|

For the month of,

|

May

|

2012

|

|

|

Commission File Number

|

001-35400

|

||

|

Just Energy Group Inc.

|

|||

|

(Translation of registrant’s name into English)

|

|||

|

6345 Dixie Road, Suite 200, Mississauga, Ontario, Canada, L5T 2E6

|

|||

|

(Address of principal executive offices)

|

|||

|

Document

|

|

|

1

|

Management Proxy Circular, dated May 18, 2012.

|

|

May 18, 2012

Dear Shareholder:

|

||

|

Please join us at the eleventh annual meeting of common shareholders of Just Energy at 3:00 p.m. EST on Thursday June 28, 2012 at the Toronto Stock Exchange – Broadcast Centre located on the main floor of The Exchange Tower, 2 First Canadian Place, 130 King Street West, Toronto, Ontario.

|

||

|

Just Energy is situated in a high growth industry, the sale of deregulated natural gas and electricity to residential and commercial customers under fixed and variable term contracts. As Just Energy expands into all available deregulated utility markets and broadens its product offerings to which regulation does not apply, there are a growing number of new potential customers for Just Energy’s suite of energy products. Just Energy is also engaged in the sale and lease of energy efficient waterheaters, furnaces and air conditioners, the installation and lease or sale of solar panels, the production of ethanol and the sale of JustGreen and JustClean energy products which permit homeowners and commercial customers to contract for green electricity and/or reduce or eliminate the carbon foot print of their natural gas usage.

|

||

|

During the past year, Just Energy has experienced significant growth, both organically through the expansion of its suite of product offerings into new markets and through the acquisition in October 2011 of Fulcrum Retail Holding LLC (“Fulcrum”), an affinity marketing business based in Texas. As well, the Hudson commercial energy platform expanded into further jurisdictions in which Just Energy operates. During the year, Just Energy added 1,091,000 new customer equivalents through marketing, above the record 999,000 customers added in the previous year. Net customer additions were 316,000. Both these numbers were before the inclusion of 240,000 customers added with the Fulcrum acquisition.

|

||

|

On January 30, 2012, Just Energy listed its common shares on the New York Stock Exchange. The NYSE listing is intended to improve liquidity in our shares and to bring Just Energy more squarely into focus for U.S. investors. This is a very exciting time for Just Energy.

|

||

|

As our Annual Report details, fiscal 2012 was another good year for Just Energy. Despite the effects of an extremely warm winter, the 5% growth in gross margin per share year over year and a 7% increase per share in adjusted EBITDA, the Company paid an annual $1.24 dividend as it has been paying for more than three years. The accompanying proxy circular and notice of meeting contains a description of the matters to be voted upon at the meeting and provides information on executive compensation and corporate governance at Just Energy.

|

||

|

We hope you will take the time to read the proxy circular in advance of the meeting as it provides background information that will help you exercise your right to vote. Whether or not you attend the meeting in person, we would encourage you to vote as this is one of your rights as a shareholder. Instructions on the ways you can exercise your voting rights are found starting on page 1 of the proxy circular. If your common shares are not registered in your name but are held in the name of a nominee, you should consult the information on page 4 of the proxy circular with respect to how to vote your shares.

|

||

|

If you are able to attend the meeting in person, there will be an opportunity to ask questions and to meet your directors, Just Energy management and your fellow shareholders.

|

||

|

On behalf of our board of directors, we would like to express our gratitude for the support of our shareholders. We would also like to thank our employees for their hard work and support. We look forward to seeing you at the meeting.

|

||

|

Sincerely,

|

||

|

|

|

|

Rebecca MacDonald

Executive Chair

Just Energy Group Inc.

|

Ken Hartwick

President and Chief Executive Officer

Just Energy Group Inc.

|

|

|

1.

|

to receive the audited consolidated financial statements of Just Energy for the year ended March 31, 2012 and the auditor’s report thereon;

|

|

2.

|

to elect the nominees of Just Energy standing for election as directors on an individual basis;

|

|

3.

|

to consider, in an advisory, non-binding capacity, Just Energy’s approach to executive compensation;

|

|

4.

|

to appoint Ernst & Young LLP as auditors of Just Energy; and

|

|

5.

|

to transact such other business as may properly be brought before the meeting or any adjournment or postponement thereof.

|

|

Dated at Toronto, Ontario

|

JUST ENERGY GROUP INC.

|

|

May 18, 2012.

|

|

|

|

|

“JONAH DAVIDS”

|

|

|

Jonah Davids

|

|

|

Vice President and General Counsel

|

|

Page

|

|

|

VOTING – QUESTIONS AND ANSWERS

|

1

|

|

NEW GOVERNANCE AND EXECUTIVE COMPENSATION HIGHLIGHTS – 2012

|

5

|

|

GENERAL BUSINESS TO BE ACTED UPON AT THE MEETING

|

7

|

|

Receipt of Consolidated Audited Financial Statements and Auditor’s Report

|

7

|

|

Election of Directors of Just Energy

|

7

|

|

Appointment of Auditors of Just Energy

|

18

|

|

JUST ENERGY’S APPROACH TO EXECUTIVE COMPENSATION – SAY ON PAY

|

18

|

|

General Background

|

18

|

|

Compensation Consultants

|

19

|

|

Executive Compensation – Related Fees

|

21

|

|

COMPENSATION AND GOVERNANCE COMMITTEES – LETTER TO SHAREHOLDERS

|

21

|

|

COMPENSATION OF THE DIRECTORS AND OFFICERS OF JUST ENERGY

|

26

|

|

Compensation of Outside Directors

|

26

|

|

Director Compensation Table

|

26

|

|

Ownership of Securities by Outside Directors

|

27

|

|

Options and Common Share Based Awards – Outside Directors

|

29

|

|

Common Share Based Awards, DSG Based Awards and Non-Equity Incentive Plan Compensation – Outside Directors

