUR PRODUCTS AND SERVICES WILL IMPAIR OUR BUSINESS AND COULD MATERIALLY ADVERSELY AFFECT OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

Currently there are approximately 11,000 synthetic turf fields installed in the U.S. and approximately 1,000 new fields installed every year, according to the Synthetic Turf Council. Given that there are approximately 50,000 colleges and high schools in the U.S. with athletic programs, in so far as athletic fields are concerned, at some point in the future saturation will slow the growth of the industry. If we meet a lower demand for our products and services than we are expecting, our business, results of operations and financial condition are likely to be materially adversely affected. Moreover, overall demand for synthetic turf products and services in general may grow slowly or decrease in upcoming quarters and years because of unfavorable general economic conditions, decreased spending by schools and municipalities in need of synthetic turf products or otherwise. This may reflect a saturation of the market for synthetic turf. To the extent that there is a slowdown in the overall market for synthetic turf, our business, results of operations and financial condition are likely to be materially adversely affected.

WE MAY BE SUBJECT TO THE RISK OF SUBSTANTIAL ENVIRONMENTAL LIABILITY AND LIMITATIONS ON OUR OPERATIONS BROUGHT ABOUT BY THE REQUIREMENTS OF ENVIRONMENTAL LAWS AND REGULATIONS.

We may be subject to various federal, state and local environmental, health and safety laws and regulations concerning issues such as, wastewater discharges, solid and hazardous materials and waste handling and disposal, landfill operation and closure. There have been a number of ecological concerns that have arisen from the creation of synthetic turf and the evolution of the synthetic turf industry. One of the biggest concerns to surface most recently is the amount of lead in some of the products used in the manufacture

13

and installation of synthetic turf and synthetic turf systems such as crumb rubber. Crumb rubber is rubber used from recycled tires and used as an infill product in most synthetic turf athletic fields in the U.S. and has shown to contain levels of lead that many argue could potentially be harmful to humans. In addition, many of the yarns used to make synthetic turf blades contain levels of lead that are also coming into question as to potential health hazards. Due to the many concerns that are now arising regarding the levels of lead contained in many synthetic turf products, the disposal of old synthetic turf fields may become an issue with municipal land-fills and could in fact add significant costs to the disposal of these worn out fields. It is possible that these old fields could be declared hazardous materials in the future by municipal land-fills, which would add enormous costs to the disposal of such products and the cost to dispose of these materials could in fact be as much as the original cost to purchase and install such fields. While Sports Field believes that it is and will continue to manufacture products in compliance with all applicable environmental laws and regulations, the risks of substantial additional costs and liabilities related to compliance with such laws and regulations are an inherent part of our business.

Risks Relating to Ownership of our SECURITIES

WE CURRENTLY DO NOT INTEND TO PAY DIVIDENDS ON OUR COMMON STOCK. AS A RESULT, YOUR ONLY OPPORTUNITY TO ACHIEVE A RETURN ON YOUR INVESTMENT IS IF THE PRICE OF OUR COMMON STOCK APPRECIATES.

We currently do not expect to declare or pay dividends on our common stock. In addition, our Revolving Loan with Genlink restricts our ability to declare or pay dividends on our common stock so long as it remains outstanding. As a result, your only opportunity to achieve a return on your investment will be if the market price of our common stock appreciates and you sell your shares and shares underlying your warrants at a profit.

YOU MAY EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST DUE TO THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK.

We are in a capital intensive business and we do not have sufficient funds to finance the growth of our business or to support our projected capital expenditures. As a result, we will require additional funds from future equity or debt financings, including potential sales of preferred shares or convertible debt, to complete the development of new projects and pay the general and administrative costs of our business. We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of holders of our common stock. We are currently authorized to issue 250,000,000 shares of common stock and 20,000,000 shares of preferred stock. We may also issue additional shares of common stock or other securities that are convertible into or exercisable for common stock in future public offerings or private placements for capital raising purposes or for other business purposes. The future issuance of a substantial number of common stock into the public market, or the perception that such issuance could occur, could adversely affect the prevailing market price of our common shares. A decline in the price of our common stock could make it more difficult to raise funds through future offerings of our common stock or securities convertible into common stock.

Our Certificate of Incorporation allows for our board of directors to create new series of preferred stock without further approval by our stockholders, which could have an anti-takeover effect and could adversely affect holders of our common stock AND WARRANTS.

Our authorized capital includes preferred stock issuable in one or more series. Our board of directors has the authority to issue preferred stock and determine the price, designation, rights, preferences, privileges, restrictions and conditions, including voting and dividend rights, of those shares without any further vote or action by stockholders. The rights of the holders of common stock and warrants will be subject to, and may be adversely affected by, the rights of holders of any preferred stock that may be issued in the future. The issuance of additional preferred stock, while providing desirable flexibility in connection with possible financings and acquisitions and other corporate purposes, could make it more difficult for a third party to acquire a majority of the voting power of our outstanding voting securities, which could deprive our holders of common stock and warrants to purchase common stock at a premium that they might otherwise realize in connection with a proposed acquisition of our company.

14

There can be no assurances that our shares AND/OR WARRANTS WILL BE LISTED ON THE NASDAQ AND, IF THEY ARE, OUR SHARES WILL BE SUBJECT TO POTENTIAL DELISTING IF WE DO NOT MEET OR CONTINUE TO MAINTAIN THE LISTING REQUIREMENTS OF THE NASDAQ.

