United states

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

For the transition period from

Commission file number

| (Name of registrant in its charter) |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

+1(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| The |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. ☐

Yes ☒

Indicate by check mark if the registrant is not required

to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐

Yes ☒

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the last 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically,

if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large-accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large-accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report.

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act). ☐ Yes

On December 31, 2023, the aggregate market value of

the voting and non-voting common equity held by non-affiliates was $

As of October 3, 2024, the number of shares outstanding of the registrant’s common stock, par value $0.0001 per share (the “Common Stock”) was .

CONTENTS

i

Cautionary Language Regarding Forward-Looking Statements and Industry Data

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the plans and objectives of management for future operations and market trends and expectations. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements are based upon our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. In some cases, you can identify forward-looking statements by the following words: “may,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “approximately,” “estimate,” “predict,” “project,” “potential” or the negative of these terms or other comparable terminology, although the absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking statements include, but are not limited to, statements concerning:

| ● | Our ability to continue as a going concern and ability to raise additional capital; | |

| ● | Our continuous incurrence of losses as a pre-clinical-stage biotechnology company with no products that have achieved regulatory approval; | |

| ● | Our ability to generate revenue if we fail to develop marketable product; | |

| ● | Our dependence on substantial additional financing to support the research, development, licensing, manufacture, and marketing of product candidates and products, and the possibility that unforeseen operational costs will arise; | |

| ● | The dilutive effect on stockholders’ ownership interests of the Company raising capital through an equity issuance in connection with future equity financing or equity debt agreements; | |

| ● | Our dependence on the services of experts, including third parties to research and develop product candidates in cooperation with our employees and officers; | |

| ● | The difficulty or impossibility of predicting future clinical trial results and regulatory outcomes of our products based upon our pre-clinical or earlier clinical trial performance; | |

| ● | The application of heightened regulatory and commercial scrutiny to our AI-based technology, gene, cell, and immunotherapy products given their novel nature and concomitant potential for actual or perceived safety issues; | |

| ● | Our ability to compete in rapidly developing fields, and the potential impact to our financial condition, product marketability, and operational capacities of a competitor receiving regulatory approval before us, or a competitor developing more advanced or efficacious products; | |

| ● | Potential delays or total failures of third parties, such as universities, non-profits, and clinical research centers, to perform obligations on which our product research and development rely; | |

| ● | The impact on our competitive position, business operations, and financial condition of implementation of amended healthcare laws and regulations; | |

| ● | The dependence of certain of our pipelines on intellectual property licensed from licensors, and the severe adverse impact to our business operations of a disruption of one of our licensing relationships; | |

| ● | The potential monetary costs of defending our intellectual property rights in a dispute, and the possibility that an intellectual property dispute will not be settled in our favor; | |

| ● | The possibility that our patents and patent applications, even if unchallenged, will not sufficiently protect or provide exclusive use of our intellectual property, which could jeopardize our ability to commercialize our products and dissuade companies from subsequently collaborating with us; |

ii

| ● | The negative impact to our competitive position and the value of our technology of our failure to protect trade secrets through the use of non-disclosure and confidentiality agreements, or the unavailability of adequate recourse for breach of such agreements; | |

| ● | The fluctuation and volatility of the market price of our Common Stock due to its limited public market, and the possibility that these issues will compound and strain our stockholders’ ability to resell their Common Stock; | |

| ● | Our significant dependence on sophisticated management with highly technical expertise to oversee business operations, and our ability to attract and retain qualified personnel to sustain growth; | |

| ● | Our ability to adapt to future growth by training an expanding employee base and shifting away from reliance on third-party contractors; | |

| ● | The risk of liability arising from claims of environmental damage, personal injury, and property damages in connection with our research and development activities, including those that involve the use of hazardous materials; | |

| ● | The possibility that enforcement actions to suspend or severely restrict our business operations will be brought against the Company for our failure to comply with laws or regulations and the potential costs of defending against such actions; | |

| ● | Our reliance on adequate maintenance of the security and integrity of our information technology systems to effectively operate our business; and | |

| ● | Such other factors as discussed throughout Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and in Part I, Item 1A. Risk Factors herein. |

A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Annual Report. Forward-looking statements involve known and unknown risks, uncertainties, and other factors, including without limitation the risks and uncertainties described below the heading “Item 1.A. Risk Factors” in this report, that may cause our actual results, performance, or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations and assumptions that involve numerous risks and uncertainties. Our plans and objectives are based, in part, on assumptions involving the continued expansion of our business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that our assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance that the forward-looking statements included in this Annual Report will prove to be accurate. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Annual Report and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. Except as required by U.S. federal securities laws, we have no obligation to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements.

In February 2024, the Company changed its corporate name from Renovaro BioSciences Inc. to Renovaro Inc. The Company will not distinguish between its prior and current corporate name and will refer to the Company’s current corporate name throughout this Annual Report on Form 10-K. As such, unless expressly indicated or the context requires otherwise, the terms “Renovaro,” “company,” “we,” “us,” and “our” in this document refer to Renovaro Inc., a Delaware corporation, and, where appropriate, its subsidiaries.

iii

PART I

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “us,” “our,” “Renovaro” or the “Company” are to Renovaro Inc., a Delaware corporation together with its wholly owned subsidiaries, Renovaro Biosciences, Inc., a Delaware corporation (“Renovaro Biosciences”), GEDi Cube Intl Ltd, a private limited company incorporated under the laws of England and Wales (“GEDi Cube UK”), GEDi Cube B.V., a Dutch private limited company, Grace Systems B.V., a Dutch private limited company, Renovaro Biosciences Denmark ApS, a Danish limited company, organized under the Danish Act on Limited Companies of the Kingdom of Denmark, and Renovaro Technologies, Inc., a Nevada corporation (“Renovaro Technologies”).

Our Business

Our Business

Renovaro Inc. operates through two subsidiaries, Renovaro Biosciences and Renovaro Cube. Renovaro Cube refers to GediCube Intl. Ltd. and its wholly owned subsidiaries GediCube, B.V. and Grace Systems B.V., which were acquired on February 13, 2024.

Renovaro Biosciences Overview

Renovaro Biosciences is a biotechnology company intending, if the necessary funding is obtained, to develop advanced allogeneic cell and gene therapies to promote stronger immune system responses potentially for long-term or life-long cancer remission in some of the deadliest cancers, and potentially to treat or cure serious infectious diseases such as Human Immunodeficiency Virus (HIV) infections. As a result of our acquisition of GEDi Cube Intl on February 13, 2024, we have shifted the Company’s primary focus and resources to the development of the GEDi Cube Intl technologies.

Therapeutic Technologies

Renovaro Bioscience aims to train the immune system to allow a person to better fight diseases through allogeneic cell and/or gene therapy. Our vision is for a world with healthy longevity, and free from toxic chemotherapy, for those with cancer and other serious diseases. Renovaro Biosciences will seek to leverage general principles and advances in the knowledge of the immune response to engineer cells with enhanced attributes to promote the recognition and elimination of disease cells.

