00015332326/30/2024false--12-312024Q2iso4217:USDiso4217:USDxbrli:sharesutr:MWiso4217:BRLxbrli:purebep:yearxbrli:sharesiso4217:CADiso4217:CNYutr:GWiso4217:EUR00015332322024-01-012024-06-3000015332322024-06-3000015332322023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-12-310001533232bep:GeneralPartnershipNoncontrollingInterestsMember2024-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-12-310001533232bep:BEPCExchangeableSharesMember2024-06-300001533232bep:BEPCExchangeableSharesMember2023-12-310001533232ifrs-full:PreferenceSharesMember2024-06-300001533232ifrs-full:PreferenceSharesMember2023-12-310001533232bep:PerpetualSubordinatedNotesMember2024-06-300001533232bep:PerpetualSubordinatedNotesMember2023-12-3100015332322024-04-012024-06-3000015332322023-04-012023-06-3000015332322023-01-012023-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-04-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-04-012023-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-01-012023-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2024-04-012024-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2023-04-012023-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2024-01-012024-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2023-01-012023-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-04-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-04-012023-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-01-012023-06-300001533232bep:ClassASharesOfNonControllingInterestMember2024-04-012024-06-300001533232bep:ClassASharesOfNonControllingInterestMember2023-04-012023-06-300001533232bep:ClassASharesOfNonControllingInterestMember2024-01-012024-06-300001533232bep:ClassASharesOfNonControllingInterestMember2023-01-012023-06-300001533232ifrs-full:PreferenceSharesMember2024-04-012024-06-300001533232ifrs-full:PreferenceSharesMember2023-04-012023-06-300001533232ifrs-full:PreferenceSharesMember2024-01-012024-06-300001533232ifrs-full:PreferenceSharesMember2023-01-012023-06-300001533232bep:PerpetualSubordinatedNotesMember2024-04-012024-06-300001533232bep:PerpetualSubordinatedNotesMember2023-04-012023-06-300001533232bep:PerpetualSubordinatedNotesMember2024-01-012024-06-300001533232bep:PerpetualSubordinatedNotesMember2023-01-012023-06-300001533232bep:LimitedPartnersEquityMember2024-03-310001533232bep:ForeignCurrencyTranslationMemberMember2024-03-310001533232ifrs-full:RevaluationSurplusMember2024-03-310001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2024-03-310001533232bep:GainslosscashflowhedgeMember2024-03-310001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2024-03-310001533232ifrs-full:EquityAttributableToOwnersOfParentMember2024-03-310001533232bep:PreferredLpEquityMember2024-03-310001533232ifrs-full:PreferenceSharesMember2024-03-310001533232bep:PerpetualSubordinatedNotesMember2024-03-310001533232bep:BEPCExchangeableSharesMember2024-03-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-03-310001533232bep:GeneralPartnershipNoncontrollingInterestsMember2024-03-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-03-3100015332322024-03-310001533232bep:LimitedPartnersEquityMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2024-04-012024-06-300001533232bep:PreferredLpEquityMember2024-04-012024-06-300001533232bep:BEPCExchangeableSharesMember2024-04-012024-06-300001533232bep:ForeignCurrencyTranslationMemberMember2024-04-012024-06-300001533232ifrs-full:RevaluationSurplusMember2024-04-012024-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2024-04-012024-06-300001533232bep:GainslosscashflowhedgeMember2024-04-012024-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2024-04-012024-06-300001533232bep:LimitedPartnersEquityMember2024-06-300001533232bep:ForeignCurrencyTranslationMemberMember2024-06-300001533232ifrs-full:RevaluationSurplusMember2024-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2024-06-300001533232bep:GainslosscashflowhedgeMember2024-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2024-06-300001533232bep:PreferredLpEquityMember2024-06-300001533232bep:LimitedPartnersEquityMember2023-03-310001533232bep:ForeignCurrencyTranslationMemberMember2023-03-310001533232ifrs-full:RevaluationSurplusMember2023-03-310001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2023-03-310001533232bep:GainslosscashflowhedgeMember2023-03-310001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2023-03-310001533232ifrs-full:EquityAttributableToOwnersOfParentMember2023-03-310001533232bep:PreferredLpEquityMember2023-03-310001533232ifrs-full:PreferenceSharesMember2023-03-310001533232bep:PerpetualSubordinatedNotesMember2023-03-310001533232bep:BEPCExchangeableSharesMember2023-03-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-03-310001533232bep:GeneralPartnershipNoncontrollingInterestsMember2023-03-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-03-3100015332322023-03-310001533232bep:LimitedPartnersEquityMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2023-04-012023-06-300001533232bep:PreferredLpEquityMember2023-04-012023-06-300001533232bep:BEPCExchangeableSharesMember2023-04-012023-06-300001533232bep:ForeignCurrencyTranslationMemberMember2023-04-012023-06-300001533232ifrs-full:RevaluationSurplusMember2023-04-012023-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2023-04-012023-06-300001533232bep:GainslosscashflowhedgeMember2023-04-012023-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2023-04-012023-06-300001533232bep:LimitedPartnersEquityMember2023-06-300001533232bep:ForeignCurrencyTranslationMemberMember2023-06-300001533232ifrs-full:RevaluationSurplusMember2023-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2023-06-300001533232bep:GainslosscashflowhedgeMember2023-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2023-06-300001533232bep:PreferredLpEquityMember2023-06-300001533232ifrs-full:PreferenceSharesMember2023-06-300001533232bep:PerpetualSubordinatedNotesMember2023-06-300001533232bep:BEPCExchangeableSharesMember2023-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-06-300001533232bep:GeneralPartnershipNoncontrollingInterestsMember2023-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-06-3000015332322023-06-300001533232bep:LimitedPartnersEquityMember2023-12-310001533232bep:ForeignCurrencyTranslationMemberMember2023-12-310001533232ifrs-full:RevaluationSurplusMember2023-12-310001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2023-12-310001533232bep:GainslosscashflowhedgeMember2023-12-310001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMember2023-12-310001533232bep:PreferredLpEquityMember2023-12-310001533232bep:LimitedPartnersEquityMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2024-01-012024-06-300001533232bep:PreferredLpEquityMember2024-01-012024-06-300001533232bep:BEPCExchangeableSharesMember2024-01-012024-06-300001533232bep:ForeignCurrencyTranslationMemberMember2024-01-012024-06-300001533232ifrs-full:RevaluationSurplusMember2024-01-012024-06-300001533232bep:GainslosscashflowhedgeMember2024-01-012024-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2024-01-012024-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2024-01-012024-06-300001533232bep:LimitedPartnersEquityMember2022-12-310001533232bep:ForeignCurrencyTranslationMemberMember2022-12-310001533232ifrs-full:RevaluationSurplusMember2022-12-310001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2022-12-310001533232bep:GainslosscashflowhedgeMember2022-12-310001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2022-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMember2022-12-310001533232bep:PreferredLpEquityMember2022-12-310001533232ifrs-full:PreferenceSharesMember2022-12-310001533232bep:PerpetualSubordinatedNotesMember2022-12-310001533232bep:BEPCExchangeableSharesMember2022-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2022-12-310001533232bep:GeneralPartnershipNoncontrollingInterestsMember2022-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2022-12-3100015332322022-12-310001533232bep:LimitedPartnersEquityMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMember2023-01-012023-06-300001533232bep:PreferredLpEquityMember2023-01-012023-06-300001533232bep:BEPCExchangeableSharesMember2023-01-012023-06-300001533232bep:ForeignCurrencyTranslationMemberMember2023-01-012023-06-300001533232bep:GainslosscashflowhedgeMember2023-01-012023-06-300001533232ifrs-full:RevaluationSurplusMember2023-01-012023-06-300001533232ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2023-01-012023-06-300001533232ifrs-full:ReserveOfGainsAndLossesOnRemeasuringAvailableforsaleFinancialAssetsMember2023-01-012023-06-300001533232bep:A60MWBatteryStorageAssetsMember2024-04-260001533232bep:A60MWBatteryStorageAssetsMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-04-262024-04-260001533232bep:A60MWBatteryStorageAssetsMember2024-04-262024-04-260001533232bep:A30MWUSHydroelectricPortfolioMember2024-05-280001533232bep:A30MWUSHydroelectricPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-05-282024-05-280001533232bep:A30MWUSHydroelectricPortfolioMember2024-05-282024-05-280001533232bep:A85MWPortfolioBiomassAssetMember2024-05-300001533232bep:BrookfieldRenewableAndInstitutionalPartnersMemberbep:A85MWPortfolioBiomassAssetMember2024-05-302024-05-300001533232bep:A85MWPortfolioBiomassAssetMember2024-05-302024-05-300001533232bep:A67MWUSWindAssetsPortfolioMember2024-06-300001533232bep:A90MWBrazilHydroelectricPortfolioMember2024-06-300001533232bep:A6MWU.S.DistributedGenerationAssetMember2024-06-300001533232ifrs-full:AssetsAndLiabilitiesClassifiedAsHeldForSaleMember2024-06-300001533232ifrs-full:Level1OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:IFRS9PPAsMember2024-06-300001533232bep:IFRS9PPAsMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:IFRS9PPAsMember2024-06-300001533232bep:IFRS9PPAsMember2024-06-300001533232bep:IFRS9PPAsMember2023-12-310001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:EnergyDerivativeContractsMember2024-06-300001533232bep:EnergyDerivativeContractsMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:EnergyDerivativeContractsMember2024-06-300001533232bep:EnergyDerivativeContractsMember2024-06-300001533232bep:EnergyDerivativeContractsMember2023-12-310001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:InterestRateSwapsMember2024-06-300001533232bep:InterestRateSwapsMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:InterestRateSwapsMember2024-06-300001533232bep:InterestRateSwapsMember2024-06-300001533232bep:InterestRateSwapsMember2023-12-310001533232ifrs-full:CurrencySwapContractMemberifrs-full:Level1OfFairValueHierarchyMember2024-06-300001533232ifrs-full:CurrencySwapContractMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:CurrencySwapContractMemberifrs-full:Level3OfFairValueHierarchyMember2024-06-300001533232ifrs-full:CurrencySwapContractMember2024-06-300001533232ifrs-full:CurrencySwapContractMember2023-12-310001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:TaxEquityMember2024-06-300001533232bep:TaxEquityMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:TaxEquityMember2024-06-300001533232bep:TaxEquityMember2024-06-300001533232bep:TaxEquityMember2023-12-310001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:CorporateBorrowingsMember2024-06-300001533232bep:CorporateBorrowingsMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:CorporateBorrowingsMember2024-06-300001533232bep:CorporateBorrowingsMember2024-06-300001533232bep:CorporateBorrowingsMember2023-12-310001533232ifrs-full:Level1OfFairValueHierarchyMemberbep:NonRecourseBorrowingsMember2024-06-300001533232bep:NonRecourseBorrowingsMemberifrs-full:Level2OfFairValueHierarchyMember2024-06-300001533232ifrs-full:Level3OfFairValueHierarchyMemberbep:NonRecourseBorrowingsMember2024-06-300001533232bep:NonRecourseBorrowingsMember2024-06-300001533232bep:NonRecourseBorrowingsMember2023-12-310001533232bep:Assets1Memberbep:IFRS9PPAsMember2024-06-300001533232bep:IFRS9PPAsMemberifrs-full:FinancialLiabilitiesMember2024-06-300001533232bep:IFRS9PPAsMemberbep:NetAssetsLiabilitiesMember2024-06-300001533232bep:IFRS9PPAsMemberbep:NetAssetsLiabilitiesMember2023-12-310001533232bep:Assets1Memberbep:EnergyDerivativeContractsMember2024-06-300001533232ifrs-full:FinancialLiabilitiesMemberbep:EnergyDerivativeContractsMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberbep:EnergyDerivativeContractsMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberbep:EnergyDerivativeContractsMember2023-12-310001533232bep:Assets1Memberbep:InterestRateSwapsMember2024-06-300001533232bep:InterestRateSwapsMemberifrs-full:FinancialLiabilitiesMember2024-06-300001533232bep:InterestRateSwapsMemberbep:NetAssetsLiabilitiesMember2024-06-300001533232bep:InterestRateSwapsMemberbep:NetAssetsLiabilitiesMember2023-12-310001533232ifrs-full:CurrencySwapContractMemberbep:Assets1Member2024-06-300001533232ifrs-full:CurrencySwapContractMemberifrs-full:FinancialLiabilitiesMember2024-06-300001533232ifrs-full:CurrencySwapContractMemberbep:NetAssetsLiabilitiesMember2024-06-300001533232ifrs-full:CurrencySwapContractMemberbep:NetAssetsLiabilitiesMember2023-12-310001533232bep:Assets1Memberifrs-full:FinancialAssetsAvailableforsaleCategoryMember2024-06-300001533232ifrs-full:FinancialLiabilitiesMemberifrs-full:FinancialAssetsAvailableforsaleCategoryMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberifrs-full:FinancialAssetsAvailableforsaleCategoryMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberifrs-full:FinancialAssetsAvailableforsaleCategoryMember2023-12-310001533232bep:Assets1Memberbep:TaxEquityMember2024-06-300001533232ifrs-full:FinancialLiabilitiesMemberbep:TaxEquityMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberbep:TaxEquityMember2024-06-300001533232bep:NetAssetsLiabilitiesMemberbep:TaxEquityMember2023-12-310001533232bep:Assets1Member2024-06-300001533232ifrs-full:FinancialLiabilitiesMember2024-06-300001533232bep:NetAssetsLiabilitiesMember2024-06-300001533232bep:NetAssetsLiabilitiesMember2023-12-310001533232bep:EnergyDerivativeContractsMember2024-04-012024-06-300001533232bep:EnergyDerivativeContractsMember2023-04-012023-06-300001533232bep:EnergyDerivativeContractsMember2024-01-012024-06-300001533232bep:EnergyDerivativeContractsMember2023-01-012023-06-300001533232bep:IFRS9PPAsMember2024-04-012024-06-300001533232bep:IFRS9PPAsMember2023-04-012023-06-300001533232bep:IFRS9PPAsMember2024-01-012024-06-300001533232bep:IFRS9PPAsMember2023-01-012023-06-300001533232bep:DebtAndEquitySecuritiesMember2024-04-012024-06-300001533232bep:DebtAndEquitySecuritiesMember2023-04-012023-06-300001533232bep:DebtAndEquitySecuritiesMember2024-01-012024-06-300001533232bep:DebtAndEquitySecuritiesMember2023-01-012023-06-300001533232ifrs-full:InterestRateSwapContractMember2024-04-012024-06-300001533232ifrs-full:InterestRateSwapContractMember2023-04-012023-06-300001533232ifrs-full:InterestRateSwapContractMember2024-01-012024-06-300001533232ifrs-full:InterestRateSwapContractMember2023-01-012023-06-300001533232bep:ForeignExchangeSwapCashflowMember2024-04-012024-06-300001533232bep:ForeignExchangeSwapCashflowMember2023-04-012023-06-300001533232bep:ForeignExchangeSwapCashflowMember2024-01-012024-06-300001533232bep:ForeignExchangeSwapCashflowMember2023-01-012023-06-300001533232bep:TaxEquityMember2024-04-012024-06-300001533232bep:TaxEquityMember2023-04-012023-06-300001533232bep:TaxEquityMember2024-01-012024-06-300001533232bep:TaxEquityMember2023-01-012023-06-300001533232ifrs-full:UnrealisedForeignExchangeGainsLossesMember2024-04-012024-06-300001533232ifrs-full:UnrealisedForeignExchangeGainsLossesMember2023-04-012023-06-300001533232ifrs-full:UnrealisedForeignExchangeGainsLossesMember2024-01-012024-06-300001533232ifrs-full:UnrealisedForeignExchangeGainsLossesMember2023-01-012023-06-300001533232bep:OtherIncomeMember2024-01-012024-06-300001533232bep:OtherIncomeMember2024-04-012024-06-300001533232bep:OtherIncomeMember2023-04-012023-06-300001533232bep:OtherIncomeMember2023-01-012023-06-300001533232bep:ForeignExchangeSwapNetInvestmentMember2024-04-012024-06-300001533232bep:ForeignExchangeSwapNetInvestmentMember2023-04-012023-06-300001533232bep:ForeignExchangeSwapNetInvestmentMember2024-01-012024-06-300001533232bep:ForeignExchangeSwapNetInvestmentMember2023-01-012023-06-300001533232bep:InvestmentInEquityAndDebtSecuritiesMember2024-04-012024-06-300001533232bep:InvestmentInEquityAndDebtSecuritiesMember2023-04-012023-06-300001533232bep:InvestmentInEquityAndDebtSecuritiesMember2024-01-012024-06-300001533232bep:InvestmentInEquityAndDebtSecuritiesMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2024-04-012024-06-300001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2024-04-012024-06-300001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2024-04-012024-06-300001533232ifrs-full:NoncontrollingInterestsMember2024-04-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2023-04-012023-06-300001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2023-04-012023-06-300001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2023-04-012023-06-300001533232ifrs-full:NoncontrollingInterestsMember2023-04-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2024-01-012024-06-300001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2024-01-012024-06-300001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2024-01-012024-06-300001533232ifrs-full:NoncontrollingInterestsMember2024-01-012024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2023-01-012023-06-300001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2023-01-012023-06-300001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2023-01-012023-06-300001533232ifrs-full:NoncontrollingInterestsMember2023-01-012023-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2024-06-300001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2024-06-300001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMember2024-06-300001533232ifrs-full:EquityAttributableToOwnersOfParentMembersrt:NorthAmericaMemberbep:HydroelectricSegmentMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:BRbep:HydroelectricSegmentMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMembercountry:CObep:HydroelectricSegmentMember2023-12-310001533232bep:WindSegmentMemberifrs-full:EquityAttributableToOwnersOfParentMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SolarSegmentMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:DistributedEnergyAndStorageMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:SustainableSolutionsMember2023-12-310001533232ifrs-full:EquityAttributableToOwnersOfParentMemberbep:CorporateSegmentMember2023-12-310001533232ifrs-full:InvestmentsAccountedForUsingEquityMethodMember2023-12-310001533232ifrs-full:NoncontrollingInterestsMember2023-12-310001533232srt:NorthAmericaMemberbep:HydroelectricSegmentMember2024-04-012024-06-300001533232srt:NorthAmericaMemberbep:HydroelectricSegmentMember2023-04-012023-06-300001533232srt:NorthAmericaMemberbep:HydroelectricSegmentMember2024-01-012024-06-300001533232srt:NorthAmericaMemberbep:HydroelectricSegmentMember2023-01-012023-06-300001533232country:BRbep:HydroelectricSegmentMember2024-04-012024-06-300001533232country:BRbep:HydroelectricSegmentMember2023-04-012023-06-300001533232country:BRbep:HydroelectricSegmentMember2024-01-012024-06-300001533232country:BRbep:HydroelectricSegmentMember2023-01-012023-06-300001533232country:CObep:HydroelectricSegmentMember2024-04-012024-06-300001533232country:CObep:HydroelectricSegmentMember2023-04-012023-06-300001533232country:CObep:HydroelectricSegmentMember2024-01-012024-06-300001533232country:CObep:HydroelectricSegmentMember2023-01-012023-06-300001533232bep:HydroelectricSegmentMember2024-04-012024-06-300001533232bep:HydroelectricSegmentMember2023-04-012023-06-300001533232bep:HydroelectricSegmentMember2024-01-012024-06-300001533232bep:HydroelectricSegmentMember2023-01-012023-06-300001533232bep:WindSegmentMember2024-04-012024-06-300001533232bep:WindSegmentMember2023-04-012023-06-300001533232bep:WindSegmentMember2024-01-012024-06-300001533232bep:WindSegmentMember2023-01-012023-06-300001533232bep:SolarSegmentMember2024-04-012024-06-300001533232bep:SolarSegmentMember2023-04-012023-06-300001533232bep:SolarSegmentMember2024-01-012024-06-300001533232bep:SolarSegmentMember2023-01-012023-06-300001533232bep:DistributedEnergyAndStorageMember2024-04-012024-06-300001533232bep:DistributedEnergyAndStorageMember2023-04-012023-06-300001533232bep:DistributedEnergyAndStorageMember2024-01-012024-06-300001533232bep:DistributedEnergyAndStorageMember2023-01-012023-06-300001533232bep:SustainableSolutionsMember2024-04-012024-06-300001533232bep:SustainableSolutionsMember2023-04-012023-06-300001533232bep:SustainableSolutionsMember2024-01-012024-06-300001533232bep:SustainableSolutionsMember2023-01-012023-06-300001533232country:US2024-06-300001533232country:US2023-12-310001533232country:CO2024-06-300001533232country:CO2023-12-310001533232country:CA2024-06-300001533232country:CA2023-12-310001533232country:BR2024-06-300001533232country:BR2023-12-310001533232srt:EuropeMember2024-06-300001533232srt:EuropeMember2023-12-310001533232srt:AsiaMember2024-06-300001533232srt:AsiaMember2023-12-310001533232bep:OtherCountriesMember2024-06-300001533232bep:OtherCountriesMember2023-12-310001533232bep:HydroelectricSegmentMember2023-12-310001533232bep:WindSegmentMember2023-12-310001533232bep:SolarSegmentMember2023-12-310001533232bep:OtherSegmentMember2023-12-310001533232bep:OtherSegmentMember2024-01-012024-06-300001533232bep:HydroelectricSegmentMember2024-06-300001533232bep:WindSegmentMember2024-06-300001533232bep:SolarSegmentMember2024-06-300001533232bep:OtherSegmentMember2024-06-300001533232bep:OtherSegmentMember2023-01-012023-06-300001533232bep:A102MWU.S.DistributedGenerationPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-06-300001533232bep:A102MWU.S.DistributedGenerationPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-01-012024-06-300001533232bep:A61MWU.S.DistributedGenerationPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-06-300001533232bep:A61MWU.S.DistributedGenerationPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-01-012024-06-300001533232bep:CreditFacilitiesMember2024-06-300001533232bep:CreditFacilitiesMember2023-12-310001533232bep:CommercialPaper1Member2024-06-300001533232bep:CommercialPaper1Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series4Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series4Member2023-12-310001533232bep:Series9Memberbep:MediumTermNotes1Member2024-06-300001533232bep:Series9Memberbep:MediumTermNotes1Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series10Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series10Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series11Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series11Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series12Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series12Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series13Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series13Member2023-12-310001533232bep:Series14Memberbep:MediumTermNotes1Member2024-06-300001533232bep:Series14Memberbep:MediumTermNotes1Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series15Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series15Member2023-12-310001533232bep:Series16Memberbep:MediumTermNotes1Member2024-06-300001533232bep:Series16Memberbep:MediumTermNotes1Member2023-12-310001533232bep:MediumTermNotes1Memberbep:Series17Member2024-06-300001533232bep:MediumTermNotes1Memberbep:Series17Member2023-12-310001533232bep:MediumTermNotes1Member2024-06-300001533232bep:MediumTermNotes1Member2023-12-310001533232bep:CorporateBorrowingsMember2024-06-300001533232bep:CorporateBorrowingsMember2023-12-310001533232bep:BrookfieldReinsuranceMember2024-06-300001533232bep:BrookfieldReinsuranceMember2023-12-310001533232bep:AuthorizedCorporateCreditFacilitiesMember2024-06-300001533232bep:AuthorizedCorporateCreditFacilitiesMember2023-12-310001533232bep:DrawsOnCorporateCreditFacilitiesMember2024-06-300001533232bep:DrawsOnCorporateCreditFacilitiesMember2023-12-310001533232bep:LetterOfCreditFacilityMember2024-06-300001533232bep:LetterOfCreditFacilityMember2023-12-310001533232bep:IssuedLettersOfCreditMember2024-06-300001533232bep:IssuedLettersOfCreditMember2023-12-310001533232bep:CorporateCreditFacilitiesMember2024-06-300001533232bep:CorporateCreditFacilitiesMember2023-12-310001533232bep:Series16Memberbep:MediumTermNotes1Member2023-06-300001533232bep:MediumTermNotes1Memberbep:Series17Member2024-08-020001533232bep:NonRecourseBorrowingsMemberbep:HydroelectricSegmentMember2024-06-300001533232bep:NonRecourseBorrowingsMemberbep:HydroelectricSegmentMember2023-12-310001533232bep:WindSegmentMemberbep:NonRecourseBorrowingsMember2024-06-300001533232bep:WindSegmentMemberbep:NonRecourseBorrowingsMember2023-12-310001533232bep:NonRecourseBorrowingsMemberbep:SolarSegmentMember2024-06-300001533232bep:NonRecourseBorrowingsMemberbep:SolarSegmentMember2023-12-310001533232bep:DistributedEnergyAndStorageMemberbep:NonRecourseBorrowingsMember2024-06-300001533232bep:DistributedEnergyAndStorageMemberbep:NonRecourseBorrowingsMember2023-12-310001533232bep:SustainableSolutionsMemberbep:NonRecourseBorrowingsMember2024-06-300001533232bep:SustainableSolutionsMemberbep:NonRecourseBorrowingsMember2023-12-310001533232bep:NonRecourseBorrowingsMember2024-06-300001533232bep:NonRecourseBorrowingsMember2023-12-310001533232bep:BrookfieldReinsuranceAndAssociatesMemberbep:SubscriptionFacilityMember2024-06-300001533232bep:BrookfieldReinsuranceAndAssociatesMemberbep:SubscriptionFacilityMember2023-12-310001533232bep:CorporateBorrowingsMember2024-01-012024-06-300001533232bep:NonRecourseBorrowingsMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiMember2023-12-310001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiiMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldInfrastructureFundIVMember2023-12-310001533232bep:BrookfieldInfrastructureFundVMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundIIMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:CanadianHydroelectricPortfolioMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsTheCataylstGroupMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNonControllingInterestsIsagenInstitutionalInvestorsMember2023-12-310001533232bep:SubsidiariesWithMaterialNonControllingInterestsIsagenPublicMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-12-310001533232bep:SubsidiariesWithMaterialNonControllingInterestsOtherMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiiMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldInfrastructureFundIVMember2024-01-012024-06-300001533232bep:BrookfieldInfrastructureFundVMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundIIMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:CanadianHydroelectricPortfolioMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsTheCataylstGroupMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNonControllingInterestsIsagenInstitutionalInvestorsMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsIsagenPublicMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsOtherMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiMember2024-06-300001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiiMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldInfrastructureFundIVMember2024-06-300001533232bep:BrookfieldInfrastructureFundVMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundIIMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:CanadianHydroelectricPortfolioMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsTheCataylstGroupMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNonControllingInterestsIsagenInstitutionalInvestorsMember2024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsIsagenPublicMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsOtherMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiiMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructreFundIiiMemberifrs-full:TopOfRangeMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberifrs-full:BottomOfRangeMemberbep:BrookfieldGlobalTransitionFundMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldGlobalTransitionFundMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsOtherMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232bep:SubsidiariesWithMaterialNonControllingInterestsOtherMemberifrs-full:TopOfRangeMemberbep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMember2024-01-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:OwnershipInterestInBRELPMemberbep:BrookfieldAssetManagementMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:BrookfieldRenewableEnergyLpMemberbep:LimitedPartnersUnitsMember2024-01-012024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:BrookfieldRenewableEnergyLpMember2024-01-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:IncentiveDistributionMember2024-04-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:IncentiveDistributionMember2024-01-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:IncentiveDistributionMember2023-04-012023-06-300001533232bep:GeneralPartnershipUnitsMemberbep:IncentiveDistributionMember2023-01-012023-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:RedeemableExchangeablePartnershipUnitsAndGeneralPartnershipUnitsMember2024-06-300001533232bep:RedeemableExchangeablePartnershipUnitsAndGeneralPartnershipUnitsMember2024-06-300001533232bep:ExchangeableSharesMemberbep:TerraformPowerIncMember2024-04-012024-06-300001533232bep:ExchangeableSharesMemberbep:TerraformPowerIncMember2024-01-012024-06-300001533232bep:ExchangeableSharesMemberbep:TerraformPowerIncMember2023-04-012023-06-300001533232bep:ExchangeableSharesMemberbep:TerraformPowerIncMember2023-01-012023-06-300001533232ifrs-full:OrdinarySharesMemberbep:TerraformPowerIncMember2024-04-012024-06-300001533232ifrs-full:OrdinarySharesMemberbep:TerraformPowerIncMember2024-01-012024-06-300001533232ifrs-full:OrdinarySharesMemberbep:TerraformPowerIncMember2023-01-012023-06-300001533232ifrs-full:OrdinarySharesMemberbep:TerraformPowerIncMember2023-04-012023-06-300001533232bep:BEPCExchangeableParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:RedeemableExchangeablePartnershipUnitsMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:RedeemableExchangeablePartnershipUnitsMember2023-12-310001533232ifrs-full:NoncontrollingInterestsMemberbep:ExchangeableSharesMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:ExchangeableSharesMember2023-12-310001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2023-12-310001533232bep:LimitedPartnersUnitsMember2023-12-310001533232bep:ExchangeableSharesMember2023-12-310001533232ifrs-full:OrdinarySharesMember2023-04-012023-06-300001533232ifrs-full:OrdinarySharesMember2024-01-012024-06-300001533232ifrs-full:OrdinarySharesMember2024-04-012024-06-300001533232ifrs-full:OrdinarySharesMember2023-01-012023-06-300001533232bep:GeneralPartnershipUnitsMemberbep:GeneralPartnershipNoncontrollingInterestsMember2024-04-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:GeneralPartnershipNoncontrollingInterestsMember2023-04-012023-06-300001533232bep:GeneralPartnershipUnitsMemberbep:GeneralPartnershipNoncontrollingInterestsMember2024-01-012024-06-300001533232bep:GeneralPartnershipUnitsMemberbep:GeneralPartnershipNoncontrollingInterestsMember2023-01-012023-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2024-04-012024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2023-04-012023-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2024-01-012024-06-300001533232ifrs-full:NoncontrollingInterestsMemberbep:GeneralPartnershipUnitsMember2023-01-012023-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-04-012024-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-04-012023-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2024-01-012024-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMember2023-01-012023-06-300001533232bep:LimitedPartnersEquityMemberbep:RedeemableExchangeablePartnershipUnitsMemberifrs-full:ParentMember2024-04-012024-06-300001533232bep:LimitedPartnersEquityMemberbep:RedeemableExchangeablePartnershipUnitsMemberifrs-full:ParentMember2023-04-012023-06-300001533232bep:LimitedPartnersEquityMemberbep:RedeemableExchangeablePartnershipUnitsMemberifrs-full:ParentMember2024-01-012024-06-300001533232bep:LimitedPartnersEquityMemberbep:RedeemableExchangeablePartnershipUnitsMemberifrs-full:ParentMember2023-01-012023-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ExternalShareholdersMember2024-04-012024-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ExternalShareholdersMember2023-04-012023-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ExternalShareholdersMember2024-01-012024-06-300001533232bep:RedeemableExchangeablePartnershipUnitsMemberbep:ExternalShareholdersMember2023-01-012023-06-300001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2024-04-012024-06-300001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2023-04-012023-06-300001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2024-01-012024-06-300001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2023-01-012023-06-300001533232bep:PreferenceSharesSeries1Member2024-06-300001533232bep:PreferenceSharesSeries1Member2024-01-012024-06-300001533232bep:PreferenceSharesSeries1Member2023-01-012023-06-300001533232bep:PreferenceSharesSeries1Member2023-12-310001533232bep:PreferenceSharesSeries2Member2024-06-300001533232bep:PreferenceSharesSeries2Member2024-01-012024-06-300001533232bep:PreferenceSharesSeries2Member2023-01-012023-06-300001533232bep:PreferenceSharesSeries2Member2023-12-310001533232bep:PreferenceSharesSeries3Member2024-06-300001533232bep:PreferenceSharesSeries3Member2024-01-012024-06-300001533232bep:PreferenceSharesSeries3Member2023-01-012023-06-300001533232bep:PreferenceSharesSeries3Member2023-12-310001533232bep:PreferenceSharesSeries5Member2024-06-300001533232bep:PreferenceSharesSeries5Member2024-01-012024-06-300001533232bep:PreferenceSharesSeries5Member2023-01-012023-06-300001533232bep:PreferenceSharesSeries5Member2023-12-310001533232bep:PreferenceSharesSeries6Member2024-06-300001533232bep:PreferenceSharesSeries6Member2024-01-012024-06-300001533232bep:PreferenceSharesSeries6Member2023-01-012023-06-300001533232bep:PreferenceSharesSeries6Member2023-12-310001533232bep:ClassAPreferenceSharesMember2024-06-300001533232bep:ClassAPreferenceSharesMember2024-01-012024-06-300001533232bep:ClassAPreferenceSharesMember2023-01-012023-06-300001533232ifrs-full:PreferenceSharesMember2024-06-300001533232ifrs-full:PreferenceSharesMember2023-12-310001533232bep:ClassAPreferenceSharesMember2024-06-300001533232bep:ClassAPreferenceSharesMember2023-12-012023-12-310001533232bep:ClassAPreferenceSharesMember2024-04-012024-06-300001533232bep:ClassAPreferenceSharesMember2023-04-012023-06-300001533232bep:A4.6PerpetualSubordinatedNotesMember2024-06-300001533232bep:A4.6PerpetualSubordinatedNotesMember2024-01-012024-06-300001533232bep:A4.6PerpetualSubordinatedNotesMember2023-01-012023-06-300001533232bep:A4.6PerpetualSubordinatedNotesMember2023-12-310001533232bep:A4.9PerpetualSubordinatedNotesMember2024-06-300001533232bep:A4.9PerpetualSubordinatedNotesMember2024-01-012024-06-300001533232bep:A4.9PerpetualSubordinatedNotesMember2023-01-012023-06-300001533232bep:A4.9PerpetualSubordinatedNotesMember2023-12-310001533232bep:A7.3PerpetualSubordinatedNotesMember2024-06-300001533232bep:A7.3PerpetualSubordinatedNotesMember2024-01-012024-06-300001533232bep:A7.3PerpetualSubordinatedNotesMember2023-01-012023-06-300001533232bep:A7.3PerpetualSubordinatedNotesMember2023-12-310001533232bep:PerpetualSubordinatedNotesMember2024-06-300001533232bep:PerpetualSubordinatedNotesMember2024-01-012024-06-300001533232bep:PerpetualSubordinatedNotesMember2023-01-012023-06-300001533232bep:PerpetualSubordinatedNotesMember2023-12-310001533232bep:PerpetualSubordinatedNotesMember2024-03-310001533232bep:PerpetualSubordinatedNotesMember2024-04-012024-06-300001533232bep:PerpetualSubordinatedNotesMember2023-04-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries7Member2024-06-300001533232bep:PreferredLimitedPartnersUnitSeries7Member2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitSeries7Member2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries7Member2023-12-310001533232bep:PreferredLimitedPartnersUnitSeries13Member2024-06-300001533232bep:PreferredLimitedPartnersUnitSeries13Member2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitSeries13Member2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries13Member2023-12-310001533232bep:PreferredLimitedPartnersUnitSeries15Member2024-06-300001533232bep:PreferredLimitedPartnersUnitSeries15Member2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitSeries15Member2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries15Member2023-12-310001533232bep:PreferredLimitedPartnersUnitSeries17Member2024-06-300001533232bep:PreferredLimitedPartnersUnitSeries17Member2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitSeries17Member2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries17Member2023-12-310001533232bep:PreferredLimitedPartnersUnitSeries18Member2024-06-300001533232bep:PreferredLimitedPartnersUnitSeries18Member2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitSeries18Member2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries18Member2023-12-310001533232bep:PreferredLimitedPartnersUnitMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMember2024-01-012024-06-300001533232bep:PreferredLimitedPartnersUnitMember2023-01-012023-06-300001533232bep:PreferredLimitedPartnersUnitMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMember2024-04-012024-06-300001533232bep:PreferredLimitedPartnersUnitMember2023-04-012023-06-300001533232bep:PreferredLimitedPartnersUnitSeries7Memberbep:BrookfieldRenewableMember2024-06-300001533232bep:ClassAPreferredLimitedPartnershipUnitsMember2023-12-012023-12-310001533232bep:ClassAPreferredLimitedPartnershipUnitsMember2023-04-012023-06-300001533232bep:ClassAPreferredLimitedPartnershipUnitsMember2023-01-012023-06-300001533232bep:ClassAPreferredLimitedPartnershipUnitsMember2024-01-012024-06-300001533232bep:ClassAPreferredLimitedPartnershipUnitsMember2024-04-012024-06-300001533232ifrs-full:OrdinarySharesMember2024-06-300001533232ifrs-full:OrdinarySharesMember2023-12-310001533232ifrs-full:OrdinarySharesMemberbep:BrookfieldAssetManagementMember2024-06-300001533232ifrs-full:OrdinarySharesMemberbep:BrookfieldAssetManagementMember2023-12-310001533232bep:OwnershipInterestInBepMemberbep:GeneralPartnershipUnitsMemberbep:BrookfieldAssetManagementMember2024-06-300001533232bep:DistributionReinvestmentPlanMemberbep:LimitedPartnersUnitsMember2024-04-012024-06-300001533232bep:DistributionReinvestmentPlanMemberbep:LimitedPartnersUnitsMember2024-01-012024-06-300001533232bep:DistributionReinvestmentPlanMemberbep:LimitedPartnersUnitsMember2023-04-012023-06-300001533232bep:DistributionReinvestmentPlanMemberbep:LimitedPartnersUnitsMember2023-01-012023-06-300001533232bep:BrookfieldAssetManagementMember2024-06-300001533232bep:OwnershipInterestInBepMemberbep:BrookfieldAssetManagementMember2024-06-300001533232bep:OwnershipInterestInBrelpMemberbep:BrookfieldAssetManagementMember2024-06-300001533232bep:OwnershipInterestInBrelpMemberbep:GeneralPartnershipUnitsMemberbep:BrookfieldAssetManagementMember2024-06-300001533232bep:LimitedPartnersUnitsMember2024-04-012024-06-300001533232bep:LimitedPartnersUnitsMember2024-01-012024-06-300001533232bep:LimitedPartnersUnitsMember2023-04-012023-06-300001533232bep:LimitedPartnersUnitsMember2023-01-012023-06-300001533232bep:BrookfieldAssetManagementMemberbep:LimitedPartnersUnitsMember2024-04-012024-06-300001533232bep:BrookfieldAssetManagementMemberbep:LimitedPartnersUnitsMember2023-04-012023-06-300001533232bep:BrookfieldAssetManagementMemberbep:LimitedPartnersUnitsMember2024-01-012024-06-300001533232bep:BrookfieldAssetManagementMemberbep:LimitedPartnersUnitsMember2023-01-012023-06-300001533232bep:PublicShareholdersMemberbep:LimitedPartnersUnitsMember2024-04-012024-06-300001533232bep:PublicShareholdersMemberbep:LimitedPartnersUnitsMember2023-04-012023-06-300001533232bep:PublicShareholdersMemberbep:LimitedPartnersUnitsMember2024-01-012024-06-300001533232bep:PublicShareholdersMemberbep:LimitedPartnersUnitsMember2023-01-012023-06-300001533232bep:LimitedPartnersUnitsMember2024-02-012024-02-290001533232bep:BrookfieldRenewableMember2024-01-012024-06-300001533232ifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMemberbep:HydroelectricSegmentMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberifrs-full:JointVenturesMemberbep:HydroelectricSegmentMember2024-01-012024-06-300001533232ifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMemberbep:HydroelectricSegmentMember2023-01-012023-12-310001533232ifrs-full:TopOfRangeMemberifrs-full:JointVenturesMemberbep:HydroelectricSegmentMember2023-01-012023-12-310001533232ifrs-full:JointVenturesMemberbep:HydroelectricSegmentMember2024-06-300001533232ifrs-full:JointVenturesMemberbep:HydroelectricSegmentMember2023-12-310001533232bep:WindSegmentMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232bep:WindSegmentMemberifrs-full:TopOfRangeMemberifrs-full:JointVenturesMember2024-01-012024-06-300001533232bep:WindSegmentMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001533232bep:WindSegmentMemberifrs-full:TopOfRangeMemberifrs-full:JointVenturesMember2023-01-012023-12-310001533232bep:WindSegmentMemberifrs-full:JointVenturesMember2024-06-300001533232bep:WindSegmentMemberifrs-full:JointVenturesMember2023-12-310001533232ifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMemberbep:SolarSegmentMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberifrs-full:JointVenturesMemberbep:SolarSegmentMember2024-01-012024-06-300001533232ifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMemberbep:SolarSegmentMember2023-01-012023-12-310001533232ifrs-full:TopOfRangeMemberifrs-full:JointVenturesMemberbep:SolarSegmentMember2023-01-012023-12-310001533232ifrs-full:JointVenturesMemberbep:SolarSegmentMember2024-06-300001533232ifrs-full:JointVenturesMemberbep:SolarSegmentMember2023-12-310001533232bep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberbep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMember2024-01-012024-06-300001533232bep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001533232ifrs-full:TopOfRangeMemberbep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMember2023-01-012023-12-310001533232bep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMember2024-06-300001533232bep:DistributedEnergyAndStorageMemberifrs-full:JointVenturesMember2023-12-310001533232bep:SustainableSolutionsMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2024-01-012024-06-300001533232ifrs-full:TopOfRangeMemberbep:SustainableSolutionsMemberifrs-full:JointVenturesMember2024-01-012024-06-300001533232bep:SustainableSolutionsMemberifrs-full:JointVenturesMemberifrs-full:BottomOfRangeMember2023-01-012023-12-310001533232ifrs-full:TopOfRangeMemberbep:SustainableSolutionsMemberifrs-full:JointVenturesMember2023-01-012023-12-310001533232bep:SustainableSolutionsMemberifrs-full:JointVenturesMember2024-06-300001533232bep:SustainableSolutionsMemberifrs-full:JointVenturesMember2023-12-310001533232ifrs-full:JointVenturesMember2024-06-300001533232ifrs-full:JointVenturesMember2023-12-3100015332322023-01-012023-12-310001533232ifrs-full:NotLaterThanOneYearMember2024-01-012024-06-300001533232ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2024-01-012024-06-300001533232ifrs-full:LaterThanTwoYearsAndNotLaterThanThreeYearsMember2024-01-012024-06-300001533232bep:ThereafterMember2024-01-012024-06-300001533232bep:ChinaWind102MWDevelopmentMembersrt:ScenarioForecastMember2024-12-310001533232bep:ChinaWind102MWDevelopmentMembersrt:ScenarioForecastMember2024-10-012024-12-310001533232srt:ScenarioForecastMemberbep:ChinaWind350MWDevelopmentMember2024-12-310001533232srt:ScenarioForecastMemberbep:ChinaWind350MWDevelopmentMember2024-10-012024-12-310001533232bep:Brazil829MWDevelopmentMembersrt:ScenarioForecastMember2026-12-310001533232bep:Brazil13MWOperatingMembersrt:ScenarioForecastMember2026-12-310001533232bep:Brazil829MWDevelopmentMembersrt:ScenarioForecastMember2024-01-012026-12-310001533232bep:Brazil13MWOperatingMembersrt:ScenarioForecastMember2024-01-012026-12-310001533232bep:Europe23GWDevelopmentMembersrt:ScenarioForecastMember2024-12-310001533232srt:ScenarioForecastMemberbep:Europe5GWOperatingMember2024-12-310001533232bep:Europe23GWDevelopmentMembersrt:ScenarioForecastMember2024-01-012024-12-310001533232srt:ScenarioForecastMemberbep:Europe5GWOperatingMember2024-01-012024-12-310001533232bep:India524MWOperatingPortfolioMembersrt:ScenarioForecastMember2024-09-300001533232bep:India2.75GWDevelopmentMembersrt:ScenarioForecastMember2024-09-300001533232bep:India524MWOperatingPortfolioMembersrt:ScenarioForecastMember2024-07-012024-09-300001533232bep:India2.75GWDevelopmentMembersrt:ScenarioForecastMember2024-07-012024-09-300001533232bep:SouthKorea238MWDevelopmentMembersrt:ScenarioForecastMember2024-12-310001533232bep:SouthKorea238MWDevelopmentMembersrt:ScenarioForecastMember2024-07-012024-12-310001533232bep:SouthKorea103MWOperatingAndDevelopmentMembersrt:ScenarioForecastMember2024-12-310001533232bep:SouthKorea4GWDevelopmentMembersrt:ScenarioForecastMember2024-12-310001533232bep:SouthKorea4GWDevelopmentMembersrt:ScenarioForecastMember2024-07-012024-12-310001533232bep:SouthKorea103MWOperatingAndDevelopmentMembersrt:ScenarioForecastMember2024-07-012024-12-310001533232bep:ContingentLiabilitiesLettersOfCreditIssuedByJointOperationMember2024-06-300001533232bep:ContingentLiabilitiesLettersOfCreditIssuedByJointOperationMember2023-12-310001533232bep:ContingentLiabilitiesLettersOfCreditIssuedBySubsidiariesMember2024-06-300001533232bep:ContingentLiabilitiesLettersOfCreditIssuedBySubsidiariesMember2023-12-310001533232bep:LetterOfCreditFacilityMemberbep:BrookfieldAssetManagementMember2024-06-300001533232bep:UnsecuredRevolvingCreditFacilityMemberbep:BrookfieldAssetManagementMember2024-04-012024-06-300001533232bep:BrookfieldAssetManagementMember2024-06-300001533232bep:BrookfieldAssetManagementMember2023-12-310001533232bep:BrookfieldAssetManagementMember2024-01-012024-06-300001533232bep:BrookfieldAssetManagementMember2024-04-012024-06-300001533232bep:BrookfieldAssetManagementMember2023-01-012023-06-300001533232bep:BrookfieldReinsuranceAndAssociatesMember2024-06-300001533232bep:BrookfieldReinsuranceAndAssociatesMember2023-12-310001533232ifrs-full:ParentMember2024-06-300001533232ifrs-full:ParentMember2023-12-310001533232ifrs-full:JointVenturesWhereEntityIsVenturerMember2024-06-300001533232ifrs-full:JointVenturesWhereEntityIsVenturerMember2023-12-310001533232bep:BrookfieldGlobalTransitionFundIMemberifrs-full:ParentMember2024-06-300001533232bep:BrookfieldGlobalTransitionFundIMemberifrs-full:ParentMember2023-12-310001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructureFundIVMemberifrs-full:ParentMember2024-06-300001533232bep:SubsidiariesWithMaterialNoncontrollingInterestsBrookfieldInfrastructureFundIVMemberifrs-full:ParentMember2023-12-310001533232bep:BrookfieldGlobalTransitionFundIIMemberifrs-full:ParentMember2024-06-300001533232bep:BrookfieldGlobalTransitionFundIIMemberifrs-full:ParentMember2023-12-310001533232bep:BrookfieldRenewableMember2024-06-300001533232bep:BrpEquityMember2024-06-300001533232bep:FincoMember2024-06-300001533232bep:HoldingEntitiesMember2024-06-300001533232bep:OtherSubsidiariesMember2024-06-300001533232bep:ConsolidatingAdjustmentsMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldRenewableMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrpEquityMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:FincoMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:HoldingEntitiesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:OtherSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:ConsolidatingAdjustmentsMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:BrookfieldRenewableMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:BrpEquityMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:FincoMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:HoldingEntitiesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:OtherSubsidiariesMember2024-06-300001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:ConsolidatingAdjustmentsMember2024-06-300001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2024-06-300001533232bep:BrpEquityMemberbep:BEPCExchangeableSharesMember2024-06-300001533232bep:FincoMemberbep:BEPCExchangeableSharesMember2024-06-300001533232bep:BEPCExchangeableSharesMemberbep:HoldingEntitiesMember2024-06-300001533232bep:OtherSubsidiariesMemberbep:BEPCExchangeableSharesMember2024-06-300001533232bep:ConsolidatingAdjustmentsMemberbep:BEPCExchangeableSharesMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:BrookfieldRenewableMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:BrpEquityMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:FincoMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:HoldingEntitiesMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:OtherSubsidiariesMember2024-06-300001533232ifrs-full:PreferenceSharesMemberbep:ConsolidatingAdjustmentsMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:BrookfieldRenewableMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:BrpEquityMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:FincoMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:HoldingEntitiesMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:OtherSubsidiariesMember2024-06-300001533232bep:PerpetualSubordinatedNotesMemberbep:ConsolidatingAdjustmentsMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMemberbep:BrookfieldRenewableMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMemberbep:BrpEquityMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMemberbep:FincoMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMemberbep:HoldingEntitiesMember2024-06-300001533232bep:OtherSubsidiariesMemberbep:PreferredLimitedPartnersUnitMember2024-06-300001533232bep:ConsolidatingAdjustmentsMemberbep:PreferredLimitedPartnersUnitMember2024-06-300001533232bep:PreferredLimitedPartnersUnitMember2024-06-300001533232bep:BrookfieldRenewableMember2023-12-310001533232bep:BrpEquityMember2023-12-310001533232bep:FincoMember2023-12-310001533232bep:HoldingEntitiesMember2023-12-310001533232bep:OtherSubsidiariesMember2023-12-310001533232bep:ConsolidatingAdjustmentsMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrookfieldRenewableMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:BrpEquityMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:FincoMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:HoldingEntitiesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:OtherSubsidiariesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsOperatingSubsidiariesMemberbep:ConsolidatingAdjustmentsMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:BrookfieldRenewableMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:BrpEquityMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:FincoMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:HoldingEntitiesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:OtherSubsidiariesMember2023-12-310001533232bep:ParticipatingNoncontrollingInterestsHoldingSubsidiariesMemberbep:ConsolidatingAdjustmentsMember2023-12-310001533232bep:BEPCExchangeableSharesMemberbep:BrookfieldRenewableMember2023-12-310001533232bep:BrpEquityMemberbep:BEPCExchangeableSharesMember2023-12-310001533232bep:FincoMemberbep:BEPCExchangeableSharesMember2023-12-310001533232bep:BEPCExchangeableSharesMemberbep:HoldingEntitiesMember2023-12-310001533232bep:OtherSubsidiariesMemberbep:BEPCExchangeableSharesMember2023-12-310001533232bep:ConsolidatingAdjustmentsMemberbep:BEPCExchangeableSharesMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:BrookfieldRenewableMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:BrpEquityMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:FincoMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:HoldingEntitiesMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:OtherSubsidiariesMember2023-12-310001533232ifrs-full:PreferenceSharesMemberbep:ConsolidatingAdjustmentsMember2023-12-310001533232bep:PerpetualSubordinatedNotesMemberbep:BrookfieldRenewableMember2023-12-310001533232bep:PerpetualSubordinatedNotesMemberbep:BrpEquityMember2023-12-310001533232bep:PerpetualSubordinatedNotesMemberbep:FincoMember2023-12-310001533232bep:PerpetualSubordinatedNotesMemberbep:HoldingEntitiesMember2023-12-310001533232bep:PerpetualSubordinatedNotesMemberbep:OtherSubsidiariesMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMemberbep:BrookfieldRenewableMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMemberbep:BrpEquityMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMemberbep:FincoMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMemberbep:HoldingEntitiesMember2023-12-310001533232bep:OtherSubsidiariesMemberbep:PreferredLimitedPartnersUnitMember2023-12-310001533232bep:ConsolidatingAdjustmentsMemberbep:PreferredLimitedPartnersUnitMember2023-12-310001533232bep:PreferredLimitedPartnersUnitMember2023-12-310001533232bep:BrookfieldRenewableMember2024-04-012024-06-300001533232bep:BrpEquityMember2024-04-012024-06-300001533232bep:FincoMember2024-04-012024-06-300001533232bep:HoldingEntitiesMember2024-04-012024-06-300001533232bep:OtherSubsidiariesMember2024-04-012024-06-300001533232bep:ConsolidatingAdjustmentsMember2024-04-012024-06-300001533232bep:BrookfieldRenewableMember2023-04-012023-06-300001533232bep:BrpEquityMember2023-04-012023-06-300001533232bep:FincoMember2023-04-012023-06-300001533232bep:HoldingEntitiesMember2023-04-012023-06-300001533232bep:OtherSubsidiariesMember2023-04-012023-06-300001533232bep:ConsolidatingAdjustmentsMember2023-04-012023-06-300001533232bep:BrpEquityMember2024-01-012024-06-300001533232bep:FincoMember2024-01-012024-06-300001533232bep:HoldingEntitiesMember2024-01-012024-06-300001533232bep:OtherSubsidiariesMember2024-01-012024-06-300001533232bep:ConsolidatingAdjustmentsMember2024-01-012024-06-300001533232bep:BrookfieldRenewableMember2023-01-012023-06-300001533232bep:BrpEquityMember2023-01-012023-06-300001533232bep:FincoMember2023-01-012023-06-300001533232bep:HoldingEntitiesMember2023-01-012023-06-300001533232bep:OtherSubsidiariesMember2023-01-012023-06-300001533232bep:ConsolidatingAdjustmentsMember2023-01-012023-06-300001533232ifrs-full:MajorBusinessCombinationMemberbep:A2.00GWOperatingAndUnderConstructionMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A2.00GWOperatingAndUnderConstructionMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A2.00GWOperatingAndUnderConstructionMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A2.00GWOperatingAndUnderConstructionMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A500MWOperatingCapacityMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:BrookfieldRenewableAndInstitutionalPartnersMemberbep:A3GWDevelopmentPipelineMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A500MWOperatingCapacityMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A500MWOperatingCapacityMember2024-07-012024-08-020001533232bep:Series18Memberbep:MediumTermNotes1Member2024-08-0200015332322024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A103MWDistributedGenerationAnd2.2GWDevelopmentPipelineMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A103MWDistributedGenerationAnd2.2GWDevelopmentPipelineMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A103MWDistributedGenerationAnd2.2GWDevelopmentPipelineMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A238MWSouthKoreaPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A238MWSouthKoreaPortfolioMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:A238MWSouthKoreaPortfolioMember2024-07-012024-08-020001533232bep:A150MWWindFacilityInChinaMemberifrs-full:MajorBusinessCombinationMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-08-020001533232bep:A150MWWindFacilityInChinaMemberifrs-full:MajorBusinessCombinationMember2024-07-012024-08-020001533232bep:A150MWWindFacilityInChinaMemberifrs-full:MajorBusinessCombinationMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:PowenMemberbep:BrookfieldRenewableAndInstitutionalPartnersMember2024-07-012024-08-020001533232ifrs-full:MajorBusinessCombinationMemberbep:PowenMember2024-07-012024-08-02

