UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _____________

For the transition period from _____________to _____________

Commission file number:

(Exact name of Registrant as specified in its charter) |

|

N/A |

(Translation of Registrant’s name into English) |

|

(Jurisdiction of incorporation or organization) |

|

(Address of principal executive offices) |

Chief Executive Officer, |

Tel: + |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading symbol(s) |

| Name of Exchange on Which Registered |

|

|

| ||

|

* Not for trading, but only in connection with the listing on The Nasdaq Stock Market LLC of the American depositary shares (“ADSs”).

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None |

(Title of Class) |

Indicate the number of outstanding shares of each of the Issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note–Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | |

Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the | Other ☐ | |

| International Accounting Standards Board ☐ |

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

1 | ||

2 | ||

2 | ||

2 | ||

2 | ||

3 | ||

68 | ||

106 | ||

106 | ||

130 | ||

140 | ||

144 | ||

146 | ||

146 | ||

166 | ||

166 | ||

168 | ||

168 | ||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 168 | |

169 | ||

169 | ||

170 | ||

170 | ||

170 | ||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 170 | |

171 | ||

171 | ||

172 | ||

DISCLOSURE REGARDING FOREIGN JURISDICTION THAT PREVENT INSPECTIONS | 172 | |

172 | ||

173 | ||

173 | ||

173 | ||

173 | ||

179 | ||

i

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

· | “active user” for any period means a registered user account that has logged onto our social entertainment platforms, including Bigo Live, Likee, imo or Hago at least once during such relevant period; |

· | “concurrent users” for any point in time means the total number of users that are simultaneously logged onto at least one of our social entertainment platforms, including Bigo Live, Likee, imo and Hago, at such point in time; |

· | “paying user” for any period means a registered user account that has purchased virtual items or other products and services on Bigo Live, Likee or imo at least once during the relevant period. A paying user is not necessarily a unique user, however, as a unique user may set up multiple paying user accounts on our platforms; thus, the number of paying users referred to in this annual report may be higher than the number of unique users who are purchasing virtual items or other products and services; |

· | “registered user account” means a user account that has downloaded, registered and logged onto our social entertainment platforms, including Bigo Live, Likee, imo and Hago, at least once since registration. We calculate registered user accounts as the cumulative number of user accounts at the end of the relevant period that have logged onto our social entertainment platforms at least once after registration. Each individual user may have more than one registered user account, and consequently, the number of registered user accounts we present in this annual report may overstate the number of unique individuals who are our registered users; and |

· | “we,” “us,” “our company,” “the Company,” and “our” refer to JOYY Inc., a Cayman Islands company, its subsidiaries, and, in the context of describing our operations and consolidated financial statements, also include the variable interest entities, or the VIEs, and the subsidiaries of the variable interest entities in mainland China in which we do not have any equity ownership but whose financial results have been consolidated based solely on contractual arrangements in accordance with U.S. GAAP. |

Historically, we presented our financial results in Renminbi. Starting from January 1, 2021, we changed our reporting currency from Renminbi to U.S. dollars since a majority of our revenues and expenses are now denominated in U.S. dollars. We believe the alignment of the reporting currency with the underlying operations would better illustrate our results of operations for each period. We have applied the change of reporting currency retrospectively to our historical results of operations and financial statements included in this annual report.

On November 16, 2020, we entered into definitive agreements with Baidu, Inc. (Nasdaq: BIDU; HKEX: 9888), or Baidu. Pursuant to the agreements, Baidu would acquire JOYY’s video-based entertainment live streaming business in mainland China, or YY Live, which includes YY mobile app, YY.com website and PC YY, among others, for an aggregate purchase price of approximately US$3.6 billion in cash, subject to certain adjustments. Subsequently, the sale was substantially completed as of February 8, 2021, with certain matters remaining to be completed in the future, including necessary regulatory approvals from government authorities. As a result, the historical financial results of YY Live are reflected in our consolidated financial statements as discontinued operations and we ceased consolidation of YY Live business since February 8, 2021. On August 22, 2022, we entered into a share subscription agreement with Shopline Corporation Limited, or Shopline. As a result of and upon the closing of the proposed financing transaction, the financial results of Shopline have been consolidated by us since September 6, 2022.

The financial information and other relevant information disclosed in this annual report is presented on a continuing operations basis, unless otherwise specifically stated. For the avoidance of confusion, the continuing operations for the year ended December 31, 2020, 2021 and 2022 as presented in this annual report primarily consisted of BIGO (including Bigo Live, Likee, imo and others), and did not include Huya or YY Live.

1

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “is expected to,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements about:

| ● | our growth strategies; |

| ● | our ability to retain and increase our user base and expand our product and service offerings; |

| ● | our ability to monetize our platforms; |

| ● | our future business development, results of operations and financial condition; |

| ● | competition from companies in a number of industries, including internet companies that provide online voice and video communications services, social networking services and online games; |

| ● | expected changes in our revenues and certain cost or expense items; |

| ● | global economic and business condition; and |

| ● | assumptions underlying or related to any of the foregoing. |

You should thoroughly read this annual report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. Other sections of this annual report, including “Item 3. Key Information—D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” sections, discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements we make as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

2

ITEM 3. KEY INFORMATION

Our Holding Company Structure and Contractual Arrangements with the Variable Interest Entities

