Exhibit 99.1

MERCURITY FINTECH HOLDING INC.

Room 1215, Xin’nan Block No.2

Yuehai Street

Nanshan District, Shenzhen 518000

Guangdong Province, People’s Republic of China

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held at 9:30 a.m. on November 21, 2022 Beijing Time

(Record Date – October 4, 2022)

To the Shareholders of Mercurity Fintech Holding Inc.:

This notice to shareholders is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Mercurity Fintech Holding Inc. (the “Company”) at the 2022 annual meeting of shareholders of the Company (the “Meeting”) and at all adjournments and postponements thereof. The Meeting will be held at on November 21, 2022, at 9:30 a.m., Beijing time, at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China, to consider and vote upon the following proposals:

| 1. | To elect eleven (11) (the “Director Nominees”) to serve on the Company’s Board of Directors (the “Board”) until the next annual shareholders meeting and until their successors are duly elected and qualified (“Proposal One”); |

| 2. | To approve a reverse stock split (the “Reverse Split”) of the Company’s issued ordinary shares at a ratio of not less than one (1)-for-three hundred sixty (360) and not more than one (1)-for-seven hundred twenty (720), with the exact ratio to be set at a whole number within this range to be determined by the Company’s Board, or any duly constituted committee thereof, in its discretion (“Proposal Two”); |

| 3. | Subject to the Shareholders’ approval of Proposal Two and the Board’s implementation of the Reverse Split, to suspend the trading of the Company’s American Depositary Receipts / Shares (“ADRs”), terminate the deposit agreement for the ADRs among the Company, its depositary bank, Citibank, N.A. (the “Depositary”), and the holders and beneficial owners of the Company’s ADRs, the exchange of ADRs for the corresponding ordinary shares of the Company and commence trading of the Company’s ordinary shares on the Nasdaq Stock Market upon the effectiveness of the Reverse Split (“Proposal Three”); and |

| 4. | To transact other such business as may properly come before the Meeting or any adjournment thereof. |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES LISTED ABOVE AND “FOR” EACH OF THE OTHER PROPOSALS.

Holders of record of the Company’s Ordinary Shares at the close of business on October 4, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, this Meeting and any adjournment or postponement thereof. Each Ordinary Share entitles the holder thereof to one vote.

Your vote is important, regardless of the number of shares you own. Even if you plan to attend this Meeting in person, it is strongly recommended that you complete the enclosed proxy card before the meeting date, to ensure that your shares will be represented at this Meeting if you are unable to attend.

A complete list of shareholders of record entitled to vote at this Meeting will be available for ten days before this Meeting at the principal executive office of the Company for inspection by shareholders during ordinary business hours for any purpose germane to this Meeting.

This notice and the enclosed proxy statement are first being mailed to shareholders on or about October 24, 2022.

You are urged to review carefully the information contained in the enclosed proxy statement prior to deciding how to vote your shares.

| By Order of the Board, | |

| /s/ Shi Qiu | |

| Shi Qiu | |

| Director of the Board | |

| October 21, 2022 |

IF YOU RETURN YOUR PROXY CARD WITHOUT AN INDICATION OF HOW YOU WISH TO VOTE, YOUR SHARES WILL BE VOTED “FOR” ALL OF THE NOMINEES LISTED ABOVE AND “FOR” EACH OF THE OTHER PROPOSALS.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Shareholder Meeting to Be Held at 9:30 a.m. Beijing Time on November 21, 2022

The Notice of Annual Meeting, notice to shareholders and Annual Report on Form 20-F for year ended December 31, 2021 are available at www.sec.gov.

TABLE OF CONTENTS

MERCURITY FINTECH HOLDING INC.

Notice to Shareholders

2022 ANNUAL MEETING OF SHAREHOLDERS

to be held on 9:30 a.m., Beijing time, on November 21, 2022

Room 1215, Xin’nan Block No.2

Yuehai Street

Nanshan District, Shenzhen 518000

Guangdong Province, People’s Republic of China

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving this proxy statement?

This proxy statement describes the proposals on which our Board would like you, as a shareholder, to vote at the Meeting, which will take place on November 21, 2022, at 9:30 a.m., Beijing time, at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China.

Shareholders are being asked to consider and vote upon proposals to (i) elect the Director Nominees to serve the Board until the next annual shareholders meeting and until their successors are duly elected and qualified; (ii) approve a reverse stock split (the “Reverse Split”) of the Company’s issued ordinary shares at a ratio of not less than one (1)-for-three hundred sixty (360) and not more than one (1)-for-seven hundred twenty (720), with the exact ratio to be set at a whole number within this range to be determined by the Company’s Board, or any duly constituted committee thereof, in its discretion; (iii) suspend the trading of the Company’s American Depositary Receipts / Shares (“ADRs”), terminate the deposit agreement for the ADRs among the Company, its depositary bank, Citibank, N.A. (the “Depositary”), and the holders and beneficial owners of the Company’s ADRs, the exchange of ADRs for the corresponding ordinary shares of the Company, and commence trading of the Company’s ordinary shares on the Nasdaq Stock Market upon the effectiveness of the Reverse Split, subject to the Shareholders’ approval of Proposal Two and the Board’s implementation of the Reverse Split; and (iv) transact other such business as may properly come before the Meeting or any adjournment thereof.

This proxy statement also gives you information on the proposals so that you can make an informed decision. You should read it carefully. Your vote is important. You are encouraged to submit your proxy card as soon as possible after carefully reviewing this proxy statement.

In this proxy statement, we refer to Mercurity Fintech Holding Inc. as the “Company”, “we”, “us” or “our.”

Who can vote at this Meeting?

Shareholders who owned shares of our Ordinary Shares or ADRs, each ADR representing 360 Ordinary Shares, on October 4, 2022 (the “Record Date”) may attend and vote at this Meeting. There were 5,143,716,229 shares of Ordinary Shares outstanding on the Record Date. All Ordinary Shares shall have one vote per share.

What is the proxy card?

The card enables you to appoint Shi Qiu, the Chief Executive Officer of the Company, as your representative at this Meeting. By completing and returning the proxy card, you are authorizing this representative to vote your shares at this Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend this Meeting. Even if you plan to attend this Meeting, it is strongly recommended to complete and return your proxy card before this Meeting date just in case your plans change. If a proposal comes up for vote at this Meeting that is not on the proxy card, the proxies will vote your shares, under your proxy, according to their best judgment.