1

Allogeneic Cell Therapy

The strategic benefit of the allogeneic cell therapy technologies is to potentially allow for the manufacture of large, “off-the-shelf” banks of therapeutic cells that are readily available on demand by healthcare professionals, to potentially decrease the time between diagnosis and treatment.

In certain treatments (e.g., HIV and cancer), cells taken from healthy donors are engineered to introduce signaling molecules that are designed to enhance the ability of specific immune cells to recognize diseased cells, and to help recruit other cells that will destroy cancer or virus infected cells.

Gene Therapy

Renovaro Biosciences may also seek to explore various approaches for gene therapy design elements to potentially eliminate virus-infected or cancer cells by the modulation of the patient’s immune system. Upon injecting into the patients, these genetically engineered allogeneic cells have little to no risk of passing those modifications to the patient since they are terminally differentiated with locked functionality to activate the host immune system. Gene modified allogeneic cells are expected to be rejected naturally once they activate the patient’s immune system therefore will have a very short survival time.

Renovaro Biosciences Focus Areas:

2

Oncology:

RENB-DC11: Genetically modified Allogeneic Dendritic Cell Therapeutic Vaccine as Potential Product for Long-term Remission of Solid Tumors; specifically Pancreatic tumors

Allogeneic Cell Therapy Platform – Completed pre-IND, IND-enabling phase.

Based on learnings from our internal research, literature reviews of ongoing clinical development for solid tumors, and recent advances in immune modulation, we have designed an innovative therapeutic vaccination platform that could potentially be used to induce life-long remission from some of the deadliest solid tumors such as pancreatic, liver, triple negative breast and head & neck cancers.

The platform may one day enable broad immune enhancements that are combined with cancer specific antigens that could be applicable to a wide range of solid tumors. This approach allows us to quickly adapt our approach to any patient solid tumor using the same banked allogenic drug substance.

3

RENB-DC20: Genetically modified Allogeneic Dendritic Cell Therapeutic Vaccine as Potential Treatment Product for Long-term Remission of Triple Negative Breast Cancer

Triple Negative Breast Cancer (TNBC) is a subtype of breast cancer that is negative for estrogens receptor (ER) negative, progesterone receptor (PR) negative and human epidermal growth factor receptor 2 (HER2). TNBC is characterized by its unique molecular profile, aggressive nature, and distinct metastatic patterns that lack targeted therapies. TNBC is well known for its aggressive behavior and is characterized by onset at a younger age, high mean tumor size, and higher-grade tumors.

Based upon our internal research, literature reviews of ongoing clinical development for solid tumors, and recent advances in immune modulation, we believe we may have the ability to design an innovative therapeutic vaccination platform that could potentially be used to treat some of the deadliest and hard-to-treat solid tumors that include triple negative breast cancer.

Infectious Diseases:

RENB-HV12: Genetically Modified Allogeneic Dendritic Cell Therapeutic Vaccine as Potential Treatment Product for Long-term Remission of HIV; A Chronic Infectious Disease

The oncology therapeutic vaccine technology could potentially be adapted to target infectious disease antigens and be a viable therapeutic approach in difficult to treat chronic infectious diseases. As described above, the engineered allogenic dendritic cell drug substance is thought to be able to be loaded with various cancer antigens for specific solid tumors but could or may be loaded with infectious disease antigens to elicit a more robust immune response to viruses and other difficult to treat infections.

4

Renovaro Cube Overview

Renovaro Cube is an AI-driven healthcare technology company focusing on the earliest possible detection of cancer and its recurrence. Renovaro Cube has developed a proprietary AI platform that analyzes genetics using Explainable AI (as defined below) to provide earlier and more accurate cancer diagnosis. This platform uses a multi-omics approach to search for individual biomarkers that are present even in asymptomatic patients. This approach is combined with differential molecular capabilities that are designed to identify, differentiate and pinpoint the exact source. Renovaro Cube’s process also involves the mining of biomarker panels, which are integrated into a machine learning library referred to as “RenovaroCube” to further enhance diagnosis.

Renovaro Cube also aims to utilize its proprietary AI platform in the development of commercial products to support clinical, research and pharmaceutical organizations that are trying to improve patient care through precision diagnosis, prediction of success of therapy, new drug discovery, treatment protocols or clinical trials. Specifically, Renovaro Cube is focused on developing products and services aimed at (i) early cancer characterization, (ii) personalized treatment selection, (iii) prediction and tracking response to therapies, (iv) recurrence detection and efficacy monitoring, and (v) ultimately, drug discovery.

Renovaro Cube was initially incorporated as Grace Systems B.V. (“Grace Systems”) in 2013 under the laws of the Netherlands to develop unique data mining algorithms to enable banking, finance and government entities to extract business insights from data. Grace Systems began applying its algorithms to biological data in 2018 to uncover cancer-associated patterns. Beginning in 2018, Grace Systems pivoted its platform to focus only on healthcare. Renovaro Cube has focused on developing its AI technology for early cancer detection.

Renovaro Cube has now focused on commercialization of its AI technology. Renovaro Cube believes that it has developed a unique approach to the early detection and diagnosis of cancer and its recurrence and, in time, other rare diseases through the systematic analysis of data using AI technologies, data mining procedures and algorithms for health technology.

Renovaro Cube’s technology has been trained on complex heterogeneous cancer data and appears to find patterns associated with cancer in public and private data resources. With the help of Renovaro Cube’s algorithms, discovered patterns may be translated into biomarkers that can be used in a clinical setting to target various aspects of cancer diagnosis and treatment.

5

Renovaro Cube’s Strategy

Renovaro Cube’s product development focuses on four core areas:

| ● | Early Detection. Multi-cancer early detection (“MCED”) blood tests are advanced diagnostic tools that analyze cell-derived molecules present in the bloodstream. These tests specifically look for abnormal genetic, epigenetic or proteomic patterns of these cell-derived molecules, which can indicate the presence of cancer cells. By examining the molecules shed from various cells, including cancer cells, MCED tests aim to detect cancer at an early stage. This approach holds promise for improving cancer detection and potentially saving lives. | |

| ● | Recurrence of cancer. A recurrence refers to the return of cancer after a period of remission. A cancer recurrence happens because, in spite of the efforts to kill the cancer, some cells may remain, which grow and eventually cause symptoms. In rare instances, a patient may develop a new cancer that’s completely unrelated to the originally diagnosed cancer, which is referred to as a second primary cancer. An early warning system could help to identify a recurrence as early as possible, thereby helping to accelerate any treatment and diagnosis. The different types of recurrence include: |

| o | Local recurrence, meaning that the cancer has returned in the same place it first started; |

| o | Regional recurrence, meaning that the cancer has returned to the lymph nodes near the place it first started; and |

| o | Distant recurrence, meaning the cancer has returned in another part of the body. |

| ● | Response to treatment. At Renovaro Cube we aim to develop a new array of diagnostic products that can accurately identify patients that are going to respond or fail to a certain drug. In highly toxic therapies it will not only increase survival but it will also reduce unnecessary exposure to chemotherapy. Furthermore, the costs for cancer drugs are usually very high. Providing the right therapy to the right patient will therefore significantly reduce the costs of medicine in cancer. |

| ● | Clinical trials. Clinical trials involve a type of research that studies new tests and treatments and evaluates their effects on human health outcomes. People volunteer to take part in clinical trials to test medical interventions including drugs, cells and other biological products, surgical procedures, radiological procedures, devices, behavioral treatments and preventive care. Clinical trials are carefully designed, reviewed and completed, and need to be approved before they can start. |

