UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to .

Commission File Number 000-54485

IONIX TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

45-0713638

|

| |

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

3773 Howard Hughes Pkwy Ste. 500S, Las Vegas, NV 89169

(Address of principal executive offices) (Zip Code)

(702) 475-5906

(Registrant’s telephone number, including area code)

___________________________

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐ |

Accelerated filer

|

☐ |

|

Non-accelerated filer

|

☐ |

Smaller reporting company

|

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

As of November 10, 2016, there were 99,003,000 shares of common stock issued and outstanding, par value $0.0001 per share.

As of November 10, 2016, there were 5,000,000 shares of preferred stock issued and outstanding, par value $0.001 per share.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this Quarterly Report on Form 10-Q and other filings of the Registrant under the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as well as information communicated orally or in writing between the dates of such filings, contains or may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements in this Quarterly Report on Form 10-Q, including without limitation, statements related to our plans, strategies, objectives, expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from expected results. Among these risks, trends and uncertainties are the availability of working capital to fund our operations, the competitive market in which we operate, the efficient and uninterrupted operation of our computer and communications systems, our ability to generate a profit and execute our business plan, the retention of key personnel, our ability to protect and defend our intellectual property, the effects of governmental regulation, and other risks identified in the Registrant’s filings with the Securities and Exchange Commission from time to time.

In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable terminology. Although the Registrant believes that the expectations reflected in the forward-looking statements contained herein are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither the Registrant, nor any other person, assumes responsibility for the accuracy and completeness of such statements. The Registrant is under no duty to update any of the forward-looking statements contained herein after the date of this Quarterly Report on Form 10-Q.

IONIX TECHNOLOGY, INC.

FORM 10-Q

SEPTEMBER 30, 2016

INDEX

|

|

|

Page

|

|

Part I – Financial Information

|

F-1 |

|

|

|

|

|

Item 1.

|

Financial Statements

|

F-1 |

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

12 |

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

15 |

|

Item 4.

|

Controls and Procedures

|

15 |

|

Item 4T.

|

Controls and Procedures

|

|

|

|

|

|

|

Part II – Other Information

|

15 |

|

|

|

|

|

Item 1.

|

Legal Proceedings

|

15 |

|

Item 1A.

|

Risk Factors

|

16 |

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

16 |

|

Item 3.

|

Defaults Upon Senior Securities

|

16 |

|

Item 4.

|

Mine Safety Disclosures

|

16 |

|

Item 5.

|

Other Information

|

16 |

|

Item 6.

|

Exhibits

|

17 |

|

|

|

|

|

Signatures

|

18 |

|

|

|

|

|

Certifications

|

|

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

|

INDEX

|

F-1

|

|

Consolidated Balance Sheets as of September 30, 2016 and June 30, 2016 (Unaudited)

|

F-2

|

|

Consolidated Statements of Comprehensive Loss for the Three Months Ended September 30, 2016

and 2015 (Unaudited)

|

F-3

|

|

Consolidated Statements of Cash Flows for the Three Months Ended September 30, 2016 and 2015

(Unaudited)

|

F-4

|

|

Notes to Consolidated Financial Statements (Unaudited)

|

F-5

|

IONIX TECHNOLOGY, INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

|

|

|

September 30,

2016

|

|

|

June 30,

2016

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Asset:

|

|

|

|

|

|

|

|

Cash

|

|

$

|

17,630

|

|

|

$

|

59,758

|

|

|

Inventory

|

|

|

40,685

|

|

|

|

-

|

|

|

Due from related parties

|

|

|

913,380

|

|

|

|

-

|

|

|

Prepaid expenses

|

|

|

9,286

|

|

|

|

103

|

|

|

Current asset of discontinued operation

|

|

|

-

|

|

|

|

2,129,360

|

|

|

Total current assets

|

|

|

980,981

|

|

|

|

2,189,221

|

|

|

Total Assets

|

|

$

|

980,981

|

|

|

$

|

2,189,221

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

545,212

|

|

|

$

|

-

|

|

|

Advance from customers

|

|

|

286,292

|

|

|

|

|

|

|

Other payable

|

|

|

38,981

|

|

|

|

|

|

|

Due to related parties

|

|

|

49,088

|

|

|

|

53,510

|

|

|

Accrued expenses

|

|

|

11,083

|

|

|

|

9,080

|

|

|

Tax payable

|

|

|

21,562

|

|

|

|

-

|

|

|

Current liability of discontinued operation

|

|

|

-

|

|

|

|

2,113,533

|

|

|

Total Current Liabilities

|

|

|

952,218

|

|

|

|

2,176,123

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENT AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity :

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Preferred share capital,5,000,000 shares authorized,

$.0001 par value; 5,000,000 and zero shares issued and

outstanding at September 30 and June 30, 2016

|

|

|

500

|

|

|

|

500

|

|

|

Common stock, 195,000,000 shares authorized,

$.0001 par value; 99,003,000 shares issued and outstanding

|

|

|

9,900

|

|

|

|

9,900

|

|

|

Additional paid in capital

|

|

|

261,610

|

|

|

|

237,246

|

|

|

Accumulated deficit

|

|

|

(243,082

|

)

|

|

|

(234,903

|

)

|

|

Accumulated other comprehensive income (loss)

|

|

|

(165

|

)

|

|

|

355

|

|

|

Total stockholders’ equity

|

|

|

28,763

|

|

|

|

13,098

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Stockholders’ Equity (Deficit)

|

|

$

|

980,981

|

|

|

$

|

2,189,221

|

|

The accompanying notes are an integral part of these consolidated financial statements.