How does the Board recommend that I vote?

Our Board unanimously recommends that shareholders vote “FOR” each of the Director Nominees listed in Proposal One and that shareholders vote “FOR” Proposal Two and Proposal Three.

1

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Certain of our shareholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record/Registered Shareholders

If, on the Record Date, your shares were registered directly in your name on the register of members, you are a “shareholder of record” who may vote at the Meeting, and we are sending these proxy materials directly to you. As the shareholder of record, you have the right to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at the Meeting. Whether or not you plan to attend the Meeting, please complete, date, sign and return the enclosed proxy card to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the shareholder of record for purposes of voting at the Meeting. As the beneficial owner, you have the right to direct your broker on how to vote your shares and to attend the Meeting. However,

since you are not the shareholder of record, you may not vote these shares in person at the Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder. If you do not make this request, you can still vote by using the voting instruction card enclosed with this proxy statement; however, you will not be able to vote in person at the Meeting.

How do I vote?

If you were a shareholder of record of the Company’s Ordinary Shares on the Record Date, you may vote in person at the Meeting or by submitting a proxy. Each share of Ordinary Shares that you own in your name entitles you to one vote, in each case, on the applicable proposals.

(1) You may submit your proxy by mail. You may submit your proxy by mail by completing, signing and dating your proxy card and returning it in the enclosed, postage-paid and addressed envelope. If we receive your proxy card prior to this Meeting and if you mark your voting instructions on the proxy card, your shares will be voted:

| ● | as you instruct, and | |

| ● | according to the best judgment of the proxies if a proposal comes up for a vote at this Meeting that is not on the proxy card. |

We encourage you to examine your proxy card closely to make sure you are voting all of your shares in the Company.

If you return a signed card, but do not provide voting instructions, your shares will be voted:

| ● | FOR each nominee for director; | |

| ● | According to the best judgment of Shi Qiu, the CEO of the Company, if a proposal comes up for a vote at the Meeting that is not on the proxy card. |

You may mail your proxy card to the following address:

Room 1215, Xin’nan Block No.2, Yuehai Street

Nanshan District, Shenzhen, 518000

Guangdong Province, People’s Republic of China

(2) You may submit your proxy by email. You may submit your proxy by completing, signing, and dating your proxy card and returning a scanned copy of your proxy card by emailing to ir@mercurityfintech.com. Your vote by email must be received by 6:00 p.m. Beijing Time on November 17, 2022.

(3) You may vote in person at the Meeting. We will pass out written ballots to any shareholder of record who wants to vote at the Meeting.

2

If I plan on attending the Meeting, should I return my proxy card?

Yes. Whether or not you plan to attend the Meeting, after carefully reading and considering the information contained in this proxy statement, please complete and sign your proxy card. Then return the proxy card in the pre-addressed, postage-paid envelope provided herewith as soon as possible so your shares may be represented at the Meeting.

May I change my mind after I return my proxy?

Yes. You may revoke your proxy and change your vote at any time before the polls close at this Meeting. You may do this by:

| ● | sending a written notice to the Secretary of the Company at the Company’s executive offices stating that you would like to revoke your proxy of a particular date; | |

| ● | signing another proxy card with a later date and returning it to the Secretary before the polls close at this Meeting; or | |

| ● | attending this Meeting and voting in person. |

What does it mean if I receive more than one proxy card?

You may have multiple accounts with brokerage firms. Please sign and return all proxy cards to ensure that all of your shares are voted.

What happens if I do not indicate how to vote my proxy?

Signed and dated proxies received by the Company without an indication of how the shareholder desires to vote on a proposal will be voted in favor of each director and proposal presented to the shareholders.

Will my shares be voted if I do not sign and return my proxy card?

If you do not sign and return your proxy card, your shares will not be voted unless you vote in person at this Meeting.

How many votes are required to elect the Director Nominees as directors of the Company?

The election of each nominee for director requires a quorum that will be present at the Meeting if not less than one-third of the ordinary shares outstanding and entitled to vote at the Meeting is presented in person or by proxy and also requires the affirmative vote of simple majority of the shares of ordinary shares represented in person or by proxy and entitled to vote in the election of directors at the Meeting.

3

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying shareholders are kept confidential and will not be disclosed, except as may be necessary to meet legal requirements.

Where do I find the voting results of this Meeting?

We will announce voting results at this Meeting and also file a Current Report on Form 6-K with the Securities and Exchange Commission (the “SEC”) reporting the voting results.

Who can help answer my questions?

You can contact the Company at ir@mercurityfintech.com with any questions about proposals described in this proxy statement or how to execute your vote.

We are furnishing this proxy statement to you, as a shareholder of Mercurity Fintech Holding Inc., as part of the solicitation of proxies by our Board for use at the Meeting to be held on November 21, 2022 at 9:30 AM Beijing time, and any adjournment or postponement thereof. This proxy statement is first being furnished to shareholders on or about October 24, 2022. This proxy statement provides you with information you need to know to be able to vote or instruct your proxy how to vote at the Meeting.

Date, Time and Place of the Meeting

The Meeting will be held on 9:30 a.m., Beijing time on November 21, 2022, at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China, or such other date, time and place to which the Meeting may be adjourned or postponed.

At the Meeting, the Company will ask shareholders to consider and vote upon the following proposals:

| 1. | To elect eleven (11) (the “Director Nominees” to serve on the Company’s Board of Directors (the “Board”) until the next annual shareholders meeting and until their successors are duly elected and qualified (“Proposal One”); |

| 2. | To approve a reverse stock split (the “Reverse Split”) of the Company’s issued ordinary shares at a ratio of not less than one (1)-for-three hundred sixty (360) and not more than one (1)-for-seven hundred twenty (720), with the exact ratio to be set at a whole number within this range to be determined by the Company’s Board, or any duly constituted committee thereof, in its discretion (“Proposal Two”); |

| 3. | Subject to the Shareholders’ approval of Proposal Two and the Board’s implementation of the Reverse Split, to suspend the trading of the Company’s American Depositary Receipts / Shares (“ADRs”), terminate the deposit agreement for the ADRs among the Company, its depositary bank, Citibank, N.A. (the “Depositary”), and the holders and beneficial owners of the Company’s ADRs, the exchange of ADRs for the corresponding ordinary shares of the Company, and commence trading of the Company’s ordinary shares on the Nasdaq Stock Market upon the effectiveness of the Reverse Split (“Proposal Three”); and |

| 4. | To transact other such business as may properly come before the Meeting or any adjournment thereof. |

Our Board fixed the close of business on October 4, 2022, as the record date for the determination of the outstanding shares of Ordinary Shares entitled to notice of, and to vote on, the matters presented at this Meeting. As of the Record Date, there were 5,143,716,229 shares of Ordinary Shares outstanding. Each share of Ordinary Shares entitles the holder thereof to one vote. Accordingly, a total of 5,143,716,229 votes may be cast at this Meeting.

