UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

Or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices and Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| The |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). ☐ Yes

The aggregate market value of the registrant’s common stock,

$0.0001 par value per share (“Common Stock”), held by non-affiliates of the registrant, based on the closing sale price

of the registrant’s Common Stock on June 30, 2023, was approximately $

As of March 15, 2024, the registrant had shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

PHIO PHARMACEUTICALS CORP.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2023

| i |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “intends,” “believes,” “anticipates,” “indicates,” “plans,” “expects,” “suggests,” “may,” “would,” “should,” “potential,” “designed to,” “will,” “ongoing,” “estimate,” “forecast,” “target,” “predict,” “could,” and similar references, although not all forward-looking statements contain these words. Forward-looking statements are neither historical facts nor assurances of future performance. These statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results may differ materially from those indicated in the forward-looking statements as a result of a number of important factors, including, but not limited to:

| · | we are dependent on the success of our INTASYL™ technology platform, and our product candidates based on this platform, which is unproven and may never lead to approved and marketable products; | |

| · | our product candidates are in an early stage of development and we may fail, experience significant delays, never advance in clinical development or not be successful in our efforts to identify or discover additional product candidates, which may materially and adversely impact our business; | |

| · | if we experience delays or difficulties in identifying and enrolling subjects in clinical trials, it may lead to delays in generating clinical data and the receipt of necessary regulatory approvals; | |

| · | topline data may not accurately reflect or may materially differ from the complete results of a clinical trial; | |

| · | we rely upon third parties for the manufacture of the clinical supply for our product candidates; | |

| · | our business and operations would suffer in the event of computer system failures, cyberattacks or a deficiency in our cybersecurity; | |

| · | we are dependent on the patents we own and the technologies we license, and if we fail to maintain our patents or lose the right to license such technologies, our ability to develop new products would be harmed; | |

| · | we will require substantial additional funds to complete our research and development activities; | |

| · | future financing may be obtained through, and future development efforts may be paid for by, the issuance of debt or equity, which may have an adverse effect on our stockholders or may otherwise adversely affect our business; | |

| · | we may not be able to regain compliance with the continued listing requirements of The Nasdaq Capital Market; and | |

| · | the price of our common stock has been and may continue to be volatile. |

The risks set forth above are not exhaustive and additional factors, including those identified in this Annual Report on Form 10-K under the heading “Risk Factors,” for reasons described elsewhere in this Annual Report on Form 10-K and in other filings Phio Pharmaceuticals Corp. periodically makes with the Securities and Exchange Commission, could adversely affect our business and financial performance. Therefore, you should not rely unduly on any of these forward-looking statements. Forward-looking statements contained in this Annual Report on Form 10-K speak as of the date hereof and Phio Pharmaceuticals Corp. does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this report, except as required by law.

| 1 |

PART I

Unless otherwise noted, (1) the term “Phio” refers to Phio Pharmaceuticals Corp. and our subsidiary, MirImmune, LLC and (2) the terms “Company,” “we,” “us” and “our” refer to the ongoing business operations of Phio and MirImmune, LLC, whether conducted through Phio or MirImmune, LLC.

| ITEM 1. | BUSINESS |

Overview

Phio Pharmaceuticals Corp. (“Phio,” “we,” “our” or the “Company”) is a clinical stage biotechnology company whose proprietary INTASYL™ self-delivering RNAi technology platform is designed to make immune cells more effective in killing tumor cells. We are developing therapeutics that are designed to leverage INTASYL to precisely target specific proteins that reduce the body’s ability to fight cancer, without the need for specialized formulations or drug delivery systems. We are committed to discovering and developing innovative cancer treatments for patients by creating new pathways toward a cancer-free future.

In 2023, the Company implemented a cost rationalization program driven by its transition from discovery research to product development. This resulted in a decision not to renew the lease for office and laboratory space in Marlborough, Massachusetts, which will expire on March 31, 2024. Beginning in April of 2024, we expect to continue operations as a remote business with a small laboratory facility in Worcester, Massachusetts for 321 square feet of space that commenced on March 1, 2024. Additionally, we rationalized discovery research personnel resulting in headcount reduction by approximately 36%. Expense reductions have been redirected to funding the Phase 1b clinical trial with PH-762 directed toward skin cancer.

INTASYL Platform

Overall, RNA is involved in the synthesis, regulation and expression of proteins. RNA takes the instructions from DNA and turns those instructions into proteins within the body’s cells. RNA interference, or RNAi, is a biological process that inhibits the expression of genes or the production of proteins. Diseases are often related to the incorrect protein being made, excessive amounts of a specific protein being made, or the correct protein being made, but at the wrong location or time. RNAi offers a novel approach to drug development because RNAi compounds can be designed to silence any one of the thousands of human genes, many of which are considered “undruggable” by traditional therapeutics.

Our development efforts are based on our proprietary INTASYL self-delivering RNAi technology platform. It is a patented platform from which specific patented compounds are developed. INTASYL compounds are comprised of a unique sequence of chemically modified nucleotides (modified small interfering RNA, or siRNAs) that target a broad range of cell types and tissues. The compounds are designed to effectively silence genes that tumors use to evade the immune system.

Since the initial discovery of RNAi, drug delivery has been the primary challenge in developing RNAi-based therapeutics. Other siRNA technologies require cell targeting chemical conjugates which limit delivery to specific cell types. INTASYL is based on proprietary chemistry that is designed to maximize the activity and adaptability of the compound and is unique in that it can be delivered to any cell type or tissue without the need to modify the chemistry. This is designed to eliminate the need for formulations or delivery systems (for example, nanoparticles or electroporation). This provides efficient, spontaneous, cellular uptake with potent, long-lasting intracellular activity.

We believe that our INTASYL platform provides the following benefits including, but not limited to:

| · | Ability to target a broad range of cell types and tissues; | |

| · | Ability to target both intracellular and extracellular protein targets; | |

| · | Efficient uptake by target cells, avoiding the need for assisted delivery; | |

| · | Sustained, or long-term, effect in vivo; | |

| · | Ability to target multiple genes in one drug product; | |

| · | Favorable clinical safety profile with local administration; and | |

| · | Readily manufactured under current good manufacturing practices. |

| 2 |

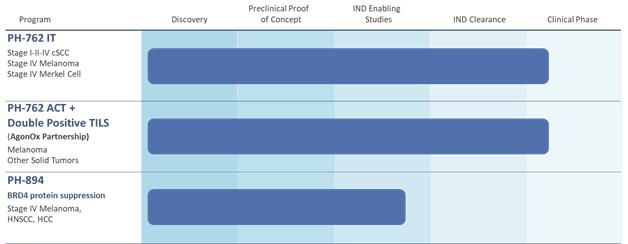

Our Pipeline

INTASYL compounds are designed to precisely target specific proteins that reduce the body’s ability to fight cancer, without the need for specialized formulations or drug delivery systems, and are designed to make immune cells more effective in killing tumor cells. Our efforts are focused on developing immuno-oncology therapeutics using our INTASYL platform. We have demonstrated preclinical activity against multiple gene targets including PD-1, BRD4, CTLA-4, TIGIT and CTGF and have demonstrated preclinical efficacy in both direct-to-tumor injection and adoptive cell therapy (“ACT”) applications with our INTASYL compounds.