|

30

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

30

|

|

The Compensation Committee

|

30

|

|

Compensation Objectives and Components – General

|

30

|

|

Compensation Components – Specific Criteria

|

32

|

|

Financial Restatement and Clawback Policy

|

38

|

|

Market Benchmarking and Comparator Groups

|

38

|

|

NEO Employment Agreements

|

40

|

|

User Friendly Shareholder Financial Criteria

|

46

|

|

Amendments to Employment Agreements

|

47

|

|

TERMINATION, CHANGE OF CONTROL AND OTHER BENEFITS

|

50

|

|

Termination Events or Circumstances

|

50

|

|

Termination Payments and Benefits

|

51

|

|

Employment Agreements – Other Terms, Conditions and Obligations

|

52

|

|

Termination Benefits

|

53

|

|

Summary Compensation Table – NEOs

|

55

|

|

Incentive Plan Awards – NEOs

|

57

|

|

Option Plan

|

58

|

|

2010 Restricted Share Grant Plan

|

58

|

|

Securities Authorized for Issuance under Equity Compensation Plans

|

60

|

|

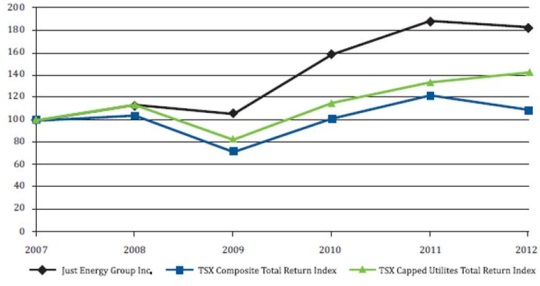

JUST ENERGY PERFORMANCE GRAPH

|

60

|

|

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

|

61

|

|

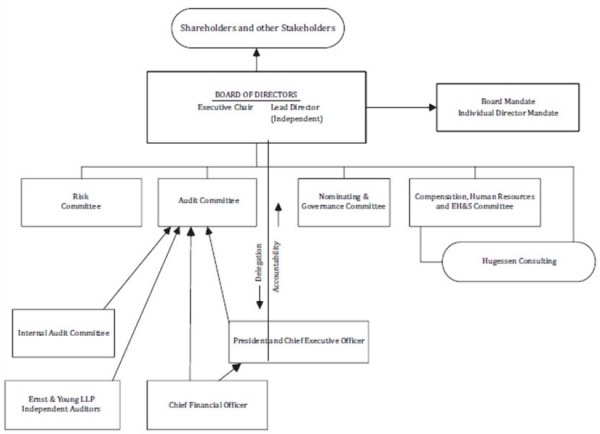

CORPORATE GOVERNANCE

|

61

|

|

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

|

63

|

|

REGULATORY MATTERS AND BANKRUPTCIES AND INSOLVENCIES

|

63

|

|

INTERESTS OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

|

64

|

|

ADDITIONAL INFORMATION

|

64

|

|

SCHEDULE A – STATEMENT OF CORPORATE GOVERNANCE PRACTICES OF JUST ENERGY

|

|

|

SCHEDULE B – OTHER PUBLIC COMPANY DIRECTORSHIPS AND COMMITTEE APPOINTMENTS

|

|

|

SCHEDULE C – JUST ENERGY GROUP INC. – BOARD MANDATE

|

|

|

SCHEDULE D – POLICY ON ENGAGEMENT WITH SHAREHOLDERS ON GOVERNANCE

|

|

|

SCHEDULE E – COMPENSATION, HUMAN RESOURCES, HEALTH, SAFETY AND ENVIRONMENTAL COMMITTEE

|

|

PROXY CIRCULAR

|

|

VOTING – QUESTIONS AND ANSWERS

|

|

1.

|

VOTING BY PROXY

|

|

|

(i)

|

How can I send my form of proxy?

|

|

|

(ii)

|

What is the deadline for receiving the form of proxy?

|

|

|

(iii)

|

How will my common shares be voted if I give my proxy?

|

|

|

(iv)

|

If I change my mind, how can I revoke my proxy?

|

|

2.

|

VOTING IN PERSON

|

|

(i)

|

GIVING YOUR VOTING INSTRUCTIONS

|

|

(ii)

|

VOTING IN PERSON

|

|

NEW GOVERNANCE AND EXECUTIVE COMPENSATION HIGHLIGHTS – 2012

|

|

Just Energy has implemented several new governance and compensation initiatives during the year ended March 31, 2012 to improve its governance structure and to address recommendations of, and issues raised by, institutional shareholder groups and our outside independent compensation consultants related to the design of, and other aspects of our approach to, executive compensation.

|

|

(a)

|

Director Orientation

|

|

(b)

|

Director Continuing Education

|

|

(c)

|

Board Diversity and Renewal

|

|

(a)

|

for the first time, the identification of an industry peer group to benchmark Just Energy’s CEO and CFO executive compensation to an industry specific peer group of companies,

|

|

(b)

|

the development of new formulaic short term and long term incentive criteria and targets for the CEO, CFO and executive chair to incorporate more mainstream bottom line “shareholder friendly” metrics in the context of Just Energy’s business such as, adjusted EBITDA, embedded gross margin and adjusted EBITDA per share (each defined on page 46 under the heading “User Friendly Shareholder Financial Criteria”), to ensure their compensation is based on pay for performance, encourages growth and to align executive compensation with the interests of Just Energy’s shareholders and other stakeholders in the context of creating shareholder value and financial criteria used by shareholders to measure performance and to monitor and control risk; and

|

|

(c)

|

a clawback policy giving independent directors the discretion to recoup all or a portion of bonuses or incentive compensation paid to an executive officer in the event of a restatement of Just Energy’s financial results based on intentional fraud or misconduct. See page 38.

|

|

GENERAL BUSINESS TO BE ACTED UPON AT THE MEETING

|

|

John A. Brussa

|

Ambassador Gordon D. Giffin

|

Kenneth Hartwick C.A.

|

||

|

The Hon. Michael J.L. Kirby

|

Rebecca MacDonald

|

The Hon. R. Roy McMurtry

|

||

|

Senator Hugh D. Segal

|

Brian R.D. Smith Q.C.

|

William F. Weld

|

|

JOHN A. BRUSSA

Age 55

Calgary, Alberta

Director since 2001

Not independent

|

Ownership of shares (includes vested and unvested DSGs)

94,249

|

March 31, 2012 value at risk @ $13.80 per

share

$1,300,636

|

Board and Committee attendance record

Board – 100%

Risk – 100%

Compensation – (non voting)

100%

|

Areas of Expertise

taxation

energy

risk

compensation

|

|

Mr. Brussa has been a director of Just Energy since 2001 and currently serves on two board committees. He is a senior partner with the law firm Burnet, Duckworth & Palmer LLP where he specializes in taxation and energy law with a special expertise relating to businesses in the energy sector. Accordingly, his contribution to the proceedings of the board and its committees is invaluable. As indicated in Schedule B of this proxy circular, Mr. Brussa serves as a director on other public boards and committees, particularly in the oil and natural gas sectors. He serves as a member of the compensation committee on other public company boards and accordingly brings considerable compensation experience as a non voting member of Just Energy’s compensation committee. It is the view of other members of the Just Energy board that his experience and knowledge in these energy sectors and his regular participation at board and committee meetings adds significant value to the board of Just Energy. He has a 100% attendance record for board and committee meetings and serves on the risk and compensation committees.

|

||||

|

82% of the votes cast at the 2011 annual meeting were for the approval of Mr. Brussa as a director of Just Energy.

|

||||

|

AMBASSADOR GORDON D. GIFFIN

Age 62

Atlanta, Georgia

Director since 2006

Not independent

|

Ownership of shares (includes vested and unvested DSGs)

48,237

|

March 31, 2012 value at risk @ $13.80 per

share

$665,671

|

Board and Committee Attendance Record

Board – 100%

Risk – 100%

Compensation – (non voting)

100%

|

Areas of Expertise

compensation

governance

finance

risk

energy

transportation

|

|

Mr. Giffin is a senior partner in the Washington, D.C. and Atlanta, Georgia based law firm, McKenna Long & Aldridge LLP. He has been a director of Just Energy since 2006 and currently serves on two board committees – the Risk Committee and the Compensation, Human Resources, Environmental, Health and Safety Committee. Mr. Giffin is a member of the Council of Foreign Relations, and is on the Board of Trustees for The Carter Center and on the Board of Counsellors of Kissinger-McLarty Associates. Mr. Giffin served as United States Ambassador to Canada from 1997 to 2001. As indicated in Schedule B of this Information Circular, Mr. Giffin serves on several boards of Canadian public companies and committees thereof in the financial, transportation and natural resource sectors and as such is in a unique position, based on his experience both as a director and lawyer, to contribute to a discussion of the issues required to be addressed by the board of Just Energy and its committees. He regularly attends all board meetings and committee meetings on which he serves, including the board meetings of all of Just Energy’s U.S. operating subsidiaries where he also serves as a director. He has a 100% attendance record for board and committee meetings for the year ending March 31, 2012.

|

||||

|

94% of the votes cast at the 2011 annual meeting were for the approval of Mr. Giffin as a director of Just Energy.

|

||||

|

KENNETH HARTWICK C.A.

Age 49

Milton, Ontario

Director since 2001

Not Independent

|

Ownership of shares (includes vested and unvested RSGs)

1,137,789

|

March 31, 2012 value at risk @ $13.80 per

share

$15,701,488

|

Board Attendance Record

Board – 100%

|

Areas of Expertise

financial

compensation

energy management

governance

marketing

|

|

Mr. Hartwick has been a director of Just Energy since 2008. Mr. Hartwick serves as President and Chief Executive Officer of Just Energy and its affiliated entities in Canada and the United States, and was previously Just Energy’s Chief Financial Officer. Before joining Just Energy he served as Chief Financial Officer of Hydro One from October 2001 to April 2004. Prior to joining Hydro One, Mr. Hartwick was Vice-President, Cap Gemini Ernst & Young (consulting business) (May to October 2000) and a partner of Ernst & Young LLP (auditors) from July 1994 to April 2000. Mr. Hartwick has a 100% attendance record for board meetings for the year ended March 31, 2012. As indicated in Schedule B, he is also a director of one other Canadian public company, where he serves as chair of the audit committee and chair of the compensation committee. He is also a member of the Ontario Energy Association.

|

||||

|

98% of the votes cast at the 2011 annual meeting were for the approval of Mr. Hartwick as a director of Just Energy.

