| OMB APPROVAL | ||

| OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response. . . 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22646

PRIVATE ADVISORS ALTERNATIVE STRATEGIES MASTER FUND

(Exact name of Registrant as specified in charter)

51 Madison Avenue, New York, NY 10010

(Address of principal executive offices) (Zip code)

J. Kevin Gao, Esq.

169 Lackawanna Avenue

Parsippany, New Jersey 07054

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 576-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2013

| Item 1. | Reports to Stockholders. |

Private Advisors Alternative Strategies Master Fund

Annual Report

March 31, 2013

This page intentionally left blank

Portfolio Management Discussion and Analysis (Unaudited)

Dear Investors and Friends:

From the Fund’s inception on May 1, 2012, through March 31, 2013, Private Advisors Alternative Strategies Master Fund (“Master Fund”) returned 7.32%. Private Advisors Alternative Strategies Fund (“Feeder Fund”) returned 6.69%, excluding all sales charges. See page 6 for Feeder Fund returns with applicable sales charges. The Master Fund outperformed the 5.48% return of the HFRI Fund of Funds Diversified Index1 and underperformed the 14.68% return of the S&P 500® Index.2

The Private Advisors Alternative Strategies Fund is a “feeder” fund in what is known in the investment company industry as a master-feeder structure. The Feeder Fund invests substantially all of its assets, net of reserves maintained for reasonably anticipated expenses, in the Master Fund. The Master Fund, which has the same investment objective as the Feeder Fund, seeks to achieve its investment objective by investing principally in private investment funds or “hedge funds” managed by third-party portfolio managers who employ diverse styles and strategies.

Fund Performance Summary

We are pleased with the Master Fund’s relative and absolute performance during its first 11 months, as it gained 7.32% and outperformed the HFRI Fund of Funds Diversified Index by nearly 180 basis points. The Master Fund also captured nearly 50% of the return of the S&P 500® Index during a very strong period for equities. March 2013 marked the ninth consecutive month of positive returns for the Master Fund, and it maintained a standard deviation of about one-third of that of the S&P 500® Index. Only four of our 28 managers posted losses for the period from May 2012 through March 2013. We are pleased with the Master Fund’s ability to achieve consistent, positive returns for nine consecutive months and minimize volatility.

The Master Fund has enjoyed strong returns since inception, although not surprisingly, it trailed the S&P 500® Index, which has nearly doubled since the beginning of 2009. Given our hedged approach, we do not expect that the Master Fund will keep pace with a stock market rally of this magnitude. Nonetheless, we continue to deliver outperformance since inception versus the HFRI Fund of Funds Diversified Index by limiting downside during market corrections.

Investment Commentary

U.S. equities, as measured by the S&P 500® Index, enjoyed a very strong start to the year, and unlike 2012’s stealth rally when many investors were still sitting on the sidelines in the aftermath of 2008, more investors actively participated in the first quarter 2013 rally. U.S. equities outperformed non-U.S. equity indices, as

measured by the MSCI EAFE® Index,3 by a substantial margin (roughly 550 basis points) in the first quarter, after trailing non-U.S. equity indices by roughly 700 basis points during the fourth quarter of 2012. Since May 2012, the MSCI EAFE® Index has slightly trailed the S&P 500® Index by 13.9% to 14.7%.

U.S. consumers continue to spend in spite of fears of a retrenching because of the increase in payroll taxes, sequestration-related spending cuts and high gasoline prices. Consumer spending was propelled by better employment prospects, sharp increases in home prices and a better performing stock market and the related beneficial wealth effect. Consumers also reacted favorably to the continually accommodative Federal Reserve, progress in Washington D.C. concerning the avoidance of the “fiscal cliff” and the ongoing economic recovery. The easy monetary policy of some of the primary central banks across the globe is prompting many investors to increase their risk appetite, with consequences unknown.

From May 2012 to March 2013, the U.S. 10-year Treasury yield fell from 1.98% to 1.87%. Corporate fundamentals, such as earnings growth and balance sheet strength, remained healthy, but yields were not particularly attractive for fixed-income instruments. The BofA Merrill Lynch Corporate Master Index4 finished March 2013 with an effective yield of 2.8%.

Fixed-income investors continued their reach for yield, while taking on more risk in non-investment grade credits. This was evident in the returns of the BofA Merrill Lynch High Yield Master II Index5 which rose 12.0% during the reporting period. Bond issuance continued to be driven by a healthy demand in these non-investment grade markets. In fact, according to Barclays, the high-yield primary market had its best first quarter on record as global high-yield issuance hit more than $100 billion, which is an increase of almost 6% from the same period in 2012. Investors continued to allocate capital to higher risk bonds in spite of strained valuations and signs that these asset classes are overbought. The outlook for high yield is becoming even more concerning as average yields linger at lows and prices and issuance remain at record highs, as both factors limit the potential for future returns.

Outside the United States, fixed-income markets struggled for the second straight quarter as measured in U.S. dollar terms (due to relative strengthening in U.S. currency). Euro zone economic data remained weak. Political turmoil, resulting from inconclusive elections in Italy and allegations of corruption against the Prime Minister in Spain, took a toll on European markets. Further, the banking crisis in Cyprus and subsequent bailout reminded investors of the continued instability of debt

| 1. | See footnote on page 6 for more information on the HFRI Fund of Funds Diversified Index. |

| 2. | See footnote on page 6 for more information on the S&P 500® Index. |

| 3. | The MSCI EAFE® Index consists of international stocks representing the developed world outside of North America. Results assume reinvestment of all income and capital gains. An investment cannot be made directly in an index. |

| 4. | The BofA Merrill Lynch Corporate Master Index is a market-value-weighted index composed of domestic corporate (BBB/Baa rated or better) debt issues. The BofA Merrill Lynch Corporate Master Index is a component of the BofA Merrill Lynch Corporate/Government Master Index. An investment cannot be made directly in an index. |

| 5. | The BofA Merrill Lynch High Yield Master II Index monitors the performance of below investment-grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. An investment cannot be made directly in an index. |

| mainstayinvestments.com/privateadvisors | 3 |

| 4 | Private Advisors Funds |

| mainstayinvestments.com/privateadvisors | 5 |

The opinions expressed are those of the portfolio managers as of the date of this report and are subject to change. There is no guarantee that any forecast made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment.

Investment and Performance Comparison1 (Unaudited)

Performance data quoted represents past performance. Past performance is no guarantee of future results. Because of market volatility, current performance may be lower or higher than the figures shown. Index performance shown is for illustration purposes only. You cannot invest directly into an index. Investment return and principal value will fluctuate, and as a result, when shares are sold, they may be worth more or less than their original cost. For more updated performance information, please visit mainstayinvestments.com/privateadvisors or call 1-888-207-6176.