4

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present at the meeting if not less than one-third of the Ordinary Shares issued and outstanding and entitled to vote at the Meeting is represented in person or by proxy. Abstentions and broker non-votes (i.e. shares held by brokers on behalf of their customers, which may not be voted on certain matters because the brokers have not received specific voting instructions from their customers with respect to such matters) will be counted solely for the purpose of determining whether a quorum is present at the Meeting.

Proposal One and Proposal Two require the affirmative vote of simple majority of the shares of ordinary shares represented in person or by proxy and entitled to vote in the election of directors at the Meeting.

Any proxy may be revoked by the shareholder of record giving it at any time before it is voted. A proxy may be revoked by (A) sending the Company at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China, either (i) a written notice of revocation bearing a date later than the date of such proxy or (ii) a subsequent proxy relating to the same shares, or (B) by attending this Meeting and voting in person.

If the shares are held by the broker or bank as a nominee or agent, the beneficial owners should follow the instructions provided by their broker or bank.

The cost of preparing, assembling, printing and mailing this proxy statement and the accompanying form of proxy, and the cost of soliciting proxies relating to this Meeting, will be borne by the Company. If any additional solicitation of the holders of our outstanding shares of Ordinary Shares is deemed necessary, we (through our directors and officers) anticipate making such solicitation directly. The solicitation of proxies by mail may be supplemented by telephone, telegram and personal solicitation by officers, directors and other employees of the Company, but no additional compensation will be paid to such individuals.

None of Cayman Islands law or our Memorandum and Articles of Association, as amended and restated, provides for appraisal or other similar rights for dissenting shareholders in connection with any of the proposals to be voted upon at this Meeting. Accordingly, our shareholders will have no right to dissent and obtain payment for their shares.

Who Can Answer Your Questions about Voting Your Shares

You can contact the Company at ir@mercurityfintech.com with any questions about proposals described in this proxy statement or how to execute your vote.

The principal executive offices of our Company are located at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China.

5

PROPOSAL ONE — ELECTION OF DIRECTORS

The nominees listed below have been nominated by the Nominating and Corporate Governance Committee and approved by our Board to stand for election as directors of the Company. Unless such authority is withheld, proxies will be voted for the election of the persons named below, each of whom has been designated as a nominee. If, for any reason, any nominee/director becomes unavailable for election, the proxies will be voted for such substitute nominee(s) as the Board may propose.

Board Qualifications and Director Nominees

We believe that the collective skills, experiences and qualifications of our directors (including director nominees) provide our Board with the expertise and experience necessary to advance the interests of our shareholders. While the Nominating and Corporate Governance Committee of our Board does not have any specific, minimum qualifications that must be met by each of our directors, the Nominating and Corporate Governance Committee uses a variety of criteria to evaluate the qualifications and skills necessary for each member of the Board. In addition to the individual attributes of each of our current directors described below, we believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, exhibit commitment to enhancing shareholder value and have sufficient time to carry out their duties and to provide insight and practical wisdom based on their past experience.

The Director Nominees recommended by the Board are as follows:

| Name | Age | Position | ||

| Shi Qiu | 31 | Director | ||

| Huahui Deng | 36 | Director | ||

| Xiang Qu | 35 | Independent Director | ||

| Er-Yi Toh | 38 | Independent Director | ||

| Cong Huang | 40 | Independent Director | ||

| Keith Tan Jun Jie | 29 | Director | ||

| Alan Curtis | 79 | Chairman of the Board and Independent Director | ||

| Daniel Kelly Kennedy | 38 | Director | ||

| Zheng Cui | 36 | Independent Director | ||

| Qian Sun | 34 | Director | ||

| Hui Cheng | 30 | Independent Director |

Information Regarding the Company’s Directors and the Nominees

Mr. Shi Qiu, age 31, is an entrepreneur with extensive experience in corporate management and business innovation in various industries, such as the media, fintech, and blockchain industries. From September 2015 to May 2018, Mr. Qiu co-founded and served as a Vice President of Newstyle Media Group, which received strategic investments from certain well-known technology companies in the PRC. Newstyle Media Group produced a popular Asian TV series “The Untamed,” which is currently available worldwide on the online streaming platform Netflix. From June 2018 to October 2018, Mr. Qiu served as the Head of Blockchain Business of North Mining Limited. Mr. Qiu then served as the Vice-General Manager of Ningbo Saimeinuo Supply Chain Management Ltd. from November 2018 until 2021. Since November, 2021, Mr. Qiu has served as the Chief Technology Officer (the “CTO”) of Singularity Future Technology (NASDAQ:SGLY). Mr. Qiu received a Bachelor’s Degree in Risk Management and Actuary from Zhejiang University and a Master's Degree in Government Management and Public Policy from Tsinghua University.

Mr. Huahui Deng, age 36, has more than eight years of experience in corporate governance and team management. Mr. Deng was appointed as a technical & sales manager of Fujian Tianma Science and Technology Group Co, Ltd from 2009 to 2017. As an early investor in cryptocurrencies, he has developed a strong interest in smart contract architecture that deals with enterprise level blockchain-as-a-service with a focus on the adoption of advanced IOT integration with real-world applications. Mr. Deng holds a bachelor’s degree from Tianjin University in the PRC.

6

Mr. Xiang Qu, age 35, is an experienced financial management professional with over ten (10) years of experience in the financial management and asset management industry. From 2010 to 2017, Mr. Qu joined Yiren Digital Ltd. (formerly known as Yixin Group, NYSE:YRD), a financial technology group in the PRC, where he served as the Chief Financial Officer and Senior Vice President. From 2017 to 2021, Mr. Qu served as a Co-Founder and the Chief Financial Officer of Yu Jin Capital. Mr. Qu currently serves as an executive director of the China Finance Forum and an executive director of the China Venture Capital Association. Mr. Qu received a Master’s Degree in Master of Business Administration from Fudan University.