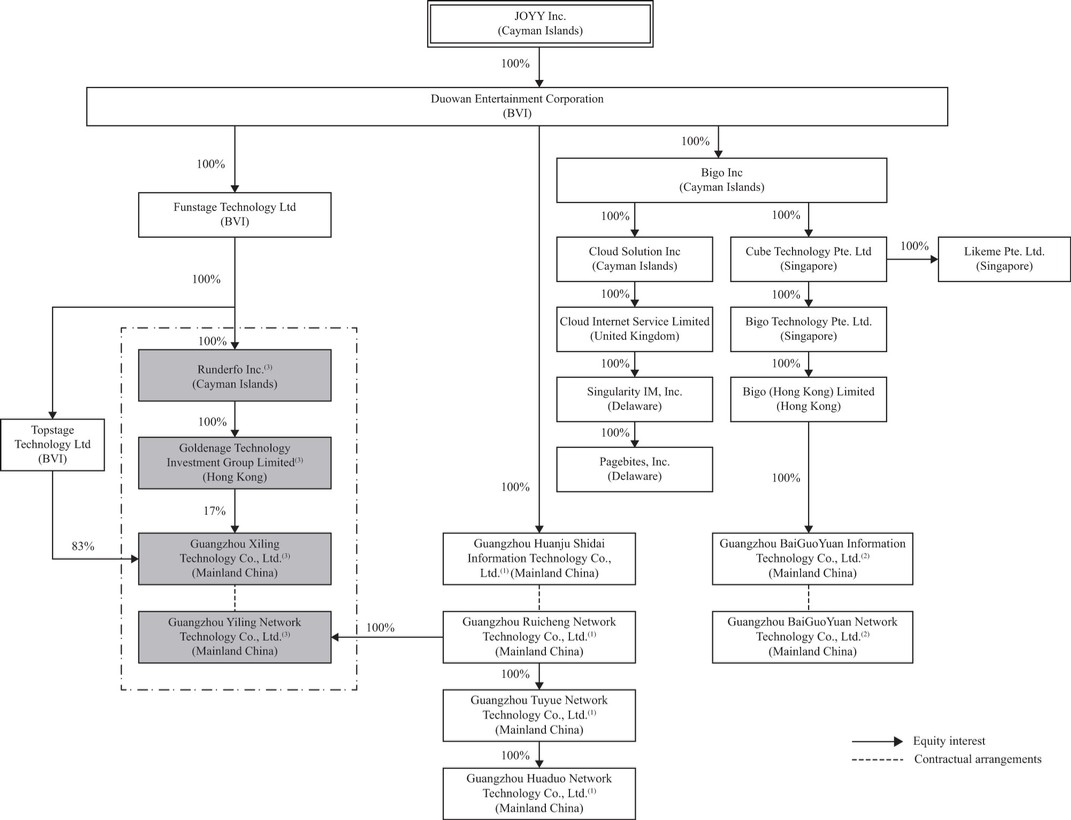

JOYY Inc. is a Cayman Islands holding company that does not have substantive operations on its own. We conduct our operations primarily through (i) our subsidiaries in Singapore, the United States, the United Kingdom, and other jurisdictions for a majority of our global business; and (ii) the variable interest entities, or the VIEs, with which we have maintained contractual arrangements, and their subsidiaries for some of our remaining business in mainland China. Laws and regulations of mainland China prohibit or restrict foreign investment in certain internet-related business, value-added telecommunication services and other-related businesses. Accordingly, we operate these businesses in mainland China through the variable interest entities, the structure of which is used to provide investors with exposure to foreign investment in companies based in mainland China where laws and regulations in mainland China prohibit or restrict direct foreign investment in certain operating companies, and rely on contractual arrangements among our subsidiaries and the variable interest entities in mainland China as well as their shareholders to direct the business operations of the variable interest entities. Revenues contributed by the variable interest entities and their subsidiaries accounted for 20.7%, 17.1% and 19.8% of our total net revenues for the year ended December 31, 2020, 2021 and 2022, respectively. As used in this annual report, “we,” “us,” “our company” and “our” refers to JOYY Inc., its subsidiaries, and, in the context of describing our operations in mainland China and consolidated financial information, also including the variable interest entities and their subsidiaries, primarily including Guangzhou Huaduo Network Technology Co., Ltd., or Guangzhou Huaduo, and Guangzhou BaiGuoYuan Network Technology Co., Ltd, or Guangzhou BaiGuoYuan. Investors in our ADSs are purchasing equity interest in a holding company incorporated in the Cayman Islands that holds equity interests in its subsidiaries in various jurisdictions. JOYY Inc. does not hold any equity interest in the variable interest entities in mainland China so investments in our ADSs would not render the investors any equity interest in the variable interest entities.

A series of contractual agreements, including voting rights proxy agreements, exclusive service agreements, equity interest pledge agreements and exclusive option agreements, have been entered into by and among our subsidiaries and the variable interest entities in mainland China as well as their respective shareholders. Terms contained in each set of contractual arrangements with the variable interest entities and their respective shareholders are substantially similar. As a result of the contractual arrangements, we are considered the primary beneficiary of these companies, and we have consolidated the financial results of these companies in our consolidated financial statements under U.S. GAAP for accounting purposes. For more details of these contractual arrangements, see “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—VIE Structure and the Contractual Arrangements.”

However, the contractual arrangements may not be as effective as direct ownership in providing us with control over the variable interest entities and we may incur substantial costs to enforce the terms of the arrangements. If the variable interest entities or the nominee shareholders fail to perform their respective obligations under the contractual arrangements, we could be limited in our ability to enforce the contractual arrangements. Meanwhile, there are very few precedents as to whether contractual arrangements would be judged to form effective control over the variable interest entities through the contractual arrangements, or how contractual arrangements in the context of a variable interest entity should be interpreted or enforced by the courts of mainland China. Furthermore, if we are unable to direct the operations of the variable interest entities and to obtain economic benefits from them through contractual arrangements, we would not be able to continue to consolidate the financial results of these entities in our financial statements. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with the variable interest entities and their shareholders for some of our operation in mainland China, which may not be as effective as direct ownership. If the variable interest entities and their shareholders fail to perform their obligations under these contractual arrangements, we may have to resort to litigation or other legal proceedings to enforce our rights, which may be time-consuming, unpredictable, expensive and damaging to our operations and reputation.”

3

There are also substantial uncertainties regarding the interpretation and application of current and future laws, regulations and rules of mainland China regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the variable interest entities and their shareholders. It is uncertain whether any new laws or regulations of mainland China relating to variable interest entity structures will be adopted or what they would provide if adopted. If we or any of the variable interest entities is found to be in violation of any existing or future laws or regulations of mainland China, or fail to obtain or maintain any of the required permits or approvals, the relevant regulatory authorities of mainland China would have broad discretion to take action in dealing with such violations or failures. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the mainland China’s government finds that the structure we have adopted for our business operations in mainland China does not comply with laws and regulations of mainland China, or if these laws or regulations or interpretations of existing laws or regulations change in the future, we could be subject to severe penalties, including the shutting down of our platforms and our business operations currently operated in mainland China” and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the variable interest entities fail to obtain and maintain the requisite licenses and approvals required under the complex regulatory environment for internet-based businesses in mainland China, our business, financial condition and results of operations in mainland China may be adversely affected.”

Our corporate structure is subject to risks associated with our contractual arrangements with the variable interest entities. If the mainland China’s government deems that our contractual arrangements with the variable interest entities do not comply with regulatory restrictions of mainland China on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company, our subsidiaries and the consolidated variable interest entities in mainland China, and investors of our company face uncertainty about potential future actions by the mainland China’s government that could affect the enforceability of the contractual arrangements with the variable interest entities and, consequently, significantly affect the financial performance of the variable interest entities and our company as a whole. For a detailed description of the risks associated with our corporate structure, please refer to risks disclosed under “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure.”

These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. For a detailed description of risks related to doing business in multiple jurisdictions, please refer to risks disclosed under “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in Jurisdictions We Operate.”

Permissions and Approvals Required from the Authorities of Mainland China for Our Operations

We generated 17.5%, 16.8% and 19.7% of our total net revenues from mainland China for the year ended December 31, 2020, 2021 and 2022, respectively. We conduct the mainland China portion of our business primarily through our subsidiaries and the variable interest entities in mainland China and are therefore subject to the laws and regulations of mainland China to the extent applicable. As of the date of this annual report, our subsidiaries and the variable interest entities in mainland China have obtained the requisite licenses and permits from the mainland China’s government authorities that are material for the business operations of our holding company, our subsidiaries and the variable interest entities in mainland China, including, among others, the Internet Culture Operation License, the Value-added Telecommunications Business Operation License (ICP License), the Radio and Television Program Production and Operating Permit and the License for Online Transmission of Audio-Visual Programs. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant mainland China’s government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the variable interest entities fail to obtain and maintain the requisite licenses and approvals required under the complex regulatory environment for internet-based businesses in mainland China, our business, financial condition and results of operations in mainland China may be adversely affected.”

