UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from _______ to _______.

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

Accelerated filer |

|

☐ |

|

☒ |

Smaller reporting company |

|

Emerging growth company |

|

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant, as of June 30, 2022, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's definitive proxy statement relating to its 2023 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant's definitive proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Auditor Firm ID: |

Auditor Name: |

Auditor Location: |

PERSONALIS, INC.

Form 10-K

For the Year Ended December 31, 2022

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

3 |

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

Item 1A. |

|

|

21 |

|

Item 1B. |

|

|

60 |

|

Item 2. |

|

|

60 |

|

Item 3. |

|

|

60 |

|

Item 4. |

|

|

60 |

|

|

|

|

|

|

Item 5. |

|

|

61 |

|

Item 6. |

|

|

61 |

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

62 |

Item 7A. |

|

|

71 |

|

Item 8. |

|

|

72 |

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

96 |

Item 9A. |

|

|

96 |

|

Item 9B. |

|

|

96 |

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

96 |

|

|

|

|

|

Item 10. |

|

|

97 |

|

Item 11. |

|

|

99 |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

99 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

99 |

Item 14. |

|

|

99 |

|

|

|

|

|

|

Item 15. |

|

|

100 |

|

Item 16. |

|

|

102 |

|

|

|

|

103 |

|

2

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding our future results of operations or financial condition, business strategy and plans, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “will,” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

Actual events or results may differ from those expressed in forward-looking statements. As such, you should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results, prospects, strategy, and financial needs. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, assumptions, and other factors described in the section titled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a highly competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report on Form 10-K. While we believe that such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information, actual results, revised expectations, or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

Unless the context otherwise requires, references in this Annual Report on Form 10-K to the “company,” “Personalis,” “we,” “us” and “our” refer to Personalis, Inc.

3

PART I

Item 1. Business.

Overview

We strive to develop some of the most comprehensive and actionable cancer genomic tests in the world to help patients live better and longer lives. We believe we have one of the most discerning technologies to both characterize and monitor cancer – with the aim of driving a new paradigm for cancer management and guiding care from biopsy through the life of the patient. Our assays combine tumor-and-normal profiling with proprietary algorithms to deliver advanced insights even as cancer evolves over time. Our products are designed to detect recurrence at the earliest timepoints, enable selection of targeted therapies based on ultra-comprehensive genomic profiling, and enhance biomarker strategy for drug development.

Today, our platforms are routinely used by many of the largest oncology-focused pharmaceutical companies for analysis of patient samples in their clinical trials and drug development programs. Our advanced genomic sequencing and analytics also support the development of personalized cancer vaccines and other next-generation cancer immunotherapies. For example, we are providing genomic testing to Moderna in its ongoing clinical trials evaluating a personalized cancer vaccine. In addition, we partner with diagnostics companies by providing our advanced tumor profiling and analysis capabilities as an input to their products. More recently, we launched new diagnostic offerings for the clinical setting and are preparing for future expansion in the clinical diagnostics market. Finally, we have also pursued non-cancer related business opportunities, specifically within the population sequencing market, by providing whole genome sequencing ("WGS") services under contract with the U.S. Department of Veterans Affairs Million Veteran Program ("VA MVP").

As part of one of our new strategies for 2023 and beyond, we are working with a growing number of leading cancer centers and world-class academic research institutions to build and publish the clinical evidence-base to support our products and our key indications. Specifically, because of the high sensitivity of our technology, we aim to focus on three indications in the next 2-3 years: immunotherapy (IO) monitoring, breast cancer, and lung cancer. We have announced collaborations with BC Cancer, Duke University, UCSF, Criterium, and Academic Breast Cancer Consortium that will focus on building the evidence-base for our technology and these indications. If the key opinion leaders ("KOLs") we are collaborating with have a positive experience using our platform, we are optimistic this will support broader use of our platform by other KOLS, as well as clinicians in the future.

Our work in oncology is underpinned by our experience and capacity for next-generation sequencing at scale. We have the capacity to sequence and analyze approximately 200 trillion bases of DNA per week in our facility. We believe that our capacity is already larger than most cancer genomics companies, and we continue to build automation and other infrastructure to scale further as demand increases. To date, we have sequenced more than 300,000 human samples, of which more than 160,000 were whole human genomes.

In October 2022, we relocated our corporate headquarters from Menlo Park, California to a new facility in Fremont, California. We signed a 13.5-year lease that extends to 2036 for the 100,000 square foot facility, which is approximately triple the amount of space than our Menlo Park location. The new facility allows for expansion of our laboratory for testing to support pharmaceutical customers and clinical diagnostic testing. In addition, the new space is intended to support the expansion of research and development efforts to bring leading edge products and services to the marketplace. Our Menlo Park office currently continues to house our Clinical Laboratory Improvement Amendments of 1988 (“CLIA”)-certified and College of American Pathologists (“CAP”)-accredited laboratory and we expect to move our laboratory operations from Menlo Park to the new facility in 2023.

We were incorporated under the laws of the state of Delaware in February 2011 under the name Personalis, Inc. Our customers include pharmaceutical companies, biopharmaceutical companies, diagnostics companies, healthcare providers, universities, non-profits, and government entities.

Market Opportunities

We have estimated the potential future annual U.S. market opportunity for our current and planned products to be approximately $38 billion as follows:

Of these 2.2 million patients, about 200,000 enroll in pharmaceutical clinical trials according to data from the U.S. National Library of Medicine, ClincalTrials.gov, January 2019, with the assumption that the remaining cancer patients undergo standard clinical care. As part of that standard care, we assumed that these patients go through therapy selection and eventual monitoring. For therapy selection, we estimated that each of the approximately 2.0 million cancer patients undergoing standard clinical care will have a tissue biopsy sequenced and tested at a cost of approximately $3,000, which is the approved Centers for Medicare & Medicaid Services ("CMS") reimbursement rate, which results in an estimated potential market opportunity of $6 billion per year.

4

Cancer mutations identified in this initial tissue-biopsy based test can then be used for subsequent monitoring using cell-free DNA ("cfDNA"). For monitoring, we estimated that each patient has a liquid biopsy sequenced and tested four times per year at an estimated cost of $2,840 per test, based on publicly-available data on comparable tests. Our NeXT Dx offering addresses the market for tissue biopsy testing while our NeXT Personal Dx offering is expected to address the liquid-biopsy based monitoring opportunity. Our estimates have led us to project approximately a $22.7 billion potential market opportunity per year for monitoring.

Our Products and Services

Our most advanced cancer genomic tests are powered by our NeXT Platform. Our research-focused products, including exome sequencing, transcriptome sequencing, and targeted cancer panels, are powered by our ACE Platform, the predecessor to NeXT. In addition, we offer WGS for various research applications and population sequencing projects.

