Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of, June 2013

Commission File Number 001-35400

Just Energy Group Inc.

(Translation of registrant’s name into English)

6345 Dixie Road, Suite 200, Mississauga, Ontario, Canada, L5T 2E6

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40F:

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Table of Contents

DOCUMENTS INCLUDED AS PART OF THIS REPORT

Document

| 1 | Management Proxy Circular, dated May 17, 2013. |

| 2 | Certificate Pursuant to National Instrument 54-101, Communication with Beneficial Owners of Securities of a Reporting Issuer, dated May 31, 2013. |

Document 1 of this report on Form 6-K is incorporated by reference into the Registrant’s outstanding registration statements on Form F-3 (No. 333-188184), Form F-10 (No. 333-184289) and Form S-8 (No. 333-183954) that have been filed with the Securities and Exchange Commission.

Table of Contents

Document 1

Just Energy Group Inc.

Management Proxy Circular

Notice of Annual and Special Meeting of Common Shareholders

June 26, 2013

May 17, 2013

Dear Shareholder:

Please join us at the 12th annual and special meeting of common shareholders of Just Energy at 3:00 p.m. EST on Wednesday June 26, 2013 at the Toronto Stock Exchange – Broadcast Centre located on the main floor of The Exchange Tower, 2 First Canadian Place, 130 King Street West, Toronto, Ontario.

Just Energy operates in a high growth industry, the sale of deregulated electricity and natural gas to residential and commercial customers under fixed and variable price term contracts. Industry data from the United States shows that more than 23 million household have switched from their incumbent utility to a retailer like Just Energy. This residential growth rate was estimated at 12% for the year ended August 31, 2012. Similarly, retailer sales to commercial customers grew by an estimated 9% over the same period.

Just Energy has seen its growth parallel that of the industry and believes it is one of the largest industry participants in North America. During fiscal 2013, the Company incurred significant expenditures to expand its customer base, geographic footprint, sales channels and the future margin embedded in their energy contracts. The Company made a significant investment opening in 10 new utility territories in fiscal 2013 including our first steps into the U.K. market. These investments will become cashflow positive in fiscal 2014 and beyond. In addition, we invested heavily in sales and marketing expenses to add new customers during the year.

The results of these investments were demonstrated in another record year for customer additions through Just Energy’s many sales channels. The energy marketing business added 1,355,000 new customers, up 24% from the previous record of 1,091,000 in fiscal 2012. Net of attrition and renewals, customer additions were 352,000, up 11% from the net additions in the prior year. As Just Energy grows larger, there is a need to replace a greater number of customers annually. Just Energy has, and will continue to more than offset customer churn through sales growth.

All of the Just Energy marketing channels showed improved performance during the year. Residential sales were a record 631,000, up 47% from fiscal 2012 driven by strong performance from our door-to-door salesforce as well as the expanded use of internet sales, affinity offerings, telemarketing and our Momentis network sales force. These new channels will be key to the continued growth of Just Energy’s customer base going forward. Our Commercial division also experienced very strong results, adding 724,000 new customer equivalents, up 9% from fiscal 2012.

Strong customer growth was also seen at the Home Services division, driven by organic sales and a small acquisition. NHS built its installed base from 165,000 to 235,000 water heater/HVAC units over the year, resulting in growth of 42%. Additionally, the Home Services division recently launched marketing efforts in Quebec and Texas and is seeing positive initial results, particularly with the new smart thermostat product.

Overall, the customer base reached 4,457,000, up 10% year over year. This higher customer base resulted in a 15% increase in embedded margin within our contracts at year end. This total reached $2.27 billion ($15.77 per share) providing a solid underpinning to the Company’s value and giving evidence that margins and, therefore EBITDA, are expected to show solid growth in the near term.

Net income from continuing operations was $601.7 million ($4.30 per share basic) for fiscal 2013 versus a loss of $128.5 million ($0.93 per share basic) for fiscal 2012. While management does not use earnings per share as an internal measure, it is important to permit shareholders who wish to focus on results under International Financial Reporting Standards to see the business performance on this basis.

Table of Contents

In addition to customer growth, one result of the heavy investment in growth during fiscal 2013 was an elevated payout ratio on funds from operations and higher than expected administrative and sales and marketing costs. This resulted in lower than expected EBITDA creating a public perception that the Company was facing a difficult operating environment. This is not the case. The lower EBITDA is a function of the fact that effectively all of the Company growth investments are expensed as either sales and marketing or administrative costs.

The Company has developed a plan which highlights how, over time, these investments will bring the payout ratio down along with increasing EBITDA and reducing our debt to EBITDA ratio to industry standard levels. The Company has provided fiscal 2014 guidance which calls for base EBITDA of $220 million, an increase of 34% over fiscal 2013. This will result in a payout ratio on funds from operations of less than 100%. As the embedded margin the Company has built is realized, we would expect further improvements to these ratios with our payout ratio targeted to fall to 60% to 65% by the end of fiscal 2016. We also target a debt to EBITDA ratio of 3.5 to 4 times by the same date.

Just Energy has been a successful and profitable growth company through its history. The investments made in fiscal 2013 will aid a continuation of this track record. The past year has seen a significant decrease in the market price of Just Energy’s common shares and convertible debentures. In light of the decrease in market value, the members of executive management recommended they not receive any short term or long term incentive bonus entitlements for the year ending March 31, 2013 despite the fact that the formula for their bonus calculations described in the circular generated a fiscal 2013 payout based on growth factors including embedded margin. Management’s recommendation was unanimously supported and approved by the board of directors.

In December 2012 the Company completed a $105 million offering of 9.75% 51/2 year unsecured notes to reduce its drawings on its working capital line, fund future growth and for general corporate purposes. In January of 2013 the Company expanded its solar financing capacity by up to $42 million. The Solar division brings attractive tax benefits to the Company and has made cumulative commitments of approximately $107 million with the status of the associated projects ranging from contracted to completed.

The Company also announced that it has placed its Terra Grain Fuels ethanol plant for sale and has listed the asset as a discontinued operation. TGF has approximately $66 million in associated debt which is non-recourse to Just Energy and will be sold with the facility. The Company does not anticipate net cash proceeds from the sale after consideration of the debt outstanding.

The accompanying proxy circular and notice of meeting contains a description of the matters to be voted upon at the meeting and provides information on executive compensation and corporate governance at Just Energy. In addition to the usual items of business, management is seeking shareholder approval for four special items of business: (a) to approve a shareholder rights plan approved by the board on February 7, 2013, (b) to approve a new performance bonus incentive plan for employees involving the issue of up to 4 million shares to employees thereunder, approved by the board on April 3, 2013, (c) to increase the number of shares available for issue to directors under the directors compensation plan (the “DSG Plan”) by 200,000 and to provide for minor amendments to the DSG Plan all of which were approved by the board on May 16, 2013 and (d) if the ordinary resolution in (b) above is not approved, to increase the number of shares available for issue under the restricted share grant plan (the “RSG Plan”), by 4 million shares. Each of these items of special business is described in detail in the circular.

We hope you will take the time to read the proxy circular in advance of the meeting as it provides background information that will help you exercise your right to vote. Whether or not you attend the meeting in person, we would encourage you to vote as this is one of your rights as a shareholder. Instructions on the ways you can exercise your voting rights are found starting on page 1 of the proxy circular. If your common shares are not registered in your name but are held in the name of a nominee, you should consult the information on page 4 of the proxy circular with respect to how to vote your shares.

If you are able to attend the meeting in person, there will be an opportunity to ask questions and to meet your directors, Just Energy management and your fellow shareholders.

On behalf of our board of directors, we would like to express our gratitude for the support of our shareholders. We would also like to thank our employees for their hard work and support. We look forward to seeing you at the meeting.