Average Annual Total Returns for the Period Ended March 31, 2013

| Fund | Sales Charge | Since Inception | Gross Expense Ratio2 |

|||||||||

| Private Advisors Alternative Strategies Fund | Maximum 3% Initial Sales Charge | With sales charges Excluding sales charges |

|

3.49 6.69 |

%

|

9.65 | % | |||||

| Private Advisors Alternative Strategies Master Fund | No Sales Charge | 7.32 | 8.30 | |||||||||

| Benchmark Performance | Since Inception | |||||||

| HFRI Fund of Fund Diversified Index3 |

5.48 | % | ||||||

| S&P 500® Index4 |

14.68 | |||||||

| Barclays U.S. Aggregate Bond Index5 |

2.64 | |||||||

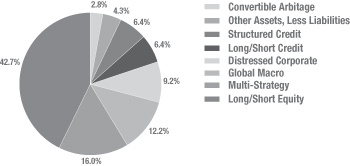

Strategy Allocations as of March 31, 2013 (Unaudited)

| 6 | Private Advisors Funds |

Private Advisors Alternative Strategies Master Fund

Annual Report

March 31, 2013

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

Private Advisors Alternative Strategies Master Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations, of changes in net assets and of cash flows present fairly, in all material respects, the financial position of Private Advisors Alternative Strategies Master Fund (hereafter referred to as the “Fund”) at March 31, 2013, and the results of its operations, the changes in its net assets and its cash flows for the period May 1, 2012 (commencement of operations) through March 31, 2013, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of investments at March 31, 2013 by correspondence with the custodian and underlying portfolio funds, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

May 30, 2013

| mainstayinvestments.com/privateadvisors | 9 |

Schedule of Investments March 31, 2013

| Percent of |

Fair Value |

Unrealized Appreciation |

Redemptions Permitted | |||||||||||||||||||||

| Investments in Hedge Funds |

Notice Period |

Permitted (a) | Liquidity Restrictions |

|||||||||||||||||||||

| Bahamas Domiciled | ||||||||||||||||||||||||

| Global Macro |

||||||||||||||||||||||||

| Moore Macro Managers Fund, Ltd. |

3.98 | % | $ | 1,791,910 | $ | 191,910 | 60 Days | Q | None | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Bahamas Domiciled |

3.98 | 1,791,910 | 191,910 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Bermuda Domiciled | ||||||||||||||||||||||||

| Long/Short Equity |

||||||||||||||||||||||||

| Pelham Long/Short Fund, Ltd. |

4.12 | 1,853,264 | 253,264 | 90 Days | A | Locked up until May 31, 2013 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Bermuda Domiciled |

4.12 | 1,853,264 | 253,264 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| British Virgin Islands Domiciled | ||||||||||||||||||||||||

| Long/Short Equity |

||||||||||||||||||||||||

| Miura Global Fund, Ltd. |

3.66 | 1,647,087 | 47,087 | 90 Days | M | None | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total British Virgin Islands Domiciled |

3.66 | 1,647,087 | 47,087 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Cayman Islands Domiciled | ||||||||||||||||||||||||

| Convertible Arbitrage |

||||||||||||||||||||||||

| Waterstone Market Neutral Offshore Fund, Ltd. |

2.77 | 1,244,794 | 44,794 | 45 Days | Q | Locked up until June 30, 2013 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Convertible Arbitrage |

2.77 | 1,244,794 | 44,794 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Distressed Corporate |

||||||||||||||||||||||||

| Aurelius Capital International, Ltd. |

4.11 | 1,850,050 | 250,050 | 65 Days | S | Locked up until May 31, 2014 | ||||||||||||||||||

| Contrarian Capital Trade Claims Offshore, Ltd. |

2.03 | 912,325 | 112,325 | 90 Days | A | None | ||||||||||||||||||

| Redwood Offshore Fund, Ltd. |

3.08 | 1,386,442 | 186,442 | 60 Days | B | Locked up until June 30, 2014 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Distressed Corporate |

9.22 | 4,148,817 | 548,817 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Global Macro |

||||||||||||||||||||||||

| ESG Credit Macro Event Offshore Fund, Ltd. |

0.67 | 298,651 | (101,349 | ) | 30 Days | M | None | |||||||||||||||||

| ESG Treasury Opportunities Offshore Portfolio, Ltd. |

0.77 | 347,611 | (52,389 | ) | 30 Days | M | None | |||||||||||||||||

| MKP Opportunity Offshore, Ltd. |

2.81 | 1,265,900 | 65,900 | 60 Days | M | None | ||||||||||||||||||

| Tudor BVI Global Fund, Ltd. (The) |

3.98 | 1,789,981 | 189,981 | 60 Days | Q | None | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Global Macro |

8.23 | 3,702,143 | 102,143 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Long/Short Credit |

||||||||||||||||||||||||

| Saba Capital Offshore Fund, Ltd. |

3.43 | 1,542,970 | (57,030 | ) | 65 Days | Q | Locked up until June 30, 2013 | |||||||||||||||||

| 10 | Private Advisors Alternative Strategies Master Fund | The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

| Percent of |

Fair Value |

Unrealized Appreciation |

Redemptions Permitted | |||||||||||||||||||||

| Investments in Hedge Funds |

Notice Period |

Permitted (a) | Liquidity Restrictions |

|||||||||||||||||||||

| Cayman Islands Domiciled (continued) | ||||||||||||||||||||||||

| Long/Short Credit (continued) |

||||||||||||||||||||||||

| North America |

||||||||||||||||||||||||

| Archer Capital Offshore Fund, Ltd. |

2.97 | % | $ | 1,337,392 | $ | 137,392 | 90 Days | Q | None | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Long/Short Credit |

6.40 | 2,880,362 | 80,362 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Long/Short Equity |

||||||||||||||||||||||||

| LAE Fund, Ltd. |

3.90 | 1,752,065 | 152,065 | 60 Days | Q | None | ||||||||||||||||||

| Sheffield International Partners, Ltd. |

4.12 | 1,853,584 | 253,584 | 90 Days | Q | Locked up until April 30, 2013 | ||||||||||||||||||

| 25% gate on redemption | ||||||||||||||||||||||||

| SRS Partners, Ltd. |

3.65 | 1,640,771 | 40,771 | 60 Days | Q | Locked up until June 30, 2014 | ||||||||||||||||||

| North America |

||||||||||||||||||||||||

| Absolute Partners Fund, Ltd. |

3.51 | 1,577,560 | (22,440 | ) | 90 Days | M | None | |||||||||||||||||

| Hoplite Offshore Fund, Ltd. |

3.74 | 1,684,230 | 84,230 | 45 Days | Q | Locked up until April 30, 2013 | ||||||||||||||||||

| Impala Fund Ltd. |

4.15 | 1,867,464 | 267,464 | 45 Days | Q | Locked up until June 30, 2013 | ||||||||||||||||||

| Marble Arch Offshore Partners, Ltd. |

4.00 | 1,800,499 | 200,499 | 60 Days | Q | Locked up until June 30, 2013 | ||||||||||||||||||

| North Run Offshore Partners, Ltd. |

4.06 | 1,825,680 | 225,680 | 90 Days | Q | Locked up until June 30, 2013 | ||||||||||||||||||

| Southpoint Qualified Offshore Fund, Ltd. |

3.77 | 1,696,319 | 96,319 | 60 Days | Q | None | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Long/Short Equity |

34.90 | 15,698,172 | 1,298,172 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Multi-Strategy |

||||||||||||||||||||||||

| HBK Offshore Fund II L.P. |

3.55 | 1,597,205 | 97,205 | 90 Days | Q | None | ||||||||||||||||||

| Mason Capital, Ltd. |

3.66 | 1,648,181 | 48,181 | 45 Days | A | Locked up until April 30, 2013 | ||||||||||||||||||

| North America |

||||||||||||||||||||||||

| Fir Tree International Value Fund II, Ltd. |

5.04 | 2,266,565 | 266,565 | 90 Days | A | Locked up until April 30, 2013 | ||||||||||||||||||

| Luxor Capital Partners Offshore, Ltd. |

3.74 | 1,681,894 | 81,894 | 90 Days | Q | None | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Multi-Strategy |

