Exhibit 99.2

CION Investment Corporation

PORTFOLIO HOLDINGS Q1 2021 As of March 31, 2021 FOR EXISTING INVESTORS ONLY. CION Investment Corporation PORTFOLIO HOLDINGS Q1 2021 As

of March 31, 2021 FOR EXISTING INVESTORS ONLY.

CION Investment Corporation

CION Investment Corporation FUND OVERVIEW CION Investment Corporation (“CIC”) is a non-traded business development company,

or BDC, that focuses on middle market loans. CIC seeks to generate current income, and to a lesser extent, capital appreciation. CIC’s

portfolio is managed by its adviser – CION Investment Management, LLC, a CION Investments company. TARGET INVESTMENTS CIC offers

investors the opportunity to invest primarily in: • Senior secured debt • Private and thinly-traded U.S. middle market companies

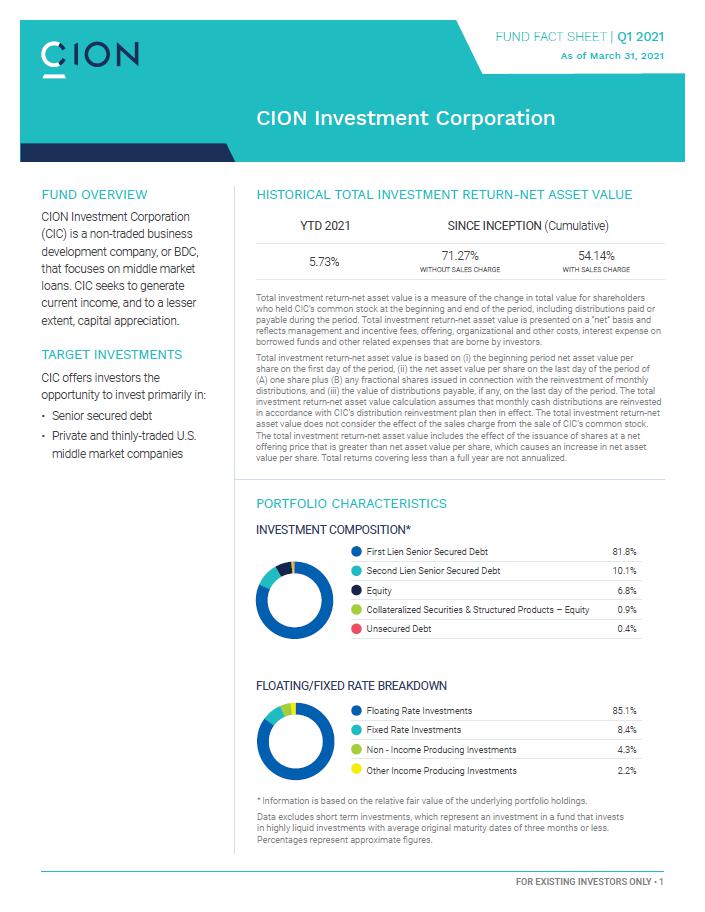

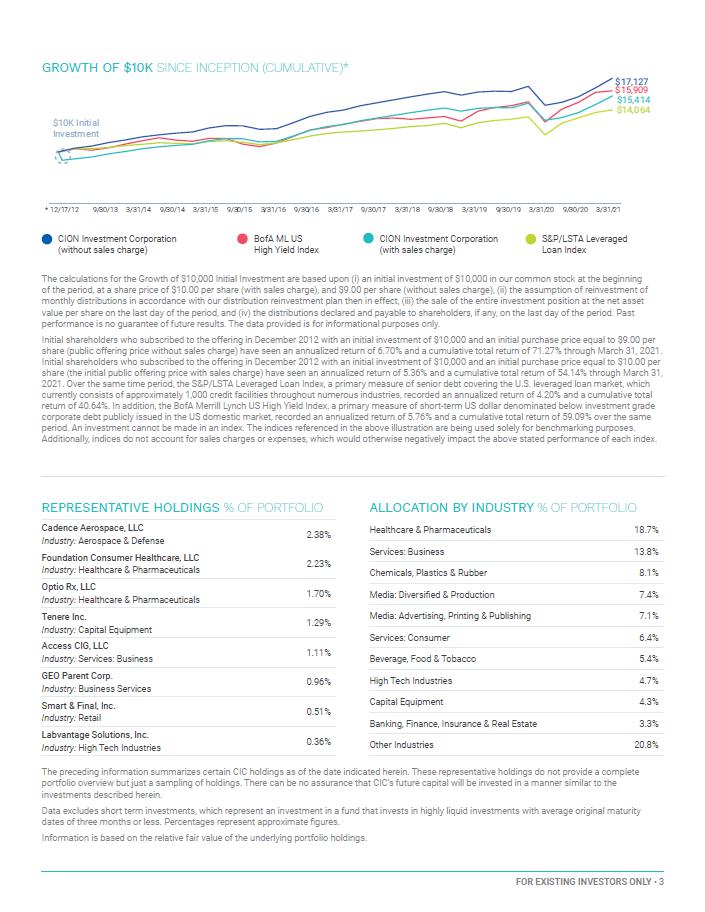

FLOATING/FIXED RATE BREAKDOWN INVESTMENT COMPOSITION(1) First Lien Senior Secured Debt 81.8% Floating Rate 85.1% Investments Second Lien

Senior Secured Debt 10.1% Fixed Rate Investments 8.4% Equity 6.8% Non - Income Producing 4.3% Collateralized Securities & Structured

Products – Investments 0.9% Equity Other Income Producing 2.2% Unsecured Debt 0.4% Investments PORTFOLIO HOLDINGS Please note that

rates are not indicative of CIC’s performance. COMPANY NAME INDUSTRY WEIGHTING(1) RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE

1ST LIEN SENIOR SECURED DEBT: 81.8% 1244311 B.C. LTD. Chemicals, Plastics & Rubber 0.15% LIBOR+5.00% 1.00% LIBOR Floor 9/30/2025

1244311 B.C. LTD. Chemicals, Plastics & Rubber 0.05% LIBOR+5.00% 1.00% LIBOR Floor 9/30/2025 Adams Publishing Group, LLC Media: Advertising,

Printing & Publishing 0.76% LIBOR+7.00% 1.75% LIBOR Floor 7/2/2023 Adapt Laser Acquisition, Inc. Capital Equipment 0.62% LIBOR+12.00%

1.00% LIBOR Floor 12/31/2023 Adapt Laser Acquisition, Inc. Capital Equipment 0.11% LIBOR+10.00% 1.00% LIBOR Floor 12/31/2023 Aegis Toxicology

Sciences Corp. Healthcare & Pharmaceuticals 0.59% LIBOR+5.50% 1.00% LIBOR Floor 5/9/2025 AIS Holdco, LLC Banking, Finance, Insurance

& Real Estate 0.33% LIBOR+5.00% 0.00% LIBOR Floor 8/15/2025 Alchemy US Holdco 1, LLC Construction & Building 0.82% LIBOR+5.50%

None 10/10/2025 Alert 360 Opco, Inc. Services: Consumer 0.80% LIBOR+6.00% 1.00% LIBOR Floor 10/16/2025 Allen Media, LLC Media: Diversified

& Production 0.64% LIBOR+5.50% 0.00% LIBOR Floor 2/10/2027 Alliance Healthcare Services, Inc. Healthcare & Pharmaceuticals 0.26%

LIBOR+4.50% 1.00% LIBOR Floor 10/24/2023 ALM Media, LLC Media: Advertising, Printing & Publishing 1.16% LIBOR+6.50% 1.00% LIBOR Floor

11/25/2024 AMCP Staffing Intermediate Holdings III, LLC Services: Business 0.00% 0.50% Unfunded None 9/24/2025 AMCP Staffing Intermediate

Holdings III, LLC Services: Business 0.68% LIBOR+6.75% 1.50% LIBOR Floor 9/24/2025 American Clinical Solutions LLC Healthcare & Pharmaceuticals

0.21% 7.00% None 12/31/2022 American Clinical Solutions LLC Healthcare & Pharmaceuticals 0.02% 7.00% None 6/30/2021 American Consolidated

Natural Resources, Inc. Metals & Mining 0.04% LIBOR+13.00% 1.00% LIBOR Floor 9/16/2025 American Media, LLC Media: Advertising, Printing

& Publishing 0.00% 0.50% Unfunded None 12/31/2023 American Media, LLC Media: Advertising, Printing & Publishing 0.69% LIBOR 7.75%

1.50% LIBOR Floor 12/31/2023 CIC Portfolio Holdings • 1 FOR EXISTING INVESTORS ONLY.

