Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2012

Registration No. 333-177328

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SHEA HOMES LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

| 1531 | California | 95-4240219 | ||

| (Primary Standard Industrial Classification Code Number) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

SHEA HOMES FUNDING CORP.

(Exact name of registrant as specified in its charter)

| 1531 | Delaware | 37-1635024 | ||

| (Primary Standard Industrial Classification Code Number) |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

The subsidiary guarantors listed on Schedule A hereto.

(Exact name of registrant as specified in its charter)

655 Brea Canyon Road

Walnut, California 91789

(909) 594-9500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul E. Mosley

Vice President and General Counsel

Shea Homes Limited Partnership

655 Brea Canyon Road

Walnut, California 91789

(909) 594-9500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Andrew L. Fabens, Esq.

Gibson, Dunn & Crutcher LLP

200 Park Avenue

New York, NY 10166-0193

(212) 351-4000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issue Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Schedule A – Subsidiary Guarantors

The following direct and indirect subsidiaries of Shea Homes Limited Partnership will guarantee the 8.625% Senior Secured Notes due 2019 and are co-registrants with Shea Homes Limited Partnership and Shea Homes Funding Corp. under this registration statement.

| Name |

Jurisdiction of Formation |

I.R.S. Employer Identification No. | ||

| Highlands Ranch Development Corporation |

Colorado | 84-0941791 | ||

| Monty Green Holdings, LLC |

Delaware | 20-3297164 | ||

| Mountainbrook Village Company |

Arizona | 86-0720451 | ||

| Sand Creek Cattle Company |

Colorado | 84-0865738 | ||

| Serenade at Natomas, LLC |

California | 26-3917295 | ||

| Seville Golf and Country Club LLC |

Arizona | 94-3383577 | ||

| Shea Brea Development, LLC |

Delaware | 72-1579307 | ||

| Shea Capital II, LLC |

Delaware | 20-3661716 | ||

| Shea Communities Marketing Company |

Delaware | 36-3347987 | ||

| Shea Financial Services, Inc. |

California | 03-0490610 | ||

| Shea Homes, Inc. |

Delaware | 86-0702254 | ||

| Shea Homes at Montage, LLC |

California | 26-3997836 | ||

| Shea Homes Southwest, Inc. |

Arizona | 86-0533374 | ||

| Shea Homes Vantis, LLC |

California | 45-2103204 | ||

| Shea Insurance Services, Inc. |

California | 01-0627555 | ||

| Shea La Quinta LLC |

California | 01-0661731 | ||

| Shea Ninth and Colorado, LLC |

Colorado | 20-1093937 | ||

| Shea Otay Village 11, LLC |

California | 33-0958666 | ||

| Shea Proctor Valley, LLC |

California | 20-1412156 | ||

| Shea Properties of Colorado, Inc. |

Colorado | 84-1058420 | ||

| Shea Rivermark Village, LLC |

California | 95-4865301 | ||

| Shea Tonner Hills, LLC |

Delaware | 20-0370852 | ||

| Shea Victoria Gardens, LLC |

Florida | 26-0148229 | ||

| SH Jubilee, LLC |

Delaware | 27-2901035 | ||

| SH Jubilee Management, LLC |

Delaware | 27-2901082 | ||

| SHI JV Holdings, LLC |

Delaware | 27-3677848 | ||

| SHLP JV Holdings, LLC |

Delaware | 27-3677812 | ||

| Tower 104 Gathering, LLC |

Colorado | 20-3384762 | ||

| Tower 104 Oil, LLC |

Colorado | 20-3384270 | ||

| Trilogy Antioch, LLC |

California | 20-2049392 | ||

| UDC Advisory Services, Inc. |

Illinois | 86-0724765 | ||

| UDC Homes Construction, Inc. |

Arizona | 86-0704849 | ||

| Vistancia Construction, LLC |

Delaware | 20-0096025 | ||

| Vistancia Marketing, LLC |

Delaware | 20-0096047 |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 23, 2012

PROSPECTUS

$750,000,000

SHEA HOMES LIMITED PARTNERSHIP

SHEA HOMES FUNDING CORP.

Exchange Offer for All Outstanding

8.625% Senior Secured Notes due 2019 and Guarantees thereof

(CUSIP Nos. 82088K AA6 and U82091 AA4)

for new 8.625% Senior Secured Notes due 2019 and Guarantees thereof

that have been registered under the Securities Act of 1933

This exchange offer will expire at 5:00 p.m., New York City time,

on , 2012, unless extended.

We are offering to exchange Shea Homes Limited Partnership and Shea Homes Funding Corp.’s 8.625% Senior Secured Notes due 2019, which have been registered under the Securities Act of 1933, as amended (the “Securities Act”) and which we refer to in this prospectus as the “exchange notes,” for any and all Shea Homes Limited Partnership and Shea Homes Funding Corp.’s 8.625% Senior Secured Notes due 2019 issued on May 10, 2011, which we refer to in this prospectus as the “outstanding notes.” The term “notes” refers to both the exchange notes and the outstanding notes. We refer to the offer to exchange the exchange notes for the outstanding notes as the “exchange offer” in this prospectus.

The Exchange Notes:

| • | The terms of the registered exchange notes to be issued in the exchange offer are substantially identical to the terms of the outstanding notes, except that the transfer restrictions, registration rights and additional interest provisions relating to the outstanding notes will not apply to the exchange notes. |

| • | We are offering the exchange notes pursuant to a registration rights agreement that we entered into in connection with the issuance of the outstanding notes. |

| • | The exchange notes will bear interest at the rate of 8.625% per annum, payable semi-annually in cash, in arrears, on November 15 and May 15 each year. |

| • | The exchange notes will be guaranteed on a senior basis by each of Shea Homes Limited Partnership’s subsidiaries that have guaranteed the outstanding notes. |

Material Terms of the Exchange Offer:

| • | The exchange offer expires at 5:00 p.m., New York City time, on , 2012, unless extended. |

| • | Upon expiration of the exchange offer, all outstanding notes that are validly tendered and not withdrawn will be exchanged for an equal principal amount of the exchange notes. |

| • | You may withdraw tendered outstanding notes at any time prior to the expiration of the exchange offer. |

| • | The exchange offer is not subject to any minimum tender condition, but is subject to customary conditions. |

| • | The exchange of the exchange notes for outstanding notes will not be a taxable exchange for U.S. federal income tax purposes. |

| • | Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act of 1933, as amended, in connection with any resale of such exchange notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such exchange notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that for a period of 180 days after the expiration of the exchange offer, we will make this prospectus available to any broker-dealer for use in any such resale. See “Plan of Distribution.” |

| • | There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or quotation system. |

See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or the accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2012

Table of Contents

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with any information or represent anything about us, our financial results or this offering that is not contained in this prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are not making an offer to sell these exchange notes in any jurisdiction where the offer or sale is not permitted.

