united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22655

Northern Lights Fund Trust III

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Ste 450, Cincinatti, Ohio 45246

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2688

Date of fiscal year end: 9/30

Date of reporting period: 9/30/23

Item 1. Reports to Stockholders.

Annual Report

September 30, 2023

Investor Information: 1-855-525-2151

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of The Covered Bridge Fund. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Northern Lights Distributors, LLC

Member FINRA

The Covered Bridge Fund

Annual Shareholder Letter

09/30/2023

Dear Fellow Shareholders,

The 12-month period ended September 30, 2023, was a much better 12-month period for the US equity markets with the S&P 500 returning 21.62%. The Covered Bridge Fund performed as expected in this period and was up 10.96%. The Fund will generally underperform a long only equity strategy in strong markets due to selling away half of the upside on each security to produce income that is then returned to shareholders. This period saw a rapid rise in interest rates which had a negative impact on dividend paying securities relative to growth stocks. This could continue until inflation is perceived to be under control and the yield curve returns to its normal slope with long rates higher than short rates.

This fiscal year saw a progressively narrowing participation in market performance ended September 30, 2023, ultimately being dominated by two sectors: Information Technology and Communication Services. The deviation in market performance accelerated in May of 2023 further differentiating growth stocks from dividend payers. In fact, from May until the end of September 2023, five sectors in the S&P 500 posted negative total returns with Utilities being the hardest hit. The Utilities sector and the Real Estate sector had negative total returns for the fiscal year.

Given the trends in the market, it is of no surprise that Information Technology stocks were among the best performing investments in the Fund with Intel Corporation (2.7%), Oracle Corporation (0.0%), and Microsoft Corporation (0.0%) leading the way. Oracle and Microsoft Corporation have since been sold out of the portfolio. With Utilities and Consumer Staples being among the poorest performing sectors in the market, they were also the poorest performing sectors in the Fund with Dominion Energy Inc. (1.6%) and Walgreens Boots Alliance Inc. (1.9%) representing the weakest names in the portfolio over this period.

While we mentioned this briefly in our Semi-Annual letter, we saw a considerable separation of performance inside the Financial sector primarily among regional banks and money center banks. For example, JPMorgan Chase & Co. (2.4%) was the best performing stock in the Fund over this period compared to Truist Financial Corporation (2.2%) which was one of the worst performing stocks. As mentioned in our Semi-Annual letter, diversification is paramount to portfolio risk management and the main factor for JPMorgan’s outperformance was superior management and leadership.

The Covered Bridge Fund | 651-424-0043 | info@thecoveredbridgefund.com

1

The Fund uses derivatives to primarily generate income and reduce risk. Covered call contracts helped the Fund generate income consistently throughout the fiscal year. At times the Fund will carry a protective put in an effort to decrease volatility. Over this period, the put was a small drag on total return which is to be expected with strong equity performance both in the Fund and the overall market.

Taking a step back, the current market dynamic and structure has found itself at a historic extreme in terms of performance. Going back to 1989, this is one of the largest performance dislocation levels observed as it relates to the Market Cap Weighted Index vs Equal Weight S&P 500. We believe this anomaly will be short-lived and the Fund is well-positioned to take advantage of a change in the current trend.

We remain very encouraged by the opportunity that lies ahead. As inflation continues to come down and the economy slows, we feel that the peak in interest rates is in sight. We believe that once interest rates level off and start to decline, we will see investors start to shift away from a very narrow, growth-oriented environment and return to high quality dividend paying securities. The Fund should continue to benefit from higher rates and the increase in volatility. These factors may allow the Fund to generate greater income from option premiums going forward. In fact, the Fund continues to receive more premium income than it has in the past. The Fund will stick to its discipline of buying what we believe to be good large-capitalization companies that pay above average dividends and overwriting approximately half of each position.

The 12-month period ended September 30, 2023, also marked the 10-year anniversary of the Covered Bridge Fund. Over the past 10 years, the Fund has met its goal of producing income for shareholders through the purchase of large-capitalization dividend paying stocks and writing calls on half of each position. Over the past decade, the Fund has produced an average annual income of $7,500 per $100,000 invested from a combination of dividends, call premiums and capital gains. The Fund has also outperformed the Cboe BuyWrite (BXM) index since its inception. This was achieved in a period that was not always friendly to the type of underlying securities the Fund is based on as growth stocks have been the clear winners over most of this period. That said, we are proud of what we have accomplished and look forward to the next 10 years!

The Covered Bridge Fund | 651-424-0043 | info@thecoveredbridgefund.com

2

Thank you for being a Covered Bridge Fund shareholder.

Sincerely,

John Schonberg, CFA &

Michael Dashner, CFA

| Since | ||||||

| Inception | ||||||

| 3-Month | YTD | 1-Year | 3-Year | 5-Year | 10/1/13 | |

| TCBIX | -2.44% | -2.46% | 10.96% | 11.86% | 4.51% | 6.08% |

| TCBAX | -2.39% | -2.63% | 10.74% | 11.63% | 4.25% | 5.82% |

| TCBAX

With Load |

-7.55% | -7.76% | 4.89% | 9.63% | 3.13% | 5.25% |

| BMX Index | -2.84% | 7.33% | 14.62% | 7.22% | 2.83% | 5.80% |

| Russell 1000 Value Index | -3.17% | 1.79% | 14.44% | 11.05% | 6.23% | 8.37% |

| S&P Index | -3.27% | 13.07% | 21.62% | 10.15% | 9.92% | 11.83% |

Maximum Sales Charge of 5.25%

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed may be worth more or less than their original cost. For performance information current to the most recent month-end, please call 855-525-2151.

There is no assurance that the fund will achieve its investment objectives. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until February 1, 2024, in order to limit the Fund’s expenses to 1.65% and 1.40% for Class A and Class I shares, respectively. Absent this contractual agreement the Fund’s gross total annual operating expenses would be 1.67% for Class A and 1.42% for Class I. Please review the fund’s prospectus for more information regarding the fund’s fees and expenses.

The Covered Bridge Fund | 651-424-0043 | info@thecoveredbridgefund.com

3

Past performance is not indicative of future results. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The data shown is for information purposes only and meant to represent how the fund may be allocated to different types of portfolios.

Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. There is no assurance that the Fund will achieve its investment objectives.

Mutual funds involve risk including the possible loss of principal. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Covered Bridge Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained at www.THECOVEREDBRIDGEFUND.com or by calling +1-855-525-2151. The prospectus should be read carefully before investing.

Important Definitions: The Russell 1000 Index: a subset of the Russell 3000 Index, represents the 1000 top companies by market capitalization in the United States. The BXM: tracks the performance of a hypothetical covered call strategy on the S&P 500 Index. The S&P 500 Index: is an unmanaged composite of 500 large capitalization companies. This index is widely used by professional investors as a performance benchmark for large-cap stocks. The referenced indices are shown for general market comparisons and are not meant to represent the Fund.

