UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 28, 2019

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission File Number 001-35849

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||

(Address of principal executive offices) | (Zip Code) | |||||

Registrant's telephone number, including area code: (954 ) 495-2112

Securities Registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the last business day of the registrant’s most recently completed second fiscal quarter was approximately $838.6 million. For purposes of this computation, all officers, directors, and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors, or 10% beneficial owners are, in fact, affiliates of the registrant.

As of April 21, 2020, there were 12,874,424 shares outstanding of the registrant’s common stock, $0.01 par value.

DOCUMENTS INCORPORATED BY REFERENCE

1

None.

2

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “10-K/A”) to the Annual Report on Form 10-K for the year ended December 28, 2019 (“Original 10-K”) of NV5 Global, Inc. (the “Company”) is being filed with the Securities and Exchange Commission (“SEC”) to provide the information required by Items 10, 11, 12, 13 and 14 of Part III of Form 10-K (“Part III Information”). In addition, in order to comply with the technical requirements of Rule 12b-15 in connection with the filing of this Form 10-K/A, updated certifications are being filed with this Form 10-K/A. No changes have been made to the Original 10-K other than the addition of the Part III Information, the inclusion of such certifications, and related updates to the Exhibit Index. Except for the foregoing, this Form 10-K/A speaks as of the filing date of the Original 10-K and does not update or discuss any other Company developments after the date of the Original 10-K, including any developments relating to the coronavirus (COVID-19) pandemic.

3

NV5 GLOBAL, INC.

FORM 10-K/A ANNUAL REPORT

TABLE OF CONTENTS

Page | ||

4

PART III

ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. |

Set forth below is certain biographical information about each director and officer of the Company as of April 21, 2020, as well as, in the case of our directors, information concerning the qualifications and experiences that led the board to conclude that such individuals should serve as directors.

Name | Age | Position | ||

Executive Officers | ||||

Dickerson Wright | 73 | Chief Executive Officer and Chairman | ||

Alexander A. Hockman | 62 | Chief Operating Officer, President and Director | ||

MaryJo E. O’Brien | 57 | Director, Executive Vice President, Chief Administrative Officer and Secretary | ||

Donald C. Alford | 76 | Executive Vice President | ||

Richard Tong | 51 | Executive Vice President and General Counsel | ||

Edward H. Codispoti | 49 | Chief Financial Officer | ||

Non-Employee Directors | ||||

William D. Pruitt | 79 | Director | ||

Gerald J. Salontai | 65 | Director | ||

François Tardan | 67 | Director | ||

Laurie Conner | 65 | Director | ||

Information about our Executive Officers

Dickerson Wright. Mr. Wright has served as Chief Executive Officer and Chairman of the Board of Directors since the Company’s inception in September 2011. Mr. Wright previously served as our President from 2011 until January 1, 2015. Prior to the Company’s inception, Mr. Wright founded NV5 Holdings, Inc. (formerly known as NV5 Global, Inc. and NV5, Inc.), a Delaware corporation and wholly owned subsidiary of ours, in December 2009 and has served as its Chief Executive Officer, President and Chairman of the Board since its inception in December 2009. Mr. Wright has over 40 years of uninterrupted experience in managing and developing engineering companies. From early 2008 through late 2009, Mr. Wright served as the Chief Executive Officer of Nova Group Services. Prior to joining Nova Group Services, Mr. Wright served as the Chief Executive Officer of Bureau Veritas, U.S. (“BV”), where he was responsible for developing BV’s U.S. operations through strategic acquisitions and follow-on growth. Before Mr. Wright joined BV, it had a minimal presence in the United States; however, by the time Mr. Wright left BV in 2007, its U.S. operations employed 3,200 people in 67 offices and generated $280 million in revenue. Prior to BV, Mr. Wright founded U.S. Laboratories in 1993 and oversaw its growth to 1,000 employees and $80 million in revenue. Mr. Wright led U.S. Laboratories to a successful initial public offering in 1999 (NASDAQ: USLB), and, in 2001, U.S. Laboratories was named as the small cap growth stock of the year. Mr. Wright earned a Bachelor of Science degree in Engineering from Pacific Western University and is a board certified engineer in California.

Alexander A. Hockman. Mr. Hockman has served as a member of our Board of Directors since January 28, 2015 and as our Chief Operating Officer and President since January 1, 2015. Prior to becoming President and Chief Operating Officer, Mr. Hockman served as our Executive Vice President beginning September 2011 and President of NV5 - Southeast beginning February 2010. Mr. Hockman has over 30 years of diverse experience in the fields of construction inspections, materials testing, geotechnical, environmental, waterfront, construction and building envelope consulting. From March 2003 until March 2010, Mr. Hockman served as the Chief Operating Officer of the Construction Materials Testing Division of BV. Further, from 1985 until its acquisition by BV in 2003, Mr. Hockman served as the President of Intercounty Laboratories. Mr. Hockman earned a Bachelor of Science degree in Civil Engineering from Florida International University and is a licensed engineer in Florida.

MaryJo O’Brien. Ms. O’Brien has served as a member of our Board of Directors since June 9, 2018 and has served as our Executive Vice President, Chief Administrative Officer and Secretary since September 2011. Prior to her present role, Ms. O’Brien served as Executive Vice President of Human Resources and Administration of NV5 Global, Inc. from January 2010 to September 2011. Ms. O’Brien has more than 30 years of experience in human resources, administration and the engineering

5

and consulting industry. From March 2008 through November 2009, Ms. O’Brien served as the Director of Human Resources for Nova Group Services, Inc. From 2002 to 2008, Ms. O’Brien held various management positions with BV. Further, Ms. O’Brien served in similar human resources and administrative capacities for Testing Engineers - San Diego and U.S. Laboratories from 1987 to 2002. Ms. O’Brien earned a Bachelor’s degree in Communications and Business Economics from the University of California at San Diego.

Donald C. Alford. Mr. Alford served as a member of our Board from March 26, 2013 to June 9, 2018 when he retired from the Board at the 2019 Annual Meeting. Mr. Alford has served as our Executive Vice President since September 2011 and as the Executive Vice President of NV5 Global, Inc. since February 2010 and is responsible for M&A and other growth initiatives. From February 2007 until February 2010, Mr. Alford held a similar position with Nova Group Services, Inc. From November 2002 to November 2006, Mr. Alford acted as the exclusive M&A agent in the U.S. for BV. Further, from 1998 to 2002, Mr. Alford served as the Executive Vice President and Secretary for U.S. Laboratories. Mr. Alford earned a Bachelor of Arts degree in History from Princeton University and a Master of Business Administration degree from the University of Virginia. Mr. Alford also served as an officer in the U.S. Marine Corps from 1965 until 1968.

Richard Tong. Mr. Tong has served as our Executive Vice President and General Counsel since April 2010. Mr. Tong has approximately 20 years of experience working in the engineering, environmental, consulting, testing and inspection industry. In his capacity as our Executive Vice President and General Counsel, Mr. Tong devotes a considerable amount of time to acquisitions, strategic planning, corporate compliance and legal matters. From November 2008 through November 2009, Mr. Tong served as the Executive Vice President and General Counsel of Nova Group Services, Inc., an engineering and consulting services company. Mr. Tong also served as the Executive Vice President and General Counsel for BV from January 2003 until November 2008 and headed BV’s Legal, Ethics, Compliance, and Risk Management programs in North America. Mr. Tong earned a Bachelor of Science degree in both Biology and Chemistry and a Juris Doctorate degree from the University of Miami and is a licensed attorney in Florida.

