1

7958 South Chester Street, Centennial, CO

Square Feet: 167,917

United Launch Alliance Corporate Headquarters

Fourth Quarter 2017

Supplemental Operating and Financial Data

Select Income REIT Exhibit 99.2

All amounts in this report are unaudited.

7958 South Chester Street, Centennial, CO

Square Feet: 167,917

United Launch Alliance Corporate Headquarters

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 2

TABLE OF CONTENT

S

PAGE/EXHIBIT

CORPORATE INFORMATION

Company Profile 7

Investor Information 8

Research Coverage 9

FINANCIALS

Key Financial Data 11

Consolidated Balance Sheets 12

Consolidated Statements of Income 13

Consolidated Statements of Cash Flows 15

Consolidated Debt Summary 17

Consolidated Debt Maturity Schedule 19

Consolidated Leverage Ratios, Coverage Ratios and Public Debt Covenants 20

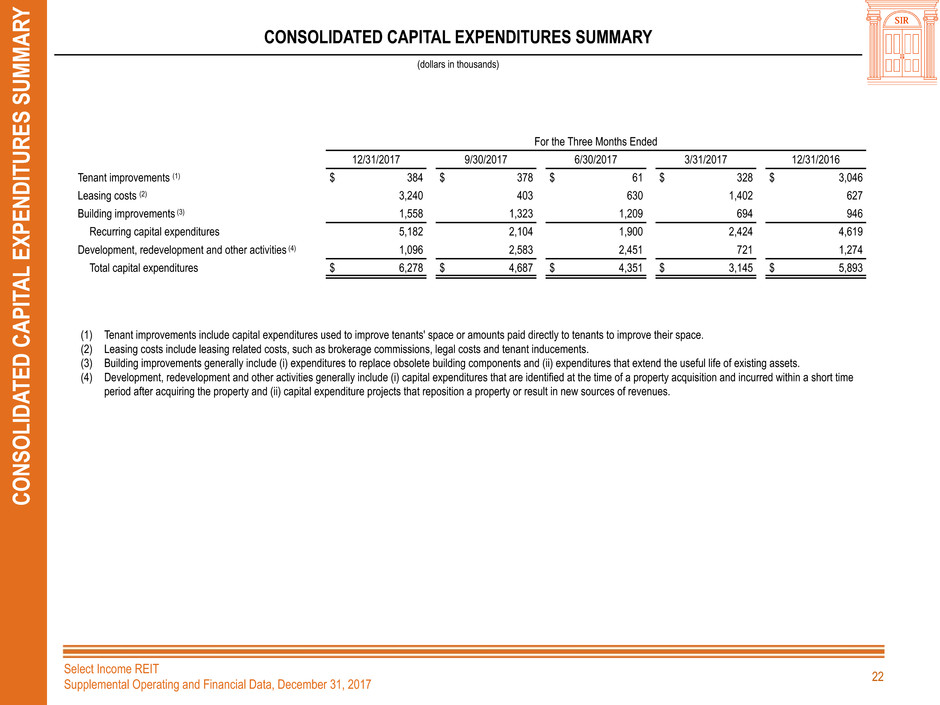

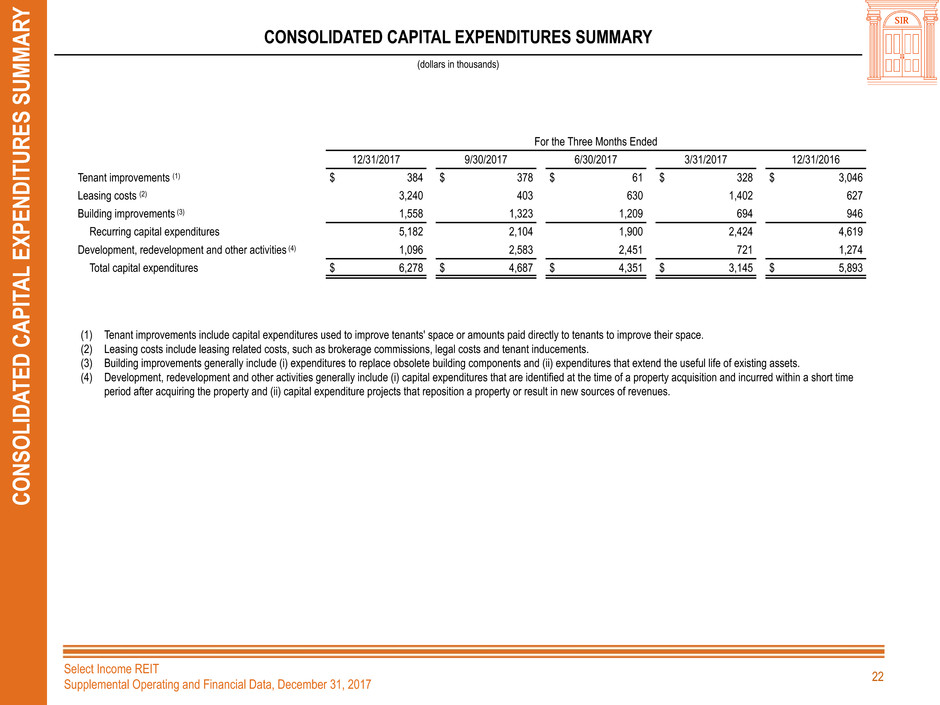

Consolidated Capital Expenditures Summary 22

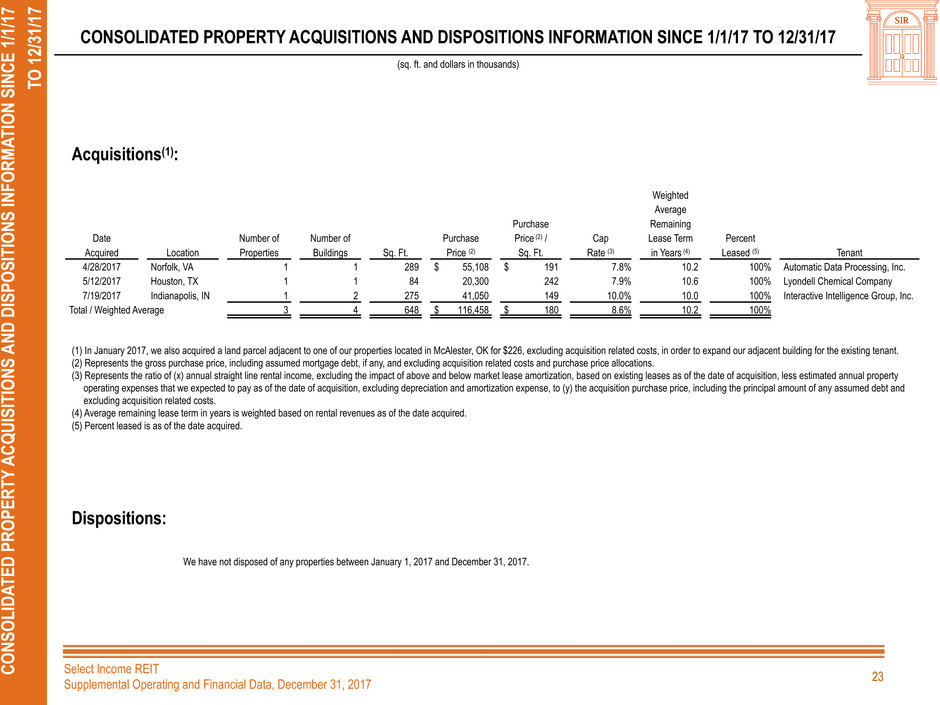

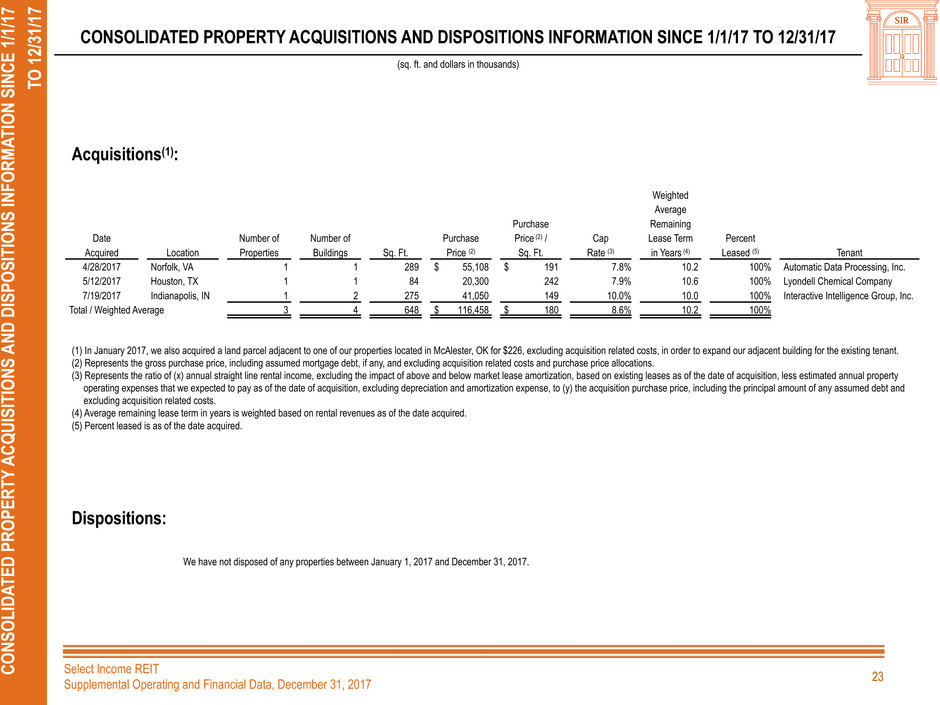

Consolidated Property Acquisitions and Dispositions Information Since 1/1/17 to 12/31/17 23

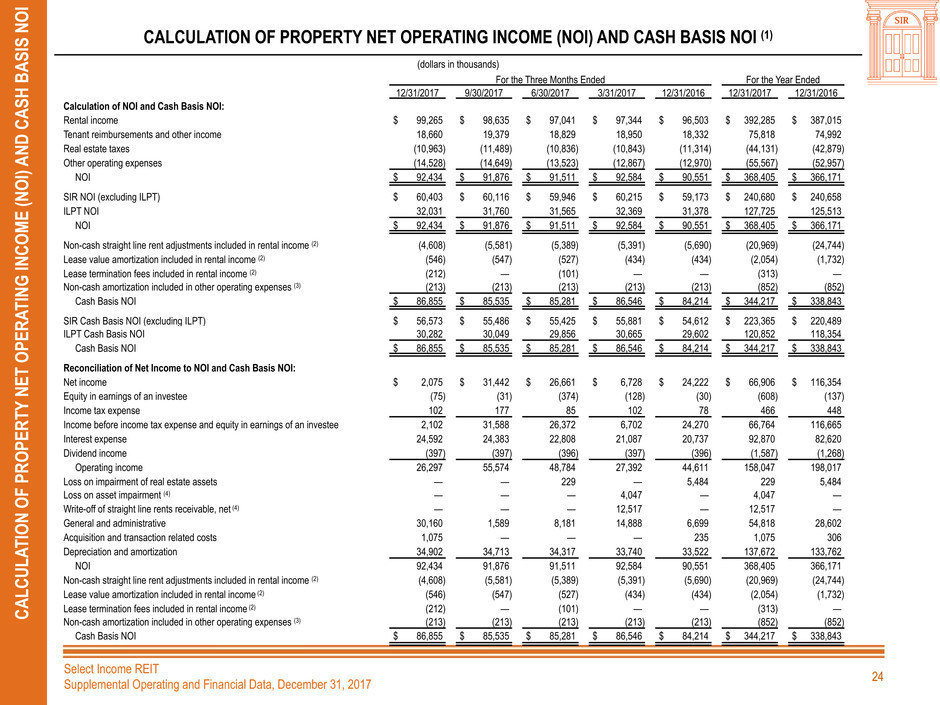

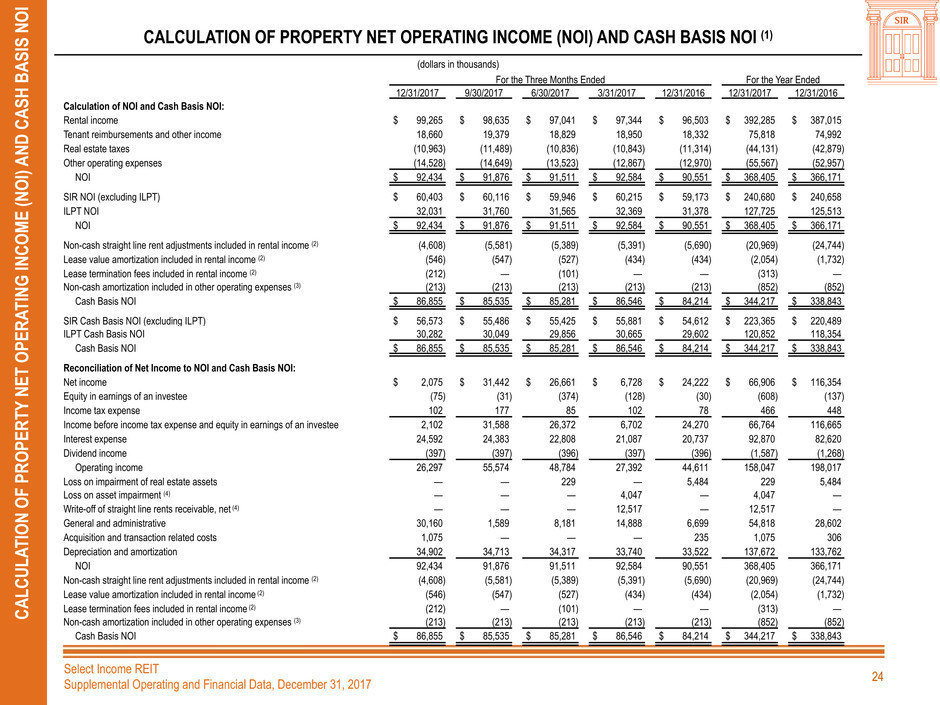

Calculation of Property Net Operating Income (NOI) and Cash Basis NOI 24

Reconciliation of NOI to Same Property NOI and Calculation of Same Property Cash Basis NOI 26