NeXT Platform

NeXT is the first platform to enable the comprehensive analysis of both a tumor and its microenvironment from a single sample. Our NeXT Platform is a high-accuracy, next-generation sequencing and analysis platform. We have created an ecosystem of products and capabilities built on the NeXT Platform that synergize to drive value for our customers: ImmunoID NeXT (comprehensive tumor profiling from tissue), NeXT Liquid Biopsy (comprehensive tumor profiling from plasma), NeXT Dx (highly-personalized comprehensive genomic cancer profiling test to optimize therapy selection and match patients to clinical trials), and NeXT Personal (highly-sensitive, tumor-informed liquid biopsy offering for personalized tumor tracking and monitoring). Additionally, the platform offers neoantigen prediction capabilities with Systematic HLA Epitope Ranking Pan Algorithm ("SHERPA"), our pan-predictive machine learning model. Accurate neoantigen prediction with SHERPA is expected to enable the determination of candidate neoantigens for rapid development of personalized cancer therapies, as well as facilitation of the generation of neoantigen burden-based composite biomarkers such as our NEOantigen Presentation Score ("NEOPS") that can potentially better predict response to immunotherapies.

Our NeXT Platform is designed to provide comprehensive analysis of both a tumor and its immune microenvironment from a single limited tissue or plasma sample. Our platform covers the DNA sequence of all of the approximately 20,000 human genes. We also report on the entire transcriptome of a tumor, which encompasses ribonucleic acid (“RNA”) expression across the approximately 20,000 human genes, allowing us to more accurately determine which of the many genomic mutations might actually be driving tumor progression. Furthermore, our platform analyzes elements of the immune cells that have infiltrated a tumor both from the adaptive immune system and the innate immune system.

Given the practical challenges in obtaining high-quality tumor samples via biopsy, we have developed our platform to work with a limited tumor tissue sample. Biopharmaceutical companies, for example, face significant challenges in attempting to divide samples to ship to multiple service providers to perform different tests. If a biopharmaceutical company is successful in acquiring results from multiple service providers, it is challenging to compare the results across multiple data platforms from multiple service providers. Our sequencing approach, validated with orthogonal technologies, allows us to run multiple analyses on a single sample. Our platform is composed of multiple proprietary technologies, many of which we have developed from the ground up. The breadth of the assays that we have integrated into our platform, our proprietary sample preparation process, and the comprehensiveness of our platform allow us to maximize the utility of often limited tumor tissue samples that our customers have from their clinical trials.

Our NeXT Platform can analyze cfDNA obtained from blood plasma, also known as a liquid biopsy. As with a tissue biopsy, we analyze all of the approximately 20,000 human genes in each plasma sample, in contrast to currently marketed liquid biopsy panels, which only analyze roughly 50 to 500 genes. This cfDNA may be obtained by a blood draw concurrently with a tissue sample. Together, the two samples can be used to provide a more comprehensive initial characterization of the tumor. Additionally, our NeXT Personal offering can monitor changes in tumor genetics that arise in response to therapy through serial measurements using cfDNA samples collected across multiple time-points.

An overview of key liquid biopsy capabilities follows.

Liquid biopsy approaches look at cfDNA in plasma samples derived from the blood. cfDNA is DNA that is released into circulation by cells, including tumor cells, most commonly as a result of cell death. This cfDNA can be obtained by a blood draw and can be used to monitor changes in tumor genetics. Circulating tumor DNA ("ctDNA") is a type of cfDNA that derives from tumor cells.

5

We believe tumor biopsy and liquid biopsy approaches to tumor molecular profiling will provide complementary information for each patient. Tumor biopsies provide tumor immune microenvironment and tumor gene expression information that current liquid biopsy panels do not provide. Liquid biopsies can be useful for providing additional DNA mutation information, especially for monitoring therapy response across different time-points when tumor biopsies are not feasible.

NeXT Personal is an advanced, tumor-informed liquid biopsy assay developed to deliver industry-leading minimal residual disease ("MRD") sensitivity in the range of 1-3 parts per million, representing a 10- to 100-fold improvement over other, previously available methods. NeXT Personal is sample sparing, requiring only a single tube of blood, along with a tumor tissue sample. The use of ctDNA as a predictive biomarker for MRD following treatment for solid tumors is rapidly being integrated into clinical trial design, translational research studies, and is on the verge of use in routine clinical care. While other detection methods for ctDNA have rapidly advanced, the limited sensitivity of these detection methods reduce their utility for diagnosing MRD across a variety of clinical applications. Standard-of-care (“SOC”) radiological-based technologies, including CT, PET and MRI scans, also remain limited in their ability to detect residual disease during or after surgical or systemic therapy due to the minimum tumor volume required. Therefore, reliable, sensitive detection and quantification of MRD remains a key challenge, particularly in early-stage cancers, where timely detection of small micrometastatic lesions may enable treatment that prevents progression to advanced metastatic, incurable disease. We believe that NeXT Personal addresses these challenges. In the biopharma setting, MRD is rapidly emerging as a key biomarker in therapy development, whereby more sensitive detection and quantification of MRD may provide substantial benefits versus less sensitive methods through the reduction of false negative detection of cancer.

NeXT makes comprehensive tumor molecular profiling practical for cancer patients at scale

To deliver a comprehensive immune-genomic assessment of a tumor, we invested substantial resources to engineer NeXT to provide data and analysis that would otherwise be unavailable or require many individual technologies, which collectively present significant costs and logistical impracticalities. With NeXT, we built a proprietary platform that is comprehensive, cost-effective, and scalable and enables a short turnaround time, making it practical to profile cancer patients at scale. This has required innovation on a number of fronts.

Revenue from our NeXT Platform products has grown rapidly in recent years. Excluding population sequencing revenue, revenue from our NeXT Platform products accounted for only a minimal proportion of revenue prior to 2020 but for over two-thirds of revenue in the year ended December 31, 2021 and nearly four-fifths of revenue in the year ended December 31, 2022. Revenue in connection with our ACE Platform products (described below) account for the remainder of revenue.

ACE Platform

The ACE Platform is the predecessor to our NeXT Platform. To address the limitations of typical NGS-based assay, we developed our patented Accuracy and Content Enhanced (“ACE”) technology for next-generation sequencing. ACE improves nucleic acid preparation processes and combines it with patented assay and sequencing methods to achieve superior, high-fidelity, clinical-grade sequencing quality that ensures high sensitivity for mutations that can inform clinical and therapeutic applications such as neoantigen prediction, biomarker identification, and novel drug target selection. Our ACE Platform powers multiple products and services to our customers including: exome sequencing, transcriptome sequencing, and targeted cancer panels.

Our ACE technology provides coverage of difficult-to-sequence gene regions across all of the approximately 20,000 human genes, filling in key gaps left by other NGS approaches. ACE technology provides superior and uniform coverage of difficult genomic regions, such as high GC content areas, and fills gaps and inconsistencies in sequencing to achieve an optimal output. ACE is able to deliver more comprehensive coverage not by simply generating more data, but by generating higher quality data. We and others have shown in two publications that our ACE technology achieves superior gene sequencing coverage and finishing.