Edward H. Codispoti. Mr. Codispoti has served as our Chief Financial Officer since June 6, 2019. Mr. Codispoti was previously the Chief Financial Officer of Ilumno Holdings, Ltd. since May 2017 and as CFO of JetSmarter, Inc. from October 2016 to March 2017. He served in various capacities for TradeStation Group, Inc. including CFO from June 2011 to August 2016, Chief Accounting Officer from February 2010 to June 2011 and Corporate Controller and Vice President of Accounting from September 2007 to May 2011. Mr. Codispoti began his career at Arthur Andersen, LLP. He is a Certified Public Accountant and a Member of the American Institute of Certified Public Accountants and the Florida Institute of Certified Public Accountants. Mr. Codispoti earned his Bachelor of Accounting and Master of Accounting degrees from Florida International University.

Non-Employee Directors

William D. Pruitt. Mr. Pruitt has served as a member of our Board since March 26, 2013. Mr. Pruitt has served as General Manager of Pruitt Enterprises, LP and President of Pruitt Ventures, Inc. since 2000. Mr. Pruitt has more than 20 years of experience as an independent board member for numerous companies and has held various roles as either member or chairman for these companies’ audit committees. These companies include MAKO Surgical Corp., a developer of robots for knee and hip surgery; Swisher Hygiene, Inc., a hygiene services company; the PBSJ Corporation, an international professional services firm; KOS Pharmaceuticals, Inc., a fully integrated specialty pharmaceuticals company and Adjoined Consulting, Inc., a full-service management consulting firm. From 1980 to 1999, Mr. Pruitt served as the managing partner for the Florida, Caribbean and Venezuela operations of the independent auditing firm of Arthur Andersen LLP. Mr. Pruitt earned a Bachelor of Business Administration degree from the University of Miami and is a Certified Public Accountant, in good standing.

Gerald J. Salontai. Mr. Salontai has served as a member of our Board since March 26, 2013. Mr. Salontai has over 35 years of progressive technical, management and leadership experience in the engineering and construction industry. Mr. Salontai is currently the Chief Executive Officer of Salontai Consulting Group, a management advisory company focused on assisting companies achieve success in the areas of strategy, business management and leadership. From 1998 until 2009, Mr. Salontai served as chairman of the board and Chief Executive Officer of The Kleinfelder Group, Inc., a management, planning, engineering, science and construction services consulting company. Prior to his time at Kleinfelder, Mr. Salontai held a number of management positions in several firms, where his responsibilities included strategy implementation, sales execution, delivery of services, quality, customer satisfaction, and overall profit and loss. Mr. Salontai earned both a Bachelor of Science and Master’s degree in Civil Engineering from Long Beach State University and graduated from the Executive Management Program at the University of California, Berkeley.

6

François Tardan has served as a member of our Board since January 28, 2015. Mr. Tardan has served as Chief Executive Officer of Leitmotiv Private Equity since 2012. From 1998 to 2011, Mr. Tardan served as Executive Vice President and Chief Financial Officer of BV. During Mr. Tardan’s tenure at BV, revenues grew from €650 million to €3.4 billion and EBITDA margins increased from 8% to 16.5%. Under his leadership, the company also completed more than 100 acquisitions in Asia, North America, Latin America, and Europe and completed a successful IPO in 2007 with a placement exceeding €1 billion. BV shares increased in price from €37.7 to €56 during the time Mr. Tardan was with the company despite the impact of the 2008 financial crisis. Before 1998, Mr. Tardan was President and CEO of Fondasol, a notable European geotechnical firm. François Tardan graduated from Ecole Nationale d’Administration (ENA) in Paris and received his MBA from Ecole des Hautes Etudes Commerciales (HEC).

Laurie Conner. Ms. Conner has served as a member of our Board since June 8, 2019. Ms. Conner has over 35 years of experience in technology companies focusing on strategy, marketing, sales and business development. Ms. Connor has been President and CEO of the Detection Group, a cloud-based IoT technology solution for commercial buildings to reduce water losses, since July 2013. Previously, Ms. Connor served as President of Gazebo Capital Management LLC, a financial technology and investment firm and as Global Vice President of Sales and Marketing for a division of New Focus, a leader in optical networking and photonics. Ms. Conner holds a Bachelor degree in Civil Engineering from Duke University, a Masters degree in Civil & Environmental Engineering from Stanford University and a Masters of Business Administration from the Harvard Business School.

Governance Information

Corporate Governance Philosophy

The business affairs of the Company are managed under the direction of our Chief Executive Officer and the oversight of our Board in accordance with the Delaware General Corporation Law, as implemented by the Company’s Amended and Restated Certificate of Incorporation and Bylaws. The fundamental role of the Board is to effectively govern the affairs of the Company in the best interests of the Company and our stockholders. The Board strives to ensure the success and continuity of our business through the selection of qualified management. It is also responsible for ensuring that the Company’s activities are conducted in a responsible and ethical manner. The Company is committed to having sound corporate governance principles.

Director Qualification Standards and Review of Director Nominees

The Nominating and Governance Committee (the “Governance Committee”) makes recommendations to the Board regarding the size and composition of the Board. The Governance Committee is responsible for screening and reviewing potential Director candidates and recommending qualified candidates to the Board for nomination. The Governance Committee considers recommendations of potential candidates from current Directors, management and stockholders. Stockholders’ nominees for Directors must be made in writing and include the nominee’s written consent to the nomination and sufficient background information on the candidate to enable the Governance Committee to assess his or her qualifications.

Criteria for Board of Directors Membership

The Governance Committee is responsible for reviewing with the Board, from time to time, the appropriate skills and characteristics required of Board members in the context of the current size and composition of the Board. This assessment includes issues of diversity and numerous other factors, such as skills, background, experience and expected contributions in areas that are relevant to the Company’s activities. These factors, and any other qualifications considered useful by the Governance Committee, are reviewed in the context of an assessment of the perceived needs of the Board as a whole when the Governance Committee recommends candidates to the Board for nomination. As a result, the priorities and emphasis that the Governance Committee, and the Board, places on various selection criteria may change from time to time to take into account changes in business and other trends, and the portfolio of skills and experience of current and prospective members of the Board. Therefore, while focused on the achievement and the ability of potential candidates to make a positive contribution with respect to such factors, the Governance Committee has not established any specific minimum criteria or qualifications that a nominee must possess. In addition, the Governance Committee and the Board are committed to considering candidates for the Board regardless of gender, ethnicity and national origin. While the Company does not have a specific policy regarding diversity, when considering the nomination of Directors, the Governance Committee does consider the diversity of its Directors and nominees in terms of knowledge, experience, background, skills, expertise and other demographic factors. We believe that the considerations and the flexibility of our nomination process have created Board diversity of a type that is effective for our Company.

7

Director Independence

The Board has determined that, other than Mr. Dickerson Wright, our Chairman and Chief Executive Officer, Mr. Alexander A. Hockman, our Chief Operating Officer, President and a Director, and Ms. MaryJo O’Brien, our Executive Vice President, Chief Administrative Officer and a Director, each of the members of the Board is an “independent director” for purposes of the NASDAQ Stock Market (“NASDAQ”) Listing Rules and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the term applies to membership on the Board and the various committees of the Board. NASDAQ’s independence definition includes a series of objective tests, such as that the Director has not been an employee of the company within the past three years and has not engaged in various types of business dealings with the Company. In addition, as further required by NASDAQ Listing Rules, our Board has made an affirmative subjective determination as to each independent Director that no relationships exist which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a Director. In making these determinations, the Board reviewed and discussed information provided by the Directors and us with regard to each Director’s business and personal activities as they may relate to the Company and the Company’s management. On an annual basis, each Director and executive officer is obligated to complete a Director and Officer Questionnaire that requires disclosure of any transactions with the Company in which the Director or executive officer, or any member of his or her family, have a direct or indirect material interest.

