UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Year ended December 31, 2018

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

1-35573

(Commission file number)

TRONOX LIMITED

(ACN 153 348 111)

(Exact name of registrant as specified in its charter)

|

Western Australia, Australia

|

98-1026700

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

263 Tresser Boulevard, Suite 1100

Stamford, Connecticut 06901 |

Lot 22 Mason Road

Kwinana Beach WA 6167 Australia |

Registrant’s telephone number, including area code: (203) 705-3800

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Class A Ordinary Shares, par value $0.01 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☒

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

|

Emerging growth company

|

o

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒

The aggregate market value of the ordinary shares held by non-affiliates of the registrant as of June 30, 2018 was approximately $2,418,666,706.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No o

As of January 31, 2019, the registrant had 94,388,170 shares of Class A ordinary shares and 28,729,280 shares of Class B ordinary shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for its 2019 annual general meeting of shareholders are incorporated by reference in this Form 10-K in response to Part III Items 10, 11, 12, 13 and 14.

TRONOX LIMITED

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2018

INDEX

Page |

||||

Form 10-K Item Number |

||||

PART I |

||||

PART II |

||||

PART III |

||||

PART IV |

||||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements under the captions “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, and in other sections of this Form 10-K that are forward-looking statements. Forward-looking statements also can be identified by words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “can,” “may,” and similar terms. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties outlined in “Risk Factors.”

These risks and uncertainties are not exhaustive. Other sections of this Form 10-K may include additional factors, which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Unless otherwise required by applicable law, we are under no duty to update any of these forward-looking statements after the date of this Form 10-K to conform our prior statements to actual results or revised expectations and we do not intend to do so.

When considering forward-looking statements, you should keep in mind the risks, uncertainties and other cautionary statements made in this Form 10-K and the documents incorporated by reference, including, in particular, the factors discussed below. These factors may be revised or supplemented in subsequent reports on Forms 10-Q and 8-K.

Factors that may affect future results include, but are not limited to:

| • | the failure to close the Cristal Transaction (as defined below), including by failure to satisfy closing conditions, and the resulting negative impact on our share price, our business and our financial results; |

| • | if the Cristal Transaction is consummated we may not realize its anticipated benefits, may experience unexpected difficulties integrating its operations and may assume unexpected liabilities; |

| • | if the Cristal Transaction is consummated it will concentrate our share ownership in the hands of Cristal Inorganic and Exxaro (each as defined below), which may result in conflicts of interest and/or prevent minority shareholders from influencing the Company; |

| • | assuming consummation of the Re-Domicile Transaction (as defined below), English law and the new articles of association may limit our flexibility to manage our capital structure and/or have anti-takeover effects; |

| • | the risk that our customers might reduce demand for our products; |

| • | market conditions and price volatility for titanium dioxide (“TiO2”) and feedstock materials, as well as global and regional economic downturns, that adversely affect the demand for our end-use products; |

| • | changes in prices or supply of energy or other raw materials may negatively impact our business; |

| • | an unpredictable regulatory environment in South Africa where we have significant mining and beneficiation operations, including amendments by the South African Department of Mineral Resources to the Mining Charter; |

| • | the risk that our ability to use our tax attributes to offset future income may be limited; |

ii

| • | that the agreements governing our debt may restrict our ability to operate our business in certain ways, as well as impact our liquidity; |

| • | our inability to obtain additional capital on favorable terms; |

| • | the risk that we may not realize expected investment returns on our capital expenditure projects; |

| • | fluctuations in currency exchange rates; |

| • | compliance with, or claims under environmental, health and safety regulations may result in unanticipated costs or liabilities, including the potential classification of TiO2 as a Category 2 Carcinogen in the EU, which could have an adverse impact on our business; and |

| • | the possibility that cybersecurity incidents or other security breaches may seriously impact our results of operations and financial condition. |

We are committed to providing timely and accurate information to the investing public, consistent with our legal and regulatory obligations. To that end, we use our website to convey information about our businesses, including the anticipated release of quarterly financial results, quarterly financial and statistical and business-related information. Investors can access announcements about the Company through our website available at http://www.tronox.com. Our website is included as an inactive textual reference only and the information contained therein or connected thereto shall not be deemed to be incorporated into this Form 10-K.

iii

PART I

For the purposes of this discussion, references to “we,” “us,” and, “our” refer to Tronox Limited, together with its consolidated subsidiaries (collectively referred to as “Tronox” or “the Company”), when discussing the business following the completion of the 2012 Exxaro transaction (as defined herein), and to Tronox Incorporated, together with its consolidated subsidiaries (collectively referred to as “Tronox Incorporated”), when discussing the business prior to the completion of the Exxaro Transaction.

| Item 1. | Business |

Overview

Tronox Limited is the world’s leading integrated manufacturer of titanium dioxide (“TiO2”) pigment. We operate titanium-bearing mineral sand mines and accompanying beneficiation and smelting operations in Australia and South Africa to produce feedstock materials that can then be used in the manufacturing process for our TiO2 pigment products. We consume a substantial part of our feedstock materials in our own TiO2 pigment facilities located in the United States, Australia and the Netherlands with a goal of delivering low cost, high-quality pigment to our approximately 700 TiO2 customers in approximately 100 countries. In addition, the mining, beneficiation and smelting of titanium bearing mineral sands creates meaningful quantities of two co-products – zircon and pig iron – which we also supply to customers around the world.