Calculation of EBITDA and Adjusted EBITDA 27

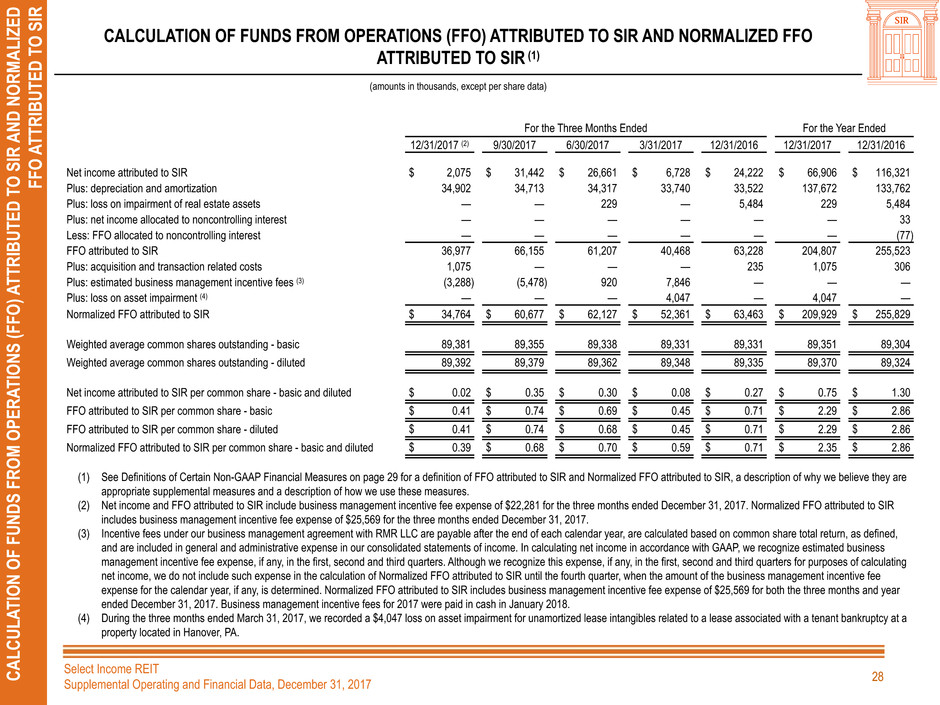

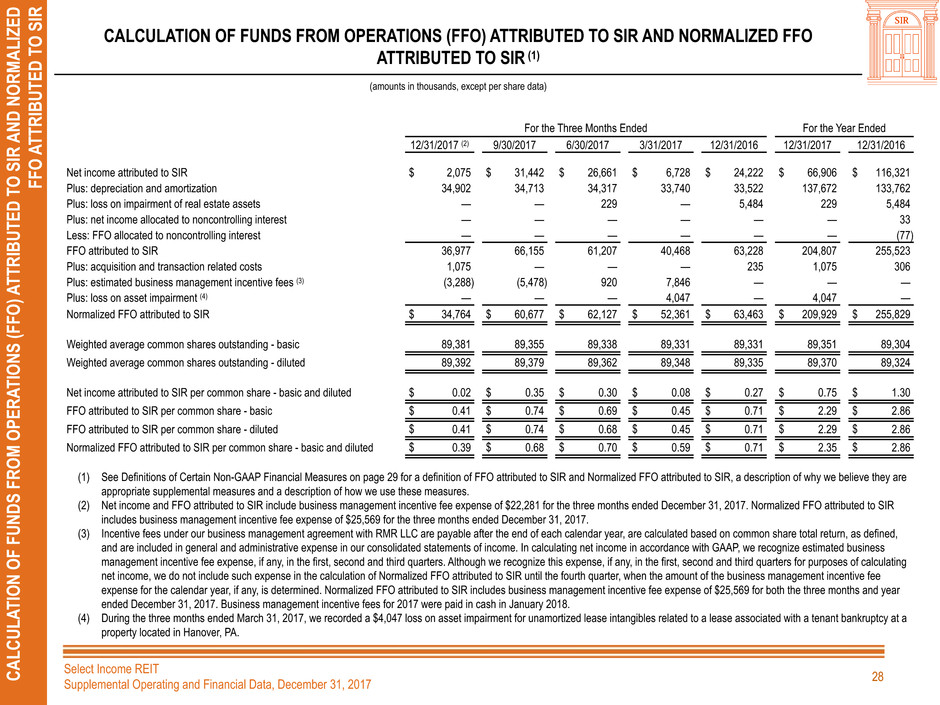

Calculation of Funds from Operations (FFO) Attributed to SIR and Normalized FFO Attributed to SIR 28

Definitions of Certain Non-GAAP Financial Measures 29

PORTFOLIO INFORMATION

Consolidated Portfolio Summary by Owner 31

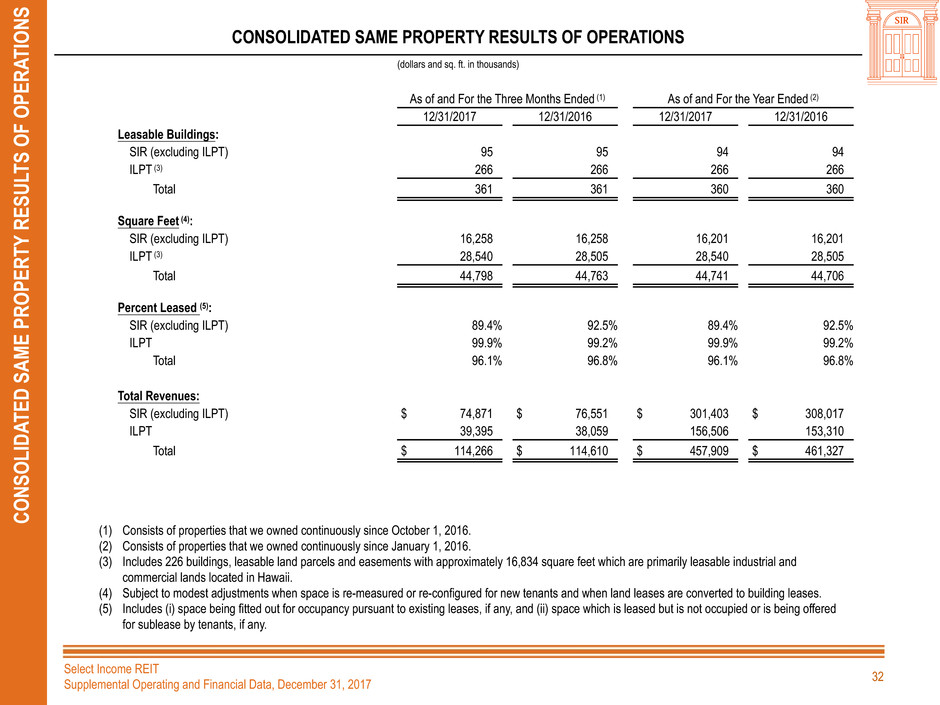

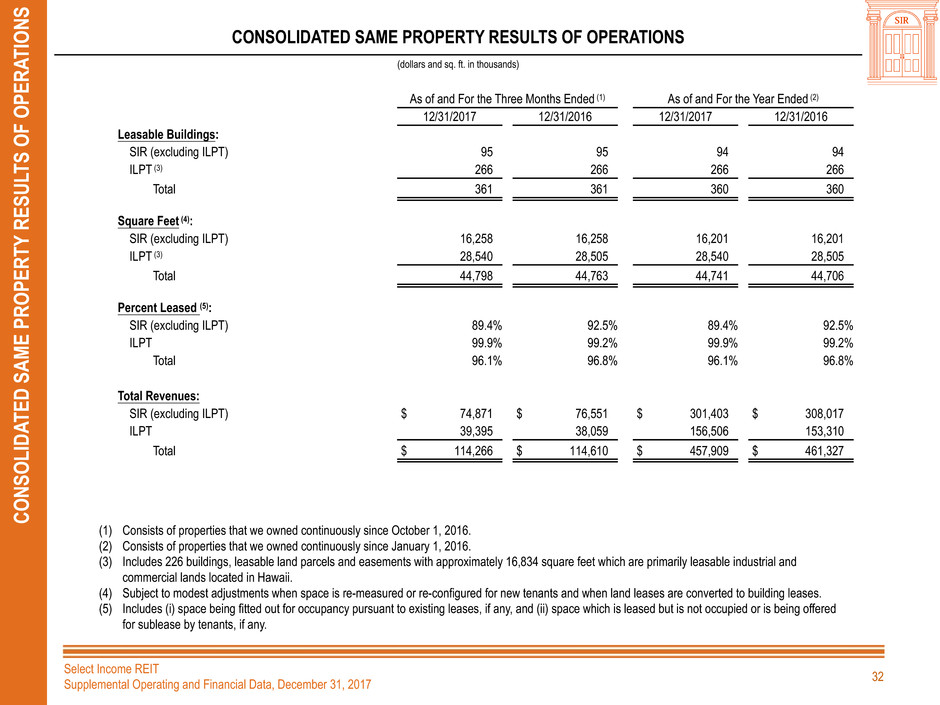

Consolidated Same Property Results of Operations 32

Consolidated Leasing Summary 34

Consolidated Occupancy and Leasing Analysis by Owner 35

Consolidated Tenant Diversity and Credit Characteristics 36

Tenants Representing 1% or More of Total Consolidated Annualized Rental Revenue 37