OUR OPERATIONS

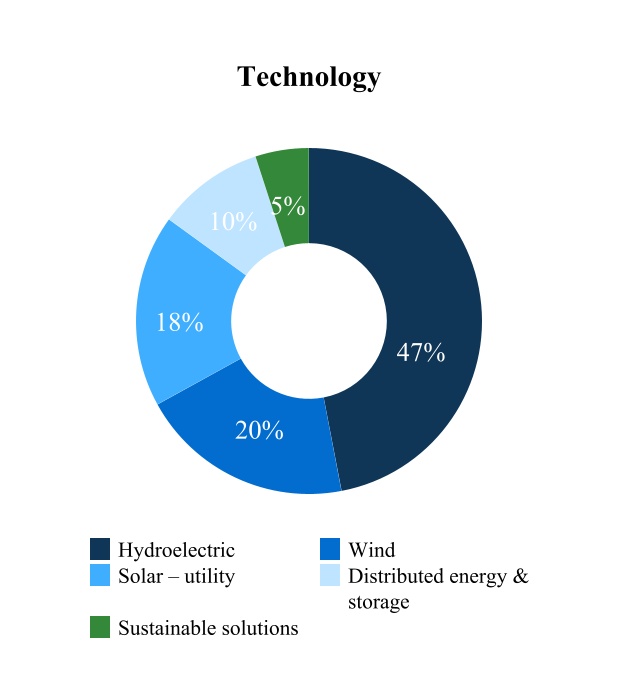

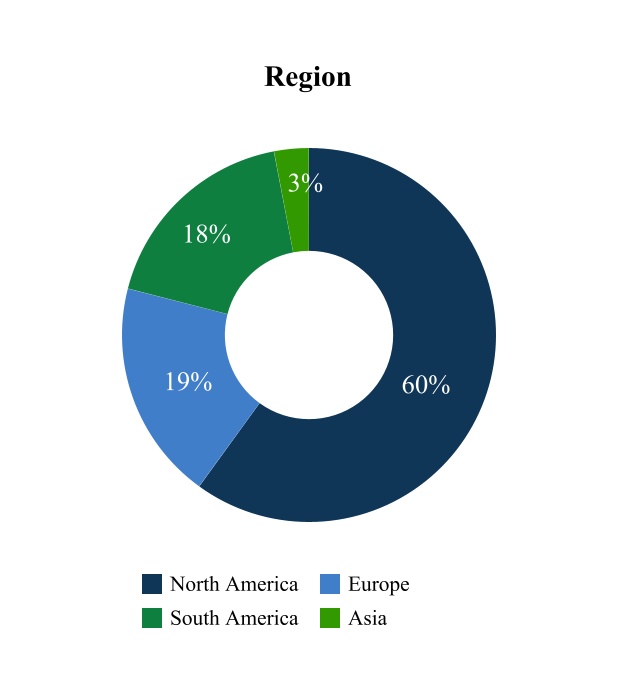

We invest in renewable power and sustainable solutions assets directly, as well as with institutional partners, joint venture partners and through other arrangements. Across our business, we leverage our extensive operating experience to maintain and enhance the value of assets, grow cash flows on an annual basis and cultivate positive relations with local stakeholders. Our portfolio includes assets for which we have access to a priority growth pipeline that if funded would provide us the opportunity to own a near-majority share of the business.

