UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

——————————————————————

FORM 10-K

| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: _001-35897 ______________________________________

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

(212 ) 309-8200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| interest in a share of 5.35% Fixed-Rate Reset Non-Cumulative Preferred Stock, Series B, $0.01 par value | ||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

As of June 30, 2022, the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was approximately $5.8 billion.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

As of February 17, 2023, there were 97,292,543 shares of the registrant's common stock outstanding.

Documents incorporated by reference: Portions of Voya Financial, Inc.'s Proxy Statement for its 2023 Annual Meeting of Shareholders are incorporated by reference in the Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14.

1 | ||||||||

Voya Financial, Inc.

Form 10-K for the period ended December 31, 2022

Table of Contents

| PAGE | |||||||||||

| PART I. | |||||||||||

| Item 1. | |||||||||||

| Item 1A. | |||||||||||

| Item 1B. | |||||||||||

| Item 2. | |||||||||||

| Item 3. | |||||||||||

| Item 4. | |||||||||||

| PART II. | |||||||||||

| Item 5. | |||||||||||

| Item 6. | |||||||||||

| Item 7. | |||||||||||

| Item 7A. | |||||||||||

| Item 8. | |||||||||||

| Item 9. | |||||||||||

| Item 9A. | |||||||||||

| Item 9B. | Other Information | ||||||||||

| PART III. | |||||||||||

| Item 10. | |||||||||||

| Item 11. | |||||||||||

| Item 12. | |||||||||||

| Item 13. | |||||||||||

| Item 14. | |||||||||||

| PART IV. | |||||||||||

| Item 15. | |||||||||||

2 | ||||||||

For the purposes of the discussion in this Annual Report on Form 10-K, the term Voya Financial, Inc. refers to Voya Financial, Inc. and the terms "Company," "we," "our," and "us" refer to Voya Financial, Inc. and its subsidiaries.

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," and "Business," contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements relating to future developments in our business or expectations for our future financial performance and any statement not involving a historical fact. Forward-looking statements use words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," and other words and terms of similar meaning in connection with a discussion of future operating or financial performance. Actual results, performance or events may differ materially from those projected in any forward-looking statement due to, among other things, (i) general economic conditions, particularly economic conditions in our core markets, (ii) performance of financial markets, including emerging markets, (iii) the frequency and severity of insured loss events, (iv) the effects of natural or man-made disasters, including pandemic events and cyber terrorism or cyber attacks, and specifically the current COVID-19 pandemic event, (v) mortality and morbidity levels, (vi) persistency and lapse levels, (vii) interest rates, (viii) currency exchange rates, (ix) general competitive factors, (x) changes in laws and regulations, such as those relating to Federal taxation, state insurance regulations and NAIC regulations and guidelines, (xi) changes in the policies of governments and/or regulatory authorities, (xii) our ability to successfully manage the separation of the Individual Life business that we sold to Resolution Life US on January 4, 2021, including the transition services on the expected timeline and economic terms, (xiii) our ability to realize the expected financial and other benefits from various acquisitions, including the transactions with Allianz Global Investors U.S. LLC and Benefitfocus, Inc., and (xiv) other factors described in Part I, Item 1A. Risk Factors.

The risks included here are not exhaustive. Current reports on Form 8-K and other documents filed with the Securities and Exchange Commission ("SEC") include additional factors that could affect our businesses and financial performance. Moreover, we operate in a rapidly changing and competitive environment. New risk factors emerge from time to time, and it is not possible for management to predict all such risk factors.

MARKET DATA

In this Annual Report on Form 10-K, we present certain market and industry data and statistics. This information is based on third-party sources which we believe to be reliable, such as LIMRA, Secure Retirement Institute, an insurance and financial services industry organization (for Wealth Solutions and Health Solutions market leadership positions), Morningstar fund data and eVestment institutional composites (for Investment Management market leadership positions) and industry recognized publications and websites such as Pensions & Investments (for Wealth Solutions and Investment Management), InvestmentNews.com (for Investment Management) and MyHealthGuide (for Health Solutions). Market ranking information is generally based on industry surveys and therefore the reported rankings reflect the rankings only of those companies who voluntarily participate in these surveys. Accordingly, our market ranking among all competitors may be lower than the market ranking set forth in such surveys. In some cases, we have supplemented these third-party survey rankings with our own information, such as where we believe we know the market ranking of particular companies who do not participate in the surveys.

In this Annual Report on Form 10-K, the term "customers" refers to retirement plan sponsors, retirement plan participants, institutional investment clients, retail investors, corporations or professional groups offering employee benefits solutions, insurance policyholders, annuity contract holders, individuals with contractual relationships with financial advisors and holders of Individual Retirement Accounts ("IRAs") or other individual retirement, investment or insurance products sold by us.

3 | ||||||||

PART I

Item 1. Business

For the purposes of this discussion, the term Voya Financial, Inc. refers to Voya Financial, Inc. and the terms "Voya," "the Company," "we," "our," and "us" refer to Voya Financial, Inc. and its subsidiaries.

We provide workplace savings and benefits products, solutions and technologies, along with investment management services, that enable a better financial future for our clients, their employees and plan participants. Serving the needs of approximately 14.7 million customers, workplace participants and institutional clients as of December 31, 2022, Voya is purpose-driven and committed to conducting its business in a socially, economically and ethically responsible manner. Our approximately 6,100 employees (as of December 31, 2022) are focused on executing our mission to make a secure financial future possible—one person, one family and one institution at a time. Through our complementary and integrated set of businesses, we deliver innovative solutions that improve financial outcomes. We offer our products and services through a broad group of financial intermediaries, independent producers, affiliated advisors and dedicated sales specialists throughout the U.S., and also offer investment management services to international clients through our distribution partnership with Allianz Global Investors U.S. LLC ("AllianzGI"). As a result of our recent acquisition of Benefitfocus, Inc. ("Benefitfocus") (described further below in —Organizational History and Structure—Recent Acquisitions—Benefitfocus), a leading benefits administration provider, we reach approximately 16.5 million subscription employees across employer and health plan clients.

Our extensive scale, breadth of product offerings and capabilities, strong distribution relationships, and focus on helping our customers become well-planned, well-invested and well-protected support our vision: clearing your path to financial confidence and a more fulfilling life. Our strategy is centered on helping improve financial outcomes for our customers from the moment they are hired, all the way through to retirement.

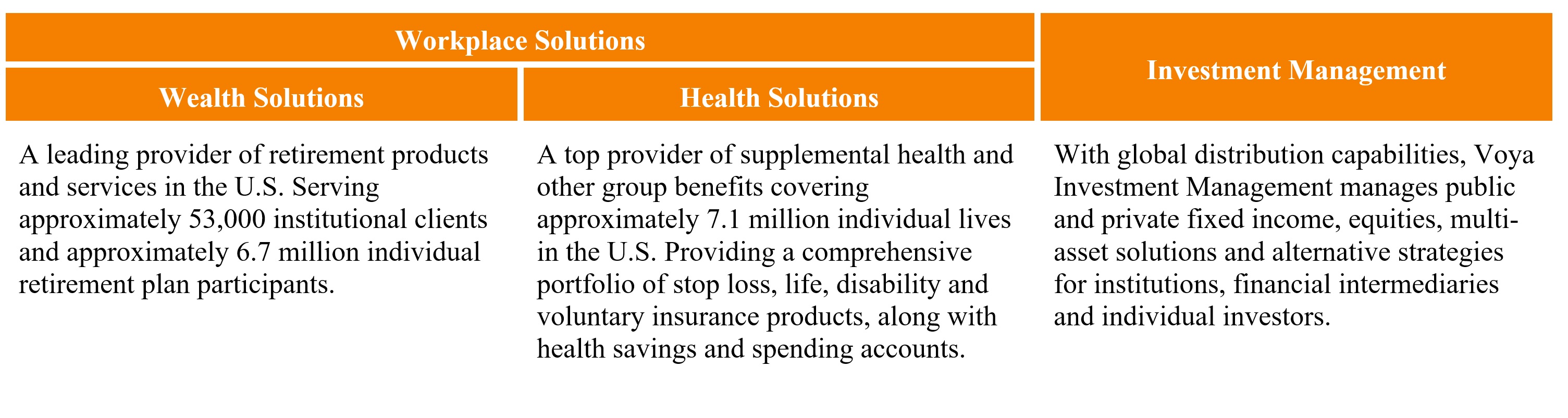

We provide our products and services principally through our Workplace Solutions business, which encompasses both our Wealth Solutions and Health Solutions segments, and through our Investment Management segment.