Consolidated Three Year Lease Expiration Schedule by Owner 38

Consolidated Portfolio Lease Expiration Schedule 39

Hawaii Land Rent Reset Summary 40

EXHIBIT A

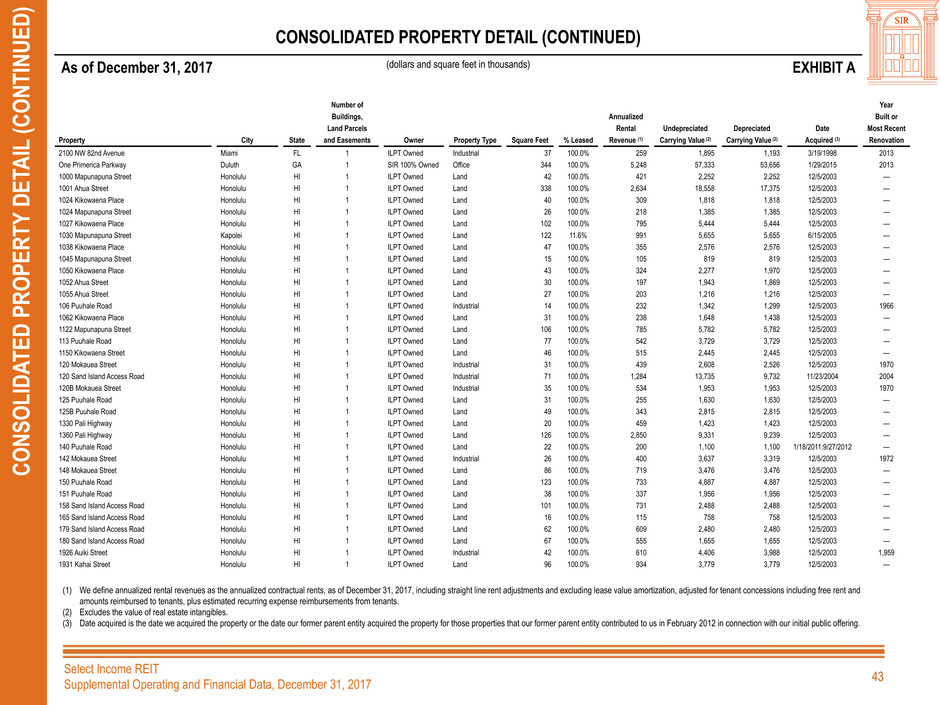

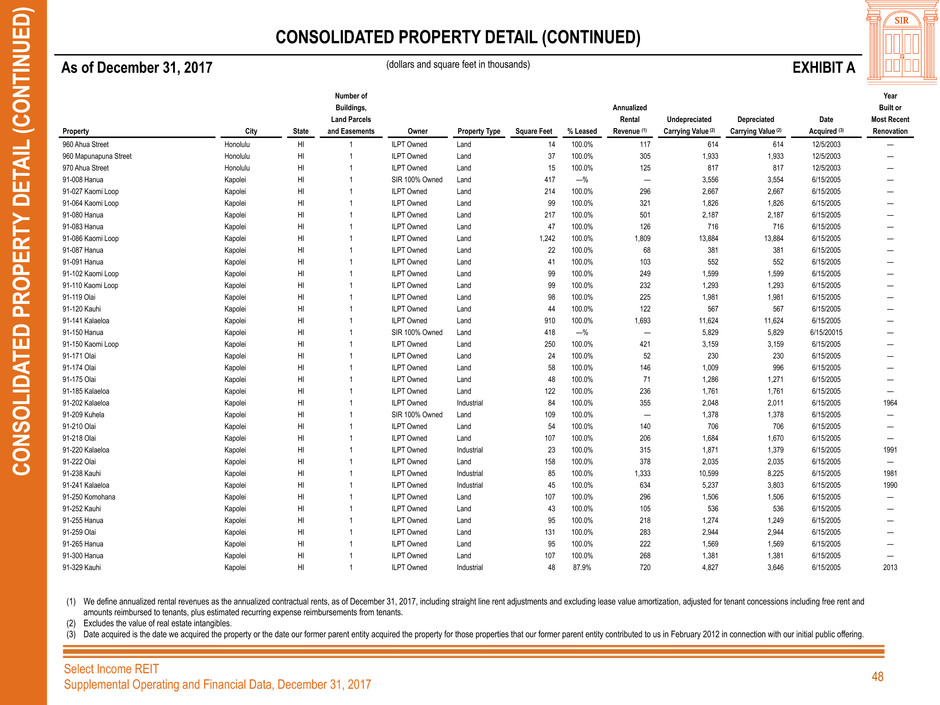

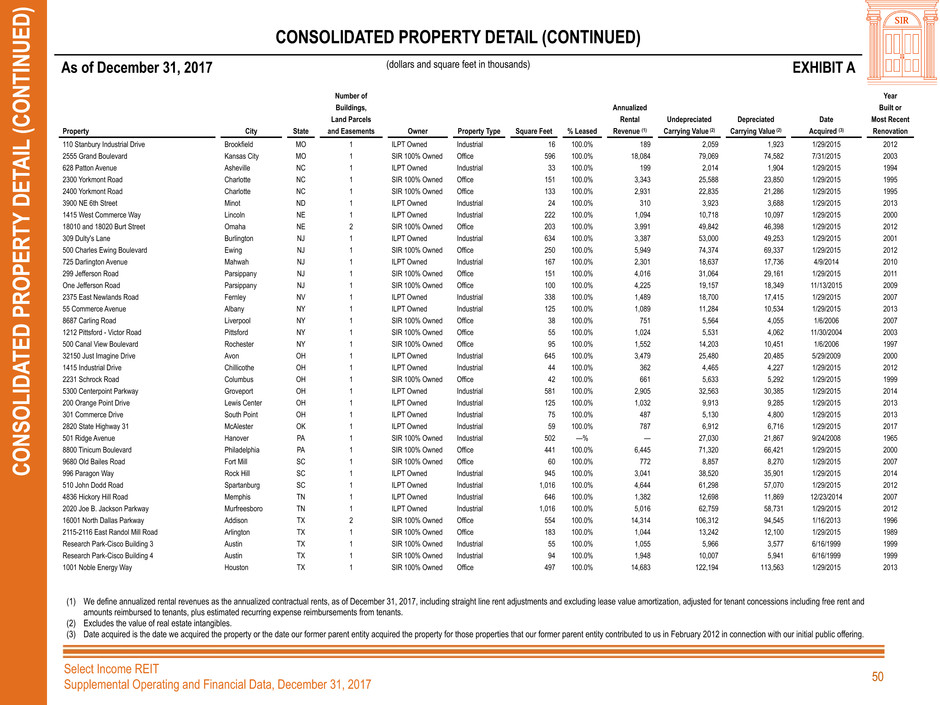

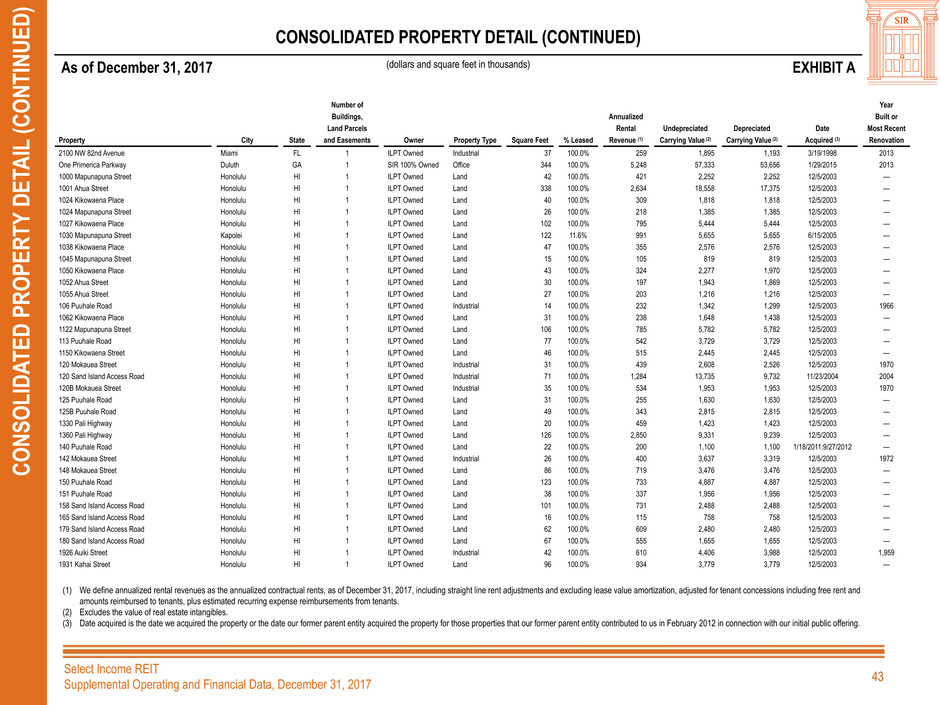

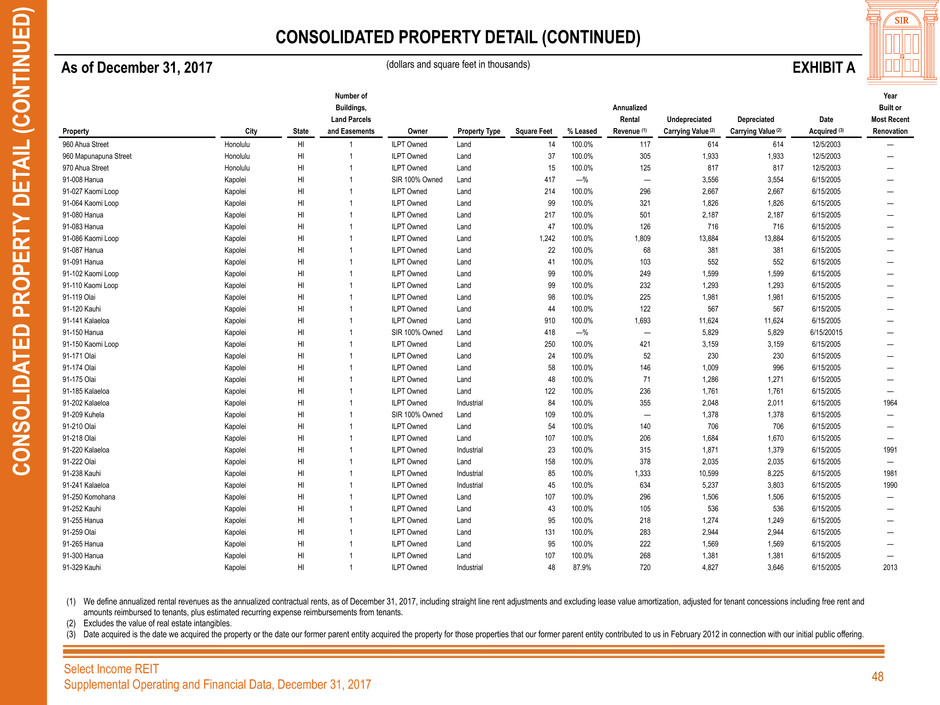

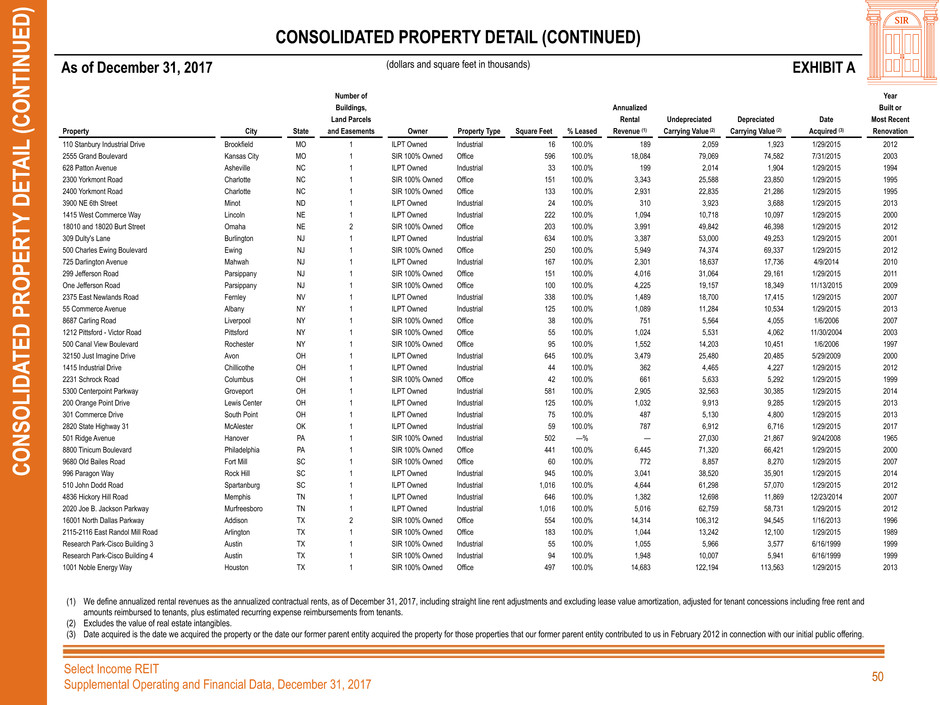

Consolidated Property Detail 42

References and data in this Supplemental Operating and Financial Data report to "SIR", "we", "us" or "our" refer to and include data for Select Income REIT and its consolidated subsidiaries,

including Industrial Logistics Properties Trust and its consolidated subsidiaries, or ILPT, which was Select Income REIT's wholly owned subsidiary for all periods until January 17, 2018,

unless the context indicates otherwise.

TABLE OF CONTENTS

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 3

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING

OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”,

“INTEND”, “PLAN”, “ESTIMATE”, “WILL”, “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE

FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO

OCCUR AND MAY NOT OCCUR. FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• THE LIKELIHOOD THAT OUR TENANTS WILL PAY RENT OR BE NEGATIVELY AFFECTED BY CYCLICAL ECONOMIC CONDITIONS,

• THE LIKELIHOOD THAT OUR TENANTS WILL RENEW OR EXTEND THEIR LEASES OR THAT WE WILL BE ABLE TO OBTAIN REPLACEMENT TENANTS,

• OUR ACQUISITIONS OF PROPERTIES,

• OUR SALES OF PROPERTIES,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS AND TENANCIES EFFECTIVELY,

• THE LIKELIHOOD THAT OUR RENTS WILL INCREASE WHEN WE RENEW OR EXTEND OUR LEASES, WHEN WE ENTER NEW LEASES OR WHEN OUR RENTS RESET, INCLUDING

RENT RESETS AT OUR SUBSIDIARY, INDUSTRIAL LOGISTICS PROPERTIES TRUST'S, OR ILPT'S, HAWAII PROPERTIES,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO SUSTAIN THE AMOUNT OF SUCH DISTRIBUTIONS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY OR ILPT'S REVOLVING CREDIT FACILITY,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• OUR ABILITY TO RAISE DEBT OR EQUITY CAPITAL,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR CREDIT RATINGS,

• OUR EXPECTATION THAT WE BENEFIT AS A RESULT OF THE RECENTLY COMPLETED INITIAL PUBLIC OFFERING BY ILPT AND FROM OUR CONTINUED OWNERSHIP INTEREST IN

AND OTHER RELATIONSHIPS WITH ILPT,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP INTEREST IN AND OTHER RELATIONSHIPS WITH THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP INTEREST IN AND OTHER RELATIONSHIPS WITH AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR

PARTICIPATION IN INSURANCE PROGRAMS ARRANGED BY AIC,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT,

• THE CREDIT QUALITIES OF OUR TENANTS, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS.

FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL

CONDITION, FUNDS FROM OPERATIONS, OR FFO, ATTRIBUTED TO SELECT INCOME REIT, OR SIR, NORMALIZED FUNDS FROM OPERATIONS, OR NORMALIZED FFO, ATTRIBUTED TO

SIR, NET OPERATING INCOME, OR NOI, CASH BASIS NOI, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR

ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE, BUT ARE NOT LIMITED TO:

• THE IMPACT OF CONDITIONS AND CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR TENANTS,

• COMPETITION WITHIN THE REAL ESTATE INDUSTRY, PARTICULARLY IN THOSE MARKETS IN WHICH OUR PROPERTIES ARE LOCATED,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

WARNING CONCERNING FORWARD LOOKING STATEMENTS

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 4

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (CONTINUED

)

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME

TAX PURPOSES,

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, THE RMR GROUP LLC, OR RMR LLC, RMR INC., ILPT,

GOVERNMENT PROPERTIES INCOME TRUST, OR GOV, AIC, AND OTHERS AFFILIATED WITH THEM, AND

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL.

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A

NUMBER OF FACTORS, INCLUDING OUR FUTURE EARNINGS, THE CAPITAL COSTS WE INCUR TO LEASE OUR PROPERTIES AND OUR WORKING CAPITAL REQUIREMENTS. WE

MAY BE UNABLE TO PAY OUR DEBT OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE

REDUCED OR ELIMINATED,

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES AND LEASE THEM FOR RENTS,

LESS THEIR PROPERTY OPERATING COSTS, THAT EXCEED OUR CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE

ACCEPTABLE PURCHASE PRICES, ACQUISITION FINANCING OR LEASE TERMS FOR NEW PROPERTIES,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES MAY NOT OCCUR, MAY BE DELAYED OR

THE TERMS OF SUCH TRANSACTIONS MAY CHANGE,

• RENTS THAT WE CAN CHARGE AT OUR PROPERTIES MAY DECLINE BECAUSE OF CHANGING MARKET CONDITIONS OR OTHERWISE,

• MOST OF ILPT'S HAWAII PROPERTIES ARE LANDS LEASED FOR RENTS THAT ARE PERIODICALLY RESET BASED ON THEN CURRENT FAIR MARKET VALUES. REVENUES FROM

ILPT'S PROPERTIES IN HAWAII HAVE GENERALLY INCREASED DURING OUR AND ILPT'S OWNERSHIP AS THE LEASES FOR THOSE PROPERTIES HAVE BEEN RESET OR RENEWED.