IONIX TECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

|

|

|

For the three months ended

September 30,

|

|

| |

|

|

|

| |

|

2016

|

|

|

2015

|

|

|

|

|

|

|

|

(Restated) |

|

|

Revenues

|

|

$

|

844,109

|

|

|

$

|

-

|

|

|

Cost of revenues

|

|

|

756,570

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

87,539

|

|

|

|

-

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

41,710

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

41,710

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Net income from continuing operations before income tax

|

|

|

45,829

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Income tax

|

|

|

18,909

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Net income from continuing operations

|

|

|

26,920

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from discontinued operation

|

|

|

(35,099

|

)

|

|

|

(59,217

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net Loss

|

|

|

(8,179

|

)

|

|

|

(59,217

|

)

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

520

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

$

|

(7,659

|

)

|

|

$

|

(59,217

|

)

|

| |

|

|

|

|

|

|

|

|

|

Loss Per Share -

|

|

|

|

|

|

|

|

|

|

Basic and Diluted-continuing operation

-discontinued operation

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Weighted average number of common shares outstanding-Basic and

Diluted

|

|

|

99,003,000

|

|

|

|

99,003,000

|

|

The accompanying notes are an integral part of these consolidated financial statements.

IONIX TECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| |

|

For the three months ended September

30,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

CASH FLOWS FROM OPERATIONS:

|

|

|

|

|

(Restated) |

|

|

Net loss

|

|

$

|

(8,179

|

)

|

|

$

|

(59,217

|

)

|

|

Net loss from discontinued operation

|

|

|

(35,099

|

)

|

|

|

(59,217

|

)

|

|

Net income from continuing operation

|

|

|

26,920

|

|

|

|

-

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

-

|

|

|

Increases in other receivable

|

|

|

-

|

|

|

|

-

|

|

|

Increases in inventory

|

|

|

(40,804

|

)

|

|

|

-

|

|

|

Increases in prepaid expense

|

|

|

(9,183

|

)

|

|

|

-

|

|

|

Increases in accounts payable

|

|

|

546,852

|

|

|

|

-

|

|

|

Increases in other payable

|

|

|

39,084

|

|

|

|

-

|

|

|

Increase in advance from customers

|

|

|

287,127

|

|

|

|

|

|

|

Increase in accrued expense

|

|

|

2,018

|

|

|

|

|

|

|

Increases in tax payable

|

|

|

21,562

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by continuing operation

|

|

|

873,576

|

|

|

|

-

|

|

|

Net cash used in discontinued operation

|

|

|

-

|

|

|

|

(5,242

|

)

|

|

Net cash provided by (used in) operating activities

|

|

|

873,576

|

|

|

|

(5,242

|

)

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOW FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Increase in due from related parties

|

|

|

(916,044 |

)

|

|

|

-

|

|

|

Net cash used in continuing operation

|

|

|

(916,044 |

)

|

|

|

-

|

|

|

Net cash used in discounted operation

|

|

|

-

|

|

|

|

-

|

|

|

Net cash used in investing activities

|

|

|

(916,044 |

)

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Decrease in due to related parties

|

|

|

577

|

|

|

|

|

|

|

Net cash provided by continuing operation

|

|

|

577

|

|

|

|

-

|

|

|

Net cash provided by discontinued operation

|

|

|

-

|

|

|

|

5,200

|

|

|

Net cash provided by financing activities

|

|

|

577

|

|

|

|

5,200

|

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

(237

|

)

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Net increase in cash

|

|

|

(42,128

|

)

|

|

|

(42

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash balance, beginning of period

|

|

|

59,758

|

|

|

|

691

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash balance, end of period

|

|

$

|

17,630

|

|

|

$

|

649

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Cash paid for income tax

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash paid for interests

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these consolidated financial statements.

IONIX TECHNOLOGY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2016

(UNAUDITED)

NOTE 1- NATURE OF OPERATIONS

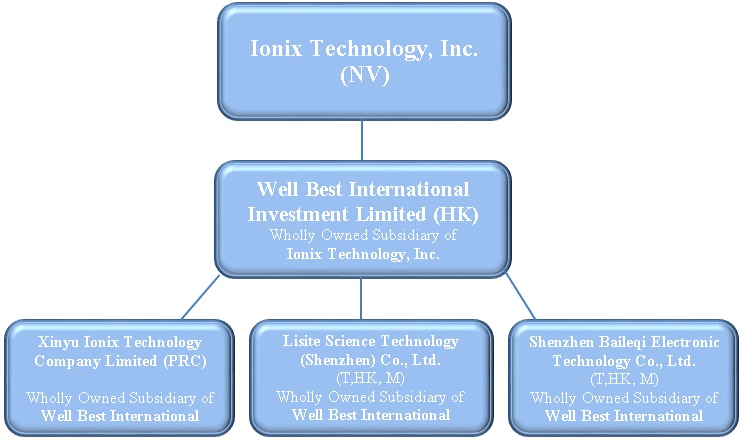

Ionix Technology, Inc. (the “Company”), formerly known as Cambridge Projects Inc., is a Nevada corporation that was formed on March 11, 2011. By and through its wholly owned subsidiaries, the Company develops, designs, manufactures and sells lithium batteries for electric vehicles in China.