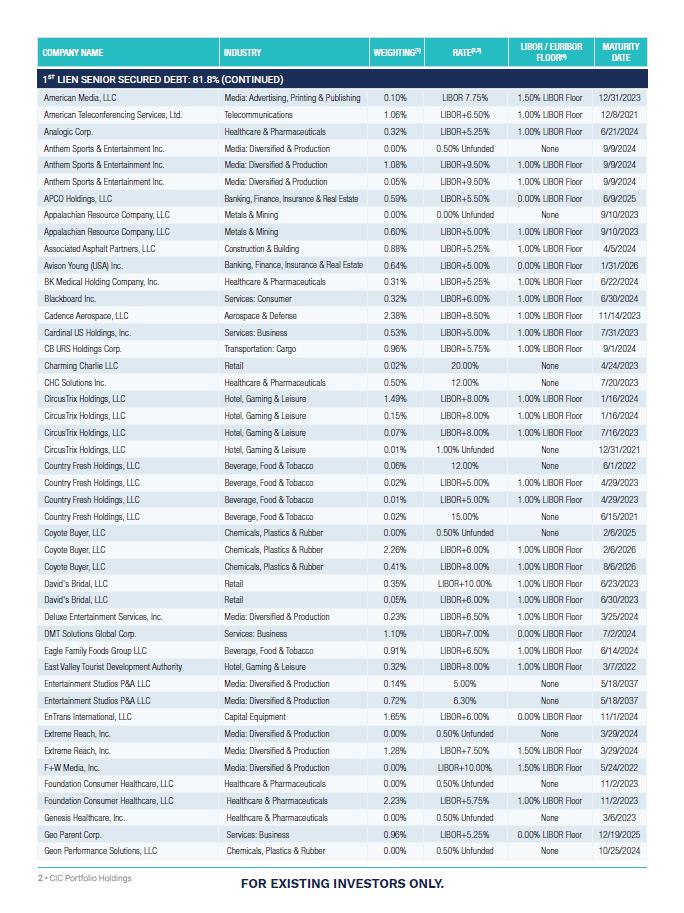

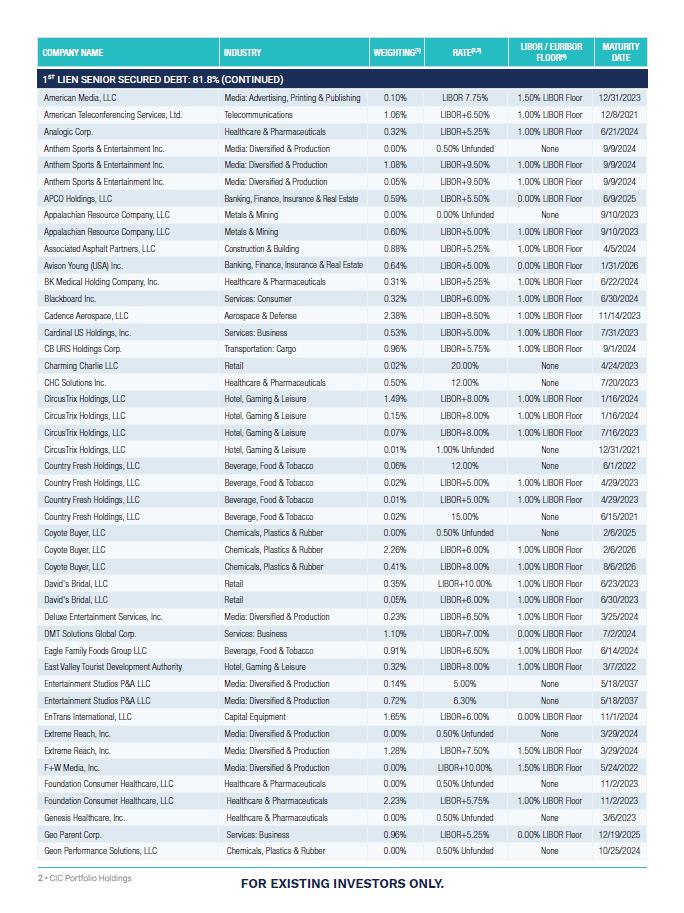

COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE 1ST LIEN SENIOR SECURED DEBT: 81.8% (CONTINUED) American Media, LLC Media: Advertising,

Printing & Publishing 0.10% LIBOR 7.75% 1.50% LIBOR Floor 12/31/2023 American Teleconferencing Services, Ltd. Telecommunications

1.06% LIBOR+6.50% 1.00% LIBOR Floor 12/8/2021 Analogic Corp. Healthcare & Pharmaceuticals 0.32% LIBOR+5.25% 1.00% LIBOR Floor 6/21/2024

Anthem Sports & Entertainment Inc. Media: Diversified & Production 0.00% 0.50% Unfunded None 9/9/2024 Anthem Sports & Entertainment

Inc. Media: Diversified & Production 1.08% LIBOR+9.50% 1.00% LIBOR Floor 9/9/2024 Media: Diversified & Production Anthem Sports

& Entertainment Inc. 0.05% LIBOR+9.50% 1.00% LIBOR Floor 9/9/2024 APCO Holdings, LLC Banking, Finance, Insurance & Real Estate

0.59% LIBOR+5.50% 0.00% LIBOR Floor 6/9/2025 Appalachian Resource Company, LLC Metals & Mining 0.00% 0.00% Unfunded None 9/10/2023

Appalachian Resource Company, LLC Metals & Mining 0.60% LIBOR+5.00% 1.00% LIBOR Floor 9/10/2023 Construction & Building Associated

Asphalt Partners, LLC 0.88% LIBOR+5.25% 1.00% LIBOR Floor 4/5/2024 Avison Young (USA) Inc. Banking, Finance, Insurance & Real Estate

0.64% LIBOR+5.00% 0.00% LIBOR Floor 1/31/2026 BK Medical Holding Company, Inc. Healthcare & Pharmaceuticals 0.31% LIBOR+5.25% 1.00%

LIBOR Floor 6/22/2024 Blackboard Inc. Services: Consumer 0.32% LIBOR+6.00% 1.00% LIBOR Floor 6/30/2024 Cadence Aerospace, LLC Aerospace

& Defense 2.38% LIBOR+8.50% 1.00% LIBOR Floor 11/14/2023 Cardinal US Holdings, Inc. Services: Business 0.53% LIBOR+5.00% 1.00% LIBOR