Sincerely,

| /s/ Rebecca MacDonald |

/s/ Ken Hartwick | |

| Rebecca MacDonald Executive Chair Just Energy Group Inc. |

Ken Hartwick President and Chief Executive Officer Just Energy Group Inc. |

Table of Contents

Notice of Annual and Special Meeting

To: Just Energy Common Shareholders

The annual and special meeting of Just Energy common shareholders will be held at the Toronto Stock Exchange – Broadcast Centre, The Exchange Tower, 2 First Canadian Place, 130 King Street West, Toronto, Ontario, Canada M5X 1J2 on Wednesday June 26, 2013, at 3:00 p.m. EST:

| 1. | to receive the audited consolidated financial statements of Just Energy for the year ended March 31, 2013 and the auditor’s report thereon; |

| 2. | to elect the nominees of Just Energy standing for election as directors on an individual basis; |

| 3. | to appoint Ernst & Young LLP as auditors of Just Energy; |

| 4. | to consider, in an advisory, non-binding capacity, Just Energy’s approach to executive compensation; |

| 5. | to consider, and if thought advisable to pass, with or without variation, an ordinary resolution the full text of which is set forth in the circular dated May 17, 2013 to approve the shareholder rights plan as set forth in the shareholder protection rights plan agreement dated February 7, 2013 between Just Energy and Computershare Investor Services Inc., and the issuance of the rights issued pursuant to such rights plan all as described in the circular; |

| 6. | to consider, and if thought advisable to pass, with or without variation, an ordinary resolution the full text of which is set forth in the circular dated May 17, 2013 to approve a performance bonus incentive plan and certain related amendments to the RSG Plan (referred to in paragraph 8 below) for service providers (employees and consultants) of Just Energy and its affiliates all as described in the circular; |

| 7. | to consider, and if thought advisable to pass, with or without variation, an ordinary resolution the full text of which is set forth in the circular dated May 17, 2013 to approve an increase in the number of common shares available for issue to directors by 200,000 under the directors’ compensation plan (the “DSG Plan”) and to make certain administrative and procedural amendments to the DSG Plan all as described in the circular; |

| 8. | if the ordinary resolution in paragraph 6 above is not approved, to consider, and if thought advisable to pass, with or without variation, an ordinary resolution the full text of which is set forth in the circular dated May 17, 2013 to approve an increase in the number of shares available for issue to service providers (employees and consultants) by 4 million under the restricted share grant plan (the “RSG Plan”) all as described in the circular; and |

| 9. | to transact such other business as may properly be brought before the meeting or any adjournment or postponement thereof. |

The matters proposed to be dealt with at the meeting are described in the proxy circular accompanying this notice. The directors have fixed May 24, 2013, as the record date for the determination of the common shareholders entitled to receive notice of and vote at the meeting.

| Dated at Toronto, Ontario |

JUST ENERGY GROUP INC. | |

| May 17, 2013. |

||

| /s/ Jonah Davids | ||

| Jonah Davids | ||

| Senior Vice President, Legal and Regulatory and General Counsel |

Table of Contents

| Page | ||||

| 1 | ||||

| 4 | ||||

| 7 | ||||

| Receipt of Consolidated Audited Financial Statements and Auditor’s Report |

7 | |||

| 7 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 20 | ||||

| 24 | ||||

| 26 | ||||

| JUST ENERGY’S APPROACH TO EXECUTIVE COMPENSATION – SAY ON PAY |

27 | |||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| COMPENSATION AND GOVERNANCE COMMITTEES – LETTER TO SHAREHOLDERS |

30 | |||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 53 | ||||

| 54 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| Employment Agreements – Other Terms, Conditions and Obligations |

59 | |||

| 59 | ||||

| 60 | ||||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| Securities Authorized for Issuance under Equity Compensation Plans |

65 | |||

| 66 | ||||

| 67 | ||||

| 67 | ||||

| 69 | ||||

| 69 | ||||

| INTERESTS OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON |

70 | |||

| 70 | ||||

| SCHEDULE A – STATEMENT OF CORPORATE GOVERNANCE PRACTICES OF JUST ENERGY |

A-1 to A-7 | |||

| SCHEDULE B – OTHER PUBLIC COMPANY DIRECTORSHIPS AND COMMITTEE APPOINTMENTS |

B-1 to B-2 | |||

| C-1 to C-3 | ||||

| SCHEDULE D – POLICY ON ENGAGEMENT WITH SHAREHOLDERS ON GOVERNANCE |

D-1 to D-2 | |||

| SCHEDULE E – COMPENSATION, HUMAN RESOURCES, HEALTH, SAFETY AND ENVIRONMENTAL COMMITTEE |

E-1 to E-5 | |||

Table of Contents

PROXY CIRCULAR This proxy circular is provided in connection with the solicitation of proxies by management of Just Energy for use at the annual and special meeting of its shareholders or at any adjournment or postponement thereof (the “meeting”). In this document “you” and “your” refer to the shareholders of, and “Just Energy”, the “Company” or “we”, “us”, “our”, refer to, Just Energy Group Inc. The information contained in this proxy circular is given as at May 24, 2013, except as indicated otherwise.

IMPORTANT – If you are not able to attend the meeting, please exercise your right to vote by signing the enclosed form of proxy or voting instruction form and, in the case of registered shareholders by returning it to Computershare Trust Company of Canada in the enclosed envelope, or by voting by fax as indicated on the form of proxy, no later than 3:00 p.m. (Toronto time) on June 24, 2013, or, if the meeting is adjourned or postponed, by no later than 3:00 p.m. (Toronto time) on the business day prior to the day fixed for the adjourned or postponed meeting. See the form of proxy. If you are a non-registered shareholder, reference is made to the section entitled “How do I vote if I am a non-registered shareholder?” on page 4 of this circular.

VOTING – QUESTIONS AND ANSWERS

VOTING AND PROXIES

Who can vote?

Shareholders who are registered as at the close of business on May 24, 2013 (the “record date”), will be entitled to vote at the meeting or at any adjournment or postponement thereof, either in person or by proxy.

As of the close of business on May 24, 2013, Just Energy had outstanding 142,249,269 common shares. Each common share carries the right to one vote.

To the knowledge of the directors and senior offices of Just Energy based on the most recent publicly available information, no shareholder, as at May 24, 2013, owned or exercised control or direction over shares carrying 10% or more of the voting rights attached to the common shares of Just Energy.

Quorum for the Meeting

At the meeting, a quorum shall consist of two or more persons either present in person or represented by proxy and representing in the aggregate not less than 25% of the outstanding common shares. If a quorum is not present at the meeting within one half hour after the time fixed for the holding of the meeting, it shall stand adjourned to such day being not less than 14 days later and to such place and time as may be determined by the chair of the meeting. At such meeting, the shareholders present either personally or by proxy shall form a quorum. In the event of a tie or deadlock vote at the meeting, the chair may not cast a deciding vote.

What will I be voting on?

Shareholders will be voting: (i) to elect directors of Just Energy, (ii) to appoint Ernst & Young LLP as auditors of Just Energy, (iii) in an advisory capacity, on Just Energy’s approach to executive compensation, (iv) to approve a shareholder rights plan, (v) to approve a performance bonus incentive plan for employees, (vi) to approve amendments to the directors compensation plan, (vii) to approve amendments to the restricted share grant plan as included in (v) above and (viii) if the resolution in (v) above is not approved, to increase the number of shares available for grant under the restricted share grant plan. Our board of directors and our management are recommending that shareholders vote FOR items (i), (ii), (iii), (iv), (v), (vi), (vii) and (viii) above.

How will these matters be decided at the meeting?

A simple majority of the votes cast, in person or by proxy, will constitute approval for each of these matters.

Why am I not voting to approve the financial statements?

The board of directors of Just Energy approved the consolidated audited financial statements of Just Energy for the year ended March 31, 2013, on May 16, 2013. Under the Canada Business Corporations Act, the legislation which governs Just Energy, the financial statements are required to be mailed to shareholders but no shareholder vote is required. You will however be entitled to ask questions of financial management at the meeting.

1

Table of Contents

Who is soliciting my proxy?

Management of Just Energy is soliciting your proxy. The solicitation is being made primarily by mail, but our directors, officers or employees may also solicit proxies at a nominal cost to Just Energy.

How can I contact the transfer agent?

You can contact the transfer agent either by mail at Computershare Trust Company of Canada, 100 University Ave., 9th Floor, North Tower, Toronto, Ontario M5J 2Y1 or by fax at 1 866 249-7775.

How do I vote?