On May 19, 2016, the Company, as the sole member of Well Best International Investment Limited (“Well Best”), formed Xinyu Ionix Technology Company Limited (“Xinyu Ionix”), a company formed under the laws of China. As a result Xinyu Ionix is a wholly-owned subsidiary of Well Best and an indirect wholly-owned subsidiary of the Company. Between May 19, 2016 and August 19, 2016, the date the Board ratified the incorporation, Xinyu Ionix conducted no business. Xinyu Ionix will focus on developing and designing lithium batteries as well as to act as an investment company that may acquire other businesses located in China

NOTE 2 –GOING CONCERN

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. The Company has not generated income from its operations and had an accumulated deficit of $243,082 at September30, 2016. These circumstances, among others, raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The Company expects to continue incurring losses for the foreseeable future and may need to raise additional capital from external sources or obtain loans from officers and shareholders in order to continue the long-term efforts contemplated under its business plan. The Company is in the process of reevaluating its current marketing strategy as it relates to the sale of its current product line. In addition, the Company is pursuing other revenue streams which could include strategic acquisitions or possible joint ventures of other business segments.

NOTE 3 –SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and the rules and regulations of the Securities and Exchange Commission. In the opinion of management, the unaudited financial statements have been prepared on the same basis as the annual financial statements and reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the financial position as of September 30, 2016 and the results of operations and cash flows for the periods ended September 30, 2016 and 2015. The financial data and other information disclosed in these notes to the interim financial statements related to these periods are unaudited. The results for the three months ended September 30, 2016 are not necessarily indicative of the results to be expected for any subsequent periods or for the entire year ending June 30, 2017 or for any subsequent periods. The balance sheet at June 30, 2016 has been derived from the audited financial statements at that date.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to the Securities and Exchange Commission's rules and regulations. These unaudited financial statements should be read in conjunction with our audited financial statements and notes thereto for the year ended June 30, 2016 as included in our Annual Report on Form 10-K as filed with the SEC on October 11, 2016.

Certain amounts have been reclassified to conform to current year presentation

Impairment of long-lived assets

In accordance with the provisions of ASC Topic 360, “Impairment or Disposal of Long-Lived Assets”, all long-lived assets such as property, plant and equipment held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is evaluated by a comparison of the carrying amount of an asset to its estimated future undiscounted cash flows expected to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets.

Revenue recognition

In accordance with the ASC Topic 605, “Revenue Recognition”, the Company recognizes revenue when persuasive evidence of an arrangement exists, transfer of title has occurred or services have been rendered, the selling price is fixed or determinable and collectability is reasonably assured.

The Company recognizes revenue from the sale of finished products upon delivery to the customer, whereas the title and risk of loss are fully transferred to the customers. The Company records its revenues, net of value added taxes (“VAT”). The Company is subject to VAT which is levied on the majority of the products at the rate of 17% on the invoiced value of sales.

Foreign currencies translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The reporting currency of the Company is the United States Dollar ("US$"). The Company's subsidiaries in the People’s Republic of China (“PRC”) maintain their books and records in their local currency, the Renminbi Yuan ("RMB"), which is the functional currency as being the primary currency of the economic environment in which these entities operate.

In general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not the US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. Stockholders’ equity is translated at historical rates. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

The exchange rates used to translate amounts in RMB into U.S. Dollars for the purposes of preparing the consolidated financial statements are as follows:

| |

|

September 30,

2016

|

|

| |

|

|

|

Balance sheet items, except for equity accounts

|

|

|

6.6700

|

|

| |

|

|

|

|

|

Items in statements of income and cash flows

|

|

|

6.6506

|

|

There were no foreign operations during the three months ended September 30, 2015.

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments: cash and cash equivalents, accounts and retention receivable, prepayments and other receivables, accounts payable, income tax payable, other payables and accrued liabilities approximate at their fair values because of the short-term nature of these financial instruments.

Management believes, based on the current market prices or interest rates for similar debt instruments, the fair value of short-term bank borrowings and note payable approximate the carrying amount.

The Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” ("ASC 820-10"), with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy that prioritizes the inputs used in measuring fair value as follows:

Level 1: Inputs are based upon unadjusted quoted prices for identical instruments traded in active markets;

Level 2: Inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques (e.g. Black-Scholes Option-Pricing model) for which all significant inputs are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Where applicable, these models project future cash flows and discount the future amounts to a present value using market-based observable inputs; and

Level 3: Inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques, including option pricing models and discounted cash flow models.

