UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number:

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (

Securities Registered Pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s shares of common stock, $0.01 par value, held by non-affiliates of the registrant, was $

As of February 24, 2021, there were

Documents Incorporated by Reference

Portions of Part III of this Form 10-K are incorporated by reference from the registrant’s definitive proxy statement for its 2021 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission no later than 120 days after the end of the registrant’s fiscal year.

TABLE OF CONTENTS

PART I

In this Annual Report on Form 10-K, or this Annual Report, we refer to STORE Capital Corporation, a Maryland corporation, as “we,” “us,” “our,” “the Company,” “S|T|O|R|E” or “STORE Capital,” unless we specifically state otherwise or the context indicates otherwise.

Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for long-term, triple-net leases of freestanding, single-tenant properties, and expected liquidity needs and sources (including the ability to obtain financing or raise capital). Words such as “estimate,” “anticipate,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “seek,” “approximately” or “plan,” or the negative of these words, and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters, are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management.

Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise, and we may not be able to realize them. Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the potential adverse effects of the COVID-19 pandemic, and federal, state and/or local regulatory guidelines and private business actions to control it, on our financial condition, operating results and cash flows, our customers, the real estate market in which we operate, the global economy and the financial markets. The extent to which the COVID-19 pandemic will continue to impact us and our customers will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, and the resulting economic impacts and potential changes in customer behavior, among others. The following risks, among others, which may be further heightened by the COVID-19 pandemic, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| ● | actual or perceived threats associated with epidemics, pandemics, including COVID-19, or public health crises; |

| ● | the performance and financial condition of our customers; |

| ● | our ability to raise debt and equity capital on attractive terms; |

| ● | the competitive environment in which we operate; |

| ● | real estate risks, including fluctuations in real estate values and the general economic climate in local markets and competition for customers in such markets; |

| ● | decreased rental rates or increased vacancy rates; |

| ● | potential defaults (including bankruptcy or insolvency) on, or non-renewal of, leases by customers; |

| ● | real estate acquisition risks, including our ability to identify and complete acquisitions and/or failure of such acquisitions to perform in accordance with projections; |

| ● | potential natural disasters and other liabilities and costs associated with the impact of climate change; |

| ● | litigation, including costs associated with defending claims against us as a result of incidents on our properties, and any adverse outcomes; |

1

| ● | potential changes in the law or governmental regulations that affect us and interpretations of those laws and regulations, including changes in real estate and zoning or real estate investment trust tax laws; |

| ● | the impact of changes in the tax code as a result of federal tax legislation and uncertainty as to how such changes may be applied; |

| ● | financing risks, including the risks that our cash flows from operations may be insufficient to meet required payments of principal and interest and that we may be unable to refinance our existing debt upon maturity or obtain new financing on attractive terms at all; |

| ● | lack of or insufficient amounts of insurance; |

| ● | our ability to maintain our qualification as a real estate investment trust; |

| ● | our ability to retain key personnel; |

| ● | possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us; and |

| ● | the factors included in this report, including those set forth under the headings “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. |

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of the document in which they are contained. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to publicly release the results of any revisions to any forward-looking statement that may be made to reflect events or circumstances after the date as of which that forward-looking statement speaks or to reflect the occurrence of unanticipated events, except as required by law.

Item 1. BUSINESS

Overview

General. S|T|O|R|E is an internally managed net-lease real estate investment trust, or REIT, that is the leader in the acquisition, investment and management of Single Tenant Operational Real Estate, or STORE Properties, which is our target market and the inspiration for our name. A STORE Property is a real property location at which a company operates its business and generates sales and profits, which makes the location a profit center and, therefore, fundamentally important to that business.

S|T|O|R|E is one of the largest and fastest-growing net-lease REITs and our portfolio is highly diversified. As of December 31, 2020, our 2,634 property locations were operated by 519 customers across the United States. Our customers operate across a wide variety of industries within the service, retail and manufacturing sectors of the U.S. economy, with restaurants, early childhood education, health clubs, metal fabrication and automotive repair and maintenance representing the top industries in our portfolio.

2

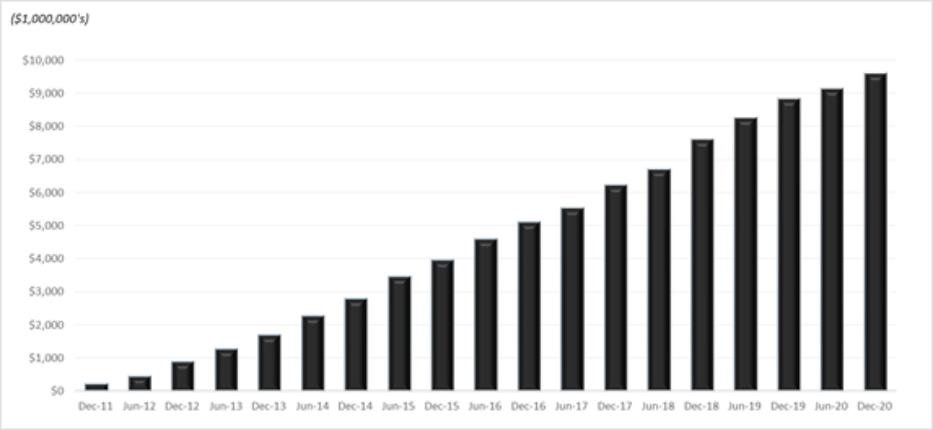

The following table depicts the growth in our investment portfolio since our inception in 2011.

Our Total Investment Portfolio at Period End

Taxation as a Real Estate Investment Trust. We have elected to be taxed as a real estate investment trust, or a REIT, under the Internal Revenue Code of 1986, as amended, or the Code, commencing with our initial taxable year ended December 31, 2011. To continue to qualify as a REIT, we must continue to meet certain tests which, among other things, require that our assets consist primarily of real estate assets, our income be derived primarily from real estate assets, and that we distribute at least 90% of our REIT taxable income (other than our net capital gains) to our stockholders annually.

The Net-Lease Model and Sustainability. S|T|O|R|E is a net-lease REIT. Accordingly, we acquire STORE Properties from business owners, and then lease the properties back to the business owners under net-leases, substantially all of which are triple-net. Under a triple-net lease, our customer (the tenant) is solely responsible for operating the business conducted at the property subject to the lease, keeping property and improvements in good order and repair, remodeling and updating the building as it deems appropriate to maximize business value, and paying the insurance, property taxes and other property-related expenses. Under the triple-net lease model, therefore, S|T|O|R|E is not a real estate operator; rather, we provide real estate financing solutions to customers seeking a long-term, lower-cost alternative to real estate ownership. Following our acquisition of a property, it is our customer, and not S|T|O|R|E, that controls the property, including with respect to decisions as to when and how to implement environmentally sustainable practices at a given property. However, as the property owner, we nevertheless recognize that the operation of commercial real estate assets can have a meaningful impact on the environment, particularly with respect to resource consumption and waste generation, and on the health of building occupants. Accordingly, at S|T|O|R|E, we believe that being conscious of, and seeking to address, environmental impacts within our control, and supporting our tenant customers to do the same in their businesses, plays a role in building and sustaining successful enterprises and, thus, is material to the success of our own business.