Whole Genome Sequencing

In recent years, the declining cost of NGS has resulted in the increased use of broad genomic characterization approaches, including WGS, for various research applications. This cost reduction has coincided with researchers’ need for more comprehensive molecular information in the disease areas of cardiology, endocrinology, rare disease, autoimmunity, and ever-increasingly, cancer. WGS is an attractive option for many researchers due to its ability to provide insights into non-coding variation as well as its unrivaled resolution of genome-wide structural variation, the impact of which is becoming more pronounced in many disease states, especially cancer. Personalis is one of the largest processors of human whole genome sequences in the world today.

The most significant customer of our WGS is the VA MVP. Since 2012, we have been contracted to provide DNA sequencing and data analysis services to the VA MVP. The VA MVP began collecting samples in 2011 and is a landmark research effort aimed at better understanding how genetic variations affect health. The VA MVP is one of the largest population sequencing efforts in the U.S. In September 2017, we entered into a one-year contract with three one-year renewal option periods with the VA for the VA MVP, and received orders under this contract in September 2017, 2018, 2019, 2020 and 2021. In September 2022, we entered into a new contract with the VA MVP for a base period of one year, with four one-year renewal option periods that may be exercised upon discretion of the VA MVP. We concurrently received an initial task order with a value of up to $10.0 million, subject to the receipt of samples from the VA MVP. The cumulative value of orders received from the VA MVP since inception is $195.7 million, of which we have recognized all but $9.1 million as revenue as of December 31, 2022.

6

All of our population sequencing revenue to date has been derived from the VA MVP. The VA MVP has accounted for a significant amount of our revenue in recent years: 13% in 2022, 53% in 2021, and 71% in 2020. To date, we have delivered WGS data sets to the VA MVP for over 155,000 veterans. This relationship with the VA MVP has enabled us to scale our operational infrastructure and achieve greater efficiencies in our lab. It has also supported our development of industry-leading, large-scale cancer genomic testing. The substantial experience that we have developed in WGS also optimally positions us for what we anticipate to be the longer-term strategic direction of the cancer genomics industry, which may include WGS of tumors.

Personalis: The Genomics Engine for Next-Generation Cancer Therapies

Pharmaceutical customers use our comprehensive platform across a diverse set of therapeutic approaches to cancer. We generate and analyze data from patients who participated in clinical trials, which we believe will enable these customers to develop more effective therapies. The information we generate is important to our customers developing three major classes of next-generation therapeutics: immunotherapies, targeted therapies, and personalized cancer therapies.

Genes that are involved in the mechanism of action of any of these drugs may develop mutations reducing or eliminating the effectiveness of those drugs. These are called therapy resistance mutations. In many cases, they only become evident after extended treatment of the patient with the drug. When these are detected, it can be an important signal that the patient may benefit from a change to another drug. Thus, it is important not only to test for mutations when a patient is first diagnosed, but periodically to check for the emergence of these potential resistance mutations. Unlike other tumor-informed liquid biopsy tests for MRD, our NeXT Personal liquid biopsy test was designed to also look for the emergence of these potential resistance mutations, which may ultimately help guide decisions about effective therapies for patients.

We anticipate that as the clinical utility of our platform is validated, we will have opportunities in connection with diagnostics and the commercialization of cancer therapeutics, which are significantly larger markets than our clinical-trial focused markets. Over time, we expect our pharmaceutical customers and research collaborators to build evidence of the clinical utility of our platform as a diagnostic for advanced cancer therapies.

Our Strategy

Our mission is to transform the active management of cancer through personalized testing. Our strategy to achieve this mission is to:

Our Proprietary Software and Robust Operational Infrastructure

We have invested significant resources to develop an operational infrastructure that allows us to easily customize our services for each of our customers and scale rapidly to meet their potential research and commercial demands. Our NeXT Platform is complemented by our enterprise-grade software and bespoke information management systems that we tailor to meet our customers’ unique needs and integrate with their workflows. Moreover, our infrastructure provides customers with visibility and control over

7

processes, ensures consistency across all components used for the duration of each clinical trial, is traceable for compliance purposes, and allows us to scale while maintaining rapid turnaround times.

We designed our proprietary informatics system, the Symphony Enterprise Informatics System (“Symphony”), as a flexible and scalable enterprise-grade system used to manage the unique complexities and challenges of our genomics laboratory. Symphony integrates laboratory information management systems (“LIMS”) and bioinformatics systems to connect laboratory operations with downstream data analysis. Symphony orchestrates all operational activities from our laboratory starting with sample receipt to the reporting of results of the genomic profiling and data delivery. We also use machine learning and artificial intelligence approaches to generate substantial performance advantages for our algorithms, such as neoantigen binding prediction.

We have the capacity to sequence and analyze approximately 200 trillion bases of DNA per week in our facility. We believe that our capacity is already larger than most cancer genomics companies, and we continue to build automation and other infrastructure to scale further as demand increases. To date, we have sequenced more than 300,000 human samples, of which more than 160,000 were whole human genomes.

We rely on a limited number of suppliers for sequencers and other equipment and raw materials that we use in our laboratory operations. For example, we rely on Illumina, Inc. (“Illumina”) as the sole supplier of sequencers and various associated reagents, and as the sole provider of maintenance and repair services for these sequencers. We have certain agreements and purchase arrangements in place with Illumina to satisfy the projected needs of our laboratory operations.

We believe our platform is well positioned to scale rapidly and substantially as the field of personalized cancer therapies matures. We believe our platform could be essential to the design of personalized cancer therapies developed using our platform. Furthermore, we expect that patients would be tested at multiple time-points during the course of treatment: first to design a therapy according to an initial genomic profile generated from a tissue and/or liquid biopsy, and then as follow-up testing via liquid biopsy to detect any changes that would require therapy modifications after initial therapeutic interventions. If a therapy that was developed using our NeXT Platform achieves regulatory approval, we believe that our commercial opportunity may increase substantially.

We leverage our proprietary software, laboratory automation and protocols, and other operational and technological know-how to power our NeXT Platform.

Our Industry

Over the past decade, the biopharmaceutical community has achieved major advances in the treatment of cancer, including approval of therapies capable of targeting specific genetic drivers of cancer and novel immunotherapies that empower the immune system to attack cancer cells. Despite these advances, the substantial majority of currently available cancer therapies have significant limitations, including efficacy only in certain subsets of patients, limited long-term survival rates, and significant toxicities. Moreover, the current research and development paradigm in oncology is beset by significant inefficiencies and substantial costs, with the average cost per patient in clinical trials reaching approximately $60,000 (Battelle Technology Partnership Practice, Biopharmaceutical Industry-Sponsored Clinical Trials: Impact on State Economies, March 2015). While tumor molecular profiling technologies have enhanced research and development efforts, most current tumor biopsy and liquid biopsy tests analyze a relatively narrow set of roughly only 50 to 500 genes, missing key genes and immune mechanisms underlying cancer therapy. With the lack of a comprehensive profiling solution, biopharmaceutical companies often attempt to use a disparate array of tests to compensate, resulting in a fragmented view of the tumor biology, insufficient tumor sample, logistical complexities, and increased costs. The resulting data heterogeneity makes it difficult to mine for new biological insights across cohorts of patients in clinical trials. These piecemeal approaches to tumor molecular profiling often result in solutions that are difficult to use at scale, especially in a clinical or therapeutic setting where simplicity, cost, turnaround time, and validation are important.

