Table of Contents

As filed with the Securities and Exchange Commission on June 17, 2013

Registration No. 333-189187

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BROOKFIELD RENEWABLE ENERGY PARTNERS L.P.

(Exact Name of Registrant as Specified in Its Charter)

| Bermuda | 3100 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

73 Front Street, 5th Floor, Hamilton HM 12, Bermuda

+1.441.295.1443

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mile T. Kurta, Esq.

Torys LLP

1114 Avenue of the Americas, New York, NY 10036

Telephone: 212-880-6000

Fax: 212-880-0200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Andrew J. Beck, Esq. Mile T. Kurta, Esq. Torys LLP 1114 Avenue of the Americas New York, NY 10036 Telephone: 212-880-6000 Fax: 212-880-0200 |

Rod Miller, Esq. Paul Denaro, Esq. Milbank, Tweed, Hadley & McCloy LLP 1 Chase Manhattan Plaza New York, NY 10005 Telephone: 212-530-5000 Fax: 212-530-5219 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to Be Registered |

Amount to Be Registered(1) |

Proposed Maximum per Unit(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Limited Partnership Units, no par value |

14,005,603 | 28.67 | $401,540,638.01 | $54,770.15(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes limited partnership units (“LP Units”) that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended. The price per LP Unit and the maximum aggregate offering price are based on the average of the high and low prices of the LP Units on June 14, 2013 on the New York Stock Exchange. |

| (3) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 17, 2013

12,178,785 Limited Partnership Units

Brookfield Renewable Energy Partners L.P.

We are offering 12,178,785 non-voting limited partnership units (our “LP Units”) in this offering.

Our LP Units are listed for trading under the symbol “BEP” on the New York Stock Exchange (the “NYSE”) and “BEP.UN” on the Toronto Stock Exchange (the “TSX”). On June 14, 2013, the last reported sale price of our LP Units on the NYSE and the TSX was $28.56 and C$28.99, respectively.

Investing in our LP Units involves risks. See “Risk Factors” beginning on page 19 of this prospectus.

| Per LP Unit | Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting fee |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

We have granted the underwriters the option (the “Over-Allotment Option”) exercisable for 30 days after the closing date to purchase 1,826,818 additional LP Units to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver our LP Units on or about , 2013.

| Barclays |

Deutsche Bank Securities | |

| CIBC | Scotiabank | |

| Citigroup | Credit Suisse | HSBC | RBC Capital Markets | TD Securities |

Prospectus dated , 2013

Table of Contents

Table of Contents

| ii | ||||

| iv | ||||

| 1 | ||||

| 19 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 55 | ||||

| 56 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

60 | |||

| 119 | ||||

| 147 | ||||

| 174 | ||||

| 175 | ||||

| 188 | ||||

| 190 | ||||

| 230 | ||||

| 232 | ||||

| 233 | ||||

| 235 | ||||

| 260 | ||||

| 264 | ||||

| 265 | ||||

| 266 | ||||

| 266 | ||||

| 266 | ||||

| A-1 | ||||

i

Table of Contents

Neither we nor the underwriters have authorized any other person to provide you with different or additional information other than that contained in this prospectus. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates. Information contained on, or accessible through, our website, www.brookfieldrenewable.com, does not constitute part of this prospectus.

The laws of certain jurisdictions may restrict the distribution of this prospectus and the offer and sale of our LP Units. Persons into whose possession this prospectus or any LP Units may come must inform themselves about, and observe, any such restrictions on the distribution of this prospectus and the offering and sale of our LP Units. In particular, there are restrictions on the distribution of this prospectus and the offer or sale of our LP Units in the United States and the European Economic Area. Neither we nor our representatives are making any representation to any offeree or any purchaser of our LP Units regarding the legality of any investment in our LP Units by such offeree or purchaser under applicable legal investment or similar laws or regulations. Accordingly, no LP Units may be offered or sold, directly or indirectly, and neither this prospectus nor any advertisement or other offering material may be distributed or published in any jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements concerning the business and operations of Brookfield Renewable Group. Forward-looking statements may include estimates, plans, expectations, opinions, forecasts, projections, guidance or other statements that are not statements of fact. Forward-looking statements in this prospectus include statements regarding the quality of Brookfield Renewable Group’s assets and the resiliency of the cash flow they will generate, Brookfield Renewable’s anticipated financial performance, the future growth prospects and distribution profile of Brookfield Renewable and Brookfield Renewable’s access to capital. Forward-looking statements can be identified by the use of words such as “plans”, “expects”, “scheduled”, “estimates”, “intends”, “anticipates”, “believes”, “potentially”, “tends”, “continue”, “attempts”, “likely”, “primarily”, “approximately”, “endeavors”, “pursues”, “strives”, “seeks” or variations of such words and phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Although we believe that our anticipated future results, performance or achievements expressed or implied by the forward-looking statements and information in this prospectus are based upon reasonable assumptions and expectations, we cannot assure you that such expectations will prove to have been correct. You should not place undue reliance on forward-looking statements and information as such statements and information involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to:

| • | our limited operating history; |

| • | the risk that we may be deemed an “investment company” under the Investment Company Act; |

| • | the risk that the effectiveness of our internal controls over financial reporting could have a material effect on our business; |

| • | changes to hydrology at our hydroelectric stations or in wind conditions at our wind energy facilities; |

| • | the risk that counterparties to our contracts do not fulfill their obligations, and as our contracts expire, we may not be able to replace them with agreements on similar terms; |

| • | increases in water rental costs (or similar fees) or changes to the regulation of water supply; |

ii

Table of Contents

| • | volatility in supply and demand in the energy market; |

| • | our operations are highly regulated and exposed to increased regulation which could result in additional costs; |

| • | the risk that our concessions and licenses will not be renewed; |

| • | increases in the cost of operating our plants; |

| • | our failure to comply with conditions in, or our inability to maintain, governmental permits; |

| • | equipment failure; |

| • | dam failures and the costs of repairing such failures; |

| • | exposure to force majeure events; |

| • | exposure to uninsurable losses; |

| • | adverse changes in currency exchange rates; |

| • | availability and access to interconnection facilities and transmission systems; |

| • | health, safety, security and environmental risks; |

| • | disputes and litigation; |

| • | our operations could be affected by local communities; |

| • | losses resulting from fraud, bribery, corruption, other illegal acts, inadequate or failed internal processes or systems, or from external events; |

| • | general industry risks relating to the North American and Brazilian power market sectors; |

| • | advances in technology that impair or eliminate the competitive advantage of our projects; |

| • | newly developed technologies in which we invest not performing as anticipated; |

| • | labor disruptions and economically unfavorable collective bargaining agreements; |

| • | our inability to finance our operations due to the status of the capital markets; |

| • | the operating and financial restrictions imposed on us by our loan, debt and security agreements; |

| • | changes in our credit ratings; |

| • | changes to government regulations that provide incentives for renewable energy; |

| • | our inability to identify and complete sufficient investment opportunities; |

| • | the growth of our portfolio; |

| • | our inability to develop existing sites or find new sites suitable for the development of greenfield projects; |

| • | risks associated with the development of our generating facilities and the various types of arrangements we enter into with communities and joint venture partners; |

| • | Brookfield’s election not to source acquisition opportunities for us and our lack of access to all renewable power acquisitions that Brookfield identifies; |

| • | our lack of control over our operations conducted through joint ventures, partnerships and consortium arrangements; |

| • | our ability to issue equity or debt for future acquisitions and developments will be dependent on capital markets; |

| • | foreign laws or regulation to which we become subject as a result of future acquisitions in new markets; |

iii

Table of Contents

| • | the departure of some or all of Brookfield’s key professionals; and |

| • | other factors described in this prospectus, including those set forth under “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”. |

We caution that the foregoing list of important factors that may affect future results is not exhaustive. The forward-looking statements represent our views as of the date of this prospectus and should not be relied upon as representing our views as of any date subsequent to the date of this prospectus. While we anticipate that subsequent events and developments may cause our views to change, we disclaim any obligation to update the forward-looking statements, other than as required by applicable law. For further information on these known and unknown risks, please see “Risk Factors”.