The following table summarizes our product pipeline. Below we provide important information and context regarding each compound.

PH-762

PH-762 is an INTASYL compound designed to reduce the expression of cell death protein 1 (“PD-1”). PD-1 is a protein that inhibits T cells’ ability to kill cancer cells and is a clinically validated target in immunotherapy. Decreasing the expression of PD-1 can thereby increase the capacity of T cells, which protect the body from cancer cells and infections, to kill cancer cells.

Our preclinical studies have demonstrated that direct-to-tumor application of PH-762 resulted in potent anti-tumoral effects and have shown that direct-to-tumor treatment with PH-762 inhibits tumor growth in a dose dependent fashion in PD-1 responsive and refractory models. Importantly, direct-to-tumor administration of PH-762 resulted in activity against distant untreated tumors, indicative of a systemic anti-tumor response. We believe these data further support the potential for PH-762 to provide a strong local immune response without the dose immune-related adverse effects seen with systemic antibody therapy.

PH-762 is currently being evaluated in a U.S. multi-center Phase 1b dose-escalating clinical trial through the intratumoral injection of PH-762 for the treatment of patients with cutaneous squamous cell carcinoma, melanoma and Merkel cell carcinoma. The trial is designed to evaluate the safety and tolerability of neoadjuvant use of intratumorally injected PH-762, assess the tumor response, and determine the dose or dose range for continued study of PH-762 and is expected to enroll up to 30 patients. In November 2023, we announced the dosing of the first patient and the trial is currently open for the continued enrollment of patients.

| 3 |

Given our intention to focus our efforts and resources on our U.S. clinical trial with PH-762, we have completed the winding down process for our first-in-human clinical trial for PH-762 in France, which was limited to the treatment of patients with metastatic melanoma. Safety data from the initial cohort of three patients in the French clinical trial were evaluated by a data monitoring committee in the first quarter of 2023. The safety data review disclosed no dose-limiting toxicity, and no drug-related severe or serious adverse events.

Due to INTASYL’s ease of administration, we have shown that our compounds can easily be incorporated into current ACT manufacturing processes. In ACT, T cells are usually taken from a patient's own blood or tumor tissue, grown in large numbers in a laboratory, and then given back to the patient to help the immune system fight cancer. By treating T cells with our INTASYL compounds while they are being grown in the laboratory, we believe our INTASYL compounds can improve these immune cells to make them more effective in killing cancer. Preclinical data generated in collaboration with AgonOx, Inc. (“AgonOx”), a private company developing a pipeline of novel immunotherapy drugs targeting key regulators of the immune response to cancer, demonstrated that treating AgonOx’s “double positive” tumor infiltrating lymphocytes (“DP TIL”) with PH-762 increased their tumor killing activity by two-fold.

In February 2021, we entered into a clinical co-development collaboration agreement (the “Clinical Co-Development Agreement”) with AgonOx to develop a T cell-based therapy using PH-762 and AgonOx’s DP TIL. Under the Clinical Co-Development Agreement, we agreed to reimburse AgonOx up to $4 million in expenses incurred to conduct a Phase 1 clinical trial of PH-762 treated DP TIL in patients with advanced melanoma and other advanced solid tumors. As of December 31, 2023, there was approximately $2.8 million of remaining costs not yet incurred under the Clinical Co-Development Agreement. We are also eligible to receive certain future development milestones and low single-digit sales-based royalty payments from AgonOx’s licensing of its DP TIL technology.

PH-762 treated DP TIL are being evaluated in a Phase 1 clinical trial in the U.S. with up to 18 patients with advanced melanoma and other advanced solid tumors by AgonOx. The primary trial objectives are to evaluate the safety and to study the potential for enhanced therapeutic benefit from the administration of PH-762 treated DP TIL. We announced the first patient was dosed in August 2023 and the trial is open for the continued enrollment of patients.

PH-894

PH-894 is an INTASYL compound that is designed to silence BRD4, a protein that controls gene expression in both T cells and tumor cells, thereby effecting the immune system as well as the tumor. Intracellular and/or commonly considered “undruggable” targets, such as BRD4, represent a challenge for small molecule and antibody therapies. Therefore, what sets this compound apart is its dual mechanism: PH-894 suppression of BRD4 in T cells results in T cell activation, and suppression of BRD4 in tumor cells results in tumors becoming more sensitive to being killed by T cells.

Preclinical studies conducted have demonstrated that PH-894 resulted in a strong, concentration dependent and durable silencing of BRD4 in T cells and in various cancer cells. Similar to PH-762, preclinical studies have also shown that direct-to-tumor application of PH-894 resulted in potent and statistically significant anti-tumoral effects against distant untreated tumors, indicative of a systemic anti-tumor response. These preclinical data indicate that PH-894 can reprogram T cells and other cells in the tumor microenvironment to provide enhanced immunotherapeutic activity. We have completed the investigational new drug application (“IND”)-enabling studies and are in the process of continuing to finalize the study reports required for an IND submission with PH-894. As a result of the reprioritization to advance our clinical trial with PH-762 in the U.S., we have elected to defer the IND submission for PH-894.

Synergies With Other Therapies

Preclinical studies with our INTASYL compounds in combination with antibodies resulted in enhanced potency in vivo. The combination of INTASYL with antibodies may also increase the number of addressable drug targets. Unlike other antibody combination approaches, INTASYL can target multiple protein drug targets in a specific therapeutic dose, thereby enhancing potency while maintain a favorable tolerability and safety profile.

| 4 |

We have demonstrated preclinical efficacy with INTASYL in ACT applications. In preclinical studies, INTASYL was shown to enhance the activity of ACT therapies, including with tumor infiltrating lymphocytes and natural killer cells. As demonstrated in these preclinical studies, INTASYL is easily incorporated into current ACT manufacturing processes.

Intellectual Property

INTASYL compounds have a single-stranded phosphorothioate region, a short duplex region, and contain a variety of nuclease-stabilizing and lipophilic chemical modifications that we believe combine the beneficial properties of both conventional RNAi and antisense technologies. We protect our proprietary information by means of United States and foreign patents, trademarks and copyrights. In addition, we rely upon trade secret protection and contractual arrangements to protect certain of our proprietary information and products. We have pending patent applications that relate to potential drug targets, compounds we are developing to modulate those targets, methods of making or using those compounds, and proprietary elements of our drug discovery platform.

