aegiss1_nov2015.htm

SUBMITTED CONFIDENTIALLY TO THE DIVISION OF CORPORATION FINANCE ON NOVEMBER 12, 2015

As filed with the U.S. Securities and Exchange Commission on _____, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

Confidential Draft Submission No. 1

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AEGIS IDENTITY SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

7372

|

45-2943801

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

Aegis Identity Software, Inc.

750 West Hampden Avenue, Suite 500

Englewood, Colorado 80110

(303) 222-1060

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

______________

Robert Lamvik

President and Chief Executive Officer

Aegis Identity Software, Inc.

750 West Hampden Avenue, Suite 500

Englewood, Colorado 80110

(303) 222-1060

(Name, address, including zip code, and telephone number, including area code, of agent for service)

______________

Copies of all communications to:

|

Spencer G. Feldman, Esq.

Olshan Frome Wolosky LLP

Park Avenue Tower

65 East 55th Street

New York, New York 10022

Telephone: (212) 451-2300

Fax: (212) 451-2222

Email: sfeldman@olshanlaw.com

|

Jack I. Kantrowitz, Esq.

DLA Piper LLP (US)

1251 Avenue of the Americas

New York, New York 10020

Telephone: (212) 335-4500

Fax: (212) 335-4501

|

______________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer

|

¨

|

Accelerated Filer

|

¨

|

|

Non-Accelerated Filer

|

¨

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

|

|

|

|

CALCULATION OF REGISTRATION FEE

|

| |

|

Title of Each Class of

Securities To Be Registered

|

|

Amount To Be

Registered (1)

|

|

|

Proposed

Maximum

Offering Price

Per Unit (1)

|

|

|

Proposed

Maximum

Aggregate

Offering Price (1)

|

|

|

Amount of

Registration Fee (1)

|

|

|

|

|

Common Stock, par value $0.001 per share

|

|

|

2,000,000 |

|

|

$ |

5.00 |

|

|

$ |

10,000,000 |

|

|

$ |

1,007 |

|

|

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. This registration statement shall also cover, pursuant to Rule 416 under the Securities Act, any additional shares of common stock that shall become issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

____________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated _____, 2015

PRELIMINARY PROSPECTUS

2,000,000 Shares

Common Stock

This is an initial public offering of 2,000,000 shares of common stock of Aegis Identity Software, Inc. Prior to this offering, there has been no public market for our common stock.

We expect that the initial public offering price will be $5.00 per share.

We have reserved the symbol “AIDM” for purposes of listing our common stock on the Nasdaq Capital Market and have applied to list our common stock on that exchange. If the application is approved, trading of our common stock on the Nasdaq Capital Market is expected to begin within five days after the date of initial issuance of the common stock. We will not close this offering without a listing approval letter from the Nasdaq Capital Market.

Investing in our common stock may be considered speculative and involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 9 to read about the risks you should consider before buying shares of our common stock.

We are an “emerging growth company” under applicable law and will be subject to reduced public company reporting requirements. Please read the disclosures on page 4 of this prospectus for more information.

| |

|

Public Offering Price

|

|

|

Underwriting

Commissions(1)

|

|

|

Proceeds to Us,

Before Expenses(2)

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

_______________

|

(1)

|

For the purpose of estimating the underwriting commissions, we have assumed that the underwriters will receive their maximum commission on all sales made in this offering, plus an advisory fee not to exceed $100,000. The underwriters will also be entitled to reimbursement of out-of-pocket expenses incurred in connection with this offering, including fees and expenses of their counsel, in an aggregate amount not to exceed $100,000.

|

|

(2)

|

We estimate the total expenses of this offering, excluding the underwriting commissions, will be approximately $562,000 if the minimum number of shares is sold and approximately $592,000 if the maximum number of shares is sold in this offering. Because this is a best efforts offering, the actual public offering amount, underwriting commissions and proceeds to us are not presently determinable and may be substantially less than the total maximum offering set forth above. See “Underwriting” beginning on page 62 of this prospectus for more information on this offering and our arrangements with the underwriters.

|

Burnham Securities Inc. and Bonwick Capital Partners are acting as the underwriters for this offering. The underwriters are selling shares of our common stock in this offering on a best efforts basis. We do not intend to close this offering unless we sell at least a minimum number of 1,100,000 shares of common stock, at the price per share set forth in the table above, and otherwise satisfy the listing conditions to trade our common stock on the Nasdaq Capital Market. This offering will terminate on _____, 2016 (60 days after the date of this prospectus), unless we sell the minimum number of shares of common stock set forth above before that date or we decide to terminate this offering prior to that date. The gross proceeds of this offering will be deposited at Signature Bank, New York, New York in an escrow account established by us, until we have sold a minimum of 1,100,000 shares of common stock and otherwise satisfy the listing conditions to trade our common stock on the Nasdaq Capital Market. Once we satisfy the minimum stock sale and Nasdaq listing conditions, the funds will be released to us. In the event we do not sell a minimum of 1,100,000 shares of common stock and raise minimum gross proceeds of $5,500,000 by _____, 2016, all funds received will be promptly returned to investors without interest or offset. See “Prospectus Summary — The Offering” on page 6.

Delivery of the shares of our common stock is expected to be made on or about _____, 2016.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Lead Underwriter |

Co-Manager |

The date of this prospectus is _____, 2016

[COMPANY GRAPHICS/ARTWORK TO BE ADDED BY AMENDMENT]

| |

Page

|

|

|

1 |

|

|

9 |

|

|

21 |

|

|

25 |

|

|

26 |

|

|

26 |

|

|

27 |

|

|

28 |

|

|

36 |

|

|

46 |

|

|

51 |

|

|

54 |

|

|

56 |

|

|

58 |

|

|

59 |

|

|

62 |

|

|

65 |

|

|

66 |

|

|

66 |

|

|

66 |

|

|

66 |

|

|

|

________________

About this Prospectus

You should rely only on the information in this prospectus. Neither we nor the underwriters has authorized anyone to provide you with different information. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since the date of this prospectus.

We are making offers to sell and seeking offers to buy shares of our common stock only in jurisdictions where offers and sales are permitted. You should not consider this prospectus to be an offer to sell, or a solicitation of an offer to buy, shares of our common stock if the person making the offer or solicitation is not qualified to do so or if it is unlawful for you to receive the offer or solicitation.