Financial Information

The financial information contained in this prospectus is presented in U.S. dollars and, unless otherwise indicated, has been prepared in accordance with IFRS. All figures are unaudited unless otherwise indicated. In this prospectus, all references to “$” are to U.S. dollars. Canadian dollars and Brazilian Reais are identified as “C$” and “R$”, respectively.

CAUTIONARY STATEMENT REGARDING THE USE OF NON-IFRS MEASURES

This prospectus contains references to Adjusted EBITDA, funds from operations and net asset value which are not generally accepted accounting measures under IFRS and therefore may differ from definitions of Adjusted EBITDA, funds from operations and net asset value used by other entities. We believe that Adjusted EBITDA, funds from operations and net asset value are useful supplemental measures that may assist investors in assessing the financial performance and the cash anticipated to be generated by our operating portfolio. Neither Adjusted EBITDA, funds from operations nor net asset value should be considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, analysis of our financial statements prepared in accordance with IFRS. As a result of the Combination, we have presented these measurements of the 2011 results on a pro forma basis. Reconciliations of each of Adjusted EBITDA and funds from operations to net income on a consolidated and pro forma basis are presented in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Net Income, Adjusted EBITDA, and Funds from Operations on a Consolidated Basis” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Reconciliation of Pro Forma Results.”

iv

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our LP Units. Before making an investment decision, you should read this entire prospectus carefully, especially the “Risk Factors” section of this prospectus and our consolidated financial statements and related notes appearing at the end of this prospectus. Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for more information. Unless the context requires otherwise, when used in this prospectus, the terms “Brookfield Renewable Group”, “we”, “us” and “our” refer to Brookfield Renewable, BRELP, the Holding Entities and the Operating Entities, each as defined in this prospectus, collectively; “Brookfield Renewable” and “BREP” refer to Brookfield Renewable Energy Partners L.P.; “Brookfield” refers to Brookfield Asset Management Inc. and its subsidiaries (other than Brookfield Renewable); “BRPI” refers to Brookfield Renewable Power Inc., an indirect wholly-owned subsidiary of Brookfield Asset Management Inc.; and “LP Unitholder” refers to holders of our LP Units. All references to “our portfolio” include 100% of the capacity and energy of the facilities even though we do not own 100% of the economic output of such facilities (see the table under “Business — Our Operations” for details on our portfolio). See “Appendix A — Glossary” for the definitions of the various defined terms used throughout this prospectus.

Overview

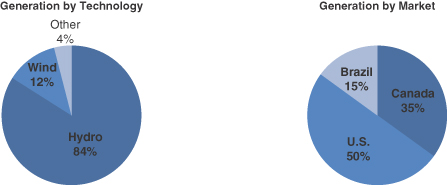

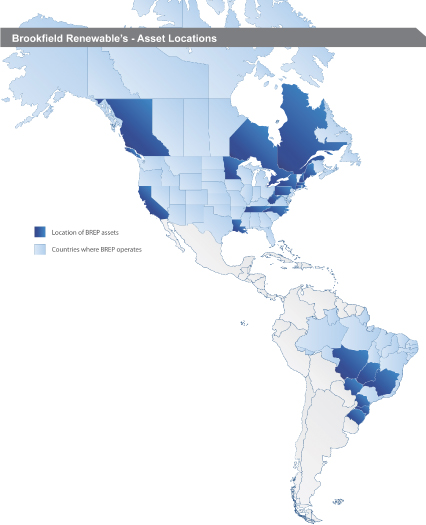

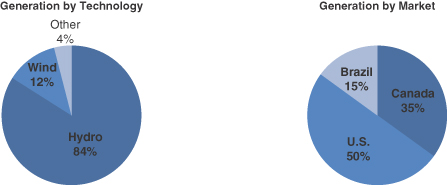

Brookfield Renewable owns one of the world’s largest, publicly-traded, pure-play renewable power portfolios with approximately 5,900 MW of installed capacity. The portfolio includes 196 hydroelectric generating stations on 70 river systems, 11 wind facilities and two natural gas-fired plants. Our portfolio is diversified across 12 power markets in Canada, the United States and Brazil, providing significant geographic and operational diversification.

We operate our facilities through three regional operating centers in the United States, Canada and Brazil, which are designed to maintain and enhance the value of our assets, while cultivating positive relations with local stakeholders. Overall, the assets we own or manage have 5,900 MW of generating capacity and annual generation exceeding 22,000 GWh based on long-term averages. The table below outlines our portfolio as at the date of this prospectus:

| Markets |

River Systems |

Generating Stations |

Generating Units |

Capacity(1) (MW) |

LTA(2)(3) (GWh) |

Storage (GWh) |

||||||||||||||||||

| Operating assets |

||||||||||||||||||||||||

| Hydroelectric generation(4) |

||||||||||||||||||||||||

| United States |

28 | 126 | 371 | 2,696 | 9,951 | 3,582 | ||||||||||||||||||

| Canada |

18 | 32 | 72 | 1,323 | 5,062 | 1,261 | ||||||||||||||||||

|

Brazil |

24 | 38 | 85 | 680 | 3,701 | N/A | (5) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 70 | 196 | 528 | 4,699 | 18,714 | 4,843 | |||||||||||||||||||

| Wind energy |

||||||||||||||||||||||||

| United States |

— | 8 | 724 | 538 | 1,394 | — | ||||||||||||||||||

| Canada |

— | 3 | 220 | 406 | 1,197 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| — | 11 | 944 | 944 | 2,591 | — | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other |

— | 2 | 6 | 215 | 899 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from operating assets |

70 | 209 | 1,478 | 5,858 | 22,204 | 4,843 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Assets under construction |

||||||||||||||||||||||||

| Hydroelectric generation |

||||||||||||||||||||||||

| Canada |

1 | 1 | 4 | 45 | 138 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

71 | 210 | 1,482 | 5,903 | 22,342 | 4,843 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Total capacity of our operating assets is 5,903 MW, and our share after accounting for our partners’ interests is 5,483 MW. |

| (2) | Long-term average is calculated on an annualized basis from the beginning of the year, regardless of the acquisition or commercial operation date. |

| (3) | Total long-term average of our operating assets is 22,342 GWh and, after accounting for our partners’ interests, is 21,617 GWh. |

1

Table of Contents

| (4) | Long-term average is the expected average level of generation, as obtained from the results of a simulation based on historical inflow data performed over a period of typically 30 years. In Brazil, assured generation levels are used as a proxy for long-term average. |

| (5) | Brazilian hydroelectric assets benefit from a market framework which levelizes generation risk across producers. |

Over the last ten years, we have acquired or developed approximately 160 hydroelectric assets totaling approximately 3,200 MW and 11 wind generating assets totaling approximately 950 MW. Since the beginning of 2013, we acquired or developed hydroelectric generating assets that have an installed capacity of 389 MW and 165 MW of wind generating assets. We also have strong organic growth potential with a 1,800 MW development pipeline spread across all of our operating jurisdictions. Our net asset value in renewable power has grown from approximately $900 million in 1999 to approximately $8.6 billion as at March 31, 2013, representing an 18% compounded annualized growth rate. We are able to acquire and develop assets due to our established operating and project development teams, strategic relationship with Brookfield and our strong liquidity and capitalization profile.

Our objective is to pay a distribution to our LP Unitholders that is sustainable on a long-term basis while retaining within our operations sufficient liquidity for recurring growth capital expenditures and general purposes. We currently have a target payout ratio of approximately 60% to 70% of funds from operations, which we believe provides us with significant flexibility and leaves us with sufficient retained cash to further invest in accretive projects or acquisitions. We further believe that this will allow us to pursue a long-term distribution growth rate target of 3% to 5% annually. We expect funds from operations to improve further in the long-term with the reinvestment of surplus cash flows. We intend to continue with a highly stable cash flow profile sourced from predominantly long-life hydroelectric assets, the vast majority of which sell electricity under long-term, fixed price contracts with creditworthy counterparties, including Brookfield, while supporting an attractive distribution yield and growth target.