We have also obtained rights to various patents and patent applications under licenses with third parties, which require us to pay royalties, milestone payments, or both.

The degree of patent protection for biotechnology products and processes, including ours, remains uncertain, both in the U.S. and in other important markets, because the scope of protection depends on decisions of patent offices, courts and lawmakers in these countries. There is no certainty that our existing patents or others, if obtained, will afford us substantial protection or commercial benefit. Similarly, there is no assurance that our pending patent applications or patent applications licensed from third parties will ultimately be granted as patents or that those patents that have been issued or are issued in the future will stand if they are challenged in court. We assess our license agreements on an ongoing basis and may from time to time terminate licenses to technology that we do not intend to employ in our technology platforms, or in our product discovery or development activities.

Patents and Patent Applications

We are actively seeking protection for our intellectual property and are prosecuting a number of patents and pending patent applications covering our compounds and technologies. A combined summary of these patents and patent applications is set forth below in the following table:

|

Pending Applications |

Issued Patents |

|||||||

| United States | 14 | 33 | ||||||

| Canada | 3 | 2 | ||||||

| Europe | 6 | 26 | ||||||

| Japan | 7 | 12 | ||||||

| Other Markets | 10 | 8 | ||||||

Our portfolio includes 81 issued patents, 73 of which cover our INTASYL platform. There are 13 patent families broadly covering both the composition and methods of use of our self-delivering INTASYL platform technology and uses of our INTASYL compounds targeting immune checkpoint, cellular differentiation and metabolism targets for ex vivo cell-based cancer immunotherapies. The INTASYL platform patents are scheduled to expire between 2029 and 2038.

Furthermore, there are 40 patent applications, encompassing what we believe to be important new RNAi compounds and their use as therapeutics, chemical modifications of RNAi compounds that improve the compounds’ suitability for therapeutic uses (including delivery) and compounds directed to specific targets (i.e., that address specific disease states). The patents that may issue from these pending patent applications will, if issued, be set to expire between 2029 and 2042, not including any patent term extensions that may be afforded under the Federal Food, Drug, and Cosmetic Act (“FFDCA”) (and the equivalent provisions in foreign jurisdictions) for any delays incurred during the regulatory approval process relating to human drug products (or processes for making or using human drug products).

| 5 |

Key Intellectual Property License Agreements

As we develop our own proprietary compounds, we continue to evaluate our in-licensed portfolio as well as the field for new technologies that could be in-licensed to further enhance our intellectual property portfolio and unique intellectual property position.

In September 2011, the Company entered into an agreement with Advanced RNA Technologies, LLC (“Advirna”), pursuant to which Advirna assigned to us its existing patent and technology rights related to the INTASYL technology in exchange for an annual maintenance fee, a one-time milestone payment upon the future issuance of the first patent with valid claims covering the assigned patent and technology rights and the issuance of shares of common stock of the Company equal to 5% of the Company’s fully-diluted shares outstanding at the time of issuance. In 2012, we issued shares of common stock of the Company to Advirna equal to 5% of our fully-diluted shares outstanding at the time of issuance and paid $350,000 to Advirna upon the issuance of the first patent in 2014. Additionally, we also pay to Advirna an annual maintenance fee of $100,000 and are required to pay low single-digit royalties on any licensing revenue received by us with respect to future licensing of the assigned Advirna patent and technology rights. To date, any royalties owed to Advirna under the Advirna agreement have been minimal.

Our rights under the Advirna agreement will expire upon the later of: (i) the expiration of the last-to-expire of the “patent rights” (as defined therein) included in the Advirna agreement or (ii) the abandonment of the last-to-be abandoned of such patents, unless earlier terminated in accordance with the provisions of the Advirna agreement. Further, the Company also granted back to Advirna a license under the assigned patent and technology rights for fields of use outside human therapeutics.

Manufacturing and Supply

We do not have any manufacturing capability and therefore we currently rely on and intend to continue to rely on contract manufacturing organizations to produce our product candidates in accordance with regulatory requirements.

We currently rely on and contract with third parties for the manufacture of drug substances and drug products for use in our preclinical studies and clinical trials in accordance with regulatory requirements. We expect that we will continue to rely on and contract with third parties to manufacture our product candidates in the future.

Competition

The biotechnology and pharmaceutical industries, including the immuno-oncology field, are a constantly evolving landscape with rapidly advancing technologies and significant competition. There are a number of competitors in the immuno-oncology field including large and small pharmaceutical and biotechnology companies, academic institutions, government agencies and other private and public research organizations. Many of these companies are larger than us and have greater financial resources and human capital to develop competing products.

Government Regulation

Review and Approval of Drugs in the United States

The United States and many other countries extensively regulate the preclinical and clinical testing, manufacturing, labeling, storage, record-keeping, advertising, promotion, export, marketing and distribution of drugs and biologic products. The U.S. Food and Drug Administration (“FDA”) regulates pharmaceutical and biologic products under the FFDCA, the Public Health Service Act and other federal statutes and regulations.

| 6 |

To obtain approval of our future product candidates from the FDA, we must, among other requirements, submit data supporting safety and efficacy for the intended indication as well as detailed information on the manufacture and composition of the product candidate. In most cases, this will require extensive laboratory tests, preclinical studies and clinical trials. The collection of these data, as well as the preparation of applications for review by the FDA involve significant time and expense. The FDA also may require post-marketing testing to monitor the safety and efficacy of approved products or place conditions on any approvals that could restrict the therapeutic claims and commercial applications of these products. Regulatory authorities may withdraw product approvals if we fail to comply with regulatory standards or if we encounter problems at any time following initial marketing of our products.

The first stage of the FDA approval process for a new biologic or drug involves completion of preclinical studies and the submission of the results of these studies to the FDA. These data, together with proposed clinical protocols, manufacturing information, analytical data and other information submitted to the FDA through an IND, must become effective before human clinical trials may commence. Preclinical studies generally involve evaluation of product characteristics and animal studies to assess the efficacy and safety of the product candidate. Many of these studies must be conducted in accordance with the FDA’s current Good Laboratory Practices, the Animal Welfare Act, and other applicable regulations.

After the IND becomes effective, a company may commence human clinical trials. These are typically conducted in three sequential phases, but the phases may overlap. Phase 1 trials consist of testing the product candidate in a small number of patients or healthy volunteers, primarily for safety at one or more doses. Phase 2 trials, in addition to safety, evaluate the efficacy of the product candidate in a patient population somewhat larger than Phase 1 trials. Phase 3 trials typically involve additional testing for safety and clinical efficacy in an expanded population at multiple test sites. A company must submit to the FDA a clinical protocol, accompanied by the approval of the Institutional Review Board (“IRB”) at the institutions participating in the trials, prior to commencement of each clinical trial.