This prospectus contains summaries of certain other documents, which summaries contain all material terms of the relevant documents and are believed to be accurate, but reference is hereby made to the full text of the actual documents for complete information concerning the rights and obligations of the parties thereto.

The industry and market data used throughout this prospectus have been obtained from our own research, surveys or studies conducted by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. We believe that each of these studies and publications is reliable.

| |

|

|

| |

|

|

| |

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. To understand this offering fully, you should carefully read the entire prospectus, including the section entitled “Risk Factors,” before making a decision to invest in our common stock. Unless otherwise noted or unless the context otherwise requires, the terms “we,” “us,” “our,” the “Company” and “Aegis Identity” refer to Aegis Identity Software, Inc.

|

|

| |

Overview of Our Business

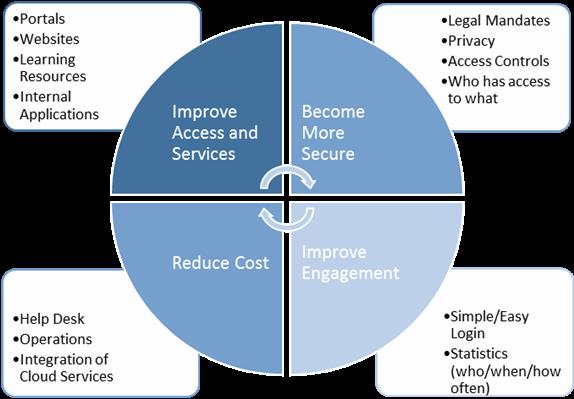

Aegis Identity Software provides identity and access management (IAM) products and services for education IT environments, including software applications, platforms and infrastructure, which are available to our customers via cloud computing or on-premise deployment models.

Our current IAM solutions – TridentHE, TridentK12, TridentCloud and EduZone – have been developed, tested and enhanced over the last four years and are being used by more than 60 major universities, private colleges, community college systems and school districts across the United States. Our IAM solutions are designed to deter and prevent fraudulent activities and thwart the misuse of protected data by establishing digital “identities” of computer system users and validating such users’ access rights to digital information. TridentHE and TridentK12 products include features such as authentication through the identification of users, roles and resources to be accessed and the creation of user accounts, authorization through password creation and management, reconciliation that minimizes security risks and ensures appropriate user access, and auditing where users can create IAM reports and have centralized access to their IAM records. We also provide TridentCloud that provides software support and applications that we host on our servers via the internet to licensees of our products, making it unnecessary for customers to install and maintain software on their own IT infrastructure.

Our EduZone product is a SaaS (software as a service) technology platform designed to be fully integrated with the educational institution’s identity and information ecosystem. EduZone is one of the first education community platforms to allow school districts to protect and utilize student data while they rapidly adopt, standardize and share learning applications with students, parents and educators.

Our present and potential customers are major universities and school systems. There are more than 4,700 universities and colleges and over 13,500 K-12 school districts in the United States. Our selling efforts are conducted by our internal sales team, which is being expanded to include a reseller channel that will buy and distribute our IAM software products and provide implementation and maintenance services. In 2014, our six largest educational institution customers (by revenue) were IlliniCloud (a voluntary organization with a potential user base of the 385 K-12 school districts in Illinois, representing approximately 2.3 million students), Chicago State University, Radford University, Colorado School of Mines, West Virginia University and City College of San Francisco. In 2013, this list included University of Oregon, Radford University, Wake Forest University, IlliniCloud (Illinois K-12), St. Edward University and a key California State University, all of which continue to license our software.

Our revenue model is based on traditional software licensing. When a customer downloads our IAM software, we receive an upfront software license fee, with annual revenue and maintenance fees of approximately 20% of the original license fee. Customer pricing is predicated on university size determined by the Carnegie Classification of Institutions of Higher Education. Additionally, we charge our customers a premium for professional services, including custom engineering and development work. We estimate that our average new licensing contract generates an initial fee of approximately $75,000, and that new maintenance/service contracts range from approximately $50,000 to $200,000. We recorded total revenue of $1,186,150 for the six-month period ended June 30, 2015 and total revenue of $1,794,634 and $846,679 for the years ended December 31, 2014 and 2013, respectively.

In response to the explosive growth of internet technologies and the associated proliferation of digital identities, schools around the country have been seeking appropriate software and services to manage large amounts of personal data, prevent the unauthorized access of such data and maintain easily accessible and navigable IT systems for their students, faculty and employees. We believe that schools that do not adopt appropriate IAM software and services are more likely to experience data breaches, losses of data, liability for failure to protect data and reputational damage. Our objective is to provide the education sector with an identity infrastructure that enables the protection of digital identities created by the growth of internet technologies.

|

|

| |

Our IAM Software Products

Our TridentHE, TridentK12 and other software products improve the efficiency of IT systems with automated tools for on-boarding of thousands of new users and provisioning user access rights. A description of each of our software products is set forth below.

TridentHE for Higher Education Market

TridentHE represents one of the education market’s first open-standards (software that can be easily adapted and extended for specific users) and class identity management software programs dedicated to addressing the specific needs of higher education. As one of the only identity management applications built specifically for higher education, TridentHE provides comprehensive provisioning, password management and identity synchronization. TridentHE’s provisioning capabilities allow for the creation of users, roles and resources, access that is role and rule based, automated workflows, delegated access administration and approvals, multiple authoritative sources of record and multiple targets. TridentHE enables the establishment of a password policy, the synchronization of passwords to all applications, self-service password changes, profile management, access request approvals, white pages and Family Education Rights and Privacy Act (“FERPA”) compliance, and integration of our software with a help desk. TridentHE’s reconciliation functionality allows connectors to determine if target systems have the correct credentials, automated error detection and correction, and periodic user access confirmation. TridentHE’s audit abilities include the creation of ad hoc and custom reports. Our TridentHE software, first released in October 2011, and its associated services and maintenance represented a majority of our total revenue for the six months ended June 30, 2015 and the years ended December 31, 2014 and 2013. Revenue from TridentHE sales is expected to continue to be a significant percentage of our total revenue for the full 2015 year and for 2016.