We believe that our scale, significant capitalization and sound investment-grade ratings will continue to enhance our ability to secure and fund new transactions globally. As such, we believe we are well-positioned to be a premium vehicle for investors seeking to invest in the renewable power sector. Our LP Units are listed on the NYSE under the symbol “BEP” and the TSX under the symbol “BEP.UN”.

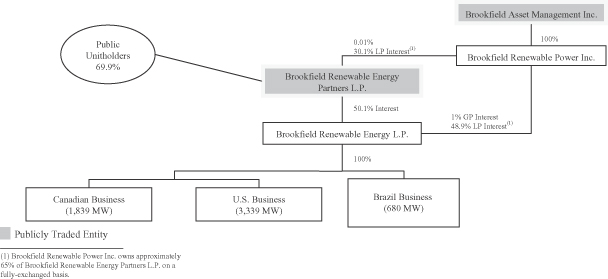

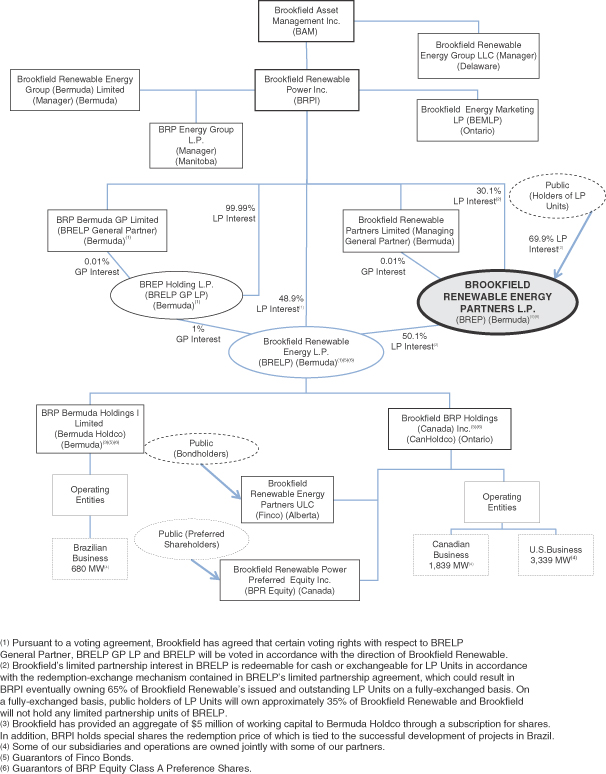

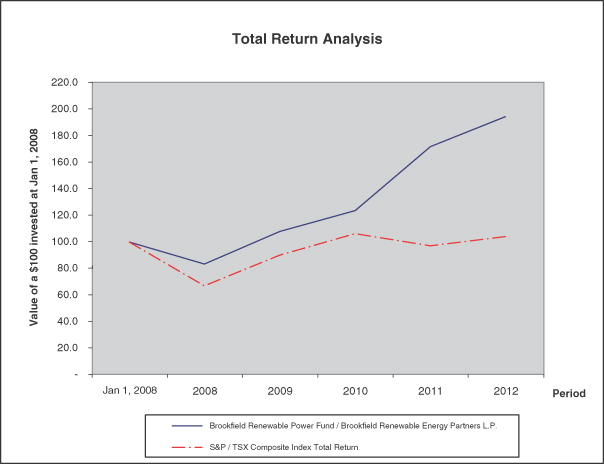

History and Development of Our Business

Brookfield Renewable was established to serve as the primary vehicle through which Brookfield will acquire renewable power assets on a global basis. Effective November 28, 2011, Brookfield Renewable Power Fund (the “Fund”) and Brookfield Asset Management’s directly-held power assets combined (the “Combination”), to form Brookfield Renewable. As a result of the Combination, all of the renewable power assets of the Fund, a publicly traded entity in Canada, and BRPI were combined and are now indirectly held by Brookfield Renewable through BRELP and BRELP’s subsidiaries. On completion of the Combination, public unitholders of the Fund received one LP Unit in exchange for each trust unit of the Fund held and the Fund was wound up. Prior to the Combination, Brookfield owned an approximate 34% interest in the Fund on a fully-exchanged basis. On completion of the Combination, Brookfield owned 73% of Brookfield Renewable on a fully-exchanged basis. Brookfield now owns 65% of Brookfield Renewable on a fully exchanged basis and the remaining 35% is held by public investors. After giving effect to this offering, Brookfield will own approximately 62% of Brookfield Renewable on a fully exchanged basis. See “Principal Unitholder”.

Recent Developments

In January 2013, BRP Equity, a wholly-owned finance subsidiary of Brookfield Renewable, issued 7,000,000 Series 5 Shares at C$25 per share for gross proceeds of C$175 million. The proceeds were used to, among other things, repay outstanding indebtedness and for general corporate purposes.

On March 1, 2013, Brookfield Renewable acquired a portfolio of hydroelectric generating stations in Maine (“White Pine”) from a subsidiary of NextEra Energy Resources, LLC, for a total enterprise value of

2

Table of Contents

approximately $760 million, subject to typical closing adjustments. The portfolio consists of 19 hydroelectric facilities and eight upstream storage reservoir dams primarily on the Kennebec, Androscoggin and Saco rivers in Maine, with an aggregate capacity of 360 MW and expected average annual generation of approximately 1.6 million MWh.

On March 13, 2013, a wholly-owned subsidiary of Brookfield sold 8,065,000 LP Units of Brookfield Renewable in Canada at an offering price of C$31.00 per LP Unit pursuant to a bought-deal secondary offering with a syndicate of underwriters.

On March 20, 2013, we acquired the remaining 50% interest held by our partner in Powell River Energy Inc., which operates a hydro facility consisting of two generating stations located in British Columbia, for C$33 million plus the assumption of related debt.

In May 2013, BRP Equity issued 7,000,000 Series 6 Shares at C$25 per share for gross proceeds of C$175 million (the “Series 6 Preferred Share Offering”). The proceeds were used to repay outstanding indebtedness and for general corporate purposes.

On June 11, 2013, our LP Units began trading on the NYSE.

As of June 17, 2013, seasonal inflows and wind conditions across the portfolio are expected to result in generation approximating long-term average (“LTA”) levels. Accordingly, Brookfield Renewable expects total generation in the second quarter of 2013 to approximate 6,151 GWh, as compared to LTA of 6,171 GWh, and generation of 4,101 GWh in the second quarter of 2012.

The table below summarizes expected generation by segment and region as at the date of this prospectus:

Preliminary Outlook – Q2 2013 Generation

| Generation (GWh) | Variance of Results | |||||||||||||||||||

| For the three months ended June 30 | Preliminary 2013 |

Actual 2012 |

LTA 2013 |

Preliminary 2013 vs. LTA |

Preliminary 2013 vs. Actual 2012 |

|||||||||||||||

| Hydroelectric generation |

||||||||||||||||||||

| United States |

2,820 | 1,619 | 2,829 | (9 | ) | 1,201 | ||||||||||||||

| Canada |

1,489 | 986 | 1,461 | 28 | 503 | |||||||||||||||

| Brazil(1) |

903 | 811 | 903 | — | 92 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 5,212 | 3,416 | 5,193 | 19 | 1,796 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Wind Energy |

||||||||||||||||||||

| United States |

439 | 221 | 468 | (29 | ) | 218 | ||||||||||||||

| Canada |

304 | 246 | 292 | 12 | 58 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| 743 | 467 | 760 | (17 | ) | 276 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other |

196 | 218 | 218 | (22 | ) | (22 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total generation(2) |

6,151 | 4,101 | 6,171 | (20 | ) | 2,050 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| — | 50 | % | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| (1) | In Brazil, assured generation levels are used as a proxy for long-term average. |

| (2) | Includes 100% of generation from equity-accounted investments. |

In the view of our management, the expected operational information above was prepared on a reasonable basis, reflects the best currently available estimates and judgments, and presents, to the best of management’s knowledge and belief, our expected generation for the second quarter of 2013. However, this information is not fact and no assurances can be given that our actual generation for the three months ended June 30, 2013 will not differ from these estimated amounts. Readers of this prospectus are cautioned not to place undue reliance on the

3

Table of Contents

estimates. These estimated amounts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These estimated amounts are preliminary, are based on management’s internal estimates and are subject to further internal review by management.