The information in this prospectus is applicable only as of the date on its cover, and may change after that date. The information in any document incorporated by reference in this prospectus is applicable only as of the date of any such document. For any time after the cover date of this prospectus, we do not represent our affairs are the same as described or the information in this prospectus is correct—nor do we imply those things by delivering this prospectus or issuing exchange notes to you.

| ii | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| 1 | ||||

| 14 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OTHER INFORMATION |

41 | |||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

51 | |||

| 85 | ||||

| 95 | ||||

| 96 | ||||

| 97 | ||||

| 99 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

103 | |||

| 105 | ||||

| 112 | ||||

| 114 | ||||

| 164 | ||||

| 166 | ||||

| 171 | ||||

| 173 | ||||

| 174 | ||||

| 174 |

i

Table of Contents

As used throughout this prospectus, unless the context otherwise requires or indicates:

| • | “SHLP” means Shea Homes Limited Partnership, and not its subsidiaries; |

| • | “SHI” means Shea Homes, Inc., a wholly-owned subsidiary of SHLP, and not its subsidiaries; |

| • | “Issuers” means SHLP and Shea Homes Funding Corp., and not their subsidiaries; |

| • | “Shea,” the “Company,” “we,” “our,” and “us” refer to SHLP and its subsidiaries, including Shea Homes Funding Corp., on a consolidated basis; and |

| • | “Guarantors” means the direct and indirect subsidiaries of SHLP that will guarantee the exchange notes. |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain parts of this prospectus and the documents incorporated by reference herein contain forward-looking statements and information relating to us that are based on the beliefs of management as well as assumptions made by, and information currently available to, us. When used in this document, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and “project” and similar expressions, as they relate to us are intended to identify forward-looking statements. These statements reflect our current views with respect to future events, are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Further, certain forward-looking statements are based upon assumptions of future events that may not prove to be accurate.

See the “Risk Factors” section of this prospectus for a description of risk factors that could significantly affect our financial results. In addition, the following factors could cause actual results to differ materially from the results that may be expressed or implied by such forward-looking statements. These factors include, among other things:

| • | changes in employment levels; |

| • | changes in the availability of financing for homebuyers; |

| • | changes in interest rates; |

| • | changes in consumer confidence; |

| • | changes in levels of new and existing homes for sale; |

| • | changes in demographic trends; |

| • | changes in housing demands; |

| • | changes in home prices; |

| • | elimination or reduction of tax benefits associated with owning a home; |

| • | litigation risks associated with home warranty and construction defect and other claims; and |

| • | various other factors, both referenced and not referenced in this prospectus. |

Many of these factors are macroeconomic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements may vary materially from those described in this prospectus as anticipated, believed, estimated, expected, intended, planned or projected. Except as required by law, we neither intend nor assume any obligation to revise or update these forward-looking statements, which speak only as of their dates.

ii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

SHLP, Shea Homes Funding Corp. and the subsidiary guarantors listed on Schedule A thereto as co-registrants (the “Guarantors”) have filed a registration statement with the Securities and Exchange Commission (the “Commission”) on Form S-4 to register the exchange offer contemplated in this prospectus. This prospectus is part of that registration statement. As allowed by the Commission’s rules, this prospectus does not contain all the information found in the registration statement or the exhibits to the registration statement. This prospectus contains summaries of the material terms and provisions of certain documents and in each instance we refer you to the copy of such document filed as an exhibit to the registration statement.

We have not authorized anyone to give any information or make any representation about us that is different from or in addition to, that contained in this prospectus. Therefore, if anyone does give you information of this sort, you should not rely on it as authorized by us. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this prospectus are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this prospectus does not extend to you. Neither the delivery of this prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date on the front cover of this prospectus.

Upon the effectiveness of the registration statement, of which this prospectus forms a part, SHLP, Shea Homes Funding Corp. and the Guarantors will be subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith will file annual, quarterly and other reports and information with the Commission.

The registration statement (including the exhibits and schedules thereto) and the periodic reports and other information filed by SHLP and Shea Homes Funding Corp. with the Commission may be inspected and copied at the Commission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for further information on the Public Reference Room. Such information may also be accessed electronically by means of the Commission’s homepage on the Internet at http://www.sec.gov.

You may also obtain this information without charge by writing or telephoning us at the following address and telephone number:

Shea Homes Limited Partnership

655 Brea Canyon Road

Walnut, CA 91789

(909) 594-9500

Attn: Bruce Varker, Chief Financial Officer

To ensure timely delivery, you must request this information no later than five business days before the expiration of the exchange offer.

MARKET INDUSTRY DATA AND FORECASTS

Any market or industry data contained in this prospectus are based on various sources, including internal data and estimates, independent industry publications, government publications, reports by market research firms or other published independent sources. Industry publications and other published sources generally state the information contained therein has been obtained from third-party sources believed to be reliable. Internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and management’s understanding of industry conditions, and such information has not been verified by any independent sources.

iii

Table of Contents

The following summary contains information about our business and the exchange offer. It does not contain all information that may be important to you in making a decision to exchange outstanding notes for exchange notes. For a more complete understanding of our business and the offering of the notes, we urge you to read this entire prospectus carefully, including the “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements” and “Where You Can Find More Information” sections and our financial statements included elsewhere in this prospectus. All financial data provided in this prospectus are financial data of SHLP and its consolidated subsidiaries unless otherwise disclosed.

Overview

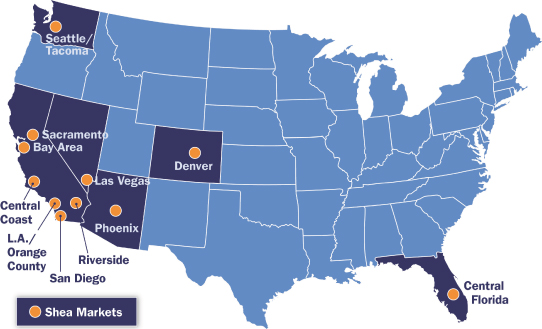

We are one of the largest private homebuilders in the United States by total number of closings according to data compiled for Builder Magazine’s 2010 “Builder 100” List. We design, build and market single-family detached and attached homes across various geographic markets in California, Arizona, Colorado, Washington, Nevada and Florida. We serve a broad customer base including entry, move-up, luxury and active adult buyers. We have been recognized by industry professionals and our homebuyers for quality, customer service and craftsmanship, as evidenced by receipt of some of the homebuilding industry’s most prominent awards, including being named as “Builder of the Year” in 2007 by Professional Builder magazine and one of “America’s Best Builders” in 2005 by the National Association of Homebuilders and Builder magazine. In February 2011, Shea Homes was honored as one of 40 brands in the country to be named a J.D. Power “Customer Service Champion” and is the only homebuilder to receive this honor.

For the nine months ended September 30, 2011, we closed 806 homes having an average selling price of approximately $416,000. Our total revenues from sales of homes, land and homebuilding related activities for the nine months ended September 30, 2011 were $346.3 million and the net loss attributable to SHLP for the same period was $107.3 million. At September 30, 2011, our total debt was $752.3 million. In addition, we have a significant number and amount of contingent liabilities which could have a material adverse effect on our liquidity, financial condition, and results of operations if they are required to be satisfied by us. See “—Risks Relating to Us and Our Business—We have a significant number of contingent liabilities, and if any are required to be satisfied by us, could have a material adverse effect on our financial condition and results of operations.” At September 30, 2011, we were selling homes in 78 communities, with home prices ranging from approximately $129,000 to $1,138,000 and we had sold but not closed 682 homes, which comprise our sales order backlog. The value of this backlog was approximately $295.1 million of revenue anticipated to be realized at closing occurring primarily from October 2011 through December 2012. However, because sales order contracts can be cancelled by the buyer in certain circumstances, not all homes in backlog will result in closings.