In response to these four core areas, the key components of Renovaro Cube’s product development are to build a software and hardware platform that:

| ● | Uses data science to develop novel insights into the characterization of diseases such as cancer. Renovaro Cube intends to apply its proprietary technology to biological data from multiple sources to enable the typification (or classification) of disease entities and sub-entities to provide insights about the nature and behavior of diseases to payers, providers, pharmaceutical companies and patients. |

6

| ● | Enables more accurate diagnosis and earlier detection of cancer and other diseases with the goal of maximizing outcomes and minimizing the costs of treatment. Renovaro Cube intends to develop a system to understand the smallest fragments of cancer in the blood of the patient. Presently, Renovaro Cube is developing a product to analyze results from liquid biopsy run through an Oxford Nanopore Sequencer. We expect the Renovaro Cube product will subsequently identify, train and validate explainable biomarkers, panels and models on different molecular layers. Multiple models will be individually trained for optimal stratification through the entire health journey, ensuring the right accuracy for a therapeutic decision in every stage. Renovaro Cube will integrate different modalities and molecular data sources into a differential diagnostic report. Diagnostics and prognosis will be explainable with quality control reports and biomarker insights for different disciplines ensuring maximum trust and insight in medical decision making. |

| ● | Assists in clinical trials with patient cohort selection and response tracking, to be used by companies like Renovaro Biosciences in their patient cohort selection for their clinical trials, by looking at which patients are reacting positively, negatively and have no reaction. This data becomes more important through the progression of the different phases of drug development, as more and more patients are added. Renovaro Cube will provide multi-omic data analysis, looking for specific changes in the patients that might indicate a change in their molecular make-up. This can then be used for the next phase of a clinical trial to look for the specific molecular data that has showed a positive reaction in the previous phase. It also provides insights for more effective response tracking, which Renovaro Cube believes is important to the providers of care as well as the development and evaluation of new pharmaceuticals and immune therapies in clinical trials. Patient response to treatment can be used to focus the target audience for drugs in development and in subsequent clinical practice. As Renovaro Cube collects more data, longitudinal about treatment and response, it will have the ability to train prognostic models to give an insight in disease progression and treatment response, both critical for enrolling in clinical trials and eventually every treatment. Because Renovaro Cube consists of many independently trained and validated models, it will have the ability to assist in virtually every therapeutic decision, for different subtypes and groups (stratifications). The multi-omics and multi-modal pipelines could allow the use of multiple combinations of tissue samples and diagnostic platforms. The detailed diagnostic reports will allow and support insights for multiple disciplines such as cancer biology, genomics and pathology to look at underpinning biomarkers, pathways and clinical annotations. |

| · | Provides insight into patients who have had cancer previously. These insights will provide for more effective recurrence monitoring, which Renovaro Cube believes is important to the providers of care and patients during follow-up monitoring of remissions. Renovaro Cube anticipates that payers want to detect and re-treat recurrences at the earliest possible stage to maximize patients’ outcomes in terms of time and cost and that, similarly, patients with a recurrence are keen to re-engage with effective treatment at the earliest opportunity. A key aspect of this will be taking blood from the patients, sequencing this blood and running it through the Renovaro Cube platform which will identify if the patient has any indication of the recurrence of the same or a new cancer. For recurrence monitoring, Renovaro Cube will focus on a highly sensitive combination of lab and information technology. Lab protocols, sequence post processing and machine learning are all designed, trained and validated to get the best signal with the highest sensitivity to catch early signals of recurrence. This will be done on a regular basis allowing surveillance analysis over time. |

| · | Includes biomarker panels that will be extended to include as many layers of genetic information (multi-omics) as possible including mutation, gene expression, methylation status, fragmentomics, nucleosome mapping, collectively named multi-omics, with the goal to reach the highest accuracy possible, both in terms of sensitivity and specificity of each individual biomarker panel. This provides a non-invasive alternative for the current complex, expensive and cumbersome procedures. |

| ● | Create value through advancing more sophisticated typification of diseases in an effort to address some of the pressing problems faced by modern healthcare, including healthcare costs, an aging population and developments in medical technology that produce a stream of increasingly sophisticated treatments requiring more precise targeting. |

One additional key focus of Renovaro Cube is its multi-modal, data analysis. Multi-modal data encompasses the whole aspect of data from a patient perspective, whether genomics, imaging, phenotypic or even wearable data, which can be cross analyzed to produce data that could not be previously produced. Renovaro Cube intends to use multi-modal data to bring new insights to the clinical and research teams trying to understand what to do next with the patient.

7

Renovaro Cube’s Technology and Techniques

Renovaro Cube is dedicated to the development of early cancer detection blood tests and expects to develop partnerships with third-party laboratories across the United Kingdom, the Netherlands and the rest of Europe and will also expand to the United States. Renovaro Cube is focused on developing diagnostic tests and test kits that would analyze samples derived from non-invasive liquid biopsy samples and intends to perform these tests from a Renovaro’s dedicated fully certified service laboratory and engage third-party laboratories to perform these tests for end-users.

For this purpose, Renovaro Cube has developed an AI platform that aims to leverage expertise in both biological and computational sciences and to go beyond traditional tumor signals by detecting the body’s early warning signs of cancer. Renovaro Cube’s goal is to provide accurate and reliable tests that can aid in the early diagnosis and treatment of cancer. Renovaro Cube’s AI technology is created to detect a wide range of biological signs to enhance the accuracy and sensitivity of early cancer detection and, thereby, enable earlier intervention and potentially improved patient outcomes.

Renovaro Cube’s AI technology aims to address three critical facets of medical needs within the domain of cancer diagnosis (as illustrated below):

| ● | type-specific cancer detection; |

| ● | pan-cancer detection; and |

| ● | patient stratification. |

Moreover, the versatility of Renovaro Cube’s AI technology extends to encompass the realm of rare cancers, including cases such as cancer of unknown primary.

Leveraging DNA methylation data, Renovaro Cube has identified and validated biomarker panels tailored for the detection of a wide range of cancers, including bladder, breast, colon, prostate, thyroid, head and neck, liver, kidney and lung cancer.