Our Relationship with Brookfield Asset Management

One of our principal attributes is our relationship with Brookfield, a global alternative asset manager with more than $175 billion in assets under management. It has over a 100-year history of owning and operating assets with a focus on property, renewable power, infrastructure and private equity. It has a range of public and private investment products and services, which leverage its expertise and experience and provide it with a distinct competitive advantage in the markets where it operates. Brookfield Asset Management is listed on the NYSE, TSX and NYSE Euronext under the symbol “BAM”, “BAM.A” and “BAMA”, respectively.

Brookfield was the manager and administrator of the Fund since its inception in 1999 and we continue to benefit from its global asset management platform and depth of experience in creating LP Unitholder value. In addition, Brookfield Renewable continues to benefit from the same management team at Brookfield who created and drove the success of the Fund. We are Brookfield’s primary vehicle through which it will acquire renewable power assets on a global basis and we benefit from its reputation and global platform to grow our business.

The Manager complements our operating platforms in three key areas:

| • | Executive oversight: The Manager provides leadership to our operating platforms and oversees the implementation of our annual and long-term operating plans, capital expenditure plans, and our power marketing plans to ensure compliance with our performance-based operating objectives and applicable laws. The Manager also oversees the implementation of our operational policies, and our management, accounting, regulatory reporting, legal and treasury functions. |

| • | Growth origination: We also benefit from the strategic advice, transaction origination capabilities and corporate development services of the Manager to grow our business. Brookfield Renewable benefits from the Manager’s renewable power acquisition experience focused in our target markets as well as market research capabilities that support evaluating opportunities to grow our business in our existing and new power markets. |

| • | Capital markets strategy: The Manager recommends and oversees the implementation of funding strategies for our existing business and in connection with our acquisitions or developments. In doing so, the Manager advises upon and assists in the execution of our equity or debt financings. The Manager also arranges for the preparation of our tax planning and filing of tax returns. |

4

Table of Contents

Industry Overview and Renewables Opportunity

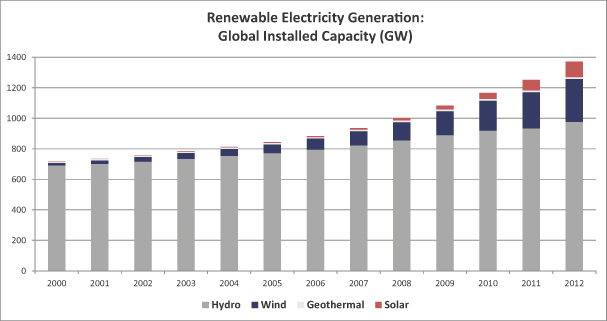

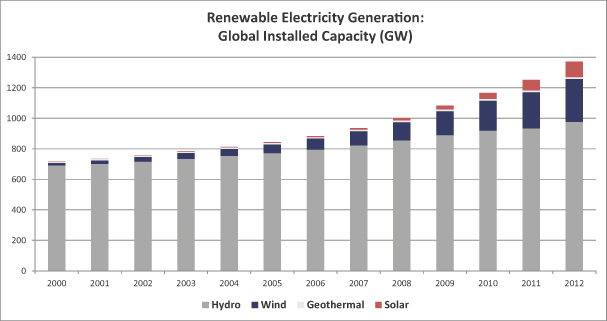

The renewable power generation sector is increasingly becoming a meaningful portion of new electricity supply globally. Significant new renewable generation supply continues to be built, consisting primarily of new hydro and wind capacity. Global installed renewable power now stands at over 1,300 GW worldwide, and the industry is adding in the range of 100 GW or $200 billion of new renewable power supply each year. The following chart illustrates the global growth in various renewable power generation sectors from 2000 to 2012.

| Source: | BP Statistical Review of World Energy (June 2013 Edition). |

We believe that, over time, strong continued growth in renewable power generation will be driven by the following:

| • | Conventional coal and nuclear generation face challenges. The continued reliance on large-scale coal and nuclear facilities is causing concern with power system regulators and the general public. Coal plants are increasingly facing legislative pressures to undertake significant environmental compliance expenditures. This in turn is accelerating the retirement of coal plants, which need to be replaced by new capacity. Following the Fukushima nuclear disaster in Japan, and in light of ongoing cost uncertainties and concern over waste disposal, public concern over new nuclear construction and continued life extension of existing facilities has increased. This has delayed or halted most new nuclear development activities in the United States and has even caused some countries, despite relying on meaningful nuclear power, to legislate the early retirement of existing nuclear capacity. |

| • | Renewables are a cost-effective way of diversifying fuel risk. The abundance of low cost natural gas in North America presents a unique opportunity to replace aging coal and nuclear facilities with a domestic fuel source that is cost-effective and has a lower environmental impact. We expect the desire to diversify fuel sources and the exposure to potentially rising and volatile natural gas prices will increase the demand for renewable technologies, particularly hydroelectric and wind energy. In addition, technological developments over the last decade continue to reduce the costs of renewable |

5

Table of Contents

| technologies enhancing their position as a cost competitive complement to gas-fired generation and a means to meeting more stringent environmental standards. |

| • | Supported by government policies. There are a number of strategies that governments are using to encourage development of renewable power resources which generally include renewable portfolio standards (“RPS”) (requiring electricity distributors to obtain a minimum percentage of their power from renewable energy resources by specified target dates) and, in certain cases, tax incentives or subsidies. Globally, at least 64 countries, including all 27 European Union countries, have national targets for renewable energy supply, and 37 U.S. states, the District of Columbia, Puerto Rico and nine Canadian provinces have RPS or policy goals that require load-serving utilities to offer long-term power purchase contracts for new renewable supply. |

| • | Widespread acceptance of climate change. Over the last five years, it has become generally accepted that the combustion of fossil fuels contributes to global warming. In 2007, the Intergovernmental Panel on Climate Change (“IPCC”) released a series of four reports to build awareness of climate change and observed that average temperatures in the world’s northern hemisphere were likely the highest in at least the past 1,300 years, and in 2005, atmospheric concentrations of carbon dioxide exceeded by far the natural range over the last 650,000 years. According to the IPCC, the ramifications of global warming for society are significant. As the electricity sector is one of the largest contributors to carbon dioxide emissions globally we have observed that universal concern about global warming has become a catalyst for governments to take environmental policy action, often through legislation of renewable power procurement targets or implementation of feed-in tariffs. |

Our Competitive Strengths

We are an owner and operator of a diversified portfolio of high quality assets that produce electricity from renewable resources and have evolved into one of the world’s largest listed pure-play renewable power businesses.

Our assets generate high quality, stable cash flows derived from a nearly fully contracted portfolio. Our business model is simple: utilize our global reach to identify and acquire high quality renewable power assets at favorable valuations, finance them on a long-term, low-risk basis, and enhance the cash flows and values of these assets using our experienced operating teams to earn reliable, attractive, long-term total returns for the benefit of our LP Unitholders.

| • | One of the largest, listed pure-play renewable platforms. We own one of the world’s largest, publicly-traded, pure-play renewable power portfolios with $17 billion in power generating assets, approximately 5,900 MW of installed capacity and long-term average generation of approximately 22,200 GWh annually. Our portfolio includes 196 hydroelectric generating stations on 70 river systems and 11 wind facilities, diversified across 12 power markets in the United States, Canada and Brazil. |