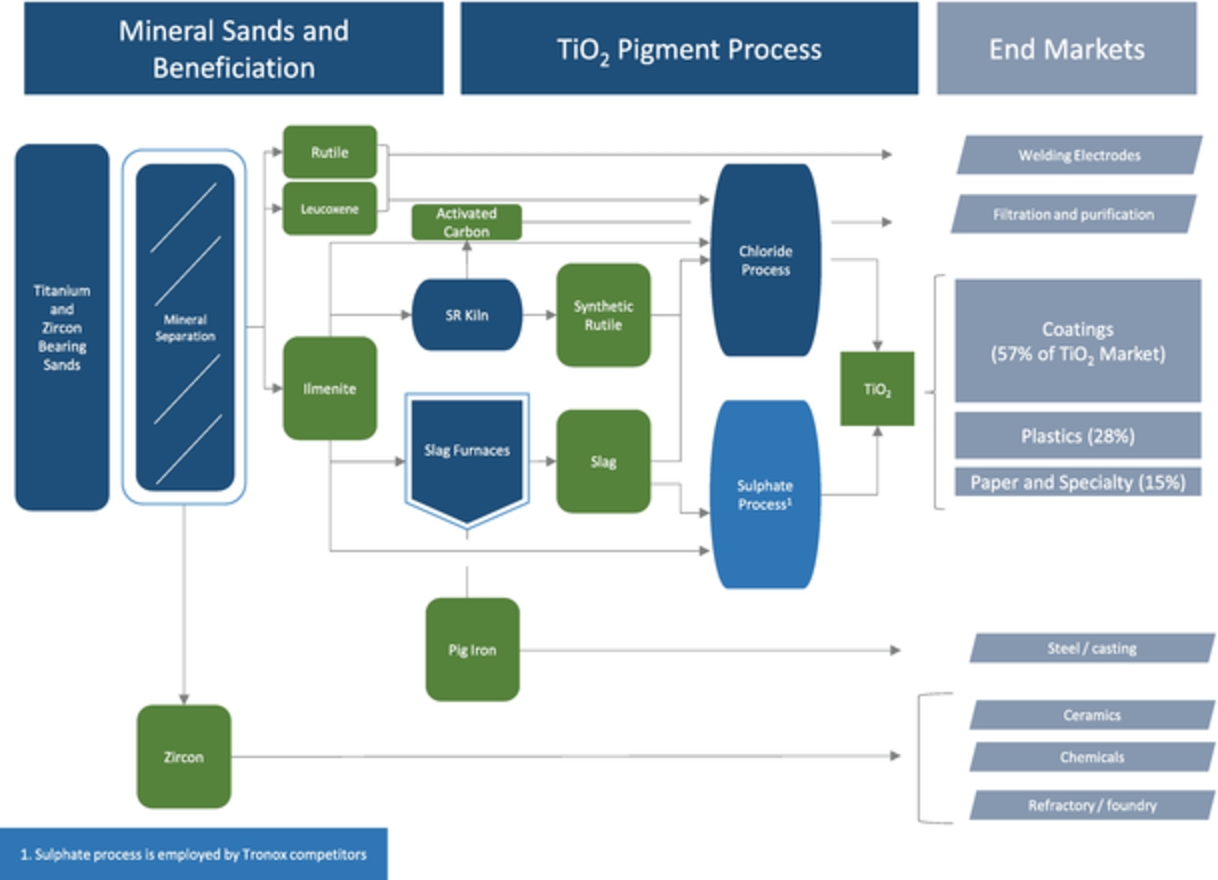

The following chart highlights the TiO2 value chain we participate in:

1

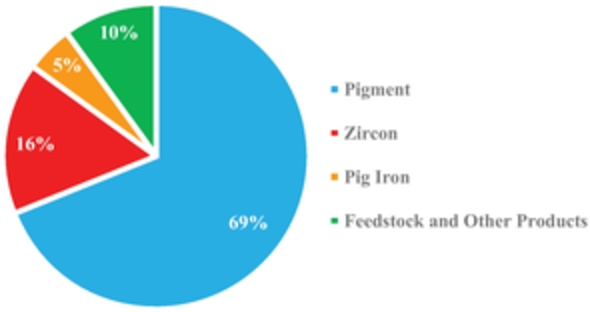

The following sets forth the percentage of our revenue derived from sales of our products by geographic region for the year ended December 31, 2018.

The below sets forth the percentage of our revenue derived from sales of our products for the year ended December 31, 2018.

For further financial information regarding our products and geographic regions, see the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, as well as Notes 3 and 23 of notes to our consolidated financial statements, each included elsewhere in this Form 10-K.

2018 Key Strategic Initiatives

The following sets forth the key strategic initiatives undertaken during 2018 that we believe will set a strong foundation for our future growth and results of operations.

Pending Cristal Acquisition

Throughout 2018 and into 2019 we continued to work diligently on obtaining regulatory approval for our proposed acquisition of the TiO2 business of The National Titanium Dioxide Company Ltd., a limited company organized under the laws of the Kingdom of Saudi Arabia (“Cristal”). The transaction was originally announced approximately two years ago when on February 21, 2017, we entered into a definitive agreement with Cristal and one of its affiliates to acquire the TiO2 business of Cristal for $1.673 billion of cash, subject to a working capital adjustment at closing, plus 37,580,000 Class A Shares (the “Cristal Transaction”). Our shareholders approved the Cristal Transaction on October 2, 2017 as well as gave us the authority to issue the Class A Shares in connection with the transaction. On February 27, 2019, we agreed with Cristal to extend the date on which our acquisition agreement expires from March 31, 2019 to May 19, 2019.

To date, we have received final approval from eight of the nine regulatory jurisdictions whose approvals are required to close the Cristal Transaction including the European Commission (“EC”) and are still seeking approval from the U.S. Federal Trade Commission (“FTC”). With regard to the EC approval, on July 16, 2018, we announced the submittal to the EC of an executed definitive agreement with Venator Materials PLC (“Venator”) to divest our 8120 paper-laminate product grade (the “8120 Grade”) currently supplied to customers from our Botlek facility in the Netherlands. Our agreement with Venator is terminable by either party under certain circumstances if the closing does not occur on or prior to April 12, 2019. On August 20, 2018, the EC approved the Cristal Transaction based on the conclusion that Venator is a suitable buyer of the 8120 Grade. The EC’s initial approval required that the Cristal Transaction to be consummated by November 16, 2018 but that deadline has been more recently extended by the EC to May 19, 2019.

2

With respect to the FTC, on December 5, 2017, the FTC announced that it would not approve the Cristal Transaction as proposed and filed an administrative action to prevent the parties from consummating the transaction alleging that the Cristal Transaction would violate Section 7 of the Clayton Antitrust Act and Section 5 of the FTC Act. The administrative complaint sought, among other things, a permanent injunction to prevent the transaction from being completed. On December 9, 2018, the administrative law judge (the “ALJ”) issued an initial decision enjoining Tronox from consummating the proposed Cristal Transaction. We filed an appeal of the administrative law judge’s initial decision on February 4, 2019 in which we sought to narrow the geographic scope of the proposed order included in the initial decision. The ALJ’s initial decision will not become final until the FTC rules on our appeal. In addition, on September 5, 2018, the U.S. District Court in the District of Columbia granted the FTC a preliminary injunction blocking the Cristal Transaction.

Following the issuance of a preliminary injunction by the U.S. District Court, we commenced settlement discussions with the FTC. We proposed to divest all of Cristal’s North American operations including the Ashtabula, Ohio two-plant TiO2 production complex to a purchaser acceptable to the FTC. Initially, we intended to divest Cristal’s North American operations to Venator. When we announced the divestiture of the 8120 Grade to Venator on July 16, 2018 we also announced that we had entered into a binding Memorandum of Understanding (“MOU”) with Venator providing for the negotiation in good faith of a definitive agreement to sell the entirety of Cristal’s North American operations to Venator if a divestiture of all or a substantial part of Ashtabula was required to secure final FTC regulatory approval for the Cristal Transaction. The MOU granted Venator exclusivity for a period of 75 days to negotiate a definitive agreement for the sale of the entirety of the Ashtabula complex. The MOU also provided for a $75 million break fee if, among other things, the parties, despite negotiating in good-faith and in conformity with the terms in the MOU, failed to reach a definitive agreement for the sale of Cristal’s North American operations and Tronox was able to consummate both the Cristal Transaction and the paper-laminate grade divestiture to Venator. On October 1, 2018, we announced that the 75-day exclusivity period under the MOU with Venator had expired without the two companies agreeing to terms.

Subsequent to the expiration of the exclusivity period with Venator, we announced an agreement in principle with INEOS Enterprises A.G., a unit of INEOS and one of the world’s largest chemicals companies (“INEOS”), to divest Cristal’s North American operations for approximately $700 million. We, Cristal and INEOS have been engaged in on-going discussions with the FTC since that time regarding the terms and conditions under which the FTC would allow the Cristal Transaction to be consummated. Most recently, on February 11, 2019, in recognition of the progress made to date in settling the dispute with the FTC, we and the FTC staff filed a joint motion with the FTC Commissioners requesting a delay of the deadline for the FTC to respond to our appeal of the ALJ’s initial December 10, 2018 decision finding that the proposed acquisition of Cristal may substantially lessen competition for the sale of chloride-based TiO2 in North America