Mr. Er-Yi Toh, age 38, is currently the Chief Executive Officer and founder of Pytheas, a software company in Singapore providing travel Ecommerce services. Prior to founding Pytheas in 2011, Mr. Toh was a Research Analyst at NUS Risk Management Institute (RMI) from 2009 to 2010 where he was responsible for designing and building the data warehouse and financial model system. Mr. Toh received a Bachelor’s Degree of Engineering in Computer Engineering from Nanyang Technological University.

Mr. Cong Huang, age 40, is a renowned researcher and entrepreneur in financial technology innovation. After receiving the PhD degree in Statistics from Yale University, he worked at Columbia University as an Assistant Professor in the Statistics Department, conducting research focused on algorithms and implementations in data mining. After a period of time, he decided to leave campus to develop his career in financial innovation and technology. At Goldman Sachs (GS), he played a pivotal role in developing various new models and algorithms to improve the speed and accuracy of options pricing methods. At McKinsey & Company, he helped financial institutions implement strategic innovation and transformation initiatives. As a founding member of PingAn Lufax (Nasdaq: LU), he led the Innovative Product Department and developed numerous retail loan products from zero, which have been widely used for reference by Internet finance industry. As the CEO of Xiaoying Tech (Nasdaq: XYF), one of the top finance companies in China, he set up the management and operations structure to lift the trading volume from RMB100 million per month to RMB3 billion per month in two years. Meanwhile, Mr. Cong Huang is the founder and CEO of Weiyan Tech, a leading AI company that provides risk-control and marketing solutions for financial institutions. Mr Huang has Bachelor’s degree in Mathematics from the University of Science & Technology of China and a PhD degree from Yale University.

Mr. Keith Tan Jun Jie, age 29, is an expert in the financial investment industry in the private and public markets. Mr. Tan currently serves as the Chief Operating Officer in Evolve Family office, focusing on traditional equities and derivative products. In 2017, Mr. Tan consulted for the products derivatives trading team in Royal Dutch Shell, London, on derivatives trading optimization for the global derivatives oil market. In 2013, Mr. Tan served in the military and held the rank of Lieutenant where he acted as the platoon commander in a motorized infantry unit. During his time in the military, Mr. Tan was awarded several awards including the Sword of Merit given to the top 10% of graduating officers. Mr. Tan graduated with First Class Honors - Deans list, in Chemical Engineering from University College London, and obtained the Masters of Philosophy (MPhil) in Management, with Distinction, at the University of Cambridge.

Mr. Alan Curtis, age 79, is an American public policy expert. Mr. Curtis served as a public safety advisor to Presidents Lyndon B. Johnson and Jimmy Carter. Since 1968, Mr. Curtis has served on the National Advisory Commission on Civil Disorders, known as the Kerner Commission. In 1969, Mr. Curtis was appointed as an Assistant Director of Crimes of Violence task force on President Lyndon B. Johnson's National Commission on the Causes and Prevention of Violence. Between 1977 and 1981, Mr. Curtis served as Executive Director of President Jimmy Carter's Urban and Regional Policy Group and as an Urban Policy Advisor to the Secretary of Housing and Urban Development. In 1981, Mr. Curtis was named as Founding President and Chief Executive Officer of the Milton S. Eisenhower Foundation, which identifies, funds, evaluates, and builds evidence-based programs for disadvantaged American youth and families. In 2018, Mr. Curtis published a book titled Healing Our Divided Society: Investing in America Fifty Years after the Kerner Report, and Mr. Curtis proposed evidence-based policies for employment, education, housing, community development, and criminal justice. Mr. Curtis holds an A.B. in Economics from Harvard, a M.Sc. in Economics from the University of London and a Ph.D. in Criminology and Urban Policy from the University of Pennsylvania.

Mr. Daniel Kelly Kennedy, age 38, is an educator, writer and inspirational leader in international business and entrepreneurship. From August 2015 to August 2016, Mr. Kennedy was an Academic English Professor at Moraine Park Technical College in Beaver Dam, Wisconsin. From August 2016 to August 2017, Mr. Kennedy was an International Business/Social Media Coordinator at Mozaik Education in Szeged, Hungary. From September 2017 to May 2018, Mr. Kennedy worked as a Yoga/Meditation teacher at the Lodge at Woodloch in Hawley, Pennsylvania. From August 2020 to July 2022, Mr. Kennedy worked as an Academic English Professor at Campus Education in New York City. From June 2021 to the present, Mr. Kennedy has been a Columnist for “Entrepreneur Magazine” in New York City. Mr. Kennedy has been writing and publishing articles on various subject ranging from finance to life style. Since June 2022, Mr. Kennedy has worked at BIT Mining, a leading publicly traded cryptocurrency mining company, as a Marketing Manager responsible for managing social media, public relations, investor relations and maintaining a professional and intelligent public image. Mr. Kennedy holds a bachelor’s degree in history and a Master’s degree in Education from King’s College in Pennsylvania.

Mr. Zheng Cui, age 36, is a sales and marketing professional, advisor, and entrepreneur. From 2011 to 2014, Mr. Cui worked at Martinwolf, a M&A advisory firm, as an Analyst providing various analytic and research supports in advisory assignments, including sell-side and buy-side M&A transactions, cross-border corporate strategy advisory and limited finder. From 2014 to 2020, Mr. Cui worked at Beyondsoft, a leading IT consulting, solution and services provider, as a sales and marketing professional responsible for the U.S. and Australia markets. In addition, in 2013, Mr. Cui founded Indeed Consulting Company, an education consulting firm which currently has two offices and over 100 consultants. In 2020, Mr. Cui joined in Mont Bleu Web3 Investment and Advisory as a Partner to provide investment and advisory services to support portfolio and client services for Web3. In 2021, Mr. Cui invested and founded Be Humble, a cannabis investment company. Mr. Cui graduated from the University of California, Berkeley, with a Bachelor of Arts degree in Political Economy.