6

Table of Contents

| • | Focus on attractive hydroelectric asset class. Our assets are predominantly hydroelectric and represent one of the longest life, lowest cost and most environmentally preferred forms of power generation. Our North American assets have the ability to store water in reservoirs approximating 32% of our annual generation. Our assets in Brazil benefit from a framework that exists in the country to levelize generation risk across producers. This ability to store water and have levelized generation in Brazil provides partial protection against short-term changes in water supply. As a result of our scale and the quality of our assets, we are competitively positioned compared to other listed renewable power platforms, providing significant scarcity value to investors. |

| • | Well positioned for global growth mandate. Over the last ten years, we have acquired or developed approximately 160 hydroelectric assets totaling approximately 3,200 MW and 11 wind generating assets totaling approximately 950 MW. Since the beginning of 2013, we acquired or developed hydroelectric generating assets that have an installed capacity of 389 MW and 165 MW of wind generating assets. We also have strong organic growth potential with a 1,800 MW development pipeline spread across all of our operating jurisdictions. Our net asset value in renewable power has grown from approximately $900 million in 1999 to approximately $8.6 billion as at March 31, 2013, representing an 18% compounded annualized growth rate. We are able to acquire and develop assets due to our established operating and project development teams, strategic relationship with Brookfield and our strong liquidity and capitalization profile. |

| • | Attractive distribution profile. We pursue a strategy which we expect will provide for highly stable, predictable cash flows sourced from predominantly long-life hydroelectric assets ensuring an attractive distribution yield. We target a distribution payout ratio in the range of approximately 60% to 70% of funds from operations and pursue a long-term distribution growth rate target in the range of 3% to 5% annually. |

| • | Stable, high quality cash flows with attractive long-term value for LP Unitholders. We intend to maintain a highly stable, predictable pricing profile sourced from a diversified portfolio of low operating cost, long-life hydroelectric and wind power assets that sell electricity under long-term, fixed price contracts with creditworthy counterparties. Over 90% of our generation output is sold pursuant to PPAs to public power authorities, load-serving utilities, industrial users or to affiliates of Brookfield Asset Management. The PPAs for our assets have a weighted-average remaining duration of 20 years, providing long-term cash flow stability. |

| • | Strong financial profile. With $17 billion of power generating assets and a conservative leverage profile, consolidated debt-to-capitalization is approximately 41%. Our liquidity position remains strong with $680 million of cash and unutilized portion of committed bank lines as of May 10, 2013, the date of our most recent Interim Report. Approximately 72% of our borrowings are non-recourse to Brookfield Renewable. Our corporate borrowings and subsidiary borrowings have a weighted-average term of approximately nine and 13 years, respectively. |

Revenue and Cash Flow Profile

We believe that our portfolio offers high quality cash flows derived from predominantly hydroelectric assets. Our cash flow profile, which we believe will be highly stable and predictable, is derived from the combination of long-term, fixed price contracts, a unique hydro-focused portfolio with a low cost structure, and a prudent financing strategy focused on non-recourse debt with an investment grade balance sheet. Accordingly, we believe that we have a high degree of predictability in respect of revenue and costs on a per MWh basis.

We expect our current business to generate approximately $1.2 billion of Adjusted EBITDA and $575 million of funds from operations, annually, based on long-term average generation; however, we can provide no assurance that we will achieve such results in the near- or long-term. Our ability to achieve the results based on

7

Table of Contents

long-term average is dependent on various risks and uncertainties that our operations face, many of which are beyond our control. Some of these risks and uncertainties include hydrology or wind conditions at our facilities, and the risk that counterparties to our contracts may not fulfill their obligations.

Our Adjusted EBITDA and funds from operations for the three months ended March 31, 2013 totaled $319 million and $162 million, respectively. For the three months ended March 31, 2012, our Adjusted EBITDA and funds from operations totaled $318 million and $175 million, respectively.

| Hydroelectric | Wind energy | Other | Total | |||||||||||||||||||||||||

| (MILLIONS) |

U.S. | Canada | Brazil | U.S. | Canada | |||||||||||||||||||||||

| For the three months ended March 31, 2013: |

||||||||||||||||||||||||||||

| Revenues(1) |

$ | 185 | $ | 94 | $ | 75 | $ | 23 | $ | 40 | $ | 20 | $ | 437 | ||||||||||||||

| Adjusted EBITDA(2) |

143 | 78 | 55 | 14 | 35 | (6 | ) | 319 | ||||||||||||||||||||

| Funds from operations(2) |

82 | 62 | 42 | 1 | 21 | (46 | ) | 162 | ||||||||||||||||||||

| For the three months ended March 31, 2012: |

||||||||||||||||||||||||||||

| Revenues(1) |

$ | 164 | $ | 100 | $ | 91 | $ | 7 | $ | 44 | $ | 20 | $ | 426 | ||||||||||||||

| Adjusted EBITDA(2) |

130 | 83 | 68 | 5 | 39 | (7 | ) | 318 | ||||||||||||||||||||

| Funds from operations(2) |

83 | 66 | 30 | 2 | 29 | (35 | ) | 175 | ||||||||||||||||||||

| (1) | Based on unaudited consolidated financial data which is derived from and should be read in conjunction with unaudited consolidated financial statements of Brookfield Renewable as at and for the three months ended March 31, 2013 and 2012. |

| (2) | Non-IFRS measures. See “Cautionary Statement Regarding the Use of Non-IFRS Measures”. |

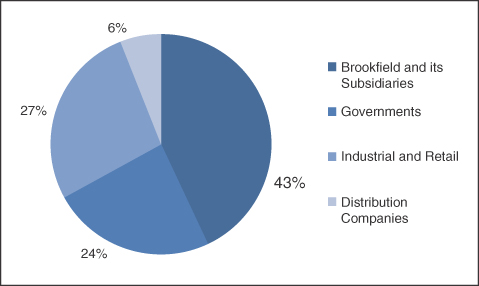

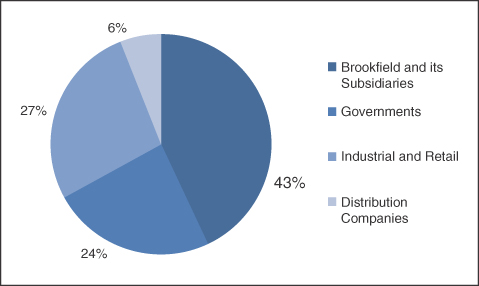

We typically maintain a predictable pricing profile based on long-term PPAs. Our current revenue profile is supported by PPAs with a weighted average remaining duration of 20 years for over 90% of our total generation. These contracts, combined with a well-diversified portfolio, reduce variability in our generation volumes and enhance the stability of our cash flow profile. The majority of our long-term PPAs are with investment-grade rated or creditworthy counterparties. As outlined in the graph below, the vast majority of our long-term PPA counterparties are government-owned utilities or power authorities, Brookfield or industrial power users.

8

Table of Contents

As at March 31, 2013, Brookfield Renewable had contracted 91% of the balance of 2013 generation at an average price of $82 per MWh. The following table sets out contracts as at March 31, 2013 over the next five years for generation from existing facilities as of that date, assuming long-term average hydrology and wind conditions:

| Balance of 2013 |

2014 | 2015 | 2016 | 2017 | ||||||||||||||||

| Contracted generation(1) |

||||||||||||||||||||

| % of total generation |

91 | 84 | 78 | 77 | 74 | |||||||||||||||

| % of total generation on a proportionate basis(2) |

92 | 90 | 85 | 84 | 81 | |||||||||||||||

| (1) | Assets under construction are included when long-term average and pricing details are available and the commercial operations date is established in a definitive construction contract. Figures assume no recontracting. |

| (2) | Long-term average on a proportionate basis includes wholly-owned assets and our share of partially-owned assets and equity-accounted investments. |

As of March 31, 2013, over the next three years Brookfield Renewable has an average annual generation of 3,157 GWh which is uncontracted. A significant portion of our uncontracted generation is located in the eastern United States and was acquired in the last six months. We have been able to acquire long-life hydroelectric facilities at values which reflect the current low commodity price environment and which may provide meaningful upside optionality if energy prices increase. All of this energy can be sold into the current wholesale or bilateral market, however we intend to maintain flexibility in re-contracting to position ourselves to achieve the most optimal pricing.

Our portfolio benefits from significant hydrology diversification, with assets distributed on 70 river systems in three countries. Our water storage capabilities and our access to the hydrological balancing pool administered by the government of Brazil amount to approximately 37% of annual generation, allowing us to mitigate hydrological fluctuations, optimize production and minimize losses due to outages.