Our operating results are aggregated into three reportable segments:

| • | California South, comprised of the results of our communities in Los Angeles, Ventura, Orange County, Inland Empire and San Diego; |

| • | California North, comprised of the results of our communities in northern and central California; and |

| • | Mountain West/Other, comprised of the results of our communities in Arizona, Colorado, Washington, Nevada and Florida. |

Our communities are grouped into these segments based on similar economic and other characteristics, including product types, production processes, suppliers, subcontractors, jurisdictional and political environments, land availability and values, and underlying demand and supply.

1

Table of Contents

We are one of a group of companies owned by the Shea family (collectively, the “Shea Family Owned Companies”). Since 1881 in Portland, Oregon, beginning with a plumbing contractor business, the Shea family has owned and operated homebuilding, heavy construction and commercial property businesses. The Shea Family Owned Companies have grown but remained privately held by the Shea family. The Shea family began building homes in 1968 through J.F. Shea Co., Inc. (“JFSCI”) and, in 1989, homebuilding under the Shea Homes brand was moved to the newly-formed SHLP, an entity under the broader umbrella of JFSCI. In all, the Shea Homes brand has enjoyed a 40-plus year legacy of consistent family management and support.

We operate under three brands: Shea Homes, Trilogy and SPACES. Each reflects our value proposition: homes designed to meet the needs of our customers, with standard energy-efficient features, built in an environmentally-responsible manner.

| • | Shea Homes, our flagship brand, targets first-time and move-up buyers. Each segment builds and markets houses under the Shea Homes brand; |

| • | Trilogy, master-planned communities designed and built to meet the needs and active lifestyles of the “baby boomer” generation. These communities combine quality homes with diverse resort-like amenities in each segment; and |

| • | SPACES, our newest brand, targets 25-40 year-old buyers in each segment with contemporary, practical homes that have flexible floor plans and stylish, energy-efficient features at an affordable price point. We have opened SPACES communities in each segment. |

2

Table of Contents

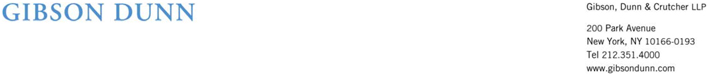

THE ISSUERS AND THE GUARANTORS

The chart below illustrates our corporate structure and is provided for illustrative purposes only and does not purport to represent all legal entities owned or controlled by the Issuers. Certain of our wholly-owned direct and indirect subsidiaries guarantee the notes. The obligations under the notes are not guaranteed by our subsidiary Partners Insurance Company, Inc. (“PIC”) (which is an unrestricted subsidiary under the indenture governing the notes) or by any joint venture with respect to which we do not own 100% of the economic interest, including certain of our joint ventures that are consolidated for financial reporting purposes (collectively, the “Consolidated Joint Ventures”)1. See “Description of the Notes— The Guarantees.”

| 1 | Shea Homes Southwest, Inc. owns 100% of the economic and voting interests in Vistancia Marketing, LLC and Vistancia Construction, LLC, both guarantors of the notes. |

3

Table of Contents

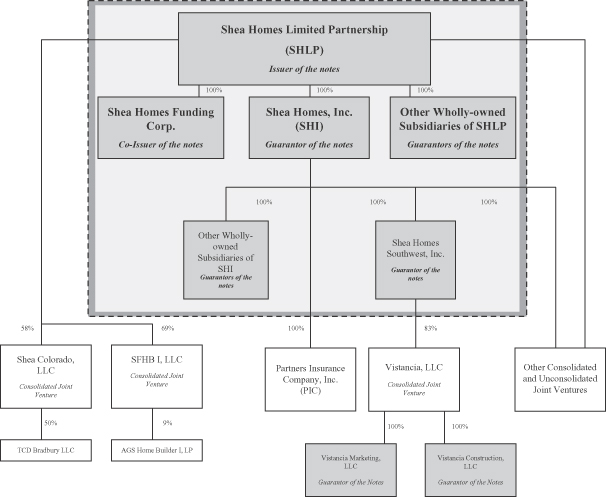

THE SHEA FAMILY OWNED COMPANIES

We are one of the Shea Family Owned Companies. The Shea Family Owned Companies are operated in three major groups: homebuilding, heavy construction and commercial property development and management. Much of the Shea Family Owned Companies’ business has traditionally been operated and managed through JFSCI, with each of the homebuilding, heavy construction and commercial property businesses providing management, administrative, financial and credit support to one another. Over the past several years, the Shea family and our management have made a series of changes to the business and operating structure of the Shea Family Owned Companies so that, currently:

| • | the Shea family homebuilding business is owned and operated primarily through SHLP, SHI and their respective subsidiaries; |

| • | the Shea family heavy construction business is owned and operated primarily through JFSCI; and |

| • | the Shea family commercial development and management operation is owned and operated primarily through Shea Properties LLC and Shea Properties II, LLC (collectively, “Shea Properties”). |

In the future, JFSCI will continue to provide management and certain administrative support, including cash management and treasury services, to SHLP, SHI and the Shea family’s heavy construction and commercial property businesses. See “Certain Relationships and Related Party Transactions.” However, we intend that SHLP, SHI and their respective subsidiaries will not receive new financial or credit support from, and will not provide new financial or credit support to, the other Shea family businesses. See “Risk Factors—We have a significant number of affiliated entities, with whom we have entered into many transactions. Our relationship with these entities could adversely affect us.”

4

Table of Contents

The chart below illustrates our ownership structure within the Shea Family Owned Companies. This chart is provided for illustrative purposes only and does not purport to represent all legal entities owned or controlled by the Shea family or the Issuers.

5

Table of Contents

THE EXCHANGE OFFER

The summary below describes the principal terms and conditions of the exchange offer. Certain of these terms and conditions are subject to important limitations and exceptions. The section of this prospectus entitled “Description of the Notes” contains a more detailed description of the terms and conditions.