Our Corporate Responsibility. We define success by our ability to make a positive difference for all of our many stakeholders. S|T|O|R|E’s beginning was inspired by our belief that we could make a positive difference for real estate intensive businesses across the U.S. by delivering innovative and superior real estate capital solutions. That belief has guided our efforts to bring much needed capital and liquidity opportunities to middle market businesses which, in turn, have brought value creation and growth to our most integral stakeholders: our customers, stockholders and employees. For our many customers, STORE’s real estate lease solutions have contributed to their prospects for wealth creation and to their ability to grow, create jobs and contribute to many communities across the country. In turn, meeting the needs of our customers provides an extraordinary investment opportunity that we believe holds the promise of sustainable long-term wealth creation for our many stockholders. We are committed to operating our business responsibly, guarding our valuable reputation and creating long-term and sustainable value for our company through a robust business model and attentiveness

3

to our many stakeholders. S|T|O|R|E is committed to playing an important role for middle market and larger companies across the U.S. in order to help them succeed, while making a positive impact on our collective communities, both today and for future generations.

2020 Highlights

| ● | During the year ended December 31, 2020, we invested approximately $1.1 billion in 214 property locations. |

| ● | As of December 31, 2020, our total gross investment in real estate had reached approximately $9.6 billion, of which $6.1 billion was unencumbered. Our long-term outstanding debt totaled $3.8 billion at December 31, 2020, and, at that date, approximately $2.2 billion of our total long-term debt was secured debt and approximately $3.5 billion of our investment portfolio served as collateral for these outstanding borrowings. |

| ● | For the year ended December 31, 2020, we declared dividends totaling $1.42 per share of common stock to our stockholders. In the third quarter of 2020 we raised our quarterly dividend 2.9% from our previous quarterly dividend amount. |

| ● | During 2020, we raised aggregate net proceeds of $686.4 million from sales of shares under our “at the market”, or ATM, equity offering program. As of December 31, 2020, we had the ability to offer and sell up to an additional $787.0 million of our shares of common stock under our $900.0 million ATM authorization established in November 2020. |

| ● | In November 2020, we completed our third public debt offering, issuing $350.0 million in aggregate principal amount of unsecured, investment-grade rated 2.75% Senior Notes, due in November 2030. |

| ● | In the fourth quarter of 2020, in conjunction with the $350.0 million public debt offering, we prepaid, without penalty, one of our $100.0 million bank term loans and STORE Master Funding notes with a balance of approximately $92.3 million at the time of prepayment; the STORE Master Funding notes were scheduled to mature in 2022 and bore a coupon rate of 3.75%. |

Our Target Market

We are the leader in providing real estate financing solutions principally to middle-market and larger businesses that own STORE Properties and operate within the broad-based service, retail and manufacturing sectors of the U.S. economy. We have designed our net-lease solutions to provide a long-term, lower-cost way to improve our customers’ capital structures and, thus, be a preferred alternative to real estate ownership. We estimate the market for STORE Properties to approximate $3.9 trillion in market value and to include more than 2.0 million properties.

We define middle-market companies as those having approximate annual gross revenues of between $10 million and $1.0 billion, although approximately 18% of our customers have annual revenues in excess of $1.0 billion. The median annual revenues of our 519 customers was approximately $50 million and, on a weighted average basis, our average customer had revenues of approximately $800 million. Most of our customers do not have credit ratings, although some have ratings from rating agencies that service insurance companies or fixed-income investors. Most of these non-rated companies either prefer to be unrated or are simply too small to issue debt rated by a nationally recognized rating agency in a cost-efficient manner.

The financing marketplace for STORE Properties is highly fragmented, with few participants addressing the long-term capital needs of middle-market and larger non-rated companies. While we believe our net-lease financing solutions can add value to a wide variety of companies, we believe the largest underserved market and, therefore, our greatest opportunity, is non-rated, bank-dependent, middle-market and larger companies that generally have less access to efficient sources of long-term capital.

Our customers typically have the choice either to own or to lease the real estate they use in their daily businesses. They choose to lease for various reasons, including the potential to lower their cost of capital, as leasing supplants traditional financing options that tie up the equity in their real estate. Leasing is also viewed as an attractive alternative to our customers because it generally locks in scheduled payments, at lower levels and for longer periods, than traditional financing options; these factors are viewed favorably relative to the amounts funded.

4

Whether companies elect to rent or own the real estate they use in their businesses is most often a financial decision. For the few highly capitalized large companies that possess investment-grade credit ratings, real estate leasing tends to be viewed as a substitute for corporate borrowings that they could otherwise access (so long as they remain highly rated and equitized). With real estate leases often bearing rental costs that exceed corporate term borrowing costs, such companies elect to rent for strategic reasons. Such reasons may include the long-term flexibility to vacate properties that are no longer strategic, the permanence of lease capital which lessens potential refinancing risk should corporate credit ratings deteriorate, the lack of corporate financial covenants associated with leasing and the ability to harness developers to effectively outsource their real estate development needs. The primary motivations for S|T|O|R|E’s middle market and larger customers tend to be different. For such companies, real estate leasing solutions offer the potential to lower their cost of capital. In addition to this primary economic motivation, our tenants also seek lease assignability, property substitution rights, property closure rights and S|T|O|R|E’s assistance with property expansion and lease contract modification. Our real estate leasing solutions offer tenants such flexibility, which, in turn, offers the potential for further tenant wealth creation. We believe that our customers select us as their landlord of choice principally as a result of our service, comparative business flexibility and the tailored net-lease solutions we provide.

We believe the demand for our net-lease solutions has grown as a result of the current bank regulatory environment. In our view, the increased scrutiny and regulation of the banking industry in response to the collapse of the housing and mortgage industries from 2007 to 2009, particularly the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, and the Basel Accords issued by the Basel Committee on Banking Supervision, have constrained real estate lending practices and limited desirable term debt real estate borrowing options. Real estate leasing today represents a highly desirable component of corporate capitalization strategies due, in part, to the unavailability of long-term, fixed rate commercial real estate mortgage financing with important features such as affordable prepayment and modification options or loan assignability.

S|T|O|R|E was formed to capitalize on a large market opportunity resulting from the widespread need amongst middle market and larger companies for efficient corporate real estate capital solutions. We believe our opportunities include both gaining market share from the fragmented network of net-lease capital providers and growing the market by creating demand for our net-lease solutions that meet the long-term real estate capital needs of these companies.

The estimated $3.9 trillion market of STORE Properties is divided into three primary industry sectors and various industry sub-sectors. The primary sectors and their proportion of this market are service at 47%, retail at 42% and manufacturing at 11%. The sub-sectors included within each primary sector are summarized in the table below.