North America. In North America, we generate revenues primarily through energy sales by way of long-term PPAs with creditworthy counterparties such as government-owned entities or power authorities (including for example, the Ontario Power Authority, Ontario Electricity Financial Corporation, Hydro-Québec, BC Hydro and the Long Island Power Authority), load-serving utilities (such as Entergy Louisiana), Brookfield and its subsidiaries, and in some cases industrial power users. Currently, our North American portfolio is largely contracted pursuant to long-term PPAs that are generally structured on a “take or pay” basis without fixed or minimum volume commitments. As a result, there is minimal risk of having to supply power from the market to customers when we are experiencing low water or wind conditions. Most of our PPAs also provide for annual escalation of the realized price, typically linked to inflation. In respect of power sold to Brookfield, Brookfield will in some cases have entered into back to back power resale agreements in respect to output purchased from Brookfield Renewable Group (see “Business — The Manager — Energy Marketing”).

Brazil. In the Brazilian electricity market, energy is typically sold under long-term contracts either to regulated load-serving distribution companies, which are customers with more than 0.5 MW of annual demand and who can choose their own electricity supplier (“free customers”). Both types of customers are required to demonstrate that they have contracts in place to meet all forecast demand annually. In the regulated market, Brookfield has typically entered into 20-30 year PPAs with creditworthy state-owned utilities. In the “free customer” market, Brookfield has typically entered into three to eight year PPAs with large industrial and commercial customers, generally engaged in producing essential services or products such as the telephone, food and pharmaceutical industries. Our PPAs in Brazil typically provide a fixed price that is fully indexed to inflation annually. Brazil has recently experienced significant dry conditions in its largely hydroelectric based system.

9

Table of Contents

This trend, combined with the growing demand and the requirement to dispatch higher cost thermal facilities, has put upward pressure on power prices. Our Brazilian portfolio has a weighted average remaining contract term of nine years and we believe that it is well positioned to capitalize on market opportunities in the medium term as 18% of the portfolio is scheduled to be re-contracted in 2014 and a further 37% is scheduled to be re-contracted in 2015.

Our Growth Strategy

We expect to continue focusing primarily on long-life renewable power assets that provide stable, long-term contracted cash flows, and which are well positioned to appreciate in value over time. We intend to combine our industry, operating, development and transaction expertise with our ability to commit capital to transactions in order to secure opportunities at attractive returns for securityholders. To grow Brookfield Renewable, we benefit from a proactive and focused business development strategy in each of our markets and Brookfield’s global investment platform that may lead to originating attractive opportunities for investment. We expect that our growth will be focused on the following:

| • | Focusing on core markets and pursuing opportunities in other high-value markets. Geographically, we expect to continue our growth in the United States, Canada and Brazil, where our existing renewable power operating platforms allow us to efficiently integrate operating or development-stage renewable power assets and capture economies of scale. Within each of these countries, our growth strategy is focused on the higher-value regional electricity markets. For example, in the United States, our strategy is to continue our growth in the eastern and western power markets, where higher electricity prices and renewable portfolio standards offer more attractive returns and better long-term value. Similarly in Brazil, our operations and growth objectives are focused on the southern and mid-western portion of the country where over 60% of the population and over 80% of economic activity is located. Over time, we would also pursue new markets that offer attractive opportunities to enhance the geographic diversifications of our operations, the ability to add operating platforms that we can grow over time and offer attractive risk-adjusted returns. We have access to Brookfield’s infrastructure investment platforms in Europe and Australasia, giving us the capability to secure transactions globally. |

| • | Maintaining our predominantly hydroelectric focus. We intend to maintain our predominantly hydroelectric focus as we believe hydroelectric assets are the longest-life, lowest cost, power generation assets. We believe that investing in the highest quality assets within a particular asset class offers an investment that typically can maintain a premium valuation and funds from operations performance throughout market cycles, and is better positioned to appreciate in value over time. We believe hydroelectric assets are the most attractive segment of the power generation infrastructure asset class as they benefit from high barriers to entry and a sustainable competitive cost advantage. In addition, wind power is a proven technology and one of the fastest growing renewable power segments globally. Also, we plan to grow our wind platform by continuing to focus on high-quality sites that benefit from a proven wind resource and are located in high-value markets where wind has significant scarcity value. Over time, we may invest in other proven renewable power technologies that share the long-life and low-cost attributes of our hydroelectric and wind assets. |

| • | Optimizing capital allocation to “build or buy” opportunities. We intend to grow our business by pursuing the acquisition of both operating and development-stage assets, or by developing and building projects from our own development project portfolio. Market conditions in some cases lead to periods where operating assets are valued at significant premiums or discounts to their replacement cost or long-term fundamental value. Similarly, renewable power policy may at certain times be particularly conducive to new developments, leading to opportunities to earn superior risk-adjusted returns by developing and building greenfield projects. For this reason, we believe a sound investment and capital |

10

Table of Contents

| allocation strategy continuously compares acquisition or “buy” investment opportunities with similar development-stage or “build” opportunities, whether sourced from our own development pipeline or through the acquisition of development-stage projects. We plan to allocate capital to the best acquisition and development opportunities sourced through our global renewable power platform and believe our ability to do so globally is one of our competitive advantages in creating value for our LP Unitholders. While we intend to pursue development projects, we expect that our development-stage capital commitments will be a relatively small portion of our cash flows and invested capital as our predominant focus will be on sites with significant competitive advantage in high-value markets that we would build once the project is “construction-ready” and that benefit from sound commercial arrangements that limit construction risk and secures long-term stable cash flows. |

Our Growth Opportunity

We believe that the current transaction environment offers attractive acquisition opportunities to invest in renewable power acquisitions or developments that we expect will allow us to deploy capital, on an accretive basis, in the following opportunities:

| • | Asset monetizations and divestitures. Significant renewable power generation capacity is owned by industrial companies, smaller independent power producers, private equity investors or foreign companies. These types of owners sell renewable power assets either because power generation is not their core business, their investment horizons are shorter, or a particular market ceases to be strategic. |

| • | Privatizations. We believe that in the current fiscal climate, governments will continue to engage the private sector in providing funding solutions for infrastructure requirements which could increasingly involve sales of existing assets. Our proven operating track record, global scale and ability to partner with local pension and institutional investors may better competitively position us to participate in such opportunities. |

| • | Development cycle divestitures. Renewable power assets are often developed or built by smaller developers or construction companies who, in our experience, seek to capture development-stage returns. We have been, and believe will continue to be, a logical acquirer of, or partner in, such projects. Our focus on acquisitions in this area also gives us a unique perspective on pursuing the best development-stage opportunities through acquisitions or by building projects in our own portfolio. |

| • | Brookfield Renewable Group’s development project portfolio. In addition to growing our business through acquisitions, we intend to pursue organic growth by developing our portfolio of greenfield projects. We indirectly own over 25 development projects in Brazil, Canada and the United States totaling an estimated 1,800 MW of potential capacity. See “Certain Relationships and Related Party Transactions — Development Projects”. Over the past ten years, Brookfield has completed or commenced construction on approximately 21 development projects totaling an aggregate of over 1,000 MW of capacity giving us a successful execution track record in each of our focus markets as a developer of both hydroelectric and wind capacity. Our regional operating platforms have the development expertise and capability to advance our renewable power projects from the development stage to commercial operation. We also have the necessary expertise to oversee the regulatory, engineering, construction execution, transmission, permitting, licensing, environmental and legal activities required for successful project development. |

11

Table of Contents

Risk Factors

Investing in our LP Units entails a high degree of risk as more fully described in the “Risk Factors” section of this prospectus. You should carefully consider such risks before deciding to invest in our LP Units. These risks include, among others, that:

| • | changes to hydrology at our hydroelectric stations or in wind conditions at our wind energy facilities could materially adversely affect the volume of electricity generated; |

| • | counterparties to our contracts may not fulfill their obligations and, as our contracts expire, we may not be able to replace them with agreements on similar terms; |

| • | increases in water rental costs (or similar fees) or changes to the regulation of water supply may impose additional obligations on Brookfield Renewable; |

| • | supply and demand in the energy market, including the non-renewable energy market, is volatile and such volatility could have an adverse impact on electricity prices and a material adverse effect on Brookfield Renewable’s assets, liabilities, business, financial condition, results of operations and cash flow; |

| • | our operations are highly regulated and may be exposed to increased regulation which could result in additional costs to Brookfield Renewable; |

| • | there is a risk that our concessions and licenses will not be renewed; |

| • | the cost of operating our plants could increase for reasons beyond our control; |

| • | we may fail to comply with the conditions in, or may not be able to maintain, our governmental permits; |

| • | we may experience equipment failure; |

| • | the occurrence of dam failures could result in a loss of generating capacity and repairing such failures could require us to expend significant amounts of capital and other resources; |

| • | our ability to finance our operations is subject to various risks relating to the state of the capital markets; and |

| • | we are subject to operating and financial restrictions through covenants in our loan, debt and security agreements. |

Corporate and Other Information

Brookfield Renewable is a Bermuda exempted limited partnership that was established on June 27, 2011 under the provisions of the Exempted Partnerships Act 1992 of Bermuda and the Limited Partnership Act 1883 of Bermuda. Our registered and head office is 73 Front Street, 5th Floor, Hamilton HM 12, Bermuda, and the telephone number is +1.441.295.1443. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it a part of this prospectus.