15.99 | 7,193,845 | 493,845 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Structured Credit |

||||||||||||||||||||||||

| Marathon Securitized Credit Fund, Ltd. |

3.32 | 1,493,503 | 293,503 | 60 Days | Q | None | ||||||||||||||||||

| One William Street Capital Offshore Fund, Ltd. |

3.10 | 1,396,215 | 196,215 | 90 Days | Q | Locked up until June 30, 2013 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Structured Credit |

6.42 | 2,889,718 | 489,718 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Cayman Islands Domiciled |

83.93 | 37,757,851 | 3,057,851 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total investments in Hedge Funds |

95.69 | 43,050,112 | $ | 3,550,112 | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Other Assets, less Liabilities |

4.31 | 1,937,189 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Net Assets |

100.00 | % | $ | 44,987,301 | ||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| (a) | A = Annually, B = Bi-Annually, M = Monthly, Q = Quarterly, S = Semi-Annually |

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

mainstayinvestments.com/privateadvisors | 11 |

Statement of Assets and Liabilities March 31, 2013

| 12 | Private Advisors Alternative Strategies Master Fund | The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

for the period May 1, 2012 (commencement of operations) through March 31, 2013

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

mainstayinvestments.com/privateadvisors | 13 |

Statement of Changes in Net Assets

for the period May 1, 2012 (commencement of operations) through March 31, 2013

| 14 | Private Advisors Alternative Strategies Master Fund | The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

for the period May 1, 2012 (commencement of operations) through March 31, 2013

| The notes to the financial statements are an integral part of, and should be read in conjunction with, the financial statements. |

mainstayinvestments.com/privateadvisors | 15 |

| 16 | Private Advisors Alternative Strategies Master Fund |

| mainstayinvestments.com/privateadvisors | 17 |

Notes to Financial Statements (continued)

| 18 | Private Advisors Alternative Strategies Master Fund |

| mainstayinvestments.com/privateadvisors | 19 |

Notes to Financial Statements (continued)

The following is a summary of the fair value inputs used as of March 31, 2013 in valuing the Master Fund’s investments in Hedge Funds.

| Assets at Fair Value as of March 31, 2013 | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investments in Hedge Funds |

||||||||||||||||

| Bahamas Domiciled |

||||||||||||||||

| Global Macro |

$ | — | $ | 1,791,910 | $ | — | $ | 1,791,910 | ||||||||

| Bermuda Domiciled |

||||||||||||||||

| Long/Short Equity |

— | 1,853,264 | — | 1,853,264 | ||||||||||||

| British Virgin Islands Domiciled |

||||||||||||||||

| Long/Short Equity |

— | 1,647,087 | — | 1,647,087 | ||||||||||||

| Cayman Islands Domiciled |

||||||||||||||||

| Convertible Arbitrage |

— | 1,244,794 | — | 1,244,794 | ||||||||||||

| Distressed Corporate |

— | 912,325 | 3,236,492 | 4,148,817 | ||||||||||||

| Global Macro |

— | 3,702,143 | — | 3,702,143 | ||||||||||||

| Long/Short Credit |

— | 2,880,362 | — | 2,880,362 | ||||||||||||

| Long/Short Equity |

— | 12,203,817 | 3,494,355 | 15,698,172 | ||||||||||||

| Multi-Strategy |

— | 7,193,845 | — | 7,193,845 | ||||||||||||

| Structured Credit |

— | 2,889,718 | — | 2,889,718 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Total investments in Hedge Funds |

$ | — | $ | 36,319,265 | $ | 6,730,847 | $ | 43,050,112 | ||||||||

|

|

|

|||||||||||||||

The Master Fund recognizes transfers between levels as of the beginning of the period.

| 20 | Private Advisors Alternative Strategies Master Fund |

The following is a reconciliation of investments in Hedge Funds in which significant unobservable inputs (Level 3) were used in determining value:

| Cayman Islands Domiciled | ||||||||||||

| Distressed Corporate |

Long/Short Equity | Total | ||||||||||

| Balance as of May 1, 2012 | ||||||||||||

| (Commencement of Operations) |

$ | — | $ | — | $ | — | ||||||

| Net realized gains (losses) | — | — | — | |||||||||

| Net change in unrealized appreciation (depreciation) | 436,492 | 294,355 | 730,847 | |||||||||

| Purchases | 2,800,000 | 3,200,000 | 6,000,000 | |||||||||

| Sales | — | — | — | |||||||||

| Transfers into Level 3 (a) | — | — | — | |||||||||

| Transfers out of Level 3 (a) | — | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Balance as of March 31, 2013 |

$ | 3,236,492 | $ | 3,494,355 | $ | 6,730,847 | ||||||

|

|

|

|

|

|

|

|||||||

| Net change in unrealized appreciation (depreciation) on Level 3 investments in Hedge Funds still held as of March 31, 2013 | $ | 436,492 | $ | 294,355 | $ | 730,847 | ||||||

|

|

|

|

|

|

|

|||||||

| (a) | Transfers between levels may occur based on changes in the underlying Hedge Funds and/or changes in liquidity and are recognized as of the beginning of the period. |

Net realized gains (losses) and net change in unrealized appreciation (depreciation) presented above are reflected in the accompanying Statement of Operations.

| mainstayinvestments.com/privateadvisors | 21 |

Notes to Financial Statements (continued)

| 22 | Private Advisors Alternative Strategies Master Fund |

The above ratios and total return have been calculated for the Shareholders taken as a whole. An individual Shareholder’s ratios and total return may vary from these due to the timing of capital share transactions.

12. Subsequent Events

In connection with the preparation of the financial statements of the Master Fund for the period May 1, 2012 (Commencement of Operations) to March 31, 2013, events and transactions subsequent to March 31, 2013 through the date the financial statements were issued have been evaluated by the Master Fund’s management for possible adjustment and/or disclosure. No subsequent events requiring financial statement adjustment or disclosure have been identified.

| mainstayinvestments.com/privateadvisors | 23 |

Board of Trustees and Officers

| Name and Date Of Birth |

Term of Office, of Service |

Principal Occupation(s) During Past Five Years |

Number

of Portfolios in Fund Complex(2) Overseen by Trustee |

Other Directorships Held by Trustee(3) | ||||||||

| Interested Trustee |

John Y. Kim 9/24/60(1) |

Trustee (since 2011) |

Chief Investment Officer, New York Life Insurance Company (since 2011); President, Investments Group—New York Life Insurance Company (since 2012); Chairman of the Board of Managers and Chief Executive Officer, New York Life Investment Management LLC and New York Life Investment Management Holdings LLC (since 2008); Member of the Board, MacKay Shields LLC, Institutional Capital LLC, Madison Capital Funding LLC, and Cornerstone Capital Management Holdings LLC (fka Madison Square Investors LLC) (since 2008); Member of the Board of Managers, McMorgan and Company LLC and GoldPoint Partners (fka NYLCAP Manager LLC) (2008-2012); Member of the Board of Private Advisors, LLC (since 2010); Member of the Board of MCF Capital Management LLC (since 2012); and President, Prudential Retirement, a business unit of Prudential Financial, Inc. (2002 to 2007) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 2008 (12 funds); Trustee, MainStay VP Funds Trust since 2008 (29 portfolios); Trustee, MainStay DefinedTerm Municipal Opportunities Fund since 2011 |