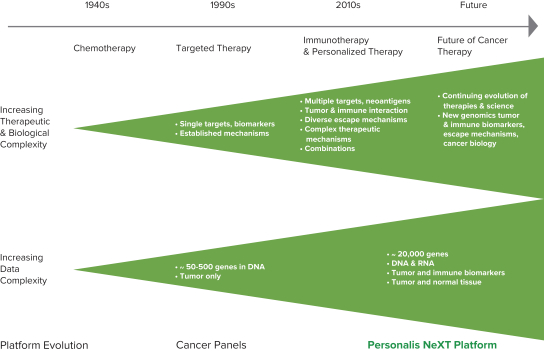

Our platforms help biopharmaceutical companies seeking to develop more efficacious therapies by comprehensively interrogating a patient’s tumor and immune cells in detail, both to discover tumor vulnerabilities and elucidate potential therapeutic alternatives. To meet the demands of our customers, we built our NeXT Platform to be cost-effective and scalable with rapid turnaround times for tissue sample data and analytics. The NeXT Platform represents the next step of our ACE Platform, allowing customers to move up the value chain by gaining more information from a single sample. We believe that our platforms have the potential to enable a research, development, and treatment paradigm that is dynamic and adaptive to the evolving genomic and immune system landscape of patients’ tumors over time. We believe our technology will drive this evolving paradigm, which we believe will ultimately enable our customers to develop safer and more efficacious therapeutics (see Figure 1). As the clinical utility of our platforms increases, we expect to grow our diagnostic capabilities, including the ability to guide therapy based on a patient’s changing tumor and immune system, and supporting the commercialization of therapeutics developed by our biopharmaceutical customers.

8

Figure 1. Personalis NeXT Platform addresses the increasingly complex understanding of cancer.

Despite the large sums invested in research and despite new treatments, cancer remains a major challenge for modern medicine and a source of high unmet medical need. According to the American Cancer Society’s Cancer Facts & Figures 2020, as of January 1, 2019, there were more than 16.9 million people in the United States who were suffering from cancer or who had previously suffered from cancer. Cancer prevalence is increasing globally as well. The World Health Organization (“WHO”) predicted in its September 2018 estimates on the global prevalence of cancer that there would be 18.1 million new cancer cases and nearly 10 million cancer deaths globally in 2018. According to the WHO, the total economic impact of healthcare expenditure and loss of productivity resulting from cancer worldwide was approximately $1.2 trillion in 2010.

Improving Cancer Treatment is Increasingly About Leveraging Molecular Data

Despite the rapid evolution of cancer therapies, the current research and development paradigm in oncology is beset by significant inefficiencies and costs. Cancer therapeutics have one of the lowest clinical trial success rates of all major diseases. According to a study of 7,455 drug development programs during 2006 to 2015, the overall likelihood of FDA approval from Phase I clinical trial for oncology developmental candidates was 5.1% (BIO Industry Analysis, Clinical Development Success Rates 2006-2015, June 2016). The majority of currently available cancer therapeutics have serious limitations, including efficacy only in certain subsets of patients, limited long-term survival rates, and significant toxicities. The mechanisms underlying the success or failure of clinical trials are often poorly understood. To develop more efficacious cancer treatments, the biopharmaceutical community is faced with multiple key questions for a given therapeutic approach:

There is a growing recognition that there is a tremendous amount of untapped molecular data that can be derived from analyzing tumors from large numbers of cancer patients, whether in cancer clinical trials or post-commercialization, that can help answer some of these seminal questions and accelerate therapeutic development. According to BIO Industry Analysis, Clinical Development Success Rates 2006-2015, June 2016, there is a threefold increase in probability of FDA approval from Phase I clinical trial for therapies with biomarkers across all diseases and therapeutic types, which provides an indication of the benefits of leveraging molecular data.

9

Current Tumor Molecular Profiling Solutions Have Not Kept Pace with New Cancer Therapies

Biopharmaceutical companies are increasingly turning to tumor molecular profiling across large cohorts of patients to generate the data needed to answer these questions. Unfortunately, many current tumor molecular profiling methods have not kept pace with new therapy development and overlook crucial elements of our evolving understanding of cancer biology.

Current Tumor Molecular Profiling Falls Short for New Cancer Immunotherapies

Currently, the most widely-used tumor molecular profiling panels were designed with a focus on targeted therapies, which, along with chemotherapy, have been used for cancer treatment for the past several decades. Targeted therapies treat cancers based on the specific genomic alterations driving their growth. Some targeted therapies have been developed to target specific molecules that are overexpressed or mutated in cancer cells. Because targeted therapies focus on cancer driver genes, the vast majority of tumor molecular profiling performed today, whether tissue or liquid biopsy based, typically sequences the DNA of between 50 to 500 genes, just a small fraction of the approximately 20,000 human genes.

Recently, however, transformational new approaches to cancer therapy that have been developed to harness the patient’s own immune system have changed the treatment paradigm and our understanding of cancer biology. These new immunotherapies have dramatically improved the treatment of certain tumors that have previously been difficult to treat. Among these new immunotherapies, checkpoint inhibitors of the CTLA-4 and PD-1/PD-L1 genes are particularly effective. These therapies help “take the brakes off” the immune system and elicit a stronger immune response against the tumor. Patients can also be treated by adoptive cell therapy, in which the patient’s immune system is supplemented with cytotoxic cells that have been programmed to attack cells expressing specific antigens on their tumors. There are also new opportunities for personalized cancer therapies where a new therapeutic vaccine or cell therapy is developed for each patient. Despite early success, the majority of patients today still do not respond to immunotherapy, underscoring the importance of gathering data that can help biopharmaceutical companies understand factors governing response and resistance to therapy.

With these new immunotherapies and our rapidly evolving understanding of cancer biology, we believe the data needed to inform therapeutic development goes far beyond the typical 50 to 500 genes on the current most widely used tumor molecular profiling panels. The paradigm has shifted from the need to understand mechanisms behind a single gene target to a dynamic, systems biology view involving complex interactions between thousands of genes in the tumor and the immune system in the pathogenesis of cancer and cancer drug response.

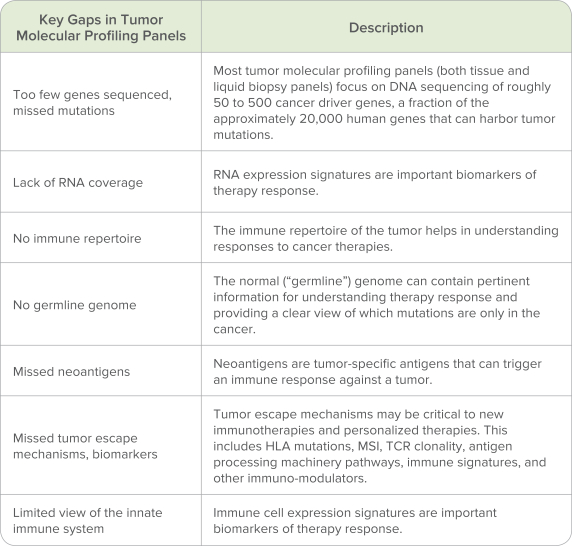

Information about all of the approximately 20,000 human genes allows deeper insight into the biology of cancer, identifying novel or patient-specific therapeutic targets, including neoantigens, and predictive biomarkers of response to therapy. Understanding the immune cell signatures in the tumor microenvironment and immune repertoire changes is critical for understanding drug response. In addition to DNA, comprehensive RNA expression information from the tumor is needed to analyze complex pathways that may be activated in the tumor. It is important to identify the increasingly complex mechanisms of tumor response and resistance to cancer therapy, such as neoantigen burden, tumor antigens, deficient antigen presentation, oncogenic pathways, immune evasion pathways, HLA mutations, T-cell clonality, immune infiltration, and others. Table 1 describes some of the biological gaps in current panels. Most of these elements go beyond the capabilities of today’s tumor molecular profiling panels.