Ms. Qian Sun, age 34, has more than 10 years of experience in corporate management and industrial investment and is currently serving as the Chief Operating Officer of the Company. In 2010, Ms. Sun joined Shenzhen Worldunion Group (SZ:002285), a publically traded real estate services company in China, as a Project Planner in Northern China, responsible for the project planning and marketing in Northern China. Thereafter, from 2012 to 2017, Ms. Sun worked at Bei Hui United Education, an online education company, as an Assistant to the Chairman and Operation Director respectively, responsible for the development of the company's curriculum and daily operation management. From 2017 to 2020, Ms. Sun worked at Blockchainer, a blockchain consulting and incubation platform company, as a Partner responsible for providing one-stop consulting and incubation services in the blockchain field. From 2020 to 2022, Ms. Sun worked at Consensus Labs, a leading blockchain investment and research firm, as a Partner responsible for industry research and post-investment management. Ms. Sun holds a bachelor's degree in Management from Beijing Normal University.

Mr. Hui Cheng, age 30, is an entrepreneur in the Internet and financial technology industry. From 2016 to 2018, Mr. Cheng worked at IDG Capital, a venture capital investment firm, as an Investment Associate. From 2018 to 2019, Mr. Cheng worked at Qudian Group (NYSE:QD), a financial technology service company in China, as a Special Assistant to the Chief Executive Officer, responsible for business globalization. From 2019 to 2022, Mr. Cheng worked for Kuaishou Technology (SEHK:01024), a live streaming services and online marketing services provider, responsible for Kuaishou Technology’s global operation, including marketing and localization operations in Latin America and Southeast Asia. Mr. Cheng holds a Bachelor of Science and a Master of Science in Management from Tsinghua University.

Each director nominee will be approved if a simple majority of the shares of ordinary shares represented in person or by proxy and entitled to vote at the Meeting vote “FOR” the director nominees set forth in the proposal. Abstentions and broker non-votes will have no effect on the result of the vote.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE ALL OF YOUR SHARES “FOR” THE ELECTION TO THE BOARD OF EACH DIRECTOR NOMINEE DESCRIBED IN THIS PROPOSAL ONE.

Director Independence

Our Board reviewed the materiality of any relationship that each of our directors has with us, either directly or indirectly. Based on this review, it is determined that Xiang Qu, Er-Yi Toh, Cong Huang, Alan Curtis, Zheng Cui, and Hui Cheng meet the “independence” requirements under Rule 10A-3 of the Exchange Act and Rule 5605 (a)(2) and Rule 5605(c)(2) of the NASDAQ Stock Market Rule.

7

Committees of the Board of Directors

Our board of directors has established an audit committee, a compensation committee and a nominating and corporate governance committee. Each of the committees of the Board has the composition and responsibilities described below.

Audit Committee

Our audit committee currently consists of Cong Huang, Er-Yi Toh, Xiang Qu, with Xiang Qu as Chair of the audit committee. We have determined that all the members of our audit committee satisfy the “independence” requirements of Rule 10A-3 under the Exchange Act and Nasdaq Marketplace Rule 5605(a) and that Xiang Qu is an audit committee financial expert as defined in the instructions to Item 16A of the Form 20-F. Xiang Qu serves as the chairperson of the audit committee.

The audit committee oversees our accounting and financial reporting processes and the audits of our consolidated financial statements. Our audit committee is responsible for, among other things:

| • | selecting the independent auditor; |

| • | pre-approving auditing and non-auditing services permitted to be performed by the independent auditor; |

| • | annually reviewing the independent auditor’s report describing the auditing firm’s internal quality control procedures, any material issues raised by the most recent internal quality control review, or peer review, of the independent auditors and all relationships between the independent auditor and our company; |

| • | setting clear hiring policies for employees and former employees of the independent auditors; |

| • | reviewing with the independent auditor any audit problems or difficulties and management’s response; |

| • | reviewing and approving all related party transactions on an ongoing basis; |

| • | reviewing and discussing the annual audited consolidated financial statements with management and the independent auditor; |

| • | reviewing and discussing with management and the independent auditor’s major issues regarding accounting principles and financial statement presentations; |

| • | reviewing reports prepared by management or the independent auditors relating to significant financial reporting issues and judgments; |

| • | discussing earnings press releases with management, as well as financial information and earnings guidance provided to analysts and rating agencies; |

| • | reviewing with management and the independent auditors the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on our consolidated financial statements; |

| • | discussing policies with respect to risk assessment and risk management with management, internal auditors and the independent auditor; |

| • | timely reviewing reports from the independent auditor regarding all critical accounting policies and practices to be used by our company, all alternative treatments of financial information within U.S. GAAP that have been discussed with management and all other material written communications between the independent auditor and management; |

| • | establishing procedures for the receipt, retention and treatment of complaints received from our employees regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; |

| • | annually reviewing and reassessing the adequacy of our audit committee charter; |

| • | such other matters that are specifically delegated to our audit committee by our board of directors from time to time; |

| • | meeting separately, periodically, with management, internal auditors and the independent auditor; and |

| • | reporting regularly to the full board of directors. |

Compensation Committee

Our compensation committee consists of Cong Huang, Er-Yi Toh, Xiang Qu, with Er-Yi Toh as the Chair of the compensation committee. We have determined that all the members of our compensation committee satisfy the “independence” requirements of Rule 5605(a) of Nasdaq Stock Market Marketplace Rules.

Our compensation committee is responsible for, among other things:

| • | reviewing and approving our overall compensation policies; |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer’s performance in light of those goals and objectives, reporting the results of such evaluation to the board of directors, and determining our Chief Executive Officer’s compensation level based on this evaluation; |

| • | determining the compensation level of our other executive officers; |

| • | making recommendations to the board of directors with respect to our incentive-compensation plan and equity-based compensation plans; |

| • | administering our equity-based compensation plans in accordance with the terms thereof; and |

| • | such other matters that are specifically delegated to the compensation committee by our board of directors from time to time. |

8

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Cong Huang, Er-Yi Toh, Xiang Qu, with Cong Huang as the Chair of the Nominating and Corporate Governance Committee, effective May 7, 2022. We have determined that all the members of our compensation committee satisfy the “independence” requirements of Rule 5605(a) of Nasdaq Stock Market Marketplace Rules.