Floor 7/31/2023 CB URS Holdings Corp. Transportation: Cargo 0.96% LIBOR+5.75% 1.00% LIBOR Floor 9/1/2024 Charming Charlie LLC Retail

0.02% 20.00% None 4/24/2023 CHC Solutions Inc. Healthcare & Pharmaceuticals 0.50% 12.00% None 7/20/2023 CircusTrix Holdings, LLC

Hotel, Gaming & Leisure 1.49% LIBOR+8.00% 1.00% LIBOR Floor 1/16/2024 CircusTrix Holdings, LLC Hotel, Gaming & Leisure 0.15%

LIBOR+8.00% 1.00% LIBOR Floor 1/16/2024 CircusTrix Holdings, LLC Hotel, Gaming & Leisure 0.07% LIBOR+8.00% 1.00% LIBOR Floor 7/16/2023

CircusTrix Holdings, LLC Hotel, Gaming & Leisure 0.01% 1.00% Unfunded None 12/31/2021 Country Fresh Holdings, LLC Beverage, Food

& Tobacco 0.06% 12.00% None 6/1/2022 Country Fresh Holdings, LLC Beverage, Food & Tobacco 0.02% LIBOR+5.00% 1.00% LIBOR Floor

4/29/2023 Country Fresh Holdings, LLC Beverage, Food & Tobacco 0.01% LIBOR+5.00% 1.00% LIBOR Floor 4/29/2023 Country Fresh Holdings,

LLC Beverage, Food & Tobacco 0.02% 15.00% None 6/15/2021 Coyote Buyer, LLC Chemicals, Plastics & Rubber 0.00% 0.50% Unfunded

None 2/6/2025 Coyote Buyer, LLC Chemicals, Plastics & Rubber 2.26% LIBOR+6.00% 1.00% LIBOR Floor 2/6/2026 Coyote Buyer, LLC Chemicals,

Plastics & Rubber 0.41% LIBOR+8.00% 1.00% LIBOR Floor 8/6/2026 David's Bridal, LLC Retail 0.35% LIBOR+10.00% 1.00% LIBOR Floor 6/23/2023

David's Bridal, LLC Retail 0.05% LIBOR+6.00% 1.00% LIBOR Floor 6/30/2023 Deluxe Entertainment Services, Inc. Media: Diversified &

Production 0.23% LIBOR+6.50% 1.00% LIBOR Floor 3/25/2024 DMT Solutions Global Corp. Services: Business 1.10% LIBOR+7.00% 0.00% LIBOR

Floor 7/2/2024 Eagle Family Foods Group LLC Beverage, Food & Tobacco 0.91% LIBOR+6.50% 1.00% LIBOR Floor 6/14/2024 East Valley Tourist

Development Authority Hotel, Gaming & Leisure 0.32% LIBOR+8.00% 1.00% LIBOR Floor 3/7/2022 Entertainment Studios P&A LLC Media:

Diversified & Production 0.14% 5.00% None 5/18/2037 Entertainment Studios P&A LLC Media: Diversified & Production 0.72% 6.30%

None 5/18/2037 EnTrans International, LLC Capital Equipment 1.65% LIBOR+6.00% 0.00% LIBOR Floor 11/1/2024 Extreme Reach, Inc. Media:

Diversified & Production 0.00% 0.50% Unfunded None 3/29/2024 Extreme Reach, Inc. Media: Diversified & Production 1.28% LIBOR+7.50%

1.50% LIBOR Floor 3/29/2024 F+W Media, Inc. Media: Diversified & Production 0.00% LIBOR+10.00% 1.50% LIBOR Floor 5/24/2022 Foundation

Consumer Healthcare, LLC Healthcare & Pharmaceuticals 0.00% 0.50% Unfunded None 11/2/2023 Foundation Consumer Healthcare, LLC Healthcare

& Pharmaceuticals 2.23% LIBOR+5.75% 1.00% LIBOR Floor 11/2/2023 Genesis Healthcare, Inc. Healthcare & Pharmaceuticals 0.00% 0.50%

Unfunded None 3/6/2023 Geo Parent Corp. Services: Business 0.96% LIBOR+5.25% 0.00% LIBOR Floor 12/19/2025 Geon Performance Solutions,

LLC Chemicals, Plastics & Rubber 0.00% 0.50% Unfunded None 10/25/2024 2 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY.

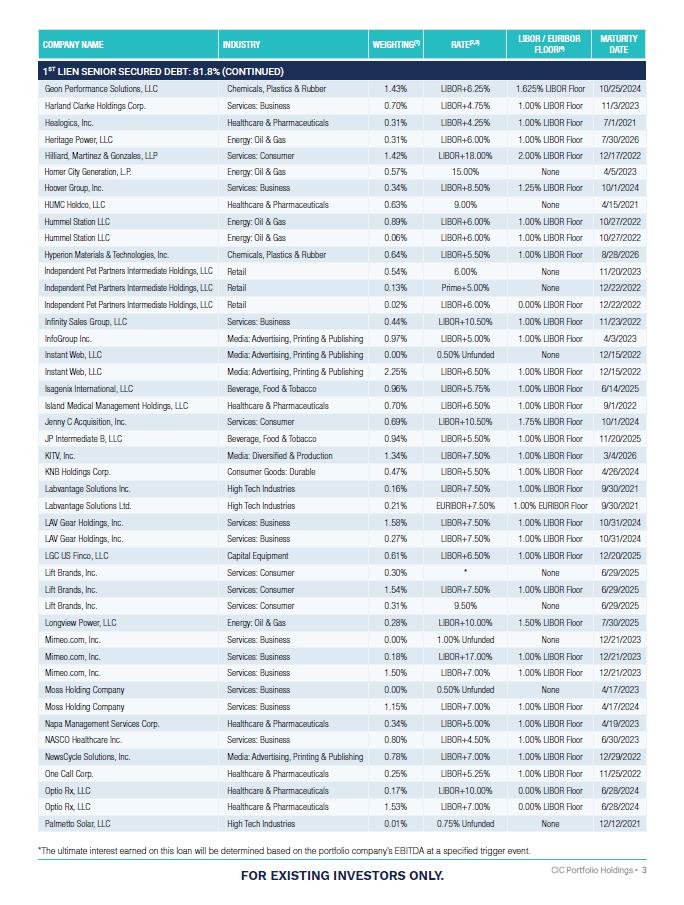

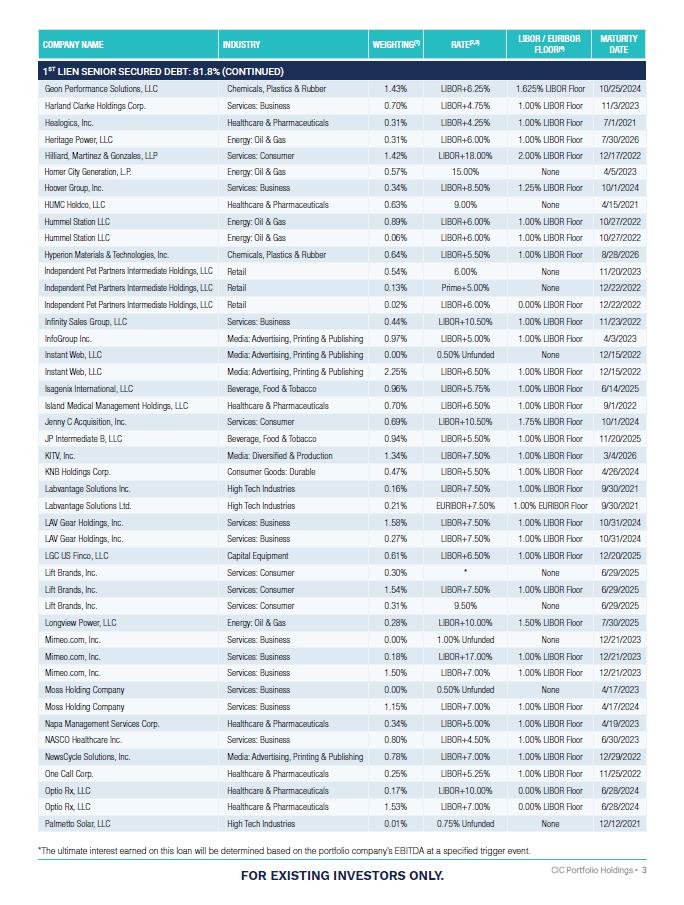

COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE 1ST LIEN SENIOR SECURED DEBT: 81.8% (CONTINUED) Geon Performance Solutions, LLC Chemicals,