| 24 | Private Advisors Alternative Strategies Master Fund |

| Name and Date Of Birth |

Term of Office, of Service |

Principal Occupation(s) During Past Five Years |

Number

of Portfolios in Fund Complex(2) Overseen by Trustee |

Other Directorships Held by Trustee(3) | ||||||||

| Independent Trustees |

Susan B. Kerley 8/12/51 |

Trustee (since 2011) |

President, Strategic Management Advisors (since 1990) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 2007 (12 funds); Trustee, MainStay VP Funds Trust since 2007 (29 portfolios); Trustee, Legg Mason Partners Funds, Inc., since 1991 (58 portfolios); Trustee, MainStay DefinedTerm Municipal Opportunities Fund since 2011 | |||||||

| Alan R. Latshaw 3/27/51 |

Trustee (since 2011) |

Retired; Partner, Ernst & Young LLP (2002 to 2003); Partner, Arthur Andersen LLP (1989 to 2002); Consultant to the MainStay Funds Audit and Compliance Committee (2004 to 2006) | 78 | Trustee and Audit Committee Financial Expert, MainStay Funds Trust since 2009 (33 funds); Trustee and Audit Committee Financial Expert, The MainStay Funds since 2006 (12 funds); Trustee and Audit Committee Financial Expert, MainStay VP Funds Trust since 2007 (29 portfolios); Trustee, State Farm Associates Funds Trusts since 2005 (4 portfolios); Trustee, State Farm Mutual Fund Trust since 2005 (15 portfolios); Trustee, State Farm Variable Product Trust since 2005 (9 portfolios); MainStay DefinedTerm Municipal Opportunities Fund since 2011 | ||||||||

| Peter Meenan 12/5/41 |

Chairman (since 2013); Trustee (since 2011) |

Independent Consultant; President and Chief Executive Officer, Babson—United, Inc. (financial services firm) (2000 to 2004); Independent Consultant (1999 to 2000); Head of Global Funds, Citicorp (1995 to 1999) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 2007 (12 funds); Trustee, MainStay VP Funds Trust since 2007 (29 portfolios) MainStay DefinedTerm Municipal Opportunities Fund since 2011 | ||||||||

| Richard H. Nolan, Jr. 11/16/46 |

Trustee (since 2011) |

Managing Director, ICC Capital Management; President—Shields/Alliance, Alliance Capital Management (1994 to 2004) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 2007 (12 funds); Trustee, MainStay VP Funds Trust since 2006 (29 portfolios); Trustee, MainStay DefinedTerm Municipal Opportunities Fund since 2011 | ||||||||

| Richard S. Trutanic 2/13/52 |

Trustee (since 2011) |

Chairman and Chief Executive Officer, Somerset & Company (financial advisory firm) (since 2004); Managing Director, The Carlyle Group (private investment firm) (2002 to 2004); Senior Managing Director, Partner and Trustee, Groupe Arnault S.A. (private investment firm) (1999 to 2002) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 1994 (12 funds); Trustee, MainStay VP Funds Trust since 2007 (29 portfolios); Trustee, MainStay DefinedTerm Municipal Opportunities Fund since 2011 |

| mainstayinvestments.com/privateadvisors | 25 |

| Name and Date Of Birth |

Term of Office, of Service |

Principal Occupation(s) During Past Five Years |

Number

of Portfolios in Fund Complex(2) Overseen by Trustee |

Other Directorships Held by Trustee(3) | ||||||||

| Independent Trustees |

Roman L. Weil 5/22/40 |

Trustee (since 2011) |

Visiting Professor, University of California—San Diego (since 2012); Visiting Professor, Southern Methodist University (2011); Visiting Professor, NYU Stern School of Business, New York University (since 2011); President, Roman L. Weil Associates, Inc. (consulting firm) (since 1981); V. Duane Roth Professor Emeritus of Accounting, Chicago Booth School of Business, University of Chicago (1996-2008) | 78 | Trustee and Audit Committee Financial Expert, MainStay Funds Trust since 2009 (33 funds); Trustee and Audit Committee Financial Expert, The MainStay Funds since 2007 (12 funds); Trustee and Audit Committee Financial Expert, MainStay VP Funds Trust since 1994 (29 portfolios); Trustee and Audit Committee Financial Expert, MainStay DefinedTerm Municipal Opportunities Fund since 2011 | |||||||

| John A. Weisser 10/22/41 |

Trustee (since 2011) |

Retired; Managing Director, Salomon Brothers, Inc. (1971 to 1995) | 78 | Trustee, MainStay Funds Trust since 2009 (33 funds); Trustee, The MainStay Funds since 2007 (12 funds); Trustee, MainStay VP Funds Trust since 1997 (29 portfolios); Trustee, Direxion Funds since 2007 (27 portfolios); Direxion Insurance Trust since 2007 (1 portfolio); Trustee, Direxion Shares ETF Trust since 2008 (50 portfolios); Trustee, MainStay DefinedTerm Municipal Opportunities Fund since 2011 |

| (1) | Trustee considered to be an “interested person” of the Master and Feeder Funds within the meaning of the 1940 Act because of his affiliation with New York Life Insurance Company, New York Life Investment Management LLC, and Private Advisors LLC, as described in detail above in the column entitled “Principal Occupation(s) During Past Five Years.” |

| (2) | The fund complex consists of the Private Advisors Alternative Strategies Fund, Private Advisors Alternative Strategies Master Fund, MainStay DefinedTerm Municipal Opportunities Fund and series of MainStay Funds Trust, The MainStay Funds and MainStay VP Funds Trust (“MainStay Group of Funds”). |

| (3) | Terms of service for MainStay VP Funds Trust includes services as a Director of MainStay VP Funds Trust’s predecessor, MainStay VP Series Fund, Inc., a Maryland corporation. |

| 26 | Private Advisors Alternative Strategies Master Fund |

| Name and Date of Birth |

Position with Funds | Term of Office And Year First Elected or Appointed |

Principal Occupation(s) During Past Five Years* | |||||||

| Officers (Who are not Trustees) |

Jack R. Benintende 5/12/64 |

Treasurer and Principal Financial and Accounting Officer | Indefinite term (since 2011) |

Assistant Treasurer, New York Life Investment Management Holdings LLC (since 2008); Managing Director, New York Life Investment Management LLC (since 2007); Treasurer and Principal Financial and Accounting Officer, MainStay VP Funds Trust, and The MainStay Funds (since 2007) and MainStay Funds Trust (since 2009); Treasurer and Principal Financial and Accounting Officer, MainStay DefinedTerm Municipal Opportunities Fund (since 2011) | ||||||

| Jeffrey A. Engelsman 9/28/67 |

Vice President and Chief Compliance Officer | Indefinite term (since 2011) |

Managing Director, Compliance (since 2009), Director and Associate General Counsel, New York Life Investment Management LLC (2005 to 2008); Assistant Secretary, NYLIFE Distributors LLC (2006 to 2008); Vice President and Chief Compliance Officer, MainStay Funds Trust , MainStay VP Funds Trust, and The MainStay Funds (since 2009), MainStay DefinedTerm Municipal Opportunities Fund (since 2011); Assistant Secretary, The MainStay Funds (2006 to 2008), The MainStay Funds and MainStay VP Series Fund, Inc. (2005 to 2008) | |||||||

