00015345040001645026falseFY2022P1Yhttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://www.pbfenergy.com/20221231#LeaseRightofUseAssethttp://www.pbfenergy.com/20221231#LeaseRightofUseAssethttp://www.pbfenergy.com/20221231#LeaseRightofUseAssethttp://www.pbfenergy.com/20221231#LeaseRightofUseAssethttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenuehttp://fasb.org/us-gaap/2022#CostOfRevenue00015345042022-01-012022-12-310001534504pbf:PbfLlcMember2022-01-012022-12-3100015345042022-06-30iso4217:USD0001534504us-gaap:CommonClassAMember2023-02-09xbrli:shares0001534504us-gaap:CommonClassBMember2023-02-090001534504us-gaap:CommonClassAMemberpbf:PBFEnergyInc.Member2022-12-31xbrli:pure0001534504pbf:PbfLlcMemberus-gaap:CommonClassAMember2023-02-0900015345042022-12-3100015345042021-12-310001534504us-gaap:CommonClassAMember2022-12-31iso4217:USDxbrli:shares0001534504us-gaap:CommonClassAMember2021-12-310001534504us-gaap:CommonClassBMember2022-12-310001534504us-gaap:CommonClassBMember2021-12-3100015345042021-01-012021-12-3100015345042020-01-012020-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-12-310001534504us-gaap:AdditionalPaidInCapitalMember2019-12-310001534504us-gaap:RetainedEarningsMember2019-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001534504us-gaap:TreasuryStockMember2019-12-310001534504us-gaap:NoncontrollingInterestMember2019-12-3100015345042019-12-310001534504us-gaap:RetainedEarningsMember2020-01-012020-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001534504us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001534504us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-01-012020-12-310001534504us-gaap:CommonClassAMember2020-01-012020-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-01-012020-12-310001534504us-gaap:TreasuryStockMember2020-01-012020-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2020-12-310001534504us-gaap:AdditionalPaidInCapitalMember2020-12-310001534504us-gaap:RetainedEarningsMember2020-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001534504us-gaap:TreasuryStockMember2020-12-310001534504us-gaap:NoncontrollingInterestMember2020-12-3100015345042020-12-310001534504us-gaap:RetainedEarningsMember2021-01-012021-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001534504us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001534504us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-01-012021-12-310001534504us-gaap:TreasuryStockMember2021-01-012021-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001534504us-gaap:AdditionalPaidInCapitalMember2021-12-310001534504us-gaap:RetainedEarningsMember2021-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001534504us-gaap:TreasuryStockMember2021-12-310001534504us-gaap:NoncontrollingInterestMember2021-12-310001534504us-gaap:RetainedEarningsMember2022-01-012022-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001534504us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001534504us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001534504us-gaap:CommonClassAMember2022-01-012022-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-01-012022-12-310001534504us-gaap:TreasuryStockMember2022-01-012022-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001534504us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001534504us-gaap:AdditionalPaidInCapitalMember2022-12-310001534504us-gaap:RetainedEarningsMember2022-12-310001534504us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001534504us-gaap:TreasuryStockMember2022-12-310001534504us-gaap:NoncontrollingInterestMember2022-12-310001534504pbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2022-01-012022-12-310001534504pbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2021-01-012021-12-310001534504pbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2020-01-012020-12-310001534504pbf:A2025SeniorSecuredNotesMember2022-01-012022-12-310001534504pbf:A2025SeniorSecuredNotesMember2021-01-012021-12-310001534504pbf:A2025SeniorSecuredNotesMember2020-01-012020-12-310001534504pbf:A2028SeniorNotesMember2022-01-012022-12-310001534504pbf:A2028SeniorNotesMember2021-01-012021-12-310001534504pbf:A2028SeniorNotesMember2020-01-012020-12-310001534504pbf:A2025SeniorNotesMember2022-01-012022-12-310001534504pbf:A2025SeniorNotesMember2021-01-012021-12-310001534504pbf:A2025SeniorNotesMember2020-01-012020-12-310001534504pbf:A2023SeniorNotesMember2022-01-012022-12-310001534504pbf:A2023SeniorNotesMember2021-01-012021-12-310001534504pbf:A2023SeniorNotesMember2020-01-012020-12-310001534504pbf:PBFEnergyRevolvingCreditFacilityMember2022-01-012022-12-310001534504pbf:PBFEnergyRevolvingCreditFacilityMember2021-01-012021-12-310001534504pbf:PBFEnergyRevolvingCreditFacilityMember2020-01-012020-12-310001534504pbf:PBFXRevolvingCreditFacilityMember2022-01-012022-12-310001534504pbf:PBFXRevolvingCreditFacilityMember2021-01-012021-12-310001534504pbf:PBFXRevolvingCreditFacilityMember2020-01-012020-12-310001534504pbf:RailTermLoanMember2022-01-012022-12-310001534504pbf:RailTermLoanMember2021-01-012021-12-310001534504pbf:RailTermLoanMember2020-01-012020-12-310001534504pbf:PbfLlcMember2022-12-310001534504pbf:PbfLlcMember2021-12-310001534504pbf:PbfLlcMemberpbf:SeriesBUnitsMember2022-12-310001534504pbf:PbfLlcMemberpbf:SeriesBUnitsMember2021-12-310001534504pbf:PbfLlcMemberpbf:SeriesUnitsMember2022-12-310001534504pbf:PbfLlcMemberpbf:SeriesUnitsMember2021-12-310001534504pbf:PbfLlcMemberpbf:SeriesCUnitsMember2022-12-310001534504pbf:PbfLlcMemberpbf:SeriesCUnitsMember2021-12-310001534504pbf:PbfLlcMember2021-01-012021-12-310001534504pbf:PbfLlcMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2019-12-310001534504pbf:PbfLlcMember2019-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2020-12-310001534504pbf:PbfLlcMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesUnitsMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:CommonStockMemberpbf:SeriesCUnitsMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:RetainedEarningsMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:NoncontrollingInterestMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:TreasuryStockMember2022-12-310001534504pbf:PbfLlcMemberpbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:CollinsPipelineCompanyAndTMTerminalCompanyMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorSecuredNotesMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorSecuredNotesMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorSecuredNotesMember2020-01-012020-12-310001534504pbf:A2028SeniorNotesMemberpbf:PbfLlcMember2022-01-012022-12-310001534504pbf:A2028SeniorNotesMemberpbf:PbfLlcMember2021-01-012021-12-310001534504pbf:A2028SeniorNotesMemberpbf:PbfLlcMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorNotesMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorNotesMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:A2025SeniorNotesMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:A2023SeniorNotesMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:A2023SeniorNotesMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:A2023SeniorNotesMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:PBFEnergyRevolvingCreditFacilityMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:PBFEnergyRevolvingCreditFacilityMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:PBFEnergyRevolvingCreditFacilityMember2020-01-012020-12-310001534504pbf:PBFXRevolvingCreditFacilityMemberpbf:PbfLlcMember2022-01-012022-12-310001534504pbf:PBFXRevolvingCreditFacilityMemberpbf:PbfLlcMember2021-01-012021-12-310001534504pbf:PBFXRevolvingCreditFacilityMemberpbf:PbfLlcMember2020-01-012020-12-310001534504pbf:RailTermLoanMemberpbf:PbfLlcMember2022-01-012022-12-310001534504pbf:RailTermLoanMemberpbf:PbfLlcMember2021-01-012021-12-310001534504pbf:RailTermLoanMemberpbf:PbfLlcMember2020-01-012020-12-31pbf:reportable_segment0001534504pbf:PBFXMergerTransactionMember2022-11-302022-11-300001534504pbf:PBFXMergerTransactionMember2022-11-300001534504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-31pbf:numberOfCustomers0001534504us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001534504us-gaap:SalesRevenueNetMemberpbf:RoyalDutchShellMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001534504us-gaap:SalesRevenueNetMemberpbf:RoyalDutchShellMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001534504us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001534504us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001534504us-gaap:AccountsReceivableMemberpbf:RoyalDutchShellMemberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001534504us-gaap:AccountsReceivableMemberpbf:RoyalDutchShellMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001534504srt:MinimumMember2022-12-310001534504srt:MaximumMember2022-12-310001534504us-gaap:RefiningEquipmentMembersrt:MinimumMember2022-01-012022-12-310001534504us-gaap:RefiningEquipmentMembersrt:MaximumMember2022-01-012022-12-310001534504us-gaap:PipelinesMembersrt:MinimumMember2022-01-012022-12-310001534504us-gaap:PipelinesMembersrt:MaximumMember2022-01-012022-12-310001534504us-gaap:BuildingMember2022-01-012022-12-310001534504us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-01-012022-12-310001534504us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2022-01-012022-12-310001534504us-gaap:LeaseholdImprovementsMember2022-01-012022-12-310001534504us-gaap:RailroadTransportationEquipmentMember2022-01-012022-12-310001534504srt:MinimumMember2022-01-012022-12-310001534504srt:MaximumMember2022-01-012022-12-310001534504pbf:PerformanceShareUnitsAndPerformanceUnitAwardsMembersrt:ParentCompanyMember2020-10-312020-10-31pbf:number_period0001534504pbf:PerformanceShareUnitsAndPerformanceUnitAwardsMembersrt:ParentCompanyMember2020-11-012021-12-310001534504pbf:PerformanceShareUnitsAndPerformanceUnitAwardsMembersrt:ParentCompanyMembersrt:MinimumMember2022-12-310001534504pbf:PerformanceShareUnitsAndPerformanceUnitAwardsMembersrt:ParentCompanyMembersrt:MaximumMember2022-12-310001534504pbf:TitledInventoryMember2022-12-310001534504pbf:InventorySupplyAndOfftakeArrangementsMember2022-12-310001534504pbf:TitledInventoryMember2021-12-310001534504pbf:InventorySupplyAndOfftakeArrangementsMember2021-12-310001534504us-gaap:ScenarioAdjustmentMember2021-01-012021-12-310001534504us-gaap:LandMember2022-12-310001534504us-gaap:LandMember2021-12-310001534504us-gaap:MachineryAndEquipmentMember2022-12-310001534504us-gaap:MachineryAndEquipmentMember2021-12-310001534504us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001534504us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001534504us-gaap:FurnitureAndFixturesMember2022-12-310001534504us-gaap:FurnitureAndFixturesMember2021-12-310001534504us-gaap:ConstructionInProgressMember2022-12-310001534504us-gaap:ConstructionInProgressMember2021-12-310001534504us-gaap:ConstructionInProgressMember2022-01-012022-12-310001534504us-gaap:ConstructionInProgressMember2021-01-012021-12-310001534504us-gaap:ConstructionInProgressMemberpbf:IdledProcessingUnitsMemberpbf:EastCoastRefiningMember2020-01-012020-12-310001534504us-gaap:ConstructionInProgressMemberpbf:CapitalProjectsMemberpbf:EastCoastRefiningMember2020-01-012020-12-3100015345042020-04-17pbf:hydrogenPlants0001534504pbf:AirProductsAndChemicalIncMember2020-04-172020-04-170001534504pbf:AirProductsAndChemicalIncMember2020-01-012020-12-310001534504pbf:TorranceRefineryMember2020-01-012020-12-310001534504pbf:IndefinitelyLivedPreciousMetalMember2022-12-310001534504pbf:IndefinitelyLivedPreciousMetalMember2021-12-310001534504pbf:A2025SeniorSecuredNotesMember2022-12-310001534504pbf:A2025SeniorSecuredNotesMember2021-12-310001534504pbf:A2028SeniorNotesMember2022-12-310001534504pbf:A2028SeniorNotesMember2021-12-310001534504pbf:A2025SeniorNotesMember2022-12-310001534504pbf:A2025SeniorNotesMember2021-12-310001534504pbf:PBFX2023SeniorNotesMember2022-12-310001534504pbf:PBFX2023SeniorNotesMember2021-12-310001534504us-gaap:RevolvingCreditFacilityMember2022-12-310001534504us-gaap:RevolvingCreditFacilityMember2021-12-310001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001534504pbf:CatalystObligationMember2022-12-310001534504pbf:CatalystObligationMember2021-12-310001534504pbf:Initial2025SeniorSecuredNotesMember2020-05-130001534504pbf:Initial2025SeniorSecuredNotesMember2020-05-132020-05-130001534504pbf:Additional2025SeniorSecuredNotesMember2020-12-210001534504pbf:Additional2025SeniorSecuredNotesMember2020-12-212020-12-210001534504pbf:A2028SeniorNotesMember2020-01-240001534504pbf:A2025SeniorNotesMember2017-05-300001534504pbf:A2028SeniorNotesMember2020-01-242020-01-240001534504pbf:A2023SeniorNotesMember2020-01-240001534504pbf:A2028SeniorNotesMember2020-01-242020-01-240001534504pbf:A2025SeniorNotesMember2017-05-302017-05-300001534504pbf:A2020SeniorSecuredNotesMember2012-02-090001534504pbf:PBFX2023SeniorNotesMember2015-05-120001534504pbf:NewPBFXSeniorNotesMember2017-10-060001534504pbf:NewPBFXSeniorNotesMember2017-10-060001534504pbf:PBFX2023SeniorNotesMember2017-10-062017-10-060001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-250001534504us-gaap:SubsequentEventMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-05-020001534504pbf:TrancheAMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-250001534504pbf:TrancheBMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-250001534504us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504pbf:CompanyCreditRatingMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504pbf:CompanyCreditRatingMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-05-262022-05-260001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2012-10-012012-10-3100015345042020-02-180001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-05-060001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-05-070001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001534504us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2014-05-142014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2018-07-302018-07-300001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:StandbyLettersOfCreditMember2014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2014-05-14pbf:renewal0001534504pbf:PBFLogisticsLPMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMembersrt:MinimumMember2014-05-142014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredDebtMember2014-05-142014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMembersrt:MinimumMember2014-05-142014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMemberus-gaap:SecuredDebtMember2014-05-142014-05-140001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-12-310001534504pbf:PBFLogisticsLPMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001534504pbf:DelawareCityCatalystMemberpbf:CatalystFinancingArrangementMember2022-12-310001534504pbf:CatalystFinancingArrangementMember2022-01-012022-12-310001534504pbf:CatalystFinancingArrangementMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001534504pbf:GuarantorAffiliatedEntityMemberpbf:SeriesBUnitsMember2020-01-012020-12-310001534504pbf:GuarantorAffiliatedEntityMemberpbf:SeriesBUnitsMember2022-01-012022-12-310001534504pbf:GuarantorAffiliatedEntityMemberpbf:SeriesBUnitsMember2021-01-012021-12-310001534504srt:MinimumMembersrt:ExecutiveOfficerMember2022-01-012022-12-310001534504srt:MaximumMembersrt:ExecutiveOfficerMember2022-01-012022-12-310001534504us-gaap:EnvironmentalIssueMemberpbf:TorranceRefineryMember2022-12-310001534504us-gaap:EnvironmentalIssueMemberpbf:TorranceRefineryMember2021-12-310001534504pbf:MartinezAcquistionMember2020-02-012020-02-010001534504pbf:MartinezAcquistionMember2022-12-310001534504pbf:MartinezAcquistionMemberus-gaap:AccruedLiabilitiesMember2022-12-310001534504pbf:MartinezAcquistionMember2021-12-310001534504pbf:MartinezAcquistionMemberus-gaap:AccruedLiabilitiesMember2021-12-310001534504pbf:EastCoastStorageAssetsAcquisitionMember2018-10-012018-10-010001534504pbf:EastCoastStorageAssetsAcquisitionMember2022-12-310001534504pbf:EastCoastStorageAssetsAcquisitionMember2021-12-310001534504us-gaap:CommonClassAMembersrt:ParentCompanyMember2021-12-310001534504pbf:AirProductsAndChemicalIncMemberpbf:TransitionServiceAgreementMember2020-04-172020-04-170001534504pbf:AirProductsAndChemicalIncMemberpbf:HydrogenSupplyMember2020-08-010001534504us-gaap:CommonClassBMember2022-01-012022-12-31pbf:vote0001534504pbf:RepurchaseProgramMemberus-gaap:CommonClassAMember2022-12-120001534504pbf:RepurchaseProgramMemberus-gaap:CommonClassAMember2022-01-012022-12-310001534504us-gaap:CommonClassAMemberpbf:PBFEnergyInc.Member2021-12-310001534504pbf:PbfLlcMemberpbf:SeriesUnitsMember2020-12-310001534504us-gaap:CommonClassAMemberpbf:PBFEnergyInc.Member2020-12-310001534504pbf:PBFLogisticsLPMember2022-01-012022-12-310001534504pbf:CommonUnitsMemberpbf:PublicUnitHoldersMember2020-12-310001534504pbf:PbfLlcMemberpbf:CommonUnitsMember2020-12-310001534504pbf:CommonUnitsMember2020-12-310001534504us-gaap:LimitedPartnerMemberpbf:PublicUnitHoldersMember2020-12-310001534504pbf:PbfLlcMemberus-gaap:LimitedPartnerMember2020-12-310001534504pbf:CommonUnitsMemberpbf:PublicUnitHoldersMember2021-12-310001534504pbf:PbfLlcMemberpbf:CommonUnitsMember2021-12-310001534504pbf:CommonUnitsMember2021-12-310001534504us-gaap:LimitedPartnerMemberpbf:PublicUnitHoldersMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:LimitedPartnerMember2021-12-310001534504pbf:CommonUnitsMemberpbf:PublicUnitHoldersMember2022-11-290001534504pbf:PbfLlcMemberpbf:CommonUnitsMember2022-11-290001534504pbf:CommonUnitsMember2022-11-290001534504us-gaap:LimitedPartnerMemberpbf:PublicUnitHoldersMember2022-11-290001534504pbf:PbfLlcMemberus-gaap:LimitedPartnerMember2022-11-2900015345042022-11-290001534504pbf:CommonUnitsMemberpbf:PublicUnitHoldersMember2022-12-310001534504pbf:PbfLlcMemberpbf:CommonUnitsMember2022-12-310001534504pbf:CommonUnitsMember2022-12-310001534504us-gaap:LimitedPartnerMemberpbf:PublicUnitHoldersMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:LimitedPartnerMember2022-12-310001534504pbf:ChalmetteRefiningMember2022-01-012022-12-31pbf:subsidiary0001534504pbf:TMTerminalCompanyMemberpbf:ChalmetteRefiningMember2015-11-010001534504pbf:CollinsPipelineCompanyMemberpbf:ChalmetteRefiningMember2015-11-010001534504us-gaap:ParentMember2021-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2021-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2021-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2021-12-310001534504us-gaap:ParentMember2022-01-012022-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2022-01-012022-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2022-01-012022-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2022-01-012022-12-310001534504us-gaap:ParentMember2022-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2022-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2022-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2022-12-310001534504us-gaap:ParentMember2020-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2020-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2020-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2020-12-310001534504us-gaap:ParentMember2021-01-012021-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2021-01-012021-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2021-01-012021-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2021-01-012021-12-310001534504us-gaap:ParentMember2019-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2019-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2019-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2019-12-310001534504us-gaap:ParentMember2020-01-012020-12-310001534504pbf:NoncontrollingInterestPBFLLCMember2020-01-012020-12-310001534504pbf:NoncontrollingInterestPBFHoldingMember2020-01-012020-12-310001534504pbf:NoncontrollinginterestPBFLogisticsLPMember2020-01-012020-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2021-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2021-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2021-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2022-01-012022-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2022-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2022-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2022-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2020-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2020-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2020-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2021-01-012021-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2019-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2019-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2019-12-310001534504us-gaap:ParentMemberpbf:PbfLlcMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollingInterestPBFHoldingMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:NoncontrollinginterestPBFLogisticsLPMember2020-01-012020-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001534504us-gaap:RestrictedStockMemberus-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMember2022-01-012022-12-310001534504us-gaap:RestrictedStockMemberus-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMember2021-01-012021-12-310001534504us-gaap:RestrictedStockMemberus-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMember2020-01-012020-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:PerformanceSharesMember2021-01-012021-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMembersrt:ParentCompanyMemberus-gaap:PerformanceSharesMember2020-01-012020-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMemberpbf:PBFLogisticsLPMember2022-01-012022-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMemberpbf:PBFLogisticsLPMember2021-01-012021-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMemberpbf:PBFLogisticsLPMember2020-01-012020-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001534504us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2020-11-012022-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2020-01-012020-10-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2021-01-012021-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2022-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2021-12-310001534504srt:ParentCompanyMemberus-gaap:EmployeeStockOptionMember2020-12-310001534504us-gaap:RestrictedStockMembersrt:ParentCompanyMember2022-01-012022-12-310001534504us-gaap:RestrictedStockMembersrt:ParentCompanyMember2021-12-310001534504us-gaap:RestrictedStockMembersrt:ParentCompanyMember2022-12-310001534504us-gaap:RestrictedStockMembersrt:ParentCompanyMember2021-01-012021-12-310001534504us-gaap:RestrictedStockMembersrt:ParentCompanyMember2020-01-012020-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMember2022-01-012022-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMember2021-01-012021-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMembersrt:MinimumMember2020-01-012020-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMembersrt:MaximumMember2020-01-012020-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMember2020-01-012020-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMember2021-12-310001534504pbf:PerformanceShareUnitsMembersrt:ParentCompanyMember2022-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMember2022-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMembersrt:MaximumMember2022-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMember2022-01-012022-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMember2021-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMember2021-01-012021-12-310001534504pbf:PerformanceUnitsMembersrt:ParentCompanyMember2020-01-012020-12-310001534504pbf:PBFXMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001534504pbf:PBFXMergerTransactionMemberus-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001534504us-gaap:PhantomShareUnitsPSUsMember2021-12-310001534504us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001534504us-gaap:PhantomShareUnitsPSUsMember2022-12-310001534504us-gaap:PhantomShareUnitsPSUsMemberpbf:LongTermIncentivePlanMember2022-01-012022-12-310001534504us-gaap:PhantomShareUnitsPSUsMemberpbf:LongTermIncentivePlanMember2021-01-012021-12-310001534504us-gaap:PhantomShareUnitsPSUsMemberpbf:LongTermIncentivePlanMember2020-01-012020-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2020-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2021-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-01-012022-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2021-01-012021-12-310001534504us-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-12-310001534504us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2020-01-012020-12-310001534504us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-12-310001534504us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-12-310001534504us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-12-310001534504us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-01-012021-12-310001534504us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-310001534504pbf:DomesticEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504pbf:DomesticEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpbf:DevelopedForeignEquitySecuritiesMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpbf:DevelopedForeignEquitySecuritiesMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpbf:LowVolatilityEquitySecuritiesMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberpbf:LowVolatilityEquitySecuritiesMember2021-12-310001534504pbf:EmergingMarketEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504pbf:EmergingMarketEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:RealEstateMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:RealEstateMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:FixedIncomeSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:RealEstateMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504pbf:GasolineAndDistillateMemberpbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:GasolineAndDistillateMemberpbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:GasolineAndDistillateMemberpbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:AsphaltandResidualOilMemberpbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:AsphaltandResidualOilMemberpbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:AsphaltandResidualOilMemberpbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:FeedstocksAndOtherMemberpbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:FeedstocksAndOtherMemberpbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:FeedstocksAndOtherMemberpbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:ChemicalsMemberpbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:ChemicalsMemberpbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:ChemicalsMemberpbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:RefiningGroupMemberpbf:LubricantsMember2022-01-012022-12-310001534504pbf:RefiningGroupMemberpbf:LubricantsMember2021-01-012021-12-310001534504pbf:RefiningGroupMemberpbf:LubricantsMember2020-01-012020-12-310001534504pbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:LogisticsGroupMember2022-01-012022-12-310001534504pbf:LogisticsGroupMember2021-01-012021-12-310001534504pbf:LogisticsGroupMember2020-01-012020-12-310001534504pbf:PriortoeliminationMember2022-01-012022-12-310001534504pbf:PriortoeliminationMember2021-01-012021-12-310001534504pbf:PriortoeliminationMember2020-01-012020-12-310001534504us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001534504us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001534504us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001534504srt:ParentCompanyMember2022-01-012022-12-310001534504srt:ParentCompanyMember2021-01-012021-12-310001534504srt:ParentCompanyMember2020-01-012020-12-310001534504us-gaap:StateAndLocalJurisdictionMember2022-12-310001534504us-gaap:DomesticCountryMember2022-01-012022-12-310001534504stpr:NJ2022-01-012022-12-310001534504stpr:MI2022-01-012022-12-310001534504stpr:DE2022-01-012022-12-310001534504stpr:IN2022-01-012022-12-310001534504stpr:PA2022-01-012022-12-310001534504stpr:NY2022-01-012022-12-310001534504stpr:LA2022-01-012022-12-310001534504stpr:CA2022-01-012022-12-31pbf:number_refinerypbf:segment0001534504us-gaap:CorporateMember2022-01-012022-12-310001534504us-gaap:CorporateMember2021-01-012021-12-310001534504us-gaap:CorporateMember2020-01-012020-12-310001534504pbf:RefiningGroupMember2022-12-310001534504pbf:LogisticsGroupMember2022-12-310001534504us-gaap:CorporateMember2022-12-310001534504us-gaap:IntersegmentEliminationMember2022-12-310001534504pbf:RefiningGroupMember2021-12-310001534504pbf:LogisticsGroupMember2021-12-310001534504us-gaap:CorporateMember2021-12-310001534504us-gaap:IntersegmentEliminationMember2021-12-310001534504pbf:PbfLlcMemberpbf:RefiningGroupMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:LogisticsGroupMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:CorporateMember2022-01-012022-12-310001534504pbf:PbfLlcMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001534504pbf:PbfLlcMemberpbf:RefiningGroupMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:LogisticsGroupMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:CorporateMember2021-01-012021-12-310001534504pbf:PbfLlcMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001534504pbf:PbfLlcMemberpbf:RefiningGroupMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:LogisticsGroupMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:CorporateMember2020-01-012020-12-310001534504pbf:PbfLlcMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001534504pbf:PbfLlcMemberpbf:RefiningGroupMember2022-12-310001534504pbf:PbfLlcMemberpbf:LogisticsGroupMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:CorporateMember2022-12-310001534504pbf:PbfLlcMemberus-gaap:IntersegmentEliminationMember2022-12-310001534504pbf:PbfLlcMemberpbf:RefiningGroupMember2021-12-310001534504pbf:PbfLlcMemberpbf:LogisticsGroupMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:CorporateMember2021-12-310001534504pbf:PbfLlcMemberus-gaap:IntersegmentEliminationMember2021-12-310001534504pbf:MartinezAcquisitionMemberpbf:RefiningGroupMember2020-01-012020-03-310001534504us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001534504us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001534504us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001534504us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001534504us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:CatalystObligationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2022-12-310001534504us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2022-12-310001534504us-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel2Memberpbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504pbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001534504us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001534504us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:InventoryIntermediationAgreementObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:CatalystObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:CatalystObligationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2021-12-310001534504us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2021-12-310001534504us-gaap:FairValueMeasurementsRecurringMemberpbf:RenewableEnergyCreditAndEmissionsObligationMember2021-12-310001534504us-gaap:FairValueInputsLevel1Memberpbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:FairValueInputsLevel2Memberpbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:ContingentConsiderationMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504pbf:ContingentConsiderationMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001534504us-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001534504us-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001534504pbf:ContingentConsiderationMember2021-12-310001534504pbf:ContingentConsiderationMember2020-12-310001534504pbf:ContingentConsiderationMember2022-01-012022-12-310001534504pbf:ContingentConsiderationMember2021-01-012021-12-310001534504pbf:ContingentConsiderationMember2022-12-310001534504pbf:PBFLogisticsLPMemberpbf:PBFX2023SeniorNotesMember2022-12-310001534504pbf:PBFLogisticsLPMemberpbf:PBFX2023SeniorNotesMember2021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:CrudeOilAndFeedstockInventoryMemberus-gaap:FairValueHedgingMember2022-12-31utr:bbl0001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:CrudeOilAndFeedstockInventoryMemberus-gaap:FairValueHedgingMember2021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:IntermediatesandRefinedProductsInventoryMemberus-gaap:FairValueHedgingMember2022-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:IntermediatesandRefinedProductsInventoryMemberus-gaap:FairValueHedgingMember2021-12-310001534504us-gaap:NondesignatedMemberpbf:CrudeOilCommodityContractMember2022-12-310001534504us-gaap:NondesignatedMemberpbf:RefinedProductCommodityContractMember2022-12-310001534504us-gaap:NondesignatedMemberpbf:CrudeOilCommodityContractMember2021-12-310001534504us-gaap:NondesignatedMemberpbf:RefinedProductCommodityContractMember2021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberpbf:InventoryIntermediationAgreementObligationMember2022-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberpbf:InventoryIntermediationAgreementObligationMember2021-12-310001534504us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:AccountsReceivableMember2022-12-310001534504us-gaap:NondesignatedMemberus-gaap:CommodityContractMemberus-gaap:AccountsReceivableMember2021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:InventoryIntermediationAgreementObligationMember2022-01-012022-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:InventoryIntermediationAgreementObligationMember2021-01-012021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:InventoryIntermediationAgreementObligationMember2020-01-012020-12-310001534504us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2022-01-012022-12-310001534504us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2021-01-012021-12-310001534504us-gaap:NondesignatedMemberus-gaap:CommodityContractMember2020-01-012020-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:IntermediatesandRefinedProductsInventoryMemberus-gaap:FairValueHedgingMember2022-01-012022-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:IntermediatesandRefinedProductsInventoryMemberus-gaap:FairValueHedgingMember2021-01-012021-12-310001534504us-gaap:DesignatedAsHedgingInstrumentMemberpbf:IntermediatesandRefinedProductsInventoryMemberus-gaap:FairValueHedgingMember2020-01-012020-12-310001534504us-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2023-02-162023-02-160001534504pbf:PBFX2023SeniorNotesMemberus-gaap:SubsequentEventMember2023-02-022023-02-020001534504pbf:RepurchaseProgramMemberus-gaap:CommonClassAMemberus-gaap:SubsequentEventMember2023-01-012023-02-160001534504us-gaap:SubsequentEventMemberpbf:PBFEnergyInc.Member2023-02-152023-02-150001534504pbf:EniSpAMemberus-gaap:SubsequentEventMember2023-02-152023-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2022