12

Table of Contents

SUMMARY TERMS OF THE OFFERING

The summary below describes the principal terms of this offering. The “Amended and Restated Limited Partnership Agreement of BREP” section of this prospectus contains a more detailed description of our LP Units.

LP Units offered by us

12,178,785 LP Units

| LP Units to be outstanding immediately after this offering |

274,775,277 LP Units issued and outstanding on a fully-exchanged basis, assuming no exercise of the Over-Allotment Option. |

| 276,602,095 LP Units issued and outstanding on a fully-exchanged basis, assuming full exercise of the Over-Allotment Option. |

Use of Proceeds

We intend to use the proceeds of this offering to repay outstanding indebtedness (which may include indebtedness outstanding under the Credit Facilities) and for general corporate purposes. See “Use of Proceeds”.

Voting Rights

Our LP Unitholders do not have a right to vote on Brookfield Renewable matters or to take part in the management of Brookfield Renewable. See “Amended and Restated Limited Partnership Agreement of BREP”.

Distribution Policy

We target a distribution payout ratio in the range of approximately 60% to 70% of funds from operations (“FFO”) and intend to pursue a long-term distribution growth rate target of 3% to 5% annually. See “Distribution Policy.”

| Material U.S. Federal Tax Considerations |

Investors in this offering will become limited partners of Brookfield Renewable. As discussed in “Tax Considerations — Material U.S. Federal Income Tax Considerations”, Brookfield Renewable will be treated as a partnership and not as a corporation for U.S. federal income tax purposes. An entity that is treated as a partnership for U.S. federal income tax purposes is not a taxable entity and incurs no U.S. federal income tax liability. Instead, each partner is required to take into account its allocable share of items of income, gain, loss and deduction of the partnership in computing its U.S. federal income tax liability, regardless of whether or not cash distributions are then made. Accordingly, an investor in this offering will generally be required to pay U.S. federal income taxes with respect to the income and gain of Brookfield Renewable that is allocated to such investor, even if Brookfield Renewable does not make cash distributions. See “Tax Considerations — Material U.S. Federal Income Tax Considerations” for a summary discussing certain U.S. federal income tax considerations related to the purchase, ownership and disposition of our LP Units as of the date of this prospectus. |

| Material Canadian Federal Tax Considerations |

Investors in this offering will become limited partners of Brookfield Renewable. Generally, as a partnership, Brookfield Renewable will incur no Canadian federal income tax liability, other than Canadian federal withholding taxes. A Canadian resident partner must report in its Canadian federal income tax return, and will be subject to |

13

Table of Contents

| Canadian federal income tax in respect of its share of each item of Brookfield Renewable’s income, gain, loss, deduction and credit for each fiscal period of Brookfield Renewable ending in or coincidentally with, its taxation year, even if the partner receives no distributions from Brookfield Renewable in such taxation year. Investors who are resident in Canada should refer to “Tax Considerations — Material Canadian Federal Income Tax Considerations — Holders Resident in Canada” for a summary discussing certain Canadian federal income tax consequences to them of the acquisition, holding and disposition of our LP Units. |

Investors who are not resident in Canada should refer to “Tax Considerations — Material Canadian Federal Income Tax Considerations — Holders Not Resident in Canada” for a summary discussing certain Canadian federal income tax consequences to them of the acquisition, holding and disposition of our LP Units.

NYSE Symbol

“BEP”

TSX Symbol

“BEP.UN”

Risk Factors

Investing in our LP Units involves substantial risks. See

“Risk Factors” for a description of certain of the risks you should consider before investing in our LP Units.

14

Table of Contents

Summary Historical Consolidated Financial and Other Data

The 2013, 2012, 2011 and 2010 information in this section, excluding the Operational Information and distributions per share set forth in the tables below, is derived from and should be read in conjunction with: (i) the unaudited consolidated financial statements of Brookfield Renewable as at March 31, 2013 and for the three months ended March 31, 2013 and 2012 and related notes, (ii) the audited consolidated financial statements of Brookfield Renewable as at and for the years ended December 31, 2012, 2011 and 2010 and related notes, and (iii) the unaudited pro forma condensed combined statement of (loss) income of Brookfield Renewable for the year ended December 31, 2011 and related notes, each of which is included elsewhere in this prospectus. The 2009 information in this section, excluding the Operational Information set forth in the tables below, is derived from the audited consolidated financial statements of Brookfield’s renewable power division (a division of BRPI) as at and for the year ended December 31, 2009, which are not included in this prospectus. The results of operations for the three months ended March 31, 2013 are not necessarily indicative of the results that can be expected for the full year or any future period. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

We are providing unaudited pro forma financial results that include the impact of the Combination, new contracts and contract amendments, management service agreements along with the tax impacts resulting from the Combination, as if each had occurred as of January 1, 2011. The unaudited pro forma financial results have been prepared based upon currently available information and assumptions considered appropriate by management. The unaudited pro forma financial results are provided for information purposes only and may not be indicative of the results that would have occurred had the above transactions been effected on the date indicated. The accounting for certain of the Combination transactions in the audited consolidated financial statements of Brookfield Renewable for the year ended December 31, 2011 required the determination of fair value estimates at the date of the transaction on November 28, 2011 rather than the date assumed in the determination of the pro forma results of January 1, 2011. Capacity, long-term average and actual generation include facilities acquired or commissioned during the respective period ends. Long-term average and actual generation was calculated from the acquisition date or the commercial operation date, whichever is later.

15

Table of Contents

The following tables present consolidated financial data for Brookfield Renewable as at and for the periods indicated:

|

As at and for the three |

As at and for the year ended December 31,(2)(3) |

|||||||||||||||||||||||

| (US$ millions, unless otherwise stated) |

2013 | 2012 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||

| Operational Information(1): |

||||||||||||||||||||||||

| Capacity (MW) |

5,858 | 4,909 | 5,304 | 4,536 | 4,309 | 4,198 | ||||||||||||||||||

| Long-term average (GWh) |

5,325 | 4,549 | 18,202 | 16,297 | 15,887 | 15,529 | ||||||||||||||||||

| Actual generation (GWh) |

5,535 | 4,817 | 15,942 | 15,877 | 14,480 | 15,833 | ||||||||||||||||||

| Average revenue per MWh |

79 | 88 | 82 | 74 | 72 | 62 | ||||||||||||||||||

| Selected Financial Information: |

||||||||||||||||||||||||

| Revenues |

$ | 437 | $ | 426 | $ | 1,309 | $ | 1,169 | $ | 1,045 | $ | 984 | ||||||||||||

| Adjusted EBITDA(4) |

319 | 318 | 852 | 804 | 751 | 743 | ||||||||||||||||||

| Funds from operations(4) |

162 | 175 | 347 | 332 | 269 | 324 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | 85 | $ | 31 | $ | (95 | ) | $ | (451 | ) | $ | 294 | $ | (580 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Distributions per share |

||||||||||||||||||||||||

| Preferred equity(5) |

0.30 | 0.33 | 1.27 | 1.34 | 1.03 | |||||||||||||||||||

| General Partnership interest in a holding subsidiary held by Brookfield |

0.36 | 0.35 | 1.38 | 0.34 | — | |||||||||||||||||||

| Participating non-controlling interests — in a holding subsidiary — Redeemable/Exchangeable partnership units held by Brookfield |