| Stephen P. Fisher 2/22/59 |

President | Indefinite term (since 2011) |

Manager, President and Chief Operating Officer, NYLIFE Distributors LLC (since 2008); Chairman of the Board, NYLIM Service Company LLC (since 2008); Senior Managing Director and Chief Marketing Officer, New York Life Investment Management LLC (since 2005); President, MainStay Funds Trust (since 2009), MainStay VP Funds Trust and The MainStay Funds (since 2007), and MainStay DefinedTerm Municipal Opportunities Fund (since 2011) | |||||||

| J. Kevin Gao 10/13/67 |

Secretary and Chief Legal Officer | Indefinite term (since 2011) |

Managing Director and Associate General Counsel, New York Life Investment Management LLC (since 2010); Secretary and Chief Legal Officer, MainStay Funds Trust, MainStay VP Funds Trust and The MainStay Funds (since 2010), and MainStay DefinedTerm Municipal Opportunities Fund (since 2011); Director and Counsel, Credit Suisse; Chief Legal Officer and Secretary, Credit Suisse Asset Management LLC and Credit Suisse Funds (2003-2010) | |||||||

| Scott T. Harrington 2/8/59 |

Vice President— Administration | Indefinite term (since 2011) |

Director, New York Life Investment Management LLC (including predecessor advisory organizations) (since 2000); Executive Vice President, New York Life Trust Company and New York Life Trust Company, FSB (since 2006); Vice President—Administration, MainStay VP Funds Trust, and The MainStay Funds (since 2005), MainStay Funds Trust (since 2009), and MainStay DefinedTerm Municipal Opportunities Fund (since 2011 |

| * | Terms of service for MainStay VP Funds Trust includes services as a Director of MainStay VP Funds Trust’s predecessor, MainStay VP Series Fund, Inc., a Maryland corporation. |

| mainstayinvestments.com/privateadvisors | 27 |

| 28 | Private Advisors Alternative Strategies Master Fund |

This page intentionally left blank

This page intentionally left blank

Not part of the Annual Report

mainstayinvestments.com/privateadvisors

MainStay Investments® is a registered service mark and name under which New York Life Investment Management LLC does business. MainStay Investments, an indirect subsidiary of New York Life Insurance Company, New York, NY 10010, provides investment advisory products and services. The Private Advisors Alternative Strategies Fund and the Private Advisors Alternative Strategies Master Fund are managed by New York Life Investment Management LLC, an indirect subsidiary of New York Life Insurance Company, and distributed through NYLIFE Distributors LLC, 169 Lackawanna Avenue, Parsippany, NJ 07054, a wholly owned subsidiary of New York Life Insurance Company. NYLIFE Distributors is a member of FINRA/SIPC. Private Advisors LLC is an affiliate of New York Life Investment Management LLC and acts as the Funds’ subadvisor.

This report may be distributed only when preceded or accompanied by a current prospectus.

| Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured by Any Government Agency |

| NYLIM-29909 PA009-13 |

|

PAAS11m-05/13

NL201 |

|

| Item 2. | Code of Ethics. |

As of the end of the period covered by this report, Private Advisors Alternative Strategies Master Fund (“Registrant” or “Fund”) has adopted a code of ethics (the “Code”) that applies to the Registrant’s principal executive officer (“PEO”) and principal financial officer (“PFO”). A copy of the Code is filed herewith. The Registrant did not make any amendments to the Code during the period covered by this report. The Registrant did not grant any waivers, including implicit waivers, from any provisions of the Code to the PEO or PFO during the period covered by this report.

| Item 3. | Audit Committee Financial Experts. |

The Board of Trustees has determined that the Registrant has two audit committee financial experts serving on its Audit Committee. The Audit Committee financial experts are Alan R. Latshaw and Roman L. Weil. Messrs. Latshaw and Weil are “independent” as defined by Item 3 of Form N-CSR.

| Item 4. | Principal Accountant Fees and Services. |

(a) Audit Fees

The aggregate fees billed for the fiscal year ended March 31, 2013 for professional services rendered by PricewaterhouseCoopers LLP (“PwC”) for the audit of the Registrant's annual financial statements or services that are normally provided by PwC in connection with statutory and regulatory filings or engagements for that fiscal year were $46,000. The Registrant was not operational during the fiscal year ended March 31, 2012.

(b) Audit-Related Fees

The aggregate fees billed for assurance and related services by PwC that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 for the fiscal year ended March 31, 2013. The Registrant was not operational during the fiscal year ended March 31, 2012.

(c) Tax Fees

The aggregate fees billed for professional services rendered by PwC for tax compliance, tax advice, and tax planning were $11,100 during the fiscal year ended March 31, 2013. These services primarily included preparation of federal, state and local income tax returns and excise tax returns, as well as services relating to excise tax distribution requirements. The Registrant was not operational during the fiscal year ended March 31, 2012.

(d) All Other Fees

The aggregate fees billed for products and services provided by PwC, other than the services reported in paragraphs (a) through (c) of this Item were $0 during the fiscal year ended March 31, 2013. The Registrant was not operational during the fiscal year ended March 31, 2012.

(e) Pre-Approval Policies and Procedures

| (1) | The Registrant’s Audit Committee has adopted pre-approval policies and procedures (the “Procedures”) to govern the Committee’s pre-approval of (i) all audit services and permissible non-audit services to be provided to the Registrant by its independent accountant, and (ii) all permissible non-audit services to be provided by such independent accountant to the Registrant’s investment adviser and to any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the Registrant (collectively, the “Service Affiliates”) if the services directly relate to the Registrant’s operations and financial reporting. In accordance with the Procedures, the Audit Committee is responsible for the engagement of the independent accountant to certify the Registrant’s financial statements for each fiscal year. With respect to the pre-approval of non-audit services provided to the Registrant and its Service Affiliates, the Procedures provide that the Audit Committee may annually pre-approve a list of the types of services that may be provided to the Registrant or its Service Affiliates, or the Audit Committee may pre-approve such services on a project-by-project basis as they arise. Unless a type of service has received general pre-approval, it will require specific pre-approval by the Audit Committee if it is to be provided by the independent accountant. The Procedures also permit the Audit Committee to delegate authority to one or more of its members to pre-approve any proposed non-audit services that have not been previously pre-approved by the Audit Committee, subject to the ratification by the full Audit Committee no later than its next scheduled meeting. To date, the Audit Committee has not delegated such authority. |

| (2) | With respect to the services described in paragraphs (b) through (d) of this Item 4, no amount was approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

(f) There were no hours expended on PwC’s engagement to audit the Registrant’s financial statements for the most recent fiscal year was attributable to work performed by persons other than PwC's full-time, permanent employees.

(g) All non-audit fees billed by PwC for services rendered to the Registrant for the fiscal year ended March 31, 2013 are disclosed in 4(b)-(d) above.

The aggregate non-audit fees billed by PwC for services rendered to the Registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the Registrant were approximately $2,876,906 for the fiscal year ended March 31, 2013. The Registrant was not operational during the fiscal year ended March 31, 2012.

