sn_Current folio_10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10‑Q

|

|

|

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the quarterly period ended September 30, 2015

|

|

OR

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 1‑35372

Sanchez Energy Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

45‑3090102

(I.R.S. Employer

Identification No.)

|

|

1000 Main Street, Suite 3000

Houston, Texas

(Address of principal executive offices)

|

77002

(Zip Code)

|

(713) 783‑8000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b‑2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

Non‑accelerated filer ☐

(Do not check if a

smaller reporting company)

|

Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

Number of shares of registrant’s common stock, par value $0.01 per share, outstanding as of November 6, 2015: 61,914,572.

CAUTIONARY NOTE REGARDING FORWARD‑LOOKING STATEMENTS

This Quarterly Report on Form 10‑Q contains “forward‑looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this Quarterly Report on Form 10‑Q that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward‑looking statements. These statements are based on certain assumptions we made based on management’s experience, perception of historical trends and technical analyses, current conditions, anticipated future developments and other factors believed to be appropriate and reasonable by management. When used in this Quarterly Report on Form 10‑Q, words such as “will,” “potential,” “believe,” “estimate,” “intend,” “expect,” “may,” “should,” “anticipate,” “could,” “plan,” “predict,” “project,” “profile,” “model,” “strategy,” “future” or their negatives or the statements that include these words or other words that convey the uncertainty of future events or outcomes, are intended to identify forward‑looking statements, although not all forward‑looking statements contain such identifying words. In particular, statements, express or implied, concerning our future operating results and returns or our ability to replace or increase reserves, increase production, or generate income or cash flows are forward‑looking statements. Forward‑looking statements are not guarantees of performance. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond our control. Although we believe that the expectations reflected in our forward‑looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Important factors that could cause our actual results to differ materially from the expectations reflected in the forward‑looking statements include, among others:

|

·

| |

our ability to successfully execute our business and financial strategies; |

|

·

| |

our ability to replace the reserves we produce through drilling and property acquisitions; |

|

·

| |

the timing and extent of changes in prices for, and demand for, crude oil and condensate, natural gas liquids (“NGLs”), natural gas and related commodities; |

|

·

| |

the realized benefits of the acreage acquired in our various acquisitions and other assets and liabilities assumed in connection therewith; |

|

·

| |

the extent to which our drilling plans are successful in economically developing our acreage in, and to produce reserves and achieve anticipated production levels from, our existing and future projects; |

|

·

| |

the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; |

|

·

| |

the extent to which we can optimize reserve recovery and economically develop our plays utilizing horizontal and vertical drilling, advanced completion technologies and hydraulic fracturing; |

|

·

| |

our ability to successfully execute our hedging strategy and the resulting realized prices therefrom; |

|

·

| |

competition in the oil and natural gas exploration and production industry for employees and other personnel, equipment, materials and services and, related thereto, the availability and cost of employees and other personnel, equipment, materials and services; |

|

·

| |

our ability to access the credit and capital markets to obtain financing on terms we deem acceptable, if at all, and to otherwise satisfy our capital expenditure requirements; |

|

·

| |

the availability, proximity and capacity of, and costs associated with, gathering, processing, compression and transportation facilities; |

|

·

| |

our ability to compete with other companies in the oil and natural gas industry; |

|

·

| |

the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations, environmental laws and regulations relating to air emissions, waste disposal, hydraulic fracturing and access to and use of water, laws and regulations imposing conditions and restrictions on drilling and completion operations and laws and regulations with respect to derivatives and hedging activities; |

|

·

| |

developments in oil‑producing and natural gas‑producing countries, the actions of the Organization of Petroleum Exporting Countries and other factors affecting the supply of oil and natural gas; |

|

·

| |

our ability to effectively integrate acquired crude oil and natural gas properties into our operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; |

|

·

| |

the extent to which our crude oil and natural gas properties operated by others are operated successfully and economically; |

|

·

| |

the use of competing energy sources and the development of alternative energy sources; |

|

·

| |

unexpected results of litigation filed against us; |

|

·

| |

the extent to which we incur uninsured losses and liabilities or losses and liabilities in excess of our insurance coverage; and |

|

·

| |

the other factors described under “Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Part II, Item 1A. Risk Factors” and elsewhere in this Quarterly Report on Form 10‑Q and in our other public filings with the Securities and Exchange Commission (the “SEC”). |

In light of these risks, uncertainties and assumptions, the events anticipated by our forward‑looking statements may not occur, and, if any of such events do, we may not have correctly anticipated the timing of their occurrence or the extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of our forward‑looking statements. Any forward‑looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to correct or update any forward‑looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

Sanchez Energy Corporation

Form 10‑Q

For the Quarterly Period Ended September 30, 2015

Table of Contents

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

Sanchez Energy Corporation

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

196,884

|

|

$

|

473,714

|

|

|

Oil and natural gas receivables

|

|

|

34,686

|

|

|

69,795

|

|

|

Joint interest billings receivables

|

|

|

1,662

|

|

|

14,676

|

|

|

Accounts receivable - related entities

|

|

|

3,790

|

|

|

386

|

|

|

Fair value of derivative instruments

|

|

|

131,991

|

|

|

100,181

|

|

|

Other current assets

|

|

|

19,210

|

|

|

23,002

|

|

|

Total current assets

|

|

|

388,223

|

|

|

681,754

|

|

|

Oil and natural gas properties, at cost, using the full cost method:

|

|

|

|

|

|

|

|

|

Unproved oil and natural gas properties

|

|

|

322,149

|

|

|

385,827

|

|

|

Proved oil and natural gas properties

|

|

|

3,052,929

|

|

|

2,582,441

|

|

|

Total oil and natural gas properties

|

|

|

3,375,078

|

|

|

2,968,268

|

|

|

Less: Accumulated depreciation, depletion, amortization and impairment

|

|

|

(2,365,396)

|

|

|

(706,590)

|

|

|

Total oil and natural gas properties, net

|

|

|

1,009,682

|

|

|

2,261,678

|

|

|

|

|

|

|

|

|

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

Debt issuance costs, net

|

|

|

43,256

|

|

|

48,168

|

|

|

Fair value of derivative instruments

|

|

|

30,442

|

|

|

24,024

|

|

|

Deferred tax asset

|

|

|

39,840

|

|

|

40,685

|

|

|

Investments

|

|

|

1,136

|

|

|

—

|

|

|

Other assets

|

|

|

19,641

|

|

|

19,101

|

|

|

Total assets

|

|

$

|

1,532,220

|

|

$

|

3,075,410

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

16,542

|

|

$

|

29,487

|

|

|

Other payables

|

|

|

3,458

|

|

|

4,415

|

|

|

Accrued liabilities:

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

72,094

|

|

|

162,726

|

|

|

Other

|

|

|

65,981

|

|

|

67,162

|

|

|

Deferred premium liability

|

|

|

18,377

|

|

|

—

|

|

|

Deferred tax liability

|

|

|

39,840

|

|

|

33,242

|

|

|

Other current liabilities

|

|

|

—

|

|

|

5,166

|

|

|

Total current liabilities

|

|

|

216,292

|

|

|

302,198

|

|

|

Long term debt, net of premium and discount

|

|

|

1,746,807

|

|

|

1,746,263

|

|

|

Asset retirement obligations

|

|

|

34,559

|

|

|

25,694

|

|

|

Deferred premium liability

|

|

|

6,170

|

|

|

—

|

|

|

Fair value of derivative instruments

|

|

|

—

|

|

|

889

|

|

|

Other liabilities

|

|

|

1,969

|

|

|

779

|

|

|

Total liabilities

|

|

|

2,005,797

|

|

|

2,075,823

|

|

|

Commitments and contingencies (Note 16)

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

Preferred stock ($0.01 par value, 15,000,000 shares authorized; 1,838,985 shares issued and outstanding as of September 30, 2015 and December 31, 2014 of 4.875% Convertible Perpetual Preferred Stock, Series A; 3,532,330 shares issued and outstanding as of September 30, 2015 and December 31, 2014 of 6.500% Convertible Perpetual Preferred Stock, Series B)

|

|

|

53

|

|

|

53

|

|

|

Common stock ($0.01 par value, 150,000,000 shares authorized; 61,885,306 and 58,580,870 shares issued and outstanding as of September 30, 2015 and December 31, 2014, respectively)

|

|

|

619

|

|

|

586

|

|

|

Additional paid-in capital

|

|

|

1,080,558

|

|

|

1,064,667

|

|

|

Accumulated deficit

|

|

|

(1,554,807)

|

|

|

(65,719)

|

|

|

Total stockholders' equity (deficit)

|

|

|

(473,577)

|

|

|

999,587

|

|

|

Total liabilities and stockholders' equity

|

|

$

|

1,532,220

|

|

$

|

3,075,410

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Sanchez Energy Corporation

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

REVENUES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil sales

|

|

$

|

69,532

|

|

$

|

157,907

|

|

$

|

244,554

|

|

$

|

414,484

|

|

|

Natural gas liquid sales

|

|

|

17,055

|

|

|

27,309

|

|

|

48,602

|

|

|

43,918

|

|

|

Natural gas sales

|

|

|

27,939

|

|

|

22,134

|

|

|

73,091

|

|

|

35,171

|

|

|

Total revenues

|

|

|

114,526

|

|

|

207,350

|

|

|

366,247

|

|

|

493,573

|

|

|

OPERATING COSTS AND EXPENSES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and natural gas production expenses

|

|

|

40,345

|

|

|

34,380

|

|

|

110,166

|

|

|

64,203

|

|

|

Production and ad valorem taxes

|

|

|

3,038

|

|

|

10,916

|

|

|

20,011

|

|

|

29,161

|

|

|

Depreciation, depletion, amortization and accretion

|

|

|

89,167

|

|

|

93,463

|

|

|

296,541

|

|

|

225,297

|

|

|

Impairment of oil and natural gas properties

|

|

|

454,628

|

|

|

—

|

|

|

1,365,000

|

|

|

—

|

|

|

General and administrative (inclusive of stock-based compensation expense of $355 and $10, respectively, for the three months ended September 30, 2015 and 2014, and $15,924 and $25,888, respectively, for the nine months ended September 30, 2015 and 2014)

|

|

|

15,851

|

|

|

12,821

|

|

|

59,290

|

|

|

60,999

|

|

|

Total operating costs and expenses

|

|

|

603,029

|

|

|

151,580

|

|

|

1,851,008

|

|

|

379,660

|

|

|

Operating income (loss)

|

|

|

(488,503)

|

|

|

55,770

|

|

|

(1,484,761)

|

|

|

113,913

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income and other income (expense)

|

|

|

(753)

|

|

|

82

|

|

|

(1,804)

|

|

|

97

|

|

|

Interest expense

|

|

|

(31,442)

|

|

|

(27,612)

|

|

|

(94,500)

|

|

|

(58,145)

|

|

|

Net gains on commodity derivatives

|

|

|

103,996

|

|

|

47,416

|

|

|

111,550

|

|

|

6,399

|

|

|

Total other income (expense)

|

|

|

71,801

|

|

|

19,886

|

|

|

15,246

|

|

|

(51,649)

|

|

|

Income (loss) before income taxes

|

|

|

(416,702)

|

|

|

75,656

|

|

|

(1,469,515)

|

|

|

62,264

|

|

|

Income tax expense

|

|

|

158

|

|

|

26,625

|

|

|

7,600

|

|

|

21,946

|

|

|

Net income (loss)

|

|

|

(416,860)

|

|

|

49,031

|

|

|

(1,477,115)

|

|

|

40,318

|

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock dividends

|

|

|

(3,991)

|

|

|

(4,274)

|

|

|

(11,973)

|

|

|

(29,599)

|

|

|

Net income allocable to participating securities

|

|

|

—

|

|

|

(2,068)

|

|

|

—

|

|

|

(495)

|

|

|

Net income (loss) attributable to common stockholders

|

|

$

|

(420,851)

|

|

$

|

42,689

|

|

$

|

(1,489,088)

|

|

$

|

10,224

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share - basic

|

|

$

|

(7.33)

|

|

$

|

0.77

|

|

$

|

(26.06)

|

|

$

|

0.20

|

|

|

Weighted average number of shares used to calculate net income (loss) attributable to common stockholders - basic

|

|

|

57,426

|

|

|

55,732

|

|

|

57,141

|

|

|

51,153

|

|

|

Net income (loss) per common share - diluted

|

|

$

|

(7.33)

|

|

$

|

0.69

|

|

$

|

(26.06)