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35764

Commission File Number: 333-206728-02

PBF ENERGY INC.

PBF ENERGY COMPANY LLC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 45-3763855 |

| Delaware | | 61-1622166 |

| | | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| One Sylvan Way, Second Floor | | |

| Parsippany | New Jersey | | 07054 |

| (Address of principal executive offices) | | (Zip Code) |

(973) 455-7500

(Registrants’ telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act.

| | | | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Class A Common Stock, par value $.001 | PBF | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

PBF Energy Inc. x Yes o No

PBF Energy Company LLC o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

PBF Energy Inc. o Yes x No

PBF Energy Company LLC o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

PBF Energy Inc. x Yes o No

PBF Energy Company LLC x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

PBF Energy Inc. x Yes o No

PBF Energy Company LLC x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PBF Energy Inc. | Large accelerated

filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting

company | ☐ | Emerging growth company | ☐ |

| PBF Energy Company LLC | Large accelerated

filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | Smaller reporting

company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

PBF Energy Inc. o

PBF Energy Company LLC o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

PBF Energy Inc. ☒

PBF Energy Company LLC ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

PBF Energy Inc. o

PBF Energy Company LLC o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

PBF Energy Inc. o

PBF Energy Company LLC o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

PBF Energy Inc. ☐ Yes ☒ No

PBF Energy Company LLC ☐ Yes ☒ No

The aggregate market value of the Common Stock of PBF Energy Inc. held by non-affiliates as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $3.5 billion based upon the New York Stock Exchange Composite Transaction closing price.

As of February 9, 2023, PBF Energy Inc. had outstanding 128,975,077 shares of Class A common stock and 13 shares of Class B common stock. PBF Energy Inc. is the sole managing member of, and owner of an equity interest representing approximately 99.3% of the outstanding economic interest in PBF Energy Company LLC as of December 31, 2022. There is no trading in the membership interest of PBF Energy Company LLC and therefore an aggregate market value based on such is not determinable. PBF Energy Company LLC has no common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

PBF Energy Inc. intends to file with the Securities and Exchange Commission a definitive Proxy Statement for its Annual Meeting of Stockholders within 120 days after December 31, 2022. Portions of the Proxy Statement are incorporated by reference in Part III of this Form 10-K to the extent stated herein.