If you are eligible to vote and your common shares are registered in your name, you can vote your common shares in person at the meeting or by proxy, as explained below. If your common shares are held in the name of a nominee, please see the instructions below under “How do I vote if I am a non-registered shareholder?”.

What is the difference between a registered shareholder and a beneficial owner of shares?

If your shares are registered on the record date directly in your name with Just Energy’s transfer agent, you are considered with respect to those shares to be a “registered shareholder”. The proxy circular and proxy have been sent directly to you by Computershare Trust Company of Canada.

If your shares are held in a stock brokerage account or by a bank or financial intermediary or other nominee, you are considered the “beneficial owner” of shares held in street name. The proxy circular has been forwarded to you by your broker, bank, financial intermediary or other nominee who is considered, with respect to those shares, the registered shareholder. As the beneficial owner, you have the right to direct your broker, bank, financial intermediary or other nominee how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting.

How do I vote if I am a registered shareholder?

| 1. | VOTING BY PROXY |

You are a registered shareholder if your name appears on your share certificate. If this is the case, you may appoint someone else to vote for you as your proxy holder by using the enclosed form of proxy. The persons currently named as proxies in such form of proxy are the executive chair and the president and chief executive officer of Just Energy. However, you have the right to appoint any other person or company (who need not be a shareholder) to attend and act on your behalf at the meeting. That right may be exercised by writing the name of such person or company in the blank space provided in the form of proxy or by completing another proper form of proxy. Make sure that the person you appoint is aware that he or she is appointed and attends the meeting.

| (i) | How can I send my form of proxy? |

You can either return a duly completed and executed form of proxy to the transfer agent and registrar for Just Energy’s common shares, Computershare Trust Company of Canada, in the envelope provided, or you can vote as indicated above by following the instructions on the form of proxy.

| (ii) | What is the deadline for receiving the form of proxy? |

The deadline for receiving duly completed forms of proxy or a vote following any one of the other two options as indicated above is 3:00 p.m. EST on June 24, 2013, or if the meeting is adjourned or postponed, by no later than 3:00 p.m. EST on the business day prior to the day fixed for the adjourned or postponed meeting.

2

Table of Contents

| (iii) | How will my common shares be voted if I give my proxy? |

Your common shares will be voted or withheld from voting in accordance with your instructions indicated on the proxy. If no instructions are indicated, your common shares represented by proxies in favour of the board, executive chair or the president and chief executive officer will be voted FOR the election of management’s nominees as directors, FOR the appointment of Ernst & Young LLP as auditors, FOR Just Energy’s approach to executive compensation, FOR the approval of the shareholder rights plan, FOR the approval of the performance bonus incentive plan for employees, FOR the approval of the amendments to the directors’ compensation plan and FOR the approval of the amendments to the restricted share grant plan and at the discretion of the proxy holder in respect of amendments to any of the foregoing matters or on such other business as may properly be brought before the meeting. Should any nominee named herein for election as a director become unable to accept nomination for election, it is intended that the person acting under proxy in favour of management will vote for the election in his or her stead of such other person as management of Just Energy may recommend. Management has no reason to believe that any of the nominees for election as directors will be unable to serve if elected to office and management is not aware of any amendment or other business likely to be brought before the meeting.

| (iv) | If I change my mind, how can I revoke my proxy? |

You may revoke your proxy at any time by an instrument in writing (which includes another form of proxy with a later date) executed by you, or by your attorney (duly authorized in writing), and (i) deposited with the Corporate Secretary of Just Energy at the registered office of Just Energy (First Canadian Place, 100 King Street West, Suite 2630, Toronto, Ontario M5X 1E1) at any time up to and including 3:00 p.m. EST on the last business day preceding the day of the meeting or any adjournment or postponement thereof, or (ii) filed with the chair of the meeting on the day of the meeting or any adjournment or postponement thereof, or in any other matter permitted by law or in the case of vote email or fax, by way of a subsequent vote by email or fax.

| 2. | VOTING IN PERSON |

If you wish to vote in person, you may present yourself to a representative of Computershare Trust Company of Canada at the registration table. Your vote will be taken and counted at the meeting. If you wish to vote in person at the meeting, do not complete or return the form of proxy.

How do I vote if I am a non-registered shareholder?

If your common shares are not registered in your name and are held in the name of a nominee such as a trustee, financial institution or securities broker, you are a “non-registered shareholder”. If, as is usually the case, your common shares are listed in an account statement provided to you by your broker or other nominee or custodian, those common shares will, in all likelihood, not be registered in your name. Such common shares will more likely be registered under the name of your broker, or an agent of that broker or other nominee or custodian. Without specific instructions, Canadian brokers and their agents or nominees are prohibited from voting shares for the broker’s client. If you are a non-registered shareholder, there are two ways, listed below, that you can vote your common shares:

| (i) | GIVING YOUR VOTING INSTRUCTIONS |

Applicable securities laws require your nominee to seek voting instructions from you in advance of the meeting. Accordingly, you will receive or have already received from your nominee a request for voting instructions for the number of common shares you hold. Every nominee has its own mailing procedures and provides its own signature and return instructions, which should be carefully followed by non-registered shareholders to ensure that their common share are voted at the meeting.

| (ii) | VOTING IN PERSON |

However, if you wish to vote in person at the meeting, insert your name in the space provided on the request for voting instructions provided by your nominee to appoint yourself as proxy holder and follow the signature and return instructions of your nominee. Non-registered shareholders who appoint themselves as proxy holders should present themselves at the meeting to a representative of Computershare Trust Company of Canada. Do not otherwise complete the request for voting instructions sent to you as you will be voting at the meeting.

3

Table of Contents

NEW GOVERNANCE AND EXECUTIVE COMPENSATION HIGHLIGHTS – 2013

Just Energy has implemented several new governance and compensation initiatives during the years ended March 31, 2012 and 2013 to improve its governance structure and to address recommendations of, and issues raised by, institutional shareholder groups and our outside independent compensation consultants related to the design of, and other aspects of our approach to, executive compensation.

GOVERNANCE INITIATIVES

Retirement Policy and Board Rejuvenation

The board of Just Energy approved a retirement policy for directors in 2012 which, in effect, requires directors to step down from the board on the earlier of: (a) 15 years of service from the date they were appointed or elected or starting from Just Energy’s April 2001 initial public offering and (b) attaining age 75. To provide the nominating and governance committee an opportunity to identify two additional independent qualified directors to replace the two directors who are over 75, the retirement policy did not become effective until December 31, 2012. See page 9.

On April 2, 2012 William F. Weld was appointed to the board as an independent director. He was formerly the Governor of the State of Massachusetts and resides in Massachusetts and New York and reflects the views and businesses of our large customer base in the Northeastern U.S. See page 15.

On November 6, 2012, the size of the board was increased by one and George Sladoje was appointed to the board as an independent director. He has extensive experience with commodity markets and in the natural gas and electricity markets. He is based in Chicago, Illinois and reflects the views and businesses of our large customer base in the Midwest. See page 13.

On February 7, 2013 Roy McMurtry, a director since 2007 retired from the board based on our new over 75 retirement policy for directors and was appointed a director emeritus for one year.

Brian Smith who has been a director since 2001 resigned on May 16, 2013 based on our new over 75 retirement policy for directors and was appointed a director emeritus for one year. If elected at the Meeting, Brett Perlman who is based in Houston, Texas will add extensive experience with energy markets and will reflect the views and businesses of our large customer base in the South. See page 14.

Orientation and Continuing Education

| (a) | Director Orientation |

On May 17, 2012, the board of Just Energy, for the first time, approved a formal policy to ensure that new appointees to the Just Energy board will be required to participate in a comprehensive orientation program to familiarize them with Just Energy’s business, its board policies and committee structure, their role as directors, their fiduciary duties and responsibilities and the contribution directors are expected to make to the deliberations of the board and the committees on which they serve. Each of Messrs Weld and Sladoje engaged in an extensive orientation program at the time they were appointed to the Just Energy board. Mr. Perlman will, prior to June 26, 2013 also engage in a similar program.

| (b) | Director Continuing Education |

On May 17, 2012, the board of Just Energy, for the first time, approved a formal program to ensure all directors will have access to continuing education and information (external and internal) on an ongoing basis pertaining to board effectiveness, the best practices associated with successful boards, briefings on future or emerging trends that may be relevant to Just Energy’s business, strategy, succession planning and risk. See page 9.

| (c) | Board Diversity and Renewal |

In furtherance of the above governance initiatives, the board adopted in 2012 a policy to encourage greater board diversity and renewal. We consider diversity of gender, ethnicity, age, business experience, functional expertise, personal skills, stakeholder perspectives and geography as factors to consider in identifying new directors. To implement the board’s objective two new independent directors were appointed to the Just Energy board – one by the end of March 2013 and one additional independent director will, subject to shareholder approval, be elected to the board at the Meeting. See page 10.