The nominating and corporate governance committee will be responsible for, among other things:

| • | selecting and recommending to the board nominees for election by the shareholders or appointment by the board; | |

| • | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; | |

| • | making recommendations on the frequency and structure of board meetings and monitoring the functioning of the committees of the board; and | |

| • | advising the board periodically with regards to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board on all matters of corporate governance and on any remedial action to be taken. |

Code of Business Conduct and Ethics

Our board of directors has adopted a code of business conduct and ethics, which is applicable to all of our directors, officers and employees. We have made our code of business conduct and ethics publicly available on our website.

In addition, our board of directors has adopted a set of corporate governance guidelines. The guidelines reflect certain guiding principles with respect to our board’s structure, procedures and committees. The guidelines are not intended to change or interpret any law, or our fourth amended and restated memorandum and articles of association.

Family Relationships

None of the directors or executive officers has a family relationship as defined in Item 401 of Regulation S-K.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years, been involved in any legal proceedings described in subparagraph (f) of Item 401 of Regulation S-K.

Board of Directors

Upon the shareholders’ approval to elect all the director nominees at this Meeting, our board of directors will consist of eleven (11) directors.

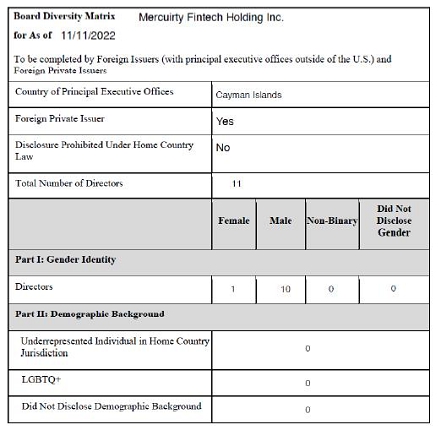

Diversity Metrix of Board of Directors

Duties of Directors

Under Cayman Islands law, our directors owe certain fiduciary duties to our company, including duties of loyalty, to act honestly, and to act in what they consider in good faith to be in our best interests. Our directors also have a duty to exercise the skills they actually possess and such care and, diligence that a reasonably prudent person would exercise in comparable circumstances. It was previously considered that a director need not exhibit in the performance of his duties a greater degree of skill than what may reasonably be expected from a person of his knowledge and experience. However, English and Commonwealth courts have moved towards an objective standard with regard to the required skill and care, and these authorities are likely to be followed in the Cayman Islands. In fulfilling their duty of care to us, our directors must ensure compliance with our fourth amended and restated memorandum and articles of association. We have the right to seek damages if a duty owed by our directors is breached.

The powers of our board of directors include, among others:

| • | convening shareholders’ annual general meetings and reporting its work to shareholders at such meetings; |

| • | issuing authorized but unissued shares; |

| • | declaring dividends and distributions; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; |

| • | approving the transfer of shares of our company, including the registering of such shares; and |

| • | exercising any other powers conferred by the shareholders’ meetings or under our fourth amended and restated memorandum and articles of association. |

Director Qualifications; Interested Directors

A director is not required to hold any shares in our company by way of qualification. A director who to his knowledge is in any way, whether directly or indirectly, interested in a contract or arrangement or proposed contract or arrangement with us shall declare the nature of his interest at the meeting of the board of directors at which the question of entering into the contract or arrangement is first considered, if he knows his interest then exists, or in any other case at the first meeting of the board of directors after he knows that he is or has become so interested. Subject to any separate requirement for the approval of the audit committee of the board of directors under applicable law or the listing rules of Nasdaq, and unless disqualified by the chairman of the relevant board meeting, such director may vote with respect to any contract, proposed contract or arrangement in which he is so interested. A director may exercise all the powers of our company to raise or borrow money, and to mortgage or charge all or any part of its undertaking, property and assets (present and future) and uncalled capital, and issue debentures, bonds or other securities, whether outright or as collateral security for any debt, liability or obligation of our company or of any third-party. The directors may receive such remuneration as our board may from time to time determine.

9

Remuneration and Borrowing

The Board may determine the remuneration to be paid to the directors. The compensation committee will assist the directors in reviewing and approving the compensation structure for the directors. The directors may exercise all the powers of the company to borrow money and to mortgage or charge its undertaking, property and uncalled capital, and to issue debentures or other securities whether outright or as security for any debt obligations of our company or of any third-party.

PROPOSAL TWO — APPROVAL OF REVERSE SPLIT

The Board has approved, and is hereby soliciting Shareholders’ approval of a Reverse Split of the Company’s issued ordinary shares at a ratio (the “Reverse Split Ratio”) of not less than one (1)-for-three hundred sixty (360) and not more than one (1)-for-seven hundred twenty (720). The par value of each ordinary share will remain unchanged at $0.00001 per ordinary share. A vote FOR Proposal Two will constitute approval of the combination, except as explained below with respect to fractional shares, of any number of the Company’s issued ordinary shares at the Reverse Split Ratio to one share and will grant the Board, or any duly constituted committee thereof, the authority to determine whether to implement the Reverse Split and, if so, to select which of the approved exchange ratios within that range will be implemented. If the Shareholders approve Proposal Two, the Board, or any duly constituted committee thereof, will have the authority, but not the obligation, in its sole discretion, and without further action on the part of the Shareholders, to select one of the approved Reverse Split ratios and effect the approved Reverse Split. If implemented, the Reverse Split will become effective after the approval of Proposal Two.

The Board believes that Shareholders’ approval of a range of the Reverse Split Ratios (rather than a specific ratio) provides the Board with flexibility to achieve the purposes of the Reverse Split. If Shareholders approve Proposal Two, the Reverse Split will be effected, if at all, only upon a determination by the Board that the Reverse Split at the Reverse Split Ratio within the range approved by the shareholders is in the Company’s and the Shareholders’ best interests at that time. In connection with any determination to effect the Reverse Split, the Board, or any duly constituted committee thereof, will set the time for such a split and select a specific Revere Split Ratio within the range approved by the Shareholders. These determinations will be made by the Board, or any duly constituted committee thereof, with the intention to create the greatest marketability of the Company’s ordinary shares based upon prevailing market conditions at that time.

The Board reserves its right to elect not to proceed with, and abandon, the Reverse Split contemplated in this Proposal Two if it determines, in its sole discretion, that implementing the Reverse Split is not in the best interests of the Company and its Shareholders.