8

The foundational architecture of Renovaro Cube’s AI technology is engineered to facilitate comprehensive pan-cancer analysis through its extensive record of informative biomarkers discovered across a diverse array of cancer types. This comprehensive repository empowers Renovaro Cube’s AI technology to swiftly cross-reference biomarkers and explore molecular commonalities and distinctions that span multiple tumor categories.

For example, the capabilities of Renovaro Cube’s AI technology have unearthed biomarkers capable of pinpointing a specific subgroup of thyroid cancer patients characterized by a distinct genomic alteration, the neurotrophic tyrosine receptor kinase (“NTRK”) gene fusion. Identification of these NTRK-positive patients provides an actionable therapeutic target.

Uses of Renovaro Cube’s AI Technology

Renovaro Cube has developed its AI platform to support:

| ● | AI-assisted patient diagnostics; |

| ● | multi-omic data analysis; |

| ● | genome-wide or targeted analysis; |

| ● | pan-cancer analysis; |

| ● | different technology platforms (sequence or array); |

| ● | tracking of each sample; |

| ● | AI-guided biomarker discovery for single or multiple cancer types; and |

| ● | logs of analysis steps and outcomes (data preparation, discovery, validation). |

Renovaro Cube’s AI platform is an enterprise software platform that is distinguished from its competitors’ technology by its core attributes encompassing AI-guided analysis and meticulous record-keeping of data handling procedures within audit trails, logs, and data discoveries. Renovaro Cube designed this technology to support and validate every phase of the process, from the initial handling of raw data to the creation of essential biomarker panels. Renovaro Cube’s AI platform also facilitates the integration of data originating from diverse sources, including public databases and collaborative partnership data.

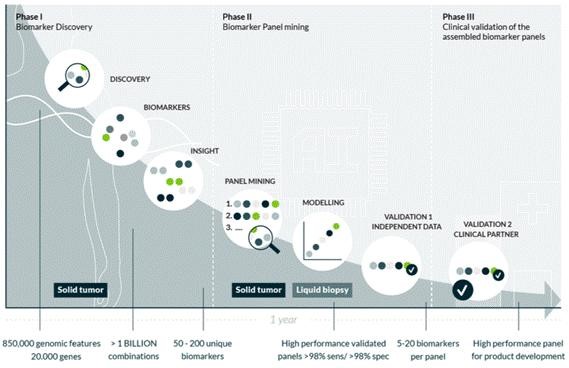

Illustrated below is the three-phase workflow behind Renovaro Cube’s AI platform for biomarker discovery using DNA methylation data. This workflow commences with the identification of pertinent single- and multi-omic data best suited to address the specific inquiries of Renovaro Cube’s clients, and the subsequent stages involve the meticulous pre-processing and loading of this data into the platform. This process culminates in the availability of a dashboard offering the client insights into the data’s characteristics, such as data quality, the technology employed, and associated metadata.

9

| ● | Phase I of the workflow behind Renovaro Cube’s AI platform primarily centers on the pivotal process of biomarker discovery. This intricate procedure unfolds through the application of data mining algorithms and statistical methodologies integrated into the AI platform. The paramount objective of Phase I is to reduce the plethora of genomic features displaying variations across samples, which is accomplished by systematically eliminating extraneous or inconsequential features while preserving those features that exhibit the greatest potential for accurately detecting cancer. |

| ● | Phase II of the workflow builds upon the foundation of selected biomarkers by focusing on understanding the dynamic interplay among these chosen biomarkers, culminating in the creation of composite panels. The goal of Phase II is to pinpoint biomarker combinations that not only demonstrate robustness in detecting cancer but also maintain their efficacy across diverse contexts. Renovaro Cube believes that its AI algorithms are adept at uncovering multiple combinations across a spectrum of panels, which is supported by Renovaro Cube’s AI-guided panel mining, a proprietary combinatorial optimization technique used by Renovaro Cube’s AI technology. This approach, coupled with the capacity to explore numerous panels, significantly enhances the likelihood of discovering panels that align with specific metric criteria, such as sensitivity, specificity, precision, and recall and allows for tailoring criteria to align with clients’ unique needs, such as the number of biomarkers included per panel, or the inclusion of biomarkers associated with the expression of specific genes. The performance of the top-tier panels is further fine-tuned through the application of machine learning models. Subsequently, the efficacy of these biomarker panels in detecting cancer is validated through independent data sets. |

| ● | Phase III of the workflow involves Renovaro Cube’s collaboration with its clinical partners to validate the performance of the biomarker panels. Through this collaboration, Renovaro Cube can confirm the utility and accuracy of its biomarker panels in real-world clinical contexts. |

AI-Assisted Diagnostics

The process of biomarker discovery facilitated by Renovaro Cube’s AI technology has yielded a set of data that enables scrutiny of the genomic distinctions and commonalities inherent in diverse cancer types. This data set can support the diagnosis of cancers when their type or origin remains unidentified.

In addition to this role in biomarker discovery and the development of diagnostic tests, Renovaro Cube’s AI technology also integrates AI-guided molecular profiling of patient samples and furnishes diagnostic patient reports. These diagnostic reports reflect the outcomes of molecular profiling, coupled with interpretations provided by Renovaro Cube’s team, to facilitate the process of cancer diagnostics by a qualified healthcare provider, who can consider these reports in the context of a patient’s medical history, clinical signs, and symptoms, among other factors.

Quality Control Process

Renovaro Cube undertakes post-processing of data generated from sequence and arrays to ensure accurate and meaningful results. These post-processing steps for omic data include:

| 1. | Quality Control: Quality control is performed to assess the overall data quality and to identify any technical issues or anomalies. |

| 2. | Normalization: arrays can introduce various sources of technical variation, such as batch effects, intensity variations, and probe-specific biases. |

| 3. | Quality Filtering: After genotype calling, additional quality filtering may be performed to remove low-quality SNPs based on criteria like call rates, minor allele frequency, Hardy-Weinberg equilibrium p-values, and linkage disequilibrium. |

Other post-processing steps may include genotype calling, population stratification and association analysis. Specific post-processing steps may vary depending on the type of array used, the study design, and the analytical goals.

10

Planning for Commercialization

Partnerships in Development

To enhance multi-omic and multi-modal capacity, and to work to validate those capabilities with human samples including liquid-biopsy-based tests/test kits, Renovaro Cube is actively pursuing relationships with leading academic cancer centers, pathology and imagery centers in Europe, the USA and the Middle East. In certain cases, scopes of work are in process. This is a very attractive model for partners to be involved with Renovaro Cube to perform multi-omics genetic analysis using liquid biopsies.

Resources

Renovaro Cube intends to hire additional staff to increase the speed and velocity of its organization, including the development of the AI platform and the opportunities to deploy the AI platform for research perspective and ultimately for clinical practice and into clinical trials.