Plastics & Rubber 1.43% LIBOR+6.25% 1.625% LIBOR Floor 10/25/2024 Harland Clarke Holdings Corp. Services: Business 0.70% LIBOR+4.75%

1.00% LIBOR Floor 11/3/2023 Healogics, Inc. Healthcare & Pharmaceuticals 0.31% LIBOR+4.25% 1.00% LIBOR Floor 7/1/2021 Heritage Power,

LLC Energy: Oil & Gas 0.31% LIBOR+6.00% 1.00% LIBOR Floor 7/30/2026 Hilliard, Martinez & Gonzales, LLP Services: Consumer 1.42%

LIBOR+18.00% 2.00% LIBOR Floor 12/17/2022 Homer City Generation, L.P. Energy: Oil & Gas 0.57% 15.00% None 4/5/2023 Hoover Group,

Inc. Services: Business 0.34% LIBOR+8.50% 1.25% LIBOR Floor 10/1/2024 HUMC Holdco, LLC Healthcare & Pharmaceuticals 0.63% 9.00% None

4/15/2021 Hummel Station LLC Energy: Oil & Gas 0.89% LIBOR+6.00% 1.00% LIBOR Floor 10/27/2022 Hummel Station LLC Energy: Oil &

Gas 0.06% LIBOR+6.00% 1.00% LIBOR Floor 10/27/2022 Hyperion Materials & Technologies, Inc. Chemicals, Plastics & Rubber 0.64%

LIBOR+5.50% 1.00% LIBOR Floor 8/28/2026 Independent Pet Partners Intermediate Holdings, LLC Retail 0.54% 6.00% None 11/20/2023 Independent

Pet Partners Intermediate Holdings, LLC Retail 0.13% Prime+5.00% None 12/22/2022 Independent Pet Partners Intermediate Holdings, LLC

Retail 0.02% LIBOR+6.00% 0.00% LIBOR Floor 12/22/2022 Infinity Sales Group, LLC Services: Business 0.44% LIBOR+10.50% 1.00% LIBOR Floor

11/23/2022 InfoGroup Inc. Media: Advertising, Printing & Publishing 0.97% LIBOR+5.00% 1.00% LIBOR Floor 4/3/2023 Instant Web, LLC

Media: Advertising, Printing & Publishing 0.00% 0.50% Unfunded None 12/15/2022 Instant Web, LLC Media: Advertising, Printing &

Publishing 2.25% LIBOR+6.50% 1.00% LIBOR Floor 12/15/2022 Isagenix International, LLC Beverage, Food & Tobacco 0.96% LIBOR+5.75%

1.00% LIBOR Floor 6/14/2025 Island Medical Management Holdings, LLC Healthcare & Pharmaceuticals 0.70% LIBOR+6.50% 1.00% LIBOR Floor

9/1/2022 Jenny C Acquisition, Inc. Services: Consumer 0.69% LIBOR+10.50% 1.75% LIBOR Floor 10/1/2024 JP Intermediate B, LLC Beverage,

Food & Tobacco 0.94% LIBOR+5.50% 1.00% LIBOR Floor 11/20/2025 KITV, Inc. Media: Diversified & Production 1.34% LIBOR+7.50% 1.00%

LIBOR Floor 3/4/2026 KNB Holdings Corp. Consumer Goods: Durable 0.47% LIBOR+5.50% 1.00% LIBOR Floor 4/26/2024 Labvantage Solutions Inc.

High Tech Industries 0.16% LIBOR+7.50% 1.00% LIBOR Floor 9/30/2021 Labvantage Solutions Ltd. High Tech Industries 0.21% EURIBOR+7.50%

1.00% EURIBOR Floor 9/30/2021 LAV Gear Holdings, Inc. Services: Business 1.58% LIBOR+7.50% 1.00% LIBOR Floor 10/31/2024 LAV Gear Holdings,

Inc. Services: Business 0.27% LIBOR+7.50% 1.00% LIBOR Floor 10/31/2024 LGC US Finco, LLC Capital Equipment 0.61% LIBOR+6.50% 1.00% LIBOR

Floor 12/20/2025 Lift Brands, Inc. Services: Consumer 0.30% * None 6/29/2025 Lift Brands, Inc. Services: Consumer 1.54% LIBOR+7.50% 1.00%

LIBOR Floor 6/29/2025 Lift Brands, Inc. Services: Consumer 0.31% 9.50% None 6/29/2025 Longview Power, LLC Energy: Oil & Gas 0.28%

LIBOR+10.00% 1.50% LIBOR Floor 7/30/2025 Mimeo.com, Inc. Services: Business 0.00% 1.00% Unfunded None 12/21/2023 Mimeo.com, Inc. Services:

Business 0.18% LIBOR+17.00% 1.00% LIBOR Floor 12/21/2023 Mimeo.com, Inc. Services: Business 1.50% LIBOR+7.00% 1.00% LIBOR Floor 12/21/2023

Moss Holding Company Services: Business 0.00% 0.50% Unfunded None 4/17/2023 Moss Holding Company Services: Business 1.15% LIBOR+7.00%

1.00% LIBOR Floor 4/17/2024 Napa Management Services Corp. Healthcare & Pharmaceuticals 0.34% LIBOR+5.00% 1.00% LIBOR Floor 4/19/2023

NASCO Healthcare Inc. Services: Business 0.80% LIBOR+4.50% 1.00% LIBOR Floor 6/30/2023 NewsCycle Solutions, Inc. Media: Advertising,

Printing & Publishing 0.78% LIBOR+7.00% 1.00% LIBOR Floor 12/29/2022 One Call Corp. Healthcare & Pharmaceuticals 0.25% LIBOR+5.25%

1.00% LIBOR Floor 11/25/2022 Optio Rx, LLC Healthcare & Pharmaceuticals 0.17% LIBOR+10.00% 0.00% LIBOR Floor 6/28/2024 Optio Rx,

LLC Healthcare & Pharmaceuticals 1.53% LIBOR+7.00% 0.00% LIBOR Floor 6/28/2024 Palmetto Solar, LLC High Tech Industries 0.01% 0.75%

Unfunded None 12/12/2021 *The ultimate interest earned on this loan will be determined based on the portfolio company’s EBITDA

at a specified trigger event. CIC Portfolio Holdings • 3 FOR EXISTING INVESTORS ONLY.

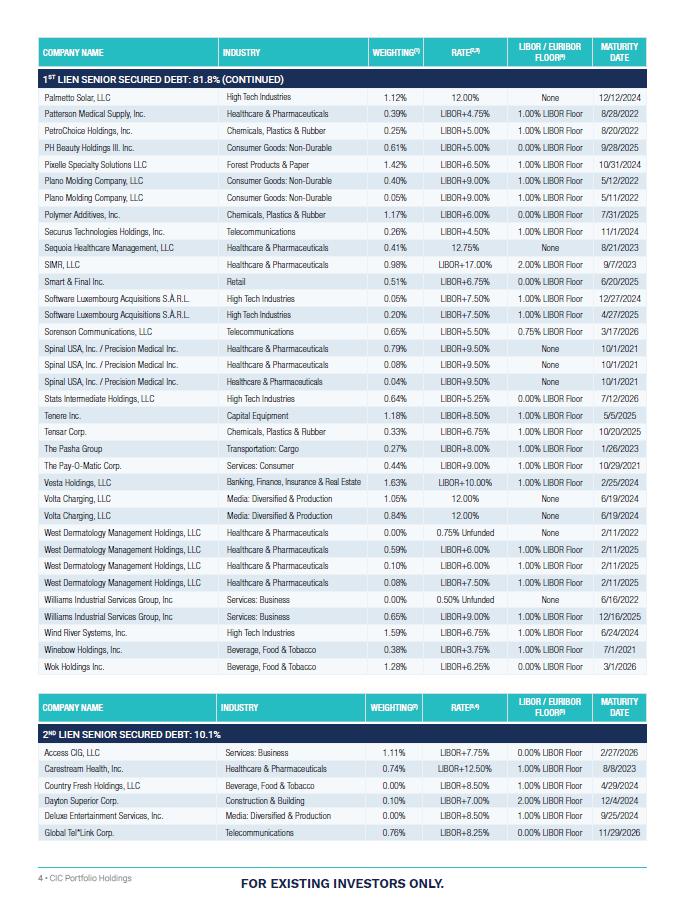

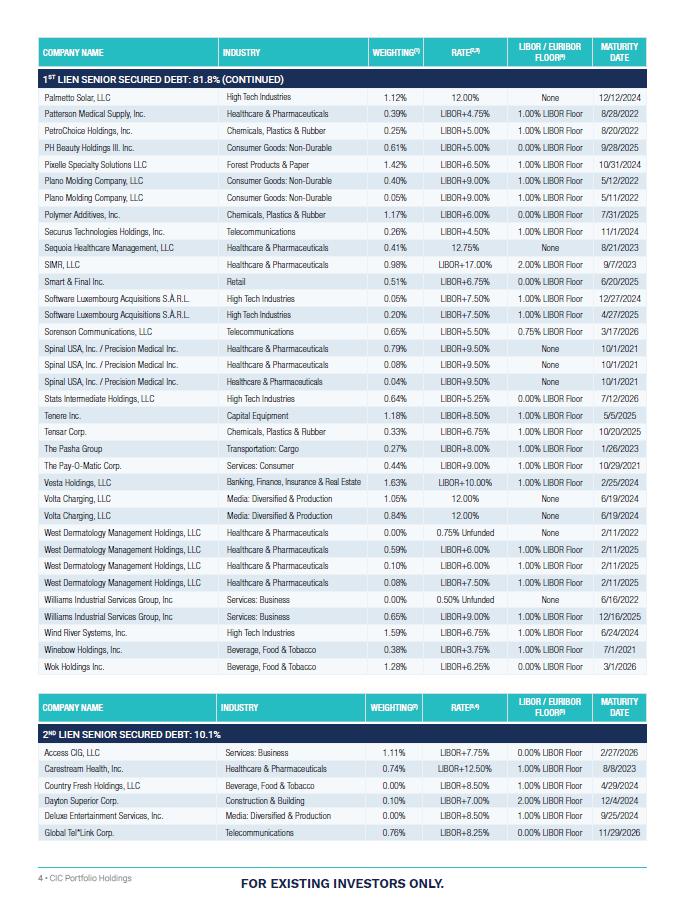

COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE 1ST LIEN SENIOR SECURED DEBT: 81.8% (CONTINUED) High Tech Industries Palmetto Solar,

LLC 1.12% 12.00% None 12/12/2024 Patterson Medical Supply, Inc. Healthcare & Pharmaceuticals 0.39% LIBOR+4.75% 1.00% LIBOR Floor

8/28/2022 PetroChoice Holdings, Inc. Chemicals, Plastics & Rubber 0.25% LIBOR+5.00% 1.00% LIBOR Floor 8/20/2022 PH Beauty Holdings

III. Inc. Consumer Goods: Non-Durable 0.61% LIBOR+5.00% 0.00% LIBOR Floor 9/28/2025 Pixelle Specialty Solutions LLC Forest Products &

Paper 1.42% LIBOR+6.50% 1.00% LIBOR Floor 10/31/2024 Plano Molding Company, LLC Consumer Goods: Non-Durable 0.40% LIBOR+9.00% 1.00% LIBOR

Floor 5/12/2022 Plano Molding Company, LLC Consumer Goods: Non-Durable 0.05% LIBOR+9.00% 1.00% LIBOR Floor 5/11/2022 Polymer Additives,

Inc. Chemicals, Plastics & Rubber 1.17% LIBOR+6.00% 0.00% LIBOR Floor 7/31/2025 Securus Technologies Holdings, Inc. Telecommunications

0.26% LIBOR+4.50% 1.00% LIBOR Floor 11/1/2024 Sequoia Healthcare Management, LLC Healthcare & Pharmaceuticals 0.41% 12.75% None 8/21/2023

SIMR, LLC Healthcare & Pharmaceuticals 0.98% LIBOR+17.00% 2.00% LIBOR Floor 9/7/2023 Smart & Final Inc. Retail 0.51% LIBOR+6.75%

0.00% LIBOR Floor 6/20/2025 Software Luxembourg Acquisitions S.À.R.L. High Tech Industries 0.05% LIBOR+7.50% 1.00% LIBOR Floor

12/27/2024 Software Luxembourg Acquisitions S.À.R.L. High Tech Industries 0.20% LIBOR+7.50% 1.00% LIBOR Floor 4/27/2025 Telecommunications

Sorenson Communications, LLC 0.65% LIBOR+5.50% 0.75% LIBOR Floor 3/17/2026 Spinal USA, Inc. / Precision Medical Inc. Healthcare &

Pharmaceuticals 0.79% LIBOR+9.50% None 10/1/2021 Spinal USA, Inc. / Precision Medical Inc. Healthcare & Pharmaceuticals 0.08% LIBOR+9.50%

None 10/1/2021 Spinal USA, Inc. / Precision Medical Inc. Healthcare & Pharmaceuticals 0.04% LIBOR+9.50% None 10/1/2021 Stats Intermediate

Holdings, LLC High Tech Industries 0.64% LIBOR+5.25% 0.00% LIBOR Floor 7/12/2026 Tenere Inc. Capital Equipment 1.18% LIBOR+8.50% 1.00%

LIBOR Floor 5/5/2025 Tensar Corp. Chemicals, Plastics & Rubber 0.33% LIBOR+6.75% 1.00% LIBOR Floor 10/20/2025 The Pasha Group Transportation:

Cargo 0.27% LIBOR+8.00% 1.00% LIBOR Floor 1/26/2023 The Pay-O-Matic Corp. Services: Consumer 0.44% LIBOR+9.00% 1.00% LIBOR Floor 10/29/2021

Vesta Holdings, LLC Banking, Finance, Insurance & Real Estate 1.63% LIBOR+10.00% 1.00% LIBOR Floor 2/25/2024 Volta Charging, LLC

Media: Diversified & Production 1.05% 12.00% None 6/19/2024 Volta Charging, LLC Media: Diversified & Production 0.84% 12.00%

None 6/19/2024 West Dermatology Management Holdings, LLC Healthcare & Pharmaceuticals 0.00% 0.75% Unfunded None 2/11/2022 West Dermatology

Management Holdings, LLC Healthcare & Pharmaceuticals 0.59% LIBOR+6.00% 1.00% LIBOR Floor 2/11/2025 West Dermatology Management Holdings,

LLC Healthcare & Pharmaceuticals 0.10% LIBOR+6.00% 1.00% LIBOR Floor 2/11/2025 West Dermatology Management Holdings, LLC Healthcare

& Pharmaceuticals 0.08% LIBOR+7.50% 1.00% LIBOR Floor 2/11/2025 Williams Industrial Services Group, Inc Services: Business 0.00%

0.50% Unfunded None 6/16/2022 Williams Industrial Services Group, Inc Services: Business 0.65% LIBOR+9.00% 1.00% LIBOR Floor 12/16/2025

Wind River Systems, Inc. High Tech Industries 1.59% LIBOR+6.75% 1.00% LIBOR Floor 6/24/2024 Winebow Holdings, Inc. Beverage, Food &

Tobacco 0.38% LIBOR+3.75% 1.00% LIBOR Floor 7/1/2021 Wok Holdings Inc. Beverage, Food & Tobacco 1.28% LIBOR+6.25% 0.00% LIBOR Floor

3/1/2026 COMPANY NAME INDUSTRY WEIGHTING(2) RATE(3,4) LIBOR / EURIBOR FLOOR(5) MATURITY DATE 2ND LIEN SENIOR SECURED DEBT: 10.1% Access

CIG, LLC Services: Business 1.11% LIBOR+7.75% 0.00% LIBOR Floor 2/27/2026 Carestream Health, Inc. Healthcare & Pharmaceuticals 0.74%

LIBOR+12.50% 1.00% LIBOR Floor 8/8/2023 Country Fresh Holdings, LLC Beverage, Food & Tobacco 0.00% LIBOR+8.50% 1.00% LIBOR Floor

4/29/2024 Dayton Superior Corp. Construction & Building 0.10% LIBOR+7.00% 2.00% LIBOR Floor 12/4/2024 Deluxe Entertainment Services,

Inc. Media: Diversified & Production 0.00% LIBOR+8.50% 1.00% LIBOR Floor 9/25/2024 Global Tel*Link Corp. Telecommunications 0.76%

LIBOR+8.25% 0.00% LIBOR Floor 11/29/2026 4 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY.

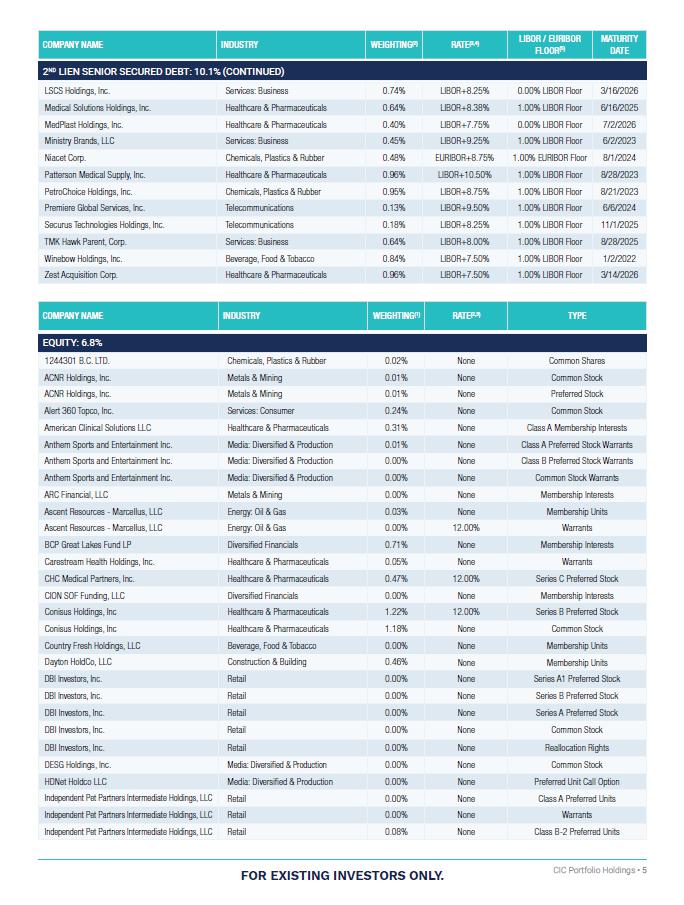

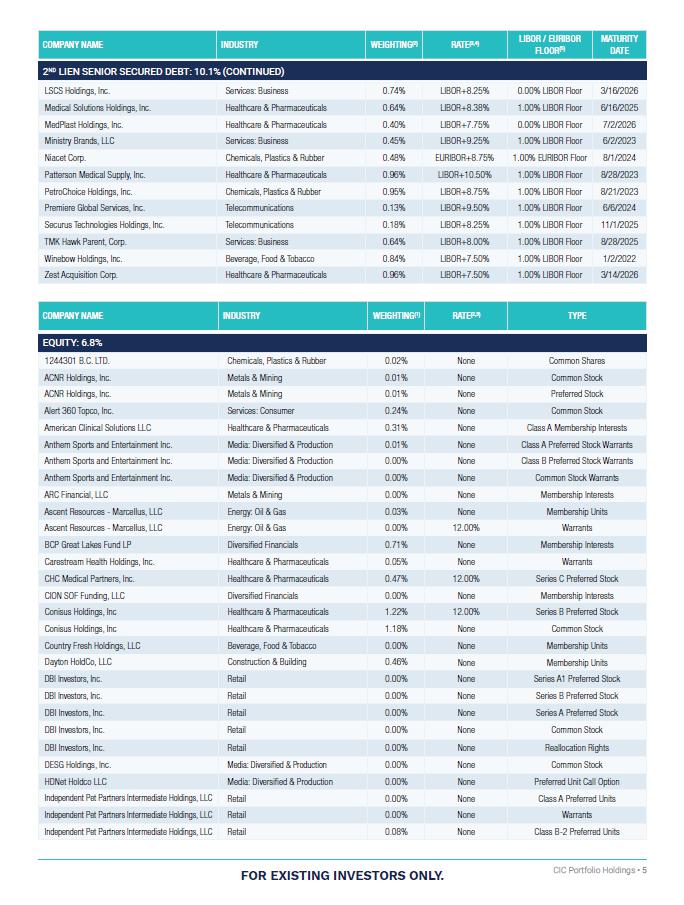

COMPANY NAME INDUSTRY WEIGHTING(2)

RATE(3,4) LIBOR / EURIBOR FLOOR(5) MATURITY DATE 2ND LIEN SENIOR SECURED DEBT: 10.1% (CONTINUED) LSCS Holdings, Inc. Services: Business

0.74% LIBOR+8.25% 0.00% LIBOR Floor 3/16/2026 Medical Solutions Holdings, Inc. Healthcare & Pharmaceuticals 0.64% LIBOR+8.38% 1.00%

LIBOR Floor 6/16/2025 MedPlast Holdings, Inc. Healthcare & Pharmaceuticals 0.40% LIBOR+7.75% 0.00% LIBOR Floor 7/2/2026 Ministry

Brands, LLC Services: Business 0.45% LIBOR+9.25% 1.00% LIBOR Floor 6/2/2023 Niacet Corp. Chemicals, Plastics & Rubber 0.48% EURIBOR+8.75%

1.00% EURIBOR Floor 8/1/2024 Patterson Medical Supply, Inc. Healthcare & Pharmaceuticals 0.96% LIBOR+10.50% 1.00% LIBOR Floor 8/28/2023

PetroChoice Holdings, Inc. Chemicals, Plastics & Rubber 0.95% LIBOR+8.75% 1.00% LIBOR Floor 8/21/2023 Premiere Global Services, Inc.

Telecommunications 0.13% LIBOR+9.50% 1.00% LIBOR Floor 6/6/2024 Securus Technologies Holdings, Inc. Telecommunications 0.18% LIBOR+8.25%

1.00% LIBOR Floor 11/1/2025 TMK Hawk Parent, Corp. Services: Business 0.64% LIBOR+8.00% 1.00% LIBOR Floor 8/28/2025 Winebow Holdings,

Inc. Beverage, Food & Tobacco 0.84% LIBOR+7.50% 1.00% LIBOR Floor 1/2/2022 Zest Acquisition Corp. Healthcare & Pharmaceuticals

0.96% LIBOR+7.50% 1.00% LIBOR Floor 3/14/2026 COMPANY NAME INDUSTRY WEIGHTING(1) RATE(2,3) TYPE EQUITY: 6.8% 1244301 B.C. LTD. Chemicals,

Plastics & Rubber 0.02% None Common Shares ACNR Holdings, Inc. Metals & Mining 0.01% None Preferred Stock Alert 360 Topco, Inc.

Services: Consumer 0.24% None Common Stock American Clinical Solutions LLC Healthcare & Pharmaceuticals 0.31% None Class A Membership

Interests Anthem Sports and Entertainment Inc. Media: Diversified & Production 0.00% None Class B Preferred Stock Warrants Anthem

Sports and Entertainment Inc. Media: Diversified & Production 0.00% None Common Stock Warrants ACNR Holdings, Inc. Metals & Mining

0.01% None Common Stock Anthem Sports and Entertainment Inc. Media: Diversified & Production 0.01% None Class A Preferred Stock Warrants

ARC Financial, LLC Metals & Mining 0.00% None Membership Interests Ascent Resources - Marcellus, LLC Energy: Oil & Gas 0.03%

None Membership Units 12.00% Warrants Ascent Resources - Marcellus, LLC Energy: Oil & Gas 0.00% Carestream Health Holdings, Inc.

Healthcare & Pharmaceuticals 0.05% None Warrants CHC Medical Partners, Inc. Healthcare & Pharmaceuticals 0.47% 12.00% Series

C Preferred Stock CION SOF Funding, LLC Diversified Financials 0.00% None Membership Interests BCP Great Lakes Fund LP Diversified Financials

0.71% None Membership Interests Conisus Holdings, Inc Healthcare & Pharmaceuticals 1.22% 12.00% Series B Preferred Stock Conisus

Holdings, Inc Healthcare & Pharmaceuticals 1.18% None Common Stock Country Fresh Holdings, LLC Beverage, Food & Tobacco 0.00%

None Membership Units Dayton HoldCo, LLC Construction & Building 0.46% None Membership Units DBI Investors, Inc. Retail 0.00% None

Series B Preferred Stock DBI Investors, Inc. Retail 0.00% None Series A Preferred Stock DBI Investors, Inc. Retail 0.00% None Common

Stock DBI Investors, Inc. Retail 0.00% None Reallocation Rights DESG Holdings, Inc. Media: Diversified & Production 0.00% None Common

Stock HDNet Holdco LLC Media: Diversified & Production 0.00% None Preferred Unit Call Option Independent Pet Partners Intermediate

Holdings, LLC Retail 0.00% None Class A Preferred Units Independent Pet Partners Intermediate Holdings, LLC Retail 0.00% None Warrants

Independent Pet Partners Intermediate Holdings, LLC Retail 0.08% None Class B-2 Preferred Units DBI Investors, Inc. Retail 0.00% None

Series A1 Preferred Stock CIC Portfolio Holdings • 5 FOR EXISTING INVESTORS ONLY.

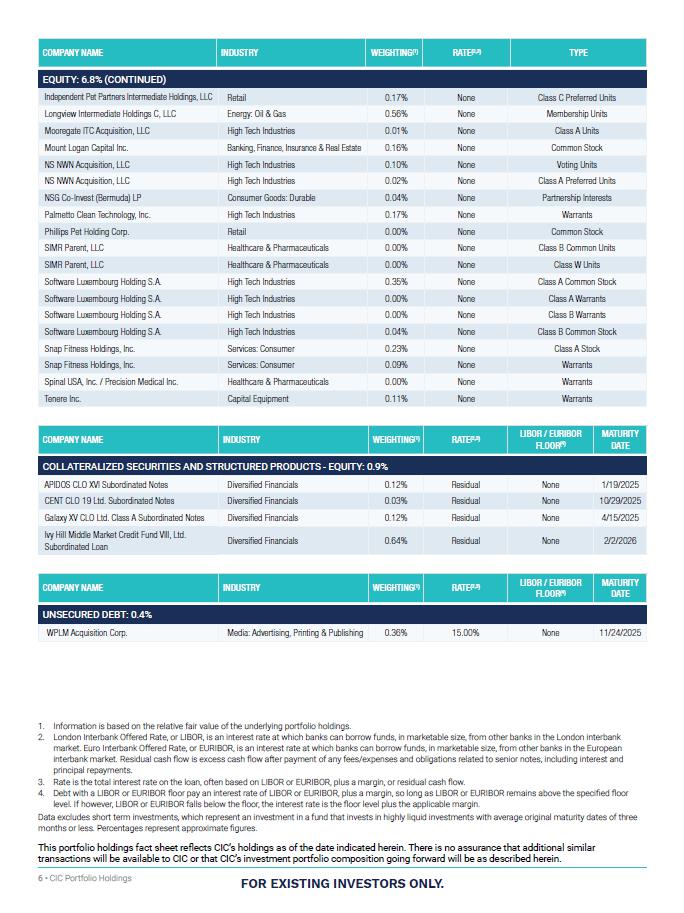

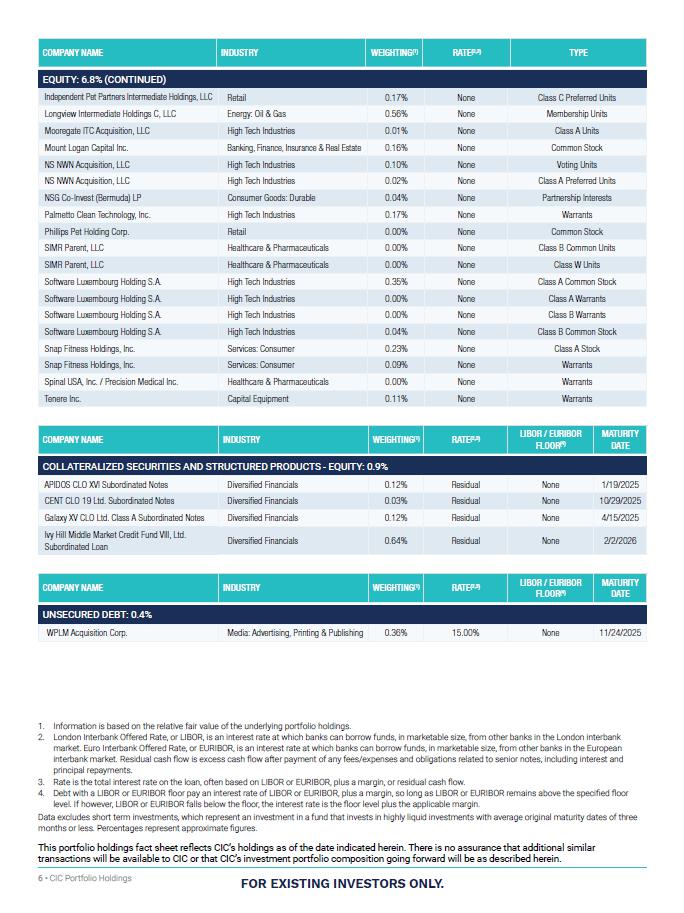

COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE COLLATERALIZED SECURITIES AND STRUCTURED PRODUCTS EQUITY: 0.9% APIDOS CLO XVI Subordinated