(h) The Registrant’s Audit Committee has determined that the non-audit services rendered by PwC for the fiscal year ended March 31, 2013 to the Registrant’s investment adviser and any entity controlling, controlled by, or under common control with the Registrant’s investment adviser that provides ongoing services to the Registrant that were not required to be pre-approved by the Audit Committee because they did not relate directly to the operations and financial reporting of the registrant were compatible with maintaining the respective independence of PwC during the relevant time period.

| Item 5. | Audit Committee of Listed Registrants |

Not applicable.

| Item 6. | Schedule of Investments |

| (a) | The Schedule of Investments is included as part of Item 1 of this report. |

| (b) | Not applicable. |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

The Fund invests in interests issued by private investment funds or hedge funds (“Hedge Funds”). As such, it is expected that proxies and consent requests will deal with matters related to the operative terms and business details of such Hedge Funds. New York Life Investment Management LLC (“New York Life Investments”) or Private Advisors LLC (“Private Advisors”) (Private Advisors together with New York Life Investments “Advisors”) are not responsible for, and these procedures are not applicable to, proxies received by portfolio managers of the Hedge Funds (related to issuers invested in by the related Hedge Fund).

It is the policy of the Fund that proxies received by the Fund are voted in the best interests of shareholders, to the extent voting rights have not been waived or such Hedge Fund interest is held in non-voting form. To the extent that the Fund receives notices or proxies from Hedge Funds (or to the extent the Fund receives proxy statements or similar notices in connection with any other portfolio securities), the Board of Trustees of the Funds (“Board”) has adopted Proxy Voting Policies and Procedures for the Fund that delegates all responsibility for voting proxies received to New York Life Investments, subject to the oversight of the Board. New York Life Investments has adopted its own Proxy Voting Policies and Procedures in order to assure that proxies voted on behalf of the Fund are voted in the best interests of the Fund and shareholders. New York Life Investments may delegate proxy voting authority to Private Advisors; provided that, as specified in New York Life Investments’ Proxy Voting Policies and Procedures, Private Advisors either (1) follows New York Life Investments’ Proxy Voting Policy and the Fund’s Procedures; or (2) has demonstrated that its proxy voting policies and procedures are consistent with New York Life Investments Proxy Voting Policies and Procedures or are otherwise implemented in the best interests of New York Life Investments’ clients and appear to comply with governing regulations. The Fund may revoke all or part of this delegation (to New York Life Investments and/or Private Advisors as applicable) at any time by a vote of the Board.

Conflicts of Interest. When a proxy presents a conflict of interest, such as when New York Life Investments has actual knowledge of a material business arrangement between a particular proxy issuer or closely affiliated entity and New York Life Investments or an affiliated entity of New York Life Investments, both the Fund’s and New York Life Investments’ proxy voting policies and procedures mandate that New York Life Investments follow an alternative voting procedure rather than voting proxies in its sole discretion. In these cases, New York Life Investments may: (1) cause the proxies to be voted in accordance with the recommendations of an independent service provider; (2) notify the Board or a designated committee of New York Life Investments, or a representative of either of the conflict of interest and seek a waiver of the conflict to permit New York Life Investments to vote the proxies as it deems appropriate and in the best interest shareholders, under its usual policy; or (3) forward the proxies to the Board, or a designated committee of New York Life Investments, so that the Board or the committee may vote the proxies itself. As part of their delegation of proxy voting responsibility to New York Life Investments, the Fund also delegated to New York Life Investments responsibility for resolving conflicts of interest based on the use of acceptable alternative voting procedures, as described above. If New York Life Investments chooses to override a voting recommendation made by Institutional Shareholder Services Inc. (“ISS”), New York Life Investments’ compliance department will review the override prior to voting to determine the existence of any potential conflicts of interest. If the compliance department determines a material conflict may exist, the issue is referred to the New York Life Investments’ Proxy Voting Committee who will consider the facts and circumstances and determine whether to allow the override or take other action, such as the alternative voting procedures just mentioned.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies. |

(a)(1) The registrant’s portfolio is managed on a team basis. The following persons are primarily responsible for the day-to-day management of the registrant’s portfolio.

Louis W. “Chip” Moelchert, III, CFA, Chief Executive Officer – Mr. Moelchert has managed the Fund since inception on May 1, 2012. He is Chief Executive Officer and Chair of Private Advisors' Executive Committee. Mr. Moelchert is a member of the Board of Managers and is responsible for leading day-to-day operations and providing strategic direction for the firm. Additionally, he serves on each of the firm’s investment committees. Mr. Moelchert joined Private Advisors, LLC in 2003. Prior to joining Private Advisors, Mr. Moelchert spent 10 years at Jefferson Capital Partners, Ltd., a boutique merchant bank with a focus on the healthcare, consumer and business services industries. He was a Partner at Jefferson Capital and focused predominately on the healthcare and business services segments. Prior to Jefferson Capital, Mr. Moelchert was an Associate Vice President/Portfolio Manager with the Asset Management division of Wheat First Butcher Singer, Inc. (now part of Wells Fargo Advisors). Mr. Moelchert received his B.S. from the University of Richmond and is a CFA charter holder and member of the CFA Institute.

Louis W. Moelchert, Chairman—Mr. Moelchert has managed the Fund since inception on May 1, 2012. He established Private Advisors, LLC in 1997. He serves on the Board of Managers and a number of the firm’s investment committees. Beginning in 1975, he managed the endowment for the University of Richmond for 30 years and began investing in alternatives in the early 1980’s. He also served as a committee member of the Virginia Retirement System from 1996 to 2000 and Chairman of the Investment Advisory Committee from 1998 to 2000. He was also Chairman of the Commonfund Board of Trustees from 1993 to 1997 and served as a trustee from 1986 to 1998. Mr. Moelchert received his B.B.A. and M.S., Accountancy from the University of Georgia.

Charles M. Johnson, III, Partner—Mr. Johnson has managed the Fund since inception on May 1, 2012. He joined Private Advisors, LLC as a Partner in 2001. He serves on the Board of Managers and a number of the firm’s investment committees. Previously he was the President of EIM (USA), Inc., a hedge fund of funds group with offices in London and Geneva. At EIM, in addition to managing the New York office, his responsibilities included portfolio construction, manager selection, and due diligence for multi-manager funds. Prior to EIM, Mr. Johnson was a Director at Dubin and Swieca Capital Management, managers of multi-strategy hedge fund of funds as well as Highbridge Capital Management LLC, a multi-strategy equity arbitrage hedge fund. He has an M.B.A. from Tulane University and a B.A. from the University of North Carolina at Chapel Hill, where he was a Morehead Scholar.

Timothy G. Berry, CFA, Partner—Mr. Berry has managed the Fund since inception on May 1, 2012. He joined Private Advisors, LLC in 2001 and is responsible for hedge fund of funds portfolio management, including manager sourcing, selection, due diligence, and monitoring. Prior to joining Private Advisors, he was an Associate with Chesapeake Capital Corporation, a billion dollar hedge fund. At Chesapeake, he was responsible for modeling and structuring multi-manager alternative investment products for institutional partners, custom quantitative analysis on behalf of investors, and performing due diligence on principals' alternative asset investments. Mr. Berry received a Masters Degree from Duke University and a B.A. with distinction from the University of Virginia and is a CFA charter holder and member of the CFA Institute.

Michael S. Fuller, CFA, CIRA, CPA, Partner—Mr. Fuller has managed the Fund since inception on May 1, 2012. He is responsible for hedge fund of funds portfolio management, including

manager sourcing, selection, due diligence, and monitoring. Prior to joining Private Advisors, LLC, Mr. Fuller was a manager with PricewaterhouseCoopers, LLP and worked with financially and operationally challenged corporations focusing on cash flow and profitability issues, strategic assessment and business plan implementation. He also managed negotiations with creditors, was responsible for the preparation of corporate and asset valuations and divestiture/merger of companies. Mr. Fuller advised and negotiated on both debt restructurings and equity financings. Mr. Fuller also served as a manager with NAVIGANT Consulting where he focused on corporate restructuring, business valuation and economic modeling. Prior to NAVIGANT, Mr. Fuller was an Auditor at Ernst & Young. Mr. Fuller received an M.B.A. in Finance from Loyola College and a B.S. in Accounting/Finance from Washington & Lee University. Mr. Fuller is a CFA charter holder and member of the CFA Institute, and is a Certified Insolvency and Restructuring Advisor (CIRA).