4

Table of Contents

EXECUTIVE COMPENSATION CONSULTANTS AND INITIATIVES

In 2012, the board, though its compensation committee, retained the services of Hugessen Consulting, executive compensation consultants to advise the compensation committee and the board on Just Energy’s executive compensation plans and policies and compensation benchmarking. Based on the recommendations in Hugessen’s Report presented to the board of Just Energy in 2012, the board adopted policies on:

| (a) | for the first time, the identification of an industry peer group to benchmark Just Energy’s CEO and CFO executive compensation to an industry specific peer group of companies, |

| (b) | the development of new formulaic short term and long term incentive criteria and targets for the CEO, CFO and executive chair to incorporate more mainstream bottom line “shareholder friendly” metrics in the context of Just Energy’s business such as, adjusted EBITDA, embedded gross margin, adjusted EBITDA per share and Funds from Operations (each defined on page 65 under the heading “User Friendly Shareholder Financial Criteria”), to ensure their compensation is based on pay for performance, encourages growth and to align executive compensation with the interests of Just Energy’s shareholders and other stakeholders in the context of creating shareholder value and financial criteria used by shareholders to measure performance and to monitor and control risk; and |

| (c) | a clawback policy giving independent directors the discretion to recoup all or a portion of bonuses or incentive compensation paid to an executive officer in the event of a restatement of Just Energy’s financial results based on intentional fraud or misconduct. See page 54. |

In February 2013, the board, through its compensation committee, retained the services of Hugessen Consulting, executive compensation consultants to advise the compensation committee and the board on several governance matters including: (a) the extent to which compensation for Just Energy’s NEO’s for the three years ended March 31, 2013 meets Canada’s newly revised quantitative pay-for-performance test simulation developed by Institutional Shareholder Services (“ISS”), (b) the extent to which Just Energy’s compensation policies comply with generally accepted corporate governance principles and standards in the context of the guidelines established by ISS and the Canadian Coalition for Good Governance (“CCGG”) and (c) an appropriate level of compensation for a chair of board.

DIRECTOR INDEPENDENCE

The board of directors has determined and declared that the relationship of each of John Brussa and Gordon Giffin as partners at law firms which represent Just Energy are not such as to impair their independent judgement as directors and accordingly, except for purposes of the audit committee, they both can be regarded as independent for purposes of the board and all other board committees. Accordingly, -78% of Just Energy’s directors are independent as defined by applicable stock exchange and securities legislation.

EXECUTIVE COMPENSATION, PAY FOR PERFORMANCE AND CORPORATE PERFORMANCE

Based on the corporate performance at Just Energy for the year ending March 31, 2013 resulting in part by a 52% drop in the market price for its common shares from April 1, 2012 to March 28, 2013 and a total shareholder return for the period of – 45%, Just Energy’s board, with named executive officer (“NEO”) approval, did not grant: (a) any discretionary performance bonuses to any one of the NEOs nor (b) any long term incentive bonuses to which each of the Executive Chair, the President and CEO and the CFO were otherwise entitled to receive based on the achievement of the long term performance criteria in their employment agreements. The Chart below indicates the absolute and percentage decrease in total compensation for the year ending March 31, 2013 compared to March 31, 2012 received by the Executive Chair, the President and CEO and the CFO along with the unrealized capital loss and decrease in the value of their shares and fully paid RSGs for the same period in absolute and percentage terms.

5

Table of Contents

| Total Compensation – Year Ending March 31 |

TSX Market Value at | |||||||||||||||||||||||

| Name and Position of NEO |

2012 | 2013 and

% (Decrease) |

# of Shares and RSGs owned at April 1, 2012 |

April

1, 2012(2) |

March

28, 2013(3) |

% and $ Decrease in Market Value (unrealized) for the YE March 31, 2013 |

||||||||||||||||||

| Rebecca MacDonald – Executive Chair |

$ | 3,000,000 | $

|

650,000 –78 |

% |

6,474,658 | (1) | $ | 89,350,280 | $ | 43,185,969 | $

|

46,164,311 (–52 |

%) | ||||||||||

| Ken Hartwick – President & CEO |

$ | 3,774,000 | $

|

988,000 –74 |

%(4) |

1,108,525 | (1)(4) | $ | 15,297,645 | $ | 7,393,862 | $

|

7,903,783 (–52 |

%) | ||||||||||

| Beth Summers – CFO |

$ | 1,548,000 | $

|

483,600 –69 |

%(4) |

230,181 | (1)(4) | $ | 3,176,497 | $ | 1,535,307 | $

|

1,641,191 (–52 |

%) | ||||||||||

| (1) | No shares have been sold or disposed of by any one of the above NEO’s since they joined Just Energy – other than a transfer of shares by Rebecca MacDonald to a charity. Rebecca MacDonald joined Just Energy in 1997, Ken Hartwick joined Just Energy in 2004 and Beth Summers joined Just Energy in 2009. |

| (2) | Based on the closing TSX market value on April 1, 2012 of $13.80 per share. |

| (3) | Based on the closing TSX market value on March 28, 2013 of $6.67 per share. |

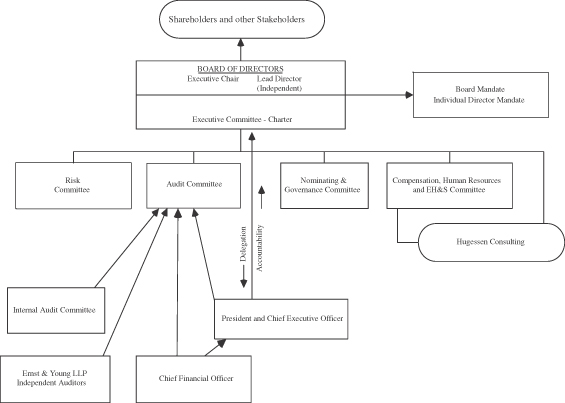

Each of the above governance and compensation initiatives and decisions have been implemented in 2012 and 2013 in the interests of all shareholders and other stakeholders and are discussed in more detail in this circular. A diagram outlining Just Energy’s corporate governance structure reflecting all of the above initiatives is included on page 79.

6

Table of Contents

GENERAL BUSINESS TO BE ACTED UPON AT THE MEETING

RECEIPT OF CONSOLIDATED AUDITED FINANCIAL STATEMENTS AND AUDITORS’ REPORT

The consolidated audited financial statements of Just Energy for the financial year ended March 31, 2013 and accompanying auditor’s report will be presented at the meeting. These documents are contained in Just Energy’s 2013 annual report and are available on SEDAR at www.sedar.com or EDGAR at www.sec.gov. The annual report is being mailed to shareholders with this proxy circular, if requested. Shareholders are not required to vote to approve the consolidated audited financial statements. Shareholders will however have an opportunity at the meeting to ask questions of executive and financial management.

ELECTION OF DIRECTORS OF JUST ENERGY

Just Energy has a board of directors which presently consists of nine members, all of whom are standing for re-election as directors of Just Energy and, if elected, will serve until the next annual meeting of Just Energy or until their successors are duly elected or appointed. Pursuant to the retirement policy described below, Mr. McMurtry and Mr. Smith retired from the board and are not standing for re-election at the Meeting and both of them has been appointed a director emeritus for one year. Mr. McMurtry was replaced by the appointment of George Sladoje on November 6, 2012. The nominees proposed for election as directors were recommended to the board by the nominating and governance committee and are listed below. All of the nominees, except for Brett Perlman, are currently directors of Just Energy. All nominees have established their eligibility and willingness to serve as directors. Unless otherwise instructed, the persons designated in the form of proxy intend to vote FOR each of the nominees listed below and in the form of proxy accompanying this circular.

| John A. Brussa |

Gordon D. Giffin | Kenneth Hartwick | ||

| Michael J.L. Kirby |

Rebecca MacDonald | Brett A. Perlman | ||

| Hugh D. Segal |

George Sladoje | William F. Weld |

If, for any reason at the time of the meeting, any of the above nominees are unable to serve, unless otherwise specified, the persons designated in the form of proxy may vote in their discretion for any substitute nominee or nominees. Except for Ken Hartwick and Rebecca MacDonald (both members of executive management), all other directors (78%) are independent under applicable stock exchange and securities legislation.

In addition to the policies, codes of conduct, individual board mandates and other corporate governance rules of Just Energy (listed in the corporate governance structure diagram on page 79), and described in Schedule A, pages A1 to A7, the directors at Just Energy are subject to the following policies:

Independent Majority

As indicated above and as required by applicable legislation and regulation including the NYSE listing standards, 7 of the 9 persons standing for election have, along with the nominating and governance committee, established their independence. All directors serving as members of the compensation committee, the nominating and governance committee, the risk committee and the audit committee (where Michael Kirby is the financial expert), are independent.

Directors to be Elected on an Individual Basis

As a corporate governance initiative approved in 2010, the nominee directors are being elected on an individual, as opposed to a slate, basis. The board of Just Energy has adopted a policy which requires that any nominee for director who receives a greater number of votes “withheld” than votes “for” his or her election as a director shall submit his or her resignation to the nominating and governance committee for consideration promptly following the meeting. The nominating and governance committee shall consider the resignation and shall recommend to the board of Just Energy whether to accept it. The board will consider the recommendation and determine whether to accept it within 90 days of the meeting and a news release will be issued by Just Energy announcing the board’s determination. A director who tenders his or her resignation will not participate in any meetings to consider whether the resignation shall be accepted.

Board Overloading

The directors of Just Energy approved a guideline on “Board Overloading” which was effective January 1, 2011. The guideline provides that as a principle of good corporate governance, directors of Just Energy should not serve on the boards of more than six publicly listed companies. The nominating and governance committee, after a consideration of all the

7

Table of Contents

circumstances, may determine annually, prior to the election of directors, to waive the guideline for persons who in exceptional circumstances with unique experience and expertise, should not be constrained from serving on the board. The nominating and governance committee has determined that the guidelines should not apply to John Brussa. See Schedule B, page B2.

Retirement Policy

On May 17, 2012 the board of Just Energy approved, as a corporate governance initiative, as being in the best interests of Just Energy and its shareholders and board renewal, a retirement policy pursuant to which directors must resign on the earlier of: (a) age 75 and (b) the day starting from the later of April 1, 2001 initial public offering and the day of the election or appointment to the board when a director has served on the board of Just Energy for more than 15 years. Special circumstances may exist or arise when it is in Just Energy’s best interests to waive the policy for up to maximum of three years based on a director’s contribution and expertise subject to solid annual performance assessments, positive peer evaluation reviews and shareholder approval. One of Just Energy’s directors based on the new retirement policy resigned in February 2013 and one retired in May, 2013 and both will not be standing for re-election at the Meeting. They have or will be replaced by two qualified independent directors: one in November, 2012 and the other who is standing for election by shareholders at the Meeting.

Director Orientation and Continuing Education

In 2012, the board of Just Energy approved, as a corporate governance initiative, a policy to formalize its approach to a comprehensive orientation plan for new directors and a policy to encourage directors to participate in continuing education. The intent of the policies is to ensure that: (a) new directors, whether appointed to fill a vacancy on the board or to be elected at an annual meeting, be required to participate in a comprehensive orientation program to familiarize them with Just Energy’s business, board policies and committee structure, their fiduciary duties and responsibilities as directors and the contribution they are expected to make to the deliberations of the board and board committees, and (b) a program is in place to ensure all directors will have access to education and information on an ongoing basis, both internal and external, pertaining to matters in (a) above and to board effectiveness, the best practices associated with successful boards, briefings on strategy, succession planning and risk, so as to enable them to carry out their duties and responsibilities as outlined in the Just Energy board mandate and the mandate for individual directors both of which are published on Just Energy’s website www.justenergygroup.com. During the year ended March 31, 2013, the board: (i) held a two day strategy session on November 31, 2012 and December 1, 2012 on succession planning, expansion of the business, capital structure and other business matters, (ii) received a presentation on insurance in February, 2013, (iii) held separate sessions on risk and the management of Just Energy’s commodity book with the chair of the risk committee, (iv) held special meetings on Just Energy’s budget for 2013-2015 on April 3, 2013 and (v) on executive compensation on April 3, 2013.

Board Diversity and Renewal

On May 17, 2012 the board of directors of Just Energy approved as a corporate governance initiative, a policy on board diversity and renewal on the basis that greater board diversity contributes to better corporate governance. The board of Just Energy believes that diversity should be considered in the context of ethnicity, gender, age, business experience, functional expertise, stakeholder perspectives and geographic background. Just Energy nominee directors reflect all of the above criteria including gender, legal, finance, accounting, business experience, public policy, management, regulatory and an age diversity ranging from 50 to 71. During Just Energy’s financial year ended March 31, 2013 two new independent directors were appointed to the Just Energy board and a third independent director has agreed to stand for election at the meeting. Each of them has significant experience in our business sector and reflecting the growth of our business in the United States, one from the North East (Bill Weld), one from the Midwest (George Sladoje) and one from the South (Brett Perlman). See pages 13 to 15.

Share Ownership

The board has adopted policies that require directors to receive $15,000 of their annual base retainer in director deferred share grants (“DSGs”) or common shares and require directors to own a minimum of three times their annual base retainer of $65,000 ($195,000) in common shares and DSGs within three years of their appointment or election to the board. See pages 18 (notes (6) and (7) and 42 and 43 (notes (1) and (2)).

All current directors are fully compliant with the ownership policy except for Bill Weld and George Sladoje each of whom have three years to become compliant.

8

Table of Contents

Biographical Summaries of Directors

Biographical summaries including: ages, skill sets, independence, share ownership and the value of Just Energy securities at risk at March 31, 2013 and attendance records for each of the nine nominee directors are set forth below. Additional information is provided in the Chart on page 17. There are no interlocking directorships. One nominee, George Sladoje was appointed to the board on November 6, 2012 to fill the vacancy created by the resignation of Roy McMurtry. Assuming shareholders elect Brett Perlman to the board at the meeting, he will replace Brian Smith, who resigned on May 16, 2013.

| JOHN A. BRUSSA Age 56 Calgary, Alberta Director since 2001 Independent |

Ownership of shares 97,596 |

March 31, 2013 value at $650,965 |

Board and Committee Board – 100% Risk – 100% Compensation – 100% |

Areas of Expertise taxation energy risk compensation | ||||

| Mr. Brussa has been a director of Just Energy since 2001 and currently serves on two board committees. He is a senior partner with the law firm Burnet, Duckworth & Palmer LLP where he specializes in taxation and energy law with a special expertise relating to businesses in the energy sector. Accordingly, his contribution to the proceedings of the board and its committees is invaluable. As indicated in Schedule B of this proxy circular, Mr. Brussa serves as a director on other public boards and committees, particularly in the oil and natural gas sectors. He serves as a member of the compensation committee on other public company boards and accordingly brings considerable compensation experience as a member of Just Energy’s compensation committee. It is the view of other members of the Just Energy board that his experience and knowledge in these energy sectors and his regular participation at board and committee meetings adds significant value to the board of Just Energy. He has a 100% attendance record for board and committee meetings and serves on the risk and compensation committees. | ||||||||

| 79% of the votes cast at the 2012 annual meeting were for the approval of Mr. Brussa as a director of Just Energy. | ||||||||

| GORDON D. GIFFIN Age 63 Atlanta, Georgia Director since 2006 Independent |

Ownership of shares 66,173 |

March 31, 2013 value at $441,374 |

Board and Committee Board – 100% Risk – 80% Compensation – 100% |

Areas of Expertise compensation governance finance risk energy transportation | ||||