ALTHOUGH ILPT EXPECTS THAT RENTS FOR ITS HAWAII PROPERTIES WILL INCREASE IN THE FUTURE, IT CANNOT BE SURE THEY WILL. FUTURE RENTS FROM THESE

PROPERTIES COULD DECREASE OR NOT INCREASE TO THE EXTENT THEY HAVE IN THE PAST,

• WE MAY NOT SUCCEED IN FURTHER DIVERSIFYING OUR REVENUE SOURCES AND ANY DIVERSIFICATION WE MAY ACHIEVE MAY NOT MITIGATE OUR PORTFOLIO RISKS OR

IMPROVE THE SECURITY OF OUR REVENUES OR OUR OPERATING PERFORMANCE,

• ILPT'S POSSIBLE REDEVELOPMENT OF CERTAIN OF ITS HAWAII PROPERTIES MAY NOT BE REALIZED OR BE SUCCESSFUL,

• WE HAVE SUBSTANTIALLY COMPLETED A 35,000 SQUARE FOOT EXPANSION OF A BUILDING ON A PROPERTY WE OWN IN OKLAHOMA. AS OF DECEMBER 31, 2017, WE EXPECTED

TO SPEND AN ADDITIONAL $1.2 MILLION TO COMPLETE THIS EXPANSION. IN ADDITION, AS OF DECEMBER 31, 2017, WE HAD ESTIMATED UNSPENT LEASING RELATED

OBLIGATIONS OF $34.5 MILLION WHICH EXCLUDES THE ESTIMATED $1.2 MILLION OF EXPANSION COSTS. IT IS DIFFICULT TO ACCURATELY ESTIMATE DEVELOPMENT AND

TENANT IMPROVEMENT COSTS. THIS DEVELOPMENT PROJECT AND OUR UNSPENT LEASING RELATED OBLIGATIONS MAY COST MORE OR LESS AND MAY TAKE LONGER TO

COMPLETE THAN WE CURRENTLY EXPECT, AND WE MAY INCUR INCREASING AMOUNTS FOR THESE AND SIMILAR PURPOSES IN THE FUTURE,

• THE UNEMPLOYMENT RATE OR ECONOMIC CONDITIONS IN AREAS WHERE OUR PROPERTIES ARE LOCATED MAY BECOME WORSE IN THE FUTURE. SUCH CIRCUMSTANCES OR

OTHER CONDITIONS MAY REDUCE DEMAND FOR LEASING OFFICE AND INDUSTRIAL SPACE. IF THE DEMAND FOR LEASING OFFICE AND INDUSTRIAL SPACE IS REDUCED, WE

MAY BE UNABLE TO RENEW LEASES WITH OUR TENANTS AS LEASES EXPIRE OR ENTER INTO NEW LEASES AT RENTAL RATES AS HIGH AS EXPIRING RENTS AND OUR FINANCIAL

RESULTS MAY DECLINE,

• OUR BELIEF THAT THERE IS A LIKELIHOOD THAT TENANTS MAY RENEW OR EXTEND OUR LEASES WHEN THEY EXPIRE WHENEVER THEY HAVE MADE SIGNIFICANT

INVESTMENTS IN THE LEASED PROPERTIES, OR BECAUSE THOSE PROPERTIES MAY BE OF STRATEGIC IMPORTANCE TO THEM, MAY NOT BE REALIZED,

• SOME OF OUR TENANTS MAY NOT RENEW EXPIRING LEASES, AND WE MAY BE UNABLE TO OBTAIN NEW TENANTS TO MAINTAIN OR INCREASE THE HISTORICAL OCCUPANCY

RATES OF, OR RENTS FROM, OUR PROPERTIES,

• WE MAY INCUR SIGNIFICANT COSTS TO PREPARE A PROPERTY FOR A TENANT, PARTICULARLY FOR SINGLE TENANT PROPERTIES,

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED)

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 5

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENTS (CONTINUED

)

• A FORMER TENANT OF TWO OF OUR PROPERTIES HAS FILED FOR BANKRUPTCY AND REJECTED ITS TWO LEASES WITH US. ALTHOUGH A SUBTENANT OF THAT FORMER TENANT AT

ONE OF THE TWO PROPERTIES IS NOW CONTRACTUALLY OBLIGATED TO PAY RENT TO US IN AN AMOUNT EQUAL TO THE RENT UNDER THE FORMER TENANT'S LEASE, THAT

SUBTENANT HAS CERTAIN RIGHTS TO TERMINATE ITS SUBLEASE, INCLUDING UPON ONE YEAR'S ADVANCE NOTICE,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR AND ILPT'S REVOLVING CREDIT FACILITIES IS SUBJECT TO US AND ILPT, AS THE CASE MAY BE, SATISFYING CERTAIN

FINANCIAL COVENANTS AND OTHER CREDIT FACILITY CONDITIONS THAT WE AND ILPT MAY BE UNABLE TO SATISFY,

• ACTUAL COSTS UNDER OUR AND ILPT'S REVOLVING CREDIT FACILITIES OR OTHER FLOATING RATE DEBT WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND

EXPENSES ASSOCIATED WITH SUCH DEBT,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR CREDIT FACILITY MAY BE INCREASED TO UP TO $1.85 BILLION IN CERTAIN CIRCUMSTANCES AND THE MAXIMUM BORROWING

AVAILABILITY UNDER ILPT'S REVOLVING CREDIT FACILITY MAY BE INCREASED TO UP TO $1.5 BILLION IN CERTAIN CIRCUMSTANCES; HOWEVER, INCREASING THE MAXIMUM

BORROWING AVAILABILITY UNDER OUR CREDIT FACILITY OR ILPT'S REVOLVING CREDIT FACILITY IS SUBJECT TO US AND ILPT, AS THE CASE MAY BE, OBTAINING ADDITIONAL

COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY, AND ILPT HAS THE OPTION TO EXTEND THE MATURITY DATE OF ITS REVOLVING

CREDIT FACILITY, UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS, RESPECTIVELY; HOWEVER, THE APPLICABLE CONDITIONS MAY NOT BE MET,

• WE RECEIVED AN ASSESSMENT FROM THE STATE OF WASHINGTON FOR REAL ESTATE EXCISE TAX, INTEREST AND PENALTIES OF $2.8 MILLION ON CERTAIN PROPERTIES WE

ACQUIRED IN CONNECTION WITH OUR ACQUISITION OF COLE CORPORATE INCOME TRUST, INC. IN JANUARY 2015. ALTHOUGH WE BELIEVE WE ARE NOT LIABLE FOR THIS TAX AND

ARE DISPUTING THIS ASSESSMENT, WE MAY NOT SUCCEED IN HAVING ALL OR ANY PART OF THIS ASSESSMENT NULLIFIED,

• THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY

TERMINATION IN CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., ILPT, GOV, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND

PROVIDE US WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE

RELATIONSHIPS MAY NOT MATERIALIZE,

• RMR INC. MAY REDUCE THE AMOUNT OF DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US,

• DISTRIBUTIONS WE MAY RECEIVE FROM ILPT MAY BE LESS THAN EXPECTED, AND

• THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR AND ILPT'S REVOLVING CREDIT FACILITIES, THE FACILITY FEE PAYABLE ON OUR REVOLVING CREDIT

FACILITY AND THE UNUSED FEE PAYABLE ON ILPT'S REVOLVING CREDIT FACILITY ARE BASED ON OUR CREDIT RATINGS AND ILPT'S LEVERAGE, RESPECTIVELY. FUTURE CHANGES

IN OUR CREDIT RATINGS AND ILPT'S LEVERAGE MAY CAUSE THE INTEREST AND FEES WE AND ILPT PAY TO INCREASE, RESPECTIVELY.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM,

NATURAL DISASTERS, CHANGES IN OUR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND FOR LEASED SPACE OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY

GENERALLY. MANY OF THESE FACTORS ALSO APPLY TO ILPT AND ITS BUSINESS, OPERATIONS, LIQUIDITY AND FINANCIAL CONDITION, THE REALIZATION OF WHICH COULD

MATERIALLY AND ADVERSELY AFFECT US, PARTICULARLY IF ILPT IS UNABLE TO MAKE DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION "RISK FACTORS" IN OUR PERIODIC

REPORTS, OR INCORPORATED THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS

WITH THE SEC ARE AVAILABLE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR

OTHERWISE.

WARNING CONCERNING FORWARD LOOKING STATEMENTS (CONTINUED)

6

CORPORATE INFORMATION

6

445 Jan Davis Drive, Huntsville, AL

Square Feet: 57,420

Digium, Inc. Corporate Headquarters

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 7

COM

PAN

Y PROFIL

E

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 796-8303

(f) (617) 796-8335

Stock Exchange Listing:

Nasdaq

Trading Symbol:

Common Shares: SIR

Issuer Ratings:

Moody’s: Baa3

Standard & Poor’s: BBB-

The Company:

SIR is a real estate investment trust, or REIT, which owns properties that are primarily leased to single tenants. As of

December 31, 2017, we owned 366 buildings, leasable land parcels and easements with approximately 45.5 million

rentable square feet located in 36 states. As of December 31, 2017, our subsidiary, Industrial Logistics Properties Trust,

or ILPT, owned 266 of our buildings, leasable land parcels and easements with approximately 28.5 million rentable square

feet, including 226 buildings, leasable land parcels and easements with approximately 16.8 million rentable square feet

which are primarily leasable industrial and commercial lands located in Hawaii. ILPT was our wholly owned subsidiary

until January 17, 2018, when it completed an initial public offering, or IPO, of its common shares and became a publicly

traded REIT. We remain ILPT's largest shareholder and, as of the date hereof, we own 45.0 million, or approximately

69.2%, of ILPT's outstanding common shares. We have been investment grade rated since 2014, and we are included

in the Russell 2000® Index and the MSCI US REIT Index.

COMPANY PROFILE

Management:

SIR is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR). RMR is an

alternative asset management company that was founded in 1986 to manage real estate companies and related

businesses. RMR primarily provides management services to five publicly owned REITs and three real estate related

operating businesses. In addition to managing SIR, RMR manages Hospitality Properties Trust, a REIT that owns hotels

and travel centers, Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical

office buildings, Government Properties Income Trust, a REIT that primarily owns properties throughout the U.S. that

are majority leased to the U.S. and state governments and office properties in the metropolitan Washington, D.C. area

that are leased to government and private sector tenants, and ILPT, a REIT and our majority owned subsidiary that owns

and leases industrial and logistics properties. RMR also provides management services to TravelCenters of America

LLC, a publicly traded operator of travel centers along the U.S. Interstate Highway System, convenience stores and

restaurants, Five Star Senior Living Inc., a publicly traded operator of senior living communities, and Sonesta International

Hotels Corporation, a privately owned franchisor and operator of hotels and cruise ships. RMR also manages publicly

traded securities of real estate companies, a publicly traded mortgage REIT and private commercial real estate debt

funds through wholly owned SEC registered investment advisory subsidiaries. As of December 31, 2017, RMR had $30.0

billion of real estate assets under management and the combined RMR managed companies had approximately $11

billion of annual revenues, over 1,400 properties and approximately 52,000 employees. We believe that being managed

by RMR is a competitive advantage for SIR because of RMR’s depth of management and experience in the real estate

industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay

for similar quality services.

(1) Includes 226 buildings, leasable land parcels and easements with approximately 16.8 million square feet which are primarily

leasable industrial and commercial lands located in Hawaii which are owned by ILPT.

(2) See page 28 for the calculation of FFO attributed to SIR and Normalized FFO attributed to SIR and a reconciliation of net

income attributed to SIR determined in accordance with U.S. generally accepted accounting principles, or GAAP, to those

amounts.

Key Data (as of December 31, 2017):

(dollars and sq. ft. in 000s)

Total buildings (1) 366

Total sq. ft. 45,496

Percent leased 96.2%

Q4 2017 total revenues $ 117,925

Q4 2017 net income attributed to SIR $ 2,075

Q4 2017 Normalized FFO attributed to

SIR (2) $ 34,764

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 8

INVES

TOR INFORM

ATIO

N

INVESTOR INFORMATION

Board of Trustees

Donna D. Fraiche William A. Lamkin Jeffrey P. Somers

Independent Trustee Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy

Managing Trustee Managing Trustee

Senior Management

David M. Blackman John C. Popeo

President and Chief Operating Officer Chief Financial Officer and Treasurer

Contact Information

Investor Relations Inquiries

Select Income REIT Financial inquiries should be directed to John C. Popeo,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 796-8303

255 Washington Street, Suite 300 or jpopeo@sirreit.com.

Newton, MA 02458-1634

(t) (617) 796-8303 Investor and media inquiries should be directed to

(f) (617) 796-8335 Christopher Ranjitkar, Director, Investor Relations,

(e-mail) info@sirreit.com at (617) 796-8320 or cranjitkar@sirreit.com.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 9

RESEARCH COVERAG

E

RESEARCH COVERAGE

Equity Research Coverage

Bank of America / Merrill Lynch

James Feldman

(646) 855-5808

james.feldman@baml.com

FBR Capital Markets & Co.