In addition, Renovaro Cube intends to build out its infrastructure by leasing space for storage, networking and hosting facilities.

Target Market

Renovaro Cube’s intended customers will be hospitals, clinics, insurance companies, pharmaceutical companies, biotech companies, research centers, physicians and individual patients.

Renovaro Cube aims to utilize its AI technology to commercialize products and test kits for healthcare providers, hospitals, clinics and doctors that will expedite diagnosis and the selection of appropriate treatment for various types of cancer. Renovaro Cube intends to differentiate its products based on the following factors:

| ● | Proprietary and unique panel mining algorithms to create multiple biomarker stratifications per cancer; |

| ● | Explainable AI, offering traceability between the prediction and the exact biomarkers, panels and genes; |

| ● | Differential diagnosis, inclusion and exclusion of cancer types based on facts; and |

| ● | Precision diagnosis, with a high accuracy percentage with machine-learning tuning. |

11

The multi-omic design of Renovaro Cube’s AI platform enables the use of different molecular layers, such as epigenomics, transcriptomics, and metabolomics, together with genomics and clinical data.

Panel Mining

The unique panel mining technique in Renovaro Cube’s technology repeatedly investigates genes to identify relevant biomarkers. The proprietary technique in Renovaro Cube’s technology not only searches for individual biomarkers, but also integrates validated panels for different cancer types into the “RenovaroCube” machine learning library. This process enables precision diagnosis, by including one cancer and excluding others based on statistically, scientifically and clinically validated machine-learning panels.

Panel mining is designed to combine biomarkers into panels in such a way that the final panel meets:

| ● | performance metric criteria; |

| ● | technical criteria, such as a minimum or maximum number of biomarkers for the selected assay; |

| ● | biological criteria, non-annotated genes inclusion; and |

| ● | stratification criteria. |

Explainable AI

The term “Explainable AI” refers to the ability of an AI system or model to provide human-understandable explanations for its decision-making process or predictions. This feature aims to bridge the gap between the “black box” nature of many AI algorithms and the need for transparency, interpretability, and accountability in AI applications.

In traditional machine learning approaches, such as deep neural networks, the internal workings of the model can be complex and difficult to interpret. This lack of interpretability poses challenges in critical domains where decisions have significant implications, such as healthcare.

Renovaro Cube believes that Explainable AI is crucial for ensuring transparency, fairness, and accountability in AI systems. Renovaro Cube’s AI platform includes Explainable AI by design. All data points, calculations and results are traceable, and all calculations are verifiable and reproducible with the same result.

Disease prognosis is one of the diagnostic capabilities of the Explainable AI feature of Renovaro Cube’s technology. Disease prognosis gives more insight for a specific patient that empowers healthcare providers, patients, and their families to make well-informed decisions about treatment, care, and future planning, thereby enhancing patient-centered care, optimizing resource utilization, and contributing to improved patient outcomes and quality of life.

Differential Diagnosis

Renovaro Cube’s AI platform offers differential diagnosis by design due to its approach with a multitude of models for different diseases and the ability to include and exclude diseases.

Diseases like cancer are very homogenous, meaning that markers like TP53 or BRCA are expressed with multiple cancers. To address this homogeneity, differential diagnosis distinguishes between two or more conditions or diseases that share similar signs, symptoms or characteristics. The goal of differential diagnosis is to consider and evaluate all possible diagnoses for the patient’s symptoms to determine the most likely cause. Differential diagnosis therefore aims to identify the underlying condition accurately and guide appropriate treatment and management strategies.

12

Differential diagnosis is important for several reasons:

| 1. | Accurate Diagnosis: Differential diagnosis helps healthcare professionals arrive at the correct diagnosis by systematically considering all possible explanations for the patient’s symptoms. This ensures that the appropriate treatment and interventions are provided, leading to better patient outcomes. |

| 2. | Avoiding Misdiagnosis: Many medical conditions have similar or overlapping symptoms, and misdiagnosis can have serious consequences. Differential diagnosis helps to avoid misdiagnosing one condition as another, preventing unnecessary treatments, delays in appropriate care or potential harm to the patient. |

| 3. | Tailored Treatment: Different conditions require different treatments. Identifying the correct diagnosis through differential diagnosis allows healthcare professionals to develop a targeted treatment plan based on the specific condition, improving the chances of successful management and recovery. |

| 4. | Avoiding Overtreatment or Undertreatment: Some conditions may require aggressive interventions, while others may resolve with minimal treatment or simply require symptomatic management. Differential diagnosis helps prevent overtreating or undertreating patients by ensuring that interventions are appropriate for the specific condition. |

| 5. | Identifying Underlying Causes: In some cases, multiple conditions may present with similar symptoms, but the underlying causes may be distinct. Differential diagnosis helps identify the root cause of the symptoms, which is crucial for implementing effective long-term management strategies and preventing complications. |

In summary, differential diagnosis is a critical process in healthcare that supports accurate identification of the underlying condition, tailored treatment plans, and improved patient outcomes.

Precision Diagnostics

Precision diagnostics and personalized care is about focusing on what is required for a specific patient, what are their individual needs, how can we understand more about them to be more precise when delivering care and identifying the right clinical pathway to move them through treatment. Renovaro Cube technology will bring a high level of detail with multi-omic data, allowing individual genes and different possible cancers under suspicion to be identified. Due to the structure of the data produced, Renovaro Cube can bring it into any format of user interface, documentation, or database. We expect to provide the flexibility to respond to the different requirements for delivering data to the right person at the right place at the right time. We will comply to user interface guidance and usability regulations (WC3C) to ensure that they meet the correct standards to enable the data to be displayed, read and understood. Personalized care is what we all in the healthcare system are striving for, we are one component that can make a huge difference.

Future Development

In driving towards future commercialization, Renovaro Cube intends to undertake or continue the following activities to enable the development of its AI platform, bolster the credibility of this platform and open up revenue opportunities:

13

| ● | Increase in-kind contribution projects with hospitals, research centers and pharmaceutical companies, focusing on rare disease, cancer diagnosis and other opportunities for clinical trials; it is expected that the investments required for these activities will be leveraged by non-dilutive funding instruments to de-risk individual projects and product development routes, |

| ● | Work to develop long-term strategic partnerships with clinical organizations, research centers and pharmaceutical companies to advance existing research in multi-modal analysis and open potential revenue streams; |

| ● | Develop Renovaro Cube’s multi-modal, multi-omics platform architecture and first prototypes, with the goal of providing integrated multi-modal solutions that would be sold as a fully deployed and fully supported solution, subject to compliance with regulatory standards for hosting and support and for production of algorithms being deployed in a clinical environment; |

| ● | Build Renovaro Cube’s service and support models for its AI platform; |

| ● | Build or lease a “supercomputer” that will be utilized for processing genomic data, the training of algorithms and the development of Renovaro Cube’s solutions; |

| ● | Continue business development across key territories in the Europe, Middle East, and Africa (“EMEA”) region, starting in the United Kingdom, the Netherlands and Germany, under the management of in-country managers supported by centralized teams in Amsterdam and London and progress to rolling out in the US leveraging the Renovaro US based staff; |

| ● | Deploy a sequencing lab in the EMEA region that will allow Renovaro Cube to control the sample preparation and medical device, thereby enabling faster commercialization analysis and quality control; and |

| ● |

Expand its team to include biomedical scientists, data scientists, machine-learning engineers, specialized medical doctors (oncologist, geneticist), high-performance-computer engineers and software engineers.

