UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter time that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of 29,812,752 shares of the registrant’s common stock, par value $0.00001 per share, held by non-affiliates on June 30, 2023 was approximately $

At February 21, 2024 there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Proxy Statement for the 2024 Annual Meeting of stockholders are incorporated by reference into Part III of this report.

ENOVA INTERNATIONAL, INC.

YEAR ENDED DECEMBER 31, 2023

INDEX TO FORM 10-K

PART I |

|

|

|

|

|

|

Item 1. |

|

|

|

1 |

|

|

Item 1A. |

|

|

|

16 |

|

|

Item 1B. |

|

|

|

38 |

|

|

Item 1C. |

|

|

|

39 |

|

|

Item 2. |

|

|

|

40 |

|

|

Item 3. |

|

|

|

40 |

|

|

Item 4. |

|

|

|

40 |

|

|

|

|

|

||||

PART II |

|

|

|

|

|

|

Item 5. |

|

|

|

41 |

|

|

Item 6. |

|

|

|

42 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

43 |

|

Item 7A. |

|

|

|

62 |

|

|

Item 8. |

|

|

|

64 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

|

102 |

|

Item 9A. |

|

|

|

102 |

|

|

Item 9B. |

|

|

|

102 |

|

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

103 |

|

|

|

|

||||

PART III |

|

|

|

|

|

|

Item 10. |

|

|

|

104 |

|

|

Item 11. |

|

|

|

104 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

|

|

104 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

|

104 |

|

Item 14. |

|

|

|

105 |

|

|

|

|

|

||||

PART IV |

|

|

|

|

|

|

Item 15. |

|

|

|

106 |

|

|

Item 16. |

|

|

|

112 |

|

|

|

|

|||||

|

|

113 |

|

|||

CAUTIONARY NOTE CONCERNING FACTORS THAT MAY AFFECT FUTURE RESULTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. You should not place undue reliance on these statements. These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of senior management with respect to the business, financial condition, operations and prospects of Enova International, Inc. and its subsidiaries (collectively, the “Company”). When used in this report, terms such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecast,” “project” and similar expressions or variations as they relate to the Company or its management are intended to identify forward-looking statements. Forward-looking statements address matters that involve risks and uncertainties that are beyond the ability of the Company to control and, in some cases, predict. Accordingly, there are or will be important factors that could cause the Company’s actual results to differ materially from those indicated in these statements. Key factors that could cause the Company’s actual financial results, performance or condition to differ from the expectations expressed or implied in such forward-looking statements include, but are not limited to, the following:

The foregoing list of factors is not exhaustive and new factors may emerge or changes to these factors may occur that would impact the Company’s business and cause actual results to differ materially from those expressed in any of our forward-looking statements. Additional information regarding these and other factors may be contained in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including on Forms 10-Q and 8-K. Readers of this report are encouraged to review all of the Risk Factors contained in Part I, Item 1A. Risk Factors to obtain more detail about the Company’s risks and uncertainties. All forward-looking statements involve risks, assumptions and uncertainties. The occurrence of the events described, and the achievement of the expected results, depends on many events, some or all of which are not predictable or within the Company’s control. If one or more events related to these or other risks or uncertainties materialize, or if management’s underlying assumptions prove to be incorrect, actual results may differ materially from what the Company anticipates. The forward-looking statements in this report are made as of the date of this report, and the Company disclaims any intention or obligation to update or revise any forward-looking statements to reflect events or circumstances occurring after the date of this report. All forward-looking statements in this report are expressly qualified in their entirety by the foregoing cautionary statements.

PART I

ITEM 1. BUSINESS

Overview

We are a leading technology and analytics company focused on providing online financial services. In 2023, we extended approximately $4.9 billion in credit or financing to borrowers. As of December 31, 2023, we offered or arranged loans or draws on lines of credit to consumers in 37 states in the United States and Brazil. We also offered financing to small businesses in 49 states and Washington D.C. in the United States. We use our proprietary technology, analytics and customer service capabilities to quickly evaluate, underwrite and fund loans or provide financing, allowing us to offer consumers and small businesses credit or financing when and how they want it. Our customers include the large and growing number of consumers who and small businesses which have bank accounts but use alternative financial services because of their limited access to more traditional credit from banks, credit card companies and other lenders. We were an early entrant into online lending, launching our online business in 2004, and through December 31, 2023, we have completed approximately 61.1 million customer transactions and collected more than 65 terabytes of currently accessible customer behavior data since launch, allowing us to better analyze and underwrite our specific customer base. We have significantly diversified our business over the past several years having expanded the markets we serve and the financing products we offer. These financing products include installment loans and line of credit accounts.

We believe our customers highly value our products and services as an important component of their personal or business finances because our products are convenient, quick and often less expensive than other available alternatives. We attribute the success of our business to our advanced and innovative technology systems, the proprietary analytical models we use to predict the performance of loans and finance receivables, our sophisticated customer acquisition programs, our dedication to customer service and our talented employees.

We have developed proprietary underwriting systems based on data we have collected over our more than 19 years of experience. These systems employ advanced risk analytics, including machine learning and artificial intelligence, to decide whether to approve financing transactions, to structure the amount and terms of the financings we offer pursuant to jurisdiction-specific regulations and to provide customers with their funds quickly and efficiently. Our systems closely monitor collection and portfolio performance data that we use to continually refine machine learning-enabled analytical models and statistical measures used in making our credit, purchase, marketing and collection decisions. Approximately 90% of models used in our analytical environment are machine learning-enabled.

Our flexible and scalable technology platforms allow us to process and complete customers’ transactions quickly and efficiently. In 2023, we processed approximately 3.0 million transactions, and we continue to grow our loan and finance receivable portfolios and increase the number of customers we serve through desktop, tablet and mobile platforms. Our highly customizable technology platforms allow us to efficiently develop and deploy new products to adapt to evolving regulatory requirements and consumer preference, and to enter new markets quickly. In October 2020, we acquired, through a merger, On Deck Capital Inc. (“OnDeck”), a small business lending company offering lending and funding solutions to small businesses in the U.S., Australia and Canada, to expand our small business offerings. In March 2021, we acquired Pangea Universal Holdings (“Pangea”), which provides mobile international money transfer services to customers in the U.S with a focus on Latin America and Asia. These new products have allowed us to further diversify our product offerings and customer base.

We have been able to consistently acquire new customers and successfully generate repeat business from returning customers when they need financing. We believe our customers are loyal to us because they are satisfied with our products and services. We acquire new customers from a variety of sources, including visits to our own websites, mobile sites or applications, and through direct marketing, affiliate marketing, lead providers and relationships with other lenders. We believe that the online convenience of our products and our 24/7 availability to accept applications with quick approval decisions are important to our customers.

Once a potential customer submits an application, we quickly provide a credit or purchase decision. If a loan or financing is approved, we or our lending partner typically fund the loan or financing the next business day or, in some cases, the same day. During the entire process, from application through payment, we provide access to our well-trained customer service team. All of our operations, from customer acquisition through collections, are structured to build customer satisfaction and loyalty, in the event that a customer has a need for our products in the future. We have developed a series of sophisticated proprietary scoring models to support our various products. We believe that these models are an integral component of our operations and allow us to complete a high volume of customer transactions while actively managing risk and the related credit quality of our loan and finance receivable portfolios. We believe our successful application of these technological innovations differentiates our capabilities relative to competing platforms as evidenced by our history of strong growth and stable credit quality.

1

Products and Services

Our online financing products and services provide customers with a deposit of funds to their bank account in exchange for a commitment to repay the amount deposited plus fees and/or interest. We originate, arrange, guarantee or purchase installment loans and line of credit accounts to consumers and small businesses. We have one reportable segment that includes all of our online financial services. Our loans and finance receivables generally have regular payments that amortize principal. Interest income is generally recognized on an effective, non-accelerated yield basis over the contractual term of the installment loan or estimated outstanding period of the draw on line of credit accounts.

Consumer installment loans. Certain subsidiaries (i) directly offer installment loans, (ii) as part of our Bank Programs, as discussed below, purchase, or purchase a participating interest in, installment loans or (iii) as part of our CSO program, arrange and guarantee installment loans, as discussed below, to consumers. Certain subsidiaries offer, or arrange through our Bank Programs and CSO program, unsecured consumer installment loan products in 37 states in the United States. Internationally, we also offer or arrange unsecured consumer installment loan products in Brazil. Effective in the third quarter of 2022, Enova no longer offers any single-pay products. Terms for our consumer installment loan products range between 3 and 60 months with an average contractual term of 39 months. Our loans have regular payments that amortize principal. Loan sizes for these products range between $300 and $10,000. The majority of these loans accrue interest daily at a fixed rate for the life of the loan and have no fees. The average annualized yield for these loans was 79% for the year ended December 31, 2023. Loans may be repaid early at any time with no additional prepayment charges.

Small business installment loans. Certain subsidiaries offer, or arrange through our Bank Programs, small business installment loans in 49 states and in Washington D.C. Terms for these products range between 3 and 24 months with an average contractual term of 16 months. Our loans have regular payments that amortize principal. Loan sizes for these products range between $5,000 and $250,000. There is generally a fee paid upon origination, and total interest is typically calculated at a fixed rate for the life of the loan. A portion of the interest is forgivable if prepaid early, although we also offer a full prepayment forgiveness option at a higher interest rate. The average annualized yield for these products was 42% for the year ended December 31, 2023.

Consumer line of credit accounts. Certain subsidiaries directly offer, or purchase participation interests in receivables through our Bank Programs, new consumer line of credit accounts in 31 states (and continue to service existing line of credit accounts in two additional states) in the United States. Line of credit accounts allow customers to draw on their unsecured line of credit in increments of their choosing up to their credit limit, which ranges between $100 and $7,000. Customers may pay off their account balance in full at any time or make required minimum payments in accordance with the terms of the line of credit account. The repayment period varies depending upon certain factors, which may include outstanding principal and differences in minimum payment calculations by product. Customers are typically charged a fee when funds are drawn and subsequently incur fee- or interest-based charges at a fixed rate, depending upon the product and the state in which the customer resides. The average annualized yield for these products was 182% for the year ended December 31, 2023.

Small business line of credit accounts. Certain subsidiaries offer, or arrange through our Bank Programs, small business line of credit accounts in 49 states and in Washington D.C. in the United States. Terms for these products range between 12 and 24 months with regular payments that amortize principal. Loan sizes for these products range between $5,000 and $100,000. Interest is calculated at a fixed rate based on the outstanding balance. There is generally no fee paid upon origination with the exception of one of our small business line of credit products, which has an origination fee when allowed by state law. The average annualized yield for these products was 46% for the year ended December 31, 2023.

CSO program. We currently operate a credit services organization or credit access business (“CSO”) program in Texas. Through our CSO program, we provide services related to a third-party lender’s installment consumer loan products by acting as a credit services organization or credit access business on behalf of consumers in accordance with applicable state laws. Services offered under our CSO program include credit-related services such as arranging loans with an independent third-party lender and assisting in the preparation of loan applications and loan documents (“CSO loans”). When a consumer executes an agreement with us under our CSO program, we agree, for a fee payable to us by the consumer, to provide certain services, one of which is to guarantee the consumer’s obligation to repay the loan received by the consumer from the third-party lender if the consumer fails to do so. For CSO loans, the lender is responsible for providing the criteria by which the consumer’s application is underwritten and, if approved, determining the amount of the consumer loan. We, in turn, are responsible for assessing whether or not we will guarantee such loan. The guarantee represents an obligation to purchase the loan, which has terms of up to six months, if it goes into default.

As of December 31, 2023 and 2022, the outstanding amount of active and current consumer loans originated by third-party lenders under the CSO program was $16.4 million and $15.6 million, respectively, which were guaranteed by us.

Bank programs. Certain subsidiaries operate programs with certain banks (“Bank Programs”) to provide marketing services and loan servicing for certain installment loans and line of credit accounts. The Bank Programs that relate to the consumer portfolio include near-prime unsecured installment loans and line of credit accounts for which our subsidiaries receive marketing and servicing fees. The bank

2

has the ability to sell, and the participating subsidiaries have the option, but not the requirement, to purchase the loans or a participating interest in receivables the bank originates. We do not guarantee the performance of the loans and line of credit accounts originated by the bank. The Bank Program that relates to the small business portfolio is with a separate bank and includes installment loans and line of credit accounts. We receive marketing fees while the bank receives origination fees and certain program fees. The bank has the ability to sell and we have the option, but not the requirement, to purchase the installment loans the bank originates and, in the case of line of credit accounts, extensions under those line of credit accounts. We do not guarantee the performance of the loans or line of credit accounts originated by the bank.

As of December 31, 2023, we operated programs with three separate bank partners. Purchases under these programs represented 28% and 22% of our consolidated originations and purchases for the years ended December 31, 2023 and 2022, respectively. Management does not deem there to be significant reliance on any of our banking partners.

Our Markets

We currently provide our services in the following countries:

United States. We began our online business in the United States in May 2004. As of December 31, 2023, we provided services in all 50 states and Washington D.C. We market our financing products under the names CashNetUSA at www.cashnetusa.com, NetCredit at www.netcredit.com, OnDeck at www.ondeck.com, Headway Capital at www.headwaycapital.com, and Pangea at www.pangeamoneytransfer.com. The United States represented 98.6% of our total revenue in 2023 and 99.2% of our total revenue in 2022.

Brazil. In June 2014, we launched our business in Brazil under the name Simplic at www.simplic.com.br, where we arrange unsecured consumer installment loans for a third-party lender. We plan to continue to invest in and expand our financial services program in Brazil. Brazil represented 1.3% of total revenue in 2023 and 0.7% of total revenue in 2022.

Key Financial and Operating Metrics

We have achieved significant growth since we began our online business as we have expanded our product offerings organically and through strategic acquisitions. We measure our business using several financial and operating metrics. Our key metrics include combined loans and finance receivables outstanding, in addition to other measures described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

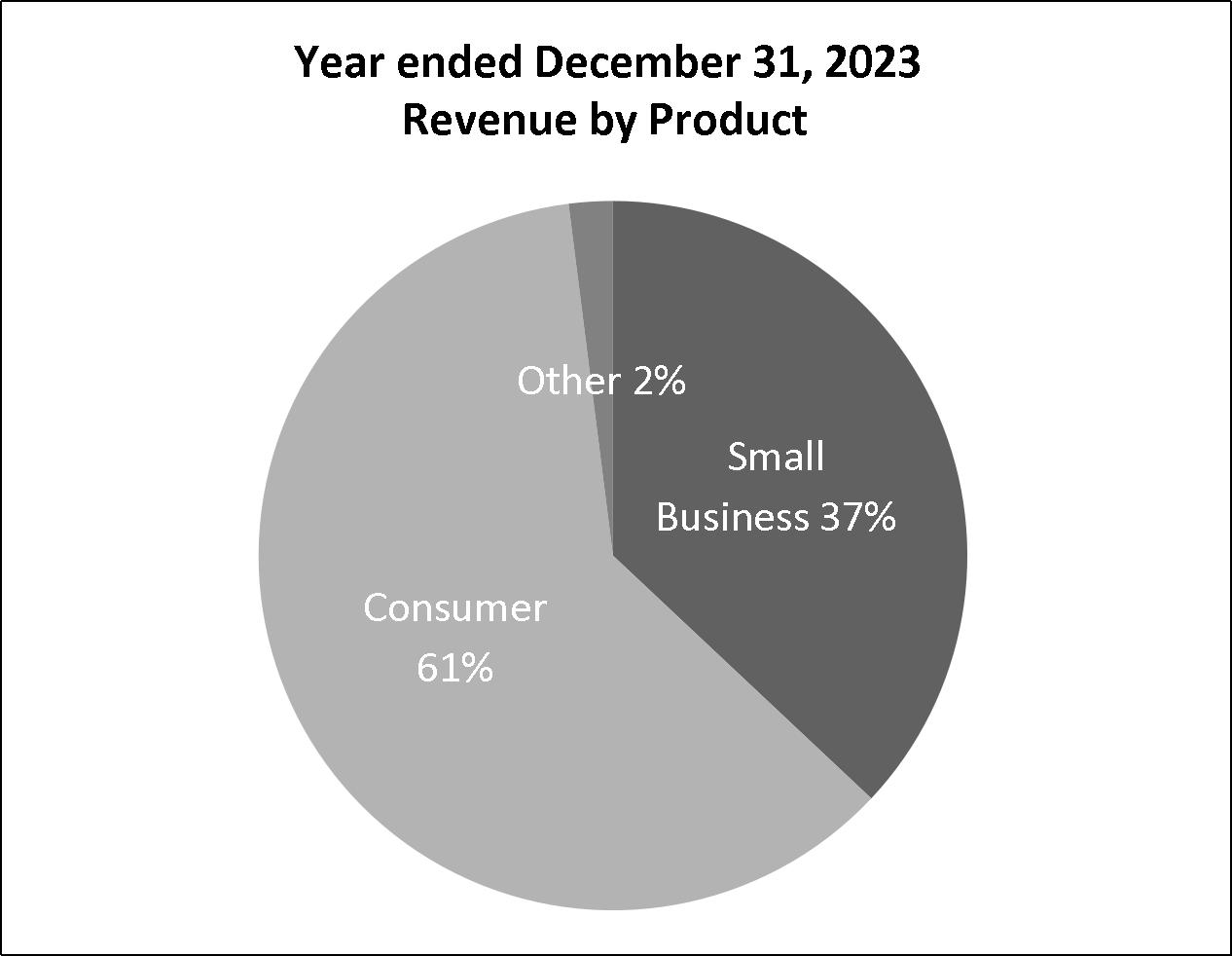

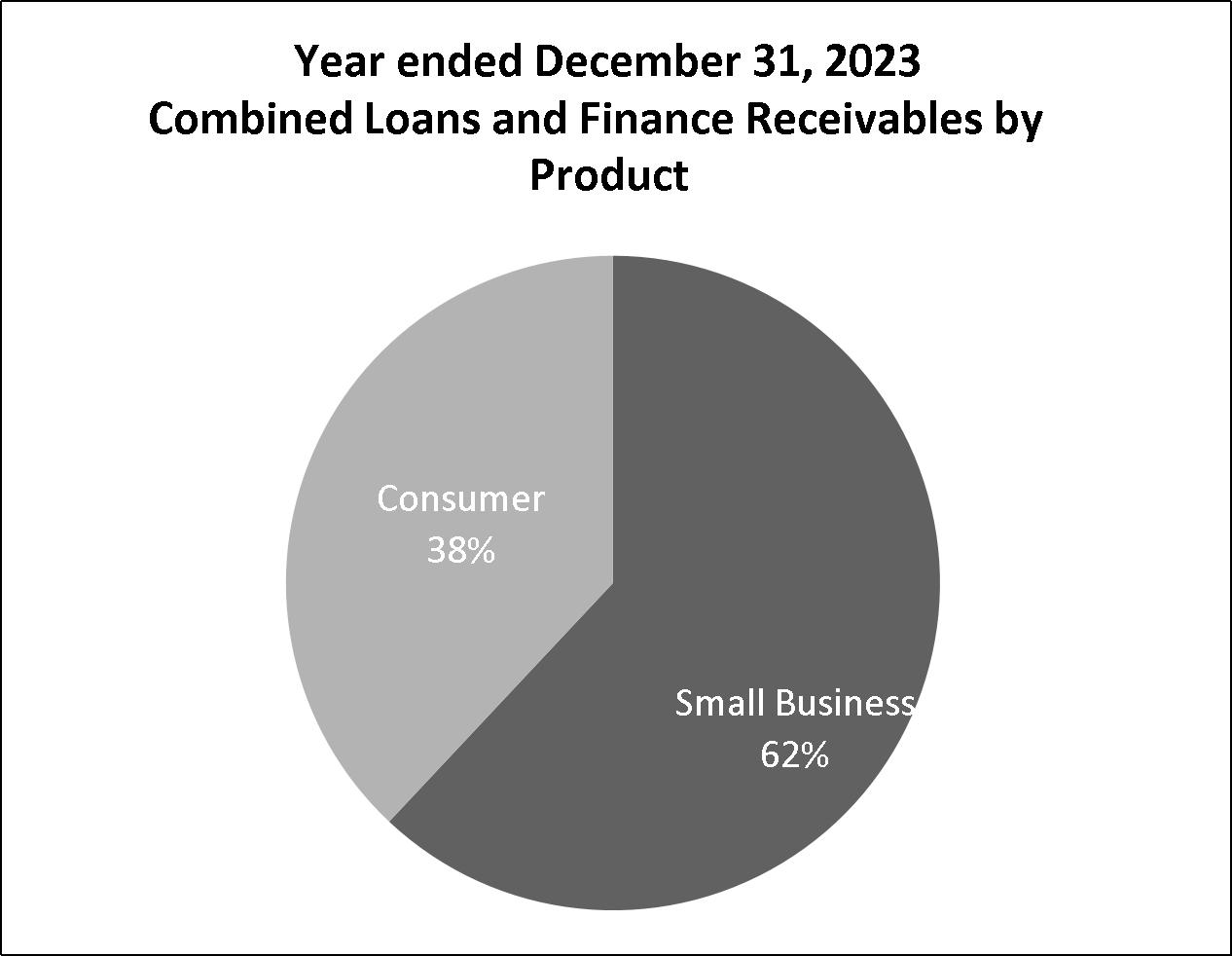

The breakout of the combined loans and finance receivables and revenue of our product offerings is set forth below:

3

Our Industry

The internet has transformed how consumers and small businesses shop for and acquire products and services. According to a study by the United Nations, 67% of the world’s population had access to the internet in 2023, a 4.7% increase from 2022. Cisco’s annual Internet Report reported that global internet usage is expected to increase at a pace of 6% through 2023. Accompanying the rise in internet usage is the continued disruption of storefront retail by e-commerce companies like Amazon, as consumers flock to purchase goods and interact with businesses online. The U.S. Census Bureau Department of Commerce reported e-commerce saw a 7.6% increase in the third quarter of 2023 compared to 2022. According to the U.S. Census Bureau, e-commerce sales as a percent of total quarterly retail sales in the United States accounted for 15.6% in the third quarter of 2023. In addition, a number of traditional financial services, such as banking, bill payment and investing, have become widely available online. An October 2023 report by the American Bankers Association found that approximately 71% of bank customers in a U.S. sample have used mobile apps or online banking as a means of accessing banking services in the past 12 months. This level of use highlights the extent to which consumers now accept the internet for conducting their financial transactions and are willing to entrust their financial information to online companies. We believe the increased acceptance of online financial services has led to an increased demand for online lending and financing, the benefits of which include customer privacy, easy access, security, 24/7 availability to apply for a loan or financing, speed of funding and transparency of fees and interest.

We use the internet to serve the large and growing number of underbanked consumers and small businesses that have bank accounts but use alternative financial services because of their limited access to more traditional credit from banks, credit card companies and other lenders. In its Report on the Economic Well-Being of U.S. Households in 2022 published in May 2023, the Federal Reserve noted that relatively small, unexpected expenses, such as a car repair or a modest medical bill, can be a hardship for many families and that, when faced with a hypothetical expense of $400, 37 percent of adults said they could not cover it completely using cash, savings or a credit card paid off at the end of the month, revealing the need for alternative sources. The onset and continued impacts of the COVID-19 pandemic have exacerbated financial disruptions for many working-class individuals. According to the same 2023 report by the Federal Reserve a sizable portion of the population (19%) is unbanked or underbanked. In 2022, the Federal Reserve reported a 2% decrease in the origination of new credit over the past 12 months.

Small businesses are also suffering from lack of access to credit from traditional lenders. According to a 2023 study by the Federal Reserve Banks, 53% of employer firms used personal funds to address their business’s financial challenges. In 2022, 34% of employer firms applied for some type of emergency funding. Online lending and funding options are emerging as a solution for small businesses that are seeking capital. The Federal Reserve found that 24% of small businesses surveyed applied for credit from a finance company that was not a bank.

We believe that consumers and small businesses seek online lending services for numerous reasons, including because they often:

Our Customers

Our non-prime consumer base is comprised largely of individuals living in households that earn an average annual income of $38,000 in the United States. The non-prime lending market is sizable in the United States and Brazil. We estimate there is a $77 billion consumer lending opportunity market in the United States. In Brazil, we estimate there to be a $43 billion consumer loans market. Small business lending is also an attractive market opportunity, with an estimated total U.S. small business loan market of $372 billion. Tighter banking regulations have forced banks to vacate the U.S. market for loans under $1 million. According to a 2021 study by the Federal Reserve Banks, loans under $250 thousand accounted for 75% of all small business loan applications. Our small business customers have median annual sales of approximately $594 thousand and an average operating history of 10.8 years.

Our Competitive Strengths

We believe that the following competitive strengths position us well for continued growth:

4

5

Our Growth Strategy

Online Financing Process

Our consumer and small business financing transactions are conducted almost exclusively online. When a customer is approved for a new loan, nearly all customers choose to have funds promptly deposited in their bank account and choose to use a pre-authorized debit for repayment from their bank account or debit card. Where permitted by law and approved by us, a customer may choose to renew a short-term consumer loan before payment becomes due by agreeing to pay an additional finance charge. If a loan is renewed or refinanced, the renewal or refinanced loan is considered a new loan.

6

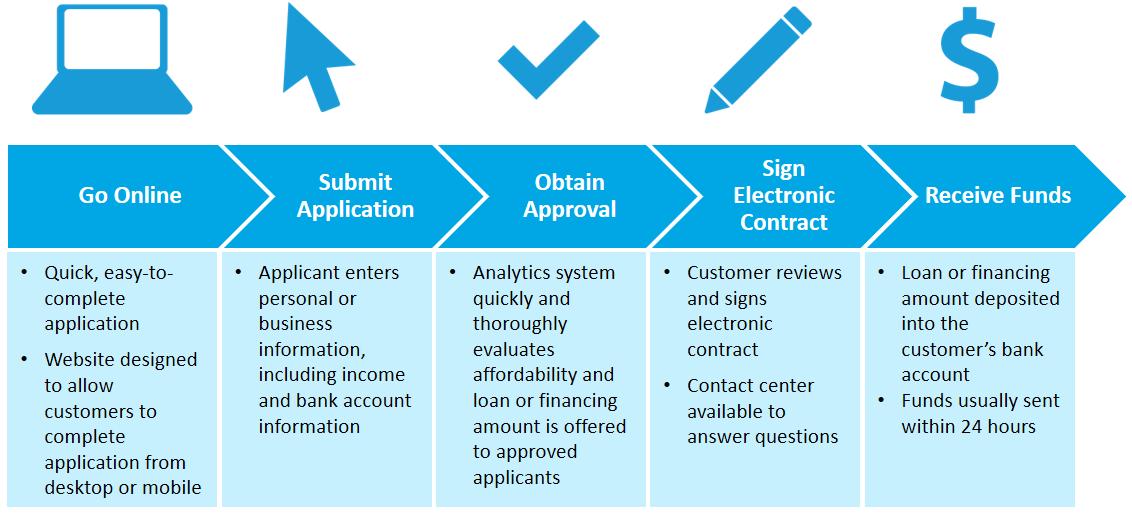

We have created a quick and simple process for customers to apply for an online loan or RPA, as shown below:

Technology Platforms

Our proprietary technology platforms are built for scalability and flexibility and are based on proven open source software. The technology platforms were designed to be powerful enough to handle the large volumes of data required to evaluate consumer and small business applications and flexible enough to capitalize on changing customer preferences, market trends and regulatory changes. The scalability and flexibility of our technology platforms allow us to enter new markets and launch new products quickly, typically within three to six months from conception to launch. With the acquisition of OnDeck, we have enhanced our capabilities to connect and integrate our small business platforms with a wider network of distribution partners.

We continually employ technological innovations to improve our technology platforms, which perform a variety of integrated and core functions, including:

The key elements of our technology platforms include:

7

Proprietary Data and Analytics

Decision Engine

We have developed a fully integrated decision engine that evaluates and rapidly makes credit and other determinations throughout the customer relationship, including automated decisions regarding marketing, fraud, underwriting, customer contact and collections that leverage artificial intelligence and machine learning-enabled models. Our decision engine currently handles more than 100 algorithms and over 1,000 variables. The algorithms in use are constantly monitored, validated, updated and optimized to continuously improve our operations. In order to support the daily running and ongoing improvement of our decision engine, we have assembled a highly skilled team of nearly 90 data and analytics professionals as of December 31, 2023.

Proprietary Data, Models and Underwriting

Our proprietary models are built on more than 19 years of history, using advanced statistical methods that take into account our experience with the millions of transactions we have processed during that time and the use of data from numerous third-party sources. We also acquired OnDeck’s proprietary data and analytics models, which strengthen our ability to serve small businesses. We continually update our machine learning-enabled underwriting models to manage risk of defaults and to structure loan and financing terms. Our system completes these assessments within seconds of receiving the customer’s data.

Our underwriting system is able to assess risks associated with each customer individually based on specific customer information and historical trends in our portfolio. We use a combination of numerous factors when evaluating a potential customer, which may include a consumer’s income, rent or mortgage payment amount, employment history, external credit reporting agency scores, amount and status of outstanding debt and other recurring expenditures, fraud reports, repayment history, charge-off history and the length of time the customer has lived at his or her current address. While the relative weight or importance of the specific variables that we consider when underwriting a loan changes from product to product, generally, the key factors that we consider for loans include monthly gross income, disposable income, length of employment, duration of residency, credit report history and prior loan performance history if the applicant is a returning customer. Similar factors are considered for small business applicants and also include length of time in business, online business reviews, and sales volumes. Our customer base for consumer loans is predominantly in the low to fair range of FICO scores, with scores generally between 500 and 680 for most of our loan products. We generally do not take into account a potential customer’s FICO score when deciding whether to make a loan. A Vantage-Score is one of the factors in our credit models for our near-prime installment product in the United States. Since we designed our system specifically for our specialized products, we believe our system provides more predictive assessments of future payment behavior and results in better evaluation of our customer base when compared to traditional credit assessments, such as a FICO score. In the small business space, we utilize both FICO and Vantage scores in our decision models, and our customer base is predominantly in the fair to better range of FICO scores with OnDeck scores generally between 650 and 780.

Fraud Prevention

Our robust fraud prevention system is built from in-depth analysis of previous fraud incidences and information from third-party data sources. To ensure sustainable growth, our fraud prevention team has built rigorous systems and processes that leverage artificial intelligence and machine learning-enabled models to detect fraud trends, identify fraudulent applications and learn from past fraudulent cases.

Working together with multiple vendors, our systems first determine whether customer information submitted matches other indicators regarding the application and that the applicant can authorize transactions for the submitted bank account. To prevent more organized and systematic fraud, we have developed predictive models that incorporate signals from various sources that we have found to be useful in identifying fraud. These models utilize advanced data mining algorithms, machine learning-enabled algorithms and artificial intelligence to effectively identify fraudulent applications with a very low false positive rate. In addition, we have built strong loan processing teams that handle suspicious activities efficiently while minimizing friction in customer experience. Our fraud prevention system incorporates algorithms to differentiate customers in an effort to identify suspected fraudulent activity and to reduce our risks of loss from fraud.

8

We continuously develop and implement ongoing improvements to these systems and, while no system can completely protect against losses from fraud, we believe our systems provide protection against significant fraud losses.

Marketing

We use a multi-channel approach to marketing our online loans and financing products, with both broad-reach and highly-targeted channels, including television, digital, direct mail, telemarketing and partner marketing (which includes lead providers, independent brokers and marketing affiliates). The goal of our marketing is to promote our brands and products in the online lending marketplace and to directly acquire new customers at low cost. Our marketing has successfully built strong awareness of and preference for our brands, as our products have achieved market leadership through the following:

Our brand, technology and machine learning-enabled analytics-powered approach to marketing has enabled us to increase the percentage of loans sourced through direct marketing (where we have more visibility and control than in the lead purchase or affiliate channels) from approximately 32% in 2009 to 49% in 2023, and we believe we have also improved customer brand loyalty during the same period.

Customer Service

We believe that our in-house contact center and our emphasis on superior customer service are significant contributors to our growth. To best serve our consumers and small businesses, we use customer-oriented business practices, such as offering extended-hours customer service. We continuously work to improve our customers’ experience and satisfaction by evaluating information from website analytics, customer satisfaction surveys, contact center feedback, call monitoring and focus groups. Our contact center teams receive training on a regular basis, are monitored by quality assurance managers and adhere to rigorous internal service-level agreements. We do not outsource our contact center operations, except in Brazil.

Collections

We operate consumer and small business-specific collection teams that have implemented loan and financing collection policies and practices designed to optimize regulatory compliant loan and financing repayment, while also providing excellent customer service. Our collections employees are trained to help the customer understand available payment alternatives and make arrangements to repay the loan or financing. We use a variety of collection strategies to satisfy a delinquent loan or finance receivable, such as settlements and payment plans, or to adjust the delivery of finance receivables. Employees are continually trained and coached towards improvement based on quality assurance and work effort audits resulting in continued success in presenting best available payment options to the customer while limiting complaints and dissatisfaction.

Contact center employees contact customers following the first missed payment and periodically thereafter. Our primary methods of contacting past due customers are through phone calls, letters and emails. At times, we sell loans that we are unable to collect to debt collection companies or place the debt for collection with debt collection companies.

Competition

We have many competitors. Our principal competitors are consumer loan and finance companies, CSOs, online lenders, credit card companies, auto title lenders and other financial institutions that offer similar financial products and services, including loans on an unsecured as well as a secured basis. We believe that there is also indirect competition to some of our products, including bank overdraft facilities and banks’ and retailers’ insufficient funds policies, many of which may be more expensive alternative approaches for consumers and small businesses to cover their bills and expenses than the consumer and small business loan and financing products we

9

offer. Some of our U.S. competitors operate using other business models, including a “tribal model” where the lender follows the laws of a Native American tribe regardless of the state in which the customer resides.

We believe that the principal competitive factors in the consumer and small business loan and financing industry consist of the ability to provide sufficient loan or financing size to meet customers’ financing requests, speed of funding, customer privacy, ease of access, transparency of fees and interest and customer service. We believe we have a significant competitive advantage as an early mover in many of the markets that we serve. New entrants face obstacles typical to launching new lending operations, such as successfully implementing underwriting and fraud prevention processes, incurring high marketing and customer acquisition costs, overcoming customer brand loyalty and having or obtaining sufficient capital to withstand early losses associated with unseasoned loan portfolios. In addition, there are substantial regulatory and compliance costs, including the need for expertise to customize products and obtain licenses to lend in various states in the United States and in international jurisdictions. Our proprietary technology, analytics expertise, scale, international reach, brand recognition and regulatory compliance would be difficult for a new competitor to duplicate.

Because numerous competitors offer consumer and small business loan and financing products, and many of our competitors are privately held, it is difficult for us to determine our exact competitive position in the market. We believe our principal online competitors in the United States include a variety of privately held, technology enabled lenders. Storefront consumer loan lenders that offer loans online or in storefronts are also a source of competition in some of the markets where we offer consumer loans, including Ace Cash Express, Check Into Cash, Check ‘n Go and One Main Financial. For online small business financing, we believe our main competitors include traditional banks, legacy merchant cash advance providers, and newer, technology-enabled FinTech lenders.

Intellectual Property

Protecting our rights to our intellectual property is critical, as it enhances our ability to offer distinctive services and products to our customers, which differentiates us from our competitors. We rely on a combination of trademark laws and trade secret protections in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions, to protect the intellectual property rights related to our proprietary analytics, predictive underwriting models, tradenames and marks and software systems. We have several registered trademarks, including CashNetUSA and our “e” logo. OnDeck also has registered trademarks in the United States, Canada and Australia, including “OnDeck,” “OnDeck Score” and the OnDeck logo. These trademarks have varying expiration dates, and we believe they are materially important to us and we anticipate maintaining them and renewing them.

Seasonality

Demand for our consumer loan products and services in the United States has historically been highest in the third and fourth quarters of each year, corresponding to the holiday season, and lowest in the first quarter of each year, corresponding to our customers’ receipt of income tax refunds. Demand for our small business loan products and services in the United States has historically been highest in the fourth quarter and early first quarter of each year, corresponding generally to holiday and post-holiday season needs, and lowest at the end of the first quarter and beginning of the second quarter of each year, where we believe that our customers' businesses are generally slower. Consequently, we experience seasonal fluctuations in our domestic operating results and cash needs.

Financial Information on Segments and Areas

Additional financial information regarding our operating segment and each of the geographic areas in which we do business is provided in “Item 8. Financial Statements and Supplementary Data—Note 17” of this report.

Operations

Management and Personnel

Executive Officers

Our executive officers, and information about each as of December 31, 2023, are listed below.

NAME |

|

POSITION WITH ENOVA |

|

AGE |

|

|

David Fisher |

|

Chief Executive Officer |

|

|

54 |

|

Kirk Chartier |

|

Chief Strategy Officer |

|

|

60 |

|

Steven Cunningham |

|

Chief Financial Officer |

|

|

54 |

|

Sean Rahilly |

|

General Counsel & Chief Compliance Officer |

|

|

50 |

|

10

There are no family relationships among any of the officers named above. Each officer of Enova holds office from the date of appointment until removal or termination of employment with Enova. Set forth below is additional information regarding the executive officers identified above.

David Fisher has served as our Chief Executive Officer since January 29, 2013 when he joined Enova. Mr. Fisher has also served as a Director since February 11, 2013. Prior to joining Enova, Mr. Fisher was Chief Executive Officer of optionsXpress Holdings, Inc., or optionsXpress, from October 2007 until The Charles Schwab Corporation (“Schwab”), acquired the business in September 2011. Following the acquisition, Mr. Fisher served as President of optionsXpress until March 2012. Mr. Fisher also served as the President of optionsXpress from March 2007 to October 2007 and as the Chief Financial Officer of optionsXpress from August 2004 to March 2007. Prior to joining optionsXpress, Mr. Fisher served as Chief Financial Officer of Potbelly Sandwich Works from February 2001 to July 2004, and before that in the roles of Chief Financial Officer and General Counsel for Prism Financial Corporation. In addition, Mr. Fisher has served on the Board of Directors of GoHealth, Inc. since May 2022 and Fathom Digital Manufacturing Corporation since December 2021. Mr. Fisher previously served on the Boards of Directors of optionsXpress, CBOE Holdings, Inc., InnerWorkings, Inc., GrubHub, Inc. and Just Eat Takeaway.com N.V. Mr. Fisher received a Bachelor of Science degree in Finance from the University of Illinois and a law degree from Northwestern University School of Law.

Kirk Chartier currently serves as our Chief Strategy Officer. Mr. Chartier joined Enova in April 2013 as Chief Marketing Officer. Prior to joining Enova, Mr. Chartier was the Executive Vice President & Chief Marketing Officer of optionsXpress Holdings from January 2010 until Schwab acquired the business in September 2011. Following the acquisition, Mr. Chartier served as Vice President of Schwab through May 2012. From 2004 to 2010, Mr. Chartier was the Senior Managing Principal and Business Strategy Practice Leader for the Zyman Group, a marketing and strategy consultancy owned by MDC Partners, where he also served in interim senior marketing executive roles for Fortune 500 companies, including Safeco Insurance. Mr. Chartier has held executive roles at technology companies including as Senior Vice President of Business Services & eCommerce for CommerceQuest, as Vice President of Online Marketing & Strategy for THINK New Ideas and as a Corporate Auditor for the General Electric Company. He started his career as a combat pilot with the U.S. Marine Corps and is a veteran of Desert Storm. Mr. Chartier received a Master of Business Administration from Syracuse University, a Bachelor of Arts in Economics from the College of the Holy Cross, and a Bachelor of Science in Engineering from Worcester Polytechnic Institute.

Steven Cunningham has served as our Chief Financial Officer since he joined Enova in June 2016. Mr. Cunningham joined Enova from Discover Financial Services, where he most recently served as Executive Vice President and Chief Risk Officer for Discover’s $8.7 billion direct banking and payment services business. He joined Discover as its Corporate Treasurer in 2010. Prior to Discover, Mr. Cunningham was the CFO of Harley-Davidson Financial Services, a $7 billion receivables business, and spent eight years at Capital One Financial in various corporate and line of business finance leadership positions, including CFO for the Auto Finance segment, a $20 billion receivables business, and CFO for the company’s banking segment. Mr. Cunningham also has experience as a bank regulator with the FDIC. Mr. Cunningham has served on the Board of Directors of AgriBank, a Farm Credit Bank, since January 2022. Mr. Cunningham received a bachelor’s degree in Corporate Finance and Investment Management from the University of Alabama and a Master of Business Administration from George Washington University. He also holds the professional designation of Chartered Financial Analyst.

Sean Rahilly has served as our General Counsel and Chief Compliance Officer since June 2018. Mr. Rahilly joined Enova in October 2013 as Chief Compliance Officer. Mr. Rahilly previously served as Assistant General Counsel and Compliance Officer of First American Bank from September 2006 to September 2013. He also served as First American Bank’s Vice President—Community Reinvestment Act and Compliance Officer from January 2006 to September 2006, Vice President—Compliance Manager from November 2003 to January 2006 and Assistant Vice President—Compliance and Community Reinvestment Act from July 2002 to November 2003. Prior to joining First American Bank, Mr. Rahilly served as an attorney with the Law Offices of Victor J. Cacciatore, a project assistant with Schiff Hardin & Waite and in various roles with Pullman Bank and Trust Company. He received a Bachelor of Science in Accountancy from DePaul University College of Commerce and a Juris Doctor from DePaul University College of Law.

Human Capital

Our Workforce. Our employees are primarily located in the United States, with a portion of our workforce in Mexico and Brazil. As of December 31, 2023, we had 1,675 employees, with 1,634 of our employees located in the United States. None of our employees are currently covered by a collective bargaining agreement or represented by an employee union. We believe we have one of the most skilled and talented teams of professionals in the industry. Our employees have exceptional educational backgrounds, with numerous post-graduate and undergraduate degrees in science, technology, engineering, and mathematics fields. We hire and develop a diverse range of top talent from graduate and undergraduate programs at premier institutions as well as from coding bootcamps such as Code Platoon. The extensive education of our team is complemented by the experience our leadership team obtained at leading financial services companies and technology firms such as optionsXpress, Discover Financial Services, First American Bank, JPMorgan Chase and Groupon.

11

Diversity, Equity, & Inclusion. Diversity, equity, and inclusion (“DEI”) are highly valued at Enova. We are committed to fostering a culture where everyone is treated equitably and fairly, with a sense of belonging, community, and value. We believe that DEI is important to all aspects of our business, including our goal to attract, develop, and retain talent from underrepresented groups. Our business is better when we have a team of people from diverse backgrounds, experiences, talents, skills, and perspectives contributing to our success. To further our commitment, in 2021, we created a new position, Diversity, Equity, & Inclusion Lead, focused exclusively on fostering and driving our DEI initiatives and values. A key part of this role is partnering with Enova’s DEI Council, DEI groups, and business teams to ensure that our initiatives have an impactful role in our culture and day-to-day work.

In The Community. We are dedicated to having a positive impact on our community. We encourage our employees to volunteer in their communities and on behalf of causes that are important to them through our Enova Gives program. Corporate employees are granted one paid volunteer day per calendar year to volunteer with or on behalf of a qualified 501(c)(3) non-profit organization of their choice during work hours. In addition, Enova matches charitable donations from employees to qualifying 501(c)(3) non-profit organizations—up to $500 per employee each calendar year. At a company level, Enova invests financially in organizations that are dedicated to strengthening and broadening access to quality education; improving the lives of children and young adults in need; and providing access to high quality financial literacy programs.

Learning & Development. We offer a combination of required and optional learning and development opportunities to every Enova employee. Our learning and development program is facilitated and guided primarily by our Talent Development team, Operations Learning and Development team, company leaders, subject matter experts and our People team. We utilize an enterprise learning management system (“LMS”) to deliver and manage all online learning. Enova employees can utilize tuition reimbursement or department training budgets for external learning and development. Required compliance training is administered and tracked through our LMS, and every Enova employee is assigned required compliance e-Learning modules. We also invest in our talent through a variety of leadership and mentor programs, as well as other events focused on professional development.

Rewards & Benefits. The primary objectives of our compensation program are to: support Enova’s core values; attract, motivate, and retain the best talent; encourage and reward high performance and results, while aligning short- and long-term interests with those of our stockholders; and reinforce our strategy to grow our business as we continue to innovate. We offer employees competitive and comprehensive total rewards packages. For U.S.-based employees, this includes competitive base bay; annual bonus consideration; long-term incentive grants; employer-subsidized health, dental, and vision insurance; an employer match for 401(k) savings; paid and unpaid time off; group term life and disability insurance; paid volunteer day; paid holidays; paid parental leave; and a summer hours program. Enova offers additional corporate perks to its U.S. employees, including a discount savings program, tuition reimbursement, last-minute childcare reimbursement, and meal ordering. Enova also offers a paid four-week sabbatical program for eligible employees. Legal, financial, and work-life solutions and support are available through our Employee Assistance Program.

Market and Industry Data

The market and industry data contained in this Annual Report on Form 10-K, including trends in our markets and our position within such markets, are based on a variety of sources, including our good faith estimates, which are derived from our review of internal surveys, information obtained from customers and publicly available information, as well as from independent industry publications, reports by market research firms and other published independent sources. None of the independent industry publications used in this report were prepared on our behalf.

REGULATION

Our operations are subject to extensive regulation, supervision and licensing under various federal, state, local and international statutes, ordinances and regulations.

U.S. Federal Regulation

Consumer Lending Laws. Our consumer loan business is subject to the federal Truth in Lending Act (“TILA”), and its underlying regulations, known as Regulation Z, and the Fair Credit Reporting Act (“FCRA”). These laws require us to provide certain disclosures to prospective borrowers and protect against unfair credit practices. The principal disclosures required under TILA are intended to promote the informed use of consumer credit. Under TILA, when acting as a lender, we are required to disclose certain material terms related to a credit transaction, including, but not limited to, the annual percentage rate, finance charge, amount financed, total of payments, the number and amount of payments and payment due dates to repay the indebtedness. The FCRA regulates the collection, dissemination and use of consumer information, including consumer credit information. The federal Equal Credit Opportunity Act (“ECOA”), prohibits us from discriminating against any credit applicant on the basis of any protected category, such as race, color, religion, national origin, sex, marital status or age, and requires us to notify credit applicants of any action taken on the individual’s credit application.

12

Consumer Reports and Information. The use of consumer reports and other personal data used in credit underwriting is governed by the FCRA and similar state laws governing the use of consumer credit information. The FCRA establishes requirements that apply to the use of “consumer reports” and similar data, including certain notifications to consumers where their loan application has been denied because of information contained in their consumer report. The FCRA requires us to promptly update any credit information reported to a credit reporting agency about a consumer and to allow a process by which consumers may inquire about credit information furnished by us to a consumer reporting agency.

Information-Sharing Laws. We are also subject to the federal Fair and Accurate Credit Transactions Act, which limits the sharing of information with affiliates for marketing purposes and requires us to adopt written guidance and procedures for detecting, preventing and responding appropriately to mitigate identity theft and to adopt various policies and procedures and provide training and materials that address the importance of protecting non-public personal information and aid us in detecting and responding to suspicious activity, including suspicious activity that may suggest a possible identity theft red flag, as appropriate.

Marketing Laws. Our advertising and marketing activities are subject to several federal laws and regulations including the Federal Trade Commission Act (the “FTC Act”), which prohibits unfair or deceptive acts or practices and false or misleading advertisements in all aspects of our business. As a financial services company, any advertisements related to our products must also comply with the advertising requirements set forth in TILA. Also, any of our telephone marketing activities must comply with the Telephone Consumer Protection Act (the “TCPA”) and the Telemarketing Sales Rule (the “TSR”). The TCPA prohibits the use of automatic telephone dialing systems for communications with wireless phone numbers without express consent of the consumer, and the TSR established the Do Not Call Registry and sets forth standards of conduct for all telemarketing. Our advertising and marketing activities are also subject to the CAN-SPAM Act of 2003, which establishes certain requirements for commercial email messages and specifies penalties for the transmission of commercial email messages that are intended to deceive the recipient as to the source of content.

Protection of Military Members and Dependents. The Military Lending Act (“MLA”) is a federal law that limits the annual percentage rate to 36% on certain consumer loans made to active duty members of the U.S. military, reservists and members of the National Guard and their immediate families. The MLA’s implementing regulation also contains various disclosure requirements, limitations on renewals and refinancing, as well as restrictions on the use of prepayment penalties, arbitration provisions and certain waivers of rights. The 36% annual percentage rate cap applies to a variety of consumer loan products. Therefore, due to these rate restrictions, we are unable to offer certain consumer loans to active duty military personnel, active reservists and members of the National Guard and their immediate dependents. Federal law also limits the annual percentage rate on existing loans when the borrower, or spouse of the borrower, becomes an active-duty member of the military during the life of a loan. Pursuant to federal law, the interest rate must be reduced to 6% per year on amounts outstanding during the time in which the service member is on active duty.

Funds Transfer and Signature Authentication Laws. The consumer loan business is also subject to the federal Electronic Funds Transfer Act (“EFTA”), and various other laws, rules and guidelines relating to the procedures and disclosures required in debiting or crediting a debtor’s bank account relating to a consumer loan (i.e., Automated Clearing House (“ACH”) funds transfer). Furthermore, we are subject to various state and federal e-signature rules mandating that certain disclosures be made and certain steps be followed in order to obtain and authenticate e-signatures.

Debt Collection Practices. We use the Fair Debt Collection Practices Act (“FDCPA”) as a guide in connection with operating our other collection activities. We are also required to comply with all applicable state collection practices laws.

Privacy and Security of Non-Public Customer Information. Under the federal Gramm-Leach-Bliley Act (“GLBA”), we must disclose to individuals our privacy policy and practices, including those policies relating to the sharing of individuals’ nonpublic personal information with third parties. The GLBA also requires us to ensure that our systems are designed to protect the confidentiality of individuals’ nonpublic personal information and dictates certain actions that we must take to notify individuals if their personal information is disclosed in an unauthorized manner.

Anti-Money Laundering and Economic Sanctions. We are also subject to certain provisions of the USA PATRIOT Act and the Bank Secrecy Act under which we must maintain an anti-money laundering compliance program covering certain of our business activities. In addition, the Office of Foreign Assets Control (“OFAC”) prohibits us from engaging in financial transactions with specially designated nationals.

Anticorruption. We are also subject to the U.S. Foreign Corrupt Practices Act (the “FCPA”), which generally prohibits companies and their agents or intermediaries from making improper payments to foreign officials for the purpose of obtaining or keeping business and/or other benefits.

13

CFPB

In July 2010, the U.S. Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Title X of the Dodd-Frank Act created the Consumer Financial Protection Bureau (the “CFPB”), which regulates consumer financial products and services, including consumer loans and remittance transfers that we offer. The CFPB has regulatory, supervisory and enforcement powers over providers of consumer financial products and services, including explicit supervisory authority to examine and require registration of certain providers. Pursuant to these powers, the CFPB has examined our lending products, services and practices, and we expect to continue to be examined on a regular basis by the CFPB.

On October 6, 2017, the CFPB issued its final rule entitled “Payday, Vehicle Title, and Certain High-Cost Installment Loans” (the “Small Dollar Rule”), which covers certain consumer loans that we offer. The Small Dollar Rule requires that lenders who make short-term loans and longer-term loans with balloon payments reasonably determine consumers’ ability to repay the loans according to their terms before issuing the loans. The Small Dollar Rule also introduces new limitations on repayment processes for those lenders as well as lenders of other longer-term loans with an annual percentage rate greater than 36 percent that include an ACH authorization or similar payment provision. If a consumer has two consecutive failed payment attempts, the lender must obtain the consumer’s new and specific authorization to make further withdrawals from the consumer’s bank account. For loans covered by the Small Dollar Rule, lenders must provide certain notices to consumers before attempting a first payment withdrawal or an unusual withdrawal and after two consecutive failed withdrawal attempts. On June 7, 2019, the CFPB issued a final rule to set the compliance date for the mandatory underwriting provisions of the Small Dollar Rule to November 19, 2020. On July 7, 2020, the CFPB issued a final rule rescinding the ability to repay (“ATR”) provisions of the Small Dollar Rule along with related provisions, such as the establishment of registered information systems for checking ATR and reporting loan activity. The payment provisions of the Small Dollar Rule remained in place. In April 2018, an action was filed against the CFPB making a constitutional challenge to the Small Dollar Rule. On October 19, 2022, a three-judge panel of the Fifth Circuit U.S. Circuit Court of Appeals ruled that the funding structure of the CFPB is unconstitutional and vacated the Small Dollar Rule. On November 14, 2022, the CFPB filed a Petition for Writ of Certiorari with the U.S. Supreme Court to review the Fifth Circuit ruling, and on October 3, 2023, the Supreme Court held oral arguments. The Supreme Court is expected to rule on the matter in spring of 2024. If the Small Dollar Rule becomes effective in its current proposed form, we will need to make certain changes to our payment processes and customer notifications in our U.S. consumer lending business. If we are not able to execute these changes effectively because of unexpected complexities, costs or otherwise, we cannot guarantee that the Small Dollar Rule will not have a material adverse impact on our business, prospects, results of operations, financial condition and cash flows.

On January 25, 2019, we consented to the issuance of a Consent Order by the CFPB pursuant to which we agreed, without admitting or denying any of the facts or conclusions, to pay a civil money penalty of $3.2 million. The Consent Order related to issues self-disclosed to the CFPB in 2014, including failure to provide loan extensions to 308 consumers and debiting approximately 5,500 consumers from the wrong bank account.

On November 15, 2023, we consented to the issuance of a Consent Order by the CFPB that supersedes the January 25, 2019 Consent Order and pursuant to which we agreed, without admitting or denying any of the facts or conclusions, to pay a civil money penalty of $15 million. The Consent Order relates to issues such as payment processing and debiting errors, the majority of which were self-disclosed. The Consent Order requires that we honor loan extensions granted to consumers and debit a loan extension fee to such consumers instead of debiting the full payment, and that we not debit or attempt to debit, on an individual or recurring basis, any consumer’s bank account without obtaining the consumer’s express informed consent and providing the consumer a copy of the authorization. The Consent Order also restricts our ability to originate or service payday loans or use payday consumer information to market consumer financial products. The Consent Order will terminate seven years from November 15, 2023.

As a result of the issues giving rise to the Consent Order that we self-identified, we implemented enhanced policies and procedures designed to prevent the prohibited actions. We continue to enhance our compliance management system and internal controls as well as our technology platform to address the issues noted above.

Enova continues to monitor and optimize its compliance program with respect to the Consent Order requirements, leveraging monitoring, testing and audit of its compliance program and payment processes. The aforementioned changes have not had a material impact on our financial results, nor do we expect them to have a material impact on future financial results.

For further discussion of the CFPB and its regulatory, supervisory and enforcement powers, see “Risk Factors—Risks Related to Our Business and Industry—The Consumer Financial Protection Bureau has examination authority over our U.S. consumer lending business that could have a significant impact on our U.S. business” in Part I, Item 1A of this report.

U.S. State Regulation

Our consumer lending business is regulated under a variety of enabling state statutes, all of which are subject to change and which may impose significant costs or limitations on the way we conduct or expand our business. As of the date of this report, we offer or arrange consumer loans in 37 states that have specific statutes and regulations that enable us to offer economically viable products. We currently do not offer consumer loans in the remaining states because we do not believe it is economically feasible to operate in those jurisdictions due to specific statutory or regulatory restrictions, such as interest rate ceilings, caps on the fees that may be charged, or costly operational

14

requirements. However, we may later offer our consumer products or services in any of these states if we believe doing so may become economically viable because of changes in applicable statutes or regulations or if we determine we can broaden our product offerings to operate under existing laws and regulations.

The scope of state regulation of consumer loans, including the fees and terms of our products and services, varies from state to state. The terms of our products and services vary from state to state in order to comply with the laws and regulations of the states in which we operate. In addition, our advertising and marketing activities and disclosures are subject to review under various state consumer protection laws and other applicable laws and regulations. The states with laws that specifically regulate our consumer products and services may limit the principal amount of a consumer loan, set maximum fees or interest rates customers may be charged and specify minimum and maximum maturity dates. Our collection activities regarding past due amounts may be subject to consumer protection laws and state regulations relating to debt collection practices. In addition, some states require certain disclosures or content to accompany our advertising or marketing materials. Also, some states require us to report consumer loan activity to state-wide databases and restrict the number and/or principal amount of loans a consumer may have outstanding at any particular time or over the course of a particular period of time.

In Texas, where we offer our CSO program, we comply with the jurisdiction’s Credit Services Organization Act and related regulations. These laws generally define the services that we can provide to consumers and require us to provide a contract to the customer outlining our services and the cost of those services to the customer. In addition, these laws may require additional disclosures to consumers and may require us to be registered with the jurisdiction and/or be bonded.

We must also comply with state restrictions on the use of lead providers. Over the past few years, several states have taken actions that have caused us to discontinue the use of lead providers in those states. Other states may propose or enact similar restrictions on lead providers in the future.

A variety of states have recently enacted legislation related to consumer data privacy. The laws have varying consumer protections, including the right to access and delete personal information and to opt-out of the sale of personal information. Other states may propose or enacted similar laws in the future.

Over the last few years, legislation that prohibits or severely restricts our consumer loan products and services has been introduced or adopted in a number of states. As a result, we have altered or ceased making consumer loans in certain states, in compliance with the new statutes. We regularly monitor proposed legislation or regulations that could affect our business.

Licensing Requirements – Small Business Loans

In states and jurisdictions that do not require a license to make commercial loans, OnDeck, and certain other of our subsidiaries, typically make commercial installment loans and extend lines of credit directly to customers pursuant to Utah or Virginia law. There are other states and jurisdictions that require a license or have other requirements or restrictions applicable to commercial loans, including both installment loans and line of credit accounts, and may not honor a Utah or Virginia choice of law. In these other states, historically we have originated some installment loans and lines of credit directly but purchased other installment loans and lines of credit from issuing bank partners, the foregoing depending on the requirements or restrictions of these other states. Certain line of credit accounts are extended by an issuing bank partner and we may purchase extensions under those line of credit accounts.

The issuing bank partner establishes its underwriting criteria for the issuing bank partner program in consultation with us. We recommend commercial loans to the issuing bank partner that meet the bank partner's underwriting criteria, at which point the issuing bank partner may elect to fund the installment finance loan or extend the line of credit. The issuing bank partner earns origination fees from the customers who borrow from it and retains the interest paid during the period that the issuing bank partner owns the loan. In exchange for recommending loans to an issuing bank partner, we earn a marketing referral fee based on the loans recommended to, and originated by, that issuing bank partner. Historically, OnDeck has been the purchaser of the loans that it referred to issuing bank partners.

Local Regulation—United States

In addition to state and federal laws and regulations, the consumer lending industry is subject to various local rules and regulations. These local rules and regulations are subject to change and vary widely from city to city. Local jurisdictions’ efforts to restrict short-term lending have been increasing. Typically, these local ordinances apply to storefront operations, however, local jurisdictions could attempt to enforce certain business conduct and registration requirements on online lenders lending to residents of that jurisdiction. Actions taken in the future by local governing bodies to impose other restrictions on short-term lenders such as us could impact our business.

15

Company and Website Information

Our principal executive offices are located at 175 West Jackson Blvd., Chicago, Illinois 60604, and our telephone number is (312) 568-4200.

Our website is located at www.enova.com. Through our website, we provide free access to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The information posted on our website is not incorporated by reference into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

Risk Factors Summary

The summary of risks below provides an overview of the principal risks we are exposed to in the normal course of our business activities:

Risks Related to Our Business and Industry

16

Risk Related to Our Indebtedness

Risk Related to Our Common Stock and the Securities Market

17

Risk Factors

Our business and future results may be affected by a number of risks and uncertainties that should be considered carefully in evaluating us. In addition, this report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including the risks faced by us described below. The occurrence of one or more of the events listed below could also have a material adverse effect on our business, prospects, results of operations, financial condition and cash flows.

Risks Related to Our Business and Industry

Our business is highly regulated, and if we fail to comply with applicable laws, regulations, rules and guidance, our business could be adversely affected.

Our products and services are subject to extensive regulation, supervision and licensing under various federal, state, local and international statutes, ordinances, regulations, rules and guidance. For example, our loan products may be subject to requirements that generally mandate licensing or authorization as a lender or as a credit services organization or credit access business (collectively, “CSO”), establish limits on the amount, duration, renewals or extensions of and charges for (including interest rates and fees) various categories of loans, direct the form and content of our loan contracts and other documentation, restrict collection practices, outline underwriting requirements and subject us to periodic examination and ongoing supervision by regulatory authorities, among other things. We must comply with federal laws, such as TILA, ECOA, FCRA, EFTA, GLBA and Title X of the Dodd-Frank Act, among others, as well as regulations adopted to implement those laws. In addition, our marketing and disclosure efforts and the representations made about our products and services are subject to unfair and deceptive practice statutes, including the FTC Act, the TCPA and the CAN-SPAM Act of 2003 in the United States and analogous state statutes under which the FTC, the CFPB, state attorneys general or private plaintiffs may bring legal actions.

Additionally, changes in laws or regulations or changes to the application or interpretation of the laws and regulations applicable to small business lenders could adversely affect the Company’s ability to operate in the manner in which the Company currently conducts business or make it more difficult or costly for the Company to originate or otherwise acquire additional small business loans, or for the Company to collect payments on the small business loans. Such changes could subject the Company to additional licensing, registration and other legal or regulatory requirements in the future or otherwise that could, individually or in the aggregate, adversely affect the Company’s ability to conduct its business.

We are also subject to various international laws, licensing or authorization requirements in connection with the products or services we offer in Brazil. Compliance with applicable laws, regulations, rules and guidance requires forms, processes, procedures, training, controls and the infrastructure to support these requirements. Compliance may also create operational constraints, be costly or adversely affect operating results. See “Business—Regulation” of Part I, Item 1 of this report for further discussion of the laws applicable to us.