Fair value estimates are made at a specific point in time based on relevant market information about the financial instrument. These estimates are subjective in nature and involve uncertainties and matters of significant judgment and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

NOTE 4– DISCONTINUED OPERATIONS

On February 8, 2012, the Company obtained exclusive licensing rights of the QI System from Quadra International Inc. (“Quadra”), the manufacturer of the QI System, to sub-license, establish joint ventures to commercialize, use and process organic waste, and sell related by-products in the states of Johore and Selangor, Malaysia for a period of 25 years. The QI System processes organic waste to marketable by-products and is proprietary technology. This business was terminated on November 15, 2015.The Company has excluded results of QI system operations from its continuing operations to present this business in discontinued operations.

The following table shows the results of operations for fiscal quarters ended September 30, 2016 and 2015 which are included in the loss from discontinued operations for the termination of QI System:

| |

|

For the three months ended on

September 30

|

|

| |

|

2016

|

|

|

2015

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cost of revenue

|

|

|

-

|

|

|

|

-

|

|

|

Gross profit

|

|

|

-

|

|

|

|

-

|

|

|

Selling, general and administrative expenses

|

|

|

-

|

|

|

|

59,217

|

|

|

Loss before income taxes

|

|

|

-

|

|

|

|

(59,217

|

)

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

Net loss

|

|

$

|

-

|

|

|

$

|

(59,217

|

)

|

On August 19, 2016, Well Best entered into a share transfer agreement whereby Well Best sold 100% of its equity interest in Taizhou Ionix Technology Co. Ltd. (“Taizhou Ionix”) to Mr. GuoEn Li, the sole director and officer of Taizhou Ionix for approximately RMB 30,000 (approximately $5,000USD). Well Best was the sole shareholder of Taizhou Ionix. The Company believed that the manufacturing contract between Taizhou Ionix and Taizhou Jiunuojie Electronic Technology Limited regarding the production of lithium batteries was not beneficial to the Company. As a result, (i) Taizhou is no longer an indirect, wholly-owned subsidiary of the Company, and (ii) Mr. Li is no longer affiliated with the Company. Well Best recorded a gain of $24,364 on disposal of Taizhou Ionix which was recorded in the account of additional paid in capital.

The following table shows the results of operations for the three months ended September 30, 2016 and 2015 which are included in the loss from discontinued operations for the disposal of Taizhou Ionix:

| |

|

For the period from

July 1 to August 19,

2016

|

|

|

For the three months

ended on September

30,2015

|

|

|

Revenue

|

|

$

|

502,003

|

|

|

$

|

-

|

|

|

Cost of revenue

|

|

|

(505,401

|

)

|

|

|

-

|

|

|

Gross profit (Loss)

|

|

|

(3,389

|

)

|

|

|

-

|

|

|

Selling, general and administrative expenses

|

|

|

31,701

|

|

|

|

-

|

|

|

Loss before income taxes

|

|

|

(35,099

|

)

|

|

|

-

|

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

Net Loss

|

|

$

|

( 35,099

|

)

|

|

$

|

-

|

|

NOTE 5-INVENTORIES

Inventories are stated at the lower of cost (determined using the weighted average cost) or market value and are composed of the following:

| |

|

September 30,

|

|

| |

|

2016

|

|

|

2015

|

|

| |

|

|

|

|

|

|

|

Raw materials

|

|

|

40,685

|

|

|

|

-

|

|

| |

|

$

|

40,685

|

|

|

$

|

-

|

|

NOTE 6- DUE FROM/TO RELATED PARTIES

Due from related party represents advances to Mr. Nan Zhengfu, a director and the general manager of Xinyu Ionix a wholly owned subsidiary. During the three months ended September 30, 2016, Xinyu Ionix advanced $913,380 (RMB 6,092,243) to Mr. Nan. There was no formal agreement between the Company and Mr. Nan. The amounts are non-interest bearing, unsecured and due on demand.

From October 1 to November 7, 2016, Mr. Nan made payments to suppliers of Xinyu Ionix for approximately RMB 3,000,000 (approximately $450,000) for settlement of account payable on behalf of Xinyu Ionix. The repayment of the unpaid balance of approximately $460,000 was guarenteed by Mr. Ben Wong, who is the sole owner of the Company’s major shareholder, Shining Glory Investments Limited.

Due to related parties represents certain advances to the company or its subsidiaries by related parties. The amounts are non-interest bearing, unsecured and due on demand.

During the three months ended September30, 2016, Ben Wang advanced $577 to Well Best and he received the proceeds of $5,000 from sales of Taizhou Ionix on behalf of the Company.

NOTE 7 – CONCENTRATION OF RISKS

Major customers

For the quarter ended September30, 2016, customer who accounted for 10% or more of the Company’s revenues and its outstanding balance as of September30, 2016 are presented as follows:

| |

|

Revenue

|

|

|

Percentage of

revenue

|

|

| |

|

|

|

|

|

|

|

Customer A

|

|

$

|

694,049

|

|

|

|

82

|

%

|

|

Customer B

|

|

|

150,060

|

|

|

|

18

|

%

|

| |

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

844,109

|

|

|

$

|

100

|

%

|

All customers are located in the PRC.