Activities not related to our business segments such as our corporate operations, corporate-level assets and financial obligations are included in Corporate.

On January 4, 2021, we completed the sale of our Individual Life and certain legacy annuities businesses. Accordingly, substantially all of our former Individual Life segment has now been reclassified as Discontinued Operations. The sale of the Individual Life business is described further below under —Organizational History and Structure—Individual Life Transaction.

Although it is not included in our financial results for the period covered by this Annual Report on Form 10-K, we will report the financial results of Benefitfocus in our Health Solutions segment for periods after our acquisition of that business on January 24, 2023.

4 | ||||||||

Our Segments

Voya is committed to making a secure financial future possible – one person, one family, one institution at a time, and is focused on high-growth, high-return, capital light businesses that provide complementary solutions to workplaces and institutions. We report our financial results in three segments: Wealth Solutions, Health Solutions, and Investment Management. We refer to our Wealth Solutions and Health Solutions segments collectively as our Workplace Solutions business.

As of December 31, 2022, on a consolidated basis, we had $741.2 billion in total assets under management ("AUM") and assets under administration ("AUA") and total shareholders' equity, excluding accumulated other comprehensive income/loss ("AOCI") and noncontrolling interests, of $6.3 billion.

For the year ended December 31, 2022, we generated $0.4 billion of Income (loss) from continuing operations before income taxes, and $0.9 billion of Adjusted operating earnings before income taxes. Adjusted operating earnings before income taxes is a non-GAAP financial measure. For a reconciliation of Adjusted operating earnings before income taxes to Income (loss) from continuing operations before income taxes, see the Segments Note to our Consolidated Financial Statements in Part II, Item 8. of this Annual Report on Form 10-K.

ORGANIZATIONAL HISTORY AND STRUCTURE

Our History

Prior to our initial public offering in May 2013, we were a wholly owned subsidiary of ING Groep N.V. ("ING Group"), a global financial institution based in the Netherlands.

Through ING Group, we entered the U.S. life insurance market in 1975 with the acquisition of Wisconsin National Life Insurance Company, followed in 1976 with ING Group's acquisition of Midwestern United Life Insurance Company and Security Life of Denver Insurance Company in 1977. ING Group significantly expanded its presence in the U.S. in the late 1990s and 2000s with the acquisitions of Equitable Life Insurance Company of Iowa (1997), Furman Selz, an investment advisory company (1997), ReliaStar Life Insurance Company (including Pilgrim Capital Corporation) (2000), Aetna Life Insurance and Annuity Company (including Aeltus Investment Management) (2000) and CitiStreet (2008). ING Group completely divested its ownership of Voya Financial, Inc. common stock between 2013 and 2015, and, as of March 2018, ING Group also divested its remaining interest in warrants to acquire additional shares of our common stock, which it acquired in connection with our IPO.

5 | ||||||||

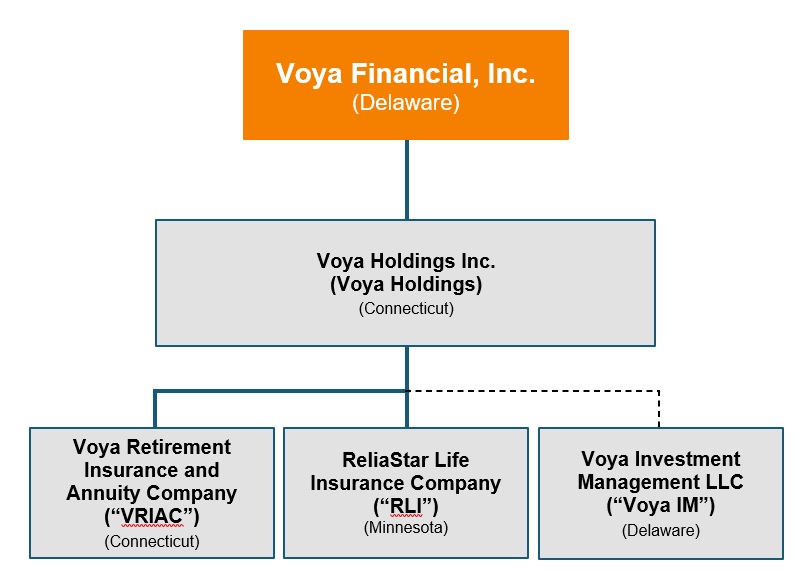

Our Organizational Structure

We are a holding company incorporated in Delaware in April 1999. We operate our businesses through a number of direct and indirect subsidiaries. The following organizational chart presents the ownership and jurisdiction of incorporation of our principal subsidiaries as of December 31, 2022:

The chart above includes:

•Voya Financial, Inc.

•Our principal intermediate holding company, Voya Holdings.

•Our principal insurance operating entities (VRIAC and RLI) that are the primary sources of cash distributions to Voya Financial, Inc.

•Voya IM, the parent company of the various entities through which we operate our Investment Management segment. We hold our interest in Voya IM through an intermediate subsidiary in which an affiliate of Allianz SE holds a 24% interest in the Class A LLC units. See —Recent Acquisition Transactions—AllianzGI.

Our former subsidiaries Security Life of Denver Insurance Company ("SLD") and Security Life of Denver International Limited ("SLDI") were divested as of January 4, 2021 upon the closing of the Individual Life Transaction described below under —Individual Life Transaction.

Individual Life Transaction

On January 4, 2021, we consummated a series of transactions (collectively, the "Individual Life Transaction") pursuant to a Master Transaction Agreement dated December 18, 2019 (the "Resolution MTA") with Resolution Life U.S. Holdings Inc., a Delaware corporation ("Resolution Life US"), pursuant to which Resolution Life US acquired all of the shares of the capital stock of SLD and SLDI, including the capital stock of several subsidiaries of SLD and SLDI. Concurrently with the sale, SLD entered into reinsurance treaties with RLI, ReliaStar Life Insurance Company of New York, an insurance company organized under the laws of the State of New York ("RLNY"), and VRIAC, each of which is a direct or indirect wholly owned subsidiary of the Company. Pursuant to these treaties, RLI and VRIAC reinsure to SLD a 100% quota share, and RLNY reinsures to SLD a 75% quota share, of their respective in-scope individual life insurance and annuities businesses. RLI, RLNY, and VRIAC remain subsidiaries of the Company. The transaction resulted in our disposition of substantially all of our life insurance and legacy non-retirement annuity businesses and related assets.

Resolution Life US is an insurance holding company formed by Resolution Life Group Holdings, L.P., a Bermuda-based limited partnership ("RLGH").