The Covered Bridge Fund is distributed by Northern Lights Distributors, LLC member FINRA/SIPC. Stonebridge Capital Advisors, LLC is not affiliated with Northern Lights Distributors, LLC. 7898-NLD 10/30/2023

The Covered Bridge Fund | 651-424-0043 | info@thecoveredbridgefund.com

4

| The Covered Bridge Fund |

| Portfolio Review (Unaudited) |

| September 30, 2023 |

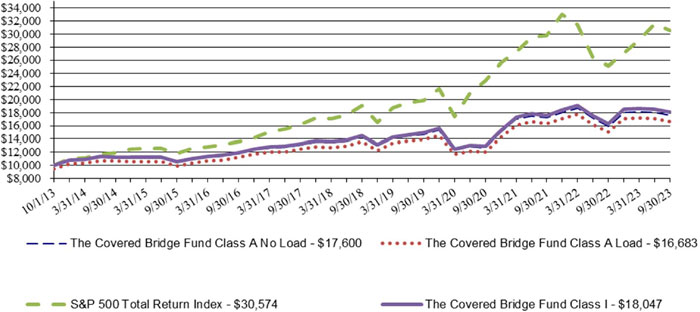

Composition of the change in value of a $10,000 investment

The Fund’s performance figures* for the periods ended September 30, 2023, compared to its benchmark:

| Annualized | ||||||||

| One Year | Five Years | Since Inception * | ||||||

| The Covered Bridge Fund: | ||||||||

| Class A without Load | 10.74% | 4.25% | 5.82% | |||||

| Class A with load | 4.89% | 3.13% | 5.25% | |||||

| Class I | 10.96% | 4.51% | 6.08% | |||||

| S&P 500 Total Return Index ** | 21.62% | 9.92% | 11.83% | |||||

| * | The Fund’s inception date was October 1, 2013. |

| ** | The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark. |

The performance data quoted is historical. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. Total returns would have been lower had the adviser not waived its fees and reimbursed a portion of the Fund’s expenses. Returns for periods greater than one year are annualized. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until February 1, 2024, to ensure that the net annual Fund operating expenses (excluding acquired fund fees and expenses and certain other non-operating expenses) will not exceed 1.65% and 1.40%, respectively for Class A and Class I, subject to possible recoupment from the Fund in future years. The Fund’s total gross annual operating expenses per its prospectus dated February 1, 2023, including underlying funds, are 1.67% for Class A and 1.42% for Class I. Class A shares are subject to a maximum sales charge imposed on purchases of 5.25%. Class A and Class I shares are subject to a redemption fee of 1.00% of the amount redeemed if held less than 90 days. The above performance figures do not reflect the deduction of taxes that a shareholder would have to pay on Fund distributions or the redemption of Fund shares. For performance information current to the most recent month-end, please call 1-855-525-2151.

5

| The Covered Bridge Fund |

| Portfolio Review (Unaudited) (Continued) |

| September 30, 2023 |

Portfolio Composition as of September 30, 2023

| Breakdown by Sector | ||||

| Percent of Net Assets | ||||

| Common Stocks | 90.6 | % | ||

| Financials | 13.5 | % | ||

| Health Care | 12.9 | % | ||

| Technology | 12.9 | % | ||

| Consumer Staples | 11.6 | % | ||

| Materials | 10.0 | % | ||

| Energy | 7.1 | % | ||

| Utilities | 5.6 | % | ||

| Communications | 5.5 | % | ||

| Industrials | 5.5 | % | ||

| Consumer Discretionary | 5.0 | % | ||

| Real Estate | 1.0 | % | ||

| Put Options Purchased | 1.2 | % | ||

| Short-Term Investments | 6.9 | % | ||

| Call Options Written | (0.3 | )% | ||

| Other Assets Less Liabilities | 1.6 | % | ||

| Net Assets | 100.0 | % | ||

| Breakdown by Country | ||||

| Percent of Net Assets | ||||

| Common Stocks | 90.6 | % | ||

| United States | 85.1 | % | ||

| Canada | 2.8 | % | ||

| Ireland | 2.7 | % | ||

| Put Options Purchased | 1.2 | % | ||

| Short-Term Investments | 6.9 | % | ||

| Call Options Written | (0.3 | )% | ||

| Other Assets Less Liabilities | 1.6 | % | ||

| Net Assets | 100.0 | % | ||

See accompanying notes to financial statements.

6

| THE COVERED BRIDGE FUND |

| SCHEDULE OF INVESTMENTS |

| September 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 90.6% | ||||||||

| AEROSPACE & DEFENSE - 2.5% | ||||||||

| 12,000 | Huntington Ingalls Industries, Inc. | $ | 2,454,960 | |||||

| 7,500 | RTX Corporation | 539,775 | ||||||

| 2,994,735 | ||||||||

| APPAREL & TEXTILE PRODUCTS - 1.4% | ||||||||

| 18,000 | NIKE, Inc., Class B | 1,721,160 | ||||||

| ASSET MANAGEMENT - 1.9% | ||||||||

| 3,500 | BlackRock, Inc. (c) | 2,262,715 | ||||||

| BANKING - 10.8% | ||||||||

| 90,000 | Bank of America Corporation | 2,464,200 | ||||||

| 20,000 | JPMorgan Chase & Company^ | 2,900,400 | ||||||

| 90,000 | Truist Financial Corporation^ | 2,574,900 | ||||||

| 90,000 | US Bancorp | 2,975,400 | ||||||

| 45,000 | Wells Fargo & Company(c) | 1,838,700 | ||||||

| 12,753,600 | ||||||||

| BIOTECH & PHARMA - 10.3% | ||||||||

| 50,000 | Bristol-Myers Squibb Company(c) | 2,902,000 | ||||||

| 33,000 | Gilead Sciences, Inc.^ | 2,473,020 | ||||||

| 22,500 | Johnson & Johnson^ | 3,504,375 | ||||||

| 100,000 | Pfizer, Inc.^ | 3,317,000 | ||||||

| 12,196,395 | ||||||||

| CHEMICALS - 8.5% | ||||||||

| 23,100 | Avery Dennison Corporation^(c) | 4,219,677 | ||||||

| 20,000 | CF Industries Holdings, Inc.^ | 1,714,800 | ||||||

| 60,000 | Chemours Company (The) | 1,683,000 | ||||||

| 40,000 | Nutrien Ltd.^ (c) | 2,470,400 | ||||||

| 10,087,877 | ||||||||

| DIVERSIFIED INDUSTRIALS - 1.4% | ||||||||

| 9,000 | Honeywell International, Inc. | 1,662,660 | ||||||

| ELECTRIC UTILITIES - 5.6% | ||||||||

| 40,000 | CenterPoint Energy, Inc. | 1,074,000 | ||||||

| 43,500 | Dominion Energy, Inc. | 1,943,145 | ||||||

See accompanying notes to financial statements.