| The Exchange Offer |

Up to $750 million aggregate principal amount of exchange notes registered under the Securities Act are being offered in exchange for the same principal amount of outstanding notes. Terms of the exchange notes and the outstanding notes are substantially identical, except that the transfer restrictions, registration rights and rights to increased interest in addition to the stated interest rate on the outstanding notes (“Additional Interest”) provisions applicable to the outstanding notes will not apply to the exchange notes. You may tender outstanding notes for exchange in whole or in part in any integral multiple of $1,000, subject to a minimum exchange of $2,000. We are undertaking the exchange offer to satisfy our obligations under the registration rights agreement relating to the outstanding notes. For a description of the procedures for tendering the outstanding notes. See “The Exchange Offer—How to Tender Outstanding Notes for Exchange.” |

| To exchange your outstanding notes for exchange notes, you must properly tender them before the expiration of the exchange offer. Upon expiration of the exchange offer, your rights under the registration rights agreement pertaining to the outstanding notes will terminate, except under limited circumstances. |

| Expiration Time |

The exchange offer expires at 5:00 p.m., New York City time on , 2012, unless the exchange offer is extended. See “The Exchange Offer—Terms of the Exchange Offer; Expiration Time.” |

| Interest on Outstanding Notes Exchanged in the Exchange Offer |

Holders whose outstanding notes are exchanged for exchange notes will not receive a payment in respect of interest accrued but unpaid on such outstanding notes from the most recent interest payment date up to but excluding the settlement date. Instead, interest on the exchange notes received in exchange for such outstanding notes will (i) accrue from the last date on which interest was paid on such outstanding notes and (ii) accrue at the same rate as and be payable on the same dates as interest was payable on such outstanding notes. However, if any interest payment occurs prior to the settlement date on any outstanding notes already tendered for exchange in the exchange offer, the holder of such outstanding notes will be entitled to receive such interest payment. |

| Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions (see “The Exchange Offer—Conditions to the Exchange Offer”), some of which we may waive in our sole discretion. The exchange offer is not conditioned upon any minimum principal amount of outstanding notes being tendered for exchange. |

6

Table of Contents

| How to Tender Outstanding Notes for Exchange |

You must tender your outstanding notes through book-entry transfer in accordance with The Depository Trust Company’s Automated Tender Offer Program, known as ATOP. If you wish to accept the exchange offer, you must arrange for The Depository Trust Company to transmit to the exchange agent certain required information, including an agent’s message forming part of a book-entry transfer in which you agree to be bound by the terms of the letter of transmittal, and transfer the outstanding notes being tendered into the exchange agent’s account at The Depository Trust Company. |

| Guaranteed Delivery Procedures |

If you wish to tender your outstanding notes and the procedures for book-entry transfer cannot be completed by the expiration time, you may tender your outstanding notes according to the guaranteed delivery procedures described in “The Exchange Offer—Guaranteed Delivery Procedures.” |

| Special Procedures for Beneficial Owners |

If you beneficially own outstanding notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct it to tender on your behalf. See “The Exchange Offer—How to Tender Outstanding Notes for Exchange.” |

| Withdrawal of Tenders |

You may withdraw your tender of outstanding notes at any time prior to the expiration time by delivering a notice of withdrawal to the exchange agent in conformity with the procedures discussed under “The Exchange Offer—Withdrawal Rights.” |

| Acceptance of Outstanding Notes and Delivery of Exchange Notes |

Upon consummation of the exchange offer, we will accept any and all outstanding notes that are properly tendered in the exchange offer and not withdrawn prior to the expiration time. The exchange notes issued pursuant to the exchange offer will be delivered promptly following the expiration time. See “The Exchange Offer—Terms of the Exchange Offer; Expiration Time.” |

| Registration Rights Agreement |

We are making the exchange offer pursuant to the registration rights agreement that we entered into on May 10, 2011 with the initial purchaser of the outstanding notes. As a result of making and consummating this exchange offer, we will have fulfilled our obligations under the registration rights agreement with respect to the registration of securities, subject to certain limited exceptions. If you do not tender your outstanding notes in the exchange offer, you will not have any further registration rights under the registration rights agreement or otherwise unless you were not eligible to participate in the exchange offer or do not receive freely tradable exchange notes in the exchange offer. |

7

Table of Contents

| Resales of Exchange Notes |

We believe the exchange notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act, provided that: |

| • | you are not an “affiliate” of ours; |

| • | the exchange notes you receive pursuant to the exchange offer are being acquired in the ordinary course of your business; |

| • | you have no arrangement or understanding with any person to participate in the distribution of the exchange notes issued to you in the exchange offer; |

| • | if you are not a broker-dealer, you are not engaged in, and do not intend to engage in, a distribution of the exchange notes issued in the exchange offer; and |

| • | if you are a broker-dealer, you will receive the exchange notes for your own account, the outstanding notes were acquired by you as a result of market-making or other trading activities, and you will deliver a prospectus when you resell or transfer any exchange notes issued in the exchange offer. See “Plan of Distribution” for a description of the prospectus delivery obligations of broker dealers in the exchange offer. |

| If you do not meet these requirements, your resale of the exchange notes must comply with the registration and prospectus delivery requirements of the Securities Act. |

| Our belief is based on interpretations by the Commission staff, as set forth in no-action letters issued to third parties. The Commission staff has not considered this exchange offer in the context of a no-action letter, and we cannot assure you that the Commission staff would make a similar determination with respect to this exchange offer. |

| If our belief is not accurate and you transfer an exchange note without delivering a prospectus meeting the requirements of the federal securities laws or without an exemption from these laws, you may incur liability under the federal securities laws. We do not and will not assume, or indemnify you against, this liability. |

| See “The Exchange Offer—Consequences of Exchanging Outstanding Notes.” |

| Consequences of Failure to Exchange Your Outstanding Notes |

If you do not exchange your outstanding notes for exchange notes in the exchange offer, your outstanding notes will continue to be subject to the restrictions on transfer provided in the legend on the outstanding notes and in the indenture governing the notes. In general, the outstanding notes may not be offered or sold unless |

8

Table of Contents

| registered or sold in a transaction exempt from registration under the Securities Act and applicable state securities laws. Accordingly, the trading market for your untendered outstanding notes could be adversely affected. |

| Exchange Agent |

The exchange agent for the exchange offer is Wells Fargo Bank, National Association. For additional information, see “The Exchange Offer—The Exchange Agent” and the accompanying letter of transmittal. |

| Certain Federal Income Tax Considerations |

The exchange of your outstanding notes for exchange notes will not be a taxable exchange for United States federal income tax purposes. You should consult your own tax advisor as to the tax consequences to you of the exchange offer, as well as tax consequences of the ownership and disposition of the exchange notes. For additional information, see “Certain Material U.S. Federal Income Tax Considerations.” |

9

Table of Contents

Summary of the Terms of the Exchange Notes

The terms of the exchange notes are substantially identical to the outstanding notes, except the transfer restrictions, registration rights and Additional Interest provisions applicable to the outstanding notes will not apply to the exchange notes. The following is a summary of the principal terms of the exchange notes. A more detailed description is contained in the section “Description of the Notes” in this prospectus.