|

||||

|

The HON. MICHAEL J.L. KIRBY

Age 70

Ottawa, Ontario

Director since 2001

Independent

|

Ownership of shares (includes vested and unvested DSGs)

37,145

|

March 31, 2012 value at risk @ $13.80 per

share

$512,601

|

Board and Committee Attendance Record

Board – 100%

Risk – 100%

Audit – 100%

|

Areas of Expertise

financial expert

risk

governance

public policy

government relations

|

|

Mr. Kirby is Chairman of the Partners for Mental Health a national mental health charity and a corporate director. Mr. Kirby was a Member of the Senate of Canada from 1984 until 2006. He holds a B.Sc. and M.A. in mathematics from Dalhousie University and a Ph.D. in Applied Mathematics from Northwestern University. He has an Honorary Doctor of Laws from Dalhousie University, Simon Fraser University, York University, Carleton University and the University of Alberta. Mr. Kirby is the financial expert on the audit committee for purposes of the NYSE listing standards.

|

||||

|

As indicated in Schedule B of this proxy circular, Mr. Kirby serves as a member of the board and committees of several public Canadian companies in several diverse business sectors which uniquely qualify him to serve as chair of the audit committee and chair of the risk committee of Just Energy. He is a dedicated and committed director reflected by a 100% attendance record at all Just Energy board and committee meetings for the year ended March 31, 2012. Until 2005, Mr. Kirby was Vice-Chair of the Accounting Standards Oversight Council. Previously, Mr. Kirby was Chair of the Standing Senate Committee on Banking, Trade and Commerce, the Senate Committee which handles all business legislative and regulatory issues, and was Chair of the Standing Senate Committee on Social Affairs, Science and Technology. From 2007 until March, 2012 he was Chairman of the Mental Health Commission of Canada. Mr. Kirby brings to the Just Energy board expertise in finance, risk, accounting and public accountability.

|

||||

|

99% of the votes cast at the 2011 annual meeting were for the approval of Mr. Kirby as a director of Just Energy.

|

||||

|

REBECCA MACDONALD

Age 58

Toronto, Ontario

Director since 2001

Not Independent

|

Ownership of shares (includes vested and unvested RSGs)

6,474,658

|

March 31, 2012 value at risk @ $13.80 per

share

$89,350,280

|

Board

Attendance Record

Board – 100%

|

Areas of Expertise

energy

marketing

regulatory

investor relations

management

|

|

Ms. MacDonald was the principal founder of Just Energy and has been a director since 2001. She has been engaged in the deregulation of natural gas for over 22 years. Before forming Just Energy in 1997 she was the president of EMI, another successful energy marketing company. She became an officer of the Just Energy in January 2000 and previously served as chief executive officer. For the past five years she has been Just Energy’s executive chair. She is a past director of the Canadian Arthritis Foundation and is actively involved in a number of other charities. She founded the Rebecca MacDonald Centre for Arthritis Research at Toronto’s Mount Sinai Hospital. She was named Canada’s top woman CEO for 2003, 2004, 2005, 2006 and 2007 by Profit Magazine. She was also named Ontario Entrepreneur of the Year by Ernst and Young in 2003. On April 3, 2009 she received the International Horatio Alger Award – Canada. Ms. MacDonald has a 100% attendance record for board meetings for the year ended March 31, 2012. She was recently elected to the board of Canadian Pacific Railways Limited.

|

||||

|

98% of the votes cast at the 2011 annual meeting were for the approval of Ms. MacDonald as a director of Just Energy.

|

||||

|

THE HON. R. ROY MCMURTRY

Age 79

Toronto, Ontario

Nominee

Independent

|

Ownership of shares (includes vested and unvested RSGs)

13,528

|

March 31, 2012 value at risk @ $13.80 per

share

$186,686

|

Board and Committee Attendance Record

Board – 100%

Compensation – 100%

Nominating and Governance – 100%

|

Areas of Expertise

utilities

governance

public policy

|

|

Mr. McMurtry has been a director of Just Energy since June, 2007. He currently serves as a member of the Compensation, Human Resources, Environmental, Health and Safety Committee and the Nominating and Corporate Governance Committee. Mr. McMurtry was Attorney General for the Province of Ontario from 1975 to 1985, the High Commissioner for Canada in Great Britain from 1985 to 1988 and was Chief Justice, Province of Ontario from February 1996 to May 31, 2007, and currently serves as Counsel, Gowling Lafleur Henderson LLP. Mr. McMurtry is also an Officer of the Order of Canada, a member of the Order of Ontario and has received a number of honorary degrees. He is also the Chancellor of York University. Mr. McMurtry’s experiences in public life and contribution to the judicial system in Canada uniquely qualifies Mr. McMurtry to contribute to the deliberations of a public company engaged in the marketing of energy contracts and related products to the public. He has a 100% attendance record for Board and committee meetings for the year ended March 31, 2012.

|

||||

|

99% of the votes cast at the 2011 annual meeting were for the approval of Mr. McMurtry as a director of Just Energy.

|

||||

|

SENATOR HUGH D. SEGAL

Age 61

Kingston, Ontario

Director since 2001

|

Ownership of shares (includes vested and unvested DSGs)

23,511

|

March 31, 2012 value at risk @ $13.80 per

share

$324,452

|

Board and Committee Attendance Record

Board – 100%

Risk – 100%

Audit – 100%

Nominating and Corporate Governance – 100%

Compensation – 100%

|

Areas of Expertise

risk

finance

marketing

governance

government relations

public policy

|

|

Mr. Segal has been a director of Just Energy since 2001. Mr. Segal is a Canadian Senator. He is a director of one other Canadian public company as described in Schedule B of this proxy circular.and is Director of the Canadian Defence and Foreign Affairs Institute in Calgary, a Member of the Atlantic Council and a former President of the Institute for Research on Public Policy. Mr. Segal was the recipient of the Order of Canada in 2003, an Honorary Doctorate from the Royal Military College in 2004 and made an Honorary Captain of the Canadian Navy in 2005. Mr. Segal earned his Bachelor of Arts (history) degree in 1972 from the University of Ottawa and studied international trade economics at the graduate level at the Norman Patterson School of International Affairs at Carleton University. In 2003, after serving as Chief of Staff to the Prime Minister, he was named Senior Fellow at the School of Policy Studies, Queen’s University, and is also an Adjunct Professor of public policy at Queen’s School of Business. His experience on several public company boards and committees and his expertise in social, economic, foreign policy and public administration qualify him well to serve as lead director and vice chairman of Just Energy and a member of all four Just Energy board committees. He attended all board, committee and strategy meetings and has a 100% attendance record for the year ended March 31, 2012.

|

||||

|

99% of the votes cast at the 2011 annual meeting were for the approval of Mr. Segal as a director of Just Energy.

|

||||

|

BRIAN R.D. SMITH Q.C.

Age 61

Victoria, B.C.

Director since 2001

|

Ownership of shares (includes vested and unvested DSGs)

55,741

|

March 31, 2012 value at risk @ $13.80 per

share

$769,226

|

Board and Committee Attendance Record

Board – 100%

Risk – 100%

Audit – 100%

Compensation – 100%

|

Areas of Expertise

financial

governance

risk

public policy

government relations

energy

|

|

Mr. Smith has been a director of Just Energy since 2001. He served as Minister of Education, Minister of Energy and the Attorney General in the government of British Columbia between 1979 and 1988 and was Chair of Canadian National Railways between 1989 and 1994. He was the Chair of British Columbia Hydro from 1996 to 2001 and presently serves as the Federal Chief Treaty Negotiator and is an Energy Consultant associated with the law firm of Gowling Lafleur Henderson LLP. He is a member of the board and committees of several Canadian public companies as indicated in Schedule B of this proxy circular and based upon his involvement on other public company boards and committees (including as a member of several audit and compensation committees), is qualified to serve as Chair of the Compensation, Human Resources, Environmental, Health and Safety Committee and as a member of the Audit Committee and Risk Committee of the Board and has a 100% attendance record for the year ended March 31, 2012.

|

||||

|

99% of the votes cast at the 2011 annual meeting were for the approval of Mr. Smith as a director of Just Energy.