6 | ||||||||

The assets associated with the businesses sold are managed, in significant part, by Voya IM pursuant to asset management agreements with the divested companies. These investment management mandates vary according to the asset class involved, and are expected to last for minimum terms of between two and seven years after closing.

Pursuant to the Individual Life Transaction, Voya Financial has divested or dissolved five regulated insurance entities, including its life companies domiciled in Colorado and Indiana, and captive entities domiciled in Arizona and Missouri. Voya Financial has also divested Voya America Equities LLC, a regulated broker-dealer, in connection with the Individual Life Transaction and has transferred or ceased usage of a substantial number of administrative systems related to the former business.

We transferred a significant number of employees to Resolution Life US on the closing date, and also agreed to provide transition services for an initial period of up to two years following the closing, with certain services having been recently extended for an additional term. We currently expect such services to be complete by the end of 2023. We earn fees for providing these transition services.

Recent Acquisition Transactions

AllianzGI

On July 25, 2022, we completed a series of transactions (the "AllianzGI Transaction") pursuant to a Combination Agreement dated as of June 13, 2022 (the "AllianzGI Agreement") with Voya IM, Allianz SE, a stock corporation organized and existing under the laws of the European Union and the Federal Republic of Germany ("Allianz"), AllianzGI, a Delaware limited liability company and an indirect subsidiary of Allianz, and VIM Holdings LLC, a newly formed Delaware limited liability company ("VIM Holdings"), pursuant to which the parties combined Voya IM with assets and teams comprising specified strategies previously managed by AllianzGI. The acquisition increases the international scale and distribution of our investment products and provides us with new capabilities that diversify our investment strategies and help us meet the needs of a larger and more global client base.

For further details, refer to the Business, Basis of Presentation and Significant Accounting Policies Note in our Consolidated Financial Statements in Part II, Item 8. of this Annual Report on Form 10-K.

Czech Asset Management

On November 1, 2022, Voya Investment Management Alternative Assets, LLC ("VIMAA"), a subsidiary of Voya IM, acquired all of the issued and outstanding equity interests of Czech Asset Management, L.P., a private credit asset manager dedicated to the U.S. middle market. The acquisition was executed for cash consideration and expands VIMAA’s private and leveraged credit business.

Benefitfocus

On January 24, 2023, we completed the acquisition of Benefitfocus, an industry-leading benefits administration technology company that serves employers, health plans and brokers. For further details, refer to the Business, Basis of Presentation and Significant Accounting Policies Note in our Consolidated Financial Statements in Part II, Item 8. of this Annual Report on Form 10-K.

Benefitfocus helps organizations simplify the complexity of benefits administration. Benefitfocus solutions have a personalized user-friendly interface designed for people to choose and access a broad line-up of workplace benefits. As a result of our acquisition of Benefitfocus, we reach approximately 16.5 million subscription employees across employer and health plan clients.

Environmental, Social and Governance ("ESG")

We have a multi-faceted ESG strategy which encompasses corporate governance, product and solution development, and ESG advocacy. We report periodically on our ESG activities in accordance with Global Reporting Initiative (GRI) Standards.

Our ESG strategy encompasses the adoption of practices and policies across the Company that help contribute to positive outcomes for our colleagues, communities and customers by providing information to attract and retain customers, investors

7 | ||||||||

and other key stakeholders, and earn their trust and confidence. In support of our business growth and success, we identify how we treat our employees; respond to climate change; increase diversity, equity and inclusion; and build community connections.

Environmental Stewardship

We encourage the responsible use of natural resources in a way that takes full and balanced account of the interests of society, future generations, and business needs. We work to minimize our environmental impact while engaging our various stakeholders on climate-related topics. In particular, we do this through the reduction of waste consumption and greenhouse gas emissions, the reduction of energy use, and the purchase of renewable energy certificates and offsets to compensate for energy consumption.

Social responsibility and financial inclusion

Voya's commitment to Diversity, Equity and Inclusion helps drive our business growth and positively influences our culture, serves our clients and enriches communities by advancing racial, social and financial equity and inclusion in underserved communities. For example, we focus on workplace diversity, talent development and retention, including through fostering a safe and supportive workplace. Our Voya Cares® program is designed to impact the lives of aging people, people with special needs and disabilities, their families and their caregivers by helping them plan for the future they envision in retirement. We have prioritized increasing our diverse representation across all employee levels, as well as continuing to sustain the gender and racial parity of our workforce. See —Human Capital Resources below for more information.

Governance and ethics

Our Board of Directors consists of our Executive Chairman and our CEO, together with nine independent directors, including a lead independent director, each of whom is elected annually. Our Board represents a diverse array of tenures, experiences and backgrounds, and reflects gender parity.

Our management team aligns its priorities with the long-term interests of our shareholders through a requirement to own meaningful amounts of Voya stock.

OUR BUSINESSES

Workplace Solutions

Our Workplace Solutions business comprises our Wealth Solutions and Health Solutions segments, and provides integrated retirement savings and workplace benefits solutions. We help our clients optimize spend on workplace benefits and savings programs and improve health and wealth outcomes for their employees and plan participants.

Wealth Solutions

Our Wealth Solutions segment provides retirement plan products and administration services to employers alongside a robust suite of financial wellness offerings to serve employees and plan participants. We also provide individual retirement accounts and financial guidance and advisory services that enable us to deepen relationships with our retirement plan participants. Wealth Solutions has a combined $474.3 billion of AUM and AUA as of December 31, 2022 (including retail assets under advisement), of which $73.7 billion were in proprietary assets.

Our Retirement Plans business, with AUM and AUA of $451.7 billion as of December 31, 2022, offers qualified and non-qualified tax-deferred employer-sponsored retirement savings plan and administrative services to corporations of all sizes, public and private school systems, higher education institutions, hospitals and healthcare facilities, not-for-profit organizations and state and local governments. We also offer stable value investment products to retirement plan sponsors. Our Retirement Plans business is diversified across economic sectors, market segments and plan sizes, and provides services to approximately 53,000 plan sponsors covering approximately 6.7 million plan participant accounts as of December 31, 2022.

Our Retail Wealth Management business has AUM and AUA of $22.6 billion as of December 31, 2022. Retail Wealth Management AUA includes assets under advisement, which comprises brokerage and investment advisory assets. This business offers planning and advisory services through protection and investment products to help individuals plan, protect and invest to and through retirement. Products and services are provided through Voya's registered investment advisor and broker-dealer, Voya Financial Advisors ("VFA").

8 | ||||||||

Our Wealth Solutions segment earns revenue from a diverse and complementary business mix, primarily fee income from asset and participant-based recordkeeping and advisory fees as well as investment income on our general account and other funds. Because our fee income is generally tied to account values, our profitability is determined in part by the amount of assets we have under management, administration or advisement, which in turn depends on sales volumes to new and existing clients, net deposits from retirement plan participants, and changes in the market value of account assets. Our profitability also depends on the difference between the investment income we earn on our general account assets, or our portfolio yield, and crediting rates on client accounts. Wealth Solutions generated Adjusted operating earnings before income taxes of $707 million for the year ended December 31, 2022. Our Investment Management segment also earns market-based fees from the management of the general account and mutual fund assets supporting the Retirement Plans business and certain Retail Wealth Management products and advisory solutions.