Bryan Maher

(646) 885-5423

bmaher@fbr.com

JMP Securities

Mitch Germain

(212) 906-3546

mgermain@jmpsecurities.com

Morgan Stanley

Vikram Malhotra

(212) 761-7064

vikram.malhotra@morganstanley.com

RBC Capital Markets

Michael Carroll

(440) 715-2649

michael.carroll@rbccm.com

SIR is followed by the analysts and its credit is rated by the rating agencies listed above. Please note that any opinions,

estimates or forecasts regarding SIR’s performance made by these analysts or agencies do not represent opinions,

forecasts or predictions of SIR or its management. SIR does not by its reference above imply its endorsement of or

concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

Rating Agencies

Moody’s Investors Service

Griselda Bisono

(212) 553-4985

griselda.bisono@moodys.com

Standard & Poor’s

Michael Souers

(212) 438-2508

michael.souers@standardandpoors.com

10

FINANCIALS

10

2300 & 2400 Yorkmont Road, Charlotte, NC

Square Feet: 284,039

Compass Group U.S. Headquarters

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 11

KE

Y FINANCIA

L D

AT

A KEY FINANCIAL DATA

(dollars in thousands, except per share data)

As of and For the Three Months Ended

12/31/2017 (1) 9/30/2017 6/30/2017 3/31/2017 12/31/2016

Selected Balance Sheet Data:

Total gross assets (2) $ 5,617,279 $ 4,972,896 $ 4,949,024 $ 4,876,465 $ 4,882,310

Total assets $ 5,303,030 $ 4,677,395 $ 4,673,590 $ 4,614,065 $ 4,639,682

Total liabilities $ 3,311,211 $ 2,655,096 $ 2,642,336 $ 2,562,862 $ 2,565,720

Total shareholders' equity $ 1,991,819 $ 2,022,299 $ 2,031,254 $ 2,051,203 $ 2,073,962

Selected Income Statement Data:

Total revenues $ 117,925 $ 118,014 $ 115,870 $ 116,294 $ 114,835

Net income $ 2,075 $ 31,442 $ 26,661 $ 6,728 $ 24,222

NOI (3) $ 92,434 $ 91,876 $ 91,511 $ 92,584 $ 90,551

Adjusted EBITDA (4) $ 59,818 $ 85,695 $ 85,534 $ 73,797 $ 84,444

FFO attributed to SIR (5) $ 36,977 $ 66,155 $ 61,207 $ 40,468 $ 63,228

Normalized FFO attributed to SIR (5) $ 34,764 $ 60,677 $ 62,127 $ 52,361 $ 63,463

Per Common Share Data:

Net income attributed to SIR - basic and diluted $ 0.02 $ 0.35 $ 0.30 $ 0.08 $ 0.27

FFO attributed to SIR - basic (5) $ 0.41 $ 0.74 $ 0.69 $ 0.45 $ 0.71

FFO attributed to SIR - diluted (5) $ 0.41 $ 0.74 $ 0.68 $ 0.45 $ 0.71

Normalized FFO attributed to SIR - basic and diluted (5) $ 0.39 $ 0.68 $ 0.70 $ 0.59 $ 0.71

Dividends:

Annualized dividends paid per share $ 2.04 $ 2.04 $ 2.04 $ 2.04 $ 2.04

Annualized dividend yield (at end of period) (6) 8.1% 8.7% 8.5% 7.9% 8.1%

Normalized FFO payout ratio (5) 130.8% 75.0% 72.9% 86.4% 71.8%

(1) Net income and FFO attributed to SIR include business management incentive fee expense of $22,281 for the three months ended December 31, 2017. Adjusted EBITDA and Normalized FFO attributed

to SIR include business management incentive fee expense of $25,569 for the three months ended December 31, 2017.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) See page 24 for the calculation of NOI and a reconciliation of net income determined in accordance with GAAP to that amount.

(4) See page 27 for the calculation of Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to that amount.

(5) See page 28 for the calculation of FFO attributed to SIR and Normalized FFO attributed to SIR and a reconciliation of net income attributed to SIR determined in accordance with GAAP to those amounts.

Excluding business management incentive fee expense of $25,569 for the the three months ended December 31, 2017, Normalized FFO attributed to SIR per share and the Normalized FFO payout ratio

would have been $0.67 and 76.1%, respectively.

(6) Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 12

CONSOLID

ATED BALANCE SHEET

S

CONSOLIDATED BALANCE SHEETS

December 31,

2017 2016

ASSETS

Real estate properties:

Land $ 1,041,767 $ 1,038,686

Buildings and improvements 3,178,098 3,103,734

4,219,865 4,142,420

Accumulated depreciation (314,249) (242,628)

3,905,616 3,899,792

Properties held for sale 5,829 —

Acquired real estate leases, net 477,577 506,298

Cash and cash equivalents 658,719 22,127

Restricted cash 178 44

Rents receivable, including straight line rents of $122,010 and $117,008, respectively,

net of allowance for doubtful accounts of $1,396 and $873, respectively 127,672 124,089

Deferred leasing costs, net 14,295 10,051

Other assets, net 113,144 77,281

Total assets $ 5,303,030 $ 4,639,682

LIABILITIES AND SHAREHOLDERS' EQUITY

Unsecured revolving credit facility $ — $ 327,000

ILPT revolving credit facility 750,000 —

Unsecured term loan, net 348,870 348,373

Senior unsecured notes, net 1,777,425 1,430,300

Mortgage notes payable, net 210,785 245,643

Accounts payable and other liabilities 101,352 101,605

Assumed real estate lease obligations, net 68,783 77,622

Rents collected in advance 15,644 18,815

Security deposits 8,346 11,887

Due to related persons 30,006 4,475

Total liabilities 3,311,211 2,565,720

Commitments and contingencies

Shareholders' equity:

Common shares of beneficial interest, $.01 par value: 125,000,000 shares authorized;

89,487,371 and 89,427,869 shares issued and outstanding, respectively 895 894

Additional paid in capital 2,180,896 2,179,669

Cumulative net income 508,213 441,307

Cumulative other comprehensive income 52,665 20,472

Cumulative common distributions (750,850) (568,380)

Total shareholders' equity 1,991,819 2,073,962

Total liabilities and shareholders' equity $ 5,303,030 $ 4,639,682

(dollars in thousands, except per share data)

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 13

CONSOLID

ATED S

TA

TEMENTS OF INCOM

E

CONSOLIDATED STATEMENTS OF INCOME

For the Three Months Ended December 31, For the Year Ended December 31,

2017 2016 2017 2016

Revenues:

Rental income $ 99,265 $ 96,503 $ 392,285 $ 387,015

Tenant reimbursements and other income 18,660 18,332 75,818 74,992

Total revenues 117,925 114,835 468,103 462,007

Expenses:

Real estate taxes 10,963 11,314 44,131 42,879

Other operating expenses 14,528 12,970 55,567 52,957

Depreciation and amortization 34,902 33,522 137,672 133,762

Acquisition and transaction related costs 1,075 235 1,075 306

General and administrative (1) 30,160 6,699 54,818 28,602

Write-off of straight line rents receivable, net (2) — — 12,517 —

Loss on asset impairment (2) — — 4,047 —

Loss on impairment of real estate assets — 5,484 229 5,484

Total expenses 91,628 70,224 310,056 263,990

Operating income 26,297 44,611 158,047 198,017

Dividend income 397 396 1,587 1,268

Interest expense (including net amortization of debt issuance costs, premiums

and discounts of $1,494, $1,384, $6,182 and $5,508, respectively) (24,592) (20,737) (92,870) (82,620)

Income before income tax expense and equity in earnings of an investee 2,102 24,270 66,764 116,665

Income tax expense (102) (78) (466) (448)

Equity in earnings of an investee 75 30 608 137

Net income 2,075 24,222 66,906 116,354

Net income allocated to noncontrolling interest — — — (33)

Net income attributed to SIR $ 2,075 $ 24,222 $ 66,906 $ 116,321

Weighted average common shares outstanding - basic 89,381 89,331 89,351 89,304

Weighted average common shares outstanding - diluted 89,392 89,335 89,370 89,324

Net income attributed to SIR per common share - basic and diluted $ 0.02 $ 0.27 $ 0.75 $ 1.30

Additional Data:

General and administrative expenses (1) / total revenues 25.6% 5.8% 11.7% 6.2%

General and administrative expenses (1) / total assets (at end of period) 0.6% 0.1% 1.0% 0.6%

Non-cash straight line rent adjustments included in rental income (3) $ 4,608 $ 5,690 $ 20,969 $ 24,744

Lease value amortization included in rental income (3) $ 546 $ 434 $ 2,054 $ 1,732

Lease termination fees included in rental income (3) $ 212 $ — $ 313 $ —

Non-cash amortization included in other operating expenses (4) $ 213 $ 213 $ 852 $ 852

Non-cash amortization included in general and administrative expenses (4) $ 344 $ 344 $ 1,378 $ 1,378

(dollars and shares in thousands, except per share data)

See accompanying notes on the following page.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 14

CONSOLID

ATED S

TA

TEMENTS OF INCOME (CONTINUED

)

CONSOLIDATED STATEMENTS OF INCOME (CONTINUED)

(dollars in thousands, except per share data)

(1) General and administrative expenses include business management incentive fee expense of $22,281 for the three months ended December 31, 2017 and $25,569 for the year ended

December 31, 2017.

(2) In March 2017, one of our tenants filed for bankruptcy and rejected two leases with us: (i) a lease for a property located in Huntsville, AL with approximately 1.4 million rentable square feet

and an original lease term until August 2032 and (ii) a lease for a property in Hanover, PA with approximately 502,000 rentable square feet and an original lease term until September 2028.

The Huntsville, AL property is occupied by a subtenant of our former tenant who is now contractually obligated to pay rent to us in an amount equal to the rent under the former tenant's lease

for a term that runs concurrently with the former tenant’s original lease term, but is subject to certain tenant termination rights. We expect that the lost rents plus carrying costs, such as real

estate taxes, insurance, security and other operating costs, from a fully vacant Hanover, PA property may total approximately $3,800 per year. The bankruptcy court overseeing this matter

granted us permission to offset our damages with a $3,739 security deposit held from the bankrupt former tenant with respect to the Hanover, PA property. During the three months ended

March 31, 2017, we recorded a non-cash charge of $12,517 to write off straight line rents receivable (net of the $3,739 security deposit) related to the rejected leases with the bankrupt

former tenant at both properties plus an impairment charge of $4,047 related to the write-off of lease intangibles related to the property located in Hanover, PA.

(3) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also

includes non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any.

(4) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR Inc. common stock in June 2015. This

liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fees and property management fees expense, which are

included in general and administrative and other operating expenses, respectively.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 15

CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Year Ended December 31,

2017 2016

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income $ 66,906 $ 116,354

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 80,239 78,151

Net amortization of debt issuance costs, premiums and discounts 6,182 5,508

Amortization of acquired real estate leases and assumed real estate lease obligations 54,061 52,691

Amortization of deferred leasing costs 1,591 1,413

Write-off of straight line rents and provision for losses on rents receivable 13,104 496

Straight line rental income (20,969) (24,744)

Impairment losses 4,276 5,484

Other non-cash expenses, net (651) (607)

Equity in earnings of an investee (608) (137)

Change in assets and liabilities:

Restricted cash — 1,127

Rents receivable 543 (534)

Deferred leasing costs (5,239) (4,485)

Other assets (3,042) (883)

Accounts payable and other liabilities 3,934 (572)

Rents collected in advance (3,171) 2,520

Security deposits 198 42

Due to related persons 25,531 735

Net cash provided by operating activities 222,885 232,559

CASH FLOWS FROM INVESTING ACTIVITIES:

Real estate acquisitions (117,468) (18,046)

Real estate improvements (15,162) (8,862)

Cash placed in escrow for investing activities (134) —

Net cash used in investing activities (132,764) (26,908)

(dollars in thousands)

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 16

CONSOLID

ATED S

TA

TEMENTS OF CASH FLOWS (CONTINUED

)