Jazan Slagger and Option Agreement

On May 9, 2018, we entered into an Option Agreement (the “Option Agreement”) with Advanced Metal Industries Cluster Company Limited (“AMIC”) pursuant to which AMIC granted us an option (the “Option”) to acquire 90% of a special purpose vehicle (the “SPV”), to which AMIC’s ownership in a titanium slag smelter facility (the “Slagger”) in “The Jazan City for Primary and Downstream Industries” in the Kingdom of Saudi Arabia (“KSA”) will be contributed together with $322 million of indebtedness currently held by AMIC (the “AMIC Debt”). The execution of the Option Agreement occurred shortly after we entered into a Technical Services Agreement (the “Technical Services Agreement”) with AMIC pursuant to which we agreed to immediately commence providing technical assistance to AMIC to facilitate the start-up of the Slagger. National Industrialization Company (“TASNEE”) and Cristal each own 50% of AMIC. The strategic intent of the Option Agreement and Technical Services Agreement is to enable us to further optimize the vertical integration between our TiO2 pigment production and TiO2 feedstock production after the closing of the Cristal Transaction. Pursuant to the Option Agreement and during its term, we agreed to lend AMIC and, upon the creation of the SPV, the SPV up to $125 million for capital expenditures and operational expenses intended to facilitate the start-up of the Slagger. Such funds may be drawn down by AMIC and the SPV, as the case may be, on a quarterly basis as needed based on a budget reflecting the anticipated needs of the Slagger start-up. The obligation to fund up to $125 million is contingent on our continued reasonable belief that such amounts will be sufficient (in addition to any amounts supplied by AMIC) to bring the Slagger up to certain sustained production levels. If we do not acquire the Slagger for any reason, the loans mature on the date that is eighteen

3

months from the termination of the Option Agreement. Pursuant to the Option Agreement, subject to certain conditions, we may exercise the Option at any time on or prior to May 9, 2023. If the Slagger achieves certain production criteria related to sustained quality and tonnage of slag produced (and the other conditions referenced above are satisfied), AMIC may require us to acquire the Slagger (the “Put”). If the Option or Put is exercised, we will acquire a 90% ownership interest in the SPV; provided, that the Option and the Put may not be exercised if the Cristal Transaction is not consummated. During the year ended December 31, 2018, we loaned $64 million for capital expenditures and operational expenses to facilitate the start-up of the Slagger. An additional $25 million was loaned on January 4, 2019.

Re-Domiciliation from Australia to the United Kingdom

In November 2018, we announced our intention to re-domicile from Western Australia to the United Kingdom (the “Re-Domicile Transaction”). The Re-Domicile Transaction will be effected via a scheme of arrangement overseen by an Australian Court. Pursuant to such scheme of arrangement, holders of our Class A Shares and Class B ordinary shares (“Class B Shares”) will be required to exchange their shares in Tronox Limited on a 1:1 basis for ordinary shares in Tronox Holdings plc, a newly formed entity incorporated under the laws of England and Wales (“New Tronox”), which shares are proposed to be listed on the New York Stock Exchange (the “NYSE”). On February 8, 2019, the first Australian Court hearing occurred whereby the Court approved the Class A and Class B shareholder meetings to be convened for the purpose of approving the Re-Domicile Transaction, as well as approved the mailing by us of the definitive proxy statement in connection with such shareholder meetings. We have scheduled a general meeting of our Class A shareholders and a separate meeting of our Class B shareholder to approve the Re-Domicile Transaction on March 8, 2019. Assuming we receive the requisite shareholder approvals, the final Australian court approval and other customary conditions are satisfied, we expect such transaction to be fully implemented by the end of the first quarter 2019. We do not anticipate that the Re-Domicile Transaction will have a material impact on our shareholders from a financial, governance or tax perspective. Rather, we believe the Re-Domicile Transaction is the next logical step in our stated strategic goal of becoming the world’s most vertically integrated and lowest cost producer of TiO2 and will benefit our shareholders in a number of important ways, including:

| • | increasing the attractiveness of our shares to certain investors by eliminating the dual class share structure, and by providing our Board with greater authority and flexibility to undertake share repurchases than our current Constitution or Australian law permits; |

| • | facilitating the ability of our Board to periodically refresh itself as we believe it will be easier to recruit new Board members to a UK incorporated company, we will have more flexibility in terms of board size and composition, and there will no longer be a requirement that two of our Board members are Australian residents; |

| • | providing greater certainty with respect to certain tax matters in light of the Multilateral Instrument by the Governments of Australia and the UK; and |

| • | bringing our jurisdiction of incorporation more into line with some of our peers and the majority of other non-US companies listed on the NYSE thereby potentially more easily attracting investors. |

Exxaro Mineral Sands Transaction Completion Agreement

On November 26, 2018, we and certain of our subsidiaries (collectively, the “Tronox Parties”) and Exxaro Resources Limited (“Exxaro”) entered into the Exxaro Mineral Sands Transaction Completion Agreement (the “Completion Agreement”). The Completion Agreement provides for the orderly sale of Exxaro’s remaining approximately 23% ownership interest in us during 2019, helps to facilitate the Re-Domicile Transaction, as well as addresses several legacy issues related to our 2012 acquisition of Exxaro’s mineral sands business (the “2012 Exxaro transaction”).

Orderly Sale of Exxaro’s 23% Ownership in Tronox

In the 2012 Exxaro transaction, as part of the consideration for Exxaro’s mineral sands business, we issued to Exxaro approximately 38.5% of our then outstanding voting securities in the form of Class B Shares. On March 8, 2017, Exxaro announced its intention to begin to sell its ownership stake in us over time. On October 10, 2017, in order to sell a portion of its ownership interest in us, Exxaro converted 22,425,000 of

4

its Class B Shares into Class A Shares and sold those shares in an underwritten registered offering. The Completion Agreement sets forth the terms under which Exxaro may convert and then sell its remaining 28,729,280 Class B Shares during the course of 2019. The Completion Agreement contemplates that the sale of Exxaro’s remaining ownership interest in Tronox will be undertaken in a manner that we believe will not cause us to lose, under limitations set forth in Section 382 of the U.S Internal Revenue Code of 1985, as amended (the “Code”), the benefit of approximately $4.1 billion of net operating losses and/or the approximately $1.1 billion of Section 163(j) of the Code interest expense carryforwards. For further information regarding the risk of us losing certain tax attributes, see the section included elsewhere in this Form 10-K entitled “Risk Factors – Risks Relating to our Business – Our ability to use our tax attributes to offset future income may be limited.”

Specific Provisions in the Exxaro Completion Agreement relating to the Re-Domicile Transaction

Pursuant to the terms of the Completion Agreement, Exxaro agreed to vote its Class B Shares in favor of the Re-domicile Transaction. In addition, the Completion Agreement contains several other provisions that are material with respect to the Re-Domicile Transaction, including:

| • | We have the right to repurchase from Exxaro any Class B Shares (or from the completion date of the Re-Domicile Transaction, any of its ordinary shares in New Tronox) that Exxaro desires to sell. The purchase price of any such repurchase will be based on market-related prices; |

| • | One of the Tronox Parties has covenanted to pay Exxaro an amount equal to any South African capital gains tax assessed on Exxaro in respect of any profit arising to it on a disposal of any of its ordinary shares in New Tronox subsequent to the completion date of the Re-Domicile Transaction where such tax would not have been assessed but for the Re-Domicile Transaction. Similarly, Exxaro has covenanted to pay one of the Tronox Parties an amount equal to any South African tax savings Exxaro may realize in certain situations from any tax relief that would not have arisen but for the Re-Domicile Transaction (such as losses on a disposal of any of Exxaro’s ordinary shares in the New Tronox subsequent to the completion date of the Re-Domicile Transaction); and |

| • | Exxaro has also agreed that it will enter into a new shareholder agreement with us conditional upon completion of the Re-Domicile Transaction which, among other things, will enable us to eliminate the Class B Shares. |

Legacy issues related to the 2012 Exxaro transaction addressed in the Completion Agreement

Pursuant to the 2012 Exxaro transaction, Exxaro retained a 26% ownership interest in our two South African subsidiaries related to the mineral sands business to enable us to satisfy certain Black Economic Empowerment regulations promulgated by the South African Department of Mineral Resources (the “DMR”). The 2012 Exxaro transaction agreements contemplated that by 2022, Exxaro would sell to us its remaining 26% interests in those two South African subsidiaries for 7.2 million additional Class B Shares. The Completion Agreement allows Exxaro and us to conclude matters from that transaction in a way that we believe is mutually beneficial to both parties by, among other things, providing us with the option to pay cash consideration for Exxaro’s remaining 26% interests in the two South African subsidiaries in lieu of issuing additional Class B Shares. Additionally, the Completion Agreement amends such “flip-in” rights granted to Exxaro by accelerating the triggering of such right based upon the application of the once-empowered-always-empowered principle that has recently been confirmed by the South African High Court. See “Risk Factors − Our South African mining rights are subject to onerous regulatory requirements imposed by legislation and the Department of Mineral Resources, the compliance of which could have a material adverse effect on our business, financial condition and results of operations.”