10

Table 1. Most current tumor tissue and liquid biopsy profiling panels miss critical tumor and immune biology.

Fragmented Tumor Molecular Profiling Approaches Result in a Fragmented View of Biology and Limited Insights

With the lack of a comprehensive profiling solution, biopharmaceutical companies often turn to fragmented, piecemeal approaches to tumor molecular profiling as a stopgap measure. Those fragmented tumor molecular profiling approaches lead to major problems for therapeutic development. Limitations in available tumor samples, including liquid biopsies, force scientists to pick and choose which profiling platforms to include and which to omit, resulting in a fragmented picture of the biology. Fragmented profiling solutions also result in inconsistent profiling from patient to patient, and clinical trial to clinical trial. This results in data heterogeneity that makes it difficult to mine for new biological insights across cohorts of patients in trials. Finally, these piecemeal approaches to tumor molecular profiling result in solutions that often are difficult to use at scale in a clinical or therapeutic setting where logistical simplicity, cost, turnaround time, and validation are important.

Current Tumor Molecular Profiling Panels Can Become Antiquated with Evolving Science

With the explosion of immunotherapy and advances in our understanding of cancer, new insights into the underlying mechanisms of response and resistance have emerged. New putative genetic or immune biomarkers of response are regularly identified for different therapies in the context of different cancers. For instance, new biomarkers have been identified including tumor mutational burden, neoantigens, HLA type, B2M mutations, TGFß, JAK1/JAK2 mutations, expression signatures, cytotoxicity signatures, and T-cell clonality, among others. A recent Nature Medicine review identified 18 different categories of biomarkers correlating with immunotherapy response spanning tumor, immune cells, and the tumor microenvironment. The limited coverage of the current most widely-used cancer panels may miss these new biomarkers. We believe this problem will continue as research uncovers new insights into cancer.

Sequencing Quality and Coverage

Next generation sequencing (“NGS”) is the technological basis for many tumor molecular profiling platforms today. NGS rapidly sequences nucleic acids and then uses a computationally intensive process to reconstruct gene sequences from millions of short sequence segments. These segments are processed in parallel, an approach that greatly increases the speed that the sequence data can be generated. However, because the segments come from random locations in the genome, reassembling the original sequence is both a technically and computationally challenging process. A key objective is to ensure that every portion of the genes being sequenced is covered by at least one sequence segment. The average number of sequence segments representing a gene is referred to as the sequence depth. The deeper the coverage, the greater fraction of the gene is likely to be covered and the higher confidence that low-frequency variants can be found.

11

However, even when sequenced to high depth, typical NGS approaches can leave uneven, poor coverage in genes with mutations linked to cancer and cancer therapy. Many of these regions cannot be fully covered by simply sequencing to higher depth because their sequencing coverage deficits are due to inherent limitations of the NGS platform. Regions of high guanine-cytosine (“GC”) content or repetitive sequence regions are two such examples of regions that are difficult to cover with standard NGS assays. This can leave gaps in coverage of therapeutically important genes. This is particularly problematic in cancer, where there can be significant heterogeneity in the tumor samples that can make it even harder to see mutations in regions of poor coverage.

To address the limitations of typical NGS-based assay, we have developed our patented ACE technology for next-generation sequencing. ACE improves nucleic acid preparation processes and combines it with patented assay and sequencing methods to achieve superior, high-fidelity, clinical-grade sequencing quality that ensures high sensitivity for mutations that can inform clinical and therapeutic applications such as neoantigen prediction, biomarker identification, and novel drug target selection.

Our NeXT Platform uses our ACE technology to provide coverage of difficult-to-sequence gene regions across all of the approximately 20,000 human genes, filling in key gaps left by other NGS approaches. ACE technology provides superior and uniform coverage of difficult genomic regions, such as high GC content areas, and fills gaps and inconsistencies in sequencing to achieve an optimal output. ACE is able to deliver more comprehensive coverage not by simply generating more data, but by generating higher quality data. We and others have shown in two publications that our ACE technology achieves superior gene sequencing coverage and finishing.

Commercialization Strategy

We commercialize our products primarily in the United States and Europe through a targeted sales organization. In June 2020, we entered into a partnership with a clinical genomics and life sciences company headquartered in China as a means to expand business operations into China in the near term. Our first wholly-owned subsidiary was formed in Shanghai in October 2020. However, we recently decided to not pursue commercialization of our products in China and to close our operations in China as expeditiously as possible in 2023.

In 2022, we derived 91% of our revenue from customers in the U.S. Our sales representatives have extensive experience in enterprise/consultative selling in the genomics space. We augment this team with Ph.D.-level Field Application Specialists that provide deep understanding and expertise in the areas of oncology and genomics applications, ensuring top-quality pre- and post-sales customer support. Our commercial efforts are focused on demonstrating the value proposition of the NeXT Platform to biopharmaceutical customers with the goal of both increasing utilization of the product at existing accounts and to drive adoption in new targeted accounts. Our entire commercial organization promotes our ability to support biopharmaceutical customers across several application areas including biomarker discovery, new target discovery, therapy development, and treatment monitoring.

We anticipate that patients in clinical trials for cancer therapies will increasingly be tested pre-treatment and periodically afterwards to understand response to treatment in deep molecular detail, as their tumors evolve under therapeutic pressure. Although the majority of our revenue comes from single time-point testing, we believe our revenue from multiple time-point testing will continue to grow. We also derive revenue from analysis of multiple customer samples from the same patient and time point to assess genetic differences between the primary tumor and metastases. Given the value of comprehensive genomic information from multiple time points or samples, we anticipate that our revenue, and the available market, will continue to grow.

We have developed a highly sensitive MRD test (Next Personal) and are focused on launching it to doctors for patient use in 2023 while developing clinical evidence to justify its use. Our focus is on breast and lung cancer and immuno-therapy monitoring as we believe the performance of our MRD test will be particularly valuable in those clinical indications. Additionally, we believe that there is an opportunity to partner with other diagnostic companies to provide our Next Personal testing service for additional clinical indications through their sales and marketing channels and are pursuing those relationships.