Our global diversified portfolio of renewable power assets, which makes up over 97% of our business, has approximately 33,200 MW of operating capacity and annualized LTA generation of approximately 94,200 GWh and a development pipeline of approximately 200,100 MW.

The table below outlines our portfolio as at June 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| River Systems | | Facilities | | Capacity

(MW) | | LTA(1) (GWh) | | Storage Capacity (GWh) |

| Hydroelectric | | | | | | | | | |

| North America | | | | | | | | | |

United States(2) | 29 | | | 139 | | | 2,905 | | | 11,882 | | | 2,559 | |

| Canada | 19 | | | 33 | | | 1,361 | | | 5,178 | | | 1,261 | |

| | 48 | | | 172 | | | 4,266 | | | 17,060 | | | 3,820 | |

Colombia(3) | 11 | | | 22 | | | 3,053 | | | 16,143 | | | 3,703 | |

Brazil(4) | 27 | | | 43 | | | 940 | | | 4,811 | | | — | |

| | 86 | | | 237 | | | 8,259 | | | 38,014 | | | 7,523 | |

Wind(5) | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| North America | — | | | 57 | | | 6,934 | | | 22,179 | | | — | |

Europe(6) | — | | | 56 | | | 1,432 | | | 3,309 | | | — | |

| Brazil | — | | | 37 | | | 890 | | | 3,949 | | | — | |

| Asia | — | | | 33 | | | 1,874 | | | 5,534 | | | — | |

| | — | | | 183 | | | 11,130 | | | 34,971 | | | — | |

Utility-scale solar(7) | — | | | 225 | | | 7,591 | | | 16,509 | | | — | |

| | | | | | | | | |

Distributed generation & storage(8)(9) | 2 | | | 6,964 | | | 5,765 | | | 3,741 | | | 5,220 | |

| | | | | | | | | |

| | | | | | | | | |

| Total renewable power | 88 | | | 7,609 | | | 32,745 | | | 93,235 | | | 12,743 | |

(1)LTA is calculated based on our portfolio as at June 30, 2024, reflecting all facilities on a consolidated and an annualized basis from the beginning of the year, regardless of the acquisition, disposition or commercial operation date. See "Part 8 – Presentation to Stakeholders and Performance Measurement" for an explanation on our methodology in computing LTA and why we do not consider LTA for our pumped storage and certain of our other facilities.

(2)Includes four battery storage facilities in North America (50 MW).

(3)Includes two wind plants (32 MW) and five solar plants (100 MW) in Colombia.

(4)Includes a portfolio of hydroelectric facilities in Brazil (90 MW) that have been presented as Assets held for sale.

(5)Excludes 303 MW of wind capacity with an LTA of 742 GWh included in our sustainable solutions segment.

(6)Includes a 67 MW portfolio of wind assets located in the United Kingdom that have been presented as Assets held for sale.

(7)Excludes 118 MW of solar capacity with an LTA of 243 GWh included in our sustainable solutions segment.

(8)Includes a battery storage facility in North America (10 MW).

(9)Includes nine fuel cell facilities in North America (10 MW) and pumped storage in North America (666 MW) and Europe (2,088 MW).

We also have investments in our sustainable solution portfolio comprised of assets and businesses that enable the transition to net-zero through established but emerging technologies that require capital to scale, and in businesses where we believe we can leverage our access to capital and partnerships to accelerate growth. This portfolio includes our investment in Westinghouse (a leading global nuclear services business) as well as investments in an operating portfolio of 57 thousand metric tonnes per annum (“TMTPA”) of carbon capture and storage (“CCS”), 3 million Metric Million British thermal units (“MMBtu”) of agricultural renewable natural gas (“RNG”) operating production capacity annually and over 1 million tons of recycled materials annually. Our sustainable solutions development pipeline includes opportunities to invest in additional projects with 20 million metric tonnes per annum (“MMTPA”) of CCS, 1.2 million tons of recycled materials, roughly 8.1 million MMBtu of RNG production capacity and a solar manufacturing facility capable of producing 3,000 MW panels annually.

The following table presents the annualized long-term average generation of our portfolio as at June 30, 2024 on a consolidated and quarterly basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GENERATION (GWh)(1) | Q1 | | Q2 | | Q3 | | Q4 | | Total |

| Hydroelectric | | | | | | | | | |

| North America | | | | | | | | | |

| United States | 3,370 | | | 3,435 | | | 2,166 | | | 2,911 | | | 11,882 | |

| Canada | 1,235 | | | 1,489 | | | 1,236 | | | 1,218 | | | 5,178 | |

| | 4,605 | | | 4,924 | | | 3,402 | | | 4,129 | | | 17,060 | |

Colombia(2) | 3,697 | | | 4,048 | | | 3,944 | | | 4,454 | | | 16,143 | |

Brazil(3) | 1,183 | | | 1,198 | | | 1,214 | | | 1,216 | | | 4,811 | |

| | 9,485 | | | 10,170 | | | 8,560 | | | 9,799 | | | 38,014 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Wind(4) | 9,006 | | | 8,927 | | | 7,868 | | | 9,170 | | | 34,971 | |

| | | | | | | | | |

| Utility-scale solar | 3,542 | | | 4,710 | | | 4,830 | | | 3,420 | | | 16,502 | |

| | | | | | | | | |

| Distributed generation & storage | 846 | | | 1,088 | | | 1,035 | | | 772 | | | 3,741 | |

| | | | | | | | | |

| Total | 22,879 | | | 24,895 | | | 22,293 | | | 23,161 | | | 93,228 | |

(1)LTA is calculated based on our portfolio as at June 30, 2024 reflecting all facilities on an annualized basis from the beginning of the year, regardless of the acquisition, disposition or commercial operation date. See "Part 8 – Presentation to Stakeholders and Performance Measurement" for an explanation on our methodology in computing LTA and why we do not consider LTA for our pumped storage and certain of our other facilities.

(2)Includes two wind plants (174 GWh) and five solar plants (248 GWh) in Colombia.

(3)Includes a 510 GWh portfolio of hydroelectric facilities in Brazil that have been presented as Assets held for sale.

(4)Includes a 231 GWh portfolio of wind assets in the United Kingdom that has been presented as Assets held for sale.

The following table presents the annualized long-term average generation of our portfolio as at June 30, 2024 on a proportionate and quarterly basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

GENERATION (GWh)(1) | Q1 | | Q2 | | Q3 | | Q4 | | Total |

| Hydroelectric | | | | | | | | | |

| North America | | | | | | | | | |

| United States | 2,217 | | | 2,352 | | | 1,465 | | | 1,948 | | | 7,982 | |

| Canada | 1,010 | | | 1,210 | | | 980 | | | 959 | | | 4,159 | |

| | 3,227 | | | 3,562 | | | 2,445 | | | 2,907 | | | 12,141 | |

Colombia(2) | 837 | | | 908 | | | 886 | | | 1,001 | | | 3,632 | |

Brazil(3) | 1,008 | | | 1,020 | | | 1,034 | | | 1,035 | | | 4,097 | |

| | 5,072 | | | 5,490 | | | 4,365 | | | 4,943 | | | 19,870 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Wind(4) | 2,526 | | | 2,458 | | | 2,150 | | | 2,574 | | | 9,708 | |

| | | | | | | | | |

| Utility-scale solar | 909 | | | 1,308 | | | 1,366 | | | 881 | | | 4,464 | |

| | | | | | | | | |

| Distributed generation | 229 | | | 327 | | | 313 | | | 208 | | | 1,077 | |

| | | | | | | | | |

| Total | 8,736 | | | 9,583 | | | 8,194 | | | 8,606 | | | 35,119 | |

(1)LTA is calculated based on our portfolio as at June 30, 2024 reflecting all facilities on an annualized basis from the beginning of the year, regardless of the acquisition, disposition or commercial operation date. See "Part 8 – Presentation to Stakeholders and Performance Measurement" for an explanation on our methodology in computing LTA and why we do not consider LTA for our pumped storage and certain of our other facilities.

(2)Includes two wind plants in (41 GWh) and five solar plants (57 GWh) in Colombia.

(3)Includes a 212 GWh portfolio of hydroelectric facilities in Brazil that have been presented as Assets held for sale.

(4)Includes a 58 GWh portfolio of wind assets in the United Kingdom that has been presented as Assets held for sale.

Statement Regarding Forward-Looking Statements and Use of Non-IFRS Measures