Furthermore, pursuant to the Completion Agreement, the parties agreed to accelerate the date on which we will buy from Exxaro its 26% membership interest in Tronox Sands LLP, a U.K. limited liability partnership (“Tronox Sands”). Tronox Sands holds intercompany loans that Exxaro held prior to our 2012 acquisition of Exxaro’s mineral sands business. On February 15, 2019, we completed the redemption of Exxaro’s ownership interest in Tronox Sands for consideration of approximately ZAR 2.06 billion (or approximately $148 million) in cash, which represents Exxaro’s indirect share of the loan accounts in our South African subsidiaries.

5

Sale of our Electrolytic Business

On September 1, 2018, Tronox LLC, our indirect wholly owned subsidiary sold to EMD Acquisition LLC certain of the assets and liabilities of our Henderson Electrolytic Operations based in Henderson, Nevada (the “Henderson Electrolytic Operations”), a component of our TiO2 segment, for $1.3 million in cash and a secured promissory note of $4.7 million which was paid in full on December 27, 2018. The total pre-tax loss on the sale of $31 million has been recorded in “Impairment loss” in the Consolidated Statements of Operations.

Our Principal Products

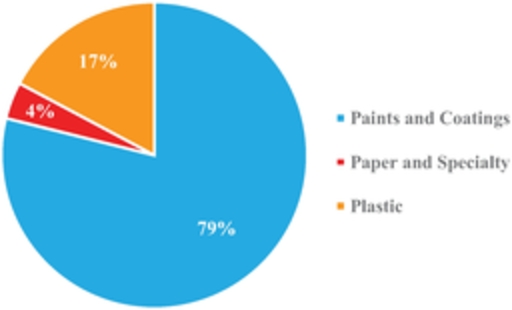

TiO2 pigment: TiO2 pigment is used in a wide range of products due to its ability to impart whiteness, brightness, and opacity. TiO2 pigment is used extensively in the manufacture of paint and other coatings, plastics and paper, and in a wide range of other applications. Moreover, it is a critical component of everyday consumer applications due to its superior ability to cover or mask other materials effectively and efficiently relative to alternative white pigments and extenders. TiO2 pigment is considered to be a quality of life product. At present, it is our belief that there is no effective substitute for TiO2 pigment because no other white pigment has the physical properties for achieving comparable opacity and brightness, or can be incorporated as cost effectively. In 2018, we generated $1.265 billion in revenue from sales of TiO2 pigment.

Zircon: Zircon (ZrSiO4) is a co-product of mining mineral sands deposits for titanium feedstock. Zircon is primarily used as an additive in ceramic glazes, which makes the ceramic glaze more water, chemical and abrasion resistant. It is also used for the production of zirconium metal and zirconium chemicals, in refractories, as molding sand in foundries, and for TV screen glass, where it is noted for its structural stability at high temperatures and resistance to abrasive and corrosive conditions. Zircon typically represents a relatively low proportion of the in-situ heavy mineral sands deposits, but has a relatively higher value compared to other heavy mineral products. Refractories containing zircon are expensive and are only used in demanding, high-wear and corrosive applications in the glass, steel and cement industries. Foundry applications use zircon when casting articles of high quality and value where accurate sizing is crucial, such as aerospace, automotive, medical, and other high-end applications. In 2018, we generated $293 million in revenue from sales of zircon.

High Purity Pig Iron: During the process of smelting ilmenite at our smelters to produce TiO2 slag, high purity pig iron is produced as a co-product. High purity pig iron is used as a raw material in foundries for the production of high quality ductile iron castings. Ductile iron is used extensively throughout the world for the production of safety critical automotive parts, such as brake calipers and steering knuckles in cars and trucks. In 2018, we generated $87 million in revenue from sales of pig iron.

Feedstock and Other Products: Most TiO2 products are derived from three minerals: ilmenite, leucoxene and rutile. Ilmenite, rutile, leucoxene, as well as two materials processed from ilmenite, namely, titanium slag and synthetic rutile, are all primarily used as feedstock for the production of TiO2 pigment. There is substantial overlap amongst each of the aforementioned with the primary differentiating factor being the level of titanium dioxide content. For instance, rutile has the highest titanium dioxide concentration of approximately 94% to 96%, while ilmenite has the lowest of approximately 45% to 65%. In 2018, we generated $137 million in revenue from the sale of feedstock and other products.

As mentioned previously, on September 1, 2018, we sold our Henderson Electrolytic Operations to EMD Acquisition LLC. Prior to the sale, we generated approximately $37 million in revenues from the operations in 2018.

In addition, the demand for certain of our products during a given year is subject to seasonal fluctuations. See “Risk Factors − Risks Relating to our Business − The markets for many of our products have seasonally affected sales patterns.”

Mining and Beneficiation of Mineral Sands Deposits

Our mining and beneficiation of mineral sands deposits are comprised of the following:

| • | KwaZulu-Natal (“KZN”) Sands operations located on the eastern coast of South Africa consisting of the Fairbreeze mine, a concentration plant, a mineral separation plant and two smelting furnaces that produce titanium slag; |

6

| • | Our Namakwa Sands operations located on the western coast of South Africa consisting of the Namakwa mine, two concentration plants, a mineral separation plant, as well as two smelting furnaces that produce titanium slag; and |

| • | Our Northern Operations complex in Western Australia consisting of the Cooljarloo dredge mine and floating heavy mineral concentration plant and the Chandala metallurgical site which includes a mineral separation plant and a synthetic rutile plant that produces synthetic rutile. |

Zircon is often, but not always, found in mineral sands deposits containing ilmenite. It is extracted, alongside ilmenite and rutile, as part of the initial mineral sands beneficiation process.

The mining of mineral sands deposits is conducted either “wet,” by dredging or hydraulic water jets, or “dry,” using earth-moving equipment to excavate and transport the sands. The type of mining operation we deploy is dependent upon the characteristics of the ore body. Dredge mining is generally the favored method of mining mineral sands, provided that the ground conditions are suitable, water is readily available and the deposit is low in slime content. Dry mining techniques are generally preferred in situations involving hard ground, discontinuous ore bodies, small tonnage, high slimes contents and/or very high grades.

Regardless of the type of mining technique, the first step in the beneficiation process is to utilize wet concentrator plants to produce a high grade of heavy mineral concentrate (typically approximately 90% to 98% heavy mineral content). Screened ore is first de-slimed, a process by which slimes are separated from larger particles of minerals, and then processed through a series of spiral separators that use gravity to separate the heavy mineral sands from lighter materials, such as quartz. Residue from the concentration process is pumped back into either the open pits or slimes dams for rehabilitation and water recovery.

After producing heavy mineral concentrate in our wet concentrator plants, we separate the non-magnetic (zircon and rutile) and magnetic (ilmenite) fractions utilizing a variety of techniques. Through the separation process, we produce zircon which is sold directly to customers and high purity rutile which can immediately be used as feedstock material to make TiO2 pigment or sold to the titanium metal, welding and other industries.