Major suppliers

Supplier who accounted for 10% or more of the Company’s total purchases (materials and services) and its outstanding balance as of September30, 2016, are presented as follows:

| |

|

Total Purchase

|

|

|

Percentage of

total purchase

|

|

|

Accounts payable

|

|

|

Percentage of

accounts

payable

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplier A

|

|

$

|

417,669

|

|

|

|

53

|

%

|

|

$

|

195,809

|

|

|

|

36

|

%

|

|

Supplier B

|

|

|

323,761

|

|

|

|

40

|

%

|

|

|

150,759

|

|

|

|

28

|

%

|

|

Total

|

|

$

|

741,430

|

|

|

|

93

|

%

|

|

$

|

346,568

|

|

|

|

64

|

%

|

All suppliers of the Company are located in the PRC.

NOTE 8- INCOME TAXES

The effective tax rate in the years presented is the result of the mix of income earned in various tax jurisdictions that apply a broad range of income tax rate. The Company operates in various countries: United States of America Hong Kong and the PRC that are subject to taxes in the jurisdictions in which they operate, as follows:

United States of America

The Company is registered in the State of Nevada and is subject to the tax laws of United States of America.

The Company has shown losses since inception. As a result it has incurred no income tax. Under normal circumstances, the Internal Revenue Service is authorized to audit income tax returns during a three year period after the returns are filed. In unusual circumstances, the period may be longer. Tax returns for the years ended June 30, 2011 to 2014 were still exposed to audit as of June 30, 2016.

The Company received a penalty assessment from the IRS in the amount of $10,000 for failure to provide information with respect to certain foreign owned US Corporations on Form 5472 - Information Return of a 25% Foreign Owned US Corporation for the tax period ended June 30, 2013. The Company disputed this claim and is working to reverse the penalty. The Company believes that the payment of this penalty is remote and did not accrue this liability as of September 30, 2016 and 2015.

Hong Kong

The Well Best is registered in Hong Kong and for the three months ended September30, 2016, there is no assessable income chargeable to profit tax in Hong Kong.

The PRC

The Company's subsidiaries, Taizhou Ionix and Xinyu Ionix, are subject to the Corporate Income Tax Law of the People’s Republic of China at a unified income tax rate of 25%.

The reconciliation of income tax expense at the U.S. statutory rate of 35% to the Company's effective tax rate is as follows:

| |

|

For the three months ended September30,

|

|

| |

|

2016

|

|

|

2015

|

|

| |

|

|

|

|

|

|

|

U.S. Statutory rate

|

|

$

|

3,755

|

|

|

$

|

(20,726

|

)

|

|

Tax rate difference between

China and U.S.

|

|

|

4,492

|

|

|

|

-

|

|

|

Change in Valuation Allowance

|

|

|

10,662

|

|

|

|

20,726

|

|

|

Effective tax rate

|

|

$

|

18,909

|

|

|

$

|

-

|

|

|

The provisions for income taxes are summarized as follows:

|

|

For three months ended September 30,

|

|

| |

|

2016

|

|

|

2015

|

|

|

Current

|

|

$

|

18,909

|

|

|

$

|

-

|

|

|

Deferred

|

|

|

-

|

|

|

|

-

|

|

|

Total

|

|

$

|

18,909

|

|

|

$

|

-

|

|

The Company has not provided deferred taxes on unremitted earnings attributable to international companies that have been considered to be reinvested indefinitely. Because of the availability of U.S. foreign tax credits, it is not practicable to determine the income tax liability that would be payable if such earnings were not indefinitely reinvested. In accordance with ASC Topic 740, interest associated with unrecognized tax benefits is classified as income tax and penalties are classified in selling, general and administrative expenses in the statements of operations.

The extent of the Company’s operations involves dealing with uncertainties and judgments in the application of complex tax regulations in a multitude of jurisdictions. The final taxes paid are dependent upon many factors, including negotiations with taxing authorities in various jurisdictions and resolution of disputes arising from federal, state and international tax audits. The Company recognizes potential liabilities and records tax liabilities for anticipated tax audit issues in the United States and other tax jurisdictions based on its estimate of whether, and the extent to which, additional taxes will be due.

NOTE 9– STOCKHOLDERS’ EQUITY

On August 19, 2016, Well Best sold 100% of its ownership in Taizhou Ionix to Mr. GuoEn Li, the sole director and officer of Taizhou Ionix for RMB30,000 (approximately $5,000) and recorded a gain of $24,364 which was recorded in the account of additional paid in capital. See Note 4 for more details.

NOTE 10– RESTATEMENT

The management of the Company has concluded that we should restate our financial statements as of and for the quarter ended September 30, 2015 due to the restatement of the year ended on June 30, 2015.