· Renovaro Cube plans to establish a state-of-the-art fully certified (CLIA and ISO standards) service laboratories to perform liquid biopsies in a multi-omic approach for third parties (primarily research and academic institutes) and provide data analysis at the same time. This activity serves two important goals:

· It provides immediate revenues for the company providing a superior service for multi-omic sequencing servicing using Oxford Nanopore Technologies for an attractive pricing and high-end services also applicable for liquid biopsies.

· The Cube needs data to expand the indications, application and improve the capabilities of the system. Acquiring this data is a lengthy and expensive. We anticipate a significant number of clients will provide data sharing for a reduced price. The outcomes can be published collaboratively, and the potential products will be commercialized by Renovaro Cube. The partner will receive royalties.

· A first service laboratory will be established in the Netherlands and rapidly expanded to other sites in the EU, US and rest of the world. |

14

Our Intellectual Property

Patents and licenses are key to our business. Our strategy is to file patent applications to protect technology, inventions, and improvements to inventions that we consider important for the development of our business. We rely on a combination of patent, copyright, trademark, and trade secret laws, as well as continuing technological innovations, proprietary knowledge, and various third-party agreements, including, without limitation, confidentiality agreements, materials transfer agreements, research agreements, and licensing agreements, to establish and protect our proprietary rights. We aim to take advantage of all of the intellectual property rights that are available to us and seek the protection of those rights so that we can fully exploit our innovations.

We also protect our proprietary information by requiring our employees, consultants, contractors, and other advisors to execute nondisclosure and assignment of invention agreements upon commencement of their respective employment or engagement.

Assigned Intellectual Property

On August 16, 2022, the USPTO issued U.S. Patent No. 11,413,338 B2, “Methods and Compositions Using Recombinant Dendritic Cells for Cancer Therapy”, pertaining to methods and compositions for treating cancer by eliciting an immune response by administering dendritic cells expressing heterologous proteins. This patent protects RENB-DC11: Genetically modified Allogeneic Dendritic Cells as Potential Product for Long-term Remission of Solid Tumors – Starting with Pancreatic Cancer and potential future products RENB-DC-12XX: Genetically modified Allogeneic Dendritic Cells as Potential Product for Long-term Remission of Additional Indications for twenty years. The Company owns this patent application, through assignment as of July 15, 2019.

On June 17, 2020, a patent titled “Allogeneic T-Cell-Based HIV Vaccine to Induce Cellular and Humoral Immunity”, US 2021/0030795 A1 for the composition and method of use concepts for RENB-HV-12. was filed. The Company owns this patent application, through assignment as of September 28, 2021.

In-Licensed Technology

Trade Secrets and Proprietary Know-How

In addition to intellectual property protected by patents and copyrights, we have trade secrets and proprietary know-how relating to our products, production processes, and future strategies.

Competition

Renovaro Cube operates in a highly competitive market with several companies developing AI-driven diagnostic platforms for early disease detection and personalized medicine. Key competitors include Grail, Freenome, and Owkin, each utilizing advanced AI and machine learning to analyze multi-omic data for cancer detection. While these companies focus primarily on specific diagnostic approaches, Renovaro Cube differentiates itself through its unique, disease-agnostic AI platform that integrates various molecular data sources for differential diagnosis. Our platform’s explainable AI system, capable of providing actionable insights and personalized treatment options, offers a distinct advantage. Despite the crowded landscape, Renovaro Cube's scalable technology, multi-omics capabilities, and ability to process diverse biopsy sources position it as a versatile leader in precision diagnostics, allowing us to address a broader range of clinical and research needs.

15

Government Regulation

FDA Review and Approval

Government authorities in the United States, at the federal, state, and local levels, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of therapeutic products such as those we are developing. Any products we develop are likely to require regulatory review and allowance to proceed prior to conducting clinical trials and additional regulatory approvals prior to commercialization. In the United States, the FDA regulates drugs under the Federal Food, Drug and Cosmetic Act (FDCA) and the Public Health Service Act (PHSA) and their implementing regulations govern, among other things, biopharmaceutical testing, manufacturing, safety, efficacy, labeling, storage, recordkeeping, advertising, and other promotional practices.

Obtaining FDA approval is a costly and time-consuming process. FDA approval requires that preclinical studies be conducted in the laboratory and in animal model systems to gain preliminary information on efficacy and to identify any major safety concerns. The results of these studies are then submitted as a part of an IND, which the FDA must review and allow before human clinical trials can start. The IND includes a detailed description of the proposed clinical investigations. An independent Institutional Review Board (“IRB”) must also review and approve the clinical protocol and each clinical site.

A company must submit an IND for each investigational medical product and specific indication(s) and must conduct clinical studies to demonstrate the safety and efficacy of the product necessary to obtain FDA approval. The FDA receives reports on the progress of each phase of clinical testing and may require the modification, suspension, or termination of clinical trials if an unwarranted risk is observed in participants including patients.

Obtaining FDA approval prior to marketing a biopharmaceutical product in the United States typically requires multiple phases of clinical trials to demonstrate the safety and efficacy of the product candidate. Clinical trials are how experimental treatments are evaluated in humans and are conducted following preclinical testing. Clinical trials may be conducted within the United States or in foreign countries. If clinical trials are conducted in foreign countries, the products under development as well as the trials are subject to regulations of the FDA and/or its regulatory counterparts in the other countries. Upon successful completion of clinical trials, approval to market the treatment for a particular patient population may be requested from the FDA in the United States and/or its counterparts in other countries.

16

Applications submitted to the FDA are subject to an unpredictable and potentially prolonged approval process. Despite good-faith communication and collaboration between the applicant and the FDA during the development process, the FDA may decide, upon final review of the data, that the application does not satisfy its criteria for approval or requires additional product development or further preclinical or clinical studies. Even if FDA regulatory approval(s) are obtained, a marketed product is subject to continual review, and later discovery of previously unknown problems or failure to comply with the applicable regulatory requirements may result in restrictions on the marketing of a product or withdrawal of the product from the market as well as possible civil or criminal sanctions.

Sponsors of clinical trials are required to register, and report results for, all controlled, clinical investigations, other than Phase 1 investigations, of a product subject to FDA regulation. Trial registration may require public disclosure of certain confidential commercial development data.