| Mr. Giffin is a senior partner in the Washington, D.C. and Atlanta, Georgia based law firm, McKenna Long & Aldridge LLP. He has been a director of Just Energy since 2006 and currently serves on two board committees – the Risk Committee and the Compensation, Human Resources, Environmental, Health and Safety Committee. Mr. Giffin is a member of the Council of Foreign Relations, and is on the Board of Trustees for The Carter Center and on the Board of Counsellors of Kissinger-McLarty Associates. Mr. Giffin served as United States Ambassador to Canada from 1997 to 2001. As indicated in Schedule B of this Information Circular, Mr. Giffin serves on several boards of Canadian public companies and committees thereof in the financial, transportation and natural resource sectors and as such is in a unique position, based on his experience both as a director and lawyer, to contribute to a discussion of the issues required to be addressed by the board of Just Energy and its committees. He regularly attends all board meetings and committee meetings on which he serves, including the board meetings of all of Just Energy’s U.S. operating subsidiaries where he also serves as a director. He has a 100% attendance record for board and committee meetings for the year ending March 31, 2013. | ||||||||

| 97% of the votes cast at the 2012 annual meeting were for the approval of Mr. Giffin as a director of Just Energy. | ||||||||

| KENNETH HARTWICK Age 50 Milton, Ontario Director since 2008 Not Independent |

Ownership of shares 1,118,525 |

March 31, 2013 value at $7,460,562 |

Board Attendance Record Board – 100% |

Areas of Expertise financial compensation energy management governance marketing | ||||

| Mr. Hartwick has been a director of Just Energy since 2008. Mr. Hartwick serves as President and Chief Executive Officer of Just Energy and its affiliated entities in Canada and the United States, and was previously Just Energy’s Chief Financial Officer. Before joining Just Energy he served as Chief Financial Officer of Hydro One from October 2001 to April 2004. Prior to joining Hydro One, Mr. Hartwick was Vice-President, Cap Gemini Ernst & Young (consulting business) (May to October 2000) and a partner of Ernst & Young LLP (auditors) from July 1994 to April 2000. Mr. Hartwick has a 100% attendance record for board meetings for the year ended March 31, 2013. As indicated in Schedule B, he is also a director of one other Canadian public company, where he serves as chair of the audit committee and chair of the compensation committee. He is also a member of the Ontario Energy Association. | ||||||||

| 98% of the votes cast at the 2012 annual meeting were for the approval of Mr. Hartwick as a director of Just Energy. He has a 100% attendance record for board meetings. | ||||||||

9

Table of Contents

| MICHAEL J.L. KIRBY Age 71 Ottawa, Ontario Director since 2001 Independent |

Ownership of shares 40,373 |

March 31, 2013 value at risk @ $6.67 per share $269,288 |

Board and Committee Attendance Record Board – 100% Risk – 100% Audit – 100% Compensation – 100% |

Areas of Expertise financial expert risk governance public policy government relations compensation | ||||

| Mr. Kirby is Chairman of the Partners for Mental Health a national mental health charity and a corporate director. Mr. Kirby was a Member of the Senate of Canada from 1984 until 2006. He holds a B.Sc. and M.A. in mathematics from Dalhousie University and a Ph.D. in Applied Mathematics from Northwestern University. He has an Honorary Doctor of Laws from Dalhousie University, Simon Fraser University, York University, Carleton University, University of Toronto and the University of Alberta. Mr. Kirby is the financial expert on the audit committee for purposes of the NYSE listing standards. As indicated in Schedule B of this proxy circular, Mr. Kirby serves as a member of the board and committees of several public Canadian companies in several diverse business sectors which uniquely qualify him to serve as chair of the audit committee and chair of the compensation committee after February 7, 2013 of Just Energy. He is a dedicated and committed director reflected by a 100% attendance record at all Just Energy board and committee meetings for the year ended March 31, 2013. Until 2005, Mr. Kirby was Vice-Chair of the Accounting Standards Oversight Council. Previously, Mr. Kirby was Chair of the Standing Senate Committee on Banking, Trade and Commerce, the Senate Committee which handles all business legislative and regulatory issues, and was Chair of the Standing Senate Committee on Social Affairs, Science and Technology. From 2007 until March, 2012 he was Chairman of the Mental Health Commission of Canada. Mr. Kirby brings to the Just Energy board expertise in finance, risk, accounting and public accountability. | ||||||||

| 99% of the votes cast at the 2012 annual meeting were for the approval of Mr. Kirby as a director of Just Energy. | ||||||||

| REBECCA MACDONALD Age 59 Toronto, Ontario Director since 2001 Not Independent |

Ownership of shares 6,474,658 |

March 31, 2013 value at $43,185,969 |

Board Attendance Record Board – 100% |

Areas of Expertise energy marketing regulatory investor relations management | ||||

| Ms. MacDonald was the principal founder of Just Energy and has been a director since 2001. She has been engaged in the deregulation of natural gas for over 22 years. Before forming Just Energy in 1997 she was the president of EMI, another successful energy marketing company. She became an officer of the Just Energy in January 2000 and previously served as chief executive officer. For the past six years she has been Just Energy’s executive chair. She is a past director of the Canadian Arthritis Foundation and is actively involved in a number of other charities. She founded the Rebecca MacDonald Centre for Arthritis Research at Toronto’s Mount Sinai Hospital. She was named Canada’s top woman CEO for 2003, 2004, 2005, 2006 and 2007 by Profit Magazine. She was also named Ontario Entrepreneur of the Year by Ernst and Young in 2003. On April 3, 2009 she received the International Horatio Alger Award – Canada. Ms. MacDonald has a 100% attendance record for board meetings for the year ended March 31, 2013. She was elected to the board of Canadian Pacific Railways Limited in 2012. | ||||||||

| 98% of the votes cast at the 2012 annual meeting were for the approval of Ms. MacDonald as a director of Just Energy. | ||||||||

| GEORGE SLADOJE Age 71 Chicago, Illinois Director since November 6, Independent |

Ownership of shares 551 |

March 31, 2013 value at risk @ $6.67 per share $3,675 |

Board and Committee Attendance Record Board – 100% Audit – 100% Risk – 100% |

Areas of Expertise energy governance public policy regulatory risk management finance | ||||

| Mr. Sladoje has been a director of Just Energy since November 6, 2012. He currently serves as a member of the audit committee and Chair of the risk committee. Mr. Sladoje was until 2011, CEO of NASDAQ OMX Commodities Clearing Company and former Chair and CEO to 2010 of North American Energy and Clearing Corporation, both centered in Chicago, Ill. Mr. Sladoje serves as Principal, Sladoje Consulting, Chicago where he specializes in providing regulatory and compliance consulting to organizations dealing in electricity and gas trading and has provided marketing services to grid operators across the United States including Midwest ISO and ERCOT. This expertise, along with his accounting background as a CPA with a big 8 accounting firm, his experience in working with energy regulators and in risk management and governance will uniquely qualify him to serve on the Just Energy board of directors and as a member of the audit committee and after February 7, 2013 chair of the risk committee. He has also served as a director of other companies and has worked with many major national regulators including The Commodity Futures Trading Commission, the SEC FERC, the public utility commissions of several states, The California Power Exchange, and the United States Power Fund. Since his appointment to the Board, he has a 100% attendance record for Board and committee meetings and strategy sessions for the year ended March 31, 2013. | ||||||||

| HUGH D. SEGAL Age 62 Kingston, Ontario Director since 2001 Independent |

Ownership of shares 31,289 |

March 31, 2013 value at risk @ $6.67 per share $208,698 |

Board and Committee Attendance Record Board – 90% Risk – 100% Audit – 100% Nominating and Corporate Governance – 100% Compensation – 100% |