Based upon all of the elements of independence set forth in the NASDAQ Listing Rules, the Board has determined that each of the following non-employee Directors is independent and has no relationship with the Company, except as a Director and stockholder of the Company: Messrs. William D. Pruitt, Gerald J. Salontai and François Tardan and Ms. Laurie Conner.

Board of Directors Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure so as to provide independent oversight of management. The Board understands that there is no single, generally accepted approach to providing Board leadership, and that given the dynamic and competitive environment in which we operate, the right Board leadership structure may vary as circumstances warrant. Our Corporate Governance Guidelines currently provide that the Board may choose to appoint a single person to a combined Chief Executive Officer and Chairman role or appoint a Chairman who does not also serve as Chief Executive Officer. Currently, our Chief Executive Officer also serves as Chairman and, as discussed below, our independent Directors also elect a Lead Independent Director. The Board believes this leadership structure is optimal for the Company at the current time, as it provides the Company with a Chief Executive Officer and Chairman with a long history of service in a variety of positions and who is, therefore, deeply familiar with the history and operations of the Company. The Board also believes that the current leadership structure provides independent oversight and management accountability through regular executive sessions of the independent Directors that are mandated by our Corporate Governance Guidelines and which are chaired by the Lead Independent Director, as well as through a Board composed of a majority of independent Directors.

Lead Independent Director

Mr. Gerald Salontai was elected by our independent Directors to serve as the Lead Independent Director, and he has served in such capacity since June 8, 2019. The Lead Independent Director is responsible for, among other things, presiding over periodic meetings of our independent Directors and overseeing the function of our Board and committees of the Board.

Executive Sessions

Our independent Directors meet periodically in executive session, without the presence of management, including the Chief Executive Officer, who is one of our three current Directors who are not independent. Generally, executive sessions are scheduled as a part of all regular Board meetings, and, in any event, such sessions are held not less than twice during each calendar year. Executive sessions are chaired by our Lead Independent Director. The Chairman of each executive session will report to the Chief Executive Officer, as appropriate, regarding relevant matters discussed in the executive session.

8

Board of Director’s Role in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure, and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The Audit Committee also has the responsibility to issue guidelines and policies to govern the process by which risk assessment and management is undertaken, monitor compliance with legal and regulatory requirements, and oversee the performance of our internal audit function as well as cyber-security measures to address risks to our information technology systems, networks and infrastructure from deliberate attacks or unintentional events that could interrupt or interfere with their functionality or the confidentiality of our information. Mr. William Pruitt was appointed by the Audit Committee of the Board as the Audit Committee member with primary risk oversight responsibility for cybersecurity issues. Our Governance Committee monitors the effectiveness of our Corporate Governance Guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs have the potential to encourage excessive risk-taking.

Board of Director’s Role in Succession Planning

As provided in our Corporate Governance Guidelines, the Board is responsible for planning for the succession of the position of Chief Executive Officer and other senior management positions. To assist the Board, the Chief Executive Officer shall report periodically to the Board on succession planning. The independent Directors shall consult with the Chief Executive Officer to (1) develop plans for interim succession of the Chief Executive Officer in the event that such officer should become unable to perform his or her duties and (2) assess the qualification of senior officers as potential successors to the Chief Executive Officer.

Stockholder Communications with Directors

Stockholders who wish to communicate with the Board or an individual Director may do so by sending written correspondence by mail, facsimile or email to: the Board or individual Director, c/o the Corporate Secretary of the Company at 200 South Park Road, Suite 350, Hollywood, FL 33021; Fax: (954) 495-2102; Email Address: MaryJo.OBrien@nv5.com. The mailing envelope, facsimile cover letter or email must contain a clear notation indicating that the enclosed correspondence is a “Stockholder Board Communication.” The Corporate Secretary has been authorized to screen such communications and handle differently any such communications that are abusive, in bad taste or that present safety or security concerns. All such communications must identify the author as a stockholder and clearly state whether the intended recipients are all or individual members of the Board. The Corporate Secretary will maintain a log of such communications and make copies of all such communications and circulate them to the full Board or the appropriate Directors.

Indemnification of Directors and Officers

As required by our Amended and Restated Certificate of Incorporation and Bylaws, we indemnify our Directors and officers to the fullest extent permitted by law so that they will be free from undue concern about personal liability in connection with their service to the Company. We also have entered into agreements with our Directors and officers that contractually obligate us to provide this indemnification.

Policies on Business Conduct and Ethics

All of our employees, including our Chief Executive Officer, Chief Financial Officer and controller, are required to abide by our Code of Business Conduct and Ethics to ensure that our business is conducted in a consistently legal and ethical manner. These policies form the foundation of a comprehensive process that includes compliance with corporate policies and procedures, an open relationship among colleagues that contributes to good business conduct, and a commitment to honesty, fair dealing and full compliance with all laws and regulations affecting the Company’s business. Our policies and procedures cover all major areas of professional conduct, including employment policies, conflicts of interest, intellectual property and the protection of confidential information, as well as strict adherence to laws and regulations applicable to the conduct of our business.

Employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of our Code of Business Conduct and Ethics. As required by the Sarbanes-Oxley Act of 2002, our Audit Committee has procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing

9

matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

The full text of our Code of Business Conduct and Ethics is posted on the “Investors - Corporate Governance” page of our website at www.nv5.com.

We will disclose any future amendments to, or waivers from, provisions of these ethics policies and standards on our website as promptly as practicable, as may be required under applicable SEC and NASDAQ rules and, to the extent required, by filing Current Reports on Form 8-K with the SEC disclosing such information.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines that address the composition of the Board, criteria for Board membership and other Board governance matters. These guidelines are available on our website at www.nv5.com on the “Investors - Corporate Governance” page.

Anti-Hedging Policy

We have adopted an insider trading policy that includes an anti-hedging provision restricting the circumstances under which our employees may engage in short sales, maintain shares of our common stock in margin accounts and engage in certain hedging transactions – including zero-cost collars and forward sale contracts – that have the economic effect of locking in a particular value in exchange for future appreciation.

Board and Committee Membership

Meetings of the Board of Directors and Committees

The Board held four (4) meetings during the fiscal year ended December 28, 2019. The Board has three standing committees: the Audit Committee, Compensation Committee and Governance Committee. During fiscal year 2019, each of our Directors attended at least 75% of the total number of meetings of the Board and at least 75% of the total number of meetings of the committees of the Board on which such Director served during that period. Mr. Gerald Salontai, our Lead Independent Director, presided over all executive sessions of our Directors.

The table below provides membership and meeting information for each of the committees of the Board for fiscal year 2019.

Director | Audit Committee | Compensation Committee | Nominating and Governance Committee | |||

Dickerson Wright | - | - | - | |||

Alexander A. Hockman | - | - | - | |||

MaryJo O’Brien | - | - | - | |||

Laurie Conner | - | X | Chairman | |||

William D. Pruitt | Chairman | X | X | |||

Gerald J. Salontai | X | Chairman | X | |||

François Tardan | X | - | - | |||

Total meetings during fiscal year 2019 | 4 | 2 | 1 | |||

10

Audit Committee

The members of the Audit Committee are Messrs. William D. Pruitt (Chairman), Mr. Gerald J. Salontai and François Tardan. Each of the members of the Audit Committee is independent for purposes of the NASDAQ Listing Rules and meets the independence standard for audit committee members set out in Rule 10A-3(b)(1) of the Exchange Act. The Board has determined that Mr. William D. Pruitt qualifies as an audit committee financial expert under the rules of the SEC. The functions of the Audit Committee include retaining our independent registered public accounting firm, reviewing its independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our independent registered public accounting firm, overseeing its audit work, reviewing and pre-approving any non-audit services that may be performed by our independent registered public accounting firm, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party transactions.