To obtain FDA marketing authorization, a company must submit to the FDA the results of the preclinical and clinical testing, together with, among other things, detailed information on the manufacture and composition of the product candidate, in the form of a new drug application (“NDA”), or, in the case of a biologic, a biologics license application (“BLA”).

The amount of time taken by the FDA to approve a NDA or BLA will depend upon a number of factors, including whether the product candidate has received priority review, the quality of the submission and studies presented, the potential contribution that the compound will make in improving the treatment of the disease in question and agency resources.

The FDA maintains several programs to facilitate and expedite the development and review of applications that are intended for the treatment of a serious or life-threatening disease or condition that meet certain other criteria, including Fast Track Designation, Breakthrough Designation, Priority Review, and the Accelerated Approval pathway.

We anticipate that our products will be manufactured by our strategic partners, licensees or other third parties. Before approving an NDA or BLA, the FDA will inspect the facilities at which the product is manufactured and will not approve the product unless the manufacturing facilities are in compliance with the FDA’s current good manufacturing practice regulations (“cGMP”), which are regulations that govern the manufacture, holding and distribution of a product. Manufacturers of biologics also must comply with the FDA’s general biological product standards. Our manufacturers also will be subject to regulation under the Occupational Safety and Health Act, the Nuclear Energy and Radiation Control Act, the Toxic Substance Control Act and the Resource Conservation and Recovery Act and other applicable environmental statutes. Following approval, the FDA and certain state agencies periodically inspects drug and biologic manufacturing facilities to ensure continued compliance with the cGMP. Our manufacturers will have to continue to comply with those requirements. Failure to comply with these requirements subjects the manufacturer to possible legal or regulatory action, such as suspension of manufacturing or recall or seizure of product. Adverse patient experiences with the product must be reported to the FDA and could result in the imposition of marketing restrictions through labeling changes or market removal. Product approvals may be withdrawn if compliance with regulatory requirements is not maintained or if problems concerning safety or efficacy of the product occur following approval.

| 7 |

The labeling, advertising, promotion, marketing and distribution of a drug or biologic product also must be in compliance with FDA and Federal Trade Commission requirements which include, among others, standards and regulations for off-label promotion, industry sponsored scientific and educational activities, promotional activities involving the internet, and direct-to-consumer advertising. We also will be subject to state and local requirements governing the manufacturing and distribution of pharmaceutical products. In addition, we will be subject to a variety of federal, state and local regulations relating to the use, handling, storage and disposal of hazardous materials, including chemicals and radioactive and biological materials. In addition, we will be subject to various laws and regulations governing laboratory practices and the experimental use of animals. In each of these areas, failure to comply with the applicable requirements could result in administrative or judicial enforcement action, which could include refusal to permit clinical trials, refusal to approve an application, withdrawal of an approval, issuance of a warning letter, product recall, product seizure, suspension of production or distribution, fines, refusals of government contracts, and restitution, disgorgement or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us.

In the future, we may also be subject to a variety of regulations governing clinical trials and sales of our products outside the U.S. Whether or not FDA approval has been obtained, approval of a product candidate by the comparable regulatory authorities of foreign countries and regions must be obtained prior to the commencement of marketing the product in those countries. The approval process varies from one regulatory authority to another and the time may be longer or shorter than that required for FDA approval. In the European Union, Canada and Australia, regulatory requirements and approval processes are similar, in principle, to those in the U.S.

European Union Data Laws For Review and Approval of Drugs in the European Union Including France

The collection and use of personal health data and other personal information in the European Union (“EU”) is governed by the provisions of the General Data Protection Regulation (“GDPR”), which came into force in May 2018, and related implementing laws in individual EU Member States. In addition, following the United Kingdom’s (“UK”) formal departure from the EU on January 31, 2020 and the end of the transition period on December 31, 2020, the UK has become a “third country” for the purposes of EU data protection law. A “third country” is a country other than the EU Member States and the three additional European Economic Area countries (Norway, Iceland and Liechtenstein) that have adopted a national law implementing the GDPR. However, the trade and cooperation agreement (“TCA”) entered into between the EU and UK following the end of the transition period includes a provision, whereby the transfer of personal data from the EU to the UK will not be considered as a transfer to a “third country” for a period of four months starting from the entry into force of the TCA. This period will be extended by two further months, unless the EU or the UK objects. Under the GDPR, personal data can only be transferred to third countries in compliance with specific conditions for cross-border data transfers. Appropriate safeguards are required to enable transfers of personal data from the EU Member States. This status has a number of significant practical consequences, in particular for international data transfers, competent supervisory authorities and enforcement of the GDPR. The GDPR increased responsibility and liability in relation to personal data that we process.

The GDPR imposes a number of strict obligations and restrictions on the ability to process (processing includes collection, analysis and transfer of) personal data, including health data from clinical trials and adverse event reporting. The GDPR also includes requirements relating to the consent of the individuals to whom the personal data relates, the information provided to the individuals prior to processing their personal data or personal health data, notification of data processing obligations to the national data protection authorities and the security and confidentiality of the personal data. The GDPR also prohibits the transfer of personal data to countries outside of the EU that are not considered by the EU to provide an adequate level of data protection, except if the data controller meets very specific requirements. These countries include the United States, and following the end of the six month period as laid out in the TCA, it may include the UK if no adequacy decision is given prior to this. Following the Schrems II decision of the Court of Justice of the European Union on July 16, 2020, there is uncertainty as to the general permissibility of international data transfers under the GDPR. In light of the implications of this decision we may face difficulties regarding the transfer of personal data from the EU to third countries. The European Data Protection Board has adopted draft recommendations for data controllers and processors who export personal data to third countries regarding supplementary measures to ensure compliance with the GDPR when transferring personal data outside of the EU. These recommendations were submitted to public consultation until December 21, 2020, however it is unclear when and in which form these recommendations will be published in final form.