7

| THE COVERED BRIDGE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 90.6% (Continued) | ||||||||

| ELECTRIC UTILITIES - 5.6% (Continued) | ||||||||

| 20,000 | Duke Energy Corporation | $ | 1,765,200 | |||||

| 28,000 | Sempra Energy | 1,904,840 | ||||||

| 6,687,185 | ||||||||

| FOOD - 4.4% | ||||||||

| 25,000 | General Mills, Inc. | 1,599,750 | ||||||

| 37,500 | Hormel Foods Corporation(c) | 1,426,125 | ||||||

| 65,000 | Kraft Heinz Company (The)^ | 2,186,600 | ||||||

| 5,212,475 | ||||||||

| HOME & OFFICE PRODUCTS - 0.4% | ||||||||

| 50,000 | Newell Brands, Inc. | 451,500 | ||||||

| INSURANCE - 0.8% | ||||||||

| 10,000 | Prudential Financial, Inc. | 948,900 | ||||||

| LEISURE PRODUCTS - 1.4% | ||||||||

| 25,000 | Hasbro, Inc. (c) | 1,653,500 | ||||||

| MEDICAL EQUIPMENT & DEVICES - 2.6% | ||||||||

| 40,000 | Medtronic PLC(c) | 3,134,400 | ||||||

| METALS & MINING - 1.5% | ||||||||

| 60,000 | Barrick Gold Corporation | 873,000 | ||||||

| 25,000 | Newmont Corporation(c) | 923,750 | ||||||

| 1,796,750 | ||||||||

| OIL & GAS PRODUCERS - 7.1% | ||||||||

| 40,000 | Chesapeake Energy Corporation^(c) | 3,449,200 | ||||||

| 16,000 | Chevron Corporation^ | 2,697,920 | ||||||

| 10,000 | EOG Resources, Inc.^ | 1,267,600 | ||||||

| 9,000 | Exxon Mobil Corporation^ | 1,058,220 | ||||||

| 8,472,940 | ||||||||

| RETAIL - CONSUMER STAPLES - 3.5% | ||||||||

| 10,000 | Target Corporation | 1,105,700 | ||||||

| 100,000 | Walgreens Boots Alliance, Inc.^ (c) | 2,224,000 | ||||||

See accompanying notes to financial statements.

8

| THE COVERED BRIDGE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2023 |

| Shares | Fair Value | |||||||

| COMMON STOCKS — 90.6% (Continued) | ||||||||

| RETAIL - CONSUMER STAPLES - 3.5% (Continued) | ||||||||

| 5,000 | Walmart, Inc.^ (c) | $ | 799,650 | |||||

| 4,129,350 | ||||||||

| RETAIL - DISCRETIONARY - 1.8% | ||||||||

| 7,000 | Home Depot, Inc. (The) | 2,115,120 | ||||||

| SEMICONDUCTORS - 6.1% | ||||||||

| 90,000 | Intel Corporation(c) | 3,199,500 | ||||||

| 36,000 | QUALCOMM, Inc.^ (c) | 3,998,160 | ||||||

| 7,197,660 | ||||||||

| TECHNOLOGY HARDWARE - 5.7% | ||||||||

| 30,000 | Cisco Systems, Inc. (c) | 1,612,800 | ||||||

| 90,000 | Juniper Networks, Inc.^ | 2,501,100 | ||||||

| 40,000 | Seagate Technology Holdings PLC^ | 2,638,000 | ||||||

| 6,751,900 | ||||||||

| TECHNOLOGY SERVICES - 1.2% | ||||||||

| 10,100 | International Business Machines Corporation^ | 1,417,030 | ||||||

| TELECOMMUNICATIONS - 5.5% | ||||||||

| 260,000 | AT&T, Inc.^ | 3,905,200 | ||||||

| 81,100 | Verizon Communications, Inc. (c) | 2,628,451 | ||||||

| 6,533,651 | ||||||||

| TIMBER REIT - 1.0% | ||||||||

| 40,000 | Weyerhaeuser Company | 1,226,400 | ||||||

| TOBACCO & CANNABIS - 1.8% | ||||||||

| 50,000 | Altria Group, Inc. | 2,102,500 | ||||||

| TRANSPORTATION & LOGISTICS - 1.6% | ||||||||

| 12,000 | United Parcel Service, Inc., Class B | 1,870,440 | ||||||

| WHOLESALE - CONSUMER STAPLES - 1.8% | ||||||||

| 3,500 | Bunge Ltd.^ | 378,875 | ||||||

| 27,000 | Sysco Corporation | 1,783,350 | ||||||

| 2,162,225 | ||||||||

See accompanying notes to financial statements.

9

| THE COVERED BRIDGE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2023 |

| Shares | Fair Value | |||||||||||||||||

| COMMON STOCKS — 90.6% (Continued) | ||||||||||||||||||

| TOTAL COMMON STOCKS (Cost $128,579,423) | $ | 107,543,068 | ||||||||||||||||

| SHORT-TERM INVESTMENTS — 6.9% | ||||||||||||||||||

| MONEY MARKET FUNDS - 6.9% | ||||||||||||||||||

| 7,701,207 | First American Treasury Obligations Fund, Class X, 5.26%(a)(c) | 7,701,207 | ||||||||||||||||

| 548,310 | JPMorgan US Treasury Plus Money Market Fund, Class L, 5.18%(a) | 548,310 | ||||||||||||||||

| TOTAL MONEY MARKET FUNDS (Cost $8,249,517) | 8,249,517 | |||||||||||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $8,249,517) | 8,249,517 | |||||||||||||||||

| Contracts(b) | Expiration Date | Exercise Price | Notional Value | |||||||||||||||

| EQUITY OPTIONS PURCHASED* - 1.2% | ||||||||||||||||||

| PUT OPTIONS PURCHASED - 1.2% | ||||||||||||||||||

| 1,200 | SPDR S&P 500 ETF Trust | 11/17/2023 | $ | 435 | $ | 51,297,600 | $ | 1,464,000 | ||||||||||

| TOTAL PUT OPTIONS PURCHASED (Cost - $891,203) | ||||||||||||||||||

| TOTAL EQUITY OPTIONS PURCHASED (Cost - $891,203) | 1,464,000 | |||||||||||||||||

| TOTAL INVESTMENTS - 98.7% (Cost $137,720,143) | $ | 117,256,585 | ||||||||||||||||

| CALL OPTIONS WRITTEN - (0.3)% (Premiums Received - $518,617) | (408,360 | ) | ||||||||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES- 1.6% | 1,862,773 | |||||||||||||||||

| NET ASSETS - 100.0% | $ | 118,710,998 | ||||||||||||||||

| Contracts(b) | ||||||||||||||||||

| WRITTEN EQUITY OPTIONS* - (0.3)% | ||||||||||||||||||

| CALL OPTIONS WRITTEN- (0.3)% | ||||||||||||||||||

| 200 | AT&T, Inc. | 10/20/2023 | $ | 15 | $ | 300,400 | $ | 7,000 | ||||||||||

| 81 | Avery Dennison Corporation | 10/20/2023 | 185 | 1,479,627 | 22,883 | |||||||||||||

| 35 | Bunge Ltd. | 10/20/2023 | 110 | 378,875 | 6,300 | |||||||||||||

| 100 | CF Industries Holdings, Inc. | 10/20/2023 | 83 | 857,400 | 47,000 | |||||||||||||

| 200 | Chesapeake Energy Corporation | 10/20/2023 | 85 | 1,724,600 | 57,000 | |||||||||||||

| 80 | Chevron Corporation | 10/20/2023 | 165 | 1,348,960 | 46,000 | |||||||||||||

| 50 | EOG Resources, Inc. | 10/20/2023 | 134 | 633,800 | 5,000 | |||||||||||||

| 45 | Exxon Mobil Corporation | 10/20/2023 | 120 | 529,110 | 7,335 | |||||||||||||

| 125 | Gilead Sciences, Inc. | 10/20/2023 | 75 | 936,750 | 17,500 | |||||||||||||

| 50 | International Business Machines Corporation | 10/20/2023 | 145 | 701,500 | 3,200 | |||||||||||||

| 75 | Johnson & Johnson | 10/20/2023 | 160 | 1,168,125 | 9,600 | |||||||||||||

See accompanying notes to financial statements.