|

|

$

|

0.20

|

|

|

Weighted average number of shares used to calculate net income (loss) attributable to common stockholders - diluted

|

|

|

57,426

|

|

|

68,340

|

|

|

57,141

|

|

|

51,153

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Sanchez Energy Corporation

Condensed Consolidated Statement of Stockholders’ Equity for the Nine Months Ended September 30, 2015 (Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A

|

|

Series B

|

|

|

|

|

|

|

Additional

|

|

|

|

|

Total

|

|

|

|

|

Preferred Stock

|

|

Preferred Stock

|

|

Common Stock

|

|

Paid-in

|

|

Accumulated

|

|

Stockholders'

|

|

|

|

|

Shares

|

|

Amount

|

|

Shares

|

|

Amount

|

|

Shares

|

|

Amount

|

|

Capital

|

|

Deficit

|

|

Equity (Deficit)

|

|

|

BALANCE, December 31, 2014

|

|

1,839

|

|

$

|

18

|

|

3,532

|

|

$

|

35

|

|

58,581

|

|

$

|

586

|

|

$

|

1,064,667

|

|

$

|

(65,719)

|

|

$

|

999,587

|

|

|

Preferred stock dividends

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(11,973)

|

|

|

(11,973)

|

|

|

Restricted stock awards, net of forfeitures

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

3,304

|

|

|

33

|

|

|

(33)

|

|

|

—

|

|

|

—

|

|

|

Stock-based compensation

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

|

15,924

|

|

|

—

|

|

|

15,924

|

|

|

Net loss

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

|

—

|

|

|

(1,477,115)

|

|

|

(1,477,115)

|

|

|

BALANCE, September 30, 2015

|

|

1,839

|

|

$

|

18

|

|

3,532

|

|

$

|

35

|

|

61,885

|

|

$

|

619

|

|

$

|

1,080,558

|

|

$

|

(1,554,807)

|

|

$

|

(473,577)

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Sanchez Energy Corporation

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

|

|

|

2015

|

|

2014

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(1,477,115)

|

|

$

|

40,318

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

Depreciation, depletion, amortization and accretion

|

|

|

296,541

|

|

|

225,297

|

|

|

Impairment of oil and natural gas properties

|

|

|

1,365,000

|

|

|

—

|

|

|

Stock-based compensation expense

|

|

|

15,924

|

|

|

25,888

|

|

|

Net gains on commodity derivative contracts

|

|

|

(111,550)

|

|

|

(6,399)

|

|

|

Net cash settlement received (paid) on commodity derivative contracts

|

|

|

89,558

|

|

|

(9,652)

|

|

|

Cash reimbursements received for operating leasehold improvements

|

|

|

2,650

|

|

|

—

|

|

|

Premiums paid on commodity derivative contracts

|

|

|

(121)

|

|

|

(241)

|

|

|

Loss on investment in SPP

|

|

|

864

|

|

|

—

|

|

|

Amortization of debt issuance costs

|

|

|

5,312

|

|

|

7,215

|

|

|

Accretion of debt discount, net

|

|

|

544

|

|

|

654

|

|

|

Deferred taxes

|

|

|

7,443

|

|

|

21,946

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

52,138

|

|

|

(52,957)

|

|

|

Other current assets

|

|

|

3,792

|

|

|

(10,734)

|

|

|

Accounts payable

|

|

|

(12,945)

|

|

|

(29,594)

|

|

|

Accounts receivable - related entities

|

|

|

(3,404)

|

|

|

257

|

|

|

Other payables

|

|

|

(836)

|

|

|

1,818

|

|

|

Accrued liabilities

|

|

|

(1,181)

|

|

|

58,864

|

|

|

Other current liabilities

|

|

|

(5,166)

|

|

|

—

|

|

|

Other liabilities

|

|

|

1,190

|

|

|

—

|

|

|

Net cash provided by operating activities

|

|

|

228,638

|

|

|

272,680

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Payments for oil and natural gas properties

|

|

|

(562,599)

|

|

|

(532,300)

|

|

|

Payments for other property and equipment

|

|

|

(4,572)

|

|

|

(9,581)

|

|

|

Proceeds from sale of oil and natural gas properties

|

|

|

81,734

|

|

|

—

|

|

|

Acquisition of oil and natural gas properties

|

|

|

(7,658)

|

|

|

(558,113)

|

|

|

Net cash used in investing activities

|

|

|

(493,095)

|

|

|

(1,099,994)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Proceeds from borrowings

|

|

|

—

|

|

|

100,000

|

|

|

Repayment of borrowings

|

|

|

—

|

|

|

(100,000)

|

|

|

Issuance of senior notes, net of premium and discount

|

|

|

—

|

|

|

1,152,250

|

|

|

Issuance of common stock

|

|

|

—

|

|

|

176,250

|

|

|

Payments for offering costs

|

|

|

—

|

|

|

(8,731)

|

|

|

Financing costs

|

|

|

(400)

|

|

|

(37,412)

|

|

|

Preferred dividends paid

|

|

|

(11,973)

|

|

|

(12,302)

|

|

|

Net cash provided by (used in) financing activities

|

|

|

(12,373)

|

|

|

1,270,055

|

|

|

|

|

|

|

|

|

|

|

|

Increase (decrease) in cash and cash equivalents

|

|

|

(276,830)

|

|

|

442,741

|

|

|

Cash and cash equivalents, beginning of period

|

|

|

473,714

|

|

|

153,531

|

|

|

Cash and cash equivalents, end of period

|

|

$

|

196,884

|

|

$

|

596,272

|

|

|

|

|

|

|

|

|

|

|

|

NON-CASH INVESTING AND FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

Asset retirement obligations

|

|

$

|

7,451

|

|

$

|

19,236

|

|

|

Change in accrued capital expenditures

|

|

|

(90,632)

|

|

|

34,789

|

|

|

Common stock issued in exchange for preferred stock

|

|

|

—

|

|

|

123,731

|

|

|

SUPPLEMENTAL DISCLOSURE:

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

98,104

|

|

$

|

24,527

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Sanchez Energy Corporation

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Organization

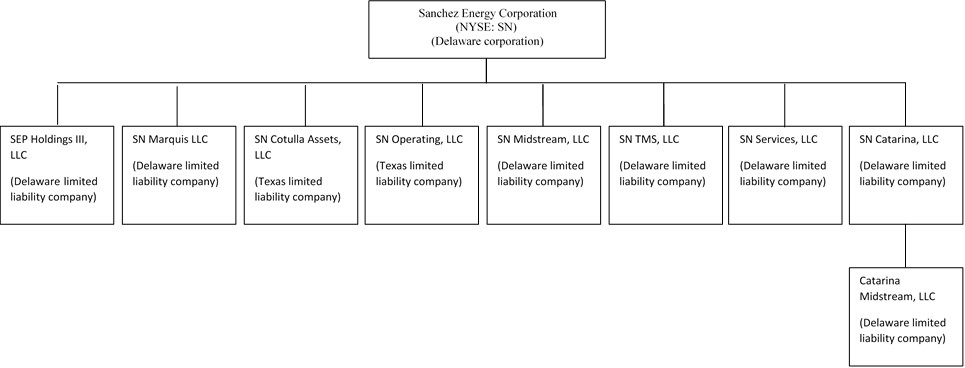

Sanchez Energy Corporation (together with our consolidated subsidiaries, the “Company,” “we,” “our,” “us” or similar terms) is an independent exploration and production company, formed in August 2011 as a Delaware corporation, focused on the exploration, acquisition and development of unconventional oil and natural gas resources in the onshore U.S. Gulf Coast, with a current focus on the Eagle Ford Shale in South Texas and the Tuscaloosa Marine Shale (“TMS”) in Mississippi and Louisiana. We have accumulated net leasehold acreage in the oil and condensate, or black oil and volatile oil, windows of the Eagle Ford Shale and in what we believe to be the core of the TMS. We are currently focused on the horizontal development of significant resource potential from the Eagle Ford Shale.

Note 2. Basis of Presentation and Summary of Significant Accounting Policies

The accompanying condensed consolidated financial statements are unaudited and were prepared from the Company’s records. The condensed consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP” or “U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. The Company derived the condensed consolidated balance sheet as of December 31, 2014 from the audited financial statements filed in its Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “2014 Annual Report”). Because this is an interim period filing presented using a condensed format, it does not include all of the disclosures required by U.S. GAAP. These condensed consolidated financial statements should be read in connection with the consolidated financial statements and notes thereto included in the 2014 Annual Report, which contains a summary of the Company’s significant accounting policies and other disclosures. In the opinion of management, these financial statements include the adjustments and accruals, all of which are of a normal recurring nature, which are necessary for a fair presentation of the results for the interim periods. These interim results are not necessarily indicative of results to be expected for the entire year.

As of September 30, 2015, the Company’s significant accounting policies are consistent with those discussed in Note 2, “Basis of Presentation and Summary of Significant Accounting Policies,” in the notes to the Company’s consolidated financial statements contained in its 2014 Annual Report.

Principles of Consolidation

The Company’s condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany balances and transactions have been eliminated.

Use of Estimates

The condensed consolidated financial statements are prepared in conformity with U.S. GAAP, which requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The most significant estimates pertain to proved oil and natural gas reserves and related cash flow estimates used in the calculation of depletion and impairment of oil and natural gas properties, the evaluation of unproved properties for impairment, the fair value of commodity derivative contracts and asset retirement obligations, accrued oil and natural gas revenues and expenses and the allocation of general and administrative expenses. Actual results could differ materially from those estimates.

Recent Accounting Pronouncements

In July 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-11, “Simplifying the Measurement of Inventory,” effective for annual and interim periods beginning

after December 15, 2016. ASU 2015-11 changes the inventory measurement principle for entities using the first-in, first out (FIFO) or average cost methods. For entities utilizing one of these methods, the inventory measurement principle will change from lower of cost or market to the lower of cost and net realizable value. We are currently in the process of evaluating the impact of adoption of this guidance on our consolidated financial statements, but do not expect the impact to be material.

In April 2015, the FASB issued ASU 2015-03, “Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs.” This guidance is intended to more closely align the presentation of debt issuance costs under U.S. GAAP with the presentation requirements under the International Financial Reporting Standards. Under this new standard, debt issuance costs related to a recognized debt liability will be presented on the balance sheet as a direct deduction from the debt liability, similar to the presentation of debt discounts, rather than as a separate asset as previously presented. This guidance is effective for fiscal years and interim periods beginning after December 15, 2015. The guidance is to be applied retrospectively to each prior period presented. Early adoption is permitted. The effects of this accounting standard on our financial position, results of operations and cash flows are not expected to be material.

In February 2015, the FASB issued ASU 2015-02, “Consolidation—Amendments to the Consolidation Analysis.” This ASU will simplify existing requirements by reducing the number of acceptable consolidation models and placing more emphasis on risk of loss when determining a controlling financial interest. The provisions of this new standard will affect how limited partnerships and similar entities are assessed for consolidation, including the elimination of the presumption that a general partner should consolidate a limited partnership. This ASU is effective for annual and interim periods beginning in 2016 and is required to be adopted using a retrospective or modified retrospective approach, with early adoption permitted. We are currently in the process of evaluating the impact of adoption of this guidance on our consolidated financial statements, but do not expect the impact to be material.

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606).” This guidance outlines a new, single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. This new revenue recognition model provides a five-step analysis in determining when and how revenue is recognized. The new model will require revenue recognition to depict the transfer of promised goods or services to customers in an amount that reflects the consideration a company expects to receive in exchange for those goods and services. The new guidance is effective for fiscal years and interim periods beginning after December 15, 2017. Early adoption is not permitted. The guidance may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of initial application. We are currently in the process of evaluating the impact of adoption of this guidance on our consolidated financial statements, but do not expect the impact to be material.

Note 3. Acquisitions and Divestitures

Our acquisitions are accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 805, “Business Combinations.” A business combination may result in the recognition of a gain or goodwill based on the measurement of the fair value of the assets acquired at the acquisition date as compared to the fair value of consideration transferred, adjusted for purchase price adjustments. The initial accounting for acquisitions may not be complete and adjustments to provisional amounts, or recognition of additional assets acquired or liabilities assumed, may occur as more detailed analyses are completed and additional information is obtained about the facts and circumstances that existed as of the acquisition dates. The results of operations of the properties acquired in our acquisitions have been included in the condensed consolidated financial statements since the closing dates of the acquisitions.