Compensation Committee

The members of the Compensation Committee are Messrs. Gerald J. Salontai (Chairman) and William D. Pruitt and Ms. Laurie Conner. Each of the members of the Compensation Committee is independent for purposes of the NASDAQ Listing Rules. The Compensation Committee is responsible for the design and oversight of our compensation program and policies for our executive officers and non-employee Directors. The Compensation Committee seeks to ensure that the executive pay program reinforces the Company’s compensation philosophy and aligns with the interests of our stockholders. The Compensation Committee also reviews and approves all equity grants under the Company’s 2011 Equity Incentive Plan (as amended, the “2011 Equity Incentive Plan”) and the Company’s Employee Stock Purchase Plan. The Compensation Committee also periodically monitors any potential risks associated with the Company’s compensation program and policies.

Nominating and Governance Committee

The members of the Governance Committee are Ms. Laurie Conner (Chairman) and Messrs William D. Pruitt and Gerald J. Salontai. Each of the members of the Governance Committee is independent for purposes of the NASDAQ Listing Rules. The Governance Committee considers qualified candidates for appointment and nomination for election to the Board and makes recommendations concerning such candidates, develops corporate governance principles for recommendation to Board and oversees the regular evaluation of our Directors and management.

Committee Charters

Our Board has adopted a written charter for each of the Audit Committee, Compensation Committee and Governance Committee. Each charter is available on our website at www.nv5.com on the “Investors - Corporate Governance” page.

Director Participation at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by Directors at an in-person meeting or participation in a virtual meeting, taking into account the Directors’ schedules. All Directors are encouraged to participate in the Company’s annual meeting of stockholders absent an unavoidable and irreconcilable conflict. All of the Directors serving at the time of the 2019 annual meeting of stockholders attended such meeting. All of our Directors and candidates for re-election, as the case may be, are expected to participate in the 2020 Annual Meeting.

ITEM 11. | EXECUTIVE COMPENSATION. |

COMPENSATION DISCUSSION AND ANALYSIS

Overview

Below is an analysis and detailed description of the Company’s executive compensation philosophy, practices and policies as they concern the officers named below, also referred to as “named executive officers” or “NEOs.” NV5 has at all times strived to reflect a fundamental “pay for performance” culture regarding executive compensation, which drives the work of both our Compensation Committee members and the members of our management team who support their efforts. Our board and senior management have long observed the primary objectives of NV5’s executive compensation policies to be:

• | Attracting and retaining the best qualified executives to provide both strategic vision and management excellence |

• | Aligning the interests of our senior executives with the long-term success of the Company |

11

• | Recognizing and rewarding growth in our business, increasing total shareholder returns and appropriate risk management |

• | Motivating our executives to work seamlessly as a team while performing at the highest levels of which they are capable as individuals |

NV5 believes that it has been very fortunate to have such stable leadership for as many years as these executives have been working together. Our overall executive compensation philosophy and the related emphasis on long-term gains (either for the Company or the executives) has – we believe – played a large role in creating the loyalty, drive and perspective of our management, which in turn has generated remarkable growth and long-term value for our stockholders.

The purpose of this compensation discussion and analysis is to provide our stockholders with the information necessary to assess our executive compensation program and observe our strong pay for performance philosophy.

For purposes of review and analysis in this 2020 Proxy Statement, our NEOs for all relevant periods were:

Name | Title | |

Dickerson Wright | Chief Executive Officer and Chairman | |

Alexander A. Hockman | Chief Operating Officer and President | |

Richard Tong | Executive Vice President and General Counsel | |

Donald C. Alford | Executive Vice President | |

Edward H. Codispoti(1) | Chief Financial Officer | |

Michael P. Rama(1) | Former Vice President and Chief Financial Officer | |

(1) Mr. Codispoti succeeded Mr. Rama as Chief Financial Officer effective June 6, 2019.

We also note that this review and analysis takes into account pay decisions relating to 2019 stock performance and compensation, neither of which were affected by the current COVID-19 pandemic. The COVID-19 pandemic has significantly impacted global stock markets and economies and has adversely affected both the market price of our common stock and our 2020 financial operating results to date. As a result, the review of base salaries generally conducted in March of each year resulted in our determination to withhold both merit increases and variable equity awards which otherwise would have been paid in March 2020 in respect to 2019 performance. We intend to continue to monitor the impact of COVID-19 pandemic on our business closely and may modify certain elements of our compensation program accordingly to align executives' interests with those of our employees, customers and stockholders, all of whom are being likewise affected, while seeking to motivate our executive team to perform at the highest level during unprecedented and extreme circumstances.

Results of 2019 Shareholder Vote on Named Executive Officer Compensation

In June 2019, we held a shareholder advisory vote on the compensation paid to our NEOs, which resulted in the approval by a significant margin of the 2018 compensation paid to our NEOs, with approximately 95% of votes cast in favor of our say-on-pay proposal. Based on this feedback, and as the Company evaluated its compensation policies and practices throughout the remainder of 2019, our Board chose to make no significant changes to our existing executive incentive programs based on this vote result.

In connection with the Committee’s determination of 2019 executive compensation, the Company was mindful of the strong support our shareholders expressed for our pay-for-performance philosophy, which is designed to link the compensation paid to our executive officers, including NEOs, to the Company’s financial and share performance in order to ensure that we are delivering value to our shareholders and not merely performing well against our peers.

Fiscal 2019 Financial Highlights

• | Fiscal 2019 Gross Revenues – GAAP increased to $508.9 million from $418.1 million in 2018. |

• | Net income for the year was $23.8 million from $26.9 million in 2018. |

• | GAAP EPS in 2019 was $1.90 per share (based on 12,513,034 diluted shares outstanding) from $2.33 per share (based on 11,506,466 diluted shares outstanding) in 2018. |

• | Cash flows from operating activities increased to $39.9 million for 2019 from $35.0 million in 2018. |

• | Acquisition of Quantum Spatial and remediation of internal control issues. |

12

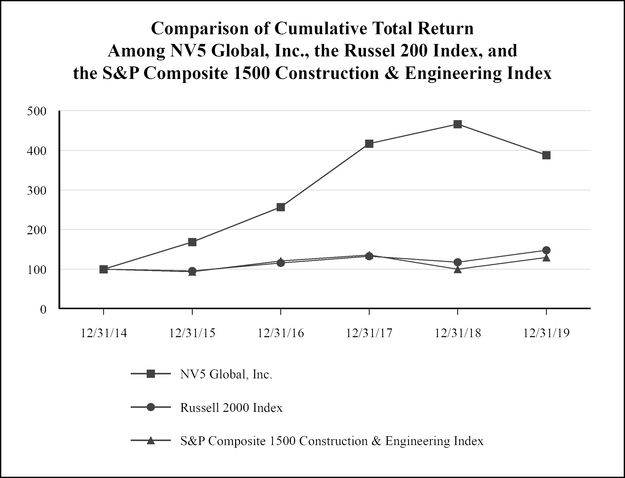

Strong Long-Term Stock Price Performance

NV5 has demonstrated a resilient track record of strong growth in cumulative total return for its stockholders since we began trading on NASDAQ in 2013. Our cumulative total stockholder return (“TSR”) was over 130% for the period from fiscal 2014 through fiscal 2019. We compare our TSR to the Russell 2000 Index and the S&P 1500 Construction and Engineering Index, and outperformed both over this cumulative five-year period. TSR measures the return that we have provided our stockholders, including stock price appreciation and dividends paid (assuming reinvestment thereof).