Retirement Plans

Employer Markets – Corporate and Tax Exempt

| Market | Employee Size | Asset Range | Typical Customer Solutions | ||||||||

| Small Market | <1,000 | $0-$50 million | •Full service retirement plans •Retirement plan recordkeeping services •Investment options, including stable value solutions •Executive benefit plans •Health account services •Financial wellness, guidance and advice services to individuals | ||||||||

| Mid-Market | 1,000-10,000 | $50-$250 million | |||||||||

| Large Market | >10,000 | >$250 million | |||||||||

| Government Market | All sizes | All sizes | |||||||||

Products and Services

We are one of the nation's leading providers that offer qualified and non-qualified tax-deferred employer-sponsored retirement savings plans, services and support to the full spectrum of private- and public-sector employers, ranging from small to mega-sized plans and across all markets and code sections. These plans may be offered either as full service options that bundle together plan administration and investment services, or as recordkeeping services products that focus on administration services alongside a fully open architecture investment structure that employers can use to customize their plan's investment menu. We also offer stable value investment options to plan sponsor clients and a suite of advice and guidance and other financial wellness solutions to our plan participants. Participant solutions include health account services (encompassing health savings accounts, health retirement accounts and flexible spending accounts), student loan debt and emergency savings support, and additional products and services through our Voya Cares® program, which serves aging people, people with special needs and disabilities, their families and their caregivers.

We also offer a broad suite of financial wellness offerings, including planning, guidance and advisory products, tools and services, student loan and emergency savings support and retirement income options. Additionally, our configurable financial wellness offering and integrated digital experiences, such as our myVoyage personalized workplace benefits and savings navigation tool, help optimize benefits spending, simplify administration and provide participants with a unique experience and more holistic view of their finances.

Full-service retirement products provide plan sponsors with options that meet their needs for both administrative and investment services, which include recordkeeping and plan administration support, tailored participant communications and education programs, supportive digital capabilities for intermediaries, sponsors and plan participants (plus mobile capabilities for participants), trustee services and institutional and retail investments. Offerings include products for defined contribution plans for tax-advantaged retirement savings, as well as non-qualified executive benefit plans and employer stock option plans. Plan sponsors may select from a variety of investment structures and products, such as general account, separate account, mutual funds, stable value or collective investment trusts and a variety of underlying asset types (including their own employer stock and socially responsible funds including a private equity option within non-qualified executive plans). A broad selection of funds is available for our products in all asset categories from over 200 fund families, including the Voya family of mutual funds managed by Voya IM. An open architecture investment platform (which offers most funds for which trades are cleared through the National Securities Clearing Corporation) is also available in certain products for larger full-service plans. Our full-service retirement plan offerings are supported by financial guidance and personalized and objective participant investment advisory services offered through our Retail Wealth Management business or through a third party to help prepare individuals for retirement.

9 | ||||||||

Recordkeeping service products provide recordkeeping and plan administration support alongside a fully open architecture investment structure that employers can use to customize their plan's investment menu. These products are offered to a sponsor base that includes multi/pooled employer plans, mid, large and mega-sized corporations and state and local governments. Our recordkeeping retirement plan offerings are supported by participant communications and education programs, digital capabilities for intermediaries, sponsors and plan participants (plus mobile capabilities for participants), as well as financial guidance and personalized and objective participant investment advisory services offered through our Retail Wealth Management business and Voya Retirement Advisors (our registered investment advisor group serving in-plan participants with the in-plan advisory services program).

Stable value investment options may be offered within our full service institutional plans, or as investment-only options within our recordkeeping services plans or within other vendor plans. Our product offering includes both separate account guaranteed investment contracts ("GICs") and synthetic GICs managed by either proprietary or outside investment managers.

The following chart presents our Retirement Plans product/service models and corresponding AUM and AUA, key markets in which we compete, primary defined contribution plan Internal Revenue Code sections and core products offered for each market segment.

| Product/Service Model | AUM/AUA (as of December 31, 2022) | Key Market Segments/Product Lines | Primary Internal Revenue Code section | Core Products* | ||||||||||

| Full Service Plans | $162.7 billion** | Small-Mid Corporate | 401(k) | Voya MAP Select, Voya Framework | ||||||||||

| K-12 Education | 403(b) | Voya Custom Choice II, Voya Retirement Choice II, Voya Framework | ||||||||||||

| Higher Education | 403(b) | Voya Retirement Choice II, Voya Retirement Plus II, Voya Framework | ||||||||||||

| Healthcare & Other Non-Profits | 403(b) | Voya Retirement Choice II, Voya Retirement Plus II, Voya Framework | ||||||||||||

| Government (Local & State) | 457 | RetireFlex-SA, RetireFlex-MF, Voya Health Reserve Account, Voya Framework | ||||||||||||

| Recordkeeping Business | $250.5 billion | |||||||||||||

| Mid-Large Corporate | 401(k) | *** | ||||||||||||

| Government (Local & State) | 457 | *** | ||||||||||||

| Non Qualified Business | **** | All Markets | 409A | **** | ||||||||||

| Stable Value/Other | $38.5 billion | All Markets | All tax codes | Separate Account and Synthetic GICs | ||||||||||

* Core products actively being sold today.

** Includes a small block of assets associated with legacy K-12 Education market products, primarily fixed annuities, issued by RLI. Voya no longer manufactures new RLI products for distribution by sales agents licensed with RLI.

*** Offerings include administration services and investment options such as mutual funds, commingled trusts and separate accounts.

****Various solutions across tax codes are record-kept and accompanied by specialized administration services, consultative plan design and financing strategies, flexible funding options and tailored participant services. We have approximately $5.0 billion of total assets and liabilities in non-qualified business both within our Full Service and Recordkeeping segments and with clients using only our non-qualified solutions.

Our Voya Framework product can be sold across both full service corporate and tax-exempt markets. It is a mutual fund program offered to fund qualified retirement plans, and it gives plan advisors and third party administrators who work with us a uniform and consistent product experience across multiple plan markets. Voya Framework is distinguished by its flexible recordkeeping platform and contains over 300 funds from well-known fund families for smaller plans or can be provided as an

10 | ||||||||

open architecture investment platform for larger plans (this platform offers most funds for which trades are cleared through the National Securities Clearing Corporation). This product also includes our general account and various stable value solutions as investment options.

In addition to Voya Framework, we offer products customized to each of the full service corporate market and the full service tax exempt market.

For plans in the full service corporate market, we offer Voya MAP Select, a group funding agreement/group annuity contract to fund qualified retirement plans. Voya MAP Select contains over 300 funds from well-known fund families for smaller plans or can be provided as an open architecture investment platform for larger plans (this platform offers most funds for which trades are cleared through the National Securities Clearing Corporation). This product also includes our general account and various stable value solutions as investment options.

For plans in the full service tax-exempt market, we offer a variety of products that include the following:

•Voya Retirement Choice II and RetireFlex-MF, mutual fund products which provide flexible funding vehicles and are designed to provide a diversified menu of mutual funds in addition to a guaranteed option (available through a group fixed annuity contract or stable value product).

•Voya Retirement Plus II and Voya Custom Choice II, registered group annuity products featuring variable investment options held in a variable annuity separate account and a fixed investment option held in the general account.

•RetireFlex-SA, an unregistered group annuity product which features variable investment options held in a variable annuity separate account and a guaranteed option (available through a group fixed annuity contract or stable value product).

Markets and Distribution

Our Retirement Plans business serves two primary markets: Corporate and Tax Exempt. Both markets utilize our innovative participant-facing digital capabilities to help shift the mindset of plan participants from focusing only on accumulation to focusing on both accumulation and adequate income in retirement.

Corporate Markets:

•Small-Mid Corporate Market. We offer full service solutions to defined contribution plans of small to medium-sized corporations. Our product offerings include menu-based investment solutions and an open architecture investment platform, comprehensive fiduciary solutions, dedicated and proactive service teams, non-qualified executive compensation plans, and product and service innovations leveraged from our expertise across multiple market segments (all sizes of plans as well as code sections).