| Issuer |

Shea Homes Limited Partnership |

| Co-Issuer |

Shea Homes Funding Corp. |

| Notes Offered |

$750,000,000 aggregate principal amount of 8.625% Senior Secured Notes due 2019. |

| Maturity Date |

The exchange notes mature May 15, 2019. |

| Interest |

Interest on the exchange notes will accrue at a rate of 8.625% per annum and is payable semi-annually in cash in arrears on May 15 and November 15 each year. |

| Holders whose outstanding notes are exchanged for exchange notes will not receive a payment in respect of interest accrued but unpaid on such outstanding notes from the most recent interest payment date up to but excluding the settlement date. Instead, interest on the exchange notes received in exchange for such outstanding notes will (i) accrue from the last date on which interest was paid on such outstanding notes and (ii) accrue at the same rate as and be payable on the same dates as interest was payable on such outstanding notes. However, if any interest payment occurs prior to the settlement date on any outstanding notes already tendered for exchange in the exchange offer, the holder of such outstanding notes will be entitled to receive such interest payment. |

| Optional Redemption |

We may redeem some or all of the exchange notes at any time on or after May 15, 2015, at the redemption prices specified under the section “Description of the Notes—Optional Redemption” plus accrued and unpaid interest, if any, to the redemption date. |

| At any time prior to May 15, 2015, we may also redeem the exchange notes, in whole or in part, at a redemption price of 100% of the principal amount of the exchange notes, plus a “make-whole” premium and accrued and unpaid interest, if any, to the redemption date. |

| At any time prior to May 15, 2014, we may also redeem up to 35% of the original aggregate principal amount of the exchange notes with the proceeds of certain equity offerings, in each case, at a redemption price equal to 108.625% of the aggregate principal amount of the exchange notes to be redeemed, plus accrued and unpaid interest, if any, to the redemption date. |

10

Table of Contents

| Change of Control |

Upon a Change of Control as described in the section “Description of the Notes—Certain Covenants—Change of Control,” we will be required to make an offer to repurchase all or part of the exchange notes at 101% of the principal amount, plus accrued and unpaid interest, if any, to the date of repurchase. |

| Guarantees |

The exchange notes will be guaranteed by the Guarantors. If the Issuers cannot make payments under the notes when they are due, the Guarantors must make such payments instead. PIC will not be a Guarantor and will be treated as an unrestricted subsidiary under the indenture governing the notes. |

| The exchange notes will not be guaranteed by any joint venture with respect to which we do not own 100% of the economic interest, including certain of our joint ventures that are consolidated for financial reporting purposes. |

| Ranking |

The exchange notes and the guarantees will be the Issuers’ and the Guarantors’ general senior secured obligations and will: |

| • | be effectively senior to all existing and future unsecured indebtedness of the Issuers to the extent of the value of the collateral securing the notes and the guarantees; |

| • | rank equally in right of payment with all of the Issuers’ and the Guarantors’ existing and future senior indebtedness; |

| • | rank senior in right of payment to the Issuers’ and the Guarantors’ future subordinated indebtedness, if any; |

| • | rank equally with the indebtedness outstanding under our letter of credit facility, but the lenders under the letter of credit facility will have the right to be repaid before the notes from the proceeds of any enforcement action taken against the collateral; |

| • | be effectively subordinated to any existing and future indebtedness of either of the Issuers and the Guarantors that is secured by assets that do not constitute collateral, to the extent of the value of such assets; and |

| • | be effectively subordinated to any existing and future indebtedness of subsidiaries or joint ventures of either of the Issuers that are not Guarantors. |

| Collateral |

The exchange notes and the guarantees will be secured by a lien on substantially all assets owned by the Issuers and Guarantors on the issue date of the exchange notes or thereafter acquired, subject to permitted liens and certain exceptions. |

| The collateral will also secure on a Pari-Passu basis our obligations with respect to our letter of credit facility, but lenders under our letter of credit facility will have the right to be repaid before the exchange notes from the proceeds of any enforcement action taken against the collateral. |

11

Table of Contents

| The collateral will not include: |

| • | except to secure our letter of credit facility, the pledge of stock of subsidiaries of SHLP to the extent such pledge would result in separate financial statements of such subsidiary being required in SEC filings; |

| • | personal property where the cost of obtaining a security interest or perfection thereof exceeds its benefits; |

| • | real property subject to alien securing indebtedness incurred for the purpose of financing the acquisition thereof (to the extent creation of additional security interests in such property is prohibited by contract); |

| • | assets, with respect to which any applicable law or contract (including certain profit and price participation arrangements) prohibits creation or perfection of security interests therein, or that otherwise results in a default, waiver or termination of rights or privileges arising under such law or contract; |

| • | all trademarks, trade names and other intellectual property bearing the name “Shea” or a variant thereof (provided noteholders shall have a non-exclusive license to use such intellectual property in connection with the exercise of default remedies); |

| • | cash collateral supporting (1) deductible, retention and other obligations to insurance carriers, (2) reimbursement claims in respect of letters of credit and surety providers, (3) contingent claims arising in respect of community facility district, metrodistrict, Mello-Roos, subdivision improvement bonds and similar obligations arising in the ordinary course of business of a homebuilder and (4) cash management services; |

| • | equity interests in joint ventures where the joint venture agreement prohibits creation of such security interests; |

| • | any leasehold interests in real property; |

| • | any real property in a community under development with an investment at the end of the most recent quarter (as determined in accordance with GAAP) of less than $2.0 million or with less than 10 lots remaining unsold (to the extent the Issuers do not create a lien in such property); |

| • | deposit accounts and securities accounts with aggregate balance for all such excluded accounts not to exceed $2.0 million in aggregate amount, or established solely for purposes of funding payroll, trust and other compensation benefits to employees; and |

| • | all vehicles covered by a certificate of title. |

12

Table of Contents

| Certain Covenants |

The indenture governing the exchange notes contains covenants that limit, among other things, the Issuer and Guarantors’ ability to: |

| • | incur additional indebtedness (including the issuance of certain preferred stock); |

| • | pay dividends and distributions on our equity interests; |

| • | repurchase our equity interests; |

| • | retire unsecured or subordinated notes more than one year prior to their maturity; |

| • | make investments in subsidiaries and joint ventures that are not restricted subsidiaries that guarantee the notes, including PIC; |

| • | sell certain assets; |

| • | incur liens; |

| • | merge with or into other companies; |

| • | expand into unrelated businesses; and |

| • | enter into certain transactions with our affiliates. |

| These covenants will be subject to a number of important exceptions and qualifications. See “Description of the Notes—Certain Covenants.” |

| Use of Proceeds |

We will not receive any cash proceeds from issuance of the exchange notes offered by this prospectus. |

| Risk Factors |

Investment in the notes involves certain risks. You should carefully consider the information under “Risk Factors” and all other information included in this prospectus before investing in the notes. |

13

Table of Contents

An investment in the exchange notes involves risks. You should carefully consider the risks described below as well as the other information contained in this prospectus prior to making an investment decision. If any of the following risks occurs, our business, financial condition and results of operations could be materially adversely affected. In such case, you may lose all or part of your original investment. As used below, the term “notes” refers to both the outstanding notes and the exchange notes.

Risks Relating to Us and Our Business

The homebuilding industry, which is very cyclical and affected by a variety of factors, is in a significant downturn, and its duration and ultimate severity are uncertain. A continuation or further deterioration in industry conditions or in broader economic conditions could have additional material adverse effects on our business, financial condition and results of operations.

The homebuilding industry is cyclical and is significantly affected by changes in industry conditions, as well as in general and local economic conditions, such as changes in:

| • | employment and wage levels; |

| • | availability of financing for homebuyers; |

| • | interest rates; |

| • | a lack of consumer confidence that results in a lack of urgency to buy; |

| • | levels of new and existing homes for sale; |

| • | demographic trends; |

| • | housing demand; and |

| • | government. |

These changes may occur on a national scale, like the current downturn, or may acutely affect some of the regions or markets in which we operate more than others. When adverse conditions affect any of our larger markets, they could have a proportionately greater impact on us than on some other homebuilding companies that have smaller presences in such markets. Our operations in previously strong markets, particularly California and Arizona, have more adversely affected our results of operations than our other markets in the current downturn.