Ilmenite is generally further refined for use in our chloride-based TiO2 pigment manufacturing processes. Depending on the characteristics of the ilmenite we use two fundamental processes to refine ilmenite. Both processes involve the removal of iron and other non-titanium material.

| • | Titanium slag is made by smelting ilmenite in an electric arc furnace to separate titanium-oxide from the iron and other impurities. The result is two products: “slag” which contains 86% to 89% titanium dioxide and is considered a high grade TiO2 feedstock material, as well as high purity pig iron which is ready for sale to end-use customers. |

| • | Synthetic rutile is made by reducing ilmenite in a rotary kiln, followed by leaching under various conditions to remove the iron from the reduced ilmenite grains. Our synthetic rutile has a titanium dioxide content of approximately 89% to 92% and is also considered a high grade TiO2 feedstock material. |

Our mining and beneficiation operations have a combined annual production capacity of approximately 721,000 metric tons (“MT”) of titanium feedstock, which is comprised of 91,000 MT of rutile and leucoxene, 220,000 MT of synthetic rutile and 410,000 MT of titanium slag. We have the capability to produce approximately 220,000 MT of zircon and 221,000 MT of pig iron.

Competitive Conditions-Mining

Globally, there are a large number of mining companies that mine mineral sand deposits containing ilmenite, as well as zircon. However, there is a smaller number of mining companies that are also involved in upgrading the underlying ilmenite to produce the high grade feedstock typically utilized by TiO2 chloride producers. We believe that our degree of vertical integration is unique and that we are the only company that has significant mining, upgrading and TiO2 pigment manufacturing capabilities.

Production of TiO2 Pigment

TiO2 pigment is produced using a combination of processes involving the manufacture of base pigment particles through either the chloride or sulfate process followed by surface treatment, drying and milling

7

(collectively known as finishing). Currently, all of our TiO2 pigment is produced using the chloride process. We believe that we are one of the largest global producers and marketers of TiO2 pigment manufactured via chloride technology.

In the chloride process, high quality feedstock (slag, synthetic rutile, natural rutile or, in limited cases, high titanium content ilmenite ores) are reacted with chlorine (the chlorination step) and carbon to form titanium tetrachloride (“TiCl4”) in a continuous fluid bed reactor. Purification of TiCl4 to remove other chlorinated products is accomplished using selective condensation and distillation process. The purified TiCl4 is then oxidized in a vapor phase form to produce raw pigment particles and chlorine gas. The latter is recycled back to the chlorination step for reuse. Raw pigment is then typically slurried with water and dispersants prior to entering the finishing step. The chloride process currently accounts for substantially all of the industry-wide TiO2 production capacity in North America, and approximately 46% of industry-wide capacity globally.

Commercial production of TiO2 pigment results in one of two different crystal forms: rutile, which is manufactured using either the chloride process or the sulfate process, or anatase, which is only produced using the sulfate process. Rutile TiO2 is preferred over anatase TiO2 for many of the largest end-use applications, such as coatings and plastics, because its higher refractive index imparts better hiding power at lower quantities than the anatase crystal form and it is more suitable for outdoor use because it is more durable. Rutile TiO2 can be produced using either the chloride process or the sulfate process.

The primary raw materials used in the production of TiO2 pigment include titanium feedstock, chlorine and coke. As discussed above, we believe we are unique in the degree to which we produce our own high grade titanium feedstock. Other chemicals used in the production of TiO2 are purchased from various companies under short and long-term supply contracts. In the past, we have been, and we expect that we will continue to be, successful in obtaining extensions to these and other existing supply contracts prior to their expiration. We expect the raw materials purchased under these contracts, and contracts that we enter into the near term, to meet our requirements over the next several years.

Marketing

We supply and market TiO2 under the brand name TRONOX® to approximately 700 customers in approximately 100 countries, including market leaders in each of the key end-use markets for TiO2, and we have supplied each of our top ten customers with TiO2 for more than 10 years.

The following sets forth the percentage of our sales volume by end-use market for the year ended December 31, 2018.

In addition to price and product quality, we compete on the basis of technical support and customer service. Our direct sales and technical service organizations execute our sales and marketing strategy, and work together to provide quality customer service. Our direct sales staff is trained in all of our products and applications. Due to the technical requirements of TiO2 applications, our technical service organization and direct sales offices are supported by a regional customer service staff located in each of our major geographic markets.

Our sales and marketing strategy focuses on effective customer management through the development of strong relationships. We develop customer relationships and manage customer contact through our sales team, technical service organization, research and development team, customer service team, plant operations personnel, supply chain specialists, and senior management visits. We believe that multiple points of customer contact facilitate efficient problem solving, supply chain support, formula optimization and co-development of products.

8

Competitive Conditions- TiO2

The global market in which our TiO2 pigment business operates is highly competitive. Competition is based on a number of factors such as price, product quality and service. We face competition not only from chloride process pigment producers, but from sulfate process pigment producers as well. Moreover, because transportation costs are minor relative to the cost of our product, there is also competition between products produced in one region versus products produced in another region.

We face competition from global competitors with headquarters in Europe, the United States and China, including Chemours, Cristal Global, Venator, Kronos Worldwide Inc. and Lomon Billions. In addition, we compete with numerous regional producers particularly in Eastern Europe and China.

Research and Development

We have research and development facilities that aim to develop new products, service our products, and focus on applied research and development of both new and existing processes. We utilize a third party for research and development support with respect to our mineral sands business located in South Africa, while the majority of scientists supporting our TiO2 pigment business are located in Oklahoma City, Oklahoma, USA.

New process developments are focused on increased throughput, efficiency gains and general processing equipment-related improvements. Ongoing development of process technology contributes to cost reduction, enhanced production flexibility, increased capacity, and improved consistency of product quality. In 2018, our product development and commercialization efforts were focused on several TiO2 pigment products that deliver added value to customers across all end use segments by way of enhanced properties of the pigment.

Patents, Trademarks, Trade Secrets and Other Intellectual Property Rights

Protection of our proprietary intellectual property is important to our business. At December 31, 2018, we held 33 patents and 4 patent applications in the U.S., and approximately 209 in foreign counterparts, including both issued patents and pending patent applications. Our U.S. patents have expiration dates ranging through 2036. Additionally, we have 2 trademark registrations in the U.S., as well as 51 trademark counterpart registrations and applications in foreign jurisdictions.

We also rely upon our unpatented proprietary technology, know-how and other trade secrets. The substantial majority of our patents and trade secrets relate to our chloride products, surface treatments, chlorination expertise, and oxidation process technology, and this proprietary chloride production technology is an important part of our overall technology position. However, much of the fundamental intellectual property associated with both chloride and sulfate pigment production is no longer subject to patent protection. At Namakwa Sands, we rely on intellectual property for our smelting technology, which was granted to us in perpetuity by Anglo American South Africa Limited for use on a worldwide basis, pursuant to a non-exclusive license.

While certain of our patents relating to our products and production processes are important to our long-term success, more important is the operational knowledge we possess. We also use and rely upon unpatented proprietary knowledge, continuing technological innovation and other trade secrets to develop and maintain our competitive position. We conduct research activities and protect the confidentiality of our trade secrets through reasonable measures, including confidentiality agreements and security procedures. We protect the trademarks that we use in connection with the products we manufacture and sell, and have developed value in connection with our long-term use of our trademarks. See “Risk Factors − Third parties may develop new intellectual property rights for processes and/or products that we would want to use, but would be unable to do so; or, third parties may claim that the products we make or the processes that we use infringe their intellectual property rights, which may cause us to pay unexpected litigation costs or damages or prevent us from making, using or selling products we make or require alteration of the processes we use.”