Failure to comply with the requirements of the GDPR and the related national data protection laws of the EU Member States may result in significant monetary fines, other administrative penalties and a number of criminal offenses (punishable by uncapped fines) for organizations and in certain cases their directors and officers as well as civil liability claims from individuals whose personal data was processed. Data protection authorities from the different EU Member States may still implement certain variations, enforce the GDPR and national data protection laws differently, and introduce additional national regulations and guidelines, which adds to the complexity of processing personal data in the EU. Guidance developed at both EU level and at the national level in individual EU Member States concerning implementation and compliance practices are often updated or otherwise revised.

| 8 |

There is, moreover, a growing trend towards required public disclosure of clinical trial data in the EU which adds to the complexity of obligations relating to processing health data from clinical trials. Such public disclosure obligations are provided in the new EU Clinical Trials Regulation, EMA disclosure initiatives and voluntary commitments by industry. Failing to comply with these obligations could lead to government enforcement actions and significant penalties against us, harm to our reputation, and adversely impact our business and operating results. The uncertainty regarding the interplay between different regulatory frameworks, such as the Clinical Trials Regulation and the General Data Protection Regulation, further adds to the complexity that we face with regard to data protection regulation.

Environmental Compliance

Our research and development activities involve the controlled use of potentially harmful biological materials as well as hazardous materials, chemicals and various radioactive compounds. We are subject to federal, state and local laws and regulations governing the use, storage, handling and disposal of these materials and specific waste products. We are also subject to numerous environmental, health and workplace safety laws and regulations, including those governing laboratory procedures, exposure to blood-borne pathogens and the handling of bio-hazardous materials. The cost of compliance with these laws and regulations could be significant and may adversely affect capital expenditures to the extent we are required to procure expensive capital equipment to meet regulatory requirements. However, to date, compliance with such environmental laws and regulations has not had a material impact on our capital expenditures.

Human Capital Management

As of December 31, 2023, we had eight full-time employees and one part-time employee at our facility in Marlborough, Massachusetts. None of our employees are represented by a labor union or covered by a collective bargaining agreement, nor have we experienced any work stoppages.

We continually evaluate our business needs and weigh the use of in-house expertise and capacity with outsourced expertise and capacity. We currently outsource substantially all preclinical and clinical trial work to third party contract research organizations and drug manufacturing contractors.

Our ability to identify, attract, retain and integrate additional qualified key personnel is also critical to our success and the competition for skilled research, product development, regulatory and technical personnel is intense. To attract qualified applicants, we offer a total rewards package consisting of base salary and cash target bonus, a comprehensive benefit package and equity compensation for every employee. Bonus opportunity and equity compensation increase as a percentage of total compensation based on level of responsibility. Actual bonus payouts are based on performance.

A majority of Phio’s employees have obtained advanced degrees in their professions and we support our employees’ further development with individualized development plans, mentoring, coaching, group training, conference attendance and financial support including tuition reimbursement.

Corporate Information

Effective January 26, 2023, the Company completed a 1-for-12 reverse stock split of the Company’s outstanding common stock. The reverse stock split did not reduce the number of authorized shares of the Company’s common or preferred stock. All share and per share amounts have been adjusted to give effect to the reverse stock split.

We were incorporated in the state of Delaware in 2011 as RXi Pharmaceuticals Corporation. On November 19, 2018, we changed our name to Phio Pharmaceuticals Corp., to reflect our transition from a platform company to one that is fully committed to developing groundbreaking immuno-oncology therapeutics. Our executive offices are located at 257 Simarano Drive, Suite 101, Marlborough, MA 01752, and our telephone number is (508) 767-3861.

| 9 |

The Company’s website address is http://www.phiopharma.com. We make available on our website, free of charge, copies of our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) as soon as reasonably practicable after these reports are filed electronically with, or otherwise furnished to, the Securities and Exchange Commission (the “SEC”). We also make available on our website the charters of our audit, compensation, nominating and governance committees, as well as our corporate code of ethics and conduct.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding Phio and other issuers that file electronically with the SEC. The SEC’s website address is http://www.sec.gov. The contents of this website, and our website, are not incorporated by reference into this report and should not be considered to be part of this report.

| ITEM 1A. | RISK FACTORS |

Risks Relating to Our Business and Industry

We are dependent on the success of our INTASYL technology platform, and our product candidates based on this platform, which is unproven and may never lead to approved and marketable products.

Our efforts have been focused on the development of product candidates based on our INTASYL technology platform. We have invested, and we expect to continue to invest, significant financial resources and efforts developing our product candidates. Our ability to eventually generate revenue is highly dependent on the successful development, regulatory approval and commercialization of our INTASYL product candidates by us or by collaborative partners, which may not occur for the foreseeable future, if ever, and is highly uncertain and depends on a number of factors, many of which are beyond our control. Therefore, it is difficult to accurately predict challenges we may face with our product candidates as they move through the discovery, preclinical and clinical development stages. We will spend large amounts of money developing our INTASYL platform technology and may never succeed in obtaining regulatory approval. In addition, our research methodology may be unsuccessful in identifying product candidates and results from preclinical studies and clinical trials may not predict the results that will be obtained in later phase trials of our product candidates or our product candidates may interact with patients in unforeseen or harmful ways that may make it impractical or impossible to manufacture, receive regulatory approval or commercialize. If we are not successful in bringing an INTASYL product candidate to market, it could negatively impact our business and financial condition and we may not be able to identify and successfully implement an alternative product development strategy.

Our product candidates are in an early stage of development and we may fail, experience significant delays, never advance clinical development or not be successful in our efforts to identify or discover additional product candidates, which may materially and adversely impact our business.

Our success depends heavily on the successful development of our product candidates, which may never occur. Our product candidates, which are in early stages of development, could be delayed, not advance into the clinic, or unexpectedly fail at any stage of development. Our ability to identify, develop and commercialize product candidates is dependent on extensive preclinical and other non-clinical tests in order to support an IND in the United States, or the equivalent with regulatory authorities in other jurisdictions, if applicable. These research programs to identify new product candidates require substantial financial and human resources, are difficult to design and can take many years to complete.

We cannot be certain of the outcome of our research studies and clinical trials and the results from these studies and clinical trials may not predict the results that will be obtained in later stages of development and we may focus our efforts and resources on product candidates that may prove to be unsuccessful. There is no assurance that we will be able to successfully develop our product candidates, and we may forego opportunities with certain product candidates or for indications that later prove to have greater commercial potential. If we are not able to successfully develop our product candidates, we may be forced to abandon or delay our development efforts, which may materially and adversely affect our business, financial condition, and results of operations.

| 10 |

Further, the FDA may not accept the results of our preclinical studies or clinical trials and may require us to complete additional studies or impose stricter approval conditions than we expect, which could impact the value of a particular program, the approvability or commercialization of the particular product candidate or product and our Company in general. Because of these factors, it is difficult to predict the time and cost of the development of our product candidates. Any delay or failure in obtaining required approvals may prevent us from completing our preclinical studies or clinical trials and could have a material adverse effect on our ability to initiate or commercialize drug or biologic candidate on a timely basis, or at all. Additionally, preclinical studies and clinical trials are lengthy and expensive and if our cash resources become limited we may not be able to commence, continue or complete such preclinical studies or clinical trials.