Please note the performance graph above does not reflect any effects of the COVID-19 pandemic, which has had and is expected to continue to result in significant fluctuations in our stock market performance and overall market indices

13

Compensation Best Practices Highlights

NV5’s executive compensation program has been designed to incorporate many industry best practices, including:

Best Practices in NV5’s Program | Practices We Do Not Engage In | |

• Pay for performance | • No defined benefit pension plan | |

• Annual performance-based incentives paid entirely in restricted stock in current periods | • No re-pricing of stock options (none issued since IPO in 2013) | |

• Multi-year vesting period for equity performance-based awards | • No excise tax gross-up provisions in employment agreements | |

• Modest perquisites | ||

• Use of peer group to benchmark and analyze compensation levels and metrics | ||

• Double-trigger change of control provisions, | ||

• NEOs (other than CEO and CFO) party to at-will employment contracts | ||

• Anti-hedging and anti-pledging policies | ||

From the Top Down – NV5’s Compensation Philosophy

Our core principle is that good people should be paid well when they do an outstanding job. We also believe that short-term opportunism should be discouraged and therefore have designed our compensation packages to reward informed risk-taking by our senior executives. We apply this philosophy to our entire senior executive team - including our CEO Mr. Wright - who by turn follow these principles when making compensation decisions lower down in the NV5 organization.

By keeping our compensation program competitive yet straightforward, NV5 believes it can attract, motivate and retain a talented and driven team of executive officers who will provide leadership for our continued success in the changing and highly competitive markets we face. We also seek to accomplish these objectives in a way that rewards both company and individual performance and aligns with our stockholders’ long-term interests.

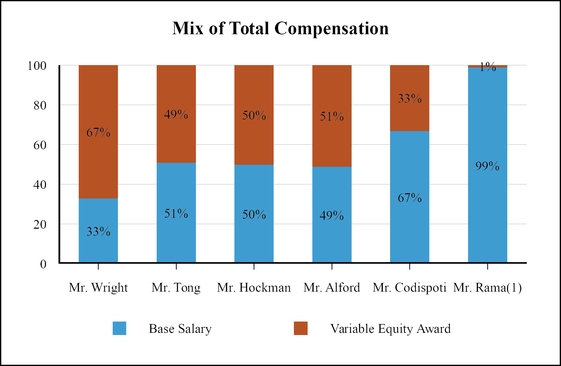

The compensation for our NEOs consists of two primary elements: base salary and annual performance bonuses, the latter of which has been paid entirely in restricted stock in current periods. While we believe that our base salaries provide a fixed level of compensation necessary to attract and retain our executive officers, a significant portion of their compensation is in the form of variable annual performance bonuses.

We do not have specific policies for allocating between cash and non-cash compensation. Rather, the Compensation Committee maintains a balance of performance-based and retention-oriented pay for each executive, considering peer group market data on the mix of pay but also using discretion in making its decisions.

14

(1) Mr. Rama was terminated on June 6, 2019 and was not eligible for variable equity awards.

Variable equity awards are designed to reward corporate and individual performance and future share value appreciation in a simple and straightforward manner. NV5’s executive compensation program is also designed to generate noticeable stability within the executive team.

Each NEO is a member of NV5’s executive team and is expected to contribute to the organization’s overall success rather than focus solely on specific objectives within his or her area of responsibility. Given this team-based approach, NV5 considers relative compensation levels among all executive team members to ensure that our compensation programs are applied consistently and equitably.

Benchmarking and Our Place in the Industry

In setting competitive compensation levels, the Compensation Committee considers pay data and information derived from our compensation peer group. Peer group companies were selected primarily based on the following criteria:

• | Companies with similar revenue and market capitalization |

• | Companies within the same industry, which includes other professional services organizations |

• | Companies that are part of the market from which we compete for talent |

The Compensation Committee reviews the information in the competitive analysis regarding peer executive compensation, our executive compensation and our financial performance in comparison to the selected peers and considers that information, among other things, when it determines total compensation levels. The Compensation Committee considered a group of companies fitting the criteria described above and, with the assistance of Meridian, selected the following companies to comprise the peer group during 2019 to be used as a reference for future executive pay:

Company |

Tetra Tech, Inc. |

Hill International, Inc. |

Willdan Group, Inc. |

15

The Process of Setting Total Compensation, Compensation Mix and Incentive Goals

For 2019, the Compensation Committee made pay decisions based on this annual market assessment of compensation and specific factors about each NEO, including individual performance, experience, internal equity, NV5 results, scope and responsibility and retention.

The Compensation Committee exercises its independent judgment to determine compensation levels for our CEO. Mr. Wright does not participate in the Compensation Committee’s deliberations or decisions about his own compensation. For all other executive officers, the Compensation Committee considers the CEO’s recommendation for setting compensation levels. The Compensation Committee gives considerable weight to the CEO’s evaluation of the other NEOs because of his direct and personal knowledge of each executive’s performance and capabilities. The Compensation Committee approved compensation for the CEO and all other executive officers.

Compensation Committee members have access to certain relevant information due to their position in the industry and will request NV5 management to compile other market information for the Committee’s review. This process generally takes place twice each year: first in March as the Compensation Committee prepares to review base salary levels and fix incentive compensation for the most recently completed fiscal year and again in December as the members meet to determine the annual incentive goals applicable to the NEOs for the upcoming fiscal year. Members of the Compensation Committee usually will convene a third time each year in connection with NV5’s annual meeting of stockholders, which provides another opportunity for them to review and discuss the overall program objectives and effectiveness, as well as review the Committee’s charter, matters relating to compensation consultants and other issues concerning its function more generally.

The Compensation Committee does not set compensation levels or mix to meet any specific market benchmark percentile such as “median peer group compensation.” NV5 believes that while peer group analysis can be helpful in guiding certain compensation determinations, differences between NV5 and the peer group may lead to skewing of results – either upwards or downwards – and also to avoid compensation being awarded in a manner unrelated to or inconsistent with the value created by the NEOs or the overall performance of NV5.

NV5’s annual incentive compensation awards are heavily based on prior year corporate and individual performance, and determined with regard to objective and quantifiable goals discussed in advance with each NEO following the December meeting of the Compensation Committee.

Compensation Elements

As noted above, the primary components of NV5’s executive compensation program are base salary and performance based annual bonuses paid in time-based restricted stock. Each element is described in more detail below.

As a general matter, determination regarding one element of compensation tend not to affect decisions regarding other elements given their different roles and purposes in motivation and retention.

Base Salary

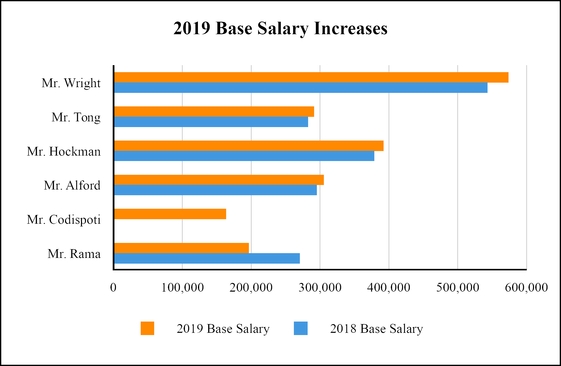

The Compensation Committee seeks to use base salary to provide the NEOs a minimum, fixed level of cash compensation commensurate with their positions, experience, performance and qualifications. Base salary is designed to reward core competence in the executive role. NV5 chooses to pay base salary for talent attraction and retention.

Salaries initially are negotiated and set forth in employment agreements with each of our executive officers and thereafter reviewed annually by the Compensation Committee, generally in March of each year. Salaries consider the performance of the executive, market data adjusted for individual qualifications, job requirements and individual performance. In 2019, the Compensation Committee approved increases in the base salaries of our NEOs as shown in the table below:

16

Annual Performance Bonus

The Compensation Committee may grant annual cash bonuses under NV5’s annual bonus plan and annual equity incentive awards (“AEIs”) under our 2011 Equity Incentive Plan, approved by our stockholders on March 8, 2013 (the “2011 Plan”). The Compensation Committee eliminated annual cash bonuses beginning in 2015 in favor of all incentive compensation being granted in the form of AEIs comprising time-based restricted stock. The AEIs are used to motivate NEOs to meet and exceed specified operating, financial, strategic, and individual measures, and goals that are expected to contribute to stockholder value creation.