The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. FDA sanctions could include, among other actions, refusal to approve pending applications, withdrawal of an approval, a clinical hold, warning letters, product recalls or withdrawals from the market, product seizures, total or partial suspension of production or distribution injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on our business, financial condition, results of operations and cash flows.

17

Other Healthcare Laws and Compliance Regulations

Although we currently do not have any products on the market, we may also be subject to additional healthcare regulations and enforcement by the federal government and by authorities in the states and foreign jurisdictions in which we conduct our business. In the United States, among other things, the research, manufacturing, distribution, sale and promotion of pharmaceutical and biological products are potentially subject to regulation and enforcement by various federal, state and local authorities in addition to the FDA, including the Centers for Medicare and Medicaid Services (“CMS”), other divisions of the United States Department of Health and Human Services (e.g., the Office of Inspector General), the Drug Enforcement Administration, the Consumer Product Safety Commission, the Federal Trade Commission, the Occupational Safety and Health Administration, the Environmental Protection Agency, state Attorneys General and other state and local government agencies. Our current and future business activities, including for example, sales, marketing, and scientific/educational grant programs, must comply with health care regulatory laws, as applicable, including, without limitation:

| ● | the federal anti-kickback statute, which is a criminal statute that makes it a felony for individuals or entities to knowingly and willfully offer or pay, or to solicit or receive, direct or indirect remuneration, in order to induce the purchase, order, lease, or recommending of items or services, or the referral of patients for services, that are reimbursed under a federal health care program, including Medicare and Medicaid; | |

| ● | the federal False Claims Act, which prohibits, among other things, individuals and entities from knowingly submitting, or causing to be submitted, false or fraudulent claims for payment of government funds, with penalties that include three times the government’s damages plus civil penalties for each false claim; in addition, the False Claims Act permits a person with knowledge of fraud, referred to as a qui tam plaintiff, to file a lawsuit on behalf of the government against the person or business that committed the fraud, and, if the action is successful, the qui tam plaintiff is rewarded with a percentage of the recovery; |

| ● | federal criminal laws that prohibit executing a scheme to defraud any healthcare benefit program or making false statements relating to healthcare matters; | |

| ● | the Health Insurance Portability and Accountability Act of 1996, or HIPAA, which governs the conduct of certain electronic healthcare transactions and protects the security and privacy of protected health information; | |

| ● | the federal Physician Payments Sunshine Act, which requires certain manufacturers of drugs, devices, biologics and medical suppliers to report annually to CMS information related to payments and other transfers of value to physicians, other healthcare professionals and teaching hospitals, and ownership and investment interests held by physicians and other healthcare professionals and their immediate family members; and |

18

| ● | state and foreign law equivalents of each of the above federal laws, such as state anti-kickback and false claims laws which may impose stricter requirements than federal law and may apply to items or services reimbursed by any payor (including commercial insurers and cash-paying patients); state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to healthcare professionals and other potential referral sources; state laws that require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare professionals or marketing expenditures; and state laws governing the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts. |

If our operations are found to be in violation of any of such laws or any other governmental laws or regulations that apply, they may be subject to penalties, including, without limitation, civil and criminal penalties, damages, fines, disgorgement, the curtailment or restructuring of operations, exclusion from participation in federal and state healthcare programs, additional program integrity obligations, individual imprisonment, injunctions, recall or seizure of products, total or partial suspension of production, denial or withdrawal of product approvals, refusal to permit us to enter into supply contracts, including government contracts, contractual damages, reputational harm, administrative burdens, diminished profits, and future earnings, any of which could have a material adverse effect on our business, financial condition, result of operations, and cash flows. These additional healthcare regulations could affect our current and future arrangements with healthcare professionals, principal investigators, consultants, customers and third-party payors.

Moreover, the introduction of legislation, implementation of new regulations, or enforcement of existing regulations that have a negative impact on the commercial prospects for the types of products we are developing could negatively impact our share price and our ability to raise capital.

Coverage and Reimbursement

In the United States, third-party payors include federal and state healthcare programs, government authorities, private managed care providers, private health insurers and other organizations. Third-party payors are increasingly challenging the price, examining the medical necessity and reviewing the cost-effectiveness of medical drug products and medical services, in addition to questioning their safety and efficacy. Such payors may limit coverage to specific drug products on an approved list, also known as a formulary, which might not include all the FDA-approved drugs for a particular indication. Third-party payor coverage may be more limited than the purposes for which the FDA or foreign regulatory authorities approve the product. Further, one payor’s determination to provide coverage for a drug product does not assure that other payors will also provide coverage for the drug product.

Further, third-party payers are increasingly challenging the price of medical products and services, and there is increasing pressure on biotechnology companies to reduce healthcare costs. If purchasers or users of our products are not able to obtain adequate reimbursement for the cost of using our products, they may forgo or reduce their use. Significant uncertainty exists as to the reimbursement status of newly approved healthcare products, and whether adequate third-party coverage will be available. Our inability to promptly obtain coverage and profitable payment rates from both government funded and private payors for future products we develop could have a material adverse effect on our operating results, our ability to raise capital needed to commercialize potential products, and our overall financial condition.

19

Healthcare Reform

In March 2010, former President Obama signed into law The Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act of 2010 (collectively, the “Affordable Care Act”), which substantially changed the way healthcare is financed by both governmental and private insurers in the United States, and significantly affected the pharmaceutical industry. The Affordable Care Act contains a number of provisions, including those governing enrollments in federal healthcare programs, reimbursement adjustments and fraud and abuse changes. Additionally, the Affordable Care Act increases the minimum level of Medicaid rebates payable by manufacturers of brand name drugs; requires collection of rebates for drugs paid by Medicaid managed care organizations; requires manufacturers to participate in a coverage gap discount program, under which they must agree to offer point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; and imposes a non-deductible annual fee on pharmaceutical manufacturers or importers who sell “branded prescription drugs” to specified federal government programs.

Since its enactment, there have been judicial and Congressional challenges to certain aspects of the Affordable Care Act, and we expect there will be additional challenges and amendments to the Affordable Care Act in the future. Other legislative changes have been proposed and adopted since the Affordable Care Act was enacted, including aggregate reductions of Medicare payments to providers and reduced payments to several types of Medicare providers. Moreover, there has recently been heightened governmental scrutiny over the manner in which manufacturers set prices for their marketed products, which has resulted in several Congressional inquiries and proposed bills designed to, among other things, bring more transparency to product pricing, review the relationship between pricing and manufacturer patient programs, and reform government program reimbursement methodologies for drug products. Individual states in the United States have also become increasingly active in implementing regulations designed to control pharmaceutical product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access and marketing cost disclosure and transparency measures, and, in some cases, proposing to encourage importation from other countries and bulk purchasing. We cannot predict what healthcare reform initiatives may be adopted in the future.