We are dependent on our collaboration partner for the successful development of our adoptive cell therapy product candidate.

We are dependent on third parties that have direct access to the patient or donor cells used in cell therapy and expect to depend on our third-party collaborator to support the clinical development of our ACT product candidate. We have entered into a clinical co-development collaboration agreement with AgonOx, Inc. to conduct a Phase 1 clinical trial of the evaluation of PH-762 treated “double positive” tumor infiltrating lymphocytes in patients with advanced melanoma and other advanced solid tumors. The success of our collaboration depends upon the efforts of our collaboration partner, and their performance in achieving the development activities to the extent they are responsible under our collaboration agreement. Our partner may not be successful in performing these activities, including completing the required preclinical studies and other information to be included in an IND application (or foreign equivalent), obtaining approval to initiate clinical trials, conducting the necessary clinical trials and arranging for the manufacturing or contract research organization (“CRO”) relationships and obtaining marketing authorization. Our partner works with other companies, potentially including some of our competitors, their corporate objectives may not align with ours, and they may change their strategic focus or pursue alternative technologies. If our collaboration is not successful or our partner terminates our collaboration agreement, our business, financial condition, and results of operations could be materially and adversely affected.

Further, we may not be successful in negotiating agreements with this collaborator or with future collaborators for the development and commercialization of our ACT product candidates through collaborations such as joint development or licensing agreements. Our ability to successfully negotiate such agreements will depend on, among other things, potential partners’ evaluation of the superiority of our technology over competing technologies, the quality of preclinical data that we have generated, the perceived risks specific to developing our product candidates and our partners’ own strategic and corporate objectives. If we fail to negotiate these agreements, we may not be able commence clinical trials with our ACT product candidates or we may be required to obtain licenses from cell therapy companies and our business, financial condition, and results of operations could be materially and adversely affected.

If we experience delays or difficulties in identifying and enrolling patients in clinical trials, it may lead to delays in generating clinical data and the receipt of necessary regulatory approvals.

Clinical trials of a new drug or biologic candidate require the enrollment of a sufficient number of patients, including patients who are suffering from the disease or condition the drug or biologic candidate is intended to treat and who meet other eligibility criteria. Rates of patient enrollment are affected by many factors, and delays in patient enrollment can result in increased costs and longer development times, which could materially and adversely impact our business and financial condition. We may experience slower than expected patient enrollment in our current or future clinical trials. In addition, clinical trials for drug or biologic candidates that treat the same indications as our product candidates may result in patients who would otherwise be eligible for our clinical trials instead enrolling in clinical trials for other drug or biologic candidates.

Topline data may not accurately reflect or may materially differ from the complete results of a clinical trial.

From time to time, we may publicly disclose topline or interim data from our clinical trials based on a preliminary analysis of then-available data, of which the results, related findings and conclusions are subject to change following a more comprehensive review of the data related to the particular trial. We also make assumptions, estimations, calculations and conclusions as part of our analyses of data, and we may not have received or had the opportunity to fully and carefully evaluate all data. Preliminary observations made in early stages of clinical trials are not necessarily indicative of results that will be obtained when full data sets are analyzed or in subsequent clinical trials. As a result, topline data may differ from future results from the same studies or different conclusions may qualify such results once additional data has been received and evaluated. Topline or interim data also remain subject to audit and verification procedures that may result in the final data being materially different from the preliminary data that we publicly disclose and should be viewed with caution until the complete data is available. If the topline data we report differs from future analysis of results, or if others, including regulatory authorities, disagree with the conclusions reached, our business, financial condition, and results of operations could be materially and adversely affected.

| 11 |

We rely upon third-parties to conduct our clinical trials and other studies for our product candidates, and if they do not successfully fulfill their obligations, the development of our product candidates may be materially impacted.

We rely upon third-party CROs, medical institutions, collaborators, clinical investigators, consultants and other third-parties to support and conduct our clinical trials and we rely on these third-party CROs for the execution of certain of our preclinical studies and expect to continue to do so. Because we rely on these third-parties, we cannot necessarily control the timing, quality of work or amount of resources that our contract partners will devote to these activities. We, our collaborators, and our CROs are responsible for ensuring that our clinical trials are conducted in accordance with applicable regulations and protocols. If we, our collaborators, or our CROs fail to comply with these applicable regulations, the FDA may not accept these data and may require us to complete additional preclinical studies and clinical trials, which could result in significant additional costs and delays to us.

As we only control certain aspects of their activities, we cannot guarantee that these partners will fulfill their obligations to us under these arrangements. If these third-parties do not successfully carry out their responsibilities, as well as within a timely fashion, our clinical trials and preclinical studies may be delayed, unsuccessful or otherwise adversely affected. If we have to enter into alternative arrangements it may delay or adversely affect the development of our product candidates and our business operations. This could be difficult, costly or impossible, and our preclinical studies or clinical trials may need to be extended, delayed, terminated or repeated, and we may not be able to obtain regulatory approval in a timely fashion, or at all, for the applicable drug or biologic candidate, or to commercialize such drug or biologic candidate being tested in such studies or trials.

A number of different factors could prevent us from advancing into clinical development, obtaining regulatory approval, and ultimately commercializing our product candidates on a timely basis, or at all.

Before obtaining regulatory approval for the sale of any drug or biologic candidate, we must conduct extensive preclinical tests and successful clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Before human clinical trials may commence, we must submit to the FDA an IND. An IND involves the completion of preclinical studies and the submission of the results, together with proposed clinical protocols, manufacturing information, analytical data and other data in the IND submission. The FDA may require us to complete additional preclinical studies or disagree with our clinical trial study design. Also, animal models may not exist for some of the disease areas we choose to develop our product candidates for. As a result, our clinical trials may be delayed or we may be required to incur more expense than we anticipated.

Clinical trials require the review and oversight of IRBs, which approve and continually review clinical investigations and protect the rights and welfare of patients. Before our clinical trials can begin, we must also submit to the FDA a clinical protocol accompanied by the approval of the IRB at the institution(s) participating in the clinical trial. An inability or delay in obtaining IRB approval could prevent or delay the initiation and completion of our clinical trials, and the FDA may decide not to consider any data or information derived from a clinical investigation not subject to initial and continuing IRB review and approval.