Catarina Acquisition

On June 30, 2014, we completed our acquisition of contiguous acreage in Dimmit, LaSalle and Webb Counties, Texas with 176 gross producing wells (the “Catarina acquisition”) for an aggregate adjusted purchase price of $557.1 million. The effective date of the transaction was January 1, 2014. The purchase price was funded with a portion of the proceeds from the issuance of the $850 million senior unsecured 6.125% notes due 2023 (the “Original 6.125%

Notes”) and cash on hand. The total purchase price was allocated to the assets purchased and liabilities assumed based upon their fair values on the date of acquisition as follows (in thousands):

|

|

|

|

|

|

|

Proved oil and natural gas properties

|

|

$

|

446,906

|

|

|

Unproved properties

|

|

|

122,224

|

|

|

Other assets acquired

|

|

|

2,682

|

|

|

Fair value of assets acquired

|

|

|

571,812

|

|

|

Asset retirement obligations

|

|

|

(14,723)

|

|

|

Fair value of net assets acquired

|

|

$

|

557,089

|

|

Palmetto Disposition

On March 31, 2015, we completed our disposition to a subsidiary of Sanchez Production Partners LP (“SPP”) of escalating amounts of partial working interests in 59 wellbores located in Gonzales County, Texas (the “Palmetto disposition”) for an adjusted purchase price of approximately $83.4 million. The effective date of the transaction was January 1, 2015. The aggregate average working interest percentage initially conveyed was 18.25% per wellbore and, upon January 1 of each subsequent year after the closing, the purchaser’s working interest will automatically increase in incremental amounts according to the purchase agreement until January 1, 2019, at which point the purchaser will own a 47.5% working interest and we will own a 2.5% working interest in each of the wellbores. We received consideration consisting of approximately $83.0 million (approximately $81.4 million as adjusted) cash and 1,052,632 common units of SPP valued at approximately $2.0 million as of the date of the closing (as discussed further in Note 8, “Investments”). The Company did not record any gains or losses related to the Palmetto disposition.

Pro Forma Operating Results

The following unaudited pro forma combined results for the three and nine months ended September 30, 2015 and 2014 reflect the consolidated results of operations of the Company as if the Catarina acquisition and related financing had occurred on January 1, 2013 and the Palmetto disposition had occurred on January 1, 2014. The pro forma information includes adjustments primarily for revenues and expenses from the acquired and disposed properties, depreciation, depletion, amortization and accretion, impairment, interest expense and debt issuance cost amortization for acquisition debt, consideration received including cash and common stock, and stock dividends for the issuance of preferred stock.

The unaudited pro forma combined financial statements give effect to the events set forth below:

|

·

| |

The Catarina acquisition completed on June 30, 2014. |

|

·

| |

The Palmetto disposition completed on March 31, 2015. |

|

·

| |

Issuance of the Original 6.125% Notes (as discussed in Note 6, “Long-Term Debt”) to finance a portion of the Catarina acquisition and the related adjustments to interest expense. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

Revenues

|

|

$

|

114,526

|

|

$

|

195,937

|

|

$

|

363,005

|

|

$

|

614,578

|

|

|

Net income (loss) attributable to common stockholders

|

|

$

|

(421,024)

|

|

$

|

42,150

|

|

$

|

(1,442,100)

|

|

$

|

18,483

|

|

|

Net income (loss) per common share, basic and diluted

|

|

$

|

(7.33)

|

|

$

|

0.76

|

|

$

|

(25.24)

|

|

$

|

0.38

|

|

The unaudited pro forma combined financial information is for informational purposes only and is not intended to represent or to be indicative of the combined results of operations that the Company would have reported had the Catarina acquisition and related financings and Palmetto disposition been completed as of the dates set forth in this unaudited pro forma combined financial information and should not be taken as indicative of the Company’s future combined results of operations. The actual results may differ significantly from that reflected in the unaudited pro forma combined financial information for a number of reasons, including, but not limited to, differences in assumptions used to prepare the unaudited pro forma combined financial information and actual results.

Note 4. Cash and Cash Equivalents

As of September 30, 2015 and December 31, 2014, cash and cash equivalents consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

|

2015

|

|

2014

|

|

|

Cash at banks

|

|

$

|

76,544

|

|

$

|

73,528

|

|

|

Money market funds

|

|

|

120,340

|

|

|

400,186

|

|

|

Total cash and cash equivalents

|

|

$

|

196,884

|

|

$

|

473,714

|

|

Note 5. Oil and Natural Gas Properties

The Company’s oil and natural gas properties are accounted for using the full cost method of accounting. All direct costs and certain indirect costs associated with the acquisition, exploration and development of oil and natural gas properties are capitalized. Once evaluated, these costs, as well as the estimated costs to retire the assets, are included in the amortization base and amortized to depletion expense using the units‑of‑production method. Depletion is calculated based on estimated proved oil and natural gas reserves. Proceeds from the sale or disposition of oil and natural gas properties are applied to reduce net capitalized costs unless the sale or disposition causes a significant change in the relationship between costs and the estimated quantity of proved reserves.

Full Cost Ceiling Test—Capitalized costs (net of accumulated depreciation, depletion and amortization and deferred income taxes) of proved oil and natural gas properties are subject to a full cost ceiling limitation. The ceiling limits these costs to an amount equal to the present value, discounted at 10%, of estimated future net cash flows from estimated proved reserves less estimated future operating and development costs, abandonment costs (net of salvage value) and estimated related future income taxes. In accordance with SEC rules, the oil and natural gas prices used to calculate the full cost ceiling are the 12-month average prices, calculated as the unweighted arithmetic average of the first-day-of-the-month price for each month within the 12-month period prior to the end of the reporting period, unless prices are defined by contractual arrangements. Prices are adjusted for “basis” or location differentials. Prices are held constant over the life of the reserves. If unamortized costs capitalized within the cost pool exceed the ceiling, the excess is charged to expense and separately disclosed during the period in which the excess occurs. Amounts thus required to be written off are not reinstated for any subsequent increase in the cost center ceiling. During the three and nine month periods ended September 30, 2015, the Company recorded a full cost ceiling test impairment after income taxes of $454.6 million and $1,365.0 million, respectively. Based on the sustained decline in average prices throughout the first three quarters of 2015 and a current expectation that prices will remain unfavorable during the remainder of 2015 based upon the current NYMEX forward prices, absent a material addition to proved reserves and/or a material reduction in future development costs, we believe that there is a reasonable likelihood that the Company will incur additional impairments to our full cost pool in 2015. No impairment expense was recorded for the three and nine month periods ended September 30, 2014.