Purpose and Background of the Reverse Split

The purpose for seeking approval to effect the Reverse Split is to maintain or increase the market price of the Company’s ordinary shares. The Board may effect the proposed Reverse Split if it believes that a change in the number of ordinary shares outstanding is likely to maintain or improve the market price for the Company’s ordinary shares after the termination of the current ADR program and commencement of the trading of its ordinary shares, and only if the implementation of a Reverse Split is determined by the Board to be in the best interests of the Company and its Shareholders.

10

The Company believes that the stabilized or increased market price for its ordinary shares that is expected as a result of implementing the Reverse Split will improve the marketability and liquidity of the Company’s ordinary shares and will encourage interest and trading in the Company’s ordinary shares. In addition, the Company believes that a number of institutional investors and investment funds are reluctant to invest, and in some cases may be prohibited from investing, in lower-priced stocks and that brokerage firms are reluctant to recommend lower-priced stocks to their clients. By effecting a Reverse Split, the Company believes it may be able to maintain or raise the market price of its ordinary shares to a level where its ordinary shares could be viewed more favorably by potential investors. Other investors may also be dissuaded from purchasing lower-priced stocks because brokerage commissions, as a percentage of the total transaction, tend to be higher for lower-priced stocks. A higher or stabilized share price after a Reverse Split could alleviate this concern.

There can be no assurance that the Reverse Split, if implemented, will achieve any of the desired results. There also can be no assurance that the price per ordinary share immediately after the Reverse Split, if implemented, will maintain the same or increase proportionately with the Reverse Split ratio, or that any increase will be sustained for any period of time.

Procedures for Exchange of Ordinary Shares

As soon as practicable after the effective date of the Reverse Split, the Shareholders will be notified that the Reverse Split has been effected. The Company expects that its transfer agent will act as the exchange agent for purposes of implementing the exchange of ordinary shares.

Shareholders holding ordinary shares in certificated form will be sent a letter of transmittal from the exchange agent, on behalf of the Company, with instructions on how such Shareholders should surrender to the exchange agent certificates representing pre-split ordinary shares in exchange for post-split ordinary shares in book-entry form. No new ordinary shares will be issued to a Shareholder until such Shareholder has surrendered such Shareholder’s outstanding share certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent. Any pre-split ordinary shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split ordinary shares. SHAREHOLDERS SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Shareholders holding ordinary shares in book-entry form with the transfer agent need not take any action to receive post-split ordinary shares or cash payment in lieu of any fractional share interest, if applicable. If a Shareholder is entitled to post-split ordinary shares, a transaction statement will automatically be sent to the Shareholder’s address of record indicating the number of ordinary shares held following the Reverse Split.

11

Upon the Reverse Split, the Company intends to treat ordinary shares held by Shareholders in “street name” through a bank, broker or other nominee in the same manner as registered Shareholders whose ordinary shares are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Split for their beneficial holders holding ordinary shares in “street name.” However, these banks, brokers or other nominees may have different procedures from those that apply to registered Shareholders for processing the Reverse Split and making payment for fractional shares. If a Shareholder holds ordinary shares with a bank, broker or other nominee and has any questions in this regard, Shareholders are encouraged to contact their bank, broker or other nominee.

No fractional shares will be created or issued in connection with the Reverse Split. Shareholders of record who otherwise would be entitled to receive fractional shares because they hold a number of pre-split ordinary shares not evenly divisible by the number of pre-split ordinary shares for which each post-split ordinary share is to be exchanged, will be entitled to a cash payment in lieu thereof at a price equal to the fraction to which the Shareholder would otherwise be entitled multiplied by the closing price of the ordinary shares on the last trading day prior to the effective date of the Reverse Split as adjusted for the Reverse Split as appropriate or, if such price is not available, a price determined by the Board, or any duly constituted committee thereof. The ownership of a fractional interest will not give the holder thereof any voting, dividend or other rights except to receive payment thereof as described herein.

Proposal Two will be approved if a simple majority of the shares of ordinary shares represented in person or by proxy and entitled to vote at the Meeting vote “FOR” Proposal Two. Abstentions and broker non-votes will have no effect on the result of the vote.

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF A REVERSE SPLIT.

PROPOSAL THREE — AMERICAN DEPOSITARY RECEIPTS PROGRAM SUSPENSION

The Board has approved, and hereby is soliciting shareholder approval of suspension of trading the Company’s American Depositary Receipts / Shares (“ADRs”) on Nasdaq Stock Market, each ADR representing 360 ordinary shares, par value US$0.00001 per ordinary share, and to authorize any Director or Officer of the Company to take all actions necessary, appropriate or advisable to commence trading the Company’s ordinary shares on Nasdaq Stock Market.

12

Purpose and Background of American Depositary Receipts Program Suspension

ADRs allow U.S. investors to invest in non-U.S. companies and give non-U.S. companies, such as us, easier access to the U.S. capital markets. However, some risks are involved in ADRs, such as limited voting rights of ADRs holders due to the terms of the deposit agreement, difficulty for ADRs holders to receive certain distributions we make on our ordinary shares or other deposited securities if the depositary decides not to make such distributions to the ADRs holders, and possible limitations on ADRs transfer. Additionally, the institutions that issue ADRs may charge quarterly or annual fees which consist of custody fees and fees for processing dividends and corporate actions. These fees can add to shareholders’ investment costs. Also, while on rare occasions, the bank offering the ADRs may decide to terminate the ADR program for any number of reasons, including lack of interest. This could result in a requirement that the position either be liquidated or converted to the underlying ordinary shares. The Board believes that suspending the Company’s ADR Program and commencing directly trading the Company’s ordinary shares on Nasdaq are cost-effective for the shareholders and the Company and are in the Company’s and the Shareholders’ best interests.

If the ADR Program is to be suspended, we will instruct the depositary bank (Citibank, N.A.) for the ADRs to terminate the ADR Program and to exchange, on a mandatory basis, the ADRs for the corresponding ordinary shares. This mandatory exchange will entail the cancellation of the ADRs and the delivery of the underlying ordinary shares to the applicable registered holders of the ADRs that have been cancelled. Holders who hold ADRs in brokerage accounts through the U.S. clearing system, The Depository Trust Company (DTC), will not be required to take any action to effectuate the exchange of ADRs for ordinary shares as the depositary bank will coordinate the cancellation of the ADRs and the delivery of the corresponding ordinary shares with DTC, and DTC will arrange for the exchange of ADRs for the corresponding ordinary shares in its electronic settlement system via a mandatory debit of ADRs and a corresponding credit of applicable ordinary shares. Any investors who hold ADRs outside of DTC will receive from the depositary bank instructions on how to exchange ADRs for ordinary shares to the extent such actions are necessary. In connection with the termination of the ADR Program and the mandatory exchange of ADRs for ordinary shares, the depositary bank will charge holders of ADRs an ADR cancellation fee.