10

| THE COVERED BRIDGE FUND |

| SCHEDULE OF INVESTMENTS (Continued) |

| September 30, 2023 |

| Contracts(b) (continued) | Expiration Date | Exercise Price | Notional Value | Fair Value | ||||||||||||||

| WRITTEN EQUITY OPTIONS* - (0.3)% | ||||||||||||||||||

| CALL OPTIONS WRITTEN- (0.3)% (Continued) | ||||||||||||||||||

| 43 | JPMorgan Chase & Company | 10/20/2023 | $ | 149 | $ | 623,586 | $ | 7,052 | ||||||||||

| 200 | Juniper Networks, Inc. | 10/20/2023 | 28 | 555,800 | 9,000 | |||||||||||||

| 200 | Kraft Heinz Company (The) | 10/20/2023 | 34 | 672,800 | 13,600 | |||||||||||||

| 150 | Nutrien Ltd. | 10/20/2023 | 65 | 926,400 | 9,750 | |||||||||||||

| 250 | Pfizer, Inc. | 10/20/2023 | 34 | 829,250 | 16,250 | |||||||||||||

| 60 | QUALCOMM, Inc. | 10/20/2023 | 113 | 666,360 | 13,440 | |||||||||||||

| 200 | Seagate Technology Holdings plc | 10/20/2023 | 65 | 1,319,000 | 50,200 | |||||||||||||

| 300 | Truist Financial Corporation | 10/20/2023 | 29 | 858,300 | 37,500 | |||||||||||||

| 200 | Walgreens Boots Alliance, Inc. | 10/20/2023 | 23 | 444,800 | 19,600 | |||||||||||||

| 50 | Walmart, Inc. | 10/20/2023 | 165 | 799,650 | 3,150 | |||||||||||||

| TOTAL CALL OPTIONS WRITTEN (Premiums Received - $518,617) | 408,360 | |||||||||||||||||

| TOTAL EQUITY OPTIONS WRITTEN (Premiums Received - $518,617) | $ | 408,360 | ||||||||||||||||

| ETF | - Exchange-Traded Fund |

| LTD | - Limited Company |

| PLC | - Public Limited Company |

| REIT | - Real Estate Investment Trust |

| SPDR | - Standard & Poor’s Depositary Receipt |

| * | Non-income producing security. |

| ^ | Security is subject to written call options. |

| (a) | Rate disclosed is the seven-day effective yield as of September 30, 2023. |

| (b) | Each option contract allows the holder of the option to purchase or sell 100 shares of the underlying security. |

| (c) | All or portion of the security is pledged as collateral for written options. |

See accompanying notes to financial statements.

11

| The Covered Bridge Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| September 30, 2023 |

| Assets: | ||||

| Investments in Securities at Value (cost $137,720,143) | $ | 117,256,585 | ||

| Deposits with Broker for Options Written | 1,879,879 | |||

| Dividend and Interest Receivable | 238,969 | |||

| Prepaid Expenses and Other Assets | 31,227 | |||

| Receivable for Fund Shares Sold | 6,404 | |||

| Total Assets | 119,413,064 | |||

| Liabilities: | ||||

| Options Written, at value (premiums received $518,617) | 408,360 | |||

| Payable for Fund Shares Redeemed | 148,788 | |||

| Investment Advisory Fees Payable | 84,212 | |||

| Payable to Related Parties | 26,437 | |||

| Distribution (12b-1) Fees Payable | 3,309 | |||

| Accrued Expenses and Other Liabilities | 30,960 | |||

| Total Liabilities | 702,066 | |||

| Net Assets | $ | 118,710,998 | ||

| Class A Shares: | ||||

| Net Assets (Unlimited shares of no par value beneficial interest authorized; 1,736,410 shares of beneficial interest outstanding) | $ | 14,874,370 | ||

| Net Asset Value and Redemption Price Per Share (a) | ||||

| ($14,874,370/1,736,410 shares of beneficial interest outstanding) | $ | 8.57 | ||

| Maximum Offering Price Per Share | ||||

| (Maximum sales charge of 5.25%) | $ | 9.04 | ||

| Class I Shares: | ||||

| Net Assets (Unlimited shares of no par value interest authorized; | ||||

| 12,198,721 shares of beneficial interest outstanding) | $ | 103,836,628 | ||

| Net Asset Value, Offering and Redemption Price Per Share (a) | ||||

| ($103,836,628/12,198,721 shares of beneficial interest outstanding) | $ | 8.51 | ||

| Composition of Net Assets: | ||||

| Paid-in-Capital | $ | 137,895,069 | ||

| Accumulated Losses | (19,184,071 | ) | ||

| Net Assets | $ | 118,710,998 |

| (a) | The Fund charges a fee of 1% on redemptions of shares held for less than 90 days. |

See accompanying notes to financial statements.

12

| The Covered Bridge Fund |

| STATEMENT OF OPERATIONS |

| For the Year Ended September 30, 2023 |

| Investment Income: | ||||

| Dividend Income (Less $16,778 Foreign Taxes) | $ | 4,046,986 | ||

| Interest Income | 218,750 | |||

| Total Investment Income | 4,265,736 | |||

| Expenses: | ||||

| Investment Advisory Fees | 1,244,194 | |||

| Administration Fees | 169,662 | |||

| Third Party Administrative Servicing Fees | 80,032 | |||

| Interest Expense | 79,956 | |||

| Transfer Agent Fees | 72,666 | |||

| Registration & Filing Fees | 58,001 | |||

| Fund Accounting Fees | 52,447 | |||

| Distribution (12b-1) Fees - Class A | 43,987 | |||

| Chief Compliance Officer Fees | 24,809 | |||

| Legal Fees | 21,091 | |||

| Audit Fees | 18,002 | |||

| Custody Fees | 15,841 | |||

| Trustees’ Fees | 15,199 | |||

| Printing Expense | 14,555 | |||

| Insurance Expense | 3,701 | |||

| Miscellaneous Expenses | 5,372 | |||

| Total Expenses | 1,919,515 | |||

| Less: Fee Waived by Adviser | (53,193 | ) | ||

| Net Expenses | 1,866,322 | |||

| Net Investment Income | 2,399,414 | |||

| Net Realized and Unrealized Gain (Loss) on Investments: | ||||

| Net Realized Gain on: | ||||

| Investments and Options Purchased | 736,055 | |||

| Options Written | 7,091,155 | |||

| Total Net Realized Gain | 7,827,210 | |||

| Net Change in Unrealized Appreciation (Depreciation) on: | ||||

| Investments and Options Purchased | 1,430,364 | |||

| Options Written | (41,787 | ) | ||

| Foreign Currency Translations | 23 | |||

| Total Net Change in Unrealized Appreciation | 1,388,600 | |||

| Net Realized and Unrealized Gain on Investments | 9,215,810 | |||

| Net Increase in Net Assets Resulting From Operations | $ | 11,615,224 |

See accompanying notes to financial statements.