|

||||

|

WILLIAM F. WELD

Age 65

New York, NY

Director since 2012

|

Ownership of shares (includes vested and unvested DSGs)

Nil

|

March 31, 2012 value at risk @ $13.80 per share

Nil

|

Board and Committee Attendance Record

Mr. Weld was appointed to the audit committee and corporate governance committee on April 2, 2012 and has attended 100% of all board and committee meetings since his appointment.

|

Areas of Expertise

finance

public policy

governance

government relations

|

|

Mr. William F. Weld currently practices with the law firm of McDermott Will & Emery, in Washington, DC and New York where he specializes in government strategies, corporate governance and compliance and international business best practices. Mr. Weld has a very distinguished career in government and business. He also served as Senior Advisor to the Chair of Ivanhoe Capital Corporation, a private holding company headquartered in British Columbia.

|

||||

|

During the 1990’s, Mr. Weld served two terms as Governor of Massachusetts, being elected in 1990 and re-elected in 1994. He served as national co-chair of the Privatization Council and led business and trade missions to many counties in Asia, Europe, Latin America and Africa. He also served as a director of other public companies and is an active member of the United States Council on Foreign Relations. Prior to his election as governor, Mr. Weld was a federal prosecutor for seven years, serving as the Assistant U.S. Attorney General in charge of the Criminal Division of the Justice Department in Washington, D.C. and the U.S. Attorney for Massachusetts during the Reagan administration. He was also a commercial litigator in Boston and Washington.

|

||||

|

Name of Director

|

Number of Board Meetings attended of which there were 9(1)(2)(3)

|

Number of Audit Committee Meetings attended of which there were 5 (Kirby, Segal, Gibson and Smith)(1)(3)

|

Number of Compensation, Human Resources, Environmental Health and Safety Committee Meetings attended of which there were 4 (Giffin, Smith, McMurtry, Segal and Brussa)(4)(1)(3)

|

Number of Nominating and Corporate Governance Committee Meetings attended of which

there were 4 (Segal, Gibson and McMurtry)(1)(3)

|

Number of Risk Committee Meetings attended of which there were 4 (Kirby, Giffin, Segal. Smith and Brussa)(1)(3)

|

|

John A. Brussa

|

9

|

-

|

4

|

-

|

4

|

|

B. Bruce Gibson(5)

|

6

|

3

|

-

|

3

|

-

|

|

Gordon D. Giffin

|

9

|

-

|

4

|

-

|

4

|

|

Ken Hartwick

|

9

|

-

|

-

|

-

|

-

|

|

Michael J.L. Kirby

|

9

|

5

|

-

|

-

|

4

|

|

Rebecca MacDonald

|

9

|

-

|

-

|

-

|

-

|

|

Roy McMurtry

|

9

|

-

|

4

|

4

|

-

|

|

Hugh D. Segal

|

9

|

5

|

4

|

4

|

4

|

|

Brian R.D. Smith

|

9

|

5

|

4

|

-

|

4

|

|

(1)

|

Includes meetings attended in person or by telephone conference call.

|

|

(2)

|

Excludes a two day strategy session attended by all directors but includes the board meeting held at the conclusion thereof.

|

|

(3)

|

In camera meetings of the board and committees (excluding management directors) were held at the conclusion of all board and committee meetings.

|

|

(4)

|

Messrs. Giffin and Brussa serve as non-voting members.

|

|

(5)

|

Resigned from the board effective April 2, 2012 and was replaced by William F. Weld.

|

|

Name, Jurisdiction of Residence and Year First Became a Director

|

Position with Just Energy

|

Principal Occupation

|

Common Shares Beneficially Owned or Over which Control or Direction is Exercised(6)(7)

|

RSGs/DSGs/Options Beneficially Owned(6)(7)(8)

|

|

John A. Brussa(2)(4)

Alberta, Canada

2001

|

Director

|

Partner,

Burnet, Duckworth & Palmer LLP

|

82,000 Shares

|

12,249 DSGs

|

|

The Hon. Gordon D. Giffin(2)(4)

Georgia, U.S.A.

2006

|

Director

|

Senior Partner,

McKenna, Long & Aldridge LLP

|

9,107 Shares

|

39,130 DSGs

|

|

Ken Hartwick C.A.

Ontario, Canada

2008

|

President, Chief Executive Officer and Director

|

President and Chief Executive Officer of Just Energy

|

29,264 Shares

|

1,079,261 RSGs

|

|

The Hon. Michael J.L. Kirby(1)(4)

Ontario, Canada

2001

|

Director

(Independent)

|

Corporate Director

|

25,776 Shares

|

11,369 DSGs

|

|

Rebecca MacDonald

Ontario, Canada

2001

|

Executive Chair and Director

|

Executive Chair of Just Energy

|

5,846,120 Shares

|

628,538 RSGs

|

|

The Hon. R. Roy McMurtry

Toronto, Canada

2007

|

Director

(Independent)

|

Counsel, Gowling Lafleur Henderson LLP

|

6,525 Shares

|

6,993 DSGs

|

|

Senator Hugh D. Segal(1)(2)(3)(4)(5)

Ontario, Canada

2001

|

Lead Director and Vice Chair of the Board

(Independent)

|

Member of the Senate of Canada and Senior Fellow, School of Policy Studies, Queens University

|

11,760 Shares

|

11,751 DSGs

|

|

Brian R. D. Smith, Q.C.

British Columbia, Canada

2001

|

Director

(Independent)

|

Federal Chief Treaty Negotiator and Energy Consultant

|

9,097 Shares

|

46,644 DSGs

|

|

William F. Weld(1)(3)

New York, U.S.A.

2012

|

Director

(Independent)

|

Partner, McDermott Will & Emery

|

Nil

|

Nil

|

|

(1)

|

Member of the audit committee. Mr. Kirby is the chair and the financial expert. All members are financially literate. Mr. Weld became a director on April 2, 2012 and was appointed to the Committee on April 4, 2012.

|

|

(2)

|

Member of the compensation committee. Mr. Smith is the chair.

|

|

(3)

|

Member of the governance and nominating committee. Mr. Segal is the chair. Mr. Weld became a director on April 2, 2012 and was appointed to the Committee on April 4, 2012.

|

|

(4)

|

Member of the risk committee. Mr. Kirby is the chair. Mr. Giffin is the vice chair.

|

|

(5)

|

Appointed lead director by the board of directors on January 17, 2005 and vice chair of the board on May 20, 2010.

|

|

(6)

|

For the year ended March 31, 2012, the non-management directors of Just Energy were required to receive $15,000 of their $50,000 annual base retainer (base retainer increased to $65,000 per year commencing January 1, 2012), in fully paid deferred share grants (“DSGs”) and/or common shares (with one-quarter thereof payable at the end of each quarter) and are entitled to elect to receive all or a portion of their remaining director’s fees in fully paid DSGs and/or common shares of Just Energy (with one-quarter thereof payable at the end of each quarter) pursuant to the Just Energy DSG Plan. The purpose of the Just Energy DSG Plan is to provide effective incentives for the independent directors to promote the business and success of Just Energy by encouraging the ownership of DSGs and/or common shares. The DSGs and/or common shares are credited to a director’s DSG and/or common share account at the end of each quarter (the “Grant Date”) and are based upon the weighted average trading price of the common shares for the 10 trading days on the TSX preceding the end of each quarter. DSGs may not be exchanged for common shares and common shares may not be released to directors until the earlier of: (i) three years from the Grant Date, (ii) the day such director ceases to be a director of Just Energy and (iii) a change of control, providing that no common shares may be issued after the expiry of 10 years from the Grant Date. As indicated above, the directors are entitled to elect to receive common shares as well as or in combination with DSGs.

|

|

(7)

|

Each director is required by December 31, 2012 to hold a minimum number of common shares (including RSGs and DSGs) equal to at least three times the director’s base retainer of $50,000 (i.e., $150,000) increased to $65,000 (i.e., $210,000 effective January 1, 2012). Based on the TSX closing market price for common shares of $13.80 on March 31, 2012, all directors are compliant with the $210,000 threshold other than Mr. Weld who has three years from his appointment to be compliant and Mr. McMurtry who has until December 31, 2012 to be compliant. See “Ownership of Securities by Outside Directors”.