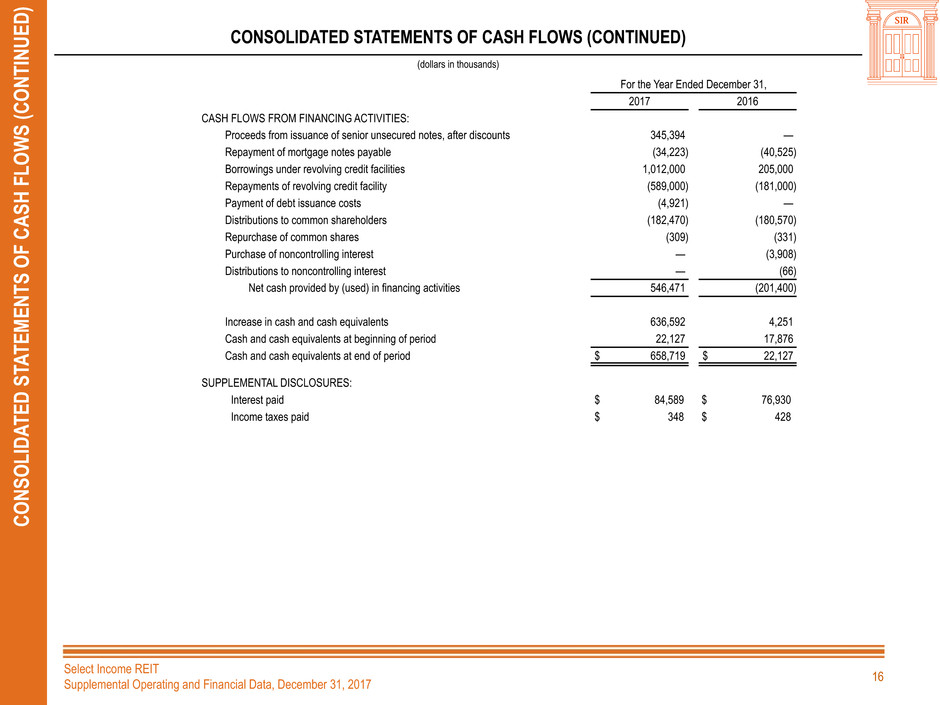

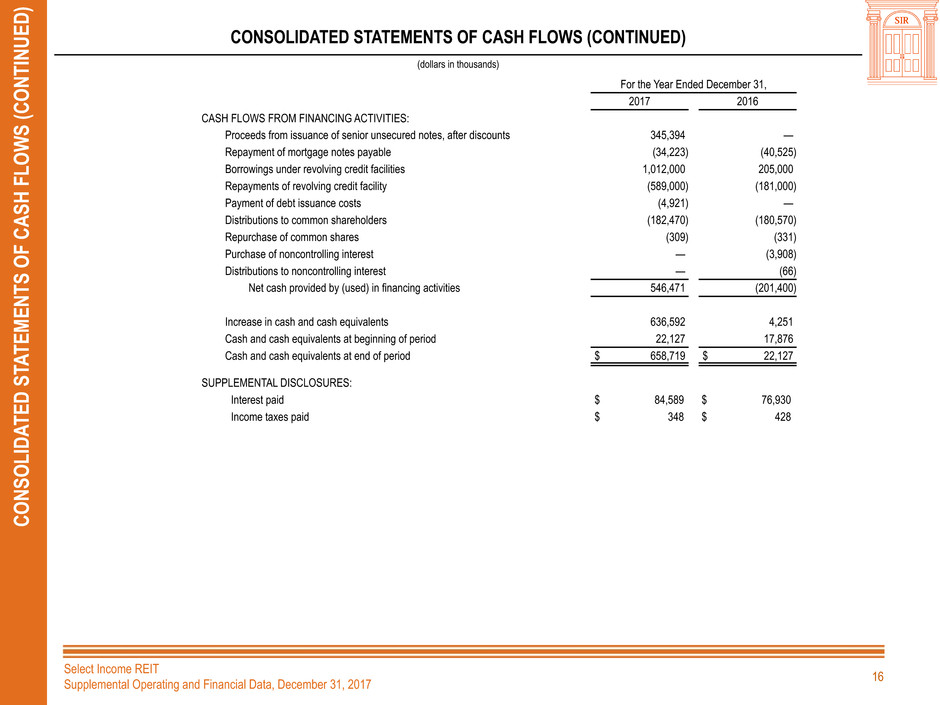

CONSOLIDATED STATEMENTS OF CASH FLOWS (CONTINUED)

For the Year Ended December 31,

2017 2016

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of senior unsecured notes, after discounts 345,394 —

Repayment of mortgage notes payable (34,223) (40,525)

Borrowings under revolving credit facilities 1,012,000 205,000

Repayments of revolving credit facility (589,000) (181,000)

Payment of debt issuance costs (4,921) —

Distributions to common shareholders (182,470) (180,570)

Repurchase of common shares (309) (331)

Purchase of noncontrolling interest — (3,908)

Distributions to noncontrolling interest — (66)

Net cash provided by (used) in financing activities 546,471 (201,400)

Increase in cash and cash equivalents 636,592 4,251

Cash and cash equivalents at beginning of period 22,127 17,876

Cash and cash equivalents at end of period $ 658,719 $ 22,127

(dollars in thousands)

SUPPLEMENTAL DISCLOSURES:

Interest paid $ 84,589 $ 76,930

Income taxes paid $ 348 $ 428

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 17

CONSOLID

ATED DEBT SUMMA

RY

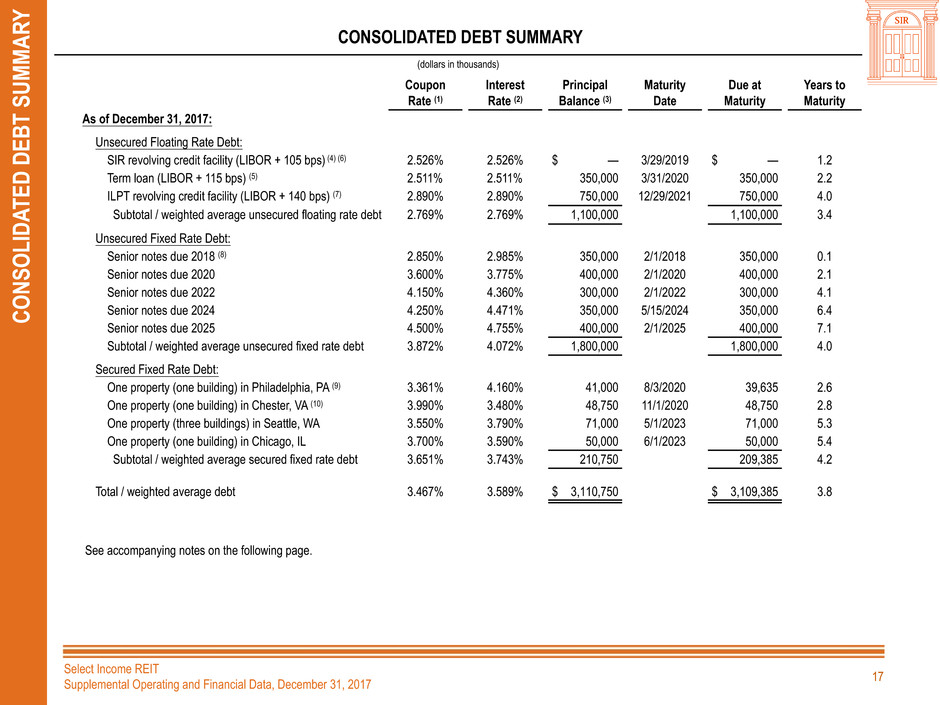

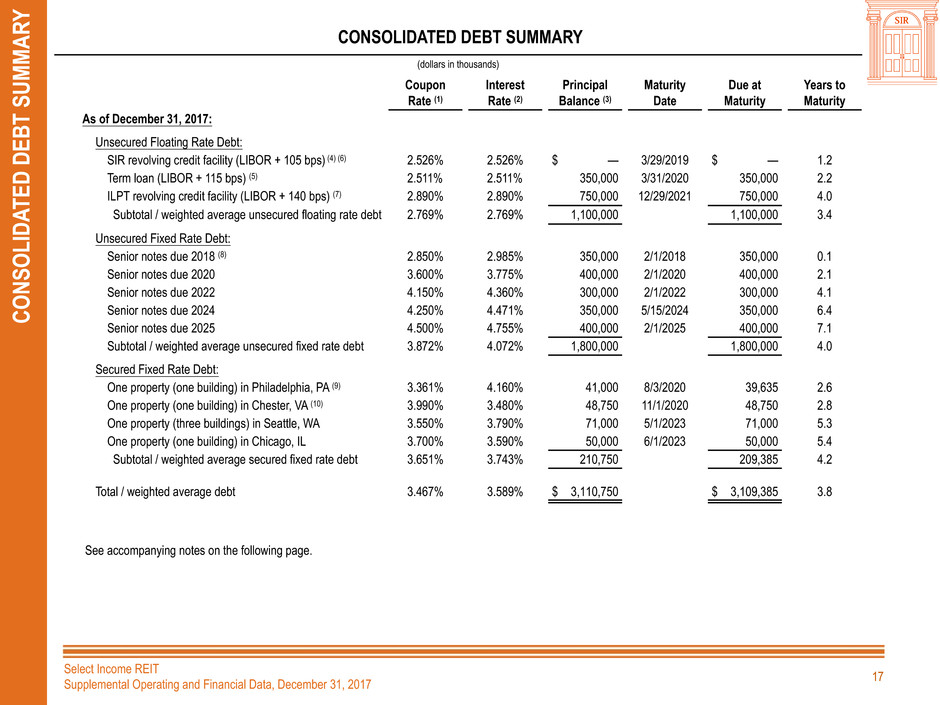

CONSOLIDATED DEBT SUMMARY

(dollars in thousands)

Coupon Interest Principal Maturity Due at Years to

Rate (1) Rate (2) Balance (3) Date Maturity Maturity

As of December 31, 2017:

Unsecured Floating Rate Debt:

SIR revolving credit facility (LIBOR + 105 bps) (4) (6) 2.526% 2.526% $ — 3/29/2019 $ — 1.2

Term loan (LIBOR + 115 bps) (5) 2.511% 2.511% 350,000 3/31/2020 350,000 2.2

ILPT revolving credit facility (LIBOR + 140 bps) (7) 2.890% 2.890% 750,000 12/29/2021 750,000 4.0

Subtotal / weighted average unsecured floating rate debt 2.769% 2.769% 1,100,000 1,100,000 3.4

Unsecured Fixed Rate Debt:

Senior notes due 2018 (8) 2.850% 2.985% 350,000 2/1/2018 350,000 0.1

Senior notes due 2020 3.600% 3.775% 400,000 2/1/2020 400,000 2.1

Senior notes due 2022 4.150% 4.360% 300,000 2/1/2022 300,000 4.1

Senior notes due 2024 4.250% 4.471% 350,000 5/15/2024 350,000 6.4

Senior notes due 2025 4.500% 4.755% 400,000 2/1/2025 400,000 7.1

Subtotal / weighted average unsecured fixed rate debt 3.872% 4.072% 1,800,000 1,800,000 4.0

Secured Fixed Rate Debt:

One property (one building) in Philadelphia, PA (9) 3.361% 4.160% 41,000 8/3/2020 39,635 2.6

One property (one building) in Chester, VA (10) 3.990% 3.480% 48,750 11/1/2020 48,750 2.8

One property (three buildings) in Seattle, WA 3.550% 3.790% 71,000 5/1/2023 71,000 5.3

One property (one building) in Chicago, IL 3.700% 3.590% 50,000 6/1/2023 50,000 5.4

Subtotal / weighted average secured fixed rate debt 3.651% 3.743% 210,750 209,385 4.2

Total / weighted average debt 3.467% 3.589% $ 3,110,750 $ 3,109,385 3.8

See accompanying notes on the following page.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 18

CONSOLID

ATED DEBT SUMMA

RY

(CONTINUED

)

CONSOLIDATED DEBT SUMMARY(CONTINUED)

(dollars in thousands)

(1) Reflects the interest rate stated in, or determined pursuant to, the contract terms.

(2) Includes the effect of interest rate protection and mark to market accounting for certain mortgages and discounts on senior unsecured notes. Excludes upfront transaction costs.

(3) Principal balance excludes unamortized premiums, discounts and certain issuance costs related to these debts. Total debt outstanding as of December 31, 2017, net of unamortized

premiums, discounts and certain issuance costs totaling $23,670, was $3,087,080.

(4) We have a $750,000 revolving credit facility which has a maturity date of March 29, 2019, interest payable on borrowings of LIBOR plus 105 basis points and a facility fee of 20 basis

points. Both the interest rate premium and the facility fee for our revolving credit facility are subject to adjustment based on changes to our credit ratings. Upon the payment of an

extension fee and meeting other conditions, we have the option to extend the maturity date to March 29, 2020. Principal balance represents the amount outstanding on our $750,000

revolving credit facility at December 31, 2017. Interest rate is as of December 31, 2017 and excludes the 20 basis points facility fee.

(5) As of December 31, 2017, we had a $350,000 term loan with a maturity date of March 31, 2020 and an interest rate on the amount outstanding of LIBOR plus 115 basis points. The

interest rate premium for our term loan was subject to adjustment based on changes to our credit ratings. Principal balance represents the amount outstanding on our $350,000 term

loan at December 31, 2017. Interest rate is as of December 31, 2017. We repaid this term loan on January 31, 2018 with cash on hand at December 31, 2017 and borrowings under our

revolving credit facility.

(6) The maximum borrowing availability under our credit facility may be increased to up to $1,850,000 in certain circumstances.

(7) ILPT has a $750,000 revolving credit facility which initially had a maturity date of March 29, 2018, interest payable on borrowings of LIBOR plus 140 basis points as of December 31,

2017 and a quarterly commitment fee varying from 0.15% to 0.25% per annum depending upon the amount of the unused portion of its revolving credit facility. The interest rate

premium for ILPT's revolving credit facility is subject to adjustment based on changes to ILPT's leverage. After the completion of ILPT's IPO in January 2018, ILPT's $750,000 secured

revolving credit facility became a $750,000 unsecured revolving credit facility and its maturity date was extended to December 29, 2021. ILPT has the option to extend the maturity date

of its revolving credit facility for two six month periods, subject to payment of extension fees and satisfaction of other conditions. Principal balance represents the amount outstanding on

ILPT's $750,000 revolving credit facility at December 31, 2017. Interest rate is as of December 31, 2017 and excludes the quarterly commitment fee. The maximum borrowing

availability under ILPT's revolving credit facility may be increased to up to $1,500,000 in certain circumstances.

(8) On January 2, 2018, we redeemed at par plus accrued interest our $350,000 senior unsecured notes due February 1, 2018 with cash on hand at December 31, 2017.

(9) Interest is payable at a rate equal to LIBOR plus a premium. The interest charge has been fixed by a cash flow hedge which sets the interest rate at approximately 4.16% until August 3,

2020, which is the maturity date of the mortgage note. Coupon rate is as of December 31, 2017.

(10) Represents a mortgage note on a property owned by ILPT.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 19

CONSOLID

ATED DEBT M

ATURIT

Y SCHEDUL

E

CONSOLIDATED DEBT MATURITY SCHEDULE

(dollars in thousands)

Scheduled Principal Payments as of December 31, 2017

Unsecured Unsecured Secured

Floating Fixed Fixed

Year Rate Debt Rate Debt Rate Debt Total (5)

2018 $ — $ 350,000 (1) $ 228 $ 350,228

2019 — (2) — 710 710

2020 350,000 (3) 400,000 88,812 838,812

2021 750,000 (4) — — 750,000

2022 — 300,000 — 300,000

2023 — — 121,000 121,000

2024 — 350,000 — 350,000

2025 — 400,000 — 400,000

Total $ 1,100,000 $ 1,800,000 $ 210,750 $ 3,110,750

Percent 35.4% 57.9% 6.7% 100.0%

(1) On January 2, 2018, we redeemed at par plus accrued interest our $350,000 senior unsecured notes due February 1, 2018 with cash on hand at December 31, 2017.