The effect of the restatement on specific line items in the financial statements for the three months ended September 30, 2015 is set forth in the table below:

| |

|

Consolidated Statement of Comprehensive Loss

|

|

| |

|

for the three months Ended September30, 2015

|

|

| |

|

Previously

|

|

|

|

|

|

|

|

| |

|

Reported

|

|

|

Adjustments

|

|

|

As Adjusted

|

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

$

|

7,491

|

|

|

$

|

51,726

|

|

|

$

|

59,217

|

|

|

Loss before income tax

|

|

$

|

(7,491

|

)

|

|

$

|

(51,726

|

)

|

|

$

|

(59,217

|

)

|

|

Net loss

|

|

$

|

(7,491

|

)

|

|

$

|

(51,726

|

)

|

|

$

|

(59,217

|

)

|

NOTE 11- SUBSEQUENT EVENTS

The Company has evaluated subsequent events that have occurred after the date of the balance sheet through the date of issuance of these consolidated financial statements and determined that no subsequent event requires recognition or disclosure to the consolidated financial statements.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following Management's Discussion and Analysis should be read in conjunction with Ionix Technology, Inc.’s. financial statements and the related notes thereto. The Management's Discussion and Analysis contains forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Any statements that are not statements of historical fact are forward-looking statements. When used, the words “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions (“will,” “may,” “could,” “should,” etc.), or similar expressions, identify certain of these forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by the forward-looking statements in this Report on Form 10-Q. The Company’s actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors. The Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances occurring after the date of this Report on Form 10-Q.

The following discussion should be read in conjunction with our unaudited consolidated financial statements and related notes and other financial data included elsewhere in this report. See also the notes to our consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in our Annual Report on Form 10-K for the year ended June 30, 2016, filed with the Commission on October 11, 2016.

Results of Operations for the three months ended September 30, 2016 and 2015 and for the Years Ended June 30, 2016, and 2015

Net Loss

During the three months ended September 30, 2016 and 2015, net loss was $8,179 and $59,217, respectively, which included net income from continuing operation of $26,920 and $NIL, respectively. The change in net income from continuing operation is primarily the result of the commencement of operations in the PRC.The net loss from discontinued operation of Taizhou Ionix is $35,099 and $Nil, respectively. The net loss from discontinued operation of Qi system is $Nil and $59,217, respectively.

During the year ended June 30, 2016 and 2015, net loss was $44,431 and $116,282, respectively, which included net loss from continuing operation of $37,892 and $0, respectively, and net loss from discontinued operation of $6,539 and $116,282, respectively. The change in net loss is primarily the result of the commencement of operations in the PRC.

Revenue

During the three months ended September 30, 2016 and 2015, revenue was $844,109 and $NIL, respectively. The difference can be attributed to the commencement of our business and generating revenue from the sale of lithium batteries in the PRC.

During the year ended June 30, 2016 and 2015, revenue was $1,970,345 and $0, respectively. The difference can be attributed to the commencement of our business and generating revenue from the sale of lithium batteries in the PRC.

Cost of Revenue

During the three months ended September 30, 2016 and 2015, the cost of revenue was $756,570 and $NIL, respectively. For the three months ended September 30, 2016, the cost of revenue included the cost of raw materials and the sub- contracting processing fee paid to Jiangxi Huanming Technology Ltd (“Jiangxi Huanming”)., pursuant to the manufacturing agreement between Xinyu Ionix and Jiangxi Huanming.

During the year ended June 30, 2016 and 2015, the cost of revenue was $1,844,471 and $0, respectively. In 2016, the cost of revenue included the cost of raw materials and the sub- contracting processing fee paid to Taizhou Jiunuojie Electronic Technology Ltd., pursuant to the manufacturing agreement between Taizhou Ionix and Jiunuojie.

Gross Profit

During the three months ended September 30, 2016 and 2015, gross profit was $87,539 and $NIL, respectively. Our gross profit maintained at 10% during the quarter ended September 30, 2016.

During the year ended June 30, 2016 and 2015, gross profit was $125,874 and $0, respectively. Our gross profit maintained at 6.4% during the year ended June 30, 2016.

Selling, General and Administrative Expenses

During the three months ended September 30, 2016 and 2015, selling, general and administrative expenses were $41,710 and $NIL, respectively. In comparison, during the year ended June 30, 2016, general and administrative expenses were $147,470. Our general and administrative expenses mainly comprised of payroll expenses, transportation, office expense, professional fees and other miscellaneous expenses. The expenses were significantly more in 2016 as we have commenced the operation in the PRC during this period.

Loss from Discontinued Operations

QI system business was terminated on November 15, 2015. Hence the Company has presented results of QI system operations as a discontinued operation in the consolidated statements of comprehensive loss. During the three months ended September 30, 2016 and 2015, loss from discontinued operation of QI system was Nil and $59,217, respectively, all of which were general and administrative expense, mainly included consulting fees, audit and legal fees.

During the year ended June 30, 2016 and 2015, loss from discontinued operation of QI system was $6,539 and $116,282, respectively, all of which were general and administrative expense, mainly included consulting fees, audit and legal fees.

On August 19, 2016, Well Best entered into a share transfer agreement whereby Well Best sold 100% of its equity interest in Taizhou Ionix Technology Co. Ltd. (“Taizhou Ionix”) to Mr. GuoEn Li, the sole director and officer of Taizhou Ionix for approximately RMB 30,000 ( approximately $5,000USD). During the three months ended September 30, 2016 and 2015, loss from discontinued operation of Taizhou Ionix was $35,099 and Nil, respectively.