•Mid-Large Corporate Market. We offer recordkeeping services and non-qualified executive compensation solutions to defined contribution clients of mid-sized to large corporations. We also offer a variety of investment options for employers to include in their plan investment line-ups for their employees should they choose to do so. Our solutions and capabilities support the most complex retirement plans with a special focus on client relationship management, tailored communication campaigns and education and enrollment support to help employers prepare their employees for retirement. We are dedicated to providing engaging information through innovative award-winning technology-based tools and print materials to help plan participants achieve a secure and dignified retirement.

Tax Exempt Markets:

•Education Market. We offer comprehensive full service solutions to both public and private K-12 educational entities as well as public and private higher education institutions. In the U.S., we rank third in higher education and fourth in K-12 education market by assets as of September 30, 2022. Our long-standing position as one of the top providers in this market is driven by our support to plan sponsors (including solutions to reduce administrative burden, deep technical and regulatory expertise, and strong on-site service teams), plus our support to plan advisors, and our broad suite of financial wellness products, tools, and services for plan participants.

11 | ||||||||

•Healthcare/Other Non-Profits Market. We service hospitals, healthcare organizations and not-for-profit entities by offering full service solutions for a variety of plan types and code sections. We offer services that reduce sponsors' administrative burdens and provide them with deep technical and fiduciary expertise. Additionally, we offer on-site service teams to assist plan sponsors with their plans and to assist their employees with understanding and using their plan benefits. We also provide tailored communications, education and enrollment support plus a broad suite of financial wellness products, tools and services that help prepare plan participants for retirement.

•Government Market. We provide both full service and recordkeeping services offerings to small and large governmental entities (e.g., state and local government) with a client base that spans nearly 50 states and U.S. territories. For large governmental sponsors, we offer recordkeeping services that meet the most complex of needs, while also offering extensive participant communication and retirement education support, including a broad suite of financial wellness products, tools and services. We also offer a broad range of proprietary and non-proprietary variable and stable value investment options. Our flexibility and expertise help make us one of the top ranked providers in the government market in the U.S. based on AUM and AUA as of September 30, 2022.

Our Retirement Plans are distributed nationally through multiple unaffiliated channels supported by our employee wholesale field force and dedicated sales teams and through other affiliated distribution such as our owned broker-dealer and investment advisor, VFA. We offer localized support to distribution partners and their clients during and after the sales process as well as a broad selection of investment options with flexibility of choice and comprehensive fiduciary solutions to help their clients meet or exceed plan guidelines and responsibilities.

Unaffiliated Distribution:

•Independent Sales Agents. As of December 31, 2022, we work with approximately 2,700 sales agents who primarily sell fixed annuity products from multiple vendors in the education market. Activities by these representatives are centered on increasing participant enrollments and deferral amounts in our existing K-12 education segment plans.

•Brokers and Advisors. Over 11,000 wirehouse and independent regional and local brokers, specialty retirement plan advisors plus registered investment advisors (calculated on a rolling three-year basis as of December 31, 2022) are the primary distributors of our small-mid corporate market products, and they also distribute products to the education, healthcare and government markets. These producers typically present their clients (i.e., employers seeking a defined contribution plan for their employees) with plan options from multiple vendors for comparison and may also help with employee enrollment and education.

•Third Party Administrators ("TPAs"). As of December 31, 2022, we have long-standing relationships with nearly 1,100 TPAs who work with a variety of retirement plan providers and are selling and/or service partners for our small-mid corporate markets and select tax exempt market plans. While TPAs typically focus on providing plan services only (such as administration and compliance testing), some also initiate and complete the sales process. TPAs also play a vital role as the connecting point between our wholesale team and unaffiliated producers who seek references for determining which providers they should recommend to their clients.

Affiliated Distribution:

•Voya Financial Advisors ("VFA"). Approximately 450 VFA representatives sell our workplace retirement plans and support plan participants with enrollment, education and advice and guidance services. These representatives are field and phone-based financial professionals. The field-based channel focuses primarily on driving enrollment and contribution activity within our education, healthcare and government market workplace retirement plans. They also provide in-plan education and guidance and retail sold-financial advisory services to help individuals in these markets meet their retirement savings and income goals. The home office phone-based representatives focus on providing education, guidance and rollover support services to our workplace retirement plan participants.

•Wholesale Field Force. Locally based employee wholesalers focus on expanding and strengthening relationships with unaffiliated distribution partners and third party administrators who sell and service our workplace retirement plan offerings to employers across the nation.

•Dedicated Voya Sales Teams. Our employee sales teams work with over 200 different pension/specialty consulting firms, including national aggregators with both affiliated and unaffiliated firm-level business models. Consultant firms represent employers in corporate and tax-exempt markets seeking large-mega retirement plans, stable value solutions

12 | ||||||||

and non-qualified executive compensation offerings. Our relationships with these firms are increasingly valuable as their continued growth expands our distribution reach through the consultant marketplace.

Competition

Our Retirement Plans business competes with other large, well-established insurance companies, asset managers, record keepers and diversified financial institutions. Top competition varies in all market segments as few institutions are able to compete across all markets as extensively as we do. The following chart presents a summary of the current competitive landscape in the markets where we offer our Workplace Retirement Plans and stable value solutions:

| Market/Product Segment | Competitive Landscape | Select Competitors | ||||||

| Small-Mid Corporate | Primary competitors are mutual fund companies and insurance-based providers with third-party administration relationships | Fidelity Empower | ||||||

| K-12 Education | Primary competitors are insurance-based providers that focus on school districts across the nation | Equitable Corebridge | ||||||

| Higher Education | Competitors are 403(b) plan providers, asset managers and some insurance-based providers | TIAA Fidelity | ||||||

| Healthcare & Other Non-Profits | Competition varies across 403(b) plan providers, asset managers and some insurance-based providers | Fidelity TIAA | ||||||

| Government | Competitors are primarily insurance-based providers, but also include asset managers and 457 providers | Empower Nationwide | ||||||

| Mid-Large Corporate Recordkeeping | Competitors are primarily asset managers and business consulting services firms, but also include payroll firms and insurance-based providers | Fidelity Empower | ||||||

| Stable Value | Competitors are primarily select insurance companies who are also dedicated to the Stable value market, but also include certain banking institutions | Empower MetLife | ||||||

In addition, we also compete more generally in the Retirement Plans business against companies such as Capital Group, Principal Financial, John Hancock, T. Rowe Price, Lincoln Financial, Transamerica, Vanguard, Paychex and ADP.

Our Retirement Plans business competes on the value we deliver to help guide individuals to greater financial wellness through competitively priced products, tools and services provided through the workplace. Our full-service business also competes on the breadth of our service and investment offerings, technical/regulatory expertise, industry experience, local enrollment and education support, investment flexibility and our ability to offer industry tailored product features to meet the financial wellness and retirement income needs of our clients. We have seen industry concentration in the large plan recordkeeping business, as providers seek to increase scale, improve cost efficiencies and enter new market segments. We emphasize our strong sponsor relationships, flexible value-added services, ability to customize recordkeeping and administration services to match client needs, and technical and regulatory expertise as our competitive strengths. Additionally, we compete with our broad suite of products and financial wellness tools and services, including our innovative and robust digital and mobile capabilities, to help employers support the retirement preparedness and financial needs of their employees. Our long standing experience in the retirement market and strong stable value expertise allows us to effectively compete against existing and new providers.