|

|

(8)

|

See “Compensation of the Directors and Officers of Just Energy – Share Option Plan” for a description of Just Energy Options.

|

|

APPOINTMENT OF AUDITORS OF JUST ENERGY

|

|

JUST ENERGY’S APPROACH TO EXECUTIVE COMPENSATION – SAY ON PAY

|

|

|

•

|

to develop appropriate industry peer group companies for pay and performance benchmarking;

|

|

|

•

|

to conduct a pay analysis to benchmark compensation for the CEO and CFO positions; and

|

|

|

•

|

to develop alternatives on the design of Just Energy’s short and long term incentive plans which plans, while specifically designed for the CEO and CFO, could be applied to the other NEOs and throughout Just Energy.

|

|

1.

|

Peer Group and Benchmarking. By developing a “general industry peer group” of companies and by conducting both a size adjusted and standard quartile compensation analysis, the compensation consultants independently confirmed the “industry specific peer group” of companies identified by Just Energy management for CEO/CFO benchmarking purposes. See pages 38 and 39.

|

|

|

2.

|

Short Term Incentive bonuses. With input from the compensation committee, the compensation consultants identified formulaic growth criteria as targets for determining the short term incentive bonus, in lieu of a discretionary approach for each of the executive chair, CEO and CFO which the committee used in determining the short term annual bonuses for the executive chair, CEO and CFO for the year ended March 31, 2012 and will use the formulaic criteria exclusively for the year starting April 1, 2012. See pages 33 and 48.

|

|

|

3.

|

Long Term Incentive bonuses. With input from the compensation committee, the compensation consultants developed a new matrix of targeted, objective, formulaic criteria, each related to annual incremental growth and the creation of shareholder value which the committee will use to determine long term incentive bonuses for the executive chair, the CEO and CFO for the year commencing April 1, 2012. The criteria incorporate more mainstream bottom line shareholder friendly metrics suitable to Just Energy’s business including adjusted EBITDA per share, embedded gross margins and new business ventures (revenues). The potential awards are capped so as not to encourage undue risk. See page 34 and pages 48 and 49.

|

|

|

4.

|

Other. The compensation committee adopted the compensation consultants recommendations:

|

|

|

(a)

|

to alter the short term bonus opportunity for the CEO to between 75% and 150% of base salary,

|

|

|

(b)

|

to maintain the short term bonus opportunities for the executive chair and CFO at between 50% and 100% of base salary, and

|

|

|

(c)

|

to permit each of the above referenced executives to receive 100% of their short term incentive bonus in cash with an entitlement to elect to take all or a portion thereof in RSGs, in each case for the year ended March 31, 2012 and for the year commencing April 1, 2012.

|

|

|

The 100% cash option (formerly 50/50 cash/RSGs), was recommended by Just Energy’s compensation consultants in the context of Just Energy’s comparator peer group, as the executive chair, CEO and CFO already own a significant amount (number and value) of Just Energy securities. See page 37.

|

||

|

Year

|

Nature of Work/Mandate(1)(2)

|

Approximate Fees

(including expenses)

|

|

|

2012

|

Developing pay and performance peer groups with supporting rationales and pay benchmarking.

|

$11,500

|

|

|

Conduct a pay analysis for the CEO and CFO and a pay performance analysis.

|

$22,500

|

||

|

Review and recommend revisions as appropriate to the short and long term incentive plan.

|

$6,000

|

||

|

Conduct interviews, report to the board, research and other.

|

$37,857

|

||

|

Total

|

$77,857

|

||

|

2011

|

Advise on the competitiveness and appropriateness of Just Energy’s compensation programs for the five NEOs; and related corporate governance practices, including:

|

$41,923

|

|

|

(i)

|

Comparator group selection;

|

||

|

(ii)

|

Compensation benchmarking for the CEO and CFO positions;

|

||

|

(iii)

|

Review of incentive plans;

|

||

|

(iv)

|

Corporate governance review; and

|

||

|

(v)

|

Performance analysis.

|

||

|

Total

|

$41,923

|

||

|

(1)

|

Hugessen Consulting are independent and have no relationship of any nature to any of Just Energy’s directors or NEO’s other than having advised compensation committees of other public company boards where three directors of Just Energy also serve as directors.

|

|

(2)

|

Hugessen Consulting has not performed any other services to Just Energy or any affiliate thereof other than as described above.

|

|

COMPENSATION AND GOVERNANCE COMMITTEES –

LETTER TO SHAREHOLDERS

|

|

|

•

|

As a policy, salaries are reviewed annually and there were minor increases to the base salaries for the NEOs (other than the president and CEO), for the year ending March 31, 2012 – i.e. a total of approximately 2.4%. The base salary for the CEO and president was increased from $700,000 to $850,000 (21% increase) to reflect his leadership, commitment, exemplary performance and increasing responsibilities for the year commencing April 1, 2011. Two of our NEOs received no increase.

|

|

|

•

|

Short-term discretionary performance bonus opportunities of up to 100% of base salary were paid as to 100% ($600,000) to the executive chair, 88% ($400,000) to the CFO and 140% ($1,190,000) to the CEO to reflect his leadership, commitment and exemplary performance. The decision to permit each of them to receive 100% of their short term incentive payments in cash (as opposed to 50% cash – 50% RSGs) was based on the recommendation of our compensation consultants as they were, in prior years, receiving a significantly higher proportion of total direct compensation in equity when compared to the average of the industry specific peer group. See page 20.

|

|

|

•

|

Long term incentive payments, 100% of which are required to be paid in restricted share grants vesting over three years from their effective grant date subject to continuing employment on each applicable vesting date, were granted at March 31, 2012 for the year then ended representing a total of approximately 40% of all direct compensation paid to the NEOs. There are no pension plans at Just Energy.

|

|

Name of NEO

|

Total Direct Compensation For Year Ended March 31, 2012(1)

|

Amount and % of Total Direct Compensation paid in Non-Cash Considerations i.e., Restricted Share Grants

|

||||

|

Rebecca MacDonald

|

$3,000,000

|

$1,700,000

|

57%

|

|||

|

Ken Hartwick

|

$3,740,000

|

$1,700,000

|

45%

|

|||

|

Beth Summers

|

$1,530,000

|

$ 680,000

|

44%

|

|||

|

Mark Silver(2)

|

$4,070,000

|

$1,410,168

|

35%

|

|||

|

R. Andrew McWilliams(3)

|

$2,949,280

|

$ 877,578

|

19%

|

|||

|

(1)

|

Includes base salary (if any), short term performance bonus payments (if any) and long term targeted bonus payments. See note (5) to the Summary Compensation Table – NEOs on page 56 of this proxy circular.

|

|

(2)

|

100% of the 116,698 RSGs granted to Mark Silver vest one year from each applicable grant date. See page 45.

|

|

(3)

|

Elected to receive 91% of his short term bonus in 37,016 RSGs which vested immediately. 100% of his estimated long term incentive bonus ($400,000) will be paid in RSGs (29,828 RSGs) vesting over three years. Amounts translated from U.S.$ to CAD$ are based on a fiscal 2012 average exchange rate of 0.9930.

|

|

Brian Smith

Chair of the compensation committee and a member of

each of the risk and audit committees.

|

Hugh Segal

Lead director, vice chair of the board, chair of the governance committee

and a member of the audit, risk and compensation committees.

|

|

COMPENSATION OF THE DIRECTORS AND OFFICERS OF JUST ENERGY

|

|

Name of Director

|

Year Ended March 31

|

Fees Earned(1)

|

Share Based Awards(2)

|

Option Based Awards(3)

|

All Other Compensation(4)

|

Total(6)

|

|

John A. Brussa

|

2012

2011

2010

|

$ 54,500

$ 69,250

$ 69,000

|

$26,250

$18,750

$15,000

|

NIL

NIL

NIL

|

NIL

NIL

NIL

|

$ 80,750

$ 88,000

$ 84,000

|

|

B. Bruce Gibson(7)

|

2012

2011

2010

|

NIL

$ 62,000

$ 18,000

|

$79,750

$33,000

$ 3,750

|

NIL

NIL

NIL

|

$19,860(5)