An oversupply of alternatives to new homes, including foreclosed homes, homes held for sale by investors and speculators, other existing homes and rental properties, can also reduce our ability to sell new homes, depress new home prices and reduce our margins on the sales of new homes. High levels of foreclosures not only contribute to additional inventory available for sale, but also reduce appraised values for new homes, potentially resulting in lower sales prices.

As a result of the foregoing matters, potential customers may be less willing or able to buy our homes.

The current downturn in the homebuilding industry is in its sixth year and has become one of the most severe housing downturns in U.S. history. The significant decline in demand for new homes, significant oversupply of homes on the market and significant reductions in the availability of financing for homebuyers that have marked this downturn are continuing and may continue for some time. We have experienced material reductions in our home sales and homebuilding revenues, and we have incurred material inventory impairments and losses from our joint venture interests and other write-offs. It is not clear when or if these trends will reverse or when we may return to profitability. The continuation or worsening of this downturn would have a further material adverse effect on our business, financial condition and results of operations.

14

Table of Contents

Our ability to respond to the downturn is limited. Numerous home mortgage foreclosures have increased supply and driven down prices, making the purchase of a foreclosed home an attractive alternative to purchasing a new home. Homebuilders have responded to declining sales and increased cancellation rates with significant concessions, further adding to the price declines. With the decline in the values of homes and the inability of many homeowners to make their mortgage payments, the credit markets have been significantly disrupted, putting strains on many households and businesses. In the face of these conditions, the overall economy has weakened significantly, with high unemployment levels and substantially reduced consumer spending and confidence. As a result, demand for new homes remains at historically low levels.

We cannot predict the duration or ultimate severity of the current economic downturn. Nor can we provide assurance that our responses to the homebuilding downturn or the government’s attempts to address the troubles in the overall economy will be successful. Additionally, we cannot predict the timing or effect of the winding down or possible withdrawal of government intervention or support.

The reduction in availability of mortgage financing has adversely affected our business, and the duration and ultimate severity of the effects are uncertain.

During the last four years the mortgage lending industry has experienced significant instability, beginning with increased defaults on subprime loans and other nonconforming loans and compounded by expectations of increasing interest payment requirements and further defaults. This in turn resulted in a decline in the market value of many mortgage loans and related securities. Lenders, regulators and others questioned the adequacy of lending standards and other credit requirements for several loan products and programs offered in recent years. Credit requirements have tightened, and investor demand for mortgage loans and mortgage-backed securities has declined. The deterioration in credit quality has caused most lenders to stop offering subprime mortgages and most other loan products that are not eligible for sale to Fannie Mae or Freddie Mac or loans that do not meet Federal Housing Administration (“FHA”) and Veterans Administration (“VA”) requirements. Fewer loan products, changes in conforming loan limits, tighter loan qualifications and a reduced willingness of lenders to provide loans make it more difficult for many buyers to finance the purchase of our homes. These factors have served to reduce the pool of qualified homebuyers and made it more difficult to sell to first-time and move-up buyers who historically made up a substantial part of our customers. These reductions in demand have adversely affected our business, financial condition and results of operations, and the duration and severity of their effects are uncertain.

The liquidity provided by Fannie Mae and Freddie Mac to the mortgage industry has been very important to the housing market. These entities have required substantial injections of capital from the federal government and may require additional government support in the future. The federal government has proposed changing the nature of the relationship between Fannie Mae and Freddie Mac and the federal government and even eliminating these entities. If Fannie Mae and Freddie Mac were dissolved or if the federal government determined to stop providing liquidity support to the mortgage market, there would be a reduction in available financing from these institutions. Any such reduction would likely have an adverse effect on interest rates, mortgage availability and new home sales.

The FHA insures mortgage loans that generally have lower down payments and, as a result, it continues to be a particularly important support for financing home purchases. In the last two years, more restrictive guidelines were placed on FHA insured loans, such as increasing minimum down payment requirements. In the near future, further restrictions are expected on FHA insured loans including, but not limited to, limitations on seller-paid closing costs and concessions. These or any other restrictions may negatively affect the availability or affordability of FHA financing, which could adversely affect our ability to sell homes.

While use of down payment assistance programs by our homebuyers has decreased significantly, some customers still utilize 100% financing through programs offered by the VA and United States Department of Agriculture. There can be no assurance these or other programs will continue to be available or will be as attractive to our customers as programs currently offered, which could adversely affect our home sales.

15

Table of Contents

Because most customers require mortgage financing, increases in interest rates could lower demand for our products, limit our marketing effectiveness and limit our ability to realize our backlog.

Most customers finance their home purchases through lenders providing mortgage financing. Increases in interest rates could lower demand for new homes because the mortgage costs to potential homebuyers would increase. Even if potential new homebuyers do not need financing, changes in interest rates could make it difficult to sell their existing homes to potential buyers who need financing. This could prevent or limit our ability to attract new customers and fully realize our backlog because our sales contracts generally include a financing contingency which permits buyers to cancel their sales contracts if mortgage financing is unobtainable within a specified time. This contingency period is typically four to eight weeks following the date of execution of the sales contract. Exposure to such financing contingencies renders us vulnerable to changes in prevailing interest rates.

Cancellations of home sales orders in backlog may increase as homebuyers choose to not honor their contracts.

Notwithstanding our sales strategies, we experienced elevated rates of sales order cancellations in 2006 through 2008. Since 2008, our sales order cancellation rate has improved, and it is currently below our historical average for the period from 1997 to 2010. We believe the elevated cancellation rate in 2007 and 2008 was largely a result of reduced homebuyer confidence, due principally to continued price declines, growth in foreclosures and continued high unemployment. A more restrictive mortgage lending environment and the inability of some buyers to sell their existing homes have also impacted cancellations. Many of these factors are beyond our control, and it is uncertain whether they will cause cancellation rates to rise in the future.

Home prices and demand in California, Arizona, Colorado, Washington, Nevada and Florida have a large impact on our results of operations because we conduct our homebuilding business in these states.

Our operations are concentrated in regions that are among the most severely affected by the current economic downturn. We conduct our homebuilding business in California, Arizona, Colorado, Washington, Nevada and Florida. Home prices and sales in these states have declined significantly since the end of 2006. These states, particularly California, continue to experience economic difficulties, including elevated levels of unemployment and precarious budget situations in state and local governments, which may materially adversely affect the market for our homes in those areas. Declines in home prices and sales in these states also adversely affect our financial condition and results of operations.

Inflation could adversely affect our business, financial condition and results of operations, particularly in a period of oversupply of homes.

Inflation can adversely affect us by increasing costs of land, materials and labor. However, we may be unable to offset these increases with higher sales prices. In addition, inflation is often accompanied by higher interest rates, which have a negative impact on housing demand. In such an environment, we may be unable to raise home prices sufficiently to keep up with the rate of cost inflation and, accordingly, our margins could decrease. Moreover, with inflation, the purchasing power of our cash resources can decline. Efforts by the government to stimulate the economy may not be successful, but have increased the risk of significant inflation and its resulting adverse effect on our business, financial condition and results of operations.