Underwriting and Pricing

We price our institutional retirement products based on long-term assumptions that include investment returns, mortality, persistency and operating costs. We establish target returns for each product based upon these factors and the expected amount of regulatory and rating agency capital that we must hold to support these contracts over their projected lifetime. We monitor and manage pricing and sales mix to achieve target returns. It may take new business several years to become profitable, depending on the nature and life of the product, and returns are subject to variability as actual results may differ from pricing assumptions. We seek to mitigate investment risk by actively managing market and credit risks associated with investments and through asset/liability matching portfolio management.

13 | ||||||||

Retail Wealth Management

Products and Services

Our Retail Wealth Management business offers a variety of investments and protection products, along with advice and guidance delivered to individuals through field-based advisory representatives and home office phone-based representatives. Our current investment solutions include a variety of mutual fund custodial IRA products, managed accounts and advisory programs, and brokerage accounts. The IRA products include certain tax-qualified mutual fund custodial products that were retained from the Annuities business we divested in 2018, which are also sold by our employee wholesale team that works directly with affiliated and unaffiliated brokers and advisers who sell individual retirement accounts to individuals or small businesses.

While the primary focus of our Wealth Solutions segment is to serve approximately 6.7 million defined contribution plan participants (as of December 31, 2022), we also seek to serve these individuals by utilizing our Retail Wealth Management business to deepen our relationships with them for the long-term. We believe that our ability to offer an integrated approach to an individual customer’s entire financial picture, while saving for or living in retirement, presents a compelling reason for our Retirement Plans participants to partner with us as their principal investment and retirement plan provider. Through our broad range of advisory programs, our financial advisers are provided with a wide set of solutions for building their clients' investment portfolios, including stocks, bonds and mutual funds, as well as managed accounts.

Markets and Distribution

Retail Wealth Management products and advisory services are primarily sold to individuals through representatives licensed through VFA, our broker-dealer and investment advisor. The VFA representatives help provide cohesiveness between our Retirement Plans and Retail Wealth Management businesses and are grouped into two primary categories: field-based and home office phone-based representatives. Field-based representatives are registered sales and investment advisory representatives that drive both fee-based and commissioned sales. They provide face-to-face interaction with individuals seeking retail investment products (e.g., IRA products) as well as planning and advisory solutions. Home office phone-based representatives focus on assisting participants in our workplace retirement plans, primarily for our larger recordkeeping plans, with rollover products and advisory services. They also provide financial advice that helps customers transition through life stage and job-related changes. Our custodial mutual fund IRA product is also sold to individuals by unaffiliated brokers and advisors.

Competition

Our Retail Wealth Management advisory services and product solutions compete for rollover and other asset consolidation opportunities against integrated financial services companies and independent broker-dealers who also offer individual retirement products, all of which currently have more market share than insurance-based providers in this space. Primary competitors to our Retail Wealth Management business include LPL, SagePoint Financial, Kestra, Waddell & Reed, Securities America and Commonwealth.

Our Retail Wealth Management advisory services and product solutions are competitively priced and compete based on our consultative approach, simplicity of design and a fund and investment selection process that includes proprietary and non-proprietary investment options. The advisory services and product solutions are targeted towards existing workplace retirement plan participants, which allow us to benefit from our extensive relationships with large corporate and tax-exempt plan sponsors, our small and mid-corporate market plan sponsors and other qualified plan segments in healthcare, higher education and K-12 education.

Underwriting and Pricing

We price our individual retirement products based on long-term assumptions that include investment returns and operating costs. We establish target returns for each product based upon these factors and the expected amount of regulatory and rating agency capital, to the extent any is required, that we must hold to support these contracts and investment products over their projected lifetime. We monitor and manage pricing and sales mix to achieve target returns. It may take new business several years to become profitable, depending on the nature and life of the product, and returns are subject to variability as actual results may differ from pricing assumptions. Where we bear investment risk, we seek to mitigate such risk by actively managing both market and credit risks associated with investments and through asset/liability matching portfolio management.

14 | ||||||||

Health Solutions

Our Health Solutions segment provides worksite employee benefits, Health Account Solutions (Health Savings Account ("HSA")/FSA/HRA and COBRA administration), Leave Management, financial wellness and decision support products and services to mid-size and large corporate employers and professional associations to help foster a workforce with a healthy balance for living today, prepared for tomorrow and feeling confident about the future. In addition, our Health Solutions segment serves the employer market by providing stop-loss coverage to employer plan sponsors that self-fund their pharmaceutical and medical benefits plans. Our Health Solutions segment is among the largest writers of stop-loss coverage in the U.S., currently ranking fourth among third-party carriers on a premium basis with approximately $1.3 billion of in-force premiums. We also rank fifth in our supplemental health benefits markets offering and are a top 15 provider of group life. As of December 31, 2022, Health Solutions total in-force premiums were $2.8 billion.

The Health Solutions segment generates revenue from premiums and fees, investment income, mortality and morbidity and other charges. Investment income is driven by the spread between investment yields and credited rates (the interest and income that is credited to the policies) to policyholders on voluntary universal life, whole life products, and HSA invested assets. Underwriting income derives from the difference between premiums and mortality charges collected and benefits and expenses paid for group life, stop loss and Voluntary Benefits. Fee income is generated from margin on expenses for services provided on Leave Management, HSA/FSA/HRA and COBRA administration and proprietary decision support tools. Our Health Solutions segment generated adjusted operating earnings before income taxes of $291 million for the year ended December 31, 2022.

We believe that our Health Solutions segment offers significant opportunities for growth through expansion of Voluntary Benefits and Health Account Solutions as employers increasingly seek to have employees bear a greater proportion of the cost of medical coverage. We are well-positioned to offer complementary products such as Accident Critical Illness and Hospital Indemnity that protect the workforce from having to consume savings and retirement assets from their HSA or retirement plans while providing financial protection from life events with short-term disability, long-term disability and life insurance.

We also provide decision support tools such as myVoyage which help employees select the right combination of benefits to meet their individual circumstances and objectives. We support employers by taking on the administrative burden of leave management, COBRA administration and other obligations with simplified billing, medical claims integration and by offering stop-loss coverage.

Products and Services

Our Health Solutions segment offers stop-loss insurance, voluntary benefits, and group life and disability, Health Account Solutions (HSA/FSA/HRA and COBRA administration), Leave Management and decision support products and services. These offerings are designed to meet the financial needs of both employers and employees by helping employers attract and retain employees and control costs, provide ease of administration and valuable financial protection for employees.

Stop Loss. Our stop-loss insurance provides coverage for mid-sized to large employers that self-insure their medical claims. These employers provide a health plan to their employees and generally pay all plan-related claims and administrative expenses. Our stop-loss product helps these employers contain their health expenses by reimbursing specified claim amounts above certain deductibles and by reimbursing claims that exceed a specified limit. We offer this product via two types of protection—individual stop-loss insurance and aggregate stop-loss insurance. The primary difference between these two types is a varying deductible; both coverages are re-priced and renewable annually.

Voluntary Benefits. Our voluntary benefits business involves the sale of whole life insurance, critical illness, accident and hospital indemnity insurance, while also servicing universal life insurance policies. This product lineup is mostly employee-paid through payroll deduction.

Group Life. Group life products span basic and supplemental term life insurance as well as accidental death and dismemberment for mid-sized to large employers. These products offer employees guaranteed issue coverage, convenient payroll deduction, affordable rates and conversion options.

