UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 000-55096

THE ALKALINE WATER COMPANY

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 99-0367049 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| 14646 N. Kierland Blvd, Suite 255, Scottsdale, AZ | 85254 |

| (Address of principal executive offices) | (Zip Code) |

(480) 656-2423

(Registrant’s telephone

number, including area code)

Not Applicable

(Former name, former

address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] | |

| (Do not check if a smaller reporting company) | Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act.

Yes [ ] No [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

21,958,062 shares of common stock issued and outstanding as of November 17, 2017 .

| THE ALKALINE WATER COMPANY INC. |

| FORM 10-Q |

| FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2017 |

| TABLE OF CONTENTS |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

| THE ALKALINE WATER COMPANY INC. |

| CONSOLIDATED BALANCE SHEET |

| September 30, 2017 | ||||||

| (unaudited) | March 31, 2017 | |||||

| ASSETS | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ | 481,831 | $ | 603,805 | ||

| Accounts receivable | 1,848,845 | 1,419,281 | ||||

| Inventory | 634,347 | 819,988 | ||||

| Prepaid expenses | 340,161 | 307,247 | ||||

| Total current assets | 3,305,184 | 3,150,321 | ||||

| Fixed assets - net | 1,154,035 | 1,120,148 | ||||

| Total assets | $ | 4,459,219 | $ | 4,270,469 | ||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||

| Current liabilities | ||||||

| Accounts payable | $ | 1,451,780 | $ | 1,343,824 | ||

| Accrued expenses | 611,833 | 455,916 | ||||

| Revolving financing | 1,846,026 | 1,436,083 | ||||

| Current portion of capital leases | 112,752 | 190,207 | ||||

| Derivative liability | 3,407 | 3,407 | ||||

| Total current liabilities | 4,025,798 | 3,429,437 | ||||

| Long-term Liabilities | ||||||

| Capitalized leases | - | 8,006 | ||||

| Convertible notes payable, net of debt discount | - | - | ||||

| Total long-term liabilities | - | 8,006 | ||||

| Total liabilities | $ | 4,025,798 | $ | 3,437,443 | ||

| Stockholders' equity | ||||||

| Preferred

stock, $0.001 par value, 100,000,000 shares authorized, Series A issued

20,000,000, Series C issued 1,500,000, Series D issued 3,000,000 |

24,500 |

23,000 |

||||

| Common

stock, Class A - $0.001 par value, 200,000,000 shares authorized

20,540,918

and 17,532,451 shares issued and outstanding at September 30, 2017 and March 31, 2017 respectively |

20,540 | 17,531 | ||||

| Additional paid in capital | 26,657,897 | 24,181,029 | ||||

| Accumulated deficit | (26,269,516 | ) | (23,388,534 | ) | ||

| Total stockholders' equity | 433,421 | 833,026 | ||||

| Total liabilities and stockholders' equity | $ | 4,459,219 | $ | 4,270,469 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

| THE ALKALINE WATER COMPANY INC. |

| CONSOLIDATED STATEMENT OF OPERATIONS |

| (unaudited) |

| For the Three Months | For the Six Months | |||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | |||||||||

| Revenue | $ | 4,841,528 | $ | 3,007,538 | $ | 10,021,722 | $ | 5,954,287 | ||||

| Cost of Goods Sold | 2,753,879 | 1,896,112 | 5,705,823 | 3,686,825 | ||||||||

| Gross Profit | 2,087,649 | 1,111,426 | 4,315,899 | 2,267,462 | ||||||||

| Operating expenses | ||||||||||||

| Sales and marketing expenses | 1,818,344 | 1,060,390 | 3,488,361 | 2,146,389 | ||||||||

| General and administrative | 877,584 | 1,056,741 | 2,967,976 | 1,897,515 | ||||||||

| Depreciation | 96,280 | 90,958 | 192,559 | 180,397 | ||||||||

| Total operating expenses | 2,792,208 | 2,208,089 | 6,648,896 | 4,224,301 | ||||||||

| Total operating loss | (704,559 | ) | (1,096,663 | ) | (2,332,997 | ) | (1,956,839 | ) | ||||

| Other income (expense) | ||||||||||||

| Interest income | - | 4 | - | 102 | ||||||||

| Interest expense | (127,836 | ) | (100,043 | ) | (251,485 | ) | (212,644 | ) | ||||

| Amortization of debt discount and accretion | (275,333 | ) | (81,025 | ) | (295,000 | ) | (126,283 | ) | ||||

| Change in derivative liability | - | 2,051 | - | 6,357 | ||||||||

| Total other income (expense) | (403,169 | ) | (179,013 | ) | (546,485 | ) | (332,468 | ) | ||||

| Net loss | $ | (1,107,728 | ) | $ | (1,275,676 | ) | $ | (2,879,482 | ) | $ | (2,289,307 | ) |

| EARNINGS PER SHARE (Basic) | $ | (0.06 | ) | $ | (0.08 | ) | $ | (0.15 | ) | $ | (0.15 | ) |

| WEIGHTED AVERAGE SHARES OUTSTANDING (Basic) | 19,778,369 | 15,390,421 | 18,877,941 | 15,070,758 | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| THE ALKALINE WATER COMPANY INC. |

| CONSOLIDATED STATEMENT OF CASH FLOWS |

| (unaudited) |

| For the Six Months | ||||||

| September 30, 2017 | September 30, 2016 | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Net loss | $ | (2,879,482 | ) | $ | (2,289,307 | ) |

| Adjustments to reconcile net loss to net cash used in operating | ||||||

| Depreciation expense | 192,559 | 180,397 | ||||

| Stock compensation expense | 1,670,294 | 319,125 | ||||

| Amortization of debt discount and accretion | 295,000 | 137,369 | ||||

| Interest expense converted to equity | 14,583 | |||||

| Interest expense relating to amortization of capital lease discount | 51,505 | 51,504 | ||||

| Change in derivative liabilities | - | (6,357 | ) | |||

| Changes in operating assets and liabilities: | ||||||

| Accounts receivable | (429,564 | ) | (168,448 | ) | ||

| Inventory | 185,641 | (112,901 | ) | |||

| Prepaid expenses and other current assets | (32,914 | ) | (10,294 | ) | ||

| Accounts payable | 107,956 | 110,383 | ||||

| Accrued expenses | 155,917 | 138,266 | ||||

| NET CASH USED IN OPERATING ACTIVITIES | (668,505 | ) | (1,650,263 | ) | ||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Purchase of fixed assets | (226,446 | ) | (79,696 | ) | ||

| Equipment Deposits - related party | - | (104,619 | ) | |||

| CASH USED IN INVESTING ACTIVITIES | (226,446 | ) | (184,315 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Proceeds from notes payable | - | 510,000 | ||||

| Proceeds from convertible note payable | 500,000 | - | ||||

| Proceeds from revolving financing | 409,943 | 87,918 | ||||

| Proceeds from sale of common stock, net | - | 425,000 | ||||

| Proceeds from the exercise of warrants, net | - | 300,000 | ||||

| Repayment of notes payable | - | (373,727 | ) | |||

| Repayment of capital lease | (136,966 | ) | (117,021 | ) | ||

| CASH PROVIDED BY FINANCING ACTIVITIES | 772,977 | 832,170 | ||||

| NET CHANGE IN CASH | (121,974 | ) | (1,002,408 | ) | ||

| CASH AT BEGINNING OF PERIOD | 603,805 | 1,192,119 | ||||

| CASH AT END OF PERIOD | $ | 481,831 | $ | 189,711 | ||

| INTEREST PAID | $ | 154,497 | $ | 36,023 | ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| THE ALKALINE WATER COMPANY INC. |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| (unaudited) |

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The consolidated financial statements included herein, presented in accordance with United States generally accepted accounting principles and stated in U.S. dollars, have been prepared by the Company, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures are adequate to make the information presented not misleading. The interim financial statements are condensed and should be read in conjunction with the Company's latest annual financial statements and that interim disclosures generally do not repeat those in the annual statements.