Charles H.G. Honey, Partner—Mr. Honey has managed the Fund since inception on May 1, 2012. He is responsible for hedge fund of funds portfolio management, including manager sourcing, selection, due diligence, and monitoring. Mr. Honey has over 17 years experience as a portfolio manager and equity analyst. Prior to joining the firm in 2007, he was Managing Partner and Founder of Rapidan Capital, LLC a registered investment advisor. He is a former Managing Director of the hedge fund group at Morgens, Waterfall, Vintiadis & Company. Prior to that, he was a Managing Director at Trainer, Wortham & Company, an investment management firm. He began his career as an equity trader and research analyst for Woodward & Associates, a New York based hedge fund. A native of Richmond, VA, Mr. Honey received a B.S. in Business Administration from Washington & Lee University. In the past he has spoken on the use of value-based analysis and metrics in portfolio management at Stern Stewart’s EVA® Institute, the World Research Group’s EVA® Conference and in appearances on CNBC.

Laura E. Baird, CFA, Managing Director—Ms. Baird has managed the Fund since inception on May 1, 2012. He is responsible for assisting in manager selection, monitoring, and due diligence for hedge fund investments. Prior to joining Private Advisors, Ms. Baird was a Vice President at Franklin Portfolio Associates, a quantitative asset manager with $32 billion under management. Prior to joining Franklin Portfolio, Ms. Baird was an Analyst at 646 Advisors LLC, a Boston-based market-neutral hedge fund where she was responsible for investment selection and monitoring, as well as risk control within the financial services sector. From 1998 to 2002, Ms. Baird was an Associate Analyst with Prudential Equity Group's Small-Cap Quantitative Research team. Her responsibilities included factor research, quantitative modeling, and small-cap market analysis. Ms. Baird received her B.A. in Economics from the University of Richmond and she is a CFA charter holder and a member of the CFA Institute.

Macon H. Clarkson, CFA, Managing Director—Ms. Clarkson has managed the Fund since inception on May 1, 2012. He is responsible for manager selection, monitoring, and due diligence for hedge fund investments. Prior to joining Private Advisors, Ms. Clarkson was an Associate on the High Yield Syndicate desk at Lehman Brothers where she helped structure, market, price, and allocate high yield bond offerings. From 2000 to 2003, Ms. Clarkson was an Analyst in the Global Leveraged Finance group at Lehman Brothers where she performed credit analysis, financial modeling, covenant analysis, and due diligence for potential and mandated bridge loan, leveraged loan and high yield bond transactions. Ms. Clarkson received a B.S. with distinction in Commerce with concentrations in Finance and Management from the University of Virginia’s McIntire School of Commerce, and she is a CFA charter holder and a member of the CFA Institute.

Bryan F. Durand, CFA, Managing Director—Mr. Durand has managed the Fund since inception on May 1, 2012. He is responsible for manager selection, monitoring, and due diligence for hedge fund investments. Prior to joining Private Advisors, Mr. Durand was a senior research

analyst at MFC Global Investment Management (U.S.), LLC, where he provided fundamental research for several value-based investment strategies. Prior to joining MFC, Mr. Durand was an equity research analyst at Thompson, Siegel & Walmsley, where he supported a small and mid-cap value team. Earlier, Mr. Durand was a summer equity research associate at Smith Barney/Citigroup, a controller at Silverstream Software, Inc, and a senior auditor at Ernst and Young. Mr. Durand holds an M.B.A. from Duke University’s Fuqua School of Business and a B.A. from the College of the Holy Cross, and is a CFA charter holder and member of the CFA Institute.

(a)(2) Other Accounts Managed by Portfolio Managers or Management Team Member and Potential Conflicts of Interest (as of March 31, 2013)

| NUMBER OF OTHER ACCOUNTS MANAGED AND ASSETS BY ACCOUNT TYPE |

NUMBER OF ACCOUNTS AND ASSETS FOR WHICH THE ADVISORY FEE IS BASED ON PERFORMANCE | |||||||||||

| PORTFOLIO MANAGER |

REGISTERED INVESTMENT COMPANY |

OTHER POOLED INVESTMENT VEHICLES |

OTHER ACCOUNTS |

REGISTERED INVESTMENT COMPANY |

OTHER POOLED INVESTMENT VEHICLES |

OTHER ACCOUNTS | ||||||

| Louis W. Moelchert, Jr. |

2 RICs $41.1 M |

8 Accounts $625.35 M |

21 Accounts $1.3 B |

0 | 25 Accounts $2.6 B |

0 | ||||||

| Charles M. Johnson, III |

2 RICs $41.1 M |

8 Accounts $625.35 M |

21 Accounts $1.3 B |

0 | 25 Accounts $2.6 B |

0 | ||||||

| Louis W. “Chip” Moelchert, III |

2 RICs $41.1 M |

8 Accounts $625.35 M |

21 Accounts $1.3 B |

0 | 25 Accounts $2.6 B |

0 | ||||||

| Timothy G. Berry |

2 RICs $41.1 M |

5 Accounts $149.2 M |

12 Accounts $779.5 M |

0 | 14 Accounts $1.7 B |

0 | ||||||

| Charles H.G. Honey |

2 RICs $41.1 M |

5 Accounts $149.2 M |

12 Accounts $779.5 M |

0 | 14 Accounts $1.7 B |

0 | ||||||

| Michael S. Fuller |

2 RICs $41.1 M |

5 Accounts $149.2 M |

12 Accounts $779.5 M |

0 | 14 Accounts $1.7 B |

0 | ||||||

| Laura E. Baird |

2 RICs $41.1 M |

5 Accounts $149.2 M |

0 | 0 | 8 Accounts $1.1 B |

0 | ||||||

| Macon H. Clarkson |

2 RICs $41.1 M |

5 Accounts $149.2 M |

0 | 0 | 8 Accounts $1.1 B |

0 | ||||||

| Bryan F. Durand |

2 RICs $41.1 M |

0 | 0 | 0 | 10 Accounts $674.5 M |

0 | ||||||

Potential Conflicts of Interest

The Advisors engage in other activities including managing the assets of various private funds and institutional accounts. In the ordinary course of business, the Advisors engage in activities in which the Advisors’ interests or the interests of its clients may conflict with the interests of the Fund or shareholders. The discussion below sets out such conflicts of interest that may arise; conflicts of interest not described below may also exist. The Advisors can give no assurance that any conflicts of interest will be resolved in favor of the Fund or shareholders.

The Advisors’ Asset Management Activities. The Advisors and their affiliates conduct a variety of asset management activities, including sponsoring unregistered investment funds. Those activities also include managing assets of employee benefit plans that are subject to ERISA and related regulations. The Advisors’ investment management activities may present conflicts if the Fund and these other investment or pension funds either compete for the same investment opportunity or pursue investment strategies counter to each other.