As we build the evidence around our Next Personal products, we are simultaneously focused on developing the use of our Next Dx product and winning early reimbursement. The focus on commercial efforts in 2023 on Next Dx by our sales, medical affairs, billing and reimbursement teams could accelerate uptake and revenue growth from our clinical laboratory business.

Our Customers

Our cancer genomic services are sold primarily to pharmaceutical companies, biopharmaceutical companies, diagnostic testing companies, biotechnology companies, healthcare providers, universities, non-profits, and government entities, while services for population sequencing initiatives are sold primarily to the VA MVP, which is a government entity. Our customers include a majority of the top ten oncology-focused pharmaceutical companies, as measured by annual revenue.

In 2022, we had three customers account for 10% or more of our revenue: Natera, Inc. (“Natera”) at 41%, VA MVP at 13% and Merck & Co., Inc. at 11%. In 2021, we had two customers account for 10% or more of our revenue: VA MVP at 53% and Natera at 10%. In 2020, VA MVP accounted for 71% of our revenue and no other customer accounted for 10% or more.

12

Our Competition

Our principal competition comes from commercial and academic organizations using established and new laboratory tests to produce information that is similar to the information that we generate for our customers. These companies offer services that implement various technological approaches including next-generation sequencing and microarray analyses. Some of our present or potential competitors include Adaptive Biotechnologies Corporation, Adela, Inc., ArcherDx, Inc., which was acquired by Invitae Corporation in October 2020, BillionToOne, Inc., BostonGene Corporation, C2i Genomics, Inc., Caris Life Sciences, Inc., Covance Inc., which was acquired by Laboratory Corporation of America Holdings in February 2015, Foresight Diagnostics Inc. (“Foresight”), Foundation Medicine, Inc., which was acquired by Roche Holdings, Inc. in July 2018, Freenome, Inc., Geneseeq Technology Inc., Genosity, Inc., which was acquired by Invitae Corporation in April 2021, GRAIL, which Illumina announced that it had acquired in August 2021, Guardant Health, Inc., Inivata Limited, which was acquired by NeoGenomics, Inc. in June 2021, Invitae Corporation, Natera, NeoGenomics, Inc., Personal Genome Diagnostics, Inc., Predicine, Inc., Roche Molecular Systems, Inc., Strata Oncology, Inc., and Tempus, Inc.

Additionally, several companies develop next-generation sequencing platforms that can be used for genomic profiling for biopharmaceutical research and development applications. These include Illumina, Thermo Fisher Scientific Inc., and other organizations that specialize in the development of next-generation sequencing instrumentation that can be sold directly to biopharmaceutical companies, clinical laboratories, and research centers. Separate from their instrumentation product lines, both Illumina and Thermo Fisher Scientific Inc., for example, currently market next-generation sequencing clinical oncology kits that are sold to customers who have bought and operate their respective sequencing instruments.

We believe that we compete favorably because of the high sensitivity and comprehensiveness of the data generated by our NeXT Platform. Maximizing insights into both the tumor- and immune-related components of the tumor microenvironment is essential in identifying and understanding the reasons why certain cancer patients respond more favorably to oncology therapies than others. It is via access to such a comprehensive dataset for each patient that our customers can begin to discover new, clinically relevant biomarkers for the immunotherapy era, and ultimately improve cancer patient outcomes with the development of more efficacious therapeutics.

Intellectual Property

Protection of our intellectual property is fundamental to the long-term success of our business. Specifically, our success is dependent on our ability to obtain and maintain proprietary protection for our technology and the know-how related to our business, defend and enforce our intellectual property rights, and operate our business without infringing, misappropriating, or otherwise violating valid and enforceable intellectual property rights of others. We seek to protect our investments made into the development of our technology by relying on a combination of patents, trademarks, copyrights, trade secrets, know-how, confidentiality agreements and procedures, non-disclosure agreements with third parties, employee disclosure and invention assignment agreements, and other contractual rights.

Our patent strategy is focused on seeking coverage for our core technology, our NeXT Platform, including applications and implementations for enhancing sequencing coverage of certain genomic regions, identifying neoantigens, analyzing cell-free nucleic acids, and creating personalized cancer recurrence detection assays. In addition, we file for patent protection on our ongoing research and development efforts, particularly related to other novel assay technologies which may be applicable to the diagnosis and treatment of cancer and other diseases.

Notwithstanding these efforts, we cannot be sure that patents will be granted with respect to any patent applications we have filed or may license or file in the future, and we cannot be sure that any patents we have or may be licensed or granted to us in the future, will not be challenged, invalidated, or circumvented, or that such patents will be commercially useful in protecting our technology. Moreover, we rely, in part, on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection. However, trade secrets can be difficult to protect. While we take steps to protect and preserve our trade secrets, including by entering into confidentiality agreements with our employees, consultants, scientific advisors, and contractors, conducting an annual training for our employees to increase awareness of cybersecurity threats, and maintaining physical security of our premises and physical and electronic security of our information technology systems, such measures can be breached, and we may not have adequate remedies for any such breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. For more information regarding the risks related to our intellectual property, please see “Risk Factors—Intellectual Property Risks.”

Our patent portfolio is comprised of patents and patent applications owned by the company. These patents and patent applications generally fall into five broad categories:

13

As of December 31, 2022, we own 18 issued U.S. patents and 7 issued foreign patents. Issued U.S. patents in our portfolio of company-owned patents are expected to expire between 2033 and 2038, excluding any additional term for patent term adjustments or patent term extensions. If patents are issued on our pending patent applications, the resulting patents are projected to expire on dates ranging from 2033 to 2042.

Government Regulations

Coverage and Reimbursement

Our ability, and the ability of our customers, to commercialize diagnostic tests based on our technology will depend in part on the extent to which coverage and reimbursement for these tests will be available from third-party payors. Coverage and reimbursement of new products and services is uncertain, and whether the companies that use our instruments to develop their own products or services will attain coverage and adequate reimbursement is unknown. In the U.S., there is no uniform policy for determining coverage and reimbursement. Coverage can differ from payor to payor, and the process for determining whether a payor will provide coverage may be separate from the process for setting the reimbursement rate. In addition, the U.S. government, state legislatures and foreign governments have shown significant interest in implementing cost containment programs to limit the growth of government-paid healthcare costs, including price controls and restrictions on reimbursement. Additionally, the coverage and reimbursement status of newly-approved or cleared laboratory tests, including our NeXT Dx offering, is uncertain. If we decide to seek reimbursement for our NeXT Dx offering or other in vitro diagnostic tests we may develop, and if such tests are inadequately covered by insurance or ineligible for such reimbursement, this could limit our ability to market any such future tests. The commercial success of future products in both domestic and international markets may depend in part on the availability of coverage and adequate reimbursement from third-party payors, including government payors, such as the Medicare and Medicaid programs, managed care organizations, and other third-party payors.

Federal and State Laboratory Licensing Requirements

Under the CLIA, a laboratory is any facility that performs laboratory testing on specimens derived from humans for the purpose of providing information for the diagnosis, prevention or treatment of disease, or the impairment of or assessment of health. CLIA requires that a laboratory hold a certificate applicable to the type of laboratory examinations it performs and that it complies with, among other things, standards covering operations, personnel, facilities administration, quality systems and proficiency testing, which are intended to ensure, among other things, that clinical laboratory testing services are accurate, reliable and timely.