We intend to apply to list the shares of our common stock on the NASDAQ. An approval of our listing application by NASDAQ will be subject to, among other things, our fulfilling all of the listing requirements of NASDAQ. In addition, NASDAQ has rules for continued listing, including, without limitation, minimum market capitalization and other requirements. Failure to maintain our listing, or de-listing from NASDAQ, would make it more difficult for shareholders to dispose of our common stock and more difficult to obtain accurate price quotations on our common stock. This could have an adverse effect on the price of our common stock. Our ability to issue additional securities for financing or other purposes, or otherwise to arrange for any financing we may need in the future, may also be materially and adversely affected if our common stock is not traded on a national securities exchange.

THERE IS CURRENTLY ONLY A LIMITED PUBLIC MARKET FOR OUR COMMON STOCK AND NO PUBLIC MARKET FOR OUR WARRANTS. FAILURE TO DEVELOP OR MAINTAIN A TRADING MARKET COULD NEGATIVELY AFFECT ITS VALUE AND MAKE IT DIFFICULT OR IMPOSSIBLE FOR YOU TO SELL YOUR SHARES AND WARRANTS.

There is currently only a limited public market for our common stock and an active public market for our common stock and warrants may not develop or be sustained. Failure to develop or maintain an active trading market could make it difficult for you to sell your shares or warrants without depressing the market price for such shares or recover any part of your investment in us. Even if an active market for our common stock or warrants does develop, the market price of our common stock and warrants may be highly volatile. In addition to the uncertainties relating to future operating performance and the profitability of operations, factors such as variations in interim financial results or various, as yet unpredictable, factors, many of which are beyond our control, may have a negative effect on the market price of our securities.

IF AND WHEN A LARGER TRADING MARKET FOR OUR SECURITIES DEVELOPS, THE MARKET PRICE OF SUCH SECURITIES IS STILL LIKELY TO BE HIGHLY VOLATILE AND SUBJECT TO WIDE FLUCTUATIONS, AND YOU MAY BE UNABLE TO RESELL YOUR SECURITIES AT OR ABOVE THE PRICE AT WHICH YOU ACQUIRED THEM.

The stock market in general has experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, you may not be able to sell your securities that you purchase in this offering at or above the price you paid for such securities. The market price for our securities may be influenced by many factors that are beyond our control, including, but not limited to:

• variations in our revenue and operating expenses;

• market conditions in our industry and the economy as a whole;

• actual or expected changes in our growth rates or our competitors’ growth rates;

• developments in the financial markets and worldwide or regional economies;

• variations in our financial results or those of companies that are perceived to be similar to us;

• announcements by the government relating to regulations that govern our industry;

• sales of our common stock or other securities by us or in the open market;

• changes in the market valuations of other comparable companies;

• general economic, industry and market conditions; and

• the other factors described in this “Risk Factors” section.

The trading price of our shares might also decline in reaction to events that affect other companies in our industry, even if these events do not directly affect us. Each of these factors, among others, could harm the value of your investment in our securities. In the past, following periods of volatility in the market,

15

securities class-action litigation has often been instituted against companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could materially and adversely affect our business, operating results and financial condition.

In the event that our common stock AND WARRANTS ARE listed on the NASDAQ our stock price could fall and we could be delisted in which case broker-dealers may be discouraged from effecting transactions in shares of our common stock AND WARRANTS because they may be considered penny stocks and thus be subject to the penny stock rules.

The SEC has adopted a number of rules to regulate “penny stock” that restricts transactions involving stock which is deemed to be penny stock. Such rules include Rules 3a51-1, 15g-1, 15g-2, 15g-3, 15g-4, 15g-5, 15g-6, 15g-7, and 15g-9 under the Securities and Exchange Act of 1934, as amended. These rules may have the effect of reducing the liquidity of penny stocks. “Penny stocks” generally are equity securities with a price of less than $5.00 per share (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market if current price and volume information with respect to transactions in such securities is provided by the exchange or system). Our securities have in the past constituted, and may again in the future constitute, “penny stock” within the meaning of the rules. The additional sales practice and disclosure requirements imposed upon U.S. broker-dealers may discourage such broker-dealers from effecting transactions in shares of our common stock and warrants, which could severely limit the market liquidity of such shares and warrants and impede their sale in the secondary market.

A U.S. broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of $1,000,000 or an annual income exceeding $200,000, or $300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt. In addition, the “penny stock” regulations require the U.S. broker-dealer to deliver, prior to any transaction involving a “penny stock”, a disclosure schedule prepared in accordance with SEC standards relating to the “penny stock” market, unless the broker-dealer or the transaction is otherwise exempt. A U.S. broker-dealer is also required to disclose commissions payable to the U.S. broker-dealer and the registered representative and current quotations for the securities. Finally, a U.S. broker-dealer is required to submit monthly statements disclosing recent price information with respect to the “penny stock” held in a customer’s account and information with respect to the limited market in “penny stocks”.

Stockholders should be aware that, according to SEC, the market for “penny stocks” has suffered in recent years from patterns of fraud and abuse. Such patterns include (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) “boiler room” practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (iv) excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, resulting in investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities.

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they change their recommendations regarding our stock adversely, our stock price and trading volume could decline.

The trading market for our common stock and warrants will be influenced by the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. If any of the analysts who may cover us change their recommendation regarding our stock adversely, or provide more favorable relative recommendations about our competitors, our securities price would likely decline.

16

If any analyst who may cover us were to cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline.

Risks Related to the Offering

Investors in this offering will experience immediate and substantial dilution in net tangible book value.