(2) Represents the amount outstanding under our $750,000 revolving credit facility at December 31, 2017. We have a $750,000 revolving credit facility which has a maturity date of

March 29, 2019, interest payable on borrowings of LIBOR plus 105 basis points and a facility fee of 20 basis points. Both the interest rate premium and the facility fee for our

revolving credit facility are subject to adjustment based on changes to our credit ratings. Upon the payment of an extension fee and meeting other conditions, we have the option

to extend the maturity date to March 29, 2020.

(3) As of December 31, 2017, we had a $350,000 term loan with a maturity date of March 31, 2020 and an interest rate on the amount outstanding of LIBOR plus 115 basis points.

The interest rate premium for our term loan was subject to adjustment based on changes to our credit ratings. We repaid this term loan on January 31, 2018 with cash on hand

at December 31, 2017 and borrowings under our revolving credit facility.

(4) Represents the amount outstanding under ILPT's $750,000 revolving credit facility at December 31, 2017. ILPT has a $750,000 revolving credit facility which initially had a

maturity date of March 29, 2018, interest payable on borrowings of LIBOR plus 140 basis points as of December 31, 2017 and a quarterly commitment fee varying from 0.15% to

0.25% per annum depending upon the amount of the unused portion of its revolving credit facility. The interest rate premium for ILPT's revolving credit facility is subject to

adjustment based on changes to ILPT's leverage. After the completion of ILPT's IPO in January 2018, ILPT's $750,000 secured revolving credit facility became a $750,000

unsecured revolving credit facility and its maturity date was extended to December 29, 2021. ILPT has the option to extend the maturity date of its revolving credit facility for two

six month periods, subject to payment of extension fees and satisfaction of other conditions.

(5) Total debt outstanding as of December 31, 2017, net of unamortized premiums, discounts and certain issuance costs totaling $23,670, was $3,087,080.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 20

CONSOLID

ATED LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

CONSOLIDATED LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

As of and For the Three Months Ended

12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 55.0% 49.4% 49.2% 48.5% 48.2%

Total debt (book value) (1) / gross book value of real estate assets (3) 63.5% 50.5% 50.6% 49.9% 49.6%

Total debt (book value) (1) / total market capitalization (4) 57.9% 53.9% 53.1% 50.7% 51.1%

Secured debt (book value) (1) / total assets 4.0% 4.9% 5.2% 5.3% 5.3%

Variable rate debt (book value) (1) / total debt (book value) (1) 35.6% 18.4% 17.1% 29.2% 28.7%

Coverage Ratios:

Adjusted EBITDA (5) / interest expense 2.4x 3.5x 3.8x 3.5x 4.1x

Total debt (book value) (1) / annualized Adjusted EBITDA (5) 12.9x 7.2x 7.1x 8.0x 7.0x

Public Debt Covenants:

Total debt / adjusted total assets (6) (maximum 60%) 55.4% 50.0% 49.9% 49.3% 49.2%

Secured debt / adjusted total assets (6) (maximum 40%) 17.1% 4.6% 5.0% 5.1% 5.1%

Consolidated income available for debt service (7) / annual debt service (minimum 1.50x) 3.4x 3.8x 3.7x 4.1x 4.4x

Total unencumbered assets (6) / unsecured debt (minimum 150%) 178.9% 199.9% 201.0% 203.7% 203.9%

(1) Debt amounts are net of unamortized premiums, discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties at cost, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any.

(4) Total market capitalization is total debt plus the market value of our common shares at the end of each period.

(5) See page 27 for the calculation of Adjusted EBITDA and for a reconciliation of net income determined in accordance with GAAP to that amount.

(6) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP and exclude depreciation and amortization, accounts receivable, other

intangible assets and impairment writedowns, if any.

(7) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, gains and losses on early extinguishment of debt,

and gains and losses on sales of properties, if any, determined together with debt service on a pro forma basis for the four consecutive fiscal quarters most recently ended.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 21

CONSOLID

ATED LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEB

T

COVENANTS (CONTINUED

)

CONSOLIDATED LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS (CONTINUED)

As of and For the Three Months Ended

12/31/2017

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 49.1%

Total debt (book value) (1) / gross book value of real estate assets (3) 50.2%

Total debt (book value) (1) / total market capitalization (4) 52.0%

Secured debt (book value) (1) / total assets 4.5%

Variable rate debt (book value) (1) / total debt (book value) (1) 32.8%

Coverage Ratios:

Adjusted EBITDA (5) / interest expense 2.4x (3.5x, as adjusted) (8)

Total debt (book value) (1) / annualized Adjusted EBITDA (5) 10.2x (7.1x, as adjusted) (8)

Public Debt Covenants:

Total debt / adjusted total assets (6) (maximum 60%) 49.6%

Secured debt / adjusted total assets (6) (maximum 40%) 19.4%

Consolidated income available for debt service (7) / annual debt service (minimum 1.50x) 3.4x (8)

Total unencumbered assets (6) / unsecured debt (minimum 150%) 201.7%

(1) Debt amounts are net of unamortized premiums, discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties at cost, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment

writedowns, if any.

(4) Total market capitalization is total debt plus the market value of our common shares at the end of the period.

(5) See page 27 for the calculation of Adjusted EBITDA and for a reconciliation of net income determined in accordance with GAAP to that amount.

(6) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP and exclude depreciation and amortization, accounts

receivable, other intangible assets and impairment writedowns, if any.

(7) Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, gains and losses on early

extinguishment of debt, and gains and losses on sales of properties, if any, determined together with debt service on a pro forma basis for the four consecutive fiscal quarters most recently

ended.

(8) As adjusted excludes business management incentive fees of $25,569 for the three months and year ended December 31, 2017. Excluding business management incentive fees of

$25,569 for the three months and year ended December 31, 2017, consolidated income available for debt service / annual debt service would be 3.7x.

On December 31, 2017, we had cash on hand of $658.7 million. In January 2018, this cash (plus drawings under our revolving credit facility of $50.0 million) was used to repay $350.0

million of 2.85% senior unsecured notes due in 2018 and to prepay the $350.0 million term loan due in 2020. The following represents the pro forma leverage ratios, coverage ratios

and public debt covenant compliance if these debt payments and prepayments occurred on December 31, 2017.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 22

CONSOLID

ATED CAPI

TA

L EXPENDITURES SUMMA

RY CONSOLIDATED CAPITAL EXPENDITURES SUMMARY

(dollars in thousands)

For the Three Months Ended

12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016

Tenant improvements (1) $ 384 $ 378 $ 61 $ 328 $ 3,046

Leasing costs (2) 3,240 403 630 1,402 627

Building improvements (3) 1,558 1,323 1,209 694 946

Recurring capital expenditures 5,182 2,104 1,900 2,424 4,619

Development, redevelopment and other activities (4) 1,096 2,583 2,451 721 1,274

Total capital expenditures $ 6,278 $ 4,687 $ 4,351 $ 3,145 $ 5,893

(1) Tenant improvements include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space.

(2) Leasing costs include leasing related costs, such as brokerage commissions, legal costs and tenant inducements.

(3) Building improvements generally include (i) expenditures to replace obsolete building components and (ii) expenditures that extend the useful life of existing assets.

(4) Development, redevelopment and other activities generally include (i) capital expenditures that are identified at the time of a property acquisition and incurred within a short time

period after acquiring the property and (ii) capital expenditure projects that reposition a property or result in new sources of revenues.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 23

CONSOLID

ATED PROPERT

Y

ACQUISITIONS

AND DISPOSITIONS INFORM

ATION SINCE 1/1/1

7

TO 12/31/1

7

CONSOLIDATED PROPERTY ACQUISITIONS AND DISPOSITIONS INFORMATION SINCE 1/1/17 TO 12/31/17

(sq. ft. and dollars in thousands)

Acquisitions(1):

Dispositions:

We have not disposed of any properties between January 1, 2017 and December 31, 2017.

(1) In January 2017, we also acquired a land parcel adjacent to one of our properties located in McAlester, OK for $226, excluding acquisition related costs, in order to expand our adjacent building for the existing tenant.

(2) Represents the gross purchase price, including assumed mortgage debt, if any, and excluding acquisition related costs and purchase price allocations.

(3) Represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases as of the date of acquisition, less estimated annual property

operating expenses that we expected to pay as of the date of acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price, including the principal amount of any assumed debt and

excluding acquisition related costs.

(4) Average remaining lease term in years is weighted based on rental revenues as of the date acquired.

(5) Percent leased is as of the date acquired.

Weighted

Average

Purchase Remaining

Date Number of Number of Purchase Price (2) / Cap Lease Term Percent

Acquired Location Properties Buildings Sq. Ft. Price (2) Sq. Ft. Rate (3) in Years (4) Leased (5) Tenant

4/28/2017 Norfolk, VA 1 1 289 $ 55,108 $ 191 7.8% 10.2 100% Automatic Data Processing, Inc.

5/12/2017 Houston, TX 1 1 84 20,300 242 7.9% 10.6 100% Lyondell Chemical Company

7/19/2017 Indianapolis, IN 1 2 275 41,050 149 10.0% 10.0 100% Interactive Intelligence Group, Inc.

Total / Weighted Average 3 4 648 $ 116,458 $ 180 8.6% 10.2 100%

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 24

CALCUL

ATION OF PROPERT

Y NET OPER

ATING INCOME (NOI)

AND CASH BASIS NO

I

CALCULATION OF PROPERTY NET OPERATING INCOME (NOI) AND CASH BASIS NOI (1)

(dollars in thousands)

For the Three Months Ended For the Year Ended

12/31/2017 9/30/2017 6/30/2017 3/31/2017 12/31/2016 12/31/2017 12/31/2016

Calculation of NOI and Cash Basis NOI:

Rental income $ 99,265 $ 98,635 $ 97,041 $ 97,344 $ 96,503 $ 392,285 $ 387,015

Tenant reimbursements and other income 18,660 19,379 18,829 18,950 18,332 75,818 74,992

Real estate taxes (10,963) (11,489) (10,836) (10,843) (11,314) (44,131) (42,879)

Other operating expenses (14,528) (14,649) (13,523) (12,867) (12,970) (55,567) (52,957)

NOI $ 92,434 $ 91,876 $ 91,511 $ 92,584 $ 90,551 $ 368,405 $ 366,171

SIR NOI (excluding ILPT) $ 60,403 $ 60,116 $ 59,946 $ 60,215 $ 59,173 $ 240,680 $ 240,658

ILPT NOI 32,031 31,760 31,565 32,369 31,378 127,725 125,513

NOI $ 92,434 $ 91,876 $ 91,511 $ 92,584 $ 90,551 $ 368,405 $ 366,171

Non-cash straight line rent adjustments included in rental income (2) (4,608) (5,581) (5,389) (5,391) (5,690) (20,969) (24,744)

Lease value amortization included in rental income (2) (546) (547) (527) (434) (434) (2,054) (1,732)

Lease termination fees included in rental income (2) (212) — (101) — — (313) —

Non-cash amortization included in other operating expenses (3) (213) (213) (213) (213) (213) (852) (852)

Cash Basis NOI $ 86,855 $ 85,535 $ 85,281 $ 86,546 $ 84,214 $ 344,217 $ 338,843

SIR Cash Basis NOI (excluding ILPT) $ 56,573 $ 55,486 $ 55,425 $ 55,881 $ 54,612 $ 223,365 $ 220,489

ILPT Cash Basis NOI 30,282 30,049 29,856 30,665 29,602 120,852 118,354

Cash Basis NOI $ 86,855 $ 85,535 $ 85,281 $ 86,546 $ 84,214 $ 344,217 $ 338,843

Reconciliation of Net Income to NOI and Cash Basis NOI:

Net income $ 2,075 $ 31,442 $ 26,661 $ 6,728 $ 24,222 $ 66,906 $ 116,354

Equity in earnings of an investee (75) (31) (374) (128) (30) (608) (137)

Income tax expense 102 177 85 102 78 466 448

Income before income tax expense and equity in earnings of an investee 2,102 31,588 26,372 6,702 24,270 66,764 116,665

Interest expense 24,592 24,383 22,808 21,087 20,737 92,870 82,620

Dividend income (397) (397) (396) (397) (396) (1,587) (1,268)

Operating income 26,297 55,574 48,784 27,392 44,611 158,047 198,017

Loss on impairment of real estate assets — — 229 — 5,484 229 5,484

Loss on asset impairment (4) — — — 4,047 — 4,047 —

Write-off of straight line rents receivable, net (4) — — — 12,517 — 12,517 —

General and administrative 30,160 1,589 8,181 14,888 6,699 54,818 28,602

Acquisition and transaction related costs 1,075 — — — 235 1,075 306

Depreciation and amortization 34,902 34,713 34,317 33,740 33,522 137,672 133,762

NOI 92,434 91,876 91,511 92,584 90,551 368,405 366,171

Non-cash straight line rent adjustments included in rental income (2) (4,608) (5,581) (5,389) (5,391) (5,690) (20,969) (24,744)

Lease value amortization included in rental income (2) (546) (547) (527) (434) (434) (2,054) (1,732)

Lease termination fees included in rental income (2) (212) — (101) — — (313) —

Non-cash amortization included in other operating expenses (3) (213) (213) (213) (213) (213) (852) (852)

Cash Basis NOI $ 86,855 $ 85,535 $ 85,281 $ 86,546 $ 84,214 $ 344,217 $ 338,843

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 25

CALCUL

ATION OF PROPERT

Y NET OPER

ATING INCOME (NOI)

AND CASH BASIS NO

I

(CONTINUED

)

CALCULATION OF PROPERTY NET OPERATING INCOME (NOI) AND CASH BASIS NOI (CONTINUED) (1)

(dollars in thousands)

(1) See Definitions of Certain Non-GAAP Financial Measures on page 29 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are

appropriate supplemental measures and a description of how we use these measures.