The vote solicited by this Proposal No. 3 is advisory, and therefore is not binding on our Company or our Board of Directors, nor will its outcome require our Company or our Board of Directors to take any action. Moreover, the outcome of the vote on Proposal 3 will not be construed as overruling any decision by our Company or our Board of Directors.

However, our Board of Directors values the opinions of our shareholders and we will consider our shareholders’ concerns and evaluate what actions, if any, may be appropriate to address those concerns.

13

Recommendation of the Board

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF SUSPENDING THE COMPANY’S AMERICAN DEPOSITORY RECEIPTS PROGRAM AND TRADING OF THE COMPANY’S ORDINARY SHARES ON THE NASDAQ.

OTHER MATTERS

Our Board knows of no other matter to be presented at the Meeting. If any additional matter should properly come before the Meeting, it is the intention of the persons named in the enclosed proxy to vote such proxy in accordance with their judgment on any such matters.

Deadline for Submission of Shareholder Proposals for 2023 Annual Meeting of Shareholders

For any proposal to be considered for inclusion in our notice to shareholders and form of proxy for submission to the shareholders at our 2023 Annual Meeting of shareholders, it must be submitted in writing and comply with the requirements of Rule 14a-8 of the Exchange Act. Such proposals must be received by the Company at its offices at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China, Attention: Chief Executive Officer, no later than the close of business on March 14, 2023.

If we are not notified of a shareholder proposal a reasonable time prior to the time we send our proxy statement for our 2023 annual meeting, then our Board will have discretionary authority to vote on the shareholder proposal, even though the shareholder proposal is not discussed in the proxy statement. In order to curtail any controversy as to the date on which a shareholder proposal was received by us, it is suggested that shareholder proposals be submitted by certified mail, return receipt requested, and be addressed to Mercurity Fintech Holding Inc., Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China. Notwithstanding, the foregoing shall not effectuate any rights of shareholders to request inclusion of proposals in our proxy statement pursuant to Rule 14a-8 under the Exchange Act nor grant any shareholder a right to have any nominee included in our proxy statement.

The solicitation of proxies is made on behalf of the Board and we will bear the cost of soliciting proxies. The registrar for our ADS program, Citibank, N.A., as a part of its regular services and for no additional compensation other than reimbursement for out-of-pocket expenses, has been engaged to assist in the proxy solicitation. Proxies may be solicited through the mail and through telephonic or telegraphic communications to, or by meetings with, shareholders or their representatives by our directors, officers and other employees who will receive no additional compensation therefor. We may also retain a proxy solicitation firm to assist us in obtaining proxies by mail, facsimile or email from record and beneficial holders of shares for the Meeting. If we retain a proxy solicitation firm, we expect to pay such firm reasonable and customary compensation for its services, including out-of-pocket expenses.

14

We request persons such as brokers, nominees and fiduciaries holding stock in their names for others, or holding stock for others who have the right to give voting instructions, to forward proxy material to their principals and to request authority for the execution of the proxy. We will reimburse such persons for their reasonable expenses.

The Annual Report is being sent with this notice to each shareholder and is available at www.proxyvote.com as well as on the SEC’s website at www.sec.gov. The Annual Report contains our audited financial statements for the fiscal year ended December 31, 2021. The Annual Report, however, is not to be regarded as part of the proxy soliciting material.

Delivery of Proxy Materials to Households

Only one copy of this proxy statement and one copy of our Annual Report are being delivered to multiple registered shareholders who share an address unless we have received contrary instructions from one or more of the shareholders. A separate form of proxy and a separate notice of the Meeting are being included for each account at the shared address. Registered shareholders who share an address and would like to receive a separate copy of our Annual Report and/or a separate copy of this proxy statement, or have questions regarding the householding process, may contact the Company’s depositary of the Company’s ADS program: Citibank, N.A., by calling (877) 248-4237, or by forwarding a written request addressed to Citibank, N.A., Depositary Receipt Services, 388 Greenwich Street, Trading Building, 4th Floor, New York, NY 10013. Promptly upon request, a separate copy of our Annual Report on Form 20-F and/or a separate copy of this proxy Statement will be sent. By contacting Citibank, N.A., registered shareholders sharing an address can also (i) notify the Company that the registered shareholders wish to receive separate annual reports to shareholders, proxy statements and/or Notices of Internet Availability of Proxy Materials, as applicable, in the future or (ii) request delivery of a single copy of annual reports to shareholders and proxy statements in the future if registered shareholders at the shared address are receiving multiple copies.

Many brokers, brokerage firms, broker/dealers, banks and other holders of record have also instituted “householding” (delivery of one copy of materials to multiple shareholders who share an address). If your family has one or more “street name” accounts under which you beneficially own shares of our Ordinary Shares, you may have received householding information from your broker, brokerage firm, broker/dealer, bank or other nominee in the past. Please contact the holder of record directly if you have questions, require additional copies of this proxy statement or our Annual Report or wish to revoke your decision to household and thereby receive multiple copies. You should also contact the holder of record if you wish to institute householding.

Where You Can Find Additional Information

Accompanying this proxy statement is a copy of the Company’s Annual Report on Form 20-F for the year ended December 31, 2021. Such Report constitutes the Company’s Annual Report to its shareholders for purposes of Rule 14a-3 under the Exchange Act. Such Report includes the Company’s audited financial statements for the 2021 fiscal year and certain other financial information, which is incorporated by reference herein. The Company is subject to the informational requirements of the Exchange Act and in accordance therewith files reports, proxy statements and other information with the SEC. Such reports, proxy statements and other information are available on the SEC’s website at www.sec.gov. shareholders who have questions in regard to any aspect of the matters discussed in this proxy statement should contact Shi Qiu, our Chief Executive Officer, at Room 1215, Xin’nan Block No.2, Yuehai Street, Nanshan District, Shenzhen, 518000, Guangdong Province, People’s Republic of China, or by telephone at +86 1870103001.

15