Areas of Expertise risk finance marketing governance government relations public policy compensation | ||||

| Mr. Segal has been a director of Just Energy since 2001. Mr. Segal is a Canadian Senator. He is a director of one other Canadian public company as described in Schedule B of this proxy circular, and is Director of the Canadian Defence and Foreign Affairs Institute in Calgary, a Member of the Atlantic Council and a former President of the Institute for Research on Public Policy. Mr. Segal was the recipient of the Order of Canada in 2003, an Honorary Doctorate from the Royal Military College in 2004 and made an Honorary Captain of the Canadian Navy in 2005. Mr. Segal earned his Bachelor of Arts (history) degree in 1972 from the University of Ottawa and studied international trade economics at the graduate level at the Norman Patterson School of International Affairs at Carleton University. In 2003, after serving as Chief of Staff to the Prime Minister, he was named Senior Fellow at the School of Policy Studies, Queen’s University, and is also an Adjunct Professor of public policy at Queen’s School of Business. His experience on several public company boards and committees and his expertise in social, economic, foreign policy and public administration qualify him well to serve as lead director and vice chairman of Just Energy and a member of all four Just Energy board committees. He attended all board, committee and strategy meetings but one, and has a 97% attendance record for the year ended March 31, 2013. | ||||||||

| 99% of the votes cast at the 2012 annual meeting were for the approval of Mr. Segal as a director of Just Energy. | ||||||||

10

Table of Contents

| BRETT A. PERLMAN Age 54 Houston, Texas Nominated Independent |

Ownership of shares Nil |

March 31, 2013 value at risk @ $6.67 per share Nil |

Board and Committee Attendance Record Nil |

Areas of Expertise financial governance risk utilities regulatory energy | ||||

| Mr. Perlman is a member of the board and committees of several public companies as indicated in Schedule B of this proxy circular and based upon his involvement on other public company boards and committees (including as a member of several audit and compensation committees), is qualified to serve as a member of the Compensation, Human Resources, Environmental, Health and Safety Committee and as a member of the Nominating and Governance Committee of the Board. Mr. Perlman is currently the President of Vector Advisors of Houston, Texas where his consulting practice focuses on business strategy, strategic marketing and mergers and acquisitions in the electric utility industry. He served as a Commissioner of the Public Utility Commission of Texas (1999-2003), was a consultant with McKinsey (1993-1999) and led the market design and implementation that resulted in the deregulation of the Texas wholesale and retail electric utility market. | ||||||||

| WILLIAM F. WELD Age 66 Cambridge, Massachusetts Director since 2012 Independent |

Ownership of shares 1,704 |

March 31, 2013 value at $11,366 |

Board and Committee Mr. Weld was appointed to |

Areas of Expertise finance public policy governance government relations | ||||

| Mr. Weld currently practices with the law firm of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., in Washington, DC and New York where he specializes in government strategies, corporate governance and compliance and international business best practices. Mr. Weld has a very distinguished career in government and business. He also served as Senior Advisor to the Chair of Ivanhoe Capital Corporation, a private holding company headquartered in British Columbia. During the 1990’s, Mr. Weld served two terms as Governor of Massachusetts, being elected in 1990 and re-elected in 1994. He served as national co-chair of the Privatization Council and led business and trade missions to many counties in Asia, Europe, Latin America and Africa. He also served as a director of other public companies and is an active member of the United States Council on Foreign Relations. Prior to his election as governor, Mr. Weld was a federal prosecutor for seven years, serving as the Assistant U.S. Attorney General in charge of the Criminal Division of the Justice Department in Washington, D.C. and the U.S. Attorney for Massachusetts during the Reagan administration. He was also a commercial litigator in Boston and Washington. He is a member of the nominations and governance committee and the audit committee of the board. | ||||||||

| 99% of the votes cast at the 2012 annual meeting were for the approval of Mr. Weld as a director of Just Energy. | ||||||||

Director Attendance Record

The Table below indicates the attendance record for all board and committee meetings for each person who was a director of Just Energy during the year ended March 31, 2013 and who is also standing for election at the meeting including the number of board and committee meetings held for such period.

The outside directors also meet separately, in camera, without management present at the end of each board and committee meeting and at the annual strategy session.

The director attendance record was 98% for all board and committee meetings for the year ended March 31, 2013.

11

Table of Contents

| Name of Director |

Number of Executive Committee Meetings attended of which there were 3 (MacDonald, Hartwick, Segal, Kirby and Sladoje(3)(4) |

Number of Board Meetings attended of which there were 10(1)(2)(3) |

Number of Audit Committee Meetings attended of which there were 8 (Kirby, Segal, Weld and Sladoje)(1)(3) |

Number of Compensation, Human Resources, Environmental Health and Safety Committee Meetings attended of which there were 5 (Giffin, Weld, Kirby, Segal and Brussa)(4)(1)(3) |

Number of Nominating and Corporate Governance Committee Meetings attended of which there were 3 (Segal, Weld(5) Giffin and Sladoje)(1)(3) |

Number of Risk Committee Meetings attended of which there were 5 (Kirby, Giffin, Segal, Sladoje and Brussa)(1)(3) |

||||||||||||||||||

| John A. Brussa |

— | 10 | — | 5 | — | 5 | ||||||||||||||||||

| Bill Weld(5) |

— | 10 | 8 | 1 | 3 | — | ||||||||||||||||||

| Gordon D. Giffin |

— | 10 | — | 5 | — | 4 | ||||||||||||||||||

| Ken Hartwick |

3 | 10 | — | — | — | — | ||||||||||||||||||

| Michael J.L. Kirby(7) |

3 | 10 | 8 | 2 | — | 5 | ||||||||||||||||||

| Rebecca MacDonald |

3 | 10 | — | — | — | — | ||||||||||||||||||

| George Sladoje(6) |

3 | 5 | 3 | — | 1 | 2 | ||||||||||||||||||

| Hugh D. Segal |

3 | 9 | 8 | 5 | 3 | 5 | ||||||||||||||||||

Notes:

| (1) | Includes meetings attended in person or by telephone conference call. |

| (2) | Excludes a two day strategy session attended by all directors but includes the board meeting held at the conclusion thereof. |

| (3) | In camera meetings of the board and committees (excluding management directors) were held at the conclusion of all board and committee meetings. |

| (4) | Established in December, 2012. |

| (5) | Appointed to the board on April 2, 2012 and to the Risk Committee, the Governance Committee and the Audit Committee on April 4, 2012. |

| (6) | Appointed to the board, the Audit Committee and to the Risk Committee on November 6, 2012 and to the Governance Committee on February 7, 2013 and became Chair of the Risk Committee on February 7, 2013. |

| (7) | Mr. Kirby became Chair and a member of the Compensation Committee on February 7, 2013. |

Director Nominees

The names, jurisdiction of residence, principal occupations, year in which each became a director of Just Energy and the number of common shares, DSGs, RSGs, convertible debentures and other securities of Just Energy beneficially owned or over which control or direction is exercised by the nominees for director, at March 31, 2013, are as follows:

| Name, Jurisdiction of |

Position with |

Principal Occupation |

Common Shares Beneficially Owned or Over which Control or Direction is Exercised(6)(7) |

RSGs/DSGs/Options Beneficially Owned(6)(7)(8) |

||||||||

| John A. Brussa(2)(4) Alberta, Canada 2001 |

Director (Independent) | Partner, Burnet, Duckworth & Palmer LLP |

82,000 Shares | 15,596 DSGs | ||||||||

| Gordon D. Giffin(2)(4) Georgia, U.S.A. 2006 |

Director (Independent) |

Senior Partner, McKenna, Long & Aldridge LLP |

21,798 Shares | 44,375 DSGs | ||||||||

12

Table of Contents

| Ken Hartwick Ontario, Canada 2008 |

President, Chief Executive Officer and Director | President and Chief Executive Officer of Just Energy | 39,264 Shares | 1,079,261 RSGs | ||||||||

| Michael J.L. Kirby(1)(2)(4) Ontario, Canada 2001 |

Director (Independent) |

Corporate Director | 25,776 Shares | 14,597 DSGs | ||||||||

| Rebecca MacDonald Ontario, Canada 2001 |

Executive Chair and Director | Executive Chair of Just Energy | 5,846,120 Shares | 628,538 RSGs | ||||||||

| George Sladoje(1)(3)(4) Illinois, U.S.A 2012 |

Director (Independent) |

Principal, Sladoje Consulting | NIL | 551 DSGs | ||||||||

| Hugh D. Segal(1)(2)(3)(4)(5) Ontario, Canada 2001 |

Lead Director and Vice Chair of the Board (Independent) |

Member of the Senate of Canada and Senior Fellow, School of Policy Studies, Queens University | 16,260 Shares | 15,029 DSGs | ||||||||

| Brett A. Perlman Texas, U.S.A. (2013 nominee) |

Director (Independent) |

President, Vector Advisors | NIL | NIL | ||||||||

| William F. Weld(1)(2)(3) Massachusetts, U.S.A. 2012 |

Director (Independent) |

Partner, Mintz, Levin, Cohen, Ferris, Glovsky and Popeo, NY, Boston and DC. | 1,704 Shares | NIL | ||||||||