Service | Retail | Manufacturing | ||

Restaurants | Big box retail | Industrial profit-centers | ||

Education | Specialty retail | Light manufacturing | ||

Fitness centers | Grocery | |||

Transportation | Drug stores | |||

Automotive services | Automotive (new and used) | |||

Family entertainment |

Within the sub-sectors, the market for STORE Properties is further subdivided into a wide variety of industries within the service, retail and manufacturing sectors, such as:

Automotive parts stores | Movie theaters | |

Cold storage facilities | Office supplies retailers | |

Department stores | Pet care facilities | |

Discount stores | Rental centers | |

Early childhood education | Secondary education | |

Family entertainment facilities | Supermarkets | |

Fast food restaurants | Truck stops | |

Full service restaurants | Wholesale clubs | |

Furniture stores |

5

Although many of these industries are represented within our diverse property portfolio, S|T|O|R|E primarily targets service sector properties that represent a broad array of everyday services (such as restaurants and early childhood education facilities) that are not readily available online and that are located near customers targeted by the business operating on the property. Although not our primary focus, the retail sector assets we target are primarily located in retail corridors, also tend to be internet resistant and include a high experiential component, such as furniture and hunting and fishing stores. In the manufacturing sector, we typically target properties that represent a broad array of industries, are located in industrial parks near customers and suppliers, and are operated by businesses that produce everyday necessities. As of December 31, 2020, our portfolio of investments in STORE Properties was diversified across more than 110 industries, of which 64% was in the service sector, 18% was in the retail sector and 18% was in the manufacturing sector, based on revenue.

Our Asset Class: STORE Properties

STORE Properties are a unique asset class that inspired the formation of S|T|O|R|E and our company name. STORE (Single Tenant Operational Real Estate) Properties are profit-center real estate locations on which our customers conduct their businesses and generate revenues and profits. Along with obtaining properties at yields exceeding the auction marketplace, we describe the ongoing receipt of unit-level profit and loss statements from our tenants, using master leases wherever possible and investing in real estate below its replacement cost, as our four “Tables Stakes” when investing in STORE Properties. The defining characteristic of STORE Properties is the number of sources that support the payment of our rent: STORE Properties have the following three sources, whereas all other commercial real estate assets have just two.

| ● | Unit-Level Profitability. STORE Properties are distinguished by the primary source that supports the payment of rent, which is the profits produced by the business operations at the real estate locations we own, which we refer to as unit-level profitability. While it is a common perception that the tenant under a lease is the primary source of the rent payment (as distinguished from the business unit operating at the leased site), we have observed a historic pattern in which tenants in corporate insolvencies seek to vacate unprofitable locations while retaining profitable ones, which indicates that the profitability of a property location is the main indicator of a tenant’s long-term ability to pay the rent on that property. Because insolvent tenants historically retain profitable locations while seeking to vacate unprofitable ones, a key component of our business includes requiring our customers to produce and submit to us unit-level financial statements of the businesses they operate at our properties. As of December 31, 2020, approximately 98% of the properties in our portfolio are subject to unit-level financial reporting requirements. Without access to these unit-level financial reports, it is difficult to accurately assess our customer’s business and, thus, the quality of the most important, and primary, source for our rent payments. |

| ● | Customer Credit Quality. In addition to the unit-level profitability of the businesses operated on the real estate we own, our customers’ overall financial health, or credit quality, serves as a secondary source supporting rent payments. Our customer’s credit can become the primary source if our unit is not profitable and our customer is required to divert cash flows from its other profitable locations or utilize other resources to pay our rents. However, we have seen that customer credit quality tends to be subject to greater volatility over time than unit-level profitability, because customer credit quality is not only a function of the unit-level profitability of the operations at our locations, but of the profitability of potentially many other properties owned by our customer or other third parties. Corporate financial health is also a function of many other decisions, such as optional changes in capital structure or growth strategies, as well as conditions in the marketplace for our customers’ products and services, that can change over time and that may have profound impacts on customer creditworthiness. |

| ● | Real Estate Residual Value. The final source supporting the payment of rent, common to all real estate investments, is the residual value of the underlying real estate, which gives us the opportunity to receive rents from substitute tenants in the event our property becomes vacant. For S|T|O|R|E, this means more than just looking at comparable lease rates and transactions. Studies we have completed underscore the importance of investing in properties at or below their as-new replacement costs. We also review the local markets in which our properties are located and seek to have rents that are at or below prevailing market rents on a per square foot basis for comparable properties. Taking these steps protects S|T|O|R|E and our customers by making it |

6

| easier for us to assign, sell or sublease properties that our customers may want to sell, reposition or vacate as part of their capital efficiency strategies. |

Creating Investment-Grade Contracts

From our inception in 2011, we have emphasized and uniquely disclosed information regarding the net-lease contracts we create with our tenants. We believe that our net-lease contracts, and not simply tenant or real estate quality, are central to our potential to deliver superior long-term risk-adjusted rates of return to our stockholders. Contract quality embodies tenant and real estate characteristics, together with other investment attributes we believe are highly material. Contract attributes include the prices we pay for the real estate we own, inclusive of the prices relative to new construction cost. As of December 31, 2020, our average investment approximated 80% of replacement cost, a statistic that has been relatively stable since 2015. Other important contract attributes include the ability to receive unit-level financial statements, which allows us to evaluate unit-level cash flows relative to the rents we receive. As of December 31, 2020, the median ability of the properties we own to cover our rents, inclusive of an allowance for indirect costs, approximated 2.1:1, which has also held fairly stable since 2015. Likewise, over many years of providing real estate net-lease capital, we have determined that tenant alignments of interest are highly important. Such alignments of interest can include full parent company recourse, credit enhancements in the form of guarantees, cross default provisions and the use of master leases. Master leases are individual lease contracts that bind multiple properties and offer landlords greater security in the event of tenant insolvency and bankruptcy. Whereas individual property leases provide tenants with the opportunity to evaluate the desirability and viability of each individual property they rent in the event of a bankruptcy, master leases bind multiple properties, permitting landlords to benefit from aggregate property performance and limiting tenants’ ability to pick and choose which leases to retain. As of December 31, 2020, 94% of our multi-property net-lease contracts were in the form of master leases. Contract economic terms are also highly important because they can enhance margins of safety. During 2020, our weighted average initial lease rate was 8.1%, with annual contractual lease escalations averaging an added 1.9% of contract rents. We believe that our initial yields, on average, range from 10% to 15% above those expected by investors seeking real estate investment opportunities through the broker auction market, which provides us greater flexibility to preserve and enhance returns. Other important tenant contract considerations include indemnification provisions, lease renewal rights, and the ability to sublease and assign leases, as well as qualitative considerations, such as alternative real estate use assessment and the composition of a tenant’s capitalization structure.