PBF ENERGY INC. AND PBF ENERGY COMPANY LLC

TABLE OF CONTENTS

| | | | | | | | | | | |

| PART I | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| PART II | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| PART III | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| PART IV | |

| | | |

| | | |

| | | |

| |

GLOSSARY OF SELECTED TERMS

Unless otherwise noted or indicated by context, the following terms used in this Annual Report on Form 10-K have the following meanings:

“AB 32” refers to the greenhouse gas emission control regulations in the state of California to comply with Assembly Bill 32.

“ANS” refers to Alaskan North Slope crude oil reflective of West Coast economics, characterized by API gravity between 28° and 35°.

“ASCI” refers to the Argus Sour Crude Index, a pricing index used to approximate market prices for sour, heavy crude oil.

“Bakken” refers to both a crude oil production region generally covering North Dakota, Montana and Western Canada, and the crude oil that is produced in that region.

“barrel” refers to a common unit of measure in the oil industry, which equates to 42 gallons.

“blendstocks” refers to various compounds that are combined with gasoline or diesel from the crude oil refining process to make finished gasoline and diesel; these may include natural gasoline, FCC unit gasoline, ethanol, reformate or butane, among others.

“bpd” is an abbreviation for barrels per day.

“CAM Pipeline” or “CAM Connection Pipeline” refers to the Clovelly-Alliance-Meraux pipeline in Louisiana.

“CARB” refers to the California Air Resources Board; gasoline and diesel fuel sold in the state of California are regulated by CARB and require stricter quality and emissions reduction performance than required by other states.

“catalyst” refers to a substance that alters, accelerates, or instigates chemical changes, but is not produced as a product of the refining process.

“coke” refers to a coal-like substance that is produced from heavier crude oil fractions during the refining process.

“complexity” refers to the number, type and capacity of processing units at a refinery, measured by the Nelson Complexity Index, which is often used as a measure of a refinery’s ability to process lower quality crude in an economic manner.

“COVID-19” refers to the 2019 outbreak of the novel coronavirus pandemic.

“crack spread” refers to a simplified calculation that measures the difference between the price for light products and crude oil. For example, we reference (a) the 2-1-1 crack spread, which is a general industry standard utilized by our Delaware City, Paulsboro and Chalmette refineries that approximates the per barrel refining margin resulting from processing two barrels of crude oil to produce one barrel of gasoline and one barrel of heating oil or ULSD, (b) the 4-3-1 crack spread, which is a benchmark utilized by our Toledo and Torrance refineries that approximates the per barrel refining margin resulting from processing four barrels of crude oil to produce three barrels of gasoline and one-half barrel of jet fuel and one-half barrel of ULSD and (c) the 3-2-1 crack spread, which is a benchmark utilized by our Martinez refinery that approximates the per barrel refining margin resulting from processing three barrels of crude oil to produce two barrels of gasoline and three-quarters of a barrel jet fuel and one-quarter of a barrel ULSD.

“Dated Brent” refers to Brent blend oil, a light, sweet North Sea crude oil, characterized by an American Petroleum Institute (“API”) gravity of 38° and a sulfur content of approximately 0.4 weight percent that is used as a benchmark for other crude oils.

“distillates” refers primarily to diesel, heating oil, kerosene and jet fuel.

“downstream” refers to the downstream sector of the energy industry generally describing oil refineries, marketing and distribution companies that refine crude oil and sell and distribute refined products. The opposite of the downstream sector is the upstream sector, which refers to exploration and production companies that search for and/or produce crude oil and natural gas underground or through drilling or exploratory wells.

“EPA” refers to the United States Environmental Protection Agency.

“ESG” refers to environmental, social, and governance matters.

“ethanol” refers to a clear, colorless, flammable oxygenated liquid. Ethanol is typically produced chemically from ethylene, or biologically from fermentation of various sugars from carbohydrates found in agricultural crops. It is used in the United States as a gasoline octane enhancer and oxygenate.

“ExxonMobil” refers to Exxon Mobil Corporation.

“FCC” refers to fluid catalytic cracking.

“feedstocks” refers to crude oil and partially refined products that are processed and blended into refined products.

“GAAP” refers to U.S. generally accepted accounting principles developed by the Financial Accounting Standard Board for nongovernmental entities.

“GHG” refers to greenhouse gas.

“Group I base oils or lubricants” refers to conventionally refined products characterized by sulfur content less than 0.03% with a viscosity index between 80 and 120. Typically, these products are used in a variety of automotive and industrial applications.

“heavy crude oil” refers to a relatively inexpensive crude oil with a low API gravity characterized by high relative density and viscosity. Heavy crude oils require greater levels of processing to produce high value products such as gasoline and diesel.

“IPO” refers to the initial public offering of PBF Energy Class A common stock which closed on December 18, 2012.

“IRA” refers to the Inflation Reduction Act; a U.S. federal law enacted on August 16, 2022 that resulted in significant law changes related to tax, climate change, energy, and health care. The tax provision includes, but is not limited to, a corporate alternative minimum tax of 15%, excise tax of 1% on certain corporate stock buy-backs, energy-related tax credits and incentives, and additional Internal Revenue Service (“IRS”) funding.

“J. Aron” refers to J. Aron & Company, a subsidiary of The Goldman Sachs Group, Inc.

“KV” refers to Kilovolts.

“LCM” refers to a GAAP requirement for inventory to be valued at the lower of cost or market.

“light crude oil” refers to a relatively expensive crude oil with a high API gravity characterized by low relative density and viscosity. Light crude oils require lower levels of processing to produce high value products such as gasoline and diesel.

“light products” refers to the group of refined products with lower boiling temperatures, including gasoline and distillates.

“LLS” refers to Light Louisiana Sweet benchmark for crude oil reflective of Gulf coast economics for light sweet domestic and foreign crudes. It is characterized by an API gravity of between 35° and 40° and a sulfur content of approximately .35 weight percent.

“LPG” refers to liquefied petroleum gas.

“Maya” refers to Maya crude oil, a heavy, sour crude oil characterized by an API gravity of approximately 22° and a sulfur content of approximately 3.3 weight percent that is used as a benchmark for other heavy crude oils.

“MLP” refers to the master limited partnership.

“MMBTU” refers to million British thermal units.