Liquidity and Capital Resources

Cash Flow from Operating Activities

During the three months ended September 30, 2016 and 2015, $873,576 cash was provided by operating activities compared with $(5,242), respectively. There was an increase in accounts payable which were partially offset by an increase in inventory. In comparison, during the year ended June 30, 2016 and 2015, the Company used $970,512 cash for operating activities compared with $23,726, respectively.

During the three months ended September 30, 2016 and 2015, net cash provided by discontinued operations was $NIL and $(5,242), respectively. During the year ended June 30, 2016 and 2015, net cash used in discontinued operations was $14,039 and $23,726, respectively

Cash Flow from Investing Activities

During the three months ended September 30, 2016 and 2015, the Company used $916,044 and $NIL in cash for investing activities, respectively. During the three months ended September 30, 2016, the Company’s subsidiary, Xinyu Ionix, made advances of $916,044 to Mr. Nan, a director and the general manager of Xinyu Ionix. There was no formal agreement between the Company and Mr. Nan relating to the advances. During the subsequent period, Mr. Nan used the fund to settle the accounts payable on behalf of Xinyu Ionix. As of November 7, 2016, approximately $450,000 had been paid to suppliers to settle accounts payable on behalf of Xinyu Ionix. During the years ended June 30, 2016 and 2015, the Company used $NIL and $NIL in cash for investing activities, respectively.

Cash Flow from Financing Activities

During the three months ended September 30, 2016, the Company received $577 in cash from financing activities, which consisted primarily of an increase in due from related party. In comparison, during the three months ended September 30, 2015, the Company received $5,200 in cash from financing activities, which resulted from net cash provided by discontinued operations.

During the year ended June 30, 2016, the Company received $1,044,949 in cash from financing activities, which consisted of $204,689 cash out flow of restricted cash, $50,000 received from the issuance of preferred stock and $1,185,655 proceeds from related parties. In comparison, during the year ended June 30, 2015, the Company received $24,336 in cash from financing activities which was attributable solely to proceeds from shareholder loans.

As of September 30, 2016, we have a working capital of $28,763.

Our total current liabilities consist primarily of account and other payables of $952,218. Our Company’s President is committed to providing for our minimum working capital needs for the next 12 months, and we do not expect previous loan amounts to be payable for the next 12 months. However, we do not have a formal agreement that states any of these facts. The remaining balance of our current liabilities relates to audit and consulting fees and such payments are due on demand and we expect to settle such amounts on a timely basis based upon shareholder loans to be granted to us in the next 12 months.

We will require approximately $150,000 to fund our working capital needs for the year ending June 30, 2017 as follows:

|

Audit and accounting

|

|

|

30,000

|

|

|

Legal Consulting fees

|

|

|

50,000

|

|

|

Salary and wages

|

|

|

30,000

|

|

|

Edgar/XBRL filing, transfer agent and miscellaneous

|

|

|

40,000

|

|

|

Total

|

|

$

|

150,000

|

|

Future Financings

We will not consider taking on any long-term or short-term debt from financial institutions in the immediate future. We are dependent upon our director and the major shareholder to provide continued funding and capital resources. If continued funding and capital resources are unavailable at reasonable terms, we may not be able to implement our plan of operations. The financial statements do not include any adjustments related to the recoverability of assets and classification of liabilities that might be necessary should the Company be unable to continue in operation.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers: Topic 606. This Update affects any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets, unless those contracts are within the scope of other standards. The guidance in this Update supersedes the revenue recognition requirements in Topic 605, Revenue Recognition and most industry-specific guidance. The core principle of the guidance is that an entity should recognize revenue to illustrate the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new guidance also includes a cohesive set of disclosure requirements that will provide users of financial statements with comprehensive information about the nature, amount, timing, and uncertainty of revenue and cash flows arising from a reporting organization’s contracts with customers. This ASU is effective for fiscal years, and interim periods within those years beginning after December 15, 2016 for public companies and 2017 for non-public entities. Management is evaluating the effect, if any, on the Company’s financial position and results of operations.

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 4. |

CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures are controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by our company in the reports that it files or submits under the Exchange Act is accumulated and communicated to our management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. Our management carried out an evaluation under the supervision and with the participation of our Principal Executive Officer and Principal Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 ("Exchange Act"). Based upon that evaluation, our Principal Executive Officer and Principal Financial Officer have concluded that our disclosure controls and procedures were not effective as of September 30, 2016.

Changes in Internal Control over Financial Reporting

Our management has also evaluated our internal control over financial reporting, and there have been no significant changes in our internal controls or in other factors that could significantly affect those controls subsequent to the date of our last evaluation.

The Company is not required by current SEC rules to include, and does not include, an auditor's attestation report. The Company's registered public accounting firm has not attested to Management's reports on the Company's internal control over financial reporting.

PART II - OTHER INFORMATION

| ITEM 1. |

LEGAL PROCEEDINGS |

From time to time, the Company may become subject to various legal proceedings that are incidental to the ordinary conduct of its business. Although the Company cannot accurately predict the amount of any liability that may ultimately arise with respect to any of these matters, it makes provision for potential liabilities when it deems them probable and reasonably estimable. These provisions are based on current information and legal advice and may be adjusted from time to time according to developments.