Group Disability. Group disability includes group long term disability, short term disability, voluntary long term disability and voluntary short term disability products for mid-sized to large employers. This product offering is typically packaged for sale with group life products, especially in the middle-market. We also provide leave administration services. We partner with

15 | ||||||||

FullScopeRMS (formerly DisabilityRMS), a third-party insurer, to provide leave management and reinsure 100% of our group disability.

Health Account Solutions. This product line involves the sale of health savings accounts, flexible spending accounts and health reimbursement arrangements, commuter and dependent care benefits, COBRA administration and direct billing services.

Financial Wellness and Decision Support. With our MyVoyage application, we offer a distinctive guidance and advice tool that assists employees and their dependents to make more informed decisions in choosing among complex enrollment decisions that span medical coverage, dental insurance, vision, HAS, FSA, Retirement contributions and emergency savings. Premiums associated with Financial Wellness and Decision Support are included within Health Account Solutions.

The following chart presents the key Health Solutions products we offer, along with annualized in-force premiums for each product:

| ($ in millions) | Annualized In-Force Premiums | ||||

| Health Solutions Products | Year Ended December 31, 2022 | ||||

| Stop Loss | $ | 1,258 | |||

| Voluntary Benefits | 670 | ||||

| Group Life | 610 | ||||

| Group Disability | 224 | ||||

| Health Account Solutions | 19 | ||||

Markets and Distribution

Our Health Solutions segment works primarily with national and regional benefits consultants, brokers, TPAs, enrollment firms and technology partners. Our tenured distribution organization provides local sales and account management support to offer customized solutions to mid-sized to large employers backed by a national accounts team. We offer innovative and flexible solutions to meet the varying and changing needs of our customers and distribution partners. We have many years of experience providing unique stop-loss solutions and products for our customers. In addition, we are an experienced multi-line employee benefits insurance carrier (group life, disability, stop loss and voluntary benefits).

Competition

The stop-loss insurance market is mature. Due to the large number of participants in this segment, price and claim servicing are important competitive drivers. Our principal competitors include Sun Life, Tokio Marine HCC (formerly Houston Casualty), and Symetra.

The supplemental benefits market is growing rapidly and we compete on price, claim servicing and product innovation with our principal competitors being Cigna, Aetna and Aflac.

The group life market is the most mature of our market segments and most often sold alongside disability where competitive drivers for both are price, claim servicing, and additional administrative capabilities (such as leave management). Our principal competitors include MetLife, New York Life and Unum.

The Health Account Solutions market continues to grow at a rapid pace, and includes HSAs, FSAs, COBRA administration, and billing services. Our principal competitors in this market are Health Equity, Optum (part of UnitedHealthcare), Fidelity and HSA Bank (part of Webster Bank).

Underwriting and Pricing

Group insurance pricing reflects the employer group’s claims experience and the risk characteristics of each employer group. The employer’s claims experience is reviewed at time of policy issuance and periodically thereafter, resulting in ongoing pricing adjustments. The key pricing and underwriting criteria are morbidity and mortality assumptions, the employer group’s demographic composition, the industry, geographic location, regional and national economic trends, plan design and prior claims experience. Pricing for our group disability products is determined by our reinsurer, FullScopeRMS, and we assume no underwriting risk in connection with such products.

16 | ||||||||

Stop loss insurance pricing reflects the risk characteristics and claims experience for each employer group. The product is annually renewable and the underwriting information is reviewed annually as a result. The key pricing and underwriting criteria are medical cost trends, morbidity assumptions, the employer group’s demographic composition, the industry, geographic location, plan design and prior claims experience. Pricing in the stop-loss insurance market is generally cyclical.

Reinsurance

Our Health Solutions reinsurance strategy seeks to limit our exposure to any one individual which helps limit and control risk. Group Life, which includes Accidental Death and Dismemberment, cedes the excess over $750,000 of each coverage to a reinsurer. Group Long Term Disability cedes substantially all of the risk including the claims servicing, to a TPA and reinsurer. As of January 1, 2022, Stop Loss has a reinsurance program in place that limits our exposure on any one specific claim to $5.0 million, with aggregate stop-loss reinsurance that limits our exposure to $5.0 million over the Policyholder's Aggregate Excess Retention. For policies issued in 2021 and 2020, the limits on any one specific claim are $4.5 million and $4.0 million, respectively and there is aggregate stop-loss reinsurance limiting our exposure to $4.5 million over the Policyholders Aggregate Excess Retention. See Quantitative and Qualitative Disclosures About Market Risk—Risk Management in Part II, Item 7A. of this Annual Report on Form 10-K. We also use an annually renewable reinsurance transaction which lowers required capital of the Health Solutions segment.

Investment Management

With global distribution capabilities, we offer domestic and international fixed income, equity, alternatives and multi-asset products and solutions across market sectors and investment styles through our actively managed, full-service investment management business. As of December 31, 2022, our Investment Management segment managed $258.5 billion for third-party institutional and individual investors (including third-party variable annuity-sourced assets), $24.8 billion in separate account assets for our other businesses and $38.0 billion in general account assets. We also offer a range of privates and alternative asset solutions across fixed income and alternative investment products with AUM of $99.7 billion for such privates and alternatives products.

On July 25, 2022, we completed the AllianzGI Transaction, pursuant to which we acquired assets and teams comprising specified strategies previously managed by AllianzGI. The AllianzGI Transaction increases the international scale and distribution of our investment products and provides us with new capabilities that diversify our investment strategies and help us meet the needs of a larger and more global client base.

We are committed to reliable and responsible investing and delivering research-driven, risk-adjusted, client-oriented investment strategies and solutions and advisory services across asset classes, geographies and investment styles. Investment Management is committed to meeting increasing demands of clients, shareholders and stakeholders with respect to ESG investment issues while continuing to focus upon our adaptive, research-driven investment practices. In evaluating existing and potential investments, we consider material factors, including the integration of ESG factors, as appropriate, to determine whether any or all of those factors might have a material effect on the value, risks, or prospects of an investment opportunity over time.

Through our institutional distribution channel and our Voya-affiliate businesses, we serve a variety of institutional clients, including public, corporate and Taft-Hartley Act defined benefit and defined contribution retirement plans, endowments and foundations, and insurance companies. We also serve individual investors by offering our mutual funds, separately managed accounts, and private and alternative funds through an intermediary-focused distribution platform or through affiliate and third-party retirement platforms.

Investment Management’s primary source of revenue is management fees collected on the assets we manage. These fees are typically based upon a percentage of AUM. In certain investment management fee arrangements, we may also receive performance-based incentive fees when the return on AUM exceeds certain benchmark returns or other performance hurdles. In addition, and to a lesser extent, Investment Management collects administrative fees on outside managed assets that are administered by our mutual fund platform and distributed primarily by our Wealth Solutions segment. Investment Management also receives fees as the primary investment manager of our general account, which is managed on a market-based pricing basis. Finally, Investment Management generates revenues from a portfolio of seed capital investments in private equity, Collateralized Loan Obligations ("CLOs") and various funds. Excluding Allianz's non-controlling interest, Investment Management generated adjusted operating earnings before income taxes of $158 million for the year ended December 31, 2022.

The success of our platform begins with providing our clients continued strong investment performance. In addition to investment performance, our focus is on client "solutions" and income and outcome-oriented products which include target date

17 | ||||||||

funds. We expect that our traditional public markets business and privates and alternatives capabilities, leveraging strong investment performance combined with superior client service, will drive positive net cash flows and AUM growth.

Products and Services

Investment Management delivers products and services that are manufactured through our traditional, private asset and alternative investment capabilities. The traditional platforms are fixed income, equities and multi-asset strategies and solutions ("MASS"). Our private asset and alternative capabilities include investment strategies such as private equity. private credit (investment grade and high yield), commercial mortgage loans, mortgage derivatives, leveraged credit and CLOs. The onboarding of former AllianzGI investment strategies has increased our product offering across thematic and fundamental equity and added multi-asset fund offerings.