13

| The Covered Bridge Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| September 30, 2023 | September 30, 2022 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 2,399,414 | $ | 1,587,201 | ||||

| Net Realized Gain | 7,827,210 | 8,505,705 | ||||||

| Net Change in Unrealized Appreciation (Depreciation) | 1,388,600 | (19,140,987 | ) | |||||

| Net Increase (Decrease) in Net Assets Resulting From Operations | 11,615,224 | (9,048,081 | ) | |||||

| Distributions to Shareholders From: | ||||||||

| Distributable Earnings | ||||||||

| Class A ($0.77 and $0.72, respectively) | (1,464,397 | ) | (1,188,634 | ) | ||||

| Class I ($0.79 and $0.74, respectively) | (9,219,820 | ) | (7,365,604 | ) | ||||

| Net Decrease in Net Assets From Distributions to Shareholders | (10,684,217 | ) | (8,554,238 | ) | ||||

| Capital Share Transactions: | ||||||||

| Class A | ||||||||

| Proceeds from Shares Issued (467,561 and 206,877 shares, respectively) | 4,316,976 | 2,016,099 | ||||||

| Distributions Reinvested (160,119 and 122,985 shares, respectively) | 1,440,691 | 1,166,539 | ||||||

| Redemption Fee Proceeds | 768 | 282 | ||||||

| Cost of Shares Redeemed (640,619 and 211,273 shares, respectively) | (5,782,715 | ) | (2,057,135 | ) | ||||

| Total Class A | (24,280 | ) | 1,125,785 | |||||

| Class I | ||||||||

| Proceeds from Shares Issued (2,236,849 and 2,488,148 shares, respectively) | 20,540,795 | 24,584,609 | ||||||

| Distributions Reinvested (831,602 and 616,714 shares, respectively) | 7,415,124 | 5,797,694 | ||||||

| Redemption Fee Proceeds | 4,676 | 1,653 | ||||||

| Cost of Shares Redeemed (1,746,997 and 1,376,620 shares, respectively) | (15,950,206 | ) | (13,474,313 | ) | ||||

| Total Class I | 12,010,389 | 16,909,643 | ||||||

| Net Increase in Net Assets from Capital Share Transactions | 11,986,109 | 18,035,428 | ||||||

| Total Increase in Net Assets | 12,917,116 | 433,109 | ||||||

| Net Assets: | ||||||||

| Beginning of Year | 105,793,882 | 105,360,773 | ||||||

| End of Year | $ | 118,710,998 | $ | 105,793,882 | ||||

See accompanying notes to financial statements.

14

| The Covered Bridge Fund - Class A |

| FINANCIAL HIGHLIGHTS |

Per share data and ratios for a share of beneficial interest throughout each year presented.

| For the Year | For the Year | For the Year | For the Year | For the Year | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2021 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 8.42 | $ | 9.82 | $ | 7.71 | $ | 9.48 | $ | 10.60 | ||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||

| Net investment income (1) | 0.16 | 0.12 | 0.12 | 0.13 | 0.16 | |||||||||||||||

| Net realized and unrealized gain (loss) on Investments | 0.76 | (0.80 | ) | 2.64 | (1.40 | ) | 0.03 | |||||||||||||

| Total from operations | 0.92 | (0.68 | ) | 2.76 | (1.27 | ) | 0.19 | |||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.15 | ) | (0.12 | ) | (0.11 | ) | (0.09 | ) | (0.16 | ) | ||||||||||

| From net realized gain | (0.62 | ) | (0.60 | ) | (0.54 | ) | (0.30 | ) | (1.15 | ) | ||||||||||

| From return of capital | — | — | — | (0.11 | ) | — | ||||||||||||||

| Total Distributions | (0.77 | ) | (0.72 | ) | (0.65 | ) | (0.50 | ) | (1.31 | ) | ||||||||||

| Paid in capital from redemption fees (1), (3) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net Asset Value, End of Year | $ | 8.57 | $ | 8.42 | $ | 9.82 | $ | 7.71 | $ | 9.48 | ||||||||||

| Total Return (2) | 10.74 | % | (7.61 | )% | 35.96 | % | (13.71 | )% | 2.58 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 14,874 | $ | 14,730 | $ | 16,009 | $ | 11,313 | $ | 14,822 | ||||||||||

| Ratio of expenses to average net assets: | ||||||||||||||||||||

| before reimbursement (4) | 1.76 | % | 1.67 | % | 1.73 | % | 1.79 | % | 1.79 | % | ||||||||||

| net of reimbursement | 1.71 | % | 1.67 | % | 1.69 | % | 1.70 | % | 1.75 | % | ||||||||||

| Ratio of expenses to average net assets, excluding interest expense: | ||||||||||||||||||||

| before reimbursement (4) | 1.70 | % | 1.65 | % | 1.69 | % | 1.74 | % | 1.69 | % | ||||||||||

| net of reimbursement | 1.65 | % | 1.65 | % | 1.65 | % | 1.65 | % | 1.65 | % | ||||||||||

| Ratio of net investment income to average net assets | 1.74 | % | 1.18 | % | 1.20 | % | 1.49 | % | 1.72 | % | ||||||||||

| Portfolio turnover rate | 154 | % | 147 | % | 232 | % | 204 | % | 159 | % | ||||||||||

| (1) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and exclude the effect of sales loads and redemptions fees. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. |

| (3) | Amount is less than $.01 per share. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the adviser. |

See accompanying notes to financial statements.