Costs associated with unproved properties and properties under development, including costs associated with seismic data, leasehold acreage and the current drilling of wells, are excluded from the full cost amortization base until the properties have been evaluated. Unproved properties are identified on a project basis, with a project being an area in which significant leasehold interests are acquired within a contiguous area. Unproved properties are reviewed periodically by management and when management determines that a project area has been evaluated through drilling operations or a thorough geologic evaluation, the project area is transferred into the full cost pool subject to amortization. The Company assesses the carrying value of its unproved properties that are not subject to amortization for impairment periodically. If the results of an assessment indicate that the properties are impaired, the amount of the asset impaired is added to the full cost pool subject to both periodic amortization and the ceiling test.

Note 6. Long‑Term Debt

Long-term debt on September 30, 2015, consisted of $1.15 billion face value of 6.125% senior notes (the “6.125% Notes,” consisting of $850 million in Original 6.125% Notes and $300 million in Additional 6.125% Notes (defined below), which were issued at a premium to face value of approximately $2.3 million) maturing on January 15, 2023, and $600 million principal amount of 7.75% senior notes (the “7.75% Notes,” consisting of $400 million in Original 7.75% Notes (defined below) and $200 million in Additional 7.75% Notes (defined below), which were issued

at a discount to face value of approximately $7.0 million), maturing on June 15, 2021. As of September 30, 2015, and December 31, 2014, the Company’s long‑term debt consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount Outstanding

|

|

|

|

|

|

|

|

|

(in thousands) as of

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

|

|

|

Interest Rate

|

|

Maturity date

|

|

2015

|

|

2014

|

|

|

Second Amended and Restated Credit Agreement

|

|

Variable

|

|

June 30, 2019

|

|

$

|

—

|

|

$

|

—

|

|

|

7.75% Notes

|

|

7.75%

|

|

June 15, 2021

|

|

|

600,000

|

|

|

600,000

|

|

|

6.125% Notes

|

|

6.125%

|

|

January 15, 2023

|

|

|

1,150,000

|

|

|

1,150,000

|

|

|

|

|

|

|

|

|

|

1,750,000

|

|

|

1,750,000

|

|

|

Unamortized discount on Additional 7.75% Notes

|

|

|

|

|

|

|

(5,160)

|

|

|

(5,837)

|

|

|

Unamortized premium on Additional 6.125% Notes

|

|

|

|

|

|

|

1,967

|

|

|

2,100

|

|

|

Total long-term debt

|

|

|

|

|

|

$

|

1,746,807

|

|

$

|

1,746,263

|

|

The components of interest expense are (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

Nine Months Ended

|

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

Interest on Senior Notes

|

|

$

|

(29,234)

|

|

$

|

(25,316)

|

|

$

|

(87,704)

|

|

$

|

(48,999)

|

|

|

Interest expense and commitment fees on credit agreement

|

|

|

(301)

|

|

|

(384)

|

|

|

(940)

|

|

|

(1,277)

|

|

|

Amortization of debt issuance costs

|

|

|

(1,748)

|

|

|

(1,710)

|

|

|

(5,312)

|

|

|

(7,215)

|

|

|

Amortization of discount on Additional 7.75% Notes

|

|

|

(226)

|

|

|

(227)

|

|

|

(678)

|

|

|

(679)

|

|

|

Amortization of premium on Additional 6.125% Notes

|

|

|

67

|

|

|

25

|

|

|

134

|

|

|

25

|

|

|

Total interest expense

|

|

$

|

(31,442)

|

|

$

|

(27,612)

|

|

$

|

(94,500)

|

|

$

|

(58,145)

|

|

Credit Facility

Previous Credit Agreement: On May 31, 2013, we and our subsidiaries, SEP Holdings III, LLC (“SEP III”), SN Marquis LLC (“SN Marquis”) and SN Cotulla Assets, LLC (“SN Cotulla”), collectively, as the borrowers, entered into a revolving credit facility represented by a $500 million Amended and Restated Credit Agreement with Royal Bank of Canada as the administrative agent, Capital One, National Association as the syndication agent and RBC Capital Markets as sole lead arranger and sole book runner and each of the other lenders party thereto (the “Amended and Restated Credit Agreement”). The Amended and Restated Credit Agreement was to mature on May 31, 2018.

On May 12, 2014, the Company borrowed $100 million under the Amended and Restated Credit Agreement. The Company used proceeds from the issuance of the Original 6.125% Notes to repay the $100 million outstanding.

Second Amended and Restated Credit Agreement: On June 30, 2014, the Company, each of SEP III, SN Marquis, SN Cotulla, SN Operating LLC (“SN Operating”), SN TMS, LLC (“SN TMS”), and SN Catarina, LLC (“SN Catarina” and together with SEP III, SN Marquis, SN Cotulla, SN Operating and SN TMS, collectively, the “Guarantors” and the Guarantors and the Company collectively, the “Loan Parties”), entered into a revolving credit facility represented by a $1.5 billion Second Amended and Restated Credit Agreement with Royal Bank of Canada as the administrative agent (the “Administrative Agent”), Capital One, National Association as the syndication agent, Compass Bank and SunTrust Bank as documentation agents, RBC Capital Markets as sole lead arranger and sole book runner and the lenders party thereto (the “Second Amended and Restated Credit Agreement”). The Company has elected an aggregate elected commitment amount under the Second Amended and Restated Credit Agreement of $300 million. Additionally, the Second Amended and Restated Credit Agreement provides for the issuance of letters of credit, limited to an aggregate amount of the lesser of $80 million and the total availability thereunder. As of September 30, 2015, there were no borrowings and no letters of credit outstanding under the Second Amended and Restated Credit Agreement. Availability under the Second Amended and Restated Credit Agreement is at all times subject to customary conditions and the then applicable borrowing base and aggregate elected commitment amount. The borrowing base under the Second Amended and Restated Credit Agreement was set at $362.5 million upon issuance of the Additional 6.125% Notes and was increased to $650 million in connection with the October 1, 2014 redetermination. However, the Company’s aggregate elected commitment amount remained $300 million and the Company retained the ability to increase the aggregate elected commitment up to the $650 million approved borrowing base upon written notice from the

Company and compliance with certain conditions, including the consent of any lender whose elected commitment is increased. On March 31, 2015, pursuant to an amendment of the Second Amended and Restated Credit Agreement, the borrowing base under such agreement was changed to $550 million, with the aggregate elected commitment amount of $300 million remaining unchanged. The borrowing base was reduced as a result of several factors that included the decrease in reserve value from the decline in commodity prices along with the reduction in reserves in connection with the Palmetto disposition discussed above partially offset by underlying new reserve growth through drilling. All of the aggregate elected commitment was available for future revolver borrowings as of September 30, 2015.