Notes:

| (1) | Member of the audit committee. Mr. Kirby is the chair and the financial expert. All members are financially literate. Mr. Weld became a director on April 2, 2012 and was appointed to the committee on April 4, 2012. |

| (2) | Member of the compensation committee. Mr. Kirby became the chair on February 7, 2013. |

| (3) | Member of the governance and nominating committee. Mr. Segal is the chair. Mr. Weld became a director on April 2, 2012 and was appointed to the Committee on April 4, 2012. Mr. Sladoje was appointed to the Committee on February 7, 2013. |

| (4) | Member of the risk committee. Mr. Sladoje became the chair on February 7, 2013. Mr. Giffin is the vice chair. |

| (5) | Appointed lead director by the board of directors on January 17, 2005 and vice chair of the board on May 20, 2010. |

| (6) | Director’s Compensation Plan. For the year ended March 31, 2013, the non-management directors of Just Energy were required to receive $15,000 of their $65,000 annual base retainer in fully paid deferred share grants (“DSGs”) and/or common shares (with one-quarter thereof issuable at the end of each quarter) and are entitled to elect to receive all or a portion of their remaining director’s fees in fully paid DSGs and/or common shares of Just Energy pursuant to the Just Energy DSG Plan. The purpose of the Just Energy DSG Plan is to provide effective incentives for the independent directors to promote the business and success of Just Energy by encouraging the ownership of DSGs and/or common shares. The DSGs and/or common shares are credited to a director’s DSG and/or common share account at the end of each quarter (the “Grant Date”) and are based upon the weighted average trading price of the common shares for the 10 trading days on the TSX preceding the end of each quarter. DSGs may not be exchanged for common shares and common shares may not be issued and released to directors until the earlier of: (i) three years from the Grant Date, (ii) the day such director ceases to be a director of Just Energy and (iii) a change of control, providing that no common shares may be issued in exchange for DSGs after the expiry of 15 years from the Grant Date. As indicated above, the directors are entitled to elect to receive common shares in lieu of or in combination with DSGs. |

The price used to determine the number of DSGs and/or common shares granted to directors pursuant to the Just Energy DSG Plan was: $11.37, for the quarter ended June 30, 2012; $10.71, for the quarter ended September 30, 2012; $9.39, for the quarter ended December 31, 2012 and $6.80 for the quarter ended March 31, 2013 based on the weighted average trading price of common shares on the TSX for the 10 trading days preceding each quarter end of Just Energy.

13

Table of Contents

The total number of DSGs and/or common shares issuable or issued pursuant to the Just Energy DSG Plan may not currently exceed 200,000 to be increased to 400,000 subject to approval of the ordinary resolution referred to at page 32. As at March 31, 2013, the non-management directors owned a total of 160,041DSGs and 20,690 common shares related to non cash payment of director’s fees. The number of DSGs and/or common shares to which a director is entitled to receive is increased pursuant to a formula in the Just Energy DSG Plan reflecting the amount of the dividends which a director would have received if he held common shares in lieu of DSGs. All RSGs held by the management directors are governed by their respective employment agreements, individual RSG grant agreements and the Just Energy RSG Plan, are subject to vesting and continued employment on the applicable vesting dates, and are exchangeable into common shares on a one-for-one basis. Neither the DSGs nor the RSGs carry the right to vote.

The Just Energy DSG Plan may not be amended without shareholder approval and the consent of the TSX. The maximum number of DSGs and/or common shares currently available for issue under the Just Energy DSG Plan is 21,420.

| (7) | Each director is required by December 31, 2013 to hold a minimum number of common shares (including RSGs and DSGs) equal to at least three times the director’s base retainer of $65,000 (i.e., $195,000). Based on the TSX closing market price for common shares of $6.67 on March 31, 2013, all directors are compliant with the $195,000 threshold other than Messrs., Weld and Sladoje each of whom has three years from the date of their appointment to the board to be compliant. See “Ownership of Securities by Outside Directors”. |

| (8) | See “Compensation of the Directors and Officers of Just Energy – Share Option Plan” for a description of Just Energy Options. |

The information as to the common shares, DSGs and RSGs of Just Energy, has been furnished by the respective nominees as of March 31, 2013. For further information on director compensation, see the director compensation table on page 42 and additional information on pages 44 to 45 of this proxy circular.

APPOINTMENT OF AUDITORS OF JUST ENERGY

The board of directors proposes that Ernst & Young LLP (“E&Y”) be re-appointed as auditors of Just Energy until the next annual meeting at such remuneration as may be approved by the board of directors. E&Y in Canada is a member firm of Ernst & Young Global, which employs 167,000 people in 728 offices in 150 countries. The Canadian firm employs approximately 4,000 people. Headquartered in Canada in Toronto, Ontario, E&Y has offices in 15 locations across Canada. The U.S. firm employs approximately 35,000 people with offices in 77 locations. They provide a full range of assurance, tax, advisory and transaction services to clients across a range of industries, including many energy companies. In order to be effective, the resolution re-appointing E&Y as auditors and authorizing the directors to fix their remuneration as such, must receive the affirmative vote of a majority of the votes cast by shareholders in person or by proxy.

For fiscal 2013, fees charged by E&Y for audit and related services to Just Energy and its subsidiaries were $1,122,800 (2012 – $949,000). Additional fees for tax related and other services were $195,000 (2012 – $325,000). Total fees for fiscal 2013 were $1,563,300 (2012 – $1,531,500). No other services were provided to Just Energy and its subsidiaries by E&Y.

99% of the votes cast at the 2012 annual meeting were cast in favour of the appointment of E&Y as independent auditors of Just Energy.

The audit committee has considered whether the magnitude and nature of these services is compatible with maintaining the independence of the external auditors and is satisfied that they are. All services provided by E&Y were approved by the audit committee.

The board of directors of Just Energy recommends a vote “FOR” the resolution approving the appointment of Ernst & Young LLP as independent auditors for Just Energy for the fiscal year ending March 31, 2014 and authorizing the board of directors of Just Energy to fix their remuneration as such.

14

Table of Contents

| (a) |

Approval of Shareholder Rights Plan

Background

On February 7, 2013, the directors of Just Energy approved the adoption of a Shareholder Protection Rights Plan (the “Rights Plan”). The Rights Plan is currently effective, but is subject to approval by the shareholders at the Meeting. Shareholders will be asked to consider and, if deemed advisable, to approve the Rights Plan and the issuance of all Rights (as defined below) issued pursuant to the Rights Plan. The Rights Plan has a term of three years and will expire at the close of the annual meeting of the Corporation in 2016, unless it is reconfirmed at such meeting or it is otherwise terminated in accordance with its terms. Approval of the Rights Plan by shareholders is required by the Toronto Stock Exchange (the “TSX”). The Rights Plan is similar to plans adopted by several other Canadian issuers and approved by their securityholders. A copy of the Shareholder protection rights plan agreement dated as of February 7, 2013 between the Corporation and Computershare Investor Services Inc., which gives effect to the Rights Plan (the “Rights Agreement”), is available on SEDAR at www.sedar.com and will also be made available upon request by contacting the Senior Vice President (Legal and Regulatory) and the General Counsel of Just Energy.

Objectives of the Rights Plan

The fundamental objectives of the Rights Plan are to provide the directors with sufficient time to explore and develop alternatives for maximizing shareholder value if an unsolicited take-over bid is made, and to provide shareholders with an equal opportunity to participate in a take-over bid.