These statements reflect all adjustments, consisting of normal recurring adjustments, which in the opinion of management, are necessary for fair presentation of the information contained therein.

Principles of consolidation

The consolidated financial statements include the accounts of The Alkaline Water Company Inc. (a Nevada Corporation), Alkaline Water Corp. (an Arizona Corporation) and Alkaline 88, LLC (an Arizona Limited Liability Company).

All significant intercompany balances and transactions have been eliminated. The Alkaline Water Company Inc. (a Nevada Corporation), Alkaline Water Corp. (an Arizona Corporation) and Alkaline 88, LLC (an Arizona Limited Liability Company) will be collectively referred herein to as the “Company”. Any reference herein to “The Alkaline Water Company Inc.”, the “Company”, “we”, “our” or “us” is intended to mean The Alkaline Water Company Inc., including the subsidiaries indicated above, unless otherwise indicated.

Reverse split

Effective December 30, 2015, the Company effected a fifty for one reverse stock split of its authorized and issued and outstanding shares of common stock. As a result, the authorized common stock has decreased from 1,125,000,000 shares of common stock, with a par value of $0.001 per share, to 22,500,000 shares of common stock, with a par value of $0.001 per share. All shares and per share amounts have been retroactively restated to reflect such split.

On January 21, 2016, stockholders of our company approved, by written consents, an amendment to the articles of incorporation of our company to increase the number of authorized shares of our common stock from 22,500,000 to 200,000,000.

The Company received written consents representing 20,776,000 votes from the holders of shares of its common stock and our Series A Preferred Stock voting as a single class, representing approximately 61% of the voting power of its outstanding common stock and its outstanding Series A Preferred Stock voting as a single class as of the record date (January 12, 2016). On January 21, 2016, there were no written consents received by the Company representing a vote against, abstention or broker non-vote with respect to the proposal.

Our authorized preferred stock was not affected by the reverse stock split and continues to be 100,000,000 shares of preferred stock, with a par value of $0.001 per share. In addition, the number of issued and outstanding shares of Series A Preferred Stock continues to be 20,000,000. However, holders of Series A Preferred Stock had 0.2 vote per share of Series A Preferred Stock, instead of 10 votes per share of Series A Preferred Stock, as a result of the reverse stock split.

On January 22, 2016, the Company amended the certificate of designation for our Series A Preferred Stock by filing an amendment to certificate of designation with the Secretary of State of the State of Nevada. The Company amended the certificate of designation for our Series A Preferred Stock by deleting Section 2.2 of the certificate of designation, which proportionately increases or decreases the number of votes per share of Series A Preferred Stock in the event of any dividend or other distribution on our common stock payable in its common stock or a subdivision or consolidation of the outstanding shares of its common stock. Accordingly, holders of Series A Preferred Stock will have 10 votes per share of Series A Preferred Stock, instead of 0.2 votes per share of Series A Preferred Stock.

On March 30, 2016, the Company designated 3,000,000 shares of the authorized and unissued preferred stock of our company as “Series C Preferred Stock” by filing a Certificate of Designation with the Secretary of State of the State of Nevada. Each share of the Series C Preferred Stock will be convertible, without the payment of any additional consideration by the holder and at the option of the holder, into one fully paid and non-assessable share of our common stock at any time after (i) the Company achieves consolidated revenue equal to or greater than $15,000,000 in any 12 month period, ending on the last day of any quarterly period of our fiscal year; or (ii) a Negotiated Trigger Event, defined as an event upon which the Series C Preferred Stock will be convertible as may be agreed by our company and the holder in writing from time to time.

On May 3, 2017, we designated 3,000,000 shares of the authorized and unissued preferred stock of our company as “Series D Preferred Stock” by filing a Certificate of Designation with the Secretary of State of the State of Nevada. On November 2, 2017, we increased the number of authorized shares of Series D Preferred Stock in our company to 5,000,000 shares by filing an Amendment to the foregoing Certificate of Designation with the Secretary of State of the State of Nevada. Each share of the Series D Preferred Stock will be convertible, without the payment of any additional consideration by the holder and at the option of the holder, into one fully paid and non-assessable share of our common stock at any time after (i) we achieve the consolidated revenue of our company and all of its subsidiaries equal to or greater than $40,000,000 in any 12 month period, ending on the last day of any quarterly period of our fiscal year; or (ii) a Negotiated Trigger Event, defined as an event upon which the Series D Preferred Stock will be convertible as may be agreed by our company and the holder in writing from time to time.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ significantly from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with an original maturity of three months or less to be considered cash equivalents. The carrying value of these investments approximates fair value. The Company had $481,831 and $603,805 in cash and cash equivalents at September 30, 2017 and March 31, 2017, respectively.

Accounts receivable and allowance for doubtful accounts

The Company generally does not require collateral, and the majority of its trade receivables are unsecured. The carrying amount for accounts receivable approximates fair value.

Accounts receivable are periodically evaluated for collectability based on past credit history with clients. Provisions for losses on accounts receivable are determined on the basis of loss experience, known and inherent risk in the account balance and current economic conditions.

Inventory

Inventory represents raw and blended chemicals and other items valued at the lower of cost or market with cost determined using the weight average method which approximates first-in first-out method, and with market defined as the lower of replacement cost or realizable value.

As of September 30, 2017 and March, 31 2017, inventory consisted of the following:

| September 30, 2017 | March 31, 2017 | |||||

| Raw materials | $ | 453,858 | $ | 587,689 | ||

| Finished goods | 180,489 | 232,300 | ||||

| Total inventory | $ | 634,347 | $ | 819,989 |

Property and equipment

The Company records all property and equipment at cost less accumulated depreciation. Improvements are capitalized while repairs and maintenance costs are expensed as incurred. Depreciation is calculated using the straight-line method over the estimated useful life of the assets or the lease term, whichever is shorter. Depreciation periods are as follows for the relevant fixed assets:

| Equipment | 5 years | ||

| Equipment under capital lease | 5 years |

Stock-based Compensation

The Company accounts for stock-based compensation to employees in accordance with Accounting Standards Codification (“ASC”) 718. Stock-based compensation to employees is measured at the grant date, based on the fair value of the award, and is recognized as expense over the requisite employee service period. The Company has elected to account for forfeitures as they occur. Company accounts for stock-based compensation to other than employees in accordance with ASC 505-50. Equity instruments issued to other than employees are valued at the earlier of a commitment date or upon completion of the services, based on the fair value of the equity instruments and is recognized as expense over the service period. The Company estimates the fair value of stock-based payments using the Black-Scholes option-pricing model for common stock options and warrants and the closing price of the Company’s common stock for common share issuances.

Revenue recognition

The Company recognizes revenue when all of the following conditions are satisfied: (1) there is persuasive evidence of an arrangement; (2) the product or service has been provided to the customer; (3) the amount to be paid by the customer is fixed or determinable; and (4) the collection of such amount is probable.

The Company records revenue when it is realizable and earned upon shipment of the finished products. The Company does not accept returns due to the nature of the product. However, the Company will provide credit to our customers for damaged goods.

Fair value measurements

The valuation of our embedded derivatives and warrant derivatives are determined primarily by the multinomial distribution (Lattice) model. An embedded derivative is a derivative instrument that is embedded within another contract, which under the convertible note (the host contract) includes the right to convert the note by the holder, certain default redemption right premiums and a change of control premium (payable in cash if a fundamental change occurs). In accordance with ASC 815 “Accounting for Derivative Instruments and Hedging Activities”, as amended, these embedded derivatives are marked-to-market each reporting period, with a corresponding non-cash gain or loss charged to the current period. A warrant derivative liability is also determined in accordance with ASC 815. Based on ASC 815, warrants which are determined to be classified as derivative liabilities are marked-to-market each reporting period, with a corresponding non-cash gain or loss charged to the current period. The practical effect of this has been that when our stock price increases so does our derivative liability resulting in a non-cash loss charge that reduces our earnings and earnings per share. When our stock price declines, the Company records a non-cash gain, increasing our earnings and earnings per share. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, there exists a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

| Level 1 |

unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access as of the measurement date. |

|

| |

| Level 2 |

inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data. |

|

| |

| Level 3 |

unobservable inputs for the asset or liability only used when there is little, if any, market activity for the asset or liability at the measurement date. |

This hierarchy requires the Company to use observable market data, when available, and to minimize the use of unobservable inputs when determining fair value.