Employees

As of December 31, 2018, we had approximately 3,330 employees worldwide, of which 610 are located in the U.S., 600 in Australia, 1,840 in South Africa, and 280 in the Netherlands and other international locations. Our employees in the U.S. are not represented by a union or collective bargaining agreement. In South Africa, approximately 74% of our workforce belongs to a union. In Australia, most employees are not currently

9

represented by a union, but approximately 46% are represented by a collective bargaining agreement. In the Netherlands, approximately 49% of our employees are represented by a collective bargaining agreement and 27% are members of a union. We consider relations with our employees and labor organizations to be good.

Environmental, Health and Safety Authorizations

Mining

Our facilities and operations are subject to extensive general and industry-specific environmental, health and safety regulations in South Africa and Australia. These regulations include those relating to mine rehabilitation, liability provision, water management, the handling and disposal of hazardous and non-hazardous materials, and occupational health and safety. The various legislation and regulations are subject to a number of internal and external audits. We believe our mineral sands operations are in compliance, in all material respects, with existing health, safety and environmental legislation and regulations.

Regulation of the Mining Industry in South Africa

The South African mining regulatory regime is comprehensive and requires regular reporting to applicable government departments. A failure to, among other things, comply with any such reporting requirements or the conditions of any mining license could result in extended mandatory shutdown periods, license and/or mining right suspensions or revocations all of which could impact our business.

In South Africa, the primary legislative enactments with which our mines are required to comply are the Mineral and Petroleum Resources Development Act (“MPRDA”) which governs the acquisition and retention of prospecting and mining rights. In addition, the Mine Health and Safety Act governs the manner in which mining must be conducted from a health and safety perspective, while the National Environmental Management Act (and its subsidiary legislation) provides the underlying framework with respect to environmental rules and regulation for which our operations must comply. For additional details regarding other South African legislative enactments that govern our mining licenses please see the section entitled “Risk Factors” set forth elsewhere in this Form 10-K.

Regulation of the Mining Industry in Australia

Mining operations in Western Australia are subject to a variety of environmental protection regulations including but not limited to: the Environmental Protection Act (the “EPA”), the primary source of environmental regulation in Western Australia, and, the Environment Protection and Biodiversity Conservation Act 1999 (Cth), which established the federal environment protection regime and prohibits the carrying out of a “controlled action” that may have a significant impact on a “matter of national environmental significance.”

Prescriptive legislation regulates health and safety at mining workplaces in Western Australia. The principal general occupational health and safety legislation and regulations are the Occupational Safety and Health Act 1984 (WA), the Occupational Health and Safety Regulations 1996 (WA) and the related guidelines. The Mines Safety and Inspection Act 1994 (WA) and Mines Safety and Inspection Regulations 1995 (WA) and related guidelines provide the relevant legislation for mining operations in Western Australia. The Dangerous Goods Act 2004 (WA) applies to the safe storage, handling and transport of dangerous goods.

Each Australian state and territory has its own legislation regulating the exploration for and mining of minerals. Our exploration and mining operations are regulated by the Western Australian Mining Act 1978 (WA) and the Mining Regulations 1981 (WA).

In Western Australia, State Agreements are contracts between the State and the proponents of major resources projects within Western Australia, and are intended to foster resource development and related infrastructure investments. These agreements are approved and ratified by the Parliament of Western Australia. The State Agreement relevant to our Australian operations and our production of mineral sands is the agreement authorized by the Mineral Sands (Cooljarloo) Mining and Processing Agreement Act 1988 (WA). State Agreements supplement the legislation and regulations referred to above, and can often have the effect of varying the way in which such legislation or regulations apply to (and generally, are for the benefit of) a specific project. State Agreements may only be amended by mutual consent, which can (among other things) serve to reduce sovereign risk and enhance security of tenure, however Parliament may enact legislation that overrules or amends the particular State Agreement (although this would not typically occur without prior engagement with the project proponent).

10

Regulation of Finished Product Manufacturing

Our business is subject to extensive regulation by federal, state, local and foreign governments. Governmental authorities regulate the generation and treatment of waste and air emissions at our operations and facilities. At many of our operations, we also comply with worldwide, voluntary standards developed by the International Organization for Standardization (“ISO”), a nongovernmental organization that promotes the development of standards and serves as a bridging organization for quality and environmental standards, such as ISO 9002 for quality management and ISO 14001 for environmental management.

Chemical Registration

As a chemical manufacturer with global operations, we are subject to a wide array of regulations regarding the import, export, labelling, use, storage and disposal of our products. We are obliged to comply with the regulation of chemical substances and inventories under the Toxic Substances Control Act in the United States and the Registration, Evaluation and Authorization of Chemicals (“REACH”) regulation in Europe, as well as a growing list of analogous regimes in other parts of the world, including China, South Korea and Taiwan. Manufacturers and importers of chemical substances must register information regarding the properties of their existing chemical substances with the European Chemicals Agency (“ECHA”). REACH regulations also require chemical substances, which are newly imported or manufactured in the EU to be registered before being placed on the market. In addition, REACH requires registrants to update registrations within specified timelines, as well as when with there may be new information relevant to human health or environmental risks of the substance. In addition, REACH includes a mechanism to evaluate substances to determine if it poses risk to human health and/or the environment. In May 2016, France’s competent authority under REACH submitted a proposal to ECHA that would classify TiO2 pigment as carcinogenic in humans by inhalation. On October 12, 2017, ECHA’s Committee for Risk Assessment (“RAC”) released a written opinion dated September 14, 2017 stating that based on the scientific evidence it reviewed, there is sufficient grounds to classify TiO2 under the EU’s Classification, Labelling and Packaging Regulation (“CLP”) as a Category 2 Carcinogen, but only with a hazard statement describing the risk by inhalation. After reviewing the RAC’s formal recommendation on February 14, 2019, the EC was unable to reach a decision and will re-consider the proposal at its next meeting on March 7, 2019. For additional information on this topic, see the section entitled “Risk Factors – Risks Relating to our Business – The classification of TiO2 as a Category 2 Carcinogen in the European Union could result in more stringent regulatory control with respect to TiO2.”

Greenhouse Gas Regulation

Globally, our operations are subject to regulations that seek to reduce emissions of “greenhouse gases” (“GHGs”). We currently report and manage GHG emissions as required by law for sites located in areas requiring such managing and reporting (EU/Australia). While the U.S. has not adopted any federal climate change legislation, the U.S. Environmental Protection Agency (“EPA”) has introduced some GHG programs. For example, under the EPA’s GHG “Tailoring Rule,” expansions or new construction could be subject to the Clean Air Act’s Prevention of Significant Deterioration requirements. Some of our facilities are currently subject to GHG emissions monitoring and reporting. Changes or additional requirements due to GHG regulations could impact our capital and operating costs; however, it is not possible at the present time to estimate any financial impact any such changes or additional requirements may have to our operating sites.

Available Information

Our public internet site is http://www.tronox.com. The content of our internet site is available for information purposes only and is included as an inactive textual reference. It should not be relied upon for investment purposes, nor is it incorporated by reference into this annual report unless expressly noted. We make available, free of charge, on or through the investor relations section of our internet site, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers, as well as any amendments to those reports filed or furnished pursuant to the U.S. Securities and Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the “SEC”).

We file current, annual and quarterly reports, proxy statements and other information required by the Exchange Act with the SEC. Our SEC filings are also available to the public from the SEC’s internet site at http://www.sec.gov.