2019 AEI Performance Measures and Targets

The AEIs for NEOs other than the CEO are granted based on the achievement of pre-determined financial metrics (Total Revenues and EBITDA) and individual performance metrics (such as “implementation of enterprise cybersecurity” or “expansion of revolving credit facility”), which are objective and ascertainable. The Compensation Committee approved these metrics at its December 2018 meeting, which are aligned to our long-term operating and financial goals that drive long-term stockholder value. Mr. Wright’s employment agreement vests discretion in the Compensation Committee to consider both personal and Company performance (without regard to specific metrics) when determining AEIs.

17

Fiscal 2019 Target AEI Opportunities

The following table sets forth each NEO’s target award expressed as a percentage of each NEO’s base salary. No bonus is paid if performance is below the threshold performance goals.

Name | Target Award (%) | |

Dickerson Wright(1) | -- | |

Alexander A. Hockman | 50% | |

Richard Tong | 50% | |

Donald C. Alford | 75% | |

Edward H. Codispoti | 100% | |

Michael P. Rama | 50% | |

(1) Mr. Wright’s employment agreement vests discretion in the Compensation Committee to grant bonus amounts without regard to fixed performance metrics.

These targets were derived in part from our 2019 peer group and competitive survey analysis data and in part by the Compensation Committee's judgment on the internal equity of the positions and scope of job responsibilities.

Retirement Benefits

The objective of our 401(k) plan is to assist employees (including our NEOs) with the accumulation of assets to fund their retirement benefits. The 401(k) plan allows us to maintain a competitive retirement package.

The 401(k) plan is available to all employees who have completed at least 30 days of service. Our executive officers may participate in the 401(k) Plan. The matching contributions to the 401(k) Plan are discretionary based on the profitability of NV5. When a contribution is made to the 401(k) Plan it is made 100% in cash.

The 401(k) Plan is intended to qualify under Sections 401(a) and 501(a) of the Code. As such, contributions to the 401(k) Plan and earnings on those contributions are not taxable to the employees until distributed from the 401(k) Plan, and all contributions are deductible by us when made. The 401(k) Plan also allows post-tax contributions. The amounts of our matching contributions for our NEOs for 2019, 2018 and 2017 under the 401(k) Plan are included in the “All Other Compensation” column of the Summary Compensation Table on page 21.

Perquisites

We provide a limited number of perquisites to our NEOs (a car lease or allowance to all NEOs and a reimbursement of certain aircraft related expenses to Mr. Wright) with the objective of attracting and retaining executive officers in a highly competitive market for executive talent.

The total value of perquisites provided to the NEOs during 2019 represented a small fraction of each NEO’s total compensation. These amounts are included in the second to last column of the Summary Compensation Table on page 21 under “All Other Compensation” and related footnotes.

Anti-Hedging and Anti-Pledging Policies

NV5 has a policy prohibiting its directors, management, financial and other insiders from engaging in transactions in NV5 securities or derivatives of NV5 securities that might be considered hedging, or from holding NV5 securities in margin accounts or pledging NV5 securities as collateral for a loan, unless such person demonstrates the financial capacity to repay the loan without resort to the pledged securities.

18

Prohibition of Re-Pricing without Shareholder Approval

The 2011 Plan contains a prohibition on the repricing of stock options without shareholder approval.

Termination of Employment and Change in Control Agreements

Employment Agreements

We generally negotiate employment agreements with our NEOs. The objective of these arrangements is to secure qualified executive officers for leadership positions in our organization as well as to protect our business and intellectual property by restrictive covenants, including non-competition covenants, contained in the agreements. As of April 21, 2020, we had employment agreements with all our NEOs for their current positions. See “Executive Employment Agreements” below.

Our employment agreements provide for the payment of certain compensation and benefits in the event of termination of an executive’s employment following a change in control of NV5. The amount payable varies depending upon the reason for the payment. Providing for payments upon a change in control helps preserve NV5’s value by reducing any incentive for key executive officers to seek employment elsewhere if a change in control of NV5 is proposed or becomes likely. Moreover, on an ongoing basis, these arrangements help maintain the continuity of our management team, which we view as a driver of shareholder value. See “Change in Control Provisions, Severance Benefits and Employment Agreements,” below for a description of these provisions and a calculation of the amounts that would be payable thereunder if a change in control of NV5 had occurred on December 28, 2019.

Accounting for Share-Based Compensation

Before granting AEIs or other equity-based compensation awards, the Compensation Committee considers the accounting impact of the award as structured and under various other scenarios to analyze the expected impact of the award.

Impact of Tax Treatments of a Particular Form of Compensation

The tax treatment of the elements of our compensation program is one factor considered by the Compensation Committee and management in the design of NV5’s executive compensation program. Prior to 2018, Section 162(m) of the Code limited the annual federal income tax deduction to $1 million for compensation paid to certain executive officers of publicly-held companies. This deduction limitation did not apply if the compensation met certain qualifying performance based requirements. However, the Tax Cuts and Jobs Act of 2017 (TCJA) repealed the performance-based exception effective with the 2018 tax year. As a result, compensation paid to certain executive officers in excess of $1 million will not be deductible unless such compensation is eligible for a grandfathering rule that preserves the performance-based compensation exemption for certain arrangements and awards in place as of November 2, 2017. Although the Compensation Committee and management considers the impact of Section 162(m) of the Code as well as other tax and accounting consequences when developing and implementing the Company’s executive compensation programs, the Compensation Committee retains the flexibility to design and administer compensation programs that are in the best interests of the Company and its shareholders.

Independent Oversight and Expertise

NV5’s Compensation Committee, which is comprised solely of independent directors, has responsibility for overseeing our executive compensation program. The charter of the Compensation Committee gives it the authority, in its sole discretion and at NV5’s expense, to obtain advice and assistance from external advisors. The Committee may retain and terminate any compensation consultant or other external advisor and has sole authority to approve any such advisor's fees and other terms and conditions of the retention. In retaining its advisors, the Committee must consider each advisor's independence from management.

In 2019, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) as its compensation consultant. Meridian will assist and advise the Compensation Committee on executive and director compensation matters.

Meridian and the Compensation Committee have the following protocols in place to ensure their independence from management:

• | The Compensation Committee has the sole authority to select, retain, and terminate Meridian, as well as authorize Meridian's fees and determine the other terms and conditions that govern the engagement |

19

• | The Compensation Committee directs Meridian on the process for delivery and communication of its work product, including its analyses, findings, conclusions, and recommendations |

• | In the performance of its duties, Meridian is accountable and reports directly to the Compensation Committee |

• | The Compensation Committee may consult with Meridian at any time, with or without members of management present, at the Compensation Committee's sole discretion |

Prior to engaging Meridian, the Compensation Committee evaluated Meridian’s independence by taking into account the six independence factors set forth under Nasdaq rules applicable to listed companies. The Compensation Committee also obtained a representation letter from Meridian addressing these six factors and certain other matters related to its independence. Based on the Compensation Committee's evaluation of these factors and the representations from Meridian, the Compensation Committee concluded that Meridian is an independent adviser and has no conflicts of interest with us.

20

Compensation of Named Executive Officers

The following table sets forth information concerning the compensation earned during the fiscal years ended December 28, 2019, December 29, 2018 and December 30, 2017 by our Named Executive Officers.