15

| The Covered Bridge Fund - Class I |

| FINANCIAL HIGHLIGHTS |

Per share data and ratios for a share of beneficial interest throughout each year presented.

| For the Year | For the Year | For the Year | For the Year | For the Year | ||||||||||||||||

| Ended | Ended | Ended | Ended | Ended | ||||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2021 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 8.37 | $ | 9.77 | $ | 7.68 | $ | 9.44 | $ | 10.56 | ||||||||||

| Increase (Decrease) From Operations: | ||||||||||||||||||||

| Net investment income (1) | 0.18 | 0.14 | 0.14 | 0.15 | 0.19 | |||||||||||||||

| Net realized and unrealized gain (loss) on Investments | 0.75 | (0.80 | ) | 2.63 | (1.38 | ) | 0.02 | |||||||||||||

| Total from operations | 0.93 | (0.66 | ) | 2.77 | (1.23 | ) | 0.21 | |||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From net investment income | (0.17 | ) | (0.14 | ) | (0.14 | ) | (0.12 | ) | (0.18 | ) | ||||||||||

| From net realized gain | (0.62 | ) | (0.60 | ) | (0.54 | ) | (0.30 | ) | (1.15 | ) | ||||||||||

| From return of capital | — | — | — | (0.11 | ) | — | ||||||||||||||

| Total Distributions | (0.79 | ) | (0.74 | ) | (0.68 | ) | (0.53 | ) | (1.33 | ) | ||||||||||

| Paid in capital from redemption fees (1), (3) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||||||||||

| Net Asset Value, End of Year | $ | 8.51 | $ | 8.37 | $ | 9.77 | $ | 7.68 | $ | 9.44 | ||||||||||

| Total Return (2) | 10.96 | % | (7.40 | )% | 36.23 | % | (13.42 | )% | 2.86 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net assets, end of year (in 000’s) | $ | 103,837 | $ | 91,064 | $ | 89,352 | $ | 70,696 | $ | 73,296 | ||||||||||

| Ratio of expenses to average net assets: | ||||||||||||||||||||

| before reimbursement (4) | 1.51 | % | 1.42 | % | 1.48 | % | 1.54 | % | 1.54 | % | ||||||||||

| net of reimbursement | 1.46 | % | 1.42 | % | 1.44 | % | 1.45 | % | 1.50 | % | ||||||||||

| Ratio of expenses to average net assets, excluding interest expense: | ||||||||||||||||||||

| before reimbursement (4) | 1.45 | % | 1.40 | % | 1.44 | % | 1.49 | % | 1.44 | % | ||||||||||

| net of reimbursement | 1.40 | % | 1.40 | % | 1.40 | % | 1.40 | % | 1.40 | % | ||||||||||

| Ratio of net investment income to average net assets | 1.99 | % | 1.43 | % | 1.46 | % | 1.74 | % | 1.97 | % | ||||||||||

| Portfolio turnover rate | 154 | % | 147 | % | 232 | % | 204 | % | 159 | % | ||||||||||

| (1) | Per share amounts are calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (2) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and exclude the effect of redemptions fees. Had the adviser not absorbed a portion of Fund expenses, total returns would have been lower. |

| (3) | Amount is less than $.01 per share. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the adviser. |

See accompanying notes to financial statements.

16

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS |

| September 30, 2023 |

| 1. | ORGANIZATION |

The Covered Bridge Fund (the “Fund”) is a diversified series of shares of beneficial interest of Northern Lights Fund Trust III (the “Trust”), a Delaware statutory trust organized on December 5, 2011 and registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The investment objective of the Fund is to seek current income and realized gains from writing options with capital appreciation as a secondary objective. The Fund commenced operations on October 1, 2013.

The Fund currently offers Class A and Class I shares. Class A shares are offered at net asset value plus a maximum sales charge of 5.25%. Class I shares are offered at net asset value. The Fund charges a fee of 1% on redemptions of shares held for less than 90 days. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the year. Actual results could differ from those estimates. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services Investment Companies” including FASB Accounting Standards Update (“ASU”) No. 2013-08.

Security Valuation – The Fund’s securities are valued at the last sale price on the exchange in which such securities are primarily traded, as of the close of business on the day the securities are being valued. In the absence of a sale on the primary exchange, a security shall be valued at the mean between the current bid and ask prices on the day of valuation. NASDAQ traded securities are valued using the NASDAQ Official Closing Price (“NOCP”). Exchange traded options are valued at the last sale price, or, in the absence of a sale, at the mean between the current bid and ask prices. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

Securities for which current market quotations are not readily available or for which quotations are not deemed to be representative of market values are valued at fair value as determined in good faith by or under the direction of the Trust’s Board of Trustees (the “Board”) in accordance with the Trust’s Portfolio Securities Valuation Procedures (the “Procedures”). The Procedures consider the following factors, among others, to determine a security’s fair value: the nature and pricing history (if any) of the security; whether any dealer quotations for the security are available; and possible valuation methodologies that could be used to determine the fair value of the security.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these procedures to the adviser as its valuation designee (the “Valuation Designee”). The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, which approval shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

Fair Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures established by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and

17

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine, the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following tables summarize the inputs used as of September 30, 2023 for the Fund’s assets and liabilities measured at fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 107,543,068 | $ | — | $ | — | $ | 107,543,068 | ||||||||

| Short-Term Investments | 8,249,517 | — | — | 8,249,517 | ||||||||||||

| Put Options Purchased | 1,464,000 | — | — | 1,464,000 | ||||||||||||

| Total | $ | 117,256,585 | $ | — | $ | — | $ | 117,256,585 | ||||||||

| Liabilities | ||||||||||||||||

| Call Options Written | (408,360 | ) | — | — | (408,360 | ) | ||||||||||

| Total | $ | (408,360 | ) | $ | — | $ | — | $ | (408,360 | ) | ||||||

The Fund did not hold any Level 3 securities during the year ended September 30, 2023.

| * | Please refer to the Schedule of Investments for Industry Classification. |

18

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

Foreign Currency Translations – The books and records of the Fund are maintained in US dollars. The market values of securities which are not traded in US currency are recorded in the financial statements after translation to US dollars based on the applicable exchange rates at the end of the period. The costs of such securities are translated at exchange rates prevailing when acquired. Related interest, dividends and withholding taxes are accrued at the rates of exchange prevailing on the respective dates of such transactions.

Net realized gains and losses on foreign currency transactions represent net gains and losses from currency realized between the trade and settlement dates on securities transactions and the difference between income accrued versus income received. The effect of changes in foreign currency exchange rates on investments in securities are included with the net realized and unrealized gain or loss on investment securities.

Option Transactions – The Fund is subject to equity price risk in the normal course of pursuing its investment objective and may purchase or sell options to help hedge against risk. When the Fund writes a call option, an amount equal to the premium received is included in the statement of assets and liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current market value of the option. If an option expires on its stipulated expiration date or if the Fund enters into a closing purchase transaction, a gain or loss is realized. If a written call option is exercised, a gain or loss is realized for the sale of the underlying security and the proceeds from the sale are increased by the premium originally received. As writer of an option, the Fund has no control over whether the option will be exercised and, as a result, retains the market risk of an unfavorable change in the price of the security underlying the written option.

The Fund may purchase put and call options. Put options are purchased to hedge against a decline in the value of securities held in the Fund’s portfolio. If such a decline occurs, the put options will permit the Fund to sell the securities underlying such options at the exercise price, or to close out the options at a profit. The premium paid for a put or call option plus any transaction costs will reduce the benefit, if any, realized by the Fund upon exercise of the option, and, unless the price of the underlying security rises or declines sufficiently, the option may expire worthless to the Fund. In addition, in the event that the price of the security in connection with which an option was purchased moves in a direction favorable to the Fund, the benefits realized by the Fund as a result of such favorable movement will be reduced by the amount of the premium paid for the option and related transaction costs. Written and purchased options are non-income producing securities. With purchased options, there is minimal counterparty risk to the Fund since these options are exchange traded and the exchange’s clearinghouse, as counterparty to all exchange traded options, guarantees against a possible default.