To determine the fair value of our embedded derivatives, management evaluates assumptions regarding the probability of certain future events. Other factors used to determine fair value include our period end stock price, historical stock volatility, risk free interest rate and derivative term. The fair value recorded for the derivative liability varies from period to period. This variability may result in the actual derivative liability for a period either above or below the estimates recorded on our consolidated financial statements, resulting in significant fluctuations in other income (expense) because of the corresponding non-cash gain or loss recorded.

Income taxes

In accordance with ASC 740 “Accounting for Income Taxes”, the provision for income taxes is computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized.

Basic and diluted loss per share

Basic and diluted earnings or loss per share (“EPS”) amounts in the consolidated financial statements are computed in accordance ASC 260 – 10 “Earnings per Share”, which establishes the requirements for presenting EPS. Basic EPS is based on the weighted average number of common shares outstanding. Diluted EPS is based on the weighted average number of common shares outstanding and dilutive common stock equivalents. Basic EPS is computed by dividing net income or loss available to common stockholders (numerator) by the weighted average number of common shares outstanding (denominator) during the period. Potentially dilutive securities were excluded from the calculation of diluted loss per share, because their effect would be anti-dilutive.

Reclassification

Certain accounts in the prior period were reclassified to conform to the current period financial statements presentation.

Newly issued accounting pronouncements

In July 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2015-11 (ASU 2015-11) "Simplifying the Measurement of Inventory". According to ASU 2015-11 an entity should measure inventory within the scope of this update at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. Subsequent measurement is unchanged for inventory measured using LIFO or the retail inventory method. The amendments in ASU 2015-11 more closely align the measurement of inventory in GAAP with the measurement of inventory in International Financial Reporting Standards (IFRS). The Board has amended some of the other guidance in Topic 330 to more clearly articulate the requirements for the measurement and disclosure of inventory. However, the Board does not intend for those clarifications to result in any changes in practice. Other than the change in the subsequent measurement guidance from the lower of cost or market to the lower of cost and net realizable value for inventory within the scope of ASU 2015-11, there are no other substantive changes to the guidance on measurement of inventory. For public business entities, the amendments in ASU 2015-11 are effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For all other entities, the amendments in ASU 2015-11 are effective for fiscal years beginning after December 15, 2016, and interim periods within fiscal years beginning after December 15, 2017. The amendments in ASU 2015-11 should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period.

The Board decided that the only disclosures required at transition should be the nature of and reason for the change in accounting principle. An entity should disclose that information in the first annual period of adoption and in the interim periods within the first annual period if there is a measurement-period adjustment during the first annual period in which the changes are effective.

On March 30, 2016, the FASB issued Accounting Standards Update (ASU) 2O16-09) Improvements to Employee Share-based Accounting which amends ASC 718, Compensation –Stock Compensation . The ASU includes provisions intended to simplify various provisions related to how share-based payments are accounted for and presented in the financial statements. Compensation cost is ultimately only recognized for awards with performance and/or service conditions that vest (or for awards with market conditions for which the requisite service period is satisfied). Under the new guidance, entities are permitted to make an accounting policy election related to how forfeitures will impact the recognition of compensation cost. Currently entities are required to develop an assumption regarding the forfeiture rate on the grant date, which impacts the estimated amount of compensation cost recorded over the requisite service period. The forfeiture estimates are updated throughout the service period so that compensation cost is ultimately only recognized for awards that vest.

Under the new guidance, entities are permitted to make an accounting policy to either estimate forfeitures each period, as required today or to account for forfeitures as they occur. The Company elects to account for forfeitures as they occur. ASU 2O16-O9 is effective for public business entities for annual reporting periods beginning after December 15, 2O16 and interim periods within that reporting period.

The Company has evaluated other recent accounting pronouncements through September 2017 and believes that none of them will have a material effect on our financial statements.

NOTE 2 – GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the recoverability and/or acquisition and sale of assets and the satisfaction of liabilities in the normal course of business. Since its inception, the Company has been engaged substantially in financing activities, developing its business plan and building its initial customer and distribution base for its products. As a result, the Company incurred accumulated net losses from Inception (June 19, 2012) through the period ended September 30, 2017 of ($26,269,516). In addition, the Company’s development activities since inception have been financially sustained through debt and equity financing.

The ability of the Company to continue as a going concern is dependent upon its ability to raise additional capital from the sale of common stock and, ultimately, the achievement of significant operating revenues. These financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

NOTE 3 – PROPERTY AND EQUIPMENT

Fixed assets consisted of the following at:

| September 30, 2017 | March 31, 2017 | |||||

| Machinery and Equipment | $ | 1,200,293 | $ | 1,012,000 | ||

| Machinery under Capital Lease | 735,781 | 735,781 | ||||

| Machinery - Construction in Progress | 224,662 | 185,848 | ||||

| Office Equipment | 79,681 | 79,681 | ||||

| Leasehold Improvements | - | 3,979 | ||||

| Less: Accumulated Depreciation | (1,086,382 | ) | (897,141 | ) | ||

| Fixed Assets, net | $ | 1,154,035 | $ | 1,120,148 |

Depreciation expense for the six months ended September 30, 2017 and September 30 2016 was $193,221and $180,397, respectively.

NOTE 4 – REVOLVING FINANCING

On February 1, 2017, The Alkaline Water Company Inc. and its subsidiaries (the “Company”) entered into a Credit and Security Agreement (the “Credit Agreement”) with SCM Specialty Finance Opportunities Fund, L.P. (the “Lender”).

The Credit Agreement provides the Company with a revolving credit facility (the “Revolving Facility”), the proceeds of which are to be used to repay existing indebtedness of the Company, transaction fees incurred in connection with the Credit Agreement and for working capital needs of the Company.

Under the terms of the Credit Agreement, the Lender has agreed to make cash advances to the Company in an aggregate principal at any one time outstanding not to exceed the lesser of (i) $3 million (the “Revolving Loan Commitment Amount”) and (ii) the Borrowing Base (defined to mean, as of any date of determination, 85% of net eligible billed receivables plus 65% of eligible unbilled receivables, minus certain reserves).

The Credit Agreement has a term of three years, unless earlier terminated by the parties in accordance with the terms of the Credit Agreement.

The principal amount of the Revolving Facility outstanding bears interest at a rate per annum equal to (i) a fluctuating interest rate per annum equal at all times to the rate of interest announced, from time to time, within Wells Fargo Bank at its principal office in San Francisco as its “prime rate,” plus (ii) 3.25%, payable monthly in arrears.

To secure the payment and performance of the obligations under the Credit Agreement, the Company granted to the Lender a continuing security interest in all of the Company’s assets and agreed to a lockbox account arrangement in respect of certain eligible receivables.

In connection with the Credit Agreement, the Company paid to the Lender a $30,000 facility fee. The Company agreed to pay to Lender monthly an unused line fee in amount equal to 0.083% per month of the difference derived by subtracting (i) the average daily outstanding balance under the Revolving Facility during the preceding month, from (ii) the Revolving Loan Commitment Amount. The unused line fee will be payable monthly in arrears. The Company also agreed to pay the Lender as additional interest a monthly collateral management fee equal to 0.35% per month calculated on the basis of the average daily balance under the Revolving Facility outstanding during the preceding month. The collateral management fee will be payable monthly in arrears. Upon a termination of the Revolving Facility, the Company agreed to pay the Lender a termination fee in an amount equal to 2% of the Revolving Loan Commitment Amount if the termination occurs before February 1, 2020. The Company must also pay certain fees in the event that receivables are not properly deposited in the appropriate lockbox account.