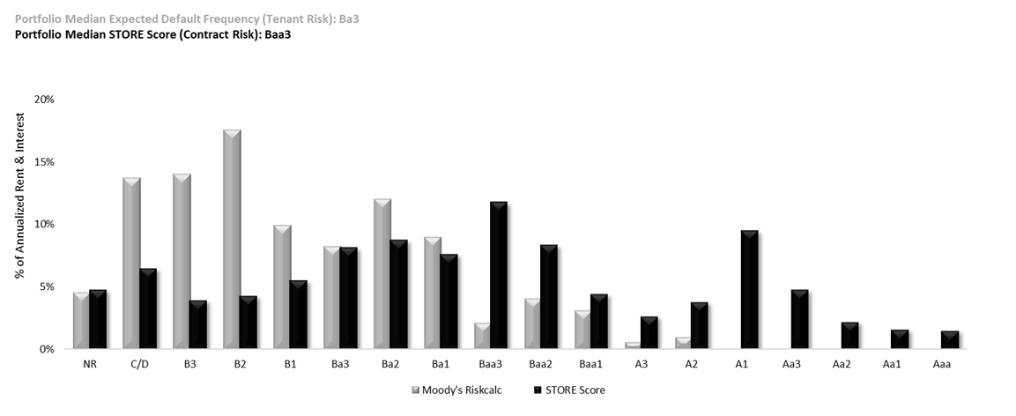

Since our November 2014 initial public offering, S|T|O|R|E’s extensive contract attribute disclosure has uniquely included a tenant credit quality distribution chart, employing computed implied credit ratings applied to regularly received tenant financial statements using Moody’s Analytics RiskCalc. Since tenant credit ratings are merely one component of contract risk, we developed a means to deliver a base quantitative contract quality estimate. Our approach was to modify risk of tenant insolvency, as estimated by the Moody’s algorithm, by our own estimate of the likelihood of property closure, based on the regularly monitored profitability of the properties bound by each lease contract we create. To accomplish this, we established a simple range of property closure likelihood ranging from 10% to 100% based upon property profitability ranges from breakeven to a computed ability to cover our rents twice over. Multiplying tenant estimated insolvency probability (Moody’s Analytics RiskCalc) by our estimate of the probability of property closure results in a contract risk measurement that we call the STORE Score and which we regularly and uniquely disclose.

7

Our Competitive Strengths

We have a market-leading platform for the acquisition, investment in and management of STORE Properties that simultaneously creates value for stockholders and customers through our five corporate competencies.

| ● | Investment Origination. We founded S|T|O|R|E to fill a need for efficient long-term real estate capital for middle-market and larger customers. We do this principally through a solutions-oriented approach that includes the use of lease contracts that address our customers’ needs and that strive to provide superior value for our customers over other financial options they may have to capitalize their businesses. A S|T|O|R|E hallmark is our ability to directly market our real estate lease solutions to middle market and larger companies nation-wide, harnessing a geographically focused team of experienced relationship managers at our home office. Approximately 80% of our investments, by dollar volume, have been originated by our internal origination team through direct new customer solicitations and a strong level of repeat business from existing customers. By creating demand for our services, we maintain a large pipeline of investment opportunities, which we estimate to be $12.4 billion as of December 31, 2020. Our objectives are to be highly selective and to achieve higher rates of return than our stockholders could achieve if they sought to acquire profit-center real estate on their own. |

| ● | Investment Underwriting. Our investment underwriting approach centers on evaluations of unit-level and corporate-level financial performance, together with detailed real estate valuation assessments, which is reflective of the characteristics of the STORE Property asset class. We have combined our underwriting approach with our portfolio management systems to capture and track computed customer credit ratings as well as the performance of the businesses conducted at the properties we own (unit-level performance). Our focus on STORE Properties, which are profit-centers for our tenants, enables us to create lease contracts having payment performance characteristics that are generally materially superior to the implied credit ratings of our diverse tenant base. Through our underwriting and portfolio management approach, we track, measure and report investment performance, with the investment underwriting goal to create a diverse portfolio centered on investment-grade quality contracts. As of December 31, 2020, we estimate that the net portfolio losses we have experienced due to credit events experienced by our customers have averaged 0.3% per year of the total investments we have made since we began in 2011 based on average annual credit events of 1.3% and average annual net credit losses of 0.4% offset by average annual gains on property sales of 0.1%, which is reflective of our underwriting and portfolio management guidelines. |

| ● | Investment Documentation. Because we believe purchase and lease contracts are the principal determinants of investment risk, we have always emphasized the importance of our investment documentation. The purchase documentation process includes the validation of investment underwriting through our due diligence |

8

| process, which includes our initiation and receipt of third-party real estate valuations, title insurance, property condition assessments and environmental reports. When we are satisfied with the results and outcome of our pre-acquisition due diligence process, we purchase the property under a purchase agreement and enter into a lease with the seller. Our lease documents incorporate lessons learned over decades to forge balanced contracts characterized by important alignments of interest, including strong enforcement provisions. Altogether, our documentation process, like our approach to investment underwriting, is integral to investment quality and designed to offer our investors a value that most could not create for themselves. |

| ● | Portfolio Management. Net-lease real estate investment portfolios require active management to realize superior risk-adjusted rates of return. S|T|O|R|E is virtually paperless and we can access detailed information on our large diversified portfolio from practically anywhere and at any time, allowing us to monitor unit-level profit and loss statements, customer corporate financial statements and the timely payment of property taxes and insurance in order to gauge portfolio quality. Having such systems is central to our ability to effectively monitor and reduce customer credit risk at the property level, which, in turn, allows us to place greater focus on effectively managing the minority of investments that may have higher risks. We believe these systems, when combined with our high degree of financial and operating flexibility, allow us to realize better stockholder risk-adjusted rates of return on our invested capital. |

| ● | Financial Reporting and Treasury. We consider and evaluate our corporate financing strategies with the same emphasis as our real estate investment strategies. Under our financing strategy, borrowings must: prudently improve stockholder returns; be structured to provide portfolio flexibility and minimize our exposure to changes in long-term interest rates; be structured to optimize our cost of financing in a way that will enhance investor rates of return; and contribute to corporate governance by enhancing corporate flexibility. Our senior leadership team has extensive experience with diverse liability strategies. Today, we are one of the few REITs able to employ our own AAA rated borrowing source, while simultaneously maintaining investment-grade corporate credit ratings. We have designed and implemented strategies that add value to our investors by offering a more efficient means to finance real estate than they could otherwise do on their own. At the same time, the flexibility we derive from our liability strategies can also result in important flexibility for our customers. |