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

None.

| ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4. |

MINE SAFETY DISCLOSURES |

N/A.

| ITEM 5. |

OTHER INFORMATION |

As reported on Form 8-K filed with the SEC on November 8, 2016, on November 7, 2016, the Company’s Board of Directors approved and ratified the incorporation of Lisite Science Technology (Shenzhen) Co., Ltd (“Lisite Science”), a limited liability company formed under the laws of Taiwan, Hong Kong, and Macao on June 20, 2016. Well Best is the sole shareholder of Lisite Science. As a result, Lisite Science is an indirect, wholly-owned subsidiary of the Company. Lisite Science will act as a manufacturing base for the Company and shall focus on developing and producing high-end intelligent electronic equipment.

Additionally, the Company’s Board of Directors approved and ratified the incorporation of Shenzhen Baileqi Electronic Technology Co., Ltd. (“Baileqi Electronic”), a limited liability company formed under the laws of Taiwan, Hong Kong, and Macao on August 8, 2016. Well Best is the sole shareholder of Baileqi Electronic. As a result, Baileqi Electronic is an indirect, wholly-owned subsidiary of the Company. Baileqi Electronic will act as a manufacturing base for the Company and shall focus on development and production of the LCD and module for civil electronic products.

|

Exhibit

|

|

|

|

|

Number

|

Description of Exhibit

|

|

|

|

3.01a

|

Articles of Incorporation, dated March 11, 2011

|

|

Filed with the SEC on August 23, 2011 as an exhibit to our Registration Statement on Form 10.

|

|

3.01b

|

Certificate of Amendment to Articles of Incorporation, dated August 7, 2014

|

|

Filed with the SEC on September 3, 2014 as part of our Current Report on Form 8-K

|

|

3.01c

|

Certificate of Amendment to Articles of Incorporation, dated December 3, 2015

|

|

Filed with the SEC on December 10, 2015 as part of our Current Report on Form 8-K

|

|

3.02a

|

Bylaws

|

|

Filed with the SEC on August 23, 2011 as an exhibit to our Registration Statement on Form 10.

|

|

3.02b

|

Amended Bylaws, dated August 7, 2014

|

|

Filed with the SEC on September 3, 2014 as part of our Current Report on Form 8-K

|

|

10.01

|

Stock Purchase Agreement between Locksley Samuels and Shining Glory Investments Limited, dated November 20, 2015

|

|

Filed with the SEC on November 23, 2015 as part of our Current Report on Form 8-K

|

|

10.02

|

Manufacturing Agreement, dated as of August 19, 2016, by and between Jiangxi Huanming Technology Limited Company and Xinyu Ionix Technology Company Limited.

|

|

Filed with the SEC on August 24, 2016 as part of our Current Report on Form 8-K

|

|

10.03

|

Share Transfer Agreement, dated as of August 19, 2016, by and between GuoEn Li and Well Best International Investment Limited

|

|

Filed with the SEC on August 24, 2016 as part of our Current Report on Form 8-K

|

|

21.1

|

List of Subsidiaries

|

|

Filed herewith.

|

|

31.01

|

Certification of Principal Executive Officer Pursuant to Rule 13a-14

|

|

Filed herewith.

|

|

31.02

|

Certification of Principal Financial Officer Pursuant to Rule 13a-14

|

|

Filed herewith.

|

|

32.01

|

CEO Certification Pursuant to Section 906 of the Sarbanes-Oxley Act

|

|

Filed herewith.

|

|

32.02

|

CFO Certification Pursuant to Section 906 of the Sarbanes-Oxley Act

|

|

Filed herewith.

|

|

101.INS*

|

XBRL Instance Document

|

|

Filed herewith.

|

|

101.SCH*

|

XBRL Taxonomy Extension Schema Document

|

|

Filed herewith.

|

|

101.CAL*

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

Filed herewith.

|

|

101.LAB*

|

XBRL Taxonomy Extension Labels Linkbase Document

|

|

Filed herewith.

|

|

101.PRE*

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

Filed herewith.

|

|

101.DEF*

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

Filed herewith.

|

*Pursuant to Regulation S-T, this interactive data file is deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, and otherwise is not subject to liability under these sections.

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Ionix Technology, Inc.

|

|

|

|

|

Date: November 14, 2016

|

By:

|

/s/ Doris Zhou

|

|

| |

Name:

|

Doris Zhou

|

| |

Title:

|

Chief Executive Officer and Director

|

|

Date: November 14, 2016

|

By:

|

/s/ Yue Kou

|

|

| |

Name:

|

Yue Kou

|

| |

Title:

|

Chief Financial Officer

|

In accordance with the Exchange Act, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

Ionix Technology, Inc.

|

|

|

|

|

Date: November 14, 2016

|

By:

|

/s/ Doris Zhou

|

|

| |

Name:

|

Doris Zhou

|

| |

Title:

|

Chief Executive Officer, Secretary,

|

|

|

Treasurer and Director

|

|

Date: November 14, 2016

|

By:

|

/s/ Yue Kou

|

|

| |

Name:

|

Yue Kou

|

| |

Title:

|

Chief Financial Officer

|

18