Fixed Income. Investment Management’s fixed income platform manages assets for domestic and international institutional investors, retail investors and our general account. As of December 31, 2022, there was $221.6 billion in AUM on the fixed income platform, of which $38.0 billion were general account assets. Through the fixed income platform, clients have access to public fixed income strategies including money market funds, investment-grade corporate debt, government bonds, residential mortgage-backed securities ("RMBS"), commercial mortgage-backed securities ("CMBS"), asset-backed securities ("ABS"), and high yield bonds. Our private fixed income capabilities include private placements, middle market private debt and syndicated debt instruments, leveraged credit, structured products (e.g., CLOs), commercial mortgages and preferred securities. Each sector within the platform is managed by seasoned investment professionals supported by significant credit, quantitative and macro research and risk management capabilities.

Equities. The equities platform is a multi-cap and multi-style research-driven platform comprising thematic, fundamental and quantitative equity strategies for institutional and retail investors. As of December 31, 2022, there were $83.4 billion in AUM on the equities platform covering both domestic and international markets. Our fundamental equity capabilities are bottom-up and research driven, and cover growth, value, and core strategies in the large, mid and small cap spaces. The AllianzGI Transaction added thematic and fundamental equity capabilities. Our quantitative equity capabilities are used to create quantitative and enhanced indexed strategies, support other fundamental equity analysis, and create extension products.

Alternatives. Investment Management’s largest alternatives platform is Pomona Capital. Pomona Capital specializes in investing in private equity funds in three ways: by purchasing secondary interests in existing partnerships; by investing in new partnerships; and by co-investing alongside buyout funds in individual companies. As of December 31, 2022, Pomona Capital managed assets totaling $10.0 billion across a suite of limited partnerships and the Pomona Investment Fund, a registered investment fund that is available to accredited investors. In addition, Investment Management's alternatives platform includes privately-placed open-end and closed-end funds, the underlying strategies of which leverage our core private credit and mortgage loan investment capabilities. As of December 31, 2022, there were $16.4 billion in alternatives AUM.

MASS. Investment Management’s MASS platform offers a variety of investment products and strategies that combine multiple asset classes using asset allocation techniques. The objective of the MASS platform is to develop customized solutions that meet specific, and often unique, goals of investors that dynamically change over time in response to changing markets and client needs. Utilizing core capabilities in asset allocation, manager selection, asset/liability modeling, risk management and financial engineering, the MASS team has developed a suite of target date and target risk funds that are distributed through our Wealth Solutions segment and to institutional and retail investors. These funds can incorporate multi-manager funds. The MASS team also provides pension risk management, strategic and tactical asset allocation, liability-driven investing solutions and investment strategies that hedge out specific market exposures (e.g., portable alpha) for clients.

18 | ||||||||

The following chart presents asset and net flow data as of December 31, 2022, broken out by Investment Management’s five investment platforms as well as by major client segment:

| AUM | Net Flows | ||||||||||

| As of | Year Ended | ||||||||||

| 12/31/2022 | 12/31/2022 | ||||||||||

| $ in billions | $ in millions | ||||||||||

| Investment Platform | |||||||||||

| Fixed income - Public | $ | 138.3 | $ | (2,218.4) | |||||||

| Fixed income - Privates | 83.3 | 5,017.8 | |||||||||

| Equities | 83.4 | (1,214.5) | |||||||||

| Alternatives | 16.4 | (511.0) | |||||||||

| Total | $ | 321.4 | (1) | $ | 1,073.9 | ||||||

MASS (1) | 30.8 | 795.5 | |||||||||

| Client Segment | |||||||||||

| Retail | $ | 121.9 | $ | (2,600.8) | |||||||

| Institutional | 161.5 | 3,674.7 | |||||||||

| General Account | 38.0 | N/A | |||||||||

| Total | $ | 321.4 | $ | 1,073.9 | |||||||

Divested Businesses (2) | 38.7 | (2,156.4) | |||||||||

(1) $24.2 billion of MASS assets are included in the fixed income, equity and alternatives AUM categories presented above. The balance of MASS assets, $6.6 billion, is managed by third parties and we earn only a modest, market-rate fee on the assets.

(2) Upon closing of the Individual Life Transaction on January 4, 2021, $26 billion of assets (measured on a market value basis) moved from the general account to external client. The external client assets are managed through our appointment as investment manager. Voya IM's mandate covers approximately 80% of these assets for a minimum term of two years following the closing of the Individual Life Transaction, grading down to at least approximately 30% by the sixth year. See —Organizational History and Structure—Individual Life Transaction.

N/A - Not applicable

Markets and Distribution

We serve our institutional clients through a dedicated sales and service platform both domestically and internationally. The strategic partnership with AllianzGI we entered into concurrently with the AllianzGI Transaction enhances our strategic outreach globally. For certain international regions, we currently also distribute through selling agreements with a former affiliated party and for sponsored structured products through the arranger. We serve individual investors through an intermediary-focused distribution platform, consisting of business development and wholesale forces that partner with banks, broker-dealers and independent financial advisers, as well as our affiliate and third-party retirement platforms.

With the exception of Pomona Capital and certain structured products, the different products and strategies associated with our investment platforms are distributed and serviced by these Retail and Institutional client-focused segments as follows:

•Retail client segment: Registered open- and closed-end funds and Separately Managed Accounts through affiliate and third-party distribution platforms, including warehouses, brokerage firms, registered investment advisors, banks, trust companies and independent and regional broker-dealers. As of December 31, 2022, total AUM from these channels was $121.9 billion. Included in our retail client segment is $14.2 billion of AUM managed on behalf of our divested businesses as of December 31, 2022.

•Institutional client segment: Individual and pooled accounts, targeting defined benefit, defined contribution recordkeeping and retirement plans, Taft Hartley plans and endowments and foundations. As of December 31, 2022, Investment Management had approximately 336 institutional clients, representing $161.5 billion of AUM primarily in separately managed accounts and collective investment trusts.

Competition

Investment Management competes with a wide array of asset managers and institutions in the highly fragmented U.S. investment management industry. In our key market segments, Investment Management competes on the basis of, among other

19 | ||||||||

things, investment performance, investment philosophy and process, product features and structure and client service. Our principal competitors include insurance-owned asset managers such as Principal Global Investors (Principal Financial Group), Prudential and Ameriprise and bank-owned asset managers such as "pure-play" asset managers including Invesco, T. Rowe Price, and Franklin Templeton.

Individual Life

As described under "–Organizational History and Structure–Individual Life Transaction", on January 4, 2021, we completed a transaction to dispose of substantially all of our individual life business and related assets. As a part of the Individual Life Transaction, we also transferred a significant portion of our remaining annuities business previously managed in Corporate. See Overview in Management's Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7. of this Annual Report on Form 10-K for further information.

Human Capital Resources

Voya is a purpose-driven company with a culture, a brand, and an operating discipline that has established us as a leader in our industry. Through our human capital strategy, we attract, retain and reward talent across our enterprise in support of our mission to make a secure financial future possible – one person, one family, one institution at a time. We have prioritized our efforts to build and maintain a diverse, inclusive and safe workplace, with opportunities for our employees to grow and develop in their careers, supported by competitive compensation, benefits and health and wellness programs. Outside of Voya, we have built and continue to build connections between our employees and the communities in which they live and serve through support of employee volunteerism and giving.