(2) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent

adjustments. Rental income also includes non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any.

(3) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR Inc.

common stock in June 2015. A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property

management fees expense, which are included in other operating expenses.

(4) During the three months ended March 31, 2017, we recorded a $12,517 non-cash write-off of straight line rents receivable related to leases associated with a

tenant bankruptcy at two properties located in Huntsville, AL and Hanover, PA and a $4,047 loss on asset impairment for unamortized lease intangibles related

to a lease associated with this tenant bankruptcy at the property located in Hanover, PA.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 26RECONCILI

ATION OF NOI

TO SAME PROPERT

Y NOI

AND CALCUL

ATION OF SAME PROPERT

Y

CASH BASIS NO

I RECONCILIATION OF NOI TO SAME PROPERTY NOI AND

CALCULATION OF SAME PROPERTY CASH BASIS NOI (1)

(dollars in thousands)

For the Three Months Ended For the Year Ended

12/31/2017 12/31/2016 12/31/2017 12/31/2016

Reconciliation of NOI to Same Property NOI (2)(3):

Rental income $ 99,265 $ 96,503 $ 392,285 $ 387,015

Tenant reimbursements and other income 18,660 18,332 75,818 74,992

Real estate taxes (10,963) (11,314) (44,131) (42,879)

Other operating expenses (14,528) (12,970) (55,567) (52,957)

NOI 92,434 90,551 368,405 366,171

Less:

NOI of properties not included in same property results (2,471) (148) (7,185) (537)

Same property NOI $ 89,963 $ 90,403 $ 361,220 $ 365,634

SIR same property NOI (excluding ILPT) $ 57,932 $ 59,025 $ 233,495 $ 240,121

ILPT same property NOI 32,031 31,378 127,725 125,513

Same property NOI $ 89,963 $ 90,403 $ 361,220 $ 365,634

Calculation of Same Property Cash Basis NOI (2)(3):

Same property NOI $ 89,963 $ 90,403 $ 361,220 $ 365,634

Less:

Non-cash straight line rent adjustments included in rental income (4) (3,895) (5,661) (18,310) (24,661)

Lease value amortization included in rental income (4) (554) (443) (2,090) (1,741)

Lease termination fees included in rental income (4) (212) — (313) —

Non-cash amortization included in other operating expenses (5) (213) (213) (852) (852)

Same property Cash Basis NOI $ 85,089 $ 84,086 $ 339,655 $ 338,380

SIR same property Cash Basis NOI (excluding ILPT) $ 54,807 $ 54,484 $ 218,803 $ 220,026

ILPT same property Cash Basis NOI 30,282 29,602 120,852 118,354

Same property Cash Basis NOI $ 85,089 $ 84,086 $ 339,655 $ 338,380

(1) See Definitions of Certain Non-GAAP Financial Measures on page 29 for the definitions of NOI and Cash Basis NOI, a description of why we believe they are appropriate supplemental measures and a description

of how we use these measures.

(2) For the three months ended December 31, 2017, same property NOI and Cash Basis NOI are based on properties we owned as of December 31, 2017, and which we owned continuously since October 1, 2016.

(3) For the year ended December 31, 2017, same property NOI and Cash Basis NOI are based on properties we owned as of December 31, 2017, and which we owned continuously since January 1, 2016.

(4) We report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes non-cash

amortization of intangible lease assets and liabilities and lease termination fees, if any.

(5) We recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price we paid for our investment in RMR Inc. common stock in June 2015. A portion of this liability is

being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees expense, which are included in other operating expenses.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 27

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(dollars in thousands)

For the Three Months Ended For the Year Ended

12/31/2017 (2) 9/30/2017 6/30/2017 3/31/2017 12/31/2016 12/31/2017 12/31/2016

Net income $ 2,075 $ 31,442 $ 26,661 $ 6,728 $ 24,222 $ 66,906 $ 116,354

Plus: interest expense 24,592 24,383 22,808 21,087 20,737 92,870 82,620

Plus: income tax expense 102 177 85 102 78 466 448

Plus: depreciation and amortization 34,902 34,713 34,317 33,740 33,522 137,672 133,762

EBITDA 61,671 90,715 83,871 61,657 78,559 297,914 333,184

Plus: acquisition and transaction related costs 1,075 — — — 235 1,075 306

Plus: general and administrative expense paid in common shares (3) 360 458 514 247 166 1,579 1,623

Plus: estimated business management incentive fees (4) (3,288) (5,478) 920 7,846 — — —

Plus: loss on asset impairment (5) — — — 4,047 — 4,047 —

Plus: loss on impairment of real estate assets (6) — — 229 — 5,484 229 5,484

Adjusted EBITDA $ 59,818 $ 85,695 $ 85,534 $ 73,797 $ 84,444 $ 304,844 $ 340,597

(1) See Definitions of Certain Non-GAAP Financial Measures on page 29 for the definitions of EBITDA and Adjusted EBITDA and a description of why we believe they are appropriate

supplemental measures.

(2) Net income and EBITDA include business management incentive fee expense of $22,281 for the three months ended December 31, 2017. Adjusted EBITDA includes business

management incentive fee expense of $25,569 for the three months ended December 31, 2017.

(3) Amount represents equity based compensation to our trustees and our officers and certain other employees of RMR LLC.

(4) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as

defined, and are included in general and administrative expense in our consolidated statements of income. In calculating net income in accordance with GAAP, we recognize

estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third

quarters for purposes of calculating net income, we do not include such expense in the calculation of Adjusted EBITDA until the fourth quarter, when the amount of the business

management incentive fee expense for the calendar year, if any, is determined. Adjusted EBITDA includes business management incentive fee expense of $25,569 for both the

three months and year ended December 31, 2017. Business management incentive fees for 2017 were paid in cash in January 2018.

(5) During the three months ended March 31, 2017, we recorded a $4,047 loss on asset impairment for unamortized lease intangibles related to a lease associated with a tenant

bankruptcy at a property located in Hanover, PA.

(6) We recorded losses on impairment of real estate assets of $229 during the three months ended June 30, 2017 and $5,484 during the three months ended December 31, 2016 in

connection with one vacant property located in Maynard, MA.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 28CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

A

TTRIBUTED

TO SIR

AND NORMALIZE

D

FFO

A

TTRIBUTED

TO SI

R

CALCULATION OF FUNDS FROM OPERATIONS (FFO) ATTRIBUTED TO SIR AND NORMALIZED FFO

ATTRIBUTED TO SIR (1)

(amounts in thousands, except per share data)

For the Three Months Ended For the Year Ended

12/31/2017 (2) 9/30/2017 6/30/2017 3/31/2017 12/31/2016 12/31/2017 12/31/2016

Net income attributed to SIR $ 2,075 $ 31,442 $ 26,661 $ 6,728 $ 24,222 $ 66,906 $ 116,321

Plus: depreciation and amortization 34,902 34,713 34,317 33,740 33,522 137,672 133,762

Plus: loss on impairment of real estate assets — — 229 — 5,484 229 5,484

Plus: net income allocated to noncontrolling interest — — — — — — 33

Less: FFO allocated to noncontrolling interest — — — — — — (77)

FFO attributed to SIR 36,977 66,155 61,207 40,468 63,228 204,807 255,523

Plus: acquisition and transaction related costs 1,075 — — — 235 1,075 306

Plus: estimated business management incentive fees (3) (3,288) (5,478) 920 7,846 — — —

Plus: loss on asset impairment (4) — — — 4,047 — 4,047 —

Normalized FFO attributed to SIR $ 34,764 $ 60,677 $ 62,127 $ 52,361 $ 63,463 $ 209,929 $ 255,829

Weighted average common shares outstanding - basic 89,381 89,355 89,338 89,331 89,331 89,351 89,304

Weighted average common shares outstanding - diluted 89,392 89,379 89,362 89,348 89,335 89,370 89,324

Net income attributed to SIR per common share - basic and diluted $ 0.02 $ 0.35 $ 0.30 $ 0.08 $ 0.27 $ 0.75 $ 1.30

FFO attributed to SIR per common share - basic $ 0.41 $ 0.74 $ 0.69 $ 0.45 $ 0.71 $ 2.29 $ 2.86

FFO attributed to SIR per common share - diluted $ 0.41 $ 0.74 $ 0.68 $ 0.45 $ 0.71 $ 2.29 $ 2.86

Normalized FFO attributed to SIR per common share - basic and diluted $ 0.39 $ 0.68 $ 0.70 $ 0.59 $ 0.71 $ 2.35 $ 2.86

(1) See Definitions of Certain Non-GAAP Financial Measures on page 29 for a definition of FFO attributed to SIR and Normalized FFO attributed to SIR, a description of why we believe they are

appropriate supplemental measures and a description of how we use these measures.

(2) Net income and FFO attributed to SIR include business management incentive fee expense of $22,281 for the three months ended December 31, 2017. Normalized FFO attributed to SIR

includes business management incentive fee expense of $25,569 for the three months ended December 31, 2017.

(3) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined,

and are included in general and administrative expense in our consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business

management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating

net income, we do not include such expense in the calculation of Normalized FFO attributed to SIR until the fourth quarter, when the amount of the business management incentive fee

expense for the calendar year, if any, is determined. Normalized FFO attributed to SIR includes business management incentive fee expense of $25,569 for both the three months and year

ended December 31, 2017. Business management incentive fees for 2017 were paid in cash in January 2018.

(4) During the three months ended March 31, 2017, we recorded a $4,047 loss on asset impairment for unamortized lease intangibles related to a lease associated with a tenant bankruptcy at a

property located in Hanover, PA.

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 29

DEFINITIONS OF CER

TAIN NON-GAA

P FINANCIA

L MEASURE

S

DEFINITIONS OF CERTAIN NON-GAAP FINANCIAL MEASURES

NOI and Cash Basis NOI:

The calculations of NOI and Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to our property level results of operations. We

calculate NOI and Cash Basis NOI as shown on page 24. We define NOI as income from our rental of real estate less our property operating expenses. NOI excludes amortization of capitalized

tenant improvement costs and leasing commissions that we record as depreciation and amortization. We define Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease

value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. We consider NOI and Cash Basis NOI to be appropriate supplemental

measures to net income because they may help both investors and management to understand the operations of our properties. We use NOI and Cash Basis NOI to evaluate individual and

company wide property level performance, and we believe that NOI and Cash Basis NOI provide useful information to investors regarding our results of operations because they reflect only those

income and expense items that are generated and incurred at the property level and may facilitate comparisons of our operating performance between periods and with other REITs. NOI and

Cash Basis NOI do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income, net income attributed to SIR or

operating income as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income attributed to SIR

and operating income as presented in our consolidated statements of income. Other real estate companies and REITs may calculate NOI and Cash Basis NOI differently than we do.

EBITDA and Adjusted EBITDA:

We calculate EBITDA and Adjusted EBITDA as shown on page 27. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our operating performance, along with

net income, net income attributed to SIR and operating income. We believe that EBITDA and Adjusted EBITDA provide useful information to investors because by excluding the effects of certain

historical amounts, such as interest, depreciation and amortization expense, EBITDA and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating

performance. EBITDA and Adjusted EBITDA do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income, net income

attributed to SIR or operating income as indicators of operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income

attributed to SIR and operating income as presented in our consolidated statements of income. Other real estate companies and REITs may calculate EBITDA and Adjusted EBITDA differently

than we do.

FFO Attributed to SIR and Normalized FFO Attributed to SIR:

We calculate FFO attributed to SIR and Normalized FFO attributed to SIR as shown on page 28. FFO attributed to SIR is calculated on the basis defined by The National Association of Real

Estate Investment Trusts, or Nareit, which is net income, calculated in accordance with GAAP, plus real estate depreciation and amortization, loss on impairment of real estate assets and the

difference between net income and FFO allocated to noncontrolling interest, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO attributed to SIR

differs from Nareit’s definition of FFO because we include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in

accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management

incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year and we exclude acquisition and transaction related costs expensed under

GAAP, loss on asset impairment and Normalized FFO, net of FFO, from noncontrolling interest, if any. We consider FFO attributed to SIR and Normalized FFO attributed to SIR to be appropriate

supplemental measures of operating performance for a REIT, along with net income, net income attributed to a REIT and operating income. We believe that FFO attributed to SIR and Normalized

FFO attributed to SIR provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO attributed to SIR and Normalized

FFO attributed to SIR may facilitate a comparison of our operating performance between periods and with other REITs. FFO attributed to SIR and Normalized FFO attributed to SIR are among the

factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our

qualification for taxation as a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements

and operating performance and our expected needs for and availability of cash to pay our obligations. FFO attributed to SIR and Normalized FFO attributed to SIR do not represent cash

generated by operating activities in accordance with GAAP and should not be considered alternatives to net income, net income attributed to SIR or operating income as indicators of our operating

performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income attributed to SIR and operating income as presented in our

consolidated statements of income. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do.

30

PORTFOLIO INFORMATION

30

2555 Grand Boulevard, Kansas City, MO

Square Feet: 595,607

Shook, Hardy & Bacon LLP Headquarters

Select Income REIT

Supplemental Operating and Financial Data, December 31, 2017 31

CONSOLID

ATED PORTFOLIO SUMMA

RY

B

Y OWNE

R

CONSOLIDATED PORTFOLIO SUMMARY BY OWNER

(dollars and sq. ft. in thousands)

(1) Includes buildings, leasable land parcels and easements which are primarily leasable industrial and commercial lands located in Hawaii, most of

which are owned by ILPT.

(2) See page 24 for the calculation of NOI and Cash Basis NOI and a reconciliation of net income determined in accordance with GAAP to those

amounts.

As of and For the Three Months Ended December 31, 2017

Key Statistic Consolidated ILPT SIR (excluding ILPT)