The Second Amended and Restated Credit Agreement matures on June 30, 2019. The borrowing base under the Second Amended and Restated Credit Agreement can be subsequently re-determined up or down by the lenders based on, among other things, their evaluation of the Company’s and its restricted subsidiaries’ oil and natural gas reserves. Redeterminations of the borrowing base are scheduled to occur semi-annually on or before April 1 and October 1 of each year. The borrowing base is also subject to (i) automatic reduction by 25% of the amount of any increase in the Company’s high yield debt, (ii) interim redetermination at the election of the Company once between each scheduled redetermination, (iii) interim redetermination at the election of the administrative agent at the direction of a majority of the credit exposures or, if none, the elected commitments of the lenders once between each scheduled re-determination and (iv) if the required lenders so direct in connection with asset sales and swap terminations involving more than 10% of the value of the proved developed oil and gas properties included in the most recent reserve report, reduction in an amount equal to the borrowing base value, as determined by the administrative agent in its reasonable judgment, of the assets so sold and swaps so terminated.

The Company’s obligations under the Second Amended and Restated Credit Agreement are secured by a first priority lien on substantially all of the Company’s assets and the assets of its existing and future subsidiaries not designated as “unrestricted subsidiaries,” including a first priority lien on all ownership interests in existing and future subsidiaries not designated as “unrestricted subsidiaries.”

The obligations under the Second Amended and Restated Credit Agreement are guaranteed by all of the Company’s existing and future subsidiaries not designated as ‘‘unrestricted subsidiaries.’’ At the Company’s election, borrowings under the Second Amended and Restated Credit Agreement may be made on an alternate base rate or an adjusted eurodollar rate basis, plus an applicable margin. The applicable margin varies from 0.50% to 1.50% for alternate base rate borrowings and from 1.50% to 2.50% for eurodollar borrowings, depending on the utilization of the borrowing base. Furthermore, the Company is also required to pay a commitment fee on the unused committed amount at a rate varying from 0.375% to 0.50% per annum, depending on the utilization of the elected commitment.

The Second Amended and Restated Credit Agreement contains various affirmative and negative covenants and events of default that limit the Company’s ability to, among other things, incur indebtedness, make restricted payments, grant liens, consolidate or merge, dispose of certain assets, make certain investments, engage in transactions with affiliates, hedge transactions and make certain acquisitions. The Second Amended and Restated Credit Agreement also provides for cross default between the Second Amended and Restated Credit Agreement and the other debt (including debt under the 6.125% Notes and the 7.75% Notes) and obligations in respect of hedging agreements (on a mark-to-market basis), of the Company and its restricted subsidiaries, in an aggregate principal amount in excess of $10 million. Furthermore, the Second Amended and Restated Credit Agreement contains financial covenants that require the Company to satisfy the following tests: (i) current assets plus undrawn borrowing capacity on the Second Amended and Restated Credit Agreement to current liabilities of at least 1.0 to 1.0 at all times, and (ii) senior secured debt to consolidated last twelve months (“LTM”) EBITDA of not greater than 2.25 to 1.0 as of the last day of any fiscal quarter

On July 20, 2015, the Company, the Guarantors, the Administrative Agent and the other agents and lenders party thereto entered into the Third Amendment to the Second Amended and Restated Credit Agreement (the “Third Amendment”) which amended the Second Amended and Restated Credit Agreement, among other things, to (a) permit one or more of the Loan Parties to (i) make direct and indirect investments of up to $10 million in an unrestricted subsidiary in connection with a joint venture to develop a midstream facility and (ii) enter into and perform certain commercial and financial support agreements with such joint venture and the other party to such joint venture on terms acceptable to the Administrative Agent, (b) permits the Loan Parties to (i) acquire an undivided interest in a midstream facility, (ii) make up to $80 million of direct and indirect investments in an unrestricted subsidiary in connection with a joint venture to develop, own and operate midstream assets to be entered into by such unrestricted subsidiary, (iii) enter into and perform midstream services agreements with the other party to such joint venture on terms acceptable to the Administrative Agent, (iv) enter into and perform financial support agreements with such joint venture and the other

party to such joint venture on terms acceptable to the Administrative Agent, (v) if the Loan Party that acquires such undivided interest in a midstream facility so elects, exchange such undivided interest in whole or in part for equity interests in such joint venture in an amount equal to the lesser of (X) 2% of the equity interests in such joint venture and (Y) equity interests having a value no greater than $5 million, as determined by the Company in good faith at such time and (vi) retain and grant security interests over any such equity interests so acquired, (c) permits the Loan Parties to (i) dispose of certain midstream assets to an unrestricted subsidiary, (ii) dispose of such midstream assets or equity interests in such unrestricted subsidiary in exchange for consideration, up to 25% by value of which may include equity interests in the transferee and payment-in-kind notes issued by the transferee or, if equity interests in such transferee are not publicly traded, its parent entity that has issued publicly traded equity interests, (iii) retain such equity interests and payment-in-kind notes, (iv) retain joint and several liability in connection with such midstream assets to the extent required under the terms of the lease under which they were acquired and (v) enter into midstream services agreements with such transferee on terms acceptable to the Administrative Agent, (d) eliminate the covenant requiring that the Borrower maintain a ratio of consolidated EBITDA to consolidated net interest expense of not less than 2.25 to 1.0, (e) adjust the limits on the Loan Parties entering into swap agreements relative to expected production from proved developed producing reserves and total proved reserves and permit the Loan Parties, within stated limits, to enter into swap agreements in connection with the contemplated acquisition of proved developed producing reserves and total proved reserves and (f) provide for other technical amendments.