Our Business and Growth Strategies

Our objective is to continue to create stockholder value through sustained investment and management activities designed to increase distributable cash flows and deliver attractive risk-adjusted rates of return from a growing, diverse portfolio of STORE Properties. To accomplish this, our principal business and growth strategies are as follows:

| ● | Focus on Middle-Market and Larger Companies Operating STORE Properties. We believe we have selected the most attractive investment opportunity within the net-lease market, STORE Properties, and targeted the most attractive customer type within that market, middle-market and larger non-investment-grade-rated companies. We focus on this market given its strong fundamentals and the limited long-term financing solutions available to the companies in it. Within the net-lease market for STORE Properties, our value proposition is most compelling to middle-market and larger, bank-dependent companies, most of which are not rated by any nationally recognized rating agency due to their size or capital markets preferences, but who have strong credit metrics and operate within broad-based industries having the potential for sustained relevance. |

| ● | Realize Stable Income and Internal Growth. We seek to make investments that generate strong and stable current income as a result of the difference, or spread, between the rate we earn on our assets (primarily our lease revenues) and the rate we pay on our liabilities (primarily our long-term debt). We augment that income with internal growth. We seek to realize superior internal growth through a combination of (1) a target dividend payout ratio that permits a meaningful level of free cash flow reinvestment and (2) cash generated from the estimated 1.9% weighted average annual escalation of base rent and interest in our portfolio (as of December 31, 2020, as if the escalations in all of our leases were expressed on an annual basis). We benefit from contractual rent escalations, as approximately 98% of our leases and loans (as of December 31, 2020, by base rent and interest) have escalations that are either fixed (13% of our leases and loans) or based on the |

9

| Consumer Price Index, or CPI (85% of our leases and loans). A final means of internal growth is the accretive redeployment of cash realized from the occasional sale of real estate. During 2020, we divested real estate which had an initial cost of $236.4 million and collected $215.3 million in proceeds on these sales which we were able to redeploy. We believe these three means of internal growth will enable strong cash flow growth without relying exclusively on future common stock issuances to fund new portfolio investments. |

| ● | Capitalize on Direct Origination Capabilities for External Growth. As the market leader in STORE Property investment originations, we plan to complement our internal growth with external growth driven by continued new investments funded through future equity issuances and borrowings to expand our platform and raise investor cash flows. |

| ● | Actively Manage our Balance Sheet to Maximize Capital Efficiency. We seek funding sources that enable us to lock in long-term investment spreads and limit interest rate sensitivity. We also seek to maintain a prudent balance between the use of debt (which includes our own STORE Master Funding program, unsecured term notes, commercial mortgage-backed securities borrowings, insurance borrowings, bank borrowings and possibly preferred stock issuances) and equity financing. We are currently rated Baa2, BBB and BBB rating by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings, respectively. As of December 31, 2020, our secured and unsecured long-term debt had an aggregate outstanding principal balance of $3.8 billion, a weighted average maturity of approximately seven years and a weighted average interest rate of 4.2%. |

| ● | Increase our portfolio diversity. As of December 31, 2020, we had invested approximately $9.6 billion in 2,634 property locations, substantially all of which are profit centers for our customers. Our portfolio is highly diversified; built on an average transaction size of just over $9.0 million, we now have over 500 customers (having added an average of approximately 14 net new customers quarterly since inception) operating across more than 750 different brand names, or business concepts, across 49 states and over 110 industry groups. Our largest customer represented 3.1% of our portfolio as of December 31, 2020, based on base rent and interest. Our portfolio’s diversity decreases the impact on us of an adverse event affecting a specific customer, industry or region, thereby increasing the stability of our cash flows. We expect that additional acquisitions in the future will further increase the diversity of our portfolio and, from time to time, we may sell properties in our portfolio to improve overall portfolio credit quality or diversity. |

| ● | Engage with our tenants. Our experienced relationship managers provide tailored lease solutions to our customers that address our customers’ needs and that strive to provide superior value for our customers over other financial options they may have to capitalize their businesses. The direct relationships we develop with our customers give us greater insights into their businesses and allow us to proactively help them grow their businesses or work with them to help solve problems that may arise from time to time. For example, during 2020 and in connection with the shutdowns and other disruptions resulting from the COVID-19 pandemic, we have worked with a number of our tenants on short-term rent deferral arrangements, including through a structured rent relief program under which we allowed such tenants to defer a portion of their rent, with repayment primarily structured through short-term, interest-bearing notes. These efforts allowed our customers to avoid lease defaults while giving their businesses time to recover and gave us the ability to continue to receive our contractual rent. |

Beyond our regular engagement with our customers on business matters, in 2019, we initiated a tenant outreach program designed to gauge our tenants’ current sustainability practices, provide them with sustainability education and support resources, and encourage them to engage in sustainable practices, including reducing power usage, saving water, assessing building equipment, and implementing other energy-efficiency upgrades. We believe that effective encouragement of sustainability initiatives, particularly related to energy, water and indoor environmental quality, can lead to the adoption of practices that can drive business and real estate value appreciation, decrease operating costs and mitigate regulatory risks.

Environmental Stewardship

We are committed to environmental sustainability and the mitigation of environmental risks in connection with

10

the development of our property portfolio. This commitment reflects the fact that the properties we acquire are subject to both state and federal environmental regulations, but, more importantly, it aligns with our belief that being conscious of, and seeking to address and manage environmental risks within our control, and supporting our customers to do the same in their businesses, plays a role in building and sustaining successful enterprises; and, thus, is material to the success of our own business.

As part of our attentiveness to environmental concerns, we:

| ● | Continuously seek to understand the environmental risks and opportunities associated with our business practices; |

| ● | Undertake initiatives to promote greater environmental awareness among our employees and evaluate opportunities to enhance our processes; and |

| ● | Promote awareness and engage with our tenants regarding sustainability practices and solutions. |

Acquisition Process. Our commitment to environmental sustainability begins before we acquire a real estate asset and involves, among other factors, a consideration of the environmental risk associated with our tenants and with prior users of the real estate asset. We then analyze environmental matters in each step of our three-phase property acquisition process:

| ● | When assessing a target company, we engage a nationally recognized and insured environmental engineer to perform a Phase I environmental site assessment against current industry standards and evaluate any recognized environmental conditions (RECs) identified in the assessment. We also conduct separate, property-level condition and sustainable practices assessments through an independent third party. |

| ● | When we identify a REC, we take appropriate mitigating action, which may include conducting a Phase II environmental assessment, submitting the property into a voluntary clean-up program, purchasing an environmental insurance policy, and remediating the REC in accordance with regulatory requirements, |

| ● | When we are satisfied with the results and outcome of our pre-acquisition due diligence process, we purchase the property and enter into a lease with the seller pursuant to which the seller agrees to certain covenants and indemnities that typically require the seller to comply with applicable environmental laws and remediate or take other corrective action should any environmental issues arise. |

We may take additional actions in situations where a target property may be subject to risks associated with climate change, particularly as a result of being located in a geographic area susceptible to floods, hurricanes, tornados, earthquakes or other climate-related occurrences. These additional steps and actions may include: maintaining comprehensive environmental insurance coverage for specified properties in our portfolio to ensure that there are financial resources available to conduct safe and timely remediation in the event of an unforeseen environmental issue; and preparing for climate-related natural disasters by requiring our tenants to carry insurance, including fire, wind/hail, earthquake, flood and other extended coverage where appropriate given the relative risk of loss, geographic location and industry best practices.