Voting Rights in Hedge Funds. From time to time, a Hedge Fund may seek the approval or consent of its investors in connection with certain matters relating to the Hedge Fund. In such a case, the Advisors have the right to vote in their sole discretion the Fund’s interest in the Hedge Fund to the extent such rights have not been waived or such interest is held in non-voting form. The Advisors consider only those matters it considers appropriate in taking action with respect to the approval or consent of the particular matter. Business relationships may exist between the Advisors and their affiliates, on the one hand, and the portfolio managers and affiliates of the Hedge Funds, on the other hand, other than as a result of the Fund’s investment in a Hedge Fund. As a result of these existing business relationships, the Advisors may face a conflict of interest acting on behalf of the Fund and its shareholders.

Hedge Funds may, consistent with applicable law, not disclose the contents of their portfolios. This lack of transparency may make it difficult for the Advisors to monitor whether holdings of the Hedge Funds cause the Fund to be above specified levels of ownership in certain asset classes. To avoid adverse regulatory consequences in such a case, the Fund may, at the time of investment: (i) elect to invest in a class of a Hedge Fund’s non-voting securities (if such a class is available), or (ii) enter into contractual arrangements under which the Fund irrevocably waives its rights (if any) to vote its interests in a Hedge Fund or waive its rights to vote its interest in a Hedge Fund to the extent such interest exceeds 4.9%. These voting restriction could diminish the influence of the Fund in a Hedge Fund, as compared to other investors in the Hedge Fund (which could include other accounts or funds managed by the Advisors, if they do not waive their voting rights in the Hedge Fund), and adversely affect the Fund’s investment in the Hedge Fund, which could result in unpredictable and potentially adverse effects on Shareholders.

Diverse Shareholders; Relationships with Shareholders. The shareholders could include entities that may have conflicting investment, tax and other interests with respect to their investments in the Fund. The conflicting interests of individual shareholders may relate to or arise from, among other things, the nature of investments made by the Fund and/or Hedge Funds, the structuring of the acquisition of investments of the Fund, and the timing of disposition of investments. This structuring of the Fund’s investments and other factors may result in different returns being realized by different shareholders. Conflicts of interest may arise in connection with decisions made by the Advisors, including decisions with respect to the nature or structuring of investments, that may be more beneficial for one shareholder than for another shareholder, especially with respect to shareholders’ individual tax situations. In selecting Hedge Funds for the Fund, Private Advisors considers the investment and tax objectives of the Fund as a whole, not the investment, tax or other objectives of any shareholder individually.

Allocation of Hedge Fund Opportunities. In some cases, investment opportunities in Hedge Funds may have longer time horizons, different risk profiles, or may have to be made at a time when the Funds do not have cash available for the investments. In other cases, due to capacity constraints, Private Advisors may be unable to allocate a Hedge Fund to all of its clients (including the Fund) for which the investment may be suitable. In such event, Private Advisors will endeavor to allocate Hedge Funds to all clients (including the Fund) in a manner that is fair and equitable all clients in accordance with internal allocation policies.

Related Funds. Conflicts of interest may arise for the Advisors in connection with certain transactions involving investments by the Fund in Hedge Funds, and investments by other accounts or funds managed by the Advisors in the same Hedge Funds. Conflicts of interest may also arise in connection with investments in the Fund by other funds advised or managed by the Advisors or any of their affiliates. Such conflicts could arise, for example, with respect to the timing, structuring and terms of such investments and the disposition of them. The Advisors or an affiliate may determine that an investment in a Hedge Fund is appropriate for a particular client or for itself or its officers, directors, principals, members or employees, but that the investment is not appropriate for the Fund. Situations

also may arise in which the Advisors, one of their affiliates, or the clients of either have made investments that would have been suitable for investment by the Fund but, for various reasons, were not pursued by, or available to, the Fund. The investment activities of the Advisors its affiliates and any of their respective officers, directors, principals, members or employees may disadvantage the Fund in certain situations if, among other reasons, the investment activities limit the Fund’s ability to invest in a particular Hedge Fund.

Management of the Fund. Personnel of the Advisors or their affiliates will devote such time as the Advisors, the Fund and their affiliates, in their discretion, deem necessary to carry out the operations of the Fund effectively. Officers, principals, and employees of the Advisors and their affiliates will also work on other projects for the Advisors and their other affiliates (including other clients served by the Advisors and their affiliates) and conflicts of interest may arise in allocating management time, services or functions among the affiliates.

(a)(3) Portfolio Managers or Management Team Members’ Compensation Structure

Private Advisors’ total compensation package is a combination of salary and bonus. Employees (including investment professionals directly involved with this product) are evaluated on a semi-annual basis with respect to stated responsibilities and objectives. The percentage of compensation that is base salary and performance bonus varies among professionals. Bonuses can be multiples of salary and are based primarily on: (i) the individual’s contribution to the firm; (ii) the success of the product line; and (iii) the financial performance of the firm.

Private Advisors believes there are two key factors that contribute to the firm’s success in retaining talented investment professionals and maintaining low turnover among employees: (i) equity ownership in the firm is distributed to those individuals that have been identified as key professionals based on their contribution (or expected contribution) to the firm; and (ii) Private Advisors’ corporate culture, collegial atmosphere, close communication among all levels of staff, and headquarters in Richmond, Virginia, have all had a significant impact on the recruitment, retention and cultivation of talented professionals. Compensation and equity allocations are contemplated and approved by the Compensation Committee of Private Advisors, as defined by the Operating Agreement of Private Advisors.

(a)(4) Disclosure of Securities Ownership

As of March 31, 2013, the investment managers did not own any shares of the Registrant.

| (b) | Changes in Portfolio Management |

There have been no changes to the portfolio management team since inception on May 1, 2012.

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders. |

Since the Registrant’s last response to this Item, there have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board.

| Item 11. | Controls and Procedures. |

(a) Based on an evaluation of the Registrant’s Disclosure Controls and Procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) (the “Disclosure Controls”), as of a date within

90 days prior to the filing date (the “Filing Date”) of this Form N-CSR (the “Report”), the Registrant’s principal executive officer and principal financial officer have concluded that the Disclosure Controls are reasonably designed to ensure that information required to be disclosed by the Registrant in the Report is recorded, processed, summarized and reported by the Filing Date, including ensuring that information required to be disclosed in the Report is accumulated and communicated to the Registrant’s management, including the Registrant’s principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d)) under the Investment Company Act of 1940 that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

| Item 12. | Exhibits. |

(a)(1) Code of Ethics

(a)(2) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2 under the Investment Company Act of 1940.

(a)(3) Not applicable

(b) Certifications of principal executive officer and principal financial officer as required by Section 906 of the Sarbanes-Oxley Act of 2002.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

PRIVATE ADVISORS ALTERNATIVE STRATEGIES MASTER FUND

| By: | /s/ Stephen P. Fisher | |

| Stephen P. Fisher | ||

| President and Principal Executive Officer | ||

| Date: June 7, 2013 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Stephen P. Fisher | |

| Stephen P. Fisher | ||

| President and Principal Executive Officer | ||

| Date: June 7, 2013 | ||

| By: | /s/ Jack R. Benintende | |

| Jack R. Benintende | ||

| Treasurer and Principal Financial and Accounting Officer | ||

| Date: June 7, 2013 | ||

EXHIBIT INDEX

| (a)(1) | Code of Ethics | |

| (a)(2) | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2 under the Investment Company Act of 1940. | |

| (b) | Certification of principal executive officer and principal financial officer as required by Section 906 of the Sarbanes-Oxley Act of 2002. | |