Name and Principal Position | Year | Salary ($) | Bonus ($) (1) | Stock Awards ($) (2) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) (1) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) (3) | Total ($) | ||||||||

Dickerson Wright | 2019 | $ | 573,757 | - | $ | 1,268,902 | - | - | - | $ | 37,875 | $ | 1,880,534 | ||||

Chief Executive Officer | 2018 | $ | 543,186 | - | $ | 959,613 | - | - | - | $ | 36,706 | $ | 1,539,505 | ||||

and Chairman | 2017 | $ | 516,355 | - | $ | 559,014 | - | - | - | $ | 23,273 | $ | 1,098,642 | ||||

- | - | - | - | ||||||||||||||

Alexander A. Hockman | 2019 | $ | 392,108 | - | $ | 399,462 | - | - | - | $ | 13,980 | $ | 805,550 | ||||

Chief Operating Officer | 2018 | $ | 378,846 | - | $ | 299,879 | - | - | - | $ | 17,328 | $ | 696,053 | ||||

and President | 2017 | $ | 365,000 | - | $ | 174,986 | - | - | - | $ | 17,035 | $ | 557,021 | ||||

- | - | - | - | ||||||||||||||

Richard Tong | 2019 | $ | 291,271 | - | $ | 279,989 | - | - | - | $ | 668 | $ | 571,928 | ||||

Executive Vice President | 2018 | $ | 282,633 | - | $ | 209,915 | - | - | - | $ | 2,776 | $ | 495,325 | ||||

and General Counsel | 2017 | $ | 273,281 | - | $ | 106,944 | - | - | - | $ | 1,129 | $ | 381,354 | ||||

- | - | - | - | ||||||||||||||

Donald C. Alford | 2019 | $ | 305,538 | - | $ | 316,160 | - | - | - | $ | 2,472 | $ | 624,170 | ||||

Executive Vice President | 2018 | $ | 295,385 | - | $ | 239,903 | - | - | - | $ | 2,419 | $ | 537,707 | ||||

2017 | $ | 278,656 | - | $ | 147,810 | - | - | - | $ | 497 | $ | 426,963 | |||||

- | - | - | - | ||||||||||||||

Edward H. Codispoti4 | 2019 | $ | 163,346 | - | $ | 80,300 | - | - | - | $ | 3,404 | $ | 247,050 | ||||

Chief Financial Officer | - | - | - | - | |||||||||||||

- | - | - | - | ||||||||||||||

Michael P. Rama4 | 2019 | $ | 196,466 | - | $ | 3,349 | - | - | - | $ | 30,358 | $ | 230,173 | ||||

Former Vice President and Chief | 2018 | $ | 270,385 | - | $ | 179,927 | - | - | - | $ | 2,289 | $ | 452,601 | ||||

Financial Officer | 2017 | $ | 253,077 | - | $ | 73,877 | - | - | - | $ | 2,678 | $ | 329,632 | ||||

(1) | Performance-based bonuses are generally paid under our Bonus Plan and reported as Non-Equity Incentive Plan Compensation. Except as otherwise noted, amounts reported as Bonus represent discretionary bonuses awarded by the Compensation Committee in addition to the amount (if any) earned under the Bonus Plan. |

21

(2) | Represents restricted stock awards granted in 2019, 2018 and 2017 pursuant to our 2011 Equity Incentive Plan. The aggregate grant date fair value of such awards were computed in accordance with Financial Accounting Standards Board ASC Topic 718, Stock Compensation (ASC Topic 718), and do not take into account estimated forfeitures related to service-based vesting conditions, if any. These amounts do not represent actual amounts paid or to be realized. Amounts shown are not necessarily indicative of values to be achieved, which may be more or less than the amounts shown as awards are subject to time-based vesting. |

(3) | Consists of group term life insurance premiums for all Named Executive Officers, reimbursements for Mr. Wright's auto lease payments, car allowance payments made by us for Messrs. Hockman and Codispoti, and termination payments made by us to Mr. Rama. |

(4) | Mr. Codispoti succeeded Mr. Rama as Chief Financial Officer effective June 6, 2019. |

For a discussion of the material terms of each NEO’s employment agreement, see the “Executive Employment Agreements” section below.

Pay Ratio Disclosure

As required by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 402(u) of Regulation S-K, we are providing the ratio of the annual total compensation of our Chief Executive Officer, Mr. Dickerson Wright, to that of our median employee (excluding our Chief Executive Officer). The pay ratio was calculated in a manner consistent with Item 402(u) of Regulation S-K and based upon our reasonable judgment and assumptions. For fiscal year 2019, Mr. Wright’s annual total compensation was $1,880,534, the median employee compensation was $82,352 and our estimate of the CEO pay ratio was 23:1.

To determine our median employee, we reviewed compensation data from the NV5 U.S. employee population on December 14, 2019. The median employee was determined using 2019 W-2 wages for all U.S. employees and equivalent taxable compensation for all non-U.S. employees were excluded as they represented less than 5% of our total employee population. We also excluded employees of Geospatial Holdings, Inc., GHD Services, Inc., WHPacific, Inc., GeoDesign, Inc., Alta Environmental, L.P., Page One Consultants, and The Sextant Group, Inc. as permitted by SEC rules in light of our acquisition of these companies in 2019. To identify the median employee, earnings during the 52-week period of December 23, 2018 to December 20, 2019 were reviewed. For employees who worked a partial year because of a hire date that fell after the start of the fiscal year, earnings were annualized.

The SEC rules for identifying the median employee and calculating the pay ratio based on that employee’s annual total compensation allow companies to adopt a variety of methodologies, to apply certain exclusions, and to make reasonable estimates and assumptions that reflect their compensation practices. As such, the pay ratio reported by other companies may not be comparable to the pay ratio reported above, as other companies may have different employment and compensation practices and may utilize different methodologies, exclusions, estimates, and assumptions in calculating their own pay ratios.

22

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information with respect to the value of all outstanding equity awards previously awarded to our NEOs as of December 28, 2019.

Option Awards | Stock Awards | ||||||||||||

Name | Number of Securities Underlying Unexercised Options (#) exercisable | Number of Securities Underlying Unexercised Options (#) unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock that Have Not Vested (#)(1) | Market Value of Shares or Units of Stock that Have Not Vested ($)(2) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that Have Not Vested ($) | ||||

Dickerson Wright | — | — | — | — | — | 47,302 | $ | 2,285,160 | — | — | |||

Richard Tong | — | — | — | — | — | 9,969 | $ | 481,602 | — | — | |||

Alexander A. Hockman | — | — | — | — | — | 14,838 | $ | 716,824 | — | — | |||

Donald C. Alford | — | — | — | — | — | 11,973 | $ | 578,416 | — | — | |||

Edward H. Codispoti | — | — | — | — | — | 1,000 | $ | 48,310 | — | — | |||

Michael P. Rama | — | — | — | — | — | 5,068 | $ | 244,835 | — | — | |||

(1) | The grant dates and vesting dates for such unvested shares are as follows: |

5/31/2017 | 07/26/2017 | 05/14/2018 | 05/03/2019 | 7/17/2019 | 7/25/2019 | Total No. of Shares | ||||||||||||||

Dickerson Wright | 15,232 | — | 16,000 | 70 | — | 16,000 | 47,302 | |||||||||||||

Richard Tong | 2,914 | — | 3,500 | 55 | — | 3,500 | 9,969 | |||||||||||||

Alexander A. Hockman | 4,768 | — | 5,000 | 70 | — | 5,000 | 14,838 | |||||||||||||

Donald C. Alford | 3,576 | 397 | 4,000 | — | — | 4,000 | 11,973 | |||||||||||||

Edward H. Codispoti | — | — | — | — | 1,000 | — | 1,000 | |||||||||||||

Michael Rama | 2,013 | — | 3,000 | 55 | — | — | 5,068 | |||||||||||||

Vesting Date | 05/31/2020 | 07/26/2020 | 05/14/2020 | 05/03/2021 | 07/18/2022 | 07/26/2021 | ||||||||||||||

(three-year cliff vesting) | (three-year cliff vesting) | (two-year cliff vesting) | (two-year cliff vesting) | (three-year cliff vesting) | (two-year cliff vesting) | |||||||||||||||

23

(2) | Calculated by multiplying the number of restricted shares of common stock held by $48.31 which is the quoted market price per share of our common stock as of December 27, 2019. |

Executive Employment Agreements

We have written employment agreements with each of our NEOs that provide for, among other things, the payment of base salary, reimbursement of certain costs and expenses, and for each NEO’s participation in our bonus plan and employee benefit plans.

We entered into employment agreements with Donald Alford effective August 1, 2010, Richard Tong and Alexander Hockman effective October 1, 2010, Dickerson Wright effective April 11, 2011 and as amended on August 29, 2017 and November 7, 2018, and Edward Codispoti effective and as amended on June 6, 2019 that govern the terms of their respective service with us. Mr. Wright’s employment agreement provides for an initial term of five years with automatic successive two-year renewal terms, unless earlier terminated in accordance with the terms of such employment agreement. Mr. Codispoti's employment agreement provides for an initial term of one year with automatic successive one-year renewal terms, unless earlier terminated in accordance with the terms of such employment agreement. The employment agreements with each of our other NEOs provide for a term of employment commencing on the date of the agreement and continuing until we or the respective NEO provide 30 days written notice of termination to the other party, upon termination by us for Cause (as defined in each NEOs respective employment agreement), or upon the executive’s death or Disability (as defined in each NEOs respective employment agreement).

Except with respect to certain items of compensation, as described below, the terms of each agreement are similar in all material respects.

The employment agreement with Mr. Wright as amended to date provides for an annual base salary of $600,000, subject to annual review by our Board and subject to an annual increase equal to the greater of a Consumer Price Index adjustment or 5%, and includes provisions relating to Section 409A of the Code. The employment agreement with Mr. Wright entitles him to receive a performance bonus based on criteria established by our Board and to receive reimbursement of all reasonable expenses incurred in connection with our business.

The other NEO employment agreements as amended and modified by annual review by our Board to date, provide for an annual base salary of $312,000 for Mr. Alford, $400,400 for Mr. Hockman, $297,400 for Mr. Tong and $310,000 for Mr. Codispoti, subject to continuing annual review by our Board. Mr. Alford’s agreement entitles him to receive up to a 75% performance bonus based on criteria established upon employment and to receive reimbursement of all reasonable and necessary expenses incurred in connection with our business. Messrs. Tong’s and Hockman’s, respective employment agreements entitle such executive to receive up to a 50% performance bonus based on criteria established upon employment and to receive reimbursement of expenses incurred in connection with our business in an amount not to exceed, on an annual basis, 10% of such executive’s annual base salary. Mr. Codispoti’s employment agreement entitles such executive to receive up to a 100% performance bonus based on criteria established upon employment and to receive reimbursement of expenses incurred in connection with our business.

Each of Messrs. Alford’s, Tong’s, Hockman’s and Codispoti's employment agreements provides that in the event of a Change in Control (as defined below), during the term of such executive’s employments we are obligated to pay such executive a single lump sum payment, within 30 days of the termination of such executive’s employment, equal to (1) one year of executive's base salary, plus any unused vacation pay for the year immediately preceding the year in which the executive's employment is terminated, which shall be paid in a lump sum; and (2) the monthly COBRA premiums for the executive, for a period of one year following termination. Further, if a Change in Control occurs during such executive’s employment, then such executive’s equity awards, if any, shall immediately vest, notwithstanding any other provision in such respective equity award agreement to the contrary. A “Change in Control” means approval by our stockholders of (1)(a) a reorganization, merger, consolidation or other form of corporate transaction or series of transactions, in each case, with respect to which persons who were our stockholders immediately prior to such transaction do not, immediately thereafter, own more than 50% of the combined voting power entitled to vote generally in the election of Directors of the reorganized, merged or consolidated company’s then outstanding voting securities, in substantially the same proportions as their ownership immediately prior to such transaction, (b) our liquidation or dissolution, or (c) the sale of all or substantially all of our assets (unless such reorganization, merger, consolidation or other corporate transaction, liquidation, dissolution or sale is subsequently abandoned); or (2) the acquisition in a transaction or series or transactions by any person, entity or “group”, within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act, of more than 50% of either the then outstanding shares of common stock or the combined voting power of our then outstanding voting

24

securities entitled to vote generally in the election of Directors (a “Controlling Interest”), excluding any acquisitions by (a) us or our subsidiaries, (b) any person, entity or “group” that as of the date of the amendments to the employment agreements owns beneficial ownership (within the meaning of Rule 13d-3 of the Exchange Act of a Controlling Interest, or (c) any employee benefit plan of ours or our subsidiaries.

Each employment agreement entitles the NEO to receive customary and usual fringe benefits generally available to our executive officers, and to be reimbursed for reasonable out-of-pocket business expenses. Pursuant to Mr. Wright’s employment agreement, we have also agreed to pay monthly management fees to a non-related third party, Chatham Enterprises, LLC, relating to an aircraft in which Mr. Wright has an ownership interest.

Except as described below with respect to Mr. Wright’s employment agreement, the employment agreements prohibit the NEOs from engaging in any work that creates an actual conflict of interest with us, and include customary confidentiality, non-competition and non-solicitation covenants that prohibit such executives, during their employment with us and for 12 months thereafter, from (1) using or disclosing any confidential proprietary information of our Company, (2) engaging in any manner, or sharing in the earnings of or investing in, any person or entity engaged in any business that is in the same line of business as us, (3) soliciting our current customers with whom such executive has contact on our behalf during the two years immediately preceding such executive’s termination and, (4) inducing or attempting to induce any of our employees to leave our employ. In addition, during the NEO’s term of employment and thereafter, the NEO shall not interfere with the business of our company by way of disrupting our relationships with customers, agents, representatives or vendors or disparaging or diminishing the reputation of the Company. Mr. Wright’s employment agreement provides that (a) the foregoing non-competition covenant does not apply following the termination of employment if his employment is terminated without Cause or for Good Reason (each as defined below), (b) the foregoing non-solicitation of employees covenant applies with respect to any current employee or any former employee who was employed by us within the prior six months, and (c) the foregoing non-solicitation of customers covenant applies to all actual or targeted prospective clients of ours to the extent solicited on behalf of any person or entity in connection with any business competitive with our business and requires Mr. Wright to keep confidential any information relating in any manner to the Company’s business relationship with such customers. As consideration and compensation to each NEO (except for Mr. Wright) for, and subject to such NEO’s adherence to certain of the above covenants and limitations, we have agreed that during the one-year non-competition period following each such NEO’s termination, we will continue to pay each such NEO’s base salary in the same manner as if such executive continued to be employed by us.

Unless otherwise noted above, and except for the termination payments pursuant to Mr. Wright’s and Mr. Codispoti's employment agreements as described below, upon termination of employment under the employment agreements, we are only required to pay the terminated NEO such portions of his respective annual base salary that have accrued and remain unpaid through the effective date of such NEO’s termination, and we have no further obligation whatsoever to such NEO other than reimbursement of previously incurred expenses which are appropriately reimbursable under our expense reimbursement policy; provided, however, that in the event of termination of employment due to the death of an NEO, we will continue to pay to such NEO’s estate such NEO’s annual base salary for the period through the end of the calendar month in which such death occurs.

In the event of a merger or consolidation of our Company with another corporation or entity, or if substantially all of our assets are sold or otherwise transferred to another corporation or entity, the provisions of the employment agreements will be binding upon and inure to the benefit of the continuing or surviving corporation.

Change in Control Provisions, Severance Benefits and Employment Agreements