Supply shortages and risks of demand for building materials and skilled labor could increase costs and delay deliveries.

The homebuilding industry has periodically experienced significant difficulties that can affect the cost or timing of construction, and adversely impact our revenues and operating margins, including:

| • | difficulty in acquiring land suitable for residential building at affordable prices in locations where our potential customers want to live; |

16

Table of Contents

| • | shortages of qualified labor; |

| • | reliance on local subcontractors, manufacturers and distributors who may be inadequately capitalized; |

| • | shortages of materials; and |

| • | increases in cost of materials, particularly lumber, drywall, cement and steel, which are significant components of home construction costs. |

While competitive bidding helps control labor and building material costs, the downward trend of these costs has stopped. Material manufacturers are less inclined to reduce prices, and TradePartners® labor costs are at a point where further reductions are unlikely, in fact, costs could increase and adversely affect our financial condition and results of operations.

In several of our markets in 2011 through 2013, we need to replenish our inventory of lots for construction. If the housing market recovers, the price of improved or finished lots for construction in these markets could increase, and adversely affect our financial condition and results of operations.

Elimination or reduction of the tax benefits associated with owning a home could prevent potential customers from buying our homes and adversely affect our business or financial results.

Significant expenses of owning a home, including mortgage interest and real estate taxes, generally are deductible expenses for an individual’s federal and, in some cases, state income taxes, subject to certain limitations. If the federal government or a state government changes its income tax laws, as has been discussed, to eliminate or substantially modify these income tax deductions, the after-tax cost of owning a new home would increase for many potential customers. The resulting loss or reduction of homeowner tax deductions, if such tax law changes were enacted without offsetting provisions, would adversely affect demand for new homes.

Homebuilding is subject to home warranty and construction defect claims and other litigation risks in the ordinary course of business that can be significant. Our operating expenses could increase if we are required to pay higher insurance premiums or incur substantial litigation costs with respect to such claims and risks.

As a homebuilder, we are subject to home warranty and construction defect claims arising in the ordinary course of business. As a consequence, we maintain liability insurance in the form of a “rolling wrap-up” insurance program which insures both us and our TradePartners®. We also record customer service and warranty reserves for the homes we sell based on historical experience in our markets and our judgment of the qualitative risks associated with the types of homes built. See the further description of “rolling wrap-up” insurance policies in the “Business—Insurance Coverage” section. Because of the uncertainties inherent in these matters, we cannot provide assurance that, in the future, our insurance coverage, TradePartners® arrangements and reserves will be adequate to address all warranty and construction defect claims.

Costs of insuring against construction defect and product liability claims are high, and the amount and scope of coverage offered by insurance companies at acceptable rates is limited. The scope of coverage may continue to be limited or further restricted and may become more costly.

Increasingly in recent years, individual and class action lawsuits have been filed against homebuilders asserting claims of personal injury and property damage caused by various sources, including faulty materials and presence of mold in residential dwellings. Furthermore, decreases in home values as a result of general economic conditions may result in an increase in both non-meritorious and meritorious construction defect claims, as well as claims based on marketing and sales practices. Our insurance may not cover all of the claims arising from such issues, or such coverage may become prohibitively expensive. Notwithstanding, our annual policy limits are $50.0 million per occurrence and $50.0 million in the aggregate. If we are unable to obtain adequate insurance against these claims, we may experience litigation costs and losses that could adversely affect our financial condition and results of operations. Even if we are successful in defending such claims, we may incur significant costs.

17

Table of Contents

Historically, builders have recovered a significant portion of the construction and product defect liabilities and defense costs from their subcontractors and insurance carriers. We try to minimize our liability exposure by providing a master insurance policy and requiring TradePartners® to enroll in a “rolling wrap-up” insurance policy. Insurance coverage available to us and our TradePartners® for construction and product defects is expensive and the scope of coverage is restricted. If we cannot effectively recover from our carriers, we may suffer greater losses, which could adversely affect our financial condition and results of operations.

Furthermore, a builder’s ability to recover against an insurance policy depends upon the continued solvency and financial strength of the insurance carrier issuing the policy. The states where we build homes typically limit property damage claims resulting from construction defects to those arising within an eight- to twelve-year period from close of escrow. To the extent any carrier providing insurance coverage to us or our TradePartners® becomes insolvent or experiences financial difficulty, we may be unable to recover on those policies, which could adversely affect our financial condition and results of operations.

Homebuilding is very competitive, and competitive conditions could adversely affect our business, financial condition and results of operations.

The homebuilding industry is highly competitive. Homebuilders compete not only for homebuyers, but also for desirable properties, financing, raw materials and skilled labor. We compete with other local, regional and national homebuilders, often within larger subdivisions designed, planned and developed by such homebuilders. We also compete with existing home sales, foreclosures and rental properties. In addition, consolidation of some homebuilding companies may create competitors with greater financial, marketing and sales resources with the ability to compete more effectively. New competitors may also enter our markets. These competitive conditions in the homebuilding industry can result in:

| • | lower sales; |

| • | lower selling prices; |

| • | increased selling incentives; |

| • | lower profit margins; |

| • | impairments in the value of inventory and other assets; |

| • | difficulty in acquiring suitable land, raw materials, and skilled labor at acceptable prices or terms; or |

| • | delays in home construction. |

These competitive conditions affect our business, financial condition and results of operations. During the current downturn in the homebuilding industry, the reactions of our competitors may have reduced the effectiveness of our efforts to achieve pricing stability and reduce inventory levels.

Our success depends on the availability of suitable undeveloped land and improved lots at acceptable prices, and having sufficient liquidity to acquire such properties.

Our success in developing land and building and selling homes depends in part upon the continued availability of suitable undeveloped land and improved lots at acceptable prices. Availability of undeveloped land and improved lots for purchase at favorable prices depends on many factors beyond our control, including risk of competitive over-bidding and restrictive governmental regulation. Should suitable land become less available, the number of homes we may be able to build and sell would be reduced, which would reduce revenue and profits. In addition, our ability to purchase land depends upon us having sufficient liquidity. We may be disadvantaged in competing for land due to our debt obligations, limited cash resources, inability to incur further debt and, as a result, more limited access to capital compared to publicly traded competitors.

18

Table of Contents

Poor relations with the residents of our communities could adversely impact sales, which could cause revenues or results of operations to decline.

Residents of communities we develop rely on us to resolve issues or disputes that may arise in connection with development or operation of their communities. Efforts to resolve these issues or disputes could be unsatisfactory to the affected residents and subsequent actions by these residents could adversely affect our reputation or sales. In addition, we could be required to incur costs to settle these issues or disputes or to modify our community development plans, which could adversely affect our financial condition and results of operations.

If we are unable to develop our communities successfully or within expected timeframes, results of operations could be adversely affected.

Before a community generates revenues, time and capital are required to acquire land, obtain development approvals and construct project infrastructure, amenities, model homes and sales facilities. Our inability to successfully develop and market our communities and to generate cash flow from these operations in a timely manner could have a material adverse effect on our business, financial condition and results of operations.