$20,328(5)

NIL

|

$ 99,610

$115,328

$ 26,350

|

|

Gordon D. Giffin

|

2012

2011

2010

|

NIL(2)

NIL(2)

NIL(2)

|

$89,250

$88,500

$84,500

|

NIL

NIL

NIL

|

$19,860(5)

$20,328(5)

$21,808(5)

|

$109,110

$108,828

$106,308

|

|

Michael J.L. Kirby

|

2012

2011

2010

|

$ 98,750

$104,000

$ 92,000

|

$15,000

$15,000

$15,000

|

NIL

NIL

NIL

|

NIL

NIL

NIL

|

$113,750

$119,000

$107,000

|

|

R. Roy McMurtry

|

2012

2011

2010

|

$ 71,750

$ 69,000

$ 63,000

|

$15,000

$15,000

$15,000

|

NIL

NIL

NIL

|

NIL

NIL

NIL

|

$ 86,750

$ 84,000

$ 78,000

|

|

Hugh D. Segal

|

2012

2011

2010

|

$145,750

$151,000

$139,000

|

$15,000

$15,000

$15,000

|

NIL

NIL

NIL

|

NIL

NIL

NIL

|

$160,750

$166,000

$154,000

|

|

Brian R.D. Smith

|

2012

2011

2010

|

$ 41,000

$ 50,000

$ 38,000

|

$63,750

$60,000

$60,000

|

NIL

NIL

NIL

|

NIL

NIL

NIL

|

$104,750

$110,000

$ 98,000

|

|

(1)

|

Amount reflects the cash portion of the fees earned by each director. The annual base retainer for each outside director is $50,000 – increased to $65,000 commencing January 1, 2012. In addition, each director who is not a member of management receives a $2,000 attendance fee for each board and committee meeting attended (reduced by $1,000 for regular quarterly meeting participation by telephone conference call), $3,000 for each board strategy session attended and is reimbursed for out-of-pocket expenses for attending directors’ board, committee and strategy session meetings. The chair of the audit committee receives an additional annual fee of $15,000 for serving as chair and the other members of the audit committee receive an annual retainer of $5,000 each. The chair of each of the compensation committee and the governance committee receives an additional annual fee of $5,000. The chair of the risk committee receives an additional $10,000 annual fee. The vice chair of the risk committee receives an additional annual fee of $2,500. The lead director receives an additional annual fee of $50,000 to reflect his role as lead director and also as vice chair of the board. All fees are payable quarterly in arrears.

|

|

(2)

|

Directors are required to receive a minimum of $15,000 of their annual base retainer in DSGs and/or common shares and may elect to take all or a portion of the balance of their base retainer, attendance, chair (including

|

|

(3)

|

All options granted to the outside directors are exercisable for an equivalent number of common shares for a period of five years from the grant date and vest as to one fifth thereof on the first, second, third, fourth and fifth anniversary of the grant date. See “Share Option Plan”. On February 6, 2009, the board of directors adopted as a policy of Just Energy that no further options be granted to directors. After June 28, 2012 all outstanding options will be expired.

|

|

(4)

|

There are no non-equity incentive plans, pension plans or other similar arrangements for non-management directors.

|

|

(5)

|

Each of Messrs. Giffin and Gibson receives an additional US $20,000 annual retainer for serving as a director of all of Just Energy’s U.S. operating subsidiaries.

|

|

(6)

|

Just Energy has issued indemnities to each of its directors and officers as permitted under applicable legislation and has purchased a directors’ and officers’ liability insurance policy for the directors and officers of all direct and indirect subsidiaries. Until January 17, 2012, the annual insurance coverage under the policy was limited to $35 million (per claim and in the aggregate each policy year) and attracted an annual premium of $146,880 including tax. For the period commencing January 17, 2012, the policy limit was increased to $70 million at annual premium of $658,500 excluding tax. Just Energy does not maintain any programs pursuant to which it makes donations to charitable institutions in a director’s name.

|

|

(7)

|

Bruce Gibson joined the board on January 1, 2010 and resigned on April 2, 2012.

|

|

Name of Director

|

Shares

#

|

Total Market Value of Common Shares(1)

($)

|

DSGs

#

|

Total Market Value of DSGs(1)

($)

|

Total Market Value of Common Shares and DSGs(1)

($)

|

|

John A. Brussa

|

82,000

|

1,131,600

|

12,249

|

169,036

|

1,300,636

|

|

Gordon D. Giffin

|

9,107

|

125,677

|

39,130

|

539,994

|

665,671

|

|

B. Bruce Gibson

|

NIL

|

NIL

|

9,612

|

132,646

|

132,646

|

|

Michael J.L. Kirby

|

25,776

|

355,709

|

11,369

|

156,892

|

512,601

|

|

R. Roy McMurtry

|

6,535

|

90,183

|

6,993

|

96,503

|

186,686

|

|

Hugh D. Segal

|

11,760

|

162,288

|

11,751

|

162,164

|

324,452

|

|

Brian R.D. Smith

|

9,097

|

125,539

|

46,644

|

643,687

|

769,226

|

|

(1)

|

The closing price of the common shares on the TSX on March 31, 2012 was $13.80, which closing price is also ascribed to the value of the DSGs as they are exchangeable for common shares on a 1:1 basis.

|

|

(2)

|

Ownership requirements for the directors who are also NEO’s are described in note (7) to the table on page 17 of this proxy circular.

|

|

(3)

|

All directors have until the end of 2012 to meet the new $210,000 ownership requirement.

|

|

Options and Common Share Based Awards – Outside Directors

|

|

Share-based Awards –

|

||||||

|

Name of Director

|

Number of Common Shares underlying unexercised options

|

Option exercise price per Share

$

|

Option expiration date

|

Value of unexercised in the money options

$

|

Number of DSGs that have not vested(1)

#

|

Market or pay out value of DSGs that have not vested(2)

$

|

|

John A. Brussa

|

NIL

|

N/A

|

N/A

|

N/A

|

6,919

|

95,482

|

|

Gordon D. Giffin

|

NIL

|

N/A

|

N/A

|

N/A

|

29,052

|

400,918

|

|

Bruce Gibson

|

NIL

|

N/A

|

N/A

|

N/A

|

9,612

|

132,646

|

|

Michael J.L. Kirby

|

NIL

|

N/A

|

N/A

|

N/A

|

5,474

|

75,541

|

|

R. Roy McMurtry

|

50,000

|

15.09

|

June 28, 2012

|

NIL

|

4,670

|

64,446

|

|

Hugh D. Segal

|

NIL

|

N/A

|

N/A

|

N/A

|

5,843

|

80,633

|

|

Brian Smith

|

NIL

|

N/A

|

N/A

|

N/A

|

23,507

|

324,397

|

|

(1)

|

Reflects DSGs and/or common shares or a DRS Advice credited to the account of each director in lieu of cash retainer which have not vested. See note (2) on page 26 of this proxy circular.

|

|

(2)

|

Market value was determined based upon the closing price of the common shares on the TSX on March 31, 2012 of $13.80.

|

|

(3)

|

Information respecting directors who are also NEOs is included under “Compensation of the Directors and Officers of Just Energy – Incentive Plan Awards – NEOs” on page 37.

|

|

Name of Director

|

Common Share based awards – value vested during the year

$

|

DSG and Common Share based awards – value vested during the year(1)

$

|

Non-equity incentive plan compensation – value earned during the year

$

|

|

John A. Brussa

|

NIL

|

25,516

|

NIL

|

|

Gordon D. Giffin

|

NIL

|

126,781

|

NIL

|

|

B. Bruce Gibson

|

NIL

|

NIL

|

NIL

|

|

Michael J.L. Kirby

|

NIL

|

25,930

|

NIL

|

|

R. Roy McMurtry

|

NIL

|

21,086

|

NIL

|

|

Hugh D. Segal

|

NIL

|

26,344

|

NIL

|

|

Brian Smith

|

NIL

|

104,728

|

NIL

|

|

(1)

|

Based upon the closing price of common shares on the TSX on March 31, 2012 of $13.80.

|

|

(2)

|

Information respecting directors who are also NEOs is included under “Compensation of the Directors and Officers of Just Energy – Incentive Plan Awards – NEOs”.