0.36 | 0.35 | 1.38 | 0.34 | — | |||||||||||||||||||

| Limited Partners’ equity |

0.36 | 0.35 | 1.38 | 0.34 | — | |||||||||||||||||||

| (1) | Includes 100% of generation from equity-accounted investments. |

| (2) | The 2011 balance sheet reflects changes in the accounting policy for construction work-in-progress. See note 2 in the audited consolidated financial statements of Brookfield Renewable as at and for the three years ended December 31, 2012, 2011 and 2010 included elsewhere in this prospectus. |

| (3) | The 2011 results reflect changes arising from the Combination. See notes 2, 8, 10 and 18 in the audited consolidated financial statements of Brookfield Renewable as at and for the three years ended December 31, 2012, 2011 and 2010 included elsewhere in this prospectus. |

| (4) | Non-IFRS measures. See “Cautionary Statement Regarding the Use of Non-IFRS Measures”. |

| (5) | Represents the weighted-average distribution to the Series 1 Shares, Series 3 Shares and Series 5 Shares, where applicable. |

16

Table of Contents

The following tables provides a summary of the key items on the consolidated balance sheet as at the dates indicated:

| As at March 31, |

As at December 31, |

|||||||||||||||||||

| (US$ millions, unless otherwise stated) |

2013 | 2012 | 2012 | 2011 | 2010 | |||||||||||||||

| Restated(3) | ||||||||||||||||||||

| Property, plant and equipment at fair value |

$16,813 | $ | 15,658 | $ | 15,658 | $ | 13,945 | $ | 12,173 | |||||||||||

| Equity-accounted investments |

326 | 344 | 344 | 405 | 269 | |||||||||||||||

| Total assets |

18,268 | 16,925 | 16,925 | 15,708 | 13,874 | |||||||||||||||

| Long-term debt and credit facilities |

7,230 | 6,119 | 6,119 | 5,519 | 4,994 | |||||||||||||||

| Fund unit liability |

— | — | — | — | 1,355 | |||||||||||||||

| Preferred equity |

659 | 500 | 500 | 241 | 252 | |||||||||||||||

| Participating non-controlling interests — in operating subsidiaries |

1,027 | 1,028 | 1,028 | 629 | 206 | |||||||||||||||

| General partnership interest in a holding subsidiary held by Brookfield |

62 | 63 | 63 | 64 | 34 | |||||||||||||||

| Participating non-controlling interests — in a holding subsidiary — Redeemable/Exchangeable partnership units held by Brookfield |

3,041 | 3,070 | 3,081 | 3,097 | 1,649 | |||||||||||||||

| Limited partners’ equity |

3,117 | 3,147 | 3,158 | 3,169 | 1,689 | |||||||||||||||

| Total liabilities and equity |

18,268 | 16,925 | 16,925 | 15,708 | 13,784 | |||||||||||||||

| Net asset value(1) |

8,647 | 8,548 | 8,579 | 8,398 | 7,480 | |||||||||||||||

| Net asset value per LP Unit(1)(2) |

32.60 | 32.23 | 32.35 | 31.67 | 28.21 | |||||||||||||||

| Debt to total capitalization(1) |

41 | % | 38 | % | 38 | % | 37 | % | 40 | % | ||||||||||

| (1) | Non-IFRS measures. See “Cautionary Statement Regarding the Use of Non-IFRS Measures”. |

| (2) | Average LP Units outstanding during the period totaled 132.9 million, (2010 and 2011: 132.8 million). |

| (3) | See note 2(c) to the unaudited consolidated financial statements as at and for the three months ended March 31, 2013 and 2012. |

17

Table of Contents

The following table reflects the Adjusted EBITDA, funds from operations and the reconciliation to net income (loss) for the periods indicated:

| For the |

For the year ended December 31, | |||||||||||||||||||||||

| (US$ millions, unless otherwise stated) |

2013 | 2012 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||

| Generation (GWh) (1) |

5,535 | 4,817 | 15,942 | 15,877 | 14,480 | 15,833 | ||||||||||||||||||

| Revenues |

$437 | $426 | $1,309 | $1,169 | $1,045 | $984 | ||||||||||||||||||

| Other income |

2 | 5 | 16 | 19 | 12 | 9 | ||||||||||||||||||

| Share of cash earnings from equity-accounted investments and long-term investments |

6 | 4 | 13 | 23 | 22 | 29 | ||||||||||||||||||

| Direct operating costs |

(126) | (117) | (486) | (407) | (328) | (279) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA (2) |

319 | 318 | 852 | 804 | 751 | 743 | ||||||||||||||||||

| Interest expense - borrowings |

(102) | (110) | (411) | (411) | (404) | (348) | ||||||||||||||||||

| Management service costs |

(12) | (7) | (36) | (1) | — | — | ||||||||||||||||||

| Current income taxes |

(3) | (6) | (14) | (8) | (32) | (23) | ||||||||||||||||||

| Cash portion of non-controlling interests |

(40) | (20) | (44) | (52) | (46) | (48) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Funds from operations (2) |

162 | 175 | 347 | 332 | 269 | 324 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cash portion of non-controlling interests included in funds from operations |

40 | 20 | 44 | 52 | 46 | 48 | ||||||||||||||||||

| Other items: |

||||||||||||||||||||||||

| Depreciation and amortization |

(128) | (126) | (483) | (468) | (446) | (321) | ||||||||||||||||||

| Unrealized financial instrument (losses) gains |

16 | (9) | (23) | (20) | 584 | (791) | ||||||||||||||||||

| Fund unit liability revaluation |

— | — | — | (376) | (159) | (244) | ||||||||||||||||||

| Share of non-cash losses from equity-accounted investments |

(2) | (3) | (18) | (13) | (7) | (13) | ||||||||||||||||||

| Deferred income tax recovery |

(1) | (13) | 54 | 50 | 3 | 335 | ||||||||||||||||||

| Other |

(2) | (13) | (16) | (8) | 4 | 82 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net (loss) income |

$85 | $31 | $(95) | $(451) | $294 | $(580) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net (loss) income attributable to: |

||||||||||||||||||||||||

| Preferred equity |

$7 | $3 | $16 | $13 | $10 | $— | ||||||||||||||||||

| Participating non-controlling interests — in operating subsidiaries |

16 | (1) | (40) | 11 | 25 | 28 | ||||||||||||||||||

| General partnership interest in a holding subsidiary held by Brookfield |

1 | — | (1) | (5) | 3 | (6) | ||||||||||||||||||

| Participating non-controlling interests — in a holding subsidiary — Redeemable/Exchangeable partnership units held by Brookfield |

30 | 14 | (35) | (232) | 127 | (297) | ||||||||||||||||||

| Limited partners’ equity |

31 | 15 | (35) | (238) | 129 | (305) | ||||||||||||||||||

| Basic and diluted earnings (loss) per LP Unit(3) |

$0.23 | $0.11 | $(0.26) | $(1.79) | $0.97 | $(2.29) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Variations in generation are described under Item 5.A “Operating Results — Segmented Disclosures.” |

| (2) | Non-IFRS measures. See “Cautionary Statement Regarding the Use of Non-IFRS Measures”. |

| (3) | Average LP Units outstanding during the period totaled 132.9 million, (2009 to 2011: 132.8 million). |

Brookfield Renewable has not included financial information for the year ended December 31, 2008, as such information is not available on a basis consistent with the consolidated financial information for the years ended December 31, 2012, 2011, 2010 and 2009 and cannot be provided on an IFRS basis without unreasonable effort or expense.

18

Table of Contents

An investment in our LP Units involves a high degree of risk. Prior to investing in our LP Units, we encourage each prospective investor to carefully read this entire prospectus, including, without limitation, the following risk factors and the section of this prospectus entitled “Cautionary Note Regarding Forward-Looking Statements.” You should carefully consider the following factors in addition to the other information set forth in this prospectus. If any of the following risks actually occur, our business, financial condition, results of operations and prospects could be adversely affected and the value of our LP Units would likely decline, and you could lose all or part of your investment.

Risks Related to Brookfield Renewable