Preclinical studies and clinical trials are lengthy and expensive, and their outcome is highly uncertain. Historical failure rates are high due to a number of factors, such as safety and efficacy of drug or biologic candidates. We, our collaborators, the FDA, or an IRB may suspend clinical trials of a drug or biologic candidate at any time for various reasons, including if we or they believe the patients participating in such trials are being exposed to unacceptable health risks. Among other reasons, adverse side effects of a drug or biologic candidate on patients in a clinical trial could result in the FDA suspending or terminating the clinical trial and refusing to approve a particular drug or biologic candidate for any or all indications of use.

| 12 |

An additional number of factors could affect the timing, cost or outcome of our drug development efforts, including the following:

| · | Delays in filing or acceptance of INDs, NDAs, or BLA for our product candidates; | |

| · | Difficulty in securing centers to conduct clinical trials; | |

| · | Conditions imposed on us by the FDA regarding the scope or design of our clinical trials; | |

| · | Problems in engaging IRBs to oversee trials or problems in obtaining or maintaining IRB approval of studies; | |

| · | Difficulty in enrolling patients in conformity with required protocols or projected timelines; | |

| · | Third-party contractors failing to comply with regulatory requirements or to meet their contractual obligations to us in a timely manner; | |

| · | Our drug or biologic candidates having unexpected and different chemical and pharmacological properties in humans than in laboratory testing and interacting with human biological systems in unforeseen, ineffective or harmful ways; | |

| · | The need to suspend or terminate clinical trials, for example, if the participants are being exposed to unacceptable health risks; | |

| · | Insufficient or inadequate supply or quality of our product candidates or other necessary materials necessary to conduct our clinical trials; | |

| · | Effects of our product candidates not having the desired effects or including undesirable side effects or the product candidates having other unexpected characteristics; | |

| · | The cost of our clinical trials being greater than we anticipate; | |

| · | Negative or inconclusive results from our clinical trials or the clinical trials of others for similar product candidates or inability to generate statistically significant data confirming the efficacy of the product being tested; | |

| · | Changes in the FDA’s requirements or expectations for testing during the course of that testing; | |

| · | Reallocation of our limited financial and other resources to other clinical programs; and | |

| · | Adverse results obtained by other companies developing similar drugs. |

A failure of any preclinical study or clinical trial can occur at any stage of testing. Any delay or failure in obtaining required approvals may prevent us from completing our preclinical studies or clinical trials and could have a material adverse effect on our ability to initiate or commercialize any drug or biologic candidate on a timely basis, or at all. Additionally, preclinical studies and clinical trials are lengthy and expensive and if our cash resources become limited we may not be able to commence, continue or complete our clinical trials, which could have a material impact on our business, financial condition, and results of operations.

| 13 |

We are subject to significant competition and may not be able to compete successfully.

The biotechnology and pharmaceutical industries are intensely competitive, contain a high degree of risk and there are many other companies actively engaged in the discovery, development and commercialization of products that may compete with our product candidates. Many of our competitors have substantially greater experience and greater research and development capabilities, staffing, financial, manufacturing, marketing, technical and other resources than us, and we may not be able to successfully compete with them. These companies include large and small pharmaceutical and biotechnology companies, academic institutions, government agencies and other private and public research organizations.

In addition, even if we are successful in developing our product candidates, in order to compete successfully we may need to be first to market or to demonstrate that our products are superior to therapies based on different technologies. Some of our competitors may develop and commercialize products that are introduced to market earlier than our product candidates or on a more cost-effective basis. A number of our competitors have already commenced clinical testing of product candidates and may be more advanced than we are in the process of developing such product candidates. If we are not first to market or are unable to demonstrate superiority, on a cost-effective basis or otherwise, any products for which we are able to obtain approval may not be successful.

We also face competition acquiring technologies complementary to our INTASYL technology. Further, we may face competition with respect to product efficacy and safety, ease of use and adaptability to modes of administration, acceptance by physicians, timing and scope of regulatory approvals, reimbursement coverage, price and patent position, including dominant patent positions of others. If we are not able to successfully obtain regulatory approval or commercialize our product candidates, we may not be able to establish market share and generate revenues from our technology.

If we fail to attract, hire and retain qualified personnel, we may not be able to design, develop, market or sell our products or successfully manage our business.

We have a small core management team and are particularly dependent on them. Accordingly, our business prospects are dependent on the principal members of our executive team, the loss of whose services could make it difficult for us to manage our business successfully and achieve our business objectives. While we have entered into an employment agreement with our Chief Executive Officer, he could leave at any time, in addition to our other employees, who are all “at will” employees. Our ability to identify, attract, retain and integrate additional qualified key personnel is also critical to our success. Competition for skilled research, product development, regulatory and technical personnel is intense, and we may not be able to recruit and retain the personnel we need. The loss of the services of any key personnel, or our inability to hire new personnel with the requisite skills, could restrict our ability to develop our product candidates.

We are subject to potential liabilities from clinical testing and future product liability claims.

The use of our product candidates in clinical trials and, if any of our product candidates receive regulatory approval, the sale of our product candidates for commercial use expose us to the risk of product liability claims. Product liability claims may be brought against us by patients, healthcare providers, consumers or others who come into contact with our product candidates or approved products. We have, and will seek to obtain, clinical trial insurance for current and any future clinical trials that we conduct, as well as liability insurance for any products that we market. However, there is no assurance that we will be able to obtain insurance in the amounts we seek, or at all. We anticipate that licensees who develop our products will carry liability insurance covering the clinical testing of our product candidates and the marketing of those product candidates, if approved. There is no assurance, however, that any insurance maintained by us or our licensees will prove adequate in the event of a claim against us. If we cannot successfully defend against product liability claims, we could incur substantial liabilities. Even if claims asserted against us are unsuccessful, they may divert management’s attention from our operations and we may have to incur substantial costs to defend such claims. Any of these outcomes could materially impact our business and financial condition.

| 14 |

We rely upon third parties for the manufacture of the clinical supply for our product candidates.

We rely on third-party suppliers and manufacturers to provide us with the materials and services to manufacture our product candidates for certain preclinical studies and for our clinical trials, and we expect that we will continue to rely on third-party manufacturers for the supply of our product candidates in the future. We have limited in-house manufacturing capabilities and resources, and we do not own or lease manufacturing facilities or have our own supply source for the required materials to manufacture our compounds. Further, we have limited cGMP manufacturing capabilities and limited experience scaling up of clinical supply as our internal capabilities are limited to small-scale production of research material. Accordingly, we are dependent upon third-party suppliers and contract manufacturers to obtain supplies and manufacture our product candidates and we will need to either develop, contract for, or otherwise arrange for the necessary manufacturers for these supplies.