|

|

COMPENSATION DISCUSSION AND ANALYSIS

|

|

Bonus Metric

|

%

|

Year ended March 31, 2012

Target

|

Year ended March 31, 2012

Actual

|

|

Net RCEs added through marketing(1)

|

328,000

|

356,000

|

|

|

Water Heater Equivalents added

|

49,600

|

56,400

|

|

|

Qualified Momentis Independent Representative Adds

|

40

|

12,000

|

47,800

|

|

Ethanol Production (litres)

|

126,000,000

|

119,300,000

|

|

|

Committed Solar Projects

|

$ 60,750,000

|

$ 90,700,000

|

|

|

Adjusted EBITDA

|

40

|

$280,000,000

|

$283,125,000

|

|

Other Factors(2)

|

20

|

N/A

|

N/A

|

|

(1)

|

Includes RCE additions and an adjustment reflecting an equivalent number of customers added for Just Green products.

|

|

(2)

|

Includes factors such as commitment, leadership, duties and responsibilities, acquisitions, financings, bank facility and relationships, product diversification, new products, organic growth, succession planning and other factors which the compensation committee believes appropriate.

|

|

YE March 31, 2012

|

Non Discretionary Targeted

Incentive Payment(3)

$

|

||||||

|

Growth Criteria(1)

|

Annual Performance Targets(2)

|

Actual Increase (Decrease)(3)

|

Rebecca MacDonald (executive chair)

|

Ken Hartwick

(CEO)

|

Beth Summers

(CFO)

|

Weighting

|

|

|

1

|

Net RCE additions

|

328,000(a)

|

356,000(a)

above 5% target

|

$ 150,000

|

$ 150,000

|

$ 60,000

|

25%

|

|

2

|

Green Product Gross Margin

$(000s)

|

40,087(b)

|

26,348(b)

(below performance target)

|

NIL

|

NIL

|

NIL

|

15%

|

|

3

|

Momentis Independent Representative Adds

|

12,287(c)

|

47,800(c)

>15%

|

$ 400,000

|

$ 400,000

|

$ 160,000

|

10%

|

|

4

|

Commercial EBITDA

$(000)

|

61,062(d)

|

61,106(d)

<5% but above target

|

$ 150,000

|

$ 150,000

|

$ 60,000

|

25%

|

|

5

|

NHS – Waterheaters EBITDA

$(000)

|

17,869(e)

|

20,606(e)

>15%

|

$ 400,000

|

$ 400,000

|

$ 160,000

|

10%

|

|

6

|

New Business Ventures

$(000)

|

10,000(f)

|

55,000(f)

>15%

|

$ 600,000

|

$ 600,000

|

$ 240,000

|

15%

|

|

Non Discretionary Targeted Incentive Payment(4)

|

$1,700,000

|

$1,700,000

|

$ 680,000

|

100%

|

|||

|

Maximum Bonus Opportunity(4)

|

$4,000,000

|

$4,000,000

|

$1,600,000

|

—

|

|||

|

(1)

|

The six criteria relate to the creation of long term growth and shareholder value.

|

|

(2)

|

Each of the annual performance targets for the above six growth criteria were derived from the budget approved by the audit committee for the YE March 31, 2012. Each criteria is allocated the weight as indicated above.

|

|

|

(a)

|

Above performance target. Reflects significant customer additions in Q3 and Q4 resulting from business changes made in Q1 and Q2 which were adversely impacted by Ontario regulatory changes. Includes RCE equivalents reflecting Just Green additions.

|

|

|

(b)

|

Below performance target as a result of under performance in door to door sales and executive management’s decision to delay the roll out of JustClean product to permit the sales force to focus on commodity sales. No bonus.

|

|

|

(c)

|

Based on accelerated and significant growth in the Momentis sales channel. Above 15% growth over target. Maximum bonus.

|

|

|

(d)

|

Above performance target, but ≤ 5%. Partial bonus.

|

|

|

(e)

|

Reflects the installation of 40,400 waterheaters and 6,400 HVAC units relative to budget of 40,000 and 4,000. One HVAC unit is equal to 2.5 waterheaters. Target excludes expenditures associated with the expansion of the business. Above 15% growth over target. Maximum bonus.

|

|

|

(f)

|

Includes $7 million from completed projects and $48 million of future tax benefits. Above 15% growth over target. Maximum bonus.

|

|

(3)

|

Actual increase (decrease) as derived from the year ended March 31, 2012 audited financial statements and the March 31, 2012 management discussion and analysis.

|

|

(4)

|

The maximum potential total non discretionary targeted incentive payment entitlement escalates as actual results exceed business plan by 5%, 10% and 15% (and above) capped for any one year for:

|

|

|

(a)

|

Rebecca MacDonald and Ken Hartwick at $1 million; $2.5 million and $4 million; and for

|

|

|

(b)

|

Beth Summers at $0.4 million; $1 million and $1.6 million.

|

|

(5)

|

The above bonuses are paid as to 100% in RSGs as described below and are reflected for each NEO in the Summary Compensation Table – NEO’s on page 55.

|

|

Name of Holder

|

Common Shares(a)

|

RSGs(d)

(vested and unvested)

|

Total Value

|

|||||||||||||||||

|

Rebecca MacDonald

|

5,846,120 | $ | 80,676,456 | 628,538 | $ | 8,673,824 | $ | 89,350,280 | ||||||||||||

|

Ken Hartwick

|

29,264 | $ | 403,843 | 1,079,261 | $ | 14,893,802 | $ | 15,297,645 | ||||||||||||

|

Beth Summers

|

2,263 | $ | 31,229 | 227,918 | $ | 3,145,268 | $ | 3,176,497 | ||||||||||||

|

Andrew McWilliams

|

NIL

|

$ | NIL | 66,606 | $ | 919,163 | $ | 919,163 | ||||||||||||

|

Mark Silver

|

538,474 | $ | 7,430,941 | 270,185 | $ | 3,728,553 | $ | 11,159,494 | ||||||||||||

|

(a)

|

Includes common shares held indirectly over which control and direction is exercised.

|

|

(b)

|

Based on the closing price of common shares on the TSX on March 31, 2012 of $13.80.

|

|

(c)

|

Under their employment agreements each of Hartwick, Summers and McWilliams is required, at the end of each financial quarter of Just Energy to own (after a date specified in each of their employment agreements (the “Specified Date”), a number of shares of Just Energy (including fully paid RSGs whether or not vested) equal to a multiple of NEO’s base salary for the most recently completed financial year preceding such Specified Date. Based on the fair market value of common shares at the end of each quarter of Just Energy, all NEOs are compliant. In the event of a sudden and significant decrease as the fair market value of common shares after such Specified Date, the compensation committee will give the NEO a reasonable period of time to comply with the requirement having regard to all of the circumstances. Mr. Hartwick was required to own by March 31, 2012 common shares and RSGs having a value equal to five times his base salary at March 31, 2012 or $4,250,000 of common shares and RSGs and at the end of each financial quarter of Just Energy thereafter. As

|

|

(d)

|

Includes long term retention RSGs granted May 20, 2010 and RSGs granted May 17, 2012 (effective March 31, 2012).

|

|

Constellation Energy

|

NRG Energy Inc.

|

|||

|

EnerCare Inc.

|

Parkland Fuel Corporation

|

|||

|

National Fuel Gas Co.

|

PPL Corporation

|

|||

|

New Jersey Resources Corp.

|

Superior Plus Corp.

|

|||

|

WGL Holdings Inc.