11

| Item 1A. | Risk Factors |

You should carefully consider the risk factors set forth below, as well as the other information contained in this Form 10-K, including our consolidated financial statements and related notes. This Form 10-K contains forward-looking statements that involve risks and uncertainties. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. The following risk factors are not necessarily presented in order of relative importance and should not be considered to represent a complete set of all potential risks that could affect our business, financial condition or results of operations.

RISKS RELATING TO THE CRISTAL TRANSACTION

Our pending acquisition of the Cristal TiO2 business may not be consummated, the failure to complete the Cristal TiO2 business acquisition could impact our stock price and financial results and the ongoing uncertainty as to whether the transaction will be consummated could all adversely affect our business.

On February 21, 2017, we entered into a transaction agreement to acquire the titanium dioxide business of The National Titanium Dioxide Co. Limited (“Cristal”) (the “Cristal Transaction”). On March 1, 2018, Tronox, Cristal and Cristal Inorganic Chemicals Netherlands Cooperatief W.A. (“Cristal Inorganic”), a wholly-owned subsidiary of Cristal, entered into an Amendment to the Transaction Agreement (the “Amendment”) that extended the termination date under the Transaction Agreement to March 31, 2019, if necessary based on the status of outstanding regulatory approvals. On February 27, 2019, we agreed with Cristal to extend the date on which our acquisition agreement expires from March 31, 2019 to May 19, 2019. Completion of the Cristal Transaction is subject to certain closing conditions, including certain regulatory approvals, as more fully described below.

On December 5, 2017, the U.S. Federal Trade Commission (“FTC”) announced that it would not approve the Cristal Transaction as proposed and filed an administrative action to prevent the parties from consummating the transaction alleging that the Cristal Transaction would violate Section 7 of the Clayton Antitrust Act and Section 5 of the FTC Act. The administrative complaint sought, among other things, a permanent injunction to prevent the transaction from being completed. On December 9, 2018, the administrative law judge issued an initial decision enjoining Tronox from consummating the proposed Cristal Transaction.

Additionally, on July 10, 2018, we received notice that the FTC had filed a complaint against us in the U.S. District Court in the District of Columbia (the “U.S. District Court”). The complaint alleged that Tronox’s pending acquisition of the TiO2 business of Cristal would violate antitrust laws by significantly reducing competition in the North American market for chloride-process TiO2. On September 5, 2018, the U.S. District Court granted the FTC a preliminary injunction blocking the Cristal Transaction.

As a result of the outstanding U.S. regulatory approval, there can be no assurance that all closing conditions for the Cristal Transaction will be satisfied and, if they are satisfied, that they will be satisfied in time for the closing to occur by May 19, 2019, at which time either party to the transaction agreement may mutually agree to extend the closing date or terminate the transaction agreement. If the Cristal Transaction has not closed by May 19, 2019 and the parties have not mutually agreed to extend such date then pursuant to the Amendment, we may be obligated to pay Cristal a $60 million break-fee.

The Cristal Transaction is conditioned on the Company obtaining financing sufficient to fund the cash consideration, and the transaction agreement provides that the Company must pay to Cristal a termination fee of $100 million if all conditions to closing, other than the financing condition, have been satisfied and the transaction agreement is terminated because closing of the Cristal Transaction has not occurred by May 19, 2019, and the parties have not mutually agreed to extend such closing date.

If the Cristal Transaction is not completed, our ongoing business and financial results may be adversely affected and we will be subject to a number of risks, including the following:

| • | depending on the reasons for the failure to complete the Cristal Transaction we could be liable to Cristal for a break fee or termination fee or other damages in connection with the termination or breach of the transaction agreement; |

12

| • | we have dedicated and we expect we will continue to commit significant time and resources, financial and otherwise, in planning for the acquisition and the associated integration; and |

| • | while the transaction agreement is in effect prior to closing the Cristal Transaction, we are subject to certain restrictions on the conduct of our business, which may adversely affect our ability to execute certain of our business strategies. |

In addition, if the Cristal Transaction is not completed or is completed subject to significant conditions or remedies, we may experience negative reactions from the financial markets and from our customers and employees. If the acquisition is not completed, these risks may materialize and may adversely affect our business, results of operations, cash flows, as well as the price of our ordinary shares.

Finally, uncertainty about the effect of the Cristal Transaction on employees, customers and suppliers may have an adverse effect on our business and financial results. These uncertainties may impair our ability to attract, retain and motivate key personnel until the Cristal Transaction is consummated and for a period of time thereafter, and could cause our customers, suppliers and other business partners to delay or defer certain business decisions or to seek to change existing business relationships with us. The occurrence of any of these events could have a material adverse effect on our operating results, particularly during the period immediately following the closing of the Cristal transaction.

Concentrated ownership of our ordinary shares by Cristal and Exxaro may prevent minority shareholders from influencing significant corporate decisions and may result in conflicts of interest.

If the Cristal Transaction is consummated, Cristal Inorganic will own approximately 23.5% of the outstanding ordinary shares of the Company. Following the closing of the Cristal Transaction, Exxaro will own approximately 18% of the Company’s outstanding ordinary shares, based upon its share ownership as of the date of this annual report.

Cristal Inorganic and Exxaro may be able to influence fundamental corporate matters and transactions. This concentration of ownership, may delay, deter or prevent acts that would be favored by our other shareholders. The interests of Cristal Inorganic and Exxaro may not always coincide with our interests or the interests of our other shareholders. Also, Cristal Inorganic and Exxaro may seek to cause us to take courses of action that, in its judgment, could enhance its investment in us, but which might involve risks to our other shareholders or adversely affect us or our other shareholders.

In addition, under the shareholders agreement, to be entered into upon the assumed closing of the Cristal Transaction (the “Cristal Shareholders Agreement”), among the Company, on the one hand, and Cristal, Cristal Inorganic and the three shareholders of Cristal, on the other hand (collectively, the “Cristal Shareholders”), as long as the Cristal Shareholders, collectively, beneficially own at least 24,900,000 or more of Class A Shares, they will have the right to designate for nomination two Class A Directors of the Board (defined below) and, as long as they beneficially own at least 12,450,000 Class A Shares but less than 24,900,000 Class A Shares, they will have the right to designate for nomination one Class A director of the Board. The Cristal Shareholders Agreement also will provide that as long as the Cristal Shareholders own at least 12,450,000 Class A Shares, they will be granted certain preemptive rights. Also under the Cristal Shareholders Agreement, the Company has agreed to file promptly after the closing of the acquisition a registration statement covering approximately four percent of the then-outstanding ordinary shares of the Company, which may be sold as soon as such registration statement is effective. Other than with respect to those shares, the Cristal Shareholders Agreement will include restrictions on Cristal Inorganic’s ability to transfer any of its Class A Shares for a period of three years after the closing of the acquisition other than to certain permitted transferees after the later of eighteen months and the resolution of all indemnification claims under the transaction agreement. The Cristal Shareholders Agreement will also contain certain demand and piggyback registration rights, which commence after the three-year transfer restriction period expires. In addition, if the Cristal Transaction closes subsequent to the Re-Domicile Transaction, then New Tronox shall enter into a shareholders agreement with Cristal, Cristal Inorganic and the three shareholders of Cristal on similar terms and conditions as the Cristal Shareholders Agreement.

As a result of these or other factors, including as a result of such offering of shares by Cristal or the perception that such sales may occur, the market price of our ordinary shares could decline. In addition, this concentration of share ownership may adversely affect the trading price of our ordinary shares because investors may perceive disadvantages in owning shares in a company with significant shareholders or with significant outstanding shares with registration rights.

13

If the Cristal Transaction is consummated, we may not be able to realize anticipated benefits of the Cristal Transaction, including expected synergies, earnings per share accretion or earnings before interest, taxes, depreciation and amortization (“EBITDA”) and free cash flow growth.