Our business is seasonal in nature and quarterly operating results can fluctuate.

Our quarterly operating results generally fluctuate by season. We typically achieve our highest new home sales orders in the spring and summer, although new homes sales order activity is also highly dependent on the number of active selling communities and the timing of new community openings. Because it typically takes us three to eight months to construct a new home, we deliver a greater number of homes in the second half of the calendar year as sales orders convert to home deliveries. As a result, our revenues from homebuilding operations are higher in the second half of the year, particularly in the fourth quarter, and we generally experience higher capital demands in the first half of the year when we incur construction costs. If, due to construction delays or other causes, we cannot close our expected number of homes in the second half of the year, our financial condition and results of operations may be adversely affected.

We may be adversely affected by weather conditions and natural disasters.

Weather conditions and natural disasters, such as hurricanes, tornadoes, earthquakes, snow storms, landslides, wildfires, volcanic activity, droughts and floods can harm our homebuilding business and delay home closings, increase the cost or availability of materials or labor, or damage homes under construction. In addition, the climates and geology of many of the states where we operate present increased risks of adverse weather or natural disasters. In particular, a large portion of our homebuilding operations are concentrated in California, which is subject to increased risk of earthquakes. Any such events or any business interruption caused thereon could have a material adverse effect on our business, financial condition and results of operations.

Utility and resource shortages or rate fluctuations could have an adverse effect on operations.

Our communities have experienced utility and resource shortages, including significant changes to water availability and increases in utility and resource costs. Shortages of natural resources, particularly water, may make it more difficult to obtain regulatory approval of new developments. We may incur additional costs and be unable to complete construction as scheduled if these shortages and utility rate increases continue. Furthermore, these shortages and utility rate increases may adversely affect the regional economies where we operate, which may reduce demand for our homes.

In addition, costs of petroleum products, which are used to deliver materials and transport employees, fluctuate and may increase due to geopolitical events or accidents. This could also result in higher costs for products utilizing petrochemicals, which could adversely affect our financial condition and results of operations.

19

Table of Contents

The IRS has disallowed certain income recognition methodologies. If we are unsuccessful in appealing this decision, we could become subject to a substantial tax liability from previous years.

Since 2002, SHI and SHLP have used the “completed contract method” of accounting (the “CCM”) to recognize taxable income or loss with respect to the majority of their respective homebuilding operations. The CCM allows SHI and SHLP to defer taxable income/loss recognition from their homebuilding operations until projects are substantially complete, rather than annually based on the sale of individual homes to buyers of those homes. The Internal Revenue Service (the “IRS”) has assessed a tax deficiency against SHLP and SHI contending they did not accurately and appropriately apply the relevant U.S. Treasury Regulations in calculating their respective homebuilding projects’ income/loss pursuant to the CCM for years 2004 through 2008, and years 2003 through 2008, respectively. SHI and SHLP believe their use of the CCM complies with the relevant regulations and have filed a petition with the United States Tax Court to challenge the IRS position. If, contrary to our expectations, the IRS should prevail in this matter, SHI and SHLP would be required to recognize income for prior years that would otherwise be deferred until future years. With respect to SHI, this earlier recognition of income could result in a tax liability of up to $59 million (federal and state income taxes inclusive of interest). With respect to SHLP, the earlier recognition of income could result in the owners of SHLP incurring an additional tax liability of up to $101 million (federal and state income taxes inclusive of interest) for the years at issue, and SHLP would be required to make a distribution to its owners to pay a portion of such tax liability. See “Certain Relationships and Related Party Transactions—Tax Distribution Agreement.” The indenture governing the notes restricts SHLP’s ability to make such distributions in excess of a specified amount determined by a formula, unless SHLP receives a cash equity contribution from JFSCI in the amount of such excess. See “Description of the Notes—Limitations on Restricted Payments.” Such potential additional taxes imposed on SHI and tax distributions by SHLP may have a material adverse effect on the financial condition and results of operations of SHI and SHLP, respectively, which could compromise our ability to service our debt, including the notes.

Under our Tax Distribution Agreement, we are required to make distributions to our equity holders from time to time based on their ownership in SHLP, which is a limited partnership and, under certain circumstances, those distributions may occur even if SHLP does not have taxable income.

Under the Tax Distribution Agreement (as described under “Certain Relationships and Related Party Transactions—Tax Distribution Agreement”), SHLP will be required to make cash distributions to the partners of SHLP (or their direct or indirect holders) for taxable income allocated to them in connection with their ownership interests in SHLP. In addition, SHLP will be required under the Tax Distribution Agreement to provide tax distributions to the partners of SHLP (or their direct or indirect holders) for any additional taxable income allocated to them as a result of any audit, tax proceeding or tax contest arising from or in connection with any tax position taken by SHLP (or any entity treated as a “pass-through” entity under U.S. federal income tax principles in which SHLP has an ownership interest). If any audit, proceeding or contest in connection with years prior to 2011 (including those related to the CCM) ultimately results in an increase in taxable income allocated to our partners, or any disallowance of losses or deductions previously allocated to our partners, then we would be required to make additional tax distributions to them, even if the audit, proceeding or contest resulted in a reduction of a tax loss previously allocated for such period and no taxable income had been previously allocated to them for such period or would be so allocated after such reduction. Any distribution under the Tax Distribution Agreement could have a material adverse effect on our business, financial condition and results of operations, which could compromise our ability to service our debt, including the notes.

Our ability to generate sufficient cash or access other limited sources of liquidity to operate our business and service our debt depends on many factors, some of which are beyond our control.

Our ability to make payments on the notes and to fund land acquisition, development and construction costs depends on our ability to generate sufficient cash flow, which is subject to general economic, financial, competitive, legislative and regulatory factors and other factors beyond our control. We cannot assure we will generate sufficient cash flow from operations to pay principal and interest on the notes or fund operations. As a

20

Table of Contents

result, we may need to refinance all or a portion of our debt, including the notes, on or before the maturity thereof, or incur additional debt. We cannot assure we will be able to do so on favorable terms, if at all. If we are unable to timely refinance our debt, we may need to dispose of certain assets, minimize capital expenditures or take other steps that could be detrimental to our business and could reduce the value of the collateral. There is no assurance these alternatives will be available, if at all, on satisfactory terms or on terms that will not require us to breach the terms and conditions of our existing or future debt agreements. Any inability to generate sufficient cash flow, refinance debt or incur additional debt on favorable terms could have a material adverse effect on our financial condition and results of operations, and could compromise our ability to service our debt, including the notes.

In addition, we use letters of credit and surety bonds to secure our performance under various construction and land development agreements, escrow agreements, financial guarantees and other arrangements. Should our future performance or economic conditions continue to make such letters of credit and surety bonds costly or difficult to obtain or lead to us being required to collateralize such instruments to a greater extent than previously, our business, financial condition and results of operations could be adversely affected.

We have a significant number of contingent liabilities, and if any are satisfied by us, could have a material adverse effect on our financial condition and results of operations.

At September 30, 2011, contingent liabilities included: