SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 31 , 2021

or

For the transition period from ___________ to ___________

Commission File Number 001-40321

(Exact Name of Registrant as Specified in its Charter)

| State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. | ||||||||||

| Address of Principal Executive Offices | Zip Code | ||||||||||

(877 ) 725-5264

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Smaller reporting company | |||||||||

Accelerated filer | ☐ | Emerging growth company | |||||||||

☒ | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The NASDAQ Stock Market on June 30, 2021, was $972.7 million.

The number of shares of registrant’s common stock outstanding as of February 18, 2022 was 90,221,109 .

DOCUMENTS INCORPORATED BY REFERENCE

| TABLE OF CONTENTS | ||||||||

| Page | ||||||||

Item 15. | Exhibit and Financial Statement Schedules. | |||||||

PART I

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements that are based on our management's beliefs and assumptions and on information currently available to our management. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). You can identify these statements by words such as "anticipates," "believes," "can," "continue," "could," "estimates," "expects," "intends," "may," "plans," "seeks," "should," "will," "strategy," "future," "likely," or "would" or the negative of these terms or similar expressions. These statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control including the recent COVID-19 pandemic and the associated effort to limit its spread. All of our forward-looking statements are subject to risks and uncertainties that may cause our actual results to differ materially from our expectations. Factors that may cause such differences include, but are not limited to, the risks described under "Risk Factors" in this Annual Report on Form 10-K and those discussed in other documents we file with the Securities and Exchange Commission, or the SEC.

Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management's beliefs and assumptions only as of the date of this Annual Report on Form 10-K. You should read this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

3

Item 1. Business.

Overview

Alkami is a cloud-based digital banking solutions provider. We inspire and empower community, regional and super-regional financial institutions (“FIs”) to compete with large, technologically advanced and well-resourced banks in the United States. Our solution, the Alkami Platform, allows FIs to onboard and engage new users, accelerate revenues and meaningfully improve operational efficiency, all with the support of a proprietary, true cloud-based, multi-tenant architecture. We cultivate deep relationships with our clients through long-term, subscription-based contractual arrangements, aligning our growth with our clients’ success and generating an attractive unit economic model.

We founded Alkami to help level the playing field for FIs. Our vision was to create a platform that combined premium technology and fintech solutions in one integrated ecosystem, delivered as a SaaS solution and providing our clients’ customers with a single point of access to all things digital. We invested significant resources to build a technology stack that prioritized innovation velocity and speed-to-market given the importance of product depth and functionality in winning and retaining clients. In October 2020, we acquired ACH Alert, LLC (“ACH Alert”) to pursue adjacent product opportunities, such as fraud prevention and to expand our addressable market. In addition, in September 2021, we acquired MK Decisioning Systems, LLC (“MK”) a technology platform for digital account opening, credit card and loan origination solutions.

Our domain expertise in retail and business banking has enabled us to develop a suite of products tailored to address key challenges faced by FIs. The key differentiators of the Alkami Platform include:

•User experience: Personalized and seamless digital experience across user interaction points, including desktop, mobile, chat and SMS, establishing durable connections between FIs and their customers.

•Integrations: Scalability and extensibility driven by 230 real-time integrations to back office systems and third-party fintech solutions as of December 31, 2021, including core systems, payment cards, mortgages, bill pay, electronic documents, money movement, personal financial management and account opening.

•Deep data capabilities: Data synchronized and stored from back office systems and third-party fintech solutions and synthesized into meaningful insights, targeted content and other areas of monetization.

The Alkami Platform offers an end-to-end set of digital banking software products. Our typical relationship with an FI begins with a set of core functional components, which can extend over time to include a rounded suite of products across account opening and loan origination, card experience, client service, extensibility, financial wellness, security and fraud protection, marketing and analytics and money movement. Due to our architecture, adding products through our single code base is fast, simple and cost-effective, and we expect product penetration to continue to increase as we broaden our product suite. As of December 31, 2021, our client base, on average, used 10 of our 30 offered products. Our 2021 client cohort, however, has contracted for 16 of our offered products, on average.

Our target clients vary in size, generally ranging from approximately $500 million to $100 billion in assets and from approximately 10,000 to 2 million digital banking users. We had 177, 151 and 118 FIs as Alkami Platform clients as of December 31, 2021, 2020, and 2019, respectively.

We primarily go to market through an internal sales force. Given the long-term nature of our contracts, a typical sales cycle can range from approximately three to 12 months, with the subsequent implementation timeframe generally ranging from six to 12 months depending on the depth of integration.

We derive our revenues almost entirely from multi-year contracts for the Alkami platform that had an average contract life since inception of 70 months as of December 31, 2021. We predominantly employ a per-registered-user pricing model, with incremental fees above certain contractual client minimum commitments for each licensed solution. Our pricing is tiered, with per-registered-user discounts applied as clients achieve higher levels of customer penetration, incentivizing our clients to internally market and promote digital engagement. Our ability to grow revenues through deeper client customer penetration and cross-sell allowed us to deliver a net dollar revenue retention rate of 115% as of December 31, 2021, 117% as of December 31, 2020, and 114% as of December 31, 2019.

To support our growth and capitalize on our market opportunity, we have increased our operating expenses across all aspects of our business. In research and development, we continue to focus on innovation and bringing novel capabilities to our platform, extending our product depth. Similarly, we continue to expand our sales and marketing organization focusing on new client wins, cross-selling opportunities and client renewals.

We had 12.4 million, 9.7 million, and 7.2 million live registered users as of December 31, 2021, 2020, and 2019, respectively, representing a growth rate for one of our key revenue drivers of 27.6% from 2020 to 2021 and 34.9% from 2019 to 2020. Our total revenues were $152.2 million, $112.1 million, and $73.5 million for 2021, 2020, and 2019, representing growth rates of 35.7% from 2020 to 2021 and 52.5% from 2019 to 2020. SaaS subscription services, as further described below, represented 94.4%, 93.7%, and 91.5% of total revenues for 2021, 2020, and 2019. We incurred net losses of $46.8 million, $51.4 million, and $41.9 million for 2021, 2020, and 2019, respectively, largely on the basis of significant continued investment in sales, marketing, product development and post-sales client activities. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for more information.

4

Our Industry

The United States banking industry is massive, with $24 trillion in assets on the balance sheets of over 10,000 FIs as of December 31, 2020, according to call report data published by the Federal Financial Institutions Examinations Council (“FFIEC”) and the National Credit Union Administration (“NCUA”). These FIs range from megabanks, which collectively held approximately $9 trillion, or 37% of FI assets in the United States, as of December 31, 2020 to significantly smaller local community banks and affinity credit unions. The United States banking industry generated over $1.2 trillion in revenues in 2020, according to S&P Global Market Intelligence, highlighting a significant market opportunity that drives intense competition and a magnitude of economic importance which requires considerable regulation, both locally and nationally.

However, banking is not a static industry, and over the last several decades technology has emerged as a differentiating factor among FIs, driving market share gains, operational efficiencies and improved regulatory compliance. While technology is involved in almost every function a bank performs, we typically see FIs’ technology spend increase in response to, or in preparation for, the following trends:

•Heightened user expectations: The digitization of everything from taxis, to food delivery, to commerce has conditioned consumers and businesses to maintain heightened user experience expectations that extend to financial services, particularly when it relates to everyday financial services such as banking services. Previously inconceivable, account opening, loan origination (and disbursement) and money transfers can now be executed within a matter of minutes, elevating digital user experience beyond branch location as the premier point of differentiation for our clients’ customers’ service and satisfaction.

•Increasingly digital competitive landscape: The competitive landscape within banking in the United States and globally is shifting. On one hand, the megabanks continue to invest substantially in absolute terms to provide technology services to U.S. banking customers. On the other hand, a fragmented and emerging group of technology platforms and challenger banks are redefining what it means to be a bank, embedding basic banking services, such as checking accounts, within elegant user experiences and attracting tens of millions of registered users, all without a single physical branch. Each market trend is accelerating with the disappearance of geographical boundaries. As banking digitizes, the importance of a physical footprint and local presence is reduced, introducing regional and national competition to even the most insulated local markets.

•Regulatory environment: Banking regulation is continuously evolving and it is the responsibility of FIs to create an internal control environment capable of ensuring compliance with a framework of local, national and international rules. Emerging technologies are increasingly built to perform routinized tasks associated with this function, freeing up resources to be reinvested in growth.

•Importance of efficiency: The recent low interest rate environment, which began as a monetary stimulus measure during the 2008–2009 global financial crisis, has put immense pressure on FI earnings, notably interest income spreads that FIs earn between taking deposits and providing loans. This has forced FIs to seek additional revenue streams, often in the form of fee income from payments processing and other non-credit products. This has also forced FIs to seek opportunities to streamline operations, in many cases automating historically manual and labor-intensive tasks with the benefit of process improvement at a markedly lower cost.

The heightened focus on technology and security in addressing the evolution of the banking industry has driven massive spend. While technology spend in banking is distributed across functions, we believe the following technology trends to be most impactful to the industry:

•Shift to mobile: Mobile is quickly redefining both retail and business banking. Today, a consumer or business can open a bank account almost instantly and take out a loan or transfer money from a mobile device. These rapid advances are contributing to a substantial decline in bank physical branch traffic and a shift to digital banking platforms like Alkami’s as an FI’s primary channel of customer interaction.

•Shift to the cloud: Today, many of the pillars serving as key differentiators across industries, including banking, stem from the benefits of cloud hosting and computing. Cloud-based, multi-tenant infrastructures that are securely delivered enable technology providers to broadly distribute capabilities historically reserved only for the best resourced. Premier technology architectures can also leverage data that can be collected into a warehouse and quickly synthesized for consumption by clients in the service of their customers. Finally, single-, low- and no-code architectures allow near same-day adaptability to evolving consumer needs or economic challenges.

•Proliferation of powerful, best-of-breed technology solutions: Advances and investment in financial technology have led to a disaggregated network of point solutions designed to improve upon discrete tasks historically executed through a single vendor, enabling FIs to select the products that best fit their objectives, scale and budget. This proliferation of powerful technology solutions has served to reduce barriers to entry for providers of point solutions, encouraging innovation and underscoring the value of integration layers.

•Increasing complexity of banking information technology architectures: Due to the proliferation of financial-related products and technology solutions, the information technology taxonomy of FIs is becoming increasingly complex. Integration challenges of the past required connections to a small number of back office systems and point solutions. Today, connections are required to dozens of third parties and many core and back office systems. This complexity is magnified with many of the point solutions and core systems operating as single tenant models. Integrating user experiences across desktop, mobile and SMS platforms with proliferating point solutions and a myriad of core and back office systems is overly burdensome to most FIs. Consequently, the industry highly values platforms that mitigate much of this complexity with modern architectures that enable real-time integrations to all constituents of the digital banking ecosystem.

•Focus on security: The increasingly interconnected and digital nature of finance renders FIs particularly vulnerable to cybersecurity attacks given the attractive nature of FIs as protectors of both capital and personal information. The modern bank robber is armed with no more than a computer and can attack from anywhere in the world, and consequently, FIs are constantly under threat. For this reason, FIs are making substantial technology investments in cybersecurity and security more broadly.

5

FIs take varying approaches to technological evolution, partially driven by philosophy, but predominantly driven by resources that are available to them. The largest FIs have the financial flexibility to make significant investments; the four largest banks based on asset size, as reported by S&P Global Market Intelligence, in the United States spent a combined $26 billion on technology in 2020, reflecting their commitment to protect and extend leadership through technology.

The vast majority of remaining FIs do not have the financial resources to match the technology advantage of megabanks. However, these FIs also have no choice but to keep up with the general pace of innovation given the alternative of losing market share to these large competitors, reinforcing the critical nature of third-party digital platforms in helping them overcome the limitations of finite discretionary budgets and resources. This is the essence of our value proposition and market opportunity.

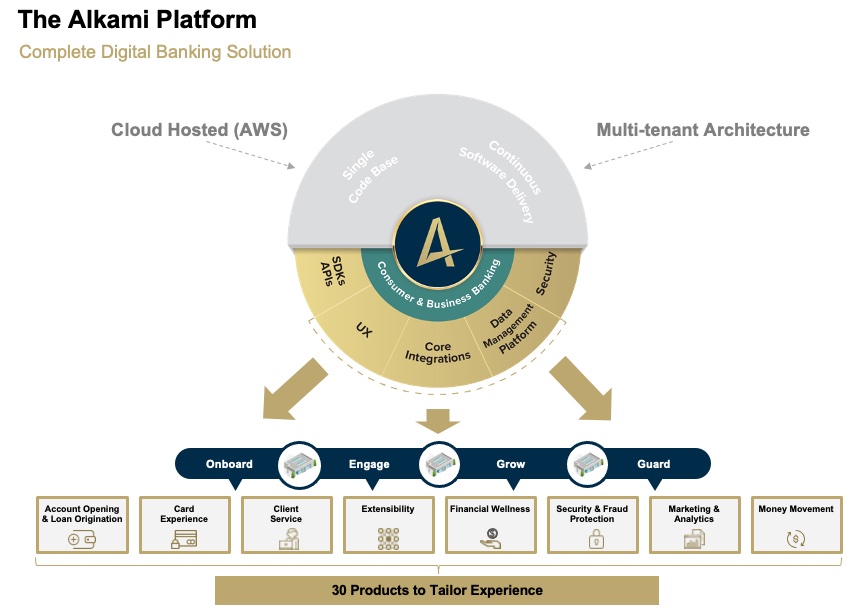

Our Platform and Ecosystem

The Alkami Platform is a multi-tenant, single code base, continuous delivery platform powered by a true cloud infrastructure. Our platform integrates with core system providers and other third-party fintech providers, and acts as the primary interaction point among consumers, businesses and FIs. The primary benefit of this model is to reduce the inefficiencies of traditional point-to-point integration strategies, instead offering a single point of integration allowing our clients’ customers to navigate seamlessly across channels. We believe this is critical to FIs as their models shift from physical to digital, enabling the creation of a digital community in the image of their broader brands and aligned with their strategic objectives.

The Alkami Platform maintains 230 integrations to more than 1,000 endpoints, as of December 31, 2021. Our third-party partnerships and integrations are a crucial element of the Alkami Platform, enabling FIs to choose from, and connect with, a broad array of third-party service providers essential to the curation of a customized digital experience. This depth of product configurability and optionality is made possible by the software adapters we have built to standardize access to solutions offered by third-party vendors.

The Alkami Value Proposition

We have grown rapidly since 2009 by understanding our clients’ objectives and pain points, including adding nearly 5.2 million live registered users from December 31, 2019 to December 31, 2021. We have designed our solutions to improve our clients’ ability to achieve their core objectives, including new client growth, customer engagement, increasing and holding deposits, making loans, facilitating money movement and lowering overall operating costs. Importantly, we make our clients more competitive against the megabanks, challenger banks and other technology-enabled competitors.

The technology that powers our platform is foundational to our success and ability to deliver a distinct value proposition to our clients, characterized by the following:

•Premier user experience: The Alkami Platform enables our clients to leverage technology to deliver a premier user experience. The experience we build, and that our clients deliver, is validated by our clients’ market-leading app ratings, which are, on average, higher than each of our main competitors and reflect the level of customer satisfaction associated with leading technology brands.

•Versatile platform: Our product breadth, depth of integrations, partner network and configurability enable our clients to more precisely match our products to suit the objectives of their digital offering. For our clients, this allows a degree of flexibility that is critical to their pursuit of differentiation without the technical burden and higher cost of custom software. For our business, this approach is tremendously scalable, enabling us to serve larger and smaller institutions alike from a single platform, with a full product suite across both retail and business banking operations.

•Velocity of innovation: Our ability to win and retain clients is a function of consistently striving to offer a platform with products and configurations that exceeds those of our competition. Our multi-tenant architecture, combined with continuous delivery, allows us to implement new and existing features in lockstep with our clients’ evolving needs. Our technological infrastructure provides a speed-to-market advantage which often allows us to remain a step ahead of competitors who operate single-tenant or other legacy architecture.

•Fraud mitigation: Our clients seek to achieve a balance between convenience and safety that is required in a digital banking solution. Biometric and multi-factor authentication, combined with machine learning wrapped in a leading user experience, creates a more secure user experience. Platform security capabilities such as card management and true real-time alerts further help to mitigate fraud and develop a relationship of trust between our clients and their customers.

The Alkami Platform delivers tangible results to clients, including increased registered user growth, increased product usage, operational efficiencies and customer retention.

Our Growth Strategies

We intend to continue to invest to grow our business and expand our addressable market by applying the following strategies:

•Deepen existing client relationships: We expect to continue to deepen our existing client relationships, increasing both the number of registered users and the number of products per client:

◦Cross-sell: We continue to broaden our product set to address the needs of our client base. We offered nine products when we

6

launched Alkami Business Banking in 2015, and as of December 31, 2021, 30 products were available through the Alkami Platform and our clients had purchased an average of ten products from us. We expect cross-sell to continue to contribute meaningfully to our growth.

◦Customer penetration: While we recently achieved nearly 12.4 million live registered digital banking users (“registered users”), we estimate this only represents 72% of our clients’ total customers as of December 31, 2021. We believe we have a substantial opportunity to grow our registered user base within our existing clients as we continue to enhance our value proposition and more consumers adopt digital banking solutions.

•Win new clients: We believe the market remains underserved by legacy solutions, which will allow us to continue to gain market share. We are increasingly winning FIs with more sophisticated needs as we grow our market presence and product capabilities. As compared to the 2019 client cohort, our 2021 client cohort, on average, has more registered users, has longer contract lengths and utilizes more products.

•Broaden and enhance product suite: We intend to invest to continue to enhance our product suite. In 2021 and 2020, we spent 32.1% and 35.9%, respectively, of revenues on research and development, underlining our commitment to ongoing innovation. This includes maintaining awareness of the evolving needs of our clients and designing products accordingly, both on a proprietary basis and in collaboration with our platform partner network.

•Select acquisitions: We intend to selectively pursue acquisitions and other strategic transactions that accelerate our strategic objectives. Our acquisition of ACH Alert, which was completed in October 2020, brought an additional fraud prevention tool to our product suite while also providing access to an additional 95 clients that were either live or under contract with ACH Alert at the time of the acquisition. In September 2021, we acquired MK Decisioning Systems, LLC (“MK”), an early-stage technology platform for digital deposit account opening, credit card and loan origination solutions, which added deeper digital account opening and loan origination capabilities to our platform while also providing access to an additional 25 live clients at the time of the acquisition.

Our Solution

The Alkami Platform provides FIs with a complete digital banking solution designed to facilitate and meet the needs of both retail and business users. We deliver our platform through a purpose-built, true cloud SaaS solution, enabling our clients to avoid costly and disruptive system-wide maintenance windows as well as testing projects during upgrades, which is typical of single-tenant platform solutions that are currently prevalent in large parts of the industry.

Our clients choose the Alkami Platform to:

•Onboard new registered users efficiently.

•Engage registered users with self-service functions, proactive alerting and financial insights.

•Grow revenues and registered users through new product and service offerings.

•Guard registered user data and interactions to mitigate fraud.

7

We deliver this value proposition through the following eight product categories, encompassing 30 products and 230 integrations as of December 31, 2021:

•Account Opening & Loan Origination: Allows our clients’ customers to create and manage deposit accounts, including checking, savings, CD and Money Market accounts. This offering enhances many of our clients’ digital platforms and gives them the opportunity to digitize and replace many of the processes which formerly required a physical branch visit. We recently enhanced this product category through our acquisition of MK in the third quarter of 2021, which added the ability to offer new customer account opening for deposit accounts as well as loan origination for personal and business credit cards and personal loans.

•Card Experience: Includes features that allow for cardholder alerts and control preferences as well as card account maintenance features for self-service.

•Client Service: Includes a suite of products digitizing and streamlining communications around largely administrative functions. Products range from basic SMS and push notification capabilities to digital authentication and chat and conversational tools, both digitally as well as by human interaction.

•Extensibility: Allows for platform extension without sacrificing continuous integration and delivery of the underlying Alkami Platform. This includes our SDK and application program interfaces (“APIs”).

•Financial Wellness: Aggregates and synthesizes information that client customers need in order to make informed financial decisions. This includes basic account aggregation, credit score monitoring, transaction data enrichment and access to third-party financial management products. Users are able to make healthier financial decisions, while our FIs gain valuable insights, enabling them to drive targeted marketing and product origination.

•Security & Fraud Protection: Includes risk-based multi-factor authentication and suspicious transaction monitoring as well as multi-channel payment fraud prevention and information reporting tools. We recently enhanced this product category through our acquisition of ACH Alert in the fourth quarter of 2020.

•Marketing & Analytics: Enables our clients to build internal analytical tools and enables clients to deliver tailored, relevant and timely

8

content via targeted marketing campaigns and educational outreaches to their customers.

•Money Movement: Includes fully integrated money movement tools to increase deposits and drive consistent user engagement. While most competitors currently provide third-party products via an intrusive, off-brand, sign-on screen, the Alkami Platform seamlessly integrates third-party services into a consistent digital banking experience that is portable across multiple user interfaces.

Our Technology and Architecture

Our platform is true cloud and entirely hosted and delivered on AWS. The benefits of this infrastructure include resiliency, reliability and increased security; we achieved an average of 99.94% uptime in the year ended December 31, 2021. True cloud infrastructure is also remarkably scalable, allowing us to pursue our growth objectives without technological limitation.

Our technology is predominantly differentiated by the speed-to-market with which we can deliver innovation on the back of a true cloud infrastructure with the combination of the following architectural pillars:

•Multi-Tenant Architecture: We built our platform from the ground up as multi-tenant. This enables our clients to share in economies of scale enjoyed by large FIs, optimizing for speed, efficiency, reliability and increased security. Importantly, this model also enables us to avoid a growth tax, or additional resource burdens arising from high growth upon a single-tenant platform. New clients can be efficiently on-boarded, new client customers can be seamlessly added and product upgrades and updates can be delivered quickly.

•Single Code Base: Our single code base is built upon a microservices architecture that leverages our multi-tenant model, compounding the efficiency of our infrastructure and software development lifecycle, regardless of the size, structure or complexity of the client. By maintaining a single code base, we are able to quickly and continuously deploy new code to our entire client base, supporting many platform releases per year. With a microservices architecture, we can support zero-downtime deployments, reduced testing complexity, automation and extensibility.

•Continuous Delivery Model: The combination of a multi-tenant architecture and single code base is made more powerful when combined with continuous software delivery, enabling us to update our entire client base at frequent intervals. This speed and execution enables our clients to confidently grow and compete with many of the most technologically advanced FIs in the world.

We synchronize, typically in real-time, the systems and modules into which we integrate while also accumulating a data warehouse that can be synthesized into actionable insights and business intelligence. FIs need access to accurate and complete data. These timely insights extend across administration, marketing and strategy, informing decision-making for FIs and increasing user stickiness. For instance, our clients can identify users with a credit card or loan from another FI and market targeted, competing products to these users. This granular level of insight allows Alkami clients to digitally and systematically drive growth through smarter marketing and forecasting.

The vast majority of our technology is invisible to our clients’ customers; however, our premier user experience delivered in partnership with our clients is highly visible. This includes an ease of use and seamlessness that begins with on-boarding, and extends through general usage, such as balance inquiries, moving money, monitoring credit, managing cards and executing transactions such as deposits, loans and payments. Across our clients’ customer base, the average registered user logged onto the digital application three to four times per week, in 2021, providing our clients more opportunities to engage with their customers than a physical branch-based relationship, further highlighting the motivation for our clients to promote client customer digital adoption.

Our security infrastructure combines security and services from AWS with our own security protocols and integrations. This includes network traffic inspection, endpoint detection and response and automated patching and encryption of data, both at rest and in transit. In a world where our clients receive hundreds of millions of access requests per month from unverified sources, our security infrastructure is a key element of our value proposition, particularly against new entrants.

While our products and solutions are highly configurable, in certain instances our clients will request custom development and other professional services which we provide. These are generally one-time in nature and involve unique, non-standard features, functions or integrations that are not as broadly desired across our client base.

Our Clients

As of December 31, 2021, we served 325 clients, of which 177 are FI clients of the Alkami Platform, including community, regional and super-regional credit unions and banks across both retail and business banking. Our original product suite was retail focused. As we enhanced our product suite to include greater depth of functionality for business banking in particular, we significantly expanded our addressable market as FIs increasingly seek a single digital banking platform for all their retail and business banking needs.

Our target client base includes the top 2,000 FIs by assets, with the exception of the megabanks. We focus on this subsection of the broader market because we view this base as offering the greatest potential lifetime value, considering the cost and resources to acquire and service the relationship. Unlike the long tail of very small institutions, this target client base is also far more likely to grow organically and through acquisition.

Our typical FI relationship begins with a subset of the Alkami Platform as part of a SaaS subscription contract, and we had an average contract life since our inception of approximately 70 months as of December 31, 2021. Over the course of a client relationship, we seek to expand the number of products our clients embed within their digital experience as well as the digital penetration of the clients’ customer base.

9

No single client represented more than 5% of our total revenues in the year ended December 31, 2021.

Sales and Marketing

Our sales team includes representatives focused on new platform sales, a cross-sell team and client success managers. This team is responsible for outbound lead generation, driving new business and helping to manage account relationships and renewals, further driving adoption of our solution within and across lines of business. These teams maintain close relationships with existing clients and act as advisors to each FI to help identify and understand their unique needs, challenges, goals and opportunities.

In 2019, we created a dedicated team for driving additional adoption of products within existing clients. In addition to identifying opportunities to extend our relationship with clients within the current product suite, this cross-sell team is also responsible for identifying and addressing pain points with our existing solution and sourcing new ideas for additional product capabilities, whether developed internally or through partnership. Cross-sell contributed 23.9% of total contract value (“TCV”) in 2021, compared to 17.0% in 2020, highlighting our significant continued opportunity to grow within our existing client base.

Our client success team is responsible for nurturing relationships holistically throughout the duration of the contract, ensuring that we understand their needs in real time and that our clients are deriving maximum value from the Alkami Platform. Importantly, this team supports retention and deepens the relationship with the client, providing us with the best opportunity to renew clients upon contract expiration, often coupled with an extension of the relationship to additional products.

Our marketing team oversees all aspects of the Alkami brand including public relations, digital marketing, social media, product marketing, graphic design, conferences and events. Our marketing efforts are focused on promoting direct sales, inbound lead generation and brand building. We leverage online and offline marketing channels through digital marketing, account-based marketing, social media, and events, among other tactics.

Intellectual Property

We rely on a combination of patent, trademark, trade secrets and copyright laws, as well as confidentiality procedures and contractual restrictions, to establish, maintain and protect our proprietary rights. Despite substantial investment in research and development activities, we have not focused on patents and patent applications historically. In addition to the intellectual property that we own, we license certain third-party technologies and intellectual property, which are integrated into some of our solutions.

The efforts we have taken to protect our intellectual property rights may not be sufficient or effective. It may be possible for other parties to copy or otherwise obtain and use the content of our solutions or other technology without authorization. Failure to protect our intellectual property or proprietary rights adequately could significantly harm our competitive position and business, financial condition and results of operations. See “Risk Factors—Risks Relating to Our Intellectual Property, Software and Third-Party Licenses—Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products, services and brand.”

In addition, third parties may initiate litigation against us alleging infringement, misappropriation or other violation of their proprietary rights or declaring their non-infringement of our intellectual property rights. Companies in the internet and technology industries, and other patent and trademark holders seeking to profit from royalties in connection with grants of licenses, own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. We have received in the past, and may in the future, receive notices that claim we have misappropriated or misused other parties’ intellectual property rights. There may be intellectual property rights held by others, including issued or pending patents and trademarks that cover significant aspects of our solutions. Any intellectual property claim against us, regardless of merit, could be time consuming and expensive to settle or litigate and could divert our management’s attention and other resources. These claims could also subject us to significant liability for damages and could result in our having to stop using solutions found to be in violation of another party’s rights. We might be required or may opt to seek a license for rights to intellectual property held by others, which may not be available on commercially reasonable terms, or at all. Even if a license is available, we could be required to pay significant royalties, which would increase our operating expenses. We may also be required to develop alternative non-infringing solutions, which could require significant effort and expense and which we may not be able to perform efficiently or at all. If we cannot license the intellectual property at issue or develop non-infringing solutions for any allegedly infringing aspect of our business, we may be unable to compete effectively. See “Risk Factors—Risks Relating to Our Intellectual Property, Software and Third-Party Licenses—Claims by others that we infringe, misappropriate or otherwise violate their proprietary technology or other rights could have a material and adverse effect on our business, financial condition and results of operations.”

Our Competition

The market for digital solutions for financial services providers is highly competitive. We compete with new and established point solution vendors and core processing vendors, as well as internally developed solutions. We believe that the comprehensive integration among our solution offerings and our clients’ internal and third-party systems, combined with our deep industry expertise, including our domain expertise in retail and business banking, reputation for consistent, high-quality client support, pace at which we bring innovation to market, and unified cloud-based digital banking and SaaS solutions distinguish us from the competition.

With respect to our digital banking platform, we compete against a number of companies, including NCR Corporation, Q2 Holdings, Inc. and Temenos AG in the online, consumer and small business banking space. We also compete with core processing vendors that also provide digital banking solutions such as Fiserv, Inc., Jack Henry and Associates, Inc. and Fidelity National Information Services, Inc.

10

Many of our competitors have significantly more financial, technical, marketing and other resources than we have, may devote greater resources to the promotion, sale and support of their systems than we can, have more extensive client bases and broader client relationships than we have and have longer operating histories and greater name recognition than we have. In addition, many of our competitors spend more funds on research and development.

Although we compete with digital banking vendors and core processing vendors, we also partner with some of these vendors for certain data and services utilized in our solutions and receive referrals from them. In addition, certain of our clients have or can obtain the ability to create their own in-house systems, and while many of these systems have difficulties scaling and providing an integrated platform, we still face challenges displacing in-house systems and retaining clients that choose to develop an in-house system.

We believe the principal competitive factors for our solutions in the financial services markets we serve include the following:

•alignment with the missions of our clients;

•ability to provide a single platform for our clients’ consumer and commercial customers;

•full-feature functionality across digital channels;

•ability to integrate targeted offers for client customers across digital channels;

•ability to support FIs in acquiring deposits with open API technologies;

•SaaS delivery and pricing model;

•ability to support both internal and external developers to quickly integrate with third-party applications and systems utilizing a software development kit;

•design of the client customer experience, including modern, intuitive and touch-centric features;

•configurability and branding capabilities for clients;

•familiarity of workflows and terminology and feature-on-demand functionality;

•integrated multi-layered security and compliance of solutions with regulatory requirements;

•quality of implementation, integration and support services;

•domain expertise and innovation in financial services technology;

•price of solutions;

•ability to innovate and respond to client needs rapidly; and

•rate of development, deployment and enhancement of solutions.

We believe that we compete favorably with respect to these factors within the markets we serve, but we expect competition to continue and increase as existing competitors continue to evolve their offerings and as new companies enter our market. To remain competitive, we believe we must continue to invest in research and development, sales and marketing, client support and our business operations generally.

Human Capital Resources

As of December 31, 2021, we had 667 employees. We consider our current relationship with our employees to be good. None of our employees are represented by a labor union or are a party to a collective bargaining agreement.

Since our inception, our culture has been distinguished by how we think, act and interact, and is foundational to fulfilling our mission and vision. Our culture is expressed by our six Essential Culture Compounds: Optimistic Perseverance, Courageous Innovation, Caring Collaboration, Transparent Communication, Trusted Accountability and Real Fun!

We regularly conduct employee surveys to better understand the level of employee engagement and the effectiveness of our programs and initiatives. We believe the review of this feedback has served to help us promote and improve our culture across our organization and has led us to create, implement or enhance a host of programs and initiatives:

•embracing remote work and enabling our employees to do their best work from anywhere in the United States allowing them to balance their work obligations with their personal lives;

•learning and development programs that are designed to invest in the professional growth and continuous learning of employees and to cultivate leadership talent;

•performance feedback and talent review programs designed to assess and identify areas for continued learning and training opportunities for employees and a succession bench for critical roles;

•wellness, benefits and flexible time-off programs designed to assist employees and their families with maintaining physical and emotional wellbeing, while balancing the demands of being part of a high-growth company;

•internship and cohort programs that seek to identify and attract diverse talent and offer opportunities for professional learning and potential future employment opportunities with Alkami;

•employee committees focused on embracing our culture, diversity and inclusion; and

•charitable causes to help create opportunities for employees to join together to make a difference in the workplace and local communities.

We have received third-party recognition for our employee engagement. In 2021, for instance, we were recognized as a "Best Place to Work in Financial Technology," "Best and Brightest Companies to Work For in Dallas" and a "Best and Brightest Companies to Work For in the Nation" by the Best and Brightest Companies to Work For program.

11

Government Regulation

We are a technology service provider to FIs in the United States that are subject to regulation, supervision and examination by a number of regulatory agencies, including the Office of the Comptroller of the Currency (the “OCC”), the NCUA, the Board of Governors of the Federal Reserve System (the “Federal Reserve”), the Federal Deposit Insurance Corporation (the “FDIC”) and other federal or state agencies that regulate or supervise FIs in the United States.

We may be subject to periodic examination by banking regulators under federal, state and other laws that apply to us as a result of the services we provide to FIs and other entities they regulate. In particular, under the Bank Service Company Act, the OCC, the Federal Reserve and the FDIC have, as part of their safety and soundness mandate, statutory authority to supervise third-party service providers, like us, that enter into outsourcing agreements with FIs under their respective jurisdictions. In addition, while we are not currently under examination by the FFIEC, a formal interagency body empowered to prescribe uniform principles, standards and report forms for the examination of FIs, to make recommendations to promote uniformity in the supervision of FIs and to directly administer, coordinate, oversee and implement a supervisory program, known as the Multi-Regional Data Processing Services program, for the supervision and examination of the largest, systemically important third-party service providers to FIs, it is possible that we may become subject to FFIEC examination at some point in the future. FFIEC examinations of service providers to FIs may occur on a rotating basis and cover a wide variety of subjects, including management, acquisition and development activities, support and delivery, cybersecurity, information technology (“IT”) audits and our disaster preparedness and business recovery planning. The federal banking regulators that make up the FFIEC have broad supervisory authority to remedy any shortcomings identified in an examination and, following any examination of us by the FFIEC, our FI clients may request an executive summary of the examination through their lead examination agency.

We are also currently registered as a credit union service organization (“CUSO”), although our status as a CUSO may be subject to change in the future. As a CUSO, while we are not regulated by the NCUA, we are subject to disclosure, annual reporting and other requirements imposed by the NCUA.

In addition, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) granted the Consumer Financial Protection Bureau (the “CFPB”) authority to promulgate rules and interpret certain federal consumer financial protection laws, some of which apply to the solutions we offer to our clients. In certain circumstances, the CFPB also has examination and supervision powers with respect to service providers who provide a material service to an FI offering consumer financial products and services.

Our clients and prospects are subject to extensive and complex regulations and oversight by federal, state and other regulatory authorities. These laws and regulations are constantly evolving, increasing in number and affect the conduct of our clients’ operations and, as a result, our business. Our solutions must enable our clients to comply with applicable legal and regulatory requirements, including, without limitation, those under the following laws and regulations:

•the Dodd-Frank Act;

•the Electronic Funds Transfer Act and Regulation E;

•the Electronic Signatures in Global and National Commerce Act;

•usury laws;

•the Gramm-Leach-Bliley Act;

•the Fair Credit Reporting Act;

•laws and regulations against unfair, deceptive or abusive acts or practices;

•the California Consumer Privacy Act of 2018 (“CCPA”), the California Privacy Rights Act (“CPRA”) and other federal, state and international data privacy, security and protection laws and regulations;

•the Privacy of Consumer Financial Information regulations;

•the Bank Secrecy Act and the USA PATRIOT Act of 2001;

•the FFIEC IT Handbook and related booklets, statements and guidance, including the Guidance on Supervision of Technology Services Providers and the Guidance on Outsourcing Technology Services promulgated by the FFIEC;

•the OCC’s “Third-Party Relationships: Risk Management Guidance”;

•the NCUA’s Guidelines for Safekeeping of Member Information;

•the Federal Credit Union Act; and

•other federal, state and international laws and regulations.

The compliance of our solutions with these requirements depends on a variety of factors, including the functionality and design of our solutions, the classification of our clients, and the manner in which our clients and their customers utilize our solutions. In order to comply with our obligations under these laws, we are required to implement operating policies and procedures to protect the privacy and security of our clients’ and their customers’ information and to undergo periodic audits and examinations.

Privacy and Information Safeguard Laws

In the ordinary course of our business, we and our clients using our solutions access, collect, store, use transmit and otherwise process certain types of data, including personal information (“PI”), which subjects us and our clients to certain privacy and information security laws in the United States and internationally, including, for example, the CCPA, the CPRA and other state privacy regulations, and other laws, rules and regulations designed to regulate consumer information and data privacy, security and protection, and mitigate identity theft. These laws impose obligations with respect to the collection, processing, storage, disposal, use, transfer, retention and disclosure of PI, and require that financial services providers have in place policies regarding information privacy and security. In addition, under certain of these laws, we must provide notice to

12

consumers of our policies and practices for sharing PI with third parties, provide advance notice of any changes to our policies and, with limited exceptions, give consumers the right to prevent use of their PI and disclosure of it to third parties. Further, all 50 states and the District of Columbia have adopted data breach notification laws that impose, in varying degrees, an obligation to notify affected individuals in the event of a data or security breach or compromise, including when their PI has or may have been accessed by an unauthorized person. These laws may also require us to notify relevant law enforcement, regulators or consumer reporting agencies in the event of a data breach. Some laws may also impose physical and electronic security requirements regarding the safeguarding of PI. In order to comply with the privacy and information security laws, we have confidentiality and information security standards and procedures in place for our business activities and our third-party vendors and service providers. Privacy and information security laws evolve regularly, and complying with these various laws, rules, regulations and standards, and with any new laws or regulations or changes to existing laws, could cause us to incur substantial costs that are likely to increase over time, requiring us to adjust our compliance program on an ongoing basis and presenting compliance challenges, change our business practices in a manner adverse to our business, divert resources from other initiatives and projects, and restrict the way products and services involving data are offered. See “Risk Factors—Risks Relating to Cybersecurity or Data Privacy—Privacy and data security concerns, data collection and transfer restrictions, contractual obligations and U.S. and foreign laws, regulations and industry standards related to data privacy, security and protection could limit the use and adoption of the Alkami Platform and materially and adversely affect our business, financial condition and results of operations.”

Available Information

Our website address is www.alkami.com. We make available, free of charge through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to these reports, as soon as reasonably practicable after filing with, or furnishing to, the Securities and Exchange Commission (“SEC”). Information contained in our website does not constitute a part of this report or our other filings with the SEC. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Item 1A. Risk Factors.

RISK FACTOR SUMMARY

Our business, prospects, financial condition, operating results and the trading price of our common stock could be materially adversely affected by a variety of risks and uncertainties, including those described below, as well as other risks not currently known to us or that are currently considered immaterial. In assessing these risks, you should also refer to the other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and related notes. Our principal risks include risks associated with:

•our ability to manage our rapid growth;

•our ability to attract new clients and retain and broaden our existing clients’ use of our solutions;

•our ability to maintain, protect and enhance our brand;

•our ability to predict the long-term rate of client subscription renewals or adoption of our solutions;

•the unpredictable and time-consuming nature of our sales cycles;

•our integration with and reliance on third-party software, content and services;

•defects, errors or performance problems associated with our solutions;

•retaining our management team and key employees and recruiting and retaining new employees;

•managing the increased complexity of our solutions and a higher volume of implementations;

•providing client support;

•mergers and acquisitions;

•intense competition in the markets we serve;

•our focus and reliance on the financial services industry as the source of our revenue;

•evolving technological requirements and changes and additions to our solution offerings;

•regulations applicable to us, our clients and our solutions;

•security breaches or other compromises of our security measures or those of third parties upon which we rely;

•increased privacy concerns and our processing and use of the personal information of end users;

•protecting our intellectual property rights and defending ourselves against claims that we are misappropriating the intellectual property rights of others;

•open-source software in our solutions;

•protecting our intellectual property rights and defending ourselves against claims that we are misappropriating the intellectual property rights of others;

•litigation or threats of litigation;

•the fluctuation of our quarterly and annual results of operations relative to our expectations and guidance;

•the way we recognize revenue, which has the effect of delaying changes in the subscriptions for our solutions from being reflected in our operating results;

•changes in financial accounting standards or practices;

•our limited operating history, our history of operating losses and our ability to use our net operating loss (“NOL”) carryforwards;

•our ability to raise sufficient capital and the resulting dilution and the terms of our credit agreements;

•stock price volatility and no intention to pay dividends;

•maintaining proper and effective internal controls;

•expenses and administrative burdens as a public company; and

•anti-takeover provisions in our charter documents and Delaware law.

13

Risks Relating to Our Business

Our business and operations have experienced rapid growth, and if we do not appropriately manage future growth, if any, or are unable to improve our systems and processes, our business, financial condition and results of operations may be adversely affected.

We have experienced rapid growth in our headcount and operations and expect to continue to experience rapid growth in the future. This growth has placed, and may continue to place, significant demands on our management and our operational and financial infrastructure. Our ability to manage our growth effectively will require us to continue to expand our operational and financial infrastructure and to continue to retain, attract, train, motivate and manage our employees. Continued growth could strain our ability to develop and improve our operational, financial and management controls, enhance our reporting systems and procedures, recruit, train and retain highly skilled personnel and maintain client and brand satisfaction.

As we expand our business and operate as a public company, we may find it difficult to maintain our corporate culture while managing our employee growth. Additionally, our productivity and the quality of our offerings may be adversely affected if we do not integrate and train our new employees quickly and effectively. Failure to manage any future growth effectively could result in increased costs, negatively affect our clients’ satisfaction with our offerings and harm our results of operations. If we fail to achieve the necessary level of efficiency in our organization as we grow, our business, financial condition and results of operations could be harmed.

Additionally, if we do not effectively manage the growth of our business and operations, the quality of our solutions could suffer, which would negatively affect our brand, operating results and overall business. We may not be able to sustain the diversity and pace of improvements to our offerings successfully or implement systems, processes and controls in an efficient or timely manner or in a manner that does not negatively affect our results of operations. Our failure to improve our systems, processes and controls, or their failure to operate in the intended manner, may result in our inability to manage the growth of our business and to forecast our revenues and expenses accurately.

If we are unable to attract new clients, continue to broaden our existing clients’ use of our solutions or develop and maintain resale agreements, our business, financial condition and results of operations could be materially and adversely affected.

To increase our revenues, we will need to continue to attract new clients and succeed in having our current clients expand the use of our solutions across their institutions. In addition, for us to maintain or improve our results of operations, it is important that our clients renew their subscriptions with us on similar or more favorable terms to us when their existing subscription term expires. Our revenue growth rates may decline or fluctuate as a result of a number of factors, including client spending levels, client dissatisfaction with our solutions, decreases in the number of client customers, changes in the type and size of our clients, pricing changes, competitive conditions, the loss of our clients to other competitors and general economic conditions. We cannot assure you that our current clients will renew or expand their use of our solutions. If we are unable to attract new clients or retain or attract new business from current clients, our business, financial condition and results of operations may be materially and adversely affected. The growth of our business also depends on our ability to develop and maintain resale agreements for third-party solutions through our digital banking platform agreements. If we are unable to develop and maintain resale agreements, our business, financial condition and results of operations may be materially and adversely affected.

Growth of our business will depend on a strong brand and any failure to maintain, protect and enhance our brand could hurt our ability to retain or expand our base of clients.

We believe that a strong brand is necessary to continue to attract and retain clients. We need to maintain, protect and enhance our brand in order to expand our base of clients. This will depend largely on the effectiveness of our marketing efforts, our ability to provide reliable services that continue to meet the needs of our clients at competitive prices, our ability to maintain our clients’ trust, our ability to continue to develop new functionality and use cases, and our ability to successfully differentiate our services and platform capabilities from competitive products and services, which we may not be able to do effectively. While we may choose to engage in a broader marketing campaign to further promote our brand, this effort may not be successful or cost effective. Our brand promotion activities may not generate customer awareness or yield increased revenues, and even if they do, any increased revenues may not offset the expenses we incur in building our brand. If we are unable to maintain or enhance client awareness in a cost-effective manner, our brand and our business, financial condition and results of operations could be materially and adversely affected.

Our corporate reputation is susceptible to damage by actions or statements made by adversaries in legal proceedings, current or former employees or clients, competitors and vendors, as well as members of the investment community and the media. There is a risk that negative information about our company, even if based on false rumor or misunderstanding, could adversely affect our business. In particular, damage to our reputation could be difficult and time-consuming to repair, could make potential or existing clients reluctant to select us for new engagements, resulting in a loss of business, and could adversely affect our employee recruitment and retention efforts. Damage to our reputation could also reduce the value and effectiveness of our brand name and could reduce investor confidence in us and materially and adversely affect our business, financial condition and results of operations.

We may not accurately predict the long-term rate of client subscription renewals or adoption of our solutions, or any resulting impact on our revenues or results of operations.

We have limited historical data with respect to rates of client subscription renewals and cannot be certain of anticipated renewal rates. Our renewal rates may decline or fluctuate as a result of a number of factors, including our clients’ satisfaction with our pricing or our solutions or their ability to continue their operations or spending levels. As we sign more contracts, we will generally have an increasing amount of contracts coming up for renewal. If our clients do not renew their subscriptions for our solutions on similar pricing terms, our revenues may decline and it could have a material and adverse effect on our business, financial condition and results of operations.

Additionally, as the markets for our solutions continue to develop, we may be unable to attract new clients based on the same subscription

14

model that we have used historically. Moreover, large or influential FI clients may demand more favorable pricing or other contract terms from us. As a result, in the past we have had, and expect to be required in the future, to change our pricing model, reduce our prices or accept other unfavorable contract terms, any of which could materially and adversely affect our business, financial condition and results of operations.

Our sales cycle can be unpredictable, time-consuming and costly, which could materially and adversely affect our business, financial condition and results of operations.

Our sales process involves educating prospective clients and existing clients about the use, technical capabilities and benefits of our solutions and typically lasts from three to 12 months or longer. Prospective clients often undertake a prolonged evaluation process, which typically involves not only our solutions, but also those of our competitors. We may spend substantial time, effort and money on our sales and marketing efforts without any assurance that our efforts will produce any sales. It is also difficult to predict the level and timing of sales opportunities that come from our referral partners. Events affecting our clients’ businesses may occur during the sales cycle that could affect the size or timing of a purchase, contributing to more unpredictability in our business and results of operations. As a result of these factors, we may face greater costs, longer sales cycles and less predictability in the future.

We leverage third-party software, content and services for use with our solutions. Performance issues, errors and defects, or failure to successfully integrate or license necessary third-party software, content or services, could cause delays, errors or failures of our solutions, increases in our expenses and reductions in our sales, which could materially and adversely affect our business, financial condition and results of operations.

We use software and content licensed from, and services provided by, a variety of third parties in connection with the operation of our solutions. This includes making our applications available through the Google Play Store and Apple’s App Store (collectively, the “App Stores”). Any performance issues, errors, bugs or defects in third-party software, content or services could result in errors or a failure of our solutions, which could materially and adversely affect our business, financial condition and results of operations. In the future, we might need to license other software, content or services to enhance our solutions and meet evolving client demands and requirements. Any limitations in our ability to use third-party software, content or services, including the App Stores, could significantly increase our expenses and otherwise result in delays, a reduction in functionality or errors or failures of our solutions until equivalent technology or content is either developed by us or, if available, identified, purchased or licensed and integrated into our solutions. In addition, third-party licenses may expose us to increased risks, including risks associated with the integration of new technology, the diversion of resources from the development of our own proprietary technology and our inability to generate revenues from new technology sufficient to offset associated acquisition and maintenance costs, all of which may increase our expenses and materially and adversely affect our business, financial condition and results of operations.

If we are unable to effectively integrate our solutions with other systems used by our clients, or if there are performance issues with such third-party systems, our solutions will not operate effectively, and our business, financial condition and results of operations could be materially and adversely affected.

The Alkami Platform integrates with other third-party systems used by our clients, including core processing systems. We do not have formal arrangements with many of these third-party providers regarding our access to their application program interfaces to enable these client integrations. If we are unable to effectively integrate with third-party systems, our clients’ operations may be disrupted, which could result in disputes with clients, negatively impact client satisfaction and materially and adversely affect our business, financial condition and results of operations. Additionally, if we are unable to address our clients’ needs or preferences in a timely fashion or further develop and enhance our solutions, or if a client is not satisfied with the quality of work performed by us or with the technical support services rendered, we could incur additional costs to address the situation, and clients’ dissatisfaction with our solutions could damage our ability to maintain or expand our client base. If the software of such third-party providers has performance or other problems, such issues may reflect poorly on us and the adoption and renewal of our solutions, which could significantly harm our reputation. Moreover, any negative publicity related to our solutions, regardless of its accuracy or whether the ultimate cause of any poor performance actually results from our products or from the systems of our clients, may further damage our business by affecting our reputation and may materially and adversely affect our business, financial condition and results of operations.

Our business, financial condition and results of operations could be materially and adversely affected if our clients are not satisfied with our digital banking solutions or our systems and infrastructure fail to meet their needs.

Our business depends on our ability to satisfy our clients and meet their digital banking needs. Our clients use a variety of network infrastructure, hardware and software, and our digital banking solutions must support the specific configuration of our clients’ existing systems, including in many cases the solutions of third-party providers. Our implementation expenses increase when clients have unexpected data, network infrastructure, hardware or software technology challenges, or complex or unanticipated business or regulatory requirements. In addition, our clients typically require complex acceptance testing related to the implementation of our solutions. Implementation delays may also require us to delay revenue recognition under the related sales agreement longer than expected. Further, because we do not fully control our clients’ implementation schedules, if our clients do not allocate the internal resources necessary to meet implementation timelines or if there are unanticipated implementation delays or difficulties as a result of expansions of project scope or otherwise, our revenue recognition may be delayed.

Further, any failure of or delays in our systems could cause service interruptions or impaired system performance. Some of our client agreements require us to issue credits for downtime in excess of certain thresholds and in some instances give our clients the ability to terminate their agreements with us in the event of significant amounts of downtime. If sustained or repeated, these performance issues could reduce the attractiveness of our solutions to new and existing clients, cause us to lose clients, decrease our revenues and lower our renewal rates by existing clients, each of which could materially and adversely affect our business, financial condition and results of operations. In addition, negative publicity resulting from issues related to our client relationships, regardless of accuracy, may adversely affect our ability to attract new clients and maintain and expand our relationships with existing clients.

If the use of our digital banking solutions increases, or if our clients demand more advanced features from our solutions, we will need to devote additional resources to improving our solutions, and we also may need to expand our technical infrastructure at a more rapid pace than we have in the past. This would involve spending substantial amounts to increase our cloud services infrastructure, purchase or lease data center capacity

15

and equipment, upgrade our technology and infrastructure and introduce new or enhanced solutions. It takes a significant amount of time to plan, develop and test changes to our infrastructure, and we may not be able to accurately forecast demand or predict the results we will realize from such improvements. There are inherent risks associated with changing, upgrading, improving and expanding our technical infrastructure. Any failure of our solutions to integrate effectively with future infrastructure and technologies could reduce the demand for our solutions, resulting in client dissatisfaction, which could materially and adversely affect our business, financial condition and results of operations. Also, any expansion of our infrastructure would likely require that we appropriately scale our internal business systems and services organization, including implementation and client support services, to serve our growing client base. If we are unable to respond to these changes or fully and effectively implement them in a cost-effective and timely manner, our service may become ineffective, we may lose clients and our business, financial condition and results of operations could be materially and adversely affected.

We depend on data centers operated by third parties and third-party internet hosting providers, principally Amazon Web Services, and any disruption in the operation of these facilities or access to the internet could adversely affect our business.

We primarily serve our clients from third-party data center hosting facilities provided by Amazon Web Services (“AWS”). We rely upon AWS to operate certain aspects of our solutions, and any disruption of or interference with our use of AWS has in the past and could in the future impair our ability to deliver our solutions to our clients, resulting in client dissatisfaction, damage to our reputation, loss of clients and harm to our business. We have architected our solutions and computer systems to use data processing, storage capabilities and other services provided by AWS. Given this, we cannot easily switch our AWS operations to another cloud provider, so any disruption of or interference with our use of AWS could increase our operating costs and materially and adversely affect our business, financial condition and results of operations, and we might not be able to secure service from an alternative provider on similar terms.