We also are subject to various federal, state, and local laws, regulations, and recommendations relating to safe working conditions, laboratory and manufacturing practices, the experimental use of animals, and the use and disposal of hazardous or potentially hazardous substances, including radioactive compounds and infectious disease agents, used in connection with our research. The extent of government regulation that might result from any future legislation or administrative action cannot be accurately predicted.

Renovaro Cube’s AI-guided diagnostic platform operates within a highly regulated environment, particularly as it involves health data and medical diagnostics. As a Software as a Medical Device (SaMD), the platform will require compliance with various regional regulations, including but not limited to the U.S. Food and Drug Administration (FDA) guidelines and European Union Medical Device Regulation (MDR). Our regulatory strategy involves a meticulous development process, adhering to international standards such as for quality management systems. Key elements include rigorous clinical validation, cybersecurity, data privacy (in compliance with HIPAA and GDPR), and quality control to ensure patient safety and diagnostic accuracy. Post-market surveillance and continuous improvement will be integral to maintaining compliance and effectiveness as we aim for global commercialization. Given the rapidly evolving regulatory landscape for AI-driven diagnostics, Renovaro Cube remains committed to working closely with regulatory bodies to navigate the approval processes and to address ethical considerations, ensuring that our products meet the highest standards of safety and efficacy.

Foreign Corrupt Practices Act

Our business activities may be subject to the Foreign Corrupt Practices Act, or FCPA, and similar anti-bribery or anti-corruption laws, regulations, or rules of other countries in which we operate. The FCPA generally prohibits offering, promising, giving, or authorizing others to give anything of value, either directly or indirectly, to a non-U.S. government official to influence official action, or otherwise obtain or retain business. The FCPA also requires public companies to make and keep books and records that accurately and fairly reflect the transactions of the corporation and to devise and maintain an adequate system of internal accounting controls. Our business is heavily regulated and therefore involves significant interaction with public officials, including officials of non-U.S. governments. Additionally, in many other countries, the health care providers who prescribe pharmaceuticals are employed by their government, and the purchasers of pharmaceuticals are government entities; therefore, our dealings with these prescribers and purchasers are subject to regulation under the FCPA. There is no certainty that all of our employees, agents, suppliers, manufacturers, contractors, or collaborators, or those of our affiliates, will comply with all applicable laws and regulations, particularly given the high level of complexity of these laws. Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers, or our employees, the closing down of facilities, including those of our suppliers and manufacturers, requirements to obtain export licenses, cessation of business activities in sanctioned countries, implementation of compliance programs, and prohibitions on the conduct of our business. Any such violations could include prohibitions on our ability to offer our products in one or more countries as well as difficulties in manufacturing or continuing to develop our products, and could materially damage our reputation, our brand, our international expansion efforts, our ability to attract and retain employees, and our business, prospects, operating results, and financial condition.

20

Employees

As of June 30, 2024, we had 25 full-time employees. The Company has streamlined the organization to focus on its oncology therapeutic vaccine and artificial intelligence driven healthcare technology. The Company has tailored its workforce to focus on these therapies and technology. We believe that we have good relations with our employees.

Corporate Information

On February 13, 2024, Renovaro Inc. acquired Renovaro Cube Intl Ltd and its subsidiaries (“Renovaro Cube”), as a wholly owned subsidiary pursuant to a stock purchase agreement.

We trade on the NASDAQ Capital Market under the ticker “RENB.”

Our website is http://www.renovarobio.com. We make available free of charge, on or through our website, our annual, quarterly, and current reports and any amendments to those reports filed or furnished pursuant to Section 13(a) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information contained in our website is not part of, nor incorporated by reference into, this report.

Item 1A. Risk Factors

RISK FACTORS

Risk Factor Summary

The following is a summary of the risks and uncertainties that could cause our business, financial condition or operating results to be harmed. We encourage you to carefully review the full risk factors contained in this report in their entirety for additional information regarding these risks and uncertainties.

| ● | We have incurred substantial losses since our inception and anticipate that we will continue to incur substantial and increasing losses for the foreseeable future. |

| ● | There is substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing. |

| ● | We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts. |

| ● | Raising additional capital may cause dilution to our existing stockholders or restrict our operations. |

| ● | From time to time, we may be subject to legal proceedings, regulatory investigations or disputes, and governmental inquiries that could cause us to incur significant expenses, divert our management’s attention, and materially harm our business, financial condition, and operating results. |

| ● | Negative publicity has had and may continue to have a negative impact on our business and may have a long-term effect on our relationships with our customers, partners and collaborators. |

| ● | Renovaro Biosciences is a pre-clinical biotechnology company and may never be able to successfully develop marketable products or generate any revenue. We have a very limited relevant operating history upon which an evaluation of our performance and prospects can be made. There is no assurance that our future operations will result in profits. If we cannot generate sufficient revenues, we may suspend or cease operations. | |

| ● | The market for artificial intelligence -based (“AI”) healthcare solutions is new and unproven and may decline or experience limited growth, and concerns over the use of AI may hinder the adoption of AI technologies. | |

| ● | Regulators and legislators may limit our ability to develop or implement our AI algorithms and may eliminate or restrict the confidentiality of our proprietary technology, which could have an adverse effect on our business, results of operations, reputation, and financial condition. |

21

| ● | The results of pre-clinical studies or earlier clinical studies are not necessarily predictive of future results, and if we fail to demonstrate efficacy in our pre-clinical studies and/or clinical trials in the future our future business prospects, financial condition and operating results will be materially adversely affected. |

| ● | Our reliance on third parties, such as university laboratories, contract manufacturing organizations and contract or clinical research organizations, may result in delays in completing, or a failure to complete, non-clinical testing or clinical trials if they fail to perform under our agreements with them. |

| ● | We have limited experience in drug development and may not be able to successfully develop any drugs, which would cause us to cease our therapeutic development activities. |

| ● | We have licensed a portion of our intellectual property from our licensors. If we breach any of our license agreements with these licensors, or otherwise experience disruptions to our business relationships with our licensors, we could lose intellectual property rights that are important to our business. |

| ● | If we are unable to obtain and maintain sufficient intellectual property protection for our product candidates, or if the scope of the intellectual property protection is not sufficiently broad, our ability to commercialize our product candidates successfully and to compete effectively may be adversely affected |

| ● |

Third-party claims of intellectual property infringement may prevent or delay our development and commercialization efforts.

| |

| ● | We use AI in our business, and challenges relating to the development and use of AI, including generative AI, could result in competitive harm, reputational harm, and legal liability, and adversely affect our results of operations. | |

| ● | We have limited corporate infrastructure and may experience difficulties in managing growth. | |

| ● | We have experienced and may continue to experience significant turnover in our management and executive leadership, which creates uncertainty and could harm our ability to operate our business effectively. | |

| ● |

If serious adverse events or other undesirable side effects or safety concerns attributable to our product candidates occur, they may adversely affect or delay our clinical development and commercialization of some or all of our product candidates.

| |