The interest rate will be increased by 5% in the event of a default under the Credit Agreement. Events of default under the Credit Agreement, some of which are subject to certain cure periods, include a failure to pay obligations when due, the making of a material misrepresentation to the Lender, the rendering of certain judgments or decrees against the Company and the commencement of a proceeding for the appointment of a receiver, trustee, liquidator or conservator or filing of a petition seeking reorganization or liquidation or similar relief.

The Credit Agreement contains customary representations and warranties and various affirmative and negative covenants including the right of first refusal to provide financing for the Company and the financial and loan covenants, such as the loan turnover rate, minimum EBTDA, fixed charge coverage ratio and minimum liquidity requirements.

NOTE 5 – DERIVATIVE LIABILITY

On May 1, 2014, the Company completed the offering and sale of an aggregate of shares of our common stock and warrants. Each share of common stock sold in the offering was accompanied by a warrant to purchase one-half of a share of common stock. The warrants include down-round provisions that reduce the exercise price of a warrant and convertible instrument. As required by ASC 815 “Derivatives and Hedging”, if the Company either issues equity shares for a price that is lower than the exercise price of those instruments or issues new warrants or convertible instruments that have a lower exercise price, the investors will be entitled to down-round protection. The Company evaluated whether its warrants and convertible debt instruments contain provisions that protect holders from declines in its stock price or otherwise could result in modification of either the exercise price or the shares to be issued under the respective warrant agreements. The Company determined that a portion of its outstanding warrants and conversion instruments contained such provisions thereby concluding were not indexed to the Company’s own stock and therefore a derivative instrument.

On August 20, 2014, the Company entered into a warrant amendment agreement with certain holders of the Company’s outstanding common stock purchase warrants whereby the Company agreed to reduce the exercise price of the Existing Warrants the Holders are to be issued new common stock purchase warrants of the Company in the form of the Existing Warrants to purchase up to a number of shares of our common stock equal to the number of Existing Warrants exercised by the Holders

The Company analyzed the warrants and conversion feature under ASC 815 “Derivatives and Hedging” to determine the derivative liability as of September 30, 2017 was $3,407.

NOTE 6 – STOCKHOLDERS’ EQUITY

Preferred Shares

On October 7, 2013, the Company amended its articles of incorporation to create 100,000,000 shares of preferred stock by filing a Certificate of Amendment to Articles of Incorporation with the Secretary of State of Nevada. The preferred stock may be divided into and issued in series, with such designations, rights, qualifications, preferences, limitations and terms as fixed and determined by our board of directors. The Series A Preferred Stock had 10 votes per share (reduced to 0.2 votes per share as a result of the fifty for one reverse stock split, which became effective as of December 30, 2015) and are not convertible into shares of our common stock.

Grant of Series A Preferred Stock

On October 8, 2013, the Company issued a total of 20,000,000 shares of non-convertible Series A Preferred Stock to Steven P. Nickolas and Richard A. Wright (10,000,000 shares to each), our directors and executive officers, in consideration for the past services, at a deemed value of $0.001 per share. The Company valued these shares based on the cost considering the time and average billing rate of these individuals and recorded a $20,000 stock compensation cost for the year ended March 31, 2014.

Our authorized preferred stock was not affected by the reverse stock split and continues to be 100,000,000 shares of preferred stock, with a par value of $0.001 per share. In addition, the number of issued and outstanding shares of Series A Preferred Stock continues to be 20,000,000. However, holders of Series A Preferred Stock had 0.2 vote per share of Series A Preferred Stock, instead of 10 votes per share of Series A Preferred Stock, as a result of the reverse-stock split.

On January 22, 2016, the Company amended the certificate of designation for our Series A Preferred Stock by filing an amendment to certificate of designation with the Secretary of State of the State of Nevada. The Company amended the certificate of designation for our Series A Preferred Stock by deleting Section 2.2 of the certificate of designation, which proportionately increases or decreases the number of votes per share of Series A Preferred Stock in the event of any dividend or other distribution on our common stock payable in its common stock or a subdivision or consolidation of the outstanding shares of its common stock. Accordingly, holders of Series A Preferred Stock will have 10 votes per share of Series A Preferred Stock, instead of 0.2 votes per share of Series A Preferred Stock.

Grant of Series C Convertible Preferred Stock

On March 30, 2016, the Company designated 3,000,000 shares of the authorized and unissued preferred stock of our company as “Series C Preferred Stock” by filing a Certificate of Designation with the Secretary of State of the State of Nevada. Each share of the Series C Preferred Stock will be convertible, without the payment of any additional consideration by the holder and at the option of the holder, into one fully paid and non-assessable share of our common stock at any time after (i) the Company achieves consolidated revenue equal to or greater than $15,000,000 in any 12 month period, ending on the last day of any quarterly period of our fiscal year; or (ii) a Negotiated Trigger Event, defined as an event upon which the Series C Preferred Stock will be convertible as may be agreed by our company and the holder in writing from time to time.

Effective March 31, 2016, the Company issued a total of 3,000,000 shares of our Series C Preferred Stock to Steven P. Nickolas and Richard A. Wright (1,500,000 shares to each), pursuant to their employment agreements dated effective March 1, 2016. On August 17, 2017, Steven P. Nickolas converted his 1,500,000 shares of Series C Preferred Stock to 1,500,000 shares of Common Stock.

Grant of Series D Convertible Preferred Stock

On May 3, 2017, the Company designated 3,000,000 shares of the authorized and unissued preferred stock of our company as “Series D Preferred Stock” by filing a Certificate of Designation with the Secretary of State of the State of Nevada. On November 2, 2017, we increased the number of authorized shares of Series D Preferred Stock in our company to 5,000,000 shares by filing an Amendment to the foregoing Certificate of Designation with the Secretary of State of the State of Nevada. Each share of the Series D Preferred Stock will be convertible, without the payment of any additional consideration by the holder and at the option of the holder, into one fully paid and non-assessable share of our common stock at any time after (i) we achieve the consolidated revenue of our company and all of its subsidiaries equal to or greater than $40,000,000 in any 12 month period, ending on the last day of any quarterly period of our fiscal year; or (ii) a Negotiated Trigger Event, defined as an event upon which the Series D Preferred Stock will be convertible as may be agreed by our company and the holder in writing from time to time. The company then issued a total of 3,000,000 shares of our Series D Preferred Stock to our directors, officers, consultants and employees. We issued these shares relying on the registration exemption provided for in Section 4(a)(2) of the Securities Act of 1933.

Common Stock

The Company was authorized to issue 1,125,000,000 shares of $0.001 par value common stock. On May 31, 2013, the Company effected a 15-for-1 forward stock split of our $0.001 par value common stock. All shares and per share amounts have been retroactively restated to reflect such split. Prior to the acquisition of Alkaline Water Corp., the Company had 109,500,000 shares of common stock issued and outstanding. On May 31, 2013, the Company issued 43,000,000 shares in exchange for a 100% interest in Alkaline Water Corp. For accounting purposes, the acquisition of Alkaline Water Corp. by The Alkaline Water Company Inc. has been recorded as a reverse acquisition of a company and recapitalization of Alkaline Water Corp. based on the factors demonstrating that Alkaline Water Corp. represents the accounting acquirer. Consequently, after the closing of this agreement the Company adopted the business of Alkaline Water Corp.’s wholly-owned subsidiary, Alkaline 88, LLC. As part of the acquisition, the former management of the Company agreed to cancel 75,000,000 shares of common stock.

On December 30, 2015, the Company effected a fifty for one reverse stock split of its authorized and issued and outstanding shares of common stock. As a result, the authorized common stock has decreased from 1,125,000,000 shares of common stock, with a par value of $0.001 per share, to 22,500,000 shares of common stock, with a par value of $0.001 per share. All shares and per share amounts have been retroactively restated to reflect such split.

On January 21, 2016, stockholders of our company approved, by written consents, an amendment to the articles of incorporation of our company to increase the number of authorized shares of our common stock from 22,500,000 to 200,000,000.

The Company received written consents representing 20,776,000 votes from the holders of shares of its common stock and our Series A Preferred Stock voting as a single class, representing approximately 61% of the voting power of its outstanding common stock and its outstanding Series A Preferred Stock voting as a single class as of the record date (January 12, 2016). On January 21, 2016, there were no written consents received by the Company representing a vote against, abstention or broker non-vote with respect to the proposal.

Common Stock Issued for Services

Effective April 28, 2017, we issued 610,000 shares of common stock to six persons, one of whom is a director and officer of our company. Of these shares, 560,000 are restricted from transfer for a period of two years.

In consideration for services rendered and to be rendered to our company pursuant to a services agreement dated July 26, 2016, we issued consultant 262,596 shares of our common stock on August 23, 2017.

NOTE 7 – OPTIONS AND WARRANTS

Stock Option Awards

Effective April 28, 2017, we granted a total of 1,790,000 stock options to our directors, officers, consultants employees. The stock options are exercisable at the exercise price of $1.29 per share for a period of six and one-half years from the date of grant. 360,000 of the stock options vest as follows: (i) 120,000 upon the date of grant; and (ii) 120,000 on each anniversary date of grant. 1,430,000 of the stock options vest as follows: (i) 357,500 upon the date of grant; and (ii) 357,500 on each anniversary date of grant. We granted the stock options to 12 U.S. Persons and 3 non U.S. Persons (as that term is defined in Regulation S of the Securities Act of 1933) and in issuing securities we relied on the registration exemption provided for in Regulation S and/or Section 4(a)(2) of the Securities Act of 1933.

In June 2017, two option holders elected to exercise their stock options. A total of 181,000 stock options were surrendered in exchange for 121,288 common stock shares.

NOTE 8 – RELATED PARTY TRANSACTIONS

On November 18, 2016, our company provided notice to Steven P. Nickolas, our then-president and chief executive officer, of our board of directors’ finding that there was “just cause” for termination of Mr. Nickolas’s employment and of our company’s intent to terminate the employment of Mr. Nickolas for “just cause” pursuant to the provision of the Employment Agreement with Mr. Nickolas dated March 1, 2016. Under the Employment Agreement, Mr. Nickolas had 30 days to cure the failures and breaches creating “just cause” for termination. Mr. Nickolas failed to cure such failure and breaches and, on April 7, 2017, our company terminated the employment of Mr. Nickolas for cause. In addition, our company removed Mr. Nickolas as the president and chief executive officer of our company.

On April 7, 2017, our board of directors appointed Richard A. Wright as president of our company. On April 28, 2017, Mr. Wright resigned as the secretary and treasurer of our company and he was appointed as the chief executive officer of our company.

On April 28, 2017, our board of directors appointed David Guarino as chief financial officer, treasurer, secretary president of our company.

On May 3, 2017, the Company designated 3,000,000 shares of the authorized and unissued preferred stock of our company as “Series D Preferred Stock” by filing a Certificate of Designation with the Secretary of State of the State of Nevada. Mr. Wright and Mr. Guarino were each issued 1,000,000 shares each of the Series D Preferred Stock.

On September 14, 2017, Wright Investment Group LLC, an entity controlled by Richard A. Wright, chief executive officer, president and director, advanced $200,000 to the Company.

NOTE 9 – CAPITAL LEASE

On October 22, 2014, the Company entered into a master lease agreement with Veterans Capital Fund, LLC (the “Lessor”) for the secured lease line of credit financing in an amount not to exceed $600,000. The lease is expected to be secured by three new alkaline generating electrolysis system machines. Our wholly-owned subsidiary, Alkaline 88, LLC, and Water Engineering Solutions, LLC acted as co-lessees. Water Engineering Solutions, LLC is an entity that is controlled and owned by our former president and chief executive officer, Steven P. Nickolas, and our current president and chief executive officer, Richard A. Wright. Pursuant to the master lease agreement, the Lessor agreed to lease to us the equipment described in any equipment schedule signed by us and approved by the Lessor. It is expected that any lease under the master lease agreement will be structured for a three year lease term with fixed monthly lease rental payments based on a monthly lease rate factor of 3.4667% of the Lessor’s capital cost. In connection with the entering into the master lease agreement, the Company also entered into a warrant agreement with the Lessor, pursuant to which the Company agreed to issue a warrant to purchase 72,000 shares of our common stock to the Lessor and/or its affiliates at an exercise price of $6. 25 per share for a period of five years, 18,000 shares vested.

On February 25, 2015, the Company amended the master lease agreement with Veterans Capital Fund, LLC for the increase in the secured lease line of credit financing to an amount not to exceed $800,000. The lease was secured by new alkaline generating electrolysis system machines by our wholly-owned subsidiary, Alkaline 88, LLC, and Water Engineering Solutions, LLC. Water Engineering Solutions, LLC is an entity that is controlled and owned by our former president and chief executive officer, Steven P. Nickolas, and our current president and chief executive officer, Richard A. Wright. Pursuant to the master lease agreement, the Lessor agreed to lease to us the equipment described in any equipment schedule signed by us and approved by the Lessor. It is expected that any lease under the master lease agreement will be structured for a three year lease term with fixed monthly lease rental payments based on a monthly lease rate factor of 3.4667% of the Lessor’s capital cost. In connection with the entering into the master lease agreement, the Company entered into a warrant agreement with the Lessor, pursuant to which the Company agreed to cancel the previously issued warrant certificate for 72,000 warrants and issue a warrant certificate for warrants to purchase 102,000 shares of our common stock to the Lessor and/or its affiliates at an exercise price of $5.00 per share for a period of five years. 18,000 shares vested on October 22, 2014, 13,316 shares on October 28, 2014, 13,606 shares on December 22, 2014, 6,945 shares on February 3, 2015 and 15,799 shares on March 5, 2015. The remaining 18,105 shares will vest on a pro rata basis according to any mounts the Lessor funds pursuant to any lease schedules under the master lease agreement, provided that if the Company draws on 90% or more of the total lease line under the master lease agreement, then all such shares will be deemed to be vested. The Company recorded the bifurcated value of $309,028 of the warrants issued as additional paid in capital, the value was determine using a Black-Scholes, a level 3 valuation measure.

During the year ended March 31, 2015 the Company agreed to lease specialized equipment used to make our alkaline water with a value of $735,781 under the above master lease agreement. The Company evaluated this lease under ASC 840-30 “Leases-Capital Leases” and concluded that the lease is a capital asset. As of September 30, 2017 the balance owed to Veterans Capital Fund, LLC under the lease is $112,752.

NOTE 10 – NOTES PAYABLE

On September 20, 2016, we entered into a loan facility agreement (the “Loan Agreement”) with Turnstone Capital Inc., whereby Turnstone Capital Inc. agreed to make available to our company a loan in the aggregate principal amount of $1,500,000 (the “Loan Amount”). In June, 2017, the Loan Agreement was amended to increase the Loan amount to $1,700,000. Pursuant to the Loan Agreement, Turnstone Capital Inc. agreed to make one or more advances of the Loan Amount to our company as requested from time to time by our company in an amount to be agreed upon by our company and the Lender (each, an “Advance”).

During the year ended March 31, 2017, Turnstone Capital Inc. made advances totaling $1,000,000. This amount together with accrued interest of $30,000 was converted to 1,030,000 shares of our common stock on March 31, 2017.

In June, 2017, Turnstone Capital Inc. advanced an additional $500,000 under the Loan Agreement. The Company evaluated this transaction under ASC 470-20-30 “Debt – liability and equity component” and determined that a debt discount of $295,000 was provided and will be amortized over the remaining term of the Loan Agreement.

On September 29, 2017, Turnstone Capital Inc. converted the $500,000 plus accrued interest of 14,583 to 514,583 common shares.

NOTE 11 – SUBSEQUENT EVENTS

On October 17, 2017, Wright Investment Group LLC, an entity controlled by Richard A. Wright, advanced $400,000 to the Company.

On October 25, 2017, Richard A. Wright forfeited stock options to purchase a total of 148,000 shares of the Company’s common stock at prices ranging between $5.75 and $7.50.

On October 31, 2017, our company and its subsidiaries entered into a Settlement Agreement and Mutual Release of Claims (the “Settlement Agreement”) with Steven P. Nickolas, the Nickolas Family Trust, Water Engineering Solutions, LLC and Enhanced Beverages, LLC, companies and trust that are controlled or owned by Mr. Nickolas, (collectively, the “Nickolas Parties”) and McDowell 78, LLC and Wright Investments Group, LLC, a company controlled or owned by Richard A. Wright, (collectively, “Wright/McDowell”). The Settlement Agreement provides, among other things, the following: a) simultaneous with the full execution of the Settlement Agreement, we agreed to pay Mr. Nickolas $110,000 in one lump sum (paid); b) in exchange of 700,000 shares of our common stock and 300,000 shares of our Series D Preferred Stock described above, Mr. Nickolas forfeited his 10,000,000 shares of our Series A Preferred Stock, to be cancelled for no further consideration; c) upon the full execution of the Settlement Agreement, Mr. Nickolas and our company agreed to file the stipulations to dismiss the complaints and counterclaim filed by each of them with prejudice, with each side to bear its own costs and attorney’s fees. In addition, our company and Wright/McDowell agreed that they will effectuate the dismissal of an arbitration proceeding against the Nickolas Parties with prejudice, with each side to bear its own attorneys’ fees and costs; e) Mr. Nickolas acknowledged and agreed that the employment agreement between Mr. Nickolas and our company was terminated as of April 7, 2017 and no further amounts are owed to Mr. Nickolas under the employment agreement and we agreed to waive restrictive covenants set out in the employment agreement; f) we agreed to assume financial responsibility for certain obligations owed by Mr. Nickolas; g) Mr. Nickolas acknowledged and agreed that 1,500,000 stock options with an exercise price of $0.52 issued to Mr. Nickolas on or about March 1, 2016 has expired and a total of 148,000 stock options issued to Mr. Mr. Nickolas before 2016 will automatically expire 90 days from October 6, 2017, the date Mr. Nickolas ceased being a director of our company; and h) the parties also agreed to mutual release of claims.

On November 8, 2017, Richard A. Wright and the Company entered in to an Exchange Agreement and Mutual Release of Claims (the “Exchange Agreement”). The Exchange Agreement provided, among other things, for the following: a) in exchange for the issuance of 700,000 shares of our common stock and 300,000 shares of our Series D Preferred Stock described above, Richard A. Wright forfeited his 10,000,000 shares of our Series A Preferred Stock, to be cancelled for no further consideration; and b) Richard A. Wright also agreed to a release of claims against the Company. Also on November 8, 2017, Richard A. Wright forfeited stock options to purchase 1,500,000 shares of our company’s common stock at an exercise price of $0.52 per share in exchange for the Company agreeing to issue Richard A. Wright an additional 200,000 shares of Series D Preferred Stock.

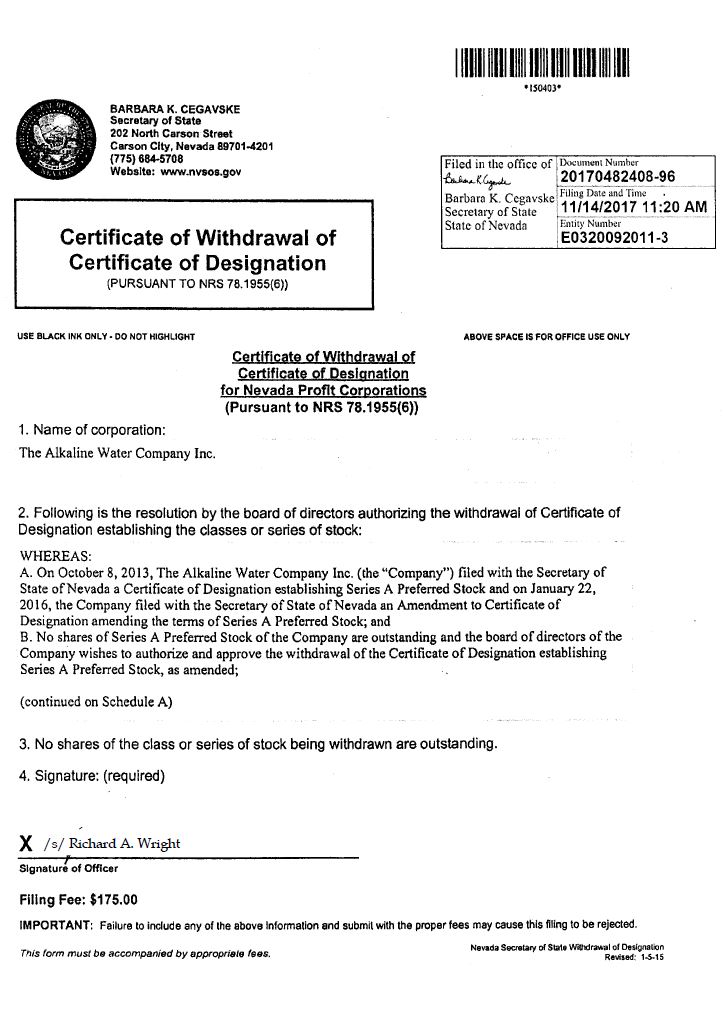

On November 14, 2017, we withdrew the Certificate of Designation establishing Series A Preferred Stock. There were no shares of Series A Preferred Stock outstanding immediately prior to the withdrawal.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Forward-Looking Statements

This report contains “forward-looking statements”. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Except as required by applicable law, including the securities laws of the United States, we do not intend, and undertake no obligation, to update any forward-looking statement.

Although we believe the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

our current lack of working capital;

inability to raise additional financing;

the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require our management to make estimates about matters that are inherently uncertain;

deterioration in general or regional economic conditions;

adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations;

inability to efficiently manage our operations;

inability to achieve future sales levels or other operating results; and

the unavailability of funds for capital expenditures.

As used in this quarterly report on Form 10-Q, the terms “we”, “us” “our”, the “Company” and “Alkaline” refer to The Alkaline Water Company Inc., a Nevada corporation, and its wholly-owned subsidiary, Alkaline Water Corp., and Alkaline Water Corp.’s wholly-owned subsidiary, Alkaline 88, LLC, unless otherwise specified.

Results of Operations

Our results of operations for the three months ended September 30, 2017 and September 30, 2016 are as follows:

| For the three | For the three | |||||

| months ended | months ended | |||||

| September 30, | September 30, | |||||

| 2017 | 2016 | |||||

| Revenue | $ | 4,841,528 | $ | 3,007,538 | ||

| Cost of goods sold | 2,753,879 | 1,896,112 | ||||

| Gross profit | 2,087,649 | 1,111,426 | ||||

| Net Loss (after operating expenses and other expenses) | (1,107,728 | ) | (1,275,676 | ) |

Revenue and Cost of Goods Sold

We had revenue from sales of our product for the three months ended September 30, 2017 of $4,841,528, as compared to $3,007,538 for the three months ended September 30, 2016, an increase of 61% generated by sales of our alkaline water. The increase in sales is due to the expanded distribution of our products to additional retailers throughout the country. As of September 30, 2017, the product is now available in all 50 states at an estimated 32,000 retail locations. As of June 30, 2017, the product was available in all 50 states at an estimated 31,000 retail locations. This increase has occurred primarily through the addition of 5 of the top national grocery retailers as customer during the year ended March 31, 2017. We distribute our product through several channels. We sell through large national distributors (UNFI, KeHe, C&S, and Core-Mark), which together represent over 150,000 retail outlets. We also sell our product directly to retail clients, including convenience stores, natural food products stores, large ethnic markets and national retailers. Some examples of retail clients are: Albertson’s, Safeway, Kroger, Schnucks, Smart & Final, Jewel-Osco, Sprouts, Bashas’, Stater Bros. Markets, Unified Grocers, Bristol Farms, Vallarta, Superior Foods, Ingles, HEB Brookshire’s, Publix, Shaw’s, Raley’s, Food Lion, Harris Teeter, and Festival Foods.

Cost of goods sold is comprised of production costs, shipping and handling costs. For the three months ended September 30, 2017, we had cost of goods sold of $2,753,879, or 57% of revenue, as compared to cost of goods sold of $1,896,112 or 63% of revenue, for the three months ended September 30, 2016. The increase in gross profit rate is a result of reduced raw material cost through greater volume purchases from our suppliers.

Expenses

Our operating expenses for the three months ended September 30, 2017 and September 30, 2016 are as follows:

| For the three | For the three | |||||

| months ended | months ended | |||||

| September 30, | September 30, | |||||

| 2017 | 2016 | |||||

| Sales and marketing expenses | $ | 1,818,344 | $ | 1,060,390 | ||

| General and administrative expenses | 876,922 | 1,056,741 | ||||

| Depreciation expenses | 96,942 | 90,958 | ||||

| Total operating expenses | $ | 2,792,208 | $ | 2,208,089 |

For the three months ended September 30, 2017, our total operating expenses were $2,792,208, as compared to $2,208,089 for the three months ended September 30, 2016.

For the three months ended September 30, 2017, the total included $1,818,344 of sales and marketing expenses and $876,922 of general and administrative expenses, consisting primarily of approximately $330,792 of stock option compensation expense, and $273,001 of professional fees.

For the three months ended September 30, 2016 the total included $1,060,390 of sales and marketing expenses and $1,056,741 of general and administrative expenses, consisting primarily of approximately $176,500 of stock option compensation expense, and $370,118 of professional fees.

Our results of operations for the six months ended September 30, 2017 and September 30, 2016 are as follows:

| For the six | For the six months | |||||

| months ended | ended | |||||

| September 30, | September 30, | |||||

| 2017 | 2016 | |||||

| Revenue | $ | 10,021,722 | $ | 5,954,287 | ||

| Cost of goods sold | 5,705,823 | 3,686,825 | ||||

| Gross profit | 4,315,899 | 2,267,462 | ||||

| Net Loss (after operating expenses and other expenses) | (2,879,482 | ) | (2,289,307 | ) |

Revenue and Cost of Goods Sold

We had revenue from sales of our product for the six months ended September 30, 2017 of $10,021,722 as compared to $5,954,287 for the six months ended September 30, 2016, an increase of 68% generated by sales of our alkaline water. The increase in sales is due to the expanded distribution of our products to additional retailers throughout the country. As of September 30, 2017, the product is now available in all 50 states at an estimated 32,000 retail locations. As of September 30, 2016, the product was available in all 50 states at an estimated 25,000 retail locations. This increase has occurred primarily through the addition of 5 of the top national grocery retailers as customer during the year ended March 31, 2017. We distribute our product through several channels. We sell through large national distributors (UNFI, KeHe, Tree of Life, C&S, Core-Mark and Nature’s Best), which together represent over 150,000 retail outlets. We also sell our product directly to retail clients, including convenience stores, natural food products stores, large ethnic markets and national retailers. Some examples of retail clients are, Albertson’s, Safeway, Kroger, Schnucks, Smart & Final, Jewel-Osco, Sprouts, Bashas’, Stater Bros. Markets, Unified Grocers, Bristol Farms, Vallarta, Superior Foods, Ingles, HEB Brookshire’s, Publix, Shaw’s, Raley’s, Food Lion, Harris Teeter, and Festival Foods.

Cost of goods sold is comprised of production costs, shipping and handling costs. For the six months ended September 30, 2017, we had cost of goods sold of $5,705,823, or 57% of revenue, as compared to cost of goods sold of $3,686,825 or 62% of revenue, for the six months ended September 30, 2016. The increase in gross profit rate is a result of reduced raw material cost through greater volume purchases from our suppliers.

Expenses

Our operating expenses for the six months ended September 30, 2017 and September 30, 2016 are as follows:

| For the six | For the six | |||||

| months ended | months ended | |||||

| September 30, | September 30, | |||||

| 2017 | 2016 | |||||

| Sales and marketing expenses | $ | 3,488,361 | $ | 2,146,389 | ||

| General and administrative expenses | 2,967,314 | 1,897,515 | ||||

| Depreciation expenses | 193,221 | 180,397 | ||||

| Total operating expenses | $ | 6,648,896 | $ | 4,224,301 |

For the six months ended September 30, 2017, our total operating expenses were $6,648,896, as compared to $4,224,301 for the six months ended September 30, 2016.

For the six months ended September 30, 2017, the total included $3,488,361 of sales and marketing expenses and $2,967,314 of general and administrative expenses, consisting primarily of approximately $1,670,294 of stock option compensation expense, and $572,348 of professional fees.

For the six months ended September 30, 2016 the total included $2,146,389 of sales and marketing expenses and $1,897,515 of general and administrative expenses, consisting primarily of approximately $319,125 of stock option compensation expense, and $649,881 of professional fees.

Liquidity and Capital Resources

Working Capital

| September 30, 2017 | March 31, 2017 | |||||

| Current assets | $ | 3,305,184 | $ | 3,150,321 | ||

| Current liabilities | 4,025,798 | 3,429,437 | ||||

| Working capital (deficiency) | $ | (720,614 | ) | $ | (279,116 | ) |

Current Assets

Current assets as of September 30, 2017 and March 31, 2017 primarily relate to $481,831 and $603,805 in cash, $1,848,845 and $1,419,281 in accounts receivable and $634,347 and $819,989 in inventory, respectively.

Current Liabilities

Current liabilities as of September 30, 2017 and March 31, 2017 primarily relate to $1,451,780 and $1,343,824 in accounts payable, revolving financing of $1,846,026 and $1,436,083, current portion of capital leases of $112,752 and $190,207 and accrued expenses of $611,833 and $455,916 respectively.

Cash Flow

Our cash flows for the six months ended September 30, 2017 and September 30, 2016 are as follows:

| For the six | For the six | |||||

| months ended | months ended | |||||

| September 30, | September 30, | |||||

| 2017 | 2016 | |||||

| Net Cash used in operating activities | $ | (668,505 | ) | $ | (1,650,263 | ) |

| Net Cash used in investing activities | (226,446 | ) | (184,315 | ) | ||

| Net Cash provided by financing activities | 772,977 | 832,170 | ||||

| Net decrease in cash and cash equivalents | $ | (121,974 | ) | $ | (1,002,408 | ) |

Operating Activities

Net cash used in operating activities was $668,505 for the six months ended September 30, 2017, as compared to $1,650,263 used in operating activities for the six months ended September 30, 2016. The decrease in net cash used in operating activities was primarily due to a $945,371 reduction of net loss after adding back non cash adjustments in the six months ended September 30, 2017 compared to the six months ended September 30, 2016.

Investing Activities

Net cash used in investing activities was $226,446 for the six months ended September 30, 2017, as compared to $184,315 used in investing activities for the six months ended September 30, 2016. The increase in net cash used by investing activities was the result of an increase of purchase of fixed assets and equipment deposits.

Financing Activities

Net cash provided by financing activities for the six months ended September 30, 2017 was $772,977, as compared to $832,170 for the six months ended September 30, 2016. The decrease of net cash provided by financing activities was mainly attributable to a decrease in proceeds received from financing activities of $412,975 offset by a decrease in repayment from financing activities of $353,782.

Cash Requirements

We believe that cash flow from operations will not meet our present and near-term cash needs and thus we will require additional cash resources, including the sale of equity or debt securities, to meet our planned capital expenditures and working capital requirements for the next 12 months. We estimate that our capital needs over the next 12 months will be up to $3,000,000. We will require additional cash resources to, among other things, expand broker network, increase manufacturing capacity, expand retail distribution and add support staff. If our own financial resources and future cash-flows from operations are insufficient to satisfy our capital requirements, we may seek to sell additional equity or debt securities or obtain additional credit facilities. The sale of additional equity securities will result in dilution to our stockholders. The incurrence of indebtedness will result in increased debt service obligations and could require us to agree to operating and financial covenants that could restrict our operations or modify our plans to grow the business. Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, will limit our ability to expand our business operations and could harm our overall business prospects.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to our stockholders.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

We maintain “disclosure controls and procedures”, as that term is defined in Rule 13a-15(e), promulgated by the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and that such information is accumulated and communicated to our management, including our principal executive officer and principal financial officer to allow timely decisions regarding required disclosure.

As required by paragraph (b) of Rules 13a-15 under the Securities Exchange Act of 1934, our management, with the participation of our principal executive officer and principal financial officer, evaluated our company’s disclosure controls and procedures as of the end of the period covered by this quarterly report on Form 10-Q. Based on this evaluation, our management concluded that as of the end of the period covered by this quarterly report on Form 10-Q, our disclosure controls and procedures were effective.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the fiscal quarter ended September 30, 2017 that have materially affected, or are reasonably likely to materially affect our internal control over financial reporting.

PART II—OTHER INFORMATION

Item 1. Legal Proceedings.

Our company is aware that we have been named in a lawsuit filed on August 9, 2017, by Steven P. Nickolas, a stockholder of our company and our former president and chief executive officer and a former director of our company, in the Maricopa County, Arizona, Superior Court, styled as “Nickolas v. The Alkaline Water Company, Inc., et al.,” cause number CV2017-007786. In the complaint in that action, Mr. Nickolas seeks damages and injunctive relief compelling our company to issue a certificate for 1,500,000 shares of our common stock, which he alleges to have converted from the same number of Series C preferred stock on July 16, 2017. This lawsuit has been dismissed with prejudice pursuant to a Settlement Agreement and Mutual Release of Claims dated October 31, 2017 detailed below in this Item 1.

Our company is a defendant in a lawsuit filed on April 11, 2017 by Steven P. Nickolas in the Maricopa County, Arizona, Superior Court, “Nickolas v. The Alkaline Water Company, Inc., et al.,” cause number CV2017-053064. Mr. Nickolas seeks damages arising out of the alleged breach of a written employment agreement between our company and Mr. Nickolas. Mr. Nickolas alleges that our company wrongfully terminated the employment agreement and has failed to pay wages due to him under the employment agreement. Our company denies the allegations of the claims, and has counterclaimed against Mr. Nickolas for damages suffered by our company as a result of numerous breaches of fiduciary duty owed to our company by Mr. Nickolas in his capacity as officer and director of our company, including diversion of corporate assets to personal matters, and actively interfering with our company’s suppliers and customers. This lawsuit against our company, along with our counterclaims, has been dismissed with prejudice pursuant to a Settlement Agreement and Mutual Release of Claims dated October 31, 2017 detailed below in this Item 1.

Our company is a nominal defendant in a lawsuit filed on April 6, 2017 by Steven P. Nickolas derivatively on behalf of our company against Richard A. Wright, David Guarino, and Aaron Keay (current directors of our company), and Daniel Lorey (current employee of our company) and our company’s former accounting firm, Seale & Beers, LLC. The lawsuit is pending in the Maricopa County, Arizona, Superior Court, “Steven P. Nickolas, derivatively on behalf of the Alkaline Water Company, v. Richard A. Wright, et al.” cause number CV2017-005488 (the “Derivative Action”). Mr. Nickolas alleges a range of conduct including breach of fiduciary and general duties owed to our company. Some of these allegations were first raised by Mr. Nickolas in August, 2016 and, at that time, our company appointed an independent director, Mr. Keay, to conduct an investigation of the allegations. Mr. Keay conducted the investigation and concluded that the claims were without merit. Though our company is a nominal defendant in this action, our company believes the claims in the action are baseless and has denied the claims. We anticipate that the other defendants will defend the action vigorously, and is paying the cost of defending against the claims, subject to a reservation of rights in the event of a finding the principal defendants breached duties owed to our company and are not eligible for indemnification. This lawsuit against all of the parties, including our company as a nominal defendant, is currently in the process of being dismissed with prejudice pursuant a Settlement Agreement and Mutual Release of Claims dated October 31, 2017 detailed below in this Item 1.

Steven P. Nickolas also filed virtually an identical lawsuit to the Derivative Action in his individual capacity against Richard A. Wright, David Guarino, and Dan Lorey. The lawsuit was filed on April 6, 2017 and is pending in the Maricopa County, Arizona, Superior Court, “Steven P. Nickolas vs. Richard A. Wright et al.” cause number CV2017-005486 (the “Individual Action”). The allegations in the Individual Action are nearly identical to those in the Derivative Action. We anticipate that the defendants will defend the action vigorously, and are paying the cost of defending against the claims, subject to a reservation of rights in the event of a finding the principal defendants breached duties owed to our company and are not eligible for indemnification. This lawsuit against all of the individual parties has been dismissed with prejudice pursuant to a Settlement Agreement and Mutual Release of Claims dated October 31, 2017 detailed below in this Item 1.

On October 31, 2017, our company and its subsidiaries entered into a Settlement Agreement and Mutual Release of Claims (the “Settlement Agreement”) with Steven P. Nickolas, the Nickolas Family Trust, Water Engineering Solutions, LLC and Enhanced Beverages, LLC, companies and trust that are controlled or owned by Mr. Nickolas, (collectively, the “Nickolas Parties”) and McDowell 78, LLC and Wright Investments Group, LLC, a company controlled or owned by Richard A. Wright, (collectively, “Wright/McDowell”).

The Settlement Agreement provides, among other things, the following:

| 1. |

Simultaneous with the full execution of the Settlement Agreement, we agreed to pay Mr. Nickolas $110,000 in one lump sum (paid); |

| 2. |

From the date of the Settlement Agreement, we agreed to waive the application of our Insider Trading Policy as to Mr. Nickolas, thereby removing any black-out periods for all future sales of our common stock by Mr. Nickolas; |

| 3. |

Within three business date of the full execution of the Settlement Agreement, we agreed to instruct our transfer agent to issue to Mr. Nickolas 700,000 shares of our common stock (issued); |

| 4. |

Within 10 business days of the full execution of the Settlement Agreement, we agreed to issue to Mr. Nickolas 300,000 shares of our Series D Preferred Stock (issued); |

| 5. |

In exchange of 700,000 shares of our common stock and 300,000 shares of our Series D Preferred Stock described above, Mr. Nickolas forfeited his 10,000,000 shares of our Series A Preferred Stock, to be cancelled for no further consideration; |

| 6. |

Upon the full execution of the Settlement Agreement, Mr. Nickolas and our company agreed to file the stipulations to dismiss the complaints and counterclaim filed by each of them with prejudice, with each side to bear its own costs and attorney’s fees. In addition, our company and Wright/McDowell agreed that they will effectuate the dismissal of an arbitration proceeding against the Nickolas Parties with prejudice, with each side to bear its own attorneys’ fees and costs; |

| 7. |