“MOEM Pipeline” refers to a pipeline that originates at a terminal in Empire, Louisiana approximately 30 miles north of the mouth of the Mississippi River. The MOEM Pipeline is 14 inches in diameter, 54 miles long and transports crude from South Louisiana to the Chalmette refinery and transports Heavy Louisiana Sweet (HLS) and South Louisiana Intermediate (SLI) crude.

“MW” refers to Megawatt.

“Nelson Complexity Index” refers to the complexity of an oil refinery as measured by the Nelson Complexity Index, which is calculated on an annual basis by the Oil and Gas Journal. The Nelson Complexity Index assigns a complexity factor to each major piece of refinery equipment based on its complexity and cost in comparison to crude distillation, which is assigned a complexity factor of 1.0. The complexity of each piece of refinery equipment is then calculated by multiplying its complexity factor by its throughput ratio as a percentage of crude distillation capacity. Adding up the complexity values assigned to each piece of equipment, including crude distillation, determines a refinery’s complexity on the Nelson Complexity Index. A refinery with a complexity of 10.0 on the Nelson Complexity Index is considered ten times more complex than crude distillation for the same amount of throughput.

“NYH” refers to the New York Harbor market value of petroleum products.

“OSHA” refers to the Occupational Safety and Health Administration of the U.S. Department of Labor.

“PADD” refers to Petroleum Administration for Defense Districts.

“refined products” refers to petroleum products, such as gasoline, diesel and jet fuel, that are produced by a refinery.

“Renewable Fuel Standard” (“RFS”) refers to the Renewable Fuel Standard issued pursuant to the Energy Independence and Security Act of 2007 implementing mandates to blend renewable fuels into petroleum fuels produced and sold in the United States.

“RINs” refers to renewable fuel credits required for compliance with the RFS.

“Saudi Aramco” refers to Saudi Arabian Oil Company.

“SEC” refers to the United States Securities and Exchange Commission.

“sour crude oil” refers to a crude oil that is relatively high in sulfur content, requiring additional processing to remove the sulfur. Sour crude oil is typically less expensive than sweet crude oil.

“Sunoco” refers to Sunoco, LLC.

“sweet crude oil” refers to a crude oil that is relatively low in sulfur content, requiring less processing to remove the sulfur than sour crude oil. Sweet crude oil is typically more expensive than sour crude oil.

“Syncrude” refers to a blend of Canadian synthetic oil, a light, sweet crude oil, typically characterized by API gravity between 30° and 32° and a sulfur content of approximately 0.1-0.2 weight percent.

“throughput” refers to the volume processed through a unit or refinery.

“turnaround” refers to a periodically required shutdown and comprehensive maintenance event to refurbish and maintain a refinery unit or units that involves the cleaning, repair, and inspection of such units and occurs generally on a periodic cycle.

“ULSD” refers to ultra-low-sulfur diesel.

“WCS” refers to Western Canadian Select, a heavy, sour crude oil blend typically characterized by API gravity between 20° and 22° and a sulfur content of approximately 3.5 weight percent that is used as a benchmark for heavy Western Canadian crude oil.

“WTI” refers to West Texas Intermediate crude oil, a light, sweet crude oil, typically characterized by API gravity between 38° and 40° and a sulfur content of approximately 0.3 weight percent that is used as a benchmark for other crude oils.

“WTS” refers to West Texas Sour crude oil, a sour crude oil characterized by API gravity between 30° and 33° and a sulfur content of approximately 1.28 weight percent that is used as a benchmark for other sour crude oils.

“yield” refers to the percentage of refined products that is produced from crude oil and other feedstocks.

Explanatory Note

This Annual Report on Form 10-K is filed by PBF Energy Inc. (“PBF Energy”) and PBF Energy Company LLC (“PBF LLC”). Each Registrant hereto is filing on its own behalf all of the information contained in this report that relates to such Registrant. Each Registrant hereto is not filing any information that does not relate to such Registrant, and therefore makes no representation as to any such information. PBF Energy is a holding company whose primary asset is an equity interest in PBF LLC. PBF Energy is the sole managing member of, and owner of an equity interest representing approximately 99.3% of the outstanding economic interests in PBF LLC as of December 31, 2022. PBF Energy operates and controls all of the business and affairs and consolidates the financial results of PBF LLC and its subsidiaries. PBF LLC is a holding company for the companies that directly and indirectly own and operate the business.

PART I

This Annual Report on Form 10-K is filed by PBF Energy and PBF LLC. Discussions or areas of this report that either apply only to PBF Energy or PBF LLC are clearly noted in such sections. Unless the context indicates otherwise, the terms “Company”, “we,” “us,” and “our” refer to both PBF Energy and PBF LLC and its consolidated subsidiaries, including PBF Holding Company LLC (“PBF Holding”), PBF Investments LLC, Toledo Refining Company LLC, Paulsboro Refining Company LLC (“PRC”), Delaware City Refining Company LLC (“DCR”), Chalmette Refining, L.L.C. (“Chalmette Refining”), PBF Energy Western Region LLC (“PBF Western Region”), Torrance Refining Company LLC (“Torrance Refining”), Torrance Logistics Company LLC, Martinez Refining Company LLC (“MRC”), PBF Logistics GP LLC (“PBFX GP”) and PBF Logistics LP (“PBFX”) and its subsidiaries.

In this Annual Report on Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions, and resources, under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 to the extent such statements relate to the operations of an entity that is not a limited liability company or a partnership. You should read our forward-looking statements together with our disclosures under the heading: “Cautionary Statement for the Purpose of Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.” When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements set forth in this Annual Report on Form 10-K under “Risk Factors” in Item 1A.

ITEM. 1 BUSINESS

Overview and Corporate Structure

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States, Canada and Mexico and are able to ship products to other international destinations. We own and operate six domestic oil refineries and related assets. Our refineries have a combined processing capacity, known as throughput, of approximately 1,000,000 bpd, and a weighted-average Nelson Complexity Index of 12.7 based on current operating conditions. The complexity and throughput capacity of our refineries are subject to change dependent upon configuration changes we make to respond to market conditions, as well as a result of investments made to improve our facilities and maintain compliance with environmental and governmental regulations. We operate in two reportable business segments: Refining and Logistics.

PBF Energy is a holding company whose primary asset is a controlling equity interest in PBF LLC. We are the sole managing member of PBF LLC and operate and control all of the business and affairs of PBF LLC. We consolidate the financial results of PBF LLC and its subsidiaries and record a noncontrolling interest in our consolidated financial statements representing the economic interests of the members of PBF LLC other than PBF Energy. PBF LLC is a holding company for the companies that directly or indirectly own and operate our business. PBF Holding is a wholly-owned subsidiary of PBF LLC and is the parent company for our refining operations. PBFX is an indirect wholly-owned subsidiary of PBF LLC that owns and operates logistics assets that support our refining operations.