|

||||

|

•

|

The industry specific peer group developed by management of Just Energy was appropriate and defensible as comparators but excluded PPL Corporation because of its size;

|

|

•

|

Relative to the Industry Specific Peer Group, Just Energy is generally smaller in size and scope and more profitable;

|

|

•

|

Based on our compensation consultants estimate of the market the total direct compensation paid to the CEO and CFO for the year ending March 31, 2011, both the CFO and CEO appear to be above the market median;

|

|

•

|

For Just Energy’s CEO, the market range from median to the first quartile was approximately $3,000,000 to $5,000,000, as compared to actual F2011 total direct compensation for Just Energy’s CEO of approximately $8,903,000 (which included $5,875,000 reflecting the one time grant in 2011 of 500,000 LTR RSGs);

|

|

•

|

For Just Energy’s CFO, the median to the first quartile range was approximately $1,000,000 to $1,500,000 as compared to actual F2011 total direct compensation for the CFO of approximately $2,631,800 (which included $1,175,000 reflecting the one time grant in 2011 of 100,000 LTR RSGs);

|

|

•

|

Compared to Just Energy, peer group companies provide a substantially higher portion of CEO and CFO compensation in cash;

|

|

•

|

A majority of the peer group companies provide substantial pension/SERP benefits to their CEO and CFO not made available to Just Energy’s CEO or CFO. At the CEO’s current pay level, the cost of implementing a traditional defined benefit SERP would be in the $300,000 to $400,000 range.

|

|

•

|

In assessing the overall market competitiveness of CEO/CFO compensation, Just Energy’s lack of a pension plan should be considered as well as corporate and individual performance. An above median position on compensation is often justified by sustained superior performance.

|

|

1.

|

Employment Agreement

|

|

2.

|

Compensation Components

|

|

|

(a)

|

Base Salary: A base salary of $650,000 subject to an upward adjustment, if any, based on an annual review by the committee. In the context of the amount of her long term bonus opportunity for the year ended March 31, 2013, the committee concluded Ms. MacDonald’s base salary will remain at $650,000 for the year ending March 31, 2013.

|

|

|

(b)

|

Annual Performance Bonus: An annual performance bonus of up to 100% of base salary based on a review by the compensation committee of: (i) criteria and factors considered relevant by the compensation committee including those set forth in her employment agreement (i.e., common share value, board leadership, energy supply, RCE/CCE growth, distributable cash (excluding commissions paid to agents), gross margins, renewals/attrition, balancing and credit issues); (ii) her success in carrying out her duties and responsibilities as set forth in her

|

|

|

employment agreement; (iii) her success in carrying out the special functions listed in her position description as executive chair of the board of directors; and (iv) other factors, all as determined by the compensation committee including the new formulaic targets developed by Just Energy’s compensation consultants to be used in determining her short term incentive bonus for the year ended March 31, 2013 i.e., (x) 40% adjusted EBITDA; (y) 40% based on key performance targets (net RCEs, waterheater equivalents, added Momentis independent representatives, ethanol production and committed solar projects) and (z) 20% based on a list of other factors. See the table on page 33. Based on the compensation committee’s assessment of the criteria which the compensation committee was directed to take into account and considered relevant (see above) and the formulaic growth criteria in the table on page 33, the compensation committee awarded Ms. MacDonald an annual performance bonus of 100% of base salary or $650,000 payable as to100% in cash with a right to elect to receive all or a portion thereof in fully paid RSGs with a 10 year term, vesting immediately. In view of her significant holding in securities of Just Energy, Ms. MacDonald elected to receive 100% of the bonus in cash.

|

|

|

(c)

|

Long Term Targeted Incentive Payment: An annual targeted incentive payment based upon the achievement by Just Energy of year over year incremental growth over business plan (as approved by the audit committee) related to the growth criteria described in the table on page 34 for the year ended March 31, 2012 payable as to 100% in fully paid RSGs with a 10 year term and vesting over a three year period, subject to continued employment on each applicable vesting date. Based on the achievement by Just Energy of annual incremental growth over budget as related to the six factors identified in the table on page 34 as determined from Just Energy’s audited consolidated financial statements and management’s discussion and analysis for the year ended March 31, 2012, Ms. MacDonald was awarded an incentive payment of $1.7 million (equal to 42.5% of the maximum bonus opportunity), paid as to 100% in the form of 126,770 RSGs granted by the compensation committee with a 10 year term vesting as to 1/3 thereof on each of March 31, 2013, 2014 and 2015, subject to continued employment on each applicable vesting date.

|

|

|

(d)

|

Options: Subject to the compensation committee’s discretion. None awarded.

|

|

|

(e)

|

RSGs: Ms. MacDonald received a total of 126,771 fully paid RSGs in fulfillment of her long term incentive bonus entitlement equal in value to 57% of the total of her base salary and all bonus payments earned for the year ended March 31, 2012.

|

|

1.

|

Employment Agreement

|

|

2.

|

Compensation Components

|

|

|

(a)

|

Base Salary: A base salary of $850,000 subject to an upward adjustment, if any, based on an annual review by the compensation committee. Mr. Hartwick’s base salary was increased to $950,000 for the year commencing April 1, 2012 in view of: (i) the factors described below which the compensation committee considered relevant, (ii) the total compensation received by

|

|

|

Mr. Hartwick for the 2012 financial year, (iii) increased responsibilities going forward and (iv) the outstanding contribution made by the CEO during the year related to the business in terms of strategic management and leadership in expanding the business from a door-to-door marketing organization to a business with an expanded and a more diverse suite of energy products including a greater emphasis on commercial and JustGreen products, the significant growth of waterheaters and HVAC products, network marketing and solar installations and the listing of the shares of Just Energy on the NYSE in January, 2012.

|

|

|

(b)

|

Annual Performance Bonus: An annual performance bonus of up to 100% of base salary based on a review by the compensation committee of: (i) criteria and factors considered relevant by the compensation committee including those set forth in his employment agreement (i.e., leadership, energy supply, RCE/CCE growth, distributable cash (excluding commissions paid to agents), gross margins, renewals/attrition, balancing and credit issues); (ii) his success in carrying out his duties and responsibilities as set forth in his employment agreement: (iii) his success in carrying out the special functions listed in his position description as president and as CEO; and (iv) other factors, all as determined by the compensation committee including those described in (a) above and the new formulaic targets to be used in determining his short term bonus for the year ended March 31, 2013 i.e., (x) 40% adjusted EBITDA; (y) 40% based on key performance targets (net RCEs, waterheater equivalents, added Momentis IRs, ethanol production and committed solar projects) and (z) 20% based on a list of other factors. See the table on page 33. Based on the compensation committee’s assessment of the above-noted criteria which the compensation committee was directed to take into account and considered relevant (see above) and the formulaic growth factors in the table on page 33, the compensation committee awarded Mr. Hartwick an annual performance bonus of 140% of base salary or $1,190,000 payable as to 100% in cash with a right to elect to receive all or a portion thereof in fully paid RSGs with a 10 year term, vesting immediately. In view of his significant holdings of securities of Just Energy, Mr. Hartwick elected to take 100% of the bonus in cash.

|

|

|

(c)

|

Long Term Targeted Incentive Payment: An annual targeted incentive payment based upon the achievement by Just Energy of year over year incremental growth over business plan (as approved by the audit committee) related to the growth criteria described in the table on page 34 for the year ended March 31, 2012 payable as to 100% in fully paid RSGs with a 10 year term vesting over a three year period, subject to continued employment on each applicable vesting date. Based on the achievement by Just Energy of annual incremental growth over budget as related to the six factors identified in the table on page 34 as determined from Just Energy’s audited consolidated financial statements for the year ended March 31, 2012, the committee granted Mr. Hartwick an incentive bonus of $1.7 million (equal to 42.5% of the maximum bonus opportunity), paid as to 100% in the form of 126,771 RSGs granted by the compensation committee with a 10 year term vesting as to 1/3 thereof on each of March 31, 2013, 2014 and 2015, subject to continued employment on each applicable vesting date.

|

|

|

(d)

|

Options: Subject to the Compensation Committee’s discretion. None awarded.

|

|

|

(e)

|

RSGs: Mr. Hartwick received a total of 126,771 fully paid long term retention RSGs in payment of his targeted bonus entitlement equal in value to 45% of the total of his base salary and all bonus payments earned for the year ended March 31, 2012. In addition, of the 500,000 LTR RSGs awarded Mr. Hartwick by the compensation committee on March 31, 2012, 25,000 thereof vested on March 31, 2012 with a value of $345,000 based on the March 31, 2012 TSX closing price of $13.80 per common share on that date. See also “Compensation of the Directors and Officers of Just Energy – New Employment Agreements”.

|

|

1.

|

Employment Agreement and Amendments

|

|

2.

|

Compensation Components

|

|

|

(a)

|