The notional value of the derivative instruments outstanding as of September 30, 2023 as disclosed in the Schedule of Investments and the amounts realized and changes in unrealized gains and losses on derivative instruments during the period as disclosed within the Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

Impact of Derivatives on the Statement of Assets and Liabilities and Statement of Operations – The following is a summary of the location of derivative investments on the Fund’s Statement of Assets and Liabilities as of September 30, 2023:

| Derivative Investments | Location on the Statement of Assets and | |||||||

| Type | Risk | Liabilities | Amount | |||||

| Options Purchased | Equity | Investments in Securities at Value | $ | 1,464,000 | ||||

| Options Written | Equity | Options Written, at value | (408,360 | ) | ||||

The following is a summary of the location of derivative investments in the Fund’s Statement of Operations for the year ended September 30, 2023:

| Derivative | ||||||||

| Investments Type | Risk | Location of Gain/Loss on Derivative | Amount | |||||

| Options Purchased | Equity | Net Realized Gain on Investments and Options Purchased | $ | (2,636,411 | ) | |||

| Options Written | Equity | Net Realized Gain on Options Written | 7,091,155 | |||||

| Options Purchased | Equity | Net Change in Unrealized Depreciation on Investments and Options Purchased | 1,818,706 | |||||

| Options Written | Equity | Net Change in Unrealized Depreciation on Options Written | (41,787 | ) | ||||

19

The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Expenses – Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses that are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust.

Federal Income Taxes – The Fund complies with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute all of its taxable income, if any, to shareholders. Accordingly, no provision for federal income taxes is required in the financial statements. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended September 30, 2020 – September 30, 2022, or expected to be taken in the Fund’s September 30, 2023 tax returns. The Fund identifies its major tax jurisdictions as U.S. federal, Ohio and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid quarterly, and distributions from net realized capital gains, if any, are declared and paid annually. Dividends and distributions to shareholders are recorded on the ex-dividend date. Dividends from net investment income and distributions from net realized gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (e.g. deferred losses) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Fund.

Indemnification – The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3. | CASH – CONCENTRATION IN UNINSURED ACCOUNT |

For cash management purposes, the Fund may concentrate cash with the Fund’s custodian. As of September 30, 2023, the Fund held $0 in cash at U.S. Bank, N.A. and $1,879,879 in cash at Interactive Brokers.

| 4. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Advisory Fees – Stonebridge Capital Advisors, LLC serves as the Fund’s investment adviser (the “Adviser”). Pursuant to an investment advisory agreement with the Trust on behalf of the Fund, the Adviser, under the oversight of the Board, directs the daily operations of the Fund and supervises the performance of administrative and professional services provided by others. As compensation for this service and the related expenses borne by the Adviser, the Fund pays the Adviser a management fee, computed and accrued daily and paid monthly, at an annual rate of 1.00% of the average daily net assets. For the year ended September 30, 2023, the Adviser earned management fees of $1,244,194.

The Adviser has contractually agreed to waive all or part of its management fees and/or make payments to limit Fund expenses (exclusive of any front-end or contingent deferred loads; brokerage fees and commissions; acquired fund fees and expenses; borrowing costs (such as interest and dividend expense on securities sold short); taxes; and extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual and indemnification of Fund service providers (other than the Adviser))) at least until February 1, 2024, so that the total annual operating expenses of the Fund do not exceed 1.65% and

20

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

1.40% of the average daily net assets for its Class A and Class I shares, respectively. Contractual waivers and expense payments may be recouped by the Adviser from the Fund, to the extent that overall expenses fall below the lesser of the expense limitation then in place or in place at time of waiver, within three years of when the amounts were waived. During the year ended September 30, 2023, the Adviser waived $53,193 in fees pursuant to its contractual agreement.

As of September 30, 2023, the following amounts are subject to recapture by the Adviser by September 30 of the following years:

| 2024 | 2025 | 2026 | Total | |||||||||||

| $ | 42,633 | $ | — | $ | 53,193 | $ | 95,826 | |||||||

Distributor – The distributor of the Fund is Northern Lights Distributors, LLC (“NLD” or the “Distributor”). The Trust, with respect to the Fund, has adopted the Trust’s Master Distribution and Shareholder Servicing Plan for the Fund’s Class A shares (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act, to pay for certain distribution activities and shareholder services. The Plan provides a monthly service and/or distribution fee that is calculated by the Fund at an annual rate of 0.25% of the average daily net assets of Class A shares. For the year ended September 30, 2023, pursuant to the Plan, the Fund paid $43,987. No such fees are payable with respect to Class I shares.

The Distributor acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s Class A shares. For the year ended September 30, 2023, the Distributor received $135,597 in underwriting commissions for sales of Class A shares, of which $21,906 was retained by the principal underwriter or other affiliated broker-dealers.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus Fund Solutions, LLC (“UFS”) – UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to separate servicing agreements with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers of UFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

| 5. | INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the year ended September 30, 2023, amounted to $182,276,351 and $175,505,603, respectively.

| 6. | REDEMPTION FEES |

The Fund may assess a short-term redemption fee of 1.00% of the total redemption amount if a shareholder sells their shares after holding them for less than 90 days. The Fund received redemption fees of $5,444 and $1,935, for the year ended September 30, 2023, and the year ended September 30, 2022, respectively.

21

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

| 7. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

The identified cost of investments in securities owned by the Fund for federal income tax purposes and its respective gross unrealized appreciation and depreciation at September 30, 2023, were as follows:

| Gross Unrealized | Gross Unrealized | Net Unrealized | ||||||||||||

| Tax Cost | Appreciation | (Depreciation) | (Depreciation) | |||||||||||

| $ | 137,454,392 | $ | 1,309,434 | $ | (21,915,601 | ) | $ | (20,606,167 | ) | |||||

| 8. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of distributions paid during the fiscal years ended September 30, 2023 and September 30, 2022 were as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| September 30, 2023 | September 30, 2022 | |||||||

| Ordinary Income | $ | 10,684,217 | $ | 8,554,238 | ||||

| $ | 10,684,217 | $ | 8,554,238 | |||||

As of September 30, 2023, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Other | Unrealized | Total | ||||||||||||||||||||

| Ordinary | Long-Term | and | Carry | Book/Tax | Appreciation/ | Distributable Earnings/ | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | (Depreciation) | (Accumulated Deficit) | ||||||||||||||||||||

| $ | 1,423,040 | $ | — | $ | — | $ | — | $ | (828 | ) | $ | (20,606,283 | ) | $ | (19,184,071 | ) | ||||||||||

The difference between book basis and tax basis accumulated net realized losses and unrealized depreciation from investments is primarily attributable to the tax deferral of losses on wash sales. In addition, the amount listed under other book/tax differences is primarily attributable to the tax deferral of losses on straddles.