To renew our CLIA certificate, we are subject to survey and inspection every two years to assess compliance with program standards. Because we are a CAP accredited laboratory, the CMS does not perform this survey and inspection and relies on our CAP survey and inspection. We also may be subject to additional unannounced inspections. Laboratories performing high complexity testing are required to meet more stringent requirements than laboratories performing less complex tests. In addition, a laboratory that is certified as “high complexity” under CLIA may develop, manufacture, validate, and use proprietary tests referred to as laboratory developed tests (“LDTs”). CLIA requires analytical validation including accuracy, precision, specificity, sensitivity, and establishment of a reference range for any LDT used in clinical testing. The regulatory and compliance standards applicable to the testing we perform may change over time, and any such changes could have a material effect on our business.

CLIA provides that a state may adopt laboratory regulations that are more stringent than those under federal law, and a number of states have implemented their own more stringent laboratory regulatory requirements. State laws may require that nonresident laboratories, or out-of-state laboratories, maintain an in-state laboratory license to perform tests on samples from patients who reside in that state. As a condition of state licensure, these state laws may require that laboratory personnel meet certain qualifications, specify certain quality control procedures or facility requirements, or prescribe record maintenance requirements. Because our laboratory is located in the state of California, we are required to and do maintain a California state laboratory license. We also maintain licenses to conduct testing in other states where nonresident laboratories are required to obtain state laboratory licenses, including Maryland, Pennsylvania, Rhode Island, and New York. Other states may currently have or adopt similar licensure requirements in the future, which may require us to modify, delay, or stop its operations in those states.

Regulatory framework for medical devices in the United States

Pursuant to its authority under the Federal Food, Drug and Cosmetic Act (“FDC Act”), the FDA has jurisdiction over medical devices, which are defined to include, among other things, in vitro diagnostic devices (“IVDs”). The FDA regulates, among other things, the research, design, development, pre-clinical and clinical testing, manufacturing, safety, effectiveness, packaging, labeling, storage, recordkeeping, pre-market clearance or approval, adverse event reporting, marketing, promotion, sales, distribution, and import and export of medical devices. Unless an exemption applies, each new or significantly modified medical device we seek to commercially distribute in the United States will require either a premarket notification to the FDA requesting permission for commercial distribution under Section 510(k) of the FDC Act, also referred to as a 510(k) clearance, or approval from the FDA of a premarket approval application

14

(“PMA”). Both the 510(k) clearance and PMA processes can be resource intensive, expensive, and lengthy, and require payment of significant user fees.

Although the FDA regulates medical devices, including IVDs, the FDA has historically exercised its enforcement discretion and not enforced applicable provisions of the FDC Act and FDA regulations with respect to LDTs, which are a subset of IVDs that are intended for clinical use and developed, validated, and offered within a single laboratory for use only in that laboratory. We currently market our diagnostic test based on the NeXT Platform as an LDT. As a result, we believe our diagnostic services are not currently subject to the FDA’s enforcement of its medical device regulations and the applicable FDC Act provisions. Despite the FDA’s historic enforcement discretion policy with respect to LDTs, if the FDA determines that our tests are subject to enforcement as medical devices, we could be subject to administrative and judicial sanctions, and additional regulatory controls and submissions for our tests, all of which could be burdensome. We and/or our collaborators may also voluntarily submit one or more of our tests for premarket notification, review, clearance or approval by the FDA as medical devices, which may be as companion diagnostic medical devices.

If the FDA determines that our tests and associated software do not fall within the definition of an LDT, or there are regulatory or legislative changes, or if we voluntarily submit one or more of our tests for premarket notification, review, clearance or approval by the FDA as medical devices, we may be required to obtain premarket clearance for our tests and associated software under Section 510(k) of the FDC Act or approval of a PMA. We would also be subject to ongoing regulatory requirements such as registration and listing requirements, medical device reporting requirements, and quality control requirements. If our tests are considered medical devices not subject to enforcement discretion, or if we voluntarily submit one or more of our tests for premarket notification, review, clearance or approval by the FDA as medical devices, the regulatory requirements to which our tests are subject would depend on the FDA’s classification of our tests. The FDA has issued regulations classifying medical devices into one of three regulatory control categories (Class I, Class II, or Class III) depending on the degree of regulation that the FDA finds necessary to provide reasonable assurance of their safety and effectiveness. The class into which a device is placed determines the requirements that a medical device manufacturer must meet both pre- and post-market.

Generally, Class I devices do not require premarket authorization, but are subject to a comprehensive set of regulatory authorities referred to as general controls. Class II devices, in addition to general controls, generally require special controls and premarket clearance through the submission of a section 510(k) premarket notification. Class III devices are subject to general controls and special controls, and also require premarket approval prior to commercial distribution, which is a more rigorous process than premarket clearance. Under the FDC Act, a device that is first marketed after May 28, 1976 is by default a Class III device requiring premarket approval unless it is within a type of generic device class that has been classified as Class I or Class II. Even if a device falls under an existing Class II, non-exempt, device classification, the product must also be shown to be “substantially equivalent” to a legally marketed predicate device through submission of a section 510(k) premarket notification. If after reviewing a firm’s 510(k) premarket notification, the FDA determines that a device is not substantially equivalent to a legally marketed predicate device, the new device is classified into Class III, requiring premarket approval. It is possible for a manufacturer to obtain a Class I or Class II designation without an appropriate predicate by submitting a de novo request for reclassification.

The process for submitting a 510(k) premarket notification and receiving FDA clearance usually takes from three to 12 months, but it can take significantly longer and clearance is never guaranteed. The process for submitting and obtaining FDA approval of a PMA is much more costly, lengthy, and uncertain. It generally takes from one to three years or even longer and approval is not guaranteed. PMA approval typically requires extensive clinical data and can be significantly longer, more expensive and more uncertain than the 510(k) clearance process. Despite the time, effort and expense expended, there can be no assurance that a particular device ultimately will be cleared or approved by the FDA through either the 510(k) clearance process or the PMA process on a timely basis, or at all.

If our tests are considered medical devices not subject to enforcement discretion, or if we voluntarily submit one or more of our tests for premarket notification, review, clearance or approval by the FDA as medical devices, one classification regulation that could be relevant to one or more of our tests is a classification for genetic health risk (“GHR”) assessment tests, codified at 21 C.F.R. § 866.5950. If our tests are considered medical devices that are not subject to enforcement discretion, or if we voluntarily submit one or more of our tests for premarket notification, review, clearance or approval by the FDA as medical devices, and one or more of our tests is considered to fall under the 21 C.F.R. § 866.5950 classification regulation for GHR tests, or under another Class II classification that is subject to a premarket notification requirement, we would be required to obtain marketing clearance for such tests. Further, if considered to fall under the 21 C.F.R. § 866.5950 classification for GHR tests, our tests would be required to adhere to specified special controls, such as labeling and testing specifications and information about the test to be posted on the manufacturer’s website.