As of December 31, 2022, PBF Energy held 129,660,538 PBF LLC Series C Units and our current and former executive officers and directors and certain employees and others held 910,457 PBF LLC Series A Units (we refer to all of the holders of the PBF LLC Series A Units as “the members of PBF LLC other than PBF Energy”). As a result, the holders of PBF Energy’s issued and outstanding shares of its Class A common stock have approximately 99.3% of the voting power in PBF Energy, and the members of PBF LLC other than PBF Energy through their holdings of Class B common stock have approximately 0.7% of the voting power in PBF Energy.

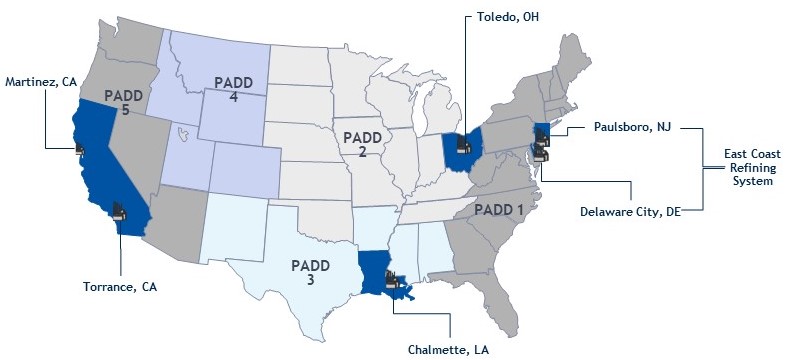

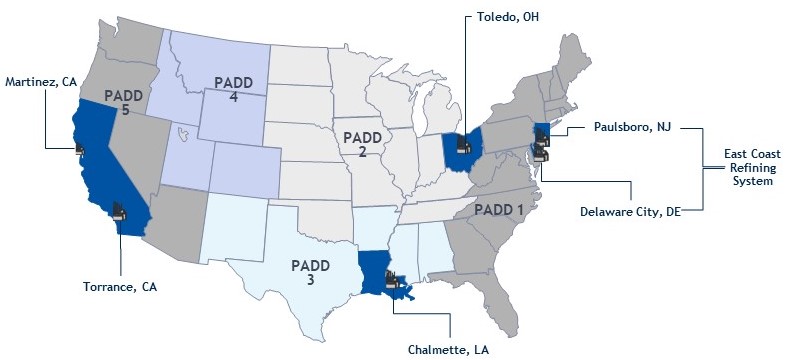

The following map details the locations of our refineries (each as defined below):

Refining

Our six refineries are located in Delaware City, Delaware, Paulsboro, New Jersey, Toledo, Ohio, Chalmette, Louisiana, Torrance, California and Martinez, California. In 2020, we reconfigured our Delaware City and Paulsboro refineries (the “East Coast Refining Reconfiguration”), temporarily idling certain of our major processing units at the Paulsboro refinery, in order to operate the two refineries as one functional unit that we refer to as the “East Coast Refining System”. Each refinery is briefly described in the table below:

| | | | | | | | | | | | | | | | | | | | |

| Refinery | Region | Nelson Complexity Index (1) | Throughput Capacity (in barrels per day) (1) | PADD | Crude Processed (2) | Source (2) |

| Delaware City | East Coast | 13.6 | 180,000 | 1 | light sweet through heavy sour | water, rail |

| Paulsboro | East Coast | 8.8(3) | 155,000(3) | 1 | light sweet through heavy sour | water |

| Toledo | Mid-Continent | 11.0 | 180,000 | 2 | light sweet | pipeline, truck, rail |

| Chalmette | Gulf Coast | 13.0 | 185,000 | 3 | light sweet through heavy sour | water, pipeline |

| Torrance | West Coast | 13.8 | 166,000 | 5 | medium and heavy | pipeline, water, truck |

| Martinez | West Coast | 16.1 | 157,000 | 5 | medium and heavy | pipeline and water |

________

(1) Reflects operating conditions at each refinery as of the date of this filing. Changes in complexity and throughput capacity reflect the result of current market conditions, in addition to investments made to improve our facilities and maintain compliance with environmental and governmental regulations. Configurations at each of our refineries are regularly evaluated and accordingly updated, which resulted in the restart of several idled processing units at the Paulsboro refinery in 2022.

(2) Reflects the typical crude and feedstocks and related sources utilized under normal operating conditions and prevailing market environments.

(3) Under normal operating conditions and prevailing market environments, our Nelson Complexity Index and throughput capacity for the Paulsboro refinery would be 13.1 and 180,000, respectively. As a result of the East Coast Refining Reconfiguration and subsequent restart of several idled processing units at the Paulsboro refinery, our Nelson Complexity Index and throughput capacity were reduced.

Logistics

PBFX, an indirect wholly-owned subsidiary of PBF Energy and PBF LLC, owns or leases, operates, develops and acquires crude oil and refined products terminals, pipelines, storage facilities and similar logistics assets. PBFX engages in the receiving, handling, storage and transferring of crude oil, refined products, natural gas and intermediates from sources located throughout the United States and Canada for PBF Energy in support of its refineries, as well as for third-party customers. The majority of PBFX’s revenues are derived from long-term, fee-based commercial agreements with PBF Holding, which include minimum volume commitments, for receiving, handling, storing and transferring crude oil, refined products and natural gas. PBF Energy also has agreements with PBFX that establish fees for certain general and administrative services and operational and maintenance services provided by PBF Holding to PBFX. These transactions, other than those with third parties, are eliminated by us in consolidation.

See “Item 1A. Risk Factors” and “Item 13. Certain Relationships and Related Transactions, and Director Independence.”

Recent Developments

Merger Transaction

On July 27, 2022, PBF Energy, PBF LLC, PBFX Holdings Inc., a Delaware corporation and wholly owned subsidiary of PBF LLC (“PBFX Holdings”), Riverlands Merger Sub LLC, a Delaware limited liability company and wholly owned subsidiary of PBF LLC (“Merger Sub”), PBFX, and PBFX GP entered into a definitive agreement (the “Merger Agreement”) pursuant to which PBF Energy and PBF LLC announced their intention to acquire all of the publicly held common units in PBFX representing limited partner interests in the MLP not already owned by certain wholly-owned subsidiaries of PBF Energy and its affiliates on the closing date of the transaction (the “Merger Transaction”). The Merger Transaction closed on November 30, 2022 and PBFX became an indirect wholly-owned subsidiary of PBF Energy and PBF LLC.