On September 29, 2015, the Company, the Guarantors, the Administrative Agent and the other agents and lenders party thereto entered into the Fourth Amendment to the Second Amended and Restated Credit Agreement (the “Fourth Amendment”) which amended the Second Amended and Restated Credit Agreement, among other things, to (a) permit one or more lenders in addition to Royal Bank of Canada to act as issuing bank upon agreement with such lenders, (b) increase the letter of credit sublimit to $80 million, (c) permit the Loan Parties to enter into and perform certain commercial and financial support agreements in connection with one of the joint ventures to develop a midstream facility permitted by the Third Amendment, (d) substitute references to Catarina Midstream, LLC (“Catarina Midstream”) in place of references to the “DW Midstream Unrestricted Subsidiary” and update the organizational chart and subsidiary list in the schedules to the Second Amended and Restated Credit Agreement to reflect Catarina Midstream’s existence and status as an unrestricted subsidiary until such time as it is disposed of in accordance with the Second Amended and Restated Credit Agreement, (e) permit the disposition of units in SPP by a Loan Party to Catarina Midstream, (f) permit certain repurchases of equity interests in the Company by the Loan Parties and (g) provide for other technical amendments, clarifications and corrections. Subsequent to quarter end, on October 30, 2015, the Company, the Guarantors, the Administrative Agent and the other agents and lenders party thereto entered into the Fifth Amendment to the Second Amended and Restated Credit Agreement (the “Fifth Amendment”) to modify certain representations, covenants, exhibits and schedules and to waive any existing breaches of, and any resulting defaults or events of default with respect to certain covenants of the Second Amended and Restated Credit Agreement, all as further discussed in Note 18, “Subsequent Events.”

From time to time, the agents, arrangers, book runners and lenders under the Second Amended and Restated Credit Agreement and their affiliates have provided, and may provide in the future, investment banking, commercial lending, hedging and financial advisory services to the Company and its affiliates in the ordinary course of business, for which they have received, or may in the future receive, customary fees and commissions for these transactions. As of September 30, 2015, the Company was in compliance with the covenants of the Second Amended and Restated Credit Agreement.

7.75% Senior Notes Due 2021

On June 13, 2013, we completed a private offering of $400 million in aggregate principal amount of the Company’s 7.75% senior notes that will mature on June 15, 2021 (the “Original 7.75% Notes”). Interest is payable on each June 15 and December 15. We received net proceeds from this offering of approximately $388 million, after deducting initial purchasers’ discounts and offering expenses, which we used to repay outstanding indebtedness under our credit facilities. The Original 7.75% Notes are senior unsecured obligations and are guaranteed on a joint and several senior unsecured basis by, with certain exceptions, substantially all of our existing and future subsidiaries.

On September 18, 2013, we issued an additional $200 million in aggregate principal amount of our 7.75% senior notes due 2021 (the “Additional 7.75% Notes” and, together with the Original 7.75% Notes, the 7.75% Notes) in a private offering at an issue price of 96.5% of the principal amount of the Additional 7.75% Notes. We received net proceeds of approximately $188.8 million (after deducting the initial purchasers’ discounts and offering expenses of

$4.2 million) from the sale of the Additional 7.75% Notes. The Company also received cash for accrued interest from June 13, 2013 through the date of issuance of $4.1 million, for total net proceeds of $192.9 million from the sale of the Additional 7.75% Notes. The Additional 7.75% Notes were issued under the same indenture as the Original 7.75% Notes, and are therefore treated as a single class of debt securities under the indenture. We used the net proceeds from the offering to partially fund the Wycross acquisition completed in October 2013, a portion of the 2013 and 2014 capital budgets and for general corporate purposes.

The 7.75% Notes are senior unsecured obligations and rank equally in right of payment with all of our existing and future senior unsecured indebtedness. The 7.75% Notes rank senior in right of payment to our future subordinated indebtedness. The 7.75% Notes are effectively junior in right of payment to all of our existing and future secured debt (including under our Second Amended and Restated Credit Agreement) to the extent of the value of the assets securing such debt. The 7.75% Notes are fully and unconditionally guaranteed (except for customary release provisions) on a joint and several senior unsecured basis by the subsidiary guarantors party to the indenture governing the 7.75% Notes. To the extent set forth in the indenture governing the 7.75% Notes, certain of our subsidiaries will be required to fully and unconditionally guarantee the 7.75% Notes on a joint and several senior unsecured basis in the future.

The indenture governing the 7.75% Notes, among other things, restricts our ability and our restricted subsidiaries’ ability to: (i) incur, assume, or guarantee additional indebtedness or issue certain types of equity securities; (ii) pay distributions on, purchase or redeem subordinated debt; (iii) make certain investments; (iv) enter into certain transactions with affiliates; (v) create or incur liens on their assets; (vi) sell assets; (vii) consolidate, merge or transfer all or substantially all of their assets; (vii) restrict distributions or other payments from the Company’s restricted subsidiaries; and (ix) designate subsidiaries as unrestricted subsidiaries.

We have the option to redeem all or a portion of the 7.75% Notes at any time on or after June 15, 2017 at the applicable redemption prices specified in the indenture plus accrued and unpaid interest. We may also redeem the 7.75% Notes, in whole or in part, at a redemption price equal to 100% of their principal amount plus a make whole premium, together with accrued and unpaid interest and additional interest, if any, to the redemption date, at any time prior to June 15, 2017. In addition, we may redeem up to 35% of the 7.75% Notes prior to June 15, 2016 under certain circumstances with an amount not greater than the net cash proceeds of one or more equity offerings at the redemption price specified in the indenture. We may also be required to repurchase the 7.75% Notes upon a change of control or if we sell certain of our assets.

On July 18, 2014, we completed an exchange offer of $600 million aggregate principal amount of the 7.75% Notes that had been registered under the Securities Act of 1933, as amended (the “Securities Act”), for an equal amount of the 7.75% Notes that had not been registered under the Securities Act.

6.125% Senior Notes Due 2023

On June 27, 2014, the Company completed a private offering of the Original 6.125% Notes. Interest is payable on each July 15 and January 15. The Company received net proceeds from this offering of approximately $829 million, after deducting initial purchasers’ discounts and offering expenses, which the Company used to repay all of the $100 million in borrowings outstanding under its Amended and Restated Credit Agreement and to finance a portion of the purchase price of the Catarina acquisition. We used the remaining proceeds from the offering to fund a portion of the remaining 2014 capital budget and for general corporate purposes. The Original 6.125% Notes are the senior unsecured obligations of the Company and are guaranteed on a joint and several senior unsecured basis by, with certain exceptions, substantially all of the Company’s existing and future subsidiaries.