The China Securities Regulatory Commission, or the CSRC, promulgated Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies, or the Overseas Listing Trial Measures, and five relevant guidelines on February 17, 2023, which came into effect on March 31, 2023. The Overseas Listing Trial Measures regulate both direct and indirect overseas offering and listing by domestic company in mainland China by adopting a filing-based regulatory regime. For details of the Overseas Listing Trial Measures, see “Item 4. Information on the Company—B. Business Overview—Regulations in Multiple Jurisdictions Where We Operate—Mainland China Regulations—Regulations on Overseas Listing by Domestic Companies.”

4

As the Overseas Listing Trial Measures are relatively new, it remains unclear on how these measures will be interpreted and implemented by CSRC and the relevant mainland China’s governmental authorities, how mainland China’s governmental authorities will regulate overseas listing in general. Given the uncertainty of the interpretation and implementation of the Overseas Listing Trial Measures and our global operations, substantial uncertainties remain and we could not rule out the possibility that we may be required to file the relevant documents with the CSRC in connection with our proposed offerings and listings outside mainland China in the future.

In addition, on December 28, 2021, the Cyberspace Administration of China, or the CAC, and several other administrations jointly promulgated the Measures for Cybersecurity Review, or the Cybersecurity Review Measures, which came into effect on February 15, 2022, superseding and replacing the current cybersecurity review measures that had been in effect since June 2020. The Cybersecurity Review Measures provide that (i) a “network platform operator” holding over one million users’ personal information shall apply for a cybersecurity review when listing their securities “in a foreign country” (ii) a critical information infrastructure operator, or a CIIO, that intends to purchase internet products and services that affect or may affect national security should apply for a cybersecurity review, and (iii) a “network platform operator” carrying out data processing activities that affect or may affect national security should apply for a cybersecurity review. Since the Cybersecurity Review Measures are relatively new, substantial uncertainties remain in relation to their interpretation and implementation. Additionally, the Cybersecurity Review Measures do not provide the exact scope of “network platform operator” or the criteria for determining which circumstance falls within the definition of “holding over one million users’ personal information.” Furthermore, on November 14, 2021, the CAC commenced to publicly solicit comments on the Regulations on the Administration of Cyber Data Security (Draft for Comments), or the Draft Cyber Data Security Regulation. The Draft Cyber Data Security Regulation provides that, among others, data processors that handle personal information of more than one million people contemplating to list its securities on a foreign stock exchange shall apply for cybersecurity review. As a result, it is possible that we may be required to go through cybersecurity review by the CAC. Moreover, the CAC issued the Measures for Security Assessment of Cross-border Data Transfer on July 7, 2022, which came into effect on September 1, 2022. According to such measures, in addition to the requirement to conduct self-assessment on the risks of the outbound data transfer, a data processor must apply to the national cyberspace department for data security assessment through the provincial-level cyberspace administration authority if it involves cross-border data transfer under any of the following circumstances: (i) outbound transfer of important data by a data processor; (ii) outbound transfer of personal information by a critical information infrastructure operator or a personal information processor who has processed the personal information of more than one million people; (iii) outbound transfer of personal information by a personal information processor who has made outbound transfers of the personal information of 100,000 people cumulatively or the sensitive personal information of 10,000 people cumulatively since January 1 of the previous year; and (iv) other circumstances where an application for the security assessment of an outbound data transfer is required as prescribed by the national cyberspace administration authority. In addition, the CAC published the Guidelines for the Security Assessment Application for Cross-border Data Transfer (first edition) on August 31, 2022, which further specifies the procedures and documents for security assessment application under the Measures for Security Assessment of Cross-Border Data Transfer.

However, the Draft Cyber Data Security Regulation has not been officially enacted as of the date of this annual report, and the Cybersecurity Review Measures and the Measures for Security Assessment of Cross-border Data Transfer are relatively new. It remains unclear as to how these regulations will be interpreted, amended and implemented by the relevant mainland China’s governmental authorities, how mainland China’s governmental authorities will regulate overseas listing in general and whether we are required to obtain any specific regulatory approvals from, or complete any filing procedures with, the CSRC, CAC or any other mainland China’s governmental authorities for our offerings outside mainland China. Therefore, there can be no assurance that we will not be required to apply for a cybersecurity review pursuant to the Cybersecurity Review Measures or a data security assessment pursuant to the Measures for Security Assessment of Cross-Border Data Transfer. To the extent any cybersecurity review or data security assessment is required, we cannot assure you that we will be able to complete it in a timely manner, or at all, and such approvals may be rescinded even if obtained. As of the date of this annual report, we have not been subject to any cybersecurity review under the Cybersecurity Review Measures or data security assessment pursuant to the Measures for Security Assessment of Cross-Border Data Transfer.

5

If we fail to obtain the relevant approval or complete other filing or review procedures for our operations and/or any future offshore offering or listing, we may face sanctions by the CSRC or other regulatory authorities of mainland China, which may include warnings, fines, suspension of business to rectify, revocation of licenses, cancellation of filings, shutdown of our platform or even criminal liability, limitations on our operating privileges in mainland China, restrictions on or prohibition of the payments or remittance of dividends by our subsidiaries in mainland China, restrictions on or delays to our future financing transactions outside mainland China, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Business and Industry—Our business is subject to complex and evolving laws and regulations across the globe regarding cybersecurity, information security, privacy and data protection. Many of these laws and regulations are subject to change and uncertain interpretation, and any failure or perceived failure to comply with these laws and regulations could result in claims, changes to our business practices, negative publicity, legal proceedings, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in Jurisdictions We Operate—The approval of and the filing with the CSRC or other government authorities of mainland China may be required in connection with our offerings and financing activities outside mainland China in the future under the laws of mainland China, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing”

We currently operate in several key markets across the globe, such as North America, Europe, the Middle East, Southeast Asia, Eastern Pacific regions, and others. We face various risks and uncertainties related to doing business in multiple jurisdictions across the globe. In particular, for our operations in mainland China, we are subject to complex and evolving laws and regulations of mainland China to the extent applicable. For example, we face risks associated with oversight on cybersecurity and data privacy and anti-monopoly regulatory actions. These may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. Implementation of industry-wide regulations, including data security or anti-monopoly related regulations, in this nature may cause the value of such securities to significantly decline or become worthless. Risks and uncertainties arising from the legal system in mainland China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in mainland China, could result in a material adverse change in our operations in mainland China and the value of our ADSs.

Cash and Asset Flows through Our Organization

JOYY Inc. is a holding company with no material operations of its own. We conduct our operations primarily through our subsidiaries, the variable interest entities and their subsidiaries incorporated under the laws of various jurisdictions where we have business presence. As a result, JOYY Inc.’s ability to pay dividends depends upon dividends paid by our subsidiaries, which may be subject to restrictions imposed by the applicable laws and regulations in these jurisdictions. In certain jurisdictions, such as Singapore, there are currently no foreign exchange control regulations which restrict the ability of our subsidiaries in these jurisdictions to distribute dividends to us. However, the relevant regulations may be changed and the ability of these subsidiaries to distribute dividends to us may be restricted in the future. As for the jurisdiction of mainland China, under the laws and regulations of mainland China, if our existing subsidiaries in mainland China or any newly formed ones incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us. In addition, our wholly foreign-owned subsidiaries in mainland China are permitted to pay dividends to us only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Under the laws and regulations of mainland China, each of our subsidiaries and the variable interest entities in mainland China is required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. For more details, see “Item 5. Operating and Financial Review and Prospects—Liquidity and Capital Resources—Holding Company Structure.”

We have established stringent controls and procedures for cash flows within our organization. Each transfer of cash between our Cayman Islands holding company and our subsidiaries, the variable interest entities or the subsidiaries of the variable interest entities is subject to internal approval. The cash inflows of the Cayman Islands holding company were primarily generated from the proceeds we received from our public offerings of common shares, our offerings of convertible senior notes and other financing activities.

6

Under the laws and regulations of mainland China, JOYY Inc. may provide funding to its subsidiaries in mainland China only through capital contributions or loans, and to the variable interest entities only through loans, subject to satisfaction of applicable government registration and approval requirements. Currently, there is no statutory limit to the amount of funding that we can provide to our subsidiaries in mainland China through capital contributions. However, the maximum amount we can loan to our subsidiaries and the variable interest entities in mainland China is subject to statutory limits. According to the current laws and regulations of mainland China, we can provide funding to our subsidiaries in mainland China through loans of up to either (i) the amount of the difference between the respective registered total investment amount and registered capital of each of our subsidiaries in mainland China, or the Total Investment and Registered Capital Balance, or (ii) two times, or the then applicable statutory multiple, the amount of their respective net assets, calculated in accordance with PRC GAAP, or the Net Assets Limit, at our election. We may also fund the variable interest entities through cross-border loans and the maximum amount would be their respective Net Assets Limit. Increasing the Total Investment and Registered Capital Balance of our subsidiaries in mainland China is subject to governmental procedures and may require a subsidiary in mainland China to increase its registered capital at the same time. If we choose to make a loan to an entity in mainland China based on its Net Assets Limit, the maximum amount we would be able to loan to the relevant entity in mainland China would depend on the relevant entity’s net assets and the applicable statutory multiple at the time of calculation. For details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in Jurisdictions We Operate—Regulations of mainland China in relation to offshore investment activities by mainland China residents and direct investment and loans by offshore holding companies to entities in mainland China may delay or limit our ability to effectively use the proceeds of public offerings, such as limiting the ability of our subsidiaries in mainland China to distribute profits to us and limiting our ability to make additional capital contributions or loans to our subsidiaries in mainland China or otherwise expose us to liability and penalties under law of mainland China.”

For the years ended December 31, 2020, 2021 and 2022, JOYY Inc., through its intermediate holding companies, provided capital contributions of US$7.2 million, US$7.8 million and US$8.7 million, respectively, to our subsidiaries in mainland China.

For the years ended December 31, 2020, 2021 and 2022, JOYY Inc. provided loans of US$954.1 million, nil and nil, respectively, to our intermediate holding companies and subsidiaries, and received repayments of nil, US$723.3 million and US$365.5 million, respectively.

For the years ended December 31, 2020, 2021 and 2022, cash paid by the variable interest entities to our subsidiaries for the settlement of technical support fees and software transactions were US$423.6 million, US$114.6 million and US$109.7 million, respectively. For the years ended December 31, 2020, 2021 and 2022, cash received by the variable interest entities from our subsidiaries were US$25.0 million, US$129.4 million and US$9.7 million, respectively, as the revenues earned from our subsidiaries. In the future, to the extent there is any fee owed to our subsidiaries in mainland China under the contractual arrangements with the variable interest entities, the variable interest entities intend to settle it.

For the years ended December 31, 2020, 2021 and 2022, the variable interest entities’ cash flows for investing activities provided to our subsidiaries were net cash outflows of US$104.1 million, US$35.6 million and US$194.1 million, respectively. For the years ended December 31, 2020, 2021 and 2022, the variable interest entities’ cash flows for financing activities provided by our subsidiaries were net cash inflows of US$25.2 million, US$5.4 million and US$32.8 million, respectively.

For the years ended December 31, 2020, 2021 and 2022, no assets other than cash were transferred between the Cayman Islands holding company and a subsidiary, a variable interest entity or its subsidiary within our corporate structure, and no subsidiaries paid dividends or made other distributions to JOYY Inc. For details of the financial position, cash flows and results of operations of the variable interest entities, see “—Financial Information Related to the Variable Interest Entities” and Note 4(a) to our audited consolidated financial statements included elsewhere in this annual report.

7

Under laws and regulations of mainland China, our subsidiaries and the variable interest entities in mainland China are subject to certain restrictions with respect to paying dividends or otherwise transferring any of their net assets to us. Remittance of dividends by a wholly foreign-owned enterprise out of mainland China is also subject to examination by the banks designated by SAFE. Current regulations of mainland China permit our subsidiaries in mainland China to pay dividends to us only out of their accumulated after-tax profits upon satisfaction of relevant statutory condition and procedures, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our subsidiaries in mainland China is required to set aside at least 10% of its accumulated profits each year, if any, to fund certain reserve funds until the total amount set aside reaches 50% of its registered capital. As of December 31, 2022, appropriations to statutory reserves amounting to US$32.5 million were made by thirty-two variable interest entities. These reserves are not distributable as cash dividends. Furthermore, if our subsidiaries and the variable interest entities in mainland China incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments to us, which may restrict our ability to satisfy our liquidity requirements. In addition, the EIT Law, and its implementation rules provide that withholding tax rate of 10% will be applicable to dividends payable by companies in mainland China to non-mainland-China-resident enterprises unless otherwise exempted or reduced according to treaties or arrangements between the mainland China’s central government and governments of other countries or regions where the non-mainland-China-resident enterprises are incorporated. For details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in Jurisdictions We Operate—Our subsidiaries and the variable interest entities in mainland China are subject to restrictions on paying dividends or making other payments to us, which may restrict our ability to satisfy our liquidity requirements.” With the sale of YY Live to Baidu being substantially completed with certain matters, including necessary regulatory approvals from government authorities, remaining to be completed in the future, the majority of our revenue and operating cash are currently generated from subsidiaries outside of mainland China, and our reliance on dividends from subsidiaries in mainland China would be limited.

JOYY Inc. has declared cash dividends from time to time, and plans to continue to pay cash dividends in accordance with its authorized dividend policy. On August 11, 2020, our board of directors approved a quarterly dividend policy for three years commencing in the second quarter of 2020. Under the policy, total cash dividend amount expected to be paid would be approximately US$300 million and quarterly dividends would be set at approximately US$25 million in each fiscal quarter. On November 20, 2020, our board of directors approved an additional quarterly dividend policy for three years, under which the total cash dividend amount expected to be paid would be approximately US$200 million and quarterly dividend would be set at a fixed amount of approximately US$16.67 million in each fiscal quarter. As of the date of this annual report, we have paid dividends in an aggregate amount of US$372.9 million. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividend Policy.” For the material Cayman Islands, Singapore, mainland China and U.S. federal income tax consequences of an investment in our ADSs or common shares, see “Item 10. Additional Information—E. Taxation.”

Financial Information Related to the Variable Interest Entities

The following table presents the condensed consolidating schedule of financial information of JOYY Inc., the variable interest entities, the primary beneficiaries of the variable interest entities, and other equity subsidiaries for the periods and as of the dates presented.

8

Selected Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) Data

For the Year Ended December 31, 2022 | ||||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Inter-company revenues (1) | — | 20,524 | 221,628 | 54,587 | (296,739) | — | ||||||

Third-party revenues | — | 1,930,532 | 2,328 | 478,656 | — | 2,411,516 | ||||||

Total revenue | — | 1,951,056 | 223,956 | 533,243 | (296,739) | 2,411,516 | ||||||

Total cost and operating expenses | (3,212) |

| (1,908,859) |

| (221,141) |

| (547,931) |

| 302,857 |

| (2,378,286) | |

Share of income of subsidiaries/VIEs (2) | 586,900 |

| 62,332 |

| 37,360 |

| — |

| (686,592) |

| — | |

Others, net | (12,963) |

| 562,107 |

| 22,149 |

| 45,801 |

| (15,750) |

| 601,344 | |

Income before income tax | 570,725 |

| 666,636 |

| 62,324 |

| 31,113 |

| (696,224) |

| 634,574 | |

Income tax (expense) benefits | — |

| (27,178) |

| 8 |

| (7,405) |

| — |

| (34,575) | |

Share of (loss) income in equity method investments, net of income taxes | (441,834) |

| (70,255) |

| — |

| 13,658 |

| — |

| (498,431) | |

Net income from continuing operations | 128,891 |

| 569,203 |

| 62,332 |

| 37,366 |

| (696,224) |

| 101,568 | |

Net income (loss) from continuing operations attributable to the non-controlling interest shareholders and the mezzanine equity classified non-controlling interest shareholders | — |

| 27,329 |

| — |

| (6) |

| — |

| 27,323 | |

Net income from continuing operations attributable to controlling interest of JOYY Inc. | 128,891 |

| 596,532 |

| 62,332 |

| 37,360 |

| (696,224) |

| 128,891 | |

Net income from discontinued operations attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| — | |

Net income attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| 128,891 | |

For the Year Ended December 31, 2021 | ||||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Inter-company revenues (1) | — | 13,995 | 239,595 | 109,618 | (363,208) | — | ||||||

Third-party revenues | — | 2,170,655 | 925 | 447,471 | — | 2,619,051 | ||||||

Total revenue | — | 2,184,650 | 240,520 | 557,089 | (363,208) | 2,619,051 | ||||||

Total cost and operating expenses | — |

| (2,176,663) |

| (264,414) |

| (701,686) |

| 391,694 |

| (2,751,069) | |

Share of loss of subsidiaries/VIEs (2) | (117,603) |

| (134,745) |

| (104,447) |

| — |

| 356,795 |

| — | |

Others, net | (6,068) |

| 26,408 |

| 18,016 |

| 22,680 |

| (6,607) |

| 54,429 | |

Loss before income tax | (123,671) |

| (100,350) |

| (110,325) |

| (121,917) |

| 378,674 |

| (77,589) | |

Income tax expense | — |

| (13,222) |

| (8,289) |

| (4,234) |

| — |

| (25,745) | |

Share of income (loss) in equity method investments, net of income taxes | 7,811 |

| (37,887) |

| — |

| 3,859 |

| — |

| (26,217) | |

Net loss from continuing operations | (115,860) |

| (151,459) |

| (118,614) |

| (122,292) |

| 378,674 |

| (129,551) | |

Net income from continuing operations attributable to the non-controlling interest shareholders and the mezzanine equity classified non-controlling interest shareholders | — |

| 11,977 |

| — |

| 1,714 |

| — |

| 13,691 | |

Net loss from continuing operations attributable to controlling interest of JOYY Inc. | (115,860) |

| (139,482) |

| (118,614) |

| (120,578) |

| 378,674 |

| (115,860) | |

Net income from discontinued operations attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| 35,567 | |

Net loss attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| (80,293) | |

9

For the Year Ended December 31, 2020 | ||||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Inter-company revenues (1) | — | 379,331 | 189,743 | 79,609 | (648,683) | — | ||||||

Third-party revenues | — | 1,521,123 | 678 | 396,343 | — | 1,918,144 | ||||||

Total revenue | — | 1,900,454 | 190,421 | 475,952 | (648,683) | 1,918,144 | ||||||

Total cost and operating expenses | — | (1,795,101) | (118,923) | (1,030,300) | 611,305 | (2,333,019) | ||||||

Share of loss of subsidiaries/VIEs (2) | (208,247) | (463,276) | (523,848) | — | 1,195,371 | — | ||||||

Others, net | 187,044 |

| 192,742 |

| (4,825) |

| 55,183 |

| (1,612) |

| 428,532 | |

Income (Loss) before income tax | (21,203) |

| (165,181) |

| (457,175) |

| (499,165) |

| 1,156,381 |

| 13,657 | |

Income tax expense | — |

| (7,332) |

| (1,491) |

| (19,002) |

| — |

| (27,825) | |

Share of income (loss) in equity method investments, net of income taxes | 2,462 |

| 2,841 |

| — |

| (12,937) |

| — |

| (7,634) | |

Net loss from continuing operations | (18,741) |

| (169,672) |

| (458,666) |

| (531,104) |

| 1,156,381 |

| (21,802) | |

Net income from continuing operations attributable to the non-controlling interest shareholders and the mezzanine equity classified non-controlling interest shareholders | — |

| 415 |

| — |

| 2,646 |

| — |

| 3,061 | |

Net loss from continuing operations attributable to controlling interest of JOYY Inc. | (18,741) |

| (169,257) |

| (458,666) |

| (528,458) |

| 1,156,381 |

| (18,741) | |

Net income from discontinued operations attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| 1,391,638 | |

Net income attributable to controlling interest of JOYY Inc. | — |

| — |

| — |

| — |

| — |

| 1,372,897 | |

Notes:

(1) | Represents the elimination of the intercompany transaction and service charge at the consolidation level. The VIEs recognized inter-company cost of revenues and operating expenses in the amounts of US$447.3 million, US$35.9 million and US$55.8 million for the years ended December 31, 2020, 2021 and 2022, respectively, for technical support services. |

(2) | Represents the elimination of investments among JOYY Inc., the primary beneficiaries of VIEs, the other subsidiaries, and VIEs and their subsidiaries that we consolidate. |

10

Selected Condensed Consolidated Balance Sheets Data

| As of December 31, 2022 | |||||||||||

Primary | ||||||||||||

Equity | Beneficiaries | VIEs and VIEs’ | ||||||||||

| The Company |

| Subsidiaries |

| of VIEs |

| subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Assets |

|

|

|

|

|

| ||||||

Cash and cash equivalents | 40,369 | 890,731 | 35,852 | 247,497 | — | 1,214,449 | ||||||

Restricted cash | — | 297,131 | — | 6,239 | — | 303,370 | ||||||

Short-term deposits | 50,000 |

| 1,933,877 |

| 14,358 |

| 362,310 |

| — |

| 2,360,545 | |

Restricted short-term deposits | — |

| 47,741 |

| — |

| — |

| — |

| 47,741 | |

Short-term investments | 86,150 |

| 196,675 |

| 43,707 |

| 36,108 |

| — |

| 362,640 | |

Accounts receivable | — |

| 112,075 |

| 22 |

| 5,830 |

| — |

| 117,927 | |

Prepayments and other current assets | 15,663 |

| 136,122 |

| 6,560 |

| 77,838 |

| — |

| 236,183 | |

Amounts due from Group companies(1) | 1,051,001 |

| 2,882 |

| 363,235 |

| 476,689 |

| (1,893,807) |

| — | |

Investments in subsidiaries/VIEs(2) | 4,631,368 |

| 2,302,101 |

| 1,916,108 |

| — |

| (8,849,577) |

| — | |

Long-term investments | 168,230 |

| 136,913 |

| — |

| 355,261 |

| — |

| 660,404 | |

Property, plant and equipment, net | — |

| 40,258 |

| 81,362 |

| 221,614 |

| (33) |

| 343,201 | |

Land use rights, net | — |

| — |

| — |

| 330,005 |

| — |

| 330,005 | |

Intangible assets, net | — |

| 375,249 |

| 5,861 |

| 49,016 |

| (31,826) |

| 398,300 | |

Goodwill | — |

| 2,649,307 |

| — |

| — |

| — |

| 2,649,307 | |

Other assets | — |

| 28,948 |

| 6,255 |

| 12,378 |

| — |

| 47,581 | |

Total assets |

|

|

|

|

| 9,071,653 | ||||||

Liabilities and shareholders’ equity Liabilities |

|

|

|

|

| |||||||

Convertible bonds | 836,260 | — | — | — | — | 836,260 | ||||||

Deferred tax liabilities | — |

| 52,009 |

| — |

| 12,253 |

| — |

| 64,262 | |

Accounts payable | — |

| 26,333 |

| 81 |

| 29,586 |

| — |

| 56,000 | |

Deferred revenue | — |

| 75,364 |

| 335 |

| 20,080 |

| — |

| 95,779 | |

Income taxes payable | 12,986 |

| 29,387 |

| 10,376 |

| 25,354 |

| — |

| 78,103 | |

Accrued liabilities and other current liabilities | 15,308 |

| 2,217,220 |

| 42,172 |

| 85,302 |

| — |

| 2,360,002 | |

Amounts due to Group companies(1) | — |

| 1,736,600 |

| 89,509 |

| 67,698 |

| (1,893,807) |

| — | |

Other liabilities | 10 |

| 29,996 |

| 28,746 |

| 19,763 |

| — |

| 78,515 | |

Total liabilities |

|

|

|

|

| 3,568,921 | ||||||

|

|

|

|

| ||||||||

Mezzanine equity | — | 91,366 | — | — | — | 91,366 | ||||||

|

|

|

|

| ||||||||

Shareholders’ equity | ||||||||||||

Total JOYY Inc.’s shareholders’ equity | 5,178,217 |

| 4,663,227 |

| 2,302,101 |

| 1,916,108 |

| (8,881,436) |

| 5,178,217 | |

Non-controlling interests | — |

| 228,508 |

| — |

| 4,641 |

| — |

| 233,149 | |

Total shareholders’ equity | 5,178,217 |

| 4,891,735 |

| 2,302,101 |

| 1,920,749 |

| (8,881,436) |

| 5,411,366 | |

Total liabilities, mezzanine equity and shareholders’ equity |

|

|

|

|

| 9,071,653 | ||||||

11

| As of December 31, 2021 | |||||||||||

Primary | VIEs and | |||||||||||

Equity | Beneficiaries of | VIEs’ | ||||||||||

| The Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Assets |

|

|

|

|

|

| ||||||

Cash and cash equivalents | 615 | 1,287,290 | 115,875 | 433,405 | — | 1,837,185 | ||||||

Restricted cash | — |

| 289,658 |

| — |

| 7,364 |

| — |

| 297,022 | |

Short-term deposits | — |

| 1,263,843 |

| 31,369 |

| 308,986 |

| — |

| 1,604,198 | |

Restricted short-term deposits | — |

| 285 |

| — |

| — |

| — |

| 285 | |

Short-term investments | 193,925 |

| 400,744 |

| 62,930 |

| 288,944 |

| — |

| 946,543 | |

Accounts receivable | — |

| 108,469 |

| 23 |

| 5,880 |

| — |

| 114,372 | |

Prepayments and other current assets | — |

| 106,748 |

| 5,812 |

| 101,173 |

| — |

| 213,733 | |

Amounts due from Group companies(1) | 1,416,481 |

| 69,112 |

| 242,517 |

| 263,373 |

| (1,991,483) |

| — | |

Investments in subsidiaries/VIEs(2) | 4,211,891 |

| 2,444,874 |

| 1,982,371 |

| — |

| (8,639,136) |

| — | |

Long-term investments | 648,153 |

| 104,655 |

| 34,370 |

| 235,277 |

| — |

| 1,022,455 | |

Property, plant and equipment, net | — |

| 117,037 |

| 76,524 |

| 171,831 |

| — |

| 365,392 | |

Land use rights, net | — |

| — |

| — |

| 370,052 |

| — |

| 370,052 | |

Intangible assets, net | — |

| 266,375 |

| 10,261 |

| 58,893 |

| (23,447) |

| 312,082 | |

Goodwill | — |

| 1,958,263 |

| — |

| — |

| — |

| 1,958,263 | |

Other assets | — |

| 14,296 |

| 48,484 |

| 15,650 |

| — |

| 78,430 | |

Total assets |

|

|

|

|

| 9,120,012 | ||||||

Liabilities and shareholders’ equity Liabilities |

|

|

|

|

| |||||||

Convertible bonds | 924,077 |

| — |

| — |

| — |

| — |

| 924,077 | |

Deferred tax liabilities | — | 27,109 | — | 9,105 | — | 36,214 | ||||||

Accounts payable | — | 3,454 | 357 | 14,200 | — | 18,011 | ||||||

Deferred revenue | — | 49,119 | 491 | 17,722 | — | 67,332 | ||||||

Income taxes payable | 13,573 | 26,322 | 237 | 25,606 | — | 65,738 | ||||||

Accrued liabilities and other current liabilities | 5,087 | 2,160,029 | 66,397 | 114,325 | — | 2,345,838 | ||||||

Amounts due to Group companies(1) | — | 1,822,123 | 37,475 | 131,887 | (1,991,485) | — | ||||||

Other liabilities | — | 12,345 | 7,348 | 14,811 | — | 34,504 | ||||||

Total liabilities | 3,491,714 | |||||||||||

Mezzanine equity | — | 65,833 | — | — | — | 65,833 | ||||||

Shareholders’ equity | ||||||||||||

Total JOYY Inc.’s shareholders’ equity | 5,528,328 | 4,235,336 | 2,498,231 | 1,929,014 | (8,662,581) | 5,528,328 | ||||||

Non-controlling interests | — | 29,979 | — | 4,158 | — | 34,137 | ||||||

Total shareholders’ equity | 5,528,328 | 4,265,315 | 2,498,231 | 1,933,172 | (8,662,581) | 5,562,465 | ||||||

Total liabilities, mezzanine equity and shareholders’ equity | 9,120,012 | |||||||||||

Notes:

(1) Represents the elimination of intercompany balances among JOYY Inc., the primary beneficiaries of VIEs, the other subsidiaries, and the VIEs and their subsidiaries that we consolidate. Unsettled balance related to technology service fees payable by VIEs to our subsidiaries amounted to US$66.8 million and US$325.4 million as of December 31, 2021 and 2022, respectively.

(2) Represents the elimination of investments among JOYY Inc., the primary beneficiaries of VIEs, the other subsidiaries, and VIEs and their subsidiaries that we consolidate.

12

Selected Condensed Consolidated Cash Flows Data

| For the Year Ended December 31, 2022 | |||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Net cash (used in) provided by transactions with external parties | (3,949) | 456,134 | (230,750) | 95,059 | — | 316,494 | ||||||

Net cash (used in) provided by transactions with intra-Group entities | — |

| (12,588) |

| 59,743 |

| (47,155) |

| — |

| — | |

Net cash (used in) provided by continuing operating activities(1) | (3,949) |

| 443,546 |

| (171,007) |

| 47,904 |

| — |

| 316,494 | |

Net cash provided by (used in) transactions with external parties | 49,963 |

| (521,706) |

| 3,858 |

| (42,399) |

| — |

| (510,284) | |

Net cash used in transactions with intra-Group entities | — |

| (372,005) |

| (44,222) |

| (194,107) |

| 610,334 |

| — | |

Net cash provided by (used in) continuing investing activities (1) | 49,963 |

| (893,711) |

| (40,364) |

| (236,506) |

| 610,334 |

| (510,284) | |

Net cash (used in) provided by transactions with external parties | (371,740) |

| 17,045 |

| 32,032 |

| 754 |

| — |

| (321,909) | |

Net cash provided by transactions with intra-Group entities | 365,480 |

| 106,413 |

| 105,688 |

| 32,753 |

| (610,334) |

| — | |

Net cash (used in) provided by continuing financing activities (1) | (6,260) |

| 123,458 |

| 137,720 |

| 33,507 |

| (610,334) |

| (321,909) | |

| For the Year Ended December 31, 2021 | |||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Net cash provided by (used in) transactions with external parties | — | 393,061 | (400,649) | 153,715 | — | 146,127 | ||||||

Net cash (used in) provided by transactions with intra-Group entities | — |

| (302,728) |

| 225,409 |

| 77,319 |

| — |

| — | |

Net cash provided by (used in) continuing operating activities (1) | — |

| 90,333 |

| (175,240) |

| 231,034 |

| — |

| 146,127 | |

Net cash (used in) provided by discontinued operating activities | — |

| (1,404) |

| 37,207 |

| 28,486 |

| — |

| 64,289 | |

Net cash provided by (used in) operating activities | — |

| 88,929 |

| (138,033) |

| 259,520 |

| — |

| 210,416 | |

Net cash (used in) provided by transactions with external parties | (104,264) |

| (978,039) |

| 65,334 |

| 170,112 |

| — |

| (846,857) | |

Net cash (used in) provided by transactions with intra-Group entities | — |

| (758,196) |

| 47,051 |

| (35,559) |

| 746,704 |

| — | |

Net cash (used in) provided by continuing investing activities (1) | (104,264) |

| (1,736,235) |

| 112,385 |

| 134,553 |

| 746,704 |

| (846,857) | |

Net cash provided by (used in) discontinued investing activities | — |

| 1,831,847 |

| (11,403) |

| (183,994) |

| — |

| 1,636,450 | |

Net cash (used in) provided by investing activities | (104,264) |

| 95,612 |

| 100,982 |

| (49,441) |

| 746,704 |

| 789,593 | |

Net cash (used in) provided by transactions with external parties | (620,839) |

| 5,508 |

| (11,007) |

| (97,198) |

| — |

| (723,536) | |

Net cash provided by (used in) transactions with intra-Group entities | 723,302 |

| 60,137 |

| (42,113) |

| 5,378 |

| (746,704) |

| — | |

Net cash provided by (used in) continuing financing activities (1) | 102,463 |

| 65,645 |

| (53,120) |

| (91,820) |

| (746,704) |

| (723,536) | |

Net cash used in discontinued financing activities | — |

| — |

| — |

| — |

| — |

| — | |

Net cash provided by (used in) financing activities | 102,463 |

| 65,645 |

| (53,120) |

| (91,820) |

| (746,704) |

| (723,536) | |

13

| For the Year Ended December 31, 2020 | |||||||||||

Primary | ||||||||||||

The | Equity | Beneficiaries of | VIEs and VIEs’ | |||||||||

| Company |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| Eliminations |

| Consolidated | |

(US$ in thousands) | ||||||||||||

Net cash (used in) provided by transactions with external parties | — | (32,982) | 104,095 | (73,830) | — | (2,717) | ||||||

Net cash provided by (used in) transactions with intra-Group entities | — |

| 314,557 |

| 30,301 |

| (344,858) |

| — |

| — | |

Net cash provided by (used in) continuing operating activities (1) | — |

| 281,575 |

| 134,396 |

| (418,688) |

| — |

| (2,717) | |

Net cash provided by discontinued operating activities | — |

| 89,804 |

| — |

| 408,059 |

| — |

| 497,863 | |

Net cash provided by (used in) operating activities | — |

| 371,379 |

| 134,396 |

| (10,629) |

| — |

| 495,146 | |

Net cash provided by (used in) transactions with external parties | 760,322 |

| (16,184) |

| (6,181) |

| (47,787) |

| — |

| 690,170 | |

Net cash (used in) provided by transactions with intra-Group entities | (954,102) |

| 16,776 |

| (49,718) |

| (104,111) |

| 1,091,155 |

| — | |

Net cash (used in) provided by continuing investing activities (1) | (193,780) |

| 592 |

| (55,899) |

| (151,898) |

| 1,091,155 |

| 690,170 | |

Net cash provided by (used in) discontinued investing activities | 262,681 |

| (177,572) |

| — |

| 7,262 |

| — |

| 92,371 | |

Net cash provided by (used in) investing activities | 68,901 |

| (176,980) |

| (55,899) |

| (144,636) |

| 1,091,155 |

| 782,541 | |

Net cash (used in) provided by transactions with external parties | (66,743) |

| (130,275) |

| 38,594 |

| 21,690 |

| — |

| (136,734) | |

Net cash provided by transactions with intra-Group entities | — |

| 1,019,855 |

| 46,081 |

| 25,219 |

| (1,091,155) |

| — | |

Net cash (used in) provided by continuing financing activities (1) | (66,743) |

| 889,580 |

| 84,675 |

| 46,909 |

| (1,091,155) |

| (136,734) | |

Net cash provided by discontinued financing activities | — |

| 1,232 |

| — |

| — |

| — |

| 1,232 | |

Net cash (used in) provided by financing activities | (66,743) |

| 890,812 |

| 84,675 |

| 46,909 |

| (1,091,155) |

| (135,502) | |

Note:

(1) | Represents the elimination of the net cash provided by (used in) operating activities, investing activities and financing activities of JOYY Inc., the primary beneficiaries of VIEs, the other subsidiaries, and the VIEs and their subsidiaries that we consolidate. For the years ended December 31, 2020, 2021 and 2022, cash paid by the VIEs to our subsidiaries for the settlement of technical support fees in operating activities were US$369.9 million, US$52.1 million and US$56.8 million, respectively. |

A. Reserved

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

14

D. Risk Factors

Summary of Risk Factors

An investment in our ADSs is subject to a number of risks, including risks related to our business and industry, risks related to doing business in jurisdictions we operate, risks related to our corporate structure and risks related to our ADSs. The following summarizes some, but not all, of these risks. Please carefully consider all of the information discussed in “Item 3. Key Information—D. Risk Factors” in this annual report for a more thorough description of these and other risks.

Risks Related to Our Business and Industry

| ● | We are subject to risks associated with operating in a rapidly developing industry and an evolving market. |

| ● | If we fail to effectively manage our growth or implement our business strategies, our business and results of operations may be materially and adversely affected. |

| ● | We face risks associated with the sale of YY Live to Baidu. |

| ● | We have a limited operating history for some of our businesses, and you should consider our prospects in light of the risks and uncertainties which early-stage companies in evolving industries globally may be exposed to or encounter, including possible volatility in the trading prices of our ADSs. |

| ● | We generate a substantial majority of our revenue from live streaming services. If our live streaming revenue declines in the future, our results of operations may be materially and adversely affected. |

| ● | We may face significant risks related to the content, information, communications and other activities on our platforms. |

| ● | The revenue model for each of our live streaming and our membership program may not remain effective, which may affect our ability to retain existing users and attract new users and materially and adversely affect our business, financial condition and results of operations. |

| ● | We generate a portion of our revenues from online advertising. If we fail to attract more advertisers to our platforms or if advertisers are less willing to advertise with us, our revenues may be adversely affected. |

| ● | Our business is subject to complex and evolving laws and regulations across the globe regarding cybersecurity, information security, privacy and data protection. Many of these laws and regulations are subject to change and uncertain interpretation, and any failure or perceived failure to comply with these laws and regulations could result in claims, changes to our business practices, negative publicity, legal proceedings, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business. |

| ● | We face competition in several major aspects of our business. If we fail to compete effectively, we may lose users, advertisers and merchants which could materially and adversely affect our business, financial condition and results of operations. |

Risks Related to Doing Business in Jurisdictions We Operate

| ● | We are subject to the risks of doing business globally. |

| ● | We have limited experience in international markets. If we fail to meet the challenges presented by our increasingly globalized operations, our business, financial condition and results of operations may be materially and adversely affected. |

| ● | We face risks and uncertainties to comply with the laws, regulations and rules in various aspects in multiple jurisdictions across the globe. Failure to comply with such applicable laws, regulations and rules may subject our global operations to strict scrutiny by local authorities, which in turn may materially and adversely affect our globalized operations. |

15

| ● | Fluctuations in foreign currency exchange rates may adversely affect our operational and financial results, which we report in U.S. dollars. |

| ● | Rising international political tension may adversely impact our business and operating results. |

| ● | The approval of and the filing with the CSRC or other government authorities of mainland China may be required in connection with our offerings and financing activities outside mainland China in the future under the laws of mainland China, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing |

Risks Related to Our Corporate Structure

| ● | If the mainland China’s government finds that the structure we have adopted for our business operations in mainland China does not comply with laws and regulations of mainland China, or if these laws or regulations or interpretations of existing laws or regulations change in the future, we could be subject to severe penalties, including the shutting down of our platforms and our business operations currently operated in mainland China. |

| ● | We rely on contractual arrangements with the variable interest entities and their shareholders for some of our operation in mainland China, which may not be as effective as direct ownership. If the variable interest entities and their shareholders fail to perform their obligations under these contractual arrangements, we may have to resort to litigation or other legal proceedings to enforce our rights, which may be time-consuming, unpredictable, expensive and damaging to our operations and reputation. |

| ● | The shareholders of the variable interest entities may have potential conflicts of interest with us, and if any such conflicts of interest are not resolved in our favor, our business may be materially and adversely affected. |

Risks Related to Our ADSs

| ● | The trading prices of our ADSs are likely to be volatile, which could result in substantial losses to investors. |

| ● | We may be named as a defendant in putative shareholder class action lawsuits and may be subject to the SEC or third-party investigations which could have a material adverse impact on our business, financial condition, results of operation, cash flows and reputation. |

| ● | We believe that we were a passive foreign investment company, or PFIC, for United States federal income tax purposes for the taxable year ended December 31, 2022, which could subject United States holders of our ADSs or Class A common shares to significant adverse United States income tax consequences. |

| ● | Our dual class common share structure with different voting rights will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A common shares and ADSs may view as beneficial. |

Risks Related to Our Business and Industry

We are subject to risks associated with operating in a rapidly developing industry and an evolving market.

Many of the elements of our business are unique, evolving and relatively unproven. Our business and prospects depend on continuing development of the online social entertainment and smart commerce solution industries of the world. The market for our services is rapidly developing and evolving, also subject to significant challenges. The success of our business heavily relies on the size and engagement level of our user base, and our ability to successfully monetize our user base and products and services. Developing and integrating new content and services could be expensive and time-consuming, and our efforts in those aspects may not yield the benefits we expect to achieve in a timely manner, or at all. We cannot assure you that we will continue to succeed in the industry or such industry will continue to grow as rapidly as it did in the past.

16

As users are facing a growing number of entertainment or smart commerce solution options that directly or indirectly compete with online social entertainment and smart commerce solution services that we offer, these services may not maintain or increase their current popularity. Growth of the online social entertainment and smart commerce solution industries is affected by numerous factors, such as quality, user experience, technological innovations, development of internet and internet-based services, regulatory environment, and macroeconomic environment. If the services that we offer lose their popularity due to changing social trends and consumer preferences, or if the global online social entertainment or smart commerce solution market does not grow as quickly as expected, our results of operation and financial condition may be materially and adversely affected.

If we fail to effectively manage our growth or implement our business strategies, our business and results of operations may be materially and adversely affected.