Building Sustainable Tenant Relationships. Despite owning our properties subject to triple-net leases, under which our tenants control all business operations at the properties, we strive to positively influence the sustainability practices of our tenants. We expect that such efforts will foster relationships with our tenants that effectively encourage sustainability initiatives, particularly related to energy, water and indoor environmental quality, which can lead to the adoption of practices that should drive business and real estate value appreciation, decrease operating costs and mitigate regulatory risks.

To advance this effort, we conduct inspections of up to 20% of our properties annually to collect data on types and prevalence of sustainability features implemented at the properties, such as programmable thermostats, LED lighting, energy efficient windows, air filtration, and energy efficient water heaters, in order to gauge our performance relative to long-term sustainability initiatives. We initiated our annual property inspection process to aid our portfolio managers and developers in evaluating the sustainability features of existing properties and informing the acquisition analysis process for

11

target properties. We believe our innovative investment analysis process is responsive to increasing market demands for sustainable features in our portfolio properties. We expect that this survey data will provide a baseline framework in which we can develop and improve on the sustainability features already implemented at such properties.

We supplement our annual property inspections with an annual tenant outreach survey from which we collect further data on sustainability features implemented by our participating tenants at their leased properties. The data collected from our survey is broken down into our three primary tenant industry sectors: manufacturing, retail and service. In collaboration with our tenants and third-party property inspection consultants, we have identified and created a survey designed to capture the approximate number of such features at STORE Property locations. We believe that ongoing tenant engagement and collaboration on environmentally focused property initiatives should create a long-term culture of sustainable tenant relationships.

Human Capital Management

We believe that to continue to deliver strong financial results, we must execute on a human capital strategy that prioritizes, among other things: (i) establishing a work environment that: attracts, develops, and retains top talent; (ii) affording our employees an engaging work experience that allows for career development and opportunities for meaningful civic involvement; (iii) evaluating compensation and benefits, and rewarding outstanding performance; (iv) engaging with, and obtaining feedback from, our employees on their workplace experiences; (v) enabling every employee at every level to be treated with dignity and respect, to be free from discrimination and harassment, and to devote their full attention and best efforts to performing their job to the best of their respective abilities; and (vi) communicating with our board of directors on key topics, including executive succession planning.

As part of our efforts to achieve these priorities:

| ● | We seek to foster a diverse and vibrant workplace of individuals who possess a broad range of experiences, backgrounds and skills, starting at the top. At the management level, 33% of our board of directors, 33% of our executive officers, and 56% of our officers at the level of senior vice president and above are women, and overall, we have a deep bench of men and women who are collectively fully capable of professionally operating the business and fulfilling the S|T|O|R|E vision. |

| ● | We empower our employees through employee-run engagement committees that develop and influence new employee onboarding, personal growth and professional development programs, company social and team-building events, and health and wellness programs. During the pendency of the COVID-19 pandemic, the health and safety of our employees has taken on particular importance; among other things, we immediately implemented a company-wide work from home policy, which continues in effect, and ensured each employee had access to the necessary tools to work remotely and remain in communication with all other employees. |

| ● | We actively support charitable organizations that promote education and social well-being and we encourage our employees to personally volunteer with organizations that are meaningful to them. For example, we proudly sponsor local charities such as the Juvenile Diabetes Research Foundation and our employees volunteer in local charitable organizations such as Arizona Helping Hands and the Society of St. Vincent de Paul. |

| ● | We seek to identify future leaders and equip them with the tools for management roles within our company. Our board periodically reviews with our CEO the identity, skills and characteristics of those persons who could succeed to senior and executive management team positions. |

As of December 31, 2020, we had 106 full-time employees, an increase of 9.3% over the total at December 31, 2019, all of whom are located in our single office in Scottsdale, Arizona. None of our employees are subject to a collective bargaining agreement. We consider our employee relations to be good.

Competition

We face competition in the acquisition and financing of STORE Properties from numerous investors, including, but not limited to, traded and non-traded public REITs, private equity investors and other institutional investment funds, as

12

well as private wealth management advisory firms that serve high net worth investors (also known as family offices), some of which have greater financial resources than we do, a greater ability to borrow funds to acquire properties and the willingness to accept more risk. We also believe that competition for real estate financing comes from middle-market business owners themselves, many of whom maintain a preference to own, rather than lease, the real estate they use in their businesses. The competition we face may increase the demand for STORE Properties and, therefore, reduce the number of suitable acquisition opportunities available to us or increase the price we must pay to acquire STORE Properties. This competition will increase if investments in real estate become more attractive relative to other forms of investment.

Insurance

Our leases and loan agreements typically require our customers to maintain insurance of the types and in the amounts that are usual and customary for similar commercial properties, including commercial general liability, fire and extended loss insurance provided by reputable companies, with commercially reasonable exclusions, deductibles and limits, all as verified by our independent insurance consultant.

Separately, we purchase contingent liability insurance, in excess of our customers’ liability coverage, to provide us with additional security in the event of a catastrophic claim.

Regulations and Requirements

Our properties are subject to various laws and regulations, including regulations relating to fire and safety requirements, as well as affirmative and negative contractual covenants and, in some instances, common area obligations. Our customers have primary responsibility for complying with these regulations and other requirements pursuant to our lease and loan agreements. We believe that each of our customers has the necessary permits and approvals to operate and conduct their businesses on our properties.

About Us

We were incorporated under the laws of Maryland on May 17, 2011. Since our initial public offering in November 2014, shares of our common stock have traded under the ticker symbol “STOR” on the New York Stock Exchange, or NYSE. Our offices are located at 8377 E. Hartford Drive, Suite 100, Scottsdale, Arizona 85255. We currently lease approximately 27,800 square feet of office space from an unaffiliated third party. Our telephone number is (480) 256-1100 and our website is www.storecapital.com.

Available Information

We electronically file with the Securities and Exchange Commission, or the SEC, our annual reports on

Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, pursuant to Section 13(a) of the Exchange Act. You may obtain a free copy of our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, on the day of filing with the SEC on our website, or by sending an email message to info@storecapital.com.

Item 1A. RISK FACTORS

There are many factors that affect our business, financial condition, operating results, cash flows and distributions, as well as the market price for our securities. The following is a description of important factors that may cause our actual results of operations in future periods to differ materially from those currently expected or discussed in forward-looking statements set forth in this Annual Report. The risks and uncertainties described below are not the only risks we face. Additional risks and uncertainties not presently known to us or that we may currently deem immaterial also may impair our business operations. Forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Annual Report, and we expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in our expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by law. See “Forward-Looking Statements.”

13

Risks Related to Our Business and Operations

Actual or perceived threats associated with epidemics, pandemics, including COVID-19, or other public health crises could have a material adverse effect on our results of operations and our customers’ businesses.

Epidemics, pandemics or other public health crises, including the continued spread of the coronavirus (“COVID-19”), that impact states where our customers operate their businesses or where our properties are located, and preventative measures taken to alleviate any public health crises, including “shelter-in-place” or “stay-at-home” orders issued by local, state or federal authorities, may have a material adverse effect on our and our customers’ businesses, results of operations, liquidity and ability to access capital markets, and may affect our ability as a net-lease REIT to acquire properties or lease properties to our customers, who may be unable, as a result of economic downturns occasioned by public health crises, to make rental payments when due.

The top industries in our portfolio are restaurants, early childhood education, health clubs, metal fabrication and automotive repair and maintenance. Our customers in each of these industries, as well as our customers that operate other service and retail businesses, depend on in-person interactions with their own customers to generate unit-level profitability, and the COVID-19 pandemic has led to a decrease in customers’ willingness to frequent, and mandated “shelter-in-place” or “stay-at-home” orders have prevented customers from frequenting, our customers’ businesses, which may result in our customers’ inability to maintain profitability and make timely rental payments to us under their leases.

Epidemics, pandemics or public health crises, and any current or future “shelter-in-place” or “stay-at-home” orders, may reduce the available workforce of our customers, which could adversely affect our customers’ abilities to maintain unit-level profitability. Risks related to epidemics, pandemics or public health crises could also lead to complete or partial shutdowns of one or more of our customers’ manufacturing facilities or distribution centers, temporary or long-term disruptions in our customers’ supply chains from local, national and international suppliers, or otherwise delay the delivery of inventory or other materials necessary for our customers’ operations. Such disruptions could adversely impact our customers’ ability to generate sufficient revenues, could force our customers to reduce or delay offerings of their products and services, or could result in our customers’ bankruptcy or insolvency, each of which would adversely impact our ability to receive rental revenue we are owed under our customers’ leases.

The continued spread of COVID-19 has already caused economic downturns on a global scale, and international financial markets may continue to experience significant volatility, which may adversely affect our and our customers’ respective businesses, financial conditions, liquidity and results of operations. Additionally, in June 2020, the National Bureau of Economic Research announced that the United States entered into a recession in February 2020. The impact of any epidemic, pandemic or public health crisis on our business, financial condition, liquidity and results of operations will depend on actions taken by local, state, national and international governments and non-governmental organizations, the medical community and other private actors, and the collective response to COVID-19, or any other public health crisis, cannot be readily predicted, and new information may be revealed, or new and unforeseen actions may be taken, which may alleviate or contribute to the further spread and effects of any such public health crisis.

The COVID-19 pandemic presents material uncertainty and risk with respect to our financial condition, results of operations, cash flows and performance, and many of the risks set forth in this section should be interpreted as heightened risks as a result of the COVID-19 pandemic.

The success of our business depends upon the success of our customers’ businesses, and bankruptcy laws will limit our remedies in the event of customer defaults.

We lease substantially all of our properties to customers who operate businesses at the leased properties. We underwrite and evaluate investment risk on the basis that the primary source that supports the payments on our leases and loans is the profitability of these businesses, which we refer to as “unit-level profitability.” We believe the success of our investments materially depends upon whether our customers successfully operate their businesses and generate unit level profitability at the locations we acquire and lease back or finance. The success of our customers requires consumers to use their discretionary income to purchase our customers’ products or services. Economic conditions are cyclical, and developments that discourage consumer spending or cause a downturn in the national economy, or the regional and local economies where our properties are located, could impair our customers’ ability to meet their lease obligations, resulting in

14

customer defaults or non-renewals under their leases, and reduce demand for our net-lease solutions, forcing us to offer concessions or reduced rental rates when re-leasing these properties.

If any of our customers struggle financially, as has occurred during the pendency of the COVID-19 pandemic, they may decline to extend or renew their leases, miss rental payments or declare bankruptcy. Claims for unpaid future rent are rarely paid in full and are subject to statutory limitations that would likely cause us to receive rental revenues substantially below the contractually specified rent. We are often subject to this risk because our triple-net leases generally involve a single tenant, but this risk is magnified when we lease multiple properties to a single customer under a master lease. Federal bankruptcy laws may prohibit us from evicting bankrupt customers solely upon bankruptcy, and we may not recover the premises from the tenant promptly or from a trustee or debtor-in-possession in bankruptcy proceedings. We may also be unable to re-lease a terminated or rejected space, on comparable terms or at all, or sell a vacant space, upon a customers’ bankruptcy. We will be responsible for all of the operating costs at vacant properties until they be sold or re-let, if at all.

The value of our real estate is subject to fluctuation.

We are subject to all of the general risks associated with the ownership of real estate. While the revenues from our leases are not directly dependent upon the value of the underlying real estate, significant declines in real estate values could adversely affect us in many ways, including a decline in the residual values of properties at lease expiration, possible lease abandonments by our customers and a decline in the attractiveness of triple-net lease transactions to potential sellers. In addition, a financial failure or other default by a customer will likely reduce or eliminate the operating cash flow generated by that customer’s leased property and might decrease the value of that property and result in a non-cash impairment charge. Also, to the extent we purchase real estate in an unstable market, we are subject to the risk that if the real estate market ceases to attract the same level of capital investment in the future that it attracts at the time of our purchases, or the number of companies seeking to acquire properties decreases, the value of our investments may not appreciate or may decrease significantly below the amounts we paid.

Some service and retail customers may be susceptible to e-commerce pressures.

Most of our portfolio is leased to or financed by customers operating service or retail businesses on our property locations. Restaurants, early childhood education, health clubs, metal fabrication and automotive repair and maintenance represent the largest industries in our portfolio. Service and retail businesses using physical outlets face increasing competition from online retailers and service providers. While we believe the businesses in our portfolio are relatively insulated from e-commerce pressures, these businesses may face increased competition from alternative online providers given the rapidly changing business conditions spurred by technological innovation, changing consumer preferences and non-traditional competitors. There can be no assurance that our customers’ businesses will remain competitive with e-commerce providers in the future; any failure to do so would impair their ability to meet their lease obligations to us and materially and adversely affect us.

Our investments are concentrated in the middle market sector, and we would be adversely affected by a lack of demand for our services or an excess of STORE Properties for rent in that sector.

Our target market is middle market companies that operate their businesses out of one or more locations that generate unit level profitability for the business. Historically, many companies have preferred to own, rather than lease, the real estate they use in their businesses. A failure to increase demand for our products by, among other ways, failing to convince middle market companies to sell and lease back their STORE Properties, or an increase in the availability of STORE Properties for rent, could materially and adversely affect us.

Geographic or industry concentrations within our portfolio may negatively affect our financial results.

Our operating performance is impacted by the economic conditions affecting the specific markets and industries in which we have concentrations of properties. As of December 31, 2020, we derived the largest amount of our base rent and interest from the following five states: Texas (10.5%), California (6.3%), Illinois (6.0%), Florida (5.5%) and Ohio (5.2%). As a result of these concentrations, local economic and industry conditions, changes in state or local governmental rules and regulations, acts of nature, epidemics, pandemics and public health crises (including the COVID-19 pandemic)

15

and actions taken in response thereto, and other factors in these states or affecting those industries could result in a decrease in consumer demand for the products and services offered by our customers operating in those states or industries, which would have an adverse effect on our customers’ businesses and their ability to meet their obligations to us. In particular, as of December 31, 2020, properties representing 12.8% of the dollar amount of our investment portfolio were dedicated to, and also 12.8% of our base rent and interest was derived from, customers operating in the restaurant industry, and the continuing downturn and ongoing business closures in the restaurant and retail industries resulting from the ongoing COVID-19 pandemic has negatively impacted our results of operations and could reduce the demand for our triple-net leases. As we continue to acquire properties, our portfolio may become more concentrated by customer, industry or geographic area. A less diverse portfolio could cause us to be more sensitive to the bankruptcy of fewer customers, changes in consumer trends of a particular industry and a general economic downturn in a particular geographic area.

Failure of our underwriting and risk management procedures to accurately evaluate a potential customer’s credit risk could materially and adversely affect our operating results and financial position.

Our success depends in part on the creditworthiness of our middle-market customers who generally are not rated by any nationally recognized rating agency. We analyze creditworthiness using Moody’s Analytics RiskCalc, our methodology of estimating probability of lease rejection and the STORE Score, each of which may fail to adequately assess a particular customer’s default risk. An expected default frequency (“EDF”) score from Moody’s Analytics RiskCalc lacks the extensive company participation required to obtain a credit rating published by a nationally recognized statistical rating organization such as Moody’s Investors Services, Inc. (“Moody’s”) or S&P Global Ratings, a division of S&P Global, Inc. (“S&P”), and may not be as indicative of creditworthiness. Substantially all of our customers are required to provide corporate-level financial information to us periodically or at our request. EDF scores and the financial ratios we calculate are based on unverified financial information from our customers, may reflect only a limited operating history and include various estimates and judgments made by the party preparing the financial information. The probability of lease rejection we assign to a particular investment may be inaccurate, and may not incorporate significant risks of which we are unaware, which may cause us to invest in properties and lease them to customers who ultimately default, and we may be unable to recover our investment by re leasing or selling the related property, on favorable terms, or at all.

Contingent rent escalators may expose us to inflation risk and can hinder our growth and profitability.

A substantial portion of our leases contain variable-rate contingent rent escalators that periodically increase the base rent payable by the customer. Our leases with rent escalators indexed to future increases in the Consumer Price Index (“CPI”) primarily adjust over a one year period, but may adjust over multiple year periods. Generally, these escalators increase rent at the lesser of (i) 1 to 1.25 times the change in the CPI over a specified period or (ii) a fixed percentage. Under this formula, during periods of deflation or low inflation, small increases or decreases in the CPI may cause us to receive lower rental revenues than we would receive under leases with fixed-rate rent escalators. Conversely, when inflation is higher, contingent rent increases may not keep up with the rate of inflation. Higher inflation may also have an adverse impact on our customers if increases in their operating expenses exceed increases in revenue, which may adversely affect our customers’ ability to satisfy their financial obligations to us.

We may be unable to identify and complete acquisitions of suitable properties, which may impede our growth.

Our ability to continue to acquire properties we believe to be suitable and compatible with our growth strategy may be constrained by numerous factors, including the following:

| ● | We may be unable to locate properties that will produce a sufficient spread between our cost of capital and the lease rate we can obtain from a customer, which will decrease our profitability. |

| ● | Our ability to grow requires that we overcome many customers’ preference to own, rather than lease, their real estate, and convince customers that it is in their best interests to lease, rather than own, their STORE Properties, either of which we may not be able to accomplish. |

| ● | We may be unable to reach an agreement with a potential customer due to failed negotiations or our discovery of previously unknown matters, conditions or liabilities during our real property, legal and financial |

16

| due diligence review with respect to a transaction and may be forced to abandon the opportunity after incurring significant costs and diverting management’s attention. |

| ● | We may fail to obtain sufficient equity, adequate capital resources or other financing available to complete acquisitions on favorable terms or at all. |

We typically acquire only a small percentage (approximately 10%) of all properties that we evaluate (which we refer to as our “pipeline”). To the extent any of the foregoing decreases our pipeline or otherwise impacts our ability to continue to acquire suitable properties, our ability to grow our business will be adversely affected.

We face significant competition for customers, which may negatively impact the occupancy and rental rates of our properties, reduce the number of acquisitions we are able to complete, or increase the cost of these acquisitions.

We compete with numerous developers, owners and operators of properties that often own similar properties in similar markets, and if our competitors offer lower rents than we are offering, we may be pressured to lower our rents or to offer more substantial rent abatements, customer improvements, early termination rights, below-market renewal options or other lease incentive payments in order to remain competitive. Competition for customers could negatively impact the occupancy and rental rates of our properties.

We also face competition for acquisitions of real property from investors, including traded and non-traded public REITs, private equity investors and other institutional investment funds, as well as private wealth management advisory firms, some of which have greater financial resources, a greater ability to borrow funds to acquire properties, the ability to offer more attractive terms to prospective customers and the willingness to accept greater risk or lower returns than we can prudently manage. This competition may increase the demand for STORE Properties and, therefore, reduce the number of, or increase the price for, suitable acquisition opportunities, all of which could materially and adversely affect us.

Some of our customers rely on government funding, and their failure to continue to qualify for such funding could adversely impact their ability to make timely lease payments to us.

Some of our customers operate businesses that depend on government funding or reimbursements, such as customers in the education, healthcare and childcare related industries, which may require them to satisfy certain licensure or certification requirements in order to qualify for these government payments. The amount and timing of these government payments depend on various factors that often are beyond our or our customers’ control. We will likely continue to invest in properties leased by customers operating in these industries and acquire other businesses in industries that rely significantly on government payments. If these customers fail to receive necessary government funding or fail to comply with related regulations, their cash flow could be materially affected, which may cause them to default on their leases and adversely impact our business.

Some of our customers operate under franchise or license agreements, which, if terminated or not renewed prior to the expiration of their leases with us, would likely impair their ability to pay us rent.

Many of our customers operate their businesses under franchise or license agreements, which generally have terms that end earlier than the respective expiration dates of the related leases. In addition, a customer’s rights as a franchisee or licensee typically may be terminated by the franchisor and the customer may be precluded from competing with the franchisor or licensor upon termination. A franchisor’s or licensor’s termination or refusal to renew a franchise or license agreement would impact the customer’s ability to make payments under its lease or loan with us. We typically have no notice or cure rights with respect to such a termination and have no rights to assignment of any such agreement, which may have an adverse effect on our ability to mitigate losses arising from a default by a terminated franchisee on any of our leases or loans.

If a customer defaults under either the ground lease or mortgage loan of a hybrid lease, we may be required to undertake foreclosure proceedings on the mortgage before we can re lease or sell the property.

In certain circumstances, we may enter into hybrid leases with customers. A hybrid lease is a modified sale-leaseback transaction, where the customer sells us land and then we lease the land back to the customer under a ground lease and simultaneously make a mortgage loan to the customer secured by the improvements the customer continues to

17