During the fiscal year ended September 30, 2023, the Fund utilized tax equalization which is the use of earnings and profits distributions to shareholders on redemption of shares as part of the dividends paid deduction for income tax purposes. Permanent book and tax differences, primarily attributable to tax adjustments for use of tax equalization credits and adjustments for prior year tax returns, resulted in reclassifications for the Fund for the fiscal year ended September 30, 2023, as follows:

| Paid | ||||||

| In | Accumulated | |||||

| Capital | Deficit | |||||

| $ | 353,857 | $ | (353,857 | ) | ||

| 9. | CONTROL OWNERSHIP |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. As of September 30, 2023, Charles Schwab & Co, Inc. and Pershing LLC, accounts holding shares for the benefit of others in nominee name, held approximately 53% and 25%, respectively, of the voting securities of the Fund. The Fund has no knowledge as to whether any beneficial owner included in these nominee accounts holds more than 25% of the voting shares of either class.

22

| The Covered Bridge Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| September 30, 2023 |

| 10. | RECENT REGULATORY UPDATES |

On January 24, 2023, the SEC adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will not appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

| 11. | SUBSEQUENT EVENTS |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

23

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of The Covered Bridge Fund and Board of Trustees of Northern Lights Fund Trust III

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Covered Bridge Fund (the “Fund”), a series of Northern Lights Fund Trust III, as of September 30, 2023, the related statements of operations and changes in net assets, the related notes, and the financial highlights for the year then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2023, the results of its operations, changes in net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial statements and financial highlights for the years ended September 30, 2022 and prior, were audited by other auditors whose report dated November 28, 2022, expressed an unqualified opinion on those financial statements and financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2023, by correspondence with the custodian and brokers. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditors of the Fund since 2023.

COHEN & COMPANY, LTD.

Cleveland, Ohio

November 29, 2023

COHEN & COMPANY, LTD.

800.229.1099 | 866.818.4538 fax | cohencpa.com

Registered with the Public Company Accounting Oversight Board

24

| The Covered Bridge Fund |

| DISCLOSURE OF FUND EXPENSES (Unaudited) |

| September 30, 2023 |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as sales charges and redemption fees; and (2) ongoing costs, including management fees; distribution and/or shareholder servicing fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period beginning April 1, 2023 through September 30, 2023.

Actual Expenses

The “Actual” lines in the table below provide information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The “Hypothetical” lines in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or redemption fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending Account | Expenses Paid | ||||

| Account Value | Value | During Period | ||||

| (4/1/23) | (9/30/23) | (4/1/23 to 9/30/23)* | ||||

| Actual | ||||||

| Class A | $1,000.00 | $968.70 | $8.29 | |||

| Class I | $1,000.00 | $969.80 | $7.11 | |||

| Hypothetical | ||||||

| (5% return before expenses) | ||||||

| Class A | $1,000.00 | $1,016.65 | $8.49 | |||

| Class I | $1,000.00 | $1,017.85 | $7.28 |

| * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratios of 1.68% and 1.44% for Class A and Class I, respectively, multiplied by the number of days in the period (183) divided by the number of days in the fiscal year (365). |

25

LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

The Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources.

During the fiscal year ended September 30, 2023, the Trust’s Liquidity Risk Management Program Committee (the “Committee”) reviewed the Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. Accordingly, the Committee concluded that (i) the Fund’s liquidity risk management program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program has been effectively implemented.

26

| The Covered Bridge Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| September 30, 2023 |

The Trustees and officers of the Trust, together with information as to their principal business occupations during the past five years and other information, are shown below. Unless otherwise noted, the address of each Trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

| Independent Trustees | |||||

| Name, Address, Year of Birth |

Position(s) Held with Registrant |

Length

of Service and Term |

Principal

Occupation(s) During Past 5 Years |

Number

of Funds Overseen In The Fund Complex* |

Other

Directorships Held During Past 5 Years** |

| Patricia

Luscombe 1961 |

Trustee | Since January 2015, Indefinite | Managing Director of the Valuations and Opinions Group, Lincoln International LLC (since August 2007). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2015); Monetta Mutual Funds (since November 2015). |

| John

V. Palancia 1954 |

Trustee, Chairman | Trustee, since February 2012, Indefinite; Chairman of the Board since May 2014. | Retired (since 2011); formerly, Director of Global Futures Operations Control, Merrill Lynch, Pierce, Fenner & Smith, Inc. (1975-2011). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2012); Northern Lights Fund Trust (since 2011); Northern Lights Variable Trust (since 2011); Alternative Strategies Fund (since 2012). |

| Mark

H. Taylor 1964 |

Trustee, Chairman of the Audit Committee | Since February 2012, Indefinite | PhD (Accounting), CPA; Professor and Director, Lynn Pippenger School of Accountancy, Muma College of Business, University of South Florida (2019 – present); Professor and Department of Accountancy Chair, Case Western Reserve University (2009-2019); President, American Accounting Association (AAA) commencing August 2022 (President- Elect 2022-2023, President 2023-2024; Past President 2024-2025). AAA Vice President-Finance (2017-2020); President, Auditing Section of the AAA; Member, AICPA Auditing Standards Board (2009-2012); Academic Fellow, Office of the Chief Accountant, United States Securities Exchange Commission (2005-2006); Center for Audit Quality research grants (2014, 2012). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2012); Northern Lights Fund Trust (since 2007); Northern Lights Variable Trust (since 2007); Alternative Strategies Fund (since June 2010). |

| Jeffery

D. Young 1956 |

Trustee | Since January 2015, Indefinite | Co-owner and Vice President, Latin America Agriculture Development Corp. (since May 2015); President, Celeritas Rail Consulting (since June 2014); Asst. Vice President - Transportation Systems, Union Pacific Railroad Company (June 1976 to April 2014). | 1 | Northern Lights Fund Trust III (for series not affiliated with the Fund since 2015). |

| * | As of September 30, 2023, the Trust was comprised of 29 active portfolios managed by 14 unaffiliated investment advisers. The term “Fund Complex” applies only to the Fund. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series. |

| ** | Only includes directorships held within the past 5 years in a company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 or subject to the requirements of Section 15(d) of the Securities Exchange Act of 1934, or any company registered as an investment company under the 1940 Act. |

9/30/23-NLFT III-v1

27

| The Covered Bridge Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) (Continued) |

| September 30, 2023 |

Officers of the Trust

| Name,

Address, Year of Birth |

Position(s)

Held with Registrant |

Length

of Service and Term |

Principal Occupation(s) During Past 5 Years |

| Brian

Curley 1970 |

President | Since May 2023, indefinite | Vice President, Ultimus Fund Solutions, LLC (since 2020); Vice President, Gemini Fund Services, LLC (2015-2020). |

| Timothy

Burdick 1986 |

Vice President | Since May 2023, indefinite | Vice President and Senior Managing Counsel, Ultimus Fund Solutions, LLC (2023 – present); Vice President and Managing Counsel, Ultimus Fund Solutions, LLC (2022 – 2023); Assistant Vice President and Counsel, Ultimus Fund Solutions, LLC (2019 – 2022). |

| Richard

Gleason 1977 |