The FDA requires medical device manufacturers to comply with, among other things, current good manufacturing practices for medical devices, set forth in the Quality System Regulation at 21 C.F.R. Part 820, which requires manufacturers to follow elaborate design, testing, control, documentation, and other quality assurance procedures during the manufacturing process; the medical device reporting regulation, which requires that manufacturers report to the FDA if their device or a similar device they market may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; labeling regulations, including the FDA’s general prohibition against promoting products for unapproved or “off-label” uses; the reports of corrections and removals regulation, which requires manufacturers to report to the FDA if a device correction or removal was initiated to reduce a risk to health posed by the device or to remedy a violation of the FDC Act caused by the device which may present a risk to health; and the establishment registration and device listing regulation.

In addition, any clearance or approval we obtain for our products may contain requirements for costly post-market testing and surveillance to monitor the safety or efficacy of the product. The FDA has broad post-market enforcement powers, and if unanticipated problems with our products arise, or if we or our suppliers fail to comply with regulatory requirements following FDA clearance or approval, we may become subject to enforcement actions such as:

15

Moreover, the FDA strictly regulates the promotional claims that may be made about medical devices. In particular, a medical device may not be promoted for uses that are not approved by the FDA as reflected in the device’s approved labeling. However, companies may share truthful and not misleading information that is otherwise consistent with the product’s FDA approved labeling. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant civil, criminal, and administrative penalties.

In addition, many of the products we use to perform our tests, including sequencers and various associated reagents supplied to us by Illumina, are labeled as research use only (“RUO”) in the U.S. RUO products are exempt from FDA medical device requirements provided their manufacturers comply with specified labeling and restrictions on distribution. The products must bear the statement: “For Research Use Only. Not for Use in Diagnostic Procedures.” Manufacturers of RUO products cannot make any claims related to safety, effectiveness or diagnostic utility, and RUO products cannot be intended by the manufacturer for clinical diagnostic use. A product promoted for diagnostic use may be viewed by the FDA as adulterated and misbranded under the FDC Act and is subject to FDA enforcement activities, including requiring the manufacturer to seek marketing authorization for the products. We currently use Illumina and other RUO products for our clinical diagnostic tests. If the FDA were to require clearance, approval or authorization for the sale of Illumina’s RUO products and if Illumina does not obtain such clearance, approval or authorization, we would have to find an alternative sequencing platform for some or all of our clinical diagnostic tests.

Federal and State Fraud and Abuse Laws

We are subject to federal fraud and abuse laws such as the federal Anti-Kickback Statute (the “AKS”), the federal prohibition against physician self-referral (the “Stark Law”), and the federal false claims law, or the False Claims Act (the “FCA”). We are also subject to similar state and foreign fraud and abuse laws.

The AKS prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration, directly or indirectly, overtly or covertly, in cash or in kind, in return for or to induce such person to refer an individual, or to purchase, lease, order, arrange for, or recommend purchasing, leasing, or ordering, any good, facility, item, or service that is reimbursable, in whole or in part, under a federal healthcare program.

The Stark Law and similar state laws, including California’s Physician Ownership and Referral Act, generally prohibit, among other things, clinical laboratories and other entities from billing a patient or any governmental or commercial payer for any diagnostic services when the physician ordering the service, or any member of such physician’s immediate family, has a direct or indirect investment interest in or compensation arrangement with us, unless the arrangement meets an exception to the prohibition.

The federal civil and criminal false claims laws including the FCA, which imposes liability on any person or entity that, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment to the federal government, and the federal Civil Monetary Penalties Law, which prohibits, among other things, the offering or transfer of remuneration to a Medicare or state healthcare program beneficiary if the person knows or should know it is likely to influence the beneficiary’s selection of a particular provider, practitioner, or supplier of services reimbursable by Medicare or a state healthcare program, unless an exception applies. Under the FCA, private citizens can bring claims on behalf of the government through qui tam actions. We must also operate within the bounds of the fraud and abuse laws of the states in which we do business which may apply to items or services reimbursed by non-governmental third-party payers, including private insurers.

The Eliminating Kickbacks in Recovery Act

The Eliminating Kickbacks in Recovery Act of 2018 (“EKRA”) prohibits payments for referrals to recovery homes, clinical treatment facilities, and laboratories and is similar to the federal Anti-Kickback Statute in that it creates criminal penalties for knowing or willful payment or offer, or solicitation or receipt, of any remuneration, whether directly or indirectly, overtly or covertly, in cash or in kind, in exchange for the referral or inducement of laboratory testing unless a specific exception applies. Unlike the federal Anti-Kickback Statute, EKRA’s reach extends beyond federal health care programs to include private insurance (i.e., it is an “all payer” statute). Additionally, most of the safe harbors available under the federal Anti-Kickback Statute are not reiterated under EKRA, and certain EKRA safe harbors conflict with the safe harbors available under the federal Anti-Kickback Statute. Therefore, compliance with a federal Anti-Kickback safe harbor does not guarantee protection under EKRA. Because EKRA is a new law, there is very little additional guidance to indicate how and to what extent it will be interpreted, applied and enforced by the government. Currently, there is no proposed regulation interpreting or implementing EKRA, nor any public guidance released by a federal agency concerning EKRA.

16

Other Federal and State Healthcare Laws

In addition to the requirements discussed above, several other healthcare laws could have an effect on our business. For example, the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) fraud and abuse provisions created federal civil and criminal statutes that prohibit, among other things, defrauding healthcare programs, willfully obstructing a criminal investigation of a healthcare offense, and falsifying or concealing a material fact or making any materially false statements in connection with the payment for healthcare benefits, items or services. Similar to the federal Anti- Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

The federal Physician Payments Sunshine Act requires certain manufacturers of drugs, biologicals, and medical devices or supplies that require premarket approval by or notification to the FDA, and for which payment is available under Medicare, Medicaid, or the Children’s Health Insurance Program (“CHIP”), with certain exceptions, to report annually to CMS information related to (i) payments and other transfers of value to physicians (defined to include doctors, dentists, optometrists, podiatrists, and chiropractors), other healthcare professionals (such as physicians assistants and nurse practitioners) and teaching hospitals, and (ii) ownership and investment interests held by physicians and their immediate family members.

The “Anti-Markup Rule” and similar state laws prohibit, among other things, a physician or supplier billing the Medicare program from marking up the price of a purchased diagnostic service performed by another laboratory or supplier that does not “share a practice” with the billing physician or supplier. Penalties may apply to the billing physician or supplier if Medicare or another payer is billed at a rate that exceeds the performing laboratory’s charges to the billing physician or supplier, and the performing laboratory could be at risk under false claims laws, described below, for causing the submission of a false claim.

The “14-Day Rule,” also known as the Medicare Date of Service Rule, prohibits a laboratory supplier from billing the Medicare program for tests performed on samples collected during or within 14 days of an inpatient hospital stay, unless an exception applies, and requires the laboratory supplier to bill the hospital in those cases. Penalties may apply to the laboratory supplier if Medicare determines that the Medicare program was inappropriately billed for testing that should have been billed to the hospital where the sample was collected.