There are a limited number of manufacturers that make oligonucleotides and we currently contract with multiple manufacturers for the supply of our product candidates to reduce the risk of supply interruption or availability. However, there is no assurance that our supply of our product candidates will not be limited, interrupted, of satisfactory quality or be available at acceptable prices. For example, constraints on the supply chain and availability of resources have resulted in delays and shortages at manufacturing facilities. While we have engaged with multiple manufacturers for the supply of our product candidates in order to mitigate the impact of the loss or delay of any one manufacturer, there can be no assurance that our efforts will be successful. If for any reason we are unable to obtain the clinical supply of our product candidates from our current manufacturers, we would have to seek to contract with another major manufacturer. If we or any of these manufacturers are unable or unwilling to increase its manufacturing capacity or if we are unable to establish alternative arrangements on a timely basis or on acceptable terms, the development and commercialization of such an approved product may be delayed or there may be a shortage in supply. Any inability to manufacture our product candidates or future approved drugs in sufficient quantities when needed would seriously harm our business.

Approval of any of our product candidates will not occur unless the manufacturing facilities are in compliance with the FDA’s cGMP regulations in order to ensure that drug products are safe and that they consistently meet applicable requirements and specifications. These requirements are enforced by the FDA through periodic inspections of the manufacturing facilities and can result in enforcement action, such as warning letters, fines and suspension of production if they are found to not be in compliance with the regulations. If our suppliers or manufacturers do not comply with the FDA regulations for our product candidates, we may experience delays in timing or supply, be forced to manufacture our product candidates ourselves or seek to contract with another supplier or manufacturer. If we are required to switch suppliers or manufacturers, we will be required to verify that the new supplier or manufacturer maintains facilities and processes in line with cGMP regulations, which may result in delays, additional expenses, and may have a material adverse effect on our ability to complete the development of our product candidates.

Unstable market and economic conditions, including elevated and sustained inflation, may have serious adverse consequences on our business, financial condition and stock price.

As has been widely reported, we are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by domestic and global monetary and fiscal policy, geopolitical instability, ongoing military conflicts, and high domestic and global inflation. The U.S. Federal Reserve and other central banks may be unable to contain inflation through more restrictive monetary policy and inflation may increase or continue for a prolonged period of time. Inflationary factors, such as increases in the cost of clinical supplies, interest rates, overhead costs and transportation costs may adversely affect our operating results. We continue to monitor these events and the potential impact on our business. Although we do not believe that inflation has had a material impact on our financial position or results of operations to date, we may be adversely affected in the future due to domestic and global monetary and fiscal policy, supply chain constraints, consequences associated with the coronavirus pandemic and the ongoing military conflicts, and such factors may lead to increases in the cost of manufacturing our product candidates and delays in initiating studies. In addition, global credit and financial markets have experienced extreme volatility and disruptions in the past several years and the foregoing factors have led to and may continue to cause diminished liquidity and credit availability, declines in consumer confidence, declines in economic growth, uncertainty about economic stability and increased inflation.

| 15 |

There can be no assurance that deterioration in credit and financial markets and confidence in economic conditions will not occur. Our general business strategy may be adversely affected by any such economic downturn, volatile business environment or continued unpredictable and unstable market conditions. If the current equity and credit markets deteriorate, or do not improve, it may make any necessary debt or equity financings more difficult, more costly, and more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms could have a material adverse effect on our growth strategy, financial performance and stock price and could require us to delay or abandon clinical development plans. In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive these difficult economic times, which could directly affect our ability to attain our operating goals.

Our business and operations would suffer in the event of computer system failures, cyberattacks or a deficiency in our cybersecurity.

Despite the implementation of security measures, our internal computer systems and those of our third-party contractors and collaborators are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures, cyberattacks or cyber-intrusions over the Internet, attachments to emails, persons inside our organization, or persons with access to systems inside our organization. The risk of a security breach or disruption, particularly through cyber-attacks or cyber intrusion, including by computer hackers, foreign governments, and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Such an event could cause interruption of our operations. As part of our business, we and our third-party contractors and collaborators maintain large amounts of confidential information, including non-public personal information on patients and our employees. Breaches in security could result in the loss or misuse of this information, which could, in turn, result in potential regulatory actions or litigation, including material claims for damages, interruption to our operations, damage to our reputation or otherwise have a material adverse effect on our business, financial condition and operating results. We expect to have appropriate information security policies and systems in place in order to prevent unauthorized use or disclosure of confidential information, including non-public personal information, but there can be no assurance that such use or disclosure will not occur.

Risks Relating to Our Intellectual Property

We may be involved in litigation to protect our patents and intellectual property rights and our ability to protect our patents and intellectual property rights is uncertain and may subject us to potential liabilities.

We have filed patent applications, have pending patents that we have licensed and those that we own and expect to continue to file patent applications. We may also need to license patents and patent applications from research sponsored by us with third-parties. There is no assurance that these applications will result in any issued patents or that those patents would withstand possible legal challenges or protect our technologies from competition. The patent granting authorities have upheld stringent standards for the RNAi patents that have been prosecuted so far and, consequently, pending patents that we have licensed and those that we own may continue to experience long and difficult prosecution challenges and may ultimately issue with much narrower claims than those in the pending applications.

In addition, others may challenge the patents or patent applications that we currently license or may license in the future or that we own and, as a result, these patents could be narrowed, invalidated or rendered unenforceable, which would negatively affect our ability to exclude others from using the technologies described in these patents. There is no assurance that these patents or other pending applications or issued patents we license or that we own will withstand possible legal challenges. Moreover, the laws of some foreign countries may not protect our proprietary rights to the same extent as do the laws of the United States. Our efforts to enforce and maintain our intellectual property rights may not be successful and may result in substantial costs and diversion of management and key employee’s time. If we are unable to defend our licensed or owned intellectual property, it may have a materially and adverse impact on our business, results of operations and financial condition.

Third-parties may claim that we infringe their patents, which may result in substantial liabilities and prevent us from pursuing the development of our product candidates.

Because the field we operate in is constantly changing and patent applications are still being processed by government patent offices around the world, there is a great deal of uncertainty about which patents will issue, when, to whom and with what claims. Although we are not aware of any blocking patents or other proprietary rights, it is likely that there will be significant litigation and other proceedings, such as interference and opposition proceedings in various patent offices, relating to patent rights in the field we operate. Further, many patents in the fields we are pursuing have already been exclusively licensed to third-parties, including our competitors. It is possible that we may become a party to such proceedings.

| 16 |

If a claim should be brought against us and we are found to infringe the rights of others, we may be required to pay substantial damages, be forced to stop the development of product candidates affected by the claim, and/or establish licenses or similar arrangements. Furthermore, any such licenses may not be available when needed, on commercially reasonable terms or at all. Whether an infringement claim is successful or not, the cost of these proceedings may be significant and divert the attention of management and other key employees. As a result, we cannot be certain that our patents or those we license will not be challenged by others, which could have a material adverse effect on our business, results of operations and financial condition.

We are dependent on the patents we own and the technologies we license, and if we fail to maintain our patents or lose the right to license such technologies, our ability to develop new products would be harmed.