The success of the pending Cristal Transaction will depend, in part, on our ability to realize anticipated cost synergies, earnings per share accretion or EBITDA and free cash flow growth. Our success in realizing these benefits, and the timing of this realization, depends on the successful integration of our business and operations with the acquired business and operations. Even if we are able to integrate the acquired businesses and operations successfully, this integration may not result in the realization of the full benefits of the pending Cristal Transaction that we currently expect within the anticipated time frame or at all. In addition, any remedial transaction entered into for the purpose of obtaining approval by the FTC may negatively impact our ability to realize any expected synergies, as well as could result in lower than anticipated cost synergies, earnings per share accretion or EBITDA and/or free cash flow growth.

There is also the possibility that:

| • | we may fail to realize expected performance optimization, including increased volume production; |

| • | the acquisition may result in our assuming unexpected liabilities; |

| • | we may experience difficulties integrating operations and systems, as well as company policies, cultures and best practices; |

| • | we may fail to retain and assimilate employees of the acquired business; |

| • | problems may arise in entering new markets in which we have little or no experience; and |

| • | our post-acquisition revenue projections may be less than anticipated due to loss of customers, price volatility or reduced demand for the combined company’s products. |

If the Cristal Transaction is consummated, the combined company’s future results could suffer if it does not effectively manage its expanded business, operations and employee base.

The size of the combined company’s business, operations and employee base following the Cristal Transaction will be greater than the current standalone size of our business, operations and employee base. The combined company’s future success depends, in part, upon our ability to manage this expanded business, operations and employee base, which will pose substantial challenges for management, including challenges related to the management and monitoring of new operations and associated increased costs and complexity. We may not be able to successfully manage the combined company’s expanded business, operations and employee base if the Cristal Transaction is consummated.

When we announced the divestiture of the 8120 Grade to Venator Materials PLC (“Venator”) on July 16, 2018 we also announced that we had entered into a binding Memorandum of Understanding (“MOU”) with Venator providing for the negotiation in good faith of a definitive agreement to sell the entirety of Cristal’s North American operations to Venator if a divestiture of all or a substantial part of Ashtabula was required to secure final FTC regulatory approval for the Cristal Transaction. The MOU granted Venator exclusivity for a period of 75 days to negotiate a definitive agreement for the sale of the entirety of the Ashtabula complex. The MOU also provided for a $75 million break fee (the “Break Fee”) if, among other things, the parties, despite negotiating in good-faith and in conformity with the terms in the MOU, failed to reach a definitive agreement for the sale of Cristal’s North American operations and Tronox was able to consummate both the Cristal Transaction and the paper-laminate grade divestiture to Venator. On October 1, 2018, we announced that the 75-day exclusivity period under the MOU with Venator had expired without the two companies agreeing to terms. There can be no assurance that if the Cristal Transaction is consummated we will not be required to pay Venator the Break Fee.

14

If the Cristal Transaction is consummated, the combined company will be exposed to the risks of operating a global business in new countries.

Cristal’s TiO2 business operates in certain countries, such as Brazil, China and the Kingdom of Saudi Arabia, in which we have not historically had operations or business. The combined company’s global operations will be subject to a number of risks, including:

| • | adapting to unfamiliar regional and geopolitical conditions and demands, including political instability, civil unrest, expropriation, nationalization of properties by a government, imposition of sanctions, changes to import or export regulations and fees, renegotiation or nullification of existing agreements, mining leases and permits; |

| • | increased difficulties with regard to political and social attitudes, laws, rules, regulations and policies within countries that favor domestic companies over non-domestic companies, including customer- or government-supported efforts to promote the development and growth of local competitors; |

| • | economic and commercial instability risks, including those caused by sovereign and private debt default, corruption, and new and unfamiliar laws and regulations at national, regional and local levels, including taxation regimes, tariffs and trade barriers, exchange controls, repatriation of earnings, and labor and environmental and health and safety laws and regulations; |

| • | implementation of additional technological and cybersecurity measures and cost reduction efforts, including restructuring activities, which may adversely affect the combined company’s ability to capitalize on opportunities; |

| • | cybersecurity attacks, including industrial espionage or ransomware attacks; |

| • | major public health issues which could cause disruptions in our operations or workforce; |

| • | war or terrorist activities; |

| • | difficulties enforcing intellectual property and contractual rights in certain jurisdictions; and |

| • | unexpected events, including fires or explosions at facilities, and natural disasters. |

Cristal is currently not a publicly reporting company and the obligations associated with integrating into a public company will require significant resources and management attention.

Cristal is, and prior to the proposed consummation of the Cristal Transaction remains, a private company that is not subject to U.S. financial reporting requirements. If the Cristal Transaction is consummated, the Cristal business will become subject to the rules and regulations established from time to time by the SEC and the NYSE. In addition, as a public company, we are required to document and test our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 so that our management can certify as to the effectiveness of our internal controls over financial reporting, which, by the time our second annual report is filed with the SEC following the consummation of the Cristal Transaction, would include the acquired Cristal business. Bringing Cristal into compliance with these rules and regulations and integrating Cristal into our current compliance and accounting system may require us to make and document significant changes to Cristal’s internal controls over financial reporting, increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources. Furthermore, the need to establish the necessary corporate infrastructure to integrate Cristal may divert management’s attention from implementing our growth strategy, which could prevent us from improving our business, financial condition and results of operations. However, the measures we take may not be sufficient to satisfy our obligations as a public company. If we do not continue to develop and implement the right processes and tools to manage our changing enterprise upon the Cristal Transaction and maintain our culture, our ability to compete successfully and achieve our business objectives could be impaired, which could negatively impact our business, financial condition and results of operations. In addition, we cannot predict or estimate the amount of additional costs we may incur to bring Cristal into compliance with these requirements. In addition, bringing Cristal into compliance with these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly. These additional obligations could have a material adverse effect on our business, financial condition, results of operations and cash flow.

15

Cristal may have liabilities that are not known to us and the indemnities we have negotiated in the Cristal Transaction Agreement may not adequately protect us.

If the Cristal Transaction is consummated, we will assume certain liabilities of Cristal, including significant environmental remediation and monitoring liabilities at Cristal’s current and formerly-owned properties and closure and post-closure costs at certain of Cristal’s mining and landfill facilities. There may be liabilities that we failed or were unable to discover in the course of performing due diligence investigations into Cristal. Any such liabilities, individually or in the aggregate, could have a material adverse effect on our business, financial condition and results of operations. As we integrate Cristal, we may learn additional information about Cristal that may adversely impact us, such as unknown or contingent liabilities, adequacy of financial reserves and issues relating to non-compliance with applicable laws.

RISKS RELATING TO THE RE-DOMICILE TRANSACTION

Assuming consummation of the Re-Domicile Transaction, English law and provisions in the new articles of association of New Tronox may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our shareholders, and may prevent attempts by our shareholders to replace or remove our current management.

Assuming consummation of the Re-Domicile Transaction, certain provisions of the U.K. Companies Act 2006 (the “Companies Act”) and the articles of association of New Tronox may have the effect of delaying or preventing a change in control of us or changes in our management. For example, New Tronox’s articles of association will include provisions that:

| • | maintain an advance notice procedure for proposed nominations of persons for election to our board of directors; |

| • | provide certain mandatory offer provisions, including, among other provisions, that a shareholder, together with persons acting in concert, that acquires 30 percent or more of our issued shares without making an offer to all of our other shareholders that is in cash or accompanied by a cash alternative would be at risk of certain sanctions from our board of directors unless they acted with the prior consent of our board of directors or the prior approval of the shareholders; and |