TridentK12 for K-12 Education Market

TridentK12 is an identity management software designed specifically for K-12 education, providing quality provisioning, password management and identity synchronization. TridentK12 is a cost-effective, open standards-based identity software program that provides “out-of-the-box” integration for K-12 education environments. TridentK12’s provisioning capabilities allow for near real-time account creation with multiple authoritative sources of record and multiple access targets based on users’ information, roles and resources, as well as automated workflow control and delegated access approvals and administration. TridentK12’s password management allows for the establishment of a customized password policy, self-service password changes, profile management, access request approvals, white pages and the school’s FERPA compliance, synchronization of passwords to all applications, and integration of our software with a help desk. TridentK12’s functionality allows for connectors to determine if target systems have the correct credentials, automated error detection and correction, and the periodic sending of access configurations to appropriate access approvers to confirm access of a user. TridentK12’s audit abilities include the creation of ad hoc and custom reports, automated audit workflows to enforce an organization’s access policy and centralized account and access records. Our TridentK12 software was released in late 2014. TridentK12 generated minimal revenue in 2014 and the first half of 2015. We expect that revenue from TridentK12 sales will increase as a percentage of our total revenue in future periods as we expand our marketing and distribution efforts in the K-12 market segment.

EduZone

EduZone is a platform of technologies that brings together an ecosystem we call Digital Citizenship in Education. Digital “citizenship” is the online presence, via school district systems, of students, teachers, administration, technology leaders, academic leaders, parents, application providers and other partners representing the educational community today and of the future. In EduZone, digital citizens access a single platform where they find their digital resources, secured by a unique login, that allows them to focus on a student’s performance. The platform is designed to be fully integrated with school district identity and information systems, under the full control and discretion of the school district, enhancing student data privacy and providing control and fast adoption that the ecosystem requires. We initially demonstrated a prototype of our EduZone platform in mid 2015 and EduZone is currently in its “pilot stage.” We expect to roll-out EduZone to the market on a commercial basis following this offering.

TridentCloud

TridentCloud is a flexible and simple to implement software designed to provide IAM services to higher education and K-12 institutions from a cloud environment, which we refer to as identity as a service (“IDaaS”). Once deployed within their infrastructure, an educational institution can deliver quality provisioning, password management and identity synchronization services at a lower cost due to economies of scale. The current version of our TridentCloud is operational and is being rolled out to K-12 school districts to provide them with IDaaS services. Subsequent versions of TridentCloud are being developed in conjunction with strategic educational partners and service providers.

|

|

| |

Our Industry and Target Markets

International Data Corporation (“IDC”), an independent market research firm, estimated in a November 2014 report that the worldwide IAM market is expected to account for $7.1 billion in license, maintenance and SaaS revenue by 2018. While IDC’s report showed significant historical revenue growth and predicted strong future growth in the IAM market, it also revealed considerable market fragmentation with respect to the market share and overall number of vendors. We believe that this fragmentation creates a significant opportunity for our company on which we plan to capitalize through an aggressive product strategy that we believe is superior to the approach to IAM software and services used by several of our competitors. During the first half of 2015, more than $2.5 billion was invested in the education technology market segment, according to a report by InsideHigherEd, a market research publication. We believe education technology lags behind numerous other commercial enterprises in terms of technological advancements, leading to greater demand for solutions that enhance student data privacy, a topic of increasing importance as there have been many data breaches in recent years.

Our Growth and Expansion Strategy

We intend to grow organically by expanding our reseller channel, developing our in-house channel support, extending our product line, building our industry position and accelerating our marketing and distribution efforts. We also intend to commercially launch our EduZone technology platform, which we expect to further broaden our product line and service offerings, and provide additional growth opportunities for our company.

We plan to develop an international market by focusing initially on countries where English is a primary working language, limiting exports to countries with sufficiently robust intellectual property and software copyright laws, enhancing global partnerships, creating greater brand awareness and building customer support infrastructure.

We are also evaluating several well-positioned companies that may be potential acquisition targets. Areas of interest to us are cyber-security companies that could provide complementary software and/or technology platforms, existing customer bases in various niche or regional markets and experienced technical employees. As of the date of this prospectus, we have not entered into any term sheets or agreements with respect to an acquisition. We intend to pursue only those acquisitions that we expect to be accretive and synergistic in terms of immediate revenues, business lines, customers and cross-selling opportunities.

Our Competitive Advantages

Open-Standards Products. We offer one of the market’s first open-standards, enterprise-class identity management software in the vertical market of higher education and K-12 school districts. We believe that our TridentHE and TridentK12 software costs less, performs better, offers open standards technology and is easier to install and support than the IAM software offered by our competitors.

Affordability. We leverage open-standards software to provide affordable software products for the education market. By using open standards as part of our software, our cost of development and our customers’ ongoing cost of ownership are lower. Complementing the overall lower cost, we offer very competitive fixed license pricing based on the overall size of the institution instead of the number of users or connectors that are required. We believe that this makes TridentHE and TridentK12 more affordable for educational institutions with budgetary constraints. We believe the lower price point of our TridentHE software expands our market opportunity well beyond the current enterprise-focused IAM software offered by most vendors. For example, in our experience Sun Microsystems focused on the top 1,000 universities and Oracle focuses on the top 600 universities. We anticipate that our TridentHE software will be able to address the larger market of over 4,700 universities and colleges due in large part to being more affordable. Additionally, we expect our TridentK12 software will be able to effectively address the unique requirements of the over 13,500 K-12 school districts in the United States.

Barriers to Entry. While there are no absolute barriers to entering the IAM software business for the education market, we believe there are significant hurdles for prospective competitors to overcome. These barriers include long software development time, the difficult and time-consuming process of acquiring new customers, systems testing, knowledge of the market and specific customer needs, and the cost of developing a sales distribution network. Unlike new entrants in the industry, we have already established an internal sales force and are building a reseller network, and our software is already installed and operating at more than 60 major universities, private colleges, community college systems and school districts across the United States.

|

|

| |

Management Experience. Our executives have extensive experience managing companies, with significant, practical experience involving numerous IAM implementations utilizing legacy Sun Microsystems, Inc. software to deliver custom IAM services to higher education customers. Additionally, our management has substantial vertical market expertise in the higher education market.

Selected Risks Relating to Our Business

Despite our growth and expansion strategy and the competitive advantages we describe above, our business and prospects may be limited by a number of risks and uncertainties that we currently face, including:

● We operate in an intensely competitive market for identity and access management software against a number of large, well-known providers, many of which also offer their products in the education market.

● We do not currently offer our IAM software and services in non-education vertical markets or outside the United States and Canada, making us dependent largely upon the prevailing conditions and growth of the United States and Canadian education markets, which are frequently subject to budgetary pressures.

● We had a net loss of $1,594,044 for the six months ended June 30, 2015 and net losses of $3,174,487 and $2,110,342 for the years ended December 31, 2014 and 2013, respectively. We expect to report a net loss for the full 2015 year. Our independent auditors, in their report dated November 12, 2015, expressed doubt about our ability to continue as a going concern. There can be no assurance we will have significant levels of total revenue or net income in future periods.

● Historically, we have been able to fund our growth and expansion through private placements of equity securities and notes, but we have no agreements for future financing after the completion of this offering.

|

|

| |

|

|

|

| |

Implications of Being an “Emerging Growth Company”

|

|

| |

As a public reporting company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart our Business Startups Act of 2012, commonly known as the JOBS Act. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

|

|

| |

● are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

● are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”);

● are not required to obtain a non-binding advisory vote from our stockholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

● are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

● may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A;

● are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

|

| |

|

|

|

| |

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under §107 of the JOBS Act. Please see “Risk Factors,” page 19 (“We are an ‘emerging growth company’. . . .”).

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding management’s assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or CEO pay ratio disclosure; and may present only two years of audited financial statements and related MD&A disclosure.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, or such earlier time that we no longer meet the definition of an emerging growth company. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period. Further, under current SEC rules we will continue to qualify as a “smaller reporting company” for so long as we have a public float (i.e., the market value of common equity held by non-affiliates) of less than $75 million as of the last business day of our most recently completed second fiscal quarter.

|

|

| |

Corporate Information |

|

| |

We were originally formed as a Colorado corporation in August 2011 and we reincorporated in Delaware in November 2015. Our executive offices are located at 750 West Hampden Avenue, Suite 500, Englewood, Colorado 80110 and our telephone number is (303) 222-1060. We maintain a corporate website at http://www.aegisidentity.com. Information on our website and any downloadable files found there are not incorporated by reference into this prospectus and should not be considered to be a part of this prospectus.

|

|

| |

THE OFFERING

|

|

| |

|

|

|

|

| |

Common stock offered by us

|

|

1,100,000 shares (minimum) to 2,000,000 shares (maximum)

|

|

| |

Proposed initial public offering price

|

|

$5.00 per share

|

|

| |

Common stock outstanding prior to this offering

|

|

4,598,850 shares(1)

|

|

| |

Best efforts offering

|

|

The underwriters are selling the shares of our common stock offered in this prospectus on a “best efforts” basis and are not required to sell any specific number or dollar amount of the shares offered by this prospectus, but will use their best efforts to sell such shares. However, one of the conditions to our obligation to sell any of the shares through the underwriters is that, upon the closing of the offering, our common stock would qualify for listing on the Nasdaq Capital Market. In order to list, the Nasdaq Capital Market requires that, among other criteria, at least 1,000,000 publicly-held shares of our common stock be outstanding, the shares be held in the aggregate by at least 300 round lot holders, the market value of the publicly-held shares of our common stock be at least $15.0 million, our stockholders’ equity after giving effect to the sale of our shares in this offering be at least $4.0 million, the bid price per share of our common stock be $4.00 or more, and there be at least three registered and active market makers for our common stock. We do not intend to close this offering unless we sell a minimum of 1,100,000 shares of common stock and otherwise satisfy the listing conditions to trade our common stock on the Nasdaq Capital Market.

|

|

| |

Common stock to be outstanding after this offering

|

|

5,698,850 shares (if minimum number of shares is sold) and 6,598,850 shares (if maximum number of shares is sold)(1)

|

|

| |

|

|

|

|

| |

Use of proceeds

|

|

Based on a proposed initial public offering price of $5.00 per share, which is the estimate of the purchase price at which we expect to offer our shares for sale under this prospectus, we estimate that the net proceeds to us from this offering, assuming we sell a minimum of 1,100,000 shares, will be approximately $4,553,000 and, assuming we sell all 2,000,000 shares, will be approximately $8,708,000, after payment of underwriting commissions and our estimated offering expenses. However, this is a best efforts offering, and there is no assurance that we will sell any shares or receive any proceeds.

We intend to use the net proceeds from this offering to expand marketing and distribution of our IAM software products in the education market, to enhance our ongoing product development and engineering programs, to fund potential acquisitions of complementary businesses, products and technologies as part of our growth strategy, and for working capital and general corporate purposes. See “Use of Proceeds” for more information.

|

|

| |

|

|

|

|

|

| |

Escrow

|

|

The gross proceeds of this offering will be deposited at Signature Bank, New York, New York, in an escrow account established by us. The funds will be held in escrow until we receive a minimum of $5,500,000 and otherwise satisfy the listing conditions to trade our common stock on the Nasdaq Capital Market, at which time the funds will be released to us. Any funds received in excess of $5,500,000 and following the satisfaction of the Nasdaq listing requirements will immediately be available to us. If we do not receive the minimum amount of $5,500,000 by _____, 2016 (60 days after the date of this prospectus), all funds will be returned to purchasers in this offering on the next business day after the offering’s termination, without charge, deduction or interest. Prior to _____, 2016, in no event will funds be returned to you. You will only be entitled to receive a refund of your subscription if we do not raise a minimum of $5,500,000 and satisfy the Nasdaq listing conditions by _____, 2016.

|

|

|

| |

|

|

|

|

|

| |

Risk factors

|

|

Investing in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this prospectus beginning on page 9 for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

|

|

| |

Proposed Nasdaq Capital Market symbol

|

|

AIDM (2)

|

|

|

| |

______________

|

|

|

|

|

| |

|

|

|

|

|

| |

(1)

|

Does not include (i) 3,201,119 shares of our common stock reserved for issuance upon the exercise of outstanding stock options, (ii) 2,641,866 shares of our common stock reserved for issuance upon the exercise of outstanding warrants, and (iii) 77,000 shares (minimum) to 140,000 shares (maximum) of our common stock reserved for issuance upon the exercise of warrants we expect to grant to the underwriters in this offering.

|

|

|

| |

(2)

|

We have reserved the trading symbol “AIDM” in connection with our application to have our common stock listed for trading on the Nasdaq Capital Market.

|

|

|

| |

|

|

| |

SUMMARY FINANCIAL DATA

|

|

| |

The following tables set forth summary historical statement of operations and balance sheet data. The summary statement of operations data for the years ended December 31, 2014 and 2013 are derived from our audited financial statements contained elsewhere in this prospectus. The statement of operations data for the six months ended June 30, 2015 and 2014 and the balance sheet data as of June 30, 2015 are derived from our unaudited condensed financial statements included elsewhere in this prospectus. We have prepared the unaudited condensed financial statements on the same basis as the audited financial statements and have included, in our opinion, all adjustments consisting only of normal recurring adjustments that we consider necessary for a fair statement of the financial information set forth in those statements. The results for the six-month periods June 30, 2015 and 2014 are not necessarily indicative of the results to be expected for the full year. The summary historical financial data set forth below should be read together with the financial statements and the related notes, as well as the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in this prospectus.

|

|

| |

|

|

| |

|

|

Years Ended

December 31,

|

|

|

Six Months Ended

June 30,

(unaudited)

|

|

| |

Statement of Operations Data:

|

|

2014

|

|

|

2013

|

|

|

2015

|

|

|

2014

|

|

| |

|

|

$ |

611,225 |

|

|

|

356,100 |

|

|

$ |

182,900 |

|

|

$ |

312,125 |

|

|

| |

|

|

|

966,947 |

|

|

|

395,350 |

|

|

|

854,163 |

|

|

|

397,592 |

|

|

| |

|

|

|

216,462 |

|

|

|

95,229 |

|

|

|

149,087 |

|

|

|

78,026 |

|

|

| |

|

|

|

1,794,634 |

|

|

|

846,679 |

|

|

|

1,186,150 |

|

|

|

787,743 |

|

|

| |

|

|

|

4,274,007 |

|

|

|

2,610,843 |

|

|

|

2,512,684 |

|

|

|

1,995,261 |

|

|

| |

|

|

|

(2,479,373 |

) |

|

|

(1,764,164 |

) |

|

|

(1,326,534 |

) |

|

|

(1,207,518 |

) |

|

| |

|

|

|

(695,114 |

) |

|

|

(346,178 |

) |

|

|

(267,510 |

) |

|

|

(179,601 |

) |

|

| |

|

|

$ |

(3,174,487 |

) |

|

$ |

(2,110,342 |

) |

|

$ |

(1,594,044 |

) |

|

$ |

(1,387,119 |

) |

|

| |

Loss per share, basic and diluted

|

|

$ |

(0.85 |

) |

|

$ |

(0.70 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.39 |

) |

|

| |

Common shares outstanding, basic and diluted

|

|

|

3,717,464 |

|

|

|

3,023,507 |

|

|

|

3,889,508 |

|

|

|

3,559,974 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The following table summarizes our balance sheet data as of June 30, 2015 on an actual and a pro forma, as adjusted basis. The pro forma, as adjusted information gives effect to (i) our 2015 private placement of 281,500 shares of our common stock for aggregate gross proceeds of $703,750, (ii) the conversion into 289,016 shares of common stock of notes payable by us in the aggregate amount of $708,664 from July to November 2015, (iii) the application of $55,055 in debt to exercise an option for 80,964 shares of common stock, (iv) the issuance of 1,334 shares of common stock in consideration for business counsulting services, and (v) the sale by us of a minimum of 1,100,000 shares and a maximum of 2,000,000 shares of common stock in this offering at a proposed initial public offering price of $5.00 per share.

|

|

|

| |

|

|

|

|

|

|

As of June 30, 2015 (unaudited)

|

|

|

| |

Balance Sheet Data:

|

|

|

|

|

|

|

Actual

|

|

|

|

Pro Forma, as Adjusted - Minimum

|

|

|

|

Pro Forma, as Adjusted - Maximum

|

|

|

| |

Cash and cash equivalents

|

|

|

|

|

|

$ |

7,245 |

|

|

$ |

5,263,995 |

|

|

$ |

9,418,995 |

|

|

| |

Working capital (deficit)

|

|

|

|

|

|

|

(3,584,941 |

) |

|

|

2,435,528 |

|

|

|

6,590,528 |

|

|

| |

Total assets

|

|

|

|

|

|

|

822,799 |

|

|

|

6,079,549 |

|

|

|

10,234,549 |

|

|

| |

Total liabilities

|

|

|

|

|

|

|

4,880,260 |

|

|

|

4,116,541 |

|

|

|

4,116,541 |

|

|

| |

Total stockholders’ equity (deficit)

|

|

|

|

|

|

|

(4,057,461 |

) |

|

|

1,963,008 |

|

|

|

6,118,008 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks described below, together with all of the other information set forth in this prospectus and the documents incorporated by reference herein, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the documents referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business.

Risks Related to Our Company and Our Industry

We have a limited operating history and therefore we cannot ensure the long-term successful operation of our business, and the likelihood of our success must be considered in light of the risks, expenses and difficulties frequently encountered by a smaller publicly-traded technology company.

We were initially formed as a corporation in Colorado in August 2011 and we reincorporated in Delaware in November 2015. For the year ended December 31, 2014, we had total revenue of $1,794,634 and a net loss of $3,174,487. As of December 31, 2014, we had a total stockholders’ deficit of $3,238,609, an increase in the deficit of $1,690,397 from December 31, 2013. Our total stockholders’ deficit increased further to $4,057,461 as of June 30, 2015. For the six-month period ended June 30, 2015, we had unaudited total revenue of $1,186,150 compared to total revenue of $787,743 for the same period in 2014. We had a net loss of $1,594,044 for the six months ended June 30, 2015, compared to a net loss of $1,387,119 for the same 2014 period. No assurance can be given that we will have significant levels of total revenue or net income in future periods. Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by growing technology companies in new and rapidly evolving markets, such as the identity and access management software and services market in which we operate. We must meet many challenges including:

|

|

·

|

establishing and maintaining broad market acceptance of our products and services and converting that acceptance into direct and indirect sources of revenue,

|

|

|

·

|

establishing and maintaining adoption of our technology on a wide variety of platforms and devices,

|

|

|

·

|

timely and successfully developing new products, product features and services and increasing the functionality and features of existing products and services,

|

|

|

·

|

developing services and products that result in high degrees of client satisfaction and high levels of end-customer usage,

|

|

|

·

|

successfully responding to competition, including competition from emerging technologies and software and services,

|

|

|

·

|

developing and maintaining strategic relationships to enhance the distribution, features, content and utility of our products and services, and

|

|

|

·

|

identifying, attracting and retaining high quality sales and technical personnel at reasonable market compensation rates.

|

Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. We cannot assure you that our business will be profitable or that we will ever generate sufficient revenue to meet our operating expenses and support our anticipated business activities.

Our independent auditors have expressed doubt about our ability to continue as a going concern.

Our independent auditors, in their report dated November 12, 2015, expressed doubt about our ability to continue as a going concern. At June 30, 2015 and December 31, 2014, our total stockholders’ deficit was $4,057,461 and $3,238,609, respectively. Our net loss was $1,594,044 and $1,387,119 for the six months ended June 30, 2015 and 2014, respectively, and we used cash in our operations of $467,745 and $945,670 in the six months ended June 30, 2015 and 2014, respectively. Net cash used in operations has resulted principally from costs incurred in the continued development of our software and marketing efforts. We have funded our operations since inception through the use of cash obtained principally from the sale of equity securities and the placement of notes, some of which are convertible into shares of our common stock. To continue development, we will need to raise additional capital through debt and/or equity financing. However, additional capital may not be available on terms favorable to us and there can be no assurance that we will be successful in obtaining adequate additional financing. We are in the process of reducing our costs associated with the delivery of services and are taking steps to grow revenues through enhanced sales effectiveness, additional sales coverage and new product offerings. Our actual results indicate the existence of a material uncertainty that may cast significant doubt about our ability to continue as a going concern.

If we are unable to convince a meaningful number of educational institutions to use our IAM software and services, our revenue growth and operating margins will suffer.

We provide IAM software and direct our product development and marketing toward products and services that enable educational institutions to utilize identity and access management software and services as the foundation for safeguarding and managing confidential information. Our success depends on a significant number of educational institutions perceiving technological and operational benefits and cost savings associated with the increasing adoption of our IAM software and services to protect the information of their organizations. To the extent that our IAM software and services are not widely adopted or are accepted more slowly or less comprehensively than we expect, the growth of our business and our ability to generate significant revenues will be materially and adversely affected.

Substantially all of our revenue has come from our TridentHE and TridentK12 IAM products. A lack of demand for our identity and access management software and products could adversely affect our results of operations and financial condition.

We currently derive and expect to continue to derive substantially all of our revenue from our TridentHE and TridentK12 software products. As such, the growth in market demand of these software products is critical to our success. Demand for the TridentHE and TridentK12 software is affected by a number of factors, including market acceptance of these IAM products, the timing of development and release of new products by competitors, price changes by us or our competitors, technological change, and general economic conditions and trends. If we are unable to meet customer demands and to achieve more widespread market acceptance of our software, our business, results of operations, financial condition and growth prospects will be materially and adversely affected. Although we expect that our IAM products and related enhancements and upgrades will achieve market acceptance, our ability to create demand for our software and services among educational institutions could be materially and adversely affected by a number of factors, including:

|

|

·

|

improved products or product versions being offered by competitors in our markets;

|

|

|

·

|

competitive pricing pressures;

|

|

|

·

|

failure to release new or enhanced versions of our IAM products on a timely basis, or at all;

|

|

|

·

|

technological change that we are unable to address with our IAM products or that changes the way educational institutions utilize our products; and

|

|

|

·

|

general economic conditions.

|

Because we have one operating and reportable business segment, our business, financial condition, results of operations and cash flows would be adversely affected by a decline in demand for our IAM products and our business and business prospects would be materially and adversely affected if the market for these products does not expand as we expect.

We currently face and continue to expect to face substantial and increasing competition in our market.

We face significant competition from many companies such as Oracle, Microsoft, Fischer International, Hitachi, IBM and NetIQ, all of which are substantially larger, have significantly greater technical and financial resources than we do and are better positioned to continue investment in competitive technologies. These and many of our other current or potential competitors have longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical, sales, marketing and other resources than we do.

We believe the key competitive factors in the IAM market include:

|

|

·

|

the level of reliability, security and new functionality of product offerings;

|

|

|

·

|

the ability to provide comprehensive software and services, including management and security capabilities;

|

|

|

·

|

the ability to offer products that support multiple hardware platforms, operating systems, applications and application development frameworks;

|

|

|

·

|

the ability to deliver an intuitive end-user experience for accessing data, applications and services from a wide variety of end-user applications;

|

|

|

·

|

the ability to attract and preserve a large installed base of customers;

|

|

|

·

|

the ability to create and maintain partnering opportunities with hardware vendors, infrastructure software vendors and cloud service providers;

|

|

|

·

|

the ability to develop robust indirect sales channels; and

|

|

|

·

|

the ability to attract and retain identity and access management engineers as key employees.

|

Existing and future competitors may introduce products in the same markets we serve or intend to serve, and competing products may have better performance, lower prices, better functionality and broader acceptance than our products. Our competitors may also add features to their IAM products similar to features that presently differentiate our product offerings from theirs. This competition could result in increased pricing pressure and sales and marketing expenses, thereby materially reducing our operating margins, and could harm our ability to increase, or cause us to lose, market share. Increased competition also may prevent us from entering into or renewing service contracts on terms similar to those that we currently offer and may cause the length of our sales cycle to increase. Some of our competitors and potential competitors supply a wide variety of products to, and have well-established relationships with, our current and prospective customers. For example, educational institutions that are evaluating the adoption of IAM technologies and services may be inclined to consider Microsoft software and services because of their existing use of Windows and Office products. Some of these competitors may take advantage of their existing relationships to engage in business practices that make our products less attractive to our customers.

We have substantial debt which could adversely affect our ability to raise additional capital to fund operations and prevent us from meeting our obligations under existing indebtedness.

As of November 10, 2015, our total indebtedness was approximately $2.8 million after giving effect to the conversion into common stock of notes payable by us in the aggregate amount of $708,664 from July to November 2015 and the application of $55,055 in debt to exercise an option. We will continue to have a significant amount of indebtedness following this offering. This substantial debt could have important consequences, including the following: (i) a substantial portion of our cash flow from operations may be dedicated to the payment of principal and interest on indebtedness, thereby reducing the funds available for operations, future business opportunities and capital expenditures; (ii) our ability to obtain additional financing for working capital, debt service requirements and general corporate purposes in the future may be limited; (iii) we may face a competitive disadvantage to lesser leveraged competitors; (iv) our debt service requirements could make it more difficult to satisfy other financial obligations; and (v) we may be vulnerable in a downturn in general economic conditions or in our business and we may be unable to carry out activities that are important to our growth.

Our ability to make scheduled payments of the principal of, or to pay interest on, or to refinance indebtedness depends on and is subject to our financial and operating performance, which in turn is affected by general and regional economic, financial, competitive, business and other factors beyond management’s control. If we are unable to generate sufficient cash flow to service our debt or to fund our other liquidity needs, we will need to restructure or refinance all or a portion of our debt, which could impair our liquidity. Any refinancing of indebtedness, if available at all, could be at higher interest rates and may require us to comply with more onerous covenants that could further restrict our business operations.

Despite our significant amount of indebtedness, we may be able to incur significant additional amounts of debt, which could further exacerbate the risks associated with our substantial debt.

Our ability to raise capital in the future may be limited, and a failure to raise capital when needed could harm us.

Our business and operations may consume resources faster than we anticipate. In the future, we may need to raise additional funds to invest in future growth opportunities. Additional financing may not be available on favorable terms, if at all. If adequate funds are not available on acceptable terms, we may be unable to invest in future growth opportunities, which could seriously harm our business and operating results. If we incur debt, the debt holders would have rights senior to common stockholders to make claims on our assets, and the terms of any debt could restrict our operations.

Our sales are difficult to predict and may vary substantially from quarter to quarter, which may cause our operating results to fluctuate significantly.

Given the critical nature of our software and services to the business processes of potential customers, a new client deciding whether to transition to TridentHE software may require several months to make their decision to purchase our software and services. As a result, the complete sales cycle can take from sixty days to over nine months and require a substantial amount of time and resources. In addition, we may experience a significant delay between the time we incurs sales-related expenses and the time we generates revenues, if any, from such expenditures and the failure to generate revenues from such expenditures could have a material adverse effect on our results of operations.

While we anticipate licensees of our products to renew support and maintenance services on at least an annual basis, the timing of new licenses and maintenance subscriptions are not subject to a typical sales cycle. Accordingly, our revenues are difficult to predict. We expect our future sales and marketing efforts will involve educating our customers about the use and benefit of our products, including their technical capabilities, potential cost savings to an educational institution and advantages compared to higher-cost products offered by our competitors. In addition, product purchases are frequently subject to budget constraints, multiple approvals, and unplanned administrative, processing and other delays. Moreover, the greater number of competitive alternatives, as well as announcements by our competitors that they intend to introduce competitive alternatives at some point in the future, can lengthen customer procurement cycles, cause us to spend additional time and resources to educate customers on the advantages of our product offerings and delay product sales. Economic downturns and uncertainty can also cause customers to add layers to their internal purchase approval processes, adding further time to a sales cycle. These factors can have an impact on the timing and length of our sales cycles.

We may not be able to attract and retain the highly skilled employees we need to support our planned growth, and our compensation expenses may increase.

To execute on our strategy, we must continue to attract and retain highly qualified personnel. Competition for these personnel is intense, especially for senior sales executives and engineers with high levels of experience in designing and developing software. We may not be successful in attracting and retaining qualified personnel. We have from time to time in the past experienced, and we expect to continue to experience in the future, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. Many of the companies with which we compete for experienced personnel have greater resources than we do. Technical personnel are also aggressively recruited by other startup and emerging growth companies, which are especially active in many of the technical areas and geographic regions in which we conduct product development. Employees trained by us also may leave to work at companies that compete with us. In addition, in making employment decisions, particularly in the technology industry, job candidates often consider the value of the stock-based compensation they are to receive in connection with their employment. Declines in the value of our common stock could adversely affect our ability to attract or retain key employees and result in increased employee compensation expenses.

Protection of our intellectual property will be limited, and any misuse of our intellectual property by others could harm our business, reputation and competitive position.

We rely on a combination of trademark and trade secret laws in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary information, technology and brand.

We protect our proprietary information and technology, in part, by requiring our employees to enter into agreements providing for the maintenance of confidentiality and the assignment of rights to inventions made by them while employed by us. We also may enter into non-disclosure and invention assignment agreements with certain of our technical consultants to protect our confidential and proprietary information and technology. We cannot assure you that our confidentiality agreements with our employees and consultants will not be breached, that we will be able to effectively enforce these agreements, that we will have adequate remedies for any breach of these agreements, or that the our trade secrets and other proprietary information and technology will not be disclosed or will otherwise be protected.

We also rely on contractual and license agreements with third parties in connection with their use of our technology and services. There is no guarantee that such parties will abide by the terms of such agreements or that we will be able to adequately enforce our rights. Protection of confidential information, trade secrets and other intellectual property rights in the markets in which we operate and compete is highly uncertain and may involve complex legal questions. We cannot completely prevent the unauthorized use or infringement of our confidential information or intellectual property rights as such prevention is inherently difficult. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our confidential information and intellectual property protection. If we are unable to protect our proprietary rights or if third parties independently develop or gain access to our or similar technologies, our business, revenue, reputation and competitive position could be materially adversely affected. Further, many of our current and potential competitors have the ability to dedicate substantially greater resources to protecting their technology or intellectual property rights than we do. Accordingly, despite our efforts, we may not be able to prevent third parties from infringing upon or misappropriating our intellectual property, which could result in a substantial loss of our market share.

We may be exposed to liability for infringing upon the intellectual property rights of other companies.

We utilized the source code of OpenIAM, LLC (“OpenIAM”), an unaffiliated company, as a framework for our software and employees and contractors internally develop our proprietary software. Although we are not aware of any patents or trademarks which our software or its use might infringe, we cannot be certain that infringement will not occur. In addition, we may become the target of aggressive patent infringement litigation tactics by an entity whose sole purpose is to pursue such litigation. We could incur substantial costs, in addition to the great amount of time lost, in defending any patent or trademark infringement suits or in asserting any patent or trademark rights, in a suit with another party.

We may experience software development delays, software defects or installation difficulties, which could harm our business and reputation and may expose us to potential liability.

We are in the process of continuing the development of our software products. Accordingly, there is no assurance we will successfully continue to develop the software in a timely manner, or at all.

Our products include complex software utilized on sophisticated computing systems and related services, and we may encounter delays when developing the software as well as any new applications, features and services. We may encounter undetected errors or defects in the initial installed versions of the software or when new versions of the software are released. In addition, we may experience difficulties in installing or integrating our technologies on platforms used by our customers. Defects in the software, errors or delays in the processing of transactions or other difficulties could result in interruption of business operations, delay in market acceptance, additional development and remediation costs, diversion of technical and other resources, loss of clients, negative publicity or exposure to liability claims. Although we attempt to limit our potential liability through disclaimers and limitation of liability provisions in our software license and customer agreements, we cannot be certain that these measures will successfully limit our liability.

We may not be able to scale our business quickly enough to meet the growing needs of our customers and, if we are not able to grow efficiently, our operating results could be harmed.

As usage of our software grows and as customers use our services, we will need to devote additional resources to improving our software and services, integrating with third-party systems and maintaining infrastructure performance. In addition, we will need to appropriately scale our internal business systems and our services organization, including customer support and professional services, to serve our growing customer base, particularly as our customer demographics expand over time. Any failure of or delay in these efforts could cause impaired system performance and reduced customer satisfaction. These issues could reduce the attractiveness of our marketing software to customers, resulting in decreased sales to new customers or lower maintenance renewal rates by existing customers, which could adversely affect our revenue growth and harm our reputation. Even if we are able to upgrade our systems and expand our staff, any such expansion will be expensive and complex, requiring management time and attention. We could also face inefficiencies or operational failures as a result of our efforts to scale our infrastructure. Moreover, there are inherent risks associated with upgrading, improving and expanding our information technology systems. We cannot be sure that the expansion and improvements to our infrastructure and systems will be fully or effectively implemented on a timely basis, if at all. These efforts may reduce revenue and our margins and adversely affect our financial results.

Because we recognize some revenue over the term of our license agreements, downturns or upturns in sales are not immediately reflected in full in our operating results.

As a license-based business, we recognize revenue over the term of each of our licenses. As a result, much of the revenue we report each quarter results from maintenance and services for licenses entered into during previous quarters. Consequently, a shortfall in demand for our software and professional services or a decline in the renewal of maintenance services for existing licenses in any one quarter may not significantly reduce our revenue for that quarter but could negatively affect our revenue in the future. Accordingly, the effect of significant downturns in new sales of our IAM software will not be reflected in full in our operating results until future periods. Our revenue recognition model also makes it difficult for us to rapidly increase our revenue through additional sales in any period, as revenue from new customers must be recognized over the applicable term of the licenses.

If we fail to establish our Trident software brand as an industry leader, our ability to expand our customer base will be impaired and our results of operations and financial condition may suffer.

We believe development of our Trident software brand is critical to achieving widespread awareness of our existing and future identity and access management products and, as a result, is important to attracting new customers and maintaining existing customers. We also believe that the importance of brand recognition will increase as competition in our market increases. Successful promotion of our brand will depend largely on the effectiveness of our marketing efforts and on our ability to provide reliable and useful IAM software at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses we incurred in building our brand. In addition, to sell to and service our customers, we utilize a combination of internal personnel and third-party service providers, as well as reseller partners. These third-party service providers, who are not in our control, may harm our reputation and damage our brand perception in the marketplace. If we fail to successfully promote and maintain our brand, our business could suffer.

If we do not offer high-quality technical and customer support, our business and reputation may be harmed.

High-quality technical and customer support is important for the successful marketing and sale of our products and for the renewal of maintenance services by existing customers. Providing this education and support requires that our customer support personnel have specific knowledge and expertise regarding our IAM software, making it more difficult for us to hire qualified personnel and to scale up our support operations due to the extensive training required. The importance of high-quality customer support will increase as we expand our business and pursue new customers. If we do not help our customers quickly resolve post-implementation issues and provide effective ongoing support, our ability to sell additional functionality and services to existing customers may suffer and our reputation with existing or potential customers may be harmed.

If we incorrectly forecast our revenue due to lengthy sales cycles, or if we fail to match our expenditures with corresponding revenue, our operating results could be adversely affected.

We have a very limited history upon which to base forecasts of future revenue. In addition, for our customers in the education market, the lengthy sales cycle for the evaluation and implementation of our software and services, which typically extends for several months, may also cause us to experience a delay between increasing operating expenses for such sales efforts, and, upon successful sales, the generation of corresponding revenue. Accordingly, we may be unable to prepare accurate internal financial forecasts or replace anticipated revenue that we do not receive as a result of delays arising from these factors. As a result, our operating results in future reporting periods may be significantly below the expectations of the public market, equity research analysts or investors, which could harm the price of our common stock.

Our success depends upon our ability to develop new products and services, integrate acquired products and services, enhance our existing products and services and develop appropriate business and pricing models.

If we are unable to develop new IAM products and services, integrate acquired products and services or enhance and improve our products and support services, in a timely manner, or position or price our products and services to meet market demand, customers may not buy new software licenses from us, update to new versions of our software or renew product support. We cannot provide any assurance that the standards on which we choose to develop new products will allow us to compete effectively for business opportunities in emerging areas such as cloud-based services.

New product development and introduction involves a significant commitment of time and resources and is subject to a number of risks and challenges including:

|

|

·

|

managing the length of the development cycle for new products and product enhancements;

|

|

|

·

|

managing customers’ transitions to new IAM software, which can result in delays in their purchasing decisions;

|

|

|

·

|

adapting to emerging and evolving industry standards and to technological developments by our competitors and customers;

|

|

|

·

|

entering into new or unproven markets with which we have limited experience;

|

|

|

·

|

tailoring our business and pricing models appropriately as we enter new markets and respond to competitive pressures and technological changes;

|

|

|

·

|

incorporating and integrating acquired products and technologies; and

|

|

|

·

|

developing or expanding efficient sales channels.

|