Notes Diversified Financials 0.12% Residual None 1/19/2025 CENT CLO 19 Ltd. Subordinated Notes Diversified Financials 0.03% Residual

None 10/29/2025 Galaxy XV CLO Ltd. Class A Subordinated Notes Diversified Financials 0.12% Residual None 4/15/2025 Ivy Hill Middle Market

Credit Fund VIII, Ltd. Subordinated Loan Diversified Financials 0.64% Residual None 2/2/2026 Independent Pet Partners Intermediate Holdings,

LLC Retail 0.17% None Class C Preferred Units Longview Intermediate Holdings C, LLC Energy: Oil & Gas 0.56% None Membership Units

Mooregate ITC Acquisition, LLC High Tech Industries 0.01% None Class A Units Mount Logan Capital Inc. Banking, Finance, Insurance &

Real Estate 0.16% None Common Stock NS NWN Acquisition, LLC High Tech Industries 0.10% None Voting Units NS NWN Acquisition, LLC High

Tech Industries 0.02% None Class A Preferred Units NSG Co-Invest (Bermuda) LP Consumer Goods: Durable 0.04% None Partnership Interests

Palmetto Clean Technology, Inc. High Tech Industries 0.17% None Warrants Phillips Pet Holding Corp. Retail 0.00% None Common Stock SIMR

Parent, LLC Healthcare & Pharmaceuticals 0.00% None Class B Common Units SIMR Parent, LLC Healthcare & Pharmaceuticals 0.00%

None Class W Units Software Luxembourg Holding S.A. High Tech Industries 0.35% None Class A Common Stock Software Luxembourg Holding

S.A. High Tech Industries 0.00% None Class A Warrants Software Luxembourg Holding S.A. High Tech Industries 0.00% None Class B Warrants

Software Luxembourg Holding S.A. High Tech Industries 0.04% None Class B Common Stock Snap Fitness Holdings, Inc. Services: Consumer

0.23% None Class A Stock Snap Fitness Holdings, Inc. Services: Consumer 0.09% None Warrants Spinal USA, Inc. / Precision Medical Inc.

Healthcare & Pharmaceuticals 0.00% None Warrants Tenere Inc. Capital Equipment 0.11% None Warrants COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) TYPE EQUITY: 6.8% (CONTINUED) COMPANY NAME INDUSTRY WEIGHTING(1) RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE COLLATERALIZED

SECURITIES AND STRUCTURED PRODUCTS EQUITY: 0.9% APIDOS CLO XVI Subordinated Notes Diversified Financials 0.12% Residual None 1/19/2025

CENT CLO 19 Ltd. Subordinated Notes Diversified Financials 0.03% Residual None 10/29/2025 Galaxy XV CLO Ltd. Class A Subordinated Notes

Diversified Financials 0.12% Residual None 4/15/2025 Ivy Hill Middle Market Credit Fund VIII, Ltd. Subordinated Loan Diversified Financials

0.64% Residual None 2/2/2026 Independent Pet Partners Intermediate Holdings, LLC Retail 0.17% None Class C Preferred Units Longview Intermediate

Holdings C, LLC Energy: Oil & Gas 0.56% None Membership Units Mooregate ITC Acquisition, LLC High Tech Industries 0.01% None Class

A Units Mount Logan Capital Inc. Banking, Finance, Insurance & Real Estate 0.16% None Common Stock NS NWN Acquisition, LLC High Tech

Industries 0.10% None Voting Units NS NWN Acquisition, LLC High Tech Industries 0.02% None Class A Preferred Units NSG Co-Invest (Bermuda)

LP Consumer Goods: Durable 0.04% None Partnership Interests Palmetto Clean Technology, Inc. High Tech Industries 0.17% None Warrants

Phillips Pet Holding Corp. Retail 0.00% None Common Stock SIMR Parent, LLC Healthcare & Pharmaceuticals 0.00% None Class B Common

Units SIMR Parent, LLC Healthcare & Pharmaceuticals 0.00% None Class W Units Software Luxembourg Holding S.A. High Tech Industries

0.35% None Class A Common Stock Software Luxembourg Holding S.A. High Tech Industries 0.00% None Class A Warrants Software Luxembourg

Holding S.A. High Tech Industries 0.00% None Class B Warrants Software Luxembourg Holding S.A. High Tech Industries 0.04% None Class

B Common Stock Snap Fitness Holdings, Inc. Services: Consumer 0.23% None Class A Stock Snap Fitness Holdings, Inc. Services: Consumer

0.09% None Warrants Spinal USA, Inc. / Precision Medical Inc. Healthcare & Pharmaceuticals 0.00% None Warrants Tenere Inc. Capital

Equipment 0.11% None Warrants COMPANY NAME INDUSTRY WEIGHTING(1) RATE(2,3) TYPE EQUITY: 6.8% (CONTINUED) COMPANY NAME INDUSTRY WEIGHTING(1)

RATE(2,3) LIBOR / EURIBOR FLOOR(4) MATURITY DATE UNSECURED DEBT: 0.4% WPLM Acquisition Corp. Media: Advertising, Printing & Publishing

0.36% 15.00% None 11/24/2025 1. Information is based on the relative fair value of the underlying portfolio holdings. 2. London Interbank

Offered Rate, or LIBOR, is an interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank

market. Euro Interbank Offered Rate, or EURIBOR, is an interest rate at which banks can borrow funds, in marketable size, from other

banks in the European interbank market. Residual cash flow is excess cash flow after payment of any fees/expenses and obligations related

to senior notes, including interest and principal repayments. 3. Rate is the total interest rate on the loan, often based on LIBOR or

EURIBOR, plus a margin, or residual cash flow. 4. Debt with a LIBOR or EURIBOR floor pay an interest rate of LIBOR or EURIBOR, plus a

margin, so long as LIBOR or EURIBOR remains above the specified floor level. If however, LIBOR or EURIBOR falls below the floor, the

interest rate is the floor level plus the applicable margin. Data excludes short term investments, which represent an investment in a

fund that invests in highly liquid investments with average original maturity dates of three months or less. Percentages represent approximate

figures. This portfolio holdings fact sheet reflects CIC’s holdings as of the date indicated herein. There is no assurance that

additional similar transactions will be available to CIC or that CIC’s investment portfolio composition going forward will be as

described herein. 6 • CIC Portfolio Holdings FOR EXISTING INVESTORS ONLY.

CION Investments 3 Park

Avenue, 36th Floor New York, NY 10016 cioninvestments.com CIC-PH-0521 FOR EXISTING INVESTORS ONLY.